5G

Upstart Wytec International 5G small cell technology for cable operators

Wytec International, Inc., a small San Antonio based technology company with with 11 employees, is ramping up to bring 5G mobile wireless services to cable operators. The company wants to upend the MVNO industry in the U.S. so that cable operators are able to compete on par with mobile carriers. That means removing excess costs with which cable operators currently contend. Wytec owns patented small cell technology now recognized as a key component to delivering 5G fixed and mobile wireless services.

“Our 5G mobile services, offered through a Mobile Virtual Network Operator (MVNO) Agreement, will include a three-option plan designed for cable operators to “compete on par” with U.S. mobile carriers,” comments William Gray, CEO of Wytec.

Since the United States Patent and Trademark Office (USPTO) awarded Wytec its small cell patent known as the Light-Pole Node (LPN-16) on September 15th 2017, Wytec has been testing its unique features, capable of supporting a robust, “neutral host” dense wireless network, utilizing utility poles as its distribution access throughout America’s cities. This feature collaborates exceptionally well with cable operators due to its existing utility pole access. In conjunction with its LPN-16 technology, Wytec’s MVNO solution includes carrier “roaming agreements” allowing cable subscribers access to a worldwide mobile network.

Wytec is nearing completion of a multi-test trial in the Central Business District (CBD) of Columbus, Ohio in preparation of securing its first MVNO Agreement to prospective cable operators in early March of 2020.

As Robert Merola, Wytec’s Chief Technology Officer and President of Wytec, states, “Our initial network deployment originates from one of the top ten Tier One providers in the U.S. and will expand accordingly in support of multiple MVNO cable operators throughout the U.S. We are excited to provide 5G services to the cable industry.”

Wytec has invested more than five years advancing its intellectual property related to fixed and mobile wireless distribution. In September of 2017 Wytec was awarded a “utility” patent on its LPN-16 Small Cell technology from the U.S. Patent and Trademark Office (USPTO) clearing a path for the development of its first 5G network deployment in Columbus, Oho.

Columbus, OH is the site of Wytec’s first 5G trial

……………………………………………………………………………………….

In June of 2019, the FCC awarded an “experimental use” license to Wytec for the testing of the newly issued Citizens Broadband Radio Service (CBRS) spectrum operating in the 3.5 GHz frequency band. The company plans to add fifteen (15) additional markets under an agreement with the sixth largest cable operator in the U.S. (unnamed).

Wytec has been funding its LPN-16 R&D through private Regulation D 506c PPM Offerings (Wytec’s Pre-IPO Offering) to accredited investors and subsequently filed an SEC S-1 registration (Now Effective) in preparation for listing its shares on a public market.

About Wytec

Wytec International, Inc. is a facilities-based wireless operator located in San Antonio, Texas with wireless networks located in San Antonio, Texas; Columbus, Ohio; and Denver, Colorado. Wytec owns six wireless patents with its latest patent focused on 5G small cell technology called the LPN-16. Wytec was named one of San Antonio’s Best Tech Startups in 2018 and 2020 by The Tech Tribune. Learn more at www.wytecintl.com.

Media Contact:

Brianna Lohse, Media Relations

(210) 233-8980

[email protected]

References:

AT&T and Verizon to use Integrated Access and Backhaul for 2021 5G networks

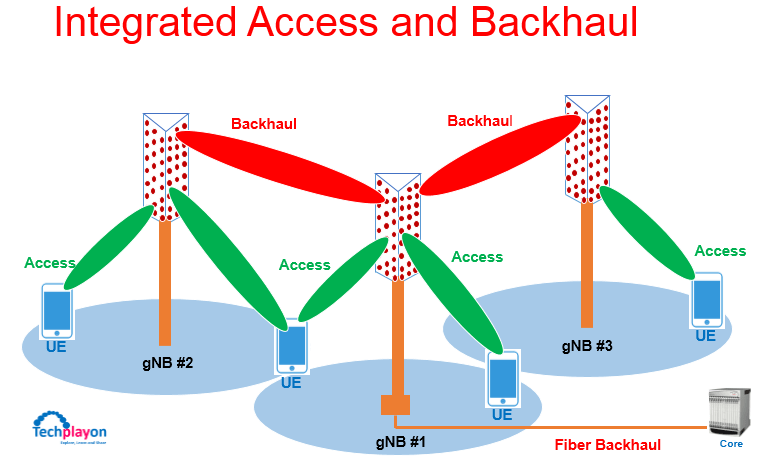

AT&T sketched out its plans to start testing Integrated Access and Backhaul (IAB) technology during 2020, saying it can prove a reliable backhaul alternative to fiber in certain cases, such as expanding millimeter-wave locations to reach more isolated areas. Verizon also confirmed, without adding any details, that it plans to use IAB, which is an architecture for the 5G cellular networks in which the same infrastructure and spectral resources will be used for both access and backhaul. IAB will be described in 3GPP Release 16 (see 3GPP section below for more details).

…………………………………………………………………………………………………………………………………………..

“Fiber is still required in close proximity to serve the capacity coming from the nodes, so if it can be extended to each of the nodes, it will be the first choice,” said Gordon Mansfield, VP of Converged Access and Device Technology at AT&T. in an statement emailed to FierceWireless.

“From there, IAB can be used to extend to hard to reach and temporary locations that are in close proximity. As far as timing, we will do some testing in 2020 but 2021 is when we expect it to be used more widely,” he said.

Verizon also told Fierce that it has plans to incorporate IAB as a tool. It doesn’t have any details to share at this time, but “it’s certainly on the roadmap,” an unknown Verizon representative said.

Earlier this year, Mike Dano of Lightreading reported:

Verizon’s Glenn Wellbrock said he expects to add “Integrated Access Backhaul” technology to the operator’s network-deployment toolkit next year, which would allow Verizon to deploy 5G more easily and cheaply into locations where it can’t get fiber.

“It’s a really powerful tool,” Glenn Wellbrock, director of architecture, design and planning for Verizon’s optical transport network, explained during a keynote presentation here Thursday at Light Reading’s 5G Transport & the Edge event.

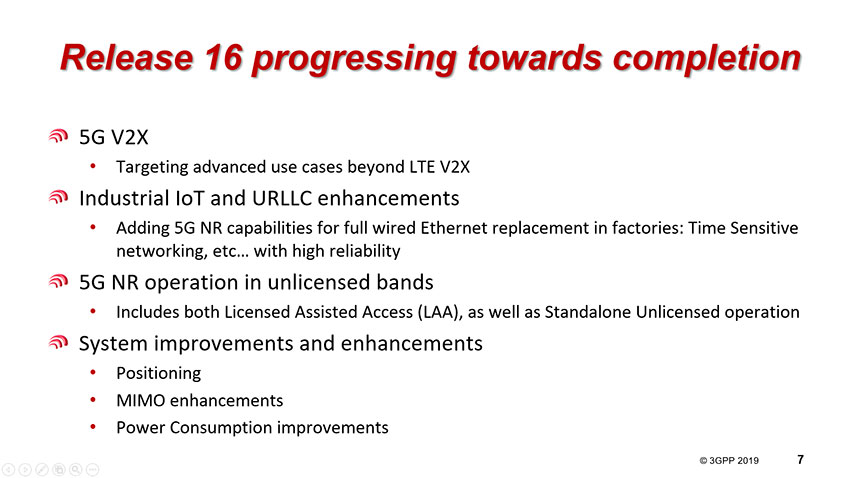

Wellbrock said IAB will be part of the 3GPP’s “Release 16” set of 5G specifications, which is expected to be completed by July 2020. However, Wellbrock said it will likely take equipment vendors some time to implement the technology in actual, physical products. That means 2020 would be the earliest that Verizon could begin deploying the technology, he added.

Wellbrock said IAB would allow Verizon to install 5G antennas into locations where routing a fiber cable could be difficult or expensive, such as across a set of train tracks.

However, Wellbrock said that IAB will be but one tool in Verizon’s network-deployment toolbox, and that Verizon will continue to use fiber for the bulk of its backhaul needs. Indeed, he pointed out that Verizon is now deploying roughly 1,400 miles of new fiber lines per month in dozens of cities around the country.

He said Verizon could ultimately use IAB in up to 10-20% of its 5G sites, once the technology is widely available. He said that would represent an increase from Verizon’s current use of wireless backhaul technologies running in the E-band; he said less than 10% of the operator’s sites currently use wireless backhaul. He said IAB is better than current wireless backhaul technologies like those that use the E-band because it won’t require a separate antenna for the backhaul link. As indicated by the “integrated” portion of the “integrated access backhaul” moniker, IAB supports wireless connections both for regular 5G users and for backhaul links using the same antenna.

………………………………………………………………………………………………………………………………………..

According to 5G Americas, the larger bandwidths associated with 5G New Radio (NR), such as those found in mmWave spectrum, as well as the native support of massive MIMO and multi-beams, are expected to facilitate and/or optimize the design and performance of IAB.

5G Americas maintains that the primary goals of IAB are to:

- Improve capacity by supporting networks with a higher density of access points in areas with only sparse fiber availability.

- Improve coverage by extending the range of the wireless network, and by providing coverage for isolated coverage gaps. For example, if the user equipment (UE) is behind a building, an access point can provide coverage to that UE with the access point being connected wirelessly to the donor cell.

- Provide indoor coverage, such as with an IAB access point on top of a building that serves users within the building.

5G Americas also said that in practice, IAB is more relevant for mmWave because lower frequency spectrum may be seen as too valuable (and also too slow) to use for backhaul. The backhaul link, where both endpoints of the link are stationary, is especially suitable for the massive beam-forming possible at the higher frequencies.

……………………………………………………………………………………………………………

3GPP Release 16 status of work items related to IAB:

(Note: Study is 100% complete, but others are 0% or 50% complete):

| 750047 | FS_NR_IAB | … Study onNR_IAB | 100% |

| 820170 | NR_IAB-Core | … Core part: NR_IAB | 0% |

| 820270 | NR_IAB-Performance | 850002 | – | … CT aspects of NR_IAB | 0% |

| 830021 | FS_NR_IAB_Sec | … Study on Security for NR_IAB | 50% |

| 850020 | – | … Security for NR_IAB | 0% |

| 850002 | – | … CT aspects of NR_IAB | 0% |

References:

https://www.fiercewireless.com/wireless/at-t-expects-to-test-iab-2020-use-it-more-widely-2021

ITU-R Schedule for completion of IMT-2020.SPECS; Workshop Results

Schedule for Detailed specifications of the terrestrial radio interfaces of International Mobile Telecommunications-2020 (IMT-2020) – IMT-2020.SPECS:

Meeting No. 33 (Dec. 2019, Geneva)

- Develop a detailed work plan

- Develop a working document towards PDNR M.[IMT-2020.SPECS]

Meeting No. 34 (Feb. 2020, Geneva)

- Review the work plan, if necessary

- Continue developing the working document towards PDNR M.[IMT-2020.SPECS]

- Receive and take note of “Form A”, in order to determine the structure of the Recommendation

- Provide and send liaisons to RIT/SRIT Proponents and GCS Proponents

Meeting No. 35 (Jun. 2020, [China])

- Receive and review information, including the texts for its RIT/SRIT overview sections, List of Global Core Specifications and Certification B by GCS Proponents1

- Reach its conclusion on the acceptability of the proposed materials for inclusion in the working document towards PDNR M.[IMT-2020.SPECS]

- Finalizes the working document including specific technologies (not necessarily including the detailed transposition references) and provisionally agree for promoting the document to preliminary draft new Recommendation

- Provide and send liaison of the provisionally agreed Preliminary Draft New Recommendation ITU-R M.[IMT-2020.SPECS] to the relevant GCS Proponents and Transposing Organizations for their use in developing their inputs of the detailed references

Meeting No. 36 (Oct. 2020, [India])

- Update PDNR if there are modifications proposed by GCS Proponent

- Perform a quality and completion check of the provisionally agreed final draft new Recommendation ITU-R M.[IMT-2020.SPECS] without the hyperlinks

- Have follow-up communications initiated with GCS Proponents and/or Transposing Organizations, if necessary

Meeting No. 36bis (Nov. 2020, Geneva)

- Receive Transposition references and Certification C from each Transposing Organization

- Perform the final quality and completeness check (with detailed transposition references) of the preliminary draft new Recommendation and promotes it to draft new Recommendation

- Send the draft new Recommendation ITU-R M.[IMT-2020.SPECS] to Study Group 5 for consideration

1____________________ If the GCS Proponentrnal (potential GCS Proponent) decides to use DIS style, it doesn’t need to submit List of Global Core Specifications but needs to submit full materials for describing its RIT/SRIT in the Recommendation and Form B.

…………………………………………………………………………………………………………….

Workshop on IMT-2020 terrestrial radio interfaces evaluation (10 to 11 December 2019, Geneva, Switzerland):

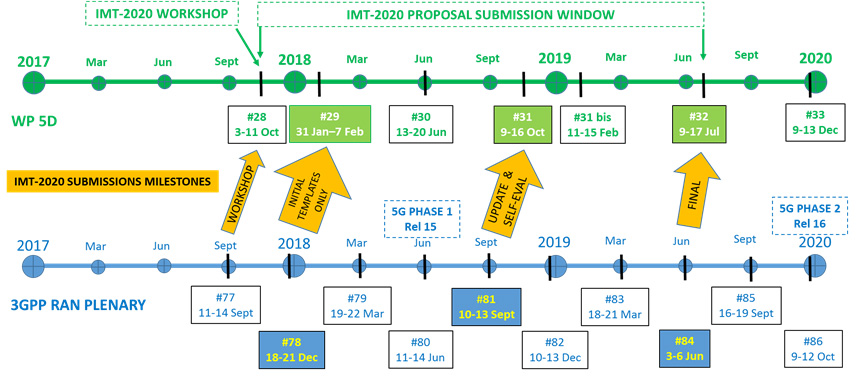

ITU-R Working Party (WP) 5D started the evaluation process for Independent Evaluation Groups (IEGs) as of its 31st meeting in Oct. 2018, in conjunction with the ongoing IMT-2020 development under Step 3 and Step 4 of the IMT-2020 process.

Working Party 5D has received, at its July 2019 meeting, several candidate technology submissions for IMT-2020 from six proponents, under Step 3 of the IMT-2020 developing process.

WP 5D held a workshop on IMT-2020, focusing on the evaluation of the candidate terrestrial radio interfaces at its 33rd meeting taking place December 2019 in Geneva, at which interim evaluation reports are expected. This will help the IEGs understand the details of the proposed candidate technologies, and interact amongst themselves as well as other WP 5D participants. This workshop is a continuation of the previous one on IMT-2020 held in 2017, Munich, which addressed the process, requirements, and evaluation criteria for IMT-2020 as well as views from proponents on the developments of IMT-2020 radio interfaces and activities of the IEGs.

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/Pages/ws-20191210.aspx

December 12, 2019 UPDATE:

See Comment in box below this article for disposition of TSDSI, ETSI/DECT Forum, and Nufront IMT 2020 RIT self evaluations. They have not “satisfactorily fulfilled Section 4.3 for the self-evaluation,” which means that the respective IMT 2020 RIT submissions will not be progressed at this time by WP 5D.

SK Telecom Selects Ericsson 5G Packet Core (3GPP Release 16- 5GC)

SK Telecom has selected Ericsson to deliver a Cloud Packet Core for its 5G network. Ericsson says its Cloud Packet Core (part of the company’s Cloud Core portfolio) helps service providers to smoothly migrate to 5G Core (5GC) stand-alone architecture.

Author’s Note:

Please see below for more information on 3GPP 5GC which is part of Release 16 and as yet has not been submitted to either ITU-R or ITU-T for IMT 2020 mobile packet core. There seems to be no independent work on a 5G mobile packet core within ITU, which is evidently waiting anxiously for 3GPP Release 16 to be completed and forwarded to various ITU-R WPs and ITU-T Study Groups.

………………………………………………………………………………………………………………………………………………………………………………………..

Ericsson’s Cloud Packet Core is at the business end of mobile broadband and IoT networks. It creates value, visibility and control of traffic and applications by determining the optimal quality of a service, then enforcing it through appropriate policy.

Jung Chang-kwan, Vice President and Head of Infra Engineering Group, SK Telecom, says: “By utilizing Ericsson’s Cloud Packet Core network solution, which realizes simplified network operations, we will unleash the full potential of new 5G-enabled use cases with greater efficiency.”

Jan Karlsson, Senior Vice President and Head of Digital Services, Ericsson, says: “This deal, and the opportunity to work with SK Telecom’s Network Functions Virtualization Infrastructure (NFVI), has put us in the ideal position to further strengthen their 5G network. Delivering our Cloud Packet Core solution will positively impact SK Telecom’s network operations and will reinforce Ericsson’s position as a leader in 5G core.”

SK Telecom switched on its commercial 5G network in December 2018 after selecting Ericsson as one of its primary 5G vendors. Previously, Ericsson provided radio access network (RAN) products, including mid-band Massive MIMO.

………………………………………………………………………………………………………………………………………………………….

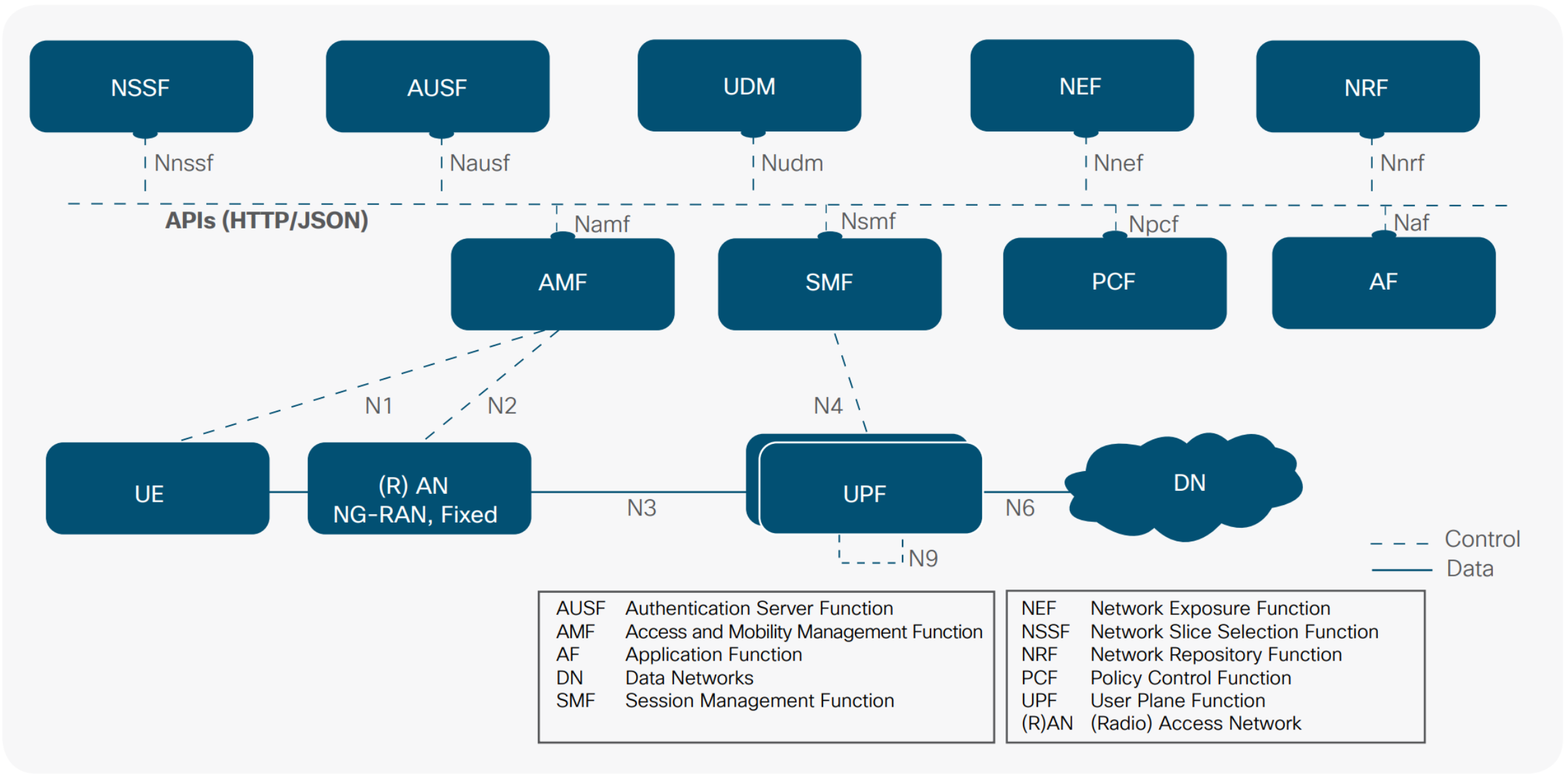

3GPP 5GC (the only specification for a 5G mobile packet core):

The 5GC (5G packet Core), specified in 3GPP TS 23.501: System architecture for the 5G System (5GS); Stage 2, will be part of 3GPP Release 16, which won’t be completed till June 2020 at the earliest.

3GPP’s 5G System architecture is defined to support data connectivity and services enabling deployments to use techniques such as e.g. Network Function Virtualization and Software Defined Networking. The 5G System architecture shall leverage service-based interactions between Control Plane (CP) Network Functions where identified. Some key principles and concept are to:

– Separate the User Plane (UP) functions from the Control Plane (CP) functions, allowing independent scalability, evolution and flexible deployments e.g. centralized location or distributed (remote) location.

– Modularize the function design, e.g. to enable flexible and efficient network slicing.

– Wherever applicable, define procedures (i.e. the set of interactions between network functions) as services, so that their re-use is possible.

– Enable each Network Function and its Network Function Services to interact with other NF and its Network Function Services directly or indirectly via a Service Communication Proxy if required. The architecture does not preclude the use of another intermediate function to help route Control Plane messages (e.g. like a DRA).

– Minimize dependencies between the Access Network (AN) and the Core Network (CN). The architecture is defined with a converged core network with a common AN – CN interface which integrates different Access Types e.g. 3GPP access and non-3GPP access.

– Support a unified authentication framework.

– Support “stateless” NFs, where the “compute” resource is decoupled from the “storage” resource.

– Support capability exposure.

– Support concurrent access to local and centralized services. To support low latency services and access to local data networks, UP functions can be deployed close to the Access Network.

– Support roaming with both Home routed traffic as well as Local breakout traffic in the visited PLMN.

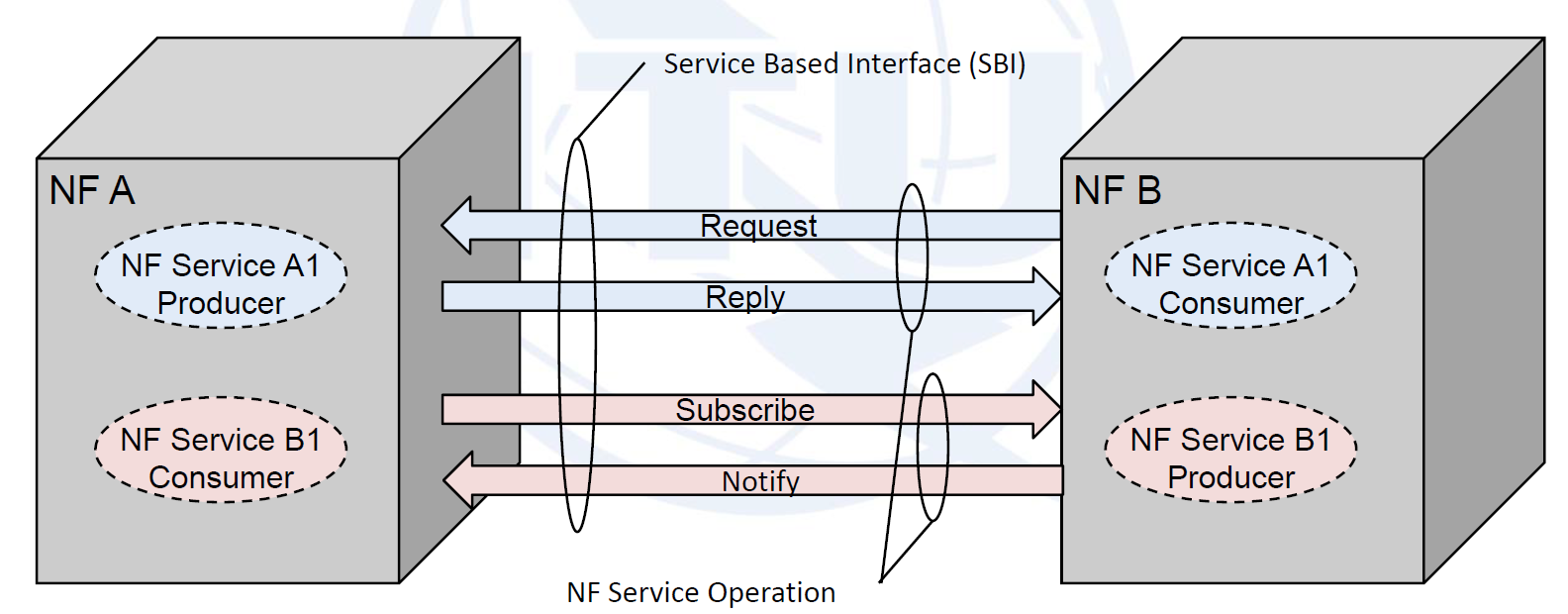

The 5G architecture is defined as service-based and the interaction between network functions is represented in the following two ways:

– A service-based representation, where network functions (e.g. AMF) within the Control Plane enables other authorized network functions to access their services. This representation also includes point-to-point reference points where necessary.

– A reference point representation, shows the interaction exist between the NF services in the network functions described by point-to-point reference point (e.g. N11) between any two network functions (e.g. AMF and SMF).

…………………………………………………………………………………………………………………………………………………………………………………………………………………..

GSMA’s Position on 5GC:

The network evolution from 4G-LTE mobile packet core (EPC) to 5G Core (5GC) plays a central role in creating a powerful network platform that is capable of being exposed and automated for service providers.

5GC has been designed from its inception to be “cloud native,” inheriting many of the technology solutions used in cloud computing and with virtualization at its core. Virtualization of network functions enables 5GC to be redesigned and become open and flexible enough to meet the diversity of service and business requirement in 5G era.

5GC will also offer superior network slicing and QoS features. Another important characteristic is the separation of the control plane and user plane that besides adding flexibility in connecting the users also allows an easier way to support a multitude of access technologies, better support for network slicing and edge computing.

5GC proposes a service based architecture (SBA), which provides unprecedented efficiency and flexibility for the network. SBA is an architectural for building system based on fine-grained, interaction of loosely coupled and autonomous components called services. This architecture model is chosen to take full advantage of the latest virtualization and software technologies.

Service-based architectures have been in use in the software industry to improve the modularity of products. A software product can be broken down into communicating services. With this approach, the developers can mix and match services from different vendors into a single product.

Compared to the previous generation reference point architecture as EPC, the elements of service based architecture are defined to be the NF (network functions), which interconnect with the rest network functions across a single API calling interface and provide the authorized services to them. Network repository functions (NRF) allows every network function to discover the services offered by other network functions. A service is an atomized capability in a 5G network, with the characteristics of high-cohesion, loose-coupling, and independent management from other services. This allows individual services to be updated independently with minimal impact to other services and deployed on demand. A service is managed based on the service framework including service registration, service authorization, and service discovery. It provides a comprehensive and highly automated management mechanism implemented by NRF, which greatly reduces the complexity of network maintenance. A service will interact with other services in a light-weight manner, e.g. API invocation.

Virtualization and cloud computing have resulted in lowering the cost of computing by pooling resources in shared data centers.

- 5G core networks can be shrunk in size by using virtualization. Varies components of the core network can be run as communicating virtual machines.

- Moving the control plane of the 5G core network to a cloud provider lowers the deployment cost.

The 5G core is a mesh of interconnected services as shown in the figure below:

…………………………………………………………………………………………………………………………………………………………………………………………………………..

Ericsson Addendum:

According to Ericsson’s latest Mobility Report, published earlier this week, global 5G subscriptions will exceed 2.6bn within the next six years and by that time Ericsson predicts that 5G will cover 65 percent of the world. It also believes that total mobile subscriptions, including to previous generation networks, will reach 8.9bn from 8bn over the next six years. More than quarter of the global subscriptions will be 5G by 2025 and will account for around 45 percent of worldwide mobile data traffic.

Additionally, Ericsson has also announced its partnership with NVIDIA in order to develop technologies that will enable communication service providers to build virtualized 5G radio access networks, which will boost the introduction of new AI and IoT-based services. The ultimate focus will be to commercialize virtualized RAN technologies to offer radio networks with flexibility and ability to enter the market in a shorter time for new services like VR, AR and gaming.

References:

https://www.itu.int/dms_pub/itu-t/opb/tut/T-TUT-HOME-2018-2-PDF-E.pdf

https://www.3gpp.org/ftp/Specs/archive/23_series/23.501/

https://www.ericsson.com/en/portfolio/digital-services/cloud-core/cloud-packet-core

https://medium.com/5g-nr/5g-service-based-architecture-sba-47900b0ded0a

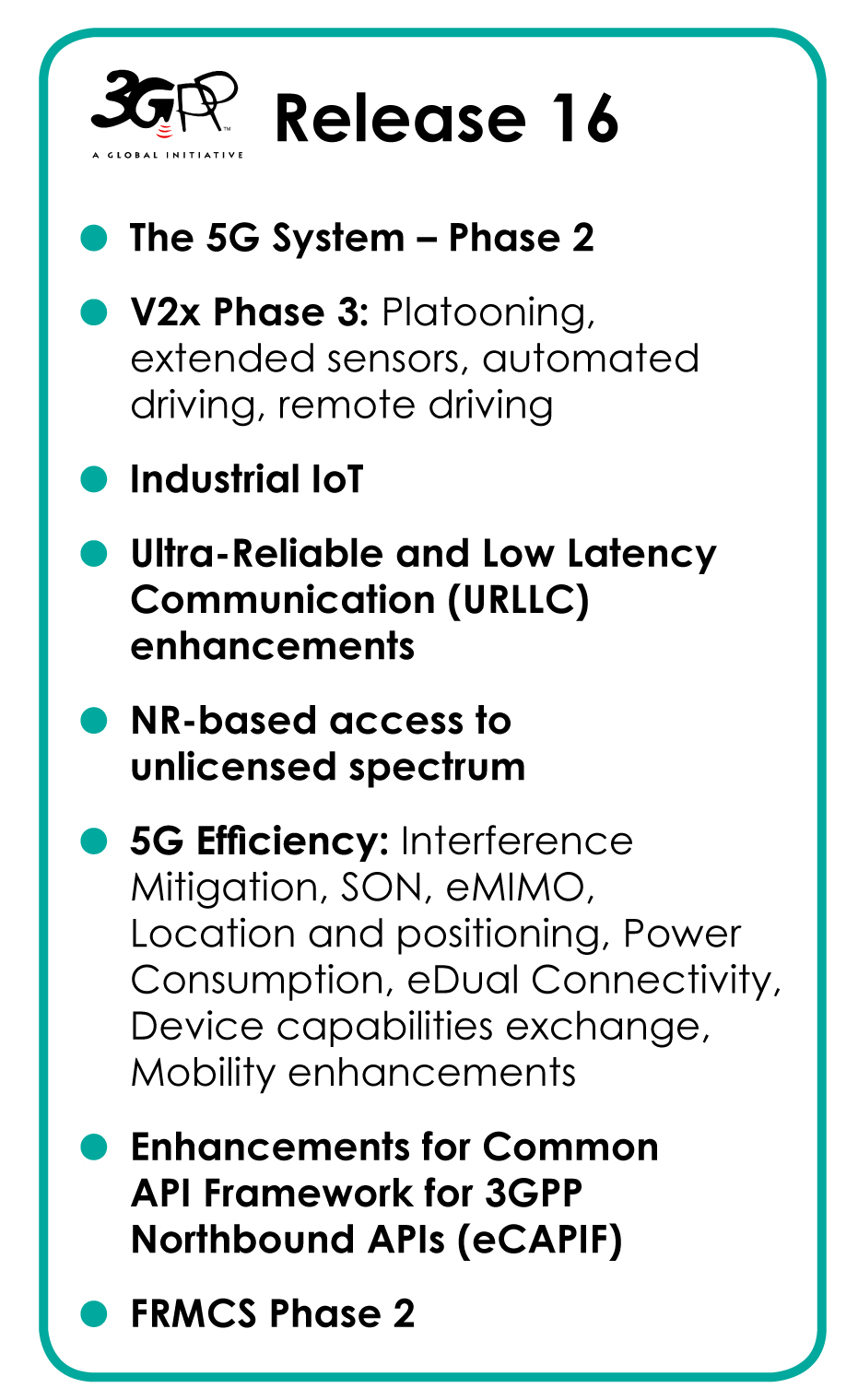

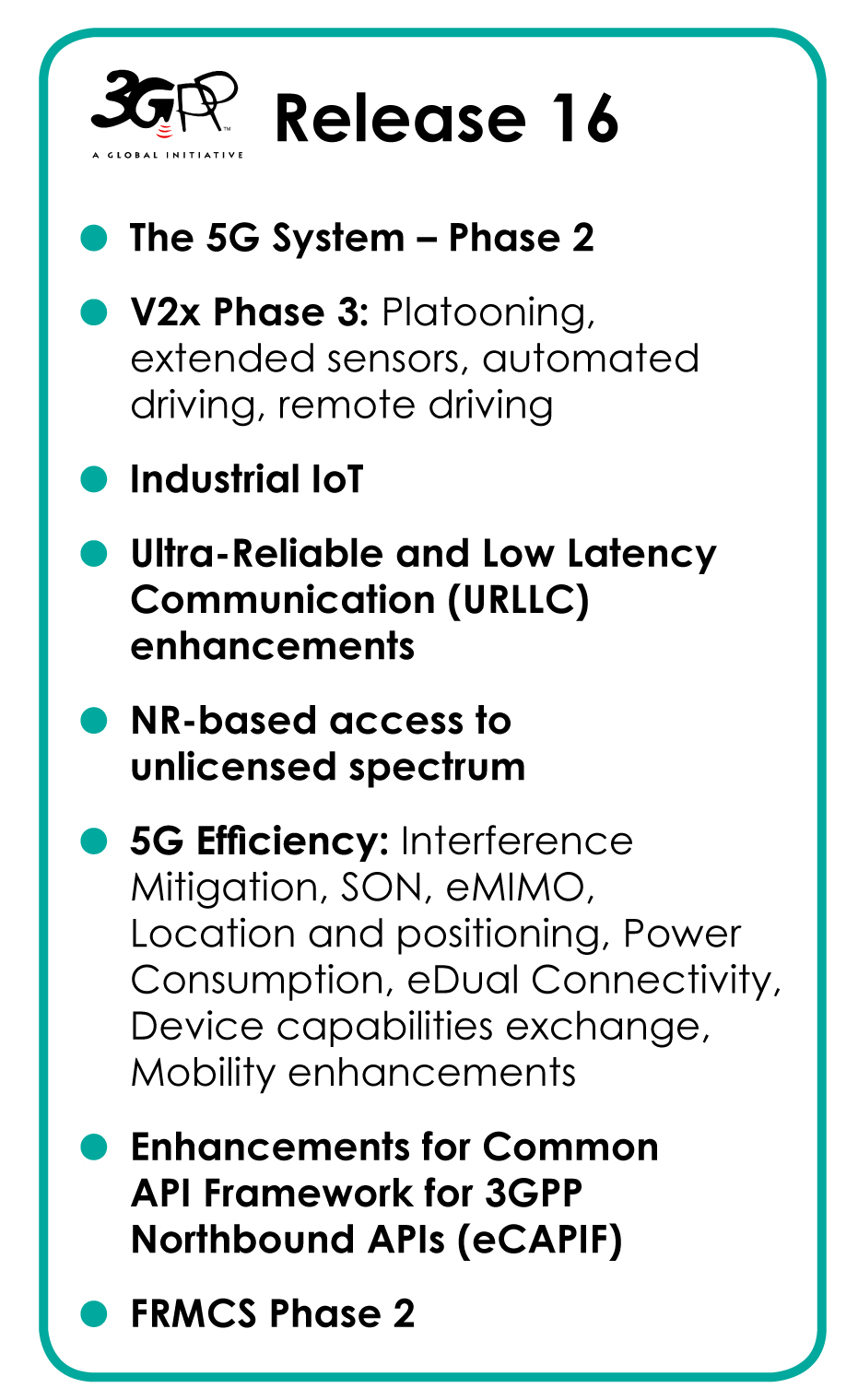

3GPP Release 16 Update: 5G Phase 2 (including URLLC) to be completed in June 2020; Mission Critical apps extended

NOTE: This article is intended as a reference, which is especially important to debunk claims made about current pre-standard 5G deployments which are almost all based on 3GPP Release 15 “5G New Radio (NR)” for the data plane with LTE signaling and LTE mobile packet core (EPC) for Non Stand Alone (NSA) operation. 5G pundits continue to site 3GPP as the standards organization responsible for 5G which is doubly wrong because it’s not a standards body and submits its 5G/IMT 2020 proposals to ITU-R WP 5D via the latter organizations member entities. As we’ve stated many times before, ITU-R is responsible for the radio standards for IMT 2020, while ITU-T is working on the non-radio aspects of IMT 2020.

………………………………………………………………………………………………………………………………………………………………………………………………………………..

Summary:

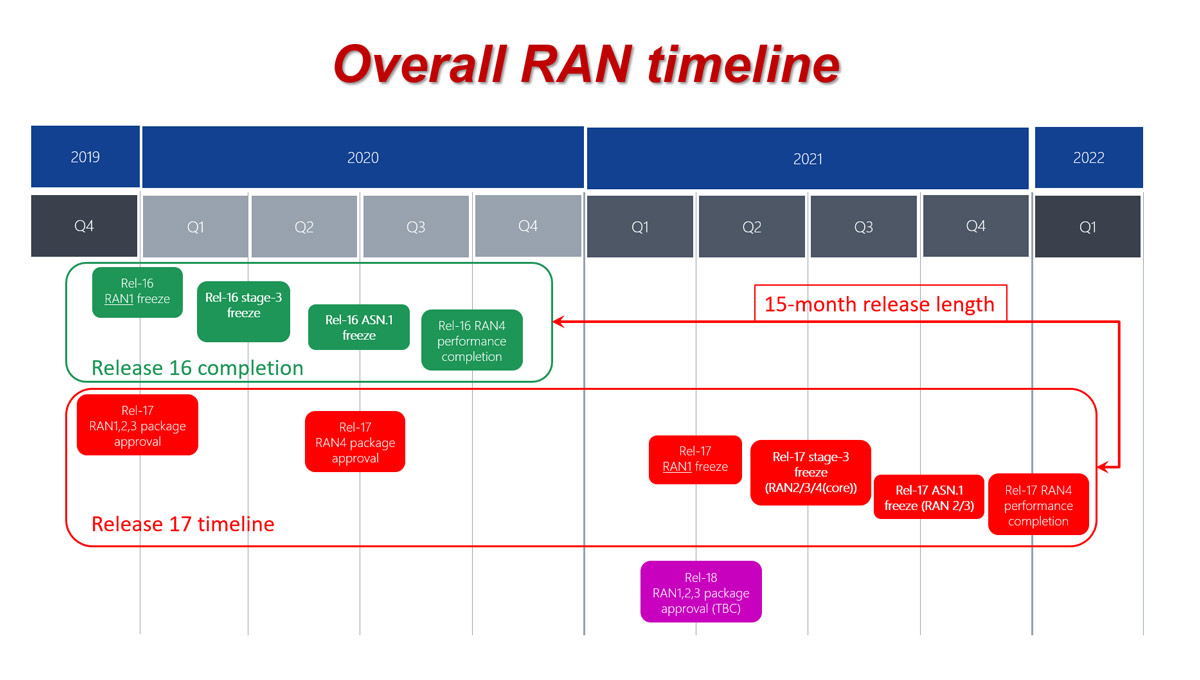

3GPP Release 16 is a major release for the project, because it will bring the specification organization’s IMT-2020 RIT/SRIT submission (to ITU-R WP 5D) for an initial full 3GPP 5G system to its completion. Release 16 will be put in a “frozen” state in March 2020 with a targeted completion date of June 2020.

3GPP work has started on approximately 25 Release 16 studies, which cover a variety of topics: Multimedia Priority Service, Vehicle-to-everything (V2X) application layer services, 5G satellite access, Local Area Network support in 5G, wireless and wireline convergence for 5G, terminal positioning and location, communications in vertical domains and network automation and novel radio techniques. Further items being studied include security, codecs and streaming services, Local Area Network interworking, network slicing and the IoT.

Here are the new features planned for 3GPP Release 16:

Details of the features and work items under each 3GPP Release are kept in the corresponding, on-line, list of features and study items.

- Enhancement of Ultra-Reliable (UR) Low Latency Communications (URLLC)

- 5GS Enhanced support of Vertical and LAN Services

- Cellular IoT support and evolution

- Advanced V2X support

- 5G Location and Positioning Services

- UE radio capability signalling optimization

- Satellite Access in 5G

- Enablers for Network Automation Architecture for 5G

- Wireless and Wireline Convergence Enhancement

- Mission Critical, Public Warning, Railways and Maritime

- Streaming and TV

- User Identities, Authentication, multi-device

- (Network) Slicing

- Other cross-TSG Release 16 Features

- NR-related Release 16 Features

- Release 16 Features impacting both LTE and NR

- LTE-related Release 16 Features

From 3GPP’s July 18, 2019 Webinar:

“For the (industry) verticals, there are three distinct pillars that we are focused on: Automotive, Industrial IoT and Operation in unlicensed bands. For 5G based V2X, which builds on the two iterations of the LTE-V2X, we are now adding advanced features – primarily in the area of low latency use cases.

The second focus is industrial IoT and URLLC enhancements. Factory automation, in particular, is a strong pillar for 5G going forward. We are trying to ensure that the radio side covers all of the functions that all the verticals need for factory automation. What this means in practice is that we are trying to make sure 5G NR can fully replace a wired ethernet – currently used – by adding time sensitive networking and high reliability capabilities.

The third pillar is operation in unlicensed bands. We have seen different schemes for generic 5G licensing strategies in Europe and in other parts of the World. We have seen in some countries that certain licensed bands have been allocated for vertical use cases, though that is not the case for a majority of countries. The use of unlicensed bands provides a great opportunity – where licensed spectrum is not an option. We are now focused on not only what we have with LTE, which is the licensed assisted access scheme, but also on standalone unlicensed operation – to be completed in Release 16.

Release 16 also delivers generic system improvements & enhancements, which target Mobile Broadband, but can also be used in vertical deployments – Particularly; positioning, MIMO enhancements and Power consumption improvements.”

………………………………………………………………………………………………………………………………………………………………………………………………….

Technical Reports (the result of the study phase) are also being developed on broadening the applicability of 3GPP technology to non-terrestrial radio access (initially satellites, but airborne base stations are also to be considered) and to maritime aspects (intra-ship, ship-to-shore and ship-to-ship). Work also progresses on new PMR functionality for LTE, enhancing the railway-oriented services originally developed using GSM radio technology that is now nearing end of life.

As part of Release 16, Mission Critical (MC) services will be extended to address a wider business sector than the initial rather narrow public security and civil defense services for which they had originally been developed. If the same or similar standards can be used for commercial applications (from taxi dispatching to railway traffic management, and other vertical sector scenarios currently being investigated), this would bring enhanced reliability to those MC services through wider deployment, and reduced deployment costs due to economies of scale – to the benefit of all users.

IMT-2020 – Final submission

- Calibration for self evaluation

- Prepare and finalize initial description template information that is to be submitted to ITU-R WP 5D#29.

Step 2: From early 2018 to Sep 2018, targeting “update & self eval” submission in Sep 2018

- Performance evaluation against eMBB, mMTC and URLLC requirements and test environments for NR and LTE features.

- Update description template and prepare compliance template according to self evaluation results.

- Provide description template, compliance template, and self evaluation results based on Rel-15 in Sep 2018.

Step 3: From Sep 2018 to June 2019, targeting “Final” submission in June 2019

- Performance evaluation update by taking into account Rel-16 updates in addition to Rel-15

- Update description template and compliance template to take into account Rel-16 updates in addition to Rel-15

- Provide description template, compliance template, and self evaluation results based on Rel-15 and Rel-16 in June 2019.

Some Background on Release 16

- See the full Release 16 Description – TR21.916 (Available at Release freeze)

- RAN Rel-16 progress and Rel-17 potential work areas (July 18, 2019)

- Early progress on Rel-16 bands for 5G (April 2, 2019)

- “Working towards full 5G in Rel-16”…See 3GPP webinar presentation (July 3, 2019)

- Preparing the ground for IMT-2020

- SA1 completes its study into 5G requirements

……………………………………………………………………………………………………………………………………………..

References:

https://www.3gpp.org/release-16

https://www.3gpp.org/news-events/2058-ran-rel-16-progress-and-rel-17-potential-work-areas

…………………………………………………………………………………………………………………………………………………………………………………………………….

Addendum (December 14, 2020):

https://www.3gpp.org/news-events/2098-5g-in-release-17-%E2%80%93-strong-radio-evolution

China’s telecom carriers to play a pioneering role in 5G; China Telecom and China Unicom may be barred from U.S.

by Ma Si <[email protected]> of China Daily Multimedia Co. Ltd.

Xiang Ligang, director-general of the Information Consumption Alliance, a telecom industry association, and a keen observer of the telecom sector for nearly two decades, said: “Chinese telecom companies have made big strides in their innovation capabilities, through their consistent and heavy input into research and development. They have strong willingness to pioneer cutting-edge applications.”

Four of the world’s top six smartphone makers – Huawei, Xiaomi, Oppo and Vivo – are Chinese. In 2018, the country produced 1.8 billion smartphones, accounting for 90 percent of global production, data from the Ministry of Industry and Information Technology showed.

Their decades of efforts have helped nurture the world’s largest online population in a single nation – the 854 million strong Chinese netizens (as of June). That is more than the combined population of European countries. More importantly, more than 99 per cent of netizens in China surf the internet through smartphones.

Vistors try 5G phones at an international expo on June 20, 2019. [Photo by Liu Chenghe/For China Daily]

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Wu Jichuan, 82, a former head of the former Ministry of Posts and Telecommunications, said handsets are becoming almost omnipresent in the country. They can help users do almost everything from buying movie tickets, booking hospital or clinic appointments to ordering meals.

“That was in sharp contrast to 1980’s when mobile communication services were first brought to China. Back then, only successful Chinese businesspeople were able to use brick-sized, palm-filling mobile phones,” Wu recalled.

Such phones, however, were capable of just two functions: making and receiving calls. Yet, they were luxury products of the time. A handset could cost as much as about 20,000 yuan ($2,798). Consumers had to pay an extra fee of 6,000 yuan to sign up for the telecom network services. Calls cost 5 jiao a minute. In comparison, the average salary of ordinary people was no more than 100 yuan a month, Wu said.

According to Wu, one of the biggest contributions of China’s telecom industry is that it laid down a sound digital infrastructure for companies and consumers to access fast internet networks at affordable prices. They laid the foundation for China’s kaleidoscope of mobile applications and thriving digital economy.

Leveraging these achievements, the country’s telecom carriers are scrambling to establish a beachhead in the 5G era, in which almost everything can be connected to the internet.

As at the end of May, Chinese companies accounted for more than 30 percent of all patents essential to the global standards for 5G. After the country granted the commercial 5G licenses in June, local telecom carriers are working to build a sound network infrastructure to accelerate the technology’s commercialization.

Yang Jie, chairman of China Mobile, the world’s largest mobile operator, said the company plans to cover 50 cities across China with 5G signals by the end of this year.

“That will involve deploying 50,000 5G base stations across the country,” Yang said, adding that the company has already raised 7 billion yuan as the first phase of a 5G fund to promote the development of key technologies. The planned total size of the fund is 30 billion yuan.

Similarly, China Unicom said it will cover at least 40 cities with 5G signals by the end of this year and work together with all industry partners, including foreign companies, to accelerate 5G infrastructure construction.

Just a day after securing its 5G license, China Unicom announced it had opened experience stores across 40 cities to encourage consumers to try applications powered by the superfast technology.

Visitors can play with mechanical robotic arms, watch 4K high-definition live-streaming, wear virtual reality goggles to play 3-D games and learn that with 5G, doctors can complete surgeries on patients 2,500 kilometers away.

Lyu Tingjie, a telecom professor at the Beijing University of Posts and Telecommunications, said: “After all the hype about 5G, the new era has finally started. All the state-of-the-art applications are getting closer to the public than ever. The next question is: How to better time the rollout and partner with a wide range of traditional sectors to boost efficiency?”

The country’s telecom carriers are expected to spend 900 billion yuan to 1.5 trillion yuan on 5G network construction from 2020 to 2025, according to a report from the China Academy of Information and Communications Technology.

The first batch of 5G smartphones hit the market in August. China Unicom said its 5G data packages will cost a minimum of 190 yuan, arguably the world’s lowest price, in its first stage of application.

In comparison, the minimum cost in South Korea’s 5G data packages is about 325 yuan per month, while US telecom operator AT&T charges users $70 (equivalent to 498 yuan) for 15-gigabytes of 5G data every 30 days.

Consumers visit the booth of China Telecom as the company’s Shanghai branch launches a promotion called “Buy 5G mobile phones and enjoy 5G network.” [Photo by Ying Liqing/China News]

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Meanwhile, Chinese telecom equipment makers are securing a growing number of 5G contracts to supply foreign telecom carriers. Huawei said it had signed 50 commercial contracts for 5G with carriers worldwide, with 28 contracts from Europe, 11 from the Middle East, six from the Asia-Pacific region, four from the Americas, and one from Africa.

According to a forecast by the Global System for Mobile Communications Association, an industry group, China is set to become the world’s largest 5G market by 2025, with 460 million 5G users.

……………………………………………………………………………………………………………………………………………………………………………………………………………………….

Sidebar: Huawei

In 2003, when Huawei Technologies Co, then known more as a manufacturer of telecom equipment like switches, and base stations, decided to set up a mobile phones department, China was still using 2G, or the second-generation wireless technology. Back then, only a fraction of consumers could use cellular phones to surf the internet. And it took them about five seconds or longer to open a web page.

Sixteen years later, Huawei is the world’s second-largest smartphone maker. Its 5G-enabled handsets can download heavy data files – say, a 1 GB movie – in seconds. That’s just a glimpse of the commercial possibilities in the 5G era, which China kicked off in June.

From a virtual non-entity in the global mobile phones market to a world-renowned company, Huawei’s rise has been meteoric, and it coincided with the development of China’s telecommunications industry.

Huawei, however, is just one of the many Chinese telecom companies that have thrived on the global stage in recent years, helping the country to transform from a follower during the period of 2G and 3G to a pioneer in the 5G era.

William Xu, a director on Huawei’s board and president of the Institute of Strategic Research, said the company has had more than 200,000 5G base stations in shipment, which marked a steady step forward, compared with its earlier announcement of 150,000 base stations in late June.

Huawei has invested about $4 billion in all so far in the research and development of 5G since 2009.Founder and CEO Ren Zhengfei has said in an interview that other players will not be able to catch up with Huawei in 5G over the next two to three years.

http://www.chinadaily.com.cn/a/201909/16/WS5d7ee28ca310cf3e3556b8d9.html

……………………………………………………………………………………………………………………………………………………………………………………………………………………….

Senators Urge F.C.C. to Review Licenses of 2 Chinese Telecom Companies:

Senator Chuck Schumer of New York along with Senator Tom Cotton of Arkansas, cited national security concerns in a letter to the FCC which asked the commission to review the licenses that giveChina Telecom and China Unicom, the right to use networks in the United States. In the letter, they said that the two Chinese government-linked telecom operators could use that access to “target” Americans’ communications. And they warned that the companies could reroute communications traveling on their networks through China. The text of the letter was obtained by The New York Times.

Brian Hart, an F.C.C. spokesman, said that Ajit Pai, the F.C.C. chairman, had made it clear that the agency was “reviewing other Chinese communications companies such as China Telecom and China Unicom” but didn’t commit to opening a formal proceeding to look at the licenses.

China Telecom denied that it represents a national security threat to the United States. China Unicom did not respond to a request for comment.

“We make the protection of our customers’ data a priority, and have built a solid reputation as one of the best telecom companies in the world,” said Ge Yu, a spokesman for China Telecom’s Americas subsidiary, adding that the company is proud of “maintaining a good standing with all regulatory agencies.”

National security officials have been worried for years that the Chinese government could use its companies to gain access to crucial telecommunications infrastructure. Those concerns have become more prominent as carriers in the United States and in China race to launch next-generation 5G wireless networks — and American regulators have targeted Chinese telecom companies in the name of security.

In May the F.C.C. denied an application from China Mobile to operate in the United States. Ajit Pai, the commission’s chairman, said at the time that there was a risk that the Chinese state would use the carrier to “conduct activities that would seriously jeopardize the national security, law enforcement, and economic interests of the United States.”

So if the FCC bans China Telecom and China Unicom it will be a trifecta ban on all three state owned Chinese telecom operators!

https://www.nytimes.com/2019/09/15/business/federal-communications-commission-china.html

………………………………………………………………………………………………………………………………………………………………………………………………………………………..

GSMA calls for 5G policy incentives in China + 2018 MWC Shanghai a big success!

China is expected to become the world’s largest 5G market by 2025, accounting for around 430 million 5G connections, representing a third of the global total.

Industry verticals where 5G are expected to play a key role include: automotive, drones and manufacturing. The report calls for China to promote the development of legislation for areas such as car-hacking and data privacy to support China’s connected car market.

The report notes that China Mobile, China Telecom and China Unicom are all currently trialing 5G autonomous driving and working on solutions such as cellular vehicle-to-everything (C-V2X) for remote driving and autonomous vehicles.

To accelerate the development of the drone market, the report calls for common standards for connectivity management. The drone market is expected to be worth around $13 billion by 2025.

Finally, the report calls for common standards for interconnection between Industry 4.0 platforms and devices (more below) to avoid market fragmentation, drive economies of scale and increase speed to market.

“China’s leadership in 5G is backed by a proactive government intent on delivering rapid structural change and achieving global leadership – but without industry-wide collaboration, the right incentives or appropriate policies in place, the market will not fulfil its potential,” commented Mats Granryd, Director General, GSMA. “Mobile operators should be encouraged to deliver what they do best in providing secure, reliable and intelligent connectivity to businesses and enterprises across the country.”

“Wide collaboration and a right policy environment are essential for 5G to unleash its potential in various verticals, and the three sectors addressed in the report are only a beginning,” said Craig Ehrlich, Chairman of GTI. “The Chinese government and all three operators have been propelling 5G trials and cross-industrial innovation, and the valuable experience gained from the process should serve as a worthwhile reference for the other markets around the globe.”

velopment of legislation for areas such as car-hacking and data privacy. New policies should be pro-innovation and pro-investment to encourage future developments in the sector. All three operators are currently trialling 5G autonomous driving and working on solutions such as Cellular Vehicle-to-Everything (C-V2X) for remote driving, vehicle platooning and autonomous vehicles.

Accelerated Growth of Drones Market:

The report also calls for common standards for connectivity management in the drones market to help accelerate investment and the deployment of new infrastructure and service models. The drones market, estimated to be worth RMB80 billion ($13 billion) by 2025, is developing rapidly in China in applications such as parcel delivery and tracking, site surveying, mapping and remote security patrols, among others. Improvements in mapping, real-time video distribution and analytics platforms are also helping to establish the technology in industrial verticals.

China Entering Age of Industry 4.0:

Backed by government support, China is transforming its manufacturing industry through embracing the use of artificial intelligence, the Internet of Things (IoT), machine learning and analytics. The government’s aim is to increase productivity and drive new revenue opportunities. The report calls for common standards for interconnection between platforms and devices to avoid market fragmentation, drive economies of scale and increase speed to market. GSMA Intelligence estimates that there will be 13.8 billion global Industrial IoT (IIoT) connections by 2025 with China accounting for 65%.

………………………………………………………………………………………………………..

Separately, GSMA today reported that more than 60,000 unique visitors from 112 countries and territories attended the 2018 GSMA Mobile World Congress Shanghai, from 27-29 June in Shanghai. The three-day event attracted executives from the largest and most influential organisations across the mobile ecosystem, as well from companies in a range of vertical industry sectors. In addition to this business-to-business audience, nearly 8,800 consumers from the greater Shanghai metropolitan area attended the Migu Health and Fitness Festival, which was held in the Mobile World Congress Shanghai halls at the Shanghai New International Exhibition Centre (SNIEC).

“We are extremely pleased with the results for the 2018 Mobile World Congress Shanghai, particularly the very strong growth in our business-to-business segment,” said John Hoffman, CEO, GSMA Ltd. “Attendees were able to truly “Discover a Better Future”, from the thought leadership conference to the exhibition and everywhere in between. With more than two-thirds of the world’s population as subscribers, mobile is revolutionising industries and improving our everyday lives, creating exciting new opportunities while providing lifelines of hope and reducing inequality. Mobile truly is connecting everyone and everything to a better future.”

Covering seven halls at the SNIEC, the 2018 Mobile World Congress Shanghai hosted 550 exhibitors, nearly half of which come from outside of China. The conference programme attracted nearly 4,000 attendees, with more than 55 per cent of delegates holding senior-level positions, including nearly 320 CEOs. Nearly 830 international media and industry analysts attended Mobile World Congress Shanghai to report on the many industry developments highlighted at the show.

………………………………………………………………………………………………………………………………………………….

About the GSMA:

The GSMA represents the interests of mobile operators worldwide, uniting nearly 800 operators with more than 300 companies in the broader mobile ecosystem, including handset and device makers, software companies, equipment providers and internet companies, as well as organisations in adjacent industry sectors. The GSMA also produces industry-leading events such as Mobile World Congress, Mobile World Congress Shanghai, Mobile World Congress Americas and the Mobile 360 Series of conferences.

For more information, please visit the GSMA corporate website at www.gsma.com. Follow the GSMA on Twitter: @GSMA

About the GTI:

GTI (Global TD-LTE Initiative), founded in 2011, has been dedicated to constructing a robust ecosystem of TD-LTE and promoting the convergence of LTE TDD and FDD. As 4G evolves to 5G, GTI 2.0 was officially launched at the GTI Summit 2016 Barcelona, aiming not only to further promote the evolution of TD-LTE and its global deployment, but also to foster a cross-industry innovative and a synergistic 5G ecosystem.

For more information, please visit the GTI website at http://gtigroup.org/

Is FCC Net Neutrality Rollback Coming? Will that spark cablcos investment in rural/ suburban areas? AT&T won’t challenge FTC

Net neutrality advocates are declaring June 26 another day of action in support of Democrats’ resolution to restore the 2015 Obama-era net neutrality rules. Public Knowledge, Common Cause, Consumers Union and other groups want to bring pro-net neutrality Americans directly to the offices of their representatives in the House to lobby for passage of the measure, drawn up under the Congressional Review Act. The Senate passed it 52-47 last month, and so far 124 House lawmakers have signed the paperwork to force a floor vote (they need 218, so they’ve got some work cut out for them). TechFreedom is hosting a more skeptical panel discussion on Democrats’ effort Tuesday. Among the panelists slated to appear is Grace Koh, who advised President Trump on telecom issues until she left the White House earlier this year.

Tom Leithauser of TR Daily (subscription required) wrote yesterday:

The rollback of net neutrality rules by the FCC will spark broadband investment in rural and suburban areas served by small and mid-sized cable TV operators, Matthew Polka, president and chief executive officer of the American Cable Association, said on this week’s “The Communicators” program.

“It created a sense of greater innovation and investment that these companies can now deploy,” Mr. Polka said on the show, which is set to air on C-SPAN tomorrow and C-SPAN2 on Monday.

He noted that broadband networks were increasingly being viewed as “infrastructure” by policy-makers and that deployment to underserved and unserved areas was a top priority at the FCC and among some members of Congress.

One impediment to broadband deployment, he said, is the time and cost required to arrange access to utility poles. Andrew Petersen, an ACA board member and senior vice president for TDS Telecom who also appeared on the C-SPAN program, said pole attachment rates for his company averaged $7.80 per pole, but were significantly higher in some markets. “It really retards our ability to make those investments to extend broadband,” Mr. Petersen said.

Mr. Petersen expressed hope that the FCC’s Broadband Deployment Advisory Committee would offer recommendations on ways to lower the cost of pole attachments and other broadband deployment expenses, which he said were his company’s top cost.

“When you bring robust broadband to a new area, you’re combatting the ‘homework gap,’ [and] you’re allowing for economic development and commerce to take place,” Mr. Petersen said. He said it was unlikely, however, for 5G service to bring broadband to unserved areas because those areas generally lack structures needed to place 5G equipment.

“We’re not bullish that 5G is going to make its way to suburban and rural areas immediately,” he said. “I don’t believe 5G technology is going to make its way to those areas in the next several years.”

In a related CNET post, Margaret Reardon wrote:

AT&T has given up efforts to challenge the Federal Trade Commission’s authority to regulate broadband (Internet access) providers. AT&T on Tuesday informed court officials that it would not file a petition to the US Supreme Court to challenge a lower court’s decision in the case. In 2014, the FTC sued AT&T in the US District Court of Northern California, accusing the company of promising unlimited data service to customers and then slowing that service down to rates that were barely usable. The case hasn’t yet gone to trial since AT&T had argued that the FTC has no authority over any of AT&T’s businesses.

The US Appeals court in Northern California rejected that argument in February and said the case could proceed. AT&T had until May 29 to file an appeal the the Supreme Court to challenge the decision.

AT&T indicated earlier this month in a status report submitted to the appeals court that it was considering appealing to the Supreme Court to stop the case.

This case was being closely watched by net neutrality supporters, because the question of whether the FTC has authority over AT&T would have had big implications for the future of the internet and whether there will be any cop on the beat ensuring that consumers are protected from big phone companies abusing their power online.

Why? When the Federal Communications Commission gave up its authority to police the internet with its repeal of net neutrality regulations in December, it specifically handed authority to protect consumers online to the FTC.

Net neutrality is the idea that all traffic on the internet should be treated equally and that large companies like AT&T, which is trying to buy Time Warner, can’t favor their own content over a competitor’s content. Rules adopted by a Democrat-led FCC in 2015 codified these principles into regulation. The current FCC, controlled by Republicans, voted to repeal the regulations and hand over authority to protect internet consumers to the FTC.

But there was one hitch in the law that could have made it impossible for the FTC to oversee some of the biggest broadband companies. Many of these companies, like AT&T and Verizon, also operate traditional telephone networks, which are still regulated by the FCC. AT&T argued that because some aspects of its business, like its traditional phone services, are regulated by the FCC, the FTC doesn’t have jurisdiction.

A federal appeals court disagreed with AT&T’s argument, stating the FTC can fill in oversight gaps when certain services, like broadband, aren’t regulated by the FCC. If AT&T had appealed to the Supreme Court and if the court had taken the case and ruled in AT&T’s favor, it would have meant that phone companies providing broadband or wireless internet services would be immune from government oversight. By contrast, cable companies, which do not operate traditional phone networks regulated by the FCC, would still be under the authority of the FTC.

For now, that doomsday scenario is put to rest and the lower court’s ruling that the FTC can, in fact, oversee all broadband providers stands.

Meanwhile, net neutrality supporters continue their fight to preserve the 2015 rules. Several states, including California and New York, are considering legislation to reinstate net neutrality rules. Earlier this year, Washington became the first state to sign such legislation into law. Governors in several states, including New Jersey and Montana, have signed executive orders requiring ISPs that do business with the state adhere to net neutrality principles.

Democrats in the US Senate are also trying to reinstate the FCC’s rules through the Congressional Review Act, which gives Congress 60 legislative days in which to overturn federal regulations. The resolution passed the Senate earlier this month and must pass the House of Representatives and eventually be signed into law by President Donald Trump to officially turn back the repeal of the rules.

Ericsson’s Deliverables and Take-aways from IoT World 2018 & Private Briefing

Ericsson is one of the top three wireless network equipment companies in the world (they were #1 until Huawei took that coveted spot). Approximately 40% of the world’s mobile traffic is carried over Ericsson networks. The company has customers in 182 countries and offers comprehensive industry solutions ranging from Cloud services and Mobile Broadband to Network Design and Optimization. Ericcson also has one of the most compelling IoT platforms in their IoT Accelerator, which we described earlier this year.

Image above courtesy of Ericsson

…………………………………………………………………………………………………………………………………………………………………..

Ericsson had a huge presence at IoT World 2018 with an impressive exhibit floor booth, a Wednesday private briefing session at their Santa Clara, CA location and three presentations at IoT World 2018 conference sessions.

I attended the private briefing at Ericsson- Santa Clara, got a tour of some of the exhibits there, heard the talk by Shannon Lucas (VP. Head of Emerging Business Unit in North America) on Tuesday and met with Ericsson’s IoT expert Mats Alendal on Thursday for a one on one conversation about Ericsson’s IoT strategy and associated wireless WANs (e.g. NB-IoT, LTE-M, and “5G”).

Most surprising was that Mats claimed that the transition from 4G LTE to whatever the 5G RAN/RIT is will be ONLY A SOFTWARE UPGRADE OF ERICSSON’S BASE STATION. He also said that if the 5G latency could be reduced to 1 or 2 ms, it would open up many new real time Industrial IoT (IIoT) applications that we haven’t thought of yet. Such a low latency would require a controlled environment, typically in a manufacturing plant or similar, and mm wave radio.

Currently most IIoT applications rely on wired connectivity on a factory floor, manufacturing plant or test facility. In a few cases wireless LANs (e.g. WiFi, Zigbee, proprietary) might be used. Hence, wireless WAN connectivity represents a big shift for many industrial customers. IIoT use cases in manufacturing require a wireless WAN with low latency, guaranteed delivery of messages/packets/frames, and instant control/feedback.

One of the best IIoT wireless WAN solutions is Private LTE. It’s probably more robust than cellular LPWANs (NB-IoT and LTE-M) and provides cost benefits as well. In a Thursday afternoon session, Nokia recommended Private LTE for many of those IIoT applications (more information by emailing this author). Ericsson is delivering Private LTE equipment via its 3GPP compliant, licensed and unlicensed bands for Private LTE.

IIoT use cases powered by Ericsson include connected factory robots, manufacture of highly precise bladed disks (BLISKs) for turbines, and spherical roller bearings for SKF. A case study for 5G trial for BLISKs may be viewed here.

Highlights of Shannon Lucas’ talk – Data Infrastructure: Mobile IoT: LPWAN & 5G:

- 18B connected IoT devices are expected by 2022 (that’s down from earlier forecasts of 20B and more by 2020)

- Edge computing network is needed for ultimate scalability and a great user experience (user might be a machine/device)

- Hardware innovation platform can make LTE-M and NB-IoT easier to implement for network operators. AT&T and Verizon are using Ericsson’s NB-IoT technology for their commercial offerings.

- Ericsson has driven standards for cellular connectivity, and that effort is now naturally extending into setting standards for IoT, and more specifically, cellular IoT. With standardization, the IoT becomes a platform from which collaboration between organizations, both private and public, will benefit us all.

- Ericsson’s standardized approach for connecting devices and sensors allows cities to collaborate and share data, regardless of legacy platforms. This helps engineers improve traffic flow, and allows emergency services to optimize response times.

- A collaboration between Ericsson, Intelight and Teleste is helping to break up traffic and information gridlock. Four cities in the Dallas-Fort Worth metroplex have launched a regional system employing the Ericsson Connected Urban Transport ITS platform.

Wednesday Evening Private Briefing:

Ericsson Ventures (VC arm of Ericsson) is focused on driving innovation in areas that will accelerate Ericsson’s core business and generate strong financial performance. Intent is to combine start-up solution with Ericsson’s technologies. 6 to 7 deals per year with average investment of $1.5M. Ericsson likes to be part of a syndicate of VCs and corporate investors in the targeted start-up. They are start-up stage agnostic.

Areas for Ericsson Ventures investment include: IoT, analytics connected car, security, SDN, AR and VR, mobile advertising, wireless connectivity AI and ML.

Many new IoT applications will be enabled by 5G (so thinks everyone), including the connected car and real time control for IIoT. This author is not so sure. We think that high bandwidth and/or low latency might be needed for at most 5 to 10% of IoT applications.

…………………………………………………………………………………………………………………………………………………………………..

References:

Ericsson IoT accelerator platform: https://www.ericsson.com/en/internet-of-things/solutions/iot-platform

Ericsson Technology Review (our most technical papers): https://www.ericsson.com/en/ericsson-technology-review

Cellular IoT Use Cases: https://www.ericsson.com/en/networks/cases/cellular-iot

Enabling intelligent transport in 5G networks

Industrial automation enabled by robotics, machine intelligence and 5G

Ericsson white papers: https://www.ericsson.com/en/white-papers

- 5G radio access – capabilities and technologies

- Cellular networks for Massive IoT

AT&T: Mobile 5G will use mm wave & small cells

AT&T says it will use small cells for its mobile “5G” service planned for 12 U.S. cities this year. The company’s first of these roll outs will use millimeter wave [1] spectrum, which offers higher capacity rates than low-band spectrum but does not propagate over large distances. That requires transmit/receive radios need to closer together than they are in LTE deployments.

Note 1. Millimeter wave (also millimeter band) is the band of spectrum between 30 gigahertz (Ghz) and 300 Ghz.

“Millimeter wave is more associated with small cell-like ranges and heights,” said AT&T’s Hank Kafka, VP of network architecture. “It can be on telephone poles or light poles or building rooftops or on towers, but generally if you’re putting it on towers it’s at a lower height than you would put a high-powered macrocell, because of the propagation characteristics.”

“5G will change the way we live, work and enjoy entertainment,” said Melissa Arnoldi, president, AT&T Technology and Operations. “We’re moving quickly to begin deploying mobile 5G this year and start unlocking the future of connectivity for consumers and businesses. With faster speeds and ultra-low latency, 5G will ultimately deliver and enhance experiences like virtual reality, future driverless cars, immersive 4K video and more.”

AT&T has announced 23 cities that are getting its 5G Evolution infrastructure, which the company describes as “the foundation for mobile 5G.” Those cities are Atlanta; Austin; Boston; Bridgeport, Connecticut; Buffalo, New York; Chicago; Fresno, CA; Greenville, South Carolina; Hartford, Connecticut; Houston; Indianapolis; Los Angeles; Louisville; Memphis; Nashville; New Orleans; Oklahoma City; Pittsburgh; San Antonio; San Diego; San Francisco; Tulsa, Oklahoma and Sacramento, California.

AT&T’s deployment of small cells to support mobile 5G will be largely independent of another 2017 AT&T infrastructure initiative – the build-out of the 700 MHz spectrum for FirstNet.

“Where appropriate we’re always going to try and get as much synergy as we can … but there’s a difference between dealing with small cell sites and dealing with macro sites,” Kafka said.

“You’ll find that a lot of radios that suppliers are putting out now are going to be upgradeable to support 5G,” Kafka said. “Some of the radios we’re deploying now do have that capability in the hardware.”

Kafka said that in some instances, tower crews might be able to add “5G” equipment near the base of the tower at the same time they add 700 MHz radios to the top. But the synergies between the two deployments are limited.

………………………………………………………………………………….

In sharp contrast to AT&Ts endorsement of millimeter wave technology, Sprint’s CTO John Saw said last week that he is not sure that using millimeter waves to deliver 5G services is a practical economic use of the high-band spectrum and that Sprint will be focusing on using its existing bandwidth to initially deploy 5G.

“What is the cost to deliver a bit over millimeter waves? Where is the business case on that?” John Saw asked at the Citi conference in Las Vegas.

………………………………………………………………………………………………………….

Verizon CTO Hans Vestberg told a CES panel last week that Verizon “will be first” to deploy 5G. Verizon is moving ahead with deployment of pre-standard fixed-wireless 5G service, starting with a rollout in Sacramento, California in the second half of this year. But Vestberg noted fixed-wireless is just one part of what Verizon plans to do with 5G.

“From 5G you can do different slices. We are now focusing on one slice, which is basically residential broadband to deliver superior performance quicker to market…That’s one use case, we can talk about many others.”

References:

https://www.rcrwireless.com/20180111/carriers/att-mobile-5g-will-rely-on-small-cells-tag4

https://policyforum.att.com/att-innovations/preparing-5g-need-small-cell-technology/

http://about.att.com/story/att_to_launch_mobile_5g_in_2018.html

https://techblog.comsoc.org/category/5g/

http://www.lightreading.com/mobile/5g/sprint-says-no-to-mmwave-yes-to-mobile-5g/d/d-id/739592