5G

IEEE/SCU SoE Virtual Event: May 26, 2022- Critical Cybersecurity Issues for Cellular Networks (3G/4G, 5G), IoT, and Cloud Resident Data Centers

This virtual event on ZOOM will be from 10am-12pm PDT on May 26, 2022.

Session Abstract:

IEEE ComSoc and SCU School of Engineering (SoE) are thrilled to have three world class experts discuss the cybersecurity threats, mitigation methods and lessons learned from a data center attack. One speaker will also propose a new IT Security Architecture where control flips from the network core to the edge.

Each participant will provide a 15 to 20 minute talk which will be followed by a lively panel session with both pre-planned and ad hoc/ extemporaneous questions. Audience members are encouraged to submit their questions in the chat and also to send them in advance to [email protected].

Below are descriptions of each talk along with the speaker’s bio:

Cybersecurity for Cellular Networks (3G/4G, 5G NSA and SA) and the IoT

Jimmy Jones, ZARIOT

Abstract:

Everyone agrees there is an urgent need for improved security in today’s cellular networks (3G/4G, 5G) and the Internet of Things (IoT). Jimmy will discuss the legacy problems of 3G/4G, migration to 5G and issues in roaming between cellular carriers as well as the impact of networks transitioning to support IoT.

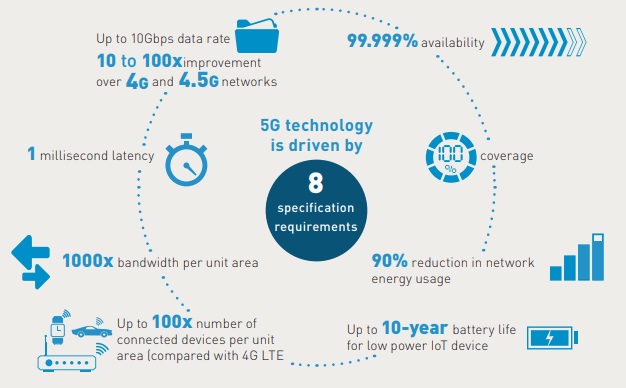

Note: It’s important to know that 5G security, as specified by 3GPP (there are no ITU recommendations on 5G security), requires a 5G Stand Alone (SA) core network, very few of which have been deployed. 5G Non Stand Alone (NSA) networks are the norm, but they depend on a 4G-LTE infrastructure, including 4G security.

Cellular network security naturally leads into IoT security, since cellular networks (e.g. NB IoT, LTE-M, 5G) are often used for IoT connectivity.

It is estimated that by 2025 we will interact with an IoT device every 18 seconds, meaning our online experiences and physical lives will become indistinguishable. With this in mind it is as critical to improve IoT security as fastening a child’s seatbelt.

The real cost of a security breach or loss of service for a critical IoT device could be disastrous for a business of any size, yet it’s a cost seldom accurately calculated or forecasted by most enterprises at any stage of IoT deployment. Gartner predicts Operational Technologies might be weaponized to cause physical harm or even kill within three years.

Jimmy will stress the importance of secure connectivity, but also explain the need to protect the full DNA of IoT (Device, Network and Applications) to truly secure the entire system.

Connectivity providers are a core component of IoT and have a responsibility to become part of the solution. A secure connectivity solution is essential, with strong cellular network standards/specifications and licensed spectrum the obvious starting point.

With cellular LPWANs (Low Power Wide Area Networks) outpacing unlicensed spectrum options (e.g. LoRa WAN, Sigfox) for the first time, Jimmy will stress the importance of secure connectivity and active collaboration across the entire IoT ecosystem. The premise is that the enterprise must know and protect its IoT DNA (Device, Network & Application) to truly be secure.

Questions from the audience:

I am open to try and answer anything you are interested in. Your questions will surely push me, so if you can let me know in advance (via email to Alan) that would be great! It’s nice to be challenged a bit and have to think about something new.

One item of interest might be new specific IoT legislation that could protect devices and data in Europe, Asia, and the US ?

End Quote:

“For IoT to realize its potential it must secure and reliable making connectivity and secure by design policies the foundation of and successful project. Success in digital transformation (especially where mission and business critical devices are concerned) requires not only optimal connectivity and maximal uptime, but also a secure channel and protection against all manner of cybersecurity threats. I’m excited to be part of the team bringing these two crucial pillars of IoT to enterprise. I hope we can demonstrate that security is an opportunity for business – not a burden.”

Biography:

Jimmy Jones is a telecoms cybersecurity expert and Head of Security at ZARIOT. His experience in telecoms spans over twenty years, during which time he has built a thorough understanding of the industry working in diverse roles but all building from early engineering positions within major operators, such as WorldCom (now Verizon), and vendors including Nortel, Genband & Positive Technologies.

In 2005 Jimmy started to focus on telecom security, eventually transitioning completely in 2017 to work for a specialist cyber security vendor. He regularly presents at global telecom and IoT events, is often quoted by the tech media, and now brings all his industry experience to deliver agile and secure digital transformation with ZARIOT.

…………………………………………………………………………………………………………………………………………………………………………………………………………………….

Title: Flip the Security Control of the Internet

Colin Constable, The @ Company

The PROBLEM:

With the explosion of Internet connected devices and services carrying user data, do current IT architectures remain secure as they scale? The simple and scary answer is absolutely no, we need to rethink the whole stack. Data breaches are not acceptable and those who experience them pay a steep price.

Transport Layer Security (TLS) encrypts data sent over the Internet to ensure that eavesdroppers and hackers are unable to see the actual data being transmitted. However, the Router needs meta data (the IP and Port) to make it work. What meta data does the Data level Router have access to?

We need to discuss how to approach the problem and selectively discard, but learn from previous IT architectures so that we can build a more solid, secure IT infrastructure for the future.

Proposition:

I will provide a glimpse of a future security focused IT architecture.

- We need to move most security control functionality to the edge of the network.

- Cloud data center storage should be positioned as an encrypted cache with encryption keys at the edge.

- No one set of keys or system admin can open all the encrypted data.

When data is shared edge to edge we need to be able to specify and authenticate the person, entity or thing that is sharing the data. No one in the middle should be able to see data in the clear.

Issues with Encryption Keys:

- IT and Data security increasingly rely on encryption; encryption relies on keys; who has them?

- Is there really any point to VPN’s Firewalls and Network segmentation if data is encrypted?

- We use keys for so many things TLS, SSH, IM, Email, but we never tend to think about the keys.

- Do you own your keys? If not someone else can see your data!

- What do we need to flip the way IT is architected?

Recommendations for Keys:

- Keys should be cut at the edge and never go anywhere else.

- You should be able to securely share keys along with the data being transmitted/received.

- There needs to be a new way to think about identity on the Internet.

The above description should stimulate many questions from attendees during the panel discussion.

Biography:

Colin Constable’s passion is networking and security. He was one of the founding members of the Jericho Forum in the 2000s. In 2007 at Credit Suisse, he published “Network Vision 2020,” which was seen by some as somewhat crazy at the time, but most of it is very relevant now. While at Juniper, Colin worked on network virtualization and modeling that blurred the boundaries between network and compute. Colin is now the CTO of The @ Company, which has invented a new Internet protocol and built a platform that they believe will change not just networking and security, but society itself for the better.

……………………………………………………………………………………………………………………….

The Anatomy of a Cloud Data Center Attack

Thomas Foerster, Nokia

Abstract:

Critical infrastructure (like a telecommunications network) is becoming more complex and reliant on networks of inter-connected devices. With the advent of 5G mobile networks, security threat vectors will expand. In particular, the exposure of new connected industries (Industry 4.0) and critical services (connected vehicular, smart cities etc.) widens the cybersecurity attack surface.

The telecommunication network is one of the targets of cyber-attacks against critical infrastructure, but it is not the only one. Transport, public sector services, energy sector and critical manufacturing industries are also vulnerable.

Cloud data centers provide the required computing resources, thus forming the backbone of a telecommunications network and becoming more important than ever. We will discuss the anatomy of a recent cybersecurity attack at a cloud data center, review what happened and the lessons learned.

Questions:

- What are possible mitigation’s against social engineering cyber- attacks?

-Multifactor authentication (MFA)

-Education, awareness and training campaigns

- How to build trust using Operational Technology (OT) in a cloud data center?

Examples:

- Access monitoring

- Audits to international standards and benchmarks

- Security monitoring

- Playbooks with mitigation and response actions

- Business continuity planning and testing

Recommendations to prevent or mitigate DC attacks:

- Privileged Access Management across DC entities

- Individual credentials for all user / device entities

- MFA: One-Time Password (OTP) via text message or phone call considered being not secure 2-Factor Authentication anymore

- Network and configuration audits considering NIST/ CIS/ GSMA NESAS

- Regular vulnerability scans and keep network entities up to date

- Tested playbooks to mitigate security emergencies

- Business continuity planning and establish tested procedures

Biography:

Thomas Foerster is a senior product manager for Cybersecurity at Nokia. He has more than 25 years experiences in the telecommunications industry, has held various management positions within engineering and loves driving innovations. Thomas has dedicated his professional work for many years in product security and cybersecurity solutions.

Thomas holds a Master of Telecommunications Engineering from Beuth University of Applied Sciences, Berlin/ Germany.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Video recording of this event: Critical Cybersecurity Issues for Cellular Networks, IoT, and Cloud-Resident Data Centers – YouTube

Previous IEEE ComSoc/SCU SoE March 22, 2022 event: OpenRAN and Private 5G – New Opportunities and Challenges

Video recording: https://www.youtube.com/watch?v=i7QUyhjxpzE

AIS Thailand, Qualcomm and ZTE showcase 1st 5G NR-DC at 2.6GHz and 26GHZ

Advanced Info Service Pcl (AIS) Thailand [1.], Qualcomm Technologies, Inc. and ZTE have jointly announced the world’s first 5G NR-DC (New Radio Dual Connectivity) [2.] showcase in the field with 2.6GHz and 26GHz. The trial achieved 8.5Gbps peak downlink speed and 2.17Gbps peak uplink speed with a single mobile device.

Note 1. AIS is Thailand’s largest mobile operator. It’s owned by INTOUCH Company (40.45%) and Singtel (23.32%)

Note 2. NR-DC is the use of two frequency bands in 3GPP’s 5G NR to improve coverage and data speeds.

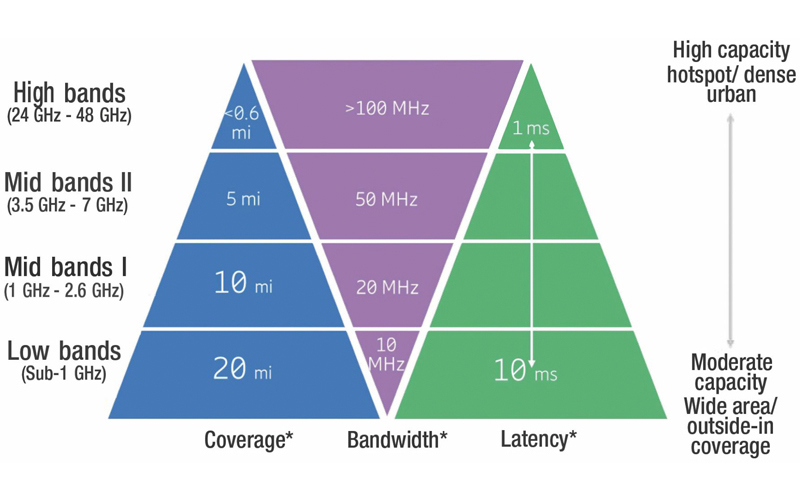

As part of the joint effort, this collaboration combines two major 5G frequency bands, sub-6GHz and 26GHz (5G mmWave frequencies have yet to be standardized in ITU-R M.1036 by ITU-R WP5D), to enhance the capabilities of Thailand’s 5G network and extend the 5G application landscape.

The trial was conducted at the AIS commercial 5G site in Korat, Thailand, using a smartphone form-factor test device powered by Snapdragon® X65 5G Modem-RF System, and ZTE’s latest mmWave AAU network infrastructure equipment.

The NR-DC was implemented with one 100MHz carrier in 2.6GHz, and four 200MHz carriers in 26GHz. The test achieved 8.5Gbps peak downlink speed and 2.17Gbps peak uplink speed demonstrating the extraordinary capability and flexibility of NR-DC for diversified requirements from individual consumers and industry leaders.

This NR-DC showcase drives the commercial progress of 5G mmWave into the fast lane in Thailand. AIS, Qualcomm Technologies and ZTE are together committed to accelerating and growing 5G for capability enhancement, efficiency improvement and application boundary extension.

“AIS’s key goal is to develop the smart 5G network as a national infrastructure with investments of 30,000-35,000 MB,” Wasit Wattanasap, head of nationwide operation and support business unit at Advanced Info Service Pcl. (AIS), commented, “We are the licensee holding the most spectrum in low band, mid band and high band or mmWave, which has the outstanding feature of rapid data transmission with low latency. We have never stopped deploying innovations to level up the network, including 5G Non NSA/SA Voice over new radio (VoNR) and 5G carrier aggregation (CA), to provide increasingly improved experiences to Thai customers, which was our intention when we joined the auction for spectrum.”

“Most recently, we have continued our collaboration with ZTE and Qualcomm Technologies, to jointly trial 5G NR-DC technology. It is a crucial step to combine different 5G spectrum, 2600 MHz (mid Band) and 26GHz (high Band) in a world-first. This enables downloads of up to 8.5 Gbps, and uplinks of up to 2.17 Gbps. This trial gave us a wider channel for the signal and extremely low latency. For instance, there could be streaming games online (cloud game), controlling driverless vehicles and commanding robots remotely in real-time. Moreover, the trial supports the development of new models of chipsets in the future, to speed up data transfer even more.”

“This cooperation highlights how AIS is the only provider using its licensed spectrum of every waveband for development to support business growth in various dimensions. It is also continuous transformation and updates for Thai consumers. Taking this joint-trial as a good start, we are confident that AIS 5G network is ready to expand the use of mmWave technology and support growth of the business sector in various aspects,” concluded Wasit.

“Our collaboration with AIS and ZTE proves the feasibility of deploying 5G mmWave in Thailand,” said ST Liew, vice president, Qualcomm CDMA Technologies Asia-Pacific Pte. Ltd. and president, Qualcomm South East Asia. “Qualcomm Technologies believes that 5G mmWave will be the key to unlocking the full potential of 5G. The possibility is endless and we are proud to take the first step in bringing the full benefits of 5G mmWave to the country.”

“We’re pleased to work with AIS and Qualcomm Technologies to achieve this milestone, which lays a technology validation foundation for 5G mmWave commercialization,” said Mei Zhong Hua, senior vice president, ZTE Corporation. “With broader 5G opportunities enabled by mmWave, we will join hands with partners to continuously drive mmWave development, create ultimate experiences and usher in a wonderful 5G era.”

References:

https://www.zte.com.cn/global/about/news/20220331e1.html

Verizon, AWS and Bloomberg media work on 4K video streaming over 5G with MEC

Verizon, Bloomberg Media, Zixi and Amazon Web Services (AWS) are working together to test how 5G and mobile edge computing (aka Multi-access Edge Computing or MEC) can transform how global business news is produced, delivered and consumed. Using Verizon 5G Edge with AWS Wavelength, Bloomberg Media will be able to package and deliver live 4K Ultra High Definition (UHD) content without the need for satellites, allowing for fast and efficient content delivery.

Verizon 5G Edge with AWS Wavelength, a real-time cloud computing platform, brings AWS compute and storage services to the edge of Verizon’s wireless network. This, coupled with Zixi’s SDVP and ZEN Master control plane, shows that it is possible to change the way broadcast content is packaged and delivered. This combination of Zixi software minimizes the latency and simplifies the networking required to connect from hosted software services on 5G Edge with AWS Wavelength to the end user’s device while ensuring a high quality broadcast signal is maintained.

Media consumption today has its challenges for content providers. Broadcasters are looking to simplify their distribution workflows being driven by a ubiquitous content economy and consumers who want more live streamed 4K content, with quick start times and minimal buffering. To accomplish this, Bloomberg Media sends UHD video using Verizon 5G Edge with AWS Wavelength coupled with Zixi’s software to quickly process the video into multiple streams for broadcast across various platforms.

The companies also plan to test streaming Bloomberg TV+ 4K UHD content direct to consumers’ 5G-connected devices, via Verizon 5G Edge with AWS Wavelength, allowing users to access data rich content on market news and business insights on the go. This will be followed by another trial that will involve near real-time native translation of Bloomberg TV+ content for transcripts, captioning and subtitles distributed globally.

“5G and edge compute have the potential to revolutionize the media and entertainment space and reinvent how global business news is produced and consumed,” said Tami Erwin, CEO of Verizon Business. “By leveraging Verizon 5G Edge with AWS Wavelength and Bloomberg Media’s premium 4K UHD service, we’re testing how we can potentially reimagine the future of media delivery and the viewer experience.”

“Bloomberg Media is committed to continuous innovation and experimentation of technologies to better reach our global audience of business leaders with the insights, information and solutions they need,” said Roman Mackiewicz, Chief Information Officer at Bloomberg Media. “This proof of concept trial combines Verizon’s 5G and mobile edge computing capabilities with Bloomberg TV+ premium 4K UHD content to create a modern streaming news experience with the potential for true industry disruption.”

“It has been fantastic working with Verizon, Bloomberg Media and AWS to deliver pristine 4K UHD quality content over 5G while leveraging edge compute” said Gordon Brooks, Executive Chairman and CEO of Zixi. “Verizon 5G Edge with AWS Wavelength and Zixi can potentially transform the M&E industry.”

Last May, Verizon demonstrated 4K video on a camera connected to its 5G Ultra Wideband network in Verizon’s 5G Lab in Los Angeles, CA. With 5G, Verizon was able to record and stream TheHxliday’s performance in a visually lossless way, nearly eliminating the side-effects of image compression that’s visible to the naked eye.

The premise behind the 4K over 5G is that there’s a great demand for 4K streamed content over a cellular network. However, 4K resolution is only really noticeable on large screens and those are usually connected via WiFI- not cellular. 5G has been desperately searching for killer apps since it’s inception, but it remains highly debatable whether 4K streaming will provide one.

Launched in August 2020, Verizon 5G Edge with AWS Wavelength is currently available in 17 metropolitan areas in the U.S. Learn more information about Verizon 5G Edge and Verizon’s 5G technology.

References:

https://www.verizon.com/about/news/verizon-bloomberg-media-zixi-aws-5g-edge-compute

ETSI MEC Standard Explained – Part II

by Dario Sabella, Intel, ETSI MEC Chair

Introduction:

This is Part II of a two part article series on MEC. Part I may be accessed here.

Access to Local and Central Data Networks (DN):

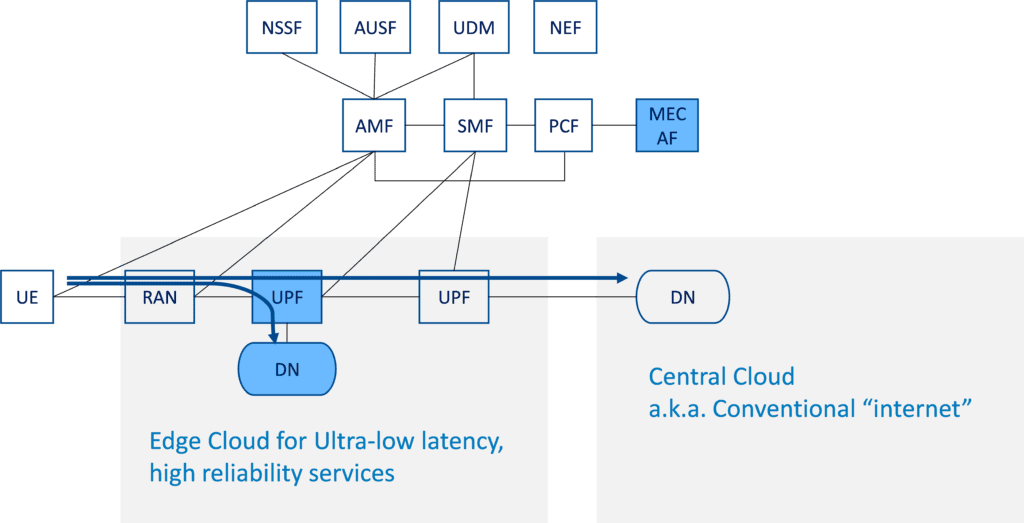

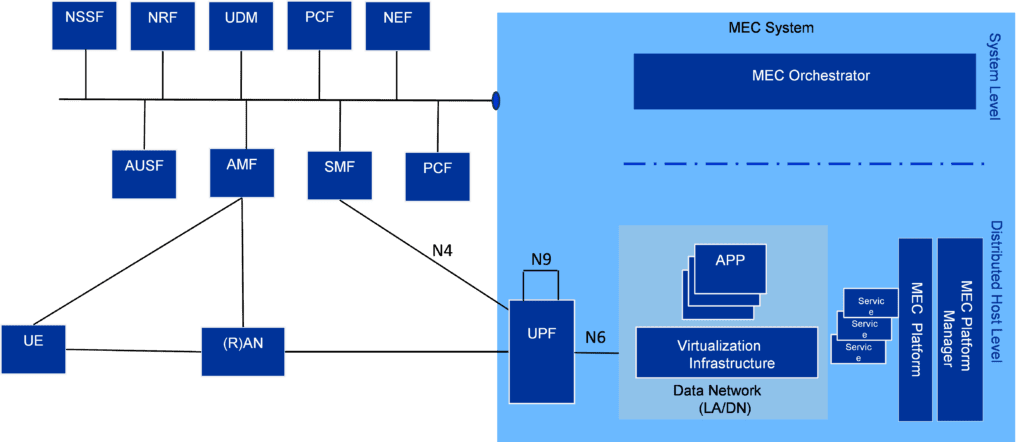

Figure 5. below illustrates an example of how concurrent access to local and central DN (Data Networks) works. In this scenario, the same UP session allows the UE to obtain content from both the local server and central server (service continuity is enabled by IP address anchoring at the centralized UPF, with no impact on UE by using Uplink Classifier -ULCL).

Figure 5. Concurrent access to local and central Data Networks (DN)

In this context it is assumed that MEC is deployed on the N6 reference point, i.e. in a data network external to the 5G system. This is enabled by flexibility in locating the UPF. The distributed MEC host can accommodate, apart from MEC apps, a message broker as a MEC platform service, and another MEC platform service to steer traffic to local accelerators. Logically MEC hosts are deployed in the edge or central data network and it is the User Plane Function (UPF) that takes care of steering the user plane traffic towards the targeted MEC applications in the data network.

The locations of the data networks and the UPF are a choice of the network operator who may choose to place the physical computing resources based on technical and business parameters (such as available site facilities, supported applications and their requirements, measured or estimated user load etc). The MEC management system, orchestrating the operation of MEC hosts and applications, may decide dynamically where to deploy the MEC applications.

In terms of physical deployment of MEC hosts, there are multiple options available based on various operational, performance or security related requirements (for more details, see the ETSI paper “MEC in 5G networks” [6] and the more recent study on “MEC 5G integration” [7]).

Moving forward with 5G (3GPP Release 17 onwards):

Given the increase of 5G adoption, and the progressive migration of network operators towards 5G SA (Stand Alone) networks this above MEC deployment is naturally becoming a long-term option considering the evolution of the networks. A major joint opportunity for MEC 5G integration, is on one hand for MEC to benefit from the edge computing enablers of the 5G system specification, and for 3GPP ecosystem to benefit from the MEC system and its APIs as a set of complementary capabilities to enable applications and services environm5 ents in the very edge of mobile networks. IN this perspective, also in the view of more mature 5G deployments, ETSI MEC is aligning with 3GPP SA6, defining from Rel.17 an EDGEAPP architecture (ref. 3GPP TS 23.558).

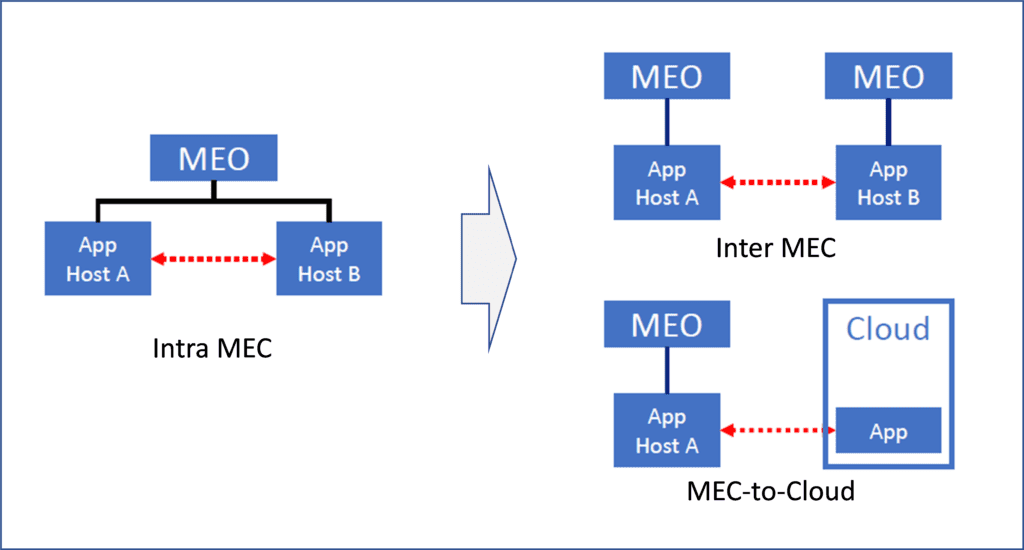

In this perspective, an ETSI white paper [3] provides some first information on this ongoing alignment, which is introducing a Synergized Mobile Edge Cloud architecture supported by 3GPP and ETSI ISG MEC specifications. This is an ongoing alignment, also in the view of future Rel.18 networks, and with respect to MEC federation and the related expansion (for MEC Phase 3 specifications) from intra-MEC communication to inter-MEC and MEC-Cloud coordination (as depicted in Figure 6). A very first study in this field has been published by ETSI MEC with the ETS GR 035 report [8].

Figure 6. MEC Phase 3: Expansion from intra-MEC to inter-MEC and MEC-Cloud

The MEC 035 study on “Inter-MEC systems and MEC-Cloud systems” was a major effort in ETSI MEC, mainly driven by the need of operators to form federated MEC environments. For example, to achieve V2X (vehicle to X) service continuity in multi-operator scenarios, to enable edge resource sharing among the federating members, and in general offer edge computing infrastructure as an asset to provide global services benefiting of better performance and low latency environments. Many use cases in MEC 035 are in need of MEC federation. Many are also based on the ETSI MEC requirements in MEC 002 (e.g. use cases like “V2X multi-stakeholder scenario” and “Multi-player immersive AR game,” among others).

This work carefully aligns with a GSMA publication introducing requirements for their “Operator Platform” concept. [The GSMA Operator Platform defines a common platform exposing operator services/capabilities to customers/developers in the 5G-era in a connect once, connect to many models. The first phase of the platform focuses on Edge which will be expanded in future phases with other capabilities such as connectivity, slicing and IPComms.] In this scenario, multiple operators will federate their edge computing infrastructure to give application providers access to a global edge cloud which may then run innovative, distributed and low latency services through a set of common APIs.

Currently ETSI MEC is working on the related normative work to enable and support this concept of MEC Federation, by defining a suitable MEC architecture variant in MEC GS 003, updating other impacted MEC specifications in Phase 3, and by introducing proper “MEC Federation Enablement APIs” (MEC GS 040) [9].

Enablement of MEC Deployment and Ecosystem Development:

MEC adoption is critical for the ecosystem. In this perspective, ETSI ISG MEC has established a WG DECODE dedicated to MEC Deployment and Ecosystem engagement activities. As a part of that (but not limited to it!) MEC is publishing and maintaining a MEC Wiki page (mecwiki.etsi.org), including links to several examples of MEC adoption from the ecosystem:

- MEC Ecosystem, with 3rd party MEC Applications and Solutions

- Proof of Concepts (PoCs), with a list and description of past and ongoing PoCs, including the ISG MEC PoC Topics and PoC Framework (and Information about process, criteria, templates….)

- MEC Deployment Trials (MDTs), with a list and description of past and ongoing MDTs (and the MDT Framework, clarifying how to participate)

Additionally, the MEC Wiki also includes: information on MEC Hackathons, MEC Sandbox, OpenAPI publications for ETSI MEC ISG API specifications, and outreach activities (e.g. MEC Tech Series of video and podcasts).

Summary and Conclusions:

- MEC (Multi-access Edge Computing) “offers to application developers and content providers cloud-computing capabilities and an IT service environment at the edge of the network” (see Ref 1. below).

- The nature of the ETSI MEC Standard (as emphasized by the term “Multi-access” in the MEC acronym) is access agnostic and can be applicable to any kind of deployment, from Wi-Fi to fixed networks.

- MEC is also serving multiple use cases and providing an open and flexible standard, in support of multiple deployment options, especially for 5G networks.

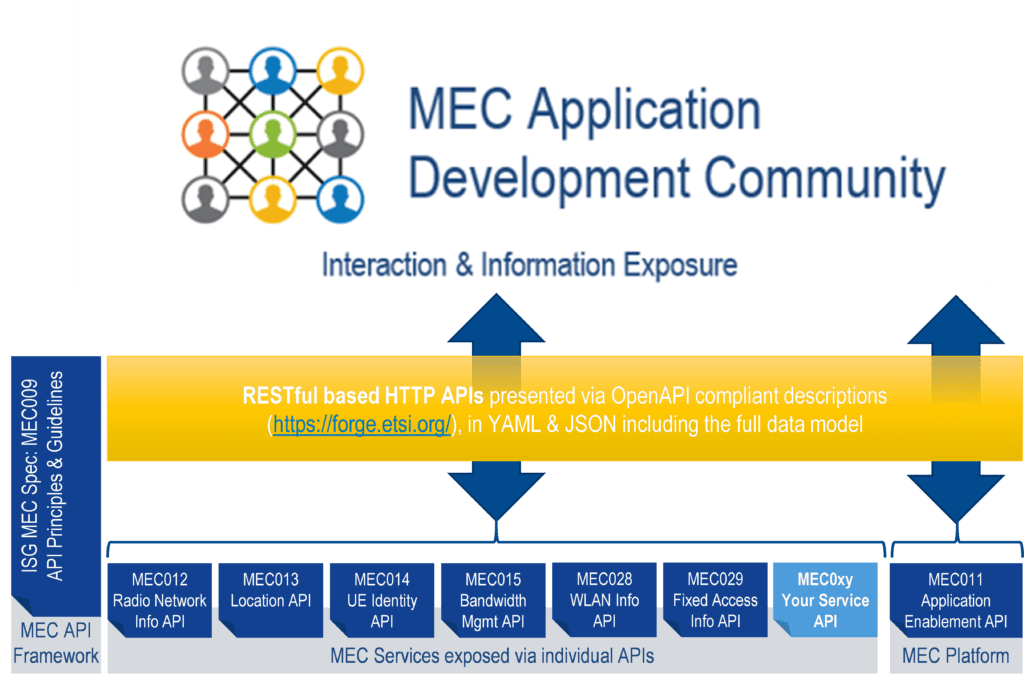

- MEC is focused on Applications at the Edge, and the specified MEC service APIs include meaningful information exposed to application developers at the network edge, ranging from RNI (Radio Network Information) API (MEC 012), WLAN API (MEC 029), Fixed Access API (MEC 028), Location API (MEC 013), Traffic Management APIs (MEC015) and many others. Additionally, new APIs (compliant with the basic MEC API principles) can be added, without the need for ETSI standardization.

- The ongoing ETSI MEC work in alignment with 3GPP includes aspects related to MEC 5G Integration and future evolution, including the standardization work on MEC Federation. Also, carefully aligning the MEC work with requirements from GSMA OPG (Operator Platform Group).

Finally, since MEC adoption is critical for the IT ecosystem, ETSI ISG MEC has established a WG dedicated to MEC Deployment and Ecosystem engagement activities.

There is also a dedicated MEC Wiki page (mecwiki.etsi.org) which provides several examples of MEC adoption from the ecosystem (PoCs, trials, MEC implementations). It also includes information on MEC Hackathons, MEC Sandbox, OpenAPI publications for ETSI MEC ISG API specifications, and outreach activities (e.g. MEC Tech Series of video and podcasts).

………………………………………………………………………………………….

Previous References (from Part I):

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

[1] ETSI MEC website, https://www.etsi.org/technologies/multi-access-edge-computing

[2] ETSI GS MEC 003 V2.1.1 (2019-01): “Multi-access Edge Computing (MEC); Framework and Reference Architecture”, https://www.etsi.org/deliver/etsi_gs/mec/001_099/003/02.01.01_60/gs_mec003v020101p.pdf

[3] ETSI White Paper #36, “Harmonizing standards for edge computing – A synergized architecture leveraging ETSI ISG MEC and 3GPP specifications”, First Edition, July 2020, https://www.etsi.org/images/files/ETSIWhitePapers/ETSI_wp36_Harmonizing-standards-for-edge-computing.pdf

[4] ETSI GS MEC 009 V3.1.1 (2021-06), “Multi-access Edge Computing (MEC); General principles, patterns and common aspects of MEC Service APIs”, https://www.etsi.org/deliver/etsi_gs/MEC/001_099/009/03.01.01_60/gs_MEC009v030101p.pdf

[5] ETSI White Paper No. 24, “MEC Deployments in 4G and Evolution Towards 5G”, February 2018, https://www.etsi.org/images/files/ETSIWhitePapers/etsi_wp24_MEC_deployment_in_4G_5G_FINAL.pdf

[6] ETSI White Paper No. 28, “MEC in 5G network”, June 2018, https://www.etsi.org/images/files/ETSIWhitePapers/etsi_wp28_mec_in_5G_FINAL.pdf

[7] ETSI GR MEC 031 V2.1.1 (2020-10), “Multi-access Edge Computing (MEC); MEC 5G Integration”, https://www.etsi.org/deliver/etsi_gr/MEC/001_099/031/02.01.01_60/gr_MEC031v020101p.pdf

[8] ETSI GR MEC 035 V3.1.1 (2021-06), “Multi-access Edge Computing (MEC); Study on Inter-MEC systems and MEC-Cloud systems coordination”, https://www.etsi.org/deliver/etsi_gr/MEC/001_099/035/03.01.01_60/gr_mec035v030101p.pdf

[9] ETSI DGS/MEC-0040FederationAPI’ Work Item, “Multi-access Edge Computing (MEC); Federation enablement APIs”, https://portal.etsi.org/webapp/WorkProgram/Report_WorkItem.asp?WKI_ID=63022

…………………………………………………………………………………………………………………………………………………………………………………………………………………….

Additional References:

https://mecwiki.etsi.org/index.php?title=Main_Page

https://www.gsma.com/futurenetworks/5g-operator-platform/

https://techblog.comsoc.org/2021/05/19/o2-uk-and-microsoft-to-test-mec-in-a-private-5g-network/

https://techblog.comsoc.org/2021/07/06/att-and-google-cloud-expand-5g-and-edge-collaboration/

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

by Dario Sabella, Intel, ETSI MEC Chair, with Alan J Weissberger

Introduction (by Alan J Weissberger):

According to Research & Markets, the global Multi-access Edge Computing (MEC) market size is anticipated to reach $23.36 billion by 2028, producing a CAGR of 42.6%. Reduced Total Cost of Ownership (TCO) due to integration of MEC in network systems as compared to legacy systems and subsequent ability to generate faster Return on Investment (RoI) is further expected to encourage smaller retail chains to leverage MEC technology.

Multi-access Edge Computing Market Highlights (from Research & Markets):

- The software segment is anticipated to be the fastest-growing segment owing to emerging demand among service providers to use software that can be deployed for various applications without making changes to existing 3GPP hardware infrastructure specifications.

- The energy and utilities segment is expected to witness the fastest growth rate over the forecast period owing to increasing demand among companies to quickly access insights and analyze data generated from remote locations

- The Asia Pacific region is expected to emerge as the fastest-growing regional market due to strong support from the government to encourage advanced network infrastructure

A few important MEC applications/ use cases include:

- Streaming video and pay TV: Increasing number of users adopting the Over the Top (OTT) video delivery model is expected to promote telecom companies and mobile networks to upgrade their existing infrastructure to cache video/audio content closer to the user. Using the multi-access edge computing (MEC) architecture system brings backend functionality closer to the user network, which is expected to aid Multichannel Video Programming Distributors (MVPD) to meet their customers’ demands. Users pay subscription fees for a specified duration of time to access the content offered by the MVPD.

- Deployment of MEC technology is expected to enable retail and on line stores to improve the performance of in-store systems and reduce data processing time, thus ensuring faster resolving of customer grievances. Furthermore, adoption of this technology is expected to reduce the load on external macro sites, thus offering a seamless in-store experience for users.

- Increasing number of IoT devices and the emerging need to gain access to real-time analysis of data generated by them is expected to drive MEC market growth. Leveraging this technology in IoT can facilitate reduced pressure on cloud networks and result in lower energy consumption, which is expected to offer significant growth opportunities to the market.

- Multi-access edge computing is expected to enhance manufacturing practices and thus facilitate the advent of connected cars ecosystem. Connected cars are equipped with computing systems, wireless devices, and sensing, which have to work together in a coordinated fashion, thus facilitating the need to adopt MEC.

- 5G MEC technology can be used to exchange critical operational and safety information to enhance efficiency, safety, and enhance value-added services such as smart parking and car finder.

Previously referred to as Mobile Edge Computing, MEC raises a lot of questions. For example:

- Can MEC be used with wireline and fixed access networks?

- Is 5G Stand Alone (SA) core network with separate control, data, and management planes required for MEC to be effective?

- Finally, why should MEC (and multi-cloud) matter to infrastructure owners and application developers?

Dario Sabella, Intel, ETSI MEC Chair, answers those questions and provides more context and color in his two part article.

………………………………………………………………………………………………..

ETSI MEC Standard Explained, by Dario Sabella, Intel, ETSI MEC Chair

ETSI MEC – Foundation for Edge Computing:

MEC (Multi-access Edge Computing) “offers to application developers and content providers cloud-computing capabilities and an IT service environment at the edge of the network” [1].

The MEC ISG (Industry Specification Group) was established by ETSI to create an open standard for edge computing, allowing multiple implementations and ensuring interoperability across a diverse ecosystem of stakeholders: from mobile operators, application developers, Over the Top (OTT) players, Independent Software Vendors (ISVs), telecom equipment vendors, IT platform vendors, system integrators, and technology providers; all of these parties are interested in delivering services based on Multi-access Edge Computing concepts.

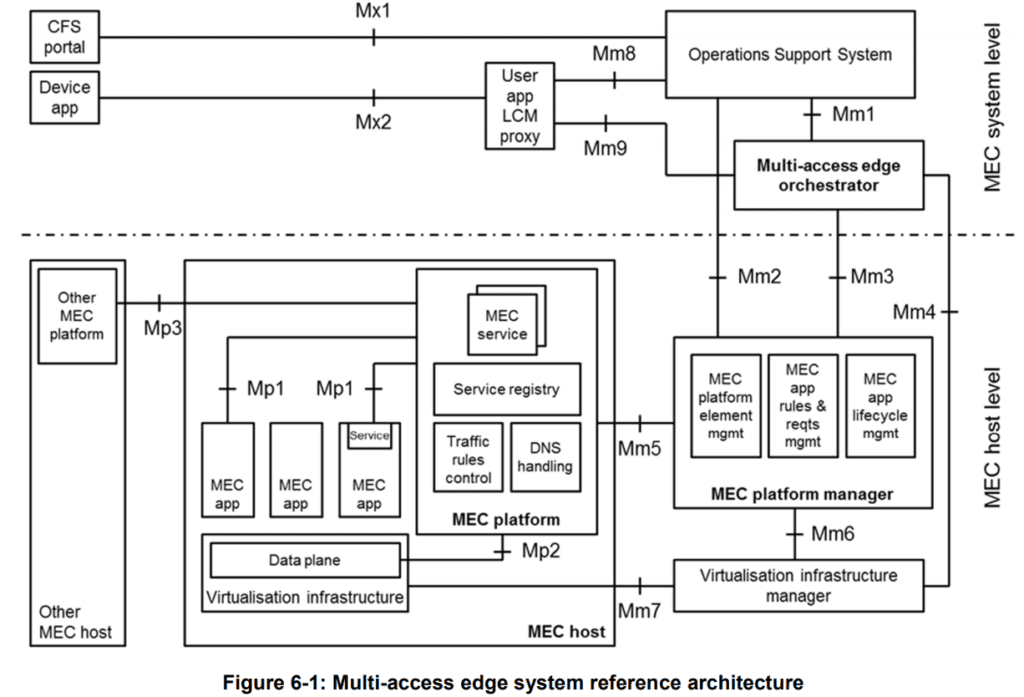

The work of the MEC initiative (see the architecture in Figure 1. above) aims to unite the telco and IT-cloud worlds, providing IT and cloud-computing capabilities at the edge: operators can open their network edge to authorized third parties, allowing them to flexibly and rapidly deploy innovative applications and services towards mobile subscribers, enterprises and vertical segments (e.g. automotive).

Author’s Note:

From a deployment point of view, a natural question is “where exactly is the edge?” In this perspective, the ETSI MEC architecture supports all possible options, ranging from customer premises, 1st wireless base station/small cell, 1st network compute point of presence, internet resident data center/compute server or edge of the core network. The MEC standard is flexible, and the actual and specific MEC deployment is really an implementation choice from the infrastructure owners.

Additionally, the MEC architecture (shown in Figure 2 and defined in the MEC 003 specification [2]) has been designed in such a way that a number of different deployment options of MEC systems are possible:

- The MEC 003 specification includes also a MEC in NFV (Network Functions Virtualization) variant, which is a MEC architecture that instantiates MEC applications and NFV virtualized network functions on the same virtualization infrastructure, and to reuse ETSI NFV MANO components to fulfil a part of the MEC management and orchestration tasks. This MEC deployment in NFV (Network Functions Virtualization) is also coherent with the progressive virtualization of networks.

- In that perspective, MEC deployment in 5G networks is a main scenario of applicability (note that the MEC standard is aligned with 3GPP specifications [3]).

- On the other hand, the nature of the ETSI MEC Standard (as emphasized by the term “Multi-access” in the MEC acronym) is access agnostic and can be applicable to any kind of deployment, from Wi-Fi to fixed networks.

- A major effort of the MEC standardization work is dedicated to publishing relevant and industry-driven exemplary specifications of MEC service APIs, that are using RESTful principles, thus exposed to application developers in a universally recognized language.

The ETSI MEC initiative is focused on Applications at the Edge, and the specified MEC APIs (see above Figure 2.) include meaningful information exposed to application developers at the network edge, ranging from RNI (Radio Network Information) API (MEC 012), WLAN API (MEC 029), Fixed Access API (MEC 028), Location API (MEC 013), Traffic Management APIs (MEC015) and many others.

Additionally, new APIs (compliant with the basic MEC API principles [4]) can be added, without the need of being standardized in ETSI.

In this perspective, MEC truly provides a new ecosystem and value chain, by opening up the market to third parties, and allowing not only operators and cloud providers but any authorized software developers that can flexibly and rapidly deploy innovative applications and services towards mobile subscribers, enterprises and vertical segments.

MEC in 4G (and 5G NSA) Deployments:

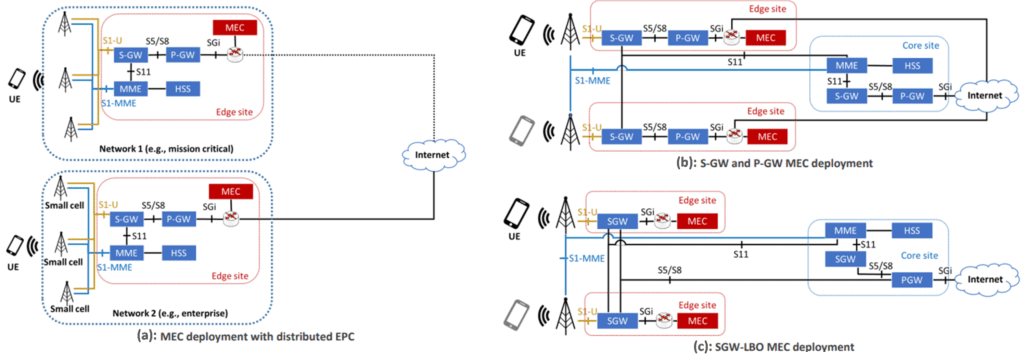

ETSI has already clarified how MEC can be deployed in 4G networks, given its access-agnostic nature [5], with many approaches:

From “bump in the wire” (where the MEC sits on the S1 interface of the 4G system architecture), to “distributed 4G-Evolved Packet Core” (EPC -where the MEC data plane sits on the SGi interface), to “distributed S/PGW” (where the control plane functions such as the MME and HSS are located at the operator’s core site) and “distributed SGW with Local Breakout” (SGW-LBO) -where the MEC system and the distributed SGW are co-located at the network’s edge.

Figure 3. MEC deployment options with distributed EPC (a), distributed S/PGW (b) and SGW-LBO (c)

Depending on the selected solution, MEC Handover is executed in different ways:

In the “bump in the wire approach,” mobility is not natively supported. Instead, in the EPC MEC, SGW + PGW MEC, and CUPS MEC, the MEC handover is supported using 3GPP specified S1 Handover with SGW relocation by maintaining the original PGW as anchor.

The same considerations apply for the SGW-LBO MEC deployment. In the latter case, the target SGW enforces the same policy towards the local MEC application.

Finally, the solutions that include an EPC gateway, such as EPC MEC, SGW+PGW MEC, SGW-LBO MEC, and CUPS MEC are compliant with LI (Lawful Interception) requirements.

This last aspect is also very relevant for MEC adoption, since public telecommunications network and service providers are legally required to make available to law enforcement authorities information from their retained data which is necessary for the authorities to be able to monitor telecommunications traffic as part of criminal investigations.

In that perspective, MEC deployment options are also chosen by infrastructure owners in the view of their compliance to Lawful Interception requirements.

Distributed SGW with Local Breakout (SGW-LBO):

A mainstream for the adoption of MEC is given by the progressive introduction of 5G networks.

Among the various 5G deployment options, local breakout at the SGWs (Figure 3c above) is a solution for MEC that originated from operators’ desire to have a greater control on the granularity of the traffic that needs to be steered. This principle was dictated by the need to have the users able to reach both the MEC applications and the operator’s core site application in a selective manner over the same APN.

The traffic steering uses the SGi – Local Break Out interface which supports traffic separation and allows the same level of security as the network operator expects from a 3GPP-compliant solution.

This solution allows the operator to specify traffic filters similar to the uplink classifiers in 5G, which are used for traffic steering. The local breakout architecture also supports MEC host mobility, extension to the edge of CDN, push applications that requires paging and ultra-low latency use cases.

The SGW selection process performed by MMEs is according to the 3GPP specifications and based on the geographical location of UEs (Tracking Areas) as provisioned in the operator’s DNS.

The SGW-LBO offers the possibility to steer traffic based on any operator-chosen combination of the policy sets, such as APN and user identifier, packet’s 5-tuple, and other IP level parameters including IP version and DSCP marking.

Integrated MEC deployment in 5G networks (3GPP Release 15 and later):

Edge computing has been identified as one of the key technologies required to support low latency together with mission critical and future IoT services. This was considered in the initial 3GPP requirements, and the 5G system was designed from the beginning to provide efficient and flexible support for edge computing to enable superior performance and quality of experience.

In that perspective, the design approach taken by 3GPP allows the mapping of MEC onto Application Functions (AF) that can use the services and information offered by other 3GPP network functions based on the configured policies.

In addition, a number of enabling functionalities were defined to provide flexible support for different deployments of MEC and to support MEC in case of user mobility events. The new 5G architecture (and MEC deployment as AF) is depicted in the Figure 4 below.

Figure 4. – MEC as an AF (Application Function) in 5G system architecture

In this deployment scenario, MEC as an AF (Application Function) can request the 5GC (5G Core network) to select a local UPF (User Plane Function) near the target RAN node. Then use the local UPF for PDU sessions of the target UE(s) and to control the traffic forwarding from the local UPF so that the UL traffic matching with the traffic filters received from MEC (AF) is diverted towards MEC hosts while other traffic is sent to the Central Cloud.

In case of UE mobility, the 5GC can re-select a new local UPF more suitable to handle application traffic identified by MEC (AF) and notify the AF about the new serving UPF.

In summary, MEC as an AF can provide the following services with a 5GC:

- Traffic filters identifying MEC applications deployed locally on MEC hosts in Edge Cloud

- Target UEs (one UE identified by its IP/MAC address, a group of UE, any UE)

- Information about forwarding the identified traffic further e.g. references to tunnels toward MEC hosts

………………………………………………………………………………………………………………………………………………………………………………………….

Part II. of this two part article will illustrate and explain concurrent access to local and central Data Networks. The enablement of MEC deployments and ecosystem development will also be presented.

Importantly, Part II will explain how MEC is evolving to the next phase of 5G– 3GPP Release 17. In particular, ETSI MEC is aligning with 3GPP SA6 which is defining an EDGEAPP architecture (ref. 3GPP TS 23.558).

Part II will also explain how MEC is evolving to multi-cloud support in alignment with GSMA OPG requirements for the MEC Federation work.

ETSI MEC Standard Explained – Part II

…………………………………………………………………………………………………………………………………………………………………………………………..

References:

1. Introduction:

https://www.accenture.com/_acnmedia/PDF-128/Accenute-MEC-for-Pervasive-Networks-PoV.pdf

PowerPoint Presentation (etsi.org)

2. Main body of this article (Part I and II):

[1] ETSI MEC website, https://www.etsi.org/technologies/multi-access-edge-computing

[2] ETSI GS MEC 003 V2.1.1 (2019-01): “Multi-access Edge Computing (MEC); Framework and Reference Architecture”, https://www.etsi.org/deliver/etsi_gs/mec/001_099/003/02.01.01_60/gs_mec003v020101p.pdf

[3] ETSI White Paper #36, “Harmonizing standards for edge computing – A synergized architecture leveraging ETSI ISG MEC and 3GPP specifications”, First Edition, July 2020, https://www.etsi.org/images/files/ETSIWhitePapers/ETSI_wp36_Harmonizing-standards-for-edge-computing.pdf

[4] ETSI GS MEC 009 V3.1.1 (2021-06), “Multi-access Edge Computing (MEC); General principles, patterns and common aspects of MEC Service APIs”, https://www.etsi.org/deliver/etsi_gs/MEC/001_099/009/03.01.01_60/gs_MEC009v030101p.pdf

[5] ETSI White Paper No. 24, “MEC Deployments in 4G and Evolution Towards 5G”, February 2018, https://www.etsi.org/images/files/ETSIWhitePapers/etsi_wp24_MEC_deployment_in_4G_5G_FINAL.pdf

[6] ETSI White Paper No. 28, “MEC in 5G network”, June 2018, https://www.etsi.org/images/files/ETSIWhitePapers/etsi_wp28_mec_in_5G_FINAL.pdf

[7] ETSI GR MEC 031 V2.1.1 (2020-10), “Multi-access Edge Computing (MEC); MEC 5G Integration”, https://www.etsi.org/deliver/etsi_gr/MEC/001_099/031/02.01.01_60/gr_MEC031v020101p.pdf

[8] ETSI GR MEC 035 V3.1.1 (2021-06), “Multi-access Edge Computing (MEC); Study on Inter-MEC systems and MEC-Cloud systems coordination”, https://www.etsi.org/deliver/etsi_gr/MEC/001_099/035/03.01.01_60/gr_mec035v030101p.pdf

[9] ETSI DGS/MEC-0040FederationAPI’ Work Item, “Multi-access Edge Computing (MEC); Federation enablement APIs”, https://portal.etsi.org/webapp/WorkProgram/Report_WorkItem.asp?WKI_ID=63022

Nokia deploys shared 5G RAN (MORAN) with SoftBank and KDDI in Japan

Nokia today announced that it has been selected by Japanese mobile operators, SoftBank Corp. and KDDI as one of the vendors to deploy Japan’s shared RAN. This deployment will deliver 5G services to both SoftBank and KDDI subscribers in the country. Nokia will install a Multi-Operator Radio Access Network (MORAN) [1.], which will allow both companies to share the RAN while keeping core networks separate. Network sharing helps support efficient RAN deployments as base station sites and infrastructure (equipment) are shared.

Note 1. In MORAN everything in the RAN (antenna, tower, site, power) except the radios are shared between two or more network operators.

The two Japanese telcos announced plans to deploy a shared network, or a Multi-Operator Radio Access Network (MORAN), in June, using equipment from Ericsson and other vendors. We now know that Nokia is one of those other vendors. Ericsson equipment supports network sharing using both TDD (Time Division Duplex) and FDD (Frequency Division Duplex) as well as 4G/LTE and 5G New Radio (NR). The solution consists of Ericsson Radio System products such as RAN Compute (base band) , radio and transport – with the powerful system on a chip, Ericsson Silicon, bringing innovative various solutions such as Ericsson Spectrum Sharing and Ericsson Uplink Booster.

KDDI and SoftBank will particularly focus on quickly building robust 5G network leveraging Ericsson Radio System products and solutions for multiple-bands. Ericsson’s future-proof network-sharing solution will significantly contribute to their nationwide network deployment of 5G and beyond. Ericsson and the service providers have completed verifications and started to deploy the solution commercially.

Under this contract, Nokia will supply its latest AirScale products including baseband and radio platforms. Nokia’s MORAN is triple mode and covers LTE, 5G as well as Dynamic Spectrum Sharing. In particular, Nokia will provide its new generation of ReefShark System-on-Chip based plug-in cards to increase the capacity of the AirScale baseband. The new ReefShark-powered plug-in cards are easily installed and simplify the upgrade and extended operation of all AirScale deployments. They also deliver up to eight times more throughput compared to previous generations. Nokia’s modular AirScale baseband will enable SoftBank and KDDI to scale capacity flexibly and efficiently and as their 5G business evolves.

MORAN is a way for mobile operators to share radio access network infrastructure, reduce their costs, expand the coverage of their networks and achieve an efficient and effective roll-out of new technologies. The RAN uses dedicated radio frequencies assigned to each service provider ensuring they maintain independent control of their resources. Nokia supports a range of network sharing solutions suiting all operating scenarios. Nokia’s flexible MORAN solution can also be utilized by mobile operators and enterprises for private networks, as well as public networks or industrial campuses.

MORAN should help Softbank and KDDI roll out 5G faster and cheaper. Costs will decrease and subscriber coverage will be quicker. They are also working together on a shared rural coverage project announced 18 months ago, that will see them share base station assets to build out 5G more quickly in rural areas.

Tomohiro Sekiwa, Senior Vice President and CNO, SoftBank, said: “In order to deliver the best 5G experience to customers nationwide as quickly as possible, SoftBank is working with KDDI to develop a shared 5G network. In this effort, a Multi-Operator Radio Access Network is a key technology that will bring various efficiencies and we look forward to the high performance of Nokia’s products in this regard.”

Tatsuo Sato, Vice President and Managing Officer, Technology Planning, KDDI, said: “We are pleased to work closely with both Nokia and SoftBank to accelerate 5G network deployment across Japan. With this Multi-Operator Radio Access Network, we anticipate delivering the superior unique experiences of 5G to customers faster.”

Tommi Uitto, President of Mobile Networks at Nokia, said: “Nokia has been at the forefront of network sharing around the world since the deployment of the world’s first commercial shared network. We have a long-standing partnership with both SoftBank and KDDI and are excited to work collaboratively with them on this project. Our latest AirScale solutions will be utilized, including the new baseband plug-in cards to add capacity where it is needed and deliver best-in-class 5G connectivity to their customers.”

It will be interesting to see the impact that this network gear sharing deal has on SoftBank and KDDI’s respective 5G businesses in the coming months and years.

Resources:

Activate massive 5G capacity with Nokia AirScale

AirScale baseband | Nokia

AirScale Active Antennas | Nokia

AirScale Radio | Nokia

Network Sharing

References:

https://telecoms.com/511728/kddi-and-softbank-add-nokia-to-shared-5g-ran-ticket

https://www.ericsson.com/en/press-releases/2021/6/ericsson-sets-up-japans-first-multi-operator-ran-with-kddi-and-softbank

Network Infrastructure Sharing and the MORAN Concept:

https://www.itu.int/dms_pub/itu-s/opb/itujnl/S-ITUJNL-JFETF.V1I1-2020-P10-PDF-E.pdf

https://www.youtube.com/watch?v=VlzuxMR2xQ4

Rootmetrics: U.S. 5G carriers in close race; South Korea 5G is worldwide #1

Executive Summary:

Rootmetrics (a division of IHS Markit) has just reported on how the U.S. carriers fared in delivering the key combination of widespread 5G availability plus higher speeds (than 4G LTE) and data reliability performances in 1H 2021.

“5G is quickly becoming more widespread, speeds are getting faster, and we expect the end-user … experience to become even better going forward as the networks continue to mature and bolster their spectrum holdings,” Rootmetrics said in its most recent report on carrier network performance testing results from the 125 most populous U.S. metropolitan areas.

Rootmetrics awards rankings across three categories: Availability, Reliability and Speed.

Here are how the top three U.S. wireless carriers fared:

- AT&T took the top honors in Rootmetrics’ “best Everyday 5G” category. AT&T had a much narrower win in fastest download speeds, winning in 20 markets while Verizon was fastest in 16 markets and T-Mo in 13. AT&T was second in reliability to Verizon.

- T-Mobile US was rated best in 5G availability and recognized as having “excellent” 5G availability. “T-Mobile also showed much faster speeds since [the second half of 2020]—in large part because of its increased usage of mid-band spectrum—as well as good data reliability in most cities,” Rootmetrics reported.

- Verizon was first in reliability and improving speeds and availability. Rootmetrics said that Verizon’s network is showing “rapid 5G expansion, providing users with 5G in far more cities than it did in [the second half of 2020]. What’s more, Verizon’s speeds were close to those of AT&T and stronger than those of T-Mobile.”

Rootmetrics said that AT&T most often provided what it judged to be the best combination of availability, speed and reliability, “until 5G becomes ubiquitous, consumers will, at times, need to weigh the benefits of high availability and lower performance or lower availability and high performance.”

“The mobile landscape—and the 5G race in particular—is highly dynamic and prone to rapid change, so it wouldn’t be a surprise to see the leaderboard shift as we move further into 2021 and beyond,” Rootmetrics stated.

Mid-band spectrum could change the 5G speed landscape going forward, according to the market research company. With the carriers investing billions at the C-Band auction earlier this year—and Verizon’s spend of $45B more than those of AT&T ($23B) and T-Mobile ($9B) combined—speeds for all three carriers could get much faster going forward. The move toward more mid-band 5G, however, has already begun. T-Mobile, which merged with Sprint primarily to acquire Sprint’s vast and coveted midband spectrum holdings, has an early lead on the competition in terms of implementing mid-band spectrum into its 5G. In fact, T-Mobile’s speeds have increased because of its additional usage of mid-band spectrum since 2H 2020.

………………………………………………………………………………………………..

Global 5G Assessment:

While this report only rated U.S. 5G carriers, Rootmetrics stated that South Korean network operators are providing the most widespread 5G in the world.

While 5G is growing fast in the U.S., South Korea still holds a commanding lead in the worldwide 5G race. With South Korean carriers the first in the world to deploy 5G on a wide scale, doing so in early April of 2019, it’s perhaps no surprise that the 5G results we’ve seen in South Korea have been outstanding and better than those in Switzerland, the UK, or the US. To see how 5G compares in major cities around the world, we looked at the highest 5G availability in South Korea’s biggest city (Seoul) compared to that in the most populated cities in Switzerland, the UK, and the U.S.

Note that with 5G availability approaching 100% for LG U+ in Seoul, Rootmetrics looked at 5G-only availability results for this comparison, which show how 5G would perform if it were ubiquitous today; all other metrics in this report reflect Everyday 5G performance.

5G availability recorded in Seoul was far higher than that in London, New York City, or Zurich. Speeds in South Korea are also much faster than those in other countries. While Everyday 5G median download speeds in the UK almost always exceed 100 Mbps in every city we test, speeds above 100 Mbps in the US are rare. In South Korea, on the other hand, we’ve seen Everyday 5G median download speeds in excess of 400 Mbps from all three major operators in multiple cities.

Conclusions:

The 5G race in the US is heating up fast. AT&T took home the top prize for providing the Best 5G experience, with the strongest combination of availability plus performance.

Even though some carriers are further ahead of others when it comes to delivering on the key combination of availability plus performance, all three major carriers showed improved Everyday 5G results compared to those in 2H 2020. As the carriers continue to make greater use of mid-band spectrum, whether from DSS, CBRS, the C-Band auction, or from T-Mobile’s already vast mid-band holdings, 5G in the US is clearly poised for better performance to come.

In fact, as 5G continues to expand across the country and more mid-band is deployed, we expect to see much stronger availability and performance over time. As we saw with T-Mobile (as well as

operators in the UK and South Korea), mid-band spectrum can certainly help contribute to faster Everyday 5G speeds.

Indeed, while it might take another year or more, the mid-band spectrum acquired at the C-Band auction could mark a watershed moment on the path toward a fully realized 5G experience in the US—perhaps one that rivals that in South Korea, where all three

major operators use mid-band spectrum for 5G.

In the meantime, stay tuned to RootMetrics for more on the Everyday 5G experience. Rootmetrics says they will continue testing the networks to keep an eye on the state of 5G in the US and around the world.

………………………………………………………………………………………..

References:

Ericsson and Telia said to provide lower 5G latency & power dissipation/longer battery life

Ericsson and Swedish telco Telia have joined forces with Qualcomm Technologies, Inc. to jointly test a claimed “industry-first feature” in Telia’s commercial 5G network.

This industry initiative adds to Telia and Ericsson’s 5G alliance with the purpose to enable better 5G for both smartphone users and advanced and emerging 5G use cases for consumers and enterprises.

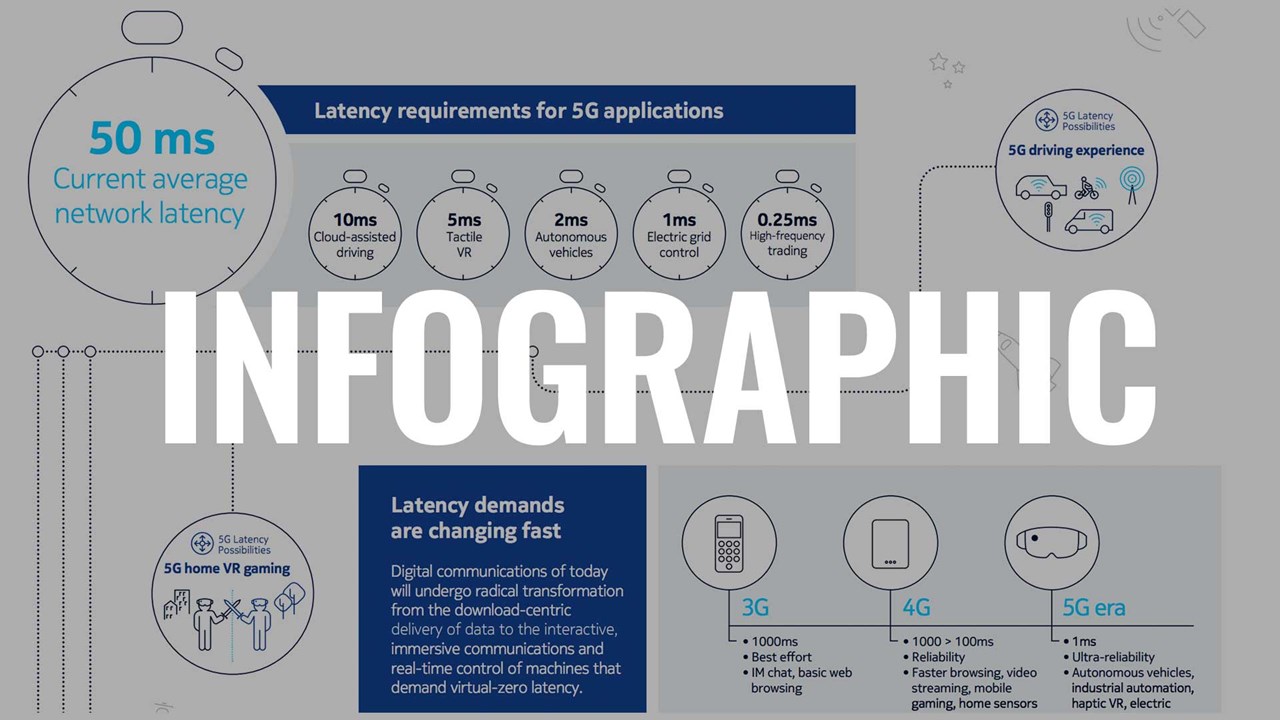

The new 5G Standalone* (5G Core network) – the inactive state of Radio Resource Control (RRC Inactive) – reduces the amount of signaling required during state transitions, making it possible to significantly lower both latency and battery consumption, which are crucial requirements for many Internet of Things (IoT) and 5G use cases, including critical control of remote devices, enhanced mobile broadband, and smart transport.

* 5G Standalone (5G SA) is the eventual architecture of 5G networks, increasing efficiency and helping develop new use cases. Many 5G networks have been deployed in Non-standalone (NSA) mode where the underlying 4G network layer supported the necessary signaling. 5G SA removes this 4G dependency. With 5G SA faster network connection times, simpler mobility management and immediate access to wide 5G bands provide an even better user experience.

…………………………………………………………………………………………

RRC Inactive was implemented using Ericsson’s software and 5G Standalone network nodes and a test device powered by Qualcomm’s Snapdragon X60 Modem-RF System. The two companies were able to demonstrate the successful transition between a connected state and inactive state without the device falling back to idle.

The transition to this new inactive state reduces the amount of signaling required during state transitions, significantly lowering latency for the end user, as was seen in this test where the access latency was shortened by up to 3x. This shortened transit delay time could have a big impact in user experience in applications such as cloud gaming where fast multi-player interactions require 20-30ms end-to-end latency. For an immersive VR gaming experience, the latency and reliability requirements are even more demanding.

Since the shorter latency makes it possible to reduce the inactivity timer, the partner companies were also able to see battery savings of up to 30 percent for the modem compared to not activating the feature. While the screen and its associated electronics are the most power-consuming components in a mobile device, implementing the feature will result in a longer battery life for a 5G smart phone user, too.

“Latency has now become a critical issue,” says Kester Mann, Director of Consumer and Connectivity at CCS Insights. “Speed and latency were always offered as the twin advantages of 5G, but now my perception is that latency has now become more important than speed.”

Latency management for applications will require a whole new set of control-points and techniques, such as segment routing to be applied right across the network (including the fixed parts) up to and including the end-user device – especially if there still any ambition to get to ‘sub-millisecond’ transmission for some applications (as in the above diagram).

It’s critically important to note that 1 way latency includes the 5G RAN, 5G Edge and Core networks. Also, that neither ITU-R 2150 recommendation or 3GPP Release 16 meet the URLLC latency performance requirements for the RAN, which is: <=1 msec for the data plane and <=10msec for the control plane as per ITU-R M.2410.

Image Credit: Thales Group

Image Credit: Broadband Library

…………………………………………………………………………………………..

Ericsson claims the development of the ‘inactive state’ has largely been driven by the growing field of Machine-type Communication (MTC), part of 3GPP’s specifications program, where Ericsson claims a leading role. In most MTC scenarios, the amount of data that wireless devices typically exchange with the network is small and usually not urgent enough to justify the high battery consumption required to handle all the signaling involved in the legacy idle-to-connected transition.

…………………………………………………………………………………….

Stefan Jäverbring, CTO, Telia Company, said: “We’re excited to be able to provide new and enhanced experiences for our customers through our close partnership with Ericsson. Our partnership has enabled this industry- and world-first feature, and this technology milestone is fundamental in making more efficient use of mobile network resources and meeting critical requirements with effective solutions.”

Jenny Lindqvist, Head of Ericsson Northern and Central Europe, said: “We’re proud to jointly with Telia and Qualcomm Technologies demonstrate a world-first innovative solution that will provide a significant boost in 5G benefits for a better mobile experience. This is already a huge milestone in taking 5G technology to the next level, and Radio Resource Control will continue to play a critical role for 5G networks for years to come.”

Enrico Salvatori, Senior Vice President and President, Qualcomm Europe/MEA, Qualcomm Europe, Inc., commented: “We are proud to have worked with Ericsson and Telia on bringing this key feature to commercialization. Reduced latency, shorter-time-to-content and increased battery life are high on the must-have lists for users and RRC Inactive helps to deliver them all.”

The development of the inactive state has largely been driven by the growing field of Machine-type Communication (MTC). This is part of 3GPP standardization where Ericsson has had a leading role in defining the functionalities. In most MTC scenarios, the amount of data that wireless devices typically exchange with the network is small and usually not urgent enough to justify the high battery consumption required to handle all the signaling involved in the legacy idle-to-connected transition. For current and future 5G use cases with a large and growing number of devices, improved connection, state, and mobility handling have been identified as key elements of efficient support.

5G skeptic William Webb said, “It’s a good practical development, but I think there is a dash of 5G-style confusion in there too. It’s not clear what or who this is aimed at. Is it aimed at (IoT/MTC) machines or mobile game users?”

……………………………………………………………………………………..

References:

https://www.ericsson.com/en/news/3/2021/5g-feature-enabling-lower-latency-and-increased-battery-life

https://www.thalesgroup.com/en/markets/digital-identity-and-security/mobile/inspired/5G

https://broadbandlibrary.com/5g-low-latency-requirements/

Samsung partners with GBL to deploy 5G testbed for U.S. Army

Samsung has teamed up with GBL Systems Corporation [1.] to deploy new 5G testbeds at U.S. Army military bases for Augmented Reality/Virtual Reality. The testbeds are part of a broader initative announced by the Department of Defense in October, which awarded $600 million in contracts for 5G testing at several US military test sites. GBL and Samsung have been contracted to support one of the largest testbeds, demonstrating the use of AR and VR over 5G networks for training applications.

Note 1. GBL Systems Corporation (GBL) is a leading provider of systems engineering, software services, advanced technology solutions to the U.S. Department of Defense (DoD)

Under the deal, GBL will be responsible for prototype creation, technology integration, and aligning the system with DoD requirements. Samsung will deliver its 5G end-to-end system and technical expertise, including network products such as its Massive MIMO Radios, cloud-native 5G Standalone (SA) Core, and Galaxy 5G mobile devices. The goal is to deploy a scalable, resilient and secure 5G network for AR/VR-based mission planning and training.

The testbeds will support AR for live field military training exercises. Simulated scenarios include virtual obstacles found in the combat theater, and overlays of data and instruments relied on by military personnel. Testing will start in a lab environment using Samsung’s mmWave and mid-band 5G radios. Field testing will then follow at two U.S. Army training bases that will support a live and simulated Army brigade.

Samsung Networks and GBL Systems deploy 5G testbeds for the U.S. Department of Defense, enabling evaluation of AR/VR applications in mission planning and training. U.S. Army trainees will use AR/VR goggles to see enhanced digital content overlaid onto real-world environments.

……………………………………………………………………………………………………………………………………………………….

“GBL is excited to work with Samsung to rapidly field a 5G network that is scalable, resilient, and secure to create a prototype test bed in support of a new DoD 5G-enabled AR/VR training capability,” said Jim Buscemi, CEO. “This effort has the potential to revolutionize how the DoD performs distributed training exercises that are more combat-like to significantly advance warfighter readiness.”

“Samsung is pleased to collaborate with GBL to deliver a reliable, resilient and secure 5G network for the DoD to evaluate new capabilities for our U.S. troops,” said Imran Akbar, Vice President and Head of New Business Team, Networks Business, Samsung Electronics America. “We believe in the transformative power of 5G and look forward to assisting the U.S. Department of Defense as they use this technology to increase training safety and strengthen the Nation’s defense capabilities.”

Samsung’s 5G solution enables quality, real-time imagery to be shared by many participants simultaneously. The Army trainees will use AR/VR goggles to see enhanced digital content overlaid onto the real world, and can use this digital imagery to interact with and acquire information about their real environment. This expands what’s possible in military training today, and provides a competitive advantage against adversaries.

Samsung pioneered the successful delivery of the first 5G end-to-end solutions in 2018, including chipsets, devices, radios, and the core network. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from fully virtualized RAN and Core to private network solutions and Artificial Intelligence (AI) powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users worldwide, including customers of leading U.S. operators.

References:

https://www.telecompaper.com/news/samsung-gbl-to-deploy-5g-testbed-for-us-army–1390248

Qualcomm’s designing custom CPU’s for dominance in laptop markets; CEO: “We will go big in China”

Qualcomm’s new CEO believes that by next year his company will supply CPU chips for laptop makers competing with Apple. Last year, the Cupertino, CA based company introduced laptops using a custom-designed central processor chip that boasts longer battery life. Longtime processor suppliers Intel Corp and Advanced Micro Devices have no chips as energy efficient as Apple’s.

Qualcomm Chief Executive Cristiano Amon told Reuters on Thursday he believes his company can have the best chip on the market, with help from a team of chip architects who formerly worked on the Apple chip but now work at Qualcomm. In his first interview since taking the top job at Qualcomm, Amon also said the company is also counting on revenue growth from China to power its core smartphone chip business despite political tensions.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RRPGOKG4OVID5I2WPBB3GWCY2Q.jpg)

“We will go big in China,” he said, noting that U.S. sanctions on Huawei Technologies Co Ltd (HWT.UL) give Qualcomm an opportunity to generate a lot more revenue.

Amon said a cornerstone of his strategy comes from a lesson learned in the smartphone chip market: It was not enough just to provide modem chips for phones’ wireless data connectivity. Qualcomm also needed to provide the brains to turn the phone into a computer, which it now does for most premium Android devices.

Now, as Qualcomm looks to push 5G connectivity into laptops, it is pairing modems with a powerful central processor unit, or CPU, Amon said. Instead of using computing core blueprints from longtime partner ARM Ltd, as it now does for smartphones, Qualcomm concluded it needed custom-designed chips if its customers were to rival new laptops from Apple.

As head of Qualcomm’s chip division, Amon this year led the $1.4 billion acquisition of startup, whose ex-Apple founders help design some those Apple laptop chips before leaving to form the startup. Qualcom will start selling Nuvia-based laptop chips next year.

“We needed to have the leading performance for a battery-powered device,” Amon said. “If ARM, which we’ve had a relationship with for years, eventually develops a CPU that’s better than what we can build ourselves, then we always have the option to license from ARM.”

ARM is in the midst of being purchased by Nvidia Corp for $40 billion, a merger that Qualcomm has objected to with regulators.

Amon said Qualcomm has no plans to build its own products to enter the other big market for CPUs – data centers for cloud computing companies. But it will license Nuvia’s designs to cloud computing companies that want to build their own chips, which could put it in competition with parts of ARM.

“We are more than willing to leverage the Nuvia CPU assets to partner with companies that are interested as they build their data center solutions,” Amon said.

Smartphone chips accounted for $12.8 billion of its $16.5 billion in chip revenue in its most recent fiscal year. Some of Qualcomm’s best customers, such as phone maker Xiaomi Corp are in China.

Qualcomm is counting on revenue growth as its Android handset customers swoop in on former users of phones from Huawei, which was forced out of the handset market by Washington’s sanctions.

Kevin Krewell, principal analyst at TIRIAS Research, called it a “political minefield” due to rising U.S.-China tensions. But Amon said the company could do business as usual there.

“We license our technology – we don’t have to do forced joint ventures with technology transfers. Our customers in China are current with their agreements, so you see respect for American intellectual property,” he said.

Another major challenge for Amon will be hanging on to Apple as a customer. Qualcomm’s modem chips are now in all Apple iPhone 12 models after a bruising legal battle. Apple sued Qualcomm in 2017 but eventually dropped its claims and signed chip supply and patent license agreements with Qualcomm in 2019. Apple is now designing chips to displace Qualcomm’s communications chips in iPhones.

“The biggest overhang for Qualcomm’s long-term stock multiple is the worry that right now, it’s as good as it gets, because they’re shipping into all the iPhones, but someday, Apple will do those chips internally,” said Michael Walkley, a senior analyst at Canaccord Genuity Group.

Amon said that Qualcomm has decades of experience designing modem chips that will be hard for any rival to replicate and that the void in the Android market left by Huawei creates new revenue opportunities for Qualcomm.

Another challenge for Amon, a gregarious executive who is energetic onstage during keynote presentations, will be that Qualcomm is not well known to consumers in the way that Intel or Nvidia are, even in Qualcomm’s hometown.

“I flew into San Diego and got an Uber driver at the airport and told him I was going to Qualcomm. He said, ‘You mean the stadium?'” Krewell said, referring to the football arena formerly home to the San Diego Chargers.

Amon has started a new branding program for the company’s Snapdragon smartphone chips to try to change that. “We have a mature smartphone industry today. People care what’s behind the glass,” he said.

References:

https://www.reuters.com/technology/qualcomms-new-ceo-eyes-dominance-laptop-markets-2021-07-01/