Data Center Interconnect

Zayo’s largest capacity wavelengths deal likely for cloud data center interconnection (DCI)

Zayo Group Holdings announced it has signed a deal for the largest amount of capacity sold on any fiber route in the company’s history. The deal with the unnamed customer will provide approximately 5 terabits of capacity that can be used to connect mega scale data centers. While Zayo didn’t disclose the customer, large hyperscale cloud providers, such as Amazon Web Services, Microsoft Azure and Google Cloud Project, and webscale companies such as Facebook, seem to be likely candidates.

Zayo provides a 133,000-mile fiber network in the U.S., Canada and Europe. Earlier this year it agreed to be acquired by affiliates of Digital Colony Partners and the EQT Infrastructure IV fund. That deal is slated to close in the first half of next year.

“Our customers [1] are no longer talking gigabits — they’re talking terabits on multiple diverse routes,” said Julia Robin, senior vice president of Transport at Zayo. “Zayo’s owned infrastructure, scalable capacity on unique routes and ability to turn up services quickly positions us to be the provider of choice for high-capacity infrastructure.”

Note 1. Zayo’s primary customer segments include data centers, wireless carriers, national carriers, ISPs, enterprises and government agencies.

Zayo to extend fiber-optic network in central Florida: The new fiber network infrastructure, comprising more than 2300 route miles, will open Tampa and Orlando as new markets for the fiber-optic network services company.

…………………………………………………………………………………………………………………………………………………………………………………………….

Zayo’s extensive wavelength network provides dedicated bandwidth to major data centers, carrier hotels, cable landing stations and enterprise locations across our long-haul and metro networks. Zayo continues to invest in the network, adding new routes and optronics to eliminate local stops, reduce the distance between essential markets and minimize regeneration points. Options include express, ultra-low and low-latency routes and private dedicated networks.

Zayo says it “leverages its deep, dense fiber assets in almost all North American and Western European metro markets to deliver a premier metro wavelength offering. Increasingly, enterprises across multiple sectors including finance, retail, pharma and others, are leveraging this network for dedicated connectivity as they seek ways to have more control over their growing bandwidth needs.”

According to a report by market research firm IDC, data created, captured and replicated worldwide will be 175 zettabytes by 2025 and 30% of it will be in real time. A large chunk of that amount will be driven by webscale, content and cloud providers that require diverse, high capacity connections between their data centers. In order to provision high bandwidth amounts, service providers and webscale companies are turning to dedicated wavelength solutions.

Zayo’s wavelength network provides dedicated bandwidth to major data centers, carrier hotels, cable landing stations and enterprise locations across its long-haul and metro networks. Its communications infrastructure offerings include dark fiber, private data networks, wavelengths, Ethernet, dedicated internet access and data center co-location services. Zayo also owns and operates a Tier 1 IP backbone and 51 carrier-neutral data centers.

References:

For more information on Zayo, please visit zayo.com

https://www.fiercetelecom.com/telecom/zayo-lands-largest-wavelengths-deal-its-history-at-5-terabits

IHS Markit: Data Center Interconnect (DCI) is Fastest-growing Application for Optical Networking

A significant driver for innovation in the optical market, data center interconnect (DCI) is the fastest-growing application for optical networking equipment, according to a new study from business information provider IHS Markit. Eighty-six percent of service providers polled for the Optical Network Applications Survey have plans to support DCI applications in their networks.

“Data center interconnect is enjoying a meteoric rise as the hottest segment in the optical networking applications space,” said Heidi Adams, senior research director for transport networks at IHS Markit. “Service providers are becoming increasingly invested in the DCI market, both for providing interconnect between their own data centers and for offering DCI services to internet content providers and enterprises. We estimate that service providers will account for around half of all DCI equipment spending in 2018.”

The optical data center equipment market reached $1.4 billion in sales in the first half of 2018, posting 19 percent year-over-year growth, according to IHS Markit. A key driver of the market is the compact DCI sub segment, which notched a 173 percent growth rate during this same time period.

“‘Compact’ DCI equipment is designed to fit within a data center environment from the form factor, power consumption and operational perspectives,” Adams said. “It’s optimized to meet the requirements of internet content providers like Google, AWS, Facebook, Microsoft and Apple.”

The top three vendors in the compact DCI sub segment are Ciena, Infinera and Cisco, who collectively account for three-quarters of the market.

Additional DCI highlights

- Cost per port is the leading criterion among survey respondents for the selection of equipment for DCI applications.

- 100G is the main currency for line-side DCI interfaces in 2018, declining in favor of 400G by 2021.

- IHS Markit forecasts the total DCI market to grow at a 15 percent compound annual growth rate (CAGR) from 2017 to 2022, representing a higher rate of growth than the overall WDM market.

Optical Network Applications Service Provider Survey – 2018

This survey analyzes the trends and assesses the needs of service providers using emerging optical networking architectures. It covers data center interconnect, packet-optical equipment and software-defined networking for transport networks. For the survey, IHS Markit interviewed 22 service providers who have deployed packet-optical transport, optical DCI and/or transport SDNs or will do so in the future.

DCI, Packet-Optical & OTN Equipment Market Tracker

This biannual report provides worldwide and regional vendor market share, market size, forecasts through 2022, analysis and trends for data center interconnect equipment, packet-optical transport systems, and OTN transport and switching hardware.

Reference:

https://www.ciena.com/insights/what-is/What-is-DCI.html

Cignal AI: Record Cloud and Colo Optical Hardware Spending in 2Q18

by Andres Schmitt

Ciena Leads Sales to North American Cloud/Colo Operators; Huawei Sees Strong Demand from Chinese Cloud Giants

|

|

|

Moore’s law alive in the Data Center; Ethernet adapter revenue up 43% YoY

by Cliff Grossner, Senior Research Director & Advisor Cloud & Data Center Research Practice at IHS-Markit

Introduction:

We cannot measure Moore’s law simply in time between generations. Even though it took Intel longer than 2 years to move from 14nm to 10nm silicon, the number of transistors in their 10nm CPUs exceeded Moore’s Law expectation of 2x per 2 years, according to new research by IHS Markit.

For example, improving transistor IC design helped Intel grow transistor density from 37.5 Million Transistor per Square Millimeter (Mtr/mm2)to 100.8 Mtr/mm2 between 2014 and 2017.

“Since 2007 we’ve seen an immense growth in consumer devices, apps, user-generated content and streaming services, as smart phones and social media gained popularity, driving the need for additional data center (DC) server computational capacity to support them. Connected devices and data-intensive applications will continue to fuel global demand for DC compute and push it up significantly ahead of the average growth of the number of transistors on a CPU,” said Cliff Grossner, Ph.D., Senior Research Director and Advisor for the Cloud and Data Center Research Practice at IHS Markit.

“Strong growth in the demand for DC server computation will compel designers of server hardware to think beyond general purpose compute and consider new server architectures purpose-built for parallel computation that will enable artificial intelligence, advanced driver assistance systems and real-time rendering for virtual and augmented reality amongst others,” Cliff added.

More Data Center Compute Market Highlights:

· Cloud service providers are expected to buy 37% of 2017 DC servers shipped, telco 15% and enterprise 48%.

· White Box – including all vendors that produce rack server hardware with OS software sold separately, such as QCT, Wiwynn and Inventec – was #1 in units shipped in 3Q17 (23% share) for DC servers.

· HPE took the #1 sport in server revenue market share (23%), Dell was #2 (19%), and White Box was #3 (17%) in 2Q17

· Programmable Ethernet adapter revenue was up 7% QoQ and up 43% YoY, hitting $22M in 3Q17

Research Synopsis:

The IHS Markit Data Center Compute Intelligence Service provides quarterly worldwide and regional market size, vendor market share, forecasts through 2021, analysis and trends for (1) data center servers by form factor[rack, blade, open compute and tower], server class[entry-level, enterprise, large-scale enterprise, large-scale compute and high performance compute], and market segment[Enterprise, Telco and Cloud Service Provider], and (2) Ethernet network adapters by CPU offload[Basic, Offload and Programmable NIC], port speed [1/10/25/40/50/100GE], form factor [stand-up, piggyback and open compite], usage case [storage and server] and market segment. Vendors tracked include Dell, HPE, Lenovo, Cisco, Huawei, Inspur, IBM, Supermicro, Cray, Intel, Broadcom, Mellanox, Cavium, and others.

……………………………………………………………………………….

In a separate IHS Markit report:

Hyperscale data center owners are driving growth of renewable energy in data centers

By Maggie Shillington, analyst, cloud and data centers, IHS Markit

Highlights

- Between 2 percent and 3 percent of developed countries’ electricity consumption is currently attributed to data centers. For most data centers, the largest operational cost is the electricity used for cooling.

- Onsite generation is the ideal way to implement renewable energy in data centers. The two most popular renewable energy methods are solar and wind power, due to their high-energy production and relative ease of implementation.

- Offsite renewable energy sources — primarily utility companies and renewable energy suppliers — are typically the easiest way for data centers to obtain renewable energy. Offsite generation removes the large upfront capital expenses to produce onsite renewable energy and the geographical limitations of renewable energy production methods.

- Although small data centers have a distinct advantage in using onsite options, owners of hyperscale data centers (i.e., Apple, Google, Microsoft, Amazon and Facebook) are driving the growth of renewable energy for data centers.

Cignal AI & Del’Oro: Optical Network Equipment Market Decline Continues

Executive Summary & Overview:

Does anyone remember the fiber optic build out boom of the late 1990’s to early 2001? And the subsequent bust, which the industry still has not recovered from!

Fast forward to today, where we hear more and more about huge fiber demand from mega cloud service providers/Internet companies for intra and inter Data Center Connections. And the huge amount of fiber backhaul for small cells and cell towers.

Yet two respected market research firms- Cignal AI and Del’Oro Group– both say that optical network transport equipment revenue declined yet again.

Cignal AI said: “global spending on optical network equipment dropped for a third consecutive quarter, led by a larger than normal seasonal decline in China and weakening trends in EMEA.” However, Cignal AI (Andrew Schmitt) stated that “North American spending increased again quarter-over-quarter, with positive results reported by most vendors. Spending on Metro WDM continues to grow at the expense of LH WDM.”

Del’Oro Group reported in a press release: “revenues for Optical Transport equipment in North America continued to decline in the third quarter of 2017.”

“Optical Transport equipment purchases in North America was about 10 percent lower in the first nine months of 2017,” said Jimmy Yu, Vice President at Dell’Oro Group. “This has been one of the more challenging years for optical equipment manufacturers selling into North America. However, a few vendors in the region performed really well considering the tough market environment. For the first nine months of the year, Ciena was able to hold revenues steady, Cisco was able to grow revenues 14 percent, and Fujitsu experienced only a slight revenue decline,” Mr. Yu added.

–>Please see Editor’s Notes below for additional optical network equipment market insight and vendor perspective.

…………………………………………………………………………………………………………

Cignal AI Report Summary:

- North American spending increased again quarter-over-quarter, with positive results reported by most vendors. Spending on Metro WDM continues to grow at the expense of LH WDM.

- EMEA revenue fell sharply though this was the result of weakness at larger vendors – smaller vendors performed better. As in North America, LH WDM bore the brunt of the decline.

- Last quarter was the weakest YoY revenue growth recorded in China in over 4 years as momentum from 2Q17 spending failed to continue into the third quarter. Spending trends in the region remain difficult to predict.

- Revenue in the rest of Asia (RoAPAC) easedfollowing breakout results in India during 2Q17 though spending remains at historically high levels.

- Quarterly coherent 100G+ port shipments broke 100k units for the first time on a global basis. 100G+ Port shipments in China were flat QoQ and are substantially up YoY.

Cignal AI’s October 29, 2017 Optical Customer Markets Report discovered an unexpected weakness in 2017 optical transport equipment spending from cloud and co-location (colo) operators (see Cignal AI Reports Unexpected Drop in Cloud and Colo Spending). This surprising trend was then further supported by public comments later made by Juniper and Applied Optoelectronics.

Contact Info:

Cignal AI – 225 Franklin Street FL26 Boston, MA – 02110 – (617) 326-3996

Email: [email protected]

…………………………………………………………………………………………………………

Editor’s Notes:

1.One prominent Optical Transport Network Equipment vendor evidently feels the effect of the market slowdown. On November 8, 2017, Infinera reported a GAAP net loss for the quarter of $(37.2) million, or $(0.25) per share, compared to a net loss of $(42.8) million, or $(0.29) per share, in the second quarter of 2017, and net loss of $(11.2) million, or $(0.08) per share, in the third quarter of 2016.

Infinera also announced it is implementing a plan to restructure its worldwide operations in order to reduce its expenses and establish a more cost-efficient structure that better aligns its operations with its long-term strategies. As part of this restructuring plan, Infinera will reduce headcount, rationalize certain products and programs, and close a remote R&D facility.

2. Astonishingly, there’s an India based optical network equipment vendor on the rise. Successful homegrown Indian telecom vendors are hard to come by. That makes Bengaluru-based Tejas Networks something of an anomaly. Started 17 years ago (in 2000), Tejas is one of India’s few hardware producers.

Tejas Networks India Ltd. has made a name for itself in the optical networking market, especially within India, which looks poised for a boom in this sector (mainly due to fiber backhaul of 4G and 5G mobile data traffic). Nearly two thirds of its sales come from India, with the rest earned overseas.

“We are growing at 35% year-on-year and we hope to grow by at least 20% over the next two to three years,” says Sanjay Nayak, the CEO and managing director of Tejas, during an interview with Light Reading. “Overseas, we mainly target south-east Asian, Latin America and African markets.” Telcos in these markets have similar concerns to those in India, explains Nayak, making it easy for Tejas to address their demands.

“R&D is in our DNA and we believe that unless you come up with a differentiated product the market will not take you seriously,” says Nayak. “We have a huge advantage as an Indian player … [which] allows us to provide the product at a lesser price.”

Nayak believes that the experience of developing solutions for the problems faced by Indian telcos has helped the company to address overseas markets as well.

“Our products do very well for networks evolving from TDM to packet, which is a key concern of the Indian telcos,” he explains. “We realized that the US-based service providers were facing a similar problem of cross connect, which we were able to resolve. So, as we say, you can address any market if you are able to handle the Indian market.”

Read more at: http://www.communicationstoday.co.in/daily-news/17152-india-s-tejas-eyes-bigger-slice-of-optical-market

3. The long haul optical transport market is dominated by OTN (Optical Transport Network) equipment (which this editor worked on from 2000 to 2002 as a consultant to Ciena, NEC, and other optical network equipment and chip companies).

The OTN wraps client payloads (video, image, data, voice, etc) into containers or “wrappers” that are transported across wide area fiber optic networks. That helps maintain native payload structure and management information. OTN offers key benefits such as reduction in transport cost and optimal utilization of the optical spectrum.

OTN technology includes both WDM and DWDM. The service segment includes network maintenance and support services and network design & optimization services. On the basis of component, the market is divided into optical switch and optical transport. Based on end user, it is classified into government and enterprises.

According to Allied Market Research, OTN equipment market leaders include: Adtran, Inc., ADVA Optical Networking, Advanced Micro Devices Inc., Fujitsu, Huawei Technologies., ZTE Corporation., Belkin Corporation., Ciena Corporation., Coriant, and Allied Telesyn.

Above illustration courtesy of Allied Market Research

………………………………………………………………………………………………..

Note that Cisco offers OTN capability on their Network Convergence System (NCS) 4000 – 400 Gbps Universal line card. Despite that and other OTN capable gear, Cisco is not covered in the above mentioned Allied Market Research OTN report.

………………………………………………………………………………………………………………….

Global Switching & Router Market Report:

Separately, Synergy Research Group said in a press release that:

Worldwide switching and router revenues were well over $11 billion in Q3 and were $44 billion for last four quarters, representing 3% growth on a rolling annualized basis. Ethernet switching is the largest of the three segments accounting for almost 60% of the total and it is also the segment that has by far the highest growth rate, propelled by aggressive growth in the deployment of 100 GbE and 25 GbE switches.

In Q3 North America remained the biggest region accounting for over 41% of worldwide revenues, followed by APAC, EMEA and Latin America. The APAC region has been the fastest growing and this was again the case in Q3, with growth being driven in large part by spending in China, which benefited Huawei in particular.

Cisco’s share of the total worldwide switching and router market was 51%, with shares in the individual segments ranging from 63% for enterprise routers to 38% for service provider routers. Cisco is followed by Huawei, Juniper, Nokia and HPE. Their overall switching and router market shares were in the 4-10% range in Q3. There is then a reasonably long tail of other vendors, with Arista and H3C being the most prominent challengers.

![S&R Q317[1]](http://www.globenewswire.com/news-release/2017/11/27/1206112/0/en/photos/494670/0/494670.jpg?lastModified=11%2F27%2F2017%2004%3A20%3A07&size=3)

“The big picture is that total switching and router revenues are still growing and Cisco continues to control half of the market,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “Some view SDN and NFV as existential threats to Cisco’s core business, with own-design networking gear from the hyperscale cloud providers posing another big challenge. While these are genuine issues which erode growth opportunities for networking hardware vendors, there are few signs that these are substantially impacting Cisco’s competitive market position in the short term.”

Contact Info:

To speak to a Synergy analyst or to find out more about how to access Synergy’s market data, please contact Heather Gallo @ [email protected] or at 775-852-3330 extension 101.

Top Optical Network Equipment Vendors: Data Center Interconnect & Overall Market

Executive Summary:

Market research firms Dell’Oro and Heavy Reading disagree on who are the top optical network equipment vendors, especially for data center interconnect (DCI). Obviously, the mega cloud computing/Internet service providers (Google, Amazon, Baidu, Facebook, etc) together account for the overwhelming market for DCI equipment purchased. None of them disclose who their DWDM vendors are. It’s well known that most of those mega cloud/Internet players design their own IT equipment (e.g. compute servers, Ethernet switches, Routers, etc), but they don’t design or build DWDM transport gear.

Dell’Oro Group DCI Market Analysis:

Ciena, Cisco and Infinera together command 85% of the disaggregated wavelength-division multiplexing field for DCI optical network equipment market segment, Dell’Oro Group estimates.

……………………………………………………………………………………………………..

–>This is a big surprise to this author as neither Nokia (via Alcatel-Lucent), Huawei (#1 overall optical network vendor) or ZTE are top tier according to Dell’Oro. See two graphs below (“Other Voices” section), courtesy of Heavy Reading and IHS-Markit.

……………………………………………………………………………………………………..

Dell’Oro Group estimated that disaggregated WDM systems reached an annualized revenue run rate of $400 million, growing 225% year-over-year. This is partly because these systems are finding utility in the booming DCI market segment.

Jimmy Yu, VP at Dell’Oro Group, said that while the disaggregation concept is not new, service provider adoption in the data center segment is.

“In most—if not all—purchases, we found that these new systems were being employed in DCI across both metro and long haul spans,” Yu said in a press release. “So far, the largest consumers have been internet content providers that appreciate the platform for its simplicity, capacity, and power savings.”

Yu added that “based on second quarter results, where disaggregated WDM systems represented nearly one-third of the optical DCI equipment purchases made, we have to say that Disaggregated WDM systems are truly hitting the sweet spot for DCI.”

As wireline operators look to diversify their revenue mix, the DCI market has a compelling growth path driven by the consumption and distribution of various data forms over the public internet and private networks.

Outside of DCI, the overall WDM market, which consists of WDM Metro and DWDM Long Haul, grew only 2% year-over-year in the second quarter, says Dell’Oro. The research firm noted that growth was driven by strength in the Asia Pacific region, especially China and India.

The share of 100G WDM wavelength shipments going to DCI was 14% in the quarter, according to Dell’Oro.

About the Report:

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 40 Gbps, 100 Gbps, and >100 Gbps). The report tracks DWDM long haul terrestrial, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, and data center interconnect (metro and long haul). To purchase this report, call Matt Dear at +1.650.622.9400 x223 or email [email protected].

………………………………………………………………………………………………………………

Other Voices on Optical Network Equipment Market:

1. Cignal AI:

Huawei and ZTE saw record shipments of 100-Gbps coherent ports in China during the second quarter of 2017 as well as strong sales in general throughout the region, reports Cignal AI. So what accounts for sour grapes from optical component houses? Inventory corrections at Chinese systems vendors, particularly Huawei, according to the market research firm.

“Demand for optical hardware in China is not slowing down, and equipment vendors are universally providing positive guidance for North America during the second half of the year,” said Andrew Schmitt, lead analyst for Cignal AI. “Operators around the world are shifting spending from long-haul to metro WDM, though this shift is materializing into gains for only a few vendors.”

Optical revenue in China is up 13 percent for the first half of 2017 as compared to the same period in 2016. The weak demand reported by component makers is a result of an ongoing inventory correction (primarily at Huawei), rather than a signal of weak end market demand.

2. IHS-Markit:

Huawei ranked first overall in combined market presence and market leadership in the recent Optical Network Hardware Vendor Scorecard released by IHS Markit. Huawei received this assessment for its comprehensive performance on multiple benchmarks including reputation for innovation, market share momentum, and global market share.

There are over a dozen vendors around the globe that make and sell optical network equipment. The 10 vendors profiled in this Scorecard–ADVA, Ciena, Cisco, Coriant, ECI, Fujitsu, Huawei, Infinera, Nokia, and ZTE–were selected because they are the top revenue producers of optical hardware.

The Scorecard used concrete data and metrics, including market share, financials and direct feedback from buyers on innovation, product reliability, service and support to evaluate 2016 market performance and future momentum of the top 10 optical network equipment vendors.

IHS Markit optical network hardware vendor scorecard (Source: IHS Markit Optical Network Hardware Vendor Scorecard)

3. Heavy Reading:

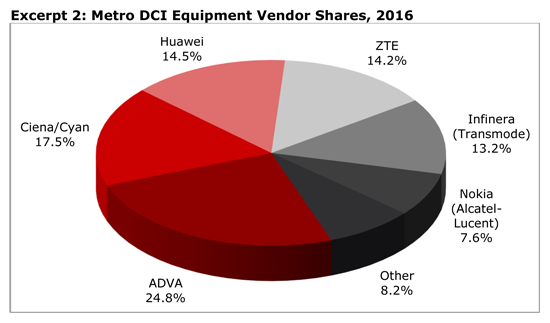

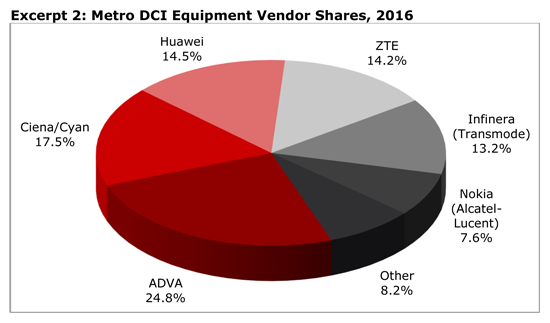

Market share estimates are based on DCI revenue contribution by Heavy Reading’s definition (not disclosed in the teaser briefing). Most vendors do not currently break out from their broader metro WDM revenue the portion accounted for by metro DCI deployments. A few companies did provide Heavy Reading with some general guidance on their revenue from metro DCI. The pie chart figure below shows Heavy Reading’s metro DCI equipment vendor share estimates for 2016.

Note that Adva has the top vendor market share and Cisco is not represented in the figure.

Source: Heavy Reading

References:

https://cignal.ai/2017/08/2q17-optical-hardware-results/

http://www.huawei.com/en/news/2017/8/Huawei-Optical-Network-IHS-Leader

http://www.heavyreading.com/details.asp?sku_id=3503&skuitem_itemid=1728

Top Optical Network Equipment Vendors: Data Center Interconnect & Overall Market

Executive Summary:

Market research firms Dell’Oro and Heavy Reading disagree on who are the top optical network equipment vendors, especially for data center interconnect (DCI). Obviously, the mega cloud computing/Internet service providers (Google, Amazon, Baidu, Facebook, etc) together account for the overwhelming market for DCI equipment purchased. None of them disclose who their DWDM vendors are. It’s well known that most of those mega cloud/Internet players design their own IT equipment (e.g. compute servers, Ethernet switches, Routers, etc), but they don’t design or build DWDM transport gear.

Dell’Oro Group DCI Market Analysis:

Ciena, Cisco and Infinera together command 85% of the disaggregated wavelength-division multiplexing field for DCI optical network equipment market segment, Dell’Oro Group estimates.

……………………………………………………………………………………………………..

–>This is a big surprise to this author as neither Nokia (via Alcatel-Lucent), Huawei (#1 overall optical network vendor) or ZTE are top tier according to Dell’Oro. See two graphs below (“Other Voices” section), courtesy of Heavy Reading and IHS-Markit.

……………………………………………………………………………………………………..

Dell’Oro Group estimated that disaggregated WDM systems reached an annualized revenue run rate of $400 million, growing 225% year-over-year. This is partly because these systems are finding utility in the booming DCI market segment.

Jimmy Yu, VP at Dell’Oro Group, said that while the disaggregation concept is not new, service provider adoption in the data center segment is.

“In most—if not all—purchases, we found that these new systems were being employed in DCI across both metro and long haul spans,” Yu said in a press release. “So far, the largest consumers have been internet content providers that appreciate the platform for its simplicity, capacity, and power savings.”

Yu added that “based on second quarter results, where disaggregated WDM systems represented nearly one-third of the optical DCI equipment purchases made, we have to say that Disaggregated WDM systems are truly hitting the sweet spot for DCI.”

As wireline operators look to diversify their revenue mix, the DCI market has a compelling growth path driven by the consumption and distribution of various data forms over the public internet and private networks.

Outside of DCI, the overall WDM market, which consists of WDM Metro and DWDM Long Haul, grew only 2% year-over-year in the second quarter, says Dell’Oro. The research firm noted that growth was driven by strength in the Asia Pacific region, especially China and India.

The share of 100G WDM wavelength shipments going to DCI was 14% in the quarter, according to Dell’Oro.

About the Report:

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 40 Gbps, 100 Gbps, and >100 Gbps). The report tracks DWDM long haul terrestrial, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, and data center interconnect (metro and long haul). To purchase this report, call Matt Dear at +1.650.622.9400 x223 or email [email protected].

………………………………………………………………………………………………………………

Other Voices on Optical Network Equipment Market:

1. Cignal AI:

Huawei and ZTE saw record shipments of 100-Gbps coherent ports in China during the second quarter of 2017 as well as strong sales in general throughout the region, reports Cignal AI. So what accounts for sour grapes from optical component houses? Inventory corrections at Chinese systems vendors, particularly Huawei, according to the market research firm.

“Demand for optical hardware in China is not slowing down, and equipment vendors are universally providing positive guidance for North America during the second half of the year,” said Andrew Schmitt, lead analyst for Cignal AI. “Operators around the world are shifting spending from long-haul to metro WDM, though this shift is materializing into gains for only a few vendors.”

Optical revenue in China is up 13 percent for the first half of 2017 as compared to the same period in 2016. The weak demand reported by component makers is a result of an ongoing inventory correction (primarily at Huawei), rather than a signal of weak end market demand.

2. IHS-Markit:

Huawei ranked first overall in combined market presence and market leadership in the recent Optical Network Hardware Vendor Scorecard released by IHS Markit. Huawei received this assessment for its comprehensive performance on multiple benchmarks including reputation for innovation, market share momentum, and global market share.

There are over a dozen vendors around the globe that make and sell optical network equipment. The 10 vendors profiled in this Scorecard–ADVA, Ciena, Cisco, Coriant, ECI, Fujitsu, Huawei, Infinera, Nokia, and ZTE–were selected because they are the top revenue producers of optical hardware.

The Scorecard used concrete data and metrics, including market share, financials and direct feedback from buyers on innovation, product reliability, service and support to evaluate 2016 market performance and future momentum of the top 10 optical network equipment vendors.

IHS Markit optical network hardware vendor scorecard (Source: IHS Markit Optical Network Hardware Vendor Scorecard)

3. Heavy Reading:

Market share estimates are based on DCI revenue contribution by Heavy Reading’s definition (not disclosed in the teaser briefing). Most vendors do not currently break out from their broader metro WDM revenue the portion accounted for by metro DCI deployments. A few companies did provide Heavy Reading with some general guidance on their revenue from metro DCI. The pie chart figure below shows Heavy Reading’s metro DCI equipment vendor share estimates for 2016.

Note that Adva has the top vendor market share and Cisco is not represented in the figure.

Source: Heavy Reading

References:

https://cignal.ai/2017/08/2q17-optical-hardware-results/

http://www.huawei.com/en/news/2017/8/Huawei-Optical-Network-IHS-Leader

http://www.heavyreading.com/details.asp?sku_id=3503&skuitem_itemid=1728