FCC

Highlights of FCC Notice of Inquiry (NOI) on radio spectrum usage & how AI might be used

The U.S. Federal Communications Commission (FCC) is requesting input from the public on new technological approaches to assessing “real-time, non-Federal (government) spectrum usage, so that it has better insights into current technologies that might help the agency to manage spectrum and identify opportunities for spectrum sharing—including how artificial intelligence (AI) might be used.

This FCC Notice of Inquiry (NOI) was approved by all four members of the Commission. It states:

“Spectrum usage information is generally non-public and made available infrequently. As the radiofrequency (RF) environment grows more congested, however, we anticipate a greater need to consider such data to improve spectrum management. That is especially true as the burgeoning growth of machine learning (ML) and artificial intelligence (AI) offer revolutionary insights into large and complex datasets. Leveraging today’s tools to understand tomorrow’s commercial spectrum usage can help identify new opportunities to facilitate more efficient spectrum use, including

new spectrum sharing techniques and approaches to enable co-existence among users and services.”

Spectrum usage has been defined in various ways. In one technical paper, for instance, NTIA and NIST defined “band occupancy” as “the percentage of frequencies or channels in the band with a detected signal level that exceeds a default or user-defined threshold.”

“Right now, so many of our commercial spectrum bands are growing crowded,” said FCC Chairwoman Jessica Rosenworcel. “Hundreds of millions of wireless connections—from smartphones to medical sensors—are using this invisible infrastructure. And that number is growing fast. But congestion can make it harder to make room in our skies for new technologies and new services. Yet we have to find a way, because no one wants innovation to grind to a halt. To do this we need smarter policies, like efforts that facilitate more efficient use of this scarce resource. … Now enter AI. A large wireless provider’s network can generate several million performance measurements every minute. Using those measurements, machine learning can provide insights that help better understand network usage, support greater spectrum efficiency, and improve resiliency by making it possible to heal networks on their own.”

“[This] inquiry is a way to understand this kind of potential and help ensure it develops here in the United States first. “I believe we can do more to increase our understanding of spectrum utilization and support the development of AI tools in wireless networks,” she added.

Rosenworcel noted that some pioneering work on dynamic, cognitive radios was kick-started with the Defense Advanced Research Project’s three-year Spectrum Collaboration Challenge, which sought to develop software-defined radios’ capability to dynamically detect other spectrum users and work around them in a congested radio frequency environment.

The FCC pointed out in a statement that it generally doesn’t collect information on spectrum usage, and instead relies on intermittent data from third-party sources.

“As the radiofrequency environment becomes more congested, leveraging technologies such as artificial intelligence to understand spectrum usage and draw insights from large and complex datasets can help facilitate more efficient spectrum use, including new spectrum sharing techniques and approaches to enable co-existence among users and services,” the agency said, adding that the inquiry will explore the “feasibility, benefits, and limitations” of various ways to understand non-federal spectrum usage, as well as band- or service-specific considerations and various technical, practical or legal aspects that should be considered.

References:

https://www.fcc.gov/document/spectrum-usage-noi

https://docs.fcc.gov/public/attachments/FCC-23-63A1.pdf

FCC proposes 100 Mbps download as U.S. minimum broadband speed

Federal Communications Commission (FCC) Chairwoman Jessica Rosenworcel proposed a national goal of 100% affordable broadband access in the U.S. According to the official FCC release, Rosenworcel seeks to gauge the progress of broadband deployment, focusing on crucial characteristics such as affordability, adoption, availability, and equitable access for all Americans.

“In today’s world, everyone needs access to affordable, high-speed internet, no exceptions,” said Chairwoman Rosenworcel. “It’s time to connect everyone, everywhere. Anything short of 100% is just not good enough.”

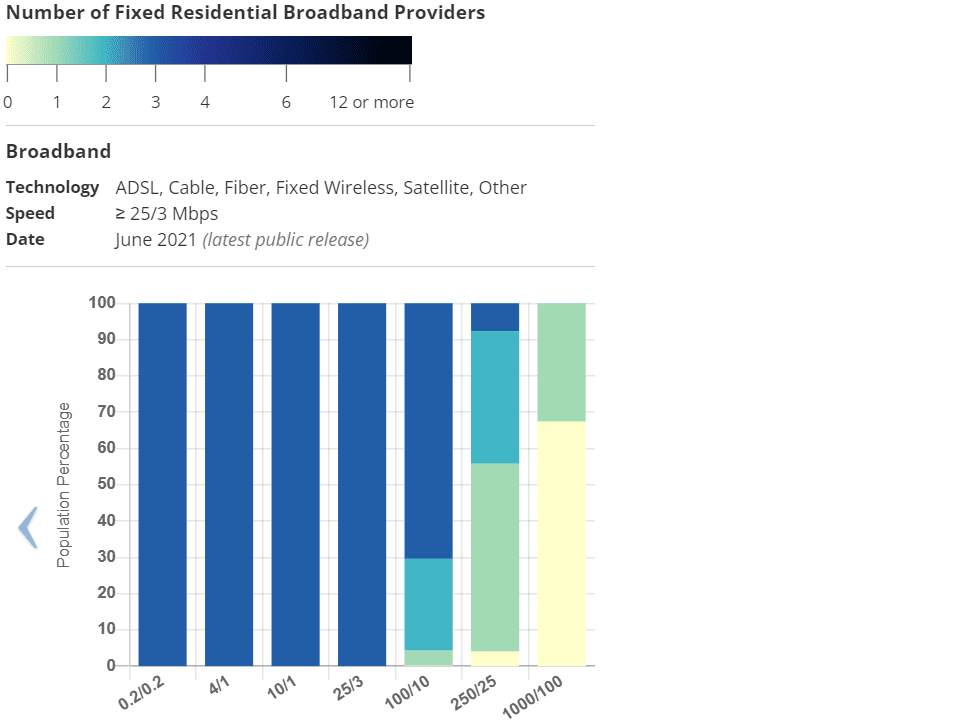

As part of the plan, FCC now proposes to increase the national fixed broadband standard to 100 Mbps for download and 20 Mbps for upload, pushing internet service providers to enhance their offerings and reach more Americans. That’s up from 25 Mbps for download and 3 Mbps for upload which was established in 2015.

Anticipating future demands, Rosenworcel outlined a separate national goal of 1 Gbps for download and 500 Mbps for upload, ensuring that the United States remains at the forefront of digital innovation.

By increasing the national fixed broadband standard and setting ambitious targets, the FCC is taking decisive steps towards digital inclusion, opening up a world of opportunities in education, business, healthcare, and beyond.

References:

FCC explores shared use of the 42 GHz band

The FCC voted Thursday to launch a proceeding to consider sharing models in 500 megahertz of spectrum in the 42 GHz band. The agency believes its examination could inform how the band might best be used —particularly by smaller wireless service providers— and provide guidance on future uses of sharing models in spectrum management.

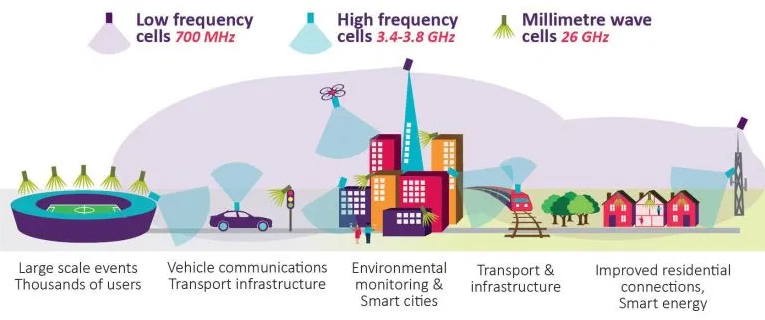

FCC Chairwoman Jessica Rosenworcel, who just returned this week from a quick trip to Sharm El-Sheikh, Egypt for an ITU meeting, said that when she took over at the FCC, she believed the agency had overinvested in millimeter wave (mmWave) auctions and done too little to bring mid-band spectrum to market. She set out to change that, launching auctions in the 3.45 GHz and 2.5 GHz bands.

“With those successful mid-band efforts in the rear-view mirror, we are now turning back to millimeter wave,” Rosenworcel said in prepared remarks. “But this time we want to consider something different. In the 42 GHz band we have 500 megahertz of greenfield airwaves with no federal or commercial incumbencies. So we are putting out ideas. We are exploring non-exclusive access models. This could entail using a technology-based sensing mechanism to help operators actively detect and avoid one another. It could involve non-exclusive nationwide licenses that leverage a database to facilitate coexistence. It could also entail site-based licensing. To get even more out of this effort we ask if our approaches could be combined with shared-used models in other spectrum bands, like the lower 37 GHz band.”

“Our goal here is to come up with a new model to lower barriers, encourage competition and maximize the opportunities in millimeter wave spectrum. In short, it’s time to be creative. I look forward to the record that develops—and then look forward to sharing our creativity with the world.”

A Notice of Proposed Rulemaking (NPRM) is in effect where the FCC will build a record on the benefits and drawbacks of implementing a shared licensing approach in the 42 GHz band. The NPRM proposes licensing the 42 GHz band as five 100 megahertz channels and seeks comment on other aspects of implementing a shared licensing approach, including coordination mechanisms, buildout requirements and technical rules.

Michael Calabrese, director of Wireless Future, Open Technology Institute at New America, said his organization agrees that a shared licensing framework is the best use of the 42 GHz band, making this spectrum available to a wide range of fixed wireless ISPs, enterprises and other users.

“Coordinated sharing will be particularly powerful if the FCC adopts a common framework for the lower 37 and 42 GHz bands, giving operators as much as 1100 megahertz of bandwidth,” he said in a statement provided to Fierce. “Fixed wireless deployments are exploding, adding options and competition for high-capacity broadband at lower prices. As open access bands, wide-channel millimeter wave spectrum can fuel and accelerate this positive trend.”

References:

https://www.fcc.gov/document/exploring-shared-use-42-425-ghz-band

https://docs.fcc.gov/public/attachments/DOC-393517A1.pdf

https://www.fiercewireless.com/wireless/fcc-eyes-42-ghz-shared-use

FCC proposes regulatory framework for space-mobile network operator collaboration

The U.S. Federal Communications Commission (FCC) has proposed a new regulatory framework meant to support collaboration between satellite and wireless terrestrial network operators. In a statement last week, the FCC noted it’s aiming to leverage the growth in space-based services to connect smartphone users in remote, unserved, and underserved areas. The FCC hopes to establish a more transparent process to support supplemental coverage from space.

Numerous such collaborations have launched recently, and the FCC seeks to establish clear and transparent processes to support supplemental coverage from space. Connecting consumers to essential wireless services where no terrestrial mobile service is available can be life-saving in remote locations and can open up innovative opportunities for consumers and businesses.

“We will not be successful in our effort to make … always-on connectivity available to everyone, everywhere if we limit ourselves to using only one technology. We are going to need it all—fiber networks, licensed terrestrial wireless systems, next-generation unlicensed technology, and satellite broadband,” said FCC Chair Jessica Rosenworcel, calling this type of seamless migration among networks the “Single Network Future.” She referenced the availability of emergency SMS service on smartphones via satellite and added, “We are starting to see direct satellite-to-smartphone communication move from sci-fi fantasy to real-world prospect. … For this innovation to have a chance to deliver at scale—and for us to move toward a full Single Network Future with more providers, in more spectrum bands, and a global footprint—regulators will need to develop frameworks that support its development.”

The Notice of Proposed Rulemaking’s suggested framework plans to see satellite operators collaborating with terrestrial service providers while being able to obtain FCC authorization to operate space stations on certain currently licensed, flexible-use spectrums allocated to terrestrial services. According to the FCC, it’s also looking to add a mobile-satellite service allocation on some terrestrial flexible-use bands.

“The FCC proposes allowing authorized non-geostationary orbit satellite operators to apply to access terrestrial spectrum if certain prerequisites are met, including a lease from the terrestrial licensee within a specified geographic area. A satellite operator could then serve a wireless provider’s customers should they need connectivity in remote areas, for example in the middle of the Chihuahuan Desert, Lake Michigan, the 100-Mile Wilderness, or the Uinta Mountains,” said the FCC in its statement.

The FCC will also seek comment on how this framework might best support access to emergency response systems like 911 and Wireless Emergency Alerts when a consumer is connected via supplemental coverage from space. The new proceeding will also seek to build a record on whether the framework can be extended to other bands, locations, and applications that might be supported by such collaborations.

“By providing clear rules, I believe we can kick start more innovation in the space economy while also expanding wireless coverage in remote, unserved, and underserved areas. We can make mobile dead zones a thing of the past. But even better, we have an opportunity to bring our spectrum policies into the future and move past the binary choices between mobile spectrum on the one hand or satellite spectrum on the other. That means we can reshape the airwave access debates of old and develop new ways to get more out of our spectrum resources,” Rosenworcel said.

…………………………………………………………………………………………………………………………………………………………………………………………..

Satellite to smartphone connectivity is expected to be crucial for emergency response systems, with the FCC noting that it is seeking input from the emergency services on how its new framework can best support these services. Companies such as SpaceX, Lynk, and AST SpaceMobile are prominent in this space.

- Apple provides emergency SOS services when it announced its iPhone 14, with the company working with Globalstar to provide satellite connectivity through emergency SOS via satellite.

- T-Mobile linked up with Elon Musk’s SpaceX to provide mobile signal connectivity from space, promising speeds of 2-4Mbps through Starlink satellites and eliminating dead zones, using T-Mobile’s mid-band spectrum.

- A number of telcos have recently penned satellite connectivity agreements with satellite operators including Vodafone, Globe, Zain, and TIM Brazil.

…………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://docs.fcc.gov/public/attachments/DOC-391794A1.docx

U.S. military sees great potential in space based 5G (which has yet to be standardized)

\

Qualcomm and Iridium launch Snapdragon Satellite for 2-Way Messaging on Android Premium Smartphones

Bullitt Group & Motorola Mobility unveil satellite-to-mobile messaging service device

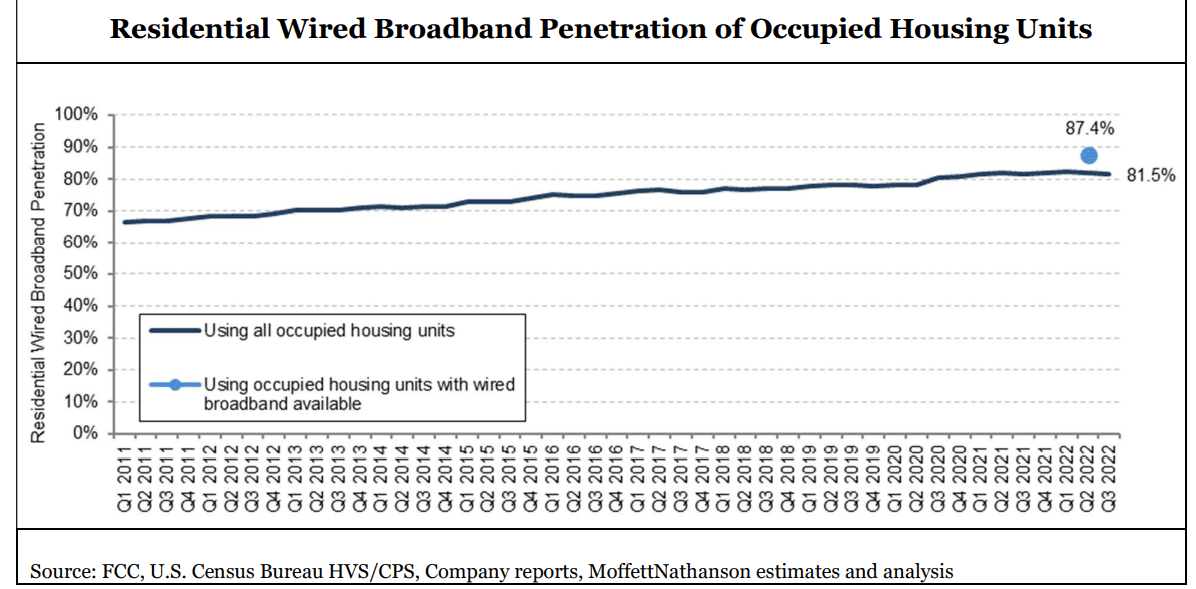

MoffettNathanson: 87.4% of available U.S. homes have broadband; Leichtman Research: 90% of U.S. homes have internet

When the FCC announced the November 18th release date for their long-awaited broadband mapping update, reflecting location-specific broadband availability as of June 2022, analysts at MoffettNathanson thought it would contain information on how many of U.S. homes have access to broadband and how many are too rural and are therefore unserved. However, that FCC release didn’t offer the numbers they needed, and the market research fim didn’t

have the necessary information to calculate it themselves.

In the underlying FCC datasets, which are provided for public download, each location served by a given technology or provider is a separate entry. One location is equivalent to one street address. But many street addresses in the U.S. correspond to multiple living units, and the number of units per location is not publicly available (the location fabric used by the FCC was contracted to a third party, CostQuest Associates, and that fabric is provided only to the FCC, broadband providers, state/local government entities, and select other interested parties). With approximately 31% of residences in multifamily homes, according to a 2019 survey by the Census Bureau, the number of units per location was, as of the November 18th release, a crucial missing piece for any meaningful coverage analysis we could do on our own.

Principal Analyst Craig Moffett wrote:

The FCC’s new maps of broadband availability can tell us coverage for residential locations or business locations, but not the combined total. The companies we cover sometimes break out residential and commercial, but not always. [As an aside, about half of small businesses in the U.S. are actually operated out of peoples’ homes, but hopefully this, at least, doesn’t introduce further distortion, since we are presumably still seeing just one subscription for one location]. So we’ll do our best to make sure we’re matching numerator and denominator by specifying whether we’re looking at all locations or residential locations only.

The FCC’s coverage data also doesn’t distinguish between occupied and vacant units. For our calculation of penetration, we’d want to exclude most vacant units, since vacant units don’t need broadband. Excluding all vacant units likely understates the denominator, though; for example, some second homes (which are treated as vacant) may have year-round broadband subscriptions. The best we can do is assume the coverage of total units is the same as the coverage of occupied units, and that vacant units with broadband subscriptions are negligible.

The FCC does report service coverage for satellite and fixed wireless. But some of those FWA subscribers are in areas where there’s no access to wired broadband, while others are in areas where wired broadband is available. Naturally, the companies won’t tell us how many of each there are. So we’ll just have to leave them all out. We’ll focus just on the availability of wired broadband.

Editor’s Note: The FCC broadband map for my address show a Licensed Fixed Wireless operator serves my condo. It’s California Internet with symmetrical 1G upstream/1G downstream. Also, there are two Satellite providers – Hughes Network Systems, LLC 25M/3M and Space X 350M/40M. Wired internet is available from AT&T and Comcast.

We’d really want to know how many DSL subscribers are in each of those different cohorts. But the

companies we cover don’t report how many of their DSL subscribers are in areas where there is

also a cable or fiber operator, and how many are in areas where DSL is the only option. The first

group is at risk. The second group is not. So, we’ll just have to include all DSL.

According to the FCC’s current estimates, wired broadband (defined as anything over 200 kbps downstream and 200 kbps upstream) was available to 93.7% of residential units in America as of June 30, 2022. Again, we don’t know the percentage of occupied housing units with wired broadband available, but let’s assume it’s the same. And we don’t know the number of residential units in the location fabric, so we’ll use the Census Bureau’s estimate of 128.1M occupied housing units in the U.S. Given these assumptions, we estimate wired broadband was available to around 120.0M occupied housing units as of June 30, 2022. With, by our count, an estimated 104.9M residential wired broadband subscriptions in America in Q2 2022 – again, including DSL, and sometimes including commercial as well as residential subscribers – that translates into penetration of 87.4% of broadband-available homes. We estimate that 81.5% of all households subscribe to wired broadband.

Craig’s Conclusions:

The goal for the FCC is to create maps that are not frozen in time but instead become living and breathing reflections of a dynamic marketplace. The new maps are subject to a public challenge process, enabling interested parties, including operators, local governments, and even individual would-be subscribers, to dispute reported availability. Challenges will eventually be part of a routine updating process. Indeed, the maps released in November were the product of what had already been a months-long initial challenge process. The maps are, again, a critical input to distribution of $42.5 billion of funds earmarked for rural broadband by the JOBS/Infrastructure Act. The National Telecommunications and Information Administration (NTIA) is required by law to use the FCC’s new map to distribute those funds in what is referred to as the Broadband Equity, Access, and Deployment (BEAD) Program, something they have committed to do by June 2023. They are likely to begin that process almost immediately, based on the number of unserved locations in each state, although NTIA chief Alan Davidson has said they will wait for the FCC to release the second version of its coverage map, later this year, before they actually begin to disburse those funds.

The network operators themselves, including the cable operators in particular, will in our view be major participants in the BEAD process, bidding aggressively to bring broadband to unserved census blocks on the periphery of their current franchise areas.

…………………………………………………………………………………………………………………………………………………………………………….

Meanwhile, Leichtman Research Group indicates that 90 per cent of U.S. households get an Internet service at home, compared to 84 per cent in 2017, and 74 per cent in 2007. Broadband accounts for 99 per cent of households with an Internet service at home, and 89 per cent of all households get a broadband Internet service – an increase from 82 per cent in 2017, and 53 per cent in 2007.

These findings are based on a survey of 1,910 households from throughout the United States and are part of a new LRG study, Broadband Internet in the U.S. 2022. This is LRG’s twentieth annual study on this topic.

Other related findings include:

- Individuals ages 65+ account for 34% of those that do not get an Internet service at home

- 56% of broadband subscribers are very satisfied (8-10 on a 1-10 scale) with their Internet service at home, while 6% are not satisfied (1-3).

- 44% of broadband subscribers do not know the download speed of their service – compared to 60% in 2017

- 61% reporting Internet speeds of >100 Mbps are very satisfied with their service, compared to 41% with speeds <50 Mbps, and 57% that do not know their speed

- 40% of broadband households get a bundle of services from a single provider – compared to 64% in 2017, and 78% in 2012

- 59% of adults with an Internet service at home watch video online daily – compared to 59% in 2020, 43% in 2017, and 17% in 2012

“The percentage of households getting an Internet service at home, including high-speed broadband, is higher than in any previous year,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Computer usage and knowledge remain the foundation for Internet services in the home. Among those that do not get an Internet service at home, 58% also do not use a computer at home..”

References:

https://broadbandmap.fcc.gov/home

https://www.leichtmanresearch.com/90-of-u-s-households-get-an-internet-service-at-home/

FCC bans Huawei, ZTE, China based connected camera and 2-way radio makers

On Friday, the Federal Communications Commission (FCC) banned Huawei Technologies Co. and ZTE Corp. from selling electronics in the U.S. by regulators who say they pose a security risk, continuing a years-long effort to limit the reach of Chinese telecommunications companies into U.S. telecommunications networks.

The FCC also named connected-camera makers Hangzhou Hikvision Digital Technology Co. and Dahua Technology Co., as well as two-way radio manufacturer Hytera Communications Corp.

“The FCC is committed to protecting our national security by ensuring that untrustworthy communications equipment is not authorized for use within our borders, and we are continuing that work here,” Chairwoman Jessica Rosenworcel said in a news release. “These new rules are an important part of our ongoing actions to protect the American people from national security threats involving telecommunications.”

“On March 12, 2021, we published the first-ever list of communications and services that pose an unacceptable risk to national security as required under the Secure and Trusted Communications Networks Act. This initial Covered List included equipment from the Chinese companies Huawei, ZTE, Hytera, Hikvision, and Dahua. Since then, we’ve added equipment and services from five additional entities. Last year I also proposed stricter data breach reporting rules and worked with the Department of State to improve how we coordinate national security issues related to submarine cable licenses.”

In the 4-0 vote, the FCC concluded the products pose a risk to data security. Past efforts to curb Chinese access include export controls to cut off key, sophisticated equipment and software. Recently US officials have weighed restrictions on TikTok over fears Chinese authorities could access US user data via the video sharing app.

“This is a culminating action,” said Klon Kitchen, a senior fellow at the Washington-based American Enterprise Institute, a public-policy think tank. “Things that began under Trump are now being carried out. The Biden administration is continuing to turn the screws on these companies because the threat isn’t changing.”

Hikvision said its video security products “present no security threat to the United States and there is no technical or legal justification for the Federal Communications Commission’s decision.” The company said the ruling will “make it more harmful and more expensive for US small businesses, local authorities, school districts, and individual consumers to protect themselves, their homes, businesses and property.”

Huawei declined to comment, while Dahua, Hytera and ZTE didn’t respond to emails sent outside normal business hours in China.

The looming FCC move didn’t come up in the bilateral meeting between US President Joe Biden and Chinese President Xi Jinping in Indonesia last week, a US official said, speaking on condition of anonymity. Biden did discuss technology issues more broadly with Xi and was clear that the US will continue to take action to protect its national security, the official said.

“This is the death knell for all of them for their US operations,” said Conor Healy, director of government research for the Bethlehem, Pennsylvania-based surveillance research group IPVM. “They won’t be able to introduce any new products into the US.”

Dahua and Hikvision stand to be affected most since their cameras are widely used, often by government agencies with many facilities to monitor, Healy said. Agencies including police also use handheld Hytera radios, he said.

In its order, the FCC also asked for comment on whether to revoke existing equipment authorization, Rosenworcel said in an online statement.

According to Healy, merchants could be stuck with gear that’s illegal to sell.

In 2018, Congress voted to stop federal agencies from buying gear from the five companies named by the FCC. The agency said earlier that the companies aren’t eligible to receive federal subsidies, and also has barred Chinese phone companies from doing business in the U.S.

The order released Friday was required under the Secure Equipment Act – a bill President Biden signed into law on November 2021.

The big picture: Huawei and ZTE are two of the world’s biggest suppliers of telecom equipment.

- Countries including Canada, Britain and Australia have ramped up restrictions against the use of 5G technologies from Huawei and ZTE in recent years.

- Huawei executives have previously said the company does not give data to the Chinese government and that its equipment is not compromised.

- The company’s chief security officer Andy Purdy has also argued that a ban would hurt American jobs because it spends over $11 billion a year from American suppliers.

References:

https://www.axios.com/2022/11/25/fcc-bans-huawei-zte-equipment-national-security

FCC establishes Space Bureau dedicated to satellite industry oversight

The Federal Communications Commission (FCC) has set up a new bureau dedicated to improving the agency’s oversight of the satellite industry. It is one of two new offices to come out of an internal reorganization at the FCC, which has also created a standalone office of international affairs.

According to the FCC, the changes will help the agency fulfill its statutory obligations and to keep pace with the rapidly changing satellite industry and global communications policy. Establishing a standalone Space Bureau will elevate the importance of satellite programs and policy internally, and will also acknowledge the role of satellite communications in advancing domestic communications policy, according to the agency.

“The satellite industry is growing at a record pace, but here on the ground our regulatory frameworks for licensing them have not kept up. Over the past two years the agency has received applications for 64,000 new satellites. In addition, we are seeing new commercial models, new players, and new technologies coming together to pioneer a wide-range of new satellite services and space-based activities that need access to wireless airwaves,” said FCC Chairwoman Rosenworcel in her prepared remarks.

After identifying space tourism, satellite broadband, disaster recovery efforts and more, Rosenworcel said the interest in space as a new market for investment and a home for new kinds of services is vast. She noted that “private investment in space companies has reached more than $10 billion in the last year, the highest it has ever been.”

She also said that “the space sector has been on a monumental run. Satellite operators set a new record last year for the number of satellites launched into orbit, a record they will surpass again.”

Under the Communications Act of 1934, the FCC licenses radio frequency uses by satellites and ensures that space systems reviewed by the agency have sufficient plans to mitigate orbital debris.

The FCC said also that creating the two new separate offices will allow expertise to be more consistently leveraged across the organization’s different bureaus.

Commenting on the reorganization, FCC Chairwoman Rosenworcel said: “The satellite industry is growing at a record pace, but here on the ground our regulatory frameworks for licensing them have not kept up. Over the past two years, the agency has received applications for 64,000 new satellites. In addition, we are seeing new commercial models, new players, and new technologies coming together to pioneer a wide-range of new satellite services and space-based activities that need access to wireless airwaves.”

“Today, I announced a plan to build on this success and prepare for what comes next,” she added. “A new Space Bureau at the FCC will ensure that the agency’s resources are appropriately aligned to fulfill its statutory obligations, improve its coordination across the federal government, and support the 21st century satellite industry.”

Jennifer Warren, VP of technology, policy and regulation at Lockheed Martin, said during a panel following Rosenworcel’s announcement that the stakes are much bigger than broadband satellite launches. This new regulatory framework can clear the way for the US to be a leader in “the commercialization of space,” she said. “It’s not for the faint-hearted.”

The FCC bureau reorg “also gives encouragement to new space actors that there will be staff accessible to answer the many questions they must have as they try to enter this exciting industry,” according to Julie Zoller, Head of Global Regulatory Affairs, Project Kuiper at Amazon. “It’s a complex process, but it is one that is full of opportunity and benefits to consumers, as Chairwoman Rosenworcel mentioned. The number of broadband satellite systems is really supercharging the ability to bridge the digital divide curve at home and abroad.”

In August, the FCC signed a joint memorandum of understanding with the NTIA aimed at improving the coordination of federal spectrum management and efficient use of radio frequencies.

References:

FCC establishes new bureau dedicated to satellite industry oversight

https://www.lightreading.com/satellite/the-fcc-takes-its-bureaucracy-beyond-stars/d/d-id/781568

Advocates of 12 GHz for 5G and Broadcasters surprised by FCC notice of inquiry on 12.7-13.25 GHz

FCC Chairwoman Jessica Rosenworcel’s announcement on Monday that the FCC will launch a notice of inquiry on 12.7-13.25 GHz was a surprise to advocates of using 12.2-12.7 for 5G, but doesn’t necessarily have negative implications for a long-awaited order on the lower part of the spectrum range. Supporters of 5G in 12-2-12.7 GHz see it as a positive that Rosenworcel acknowledged that 12 GHz is mid-band spectrum, which the administration identified as critical to 5G. Some refer to the upper section as 13 GHz to avoid confusion with work on the ongoing 12 GHz band.

Rosenworcel said the country needs more mid-band spectrum in the pipeline. “We need to keep up our efforts to find more airwaves to fuel the mid-band spectrum pipeline, following our successful auctions of the 3.45 and 2.5 GHz bands … these are the airwaves that are essential for 5G services to reach everyone, everywhere.”

The most substantial objections are likely to come from broadcasters, though fixed service, satellite and other links are in the band.

NAB (National Association of Broadcasters) was surprised by Rosenworcel’s announcement and hadn’t received any indications from the agency before the speech that it was looking to the 13GHz band, said Robert Weller, Vice President-Spectrum Policy in an interview.

“We’re awaiting the NOI,” he said. TV stations use the band for fixed length transmissions from studio to transmitter, and for relays and electronic newsgathering, he said. “Records at the @FCC show 1,989 broadcast auxiliary authorizations in this band, including 400 ENG authorizations,” Weller tweeted Tuesday.

“The NOI (Notice of Inquiry), if adopted, would provide an opportunity for all stakeholders to provide information and views well in advance of any policy proposal,” said an FCC spokesperson.

“The FCC, on a bipartisan basis, recognizes we need more mid-band spectrum freed up for 5G,” said an industry expert active in the proceeding.

A top DOD official noted the difficulty of clearing the 3.1-3.45 GHz band, the top candidate band for 5G, experts said. They predicted analysis of the 13 GHz band would likely take several years.

“While certainly giving credit for recognizing the need to act on new commercial mid-band spectrum, the focus on the upper 12 GHz is a bit puzzling because an NOI could take years and lower 12 GHz is essentially ready to go,” former Commissioner Mike O’Rielly told us. “I have to hope yesterday’s announcement is part of a multipronged band identification and reallocation effort to be released soon, coupled with definitive action on lower 12 and lower 3 GHz,” he said. “The only mid-band spectrum that is available to be put to use quickly is 12.2 to 12.7,” said Jeff Blum, Dish Network executive vice president-external and legislative affairs. “We continue to urge the FCC to unleash that band for 5G to help Dish compete in the wireless market while protecting incumbent operations from harmful interference,” he told us. “It’s very encouraging for us in the 12 GHz band to see the commission recognizing the value of bringing mid-band spectrum in the 7-16 GHz range to the U.S.’s spectrum pipeline,” said RS Access CEO Noah Campbell. The lower 12 GHz band “is very unique, and it’s very important for continued U.S. 5G leadership,” he said. “The opportunity to create a 1,000 MHz block between 12.2 and 13.2 is extremely compelling,” he said.

The Rosenworcel comments show the FCC won’t act before it’s ready on 12 GHz, said Digital Progress Institute President Joel Thayer. “The chairwoman is standing with the FCC’s engineers and not bending to political pressure,” he said. “This proceeding has been unnecessarily politicized and this move sends a clear message that the engineering and FCC procedure will be the determining factor here, not corporate lobbying.” In a white paper last year, IEEE said the 13 GHz band “could be considered as a future candidate for unlicensed use due to its allocation to the same types of incumbents as the recently opened 6 GHz band.” IEEE found little interference risk. “The demand for unlicensed spectrum will continue to increase in the next years, it is necessary to study potential new bands to accommodate new technologies and services in the mid-band spectrum,” the report said.

Author’s Comment:

We’ve posted two articles on the battle for 12 GHz spectrum policy (see References below). It’s important that the FCC is proposing 12GHz for 5G despite that frequency band NOT included in revision 6 of ITU M.1036 Frequency Arrangements for IMT (and in particular for 5G).

References:

https://www.law360.com/media/articles/1531929/fcc-chair-plans-to-explore-revamp-of-12-7-ghz-band

Bloomberg: U.S. Billionaire’s Battle Over FCC’s 12 GHz Spectrum Policy

FCC to release U.S. broadband maps in November 2022

Today, the Federal Communications Commission (FCC) confirmed that its first data collection window for the broadband serviceable location fabric has closed. The agency also said it is targeting November 2022 for a public release of a first draft of the new map.

“For the first time ever, we have collected extensive location-by-location data on precisely where broadband services are available, and now we are ready to get to work and start developing new and improved broadband maps,” wrote Chairwoman Jessica Rosenworcel in a note on Friday afternoon. This comes after FCC work over the past 18 months to update and improve their broadband maps.

What’s next for the FCC’s broadband maps:

- FCC is targeting November 2022 for release of the first draft of the map.

- The Fabric challenge process will begin in 10 days.

- The Fabric is the first-ever national dataset capturing individual locations that should have fixed broadband service availability. It is the product of integrating multiple data sources for each state and territory—in other words, hundreds of data sources. These data sources include, among other things, address records, tax assessment records, imagery and building footprints, Census data, land use records, parcel boundaries, and geo-spatial road and street data. Our old broadband maps, in contrast, lacked any of this location-specific information.

- Broadband providers reported their own availability data to the locations identified in the Fabric.

- The FCC is continually working to improve our Fabric through additional data sources, such as LIDAR data and new satellite and aerial imagery sources, as they become available and through our upcoming challenge processes.

- States, local governments, Tribal governments, and providers can now access the initial Fabric data, and, in 10 days we will open up a window for them to challenge this data.

In a public notice, the FCC set some parameters for that process, writing: “We remind governments, service providers, and other entities and organizations planning to submit challenges that the Fabric is intended to identify BSLs as defined by the Commission, which will not necessarily include all structures at a particular location or parcel.” The FCC will host a webinar on September 7, at 2 p.m. ET, “to assist state, local, and Tribal governments, service providers, and other entities who intend to submit bulk challenges, or proposed corrections, to the location data in the Fabric,” it said.

Once the maps are released, FCC will open a process for the public and other stakeholders to make challenges directly through the map interface.

Looking ahead, there’s one more important thing to note about the new maps. When the first draft is released, it will provide a far more accurate picture of broadband availability in the United States than our old maps ever did. That’s worth celebrating. But our work will in no way be done. That’s because these maps are iterative. They are designed to updated, refined, and improved over time.

Broadband providers are constantly updating and expanding their networks. We have set up a process to make sure our maps will reflect these changes and yield more precise data over time. We have also built a process in which state, local and Tribal governments, other third parties and, perhaps most importantly, consumers, will be able to give us feedback on the maps and help us continually improve and refine the data we receive from providers. All of this will require persistent effort—from the agency, providers, and other stakeholders. The Commission is committed to doing this hard work and keeping the public informed of our efforts every step of the way.

Here’s the most current broadband map for Santa Clara County, CA (oven referred to as Silicon Valley and previously as the Valley of Hearts Delight):

References:

https://www.fcc.gov/news-events/notes/2022/09/02/another-step-toward-better-broadband-maps

https://www.fcc.gov/document/start-bulk-fabric-challenge-process-announced

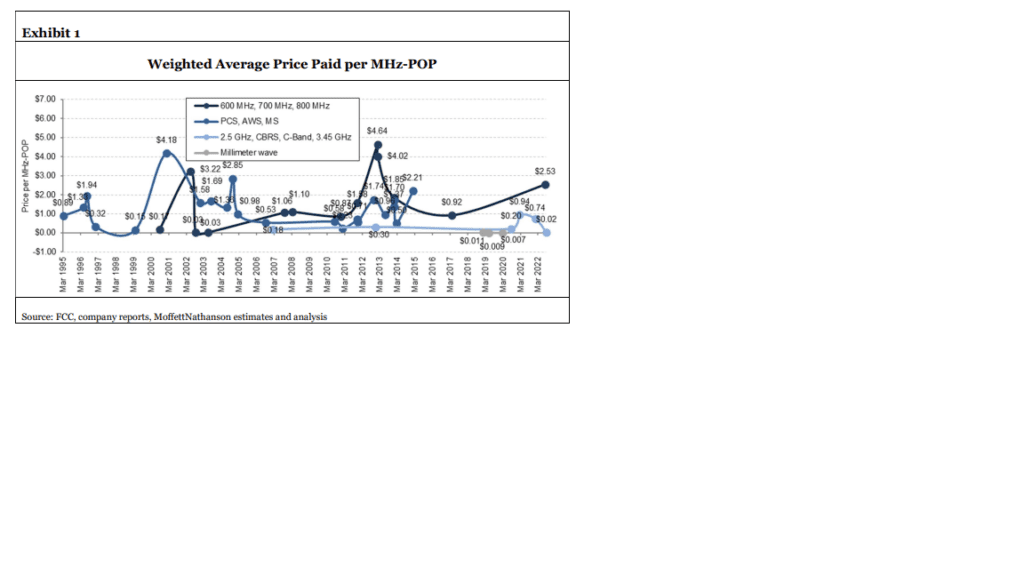

FCC Auction 108 (2.5 GHz) ends with total proceeds << than expected; T-Mobile expected to be #1 spectrum buyer

The FCC’s 2.5 GHz auction (FCC Auction 108) ended Monday, after 73 rounds, reaching net proceeds of only $427.8 million (M). The FCC found winning bidders for 7,872 of the 8,017 licenses offered. The FCC holds the remaining 145 licenses. Proceeds were much less than anticipated before the auction. Pre-auction estimates had run as high as $3B, or in the range of $0.10 to $0.20 per MHz-POP. In reality, the end result was just $427.8M in aggregate proceeds, and less than two cents per MHz-POP on average.

“After some extended bidding in Guam today, Auction 108 finally came to an end,” wrote Sasha Javid, BitPath chief operating officer. “While the end of this auction should not be a surprise for those following activity on Friday, it certainly ended faster than I expected just a week ago.”

With no assignment phase, Javid predicted the FCC will issue a closing public notice in about a week, with details on where each bidder won licenses. T-Mobile was expected to be the dominant bidder as it fills in gaps in the 2.5 GHz coverage it’s using to offer 5G. AT&T, Verizon and Dish Network qualified to bid but weren’t expected to acquire many licenses (see Craig Moffett’s comments below).

New Street analysts significantly downgraded projections for the auction as it unfolded, from $3.4 billion, to less than $452 million in its latest projection. New Street’s Phillip Burnett told investors Sunday Guam Telephone Authority was likely the company making a push for the license there. The authority owns citizens broadband radio service and high-band licenses “but lacks a powerful mid-band license” since “no C-Band or 3.45GHz licenses were offered for Guam,” he said. “We still assume T-Mobile won essentially all the licenses,” Burnett said in a Monday note. The auction translated to just 2 cents/MHz POP, 8 cents excluding the areas where T-Mobile is already operating, he said: “This will make it the cheapest of the 5G upper mid-band auctions at the FCC to date, both in terms of unit and aggregate prices. However, given how odd these licenses were, we wouldn’t expect to see the auction used as a marker for mid-band values going forward.”

Craig Moffett of MoffettNathanson wrote:

While we won’t know for sure who “won” the licenses in question for another week or so, it is universally assumed that T-Mobile was far and away the auction’s principal buyer. They are the only U.S. company that uses 2.5 GHz spectrum (2.5 GHz is the backbone spectrum band of their 5G network), and the licenses at auction were best seen as the “holes in the Swiss cheese” of T-Mobile’s otherwise national 2.5 GHz footprint. There was a great deal of spectrum here for sale, but it wasn’t geographically contiguous, and thus it would be difficult for anyone other than T-Mobile to use it. Nor should one expect spectrum speculators to have played a large role; after all, if there is but one true exit – i.e., to sell to T-Mobile – then bidding more than T-Mobile was willing to pay would seem an ill-advised strategy. Usually, we refrain from using the term “winner” when discussing auction results.

Winning, after all, depends on price paid. In this case, however, there can be little argument that T-Mobile is the auction’s big winner (assuming, again, that it was indeed T-Mobile that bought almost everything here). They will have significantly expanded their already-large spectrum advantage versus Verizon and AT&T and they will have done so at a much lower price than had been expected. Remember that not only does T-Mobile enjoy a spectrum quantity advantage versus Verizon and AT&T– they already had more mid-band spectrum than either VZ or T, and now they will have significantly augmented their already prodigious holdings – but they also have a spectrum quality advantage, inasmuch as 2.5 GHz spectrum propagates better than the 3.7 GHz C-Band spectrum used for 5G by Verizon and AT&T, and therefore promises better coverage and fewer dead spots with less required capital spending for density/coverage.

T-Mobile just a few weeks ago invested about $3.5B in low frequency spectrum, allocating about the same amount of capital many had expected them to spend on Auction 108. But their low (600 MHz) frequency spectrum purchase – done at what we assume is $2.53 per MHz-POP in a two-part acquisition from private equity owners – is for spectrum they were already leasing, so it represents a direct substitution of capital for opex without changing the amount of spectrum employed in their network. Margins should be higher, as what was previously leased is now owned. And, happily, they got the deal done just before the Inflation Reduction Act eliminated the cash tax shield from spectrum purchases as it relates to the 15% minimum corporate tax rate on future spectrum purchases.

If there is one additional takeaway here, it is the reminder that spectrum is NOT a commodity, where prices inherently reflect some immutable “intrinsic value.” Instead, they are highly volatile, reflecting much more the dynamics of supply and demand for each individual spectrum band at any given moment, factoring in not just how much different carriers might want the spectrum, but also what their balance sheets will bear.

Our long-term tracking of spectrum transactions, sorted into low-band, mid-band, upper mid-band, and millimeter wave cohorts, now updated to include both Auction 108 and T-Mobile’s private market transactions for 600 MHz spectrum, tells the tale:

References:

https://www.fcc.gov/document/auction-108-25-ghz-band-qualified-bidders