fiber optics

AT&T ends DSL sales while CWA criticizes AT&T’s broadband deployments

AT&T: DSL is Dead:

According to a message board post on DSL Reports, AT&T notified customers on billing statements in August that effective Oct. 1 it would no longer accept new orders for its copper-based DSL service. The notice also said that existing DSL subs will no longer be able to make speed changes to their respective DSL service.

The message board author wrote:

“On my August AT&T statement, traditional DSL is officially grandfathered effective October 1st. No new orders (moves, installs, speed change, etc.). Hopefully they will still allow promos….”

That’s no surprise to this author. AT&T’s DSL subscriber base has been eroding steadily – losing almost 350,000 subs over the past couple of years. In Q2 2020, AT&T shed 23,000 DSL subs, ending the period with just 463,000.

“We are focused on enhancing our network with more advanced, higher speed technologies like fiber and wireless, which consumers are demanding,” AT&T said in a statement. “We’re beginning to phase out outdated services like DSL and new orders for the service will no longer be supported after October 1. Current DSL customers will be able to continue their existing service or where possible upgrade to our 100% fiber network.”

……………………………………………………………………………………………………………………….

AT&T Fiber Update:

AT&T also announced three new price points for its AT&T Fiber tiers and said that all new and existing AT&T Fiber Internet 100, Internet 300 and Internet 1000 subscribers would enjoy unlimited data without additional charges. AT&T Fiber started offering the new deals as a standalone product with no annual contracts for new customers on Sunday.

As of Q2-2020, AT&T had 4.3 million AT&T Fiber customers with nearly two million of them on 1-gigabit speeds. Overall, AT&T has about 15.3 million broadband subscribers while Charter has 28 million and Comcast has over 29 million.

AT&T’s fiber tier announcement comes after AT&T CEO John Stankey told a Goldman Sachs investor conference in September that “priority number one” is investing in fiber for 5G and FTTP services.

The new prices are also an indication that AT&T intends to ramp up its drive on FTTP sales in the wake of a recent study showing that many of AT&T’s new subs were coming from existing customers upgrading to fiber rather than from gaining market share from cable Internet operators (MSOs).

………………………………………………………………………………………………….

CWA Calls Out AT&T’s broadband efforts:

Coincidently today, the Communications Workers of America (CWA) criticized AT&T’s lack of fiber deployments. The report, co-authored with the National Inclusion Alliance (NDIA) stated:

AT&T is making the digital divide worse and failing its customers and workers by not investing in crucial buildout of fiber-optic infrastructure that is the standard for broadband networks worldwide. The company’s recent job cuts — more than 40,000 since 2018 — are devastating communities and hobbling the company’s ability to meet the critical need for broadband infrastructure.

An in-depth analysis of AT&T’s network shows the company has made fiber available to fewer than a third of households in its footprint, halting most residential deployment after mid-2019. The analysis also shows that 28% of households in AT&T’s footprint do not have access to service that meets the FCC’s standard for high-speed internet, and in rural counties 72% of households lack this access. In some places, AT&T is decommissioning its outdated DSL networks and leaving customers with no option but wireless service, which is not a substitute for wireline service.

In all, AT&T has made fiber-to-the-home available for fewer than one-third of the households in its network. AT&T’s employees — many of whom are Communications Workers of America (CWA) members — know that the company could be doing much more to connect its customers to high-speed Internet if it invested in upgrading its wireline network with fiber. They know the company’s recent job cuts — more than 40,000 since 2018 — are devastating communities and hobbling the company’s ability to meet the critical need for broadband infrastructure.

CWA recommends that AT&T dedicate a substantial share of its free cash flow to investment in next-generation networks across rural and urban communities, make its low-income product offerings available widely, and stop laying off its skilled, unionized workers and outsourcing work to low-wage, irresponsible subcontractors.

Editor’s Note:

According to CWA, AT&T has deployed fiber-to-the-home (FTTH) to only 28% of the households in its fiber coverage area as of the end of June 30, 2019.

……………………………………………………………………………………………………………………………………………………………………………………………………..

The CWA/NDIA report said AT&T has targeted more affluent, non-rural areas for its fiber upgrades. Houses with fiber have a median income that’s 34% higher than those with DSL only. Across the rural counties in AT&T’s 21-state footprint, only a miniscule 5% have access to fiber, according to the report.

According to the report, 14.93 million—out of almost 53 million households—have access to AT&T’s fiber service. Among states, AT&T’s FTTH build out is the lowest in Michigan with 14% have access followed by Mississippi (15%) and Arkansas (16%).

“AT&T is also failing to make fiber available to the majority of its customer base in cities,” according to the report. “While most of AT&T’s fiber build has focused on urban areas—96 percent of households with access to fiber in AT&T’s footprint are in predominantly urban counties—the company hasn’t built enough fiber to reach the majority of urban residents. Seventy percent of households in urban counties still lack access to fiber from AT&T because the company has made fiber available to only 14.7 million households out of 48.4 million total households in these counties.”

The report also said there were many areas in AT&T’s footprint where it doesn’t offer the Federal Communications Commission’s “broadband” definition of 25 Mbps downstream and 3 Mbps upstream.

“For 28% of the households in its network footprint, AT&T’s internet service does not meet the FCC’s 25/3 Mbps benchmark to be considered broadband,” the report said. A key recommendation is that “AT&T must upgrade its network in rural communities to meet the FCC’s broadband definition, at least, and renew its efforts to deploy next-generation fiber.”

The report noted that in some areas where AT&T doesn’t provide faster speeds, cable operators, such as Comcast and Charter do.

“Even where that access is available from another provider—typically a cable provider—consumers are deprived of the benefits of competition in price, choice and service quality,” the report said.

…………………………………………………………………………………………………………

AT&T is counting on fiber for both residential and commercial services, including AT&T TV. In order to win over customers from cable operators, AT&T has paired its 1-Gig service with AT&T TV.

Regarding DSL, the report states: “AT&T’s poor maintenance of its DSL networks, with limited capacity for new connections, results in would-be new customers in some areas being denied service entirely or told they can only subscribe to fixed wireless service (a 4G wireless connection for home use, designed for rural areas).”

As expected, AT&T refuted the claims made in the CWA/NDIA report in a statement to FierceTelecom and Broadband World News on Monday afternoon.

“Our investment decisions are based on the capacity needs of our network and demand for our services. We do not ‘redline’ internet access and any suggestion that we do is wrong. We have invested more in the United States over the past 5 years (2015-2019) than any other public company. We have spent more than $125 billion in our U.S. wireless and wireline networks, including capital investments and acquisition of wireless spectrum and operations. Our 5G network provides high-speed internet access nationwide, our fiber network serves more 18 million customer locations and we continue to invest to expand both networks.”

……………………………………………………………………………………………………………………………………………………..

New Fiber Optics Market Report:

Finally, a new report by Technavio forecasts that the global fiber optics market size will grow by USD 2.44 billion during 2020-2024, progressing at a CAGR of almost 5% throughout the forecast period.

Image Credit: Technavio

The increase in the number of FTTH homes and subscribers is the key factor driving the market growth. A higher number of customers are opting for fiber optic connections to leverage broadband services. This reduces the requirements for customer premises equipment (CPE) and distribution point unit (DPU).

References:

https://cwa-union.org/sites/default/files/20201005attdigitalredlining.pdf

https://www.fiercetelecom.com/telecom/cwa-calls-out-at-t-s-lack-fiber-its-dsl-footprint

http://www.broadbandworldnews.com/document.asp?doc_id=764417

AT&T CEO: Fiber, Stories and (Video) Content to drive future revenues and growth

https://www.businesswire.com/news/home/20201005005444/en/

AT&T CEO: Fiber, Stories and (Video) Content to drive future revenues and growth

At Goldman Sachs Communacopia conference, AT&T CEO John T. Stankey said that broadband connectivity was a key focus area for the company. “Anything that we can do to put more fiber out into the network, serve both our consumer and business segments and use that to power what over time is going to become a much more dense and distributed wireless network. And that’s, first of all, one of our key focus areas and something that we see as being very important to us,” he said.

What Stankey said next was somewhat of a surprise, “We think we’re great storytellers, and that we have a unique ability to produce (video) content that’s special and different. And we’d like to continue doing that and telling those great stories and then using the combination of that connectivity in those stories to wrap it in software.”

When asked where should AT&T allocate capital, the CEO said:

- Invest in its core business, which is fiber and broadband connectivity on 5G

- Software driven entertainment products with HBO Max at the forefront of that, but it is a multi-year effort.

- Ensuring that AT&T operations are set up to be successful and effective in the market that they’re serving customers. Also, that AT&T has data properly positioned for advertising monetization and to gain “great insights on customers.”

“When you have a great 5G network, you’re deploying a lot of fiber, and that’s something that we think are married well,” Stankey said, as per this transcript. “And we think we’re in a very unique position because the fiber that we deploy not only powers our wireless business, but it helps our consumer business and fixed broadband. It helps our enterprise customers and how we deal with them as well, and so we strategically want to make sure we’re doing that.”

When asked if there was a business case for adding more fiber, Stankey answered in the affirmative. Stankey said AT&T’s confidence level for deploying more fiber is even higher now due to increased traffic on its network as a result of the Covid-19 lockdowns.

“There is clearly an easy path for us to think about a substantially larger fiber footprint than what we have today with returns that are as good as the great returns we’ve gotten from the first tranche that we’ve built,” Stankey said.

“If you go in and look at the rest of our business on the core connectivity, we thought robust scale and connectivity networks were always going

to be important. And what we’ve seen is what was important in the urban areas is now distributed. And while we’ve had good infrastructure in

place in many areas, we have an opportunity to go do more. We have an opportunity to think about more varied forms of access that are more

flexible. And I think that, that plays right into our strength, and we’re looking at redoubling our efforts on those product development opportunities

that allow for true flexibility of bandwidth as somebody moves through a city center out to suburban areas. Our play in 5G, a more dense fiber

network all play really well into those thing.”

Stanky added that he was pleased with the investments the company has made in infrastructure and in its network over the last several years. Also, some of the new initiatives round FirstNet and focus on the development of 5G are really starting to to “bear fruit” in terms of AT&T’s performance in the industry.

In closing, Goldman moderator John E. Waldron asked the AT&T CEO, “If we were to have this conversation 5 to 10 years from now, how do you think AT&T will have changed from the company you are today?”

Stankey talked up AT&T’s broadband services and entertainment products:

“If I were to think about 5 years out and what I’d like to be able to come and tell you is, to my point earlier, that we are focused in a set .of products; that we’re really proud of in the market that were — that customers love and think are really strong; that our broadband connectivity products (these are actually services, not products), whether you’re a business with a complicated distributed network or you’re at home, using one of our fixed broadband connections or a subscriber of our wireless service, you view them as being the best-in-class that are there; that our entertainment products are unique and that you can’t live without the stories that we’re telling; and that our employees who bring those products and services to our customers have a lot of pride in those, and they see them as being best-in-class and unique and special in the market. And that’s kind of universally held across our business. And as a result of that, employees want to come, not only continue to work here, we’re able to go out the market and recruit because people say, “Those are great products. It’s a great company that offers those things, and I feel compelled to want to go and participate in that.” So a high degree of employee loyalty around the products and services that we bring in that manifest itself in great employee engagement and great customer receptivity of those products. And 5 years from now that we’re known in that regard.”

………………………………………………………………………………………………………………………………………………………

References:

https://event.webcasts.com/viewer/event.jsp?ei=1365838&tp_key=1587a26f6b

Arthur D Little: 10 countries provide >= 95% FTTH coverage; Gigabit Fiber driving take-up of new apps and services

Gigabit broadband can be delivered using cable DOCSIS, fiber or other 5G-based technologies. This ADL report focuses on the rollout, take-up and services delivered with fiber -based gigabit broadband networks. ADL especially considers the developments made in fiber take-up and gigabit services enabled by fiber. See the previous edition of this study, “Race to gigabit fiber: Telecom incumbents pick up pace”4 for further details on which markets are taking the lead on fiber rollout and the deployment models used for it.

Non-telecom entities such as energy companies, railway operators and local municipalities are also entering the market, with large fiber rollout plans in fiber-lagging countries such as Italy, Germany and Austria, to bridge the gigabit broadband gap.With 5G deployment models crystallizing, operators are also considering 5G-based technologies to complement high-cost,

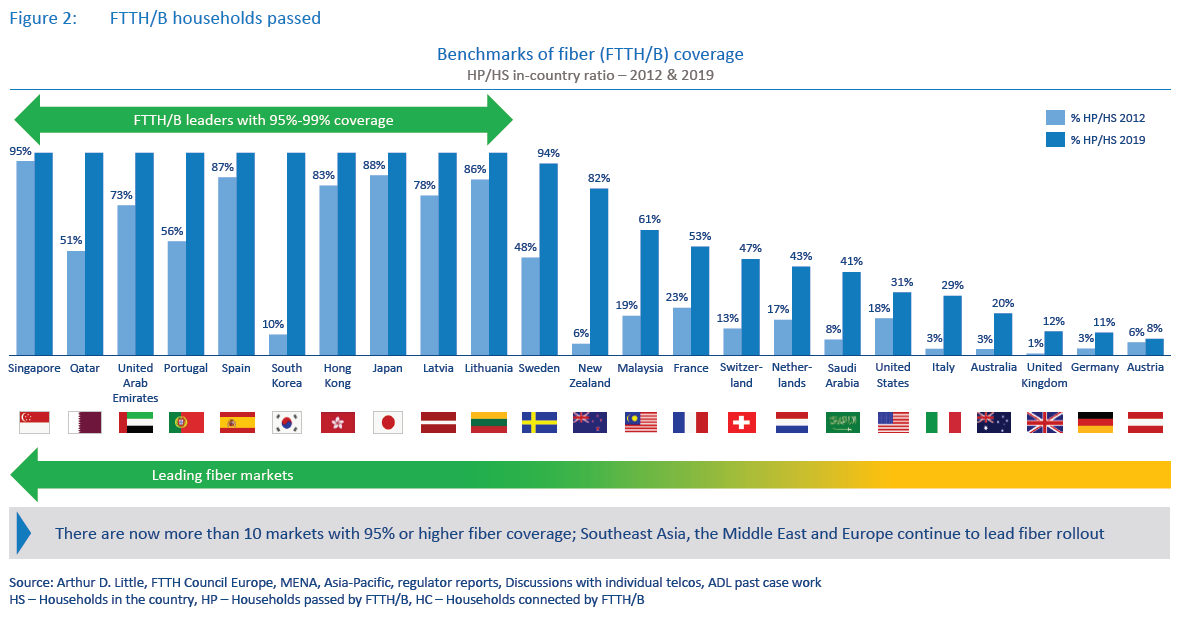

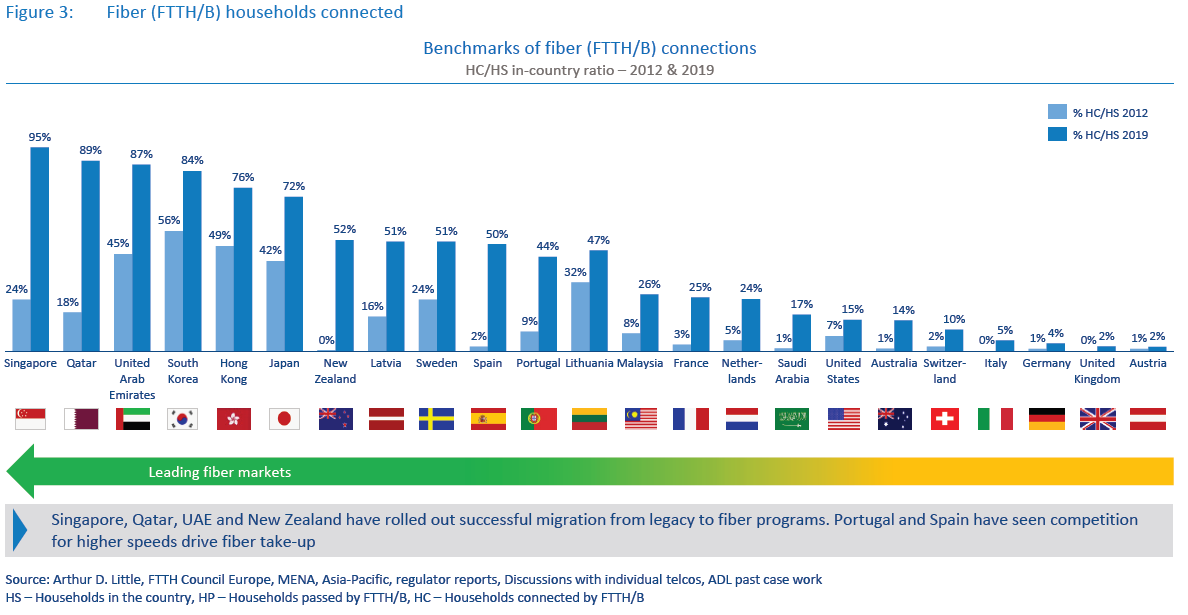

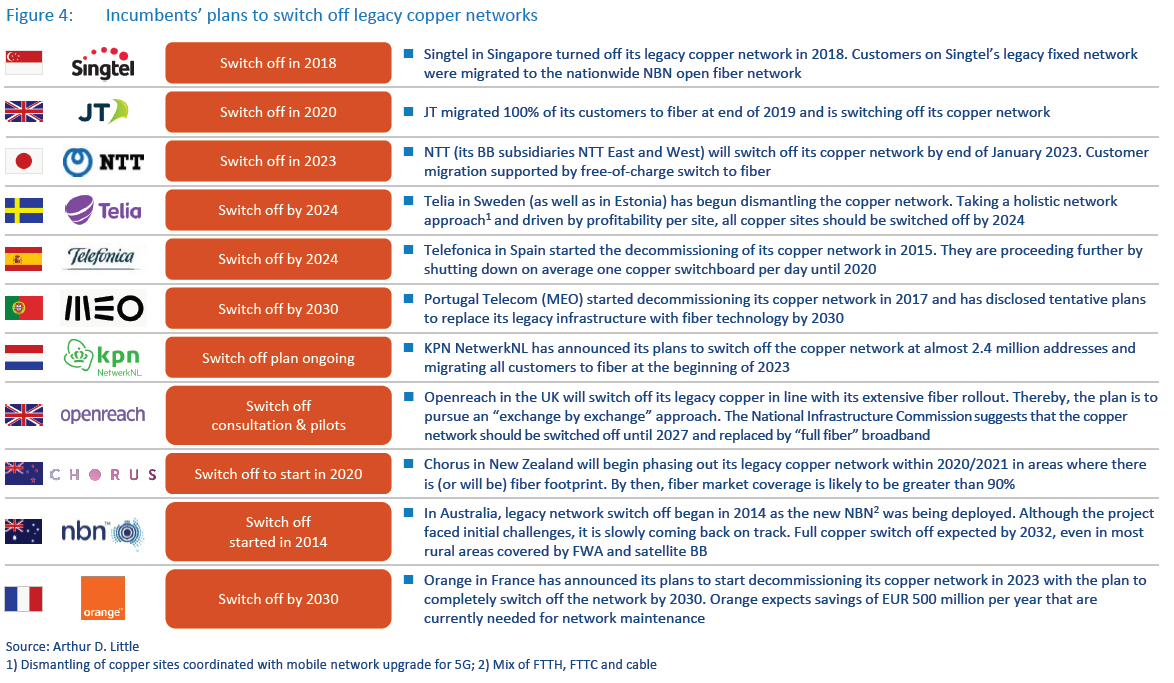

last-mile fiber access, especially in rural areas.While there were big improvements in fiber rollout from 2012 to 2017, take-up was still lagging behind, even though several markets invested large amounts of capex into nationwide fiber. However, we now see take-up rapidly improving, driven by both effective migration of legacy customers to fiber and competition driving demand for higher-speed broadband adoption at home.As the fiber coverage and take-up rates continue to grow, incumbents are increasingly announcing plans to switch off and dismantle their legacy copper networks. Singtel in Singapore turned off its copper network in 2018 and migrated its copper and cable subscribers to fiber, allowing the incumbent Singtel and cable company StarHub to switch off their copper and cable networks. Another example is JT Global in Jersey, which already migrated its entire fixed broadband customer base to fiber and will switch off the copper infrastructure in 2020. Operators in at least three other countries plan to completely migrate their customer base to fiber in the next four to five years (see Figure 4 below).

However, before decommissioning their legacy networks, telcos will need to overcome regulatory and other obstacles, such as providing an alternative to existing regulatory wholesale products and replacing some copper-specific B2B use cases with other technologies. With legacy network switch off, incumbents hope to achieve cost efficiencies especially in network operations. In recent projects, we estimate that fiber networks have up to a 15x lower fault rate and use up to 85 percent less energy compared to legacy copper-based networks.

Fiber is undoubtedly an advanced fixed broadband technology that can efficiently deliver multi-gigabit speeds to a large volume of customers in real-life conditions, especially in dense urban areas. Offering 1 Gbps plans has become the norm in the leading Asian fiber markets such as Singapore, Japan, South Korea and Hong Kong, opening the way for multi-gigabit tariffs.

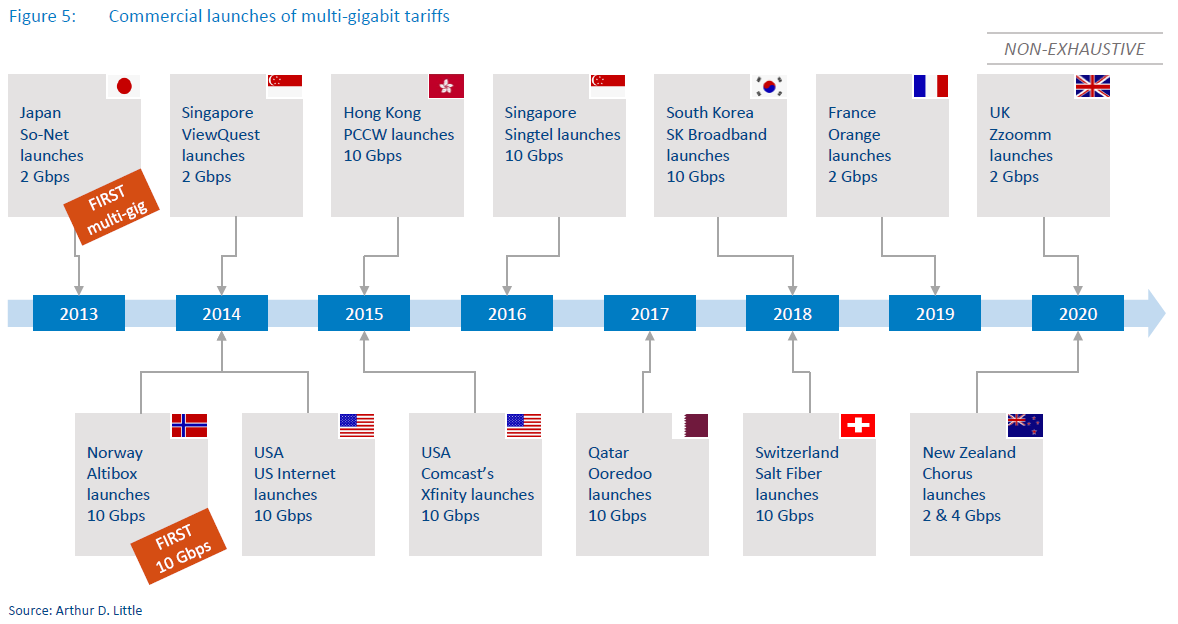

It has been more than five years since the first 10 Gbps plans were initially introduced in the US, Singapore, Hong Kong and Norway (see Figure 5. below). As of September 2020, we are not aware of any faster commercially available plan for the residential segment. Availability of multi-gigabit plans is still limited to a handful of markets and approximately 10-15 ISPs. However, just in the first half of 2020, there have been at least three ISPs that launched multi-gigabit offers: Zzoomm in the UK, Orange in France and Chorus in New Zealand.

Incumbent operator led deployments continue to play the leading role in fiber deployment today. However, we believe the importance of open access fiber providers will gain in significance, especially in important markets such as Italy, Germany, UK and Saudi Arabia, among others. Large-scale investment by non-telco entities such as energy companies and infrastructure funds, among others, will continue to expand fiber coverage in these markets. (For further details on open access fiber developments, please refer to our other report on this topic.)

An increasing number of incumbents acknowledge the inevitability of switching off and dismantling their legacy copper networks as fiber coverage becomes ubiquitous, while the cost economics of maintaining a fiber network are far superior to maintaining a legacy fixed network. Initiatives for legacy network switch off have been announced in multiple markets, and we expect to see results in larger markets such as Spain, France or Sweden soon. We also see regulators opening up to the idea that fiber-based solutions can eventually replace regulated legacy network–based products, giving a further impetus to open access fiber rollout in some regions.

Gigabit tariffs have become commonplace in developed fiber markets (mostly in Asia) and are increasingly being offered to customers worldwide. However, multi-gigabit speeds are still available only in a handful of markets. Salt in Switzerland is an example of a provider that uses its aggressively priced multigigabit offer to differentiate and disrupt the fiber market and not only as a marketing tool. We expect that, with new fiber rollouts and increasing competition on the broadband markets, the number of multi-gigabit offerings will continue to grow.

Note: This report, “The race to gigabit fiber,” is the 2020 update to Arthur D. Little’s Global FTTH study, published in 2010, 2013, 2016 and 2018.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Ciena and TELUS demo 800Gbps fiber optic transmission over 970km link from Toronto to Quebec City; Ciena Earnings & Guidance

Ciena claims to have achieved a worldwide transmission record of 800 Gbps with TELUS, over a record-breaking 971.2km distance. Teams from both organizations worked together and turned up an 800G wavelength from Toronto to Quebec City.

TELUS is one of the early 800 Gbps technology adopters who is in the process of augmenting their network with Ciena’s WaveLogic5 Extreme (WL5e). TELUS will be standardizing WaveLogic 5 Extreme for deployment in the near future. Part of the standardization activities include testing the full capabilities of the product to plan end user service offerings.

TELUS supports 15.3 million customer connections spanning wireless, data, IP, voice, television, entertainment, video and security. The TELUS network extends 6,000 km from Victoria, British Columbia to Halifax, Nova Scotia. Designed with the future in mind, TELUS’s next generation optical network consists of a state-of-the-art, colorless, directionless, contentionless, flexible grid (CDC-F) ROADM architecture with Layer 0 Control Plane, designed to support reliable, fast turn-up and re-route of unpredictable bandwidth demands across the network. Furthermore, it is ready to support new innovations in optical technologies as they become available, including the ability to carry optical channels of any spectrum size across the fiber. This fully flexible, intelligent photonic infrastructure allows for the simple addition of WL5e wavelengths and with that, access to significant cost, footprint, and power benefits.

“TELUS prides itself on having one of the world’s fastest networks and using industry-leading technology to deliver the best experience for our customers across Canada. Our collaboration with Ciena on breaking transmission records is an exciting innovation that speaks to both teams track records of success,” said Ken Nowakowski, Director Planning and Engineering, Transport and IP Infrastructure Development and Operations at TELUS.

Testing continues at TELUS, with planned deployment of WL5e in the coming months. Does this mean 800G will be deployed across long haul links? This is not a yes or no response, but 800G will be deployed where it makes sense in the TELUS network. As has always been the case, the line rate capacity that will be deployed depends on specific link characteristics, number of channels and desired reserved margin by the operator.

Ciena 6500 shelves with WaveLogic 5 Extreme

The real news here is the resulting long-term benefits of the WL5e network upgrade for both TELUS and their end users. TELUS can continue to provide high quality, high speed connectivity to their end users – such as teleworker videoconferencing, multi-player interactive gaming, Internet access for low income families, and even live-streaming the Stanley Cup playoffs – while more efficiently using bandwidth resources and evolving to a greener network.

……………………………………………………………………………………………………………………………………………………………………………………….

Separately, Ciena announced earnings today. For the fiscal third quarter ended Aug. 1, Ciena (ticker: CIEN) reported revenue of $876.7 million, up 1.7% from a year earlier, and ahead of the Wall Street analyst consensus at $971.8 million. Non-GAAP profit was $1.06 a share, nicely above the Street consensus at 83 cents.

“Operating conditions have complicated and extended the time required to deploy and activate new equipment and services with many of our large and long-standing international customers,” the company said in a presentation prepared for its earnings call with analysts on Thursday. “Conditions have made it more challenging to ramp up and operationalize some of our newer international deals and customer wins on their original timelines.”

Ciena also said “customer uncertainty around broader economic conditions is driving more cautious spending behaviors.” It said “longer term fundamental drivers—increasing network traffic, demand for bandwidth and adoption of cloud architectures—remain strong.” Ciena CEO Gary Smith said Covid-19-related market dynamics were likely to adversely impact revenue “for a few quarters.”

Here are a few data points from the company’s earnings presentation:

- Non-telco represented 43% of total revenue

- Direct web-scale contributed 25% of total revenue

- MSO’s contributed 9% of total revenue

- Americas revenue up 9% YoY

- TTM Adjusted R&D investment was $518M

- 535 100G+ total customers, which includes 37 new wins on WaveLogic Ai and 27 new wins on WaveLogic 5e in Q3-2020

- Shipped WL 5 Extreme to almost 40 customers, and the technology is live and carrying traffic in several networks

……………………………………………………………………………………………………………………………………………………………………………………………………..

Overview of Ciena’s Technology Portfolio:

PROGRAMMABLE INFRASTRUCTURE:

Converged Packet-Optical Networking: Software-defined platforms, featuring Ciena’s award-winning WaveLogic™ Photonics and agnostic packet/OTN switching, designed to maximize scale, flexibility and openness. Optimizes network performance from the access edge, along the backbone, and across ocean floors.

Packet Networking: Purpose-built platforms hosting a common Service-Aware Operating System that are the building blocks for low-touch, high-velocity Ethernet/MPLS/IP access to metro networks.

SOFTWARE CONTROL AND AUTOMATION:

Open software that includes Blue Planet® multi-domain orchestration, inventory, and route optimization to support the broadest range of closed-loop automation use cases across multi-layer, multi-vendor networks, as well as Ciena’s Manage, Control and Plan (MCP) domain controller for bringing software-defined programmability to next-gen Ciena networks.

ANALYTICS AND INTELLIGENCE:

Blue Planet Unified Assurance and Analytics: An open suite of software products that unifies multilayer, multi-domain assurance with AI-powered analytics to provide unprecedented insights that help transform and simplify business operations for network providers.

INNOVATION AND THE ADAPTIVE NETWORK:

▪ WaveLogic™ roadmap extends beyond 400G and with multiple form factors

▪ Adaptive IP™ capabilities for Packet Networking to address fiber densification (5G & Fiber Deep)

▪ Blue Planet® Intelligent Automation Portfolio and closed-loop automation capability strengthened with recent acquisition of Centina

References:

Cignal AI: COVID-19 Continued to Pressure Optical Network Supply Chain in Q2-2020

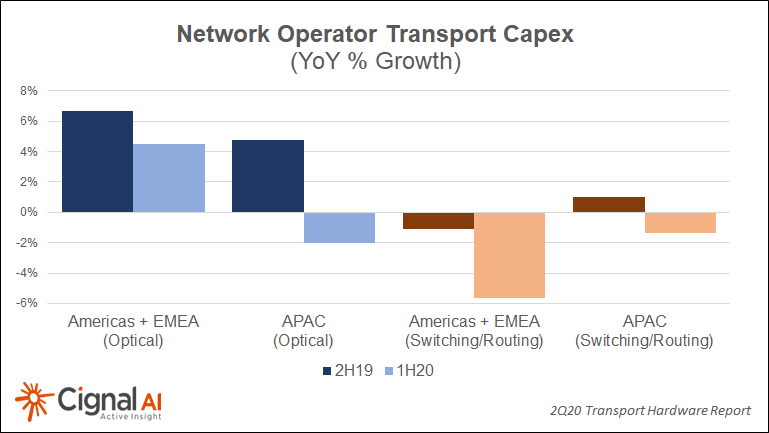

Delayed order fulfillment due to COVID supply chain impact earlier this year was expected to spur sales growth in 2Q20, but instead the results were mixed, according to the most recent Transport Hardware Report from research firm Cignal AI. Forecasted growth in Q2 from sales pushed out from Q1 did not materialize, and network operators indicated that annual CapEx would not increase (see chart below). As a result, spending on optical and switching/routing equipment will be flat to down in the second half of the year.

“COVID operational issues slowed deliveries and revenue recognition in the second quarter, although optical hardware sales increased in NA and EMEA due to high demand for inventory,” stated Cignal AI Lead Analyst Scott Wilkinson. “Growth is not expected to continue in the second half as carriers have pulled forward annual CapEx spending and networks are now able to cope with COVID-related surges.”

Some regions did shine in 2Q20. North American optical sales were up sharply YoY in both metro and long haul WDM, though the second half of the year is expected to be flat or down. Japan’s extraordinary growth in optical sales expanded to packet sales this quarter, with sales to both market segments up substantially YoY.

Additional 2Q20 Transport Hardware Report Findings:

- In addition to COVID woes, RoAPAC continues to suffer from the CapEx limitations in India, and optical sales declined -20% for the quarter while packet sales also declined.

- China has overcome its COVID related issues and returned to optical and packet spending growth this quarter, with increasing growth forecasted for Q3.

- EMEA optical spending increased YoY but was weighed down by weak Nokia sales. Nokia predicts that Q3 sales increases will offset Q2 declines.

Real-Time Market Data:

Cignal AI’s Transport Hardware Dashboardis available to clients of the Transport Hardware Report and provides up-to-date market data, including individual vendors’ results as they are released. Users can manipulate variables online and see information in a variety of useful ways, as well as download Excel files with up-to-date snapshots of market reporting.

Contact: sales@@cignal.ai

References:

https://cignal.ai/2020/08/transport-hardware-misses-expected-bounce-back-in-2q20/

Addendum:

According to Industry Research, the global Optical Transport Network (OTN) Equipment (optical transport and switching) market is projected to reach USD 20360 million by 2026, from USD 15810 million in 2020, at a CAGR of 4.3% during 2021-2026.

The Optical Transport Network (OTN) Equipment market is segmented into the following categories:

- Mobile Backhaul Solutions

- Triple Play Solutions

- Business Services Solution

- Industry and Public Sector

- Others

With respect to data rates, the Optical Transport Network (OTN) Equipment market is segmented into three categories:

- < 10G

- 10G-100G

- 100-400G

https://www.industryresearch.co/global-optical-transport-network-otn-equipment-market-16157288

ETNO, GSMA: EU should adopt “fresh approach” to support fiber & 5G investments; GSMA says 5G SA coming soon?

The European telecom network operators industry group ETNO together with the GSMA have called on the EU to make support for fiber optics communications and 5G investments part of the bloc’s economic recovery plans. In a joint statement to mark the start of the German presidency of the EU, the associations said a fresh approach is needed to ensure the focus is on closing the digital divide and that plans to alleviate that should not become bogged down in regulatory discussions.

“We encourage all institutions to take stock of the socio-economic context and shift regulatory modes from ‘business-as-usual’ to a fresh and comprehensive approach aimed at unleashing the full power of network investment, at full scale and at full pace,” the statement said.

The joint communique then delineated ways policymakers can support the investment in improved connectivity for the EU:

- Spectrum auctions are timely and conditions for spectrum assignment support network deployment. This includes taking a long-term view to spectrum prices, rather than imposing punitive fees that hamper 5G investment. Also, access and coverage obligations should not diminish the speed and scale of investment in network roll-out;

- Sharing agreements for Radio Access Network (RAN) are supported and incentivised, so that they contribute to a speedy 5G deployment;

- All fibre investment models are adequately incentivised at the national level, including co-investment and other forms of partnerships;

- Innovative infrastructure solutions, such as cloud, edge and quantum computing, are given the appropriate support;

- Future EU initiatives dramatically reduce roll-out costs for both mobile and fixed networks. This should tackle, for example, unreasonable costs for using public ground as well as complex authorization procedures for both fixed and mobile networks;

- Open and interoperable interfaces in the RAN are supported. Initiatives such as Open RAN have the potential to support Europe’s multi-vendor approach, while reducing deployment costs, further strengthening the security of the equipment and unleash more network innovation.

The most important thing is helping grow adoption of the new technologies by citizens and businesses, the statement said. This includes supporting digital skills education and training. “Finally, workers of all ages should be put in the condition to develop the necessary digital skills – both through upskilling and reskilling – to thrive in innovative and fast-paced markets.”

Demand stimulus measures can also help bring digital services to public sector organizations like schools, hospitals and local administrations. That would not only support Europe’s economic recovery, but also can contribute to the EU’s climate goals.

The GSMA and ETNO also called on the EU governments to combat the attacks against telecom infrastructure and misinformation surrounding 5G. To date they have counted over 180 arson attacks against mobile antennas in 11 countries.

Media Inquiries:

Alessandro Gropelli, ETNO – [email protected] 0032 476 9418 39

Noelle Knox, GSMA Europe – [email protected] 0032 470 45 2941

…………………………………………………………………………………………………………………………………………………………………………..

Separately, GSMA says “5G Stand Alone to Become Reality“:

“The deployment of fully virtualized networks using 5G Stand Alone Cores, thereby facilitating Edge Computing and Network Slicing, will enable enterprises and governments to reap the many benefits from high throughput, ultra-low latency and IoT to improve productivity and enhance services to their customers,” said Alex Sinclair, Chief Technology Officer, GSMA.

“5G Stand Alone Option 2 can meet various and more stringent requirements and provide optimal and differentiated solutions, thereby empowering more businesses and unlocking the potential of many services. 5G is changing our society and life,” said Liu Guiqing, Executive Vice President of China Telecom.

“NTT DOCOMO has been actively promoting virtualisation of our core network; we believe that this virtualisation technology is already mature and that our operational know-how will be our advantage. In the future we expect to build dedicated networks, optimised for consumer use cases, such as AR /VR and gaming,” said Hiroyuki Oto, General Manager of Core Network Development Department, NTT DOCOMO, Inc.

The latest version of the 5G SA guidelines ‘5G Implementation Guidelines: SA Option 2 will be released 30th June at 17:00 Beijing time during Thrive China, a new virtual event from the GSMA.

NOTE that those GSMA guidelines come before 3GPP Release 16 5G Architecture (including 5G Core) spec 23.501 is finalized/frozen at 3GPP’s July 2020 meeting. It seems there will be many versions of 5G core networks:

Alex Quach, VP of Intel’s Data Platforms Group: “The way different service providers implement their 5G core is going to vary. Every service provider has unique circumstances. The transition to a new 5G core is going to be different for every operator.”

Asked if SK Telecom has now completed its 5G Standalone core network, the South Korean carrier was vague in an email reply to FierceWireless. “To commercialize standalone 5G service in Korea, we are currently making diverse R&D efforts including conducting tests in both lab and commercial environment. Our latest achievements include the world’s first standalone (SA) 5G data session on our multi-vendor commercial 5G network.

fiercewireless.com/operators/sk-t

……………………………………………………………………………………………………………………………………………………………………………..

GSMA also states that:

Mobile connections, including cellular IoT as of 1 July 2020 =8,805,024,140 (not the 20B Ericsson and others predicted for 2020)

……………………………………………………………………………………………………………………………………………………………………..

References:

https://etno.eu/news/all-news/8-news/678-joint-statement-telecoms-eu-recovery.html

https://etno.eu/news/all-news.html

NeoPhotonics demonstrates 90 km 400ZR transmission in 75 GHz DWDM channels enabling 25.6 Tbps per fiber

NeoPhotonics completed experimental verification of the transmission of 400Gbps data over data center interconnect (DCI) link in a 75 GHz spaced Dense Wavelength Division Multiplexing (DWDM) channel.

NeoPhotonics achieved two milestones using its interoperable pluggable 400ZR [1.] coherent modules and its specially designed athermal arrayed waveguide grating (AWG) multiplexers (MUX) and de-multiplexers (DMUX).

Note 1. ZR stands for Extended Reach which can transmit 10G data rate and 80km distance over single mode fiber and use 1550nm lasers.

- Data rate per channel increases from today’s non-interoperable 100Gbps direct-detect transceivers to 400Gbps interoperable coherent 400ZR modules.

- The current DWDM infrastructure can be increased from 32 channels of 100 GHz-spaced DWDM signals to 64 channels of 75 GHz-spaced DWDM signals.

- The total DCI fiber capacity can thus be increased from 3.2 Tbps (100Gbps/ch. x 40 ch.) to 25.6 Tbps (400Gbps/ch. x 64 ch.), which is a total capacity increase of 800 percent.

NeoPhotonics said its technology overcomes multiple challenges in transporting 400ZR signals within 75 GHz-spaced DWDM channels.

The filters used in NeoPhotonics MUX and DMUX units are designed to limit ACI [2.] while at the same time having a stable center frequency against extreme temperatures and aging.

Note 2. ACI stands for Adjacent Channel Interface; it also can refer to Application Centric Infrastructure.

NeoPhotonics has demonstrated 90km DCI links using three in-house 400ZR pluggable transceivers with their tunable laser frequencies tuned to 75GHz spaced channels, and a pair of passive 75GHz-spaced DWDM MUX and DMUX modules designed specifically for this application. The optical signal-to-noise ratio (OSNR) penalty due to the presence of the MUX and DMUX and the worst-case frequency drifts of the lasers, as well as the MUX and DMUX filters, is less than 1dB. The worst-case component frequency drifts were applied to emulate the operating conditions for aging and extreme temperatures, the company said in a press release.

“The combination of compact 400ZR silicon photonics-based pluggable coherent transceiver modules with specially designed 75 GHz channel spaced multiplexers and de-multiplexers can greatly increase the bandwidth capacity of optical fibers in a DCI application and consequently greatly decrease the cost per bit,” said Tim Jenks, Chairman and CEO of NeoPhotonics. “These 400ZR coherent techniques pack 400Gbps of data into a 75 GHz wide spectral channel, placing stringent requirements on the multiplexers and de-multiplexers. We are uniquely able to meet these requirements because we do both design and fabrication of planar lightwave circuits and we have 20 years of experience addressing the most challenging MUX/DMUX applications,” concluded Mr. Jenks.

About NeoPhotonics

NeoPhotonics is a leading developer and manufacturer of lasers and optoelectronic solutions that transmit, receive and switch high-speed digital optical signals for Cloud and hyper-scale data center internet content provider and telecom networks. The Company’s products enable cost-effective, high-speed over distance data transmission and efficient allocation of bandwidth in optical networks. NeoPhotonics maintains headquarters in San Jose, California and ISO 9001:2015 certified engineering and manufacturing facilities in Silicon Valley (USA), Japan and China. For additional information visit www.neophotonics.com.

References:

Grand View Research: Dark Fiber Networks – Market Size, Share & Trends Analysis

Executive Summary

The global dark (unlit) fiber network [1.] market size is estimated to reach $11.22 billion by 2027, according to the new report by Grand View Research, Inc. That market is anticipated to expand at a 12% compound annual growth rate (CAGR) during the forecast period.

Note 1. In fiber-optic communications, fiber optic cables that are not yet put in service by a provider or carrier, are termed as dark or unlit fiber. Network communications and telecom usually use the network. In regular fiber networks, information is sent through the cables in light pulses. Whereas, dark fiber networks are known to be ‘dark’ as no light or data is transmitted from it.

……………………………………………………………………………………………………………

Dark Fiber Market Positioning

The dark fiber market has emerged as a sustainable solution for various organizations that are focusing on enhanced communication and network management. Continuously increasing penetration of internet services, over the period, has paved the way for the high demand for internet bandwidth. This demand is expected to remain rampant over the forecast period. This is the most significant factor driving the market growth. The market is strongly supported by companies with high reliance on internet connectivity. These networks are highly beneficial for organizations with a high volume of data flow in their operation. These benefits include reduced network latency, scalability, reliability, and enhanced security.

Dark fiber networks can be installed and set-up using point-to-multipoint or point-to-point configurations. Dense Wavelength Division Multiplexing (DWDM) is an essential factor for the improvement and development of dark fiber networks. DWDM occurs when many data signals are transmitted using the same optical fiber at the same time. Although these signals are transmitted around the same time, they are transmitted at separate and unique wavelengths to keep these data signals separate. The significant benefits of DWDM include an increase in bandwidth of the optical fiber, high-quality internet performance, lightning-fast internet, and secure and powerful network.

Dark fiber networks are not just used for business purposes but can be installed beneath land and oceans. Some of the interesting uses cases of dark fiber include earthquake research and to monitor permafrost. Some of the disadvantages include high initial cost and loss of time in setting up your infrastructure and high repairing and maintenance costs. Similarly, large dark fiber networks are currently available at metropolitan cities only and yet to at small cities and towns.

Key suggestions from the report:

- The significant benefits of DWDM include an increase in bandwidth of the optical fiber, high-quality internet performance, lightning-fast internet, and secure and powerful network

- Telecommunication is anticipated to present promising growth prospects due to growing adoption of the 5G technology in communication and data transmission services

- Medical and military and aerospace application segments are poised to witness significant growth, attributed to increasing adoption of optic technology devices

- Asia Pacific is expected to witness the fastest growth owing to technological advancements and large-scale adoption of the technology in IT and telecommunication and administrative sector

………………………………………………………………………………………………………………………………….

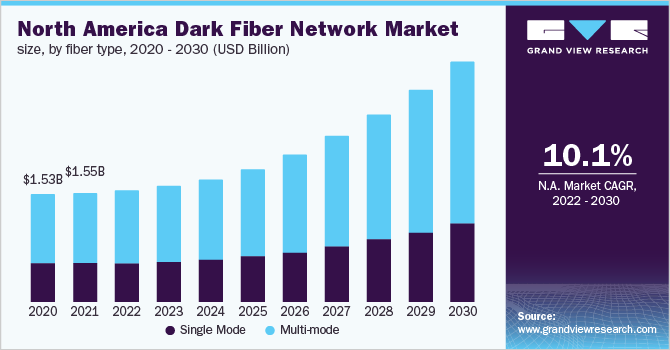

Fiber Type Insights

In 2019, the multimode segment led the market in terms of revenue and held around 60% of the total market share. It is also expected to continue leading the market over the forecast period. This type is best suited for short transmission distances. It is mainly used in video surveillance and Local-area Network (LAN) systems. Single-mode fiber, on the other hand, is best suited for longer transmission distances. It is mainly used in multi-channel television broadcast systems and long-distance telephony. Single mode segment is anticipated to witness considerable growth over the projected period. This product type is used for long distance installations ranging from 2 meters to 10,000 meters. It offers lower power loss in comparison to multimode. However, it is costlier than multimode fibers.

Network Type Insights

Long-haul fiver systems remained the mainstay of the market in 2019, capturing 69.7% revenue share. The segment continues to gather pace due to their capacity to connect over large distances at low signal intensity. Such long-haul terrestrial networks are widely applied in undersea cabling across long oceanic distance, thus attracting the participation of several organizations in terms of investments. For instance, in May 2018, Vodafone Group deployed 200G long-haul network-largest in the world-across 88 cities in India, covering over 43,000 km of network.

Long-haul network is driven by continuously growing investments, development of smart cities, and strong competitive dynamics in the market. However, the broadening availability of metro network fibers at relatively cost-effective price is gradually swinging the momentum towards the segment over the next few years.

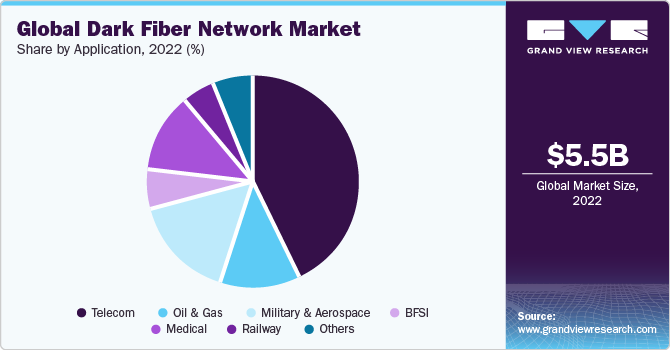

Application Insights

In terms of revenue, telecommunication segment dominated the market with a share of 43.3% in 2019 and is anticipated to retain its dominance in terms of market size by 2027. Telecommunication is anticipated to present promising growth prospects due to growing adoption of the 5G technology in communication and data transmission services. Dark fiber enables high-speed data transfer services in both small and long-range communications. Furthermore, increasing cloud-based applications, audio-video services, and Video-on-Demand (VoD) services stimulate the demand.

Medical and military and aerospace application segments are poised to witness significant growth, attributed to increasing adoption of optic technology devices. Stringent regulations and standards imposed by the regulatory authorities and medical associations are further fueling the market to flourish in the medical sector, eventually driving the overall growth.

Regional Insights

In 2019, North America led held largest market share in terms of revenue with around 30%. Asia Pacific is spearheading revenue growth owing to technological advancements and large-scale adoption of the technology in IT and telecommunication and administrative sector. High penetration of the technology in manufacturing sector and expanding IT and telecom sector across Asia Pacific are strengthening the regional market hold. Moreover, increasing application of fiber networks in medical sector is catapulting growth across countries, such as China, Japan, and India, thus propelling the overall demand at a significant pace.

Governments of developed countries such as U.S., U.K., Germany, China, and Japan are heavily investing in security infrastructure at country levels. Awareness is growing among the rapidly developing economies that aim to strengthen their hold at the global level. This is eventually necessitating the funding for technologies, majorly across the fiber networks that would enhance the telecommunication sector infrastructure with better security measures.

Dark Fiber Networks Market Report Scope

| Report Attribute | Details |

| Market size value in 2020 | USD 5.09 billion |

| Revenue forecast in 2027 | USD 11.22 billion |

| Growth Rate | CAGR of 12.0% from 2020 to 2027 |

| Base year for estimation | 2019 |

| Historical data | 2016 – 2018 |

| Forecast period | 2020 – 2027 |

| Quantitative units | Revenue in USD million and CAGR from 2020 to 2027 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Fiber type, network type, application, region |

| Regional scope | North America; Europe; Asia Pacific; South America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; U.K.; Germany; France; Japan; China; India; Australia; Brazil |

| Key companies profiled | AT&T Intellectual Property; Colt Technology Services Group Limited; Comcast; Consolidated Communications; GTT Communications, Inc.; Level 3 Communications, Inc. (CenturyLink, Inc.); NTT Communications Corporation; Verizon Communications, Inc.; Windstream Communications; Zayo Group, LLC |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. Explore purchase options |

…………………………………………………………………………………………………………………………………………..

Grand View Research has segmented the global dark fiber network market based on fiber type, network type, application, and region:

- Dark Fiber Network Fiber Type Outlook (Revenue, USD Million, 2016 – 2027)

- Single Mode

- Multi-mode

- Dark Fiber Network Type Outlook (Revenue, USD Million, 2016 – 2027)

- Metro

- Long-haul

- Dark Fiber Network Application Outlook (Revenue, USD Million, 2016 – 2027)

- Telecom

- Oil & Gas

- Military & Aerospace

- BFSI

- Medical

- Railway

- Others

- Dark Fiber Network Regional Outlook (Revenue, USD Million, 2016 – 2027)

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- Germany

- U.K.

- Asia Pacific

- China

- India

- Japan

- Australia

- South America

- Brazil

- Middle East & Africa

- North America

- List of Key Players in the Dark Fiber Network Market

- AT&T Intellectual Property

- Colt Technology Services Group Limited

- Comcast, Consolidated Communications

- GTT Communications, Inc.

- Level 3 Communications, Inc. (CenturyLink, Inc.)

- NTT Communications Corporation

- Verizon Communications, Inc.

- Windstream Communications

- Zayo Group, LLC

………………………………………………………………………………………………………………………….

References:

https://www.grandviewresearch.com/industry-analysis/dark-fiber-networks-market

Windstream Wholesale and Infinera Complete Successful Trial of LR8-Based 400GbE Client-Side Services

“Our customers’ bandwidth requirements are growing rapidly, and Windstream is increasing network capacity to meet this demand,” said Buddy Bayer, chief network officer at Windstream. “Infinera’s GX G30 Compact Modular Platform provides an ultra-efficient transport solution enabling us to offer 400GbE services to support our customers’ high-bandwidth needs. The use of LR8 clients with a single mode fiber interface and a 10-kilometer reach provides an extremely cost-effective solution by enabling us to extend these services directly to our customers’ premises.”

Windstream Wholesale is currently engaging with customers for initial deployment of the end-to-end 400G Wave service. For more information on how you can bring 400G Wave services to your company, call 1-866-375-6040.

To view the Windstream network map, visit https://www.windstreamenterprise.com/wholesale/interactive-map/.

About Windstream

Windstream Holdings, Inc., a FORTUNE 500 company, is a leading provider of advanced network communications and technology solutions. Windstream provides data networking, core transport, security, unified communications and managed services to mid-market, enterprise and wholesale customers across the U.S. The company also offers broadband, entertainment and security services for consumers and small and medium-sized businesses primarily in rural areas in 18 states. Services are delivered over multiple network platforms including a nationwide IP network, our proprietary cloud core architecture and on a local and long-haul fiber network spanning approximately 150,000 miles. Additional information is available at windstream.com or https://www.windstreamenterprise.com/wholesale/. Please visit our newsroom at news.windstream.com or follow us on Twitter at @Windstream.

About Infinera

Infinera is a global supplier of innovative networking solutions that enable carriers, cloud operators, governments, and enterprises to scale network bandwidth, accelerate service innovation, and automate network operations. The Infinera end-to-end packet optical portfolio delivers industry-leading economics and performance in long-haul, submarine, data center interconnect, and metro transport applications. To learn more about Infinera, visit www.infinera.com, follow us on Twitter @Infinera, and read our latest blog posts at www.infinera.com/blog.

Windstream Media Contact

Scott Morris, 501-748-5342

[email protected]

Infinera Media Contact

Anna Vue, (916) 595-8157

[email protected]

Source: Windstream Holdings, Inc.

Reference:

Nokia Bell Labs sets world record in fiber optic bit rates

Nokia Bell Labs announced that its researchers set the world record for the highest single carrier bit rate at 1.52 Tbps over 80 km of standard single mode fibre, the equivalent of simultaneously streaming 1.5 million YouTube videos – which is four times the market’s existing approximately 400 Gbps. The company said this world record, along with other announced optical networking innovations, will further strengthen its ability to create networks for the 5G era that meet the ever-growing data, capacity and latency demands of Industrial Internet of Things (IIoT) and consumer applications.

Several of these achievements were presented as part of Nokia Bell Labs’ post deadline research papers at the Optical Fiber Communications Conference & Exhibition (OFC) that took place during March 9-15, 2020 in San Diego, CA. In addition, Nokia Bell Labs researcher Di Che was awarded the OFC Tingye Li Innovation Prize.

The highest single-carrier bitrate at 1.52 Tbps was set by a Nokia Bell Labs optical research team led by Fred Buchali. This record was established by employing a new 128 Gigasample/second converter enabling the generation of signals at 128 Gbaud symbol rate and information rates of the individual symbols beyond 6.0 bits/symbol/polarization. This accomplishment breaks the team’s own record of 1.3 Tbps set in September 2019 while supporting Nokia’s record-breaking field trial with Etisalat.

Nokia Bell Labs researcher Di Che and his team also set a new data-rate world record for directly modulated lasers (DML), which are crucially important for low-cost, high-speed applications such as datacenter connections. The DML team achieved a world record data rate beyond 400 Gbps for links up to 15 km.

Marcus Weldon, Nokia CTO and President of Nokia Bell Labs, said:

“It has been fifty years since the inventions of the low-loss fiber and the associated optics. From the original 45 Megabit-per-second systems to more than 1 Terabit-per-second systems of today – a more than 20,000-fold increase in 40 years – to create the fundamental underpinning of the internet and the digital societies as we know it. The role of Nokia Bell Labs has always been to push the envelope and redefine the limits of what’s possible. Our latest world records in optical research are yet another proof point that we are inventing even faster and more robust networks that will underpin the next industrial revolution.”

In addition to these world records, Nokia Bell Labs researchers have also recently achieved significant achievements in optical communications, including:

- The first field trial using spatial-division-multiplexed (SDM) cable over a 2,000km span of 4-core coupled-core fiber was achieved by researchers Roland Ryf and the SDM team. The experiments clearly show that coupled-core fibers are technically viable, offer high transmission performance, while maintaining an industry standard 125-um cladding diameter.

- A research team led by Rene-Jean Essiambre, Roland Ryf and Murali Kodialam introduced a novel new set of modulation formats that provide improved linear and nonlinear transmission performance at submarine distances of 10,000 km. The proposed transmission formats are generated by a neuronal network and can significantly outperform traditional formats (QPSK) used in today’s submarine systems.

- Researcher Junho Cho and team experimentally demonstrated capacity gains of 23% for submarine cable systems that operate under electrical supply power constraints. The capacity gains were achieved by optimizing the gain shaping filters using neural networks.

The researchers that achieved the world record and research results are part of Nokia Bell Labs’ Smart Optical Fabric & Devices Research Lab, which designs and builds the future of optical communications systems, pushing the state-of-the-art in physics, materials science, math, software and optics to create new networks that adapt to changing conditions and go far beyond today’s limitations.

……………………………………………………………………………………………………..

About Nokia

We create the technology to connect the world. Only Nokia offers a comprehensive portfolio of network equipment, software, services and licensing opportunities across the globe. With our commitment to innovation, driven by the award-winning Nokia Bell Labs, we are a leader in the development and deployment of 5G networks.

Our communications service provider customers support more than 6.4 billion subscriptions with our radio networks, and our enterprise customers have deployed over 1,300 industrial networks worldwide. Adhering to the highest ethical standards, we transform how people live, work and communicate. For our latest updates, please visit us online www.nokia.com and follow us on Twitter @nokia.

About Nokia Bell Labs

Nokia Bell Labs is the world-renowned industrial research arm of Nokia. Over its more than 90-year history, Bell Labs has invented many of the foundational technologies that underpin information and communications networks and all digital devices and systems. This research has resulted in 9 Nobel Prizes, three Turing Awards, three Japan Prizes, a plethora of National Medals of Science and Engineering, as well as three Emmys, two Grammys and an Oscar for technical innovations. For more information, visit www.bell-labs.com.

Media Inquiries:

Nokia

Communications

Phone: +358 (0) 10 448 4900

E-mail: [email protected]

……………………………………………………………………………………………..

References: