fiber optics

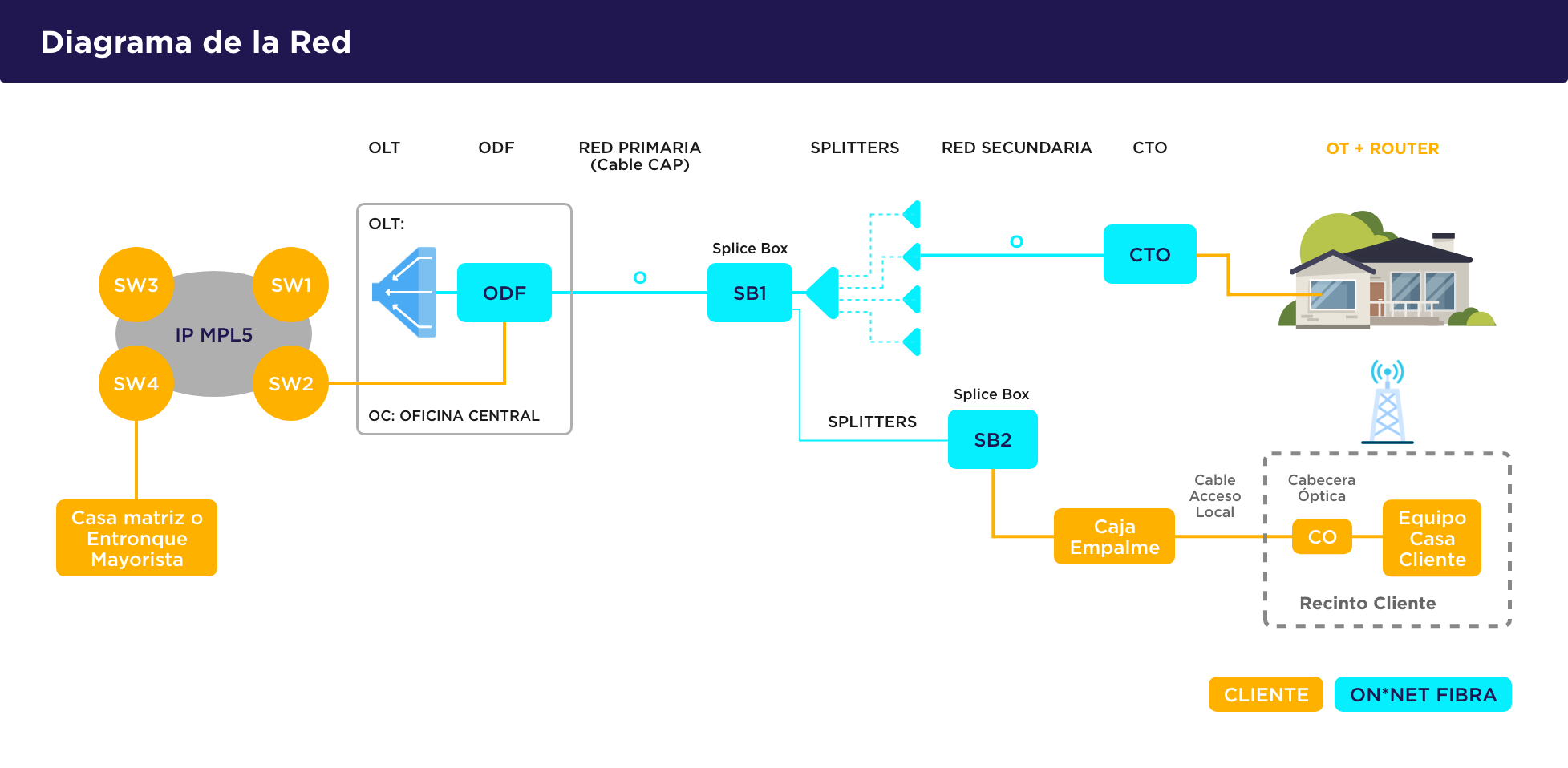

Chile’s Entel to sell fiber optic assets for $358 million to ON*NET Fibra

Chilean telecoms giant Entel (which this author consulted for in 2002 and 2005) said on Saturday it would sell the assets of its fiber optic business, which provides services to homes, to local company ON*NET Fibra (?) in a deal worth $358 million.

The sale, led by investment banks BNP Paribas, Santander and financial adviser Scotiabank, is subject to approval by Chile’s economic regulator, expected in the first half of 2023.

Entel and ON*NET Fibra signed an agreement as part of the deal that will enable Entel to continue offering internet services for residences on ON*NET’s network, Entel said in a statement.

…………………………………………………………………………………………………………………………………………………………….

“By selling our network, rather than leaving the fixed market, we are increasing coverage rapidly to offer our internet services to the home at efficient costs and without the need to invest the sums required for a fiber deployment with this coverage,” the statement added.

Following the closing of this transaction, ON*NET Fibra is expected to reach more than 4.3 million homes in 2024. Entel has operations in Chile and Peru and has more than 20 million mobile subscribers.

Source: ON*NET Fibra

……………………………………………………………………………………………………………………….

References:

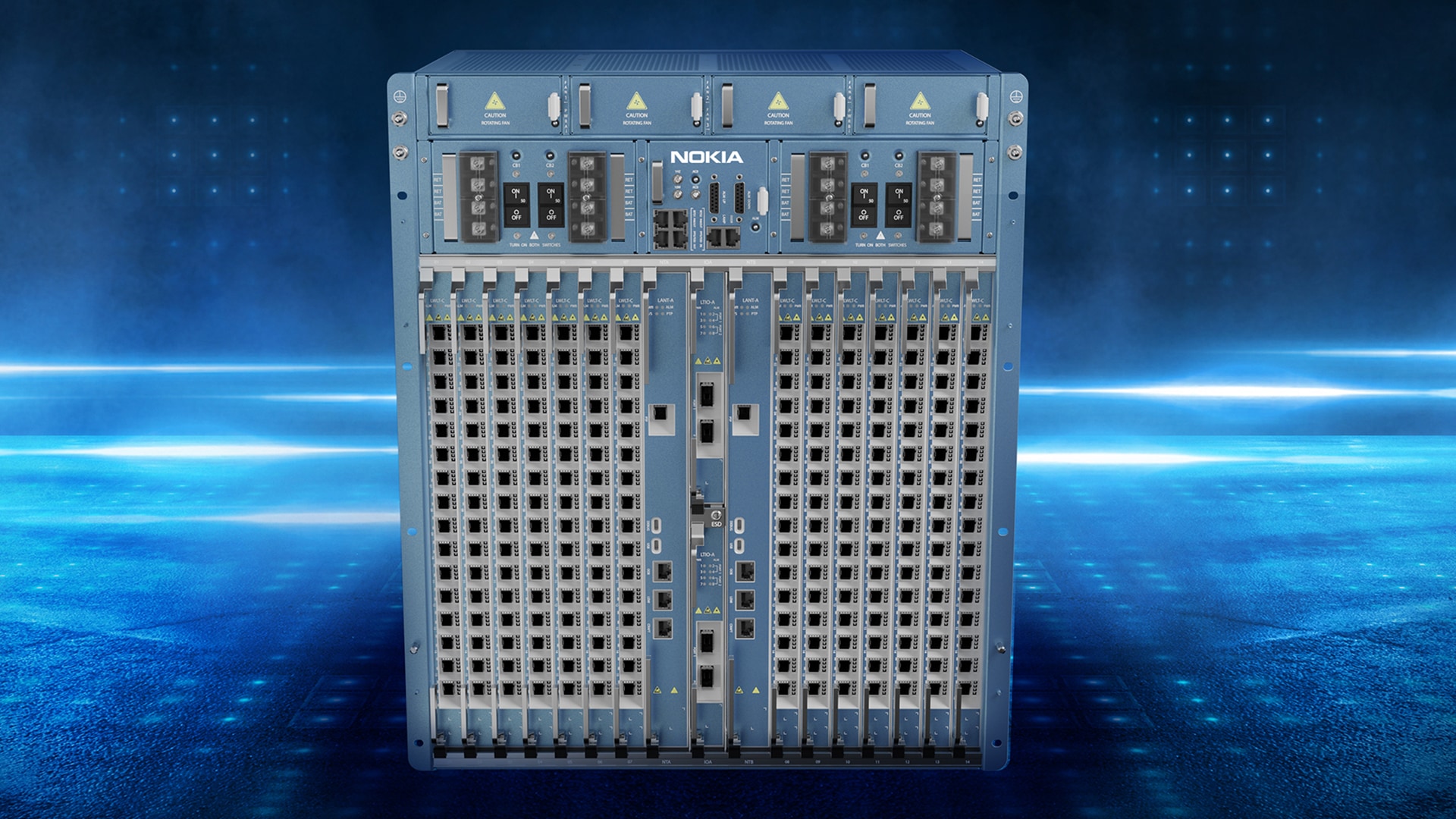

Nokia announces Lightspan MF-14 platform as “most advanced in the world”

Nokia has unveiled what it boldly claims is the “most advanced fiber broadband platform in the world,” one it’s calling the “fiber-for-everything” world. According to the vendor, the new Lightspan MF-14 platform extends the upper reaches of its fiber broadband range, bringing “unmatched” capacity, low latency, intelligence, reliability and efficiency. The platform, which falls into “Generation 6” of such things, is already being tried out by customers looking to build 25Gbit/s-capable network in Europe, North America and the Asia-Pacific region. Lightspan MF-14 is being premiered at the Network X event in Amsterdam from 18 to 20 October.

The industry is entering a ‘fiber-for-everything’ era. Once operators have deployed fiber-to-the-home, their networks pass every other building in the street, as well as the homes, meaning they can connect businesses and other services. Fiber PON will be capable of supporting high bandwidth consumer services, industry 4.0 applications, business connectivity, 5G transport and smart city services. This creates more revenue opportunities, lowers TCO and significantly reduces overall power consumption. This new broadband era, designated Broadband 6 by the World Broadband Association (WBBA), requires a new technical solution. Nokia’s pioneering Lightspan MF-14 is the first Gen 6 optical line terminal (OLT) in the world and has already been selected by customers building 25 Gb/second capable networks in Europe, North America and Asia Pacific.

Geert Heyninck, Nokia’s VP Broadband Networks, said: “Fiber-to-the-home is becoming fiber-for-everything. This is enabled by several technology advances, most notably higher speed PON technologies to accommodate all new services, and SDN to bring more intelligence in the network. If you think about it, the massive number of connection points on fiber make it a challenge to get an instant view of everything that happens in your network, fully automate network control, and perform actions with no service interruption. Our current portfolio is doing an excellent job in supporting many of these requirements for today’s and tomorrow’s services, but we are looking ahead. The MF-14 platform will suit operators who are planning large scale 25G PON, 50G and even 100G PON within the same environment.”

In his recent report* Erik Keith, Senior Research Analyst for Broadband Infrastructure at S&P Global, says: “The PON market is at a pivotal moment in the evolution of networks, where fiber broadband means so much more than residential connectivity. There is a huge opportunity for service providers to connect everything much more efficiently by leveraging their existing fiber broadband networks. After all, the same fiber cables that were originally laid in residential areas also pass commercial buildings such as office blocks, hospitals and government properties. This approach eliminates multiple overlay networks, minimizes digging up the streets, and lowers energy use substantially. The new Lightspan MF-14 OLT can enable operators to deploy a solution that will last for decades, while providing a platform that can increase network performance exponentially compared to most networks in use today.”

Based on new, advanced hardware and disaggregated software design, MF-14 is a generation leap in fiber access solutions. It is the highest capacity platform in the industry and the only solution ready for mass delivery of 25G, 50G and 100G PON services. It’s also the industry’s first OLT with the six-nines availability and sub-millisecond latency needed for mission critical industry 4.0 and 5G transport services.

Frontier Communications, the first in the U.S. to trial 25G PON, is also the first to evaluate MF-14 in its live network. Frontier’s Scott Mispagel, SVP National Architecture and Engineering, said: “We are proud to be the first to embrace this next-generation platform. This is another way for us to provide customers with the fastest broadband available. The MF-14 platform will support our path to 100G using our existing fiber network and future-proof our network with speeds that will continue to outpace cable and other technologies for generations to come.”

Nokia Lightspan MF-14

In July this year CityFibre – the UK’s largest independent full fibre infrastructure platform – signed a 10-year equipment agreement to support its nationwide network upgrade. John Franklin, CTIO, CityFibre said: “As we accelerate our full fibre rollout to serve a third of the UK market by 2025, the demand placed on those networks will also accelerate. MF-14’s flexibility and capacity will help us to meet the needs of our partner’s and their customers for generations to come.”

* From “Nokia launches 6th generation flagship fiber platform” published by S&P Global Market Intelligence.

Resources

Lightspan MF-14, a generation leap in fiber access solutions

- 4x higher capacity than previous generation, ensures smooth evolution to massive connectivity with 25, 50, 100.

- No single point of failures, ensuring the highest availability (six nines) in the market. This is important because consumers and business depend on broadband non-stop

- Sub millisecond latency for 5G transport and new array of industry 4.0 applications

- 20% higher power efficiency than the industry average so operators can decrease overall power consumption as they connect more points on fiber network and meet sustainability targets

- Modular software architecture for more agility for upgrading software and onboarding of new functionality, with much less effort and time.

- SDN programmability and open APIs to enable control function by Nokia or 3rd party network control functions

- Fast telemetry and digital mirror in the cloud for enhanced network overview

- For more details visit the web page

Fiber for everything website

World Broadband Association (WBBA) BB6 network characteristics, published in Next-Generation Broadband Roadmap white paper, Oct 2022

- Residential speed. Up to 50Gbps *

- Enterprise speed. Up to 1.6–3.2Tbps

- Intelligence. Fully autonomous

- Reliability & latency. Deterministic reliability / <1ms latency (hard guarantee) / very low jitter

- Trustworthy & green. 10×-plus better per bit energy efficient, very fast problem detection and response (seconds)

- Connectivity. Fiber sensors, 10 times more IoT terminals

- Sensing Capability. Fiber sensing for applications, application and computing awareness, AI

*Speeds listed are speculative given the timeframe, and further work by the WBBA will explore this in more detail in future reports.

California begins construction of $3.8B middle mile fiber network

California began work on an ambitious fiber project which aims to deliver statewide open access middle mile connectivity by the end of 2026. The project, which was announced in 2021, is being fueled by $3.8 billion in federal and state funds.

The sate’s network design calls for a total of 10,000 miles of fiber. The largest portion of the project will run through San Bernadino County, which will be home to 850 miles of fiber. Kern County (544 miles), Riverside County (535 miles) and Los Angeles County (525 miles) will also account for substantial portions of the system.

California’s Department of Transportation (Caltrans) is working with the state’s Department of Technology to complete the project.

During a project meeting in September, Caltrans’ Acting Assistant Deputy Director for the Middle Mile Broadband Initiative Janice Benton said preconstruction work – including environmental, permitting and design tasks – was already underway for 93% of the project’s fiber miles.

She added 114 miles of the project are expected to go into construction in 2022, with another 300 miles to come in 2023. The first leg of its work got underway this week.

The state of California has already advertised contracts covering 900 miles of the project. And by October 14, it was planning to have 60% of the middle mile network out for construction bids. It is aiming to have 100% of the system under contract by May 2023.Once the network is complete, ISPs will be able to tap into it to provide last mile connectivity. Those efforts will also get a funding boost. The same 2021 legislation that allocated $3.25 billion for the middle mile project (which was subsequently supplemented by another $550 million from the 2022 state budget) also set aside $2 billion for the rollout of last mile connections.

The 10,000-mile “middle mile” network is expected to cost $3.8 billion and help connect the roughly one in five Californians do not have access to reliable and affordable high-speed internet.

“We are thrilled to see construction begin on the middle-mile network,” said Secretary Tong. “Too many rural and urban areas lack adequate broadband infrastructure, forcing residents to attempt to connect via mobile hotspots and unreliable satellite service, which leaves out too many Californians.”

Former Los Angeles Mayor Antonio Villaraigosa, who was named by the Governor in August to serve as Infrastructure Advisor to the State of California, joined the event Thursday to highlight the substantial federal resources coming to the state for infrastructure investments like broadband networks.

“This broadband network is one of the most ambitious and impactful infrastructure projects in California – and we’re thrilled that construction is underway starting today,” Mayor Villaraigosa said. “With billions more in federal infrastructure dollars on the way, we’re getting ready to celebrate many more groundbreakings for innovative projects across California. This goes far beyond infrastructure, this is about building the future of our state and creating thousands of good-paying jobs along the way.”

CDT Director Liana Bailey-Crimmins said construction on the first segment of the Middle Mile network follows more than a year of planning.

“The rapid planning by the Middle Mile team as well as our local partners is coming to fruition. It’s wonderful to see the hard work paying off, to make a difference in the lives of Californians who live in unserved areas like this one.”

Caltrans Director Tony Tavares said each of the Department’s 12 districts is working to build segments of the Middle Mile network on an ambitious timeline in the hope of capturing the maximum amount of federal funding available.

“This project provides a wonderful opportunity for us to ‘dig smart’ and highlights the benefits of coordination among state agencies and with our local partners. Caltrans is proud to partner with the Department of Technology to create a broadband Middle Mile network, providing equitable, high-speed broadband service to all Californians.”

Once the Middle Mile network is complete, local carriers will have access to the network to provide communities with direct service to homes and businesses as well as reduced-cost or free broadband internet service for those who are eligible.

References:

https://www.fiercetelecom.com/telecom/california-kicks-construction-38b-middle-mile-fiber-network

Altice USA bets on FTTP with multi-gigabit speeds by 2025; MVNO with T-Mobile

Dexter Goei, Altice USA’s outgoing CEO, continues to strongly defend the company’s decision to upgrade large portions of its network to fiber, stating that the product and business performance of the move make dollars and sense. Altice USA’s current plan is to upgrade about 6.5 million passings to fiber-to-the-premises (FTTP) by 2025 and back that up with multi-gigabit speeds, which Altice USA has begun to soft-launch in parts of its fiber upgrade areas.

At the Goldman Sachs Communacopia + Technology conference in San Francisco, Goei said while the company has made strides in deploying its fiber network — it expects to finish 2022 with up to 2.3 million homes passed with the technology — it is still seeing customer declines in its former Cablevision and Suddenlink footprints.

In Altice’s former Cablevision systems in metropolitan New York City, gross additions are lower, there is less move activity and churn levels are low, but the company also is competing against a telco — Verizon Communications — that has been extremely aggressive on price. In its Suddenlink markets mainly in the Midwest, gross addition activity is high but churn is high, especially in markets where it is being overbuilt.

“We’re still losing subs in both markets but for different reasons,” Goei said. “We feel good about the fourth quarter turning around and looking better next year.”

Altice USA lost about 3,000 subscribers in 2021 — the only major cable operator to do so — and shed more than 50,000 broadband customers in the first half of this year.

Altice began accelerating its fiber rollout last year, with a goal of passing 6.5 million homes by 2025. At the Goldman conference, Goei said the company expects to end 2022 with 2.2 million to 2.3 million homes passed with fiber (an increase of about 1 million homes), and should add another 1.6 million to 1.8 million households by the end of 2023.

While other cable operators have seen an increase in competition from fixed wireless access providers from telcos, Goei said most of Altice USA’s telco competition is replacing slower DSL lines with fiber, hence the acceleration of its own fiber buildout plans. But he shared his peers’ disdain for fixed wireless access (FWA), agreeing with some pundit predictions that the technology will reach a performance and penetration plateau in the next two or three years.

Goei announced his intention to step down as CEO earlier this month, and will become executive chairman of Altice USA on October 3. In his place the company named Comcast executive Dennis Mathew as CEO, also effective October 3. Mathew has 17 years of experience with Comcast, most recently as senior VP of its Freedom Region (Southeast Pennsylvania, New Jersey and Northern Delaware). He earlier served as senior VP for its Western New England Region (Connecticut, Vermont, Western Massachusetts and areas of New York and New Hampshire) and has extensive experience in running cable businesses.

Goei said at the Goldman conference that his main motivation for stepping down was a desire to return to Europe, where he spent his childhood and most of his professional career, with his family. He added that he notified the Altice USA board of his decision about a year ago, starting the search process for a replacement about six months ago. He believes he’s leaving Altice USA in capable hands.

“I interviewed many, many people during the process; Dennis fits the bill across the board,” Goei said, adding that Mathew has a proven track record in operations, running one of Comcast’s most high-profile regions (the Freedom Region) and will fit in well with the Altice team. “He’s just a great guy, a team player, will focus on the prize and is someone who would do very well with the executive team at Altice USA.”

The average revenues per user (ARPU) on Altice USA’s fiber-based products are 7% to 8% higher than ARPU on cable-based services, he said. Additionally, churn rates on fiber services are also coming in about 6% to 8% lower than on HFC, and the NPS (net promoter score) for the fiber product is also coming in higher.

“Every single metric that you can imagine – that you would anticipate – are better” on the fiber product, Goei said. He acknowledged, however, that the installation process for fiber customers getting a triple-play bundle that includes pay-TV and voice could be better.

As for Altice USA’s fiber network build update, the company finished almost 270,000 new homes in the second quarter of 2022, a record the company expects to beat in Q3 and, weather permitting, in Q4.

For 2022, Altice USA expects to complete an additional 1 million fiber passings, with 1.2 million as its “stretch target.” That will put Altice USA in a position to end the year with 2.2 million to 2.3 million homes passed with fiber.

In 2023, Goei said Altice USA expects to ratchet up the build to 1.6 million to 1.8 million homes passed as the operator starts to push fiber upgrades into the Suddenlink footprint.

Altice USA is also doing edge-out builds to areas adjacent to existing facilities and pursuing grants for fiber builds in underserved and unserved areas. Altice USA has won grants or subsidies covering 40,000 to 45,000 homes, a number that Goei predicts could rise to about 200,000 in the next 12 to 24 months.

Altice USA, which has been fielding M&A inquiries about the Suddenlink properties, believes its fiber focus will set the stage for a return to broadband subscriber growth as early as Q4 2022, and certainly by sometime in 2023.

Goei said 80% of gross broadband subscriber adds in fiber areas take a fiber-based service. Though Altice USA is trying to convert HFC customers to fiber proactively, exceptions include customers who want to keep their existing setup or who are in homes and locations where a landlord won’t allow a new fiber drop.

Altice USA has been building a fiber broadband network in its Optimum territory in the New York tri-state area (New York, New Jersey, Connecticut) with 1.2 million fiber passings available for sales as of December 31, 2021. For Suddenlink, construction is expected to begin this year in areas of Texas. Additional states in the Suddenlink footprint that will benefit from this fiber expansion plan include areas of Arizona, California, Louisiana, Missouri, North Carolina, New Mexico, Oklahoma, and West Virginia.

“Altice USA is proud to announce plans to invest further in our fiber deployment strategy by accelerating the build of a 100% fiber broadband network capable of delivering multi-gig speeds across our Optimum and Suddenlink footprint,” said Dexter Goei, Altice USA Chief Executive Officer. “Fiber is the future and given the progress we have made at Optimum with our fiber expansion, we’re excited to build on that success and break ground later this year at Suddenlink to bring our advanced network to more customers and communities.”

Goei touched briefly on Altice USA’s Optimum Mobile product, which is supported by an MVNO deal with T-Mobile. He agreed that there are benefits to bundling mobile with home broadband but lamented that mobile EBIDTA is challenged by “thin margins” being driven by a mobile marketplace that’s seeing falling ARPU and rising levels of promotions.

With that backdrop, Altice USA expects to market fiber more aggressively than mobile this year and into 2023. “For the balance of this year, I don’t think you should expect real big waves in the mobile product,” Goei said.

Goei also offered some additional commentary on the recent announcement that he will be stepping down as CEO to become executive chairman of the board. Comcast exec Dennis Mathew has been tapped to take the CEO slot effective October 3.

Goei reiterated that he is shifting gears for personal reasons, as he and his family want to return to Europe. He said he informed the board of his decision about a year ago. Altice USA started its CEO search roughly six months ago.

In his new role, Goei said he will focus on “large strategic stuff” and external elements such as government affairs and conversations with the financial community, so that Mathew can focus squarely on operations.

References:

AT&T remains a fiber first network provider with FWA in rural areas

AT&T remains a fiber-first broadband broadband network provider. The carrier’s CFO Pascal Desroches told investors that the most likely instance for AT&T to use FWA (fixed wireless access) would be in rural areas where deploying fiber could prove too costly.

“We think in certain instances FWA makes sense,” Desroches said during an interview at this week’s Bank of America Media, Communications, and Entertainment Conference, according to a transcript. “If you’re in a rural area where it does make – where the economics don’t pan out for fiber, fixed wireless will be an interesting solution.”

AT&T’s transition end game is predicated on the carrier’s belief that fiber is a better long-term solution for customers and its operations. Desroches explained that FWA extracts a “very expensive” toll on the carrier’s mobile operations.

“Long term, we don’t believe it will be good enough,” Desroches said of FWA. “And that’s why we think it is really important to start to place our bets now with fiber because by the time fiber becomes the only acceptable solution, it will be too late to start to build out because of the long lead times.”

Editor’s Note: This is what investors are missing about AT&T – it’s growing fiber footprint (#1 in the U.S.) which is probably the biggest growth area in all of telecom!!!

…………………………………………………………………………………………………………………………………………………….

“With connectivity increasing at what we estimate will be a fivefold increase between 2021 and 2025, fiber will be the solution of choice. And given the long lead times, the long payback periods, if you decide you want to do fiber 4 to 5 years from now, it’s too late. And this is why we think we are building a strategy for long-term sustainable earnings with the best possible technology.”

To support that need, AT&T recently signed a long-term deal with fiber builder Corning, which is using that deal as the basis to build a new cable manufacturing facility in Gilbert, Arizona. AT&T also formed a “Fiber Optic Training Program” with Corning targeted at training 50,000 people to design, install, and maintain fiber networks.

“This investment is a significant step forward for our country and building world-class broadband networks that will help narrow the nation’s digital divide,” AT&T CEO John Stankey noted in a statement tied to the Corning deal. “This new facility will provide additional optical cable capacity to meet the record demand the industry is seeing for fast, reliable connectivity.”

“The market demand remains really healthy. We’re continuing to see good demand for subscriber — for new subscribers coming into the service. And also, look, our churn levels are at really low levels. You look at all that together, we have a mobility business now that we expect service revenues to grow 4.5% to 5%. And we expect profitability to accelerate in the back half of the year. So all indications are green and that we are performing really well.”

“We’re going to be competitive. For years, AT&T was not competitive, and we’re going to be competitive, and we’re capitalists. At the end of the day, if there are opportunities to grow subscribers in a more efficient way, we’re going to seize those. But at the same time, we’re no longer going to be the share donor to the industry.”

“We have relationships with virtually over 90% of the Fortune 1000. And it’s a core competency that we have, and it’s one that has served us well. But it is very much in transition, and we’re — what we have to do is to grow our small, mid-business connectivity solutions.”

“There will be a very attractive market for 5G-enabled IoT solutions. There is — it will come. It is nascent today. It will come and the relationships that we have among the Fortune 1000 is critical to — is critical in serving — in helping exploit that opportunity. And again, our wireless relationships. The big part of the growth in wireless is also the ability to surgically attack our enterprise base and partner with different organizations to really drive increased subscriber adoption.”

References:

Corning to Build New Fiber Optic Plant in Phoenix, AZ for AT&T Fiber Network Expansion

AT&T continues to add customers in key focus areas- 5G and fiber

AT&T added 813K mobile postpaid subscribers & >300K net fiber subs during 2Q-2022

Corning to Build New Fiber Optic Plant in Phoenix, AZ for AT&T Fiber Network Expansion

Corning will build a new fiber optical cable manufacturing plant near Phoenix, AZ that will primarily supply AT&T’s continuing fiber optic network buildout. The new facility, expected to open in 2024, will add about 250 jobs to Corning’s payroll.

“At Corning, our investments in capacity are always based on strong customer commitments, and that’s the case here, with a long-term commitment from AT&T,” said John McGirr, the SVP and GM of Corning’s optical fiber and cable group. “As for who it will serve: This expansion will serve AT&T as well as the broader industry by adding capacity during a time of record demand.”

AT&T, in its recent quarterly earnings update, disclosed that it now has 6.59 million fiber-connected customers and marked its tenth straight quarter with more than 200,000 fiber net adds. AT&T says it’s on pace to cover more than 30 million locations with fiber by the end of 2025.

“This investment is a significant step forward for our country and building world-class broadband networks that will help narrow the nation’s digital divide,” said AT&T Chief Executive Officer John Stankey. “This new facility will provide additional optical cable capacity to meet the record demand the industry is seeing for fast, reliable connectivity. We are also working with Corning to create training programs to equip the next generation of technicians with the skills to build the networks that will expand high-speed internet access to millions of Americans.”

Separately, AT&T announced today that it is deploying fiber internet service to the Mesa, Arizona area, with service expected to be available to Mesa residents in 2023.

Corning said the Gilbert site is part of a $500 million expansion plan for optical fiber and cable manufacturing that started in 2020, nearly doubling the company’s capacity. Optical communications has been one of Corning’s fastest-growing businesses. In the June quarter, optical sales grew 22% from the year-ago quarter to $1.3 billion, about 36% of the specialty glass company’s total sales in the period.

Corning CEO Wendell Weeks said in an interview that the decision to add the new facility largely reflects a commitment from AT&T to continue to source fiber optic cable and systems from Corning. “They are the keystone of this investment,” Weeks said.

AT&T CEO John Stankey noted in an interview that his company has “a very long relationship with Corning that goes back many years,” and now supplies all of the fiber that the company deploys to home and businesses.

AT&T now offers fiber optic service in more than 100 U.S. metro areas, reaching a potential audience of more than 18 million homes.

Stankey notes that the company has plans to reach more than 30 million homes by 2025. The company will add service in Mesa, Ariz., close to the new facility, starting in 2023.

“Ultimately everything is moving to one fiber-fed infrastructure to be able to deal with the demand equation,” said AT&T CEO John Stankey, adding the trends are “all rooted by massively increasing amount of consumption.”

Stankey said that data traffic is expected to grow five times its current level over the next five years. “There needs to be infrastructure to deal with that,” Stankey said.

Although AT&T and Corning didn’t disclose the details of their arrangement, Stankey said that the company has made long-term commitments to Corning, “as we do with other major component providers” that covers pricing, volume and other terms.

At an event in Arizona on Tuesday to announce the new facility, Weeks and Stankey will be joined by U.S. Commerce Secretary Gina Raimondo. Both Weeks and Stankey pointed to the Infrastructure and Investment Act, a measure signed into law last year which includes $65 billion for broadband deployment, as a boost to their confidence in expanding capacity.

“In order to have a foundation to invest, you need consistent and stable policy going forward,” Stankey said. The AT&T CEO said that the Biden Administration has recognized that there is a significant percentage of the U.S. population that hasn’t been effectively served by broadband–and that “the infrastructure act is intended to address that.”

Weeks notes that this is Corning’s seventh fiber optic cable manufacturing facility, and stressed that it is the Westernmost location. AT&T CEO Stankey added that the bulky nature of fiber optic cable makes proximity to manufacturing an important factor. Shipping fiber optic cables around the country is costly.

The new plant is “a great step” in that direction but the supply chain is “large and complex,” and there are many other components to look at as well, said Jeff Luong, President – Broadband Access & Adoption, AT&T.

Corning and AT&T have also expanded the Fiber Optic Training Program that kicked off four months ago in North Carolina, following a joint investment in optical cable manufacturing there. It’s not clear what the cost of the training is or how long it takes to become a fully credentialed fiber installer. The companies said the initial class is currently underway in North Carolina and the program aims to train 50,000 American workers over the next five years. The company said the industry needs another 850,000 workers by the end of the 2025 to carry out planned expansion and maintenance of fiber optic networks.

References:

https://www.barrons.com/articles/corning-fiber-optic-plant-arizona-51661818036

Cable Labs: Interoperable 200-Gig coherent optics via Point-to-Point Coherent Optics (P2PCO) 2.0 specs

Cablecos use of 200-Gig coherent optical signals in their broadband access network progressed following a recent interop event at CableLabs that involved a five suppliers of coherent optical modules.

CableLabs confirmed that equipment and silicon from those players – Acacia (now part of Cisco), Ciena, Fujitsu Optical Components, Lumentum and Marvell – were found to interoperate with the organization’s Point-to-Point Coherent Optics (P2PCO) 2.0 specs [1.]. The number of participants might not be high, but what’s important is that the participants include DSP silicon from multiple manufacturers that represent the majority of the coherent optics industry.

Note 1. The P2PCO 2.0 specs doubled the operating capacity – from 100 Gbit/s per wavelength in the 1.0 specs, to 200 Gbit/s.

Demonstrating interoperability among so many different coherent DSP suppliers bodes incredibly well for network operators as it provides multi-vendor interoperability, which promotes scale and competition.

Image Courtesy of Cable Labs

Cable Labs conducted 100-Gig interops in 2018 and 2019. Those efforts tie into a broader initiative to use coherent optics technologies, typically used for long-haul, metro and submarine networks, to expand the capacity of fiber that’s already deployed on the hybrid fiber/coax (HFC) access network.

The CableLabs specs also describe a new technology called the Coherent Termination Device (CTD), which can be deployed in an outdoor aggregation node.

Matt Schmitt, a principal architect at CableLabs, said the scope of CableLabs’ interoperability efforts focus on the modules on the optical end – basically describing how a transceiver works at the physical layer.

And to help fit the cable network environment, the end of the network using the CTD is made to reside outdoors, rather than inside a facility.

“Almost every other application of coherent that you see, both ends of the link are in facilities,” such as a data center interconnect where many links are densely packed with racks and modules, Schmitt explained. The cable access application of coherent optics might involve one end that does sit at a facility, such as a hub site, with the other end involving the aforementioned field-deployed CTD.

“Those field boxes didn’t really exist when we started this,” he said.

The broader concept is to help cable operators improve the performance of their access network fibers situated between headends and hubs and fiber nodes for a range of use cases, and to do so without getting locked into one supplier.

CableLabs and its partners originally thought this 200-Gig interop would be completed sooner, but it was delayed a bit during the pandemic when travelling and in-person gatherings were limited or non-existent.

But Schmitt said the plus side of that intervening period meant that the interop ended up with wider supplier participation, particularly at the DSP (digital signal processor) level, than it might have otherwise.

Beyond raw capacity, the 200-Gig capability should help to support the new distributed access architecture (DAA), supported by multiple remote PHY or remote MAC/PHY devices, and the cable’s industry’s broader pursuit of delivering symmetrical 10Gbit/s performance to customers on the access network.

Schmitt said 200-Gig technology gets particularly interesting when operators look to support large, high-density areas that are being split into smaller service groups. It might also factor in as operators explore services beyond high-speed data over cable, such as mobile XHaul.

The use of CTDs with pluggable optics is also designed to support a relatively easy upgrade path. If an operator starts with 100-Gig, those modules can be swapped out for 200-Gig modules later.

This point-to-point P2P use case is just one aspect of coherent optics being explored by CableLabs. A separate-but-related coherent PON initiative still uses coherent signaling, but is focused on point-to-multipoint links.

For now, Schmitt said CableLabs doesn’t plan to hold another interop for P2PCO v2.0 products. “It really just worked so well. I’m not sure what more there will be to do in a follow-up interop,” he said.

CableLabs would be open to doing qualification testing for these new P2P coherent products if the market demands it. “Thus far, I haven’t been hearing of a big push for that,” Schmitt said. “I think people have been comfortable with what we’re getting from the interops and doing their own testing to see how it works.” As for next steps, this latest batch of handiwork will be showcased at the 10G Lab at CableLabs, Schmitt said.

Meanwhile, future commercial deployments will be determined by the availability of CPDs and interest form cable operators.

Among suppliers involved in the recent interop, Ciena confirmed that it currently has interoperable, CableLabs-compliant 200G coherent pluggables available as part of the supplier’s WaveLogic 5 Nano coherent pluggable portfolio.

Another factor for adoption will be costs compared to the 10-Gig DWDM tech that’s in use today. Schmitt acknowledges that the first endpoint is going to be greater with coherent technology, since it involves putting a switch or router in the field.

“Where it gets interesting is every time you need to add another device that’s sharing that same fiber run,” Schmitt said.

“With coherent, you have a higher upfront cost, but you’re going to have a much lower slope, because as you add more devices, all you have to do is add a pair of gray (standard) optics modules – very low cost … Where’s that crossover point in terms of number of endpoints? To me, is going to be one of the big deciders on when and how widespread the deployment of this technology gets.”

References:

A Jolt of Light: CableLabs Holds First 200G P2P Coherent Optics Interop

First Light for CableLabs® Point-to-Point Coherent Optics Specifications

China Mobile and ZTE complete commercial trial of optical network co-routing detection

ZTE and the Yunnan Branch of China Mobile have completed the commercial trial of co-routing detection in China Mobile’s existing optical network in Yunnan Province, China.

The trial involves two scenarios: co-cable routing detection and co-ditch routing detection. The trial result shows that there will be an early warning of active/standby paths in the same optical fiber or route so that it can be avoided in time based on fiber sensing. Besides, the originally dumb fiber resource will be visualized. Thus, the operator’s service reliability and network O&M efficiency can be greatly improved.

As digital transformation is developing rapidly in all industries, the optical network is facing intelligence challenge. Intelligent OA&M emerges as one of the focus areas, while the problem of low service survivability caused by co-routing becomes serious.

China Mobile cooperated with ZTE to verify the feasibility of co-cable and co-ditch routing detection of service paths on the existing optical network, including active/standby service routing detection and inbound/outbound service route detection at specific sites.

According to the verification, ZTE’s optical network co-routing detection function can exactly detect co-cable routing of 14 optical cables and 54 fiber cores by dynamic parameter optimization, AI algorithm and experience threshold adjustment. Also, ZTE takes analysis, contrast and on-site specialist inspection to exactly detect co-ditch routing of 12 optical cables and about 20 ditches in 4 core equipment rooms. The verification proves that ZTE can provide the operator with flexible optical network co-routing detection methods, along with real-time, accurate and reliable intelligent O&M measures, which well guarantees service survivability and alleviates the difficulty in dumb fiber resource management.

“The function can effectively solve actual problems in production and operation. Before this, active/standby routes are planned on the resource management map, and routing is determined manually, which leads to high error rate. Additionally, the accuracy of resource management information is hardly under control, thereby increasing routing risks,” said the leader of Network Management Center of China Mobile Yunnan.

“In the original routing detection, people pulled or pushed the cable underground manually, which resulted in low efficiency and service interruption. However, the co-routing detection now leverages dumb fiber resources without service switching. The innovative function remarkably reduces manpower and ensures service survivability while allowing resource management information modifications and route re-planning to avoid service interruption losses,” he added.

The trial will further promote the growth of the operator’s autonomous optical network and lay a strong foundation for its intelligent network in the “east-data-west-computing” project. Moving forward, ZTE will continue in-depth research and exploration on autonomous optical networks, and work together with global operators to build new intelligent networks to boost the development of digital economy.

This announcement comes just six days after ZTE said that it has ranked No.1 with a share of 50% in China Mobile’s centralized procurement 2022-2023 of Optical Transport Network (OTN) devices. ZTE’s selected devices will help the operator increase the coverage and bandwidth of its provincial networks to satisfy all-optical network development in the era of computing-network convergence.

This centralized procurement involves provincial backbone, core, aggregation and access, covering all network layers in the provinces. AIso, it imposes high requirements upon device types, transmission performance, and cross-connect capabilities.

At provincial backbone, core and aggregation layers, ZTE’s OTN products provide a single-device cross-connect capacity of up to 64T and a single-fiber capacity of up to 96T. With industry-leading 200G/400G transmission performance, they can provide sufficient network bandwidth for new service growth of China Mobile in the 5G era. At the access layer, ZTE’s compact OTN products based on the ODUk/PKT/VC/OSU unified cross-connect platform can provide access of various services such as 4G/5G/home broadband/enterprise network/edge cloud, significantly decreasing operator’s CAPEX and OPEX.

According to the latest assessment released by GlobalData, ZTE maintains the “Leader” rating in “Core Packet-Optical Transports”, with the “Leader” ratings in “cross-connect capacity and functions” as well as “port capacity”. Also, ZTE is rated as “Very Strong” in “Packet-Optical Access” assessment. In addition, ZTE has received high scores from Lightwave Innovation Reviews in February this year.

Moving forward, ZTE will adhere to technological innovation, step up product R&D, and work with global operators to build new intelligent optical networks and boost the digital transformation of the entire industry.

References:

Verizon upgrades fiber optic core network using latest 400 Gbps per port optical technology from Juniper Networks

Verizon is tripling the capacity of its fiber core network by upgrading older router equipment with new equipment, capable of utilizing the latest 400 Gbps per port optical technology. When the overhaul of the fiber core network (the superhighway Verizon uses to move customers’ data) is complete, Verizon will be able to manage 115 Tbps of data, the equivalent of almost 24 billion streaming songs, at any given moment. This upgrade will significantly increase the bandwidth needed to support wireless, home internet, enterprise, small business and FIOS customers.

In addition to providing the increased bandwidth needed for data growth over the next decade, the new equipment provided by Juniper Networks, Inc. offers many additional operational benefits:

- The equipment is half the size of the existing equipment, reducing space requirements in core facilities and driving down both power usage per GB and cost per GB to operate.

- The new equipment offers an advanced level of automation, allowing for automated interfaces with other network systems to make faster decisions and changes, improving reporting telemetry to advance analytics and real-time adjustments to address congestion or other performance improvements, and incorporating protocols like segment routing to make more intelligent routing decisions. These automations will make the Verizon network even more reliable, programmable and efficient.

- Additionally, because this new equipment is so dense with such large capacity, Verizon will be able to redesign its network architecture to spread the equipment out to additional facilities across geographies, building in an additional level of redundancy with the ability to reroute traffic onto a greater number of fiber routes when needed.

Verizon will replace its legacy 100 Gb/s packet network routers with Juniper’s latest PTX10000-series of modular routers. These use Juniper’s Express silicon that will eventually include the Express 5 platform Juniper introduced earlier this year. The Express 5 silicon can support up to 28.8 Tb/s of throughput, or the equivalent of 36, 800 Gb/s interfaces. This represents a 45% improvement in power efficiency over previous chipsets. The packet optical devices place data packets directly onto and receive them from an optical transport network. They are placed onto that network in what Juniper describes as an “optical transport envelope” that allows that data to bypass “much of the other external networking equipment needed to groom or otherwise process electrical or optical signals originating on the router.” This process reduces the chance of data corruption and allows for closer monitoring of that data.

“Our fiber network is the largely invisible foundation that is a key driving force behind providing the scalability and reliability our customers need and expect,” said Kyle Malady, Executive Vice President, President Global Networks & Technology at Verizon. “This new packet core will provide the reliability and capacity we need today, but more importantly will be able to scale to meet the forecasted future demands that will result from the incredible capabilities of our robust 5G network, the platform for 21st century innovation,” he added.

Kevin Smith, VP of planning at Verizon, said the PTX10000-series update will be replacing its legacy Juniper PTX3000 and PTX5000 routers that it deployed a decade ago. That legacy equipment tops out at 100 Gb/s throughput. “The kind of traffic that is on this network is all of our public and private traffic, global FiOS traffic, all of our wireless traffic, as well as our former XO [Communications] network. As we look ahead and we see both from an infrastructure as well as a customer perspective, a lot for 200-gig and 400-gig for both those places, and our current platform just can’t support that level of services,” Smith said. He added that Verizon expects a 10-times improvement in total throughput with the Express 5 silicon and new chassis footprint. Smith also said that the new equipment is upgradeable to support higher-performing optical protocols like 800 Gb/s and 1 Tb/s per-port optical technology. The current 400 Gb/s move can manage up to 115 Tb/s of data, which the carrier expects to meet network demands through 2032. Updating to 800 Gb/s or 1 Tb/s will increase support to 230 Tb/s of data.

Sally Bament, VP of cloud and service provider marketing at Juniper Networks, said those boxes will include the vendor’s four-slot, eight-slot, and 16-slot chassis housing Juniper’s line cards. Those boxes are more power-dense with a footprint half the size of the existing equipment. This results in each box requiring less power, which drives down power usage per gigabyte and the cost per gigabyte to operate.

Smith advised that the upgrades are just getting started and that it will take a couple of years to complete. This will involve overlaying the new equipment into the same locations as the current deployment as well as installing physically smaller options into more edge locations. That legacy equipment will continue to operate for some time after the new network is turned on as it will need to continue supporting the large number of network elements that will eventually be migrated to the new core.

References:

https://www.verizon.com/about/news/verizon-quadruples-capacity-fiber-network-core

Liberty Global, Telefónica and InfraVia in new UK fiber optic deal; VMO2 is the wholesale client

Liberty Global and Telefónica together will own 50% of the joint venture while InfraVia Capital Partners will own the other 50%. VMO2 will be the anchor wholesale client and provide technical services.

The new (unnamed) entity will roll out fibre-to-the-home to greenfield premises across the UK, with an initial target of 5 million homes not currently served by VMO2’s network by 2026, and an opportunity to expand to an additional 2 million premises. Liberty Global, Telefónica and InfraVia Capital Partners are putting £4.5 billion behind the project, partly through borrowing (more details below).

Liberty Global and Telefónica will jointly have a 50% stake in the JV through a holding company, with InfraVia owning the remaining 50%. VMO2 is acting as the acting as the anchor client, and has apparently pledged to enter into an agreement with the JV upon closing of the transaction. The company will target homes across the UK, both adjacent to the existing VMO2 footprint and new areas. It will seek to attract additional third-party wholesale clients later down the line.

The business plan for the initial rollout of 5 million homes envisages an investment of approximately £4.5 billion, which includes investments related to the roll-out, envisaged connection capex and other related set-up costs. The three partners will fund their pro rata share of equity funding for the build, up to £1.4 billion in aggregate, phased over 4-5 years. In addition, the JV has obtained £3.3billion of fully underwritten debt financing from a consortium of financing banks, including a £3.1bn capex facility. As part of the transaction, InfraVia will make certain payments to Liberty Global and Telefónica, a portion of which will be linked to the progression of the network build-out.

“Telefónica has a recent track record of successfully developing broadband connectivity in many markets through strategic partnerships,” said José María Alvarez-Pallete, Chairman and CEO of Telefónica. “These deals help each country firmly increase their competitiveness and digital infrastructure to help their companies and economy thrive. The UK is, indeed, a growth market for us and we are very excited to be partnering with InfraVia to accelerate access to next generation broadband connectivity to a larger number of UK households and adding to Telefónica Infra’s growing portfolio.”

Vincent Levita, CEO and Founder of InfraVia said: “We are excited to be partnering with VMO2, Liberty Global and Telefónica to build and operate up to 7 million premises FTTH in the UK. The combination of our respective expertise in fibre network deployment, financing and operations in the UK, together with VMO2’s industrial scale and network construction know-how will be key to creating the undisputed second national fibre network in the UK providing access to broadband connectivity to millions of UK households. InfraVia has been a leading investor in digital infrastructure for the past decade. Attracted by the long-term trends of ever-increasing data usage and increased need for home connectivity, this would represent our 5th investment in fibre network deployment in Europe through strategic partnerships. We look forward to working with VMO2, Liberty Global and Telefonica in this partnership in the years ahead.”

Mike Fries, CEO and Vice Chairman, Liberty Global, comments: “This landmark agreement with Liberty Global, Telefonica and InfraVia will expand our FTTH footprint to millions of new UK homes, creating the undisputed second national fibre network in the UK. VMO2 has already committed to upgrading its entire existing 16 million footprint to FTTH. This JV will take our aggregate FTTH footprint to up to 23 million homes, reaching around 80% of the UK. VMO2 will bring significant build expertise, and will benefit from a meaningful off-net growth opportunity and as the anchor client will support attractive returns for the JV – a winning combination. Finally, we are very excited to be working with InfraVia who we already partner with in Germany, and welcome the expertise they bring to the JV.”

The transaction is subject to the usual regulatory approval, and is expected to close in Q4 2022. It seems there is a very high ceiling for the amount of investment money available for fibre rollouts, this new JV represents just one of many recent announcements that involve cash outlays measured in the multiple billions. Whether the ongoing cost of living crisis has any impact on projected consumer upgrades remains to be seen.

References:

Liberty Global, Telefónica and InfraVia Form Joint Venture to Build a New Fibre Network in the UK

Liberty Global, Telefónica and InfraVia plough £4.5 billion into new UK fibre JV