fiber optics

China Telecom with ZTE demo single-wavelength 1.2T bps hollow-core fiber transmission system over 100T bps

China Telecom, along with its partners [1.], says it has launched the world’s first live single-wavelength 1.2T bps hollow-core fiber optics transmission system with unidirectional capacity over 100T bps.

Note 1. ZTE, Yangtze Optical Fibre, Cable Joint Stock Limited Company and Huaxin Design Institute were also involved in the project, which was deployed over a transmission distance of 20km in the live network of the All-Optical Network Technology and Application in the Intelligent Computing Era seminar of the CCSA TC618/NGOF.

ZTE optical transport equipment was used for project, alongside some improvements in spectral efficiency, baud rate optimization, and amplification optimization technologies. The system extends 41 C-band 1.2T bps and 64 L-band 800G bps wavelengths, and archives unidirectional transmission capacity of over 100T bps and a transmission distance of 20km in the field network.

This demonstration completed the hollow-core fiber deployment and large-capacity transmission between China Telecom’s Hangzhou Intelligent Computing Center and Yiqiao IDC. As a key node of China Telecom’s intelligent computing power layout “2+3+7+M”, the Hangzhou Intelligent Computing Center has been deployed with the 1k GPUs computing power of the China Telecom Cloud. It also hails ‘breakthroughs in hollow-core fiber fusion splicing technologies,’ such as low-power discharge and mode field matching related to the demonstration.

To meet the requirements for distributed computing power with large bandwidth and low latency of optical networks, ZTE used its advanced high-speed optical transport equipment. Combined with improvements in spectral efficiency, baud rate optimization, and amplification optimization technologies, the system extends 41 C-band 1.2Tbit/s wavelengths and 64 L-band 800Gbit/s wavelengths. It achieves a unidirectional transmission capacity of over 100Tbit/s and a transmission distance of 20km in the field network.

The hollow-core fiber cable, independently developed by YOFC, is deployed in the field network with multiple waterproofing solutions. For instance, water-blocking glue and double-layer plastic caps are used at the cable ends to isolate the atmosphere, a pulling unit with a swivel is employed for cable deployment to minimize wear on the end caps, and a horizontal waterproof cable closure is utilized at the fusion splice point. Additionally, breakthroughs in hollow-core fiber fusion splicing technologies, such as low-power discharge and mode field matching, have achieved 0.05dB fusion splice loss between hollow-core fibers and 0.25dB fusion splice loss with 54dB return loss between hollow-core fibers and standard solid-core single-mode fibers.

China Telecom’s Zhejiang branch said: “We have always maintained the leading position in the field of basic transmission networks. By undertaking the national key R&D project, we have demonstrated and verified the hollow-core fiber and 1.2Tbit/s transport system in the field network, and can offer detailed engineering data and demonstration applications. In the future, we will further cooperate with the industry to conduct research on a larger scope, and provide practical scenarios for the interconnection of distributed intelligent computing centers.”

China Telecom says they will continue to expand the hollow-core optical cable environment and build a platform for testing and verifying new technologies and applications oriented towards intelligent computing scenarios. This effort aims to continuously promote technological innovation and application expansion in the telecommunications industry.

……………………………………………………………………………………………………………………………………………

Separately, China Telecom received four awards at the “Asia’s Best Managed Companies Poll 2024” by FinanceAsia, a reputable financial magazine in Asia:

⚫ “Best Investor Relations in China” – Gold Award

⚫ “Best Managed Company in China” – Silver Award

⚫ “Best Telecommunication Services Company” – Silver Award

⚫ “Best Large-Cap Company in China” – Bronze Award

……………………………………………………………………………………………………………………………

References:

https://www.telecoms.com/fibre/china-telecoms-claims-a-world-s-first-hollow-core-fibre-demonstration

https://www.chinatelecom-h.com/en/media/news/p240730.pdf

ZTE reports higher earnings & revenue in 1Q-2024; wins 2023 climate leadership award

ZTE and China Telecom unveil 5G-Advanced solution for B2B and B2C services

China Telecom, ZTE jointly build spatiotemporal cognitive network for digital transformation

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

U.S. fiber rollouts now pass ~52% of homes and businesses but are still far behind HFC

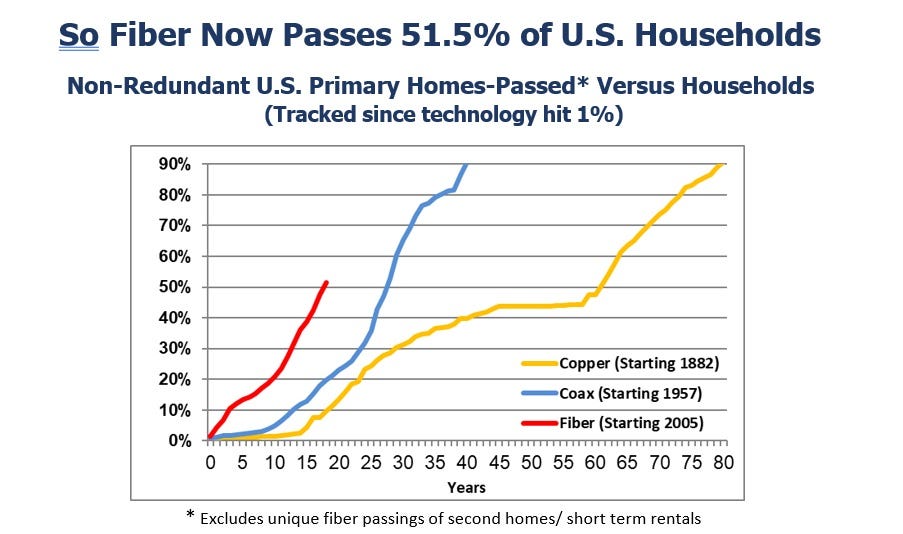

Fiber optic network deployments have reached a milestone as they now pass more than 50% of U.S. households, according to recent report from the Fiber Broadband Association (FBA) [1.] and RVA Market Research and Consulting. Fiber broadband deployment set a new historical record in 2023, passing nine million new homes at a growth rate of 13% year-over-year. The 2023 North America Fiber Provider Survey, sponsored by the FBA, concluded that 77.9 million U.S. homes were passed with fiber, with nearly 52% of all the nation’s unique homes and businesses passed.

Note 1. The FBA is an all-fiber trade association that provides resources, education, and advocacy for companies, organizations, and communities that want to deploy fiber networks. The FBA’s goal is to raise awareness and provide education about the fiber deployment process, safe worksites, and effective fiber installs.

Image Credit: The Fiber Broadband Association (FBA)

………………………………………………………………………………………………………………………………………………………………………………………….

The last $10 billion U.S. Treasury American Rescue Plan (ARP) funding for infrastructure projects such as broadband networks is being distributed this year. The $42.5 billion in NTIA BEAD funding available over the next few years will significantly contribute to enabling and upgrading communities across America with the high-speed, low-latency broadband necessary for participation in today’s 21st-century society. We are seeing a steady stream of NTIA approvals and expect the first states to make BEAD awards in the second half of 2024.

Here’s how the growth of fiber has risen in recent years compared to coax cable (or hybrid fiber/coax, HFC) and the long history of copper.

“Thanks to this latest surge, fiber lines now pass nearly 78 million U.S. homes, up 13% from a year ago,” Alan Breznick, Heavy Reading analyst and the cable/video practice leader at Light Reading, explained in recorded opening remarks here at Light Reading’s 17th’s annual Cable Next-Gen event. Almost 69 million of those locations are “unique” fiber homes, meaning that about 9 million are passed by more than one fiber provider, Breznick added.

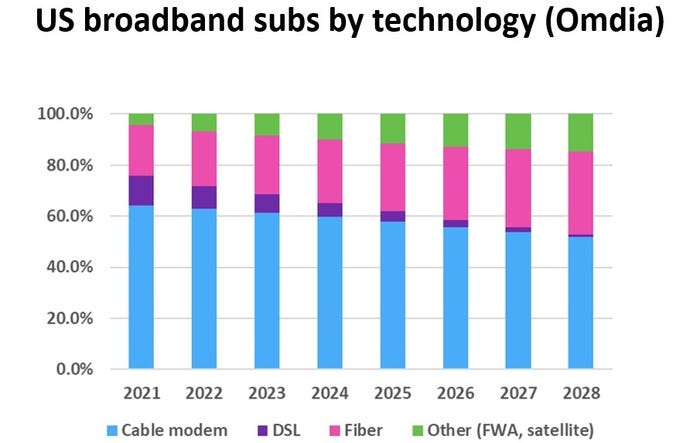

The share of broadband technology is also evolving. While HFC remains the primary way of delivering broadband, fiber-to-the-premises (FTTP) and fixed wireless access (FWA) will continue to make their presence felt in the coming years. Omdia (owned by Informa) expects cable’s share of that mix to drop over the next four years, hitting about 55% by 2028, while fiber’s share is expected to rise to 30% by that time, Breznick explained.

For the cable industry, fiber and FWA are not solely about competition. Many operators are also using FTTP extensively in greenfield deployments and subsidized rural buildouts. They are deploying it on a targeted basis via a new generation of nodes that can support multiple access technologies, including HFC and wireless.

CableLabs has put fiber-to-the-premises on the front burner via a pair of new working groups. A recent survey from Omdia shows that more than one-third of cable operators have already deployed passive optical networking (PON) in some form. That number will “undoubtedly keep rising” thanks to initiatives such as the Broadband Equity Access and Deployment (BEAD) program, Breznick said. Omdia expects spending on next-gen cable technologies to tick up in 2024 and 2025 and then reach a relatively steady annual state through 2029.

Meanwhile, operators such as Mediacom Communications have tapped into FWA to extend the reach of broadband in rural areas. Combined, they demonstrate some of the reasons why the industry has been shedding the “cable” label via rebranding efforts and name changes in recent years.

Cable’s broadband challenge is to grow broadband subscribers as it faces more broadband competition combined with historically low churn and a slow housing move market. “If it feels like an uphill battle for cable, maybe that’s because it is. But that doesn’t mean it has to be a losing battle,” Breznick said. “That’s because the cable industry still has plenty of tricks left up its sleeve.”

Those tricks include the use of next-generation DOCSIS 3.1 (sometimes called DOCSIS 3.1+ or extended DOCSIS 3.1) that can bump up speeds as high as 8 Gbit/s by opening up new orthogonal frequency division multiplexing (OFDM) channels. Some operators, including Comcast, Charter Communications, Rogers Communications, Cox Communications and Cable One, have begun to deploy DOCSIS 4.0 or have put it squarely on their network upgrade roadmaps.

And though cable operators’ network spending is expected to be down in the first half of 2024, vendors are optimistic that the spigots will start to open up again in the second half of the year as operators pick up the pace.

References:

https://www.lightreading.com/fttx/us-fiber-rollouts-reach-tipping-point-but-are-still-far-behind-hfc

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Nokia’s launches symmetrical 25G PON modem

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

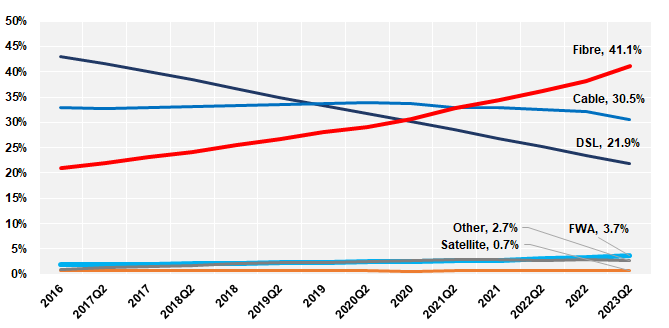

The latest OECD statistics show that Fiber and Fixed Wireless Access (FWA) have seen the strongest growth in fixed broadband technologies in three years. Fibre subscriptions have increased by 56% between June 2020 to June 2023, and FWA subscriptions have increased by 64%. The United States (252%), Estonia (153%), Norway (139%) and Spain (118%) led this FWA growth. The dynamism of fiber and FWA stands in stark contrasts to the decline in DSL (-24%).

Nine OECD countries have more than 70% of fibre connections over total broadband, with Korea, Japan, Iceland, Spain leading the way with the highest fibre penetration rates of 89%, 86%, 85% , and 84%, respectively. The highest fibre growth rates are in Europe, with Austria and Belgium having growth rates of 75% and 73% over the last year, closely followed by Mexico with a growth in fibre of 68%. Two other Latin American countries are in the top 7: Costa Rica and Colombia with fibre growth rates of 42% and 34%, respectively.

Mobile data usage per subscription grew substantially by 28% in one year passing from 10.2 GB to 13 GB per subscription per month in OECD countries as of June 2023. The amount of data consumed in countries vary greatly from 6 GB to 46 GB, with Latvia being the OECD leader.

Despite an already very high mobile broadband penetration in the OECD area, overall mobile subscriptions continue to grow by 4.6% over the last year, which totalled 1.8 billion as of June 2023, up from 1.74 billion a year earlier. Mobile broadband penetration is highest in Japan, Estonia, the United States and Finland, with subscriptions per 100 inhabitants at 200%, 192%, 183% and 161%, respectively.

Eighteen countries were able to provide the number of their 5G subscriptions separately from mobile broadband subscriptions. The share of 5G in total mobile broadband subscriptions is 23% on average for the OECD countries that provided this data.

Machine-to-machine (M2M) SIM cards grew 14% increase in one year. The two leading countries are Sweden with 238 M2M SIM cards per 100 inhabitants and Iceland (203), followed by Austria (179), the Netherlands (93) and Norway (76). Both Sweden and Iceland issue M2M SIM cards for international use.

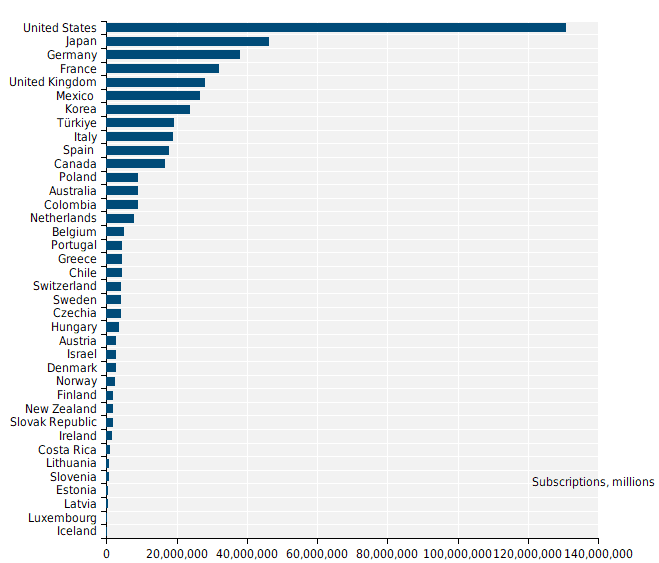

Total number of fixed broadband subscriptions, by country, millions, June 2023:

……………………………………………………………………………………………………………………….

Calix and Corning Weigh In: When Will Broadband Wireline Spending Increase?

Broadband wireline network operators (telcos and MSOs/cablecos) have cutback on CAPEX with decreased spending for network equipment. In its latest earnings call, Calix warned that broadband operator spending might not increase until 2025, when BEAD subsidies have been allocated. However, fiber vendor Corning and others suggested spending might increase earlier than that.

Calix specializes in providing optical network access equipment to smaller broadband service providers and has seen significant revenue growth in recent years, but near-term growth will be challenged. Calix management’s guidance was that the 2024 fiscal year will be soft for its business. Despite that softness, the company still believes that it has years of growth ahead for itself starting in 2025 due to BEAD regulatory stimulus that should prove beneficial for the enterprise.

The U.S. government’s BEAD program promises to funnel a massive $42 billion in subsidies through US states to telecom companies willing to build networks in rural areas. However, allocation of those funds is taking longer than expected, forcing network operators to stall their deployment plans until they have a better sense of how much funding they might get.

“We have seen a significant broadening in the number of customers interested in competing for BEAD [Broadband Equity Access and Deployment program] funds. Today, nearly all our customers are either assembling a BEAD strategy or actively pursuing funds,” Calix CEO Michael Weening said during the company’s quarterly earnings call, according to Seeking Alpha.

“While they do this, they slow their new [network] builds as BEAD money could be used instead of consuming their own capital, and thus, we’ll slow our appliance shipments until decisions are made and funds are awarded,” Weening said. “At that point, the winners will move ahead and those who decided to skip the BEAD program or did not receive BEAD funding, we’ll begin investing to ensure that the winner does not impinge on their market. This represents a delay but also represents a unique opportunity for Calix.”

……………………………………………………………………………………………………..

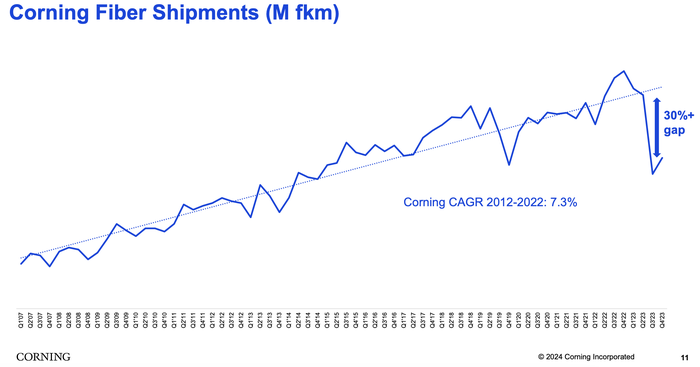

Corning manufactures and sells most of the physical fiber cabling used in U.S. fiber networks. Sales in Corning’s optical business unit – which houses its fiber products – continued to slide in the fourth quarter of 2023.

“We anticipate optical communications sales will spring back because we believe and our carrier customers have confirmed that they purchased excess inventory during the pandemic and that they’ve been utilizing this inventory to continue deploying their networks,” said Corning CEO Wendell Weeks during his company’s quarterly earnings call, according to Seeking Alpha.

“We believe these carriers will soon deplete their inventory and execute on the increased broadband deployment plans they’ve communicated to us over the last several months,” Weeks said. “As a result, we expect them to return to their normal purchasing patterns to service their deployments.”

He also noted that operators are waiting for BEAD funding. “We continue to expect BEAD funding really to start to translate into demand, the beginning of it, sort of late this year. They are progressing with awarding the grants and it will just take a bit for those to turn into real programs,” Weeks said.

Weeks suggested that the company is starting to see the glimmer of an uptick in demand from its broadband operator customers, but nothing definite yet. “We’ll know more in the coming months,” he said in his concluding remarks.

Meanwhile, executives at vendor Harmonic said this week they expect sales in the first half of this year to be relatively soft and then accelerate in the second half of the year as operators start to ramp up network upgrades, including moves to DOCSIS 4.0 technologies.

Deutsche Telekom Network Day: Fiber, Mobile Network, Open RAN and 5G SA Launch in 2024

2023 Deutsche Telekom (DT) Highlights:

- Fiber offensive: more than 2.5 million new fiber connections made possible in 2023, reaching a total of more than ten million fiber households in 2024

- 5G front-runner: 5G population coverage of 96%, 5G Standalone also for private customers in 2024

- State-of-the-art technologies: Artificial intelligence supports fiber and mobile rollout

- EURO 2024: Deutsche Telekom connects all stadiums, fan zones & team quarters, data gift for all mobile customers

………………………………………………………………………………………………………………………………………

DT Network Day photo courtesy of Deutsche Telekom

………………………………………………………………………………………………………………………………………

Deutsche Telekom announced that it has successfully enabled more than 2.5 million new fiber connections this year, thereby realizing its fiber plant expansion target. The company invested EUR 2.5 billion in fiber expansion, expanding coverage in almost 3,500 towns and municipalities. According to the announcement, the company projects a total investment of EUR 30 billion in the fiber optic rollout by 2030.

Its Fiber-to-the-home (FTTH) network is set to reach eight million households by the end of the year, with plans to extend this to ten million fiber optic connections by 2024.

………………………………………………………………………………………………………………………………………..

In mobile, Deutsche Telekom currently provides 5G coverage to 96 percent of the population, serving 80 million people through a network of over 80,000 5G antennas, including 10,000 in the 3.5 GHz band spread across more than 800 cities and municipalities. The network delivers download speeds of up to 1 Gbps.

The company aims to achieve 99 percent 5G coverage for the German population by 2025 and plans to launch 5G Standalone (SA) core network for private customers in 2024. DT indicates that 10,000 antennas are compatible with 5G SA in the 3.6 GHz band, covering more than 800 cities and municipalities. This is up from 9,700 antennas in August 2023.

Deutsche Telekom’s business customers are already using 5G SA technology with functions such as network slicing. For example, for live TV transmission of media or in 5G campus networks for industry and research. “In the coming year, 5G SA should then offer all customers real added value,” DT said.

Meanwhile, rival operators Telefónica Deutschland (O2 Germany) and Vodafone Germany already offer standalone 5G services.

…………………………………………………………………………………………………………………………

DT began the deployment of its open radio access network (O-RAN) in Germany in December, in collaboration with Nokia and Fujitsu. The first O-RAN commercial deployment will be in Neubrandenburg. Nokia and Fujitsu are supplying the necessary technology components.

“Open RAN increases the choice of manufacturers and therefore our flexibility. The open access network enables more automation. And makes our networks even more resilient. This benefits the people that our mobile network connects,” says Claudia Nemat.

The German telco expects to have 3,000 O-RAN compatible antennas by the end of 2026.

…………………………………………………………………………………………………………………………

Deutsche Telekom also says it’s using Artificial Intelligence (AI) in network expansion and mobile communications. AI aids in analyzing and evaluating cell usage and capacity utilization, with the ongoing development of a large language model for telco-specific applications in collaboration with SK Telekom. Additionally, AI contributes to enhanced network security through automated pattern recognition, according to the company.

References:

https://www.telekom.com/en/media/media-information/archive/telekom-network-day-2023-1055364

https://www.fiercewireless.com/wireless/deutsche-telekom-plans-5g-standalone-launch-2024

Bell and FirstLight: 3 new wavelength routes with triple redundancy and speeds up to 400G b/sec

In partnership with FirstLight Fiber, Bell Canada announced new, unique wavelength data routes this week with speeds up to 400G b/sec with triple redundancy between Secaucus, NJ, Toronto, and Montreal, Canada. These data routes, enabling triversity, are expected to be available in Q1 of 2024.

According to the statement, Bell launched 400G wavelength technology in April 2021, delivering increased speeds and the capacity required for large cloud and data centre providers. The technology is said to offer reliable, secure fibre-optic networks for the transport of voice, data, and video.

Additionally, Bell noted that, as Secaucus, NJ is a major data centre hub experiencing growth and increased customer demand, this development will support the company in enhancing network resilience. This improvement addresses the needs of customers requiring connectivity between Canada and the US.

The new routes will terminate at Equinix’s data centre campus in Secaucus, facilitating traffic flow into the U.S. and strengthening the networks for Bell customers.

The introduction of new routes brings triversity to Secaucus, offering alternative connections without the need to pass through New York City for two key routes.

The first route originates in Toronto, directly connecting to Secaucus. The second route from Montreal to Secaucus travels via Albany, creating a diverse pathway. The third route, also from Montreal to Secaucus through the Maritimes, passes through Manhattan.

These routes not only enhance accessibility to Secaucus but also contribute to triversity in New York City. Alongside the existing routes to New York City, these new connections with diverse paths include Toronto to Secaucus to NYC, Montreal to NYC via Albany, and Montreal to NYC via the Maritimes.

Bell Canada said these new routes will fortify its extensive footprint, enabling faster and more reliable data transport between major hubs in Secaucus, Toronto, and Montreal.

……………………………………………………………………………………………………………………………..

“With continued growth in data demand, – particularly because of cloud technology and AI delivered by leading telecom networks like Bell Canada – we are excited to fortify Bell’s extensive footprint further with these new routes, which will enable faster and more reliable data transport between the major hubs in Secaucus, Toronto, and Montréal.”

– Ivan Mihaljevic, SVP, Bell Wholesale

“Given the vast amount of bandwidth we expect AI will require, coupled with the criticality of network resilience, we are delighted to work with Bell Canada to offer these unique routes that provide bandwidth up to 400G, diversely routed between Canada and the United States.”

– Patrick Coughlin, Chief Development Officer for FirstLight.

Bell is Canada’s largest communications company,1 providing advanced broadband wireless, TV, Internet, media, and business communication services throughout the country. Founded in Montréal in 1880, Bell is wholly owned by BCE Inc. To learn more, please visit Bell.ca or BCE.ca.

Through Bell for Better, we are investing to create a better today and a better tomorrow by supporting the social and economic prosperity of our communities. This includes the Bell Let’s Talk initiative, which promotes Canadian mental health with national awareness and anti-stigma campaigns like Bell Let’s Talk Day and significant Bell funding of community care and access, research, and workplace leadership initiatives throughout the country. To learn more, please visit Bell.ca/LetsTalk.

|

1 Based on total revenue and total combined customer connections. |

FirstLight, headquartered in Albany, New York, provides fibre-optic data, Internet, data center, cloud, unified communications, and managed services to enterprise and carrier customers throughout the Northeast and mid-Atlantic connecting more than 15,000 locations in service with more than 125,000 locations serviceable by our more than 25,000-route mile network. FirstLight offers a robust suite of advanced telecommunications products featuring a comprehensive portfolio of high bandwidth connectivity solutions including Ethernet, wavelength and dark fibre services as well as dedicated Internet access solutions, data center, cloud and voice services. FirstLight’s clientele includes national cellular providers and wireline carriers and many leading enterprises, spanning high tech manufacturing and research, hospitals and healthcare, banking and financial, secondary education, colleges and universities, and local and state governments FirstLight was named a Top Workplace USA in 2022 and 2023.

………………………………………………………………………………………………………………………….

References:

Bell Canada Announces New High-Speed Data Routes With FirstLight

Bell MTS Launches 3 Gbps Symmetrical Internet Service in Manitoba, Canada

Bell Canada deploys the first AWS Wavelength Zone at the edge of its 5G network

Bell Canada Partners selects Google Cloud to Deliver Next-Generation Network Experiences

AWS deployed in Digital Realty Data Centers at 100Gbps & for Bell Canada’s 5G Edge Computing

Bell Canada Announces Largest 5G Network in Canada

Precision Optical Technologies (OT) in multi-year “strategic partnership” to upgrade Charter Communications optical network

Rochester, N.Y., based Precision Optical Technologies (OT) has struck a multi-year “strategic partnership” with Charter Communications to upgrade the latter’s optical network. In alignment with Charter’s Distributed Access Architecture (DAA) network expansion and operational enhancement initiatives, this collaboration will see the deployment of nearly all of Precision OT’s active and passive portfolio of solutions; to include 10G DWDM tunable optics, 100G and 400G optics, Bluetooth® DWDM tuning modules, passive connectivity solutions and more. Precision OT didn’t announce the financial terms of the agreement.

Charter plans to upgrade about 85% of its HFC plant using a distributed architecture paired with a virtual cable modem termination system (vCMTS) and “high-split’ upgrades that dedicate more spectrum to the DOCSIS upstream. About 50% of Charter’s HFC plant will be upgraded to 1.2GHz of capacity and 35% will upgrade to 1.8GHz and a full deployment of DOCSIS 4.0. The remaining 15% of Charter’s footprint will be moved to 1.2GHz with a high-split but forgo DAA and a vCMTS.

Greg Mott, SVP Field Operations Engineering at Charter Communications said of the partnership, saying: “The team at Precision OT has a clear understanding of Charter’s broadband network evolution — cost, scale, and speed — and their mix of solutions will help us deliver on our commitments across our 41-state service area.”

Charter has also tapped Harmonic for the vCMTS component and selected Vecima Networks’ DAA platform, including remote PHY nodes. ATX Networks, which recently introduced a 1.8GHz platform that can be used to upgrade legacy Cisco nodes, is also expected to be in the mix at Charter. Teleste, a Finnish supplier that is boosting its investment in the North American cable market as operators push ahead with DAA and D4.0 upgrades, also has projects underway with Charter, according to industry sources.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

With a global footprint, Precision OT currently serves a diverse range of customers across various industries worldwide. Among its clientele are leading broadband service providers in North America, Europe, Latin America, and beyond. This partnership further solidifies Precision OT’s reputation as a trusted partner and solutions provider in the telecommunications and optical technology sectors.

“We are pleased that Charter Communications has chosen Precision OT as a trusted technology partner to deploy cutting-edge optical networking solutions,” said Keith Habberfield, SVP of Sales & Marketing at Precision OT. “Optics and their components are the integration point that enables networks to communicate. We provide a suite of solutions that work in all of Charter’s identified use-cases; this drives measurable operational simplicity and speeds deployments for their project.”

About Charter Communications:

Charter Communications, Inc. (NASDAQ:CHTR) is a leading broadband connectivity company and cable operator serving more than 32 million customers in 41 states through its Spectrum brand. Over an advanced communications network, the Company offers a full range of state-of-the-art residential and business services including Spectrum Internet®, TV, Mobile and Voice.

For small and medium-sized companies, Spectrum Business® delivers the same suite of broadband products and services coupled with special features and applications to enhance productivity, while for larger businesses and government entities, Spectrum Enterprise® provides highly customized, fiber-based solutions. Spectrum Reach® delivers tailored advertising and production for the modern media landscape. The Company also distributes award-winning news coverage and sports programming to its customers through Spectrum Networks. More information about Charter can be found at corporate.charter.com.

About Precision OT:

Precision OT is a systems integration company focused on end-to-end optical networking solutions, network design services and cutting-edge product development advancements. Backed by our extensive experience and robust R&D efforts, we play an integral role in enabling next-generation optical networks worldwide. For more information, visit www.precisionot.com.

References:

https://www.fiercetelecom.com/broadband/charter-plots-3-year-upgrade-deploy-docsis-40-2025

Charter Communications selects Nokia AirScale to support 5G connectivity for Spectrum Mobile™ customers

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

Comcast Xfinity Communities Wi-Fi vs Charter’s Advanced Wi-Fi for Spectrum Business customers

Nokia Bell Labs claims new world record of 800 Gbps for transoceanic optical transmission

Nokia today announced it has set two new world records in submarine optical transmission, both of which will shape the next generation of optical networking equipment.

The first sets a new optical speed record for transoceanic distances. Nokia Bell Labs researchers were able to demonstrate an 800-Gbps data rate at a distance of 7865 km using a single wavelength of light. That distance is two times greater than what current state-of-the-art equipment can transmit at the same capacity and is approximately the geographical distance between Seattle and Tokyo. Nokia Bell Labs achieved this milestone at its optical research testbed in Paris-Saclay, France.

The second record was achieved by both Nokia Bell Labs and Nokia subsidiary Alcatel Submarine Networks (ASN), establishing a net throughput of 41 Tbps over 291 km via a C-band unrepeated transmission system. C-band unrepeated systems are commonly used to connect islands and offshore platforms to each other and the mainland proper. The previous record for these kinds of systems is 35 Tbps over the same distance. Nokia Bell Labs and ASN broke the record at ASN’s research testbed facility, also in Paris-Saclay.

Nokia Bell Labs and ASN presented the scientific findings behind both records on the 4th and 5th of October at the European Conference on Optical Communications (ECOC), held in Glasgow, Scotland.

Making lasers that blink faster:

Nokia Bell Labs and Alcatel Submarine Networks were able to achieve both world records through the innovation of higher-baud-rate technologies. “Baud” measures the number of times per second that an optical laser switches on and off, or “blinks”. Higher baud rates mean higher data throughput and will allow future optical systems to transmit the same capacities per wavelength over far greater distances. In the case of transoceanic systems, these increased baud rates will double the distance at which we could transmit the same amount of capacity, allowing us to efficiently bridge cities on opposite sides of the Atlantic and Pacific oceans. In the case of C-band unrepeated systems, higher baud would allow service providers connecting islands or off-shore platforms to achieve higher capacities with fewer transceivers and without the addition of new frequency bands.

The research behind these two records will have significant impact on the next generation of submarine optical transmission systems. While future deployments of submarine fiber will take advantage of new fiber technologies like multimode and multicore, the existing undersea fiber networks can take advantage of next-generation higher-baud-rate transceivers to boost their performance and increase their long-term viability.

Sylvain Almonacil, Research Engineer at Nokia Bell Labs, said: “With these higher baud rates, we can directly link most of the world’s continents with 800 Gbps of capacity over individual wavelengths. Previously, these distances were inconceivable for that capacity. Furthermore, we’re not resting on our achievement. This world record is the next step toward next-generation Terabit-per-second submarine transmissions over individual wavelengths.”

Hans Bissessur, Unrepeated Systems Group leader at ASN, said: “These research advances show that that we can achieve better performance over the existing fiber infrastructure. Whether these optical systems are crisscrossing the world or linking the islands of an archipelago, we can extend their lifespans.”

………………………………………………………………………………………………………………………….

According to TeleGeography, there were an estimated 1.4 million km of submarine cables in service globally at the start of 2023 and that number is rapidly increasing.

Recent highlights include Orange and ASN agreeing in July to construct the new Medusa cable system between multiple locations in North Africa and Southern Europe. In late September, Telecom Egypt agreed to extend Medusa all the way to the Red Sea.

On a slightly smaller scale, early last month, Telecom Italia Sparkle began offering commercial services on a stretch of the Blue cable system, linking Palermo with Genoa to Milan. It is part of the larger Blue and Raman system, being built in partnership with Google. Once completed, the Blue part will connect various locations on the Med – including Greece and Israel in addition to Italy – while the Raman part will connect Jordan, Saudi Arabia, Oman and eventually India.

Resources and additional information:

https://telecoms.com/524184/nokia-bell-labs-makes-submarine-cables-go-blinkin-fast/

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

Derek Kelly, Lumos’ VP of market development, went as far as to say that “fiber is always the answer,” and suggested cable alternatives will not stand the test of time. Kelly claimed that as $42.5 billion is set to roll out through the Broadband, Equity, Access, and Deployment (BEAD) program, relying on investments in fiber will provide stability over the next 15 years.

“I think we’ve all seen DSL and fixed wireless projects get funded over the last couple of years. And then what happens? Those areas ultimately become blocked from future funding until the definitions change. And then they become available for another grant. And we see public dollars going on top of previous public dollars.” Kelly said. He noted Lumos defines “unserved being no cable, underserved means they’re stuck with cable. And then there’s everyone else that has life-changing fiber. So we don’t care about speeds at this point.”

While acknowledging the need for funding in areas without even cable access, he noted another large-scale program after the BEAD initiative is unlikely. “Cable modems aren’t going to keep up with these definitions forever. Their lobbyists aren’t going to be able to convince people forever just make sure that they just barely can meet the definition of unserved,” he said. “We have communities that don’t have access to fiber. The FCC and NTIA may consider them as served today. And I agree the funding should go to areas that don’t even have cable yet, but the time is coming, where cable is going to be what’s unserved or underserved.”

Fiber execs mostly targeted cable’s “Achilles heel,” which is its lacking symmetric speed capabilities (upstream and downstream).

AT&T Fiber’s EVP Chris Sambar told a large keynote audience, “Don’t ask cable about symmetrical speeds, they don’t even know what that means.” In an earlier blog post, he wrote, “Fiber is superior technology for things like uploading large files and increased bandwidth. It delivers an amazing experience, with multi-gig speeds and equally fast up- and downlinks. It’s also critical for powering technologies like 5G (backhaul) and edge computing (fiber access for ultra low latency). And with a far superior upgradeable capacity to handle soaring demand for high-quality bandwidth well into the future.”

However, Jay Lee, CTO of ATX Networks said that cable operators are “right in the throes” of upgrading their networks to get to full DOCSIS 3.1, and that high-split type of architecture will allow them to achieve competitive speeds in the upstream. “Their downstream is probably two gigabits per second now and there’s a line of sight to be more than that,” he said. “Is it 10 Gig PON? No. But it’s still in that gig threshold that I think is as important from a consumer standpoint,” he added.

The next plan phase for cable is to move up to DOCSIS 4.0, which starts to get toward multi-gigabit upstream and five-plus in the downstream, sometimes upwards of 10 in the downstream. Lee noted that plenty of cable companies are doing “lots” of their own fiber buildouts. “Some of the statements made on cable were like ‘they can’t do anything about it’ and certainly they can. DOCSIS 3.1 high-split is just the start.”

Jeff Heynen, VP at Dell’Oro Group echoed Lee’s comments, noting that current DOCSIS 3.1 mid-split can deliver 2 Gbps downstream and up to 200 Mbps upstream, which is what Comcast is offering today. Charter and Cox’s high-split offerings can go even further, delivering 2 Gbps downstream and up to 1 Gbps upstream.

A recent interoperability test conducted by Cable Labs showed that DOCSIS 4.0 modems paired with CCAP and vCMTS platforms in high-split configurations could deliver up to 8.6 Gbps downstream and 1.5 Gbps upstream. Cable operators have claimed DOCSIS 4.0 modems should become available later this year, with volumes in 2024. Those downstream speeds would give cable “very comparable service tiers to most fiber providers,” Heynen said. “And this is before the outside plant is upgraded to DOCSIS 4.0, which will be capable of delivering up to 10 Gbps down and 6 Gbps up.” However, other analysts have hinted that DOCSIS 4.0 rollouts will take longer than cable companies are saying.

References:

https://www.fiercetelecom.com/broadband/cable-fiber-rivalry-separating-fact-fiction

https://www.business.att.com/learn/articles/docsis-vs-fiber-why-knowing-the-difference-matters.html

https://about.att.com/innovationblog/2022/sambar-fiber-expansion.html

Nokia will manufacture broadband network electronics in U.S. for BEAD program

Nokia has become the first telecom company to announce the manufacturing of fiber-optic broadband network electronics products and optical modules in the U.S. for use in the Broadband Equity, Access and Deployment (BEAD) program.

Using thin strands of glass to transmit data with light, fiber-optic networks have become the backbone of today’s digital economy and are used to connect everything to fast, reliable gigabit data services. Seventy percent of fiber broadband lines in North America are powered by Nokia. Now, partnering with Sanmina Corporation, Nokia will manufacture in the U.S. several fiber-optic broadband products at Sanmina’s state-of-the-art manufacturing facility located in Pleasant Prairie, Kenosha County, Wisconsin, bringing up to 200 new jobs to the state.

By manufacturing fiber-optic technology in the U.S., Nokia will be able to supply its products and services to critical projects like BEAD that are focused on narrowing the digital divide, helping to further contribute to the nation’s economic growth and job creation. Having access to technology that is built in the U.S. is an important requirement for states and infrastructure players seeking to participate in BEAD and the $42.45bn of available funding allocated for broadband rollouts to unserved and underserved communities.

Pekka Lundmark, President and CEO of Nokia, said: “At Nokia, we create technology that helps the world act together. We are committed to connecting people and communities. However, many Americans still lack adequate connectivity, leaving them at a disadvantage when it comes to accessing work, education and healthcare. Programs like BEAD can change this. By bringing the manufacturing of our fiber-optic broadband access products to the U.S., BEAD participants will be able to work with us to bridge the digital divide. We look forward to bringing more Americans online.”

Vice President of the United States, Kamala Harris, said: “President Biden and I are delivering on our promise to strengthen our economy by investing in working people, expanding domestic manufacturing, empowering small business owners, and rebuilding our nation’s infrastructure—today’s announcement is a direct result of this work. Our investments in broadband infrastructure are creating jobs in Wisconsin and across the nation, and increasing access to reliable, high-speed internet so everyone in America has the tools they need to thrive in the 21st century.”

U.S. Secretary of Commerce, Gina Raimondo, said: “President Biden promised to bring high-speed internet to every corner of America, and to do it with American workers and American-made equipment. This announcement is proof that he’s delivering on that promise. When we invest in American manufacturing and American jobs, there’s no limit to what we can achieve. Thanks to the President’s leadership, we’re going to connect everyone in America and create a strong and equitable economy that’s built for the future.”

Jure Sola, Chairman and CEO of Sanmina, said: “Sanmina has been manufacturing in the U.S. for more than forty years and we are excited to partner with Nokia to support their efforts to build robust and resilient high-tech fiber broadband networks that will connect people and societies. By continuing to invest in domestic manufacturing, Nokia and Sanmina will be able to help create a sustainable future for the industry, one that drives job growth and ensures the fiber products produced embody the quality and excellence associated with American manufacturing.”

Nokia fiber-optic broadband products manufactured in the U.S. will include:

- Optical Line Termination card for a modular Access Node

- A small form factor OLT

- OLT optical modules

- An “outdoor-hardened” Optical Network Terminal (ONT)

Resources and additional information

- Seven out of ten fiber broadband connections in North America are made through Nokia equipment.

- Nokia is the top supplier of fiber-optic broadband technology for service providers in the U.S.

- Nokia is the number one vendor for XGS-PON technology globally and in the U.S. market. XGS-PON can deliver up to 10 Gbps (Gigabits-per-second) broadband speeds to end-users. With 10 Gbps, you can download a 4K movie in less than 30 seconds or stream around 1,700 movies simultaneously.

- Nokia was the first to deploy 1, 10 and 25 Gigabit fiber-optic broadband networks in the U.S. with the Electric Power Board (EPB) in Chattanooga, Tennessee.

- Website: More about funding opportunities and Nokia broadband solutions

- Infograph: Why Fiber Broadband is Essential

- Article: U.S. Broadband Infrastructure Funding explained

- Video: Explaining the limitless speeds for fiber broadband

- https://www.nokia.com/about-us/news/releases/2023/08/03/nokia-first-to-announce-manufacturing-of-broadband-network-electronics-products-for-bead-program-in-us/

……………………………………………………………………………………………………………………..

August 16, 2023 Addendum:

Nokia announced today its partnership with Fabrinet to become the first telecom vendor to manufacture fiber broadband optical modules in the U.S. for use in the Broadband Equity, Access and Deployment (BEAD) program.

Starting in 2024, Nokia’s next generation, multi-rate optical modules for Optical Line Terminals (OLTs) will be produced at Fabrinet’s state-of-the- art manufacturing facility located in Santa Clara, California, bringing high-tech innovation and additional jobs to the country.

This news builds on Nokia’s recent announcement that they will produce fiber-optic broadband network electronic products in Kenosha, Wisconsin – expanding Nokia’s list of products and solutions for networks rollouts using BEAD or other funding to help bridge the digital divide.