fiber optics

Nokia and CityFibre sign 10 year agreement to build 10Gb/second UK broadband network

UK wholesale fiber network operator CityFibre [1.] is building an open access network which will connect up to 8 million premises in 285 cities, towns and villages, reaching a third of the country. Nokia’s Lightspan access nodes will be used by CityFibre to offer its wholesale customers multi-gigabit/sec residential broadband (up to 10Gb/s in both directions) and higher bandwidth services such as connecting enterprises and providing backhaul for mobile networks.

Note 1. CityFibre operates the UK’s largest and finest independent Full Fibre platform. Their high quality digital infrastructure enables wholesale customers to serve ultra-reliable, gigabit speed and futureproof broadband, ethernet and 5G services to homes, businesses, schools, hospitals and GP surgeries – plus anything else that need a digital connection.

……………………………………………………………………………………………………………………………………………………

Nokia recently announced a 10-year XGS-PON broadband equipment agreement with CityFibre including access nodes for its nationwide network of purpose-built Fibre Exchanges, fiber modems for customer homes and IP aggregation switches.

Using Nokia’s Quillion chipset, the same access nodes can be used for both XGS-PON and 25G PON (25Gb/s) on the same fiber, should CityFibre wish to do this in the future. Successful delivery of 25G PON for 5G transport using the same Lightspan access node has already been proven by CityFibre, Nokia and the University of Glasgow during a trial undertaken at the end of 2021.

John Franklin, Chief Technology and Information Officer at CityFibre said: “CityFibre is committed to building a Full Fibre network that is ”Better By Design”, providing our partners and their customers with the fastest and most reliable services at the best value. By partnering with Nokia we have enlisted a trusted and market-leading technology vendor to help support a nationwide 10Gbps XGS-PON technology deployment programme.”

Sandy Motley, President, Fixed Networks at Nokia, said: “The demand for ever-faster speeds continues and we’re delighted that our 25G ready solution has been chosen by CityFibre to enable their GPON to 10G XGS-PON national network upgrade program, supporting their mission to offer the highest capacity wholesale services into the UK market.”

John Franklin, Chief Technology and Information Officer at CityFibre said: “CityFibre is committed to building a Full Fibre network that is ”Better By Design”, providing our partners and their customers with the fastest and most reliable services at the best value. By partnering with Nokia we have enlisted a trusted and market-leading technology vendor to help support a nationwide 10Gbps XGS-PON technology deployment programme.”

Sandy Motley, President, Fixed Networks at Nokia, said: “The demand for ever-faster speeds continues and we’re delighted that our 25G ready solution has been chosen by CityFibre to enable their GPON to 10G XGS-PON national network upgrade program, supporting their mission to offer the highest capacity wholesale services into the UK market.”

Usually located in fiber exchanges, Nokia’s high-capacity optical line terminals are deployed for massive scale fiber roll-outs. They connect thousands of users via optical fiber, aggregate their broadband traffic and send it deeper in the network. The fiber access nodes can support multiple fiber technologies including GPON, XGS-PON, 25G PON and Point-to-Point Ethernet to deliver a wide range of services with the best fit technology.

Nokia ONT (Optical Network Termination) devices, or fiber modems, are located at the user location. They terminate the optical fibre connection and delivers broadband services within the user premises or cell sites.

Included in the deal:

- Lightspan MF optical line terminals family (access nodes)

- XS-010X-Q optical network terminations (fiber modems)

- 7220 IXR-D3L IP Aggregation Switch

References:

WOW now offers 1.2G bps download speeds in all markets it serves

WOW! Internet, Cable & Phone, a leading broadband services provider, today announced the launch of its 1.2 Gig high speed data tier in all markets it serves. This highest speed tier is available for all new WOW! residential customers and available as an upgrade for existing residential customers.

The new speed tier offers 1.2 G Mbps download speeds and 50 Mbps upload speeds to support even faster Internet capabilities for residential customers – for work, entertainment, connecting with friends and family, and more – enabling simultaneous streaming, instantaneous downloads, professional-level gaming, and frictionless livestreaming.

“As part of our dedication to bringing customers the fastest, most reliable broadband speeds available, we’re now able to offer our fastest speeds yet across our markets with 1.2 Gig service,” said Henry Hryckiewicz, chief technology officer for WOW!. “Our ability to offer these speeds is just the latest demonstration of the deep capabilities available with our robust fiber network. Our customers now have even more options for staying connected and we look forward to seeing them benefit from it.”

Ongoing effects from the pandemic have reinforced WOW!’s commitment to bring even faster speeds to customers. With changing dynamics for how we work, learn and play, consumers need a reliable internet connection, with 81 percent of adults saying they’ve used bandwidth-hungry video calls since the onset of the pandemic according to Pew Research Center.

Along with its blazing fast 1.2 Gig speeds, WOW! is offering a free modem for the duration that the customer is subscribed to the plan, unlimited data usage where applicable and a $5.00 AutoPay discount.

WOW! is one of the nation’s leading broadband providers, with an efficient, high-performing network that passes 1.9 million residential, business and wholesale consumers. WOW! provides services in 14 markets, primarily in the Midwest and Southeast, including Michigan, Alabama, Tennessee, South Carolina, Florida and Georgia. With an expansive portfolio of advanced services, including high-speed Internet services, cable TV, phone, business data, voice, and cloud services, the company is dedicated to providing outstanding service at affordable prices. WOW! also serves as a leader in exceptional human resources practices, having been recognized eight times by the National Association for Business Resources as a Best & Brightest Company to Work For, winning the award for the last four consecutive years. SOURCE WideOpenWest, Inc. Please visit wowway.com or call 800-560-1824 for more information. Areas served by WOW:

References:

More KPN customers use fiber vs copper for broadband services in Nederlands

Dutch network operator KPN announced a new milestone on its fixed network: more customers are using fiber services than the old copper infrastructure for the first time. The disclosure was made in an internal announcement obtained by Telecompaper. KPN is seeing a steady increase in fiber orders in its consumer/residential market. The company said around 65% of orders are fiber and 35% for services on copper lines (DSL or POTs).

According to the Q1 Dutch Consumer Broadband report [1.], KPN had roughly the same number of residential DSL and fiber subscribers at the end of March, with just over 1.3 million lines each. While it has been adding fiber optic subscribers steadily each quarter, DSL losses remain slightly greater when including its second brand. The total consumer fixed broadband base has been flat (0% growth) over the past year.

Note 1. This Telecompaper report analyses developments in the first quarter of 2022 in the Dutch market for broadband internet access, focusing on consumer connections. The report further includes data on developments, fixed market revenues and broadband revenues. The findings are compared with results from previous periods. The analysis is based on Telecompaper’s continuous research into the development of the Dutch broadband communication services market. The focus is on cable network operators (Ziggo, Delta, Caiway), DSL providers (KPN, T-Mobile, Tele2, Online.nl, Budget Thuis) and FTTH providers (including KPN, T-Mobile, Caiway, Delta, Tele2, Online.nl, Budget Thuis).

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Babak Fouladi, KPN’s Chief Technology & Digital Officer and member of the Board of Management, spoke at the Telecom Insights 2022 conference in May. He said:

“Telecom networks are essential and vital, and we do not only literally ensure that the world remains connected to everything and everyone. Our networks also support massive digitization, essential in crisis situations since online access is often the only door to the outside world and contact with others. Our networks enable people to work from home, study online or continue doing business. In addition, the digital infrastructure contributes to the global economy and to keeping healthcare and education affordable. And our infrastructure makes a structural contribution to reducing CO2 emissions, the use of fossil fuels and cleaner air. Digitization is more and more important as accelerator for sustainability.”

He concluded his speech with an appeal to the Dutch telecom sector: “Let’s make the Netherlands the best connected country in the world! Let’s make it happen, together.”

References:

https://www.overons.kpn/nieuws/en/lets-make-the-netherlands-the-best-connected-country-in-the-world/

Swisscom tests 50G PON technology on a live network

State-owned network provider Swisscom has begun testing 50G PON technology in the live network of an unnamed Swiss municipality, after putting it through its paces in a laboratory in 2020 – the first telco in the world to do so, it claims. Swisscom believes 50G PON will lead to increased flexibility for its business customers, facilitating, for example, additional security features.

Swisscom claims that “50G-PON will lead to a new kind of flexibility in high-speed connectivity, chiefly for business customers, paving the way for additional security service features or connection service attributes. For example, the technology significantly reduces latency compared to today’s standards, and guaranteed transmission speeds can be defined by network slicing (NOTE: network slicing requires a 5G SA Core network and is not intended for fiber optics networks). These are just a few examples that, thanks to 50G-PON, can be included in considerations for new products and services aligned to business customer requirements in the coming years.”

Swisscom plans to introduce the technology by 2025 at the latest. PON technologies can be used in both point-to-point and point-to-multipoint networks. The passive splitter is placed in a point-to-point network rather than in the cable conduit at the control center.

References:

https://www.swisscom.ch/en/about/news/2022/07/11-neuster-glasfasertechnologie.html

https://www.swisscom.ch/en/about/network.html

Future Market Insights: Lit Fiber Market to reach US$ 20B by 2032

The global lit fiber market is expected to witness an impressive growth rate of 16.7% over the forecasted years of 2022 to 2032, according to a new report by Future Market Insights, Inc. The lit fiber market size is anticipated to reach a valuation of around US$ 20 Billion by the end of year 2032 from the current valuation of US$ 4.28 Billion in 2022.

Lit fiber has been used in the IT and telecommunications sectors for a number of noteworthy applications since its beginnings. But in recent years, the sales of lit fiber have grown as a result of the discovery of various more unique applications.

Compared to conventional copper lines, lighted fiber is more durable and extremely resistant to the dangers and traffic found in the previous system. Over the years, the demand for lit fiber has strengthened as an active cable that is set up, controlled, and maintained exclusively by service providers.

Elevated level of data transfer via short- and long-distance communications is made possible by fiber optics that is observed to have strengthened the lit fiber market opportunities. For connectivity, industrial, IT and communications, and security applications, a number of international businesses have started providing illuminated fiber connectivity proliferating the market further.

Increased investment in research and development by key actors leads to the creation of new technologies, and advancements in fiber optic connectivity that is predicted to increase the competition among lit fiber market participants.

Key Takeaways from Market Study:

- The overall growth of the global lit fiber market is estimated to be around US$ 15.7 Billion during the coming decade by following the average CAGR of 16.7%.

- The global market for lit fiber is dominated by multi-modal fiber segment, which is estimated to grow at a rate of 16.3%, while the single-mode segment is projected to develop at the fastest pace of 17.2%.

- The higher selling segment, which accounts for over 60% of the sales revenue, is the lit fiber on-net connectivity items that is expected to grow at a CAGR of 17% during the projection period. And from the other front, the off-net lit fiber segment has grown in popularity recently and is expected to increase the sales of lit fiber over the years 2022 to 2032.

- With a market dominance the networking application segment have historically been the key driver of lit fiber industry expansion. However, due to the product’s growing popularity, a 31.7% growth rate in this segment is anticipated throughout the anticipated time frame.

- Of the world’s major geographical areas, North America accounts for more than 28% of the global lit fiber market. In contrast, the Asia Pacific lit fiber market has recently picked up steam and is expected to increase at an above average CAGR from 2022 to 2032.

Competitive Landscape:

The global lit fibre industry is highly fragmented and is anticipated to see an increased competition in the coming days as a result of the existence of several illuminated fibre market rivals. The major lit fibre companies are prioritising growing their customer base and serving underdeveloped areas at the same time as their major strategy to penetrate wider market.

Some of the well-known market players are among

- AT&T

- Attice USA

- Comcast

- Crown Castle Fiber

- Frontier

- GigabitNow

- Lumen

- Spectrum Enterprise

- Verizon

- Zayo among others

Recent Developments in the Global Lit Fiber Market:

- In line with the target of providing lit plus dark fibre connectivity at Coloblox’s ATL1 Atlanta data centre, FiberLight, LLC, which is a vendor of optical equipment, joined forces in August 2021.

References:

https://www.futuremarketinsights.com/reports/brochure/rep-gb-15116

Telefonica Deutschland in deal with German fiber association (BUGLAS) to connect 5G sites

Germany has been deploying 5G networks for a number of years now. German telecoms regulator Bundesnetzagentur (BNetzA), announced at the end of last year that coverage had reached 53% coverage of the population. However, much work needs to be done to get new 5G sites to be deployed.

Backhaul solutions must be arranged for all of these new sites, delivering the mobile data from the sites back to the network core. Currently, in most mobile markets, this is done through a mix of wireless technologies (primarily microwave spectrum, but increasingly mmWave spectrum) and fibre, both of which can handle the requirements of 5G. In less developed markets, on the other hand, older copper infrastructure is sometimes used, while some of the most remote sites will be forced to use satellite when no other options are practical.

According to the GSMA, microwave and mmWave links will account for at least 60% of global macro and small cell backhaul links from 2021 to 2027.

Nonetheless, it now seems that Telefonica Deutschland is leaning even more heavily into fibre for its backhaul needs, striking a new agreement with BUGLAS to create a pre-negotiated framework agreement. The agreement should provide a basis for all of BUGLAS’s fibre network operators to strike technology, interconnection, maintenance, and service level agreements with Telefonica in a faster and more efficient manner.

BULGAS represents fibre network operators in more than 80 German cities, all of which can now request this framework agreement from BUGLAS.

Image courtesy of Telefonica

“For both 5G and FTTB/H rollout, co-operations are the central, efficient and resource-saving key to the modern gigabit society. In order to bring together the multitude of local, municipal and regional network operators with national providers such as O2 Telefónica, the telecommunications market needs standardized offers and framework agreements,” said Wolfgang Heer, MD of BULGAS. “We are therefore very pleased to have been able to conclude a 5G framework agreement with O2 Telefónica and also invite all other national network operators to join us in discussing further framework agreements and standardization.”

Telefonica views fibre as a more effective choice than terrestrial wireless for its 5G backhaul needs, suggesting that the technology is “significantly faster and more powerful than conventional microwave links”. There is a future-proofing angle here too, with Telefonica suggesting that wireless backhaul will “reach their limits in future” based on the steady growth of mobile and 5G application data that is expected in the coming years.

Telefonica-Deutschland already has over 100 strategic agreements signed with fiber players in Germany, currently connecting its 28,000 mobile sites with fiber. Earlier this year, the network operator agreed to collaborate with NEC to build an OpenRAN, small cell network in Germany which has already been deployed.

References:

https://www.gsma.com/spectrum/wp-content/uploads/2021/02/wireless-backhaul-spectrum-positions.pdf

Telefónica Germany and NEC partner to deliver 1st Open RAN with small cells in Germany

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

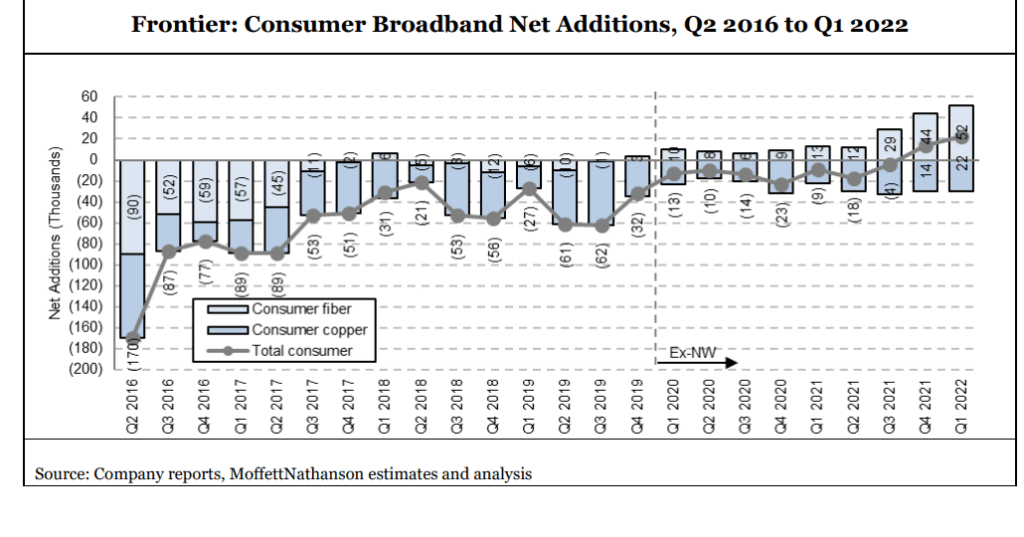

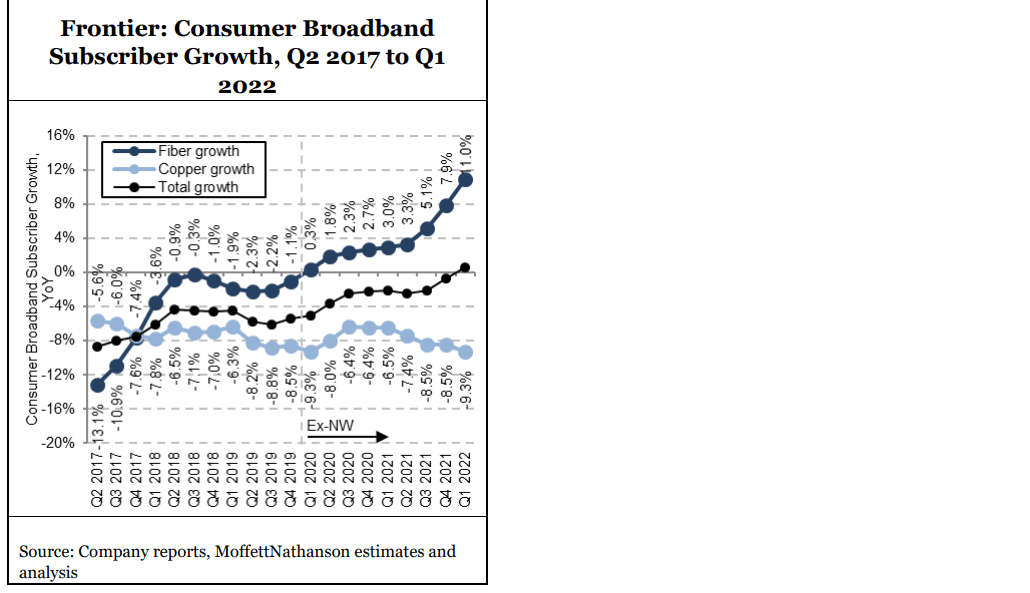

Frontier Communications added a record 54,000 fiber broadband customers in the first quarter of 2022, a 20% gain over the previous record set in Q4 2021 and somewhat higher than expectations coming in to the quarter. These fiber customer adds are coming from both new and existing fiber markets. Frontier’s data continues to track nicely: 22% penetration at the 12-month mark for its 2020 cohort and 18% for its larger 2021 cohort, and 44% at the 24-month mark for its (admittedly small and probably not broadly representative) 2020 cohort. Base market penetration was up 50 basis points in the quarter and 90 basis points over the past two quarters.

Frontier’s aggressive fiber network buildout and a record low churn of 1.19%, enabled the telco to offset copper losses and add 20,000 net broadband subs for Q1 2021. That’s a record nearly two times higher than that set in the prior quarter. Frontier ended the quarter with 1.38 million residential fiber broadband subs, up 11% YoY.

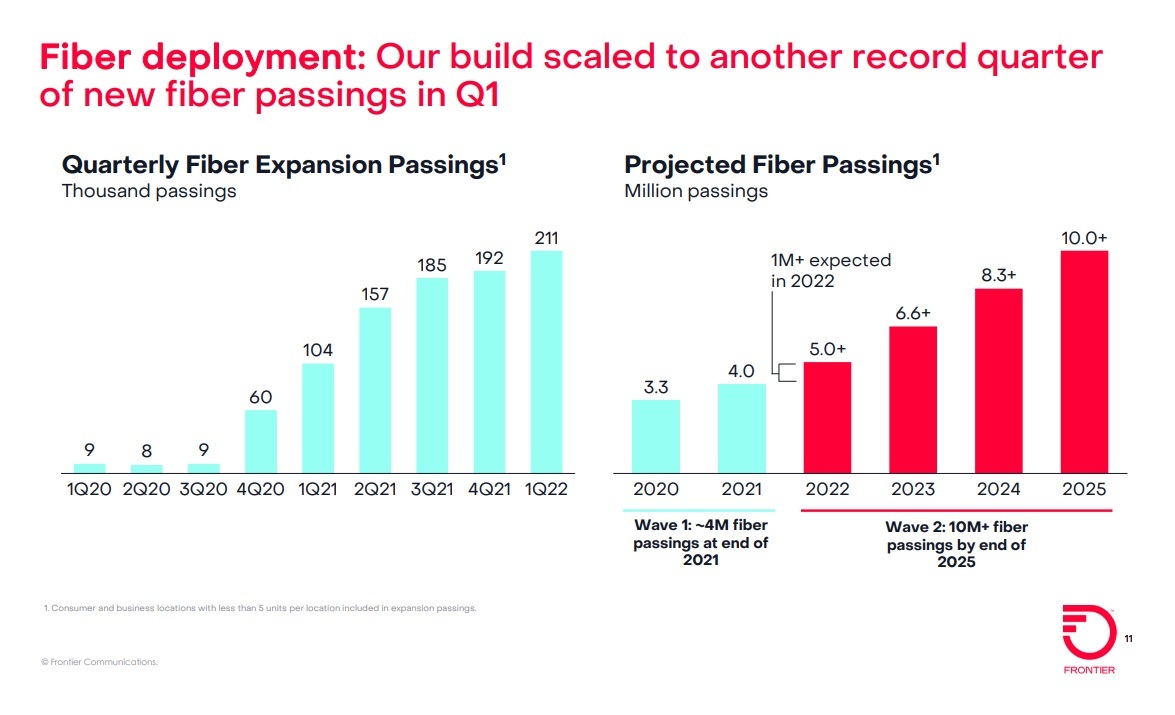

Frontier plans to expand its fiber-to-the-premises (FTTP) footprint to 10 million locations by 2025 – a figure that includes the company’s “Wave 1” and “Wave 2” builds. Frontier built fiber out to another 211,000 locations in the first quarter of 2022, and says it’s on track to add more than 1 million FTTP locations for all of 2022, and another 1.6 million in 2023.

Frontier passed another 211K locations with fiber in the quarter, up from the ~190K level of the prior two quarters, a nice accomplishment in light of the disruptions associated with Omicron early in the quarter (100K of the 211K passings were achieved in March alone). Management continues to expect to add at least 1M fiber locations in 2022, and it seems on track to meet or exceed that target.

“Positive net adds is the new normal,” Nick Jeffery, Frontier’s president and CEO, declared on Friday’s earnings call. The CEO continued:

“We gained momentum in business and wholesale, reaching a key inflection point in SMB and we made progress improving our employee engagement. And last week, we unveiled our new Frontier brand. A year ago, we said we will take a long and hard look at our brand and its future and after a thorough data-driven evaluation I am delighted with the results. Our new brand is modern, more relevant, more tech-oriented, and reflects our commitment to relentlessly being better in our business and for our customers. We also gained customers in our mature fiber market, what we refer to as our base fiber footprint. In our base fiber footprint, penetration increased 50 basis points sequentially to 42.4%. And our base fiber footprint serves as a target for where we expect to drive penetration in our expansion fiber footprint and we expect to steadily grow penetration to at least 45% over time.

In our expansion fiber footprint, we are also making excellent progress. At the 12-month mark, our 2021 build cohort reached penetration of 18%, consistent with our target range of 15% to 20%. And at the 24-month mark, our 2020 build cohort reached penetration of 44%, significantly outperforming our target range of 25% to 30%. As larger builds are pulled into our 2020 cohort throughout the year, we continue to expect penetration of 25% to 30% at the 24-month mark.”

Indeed, Frontier’s operations and service levels have improved dramatically over the past two years. Our colleague Nick Del Deo at MoffettNathanson wrote in a research note to clients:

By some measures, Frontier is now operating at as high a level as key competitor Charter in the California market. And this is having an effect on its customer perceptions and market traction. Its American Consumer Satisfaction Index scores are slowly moving up, while its net promoter score has surged, especially where it has rolled out FTTH. Churn has fallen, as have customer care call volumes.

Frontier’s post-emergence management team has taken a data-driven approach to running the business and making key decisions. Put simply, the choice to refresh the company’s font and logo rather than totally rebrand is further evidence that changes to the business are working.”

To reiterate, 1Q-2022 fiber penetration rates rose to 42.45% in the company’s base fiber footprint. Frontier expects to reach penetration rates of at least 45% over time.

In the expansion areas, Frontier realized a penetration rate of 12% at the 12-month mark in its 2021 fiber build cohort – within its target range of 15%-20%. In the 2020 FTTP build cohort, Frontier is seeing a 44% penetration rate at the 24-month mark, outperforming its target range of 25%-30%.

Source: Frontier Communications Q1 2022 earnings presentation

CEO Jeffery said Frontier’s fiber-powered services are taking share from incumbent cable operators, but didn’t elaborate on how much damage Frontier is inflicting. He also acknowledged that fixed wireless access (FWA) could present an attractive option in rural areas where fiber isn’t present. Jeffery also believes fiber represents “a fundamentally different proposition” over FWA, given current data usage trends. In March, the average Frontier fiber subscriber consumed about 900 gigabytes of data, up 30% from pre-pandemic levels, with a portion consistently consuming more than 1 terabyte per month.

Significantly, Frontier gained new customers in areas where fiber is being built out. “This is critical because we know our future is fiber and fiber customers are the ones that will drive our growth in the years to come,” said Jeffery, a former Vodafone UK exec who took the helm of Frontier in March 2021.

For the full 2022 year, Frontier is targeting adjusted EBIDTA of $2 billion to $2.15 billion, and capital expenditures in the range of $2.4 billion to $2.5 billion, the same as guidance issued last quarter. This implies $2,003M for the remainder of the year at the midpoint. Management continues to target FTTH builds in 2022 of at least 1,000K vs. 638K built in 2021.

References:

https://s1.q4cdn.com/144417568/files/doc_financials/2022/q1/Frontier-First-Quarter-2022-Results.pdf

Altice USA transition to fiber access; MoffettNathanson analysis of low population growth on cablecos broadband growth

Altice USA recently disclosed a plan to overbuild its hybrid fiber-coaxial (HFC) network to blanket 6.5 million locations with fiber by 2025. The NYC based cableco/MSO operates the Optimum and Suddenlink brands, which it plans to rebrand under the Altice USA name.

During a New Street Research investor conference, Altice USA EVP of corporate finance and development Nick Brown said the decision to make that move was a “no brainer” for the company, but acknowledged that it’s in a slightly different position than fellow cable giants Comcast and Charter Communications. Brown stated Altice USA’s own experience and that of its sister companies in Europe gave it better insight into what the transition to fiber would look like in terms of costs and returns, leaving it unafraid to take the leap. But it also already faces “a lot of fiber-based competition relative to others,” especially from Verizon Fios in its legacy Cablevision footprint in the eastern part of the country.

Altice has already upgraded its head ends and backbone rings with fiber. Since DOCSIS would require it to push fiber deeper and deeper into the network anyway, Brown said it made sense to go all-in to pull forward the benefits full fiber has to offer. “The FTTH end-to-end glass network that we’re deploying here in the U.S. for us is pretty much the end state, the logical end state, of a coax upgrade anyway,” Brown argued.

Brown said the move to fiber will allow Altice USA to save in the “low hundreds of millions” of dollars in operating expenses and “materially” reduce its capital expenditures over time. It’s also expected to help Altice more effectively compete by allowing it to offer a better product, reduce churn and improve network reliability. He also pointed out it’ll make future network upgrades easier. Today, it has around half a million active components in its coax network, nearly all of which need to be touched for a DOCSIS upgrade. But with fiber “the equivalent is about 1,000 to 2,000 pieces of equipment that you would need to upgrade to go to next generations of fiber technology as we’re doing this year as we’re moving to XGS-PON,” he said, noting its current fiber footprint of more than 1 million locations was originally built with GPON technology.

“I think it’s just a lot more scalable, a lot more future-proof in our mind, and a lot more cost effective to move to future broadband technologies,” Brown concluded.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

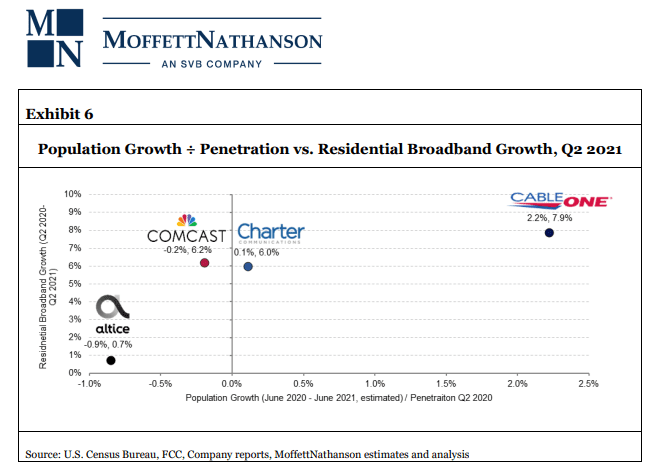

To determine which operators might have been most negatively affected by low population growth (and therefore likely low household growth) from July 2020 to July 2021, and which might have been net beneficiaries of the fastest growth, analysts at MoffettNathanson aggregated the population by county in each cable operator’s footprint using FCC Form 477 data as of Q4 2020. Using those totals, we calculated a weighted average population growth for each operator’s total footprint based on the county-level annual estimates published by the Census Bureau. The weighted-average population growth implies a meaningful headwind to Altice USA (at -0.4% growth), and a significant tailwind to Cable One (at 0.7% growth).

Craig concluded: “Again, there’s a lot more at work in broadband subscriber growth rates than just population (new household formation) growth or starting penetration. Different operators have different demographics. They face different overlaps with fiber, and some will face more FWA than others. They have different pricing strategies.”

References:

https://www.fiercetelecom.com/telecom/altice-usa-exec-fiber-logical-end-state-coax

FTTP build out boom continues: AT&T and Google Fiber now offer Gig speeds to residential/business customers

AT&T has extended its symmetrical 2-Gig and 5-Gig to parts of its full fiber-to-the-premises (FTTP) footprint. The expansion (the full list can be viewed here) follows AT&T’s initial launch of multi-gig services to more than 70 US markets.

AT&T said this expansion includes parts of its fiber footprint spanning more than 100 U.S. metro areas.

AT&T Fiber and their Hyper-Gig speeds will be introduced to 7 all-new fiber metro areas in Texas, Oklahoma and Ohio by year-end 2022. Customers in these areas can sign up to be alerted when AT&T Fiber is available to their address through the company’s Notify Me service by visiting att.com/notifyme.

AT&T said it will continue to expand multi-gig capabilities inside its FTTP footprint in 2022, and reiterated plans to expand fiber to more than 30 million customer locations by the end of 2025. Markets on tap for fiber builds include Abilene, Tyler, Victoria, Wichita Falls, and Longview, Texas; Lawton, Oklahoma; and Youngstown, Ohio.

Pricing on AT&T’s new multi-gig remain at the levels announced last month:

- Residential 2-Gig for $110 per month, or business 2-Gig for $225 per month

- Residential 5-Gig for $180 per month, or business 5-Gig for $395 per month

“We’re thrilled to bring our fastest speeds and our best internet experience to more homes and businesses across the country,” said Rick Welday, Executive Vice President & GM of Broadband, AT&T. “The energy and momentum we have in the marketplace is unmistakable and we are proud to be bringing connectivity to more people every single day.”

“The importance of high-speed broadband internet service has never been clearer,” said Bob O’Donnell, President of TECHnalysis Research. “Whether it’s ongoing hybrid work efforts with bandwidth-hungry video meetings, increasing reliance on high-resolution streaming video content, growing interest in online gaming and more, US consumers recognize the need and value of high-quality internet. Multi-gig fiber ups the ante and answers those demands with faster, reliable, symmetrical download and upload speeds.”

AT&T Fiber is internet that upgrades everything! There’s a big difference in the architectural nature of fiber compared to cable. Cable was designed to provide TV content to households, while fiber was designed specifically to provide high-speed internet. Fiber allows high-capacity tasks, such as uploading large documents during video calls and gaming, to flow seamlessly, even during high-usage times.

……………………………………………………………………………………………………………………………………………………………….

AT&T’s gig FTTP offering comes as Frontier Communications, Verizon Communications and Ziply Fiber, get more aggressive with their own multi-gig offerings. Cablecos like CableOne,Suddenlink Communications (asubsidiary of Altice USA), and Comcast/Xfinity are also offering gig download speeds to residential subscribers.

FTTX (Node, Curb, Building, Home) architectures vary with regard to the distance between the optical fiber and the end user. The building on the left is the central office; the building on the right is one of the buildings served by the central office. Dotted rectangles represent separate living or office spaces within the same building.

…………………………………………………………………………………………………………………………………………………………………

Meanwhile, long dormant (and presumed dead) Google Fiber has moved ahead with the debut of a top-tier broadband service for business users that delivers 2 Gbit/s downstream and 1 Gbit/s upstream. Google Fiber’s Webpass fixed wireless services currently deliver up to 1 Gbit/s. Business 2 Gig is available to any business address in any Google Fiber service area. You can Sign up today to see where truly fast, affordable internet can take your business!

Google Fiber’s new business tier costs $250 per month. It’s being bundled with a static IP address (for components such as web and email servers), a Wi-Fi 6 router and a tri-band mesh extender. The new 2-Gig business tier sells for the same price previously affixed to Google Fiber’s 1-Gig service for business, which has been reduced to $100 per month.

Google Fiber introduced its $100 per month, 2-Gig residential service in the fall of 2020, and initially tested it in Nashville, Tennessee, and Huntsville, Alabama. The company has since launched 2-Gig in other FTTP markets, including Atlanta; Austin; Charlotte, North Carolina; San Antonio; Kansas City (Missouri and Kansas); Orange County; Provo and Salt Lake City, Utah; The Triangle, North Carolina. Google Fiber is in the process of launching services in West Des Moines, Iowa, where it tangles with Mediacom Communications.

………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://about.att.com/story/2022/expands-hyper-gig-fiber-offering.html

https://about.att.com/ecms/dam/pages/internet-fiber/ATT-Fiber-market-cities.pdf

For more information or to check availability for all speed tiers of AT&T Fiber, visit att.com/hypergig

https://fiber.google.com/blog/2022/your-business-now-even-faster/

Ziply Fiber deploys 2 Gig & 5 Gig fiber internet tiers in 60 cities – AT&T can now top that!

Analysts: Increased Fiber internet services may force cablecos to alter pricing & deploy FTTP

MoffettNathanson: Robust broadband and FWA growth, but are we witnessing a fiber bubble?

According to a new comprehensive, market research report from MoffettNathanson (written by our colleague Craig Moffett), Q4 2021 broadband growth, at +3.3%, “remains relatively robust,” and above pre-pandemic levels of about +2.8%.

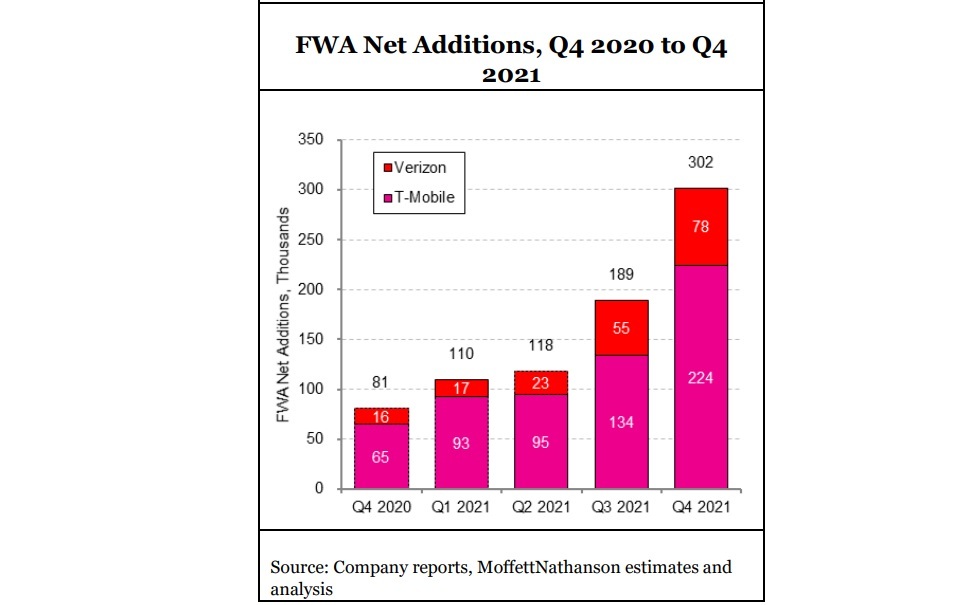

Meanwhile, the U.S. fixed wireless access (FWA market) captured ~ 38% share of broadband industry net adds in the fourth quarter of 2021. Approximately half of Verizon’s FWA customers are coming from commercial accounts, T-Mobile has indicated that about half its FWA customers are coming from former cable Internet subscribers. FWA’s strong Q4 showing left cable’s flow share at just 66%, about the same as cable’s share of installed US broadband households. “In other words, Cable likely neither gained nor lost share during the quarter, and instead merely treaded water,” Moffett noted. FWA “has gone from low-level background noise to suddenly a major force, with Verizon and T-Mobile alone capturing more than 300K FWA subscribers in the fourth quarter,” Craig noted. However, he isn’t sure that wireless network operators will allocate enough total bandwidth capacity for FWA to fully scale.

In 2020, a year that witnessed a surge in broadband subs as millions worked and schooled from home, the growth rate spiked to 5%. Here’s a snapshot of the broadband subscriber metrics per sector for Q4 2021:

Table 1:

| Sector | Q4 2021 Gain/Loss | Q4 2020 Gain/Loss | Year-on-Year Growth % | Total |

| Cable | +464,000 | +899,000 | +3.8% | 79.43 million |

| Telco | -26,000 | +21,000 | -0.4% | 33.51 million |

| FWA* | +302,000 | +81,000 | +463.9% | 869,000 |

| Satellite | -35,000 | -35,000 | -6.6% | 1.66 million |

| Total Wireline | +437,000 | +920,000 | +2.8% | 112.95 million |

| Total Broadband | +704,000 | +966,000 | +3.3% | 115.48 million |

| * Verizon and T-Mobile only (Source: MoffettNathanson) |

||||

U.S. broadband ended 2021 with a penetration of 84% among all occupied households. According to US Census Bureau data, new household formation, a vital growth driver for broadband, added just 104,000 to the occupied housing stock in Q4 2021, versus +427,000 in the year-ago period. Moffett said the “inescapable conclusion” is that growth rates will continue to slow, and that over time virtually all growth will have to stem from new household formation.

Factoring in competition and other elements impacting the broadband market, MoffettNathanson also adjusted its subscriber forecasts for several cable operators and telcos out to 2026. Here’s how those adjustments, which do not include any potential incremental growth from participation in government subsidy programs, look like for 2022:

- Comcast: Adding 948,000 subs, versus prior forecast of +1.25 million

- Charter: Adding 958,000 subs, versus prior forecast of +1.22 million

- Cable One: Adding 39,000, versus prior forecast of +48,000

- Verizon: Adding 241,000, versus prior forecast of +302,000

- AT&T: Adding 136,000, versus prior forecast of +60,000

Are we witnessing a fiber bubble?

“The market’s embrace of long-dated fiber projects rests on four critical assumptions. First, that the cost-per-home to deploy fiber will remain low. Second, that fiber’s eventual penetration rates will be high. Third, that these penetration gains can be achieved even at relatively high ARPUs. And fourth, that the capital to fund these projects remains cheap and plentiful.

None of these assumptions are clear cut. For example, there is an obvious risk that all the jostling for fiber deployment labor and equipment will push labor and construction costs higher. More pointedly, we think there is a sorely underappreciated risk that the pool of attractive deployment geographies – sufficiently dense communities, preferably with aerial infrastructure – will be exhausted long before promised buildouts have been completed.

Revenue assumptions, too, demand scrutiny. Cable operators are increasingly relying on bundled discounts of broadband-plus-wireless to protect their market share. What if the strategy works, even a little bit? And curiously, the market’s infatuation with fiber overbuilds comes at a time when cable investors are growing increasingly cautious about the impact of fixed wireless. Won’t fixed wireless dent the prospects of new overbuilds just as much (or more) as those of the incumbents.”

Moffet estimates that about 30% of the U.S. population has been overbuilt by fiber over the past 20 years, and that the number is poised to rise as high as 60% over the next five years. But the big question is whether there’s enough labor and equipment to support this magnitude of expansion. “Our skepticism about the prospects for all of the fiber plans currently on the drawing board is not born of doubt that there is enough labor to build it all so much as it is that the cost of building will be driven higher by excess demand,” Moffett explained. “There are already widespread reports of labor shortages and attendant higher labor costs,” he added.

“The outlook for broadband growth for all the companies in our coverage, particularly the cable operators, is more uncertain than at any time in memory. IMarket share trends are also more uncertain that they have been in the past. Cable continues to take share from the telcos, but fixed wireless, as a new entrant, is now taking share from all players. Share shifts between the TelCos and cable operators are suppressed by low move rates, likely due in part to supply chain disruptions in the housing market. This is likely dampening cable growth rates. In at least some markets, returns will likely be well below the cost of capital,” Moffett forecasts.

References:

U.S. Broadband: Are We Witnessing a Fiber Bubble? MoffetNathanson research note (clients and accredited journalists)