Fiber to the building

Fiber Build-Out Boom Update: GTT & Ziply Fiber, Infinera in Louisiana, Bluebird Network in Illinois

This week GTT Communications, Infinera, and Bluebird Network all announced network expansions within the U.S. The various announcements follow AT&T’s deal last month with venture capital firm BlackRock to deploy a multi-gigabit fiber network to 1.5 million customer locations using a commercial open access platform.

GTT Communications, Inc., a leading global provider of managed network and security services to multinational organizations, has announced that it has expanded its partnership with Ziply Fiber, a provider of fiber networks purpose-built for the internet, to establish a new network Point of Presence (PoP) to serve the fast-growing data center market in Portland, Oregon. The two companies linked in hopes to “serve the fast-growing data center market” in the city, according to the announcement.

The new PoP is providing an initial 400G of capacity to customers in the U.S. Pacific Northwest region and will expand the power of GTT’s global Tier 1 IP network by offering an additional option for customers to connect in 11 major data centers and the Hillsboro subsea cable landing station, expanding the reach of GTT via Ziply Fiber’s high-count Silicon Forest fiber cross connection service.

“We are pleased to expand our partnership with GTT to establish a new network PoP in Portland to help customers in the region and beyond to connect to area data centers as well as other geographies,” said Mike Daniel, vice president of Enterprise Sales at Ziply Fiber. “Our regional fiber network, combined with GTT’s global Tier 1 network and suite of leading managed networking and security services, will give enterprises new options to improve connectivity securely and reliably.”

GTT’s global Tier 1 IP backbone is ranked among the largest in the industry1 and connects more than 260 cities on six continents. With the addition of the new Portland PoP, GTT customers in the region can benefit from the improved connectivity, security and scalability available through GTT’s suite of managed connectivity services.

Ziply Fiber’s network was architected to meet today’s increasing digital demands and was engineered to be fully redundant, with a dual infrastructure that maintains customer connections even when issues arise. Ziply Fiber maintains a four-state footprint in Washington, Oregon, Idaho and Montana and has built redundancies into its network to avoid service interruptions, while updating routing to steer clear of congestion across the broader internet. This ensures content is accessible directly on the fiber backbone and can be accessed more quickly.

“This new PoP deployment creates an exciting opportunity to use the Ziply Fiber network to allow our regional data center customers to easily connect to and take advantage of GTT’s global Tier 1 IP network and our full suite of managed services offerings,” said Jim Delis, president, Americas Division, GTT. “Our work with Ziply Fiber demonstrates GTT’s continued focus on investment to expand the reach of our network for customers with locations in the Pacific Northwest.”

GTT will offer additional customer options to connect in 11 data centers and the Hillsboro subsea cable landing station. Jim Delis, president for GTT’s Americas Division, stated the PoP deployment will enable the network provider’s data center customers to link into its tier-one IP network.

………………………………………………………………………………………………………………………………………………..

Infinera announced today that the Louisiana Board of Regents, acting on behalf of the statewide Louisiana Optical Network Infrastructure (LONI) and the Board of Supervisors of Louisiana State University (LSU) and Agricultural and Mechanical College, has selected and deployed Infinera’s advanced coherent optical networking solutions to upgrade LONI. Also announced today is the initial deployment of four 400G optical channels along a 220-mile intrastate route in Louisiana.

LONI connects 38 university campuses and data centers and provides connectivity to additional research and education networks in other states. The solution, which increases LONI’s network capacity by a factor of 10, comprises Infinera’s XTM Series open line system and GX Series transponders. The upgraded network expands the ability for the research and education community to share and access information, resources, and remote instruments in real time.

LONI promotes scientific computing and technology across Louisiana and is the backbone infrastructure to the state’s heroic research efforts. These efforts are made possible by utilizing cutting-edge technology to push the limits of scientific discovery at leading university campuses and achievable with LONI’s high-bandwidth optical network. Infinera’s XTM Series line system coupled with GX Series high-performance transponders equips LONI with a 200G/400G/600G solution that offers unmatched high-bandwidth services to its customers today and is scalable to 800G in the future. Infinera’s combined solution delivers superior performance, increasing LONI’s service offering with more bandwidth, greater flexibility, and faster data transfer capabilities.

“A high-capacity state-of-the-art network is critical to enabling breakthrough discoveries that can only be achieved through multi-site collaboration and cloud connectivity,” said Lonnie Leger, LONI’s Executive Director. “We are committed to offering our members up to 100G and deploying Infinera’s innovative solutions, which exceeded both our expectations and commitment, enabling us to exceed what other state universities can offer.”

“LONI operates with a small staff, which requires a highly automated network and cost-effective solution that enables them to meet their bandwidth growth requirements,” said Nick Walden, Senior Vice President, Worldwide Sales, Infinera. “The Infinera team worked closely with LONI to deliver a solution that met their needs now and positions them to meet future bandwidth needs with minimal maintenance and manpower to operate.”

“As bandwidth continues its relentless growth driven by new high-speed applications such as 5G, [augmented reality], [virtual reality], and cloud services, legacy copper-based networks – such as DSL and cable – are simply not capable [of] meeting the bandwidth requirements,” Robert Shore, SVP of marketing at Infinera, told SDxCentral.

Shore added that the current fiber boom “reinforces Infinera’s focus on continuing to innovate and manufacture optical transport solutions that can help network operators effectively leverage their fiber deployments from the core of their network all the way to the very edge.”

Infinera also announced that its ICE6 solution was deployed along the trans-Pacific Unity Submarine Cable System connecting Japan and the U.S., doubling the capacity of that connection.

……………………………………………………………………………………………………………………………………………………….

Bluebird Network completed a 126-mile fiber buildout in Illinois. The route connects the towns of Aurora, Dixon, DeKalb, Sterling, and Rock Falls to Bluebird’s network and services, and provides a “diverse route” to Chicago, the company stated.

Bluebird’s management noted the deployment builds on its recently acquired middle-mile fiber network assets from Missouri Telecom, and expansion into Salina, Kansas, and Waterloo, Iowa.

“Bluebird has no plans to slow down its fiber expansions any time soon,” Bluebird Network President and CEO Michael Morey stated in the release tied to its Kansas and Iowa expansion. “To foster even more growth and strengthen connectivity for businesses in the Midwest, we have builds underway for additional expansions coming online this summer.”

Those moves come on the heels of the AT&T/BlackRock JV that is looking to deploy fiber to more than 30 million locations within AT&T’s 21-state wireline footprint by the end of 2025, and positions the newly created Gigapower entity to boost its reach outside of those initial 21 states.

The deal also prompted a predication from Analysys Mason, saying the move further indicates “that the [U.S.] wireline market is entering a period of profound transformation that will leave it more aligned with the market structures seen in Europe.”

…………………………………………………………………………………………………………………………………………………

References:

https://www.sdxcentral.com/articles/news/us-fiber-build-booms/2023/01/

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

ITU-T: 25 years of increasing fixed-broadband speeds over copper and fiber optic networks

by ITU News

The ITU Telecommunications standardization (ITU-T) working groups on broadband access over metallic conductors (Q4/15) and optical systems for fiber access networks (Q2/15), established in 1997 (25 years ago), laid the foundations for fixed broadband and have since then facilitated the meteoric rise in access speeds. Both groups are part of ITU-T Study Group 15, which looks at networks, technologies and infrastructures for transport, access and home.

DSL: ITU-T Q4/15 was formed to make DSL globally scalable:

“What followed was a 25-year journey of dedicated engineers fighting physics for ever-higher broadband speeds, through several generations of ITU-standardized DSL technology,” says Q4/15 Rapporteur Frank Van der Putten (a strong colleague of this author from 1996-2002 when both of us worked on ADSL and VDSL standards in T1E1.4 and the ADSL Forum).

Building on prior work by Alliance for Telecommunications Industry Solutions (ATIS) committee T1E1.4 and European Telecommunications Standards Institute (ETSI) working group TM6, the DSL technologies standardized by ITU now connect over 600 million homes and businesses to the Internet.

“DSL changed the world by enabling mass-market broadband,” Van der Putten says.

DSL enabled rapid broadband deployment at low cost because it used the existing telephone wires to the home.

“Championed at first by an impassioned few, continually provoking debates among Q4/15 experts, it has been an intellectual catalyst for the advancement of communications technology,” he adds. “We are proud to have played a part in that.”

While ADSL (asymmetric DSL), as defined by ITU in 1999, could deliver 8 megabits per second (Mbit/s), it was followed by ADSL2plus in 2003 at 24 Mbit/s and the very high speed VDSL2 at 70 Mbit/s. With the introduction of vectoring, VDSL2 reached 100 Mbit/s by 2010 and 300 Mbit/s by 2014.

In 2014, G.fast raised the bar to 1 Gbit/s, doubling this to 2 Gbit/s in 2016. Its successor standard, MGfast, achieves an aggregate bit rate up to 8 gigabits per second (Gbit/s) in Full Duplex mode and 4 Gbit/s in Time Division Duplexing mode.

The architecture standards for DSL, G.fast and MGfast were defined by the Broadband Forum (once known as the ASDL forum), which also plays a key part in promoting interoperability.

Van der Putten explains: “Both technologies intend to meet service providers’ need for a complement to the fibre-to-the-home technologies in scenarios where G.fast or MGfast prove the more cost-efficient strategy.”

The continual upgrading of ITU’s standards has also sparked huge upward revisions in forecasts for the life left in traditional telephone wiring.

Future directions for Q4/15 work include G.fast-based backhaul, MGfast at aggregate data rates of 10 Gbit/s, and ultra-low latency transmission optimized for 5G wireless back/mid-haul, he says.

…………………………………………………………………………………………………………………………………………………………………………………………………………

Cost-efficient fiber access – PON and FTTH:

ITU-T Q2/15 paved the way for passive optical network (PON) technologies as a highly cost-efficient means of enabling FTTH. Optical access networks now serve over a billion users worldwide, mostly based on PON. Q2/15 works closely with Full Service Access Network (FSAN), which collects system requirements from operators to determine common requirements for ITU standards.

“The result has been systems ideally suited for a large group of networks and applications,” says Q2/15 Rapporteur Frank Effenberger.

“The first widely deployed system, G-PON [Gigabit PON], is found almost everywhere now,” he adds.

Q2/15 has developed seven generations of PON systems. The first, pi-PON, operated at 50 Mbit/s. This was followed by A-PON (155 Mbit/s), B-PON (622 Mbit/s), G-PON (2.5 Gbit/s), XG(S)-PON (10 Gbit/s), and NG-PON2 (4 x 10 Gbit/s).

To provide the basis for interoperability, ITU standards specify the control system for PON systems. Q2/15 has also developed a range of implementer’s guides and works closely with FSAN, ATIS, and the Broadband Forum to foster common designs and interoperability.

From 10 to 50 Gbit/s PONs:

Demand for higher capacity keeps growing fast. Optical access solutions also support 5G wireless communications and innovation for smart cities and factories.

“What we are seeing is a gradual evolution from G-PON to XG-PON [a 10G, or 10 Gbit/s, network] and XGS-PON [a 10G symmetric network], which is now being deployed at scale in many countries,” says Effenberger.

The latest generation of ITU-standardized PON, known as “Higher Speed PON”, provides for speeds of 50 Gbit/s per wavelength, up from the 10 Gbit/s of its predecessors. Market demand for Higher Speed PON is expected to begin in 2024.

“Given the large size and cost of the fixed access network, upgrades generally come once per decade,” says Effenberger.

Higher Speed PON includes both single-channel 50 Gbit/s systems to succeed XG(S)-PON and multi-channel 50 Gbit/s systems to succeed today’s NG-PON2 – a 40G PON that operates at 10Gbit/s per wavelength.

Although Higher Speed PON offers a five-fold capacity increase over its predecessors, it has been designed to work with the same fibre plant as G-PON, XG(S)-PON and NG-PON2.

“A successful technology requires a coincidence of both technical feasibility and strong global market demand,” notes Effenberger. “We strongly believe that 50G PON will provide the right capacity, at the right price, and at the right time.”

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

All-fiber future at Gbit/s speeds:

Q2/15 aims to continue delivering higher-capacity PON solutions, such as a multi-wavelength version of Higher Speed PON, and speeds even higher than 50 Gbit/s on a single wavelength. But passive networks cannot handle all foreseen demand.

“Certain applications will require more dedicated and higher-capacity solutions than PON,” says Effenberger, highlighting the motivations behind Q2/15’s development of various point-to-point bidirectional optics with speeds of 1 Gbit/s, 10 Gbit/s, 25 Gbit/s, and 50 Gbit/s.

Q2/15 continues to study 100 Gbit/s transmission and point-to-point wavelength connections over a shared optical distribution network based on wavelength division multiplexing. “These are likely to find use in wireless fronthaul applications, given their exacting latency requirements,” says Effenberger.

References:

RVA LLC: Fiber Deployment in U.S. Reaches Highest Level Ever; Google Fiber Returns

Fiber facility service providers passed 7.9 million additional homes in the U.S. in 2022—the highest annual deployment ever, even with challenges in materials supply chain and labor availability, according to a fiber deployment report from the Fiber Broadband Association.

The 2022 Fiber Provider Survey was based on research conducted by RVA LLC Market Research & Consulting (RVA). Their researchers found that there are now a total of 68 million fiber broadband passings in the U.S., with strong recent increases of 13% over the past 12 months and 27% over the past two years. The survey also found that 63 million unique homes have now been passed (this figure “excludes homes with two or more fiber passings”). To date, fiber has passed nearly half of primary homes and over 10% of second homes. The annual fiber deployment rate is likely to be even higher over the next five years as BEAD and other broadband funding programs kick in.

In its research, RVA notes that although deployment expectations from individual companies are in constant flux based on many factors, many service providers have announced network builds exceeding the fiber footprint they have built through private funding. Canada is seeing strong fiber deployment as well, with about 66% of homes passed.

“High-quality broadband has become more important to consumers every year. Fiber broadband exceeds all other types of delivery in every single measurement of broadband quality, including speeds, uptime, latency, jitter, and power consumption,” Gary Bolton, Fiber Broadband Association president and CEO, said in a prepared statement. “For the consumer this has real-world impacts, like more productivity, better access to health care and education, more entrepreneurism, and the option of more rural living. For society, this means more sustainability and, ultimately, digital equity.”

Mike Render, Founder and CEO of RVA, will present the findings of the 2022 Fiber Provider Survey on Fiber for Breakfast, Wednesday, December 28, 2022, at 10:00am ET. Click here to register for the episode.

About the Fiber Broadband Association (FBA):

The Fiber Broadband Association is the largest and only trade association that represents the complete fiber ecosystem of service providers, manufacturers, industry experts, and deployment specialists dedicated to the advancement of fiber broadband deployment and the pursuit of a world where communications are limitless, advancing quality of life and digital equity anywhere and everywhere. The Fiber Broadband Association helps providers, communities, and policy makers make informed decisions about how, where, and why to build better fiber broadband networks. Since 2001, these companies, organizations, and members have worked with communities and consumers in mind to build the critical infrastructure that provides the economic and societal benefits that only fiber can deliver. The Fiber Broadband Association is part of the Fibre Council Global Alliance, which is a platform of six global FTTH Councils in North America, LATAM, Europe, MEA, APAC, and South Africa. Learn more at fiberbroadband.org.

The Fiber Broadband Association is also helping with the expansion by helping to train installers through its Optical Telecom Installation Certification (OpTIC) Path program.

Press Contact:

Ashley Schulte

Connect2 Communications for the Fiber Broadband Association

[email protected]

…………………………………………………………………………………………………………………………………………………………….

Separately, Light Reading says that Webpass to play role in Google Fiber’s new expansion efforts. “As we continue to grow our footprint across the country, we’re integrating this [wireless] method for delivering high-speed service in more areas where it makes sense in all our existing cities and in our new expansion areas as well,” Tom Brownlow, senior network operations manager at Google Fiber, and Blake Drager, the head of technology at Google Fiber’s Webpass business, wrote in a post to the company’s website.

Google Fiber recently announced talks were underway with city leaders in five states – Arizona, Colorado, Nebraska, Nevada and Idaho – about expanding fiber services to various communities. Cities to make Google Fiber’s new-build list recently include Omaha, Nebraska, Mesa, Arizona and Lakewood, Colorado. Brownlow and Drager didn’t specify which of those expansion markets might include wireless offerings.

References:

Comcast demos 10Gb/sec full duplex with DOCSIS 4.0; TDS deploys symmetrical 8Gb/sec service

Comcast announced in a press release it successfully tested a symmetrical multi-gigabit DOCSIS 4.0 connection on its live network, taking a major step toward “offering 10G-enabled services” in the second half of 2023. In Philadelphia, where Comcast is headquartered, it connected service at an undisclosed business location using multiple cable modems and a DOCSIS 4.0-enabled 10G node. If you’re wondering what 10G means, the answer is — more than 5G. As we noted in 2019, the cable industry rolled out its marketing term just in time to have something that’s twice as many Gb/sec as 5G wireless has.

DOCSIS 4.0 technology should enable download speeds of up to 10Gbps with 6Gbps uploads, and Comcast said a lab test in January achieved more than 4Gbps speed in both directions.

Earlier this year, Comcast announced it was working on rolling out multi-gig Internet speeds to more than 50 million residences and businesses in the U.S. by the end of 2025. The company planned on deploying 2Gbps speeds to 34 cities by the end of this month and has also given a slight bump to download speed on internet service in many areas.

The advantage of 10G tech is that it should make multi-gig speeds available for both downloads and uploads (currently, Comcast’s gigabit plans include upload speeds of just 200Mbps), just as it is with fiber optic internet connections. However, for anyone considering upgrading, we should note that you will probably need another new cable modem.

Ideally, this will increase speeds for those in places where fiber isn’t available, especially non-metropolitan areas. And in places that have competition, it measures closer against rivals that deliver fiber services, such as Verizon, AT&T, Google, and Frontier Communications, which are already offering some customers symmetrical multi-gigabit connections.

“We started this year with the announcement of our world-first test of 10G modem technology capable of delivering multi-gig speeds to homes and, as of today, 10G is a reality with the potential to transform and evolve the Internet as we know it,” said Elad Nafshi, EVP and Chief Network Officer at Comcast Cable. “It’s been an incredible year of progress, and we look forward to continuing to refine and harden our 10G technology as we work to make this service—and all its incredible benefits—available to all customers in the years ahead.”

……………………………………………………………………………………………………………………………………………………………………………………………

Separately, TDS Telecom [1.] said its new symmetrical 8Gb/sec (gig) service is already available in more than 75 of its fiber markets and runs $295 per month. While most U.S. operators [2.] are sticking with 2-gig as their top tier product for now, a handful of others have already pushed further into multi-gig territory. AT&T and Ziply Fiber, for instance, both offer residential plans providing up to 5 Gbps. And fewer still have gone beyond that. Lumen Technologies introduced an 8-gig tier for its Quantum Fiber service in August and Google Fiber has announced plans to trot out 5-gig and 8-gig plans in early 2023. Lumen’s service costs $300 per month.

Note 1. TDS Telecom offers internet service across 31 states with the greatest coverage in Wisconsin, Tennessee, and Utah.

Note 2. TDS is competing directly against AT&T, Comcast, Consolidated Communications and Lumen in the territory it serves.

While TDS in a press release pitched the 8-gig product as suitable for power users such as gamers and content creators, an operator representative told Fierce Telecom it doesn’t initially expect significant uptake of the plan. Instead, such offerings are tools in a marketing war being waged across the broadband industry.

Wire 3 offers a 10-gig service to customers in Florida, and Tennessee’s EPB and also provides a 25-gig service. However, it is not likely that consumers need those kinds of speeds currently.

On TDS’s Q3 2022 earnings call, TDS CFO Michelle Brukwicki stated its 1-gig and 2-gig plans are “important tools that will allow us to defend and win new customers.” She added nearly a quarter of new customers are taking its 1-gig service where it is available and its faster, higher-APRU tiers helped it boost residential broadband revenue in the quarter. However, TDS expects to miss 2022 fiber build target.

References:

https://corporate.comcast.com/press/releases/comcast-live-10g-connection-4-gig-symmetrical-speeds

https://www.theverge.com/2022/12/12/23505779/comcast-multi-gigabit-10g-docsis-40-cable-fiber-isp

https://www.fiercetelecom.com/broadband/tds-cranks-fiber-speeds-8-gbps

MoffettNathanson: Fiber Bubble May Pop; AT&T is by far the largest (fiber) overbuilder in U.S.

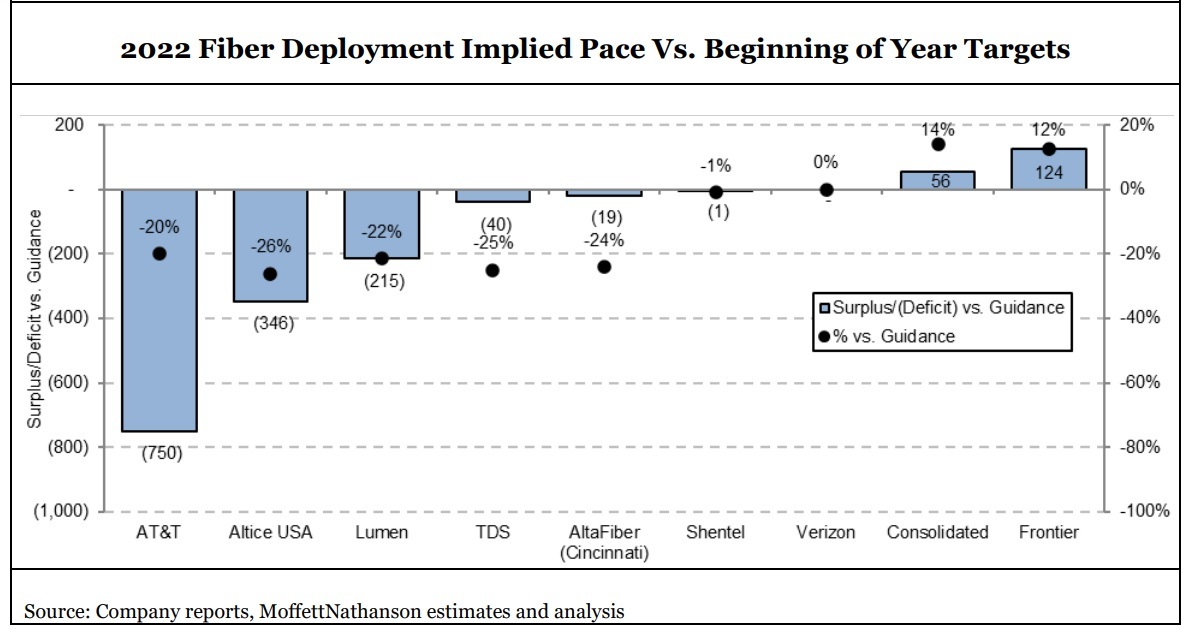

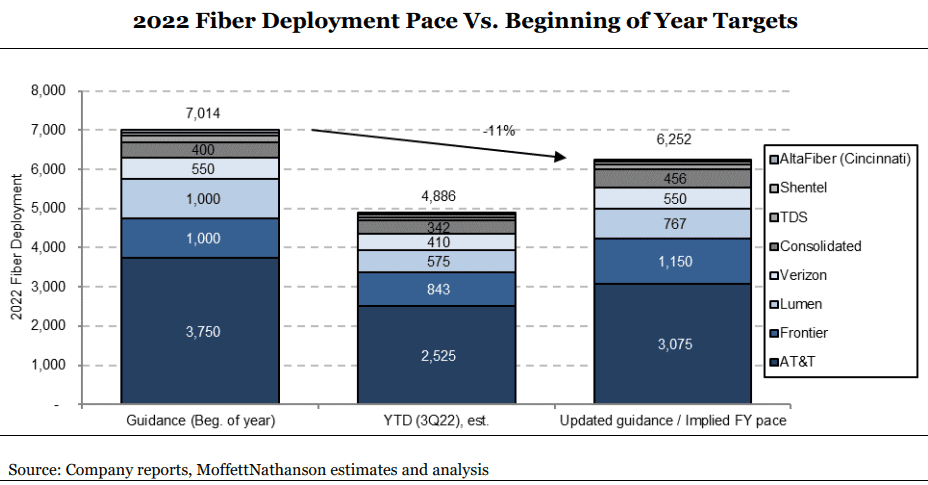

Fiber network build-outs are still going strong, even as the pace of those builds slowed a bit in 2022. Our colleague Craig Moffett warns that the fiber future isn’t looking quite as bright due to an emerging set of economic challenges that could reduce the overall rate of return on those build-outs. Rising costs, reflecting labor cost inflation, equipment cost inflation, and higher cost of capital, all point to diminished investment returns for fiber overbuilds. Craig wrote in a note to clients:

Our by-now familiar tally of planned competitive fiber builds for 2022 started the year at to 6M or so homes passed. By early Spring it had climbed to 7M. It currently sits at ~8M. Next year’s number is flirting with 10M. All for an industry that has never built even half that many in a single year. As we approach the end of the year, however, it is clear that the actual number, at least for this year, will fall short. The number is still high, to be sure… but lower.

There does not appear to be a single explanation for the construction shortfall; some operators blame labor supply, some permitting delays. And some, of course, are actually doing just fine. For the industry as a whole, however, notably including AT&T, by far the nation’s largest (fiber) overbuilder, the number will almost certainly end the year meaningfully below plan. Costs appear to be rising, as well. Here again, there is no single explanation. Labor costs are frequently cited, but equipment costs are rising as well. For example, despite construction shortfalls, AT&T’s capital spending show no such shortfall, suggesting higher cost per home passed. Higher cost per home passed, coupled with a higher cost of capital, portend lower returns on invested capital.

If, as we expect, investment returns for fiber overbuilds increasingly prove to be inadequate, the capital markets will eventually withdraw funding. Indeed, this is how all bubbles ultimately pop. There are already signs of growing hesitancy. To be sure, we don’t expect a near-term curtailment; operators’ plans for the next year or two are largely locked in. Our skepticism is instead about longer-term projections that call for as much as 70% of the country to be overbuilt by fiber. We believe those kinds of forecasts are badly overstated.

As recent as its Q3 2022 earnings call, AT&T has reiterated that it’s on track to expand its fiber footprint to more than 30 million locations by 2025. The company deployed fiber to about 2.3 million locations through the third quarter of this year, but appears hard-pressed to meet its guidance to build 3.5 million to 4 million fiber locations per year.

Given that the fourth quarter is typically a slow construction period, AT&T “looks to be well behind its deployment goals,” Moffett wrote. “If the company retains the pace of deployment in Q3, they will end the year 675K homes short of their goal, or an 18% shortfall compared to the midpoint of their target.”

But AT&T isn’t alone. Lumen has also fallen behind its target, as has TDS and altafiber (formerly Cincinnati Bell) and Altice USA. Those on track or ahead of pace include Frontier Communications, Consolidated Communications and Verizon.

The analysts at Wells Fargo recently lowered their fiber buildout forecasts for 2022 and 2023. They cut their 2022 forecast for the US to about 8 million new fiber locations, down from 9 million. For 2023, they expect the industry to build about 10 million locations, cut from a previous expectation of 11 million.

Though overall buildout figures are still relatively high, some operators recently have blamed a blend of reasons for the recent slowdown in pace, including a challenging labor supply, permitting delays and rising costs for capital and equipment.

“Labor costs are frequently cited, but equipment costs are rising as well,” Moffett noted. “For example, despite construction shortfalls, AT&T’s capital spending show no such shortfall, suggesting higher cost per home passed.”

And, like the pace of buildouts, the cost situation is clearly not the same for all operators. While Consolidated is seeing the cost per home passed rising to a range of $600 to $650 (up from $550 to $600), Frontier expects its costs to remain at the expected range of $900 to $1,000.

But more generally, Moffett believes the returns on those investments “will only weaken further as buildouts are necessarily pushed out to less attractive, lower density, markets.”

One takeaway from that, Craig warns, is that fiber overbuilding is poised not only to generate lower returns that originally hoped, but that there also will be upward, not downward, pressure on broadband prices.

With respect to the pace of fiber build-outs, there’s heavy demand for labor for today’s overbuilding plans, and it will only get heavier as the $42.5 billion Broadband Equity, Access and Deployment (BEAD) program gets started.

With respect to the pace of fiber build-outs, there’s heavy demand for labor for today’s overbuilding plans, and it will only get heavier as the $42.5 billion Broadband Equity, Access and Deployment (BEAD) program gets started.

Remedies are out there, with Moffett pointing to the Fiber Broadband Association’s rollout of its OpTICs Path fiber technician training program earlier this year as one example. ATX Networks, a network tech supplier, is contributing with the recent launch of a Field Personnel Replenishment Program.

But they might not completely bridge the gap. “These efforts may help expand capacity, but they are unlikely to fully meet demand, and they are almost certainly not going to forestall near-term labor cost inflation, in our view,” Moffett wrote.

With rising equipment costs and the cost of capital also factoring in, Moffett views a 20% rise in fiber deployment (for both passing and connecting homes) a “reasonable range” in the coming two to three years.

Moffett wonders if network operators will be forced to raise prices to help restore returns to the levels anticipated when fiber buildout plans were first conceived. While it’s unclear if competitive dynamics will allow for that, “it does appear to us that expectations of falling ARPU [average revenue per user] are misplaced,” Craig wrote.

But the mix of higher cost of capital and deployment for fiber projects, paired with deployment in lower density markets or those with more buried infrastructure, stand to reduce the value of such fiber projects further.

“Capital markets will sniff out this dynamic long before the companies themselves do, and they will withdraw capital. This is, of course, how bubbles are popped,” Moffett warned.

The MoffettNathanson’s report also provided an update on broadband subscriber metrics. US cable turned in a modest gain of 38,000 broadband subs in Q3 2022, an improvement from cable’s first-ever negative result in Q2. Cable saw broadband subscriber growth of 1.2% in Q3, down from +4.4% in the year-ago quarter. U.S. telcos saw broadband subscriber growth fall to -0.5% in Q3, versus +.06% in the year-ago quarter.

Meanwhile, fixed wireless additions set a new record thanks to continued growth at both Verizon and T-Mobile. However, T-Mobile’s 5G Home business posted 578,000 FWA subscriber adds in Q3, up just 3.2% from the prior quarter.

References:

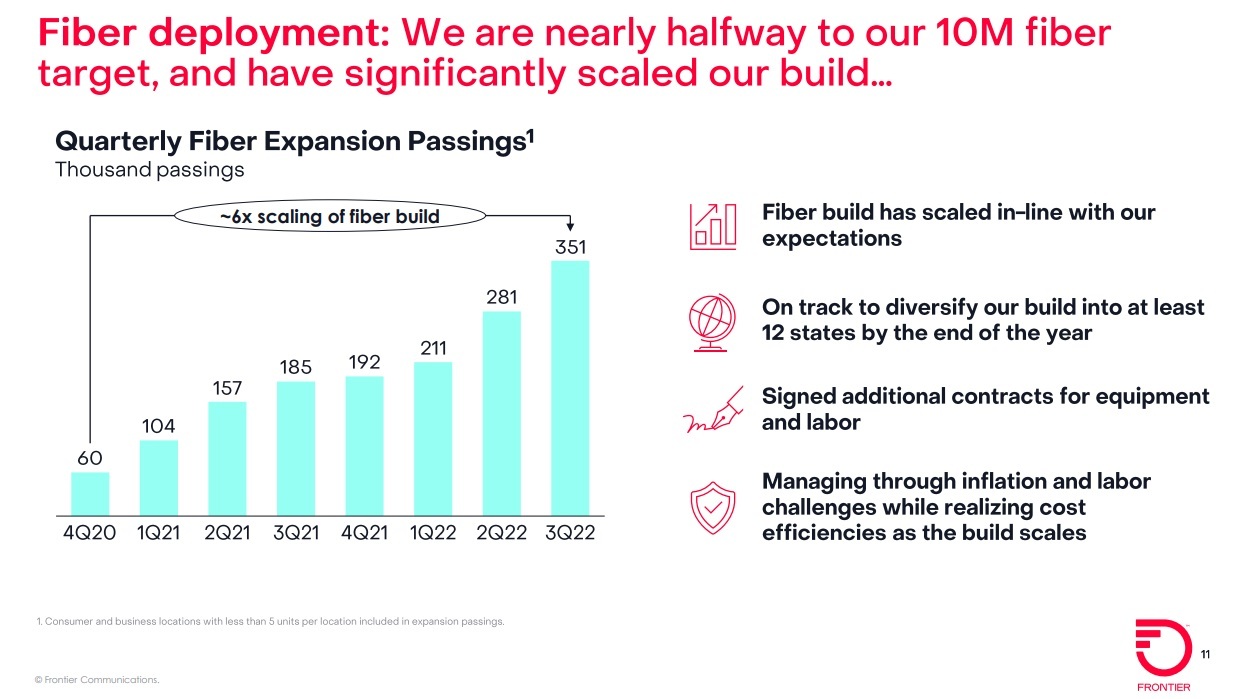

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communicatons massive fiber build-out continued in the third quarter (Q3-2022), as the company added record number of fiber subscribers to reach a total of 4.8M fiber locations. Frontier is poised to reach 5 million locations passed with fiber-to-the-premises (FTTP) networks this month, putting it at the halfway point toward a goal to reach at least 10 million locations with fiber by the end of 2025. The company added a record 64,000 fiber subscribers, beating the 57,000 expected by analysts. That helped to offset greater than expected copper subscriber losses of -58,000. Consumer fiber Q3 revenue climbed 14% to $424 million while consumer copper fiber dropped 3% to $361 million.

Frontier built FTTP to a record 351,000 fiber optic premises in Q3-2022, handily beating the 185,000 built out in the year-ago quarter and the 281,000 built in Q2 2022. Frontier ended Q3 with 1.50 million fiber subs, up 16% versus the year-ago quarter.

“We delivered another quarter of record-breaking operational results,” said Nick Jeffery, President and Chief Executive Officer of Frontier. “Our team set a new pace for building and selling fiber this quarter. At the same time, we radically simplified our business and delivered significant cost savings ahead of plan. This is a sign of a successful turnaround.

“Our team has rallied around our purpose of Building Gigabit America and is laser-focused on executing our fiber-first strategy. As the second-largest fiber builder and the largest pure-play fiber provider in the country, we are well-positioned to win.”

Third-quarter 2022 Highlights:

- Built fiber to a record 351,000 locations to reach a total of 4.8 million fiber locations, nearly halfway to our target of 10 million fiber locations

- Added a record 66,000 fiber broadband customers, resulting in fiber broadband customer growth of 15.8% compared with the third quarter of 2021

- Revenue of $1.44 billion, net income of $120 million, and Adjusted EBITDA of $508 million

- Capital expenditures of $772 million, including $18 million of subsidy-related build capital expenditures, $442 million of non-subsidy-related build capital expenditures, and $170 million of customer-acquisition capital expenditures.

- Net cash from operations of $284 million, driven by healthy operating performance and increased focus on working capital management

- Nearly achieved our $250 million gross annual cost savings target more than one year ahead of plan, enabling us to raise our target to $400 million by the end of 2024

In Frontier’s “base” fiber footprint of 3.2 million homes (in more mature areas where fiber’s been available for several years), penetration rose 30 basis points in Q3 to 42.9%. “When we look at the growth over the past year, we see a clear path to achieving our long term target of 45% penetration in our base markets,” Frontier CEO Nick Jeffery said.

Penetration rates in Frontier’s expansion fiber footprint for the 2021 cohort is on target and is exceeding expectations in the 2020 expansion fiber footprint, he said.

Fiber ARPU (average revenue per user) was up 2.6% year-over-year, but came a little short of expectations thanks in part to gift card promotions. Frontier’s consumer fiber ARPU, at $62.97, missed New Street Research’s expectation of $63.67 and a consensus estimate of $64.51. Copper ARPU, however, beat estimates: $49.65 versus an expected $48.57.

Frontier CEO Jeffery said faster speeds remain a top ARPU driver, with 45% to 50% of new fiber subs selecting tiers offering speeds of 1Gbit/s or more. Fiber subs taking speeds of 1Gbit/s or more now make up 15% to 20% of Frontier’s base, up from 10% to 15% last quarter, he said.

Frontier currently has no plans to raise prices due to inflation and other economic pressures, but the company left the door open to such a move.

“We’ll be a rational pricing actor in this market,” Jeffery said. “If those [inflationary pressures] don’t moderate, then of course we maybe consider pricing actions to compensate…just as we’re seeing others doing.”

Frontier also has no immediate plans to strike an MVNO deal that would enable it to use mobile in a bundle to help gain and retain broadband subscribers – a playbook already in use by Comcast, Charter Communications, WideOpenWest and Altice USA.

As churn rates remain stable and low, Jeffery explained, “the argument for using some of that scarce capital to divert into an MVNO to solve a problem that we don’t yet have, I think, would probably not make our shareholders super happy.” Importantly, Frontier has experience in the mobile area from execs who previously worked at Vodafone, Verizon and AT&T.

“We’re watching it very closely and if consumer behavior changes or if the market changes in a material way that impacts us such that moving some of our scarce capital to build or partner with an MVNO would be a smart thing to do, we’ll do it and we’ll do it very quickly,” Jeffery said. “But now isn’t the moment for us.”

Frontier ended the quarter with $3.3 billion of liquidity to fund its fiber build. Beasley said Frontier has additional options if needed, including taking on more debt, selling non-core real estate assets, access to government subsidies and the benefits of a cost-savings plan that has exceeded the target (from an original $250 million to $400 million).

References:

The conference call webcast and presentation materials are accessible through Frontier’s Investor Relations website and will remain archived at that location.

https://events.q4inc.com/attendee/387527166

https://www.lightreading.com/broadband/frontiers-big-fiber-build-nears-halfway-point-/d/d-id/781503?

Clearwave Fiber Expands Fiber Buildout in Savannah, Hinesville and Richmond Hill, GA

Clearwave Fiber [1.] continues its construction of a state-of-the art, all-Fiber Internet network in the “Coastal Empire.” This latest expansion for the Savannah-based operation marks a continuation of almost 6,000 route miles of Fiber in the Southeast and Midwest. The company’s goal is to bring the most advanced and fastest Internet available to more than 500,000 homes and businesses across the United States by the end of 2026.

Note 1. Clearwave Fiber was formed in January of 2022 as a rebranding of Hargray Fiber, which has been serving the Southeast for 70+ years. Senior leadership and operations management have a long history with Hargray and now lead Clearwave Fiber during this rapid expansion.

………………………………………………………………………………………………………………………………………………………..

“Clearwave Fiber is excited to contribute to the continual growth in Southeast Georgia and provide such a crucial resource to residents and commercial operations,” said Clearwave Fiber General Manager John Robertson. “We’re committed to providing communities with the high-speed connectivity that is essential for families, businesses and local economies.”

“We’re ingrained in the fabric of Savannah and its surrounding communities,” said Clearwave Fiber Chief Operating Officer Gwynne Lastinger. “Our sales and technical support staff live and work in the Coastal Empire and we continue to add to our team of more than 500 throughout the Southeast and Midwest.”

With gigabit download and upload speeds, Clearwave Fiber will bring 10 times more speed to consumer doorsteps at a time when fast, reliable Internet is becoming increasingly critical to modern households and businesses. Remote work, streaming, gaming, smart home technology and multiple device connectivity all require robust, reliable connections. Clearwave Fiber is committed to providing hassle-free, high-quality Fiber data connection to every location of its growing footprint.

“We’re seeing an increase in households where multiple online activities are occurring at the same time. Many Internet connections aren’t up to the task of keeping it all running at top speeds,” said Robertson. “Clearwave Fiber solves the problem of the bandwidth issues that happen when everyone in the house is connected. We also have solutions for businesses that keep them operating on a fast, reliable network.”

For many consumers, Internet touches every facet of daily life. Remote work, telehealth, and virtual learning all require robust, reliable connections. A 2022 study by Deloitte indicated that 45 percent of surveyed households include one or more remote workers, and 23 percent include at least one or more household member attending school from home. Additionally, 49 percent of U.S. adults had virtual medical appointments in the past year.

In addition, the Deloitte report noted that the average U.S. household now utilizes a total of 22 connected devices, including laptops, tablets, smartphones, smart TVs, game consoles, home concierge systems like Amazon Echo and Google Nest, fitness trackers, camera and security systems, and smart home devices such as connected exercise machines and thermostats.

Supporting this burgeoning ecosystem of household devices can challenge companies serving customers over DSL or cable systems. “Older copper wire and coaxial networks worked just fine for the technologies they were built for. Copper lines are great for telephone calls and coax worked well for cable TV, but those networks struggle to deliver the kind of bandwidth possible with fiber,” noted Lastinger. “Fiber optic technology is the future. Fiber networks are more durable, more consistent, and they move data at the speed of light. Best of all, our network easily keeps pace with technology innovations, exponentially increasing demands for bandwidth, and evolving customer needs. The options are almost limitless.”

Fiber networks are currently being installed on Wilmington and Whitemarsh Islands, Windsor Forest, Hinesville, Rincon, Pooler and Richmond Hill. Clearwave Fiber is scheduled to complete these projects by the end of November and will continue working in other areas in the region into 2023 and beyond.

For more information, visit ClearwaveFiber.com

References:

Altice USA bets on FTTP with multi-gigabit speeds by 2025; MVNO with T-Mobile

Dexter Goei, Altice USA’s outgoing CEO, continues to strongly defend the company’s decision to upgrade large portions of its network to fiber, stating that the product and business performance of the move make dollars and sense. Altice USA’s current plan is to upgrade about 6.5 million passings to fiber-to-the-premises (FTTP) by 2025 and back that up with multi-gigabit speeds, which Altice USA has begun to soft-launch in parts of its fiber upgrade areas.

At the Goldman Sachs Communacopia + Technology conference in San Francisco, Goei said while the company has made strides in deploying its fiber network — it expects to finish 2022 with up to 2.3 million homes passed with the technology — it is still seeing customer declines in its former Cablevision and Suddenlink footprints.

In Altice’s former Cablevision systems in metropolitan New York City, gross additions are lower, there is less move activity and churn levels are low, but the company also is competing against a telco — Verizon Communications — that has been extremely aggressive on price. In its Suddenlink markets mainly in the Midwest, gross addition activity is high but churn is high, especially in markets where it is being overbuilt.

“We’re still losing subs in both markets but for different reasons,” Goei said. “We feel good about the fourth quarter turning around and looking better next year.”

Altice USA lost about 3,000 subscribers in 2021 — the only major cable operator to do so — and shed more than 50,000 broadband customers in the first half of this year.

Altice began accelerating its fiber rollout last year, with a goal of passing 6.5 million homes by 2025. At the Goldman conference, Goei said the company expects to end 2022 with 2.2 million to 2.3 million homes passed with fiber (an increase of about 1 million homes), and should add another 1.6 million to 1.8 million households by the end of 2023.

While other cable operators have seen an increase in competition from fixed wireless access providers from telcos, Goei said most of Altice USA’s telco competition is replacing slower DSL lines with fiber, hence the acceleration of its own fiber buildout plans. But he shared his peers’ disdain for fixed wireless access (FWA), agreeing with some pundit predictions that the technology will reach a performance and penetration plateau in the next two or three years.

Goei announced his intention to step down as CEO earlier this month, and will become executive chairman of Altice USA on October 3. In his place the company named Comcast executive Dennis Mathew as CEO, also effective October 3. Mathew has 17 years of experience with Comcast, most recently as senior VP of its Freedom Region (Southeast Pennsylvania, New Jersey and Northern Delaware). He earlier served as senior VP for its Western New England Region (Connecticut, Vermont, Western Massachusetts and areas of New York and New Hampshire) and has extensive experience in running cable businesses.

Goei said at the Goldman conference that his main motivation for stepping down was a desire to return to Europe, where he spent his childhood and most of his professional career, with his family. He added that he notified the Altice USA board of his decision about a year ago, starting the search process for a replacement about six months ago. He believes he’s leaving Altice USA in capable hands.

“I interviewed many, many people during the process; Dennis fits the bill across the board,” Goei said, adding that Mathew has a proven track record in operations, running one of Comcast’s most high-profile regions (the Freedom Region) and will fit in well with the Altice team. “He’s just a great guy, a team player, will focus on the prize and is someone who would do very well with the executive team at Altice USA.”

The average revenues per user (ARPU) on Altice USA’s fiber-based products are 7% to 8% higher than ARPU on cable-based services, he said. Additionally, churn rates on fiber services are also coming in about 6% to 8% lower than on HFC, and the NPS (net promoter score) for the fiber product is also coming in higher.

“Every single metric that you can imagine – that you would anticipate – are better” on the fiber product, Goei said. He acknowledged, however, that the installation process for fiber customers getting a triple-play bundle that includes pay-TV and voice could be better.

As for Altice USA’s fiber network build update, the company finished almost 270,000 new homes in the second quarter of 2022, a record the company expects to beat in Q3 and, weather permitting, in Q4.

For 2022, Altice USA expects to complete an additional 1 million fiber passings, with 1.2 million as its “stretch target.” That will put Altice USA in a position to end the year with 2.2 million to 2.3 million homes passed with fiber.

In 2023, Goei said Altice USA expects to ratchet up the build to 1.6 million to 1.8 million homes passed as the operator starts to push fiber upgrades into the Suddenlink footprint.

Altice USA is also doing edge-out builds to areas adjacent to existing facilities and pursuing grants for fiber builds in underserved and unserved areas. Altice USA has won grants or subsidies covering 40,000 to 45,000 homes, a number that Goei predicts could rise to about 200,000 in the next 12 to 24 months.

Altice USA, which has been fielding M&A inquiries about the Suddenlink properties, believes its fiber focus will set the stage for a return to broadband subscriber growth as early as Q4 2022, and certainly by sometime in 2023.

Goei said 80% of gross broadband subscriber adds in fiber areas take a fiber-based service. Though Altice USA is trying to convert HFC customers to fiber proactively, exceptions include customers who want to keep their existing setup or who are in homes and locations where a landlord won’t allow a new fiber drop.

Altice USA has been building a fiber broadband network in its Optimum territory in the New York tri-state area (New York, New Jersey, Connecticut) with 1.2 million fiber passings available for sales as of December 31, 2021. For Suddenlink, construction is expected to begin this year in areas of Texas. Additional states in the Suddenlink footprint that will benefit from this fiber expansion plan include areas of Arizona, California, Louisiana, Missouri, North Carolina, New Mexico, Oklahoma, and West Virginia.

“Altice USA is proud to announce plans to invest further in our fiber deployment strategy by accelerating the build of a 100% fiber broadband network capable of delivering multi-gig speeds across our Optimum and Suddenlink footprint,” said Dexter Goei, Altice USA Chief Executive Officer. “Fiber is the future and given the progress we have made at Optimum with our fiber expansion, we’re excited to build on that success and break ground later this year at Suddenlink to bring our advanced network to more customers and communities.”

Goei touched briefly on Altice USA’s Optimum Mobile product, which is supported by an MVNO deal with T-Mobile. He agreed that there are benefits to bundling mobile with home broadband but lamented that mobile EBIDTA is challenged by “thin margins” being driven by a mobile marketplace that’s seeing falling ARPU and rising levels of promotions.

With that backdrop, Altice USA expects to market fiber more aggressively than mobile this year and into 2023. “For the balance of this year, I don’t think you should expect real big waves in the mobile product,” Goei said.

Goei also offered some additional commentary on the recent announcement that he will be stepping down as CEO to become executive chairman of the board. Comcast exec Dennis Mathew has been tapped to take the CEO slot effective October 3.

Goei reiterated that he is shifting gears for personal reasons, as he and his family want to return to Europe. He said he informed the board of his decision about a year ago. Altice USA started its CEO search roughly six months ago.

In his new role, Goei said he will focus on “large strategic stuff” and external elements such as government affairs and conversations with the financial community, so that Mathew can focus squarely on operations.

References:

Neos Networks and Giganet partner to deliver FTTP to millions of UK homes

Dark Fiber network operator Neos Networks has announced a new partnership with Giganet, aiming to support the ISP’s burgeoning FTTP rollout with backhaul and data centre services.

Giganet currently offers customers access to its gigabit services through a variety of network providers, including Openreach and CityFibre, reaching millions of homes across the UK. In fact, earlier this year, Giganet announced that they had extended their partnership with CityFibre, thereby making their services available to customers across the entirety of CityFibre’s UK network.

However, last year Giganet announced they would also be rolling out their own FTTP network directly, investing £250 million to cover underserved areas of Hampshire, Dorset, Wiltshire, and West Sussex.

In total, the company hopes to reach 300,000 premises with full fibre over the next four years, with its core network and first four exchange rings set to be live by the end of 2022.

As this new network grows, it will need additional backhaul capacity and support – something that Neos, with its 550 unbundled exchange network, is well positioned to provide.

“Neos Networks rose to the challenge of providing us with resilient and high capacity backhaul circuits across a wide range of exchanges as well as our core data centres,” explained Matthew Skipsey, Chief Technology Officer at Giganet. “Using Neos Networks, we have been able to secure connectivity to our points of presence faster than expected, initially enabling each of our first four regional rings with resilient 100Gb/s backhaul. This means our south coast roll-out is progressing at pace.”

This network expansion project will see Neos support Giganet to deliver a more than tenfold capacity increase.

“Both Neos Networks and Giganet have adopted a collaborative approach to this relationship. This has resulted not only in solutions being delivered faster than ever, as the Giganet network grows, it also gives us the ability to transition connectivity between points of presence without any disruption,” explained Sarah Mills, Chief Revenue Officer at Neos Networks. “There is no doubt that by working in partnership with alternative network providers, like Giganet, UK residents will benefit from a better, faster, and more resilient connectivity.”

Matthew Skipsey added: “The ready availability of high-quality resilient connections to our points of presence, undoubtedly enabled us to quickly roll-out hyperfast, full broadband to a marketplace hungry for improved connectivity.”

References:

https://totaltele.com/giganet-teams-up-with-neos-networks-to-support-new-fibre-rollout/

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

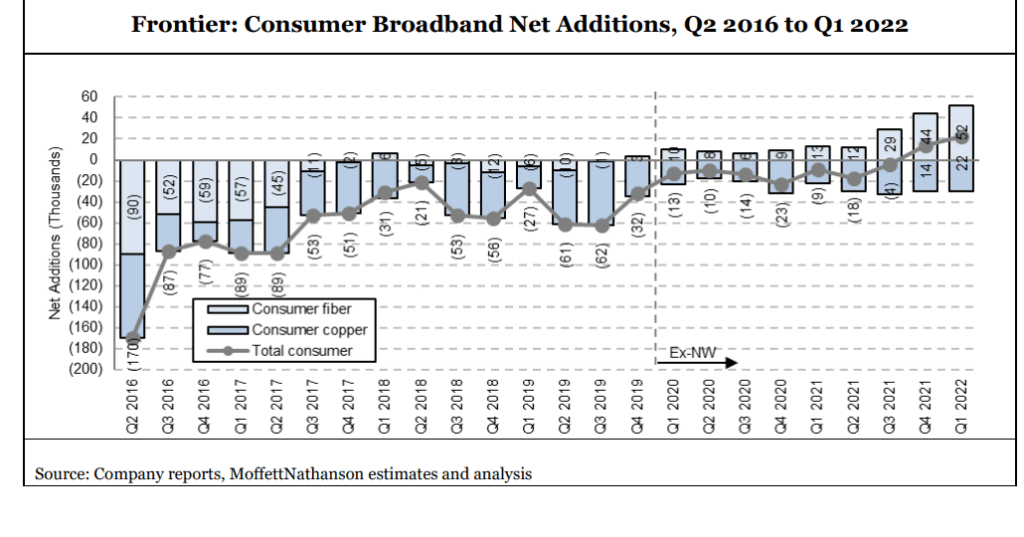

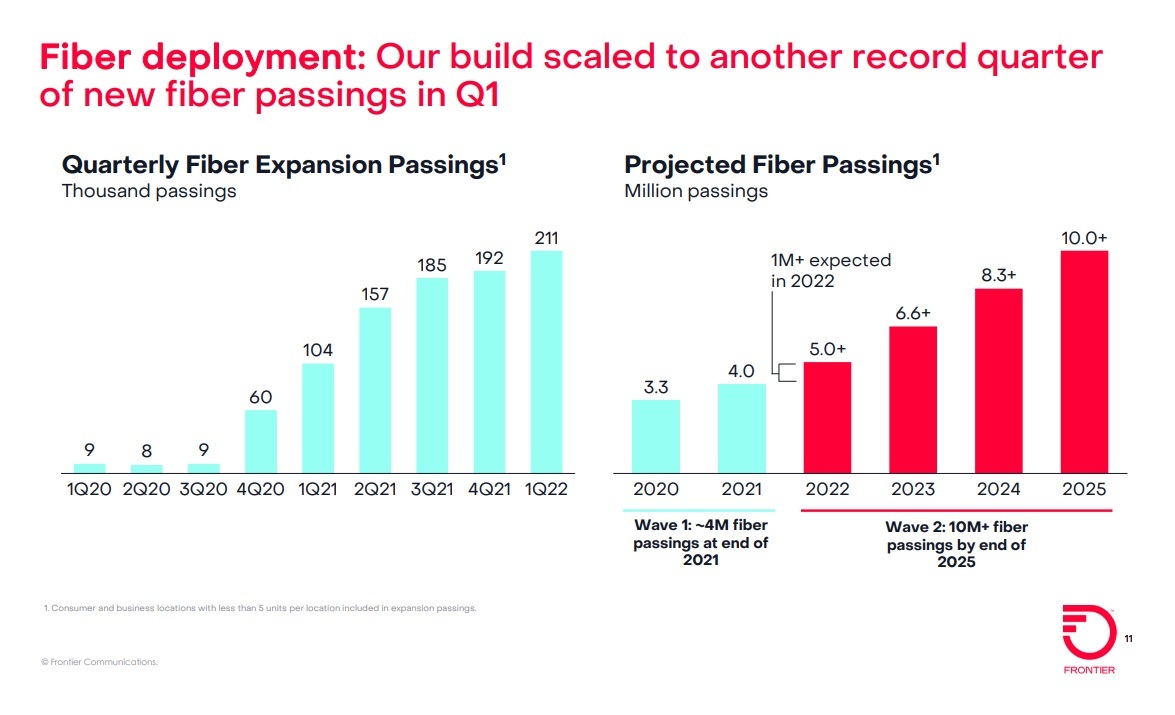

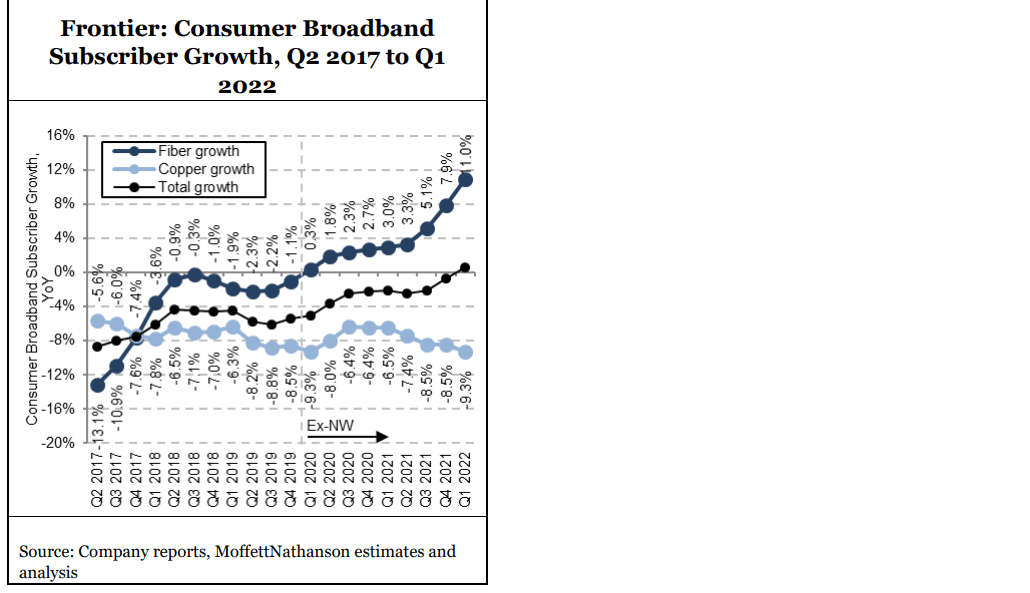

Frontier Communications added a record 54,000 fiber broadband customers in the first quarter of 2022, a 20% gain over the previous record set in Q4 2021 and somewhat higher than expectations coming in to the quarter. These fiber customer adds are coming from both new and existing fiber markets. Frontier’s data continues to track nicely: 22% penetration at the 12-month mark for its 2020 cohort and 18% for its larger 2021 cohort, and 44% at the 24-month mark for its (admittedly small and probably not broadly representative) 2020 cohort. Base market penetration was up 50 basis points in the quarter and 90 basis points over the past two quarters.

Frontier’s aggressive fiber network buildout and a record low churn of 1.19%, enabled the telco to offset copper losses and add 20,000 net broadband subs for Q1 2021. That’s a record nearly two times higher than that set in the prior quarter. Frontier ended the quarter with 1.38 million residential fiber broadband subs, up 11% YoY.

Frontier plans to expand its fiber-to-the-premises (FTTP) footprint to 10 million locations by 2025 – a figure that includes the company’s “Wave 1” and “Wave 2” builds. Frontier built fiber out to another 211,000 locations in the first quarter of 2022, and says it’s on track to add more than 1 million FTTP locations for all of 2022, and another 1.6 million in 2023.

Frontier passed another 211K locations with fiber in the quarter, up from the ~190K level of the prior two quarters, a nice accomplishment in light of the disruptions associated with Omicron early in the quarter (100K of the 211K passings were achieved in March alone). Management continues to expect to add at least 1M fiber locations in 2022, and it seems on track to meet or exceed that target.

“Positive net adds is the new normal,” Nick Jeffery, Frontier’s president and CEO, declared on Friday’s earnings call. The CEO continued:

“We gained momentum in business and wholesale, reaching a key inflection point in SMB and we made progress improving our employee engagement. And last week, we unveiled our new Frontier brand. A year ago, we said we will take a long and hard look at our brand and its future and after a thorough data-driven evaluation I am delighted with the results. Our new brand is modern, more relevant, more tech-oriented, and reflects our commitment to relentlessly being better in our business and for our customers. We also gained customers in our mature fiber market, what we refer to as our base fiber footprint. In our base fiber footprint, penetration increased 50 basis points sequentially to 42.4%. And our base fiber footprint serves as a target for where we expect to drive penetration in our expansion fiber footprint and we expect to steadily grow penetration to at least 45% over time.

In our expansion fiber footprint, we are also making excellent progress. At the 12-month mark, our 2021 build cohort reached penetration of 18%, consistent with our target range of 15% to 20%. And at the 24-month mark, our 2020 build cohort reached penetration of 44%, significantly outperforming our target range of 25% to 30%. As larger builds are pulled into our 2020 cohort throughout the year, we continue to expect penetration of 25% to 30% at the 24-month mark.”

Indeed, Frontier’s operations and service levels have improved dramatically over the past two years. Our colleague Nick Del Deo at MoffettNathanson wrote in a research note to clients:

By some measures, Frontier is now operating at as high a level as key competitor Charter in the California market. And this is having an effect on its customer perceptions and market traction. Its American Consumer Satisfaction Index scores are slowly moving up, while its net promoter score has surged, especially where it has rolled out FTTH. Churn has fallen, as have customer care call volumes.

Frontier’s post-emergence management team has taken a data-driven approach to running the business and making key decisions. Put simply, the choice to refresh the company’s font and logo rather than totally rebrand is further evidence that changes to the business are working.”

To reiterate, 1Q-2022 fiber penetration rates rose to 42.45% in the company’s base fiber footprint. Frontier expects to reach penetration rates of at least 45% over time.

In the expansion areas, Frontier realized a penetration rate of 12% at the 12-month mark in its 2021 fiber build cohort – within its target range of 15%-20%. In the 2020 FTTP build cohort, Frontier is seeing a 44% penetration rate at the 24-month mark, outperforming its target range of 25%-30%.

Source: Frontier Communications Q1 2022 earnings presentation

CEO Jeffery said Frontier’s fiber-powered services are taking share from incumbent cable operators, but didn’t elaborate on how much damage Frontier is inflicting. He also acknowledged that fixed wireless access (FWA) could present an attractive option in rural areas where fiber isn’t present. Jeffery also believes fiber represents “a fundamentally different proposition” over FWA, given current data usage trends. In March, the average Frontier fiber subscriber consumed about 900 gigabytes of data, up 30% from pre-pandemic levels, with a portion consistently consuming more than 1 terabyte per month.

Significantly, Frontier gained new customers in areas where fiber is being built out. “This is critical because we know our future is fiber and fiber customers are the ones that will drive our growth in the years to come,” said Jeffery, a former Vodafone UK exec who took the helm of Frontier in March 2021.

For the full 2022 year, Frontier is targeting adjusted EBIDTA of $2 billion to $2.15 billion, and capital expenditures in the range of $2.4 billion to $2.5 billion, the same as guidance issued last quarter. This implies $2,003M for the remainder of the year at the midpoint. Management continues to target FTTH builds in 2022 of at least 1,000K vs. 638K built in 2021.

References:

https://s1.q4cdn.com/144417568/files/doc_financials/2022/q1/Frontier-First-Quarter-2022-Results.pdf