Global Networks

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

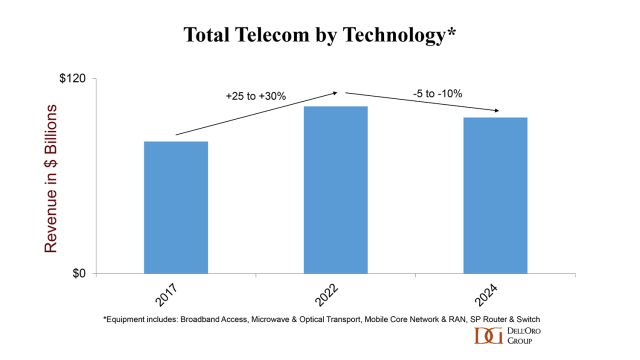

Preliminary Dell’Oro Group data found that worldwide telecom equipment revenues across the six telecom programs tracked – Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch – declined 5% year-over-year (YoY) for the full year 2023, performing worse than expected. First and foremost, challenging comparisons in some of the advanced 5G markets with higher 5G population coverage taken together with the slow transition towards 5G SA helped to partially explain steep declines in wireless-based investments. This capex deceleration was not confined to the RAN and MCN segments. Following a couple of years of robust PON investments, operators were able to curtail their home broadband capex as well. This reduction was more than enough to offset positive developments with optical transport and Service Provider routers.

The North America telecom equipment market declined faster than expected. Initial readings show that the aggregate telecom equipment market dropped by roughly a fifth in the North America region, underpinned by weak activity in both RAN and Broadband Access. On the bright side, regional dynamics were more favorable outside of the US. Our assessment is that worldwide revenues excluding North America advanced in 2023, as positive developments in the Asia Pacific region were mostly sufficient to offset weaker growth across Europe.

Also contributing to the regional and technology trends is the disruption caused by Covid hoarding and the supply chain crisis. Although this inventory correction was not felt everywhere and varied across the telecom segments, it was more notable in the RAN this past year.

Renewed concerns about macroeconomic conditions, Forex, and higher borrowing costs are also weighing down prospects for growth. The gains in the USD against the Yuan and the Yen are impacting USD-based equipment revenue estimates in China and Japan.

………………………………………………………………………………………………………………………………………………………………………………………………

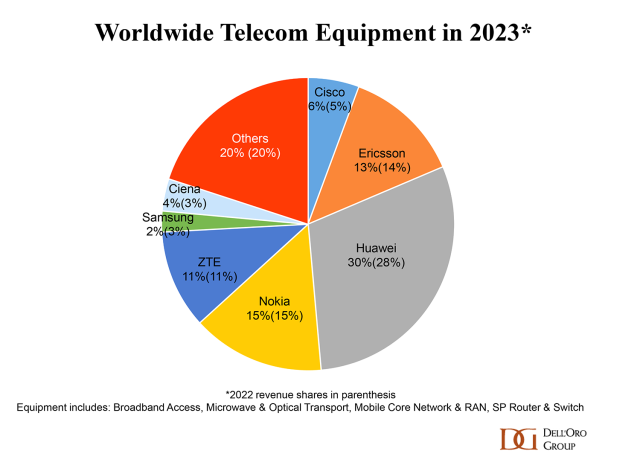

Dell’Oro says that Huawei maintained its lead as the top global telecom equipment company by revenue in 2023, despite efforts by the U.S. government and other countries to limit its addressable market and access to Android and the latest chips and semiconductor technology from TSMC. In fact, Dell’Oro’s assessment is that Huawei’s lead widened in 2023, in part because its limited exposure to the North America region was a benefit in 2023 on a relative basis.

Supplier rankings were mostly unchanged. However, vendor revenue shares shifted slightly in 2023. Still, the overall concentration has not changed – the top seven suppliers accounted for around 80% of the overall market.

Market conditions are expected to remain challenging in 2024, though the decline is projected to be less severe than in 2023. The analyst team is collectively forecasting global telecom equipment revenues to contract 0 to -5% in 2024. Risks are broadly balanced. In addition to currency fluctuations, economic uncertainty, and inventory normalization, there are multiple regions/technology segments that are operating in a non-steady state.

References:

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Intelsat and PCCW Global combine networks; Intelsat achieves MEF 3.0 Carrier Ethernet (CE) Certification

Intelsat and PCCW Global Combine Networks:

Satellite communications specialist Intelsat and Hong Kong based PCCW Global have announced a new collaboration to extend the reach, resiliency, and quick delivery of on-demand enterprise connectivity offerings.

The integration of Intelsat’s FlexEnterprise global connectivity fabric with PCCW Global’s Console Connect Software Defined Interconnection® platform enables organizations to deliver enterprise connectivity to locations around the globe while leveraging an easy-to-use platform underpinned by one of the world’s largest private MPLS networks.

The combined solution addresses two key obstacles to delivering reliable, agile services across all of an enterprise’s locations: limited local telecom infrastructure that can challenge traditional network deployments in developing or hard-to-reach places, and lengthy lead times typically associated with creating high-performance networks and services. The collaboration brings together FlexEnterprise’s reach and reduced network deployment speed and Console Connect’s real-time quoting, ordering and provisioning of high-performance connectivity.

Mr. Frederick Chui, Chief Commercial Officer, PCCW Global, said, “The collaboration with Intelsat brings together the latest innovations in fixed network and satellite network technologies to deliver more flexible enterprise connectivity solutions. By integrating Intelsat’s FlexEnterprise solution with the Console Connect digital platform, our global customers can access satellite connected locations wherever they need to and effortlessly turn up services across all sites.”

FlexEnterprise leverages the world’s largest and most advanced integrated satellite fleet and ground infrastructure to enable service providers to integrate the reach and reliability of Intelsat services without the need to manage wholesale satellite capacity. The connectivity-as-a-service solution offers packaged service that makes it quicker and more cost-effective to add resiliency to existing sites and extend the reach of enterprise networks to even the most remote areas.

The Console Connect digital platform puts users in control of one of the world’s largest MPLS and Tier 1 IP networks, providing them with private, on-demand connections between over 750 data centres across more than 50 countries worldwide. Console Connect is home to a growing ecosystem of cloud, SaaS, IX, IoT, carrier and enterprise partners, which are directly interconnected by the platform’s private high-performance network, delivering higher levels of network performance, speed, and security. Through the platform’s MeetingPlace feature, users can also directly order and provision partner services, such as remote peering, colocation and business applications, as well as access native services from Console Connect.

Mr. Brian Jakins, General Manager and Vice President of Networks, Intelsat, said, “Our Sales and Product teams work closely with the telecom ecosystem to make satellite services more relevant and easier to adopt for a broader set of customers. With the integration into the Console Connect platform, Intelsat is able to more easily meet customers anywhere on the PCCW Global network, while enterprises leverage the platform to extend applications and services to their most remote users and outposts.”

Intelsat’s Global Network is First to Achieve MEF 3.0 Carrier Ethernet Certification for New Performance Tier:

Intelsat has become the first satellite operator to achieve MEF 3.0 Carrier Ethernet (CE) Certification for services delivered through its integrated space and global terrestrial network. Intelsat’s achievement means that customers can dependably integrate Intelsat’s global network solutions into their network solutions with assurance of performance and security. This also represents continued progress towards Intelsat’s Unified Network vision to enable seamless, end-to-end orchestrated services, driven by our integration of 5G and other open standards.

“Intelsat’s achievement of MEF 3.0 certification ensures that customers can rely on Intelsat to provide Ethernet services that meet the demands of enterprise, government and wholesale use cases with key performance indicators that define the industry standard for high-quality,” said Lance Hassan, Director of Terrestrial Network Innovation at Intelsat. “This achievement also demonstrates Intelsat’s leadership as a satellite communications company and global provider of network solutions.

MEF service definitions help telecom service providers accelerate product development and service implementations, with definitive measures to ensure consistency of the quality of the services they provide. As part of Intelsat’s continued efforts to drive open standards development and adoption across the satellite industry, the company worked with MEF member companies to amend MEF 23 with a new Performance Tier (PT5) that defines new Class of Service performance objectives for satellite-based networks.

“Intelsat, in achieving our industry’s first MEF 3.0 certification for GEO satellite-based Carrier Ethernet services, is adding a dimension to MEF’s important work that will benefit users no matter where they stand on the globe,” said Bob Mandeville, president and founder of Iometrix, MEF’s testing partner for carrier ethernet certifications.

“Companies in the satellite community are crucially important in enabling accessibility of carrier ethernet services anywhere on the planet,” said Kevin Vachon, chief operating officer, MEF. “Achieving MEF 3.0 certification facilitates interoperability with terrestrial networks and lays the groundwork to ultimately achieve service automation with MEF’s Lifecycle Service Orchestration (LSO) framework and APIs. We congratulate Intelsat on their certification achievements.”

Intelsat services are provided by the company’s integrated satellite and terrestrial network. For more information and to check availability, click here.

References: