OpenRAN

Rakuten Communications Platform (RCP) defacto standard for 5G core and OpenRAN?

In Japanese, Rakuten stands for “optimism.” This philosophy lies at the core of the company’s brand. They may be the leader is selling 5G mobile core network specs and virtualization network software to global network operators in the absence of any ITU-T standards or 3GPP detailed implementation specs. [Please refer to References for more details, especially on the 3GPP Technical Specifications 23.501, 23.502, 23.503.]

Rakuten Communications Platform (RCP) has been sold to a total of 15 customers so far, according to the company’s mobile networking CTO Tareq Amin.

“We have already 15 global customers. A lot of people don’t know that the sales already started. And these are not small customers. Some of them are very, very massive,” he said this week during a virtual roundtable with members of the media. “I’m really delighted to see that we finally are reaching a stage where possibly in the next quarter or so we have a very large contract about the entire RCP stack.”

Regarding network performance, Amin explained that success factors are based on virtualization, standardization, optimization and automatizing. Combined, they lead to more cost efficiency, innovation, affordability and growth.

Rakuten Mobile was the first to deploy a large-scale OpenRAN commercial network and the first fully virtualized, cloud-native mobile network. And Amin refutes the perceived limitations of open radio access networks, arguing that Rakuten Mobile’s only limitation today is spectrum assets.

“With less than 20% of spectrum assets compared to our competitors, we are doing great. OpenRAN does not mean we have an average network; the truth is that we have a world-class network,” he added, explaining that once Rakuten Mobile moves from five to 20MHz, there will be a significant improvement in performance, while 5G deployment is also accelerating.

Despite launching a commercial service during a global pandemic, Rakuten Mobile already has received more than 2 million applications, with the majority of applications made online rather than in stores.

Rakuten appears to have broadened its focus a few months later when it announced it acquired operational support system (OSS) provider Innoeye for the “Rakuten Communications Platform (RCP).”

Rakuten officially took the wraps off RCP in October 2020 with an announcement that it was “bringing 5G to the word.” The business is based in Singapore and headed by Rabih Dabboussi, who previously worked at networking giant Cisco and cybersecurity company DarkMatter, according to his LinkedIn profile, before joining Rakuten in May 2020.

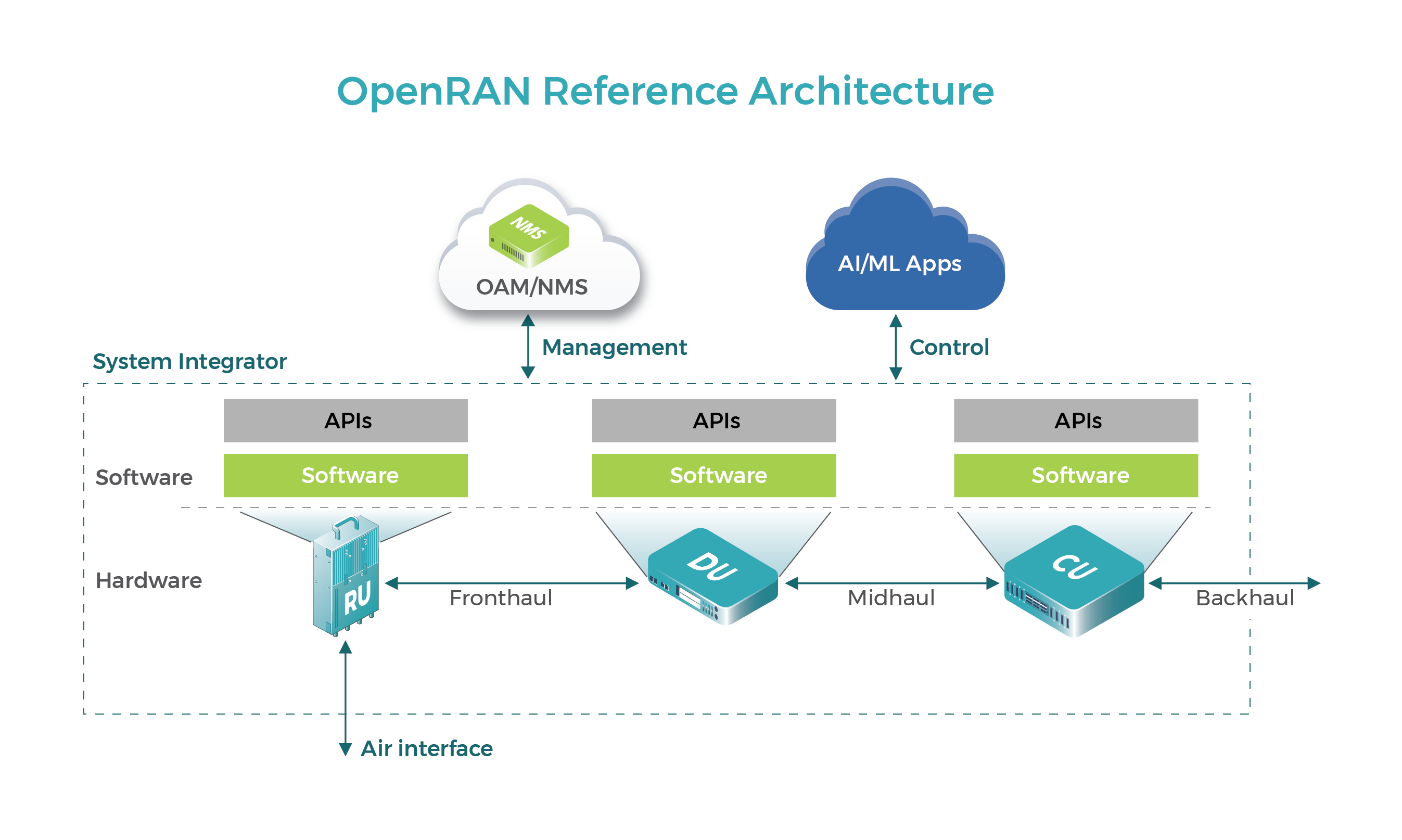

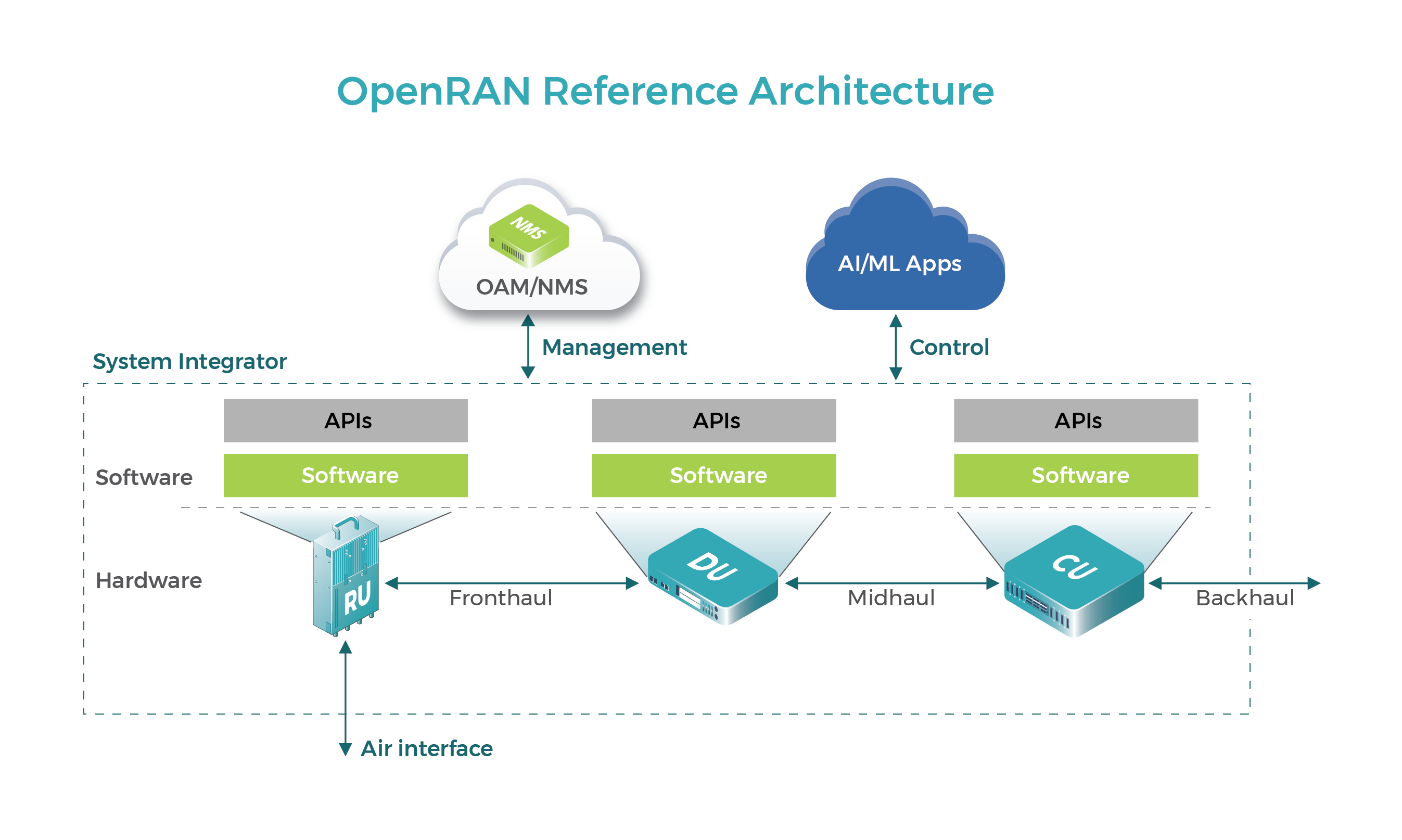

RCP essentially is the platform on which Rakuten is building its 4G and 5G networks in Japan. Amin explained that the offering consists of a number of different, interchangeable pieces including network orchestration, cloud management and artificial intelligence provided by a range of participating suppliers. RCP customers can pick and choose which parts of the platform they wish to use.

From Amin’s email to this author: “NEC/Rakuten 5GC is 3GPP based standardized software for network service and a de facto standard container basis infrastructure (“infrastructure agnostic”). It is a forward looking approach, but not proprietary.”

“NEC/Rakuten 5GC openness are realized by implementation of “Open Interface” defined in 3GPP specifications (TS 23.501, 502, 503 and related stage 3 specifications). 3GPP 5GC specification requires cloud native architecture as the general concept (service based architecture). It should be distributed, stateless, and scalable. However, an explicit reference model is out of scope for the 3GPP specification. Therefore NEC 5GC cloud native architecture is based on above mentioned 3GPP concept as well as ETSI NFV treats “container” and “cloud native”, which NEC is also actively investigating to apply its product.”

RCP essentially positions Rakuten against cloud giants like Amazon, Google and Microsoft, companies that are also selling cloud-based network management and operational services to network operators globally. Indeed, Microsoft last year acquired Affirmed Networks and Metaswitch Networks in pursuit of that goal.

Rakuten’s sales of RCP are directly linked to the success of the company’s ongoing 4G and 5G network buildouts in Japan. As a result, the company has been quick to address concerns over the performance of its mobile network in Japan which is both based on RCP.

“What we’ve done in 4G was enabling a world-first virtualized infrastructure. For 5G, we have a world-first containerized architecture, completely cloud-native radio access software that is (made up of) disaggregated micro services,” he explained.

“Between LTE, which is 40MHz and about 500MHz of spectrum assets, we think we have a very strong position to be able to increase capacity and demand.”

“We’re very confident about our business model and our business plan. And the idea to have zero churn in the network is also a unique value proposition that really emphasizes the critical role of the [Rakuten Mobile] ecosystem and the critical role of data for our long term viability,” said Amin.

References:

https://rakuten.today/blog/rakuten-scales-nationwide-mobile-network.html

https://www.etsi.org/deliver/etsi_ts/123500_123599/123501/16.06.00_60/ts_123501v160600p.pdf

Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS

Rakuten Mobile, Inc. and NEC to jointly develop the containerized standalone (SA) 5G core network

Another Open RAN Consortium: 5G Open RAN Ecosystem led by NTT Docomo

Japan wireless network operator NTT Docomo has partnered with 12 companies to create the ‘5G Open RAN Ecosystem.’ The companies are: Dell Technologies Japan, Fujitsu, Intel, Mavenir, NEC, NTT Data, Nvidia, Qualcomm Technologies, Red Hat, VMware, Wind River and Xilinx.

Their plan is to accelerate open radio access networks (Open RAN) and help enable global network deployment to serve diverse company and operator needs in the 5G era.

The O-RAN Alliance, which NTT Docomo has helped lead since its launch, has developed specifications and promoted products that allow operators to combine disaggregated base station equipment. Docomo has been actively developing the products for its own 4G/5G network in Japan.

Docomo will start talks with the 12 companies on accelerating open RAN introduction to operators.

Specifically, NTT DOCOMO’s target is to package best-of-breed RAN and to introduce, operate and manage them based on demands from operators considering open RAN introduction. By leveraging its years of activities in driving open network and know-how (which realized the world’s first open RAN for 5G using O-RAN), NTT DOCOMO is committed to maximize companies’ strengths in furtherance of the 5G Open RAN Ecosystem, and providing high-quality and flexible networks.

5G Open RAN Ecosystem:

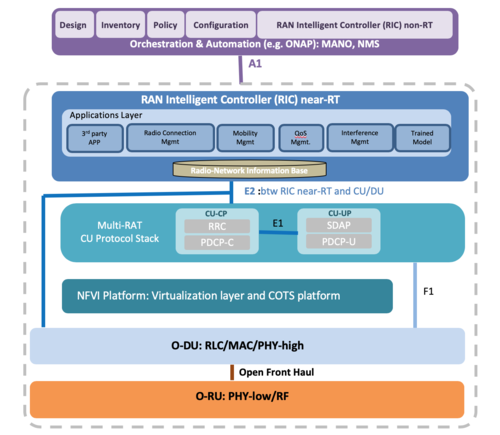

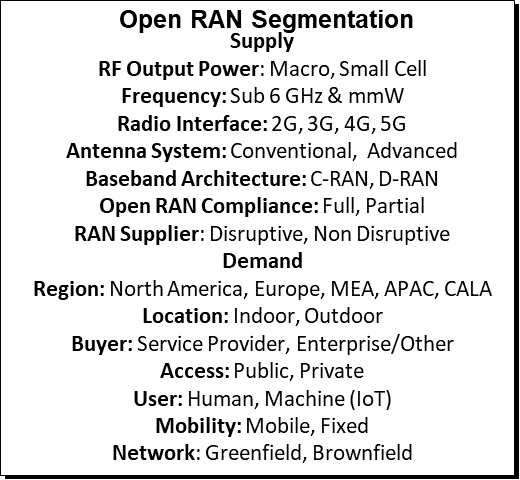

Image courtesy of Viavi Solutions

………………………………………………………………………………………………….

Additionally, NTT DOCOMO will develop vRAN (virtualized RAN) with higher flexibility and scalability to further drive open RAN targeting commercialization in 2022. As COTS (Commercial Off-The-Shelf) servers can be used and dedicated equipment are not required for vRAN, it is possible to realize flexible and cost efficient networks. As of today, NTT DOCOMO will start discussion towards verification of vRAN, including performance assessments. As for the vRAN verification environment that will be constructed, opportunities for remote usage will be made available for operators themselves to freely conduct tests.

NTT DOCOMO says it will continue to cooperate with various industry partners towards accelerating wide adoption of open network, especially O-RAN and vRAN, which can cater for diversifying needs with flexibility and agility.

Comment & Analysis::

As with the two other Open RAN alliances (TIP Open RAN and O-RAN), the new 5G Open RAN Ecosystem does NOT have a formal liaison agreement with either 3GPP or ITU-R WP 5D (4G-LTE and IMT 2020 standards). Yet they are all trying to implement disaggregated network elements/equipment for 4G and 5G.

Last month legacy mobile operators Deutsche Telekom, Orange, Telefonica and Vodafone Group established a collaboration or Memorandum of Understanding (MoU) covering the rollout and development of open RAN technology, in a bid to ensure the continent keeps up with early pacesetters, namely Rakuten Mobile and NTT Docomo in Japan.

Today, Telecom Italia (TIM) said it has joined that initiative to support the development and implementation of Open RAN as the technology of choice for future mobile networks across Europe. TIM said it was committed to the development of innovative mobile network systems that used open virtualized architecture to facilitate increasingly agile, flexible, secure and functional 5G services.

However, there are no standards or 3GPPP specifications on Open RAN. Therefore, one must question if there will be different versions coming out of each consortium? Will the virtualized Open RAN architecture be implemented consistently? Will the 4G/5G endpoints be affected by different Open RAN implementations?

What is Open RAN is a good tutorial on this increasingly important subject.

References:

…………………………………………………………………………………………………

NTT DOCOMO to Establish a 5G Consortium in Thailand

NTT Docomo and an international group of several other companies have recently established a consortium to provide 5G services, first in Thailand and later in other Asia Pacific countries with the possible inclusion of additional partners. The initial members of the 5G Global Enterprise solution Consortium (5GEC) will be Activio, AGC, Advanced Wireless Network, Exeo Asia, Fujitsu, Loxley Public Company, Mobile Innovation, NEC Corp, NEC Networks & System Integration, NTT Communications, NTT Data Institute of Management Consulting, NTT Docomo, and NTT Ltd.

https://www.nttdocomo.co.jp/english/info/media_center/pr/2021/0203_00.html

Analysis: Telefonica, Vodafone, Orange, DT commit to Open RAN

Four of Europe’s biggest network operators have signed a Memorandum of Understanding (MoU) to express their individual commitment to the implementation and deployment of Open Radio Access Network (Open RAN) as the technology of choice for future mobile networks across Europe. In a statement, Telefonica, Deutsche Telekom, Orange and Vodafone pledged to back Open RAN systems that take advantage of new open virtualized architectures, software and hardware with a view to enhancing the flexibility, efficiency and security of European networks in the 5G era.

The four operators committed to working together with existing and new ecosystem partners, industry bodies like the O-RAN Alliance and the Telecom Infra Project (TIP), as well as European policy makers, to ensure Open RAN quickly reaches competitive parity with traditional RAN solutions. “This initiative is an important milestone towards a diverse, reinvigorated supplier ecosystem and the availability of carrier-grade Open RAN technology for a timely commercial deployment in Europe,” they said in a joint statement.

The MNOs added that the introduction of Open RAN, virtualisation and automation would pave the way for a fundamental change in the way operators manage networks and deliver services, allowing them to add or shift capacity more quickly for end users, automatically resolve network incidents or provide enterprise level services on-demand for industry 4.0.

The four operators also expressed the hope that the European Commission and national governments will agree to play an important role in fostering and developing the Open RAN ecosystem by funding early deployments, research and development, open test lab facilities as well as incentivising supply chain diversity by lowering barriers to entry for small suppliers and startups.

The MoU comes a few days after Telefonica announced plans to use open RAN technology at around 1,000 of its mobile sites in Germany. Vodafone made a similar commitment at around 2,600 of its masts and rooftops in the UK at the end of last year.

Without orders from numerous large operators, open RAN producers have struggled to increase volumes and generate the necessary economies of scale.

“This is like putting the band back together,” says Gabriel Brown, a principal analyst with Heavy Reading, a sister company to Light Reading. “The European operators are saying if we co-operate then we can have a meaningful influence and impact on the way open RAN develops.”

Operators are drawn to open RAN because it would allow them to mix and match vendors, using radio software from one vendor in tandem with general-purpose equipment developed by another. Traditional radio access networks typically force operators to buy all their components from the same supplier.

While today’s statement is light on details of firm commitments, Vodafone has already promised to use open RAN technology at around 2,600 of its mobile sites in the UK, while Telefónica this week said it would do the same at roughly 1,000 sites in Germany.

Deutsche Telekom, Germany’s telecom incumbent, has had less to say about rollout targets, although in December it revealed plans to build an “O-RAN town” in Neubrandenburg this year. “This will be a small-scale commercial deployment, which will encompass up to 150 cells, and will bring open RAN into a real 4G/5G network environment,” said a Deutsche Telekom spokesperson by email.

That leaves France’s Orange, which has now made a jaw-dropping commitment: Starting in 2025, it will buy only open RAN equipment when upgrading its European networks.

“From 2025, our intention is that all new equipment deployed by Orange in Europe should be based on open RAN,” says Arnaud Vamparys, Orange’s senior vice president of radio networks. “This is a good time to send a clear message.”

His expectation is that over this timeframe open RAN will reach “parity” with traditional RAN for deployment in a macro network. That would mean resolving some of the performance shortcomings that have mainly restricted open RAN to rural and less demanding conditions.

“2025 sounds about right,” says Brown. “The integrated systems are really setting a very high bar and open RAN is behind on features and performance right now.”

Brown told Light Reading he was encouraged by some of the recent open RAN activity in the semiconductor industry, citing baseband advances by Marvell and radio innovation by Xilinx. But he says it is too early to say open RAN will definitely be a mainstream success by the mid-2020s. “Can this be the best way to build a radio access network? If it isn’t, it is probably not going to succeed.”

“We continue to work to unlock the value of these European programs because clearly there are industry-leading initiatives of some of the manufacturing being brought back to Europe, especially on open RAN,” said Markus Haas, Telefónica Deutschland’s CEO, when asked during an analyst call this week if the telecom sector could be a beneficiary of Europe’s COVID-19 recovery fund.

“There is high interest so that the overall industry, the vendor landscape, might change or might be empowered by additional funds in order to progress and accelerate open RAN.”

While Ericsson and Nokia say they are now investing in open RAN technology, Vodafone looks determined to use alternative players for its 2,600-site rollout. Supplier diversification has topped the agenda for other service providers, as well.

“We want Europe to play a role in that evolution and it has to unite a bit to achieve this goal,” says Orange’s Vamparys. “There are lots of US and Japanese companies pushing strongly for the acceleration of open RAN. If we don’t communicate and help other companies, it could create an unbalanced situation.”

SOURCE: ORAN Alliance

Telefónica Deutschland named Altiostar, KMW, NEC and Supermicro as potential open RAN partners in a presentation it gave this week, while Deutsche Telekom has been in talks with Dell, Fujitsu, Mavenir, Nokia and NEC.

Vodafone has already carried out open RAN trials with Mavenir and Parallel Wireless.

The region’s biggest gap is probably in silicon, says Heavy Reading’s Brown. Most of the high-profile chipmakers developing open RAN technology, including Marvell and Xilinx, are based in the US.

Arm, a UK-based firm whose processor designs are used in many of the world’s smartphones, is a member of the O-RAN Alliance, the group responsible for open RAN specifications. But it is also currently the target of a $40 billion takeover move by Nvidia, a US semiconductor maker.

In the meantime, any plan to use part of the European recovery fund to support open RAN could meet with political resistance given the healthy state of the telecom sector compared with other industries, including airlines, hospitality, retail and tourism.

John Strand, the CEO of advisory firm Strand Consult, lashed out at the suggestion that open RAN could benefit from Europe’s COVID-19 stimulus package.

“Do these companies need subsidies? Is Telefónica in such a bad position that it needs public funding?” he told Light Reading. “We are living in a time when numbers of companies are in deep financial crisis because of COVID-19 and telecom operators, which definitely haven’t been hit, are asking for subsidies.”

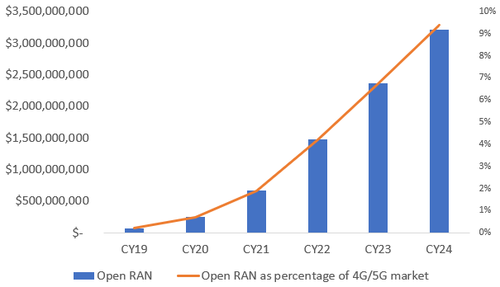

Market forecasters now think open RAN will account for about one tenth of the overall market for radio access network products by the mid-2020s:

- Omdia expects industry revenues to increase from just $70 million in 2019 to about $3.2 billion in 2024, giving it a 9.4% share of the 4G and 5G market.

- Dell’Oro, another analyst firm, is in broad agreement: Last year, it predicted operators would spend somewhere north of $3 billion on open RAN products in 2024.

……………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.telecompaper.com/news/telefonica-vodafone-orange-dt-sign-open-ran-mou–1369273

Progress in 5G private networks and Open RAN

Harry Baldock of Total Telecom writes, “The month of November was one of quiet progress for 5G, with more momentum steadily being gained for long-term trends towards private network deployments and open RAN innovation.”

Private 5G networks could be viable connectivity options for major industries like manufacturing and shipping, giving them not only access to the latest technologies to enhance efficiency, but also the flexibility to structure their network however they please.

In Europe, the German telecom regulator announced in November that it has awarded 88 licences for private 5G networks this year and expects more to come. For example, Nokia recently installed a private 5G network in Nuremburg for industrial IoT specialist MYNXG. In France, electronics manufacturer Lacroix is working with with Orange and Ericsson to create a 5G factory, and in the UK BT is installing a 5G network into Belfast Harbour, while Huawei is creating a private 5G testbed in Cambridge.

There has also been significant movement in the U.S., with General Motor’s new Factory ZERO installing a private 5G network from Verizon to manufacture the next generation of electric vehicles.

However, it should be remembered that despite its promise, private 5G networks are also still very much in their infancy, with a survey from STL Partners showing that the majority of enterprises still rely primarily on Wi-Fi and ethernet or fixed broadband for their connectivity needs.

Meanwhile, Open RAN has been gaining momentum for some months now as we reported yesterday in this IEEE Techblog post. In November, Dish and Qualcomm announced that they are set to work together on the U.S.’s first Open RAN-compliant (which spec?) 5G network. Similarly, in the UK, Vodafone’s August pilot for Open RAN, that took place in Wales, is being scaled up to 2,600 Open RAN sites in Wales and England, potentially using them to replace Huawei gear.

Meanwhile, companies like Mavenir continue to rapidly develop open RAN solutions, recently boasting of supporting 2G–5G for its open RAN packet core, thanks to a recent acquisition of ip.access.

Baldock concludes, “it seems fair to say that Open RAN is here to stay and is no longer something of a novelty. While many issues remain around things like standardization (e.g. no liaison with either ITU, ETSI or 3GPP) the movement is beginning to see increasing interest from operators and policymakers alike.”

…………………………………………………………………………………………………………………………………….

References:

https://techblog.comsoc.org/2020/12/04/omdia-and-delloro-group-increase-open-ran-forecasts/

German Telecom Regulator awards 5G private network licenses in the 3.7GHz to 3.8GHz band

Omdia and Dell’Oro Group increase Open RAN forecasts

In an updated forecast out this month, Informa owned Omdia predicts that Open RAN is likely to generate about $3.2 billion in annual revenues by 2024. That would make it about 9.4% of the total 4G and 5G cellular market.

That forecast implies a massive increase on last year’s sales of just $70 million (see Dell’Oro forecast below), and Omdia’s Open RAN numbers have been raised significantly in the last few months. Previously, it was expecting Open RAN to generate about $2.1 billion in revenues in 2024.

Telco buy-in and support is critical, according to Daryl Schoolar, practice leader at Omdia responsible for the firm’s Open RAN forecasts. “Mobile operators remain the real driving force behind the development of open virtual RAN,” he says. “I see this as a positive sign for the market versus other technology and network developments I have seen during my career that were driven by vendors and ultimately went nowhere. The bigger market opportunity is with brownfield deployments, but this takes more time to accomplish as operators have to integrate open RAN with their legacy network systems and make sure those legacy networks and services are not adversely impacted,” Schoolar added.

Here are some of the network operators that have committed to OpenRAN:

- Japan’s Rakuten, which already operates a 4G and 5G network based on open RAN. While customer numbers remain low, its early success has undoubtedly encouraged others.

- Telefónica and Rakuten have announced a partnership to accelerate the development of Open RAN technology for 5G access and core networks, and the associated operations support systems (OSS). They will jointly test, develop and procure Open RAN systems.

- Dish Network, is another greenfield builder that is using open RAN technology to roll out a fourth mobile network in the US. which is primarily focused on business customers.

- Orange sees a role for Open RAN vendors to provide more “plug and play” indoor coverage for businesses through 2021 and 2022. Open RAN could also play a part in the macro network, although that is more likely to come from 2023, and still requires work.

Dell’Oro Group (see forecast below) says: “Dish is running into delays in the US market, Rakuten is moving forward at a rapid pace in Japan deploying a variety of both sub 6 GHz and mmWave RAN systems. In addition, some of the Japanese telecom equipment vendors (e.g. NEC) are reporting that the lion share of their radio shipments are already O-RAN compatible.”

Open RAN progress:

Source: Omdia

……………………………………………………………………………………………………………………

Omdia notes that Open RAN is a potential dilemma for the big telco equipment vendors like Ericsson and Nokia (which intends to supply Open RAN products). The risk is that it decreases their market share for traditional cellular gear, as wireless network providers opt for Open RAN products developed by alternative suppliers. Yet open RAN might also bring opportunities in new markets for the old guard. “Either way, vendors cannot ignore this market trend,” says Omdia.

Gabriel Brown, a principal analyst at Heavy Reading, a sister company to Omdia and Light Reading, says he is positive about Open RAN but warns against expectations of liftoff next year. “The right timeline to view it on is a four-to-five-year timeline,” he said in a discussion with Light Reading this week. “I think next year continues to be primarily trials, scaling the trials … and some operators moving into production networks, but I don’t think it’s the year when it all takes off.”

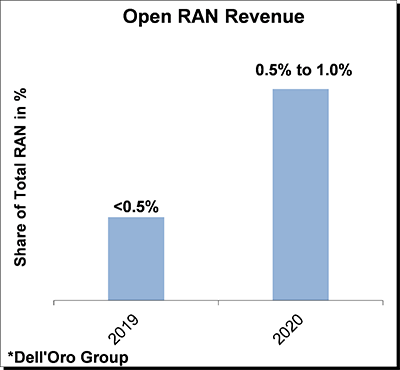

Separately, Dell’Oro Group’s latest Open RAN forecast, projects that Open RAN baseband and radio investments—including hardware, software, and firmware excluding services—will more than double in 2020 with cumulative investments on track to surpass $5B over the forecast period.

Open and Virtual RAN continues to gain momentum, bolstered by Ericsson now formalizing its support with its Cloud-RAN announcement. The uptake remains mixed. In this blog we will discuss three key takeaways for the 3Q20 quarter including:

1) The primary objective of Open RAN is to address market concentration and vendor lock-in;

2) Open RAN revenues are trending ahead of schedule;

3) Not all Open RAN is disruptive.

Source: Dell’Oro Group

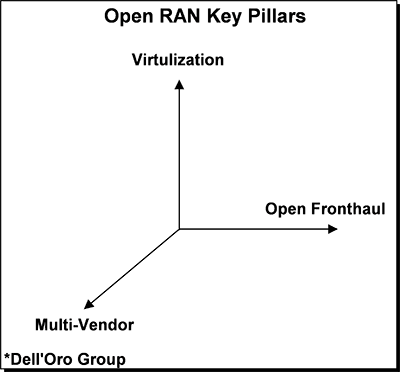

Dell”Oro says that the more favorable Open RAN outlook to a confluence of factors including:

- Verification from live networks the technology is working in some settings;

- Three of the five incumbent RAN suppliers are planning to support various forms of Open RAN – “Partial Open RAN” (open and virtual but not multi-vendor) are at this juncture captured in the Open RAN estimates meaning we require the first two pillars but we are excluding the third multi-vendor requirement as a necessity to reflect the Open RAN movement;

- The geopolitical uncertainty has escalated significantly in the past six months, with multiple operators reassessing and/or reviewing their reliance on Huawei’s RAN portfolio, resulting in an improved entry point for the Open RAN suppliers;

- Progress with full virtualization is firming up, with multiple suppliers announcing the commercial availability of V-RAN, consisting of both vCU and vDU;

- Operators are increasingly optimistic the technology will move beyond the rural settings for brownfield deployments;

- Policies to stimulate Open RAN are on the rise.

Source: Dell’Oro Group

“We estimate total open RAN revenues are tracking ahead of schedule,” wrote Stefan Pongratz of Dell’Oro Group, noting the market research firm recently raised its 2020 open RAN revenue forecast to $300,000 from $200,000. “On the other hand, the lion share of any ‘security’ related RAN swaps are still going to the traditional RAN players, suggesting the technology for basic radio systems remains on track but the smaller players also need to ramp up investments rapidly to get ready for prime time and secure larger brownfield wins.”

…………………………………………………………………………………………………………….

References:

https://www.lightreading.com/open-ran/open-ran-will-be-$32b-market-in-2024-says-omdia/d/d-id/765889?

https://omdia.tech.informa.com/OM011039/Open-RAN-commercial-progress-in-2020 (must be an Omdia client to access)

https://www.delloro.com/open-ran-results-mixed-in-3q20/

Bank of America: OpenRAN primer with global 5G implications

Written by Multiple Bank of America Research Analysts

Introduction:

OpenRAN turns base stations using proprietary hardware into software running on common off-the-shelf hardware. Tal Liani views this trend as a continuation of ongoing forces in the broader IT and hardware markets – a shift to virtualized hardware, merchant silicon and general software disruption of proprietary hardware markets.

With 78% of the cellular base station/ RAN market controlled by Huawei, Ericsson and Nokia, OpenRAN represents an opportunity for software-only vendors like Altiostar, Parallel Wireless and Mavenir to offer traditional as well as new carriers such as Rakuten and DISH the technology to build cost effective networks with no legacy equipment consideration. OpenRAN is ideally deployed in a virtualized or cloud-based architecture, offering a high degree of automation as well as enabling vendor mixing/matching to reduce costs of innovation and increase efficiencies.

$35bn RAN market set for new competition, disruption:

Radio Access Networks (RANs) represent the largest category of hardware technology, estimated at just under $35bn in 2020. The market is highly concentrated, with 78% controlled by Huawei, Ericsson, and Nokia. OpenRAN is disrupting the market, enabling vendor mixing and matching, greater competition, and introducing new entrants via standardization, separation of software and hardware, and by turning certain elements into independent applications.

Early days for OpenRAN, likely limited impact in near-term:

OpenRAN is still in its early days, representing ~1% of the total RAN market in 2020 and ~6% projected by 2024. These estimates are preliminary though, and like any other disruptive technology, deployments could gain momentum as they are adopted by key carriers. To date, the biggest OpenRAN advocates are new carriers, like Rakuten and DISH, which are utilizing the technology to build cost effective networks having no legacy equipment considerations. Tier-1 carriers are taking a more measured approach with legacy architectures/vendors still offering better economics. Yet, at the same time, most leading carriers are testing OpenRAN and some already deploy it on a small scale. For example, Verizon‘s 5G upgrade is partially done with Ericsson‘s proprietary approach and partially with Samsung‘s OpenRAN solution. We also see interest from European carriers, with OpenRAN providing an efficient way to replace Huawei equipment.

Importance of semis, commodity hardware on the rise:

On the vendor side, OpenRAN represents new opportunities for software-only vendors like Altiostar, Parallel Wireless, and Mavenir, hardware providers like Fujitsu and leading semi vendors like Intel and Qualcomm. Nokia and Ericsson partially support OpenRAN, given its disruptive nature, focusing instead on proprietary software-based solutions, like virtualized (vRAN) or Cloud RAN. However, as momentum grows, we expect all leading vendors to support OpenRAN, similar to trends seen in Switching and Routing. We expect the legacy Radio vendors to offset the negative implications of OpenRAN via a growing focus on software, applications and expansion into adjacent markets.

Open Radio Access Networks, or OpenRAN, is an emerging trend that is set to shake up the roughly $40bn 4G/5G infrastructure market. We view this trend as a continuation of ongoing forces in the broader IT and Telecom Hardware markets, such as the shift to virtualized software, whitebox hardware, merchant silicon, and general software disruption of the proprietary hardware markets. We have witnessed similar efforts to open and standardize other networking markets such as Ethernet Switching and IP Routing, however, the complexity, performance demands, and tight vendor controls in the Mobile Infrastructure market have left the Radio Access Networks proprietary thus far. 5G deployments represent an entry point and a catalyst for OpenRAN, and our deep dive aims to explore the potential opportunities and disruption across vendors and sectors that service the RAN market.

Our note is organized into 5 main sections: 1) drivers of OpenRAN deployments vs the challenges, 2) introduction to the Radio Access Market, which describes the technical components, leading vendors, and market dynamics of the traditional RAN market, 3) an OpenRAN 101 section that outlines the architectural changes, new vendors, and growth forecasts, 4) the impact of OpenRAN, and opportunities related to adjacent areas of technology, such as semiconductors, and lastly 5) OpenRAN traction by geographic region.

Ultimately, we see three key takeaways for investors: 1) we flag that OpenRAN and Virtualized/Cloud RAN are separate trends that are coming together to form the attractiveness of Open and Virtualized RAN (vRAN), 2) it remains early for OpenRAN, which is expected to represent less than 1% of RAN spending in 2020 and grow to only 6% of the total market by 2024, and 3) OpenRAN creates opportunities for legacy and new vendors, in our view. We quantify the disruptive potential on page 33, and compare the OpenRAN phenomenon to what happened in the virtualized Evolved Pack Core (EPC) market. We also view OpenRAN as an enabling technology for global carriers to replace Huawei in certain areas, either through growing share of Nokia and Ericsson, or via the introduction of new vendors.

|

Figure 1: OpenRAN vs Virtual RAN and evolution to Open vRAN |

|

|

|

Source: BofA Global Research, Omdia |

A key benefit of OpenRAN is new innovation in the radio access market, with newer software companies such as Altiostar pushing incumbent vendors to begin disaggregating their software from hardware and support industry groups dedicated to developing OpenRAN technology, such as the O-RAN Alliance. OpenRAN itself also encourages innovation via its open interfaces, and the enablement of third party vendors to add new solutions. OpenRAN is ideally deployed in a virtualized and cloud-based architecture, offering a high degree of automation, increasing efficiencies and reducing costs. Currently, OpenRAN development is supported by a wide range of semiconductor, hardware, testing, systems integration, and software companies, helping foster innovation in each domain and cooperation toward a more ‘hyperscale-like‘ network. As we have seen in other areas of cloud networking and technology, open ecosystems often foster greater innovation.

|

Figure 2: Comparison of Traditional RAN versus OpenRAN |

|

|

| Source: World Wide Technology |

Less vendor lock-in to create more competition:

Another key driver for OpenRAN interest is the ability to avoid vendor lock-in. Following years of vendor consolidation in the Mobile Infrastructure market, there are only four leading equipment provider choices: Huawei, Nokia, Ericsson, and ZTE to a lesser extent. On top of limited choice, it is notoriously difficult to switch vendors, requiring expensive and labor-intensive equipment swaps from the radio head to the baseband data center infrastructure. In some cases, the equipment swap cost burden falls on the carrier and in some cases vendors provide such services as part of the sales/services strategies. Ultimately, the lack of choice and difficulty in switching vendors create a market rife with equipment vendor lock-in.

Swapping out Huawei represents a major catalyst:

As the market has consolidated, political pressures versus Chinese vendors‘ role in 5G (see note on Huawei pressure and risk) further limit vendor choice to only 2-3 firms in some regions. Therefore, global pushback against Huawei/ZTE may be one of the largest drivers of OpenRAN adoption, pulling forward the timing of operator decisions on RAN architectures. Huawei has gained significant share in the $38bn market over the last seven years, now representing 34% of the total market, and government support for removing the vendor from networks has grown in recent months. The UK government recently instituted a policy banning UK carriers from buying new Huawei equipment beginning in 2021, and all Huawei equipment must be removed from UK networks by 2027. Other regions of Europe such as Belgium, Poland, and Sweden have also recently shied away from Huawei.

Importantly, replacing Huawei brings large costs, both from losing Huawei as a competitor (Huawei known for its attractive price/performance) and equipment swaps. As a result, the US government is beginning to take steps to help developing countries within Africa and the Middle East fund the costly replacement of Huawei/traditional equipment. Specifically, the US Agency for International Development is spearheading the effort, while the US State Department continues to pressure US allies to displace Huawei and ZTE equipment from their networks. In our view, the replacement of Chinese RAN technology could open up a $35bn market to both incumbent and new vendors, and the replacement of network vendors‘ architectures offers an attractive opportunity for carries to re-architect the Access network utilizing modernization and virtualization, which are both drivers for OpenRAN. The US government has also explored investing in OpenRAN technologies to help US software/hardware/semi vendors play more of a role in cellular networks.

Open RAN Cost Savings:

Opening the interfaces between the baseband unit (BBU) and remote radio unit (RRU) helps increase competition, lowers the switching costs, and likely saves carrier capex to some degree. However, we believe the real benefits related to the OpenRAN vision come to fruition when the architecture becomes virtualized or cloud OpenRAN (often referred to as Open vRAN). In Open vRAN, carriers first save on equipment capex as the baseband unit software runs on commodity off the shelf (COTS) hardware (i.e., x86 servers) rather than proprietary integrated hardware. Software can be purchased from new vendors and the equipment can be provided by vendors such as Quanta Computer. High degree of competition for the RRU component and the hardware commoditization for the BBU component could result in potential capex savings of 40-50%. Installation and integration services can also potentially be brought in house or outsourced to a longer list of competitors, adding RAN installation savings that are typically part of capex (see Exhibit 3).

The second area of carrier total cost of ownership (TCO) savings is related to the maintenance and operating expense. By copying the efficient cloud models of hyperscalers and centralizing/standardizing the foundation of the RAN, carriers stand to run more efficient data center operations. The software-defined approach also adds to network agility and automation. Through better agility and automation, carriers save on the management, maintenance, and upgrades for the network. Early reports suggest potential 31% operating expense savings as a result (see Exhibit 4).

|

|

|

OpenRAN Industry groups:

1. Telecom Infra Project (TIP):

TIP was formed in February 2016, with Facebook playing a central role. Major vendor Nokia is also part of the group. Japanese members include NTT, KDDI, SoftBank, Rakuten Mobile, NEC and Fujitsu. TIP‘s goal is to create mobile networks using open and disaggregated solutions. The scope of the group‘s work extends from OpenRAN to include the backhaul portion of the network, core network architecture and other areas.

TIP and O-RAN Alliance announced a liaison agreement in February 2020. Under the agreement, the groups will share information, reference respective specifications and collaborate on testing.

2. O-RAN Alliance:

O-RAN Alliance was formed in February 2018 through a merger between x-RAN Forum and C-RAN Alliance. Japanese members include NTT DoCoMo, KDDI, SoftBank, Fujitsu and NEC. In May 2020, O-RAN Alliance and GSMA, an industry body representing MNOs, agreed to collaborate on opening up 5G networks.

Major vendors Ericsson and Nokia are also part of the O-RAN Alliance. However, they appear to be taking a slightly different stance on OpenRAN. In February 2019, some members of O-RAN Alliance announced new open fronthaul specifications and related testing. Nokia is mentioned in the announcement, but Ericsson is absent. Nokia believes open standards are a viable option for RU-DU, but is doubtful about the effectiveness for the CU-DU interface.

The O-RAN Alliance is focused on efforts to standardize technologies. NTT DoCoMo is expected to play a key role in the standardization process. In September 2019, DoCoMo announced it had achieved interoperability with equipment from different vendors in a 4G/5G demo project. Vendors in the demo were Nokia, Fujitsu and NEC. As widely reported, Fujitsu has teamed up with Ericsson and NEC is collaborating with Samsung in OpenRAN technology.

Altiostar and NEC demonstrate front haul at India’s first O-RAN Alliance plugfest hosted by Bharti Airtel

Altiostar and NEC today said that they participated in the first plugfest event in the India region for the O-RAN ALLIANCE. Hosted by Bharti Airtel (“Airtel”), India’s largest integrated telecommunications services provider, the goal of the O-RAN Plugfest was to test and demonstrate the growing maturity of the O-RAN ecosystem.

Bharti Airtel plugfest was in partnership with telecom players like Altiostar, Altran, ASOCS, Mavenir, NEC, Sterlite Technologies (STL), VVDN, among others to demonstrate emerging technologies such as 5G.

“We are committed to evolving our network through an open architecture and are delighted to partner with the O-RAN community. This offers a great opportunity to Indian organizations with innovative hardware, software, and services capabilities to build a “’ Make in India – O-RAN solution’ – for Indian and global markets.” said Randeep Sekhon, CTO, Bharti Airtel.

The Indian telco is currently working with various US and Japanese vendors like Altiostar and NEC to develop OpenRAN based 5G telecom equipment, ETTelecom exclusively reported recently.

Airtel revealed that it is engaging with “Disruptive Telecom Equipment Vendors” to develop innovative solutions customized to Airtel’s requirements based on OpenRAN technology. “As a TSDSI Member, Airtel has proposed a new study Item on “Adoption of O-RAN Specification by TSDSI and contribution towards the development of India.

Specific use cases within the TSDSI Network Study Group (SG-N). Airtel will be submitting contributions in the form of a Study Report on O-RAN in SGN, and will also be collaborating with industry partners on the subject,” the telco had said.

“Testing and integration are crucial for developing a commercially available open RAN ecosystem and that’s why the O-RAN Alliance provides its member companies with an efficient global plugfest framework, which complements the O-RAN specification effort as well as the O-RAN Software Community,” said Andre Fuetsch, Chairman of the O-RAN Alliance and Chief Technology Officer of AT&T.

The telco has been a member of the O-RAN Alliance since its establishment in 2018. The first India edition of O-RAN Plugfest is part of Airtel’s commitment to building an open technology ecosystem, including O-RAN-based deployments, said the telco in an official statement.

It was also the first operator in India to commercially deploy a virtual RAN solution based on disaggregated and open architecture defined by the O-RAN Alliance.

Airtel, Altiostar and NEC teamed up for this project to demonstrate the world’s first interoperability testing and integration of massive MIMO radio units (O-RU) and virtualized distributed units (O-DU) running on commercial-off-the-shelf (COTS) servers. The project featured a commercial end-to-end Open Fronthaul interface based on O-RAN specifications. This demonstration was comprised of control, user, synchronization and management plane protocols, including 3GPP RCT and performance cases.

The purpose and scope of this demonstration was to show O-RAN option 7.2x split integration between a virtualized O-DU from Altiostar and an NR O-RU (i.e. 5G radio unit) from NEC. The demonstration also showed how this integrated setup can be used in an end-to-end EN-DC network setup (i.e. 5G non standalone architecture).

Going forward, Altiostar and NEC will continue to jointly drive new levels of openness in radio access networks (RAN) and across next-generation 5G networks.

“Today’s 4G and 5G radio access networks are undergoing a profound transformation, as the wireless industry is shifting to an open and cloud-native architecture that is being driven by vendors such as Altiostar and NEC, who are at the forefront of providing software and radio solutions based on O-RAN standards,” said Anil Sawkar, Vice President of Engineering and Operations at Altiostar. “Dozens of greenfield and brownfield wireless operators worldwide are trialling and deploying O-RAN networks as they realize the benefits of this new approach, including reduced costs, increased automation, and faster time to market with services.”

“Providing open innovations that conform to industry standards in the radio access network is critical to accelerating our customers’ journey towards Open RAN deployment and provisioning of more flexible and efficient networks that meet the requirements of cutting edge 5G use cases,” said Kazuhiko Harasaki, Deputy General Manager, Service Provider Solutions Division, NEC Corporation. “It is NEC’s honor to contribute to interoperability verification initiatives in India towards Open RAN innovation.”

Airtel has been a member of the O-RAN ALLIANCE since its inception in 2018. Airtel was the first operator in India to commercially deploy a virtual RAN solution based on a disaggregated and open architecture defined by O-RAN. “We are delighted to partner with the global O-RAN community. Our engagement with Altiostar and NEC for demonstrating O-RAN O-DU and O-RU, 5G RCT and E2E performance is another step forward towards building 5G systems with open network architecture,” said Randeep Sekhon, CTO at Bharti Airtel.

…………………………………………………………………………………………………………………………………………………………………………………………

About Altiostar:

Based outside Boston, Altiostar provides 4G and 5G open virtualized RAN (Open vRAN) software that supports open interfaces and virtualizes the baseband unit to build a disaggregated multi-vendor, web-scale, cloud-native mobile network. Operators can add intelligence, quickly adapt the network for different services and automate operations to rapidly scale the network and reduce Total Cost of Ownership (TCO). Altiostar collaborates with a growing ecosystem of partners to support a diverse Open RAN supply chain. The Altiostar Open vRAN solution based on O-RAN standards has been deployed globally, including the world’s first cloud-native commercial-scale mobile network with Rakuten Mobile in Japan. For more information, visit www.altiostar.com.

About NEC Corporation:

NEC Corporation has established itself as a leader in the integration of IT and network technologies while promoting the brand statement of “Orchestrating a brighter world.” NEC enables businesses and communities to adapt to rapid changes taking place in both society and the market as it provides for the social values of safety, security, fairness and efficiency to promote a more sustainable world where everyone has the chance to reach their full potential. For more information, visit NEC at http://www.nec.com.

About Airtel:

Headquartered in India, Airtel is a global telecommunications company with operations in 18 countries across South Asia and Africa. The company ranks amongst the top three mobile operators globally and its mobile network covers a population of over two billion people. Airtel is India’s largest integrated telecom provider and the second largest mobile operator in Africa. At the end of September 2020, Airtel had approx. 440 mn customers across its operations.

Airtel’s portfolio includes high speed 4G/4.5G mobile broadband, Airtel Xstream Fiber that promises speeds up to 1Gbps, converged digital TV solutions through the Airtel Xstream 4K Hybrid Box, digital payments through Airtel Payments Bank as well as an integrated suite of services across connectivity, collaboration, cloud and security that serves over one million businesses.

Airtel’s OTT services include Airtel Thanks app for self-care, Airtel Xstream app for video, Wynk Music for entertainment and Airtel BlueJeans for video conferencing. In addition, Airtel has forged strategic partnerships with hundreds of companies across the world to enable the Airtel platform to deliver an array of consumer and enterprise services.

References:

Vodafone says Open RAN ready for prime time as Huawei is phased out in the UK

Vodafone has made a major commitment to use Open RAN at about 2,600 mobile base stations currently served by Huawei. That’s about 35% of the Chinese telecom equipment vendor’s installed base within Vodafone’s network, according to a spokesperson for the UK service provider after it was reported by the Financial Times (subscription required).

Approximately 2,600 sites in rural Wales and the south west of England will be switched to OpenRAN by the government-imposed deadline, a process that will commence in 2022. Vodafone wants to be viewed as a trailblazer for OpenRAN, which increasingly looks like the most likely source of telecoms vendor diversity in the wake of Huawei’s blacklisting by the U.S., UK and other countries.

“This commitment can get Open RAN ready for prime time,” Scott Petty, chief technology officer at Vodafone UK, told the Financial Times. He added that although open RAN was still a nascent technology more suited to rural coverage than dense urban areas, including such a large chunk of its network would create an opportunity for it to push into the mainstream. Spanish telecom operator Telefónica is also exploring greater use of open RAN systems for future upgrades.

Vodafone’s plan represents a boost for the UK government, after a task force launched to help strip Huawei equipment out of the country’s 5G networks by 2027 identified open RAN as a potential growth opportunity for the UK. It could also support a government ambition to rebuild a foothold in the telecoms equipment market if growing Open RAN use is used to justify research and development subsidies and companies in the field based themselves in Britain.

“The UK could regain a foothold which it hasn’t had since the break-up of Marconi,” said Mr Petty, referring to the collapsed British telco. Recommended Huawei Technologies Huawei develops plan for chip plant to help beat US sanctions US companies Mavenir, Parallel Wireless and Altiostar have emerged as open RAN specialists in recent years, hoping to compete with larger companies, while hardware vendors like Samsung, NEC and Fujitsu are hoping to win market share as Huawei kit is removed. The move to ban Huawei, the world’s biggest telecoms equipment maker, from 5G networks has meant networks have turned to Ericsson and Nokia to fill the void.

BT has signed deals with both the Ericsson and Nokia to replace Huawei base stations over time, putting the cost of complying with the government phase out at £500m. Ian Livingston, the former BT chief executive and trade minister heading up the government’s telecoms task force, told MPs last week that the push to foster Open RAN would grant telecoms companies a greater choice of vendors in the wake of the Huawei ban and avoid a bottleneck in the supply chain. Using Open RAN is a more costly exercise which has led to some calls within the industry for more financial support. Mr Petty said this need not be in the form of direct subsidies to use the equipment but could be directed at speeding up the development of chips and software to compete with established companies such as Huawei.

Vodafone’s pledge to use emerging open RAN tech for at least 2,600 masts and rooftops is the largest confirmed promise made by a European carrier © Alamy Stock Photo

…………………………………………………………………………………………………………………………………………………………………………………………………………………….

Analysis & Opinion:

Vodafone is likely interested in Open RAN because that could boost supplier diversity in a market where there are currently few viable alternatives to the giant kit vendors. Trials in various geographies have already been carried out with Mavenir and Parallel Wireless, two U.S. developers of Open RAN software. Many telecom operators have complained that today’s systems force them to rely on one company for all the RAN technologies at a particular site. Thanks to other “virtualization” schemes, they would be able to run open RAN software on commoditized, general-purpose equipment.

Vodafone hasn’t named any of the vendors that will help it with this initiative. Telecoms.com was told that it’s committing a fair bit to OpenRAN R&D and that it definitely sees a significant role for the technology across its entire radio estate. It seems the UK government has actually been of some help in this matter too, with the creation of a taskforce charged with improving vendor diversity considered a step in the right direction.

Vodafone seems to be trying to set the agenda when it comes to emerging technology trends. For years it promoted NB-IoT, but it’s been silent on that LPWAN (for IoT) lately. OpenRAN suffers from the classic paradox of new technologies in that companies are reluctant to invest much in being first movers. Vodafone is putting its money where its mouth is regarding OpenRAN and it will be watched closely by other operators looking for reassurance before deploying this untested technology.

Vodafone is under pressure to comply with a government deadline for the removal of all Huawei’s 5G products by the end of 2027. This would be fairly straightforward with mainstream technologies from Ericsson and Nokia. Using open RAN as a substitute, even across only 35% of these sites in rural areas, may be tough.

The payoff for Open RAN is a much larger choice of telecom equipment and software vendors. That might even include UK firms, which have not featured in the network equipment sector since the days of Marconi, eventually bought by Ericsson in 2006. Lime Microsystems, based in the UK town of Guildford, is one player that might benefit. It is already supplying 4G equipment to a Vodafone site in Wales that was supposed to be used during this year’s Royal Welsh Show, an agricultural event canceled in 2020 because of the coronavirus pandemic.

Japan’s Rakuten Mobile and U.S. based Dish Network have already made significant open RAN commitments. Yet both of those companies are building their networks from scratch as greenfield wireless carriers. With today’s update, Vodafone is taking a bigger step into the unknown than any other brownfield telco in a developed market has taken, including Telefonica.

………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.ft.com/content/a872a299-2f49-45b3-b3ff-9200f6ce8247

https://www.lightreading.com/vodafone-uk-to-swap-big-part-of-huawei-for-open-ran/d/d-id/765104?

Vodafone and NEC Europe trial Open RAN technology with voice call

Vodafone and NEC Europe Ltd., a wholly owned subsidiary of NEC Corporation, in partnership with Altiostar, have jointly announced the first successful voice call made on an open virtual Radio Access Network (Open RAN) on Vodafone’s network in the Netherlands.

Open RAN technology holds promise and potential for next-generation wireless infrastructure. It’s being driven by innovation and open specifications from various consortiums (O-RAN, TIP Open RAN, and ONF). Today’s announcement demonstrates Vodafone’s strong commitment to sustaining its technological leadership, by bringing in such technological advances.

During the course of this trial, Vodafone and NEC intend to integrate solutions of leading Open RAN technology vendors, such as Altiostar [1.] and various other radio vendors, including NEC’s own 5G radio products, using commercial off the shelf (COTS) hardware from third parties, enabling Vodafone to transform its network to a software-based one suiting multiple deployment scenarios.

Note 1. It’s somewhat surprising that Altiostar was the only OpenRAN software vendor to be mentioned. Altiostar is part-owned by Rakuten and must therefore be near the front of the queue for its OpenRAN vendors. Rakuten has said it would make its Open RAN platform technology available to other operators. If successful, NEC and Altiostar will be involved in more deals as OpenRAN gathers momentum. Separately, there is the Rakuten-NEC 5G Core network (based on 3GPP 5G core “vision” specs) that Rakuten also wants to sell to global network operators.

…………………………………………………………………………………………………………………………………………………………………………………………

Image Credit: Rakuten Mobile

“We are proud to embark on this journey together with Vodafone that will transform mobile network economics, while deploying technology with greater flexibility, greater efficiencies, and more agility,” said Yogarajah Gopikrishna, GM at NEC Europe. “By integrating best of breed solutions, NEC, as an experienced Open RAN System Integrator, is committed to bring transformative change to the telecommunications space leveraging our long history and experience in mobile network solutions.”

“We are delighted to work together with NEC towards the first live Open RAN site,” said Ruud Koeyvoets, Vodafone Mobile Networks’ Director. “The introduction of the technology enables us to introduce new suppliers, such as Altiostar, giving us greater flexibility when rolling out our mobile network. We’re proud to be pioneering the development of Open RAN and will be monitoring the performance of this pilot.”

…………………………………………………………………………………………………………………………………………

About Vodafone

VodafoneZiggo is a leading Dutch company that provides fixed, mobile and integrated communication and entertainment services to consumers and businesses. As of June 30, 2020 we have more than 5 million mobile, nearly 4 million TV, nearly 3.4 million fixed broadband internet and 2.4 million fixed telephony subscriptions. VodafoneZiggo is a joint venture by Liberty Global, the largest international TV and broadband internet company, and Vodafone Group, one of the world’s largest telecommunication companies.

About NEC Europe Ltd.

NEC Europe Ltd. is a wholly owned subsidiary of NEC Corporation, a leader in the integration of IT network technologies that benefit businesses and people around the world. NEC Europe Ltd. is building upon its heritage and reputation for innovation and quality by providing its expertise, solutions and services to a broad range of customers, from telecom operators to enterprises and the public sector. For additional information, please visit the NEC Europe Ltd. home page at:

http://uk.nec.com/

References:

https://www.nec.com/en/press/202010/global_20201019_04.html

Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS

ABI Research: Open RAN radio units to exceed $47 billion by 2026

ABI Research expects the total CAPEX spent on Open RAN radio units (RUs) for public outdoor networks, including both macro and small cells will reach US$40.7 billion in 2026. Cumulative unit shipments will reach 9.9 million during the same year. Meanwhile, the total revenue of Open RAN radios for indoor enterprise networks will reach as much as US$6.7 billion in 2026, with cumulative unit shipments expected to reach 29.4 million. The Open Radio Access Network (Open RAN) market is rapidly expanding and is expected to exceed the traditional RAN market for the first time around 2027-2028.

“The Open RAN opportunity invites various stakeholders to bring their best in class technologies and hardware/software components to contribute to building a flexible, secure, agile, and multi-vendor interoperable network solution,” said Jiancao Hou, Senior Analyst at ABI Research. “In addition, trade wars and the global pandemic of COVID-19 have resulted in tremendous restrictions on the telecom supply chain and disrupt the evolution of new technologies. These effects will accelerate the development of Open RAN and open networks.”

Rakuten Mobile, a greenfield network operator in Japan, set a prime example to deploy this new approach. Moreover, many other operators are also quite active in the field, namely Dish Network in the U.S., Vodafone, Telefonica, Deutsche Telekom, Orange, and Turkcell in the EU and other geological regions. The Open RAN supply chain is also expanding with Altiostar, Mavenir, and Parallel Wireless leading the charge while new entrants are announced every week.

“ABI Research expects greenfield installations, as well as private enterprise networks and public consumer networks, in rural/uncovered areas to drive the deployment of Open RAN throughout the entire forecast period,” Hou points out. Open RAN can introduce many advantages to the enterprise market, including infrastructure reconfigurability, network sustainability, and deployment cost efficiency. On the other hand, these small and easily manageable network use cases will likely lower the entry barrier for Open RAN. Simultaneously they help network operators and their ecosystem partners clearly understand the approach and suppliers’ maturity level, therefore paving the way for a broader market. Besides, “ABI Research sees new entrants will lead the early deployment for Open RAN, but they will be increasingly challenged by tier-one vendors and system integrators for both public cellular implementations and enterprise deployment,” Hou concludes.

These findings are from ABI Research’s Open RAN market data report. This report is part of the company’s 5G & Mobile Network Infrastructure research service, which includes research, data, and analyst insights. Market Data spreadsheets are composed of in-depth data, market share analysis, and highly segmented, service-specific forecasts to provide detailed insight where opportunities lie.

Earlier this week, the Telecom Infra Project (TIP) saw fit to recap its recent achievements regarding OpenRAN; read more about them here.

Image Credit: Telecom Infra Project

…………………………………………………………………………………………………………………………………………………………………………………………

About ABI Research

ABI Research provides strategic guidance to visionaries, delivering actionable intelligence on the transformative technologies that are dramatically reshaping industries, economies, and workforces across the world. ABI Research’s global team of analysts publish groundbreaking studies often years ahead of other technology advisory firms, empowering our clients to stay ahead of their markets and their competitors.

References:

https://www.abiresearch.com/press/open-ran-radio-units-soar-more-us47-billion-2026/