Optical Transceivers

Ciena demo’s 45 wavelengths @400G; Joins Google’s Cloud’s 5G/Edge ISV Program

During OFC 2021 last week, Ciena and Lumenisity Ltd. said that they had partnered to demonstrate transmission of 45 wavelengths, each at 400G, over 1,000 km of hollowcore fiber cable.

The demonstration paired Lumenisity’s CoreSmart hollowcore cable with Ciena’s WaveLogic 5 Extreme and Nano coherent optical engines, with the transmission occurring in a recirculating loop. The companies say their work indicates that hollowcore fiber cable can be used for high-bandwidth, long-reach applications such as data center interconnect (DCI) in addition to edge and 5G xHaul applications Lumenisity had previously cited (see “Lumenisity, BT drive 400ZR DWDM transmission over hollowcore fiber“ and “BT testing hollowcore fiber for 5G support”).

Lumenisty said that it has been working over the past six months with ecosystem partners to test the CoreSmart low-latency hollowcore cable in its System Lab in Romsey, UK (see “Startup Lumenisity unveils hollowcore fiber cables for DWDM applications, new funding” for more on Lumenisity’s fiber). Ciena participated in at least some of those exercises, including a second trial in which the two companies achieved a capacity of 38.4 Tbps with 48x800G channels over greater than 20 km without in line amplification using the current generation of CoreSmart. Lumenisity says the next generation of CoreSmart will be able to extend reach in such an application to between 50-100 km with no inline amplification when paired with the WaveLogic 5 Extreme.

“The results obtained both internally and with Ciena commercial WaveLogic 5 systems show further evidence that we are bringing our world-class hollowcore fiber cable technology to market at an accelerating rate for multiple high-capacity applications, that solve real world latency issues for our customers,” commented Tony Pearson, business development director at Lumenisity.

“System characterization results of WaveLogic 5 Extreme programmable 800G and WaveLogic 5 Nano 400ZR coherent pluggables running over CoreSmart show promising results with hollowcore fiber now proven to preserve high-capacity while materially reducing latency,” added Steve Alexander, senior vice president and CTO of Ciena. “We are proud to be at the forefront of this breakthrough technological achievement where we can enable a 50% increase in reach for latency-sensitive data center interconnects.”

…………………………………………………………………………………………………………………………………….

Separately, CTO Alexander wrote a blog titled, “Ciena has joined Google Cloud’s 5G/Edge ISV Program to help enterprises accelerate migration of their IT resources to the cloud“

Here’s an excerpt:

To facilitate the migration of enterprise IT workloads to the cloud, there is a requirement for higher speed connections from the enterprise edge to cloud provider that are scalable with enhanced security to best protect critical business data. Shared IP network connections to the cloud are acceptable for lower speed (10Gb/s) connections and below. However, when secure, higher speed connections are required to the cloud, connectivity via the IP network can become overly complex, expensive, and inefficient when compared to the optical network (Optical Fast Lane) that can provide a more efficient, cost-effective, and secure option for enterprises needing to reduce their workload migration times to support their evolving business objectives.

For the multi-cloud market to succeed, it must reduce the friction for enterprises to migrate their workloads to a cloud provider, as well as between cloud providers – on demand. This is analogous to the days when you had a mobile plan with one carrier, and to switch to another carrier, you had to switch mobile numbers, which was too complex for most customers, so they stuck with their existing carrier. Only when consumers could keep their phone number when they switched carriers (through Local Number Portability), did it make the mobile market truly competitive leading to improved choice, pricing, and innovation. This is what we’re trying to achieve in the multi-cloud market.

Google Cloud is one of the leading cloud providers in the market that embraces an architecture that enables their enterprise customers to gracefully migrate their workloads to Google Cloud via an Optical Fast Lane that enables Enterprise to develop and leverage the Google Cloud for new and innovative applications. Ciena is excited to be a key player in this program and in addressing this opportunity in the industry. This builds off Ciena’s long standing relationship with Google and other Cloud Providers serving both private and managed high-capacity optical transport networks – principally dominated by subsea, long-haul, metro and DCI connectivity.

Ciena is also a major supplier to Communication Service Providers (CSPs) and MSOs – serving all segments of the network – including high-speed access connectivity for Enterprises as well as cell-site routing and backhaul. In partnership with CSPs, Google Cloud is helping customers leverage their edge real-estate assets to facilitate low latency connectivity to Google Cloud and reduce the friction required for enterprises to improve their mean time to the cloud for their data and workloads.

………………………………………………………………………………………………………………….

References:

2021 Optical Fiber Conference (OFC) Highlights and Links to Videos

The premier event in optical telecom—the 2021 Optical Fiber Communication Conference and Exhibition (OFC) concluded last week. The virtual event drew over 6,500 registrants from 83 countries.

“OFC 2021 saw technology announcements and technical presentations spanning the optical communications ecosystem, including advancements in optoelectronic devices, packaging and digital signal processing that are all rapidly evolving to achieve 800G and beyond, as well as those in architectures and algorithms towards more intelligent optical networking,” said Jun-ichi Kani, OFC General Chair, NTT, Japan. “OFC is the only event where attendees can access the full spectrum of trends shaping the industry and the way we connect across the globe.”

Speakers presented breakthroughs in many areas, including 400/ZR+, 800G, co-packaged optics, embedded optics, next-gen optical access, silicon photonics, space-division multiplexing, data center networks, automation and intelligence in networks and more. Sessions on quantum science and technologies, sensor applications and free space optics appealed to a large audience and enriched the OFC experience. Recorded sessions are available to registrants as on-demand content for 60 days following the close of the event.

“OFC is the go-to event for the optics industry,” said Jimmy Yu, vice president, Dell’Oro Group. “From the thought-provoking panel discussions to the product announcements, OFC has always been the place where I learn about emerging technologies.”

Technology experts from global leaders II-VI, Broadcom, Ciena, Cisco, Corning, Innolight, Intel, Juniper Networks, Lumentum, NeoPhotonics, Nokia and Ribbon discussed developments in hardware and software-based networking solutions in daily briefings with leading analysts, Sterling Perrin, Heavy Reading; Ian Redpath, OMDIA; Andrew Schmitt, Cignal AI; Jimmy Yu, Dell’Oro Group and Vladimir Kozlov, LightCounting. The videos can be viewed here.

The TIP sub-group said multi-vendor integration and services operations “were achieved through open standard models and APIs supported by the Optical SDN Controller, including Transport-API, OpenConfig and Open REST.”

“This proof of concept is an important milestone in the journey to fully open and disaggregated optical networking. It offers new levels of visibility and a way to manage the entire multi-vendor environment,” commented Christoph Glingener, CTO at ADVA.

Technology Showcases from 3M, AIM Photonics, Corning, EFFECT Photonics, Infinera, Jabil, Juniper Networks, Keysight Technologies, Lumentum, Luna Innovations, Murata, Nokia, Pi, Renesas, Ribbon, Samtec, Sicoya, Synopsys, Tektronix, Telescent and Xilinx gave deep dives into their cutting-edge products.

OFC 2021 exhibitor news announcements are posted to the OFC Newsroom.

Innovations in Optics

Leading researchers from around the world presented technical peer-reviewed papers, including:

- Trans-Atlantic Real-Time Field Trial Using Super-Gaussian Constellation-Shaping to Enable 30 Tb/s+ Capacity — A team of researchers from Infinera Corporation, USA and Facebook demonstrated a record-breaking transatlantic transmission across MAREA.

- A Latency-Aware Real-Time Video Surveillance Demo: Network Slicing for Improving Public Safety — Researchers presented a latency-aware optical metro network having sophisticated monitoring and data analytics capabilities and discussed the network architecture and enabling technologies, as well as a video surveillance case of the system.

- Demonstration of 100Gbit/s Real-Time Ultra High Definition Video Transmission Over Free Space Optical Communication Links — A team of researchers discussed how they achieved real-time FSO transmission of an ultrahigh-definition video stream between two buildings in Beijing.

- 224-Gb/s PAM4 Uncooled Operation of Lumped-electrode EA-DFB Lasers with 2-km Transmission for 800GbE Application — Researchers at Lumentum showed how they developed an optical solution that uses four 200 Gbps wavelength lanes to reach 800 GbE.

Post Deadline Papers looked to the future with developments in high-speed individual LEDs, modulated lasers, record low loss in hollow core fibers for applications in power delivery and sensing and other topic areas important to industry.

Analysts also revealed their recent findings around the sector to coincide with the event. For instance, Cignal AI suggested there have been strong gains in switching and routing spending by operators in the first quarter of the year, but these were offset by the slightly weaker deployment of optical transport gear.

Scott Wilkinson, lead analyst for transport hardware at Cignal AI, noted that “Chinese spending on optical hardware has plateaued as major 5G network builds mature and new projects have not been initiated.” He added that the country’s “extraordinary growth during 2015 to 2018 could not continue long term due to the impracticality of expanding upon the enormous amounts that had been spent in the region.”

In general, analysts reported subdued activity by Chinese operators across all product categories after last year’s strong growth, while most other territories showed a rebound this quarter.

………………………………………………………………………………………………………………………………………………

OFC 2022 will be held 06 – 10 March at the San Diego Convention Center, San Diego, CA.

For more information contact: [email protected]

References:

https://www.ofcconference.org/en-us/home/

https://www.eetindia.co.in/ofc-highlights-open-optical-nets/

Mobile Optical Pluggables (MOPA) Technical Whitepaper

Nokia, Ericsson, II-VI, Lumentum and Sumitomo Electric published a joint technical paper making the case for reducing the wide choice of Mobile Optical Pluggables (MOPA) used to connect cell sites to fiber optic networks. The co-authors of the paper have recommended predefined optical blueprints that help operators speed up time to market using a common list of optical pluggable modules in a market worth $500 million per year.

Optical pluggables are defined as front-panel pluggable optical transceivers in popular form factors like SFP+, SFP28, QSFP28, etc. and the Blueprints are intended as global solutions, i.e., as generic as possible to cover a wide range of network scenarios.

The first-time joint industry initiative, published in time for the Optical Networking and Communication Conference & Exhibition, lays out a set of Mobile Optical Blueprints which describe the most optimized optical pluggable modules and passive optical components. Recommendations include optical characteristics such as data rates, reach, power, wavelengths as well as mechanical characteristics such as form factor, heat dissipation and operational temperature.

Ian Redpath, Practice Leader, Transport Networks and Components at Omdia said: “In a 5G world, optical pluggables will be utilized to connect cell sites to the network core. Network operators are currently challenged with assessing many pluggable variations, increasing their qualification work load and slowing time to deploy. MOPA will streamline efforts for the connectivity community, enabling cost reductions and reducing time to deploy.”

Stefaan Vanhastel, CTO Nokia Fixed Networks said: “Fiber is a critical component of 5G rollouts and provides unmatched capacity for 5G transport. A clear overview of available optics strategies makes it easier to design and deploy 5G networks. We are pleased to be joining forces with Ericsson, II-VI, Lumentum and Sumitomo Electric on this vital initiative which will make the choice for fiber even more compelling in the transport domain.”

References:

https://onestore.nokia.com/asset/210585

Mobile Optical Pluggables (MOPA) Technical Paper, June 8, 2021

NeoPhotonics CFP2-DCO Module Transmission of 400Gbps over 1500 km

Optical components maker NeoPhotonics said it was able to transmit data at 400 Gbps over a distance of 1500 km, using its Multi-Rate CFP2-DCO coherent pluggable transceivers, in a 75 GHz-spaced DWDM network.

The demonstration was done in NeoPhotonics Transmission System Testbed using production modules with enhanced firmware and 19 in-line erbium-doped fiber amplifiers (EDFA).

To achieve 1,500 km reach and a 400G data rate, the modules were operated at 69 Gbaud using 16 QAM modulation. NeoPhotonics added that the modules each consumed considerably less electrical power than line card systems operating at comparable data rates and distances. These 400G CFP2-DCO coherent pluggable transceiver modules use NeoPhotonics Indium Phosphide-based coherent components, along with its ultra-narrow linewidth tunable laser. These components include Class 40 CDM, Class 40 Micro-ICR and Nano-ITLA.

These 400G CFP2-DCO coherent pluggable transceiver modules use NeoPhotonics high performance Indium Phosphide-based coherent components, along with its ultra-narrow linewidth tunable laser. These components are all shipping in high volume into multiple coherent system applications, and include:

- Class 40 CDM: NeoPhotonics Class 40, polarization multiplexed, quadrature coherent driver modulator (CDM) features a co-packaged InP modulator with a linear, high bandwidth, differential driver, and is designed for low V-Pi, low insertion loss and a high extinction ratio. The compact package is designed to be compliant with the form factor of the OIF Implementation Agreement #OIF-HB-CDM-01.0.

- Class 40 Micro-ICR: NeoPhotonics Class 40 High Bandwidth Micro-Intradyne Coherent Receiver (Micro-ICR) is designed for >60 GBaud symbol rates. The compact package is designed to be compliant with the OIF Implementation Agreement OIF-DPC-MRX-02.0.

- Nano-ITLA: NeoPhotonics Nano-ITLA is based on the same proven and reliable high performance external cavity architecture as NeoPhotonics’ industry leading Micro-ITLA and maintains comparable ultra-narrow linewidth, low frequency phase noise and the low power consumption in a compact package approximately one half the size.

NeoPhotonics Multi-Rate CFP2-DCO modules are fully qualified. Telcordia testing has been successfully extended to 2000 hours of High Temperature Operating Life (HTOL) testing, showing the high reliability and performance of NeoPhotonics CFP2-DCO platform.

Multi-Rate CFP2-DCO modules supporting Metro (64G baud/DP-16 QAM) and Long Haul (64 G baud/DP-QPSK) applications are shipping in General Availability.

“Coupled with our recent demonstration of 800 km 400 Gbps transmission using our 400ZR+ QSFP-DD, our CFP2-DCO 400G 1500 km transmission brings the use of pluggable modules in regional and long haul networks closer to reality,” said Tim Jenks, Chairman and CEO of NeoPhotonics. “The ability to implement a long haul coherent transponder in the size and power envelope of a pluggable module is a testament to the progress that has been made in photonic integration and DSP development, and has the potential to be a game changer for telecom as well as DCI networks,” concluded Mr. Jenks.

June 8, 2021 Update:

NeoPhotonics announced that its QSFP-DD and OSFP 400ZR pluggable modules are in General Availability and shipping to customers.

These products utilize NeoPhotonics Silicon Photonics Coherent Optical Subassembly (COSA) and low power consumption, ultra-narrow linewidth Nano-ITLA tunable laser, combined with the latest generation of 7 nm node DSP (digital signal processing) technology, to provide full 400ZR transmission in a standard data center QSFP-DD or OSFP form factor that can be plugged directly into switches and routers. This greatly simplifies and cost reduces data center interconnect (DCI) networks by enabling the elimination of a layer of network equipment and a set of short reach client-side transceivers, and paves the way for similar benefits in metro networks.

These 400G modules are compliant with the OIF 400ZR Implementation Agreement and are interoperable with other manufacturers’ 400ZR modules that utilize a standard forward error correction (FEC) encoder and decoder. These modules are capable of tuning to and transmitting within 75 GHz or 100GHz spaced wavelength channels, as specified in the OIF agreement, and operate in 400ZR mode for Cloud DCI applications. For longer metro reaches, the modules are designed to support 400ZR+ modes.

NeoPhotonics QSFP-DD and OSFP modules have completed reliability qualification and have passed 2000 hours of High Temperature Operating Life (HTOL) as well as other critical tests per Telcordia requirements.

The company recently announced that it had used its QSFP-DD coherent pluggable transceiver to transmit at a 400 Gbps data rate over a distance of 800 km in a 75GHz-spaced DWDM system with more than 3.5 dB of OSNR margin in the optical signal while remaining within the power consumption envelope of the QSFP-DD module’s power specification.

“This demonstration of high data rates over longer distances shows the potential of these game-changing products, and we expect to see increasing deployment of coherent pluggable modules with different use cases, from data center interconnect to metro and regional applications as well as 5G wireless backhaul,” said Tim Jenks, Chairman and CEO of NeoPhotonics. “Since the beginning of coherent transmission, NeoPhotonics has been at the forefront in meeting the volume needs of our customers, as is indicated by our recent announcement that we had shipped a cumulative total of more than two million ultra-narrow linewidth tunable lasers,” concluded Mr. Jenks.

About NeoPhotonics:

NeoPhotonics is a leading developer and manufacturer of lasers and optoelectronic solutions that transmit, receive and switch high-speed digital optical signals for Cloud and hyper-scale data center internet content provider and telecom networks. The Company’s products enable cost-effective, high-speed over distance data transmission and efficient allocation of bandwidth in optical networks. NeoPhotonics maintains headquarters in San Jose, California and ISO 9001:2015 certified engineering and manufacturing facilities in Silicon Valley (USA), Japan and China. For additional information visit www.neophotonics.com.

Internet 2’s Next Generation Infrastructure team deploys 800Gbps optical link

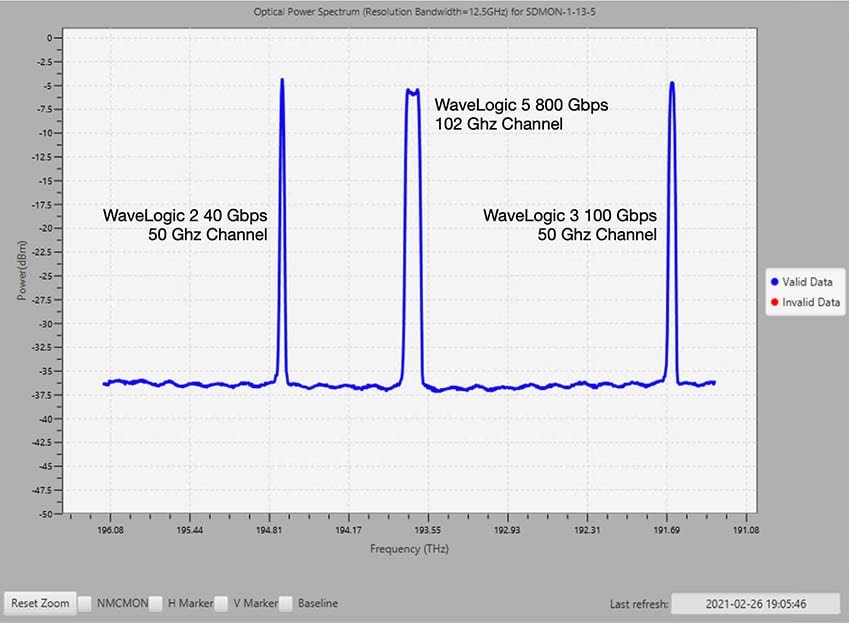

On February 26, 2021, Internet2 deployed its first 800 Gbps single-carrier optical circuit between Phoenix and Tucson, AZ as part of its Next Generation Infrastructure (NGI) program.

This milestone marks the first 800G native link to be deployed by a U.S. research and education network. The optical circuit leverages a 102 Ghz carrier generated by a single Ciena Waveserver 5 transponder at each endpoint.

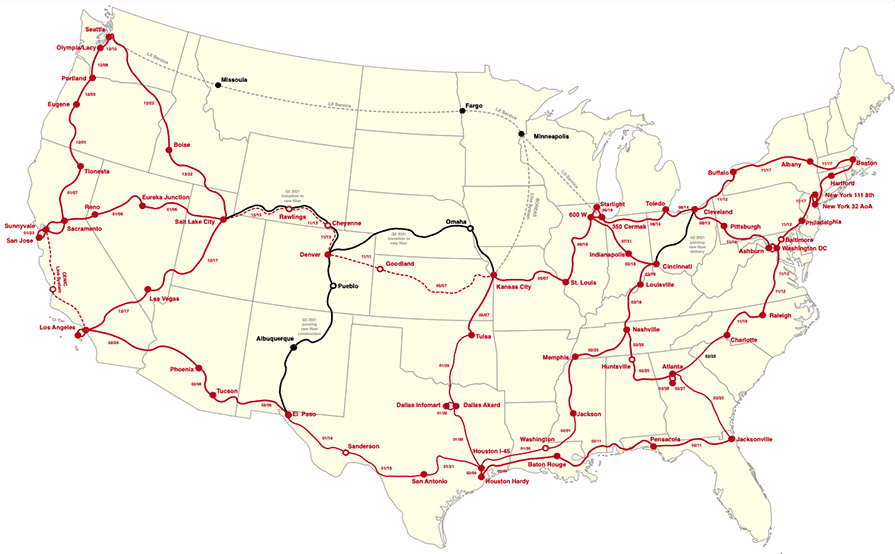

On February 25, 2021, the Internet2 project team completed the upgrade of all Reconfigurable Optical Add-Drop Multiplexers (ROADMs) to flex spectrum on all east-west long-haul routes nationwide. Additionally, the majority of the optical fiber was upgraded from LEAF to SMF28 to better match the coherent transmission technologies being used to convey the new 800 Gbps optical link.

Internet2 plans to rapidly expand its 400G and 800G transmission capabilities along these newly flex-grid enabled routes; more link capacity will come online as our phase 2 hardware deployment team (GDT) continues to move across the country. The Internet2 team is deploying the Cisco 8200 and Ciena Waveserver 5 platform. Completion is targeted for the end of this month (March 2021).

The successful deployment of this initial 800 Gbps optical link is the culmination of thousands of hours of effort from both the Internet2 community and teams in many organizations, including Internet2, GlobalNOC at Indiana University, Ciena, Lumen, and GDT.

Just two weeks ago, Telefonica said it had trialed an 800 Gbps optical link, using Huawei and Nokia network equipment. However, there are no 800 Gps links in any commercial production network, as far as we can determine.

References:

Windstream Wholesale and Infinera Complete Successful Trial of LR8-Based 400GbE Client-Side Services

“Our customers’ bandwidth requirements are growing rapidly, and Windstream is increasing network capacity to meet this demand,” said Buddy Bayer, chief network officer at Windstream. “Infinera’s GX G30 Compact Modular Platform provides an ultra-efficient transport solution enabling us to offer 400GbE services to support our customers’ high-bandwidth needs. The use of LR8 clients with a single mode fiber interface and a 10-kilometer reach provides an extremely cost-effective solution by enabling us to extend these services directly to our customers’ premises.”

Windstream Wholesale is currently engaging with customers for initial deployment of the end-to-end 400G Wave service. For more information on how you can bring 400G Wave services to your company, call 1-866-375-6040.

To view the Windstream network map, visit https://www.windstreamenterprise.com/wholesale/interactive-map/.

About Windstream

Windstream Holdings, Inc., a FORTUNE 500 company, is a leading provider of advanced network communications and technology solutions. Windstream provides data networking, core transport, security, unified communications and managed services to mid-market, enterprise and wholesale customers across the U.S. The company also offers broadband, entertainment and security services for consumers and small and medium-sized businesses primarily in rural areas in 18 states. Services are delivered over multiple network platforms including a nationwide IP network, our proprietary cloud core architecture and on a local and long-haul fiber network spanning approximately 150,000 miles. Additional information is available at windstream.com or https://www.windstreamenterprise.com/wholesale/. Please visit our newsroom at news.windstream.com or follow us on Twitter at @Windstream.

About Infinera

Infinera is a global supplier of innovative networking solutions that enable carriers, cloud operators, governments, and enterprises to scale network bandwidth, accelerate service innovation, and automate network operations. The Infinera end-to-end packet optical portfolio delivers industry-leading economics and performance in long-haul, submarine, data center interconnect, and metro transport applications. To learn more about Infinera, visit www.infinera.com, follow us on Twitter @Infinera, and read our latest blog posts at www.infinera.com/blog.

Windstream Media Contact

Scott Morris, 501-748-5342

[email protected]

Infinera Media Contact

Anna Vue, (916) 595-8157

[email protected]

Source: Windstream Holdings, Inc.

Reference:

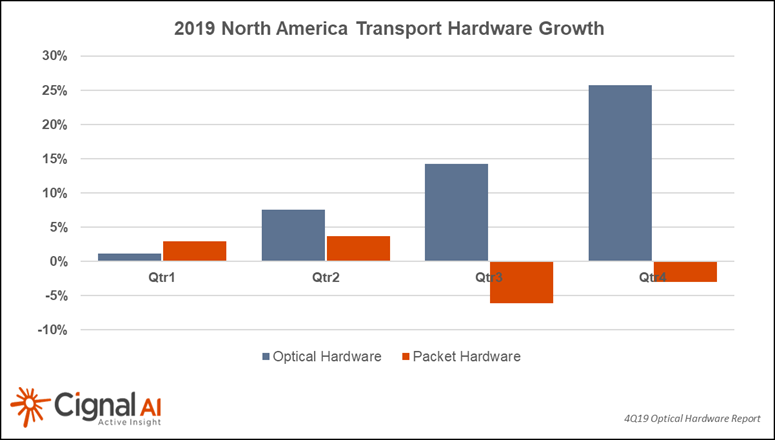

Cignal AI: North American Optical Sales Rebound In 2019

|

||||

|

||||

Additional 4Q19 Transport Hardware Report Findings:

Transport Hardware Superdashboard:

|

||||

About the Transport Hardware Report

About Cignal AI:

Contact Cignal AI/Purchase Report:

|

CoBank: Secular Tailwinds Support Current Fiber Optic Company Valuations

Fiber network consolidation has driven up the value of fiber optic networks for strategic buyers and infrastructure funds, says rural communications infrastructure financing company CoBank in a new report. As CoBank notes, the number of fiber networks available for acquisition has declined, causing the report authors to speculate that investors will turn their attention next to regional cable operators and potentially to rural local exchange carriers (RLECs).

Driving fiber consolidation and fiber network values is Americans’ growing demand for bandwidth, the report states. The authors cite research from Deloitte that forecasts the need for an estimated $130 billion to $150 billion in fiber infrastructure investment over the next five to seven years. Key demand drivers include broadband competition, rural coverage and wireless densification.

Building fiber networks takes a long time and as operators race to meet the expected surge in demand, a build/lease hybrid model will likely continue to play out over the next several years. Institutional investor interest in the fiber market should continue given the underlying demand drivers and predictable revenue streams these networks offer.

Given the relatively high entry barriers in the fiber market and consumers’ insatiable demand for data, there do not appear to be many glaring risks to fiber valuations. Oversupply is the most obvious one, but this is more region-specific than any kind of systemic risk, particularly given the proliferation of data usage.

Considering the amount of industry consolidation and scarcity of acquisition candidates, fiber-rich cable operators could become attractive assets for both institutional investors and strategic buyers. All of these factors paint a positive picture for future fiber valuations.

According to CoBank, fiber valuations have increased approximately 30% over the last 12 months, and some buyers have paid multiples above 20 times earnings before interest, taxes, depreciation and amortization (EBITDA).

The authors caution that “there is clearly a disconnect between public (e.g. fiber operator Zayo) and private fiber valuations.” The report attributes this disparity to “volatility in equity markets and waning investor confidence that have resulted in public valuations coming in much lower than private valuations.”

CoBank doesn’t see lower public company valuations negatively impacting those of private companies, however.

“Infrastructure funds have a much longer time horizon, and strategic buyers enjoy synergies that will allow them to pay a higher multiple versus myopically focused public equity investors,” the authors wrote.

Fiber Network Consolidation

The CoBank report references several key fiber network acquisitions by strategic buyers and foreign infrastructure funds, including:

- Macquarie Infrastructure’s plan to purchase Bluebird Network in conjunction with Uniti Group

- European-based EQT purchasing a majority stake in Spirit Communications and EQT’s plan to combine those operations with Lumos

- Antin Infrastructure Partners purchase of FirstLight Fiber

- Crown Castle’s purchase of Lightower, Wilcon Holdings and Fibernet Holdings

With so many deals in the rear-view mirror, CoBank noted that FiberLight, which has 14,000 route miles of fiber, is one of few remaining privately held fiber network operators that has yet to be acquired.

As a result, CoBank argues that strategic buyers and infrastructure funds are likely to begin taking a closer look at those regional cable operators that have been investing in fiber and at “progressive RLECs” that have been investing in fiber to offset their declining regulated revenues.

Although CoBank didn’t specifically identify the category, it would seem that statewide and regional fiber networks owned by RLEC consortia might be a particularly attractive category for such investors.

………………………………………………………………………………………………………………………………………………………..

References:

https://www.cobank.com/knowledge-exchange/communications/fiber-valuations

https://www.youtube.com/watch?v=GDqOw3jfsMshttps://www.youtube.com/watch?v=GDqOw3jfsMs

LightCounting: Optical Transceiver Sales Increased in 2Q-2018 despite ZTE shutdown

Sales of optical transceivers rose sequentially and held their own year-on-year, according to LightCounting. The market research firm’s “September 2018 Quarterly Market Update Report” states that strong demand for Ethernet optics for data center and enterprise applications, as well as improvements in worldwide wireless front haul and FTTx optics interest, provided a boost for fiber optic transceiver sales in 2Q-2018. That’s despite demand for DWDM transceivers hit a multiyear low due to the temporary shutdown of Chinese vendor ZTE.

LightCounting reported that shipments of 100GbE SR4 and CWDM4 modules in the first half of the year exceeded their expectations. The opposite was true of all other 100GbE transceivers, with several suppliers citing excess inventory at Amazon as a drag on 100GbE PSM4 sales. However, demand for 10GbE transceivers was very strong in the first six months of this year; unit shipments grew by more than 20%, according to the new report. The majority of these modules went to applications in enterprise networks. Cisco reported a 42% increase in the number of 10GbE ports shipped into this market in 1H18. And even 1GbE transceiver sales grew slightly in Q2 2018, LightCounting added.

Sales of optical transceivers picked up sequentially during the second quarter of 2018. (Source: LightCounting)

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Looking at the market from a fiber optic transceiver customer perspective, Internet Content Providers (ICPs) spent 80% more on their optical infrastructures in the first half of 2018 than during the same time in 2017. Communications Service Providers (CSPs) also increased their spending during this year’s first half versus 2017, although by only 2.6%.

The LightCounting 2Q-2018 report was more positive than either IHS-Markit or Cignal AI which both found the optical hardware market struggling in this year’s second quarter.

Looking ahead, LightCounting expects DWDM module sales to pick up now that ZTE is back in business. The company cited the fact that Acacia Communications executives anticipate a nearly 40% sequential increase in third quarter 2018 sales, with ZTE responsible for 60% of that.

The new “Quarterly Market Update” includes data and commentary on the Q2 2018 financial results of CSPs, ICPs, networking hardware, optical components, modules, and semiconductor chip makers. It also includes shipment data through Q2 2018 for more than 100 optical transceiver and wavelength selective switch (WSS) products.

LightCounting Contact Info: Tel: 408.962.4851 Email: [email protected]

Press Release for this report: https://www.lightcounting.com/News_091818.cfm