Optical Transceivers

Industry Analysts: Important Optical Networking Trends for 2023

Optical Transceivers:

Optical transceivers save space and reduce the need for additional transmitting and receiving devices because they transmit and receive information all in one device! Additionally, they are an economical, compact tool to enable networks to send information over larger distances, come in a variety of Ethernet speeds from Fast Ethernet to 100 Gigabit Ethernet, and offer great flexibility to grow your network while leveraging existing network devices and infrastructure.

Many newer, high quality Small Form-factor Pluggable (SFP) modules have Diagnostic Monitoring Interface (DMI), which automatically monitors SFP operations such as output and input power, temperature, and supply voltage in addition to providing multimode, single mode, and multi-rate SFP options for more flexibility.

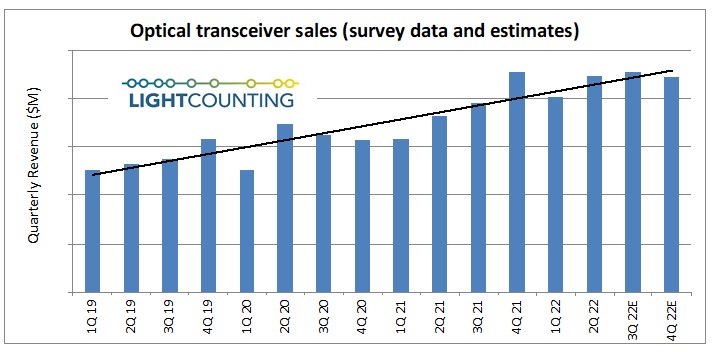

Market Research Future® (MRFR) predicts that the global optical transceiver market will rise to 8 billion in the U.S. by 2023.

Pluggable optics:

400ZR coherent pluggable optics emerged as a connectivity tool for metro-distributed data center connectivity. In 2023, look for three additional innovations to enable even more opportunities for coherent pluggables.

High-performance pluggables with 0 dBm transmit power and low out-of-band noise will enable coherent pluggable transceivers to cover a richer set of use cases, including deployment in metro networks with multiple cascaded ROADMs. This increased transceiver performance will also push some pluggables beyond the 600-km metro threshold and into a portion of the long-haul network.

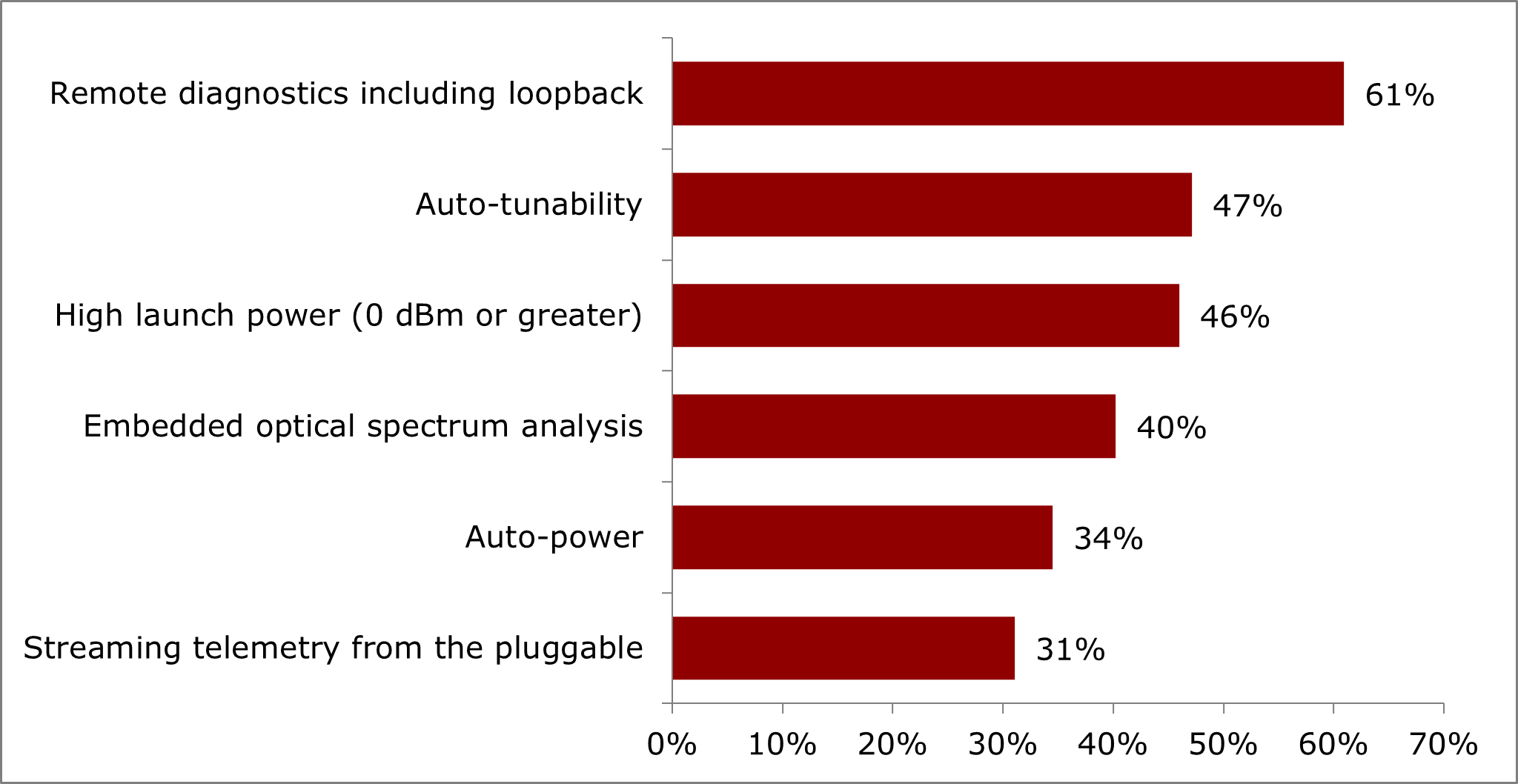

Advances in intelligent pluggables management, as being defined in the 28-member Open XR Forum and with inputs to other organizations like the OIF, will ease deployment complexity and enable operational support for advanced functionality like remote diagnostics, auto-discovery, spectrum analysis, and streaming telemetry in all types of non-optical hosts, including switches and routers.

A new class of coherent pluggables, such as Infinera’s ICE-XR with digital subcarrier technology, will enable commercial deployment of point-to-multipoint architectures, where a single high-speed (e.g., 400G) hub optic can communicate with multiple lower-speed (e.g., 25G to 100G in 25G increments) optics without requiring intermediate electrical aggregation – thus reducing the amount of equipment, space, and power utilized and the total cost of network ownership by up to 70% over multiple years.

Heavy Reading’s optical networking analyst Sterling Perrin sees “pluggable optics everywhere” being a dominant theme. “This includes the continuing trends in 400ZR and ZR+ but also a big focus on migrating down to small coherent 100G pluggables, pluggables across 5G XHaul networks, and pluggables in PON,” he writes in a note to Light Reading.

Data center transmission:

In 2023, look for modular, distributed data center deployments to accelerate, along with 400 Gb/s, 600 Gb/s, and 800 Gb/s per wavelength coherent optical connectivity to support their interconnection

Modular data centers, where construction and integration tasks are moved offsite and then shipped and assembled onsite, are becoming mainstream and enabling compute and storage to be quickly and reliably deployed in all types of settings – from just a few racks in a small hut to megawatts of equipment in a multi-story configuration. In 2023, look for modular, distributed data center deployments to accelerate, along with 400 Gb/s, 600 Gb/s, and 800 Gb/s per wavelength coherent optical connectivity to support their interconnection.

Lisa Huff, Omdia’s senior principal analyst covering optical components will keep an eye out for whether 800G and 1.6T transmission will show up next in data centers. “We are in the middle of 400G deployment inside the data center and, as always, there is much hype around what the next data rate will be,” she writes.

“Omdia expects to see 2x400G and 8x100G solutions start to be deployed inside the data center in 2023, but we will not see high-volume deployment until about 2025 when DR4 and FR4 variants mature and 400G starts to slow down,” she writes. Deployments of 1.6T may start in 2026, but Huff said it might be 2027 or later before we see significant volume.

Coherent routing:

Omdia Senior Principal Analyst Timothy Munks said that with data traffic growing at the network’s edge, network operators are looking for better solutions to collect and move that data into metro and core networks.

“The convergence of IP and optical, or coherent routing, provides cost effective aggregation and transport of diverse traffic streams and offers network operators a pure pay-as-you-grow business model for adding capacity,” he writes.

In this video, Cisco’s Bill Gartner, SVP/GM Optical Systems & Optics, chats with Phil Harvey to discuss their Leading Lights Award and how Routed Optical Networking is transforming infrastructure and the economics of the network.

References:

Heavy Reading: Coherent Optics for 400G transport and 100G metro edge

To understand the future of high speed coherent optics, Heavy Reading launched the Coherent Optics Market Leadership Program with industry partners Ciena, Effect Photonics, Infinera and Ribbon. The 2022 project was based on a global network operator survey, conducted in August, that attracted 87 qualified responses.

Heavy Reading reports that network operators are using or evaluating coherent optics for 400G transport services for both internal and external applications, as well as 100G data rates for the metro edge.

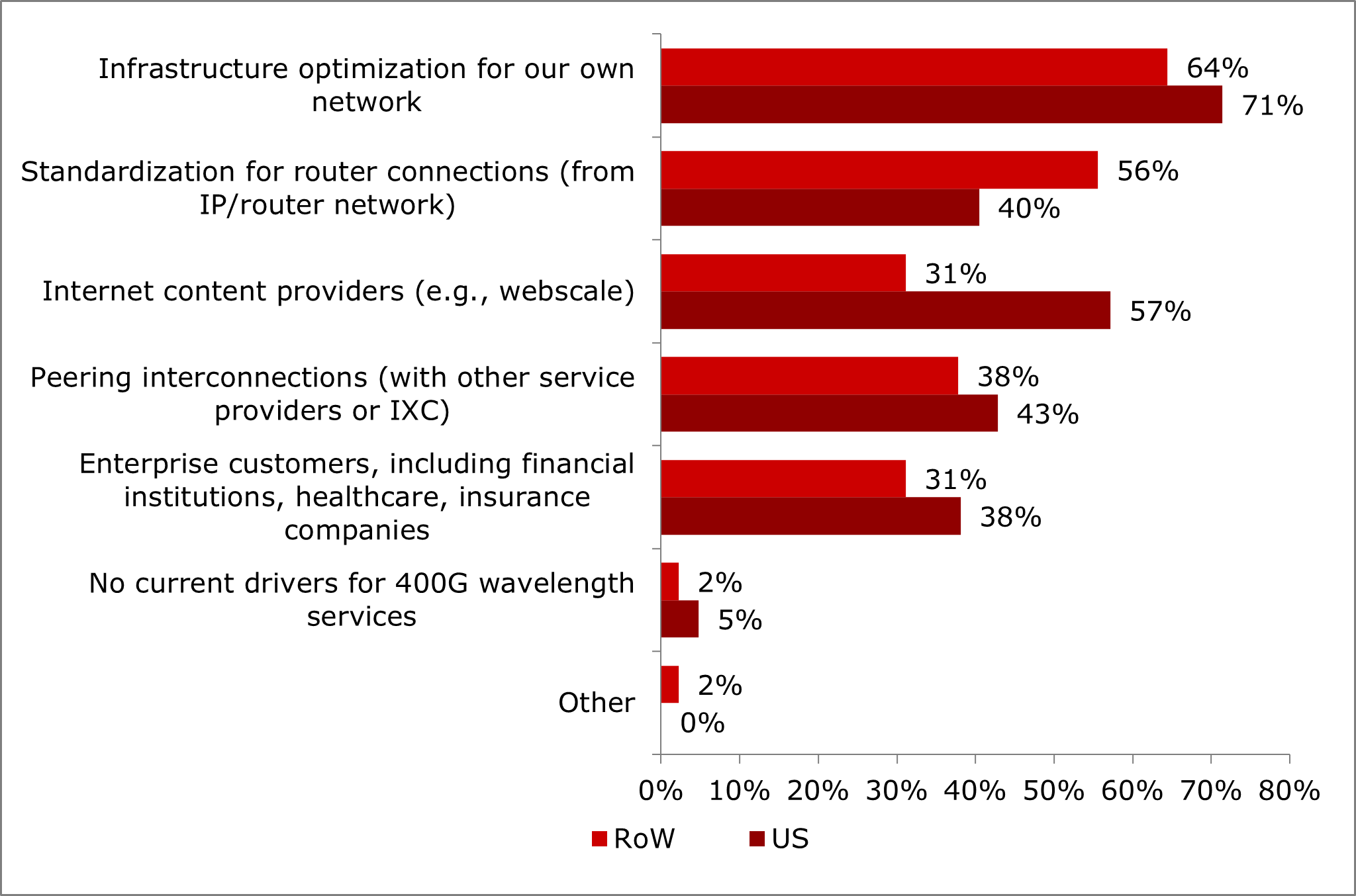

Nearly half of operator respondents in Heavy Reading’s survey will have deployed 400G transport services in their network between now and the end of 2023. But what are their top motivations for offering 400G transport services? Globally, the top driver for 400G services by far is infrastructure optimization for internal networks. This driver was selected by more than two-thirds of operators surveyed and well ahead of the second choice, standardization of router connections.

The data suggests that, for the global audience of operators, there are not that many customers currently that require full 400Gbit/s connectivity. Yet, there is value in grooming internal traffic up to 400G for greater efficiency and lower costs (e.g., fewer ports, lower cost per bit, etc.).

Beyond internal infrastructure, however, the drivers vary significantly by region, particularly when separating U.S. respondents from their Rest of World (RoW) counterparts. 57% of U.S.operators surveyed identified hyperscalers (or Internet content providers) as a 400G service driver — a strong showing and second only to internal infrastructure in the U.S. In contrast, just 31% of RoW operators identified Internet content providers as a top driver.

What are your top drivers for 400G wavelength (or optical) transport services?

High launch power optics are widely seen as essential for 400G+ pluggables in telecom applications, which are typically brownfield networks with lots of ROADM nodes. However, when filtering the survey results to include optical specialists only (i.e., those who identify as working in optical transport), higher launch power is the number one requirement, well ahead of remote diagnostics. It is likely that, at this early stage, optical specialists within operators understand the criticality of this particular technical requirement better than their peers.

What advanced coherent DWDM pluggable features or capabilities do you find most beneficial to your network/operations?

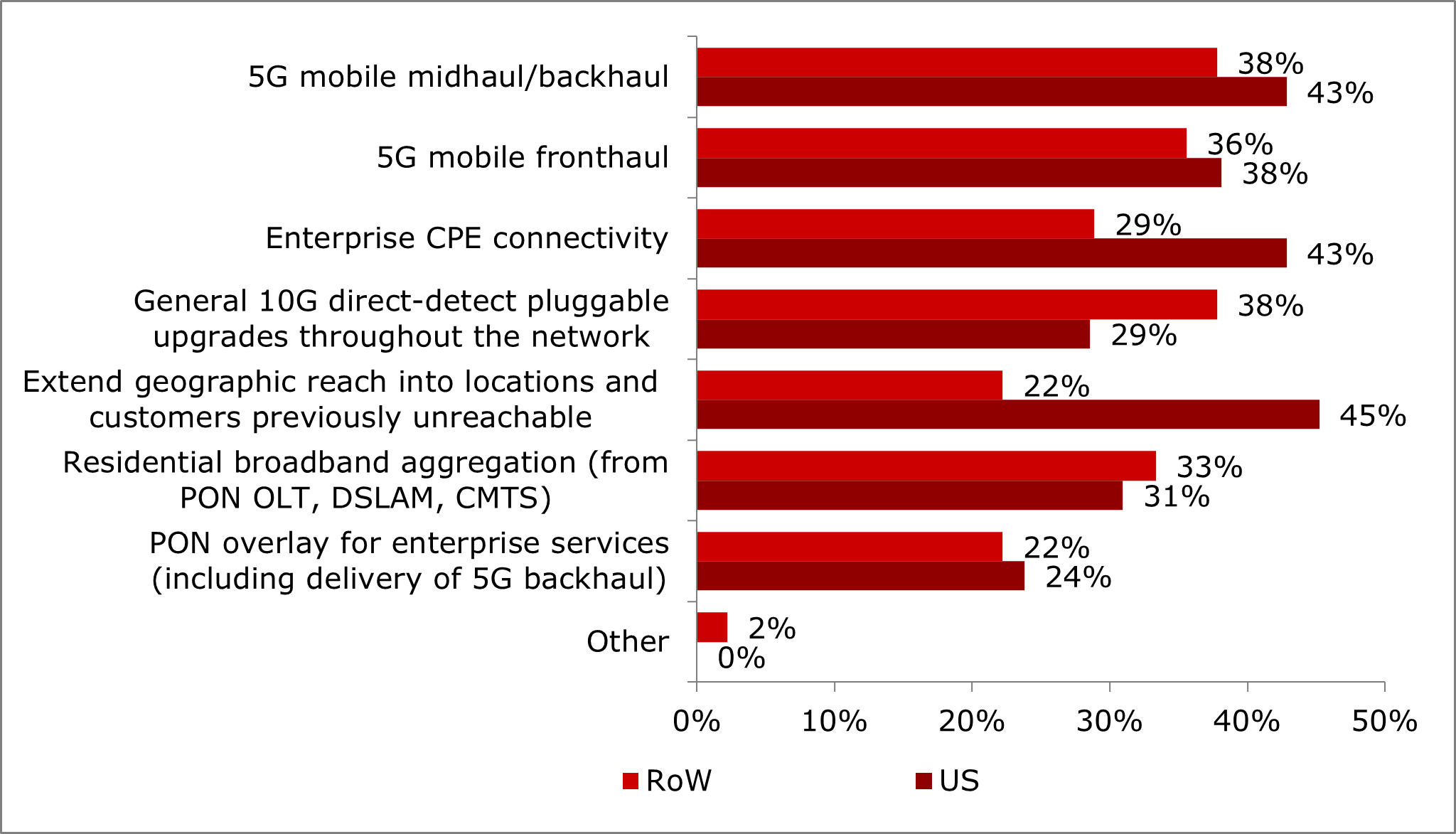

Coherent pluggable optics at 100G have use case priorities which vary significantly based on geographic region, particularly when separating U.S. respondents from their RoW counterparts. For the U.S., extending geographic reach is the top use case, followed by 5G backhaul/midhaul and enterprise connectivity. For RoW operators, however, extending geographic reach is not a priority use case.

When considering 100G coherent pluggables, what do you see as the most common use cases?

References:

https://www.lightreading.com/new-frontiers-for-coherent-optics/a/d-id/781813?

Coherent Optics: 100G, 400G and Beyond

Coherent Optics: 100G, 400G, & Beyond: A 2022 Heavy Reading Survey

Cable Labs: Interoperable 200-Gig coherent optics via Point-to-Point Coherent Optics (P2PCO) 2.0 specs

Microchip and Cisco-Acacia Collaborate to Progress 400G Pluggable Coherent Optics

Cignal AI: Metro WDM forecast cut; IP-over-DWDM and Coherent Pluggables to impact market

Smartoptics Takes Leading Role in Sustainable Optical Networking

Dell’Oro: Demand for Optical Transport equipment strong and headed for double-digit growth in NA

In a new report, the Dell’Oro Group states that the demand for Optical Transport equipment remained strong in North America during 2Q 2022. In the quarter, the North American market for Optical Transport grew 10 percent year-over-year.

“At this pace, we could be headed for another year of double-digit growth in North America,” said Jimmy Yu, Vice President at Dell’Oro Group. “While we expected another year of North American optical market expansion in 2022, we thought the growth rate could slow a bit after such a strong 2021. However, considering the first-half results and higher than usual backlog held by equipment manufacturers, we think a double-digit rate of growth could occur in 2022. Our biggest concern, however, remains to be the component shortage and supply chain issues that have limited revenue growth for the past couple years,” added Yu.

Additional highlights from the 2Q 2022 Quarterly Report:

- The worldwide Optical Transport market excluding China grew 2 percent in 2Q 2022 and is projected to grow a little over 4 percent in 2022.

- The region with the lowest year-over-year growth rate in the quarter was Asia Pacific due to lower demand in China.

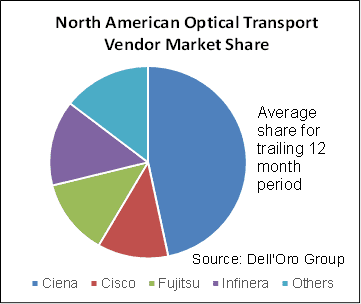

- The system manufacturers with the highest share of North America Optical Transport revenue in the quarter were Ciena, Infinera, Cisco, and Fujitsu. These four vendors held a combined market share of approximately 85 percent. Please see chart below:

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, and unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM.

To purchase this report, please contact us at [email protected].

Cable Labs: Interoperable 200-Gig coherent optics via Point-to-Point Coherent Optics (P2PCO) 2.0 specs

Cablecos use of 200-Gig coherent optical signals in their broadband access network progressed following a recent interop event at CableLabs that involved a five suppliers of coherent optical modules.

CableLabs confirmed that equipment and silicon from those players – Acacia (now part of Cisco), Ciena, Fujitsu Optical Components, Lumentum and Marvell – were found to interoperate with the organization’s Point-to-Point Coherent Optics (P2PCO) 2.0 specs [1.]. The number of participants might not be high, but what’s important is that the participants include DSP silicon from multiple manufacturers that represent the majority of the coherent optics industry.

Note 1. The P2PCO 2.0 specs doubled the operating capacity – from 100 Gbit/s per wavelength in the 1.0 specs, to 200 Gbit/s.

Demonstrating interoperability among so many different coherent DSP suppliers bodes incredibly well for network operators as it provides multi-vendor interoperability, which promotes scale and competition.

Image Courtesy of Cable Labs

Cable Labs conducted 100-Gig interops in 2018 and 2019. Those efforts tie into a broader initiative to use coherent optics technologies, typically used for long-haul, metro and submarine networks, to expand the capacity of fiber that’s already deployed on the hybrid fiber/coax (HFC) access network.

The CableLabs specs also describe a new technology called the Coherent Termination Device (CTD), which can be deployed in an outdoor aggregation node.

Matt Schmitt, a principal architect at CableLabs, said the scope of CableLabs’ interoperability efforts focus on the modules on the optical end – basically describing how a transceiver works at the physical layer.

And to help fit the cable network environment, the end of the network using the CTD is made to reside outdoors, rather than inside a facility.

“Almost every other application of coherent that you see, both ends of the link are in facilities,” such as a data center interconnect where many links are densely packed with racks and modules, Schmitt explained. The cable access application of coherent optics might involve one end that does sit at a facility, such as a hub site, with the other end involving the aforementioned field-deployed CTD.

“Those field boxes didn’t really exist when we started this,” he said.

The broader concept is to help cable operators improve the performance of their access network fibers situated between headends and hubs and fiber nodes for a range of use cases, and to do so without getting locked into one supplier.

CableLabs and its partners originally thought this 200-Gig interop would be completed sooner, but it was delayed a bit during the pandemic when travelling and in-person gatherings were limited or non-existent.

But Schmitt said the plus side of that intervening period meant that the interop ended up with wider supplier participation, particularly at the DSP (digital signal processor) level, than it might have otherwise.

Beyond raw capacity, the 200-Gig capability should help to support the new distributed access architecture (DAA), supported by multiple remote PHY or remote MAC/PHY devices, and the cable’s industry’s broader pursuit of delivering symmetrical 10Gbit/s performance to customers on the access network.

Schmitt said 200-Gig technology gets particularly interesting when operators look to support large, high-density areas that are being split into smaller service groups. It might also factor in as operators explore services beyond high-speed data over cable, such as mobile XHaul.

The use of CTDs with pluggable optics is also designed to support a relatively easy upgrade path. If an operator starts with 100-Gig, those modules can be swapped out for 200-Gig modules later.

This point-to-point P2P use case is just one aspect of coherent optics being explored by CableLabs. A separate-but-related coherent PON initiative still uses coherent signaling, but is focused on point-to-multipoint links.

For now, Schmitt said CableLabs doesn’t plan to hold another interop for P2PCO v2.0 products. “It really just worked so well. I’m not sure what more there will be to do in a follow-up interop,” he said.

CableLabs would be open to doing qualification testing for these new P2P coherent products if the market demands it. “Thus far, I haven’t been hearing of a big push for that,” Schmitt said. “I think people have been comfortable with what we’re getting from the interops and doing their own testing to see how it works.” As for next steps, this latest batch of handiwork will be showcased at the 10G Lab at CableLabs, Schmitt said.

Meanwhile, future commercial deployments will be determined by the availability of CPDs and interest form cable operators.

Among suppliers involved in the recent interop, Ciena confirmed that it currently has interoperable, CableLabs-compliant 200G coherent pluggables available as part of the supplier’s WaveLogic 5 Nano coherent pluggable portfolio.

Another factor for adoption will be costs compared to the 10-Gig DWDM tech that’s in use today. Schmitt acknowledges that the first endpoint is going to be greater with coherent technology, since it involves putting a switch or router in the field.

“Where it gets interesting is every time you need to add another device that’s sharing that same fiber run,” Schmitt said.

“With coherent, you have a higher upfront cost, but you’re going to have a much lower slope, because as you add more devices, all you have to do is add a pair of gray (standard) optics modules – very low cost … Where’s that crossover point in terms of number of endpoints? To me, is going to be one of the big deciders on when and how widespread the deployment of this technology gets.”

References:

A Jolt of Light: CableLabs Holds First 200G P2P Coherent Optics Interop

First Light for CableLabs® Point-to-Point Coherent Optics Specifications

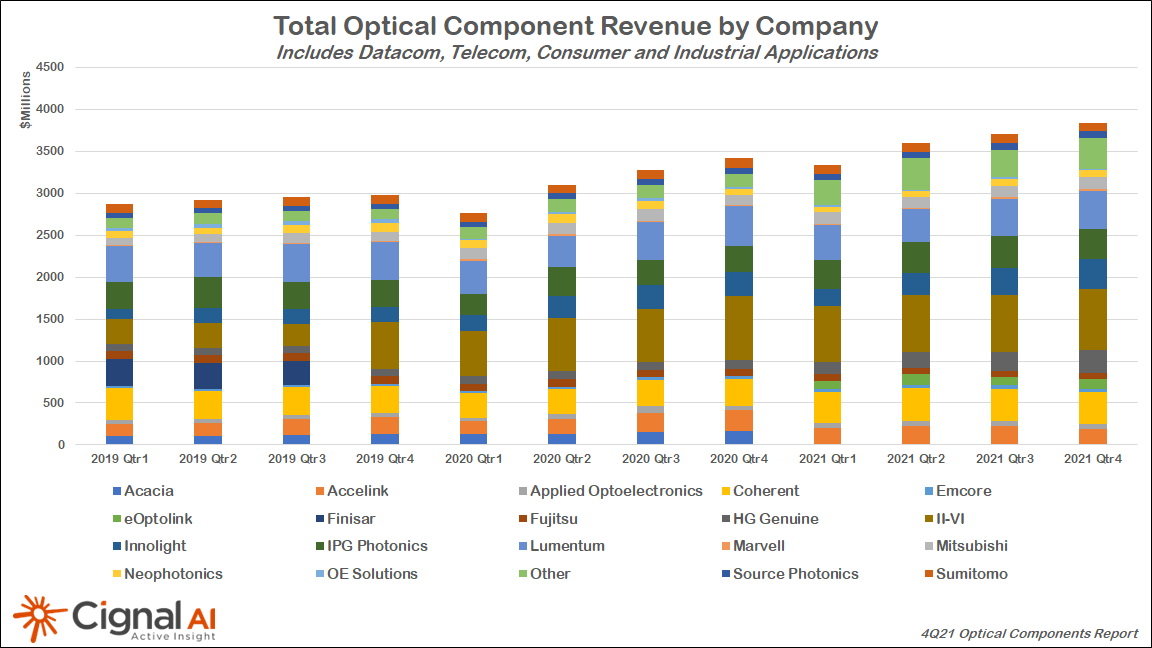

Cignal AI: Datacom optical component revenue +27% to reach $4.7B in 2021

Cignal AI reports that total revenue for optical components, a category that includes optical transceivers, grew 15% in 2021. Components for datacom optical network applications led the way, growing 27% to account for $4.7 billion of the total $14.5 billion component sales registered for the year within the datacom, telecom, industrial, and consumer markets, the market research firm states in its latest Optical Components Report.

A transition by large cloud service providers and some enterprise network operators toward 400-Gbps transmission helped spur this growth. For example, 1.8 million QSFP-DD and OSFP datacom modules shipped during 2021, most of which were DR4 format. Meanwhile, more than 60,000 400G pluggable coherent modules shipped at the same time, with QSFP-DD ZR devices accounting for the majority.

“The transition to 400GbE is well underway, and pluggable coherent 400Gbps technology is revolutionizing the design of the optical networks that connect datacenters,” said Scott Wilkinson, Lead Optical Component Analyst at Cignal AI. “400Gbps speeds will drive spending and bandwidth growth both inside and outside the datacenter in 2022,” Scott added.

More Key Findings from the 4Q21 Optical Components Report:

- Supply chain difficulties limited Telecom optical components market growth the most in 2021. However, the segment is forecast to grow more than 8% in 2022.

- Consumer component revenue for 3D sensing applications was flat YoY as lower-cost components offset higher unit shipments.

- Industrial optical components used for welding and medical applications grew 18% in 2021, following a weak 2020. Following the acquisition of Coherent, II-VI is poised to control over 50% of this market.

- 1.8M QSFP-DD Datacom modules shipped during 2021, most of which were DR4 format. The report also tracks SR4, FR4, and LR4 Datacom transceivers.

- Over 60k 400Gbps pluggable coherent modules shipped last year, the majority of which were QSFP-DD ZR. The report captures the shipment details of all the emerging derivatives of this format, including ZR, ZR+, 0dB ZR+, and CFP2 based ZR+.

- Shipments of 200Gbps coherent CFP2 modules grew 17% to just over 200k units during 2021 as Chinese OEMs ramp this speed (which is less dependent on western technology) for longer distance metro and long haul applications.

References:

IPS Expands Long Haul Submarine Data Transmission Capacity with Ribbon’s 100 Gigabit Ethernet (100GbE) services

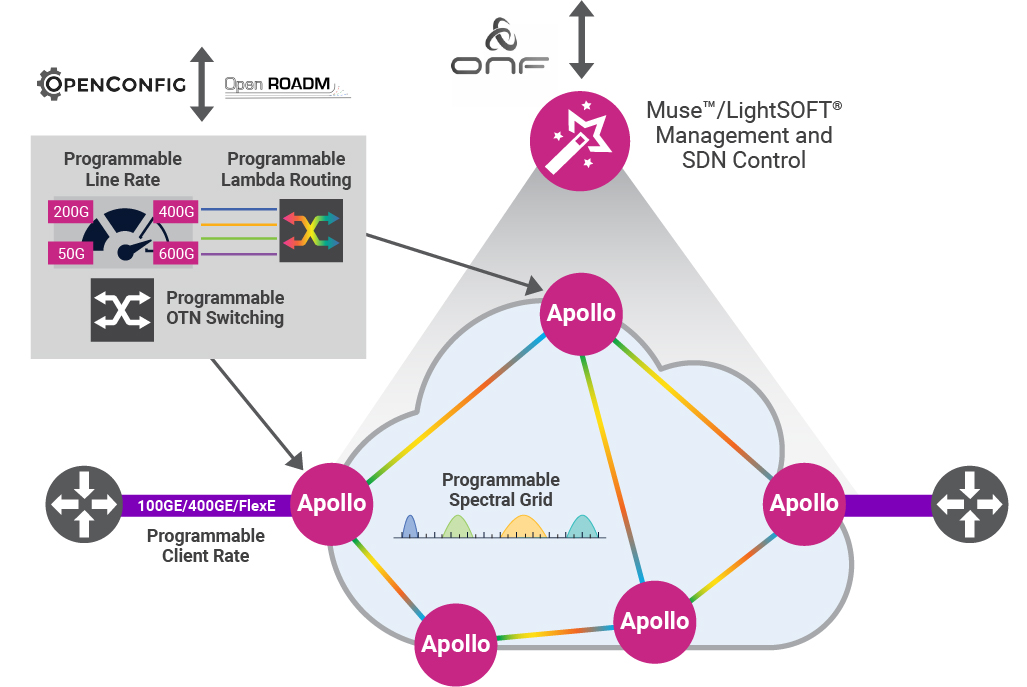

Ribbon Communications Inc, a global provider of real time communications software and IP Optical networking solutions to service providers, enterprises, and critical infrastructure sectors, today announced that Tokyo based IPS (a leading provider of international connectivity services for communications service providers), is using Ribbon’s Apollo Optical Networking solution to power 100 Gigabit Ethernet (100GbE) services delivered over both terrestrial and undersea cables from Manilla to Hong Kong and Singapore.

“Our ability to seamlessly deliver connectivity services to our customers over long distances is key to the success of our business,” said Koji Miyashita, President and CEO, IPS. “Ribbon’s Optical transport technology allowed us to maximize our available capacity and transmit world-class communications applications via our submarine services under the South China Sea.”

“Submarine applications must deliver extensive capacity and carry the highest level of communications services on each channel in order to realize cost efficiencies,” said Mickey Wilf, General Manager APAC and MEA Regions for Ribbon. “Our Apollo solution enables IPS to maximize capacity by leveraging dual wavelengths with programmable baud rate and modulation, in conjunction with flex grid technology.”

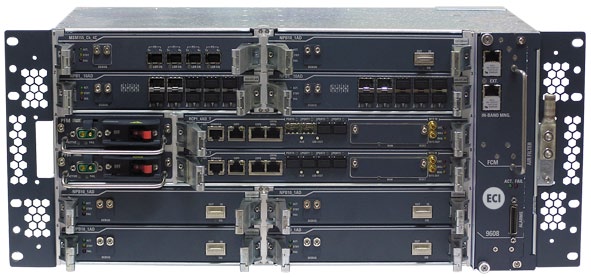

The solution deployed by IPS leverages Apollo’s high-performance programmable TM800 muxponder cards on Apollo 9600 series platforms to provide optimized long haul undersea connectivity for 100GbE services.

| 9504D | 9603 | 9608 | 9608D | 9624 | ||||

| Size | 1RU | 2RU | 5RU | 5RU | 15RU | |||

| Line Capacity | 1.6T | 2.4T | 6.4T | 6.4T | 19.2T | |||

| Photonics | CDC-F ROADMs, Fixed and Dynamic Amplifiers | |||||||

| Datasheet | Apollo 9504D | Apollo 9603 | Apollo 9608 | Apollo 9608D | Apollo 9624 | |||

| Image | Data Center |

|

|

Data Center |

|

|||

About IPS:

IPS Inc. operates as a Carriers-of Carrier in the Philippines providing network services for local and international telecom companies, contact centers and data centers. It has international telecommunication lines connecting Manila with Hong Kong, Singapore, and many other countries. IPS is listed on the Tokyo Stock Exchange.For more information visit ipsism.co.jp/en/.

About Ribbon:

Ribbon Communications (Nasdaq: RBBN) delivers communications software, IP and optical networking solutions to service providers, enterprises and critical infrastructure sectors globally. We engage deeply with our customers, helping them modernize their networks for improved competitive positioning and business outcomes in today’s smart, always-on and data-hungry world. Our innovative, end-to-end solutions portfolio delivers unparalleled scale, performance, and agility, including core to edge software-centric solutions, cloud-native offers, leading-edge security and analytics tools, along with IP and optical networking solutions for 5G. To learn more about Ribbon visit rbbn.com.

References:

https://ribboncommunications.com/products/service-provider-products/apollo-optical-systems

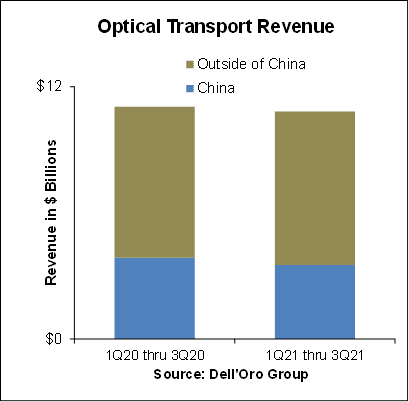

Dell’Oro: Optical Transport Market Down 2% in 1st 9 Months of 2021

According to a recently published report from Dell’Oro Group, the Optical Transport equipment market contracted 2 percent year-over-year in the first nine months of 2021 due to lower sales in China. Outside of China, however, the demand for optical equipment continued to increase, outpacing supply.

“Optical equipment revenue in China took a sharp turn for the worse in 3Q 2021,” said Jimmy Yu, Vice President at Dell’Oro Group. “As a result, optical revenue in China declined at a double-digit rate in the quarter, resulting in a 9 percent decline for the first nine months of 2021. At this rate, we are expecting a full year optical market contraction in the country. Something that has not occurred since 2012. Helping to offset some of this lower equipment revenue from China was the robust demand in North America, Europe, and Latin America.”

“We estimate that Optical Transport equipment revenue outside of China grew 6 percent year-over-year in the third quarter. However, we believe this growth rate could have been higher, closer to 10 percent, if it was not for component shortages and other supply issues plaguing the industry. So, fortunately while optical demand is hitting a rough patch in China, it seems to be accelerating in other parts of the world,” added Yu.

The optical transport market is predicted to reach $18 billion by 2025, primarily as a result of demand for WDM equipment, Dell’Oro reported in July 2021. In addition, Dell’Oro says the ZR pluggable optics market could exceed $500 million in annual sales by 2025.

In a 2Q-2021 report by market research firm Omdia, analysts noted that 5G investment, cloud service growth and demand for “infotainment-at-home” are among the drivers increasing demand in the optical networking market. “The twin dynamics of increasing optical capillarity and increasing end-point capacity continue to drive the optical core,” Omdia wrote in a note to clients.

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM. To purchase this report, please contact us at [email protected].

Jimmy Yu, Vice President, Dell-Oro Group

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

Optical Transport Market Down 2 Percent in First Nine Months of 2021, According to Dell’Oro Group

Disaggregated DWDM Equipment Market Up 36 Percent in 2Q 2021, According to Dell’Oro Group

5-Year Forecast: Optical Transport Market Reaches $18 Billion by 2025

Orange and Nokia demo 600Gb/sec transmission over a 914 km optical network; Nokia 25G PON

Nokia and Orange announced the completion of a network trial using the Nokia PSE-Vs, its fifth generation super coherent optics. With this field trial, Orange has successfully validated a planned upgrade of its long-haul backbone networks to support new high-bandwidth 400 Gb/sec services, and the ability to scale fiber capacity up to 600Gb/sec. This represents an increase in spectral efficiency by 50% compared to prior technologies on its long distance optical network.

The trial was performed in real-world conditions using Nokia PSE-Vs super coherent optics in production-ready optical transport hardware, just 16 months after the lab prototype trial done on Orange’s live network. Orange and Nokia demonstrated error-free performance at a data rate of 600Gb/sec over a 914 km network between Paris and Biarritz, under challenging live network conditions. The fiber network consisted of 13 spans of Orange’s existing network, through multiple cascaded reconfigurable optical add/drop multiplexers (ROADM), using 100GHz WDM spectrum channels.

Jean-Luc Vuillemin, Vice President of International Networks and Services at Orange, said: “With the booming market bandwidth requirement and need for scalability and flexibility, it is important that Orange continues to support an ever-greater network scale and new high-bandwidth services across our terrestrial and subsea global footprint.

Validating super coherent optics with Nokia represents an important enabler for future-proof networks which will bring spectral efficiency and operational deployment flexibility to our customer solutions. Furthermore this technology will allow for power savings by nearly 50%, which is key to our objective of developing greener networks for our customers. ”

James Watt, Head of Optical Networks Division, Nokia, said: “We are delighted to work with Orange in continued support of their network upgrade plans. With the introduction of the PSE-Vs super coherent capabilities across our entire 1830 portfolio, Nokia enables spectrally-efficient transport at 600Gb/sec over real-world long haul networks, and 400Gbps services over ultra long haul networks spanning multiple 1000’s of kilometers.”

Nokia 1830 Photonic Service Interconnect (PSE)

The Nokia PSE-V

The Nokia PSE-V is the industry’s most advanced family of digital coherent optics (DCO), powering the next generation of Nokia high-performance, high-capacity transponders, packet-optical switches, disaggregated compact modular and subsea terminal platforms. The PSE-V Super Coherent DSP (PSE-Vs) implements the industry’s only 2nd generation probabilistic constellation shaping (PCS) with continuous baud rate adjustment, and supports higher wavelength capacities over longer distances – including support for 400G over any distance – over spectrally efficient 100GHz WDM channels while further reducing network costs and power consumption per bit.

Further resources:

• Web page: Nokia 1830 Photonic Service Interconnect (PSI)

• Web page: Nokia Photonic Service Engine (PSE) Coherent DSPs

• Web page: 400G Everywhere

……………………………………………………………………………………………………………………..

Earlier this week, Nokia and Bell Canada announced the first successful test of 25G PON fiber broadband technology in North America at Bell’s Advanced Technical Lab in Montréal, Québec.

The trial validates that current GPON and XGS-PON broadband technology and future 25G PON can work seamlessly together on the same fiber hardware, which is being deployed throughout the network today. 25G PON delivers huge symmetrical bandwidth capacity that will support new use cases such as premium enterprise service and 5G transport. Nokia’s 25G PON solution utilizes the world’s first implementation of 25G PON technology and includes Lightspan and ISAM access nodes, 25G/10G optical cards and fiber modems.

For the past decade, Bell has been rolling out fiber Internet service to homes and businesses across the country, a key component in the company’s focus on connecting Canadians in urban and rural areas alike with next-generation broadband networks. With this successful trial, Bell can be confident that its network will absorb the increased capacity of future technologies and connect Canadians for generations to come.

Stephen Howe, EVP & Chief Technology Officer, Bell, said:

“As part of Bell’s purpose to advance how Canadians connect with each other and the world, we embrace next-generation technologies such as 25G PON to ensure we remain at the forefront of broadband innovation. Our successful work with Nokia to deliver the first 25G PON trial in North America will help ensure we maximize the Bell fiber advantage for our customers in the years to come.”

Jeffrey Maddox, President of Nokia Canada, said: “Nokia innovations powered the fiber networks and the connectivity lifeline that carried Canadian homes and businesses through the pandemic. 25G PON innovations will drive the next generation of advances in our connected home experience.”

Bell and Nokia have closely collaborated over the years on many industry breakthroughs, such as the first Canadian trial of 5G mobile technology in 2016. Bell continues to work with Nokia to build and expand its 5G network across Canada.

References:

Microchip and Cisco-Acacia Collaborate to Progress 400G Pluggable Coherent Optics

Bandwidth growth, driven by the expansion of data centers and 5G network build-outs, is expected to drive the need for faster coherent Dense Wavelength Division Multiplexing (DWDM) pluggable optics. Consequently, Data Center Interconnect (DCI) and metro Optical Transport Network (OTN) platforms are transitioning from 100/200G to 400G pluggable coherent optical modules to support these hyper-connected architectures.

Microchip Technology (a fabless semiconductor company) and Cisco’s Acacia unit are working together to validate the interoperability of their 400G pluggable optics components – Microchip’s DIGI-G5 OTN processor and META-DX1 terabit secured-Ethernet PHY and Acacia’s 400G pluggable coherent optics.

The purpose of the collaboration is to establish an ecosystem to support 400G CFP2-DCO, QSFP-DD and OSFP modules for the 400ZR specification as well as the OpenZR+ and Open ROADM Multi-Source Agreement (MSA) applications.

The collaboration between Microchip and Acacia helps to enable the use of 400G coherent pluggable optics in OTN and Ethernet systems as follows:

- For converged packet/OTN optical platforms, Microchip’s DIGI-G5 and Acacia’s 400G CFP2-DCO module are designed to enable terabit-class OTN switching line cards, mux/transponders, and switch/transponders. The DIGI-G5 interoperates with Acacia’s 400G CFP2-DCO module using a Flexible OTN (FlexO) or NxOTU4 interface to efficiently support OTN traffic, including Open ROADM MSA interface modes and 200G/400G ITU-T standards currently being drafted.

- For compact modular optical systems, Microchip’s META-DX1 and Acacia’s 400ZR and OpenZR+ modules are designed to enable 400G flexible line rate muxponders/transponders with support for multiple client optics types including QSFP28, QSFP-DD, and OSFP modules, helping service providers to transition from 100 GbE to 400 GbE using the same hardware.

- For data center routing and switching platforms, Microchip’s META-DX1 and Acacia’s 400ZR and OpenZR+ modules are designed to enable dense 400 GbE or FlexE with per port MACsec encryption coherent line cards. This helps customers leverage IP routers/switches over DWDM (IPoDWDM) infrastructure in DCI deployments.

“DIGI-G5 and META-DX1 have enabled our optical transport, IP routing and Ethernet switching customers to implement a new class of multi-terabit OTN switching and high-density 100/400 GbE and FlexE line cards that deliver on stringent packet timing and integrated security capabilities for the build out of cloud and carrier 5G-ready optical networks,” said Babak Samimi, vice president for Microchip’s Communications business unit. “Our interoperability efforts with Acacia help to demonstrate that an ecosystem for volume deployment of these new line cards with pluggable 400G coherent optics exists.”

“With Acacia’s 400G coherent modules verified to interoperate with Microchip’s DIGI-G5 and META-DX1 devices, we see it as a robust solution designed to address network capacity growth and improved efficiency,” said Markus Weber, senior director DSP, product line management of Acacia, now part of Cisco. “The compact size and power efficiency of our 400G OpenZR+ CFP2-DCO modules were designed to help network operators deploy and scale capacity of high-bandwidth DWDM connectivity between data centers and in metro networks.”

Kevin So, associate director of product line management and marketing at Microchip, told Fierce Telecom that the pair have a history of collaboration that goes back to work on 100G. He said their latest effort is meant to proactively eliminate elements of risk operators face as they begin to upgrade to the latest 400G technology. While most solutions are based on industry standards, So cautioned that’s not always a guarantee that components from different companies will work well together.

“I’ve seen in our industry often standards are written, people think things are going to work and then you show up at a carrier lab and that’s when you discover problems. Standards still do not necessarily always ensure everything is interoperable ready to go, and it can be a barrier for ultimately our customers and service providers in deploying it,” Mr. So said.

The companies stated they successfully validated interoperability between their respective components for 400G, ZR and OpenZR+ configurations in converged packet and OTN optical platforms, compact modular optical systems and data center routing and switching platforms.

So said Microchip’s work with Acacia started in the pre-silicon stage, ensuring the interfaces and designs they were pursuing were compatible. Once the silicon in question became available, the pair “tested these components together as a system to make sure it’s robust enough.”

Tom Williams, director of marketing for Acacia told Fierce Telecom, “This interop testing demonstrates that leading vendors are working together to streamline the integration process. There wasn’t any expectation of issues, but it builds confidence to know that the vendors have already done this work directly.”

References:

https://www.fiercetelecom.com/telecom/cisco-s-acacia-microchip-team-400g-interoperability-testing

Additional Resources:

For more information about the Microchip products, contact a Microchip sales representative, authorized worldwide distributor, or visit the DIGI-G5 and META-DX1 pages.

For more information on Acacia’s 400G coherent pluggable optical solutions, visit acacia-inc.com/products/.

For additional information on standards:

- For OpenZR+ MSA visit openzrplus.org

- For Open ROADM MSA visit openroadm.org

- For 400ZR visit www.oiforum.com/technical-work/hot-topics/400zr-2/

Lightpath to deploy 800Gb/sec links using Ciena’s WaveLogic 5 Extreme technology

Fiber-optic network services provider Lightpath has rolled out 800-Gbps capabilities via implementation of Ciena’s WaveLogic 5 Extreme technology. The company also will deploy Ciena’s Waveserver Ai platform, which will pair with a flexible-grid optical transport network based on Ciena’s 6500 RLS platforms.

The Lightpath Network consists of over 18,000 route miles of fiber providing connectivity to over 12,000 service locations. Lightpath provides a variety of connectivity and business services to customers in the metro New York area, including financial services firms (e.g. “Lightpath intros 100-Gbps optical transport service” and “Lightpath raises New York metro fiber-optic network footprint”). Using Ciena’s coherent optical solution, Lightpath’s network becomes more adaptive, allowing it to respond quickly to ever-changing bandwidth demands while maximizing operational efficiencies, providing customers with more reliable, high-speed services.

The enhanced optical transport technology will increase fiber network flexibility and efficiency as well as support Physical Layer encryption for data security. Cable MSO Altice USA owns a controlling interest in the company (see “Altice USA to sell almost 50% of Lightpath fiber enterprise business to Morgan Stanley Infrastructure Partners”).

“In order for our customers to execute on their own digital innovations, we need to provide them with fast and reliable connectivity. With Ciena’s solutions, our customers in the New York and Boston metro areas will now experience next-level digital services with high bandwidth and minimal latency,” commented Phil Olivero, CTO at Lightpath.

“As users consume more digital content, it is crucial for service providers to ensure their network can adapt to these surging and often unpredictable demands. With Ciena’s technology, Lightpath is adding scalability to meet bandwidth demands and also gaining real-time visibility into the performance of its network,” added Kevin Sheehan, CTO, Americas, for Ciena.

WaveLogic 5 Extreme is now available in three different product implementations to meet network architecture preferences: 6500 Packet-Optical Platform, Waveserver 5 compact interconnect platform, and the WaveLogic 5 Extreme 800G transceiver module

The WaveLogic 5 Extreme chip is 12mm x 16mm CMOS device. Here are some of its remarkable features:

- It is the industry’s first commercial 7nm CMOS device for optical networks.

- Based on 7nm FinFET technology, it includes 3km of wiring and contains 800 Trillion operations per second, which is about as much horsepower as 400,000 laptops!

- Some of the capabilities that are packed into the ASIC include nonlinear probabilistic constellation shaping, throughput-optimized forward error correction, frequency division multiplexing, and encryption.

…………………………………………………………………………………………………………………………………………………………………..

About Ciena

Ciena is a networking systems, services and software company. We provide solutions that help our customers create the Adaptive Network™ n response to the constantly changing demands of their end-users. By delivering best-in-class networking technology through high-touch consultative relationships, we build the world’s most agile networks with automation, openness and scale. For updates on Ciena, follow us on Twitter @Ciena, LinkedIn, the Ciena Insights blog, or visit www.ciena.com.

About Lightpath

Lightpath is revolutionizing how customers connect to their digital destinations by combining our next-generation network with our next-generation customer service. Lightpath’s advanced fiber-optic network offers a comprehensive portfolio of custom-engineered connectivity solutions with unparalleled performance, reliability, and security. Our consultative customer service means we work with you to design, deliver, and support the solution for your unique needs, faster and more easily than ever before. For over 30 years, thousands of enterprises, governments, and educators have trusted Lightpath to power their organization’s innovation. Altice USA (NYSE: ATUS) owns a 50.01% controlling interest in Lightpath and Morgan Stanley Infrastructure Partners (MSIP) owns 49.99% of the Company.

………………………………………………………………………………………………………………………………………………………………..

References: