Telecom in India

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

Despite being very late to deploy 5G due to tardy licensed spectrum auctions, and with no known indigenous 5G network equipment vendors, India’s Communications Minister Ashwini Vaishnaw believes the country’s indigenous 4G/5G technology stack is “now ready” and the country is poised to emerge as a major telecom technology exporter to the world in the coming three years. Speaking at the Economic Times Global Business Summit 2023, Vaishnaw, who is also the Minister for Railways, categorically said there is no program for the privatization of the national transporter.

The 5G services were launched on October 1, 2022, and within a span of 100 days have been rolled out in 200-plus cities. The sheer speed of rollout has been appreciated by industry leaders globally and is being described in many international forums as the “fastest deployment happening anywhere in the world,” he said. Vaishnaw highlighted the population-scale solutions being tested on India stack, across platforms such as payments, healthcare and identity. Each of these platforms is powerful in itself, but together become a dynamic force that can solve “any major problem in the world.”

The minister said India is set to emerge as a telecom technology exporter to the world in the next three years. “Today there are two Indian companies that are exporting to the world…telecom gear. In the coming three years, we will see India as a major telecom technology exporter in the world,” Vaishnaw said.

The minister talked of the rapid strides taken by India in developing its own 4G and 5G technology stack, a feat that caught the attention of the world. “The stack is now ready. It was initially tested for 1 million simultaneous calls, then for 5 million, and now it has been tested for 10 million simultaneous calls,” he said terming it a “phenomenal success.” At least 9-10 countries want to try it out, he added.

The minister gave a presentation outlining key initiatives under his three ministries of telecom, IT and Railways. For Railways, the focus is on transforming passenger experience, he said as he presented slides on how railways is redeveloping stations and terminals (New Delhi, Ahmedabad, Kanpur, Jaipur among others) with modern and futuristic design blueprint, and in the process creating new urban spaces while also preserving rich heritage.

The minister also gave an overview on the Vande Bharat train, the indigenous train protection system Kavach and progress on the bullet train project. To a question on the past talks around private freight rail corridors to boost logistics, the minister said “there is no program for Railway privatization.” “In a country where we have 1.35 billion people, 8 billion people moving every year on Railways, we thought that it is prudent to learn from the experience of others, and keep it within the Government set-up,” Vaishnaw said.

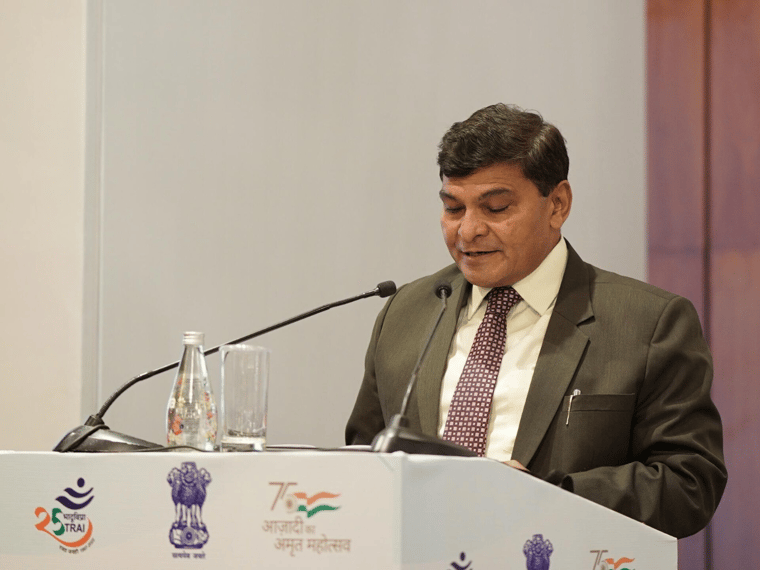

India’s Communications Minister Ashwini Vaishnaw (Photo Credit: PT)

To another query on dedicated freight corridor for food grains, the minister explained that when it comes to transport economics it is important not to divide assets between different applications.

“Today, the thought process has got very refined, and we are adding close to 4500 km of network every year, which amounts to 12 km of new tracks per day. So we have to increase the capacity to such a large extent that there is enough capacity for food grains, enough for coal, small parcels, and every kind of cargo,” he said. While Railways had been consistently losing market share over the last 50-60 years, it has started clawing it back.

“The lowest point was 27 per cent. I am happy to share that from the 27 per cent level, last year Railways increased to 28 per cent, this year we are doing close to 29-29.5 per cent, and in the coming 2-3 years Railways will go towards 35 per cent market share,” he added.

People will choose between transport via road, railways or air based on the distance to be travelled, and “there will be enough for everybody”. “The country will have enough for everybody, is my point. Up to 250 kilometres road is very good, 250 to 1000 kilometres railway is the ideal mode. Beyond 1000 kilometres air will be the ideal mode. So there will be enough for everybody,” the minister said.

References:

India to set up 100 labs for developing 5G apps, business models and use-cases

Even as India’s long delayed 5G network roll-out continues at a rapid pace, the government has outlined plans for expanding 5G’s use beyond consumers and enterprises. In her Budget speech, Union Finance minister Nirmala Sitharaman called for the development of new applications and business models, which will also create more jobs. There are plans to set up 100 labs in engineering institutions to develop applications and use-cases for 5G services. It should be noted that GE setup India’s first 5G innovation lab in July 2022.

“The labs will cover, among others, applications such as smart classrooms, precision farming, intelligent transport systems, and health care applications,” Sitharaman said in her speech.

“The proposed outlay for 5G labs will further push the development of use-cases and the set-up of private networks in India. The research across universities will push innovations and job opportunities,” said Peeyush Vaish, partner and telecom sector leader, Deloitte India.

The speed at which commercial 5G networks have rolled out, since the official launch in October, has been impressive. India’s 5G auctions, which culminated in the second half of 2022, saw Bharti Airtel, Reliance Jio and Vi acquire 5G spectrum for commercial networks, while Adani Data Networks is expected to launch enterprise 5G services with the spectrum it bought. In particular, Reliance Jio confirms it has enabled 5G networks (SA) in 225 cities across India. Airtel doesn’t give a confirmed count of its 5G NSA network service coverage, but continues to add cities every day. Vi is yet to launch 5G services.

“We believe 5G will have country-specific use-cases and India is no different. In fact, India can set an example for the rest of the world,” said Tarun Pathak, research director at Counterpoint Research.

“5G networks and devices without use-cases is akin to highways without places to travel to,” said Muralikrishnan B, president, Xiaomi India.

Test labs for 5G applications provide a sandboxed environment for testing use-case prototypes. Indian telecom equipment company Himachal Futuristic Communications Limited (HFCL) is working closely with tech giant Qualcomm and has a 5G lab which focuses on rural mobile broadband.

GE’s 5G Innovation Lab in India. Top: Jan Makela, president and CEO of imaging at GE Healthcare (center), cuts the ribbon to open the 5G Innovation Lab. Second from left: Girish Raghavan, vice president of engineering for GE Healthcare.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Bipin Sapra, Tax & Regulatory Services, Partner, EY India said that the government had taken a big leap to embrace 5G much more swiftly by setting up these labs. He agreed that they would indeed further boost employment and business opportunities in the country. “Amrit Kaal focuses on being a technology-driven and knowledge-based economy with one of the primary visions of growth and job creation. India has made remarkable advancements in the digital realm and various new initiatives have been adopted to improve the lives of people, accelerating the societal benefits of these technologies,’‘ added Mr. Sapra.

“The setting up of 100 labs to develop 5G will better network connectivity in every nook and corner of the country and further help more sectors and communities to access the benefits of 5G networks,” said Sanmeet Singh Kochhar, vice-president – India and MENA at HMD Global.

Piyush N. Singh, Senior Managing Director, Accenture, said setting up new centers of excellence for AI and 5G labs for developing apps would help democratize AI and push for wider adoption of 5G services. “It will be important for the private sector ecosystem to work closely with the government to realize the digital future of India,’‘ Mr. Singh said.

References:

https://www.gehealthcare.com/insights/article/new-5g-innovation-lab-in-india-poised-to-unlock-the-future-of-healthcare

Tech Mahindra and Microsoft partner to bring cloud-native 5G SA core network to global telcos

India’s Tech Mahindra and Microsoft have announced a collaboration to enable cloud-powered 5G SA core network for telecom operators worldwide. As a part of the collaboration, Tech Mahindra will provide its expertise, comprehensive solutions, and managed services offerings to telecom operators for their 5G SA Core networks. Tech Mahindra will provide its expertise like “Network Cloudification as a Service” and AIOps to global telecom operators for their 5G Core networks. AIOps will help operators combine big data and machine learning to automate network operations processes, including anomaly detection, predicting fault and performance issues.

CP Gurnani, Managing Director and Chief Executive Officer, Tech Mahindra said, “Today, it is critical to leverage next-gen technologies to build relevant and resilient services and solutions for customers across the globe. At Tech Mahindra, we are well-positioned to help telecom operators realize the full potential of their networks and provide innovative and agile services to their customers while also helping them meet their ESG commitments. Our collaboration with Microsoft will further strengthen our service portfolio by combining our deep expertise across the telecom industry with Microsoft Cloud. Further to this collaboration, Tech Mahindra and Microsoft will work together to help telecom operators simplify and transform their operations in order to build green and secure networks by leveraging the power of cloud technologies. At Tech Mahindra, we are well-positioned to help telecom operators realize the full potential of their networks and provide innovative and agile services to their customers while also helping them meet their ESG commitments.”

Tech Mahindra believes the 5G core network will enable use cases such as Augmented Reality (AR), Virtual Reality (VR), IoT (Internet of Things, and edge computing. Of course, 5G URLLC performance requirements, especially ultra low latency, in the RAN and core network must be met first, which they are not at this time. The company will leverage the Microsoft Azure cloud for its sustainability solution iSustain to measure and monitor KPIs across all three aspects of E, S & G. iSustain will help operators address the challenge of measuring and reducing carbon emissions from the networks while meeting demands of the countless energy intense digital technologies, from AR/ VR to IoT.

Anant Maheshwari, President, Microsoft India said, “Harnessing the power of Microsoft Azure, telecom operators can provide more flexibility and scalability, save infrastructure cost, use AI to automate operations, and differentiate their customer offerings. The collaboration between Tech Mahindra and Microsoft will help our customers build green and secured networks with seamless experiences across the Microsoft cloud and the operator’s network. Azure provides operators with cloud solutions that enable them to create new revenue generating services and move existing services to the cloud. Through our collaboration with Tech Mahindra, Microsoft will further help telcos overcome challenges, drive innovation and build green and secured networks that provide seamless experiences by leveraging the power of Microsoft Cloud for Operators.”

The partnership is in line with Tech Mahindra’s NXT.NOWTM framework, which aims to enhance the ‘Human Centric Experience’, Tech Mahindra focuses on investing in emerging technologies and solutions that enable digital transformation and meet the evolving needs of the customer.

About Tech Mahindra:

Tech Mahindra offers innovative and customer-centric digital experiences, enabling enterprises, associates and the society to Rise. We are a USD 6 billion organization with 163,000+ professionals across 90 countries helping 1279 global customers, including Fortune 500 companies. We are focused on leveraging next-generation technologies including 5G, Blockchain, Metaverse, Quantum Computing, Cybersecurity, Artificial Intelligence, and more, to enable end-to-end digital transformation for global customers. Tech Mahindra is the only Indian company in the world to receive the HRH The Prince of Wales’ Terra Carta Seal for its commitment to creating a sustainable future. We are the fastest growing brand in ‘brand strength’ and amongst the top 7 IT brands globally. With the NXT.NOWTM framework, Tech Mahindra aims to enhance ‘Human Centric Experience’ for our ecosystem and drive collaborative disruption with synergies arising from a robust portfolio of companies. Tech Mahindra aims at delivering tomorrow’s experiences today and believes that the ‘Future is Now.’

References:

Tech Mahindra: “We can build and run an entire 4G and 5G or any enterprise network”

Tech Mahindra: India Needs to Begin 5G Spectrum Auction Now!

Adani Group to launch private 5G network services in India this year

Adani Group, the newest entrant in India’s telecom space, is looking to launch private 5G services for enterprises in 2023. The conglomerate also announced that it would be launching consumer apps this year as part of its digital strategy.

Addressing his employees in the New Year, Chairman Gautam Adani said they will invest in expanding the network of data centers, building AI-ML and industrial cloud capabilities, along with rolling out 5G services and launching B2C apps.

“While we are fully invested in building India, it is an opportune time to contribute to nation-building outside India. All of these are big ticket, independent yet mutually connected digital opportunities that are backed by our adjacency in the energy business,” he said.

The Gujarat-based conglomerate surprised industry incumbents when it took part in 5G auctions in 2022. While Adani has not purchased spectrum across all 5G bands and thus cannot provide consumer telephony, the conglomerate parted with Rs. 212 crore to buy 400MHz spectrum in the mm-wave band. Adani is gunning to provide private network services to enterprises, including its own.

However, telecom operator Bharti Airtel beat Adani to the punch, bagging the first private 5G network deal with Mahindra Group late last year.

Reliance Jio has also indicated that private 5G will be a key avenue for monetization for the operator in the future. Chairman Mukesh Ambani has committed Rs 2 trillion investment for rolling out a 5G network across the country by December 2023, according to a recent report by the Press Trust of India.

Other entities, such as IT major Tata Consultancy Services (TCS), could also participate in the private 5G network market. They are awaiting spectrum assignment rules from the DoT and TRAI, who are still deliberating the spectrum bands, which will be given to enterprises for private network use through administrative allocation.

References:

Hindu businessline: Indian telcos deployed 33,000 5G base stations in 2022

As 2022 nears an end, India based telcos like Reliance Jio and Bharti Airtel have deployed about 33,000 base stations for 5G services. Sources in India’s Department of Telecommunications told businessline that the telcos deployed around 10,000 base stations in December, taking the cumulative number of base stations deployed for 5G services to about 33,000.

[For another report on 5G base stations in India see; 20,980 base stations installed for 5G, about 2,500 being set up per week, Government tells Rajya Sabha | Headlines (devdiscourse.com)]

Telecom operators commenced deploying the 5G network after Prime Minister Narendra Modi inaugurated 5G services on October 2. Only Reliance Jio and Bharti Airtel have commenced 5G capex, as debt-laden Vodafone Idea is still trying to raise additional funds to commence capital expenditure for its 5G network.

Quoting the Ministry of Communications report to the Rajya Sabha, businessline reported last week that the telcos had deployed about 21,000 base stations for 5G services till November 26. According to senior DoT officials, the telcos have added more than 10,000 additional base stations to that number.

Since operators need to deploy 2–6 base stations per tower, the number of telecom towers for 5G has not increased substantially in the past three months. The two operators alone would have deployed 3,000 to 4,000 telecom towers for 5G services.

While telcos have commenced deploying 5G towers in the majority of Indian States, the national capital Delhi is experiencing the fastest deployment of 5G services. Almost a third of all the base stations deployed are located in Delhi. Therefore, users in Delhi NCR will experience the best 5G services.

References:

Telecom operators deploy 33,000 5G base stations this year – The Hindu BusinessLine

OneWeb, Jio Space Tech and Starlink have applied for licenses to launch satellite-based broadband internet in India

On December 13th, the chairman of Telecom Regulatory Authority of India (TRAI), PD Vaghela, said that India will be the first country in the world to auction spectrum for satellite communications. Noting that India’s telecom regulator (DoT was working on the matter, he added that TRAI will soon come out with ‘some sort of a model’ for the auction of space spectrum.

Addressing the Broadband India Forum summit, Vaghela said that TRAI has received a reference from the Department of Telecommunications (DoT) on the allocation of the spectrum and other allied aspects. He added that TRAI plans to streamline the process of seeking permissions from multiple ministries. In this regard, the regulator will make recommendations to the Ministry of Information and Broadcasting, Communications and the Ministry of Space to ensure ease of doing business in the sector. “Any system that we will be bringing is to actually encourage and promote investment in the sector, and not increase any burden,” added Vaghela.

Responding to questions about the status of the consultation paper on the spectrum action for satellite communication, TRAI chief said that the telecom authority was deliberating with experts and regulators globally to arrive at a suitable framework. The paper could see the light of the day only after these discussions are over. He reiterated that nanosatellites coupled with other emerging technologies would drive innovation and bridge the digital divide.

“Nanosatellites and satellite Internet of Things (IoT) would drive the next generation of technology and such innovations are expected to enable connectivity across industries and empower it and the upcoming 6G capability. Innovations in satellite ground stations, orbital services, payloads, operational systems and artificial intelligence would enable satellites to perform more complex functions,” the chairman said.

TRAI chairman’s comments have come at a time when the satellite communications arena is witnessing rapid developments. In the recently released Telecommunications Bill, 2022, the government has sought to extend the scope of telecommunication services to include satellite-based communication services.

Alongside, the center is also looking at new technologies to increase the penetration of the internet. Recently, Minister of State for Electronics and Information Technology Rajeev Chandrasekhar said that satellite communications would play a key role in delivering internet services to 1.2 Bn Indians by 2025-26.

The government recently also announced a slew of reforms for the satcom space. The center has relaxed norms for obtaining the Global Mobile Personal Communication by Satellite (GMPCS) license, which is mandatory to operate as a Satcom player in India.

So far, usual telecom players are looking to grab a pie of this burgeoning space. In the race are Airtel-backed OneWeb and Jio Space Tech. Besides, Elon Musk‘s Starlink has also applied for a license to launch satellite-based broadband in India.

As per a report, the global demand for satellite applications is expected to soar to $7 Bn by 2031. On similar lines, the overarching Indian space industry is projected to grow to $13 Bn by 2025, with the satellite launch services segment expected to garner the fastest growth.

TRAI Chairman PD Vaghela addressing Broadband India Forum

………………………………………………………………………………………………………………………………………………………

In summary:

- TRAI is said to have already received a reference from DoT for the auction of the spectrum

- TRAI will send recommendations to multiple ministries to streamline the process of permissions and enhance ease of doing business

- The government targets to deliver internet services to 1.2 B India residents by 2025-26

References:

https://inc42.com/buzz/india-to-be-first-country-to-auction-satcom-spectrum-trai-chairman/

India creates 6G Technology Innovation Group without resolving crucial telecom issues

India’s COAI joins 4 European telcos in demanding OTT players pay to use their networks

India Telecom industry body Cellular Operators Association of India (COAI) has reiterated that over-the-top (OTT) players should pay telcos for using their network. The payment can be done directly to the telecom firms on mutually agreed terms and in case a mutual agreement is not reached, an appropriate licensing and regulatory framework should be formed which governs the contribution of OTT players towards creation of network infrastructure.

The association has highlighted that globally, the desirability of OTTs making a “fair contribution” to network costs of telecom firms has gained momentum. For instance, the European Commission (EU) is advocating for formalizing due legislation for OTT players to share the network investment burden of the telecom players in a proportionate manner.

The EU continues to express concern that there are big tech companies who generate a lot of data traffic but do not invest towards building infrastructure. The governments of France, Italy and Spain sent a joint paper to the European commission in August 2022, requesting for the swift development of a legislative proposal in this regard. Similar sentiments have been expressed by representatives of the US regulator FCC and in Australia, a world-first law was passed in Feb 2022, aimed at making tech giants pay for news content on their digital platforms, COAI said.

“We wish to submit that any entity which creates a property or infrastructure by investing funds, is entitled to take usage charges (rent /lease charges, etc.) from the user of that property or infrastructure who uses the same for commercial purposes,” COAI said in a letter to India’s Telecom Secretary K Rajaraman.

Further, the association stressed that the government needs to provide a legal framework and empowerment for enabling such entity to charge any user that uses its service/infrastructure on a reasonable basis. The telecom body had demanded the same thing while submitting its comments on the draft telecom bill to the Department of Telecommunications (DoT), which is currently working on a revised draft of the bill. The COAI has suggested a few methods that can be used for making such payments. As per COAI, OTT players can pay telecom firms by way of an equivalent of “usage charge” for the actual traffic carried by these OTTs on telcos’ network which can be easily measured. The usage charge is to be mutually agreed between the telecom firms and OTT players and paid directly to the telcos. The definition of the “usage charge” may be clearly mentioned in the Telecom Bill itself.

“If a mutual agreement is not reached, then an appropriate licensing and regulatory framework should be in place which governs the contribution of OTT players towards creation of network infrastructure,” COAI said. Please refer to this video for more details on the proposed Telecom Bill.

…………………………………………………………………………………………………………………………………………………………………………………………….

In February, four major European telcos are demanding legislation at European Union level to force the platforms, aka Big Tech, over-the-top (OTT) providers or hyperscalers, to pay their fair share of network investments. Timotheus Höttges, CEO of Deutsche Telekom (DT), Stéphane Richard, outgoing chairman and CEO of Orange, José María Álvarez-Pallete, chairman and CEO of Telefónica and Nick Read, CEO of Vodafone, penned a joint statement saying the current situation is simply not sustainable.

Citing the Sandvine Global Internet Phenomena Report from January 2022, they point out that video streaming, gaming and social media “originated by a few digital content platforms” accounts for over 70% of all traffic running over the networks.

“The investment burden must be shared in a more proportionate way,” the four CEOs insist. “Digital platforms are profiting from hyper scaling business models at little cost while network operators shoulder the required investments in connectivity. At the same time our retail markets are in perpetual decline in terms of profitability.”

They also warn that Europe risks falling behind other regions of the world if it does not take steps now, “ultimately degrading the quality of experience for all consumers.”

While the CEOs of DT, Orange, Telefónica and Vodafone have taken heart from recent commitments by the European Commission to ensure that all market players make a “fair and proportionate contribution” to infrastructure costs, they want legislators “to introduce rules at EU level to make this principle a reality.”

“The clock is ticking loudly, particularly given the huge investments still required to achieve the connectivity targets for 2030 set by the European Commission in its Communication on the European Digital Decade. Without an equitable solution, we will not get there,” the statement concluded.

References:

https://www.sandvine.com/phenomena

Nokia Executive: India to Have Fastest 5G Rollout in the World; 5Gi/LMLC Missing!

While speaking at an event organized by the Foreign Correspondent Club on Friday evening, Nokia India Head of Marketing and Corporate Affairs, Amit Marwah said India is going to record the fastest 5G rollout in the world and it is going to have the biggest success of the next -generation telecom service with the support of the government.

“We (India) are not late, we are at the right time. In the rest of the country compared to other countries where the ecosystem has to develop. We have a 5G-ready ecosystem. We have 10 per cent of smartphones in India which are 5G ready. India is going to witness the fastest rollout of 5G which will be at least three times faster than what we have seen in 4G,” Marwah said. The 5G services will progressively cover the entire country over the next couple of years — Reliance Jio promises to do that by December 2023 and Bharti Airtel by March 2024.

Marwah said telecom manufacturing is becoming robust in India backed by the production-linked incentive (PLI) scheme. “We were part of PLI 1.0. We were one of the only companies that met and exceeded our target of PLI 1.0. We let go-off that scheme and let go-off the incentive of one year because PLI 2.0 was even more interesting. Volumes and scale in India are increasing so much that you have let go for one year. We re-applied for PLI f2.0 and today we are part of PLI 2.0 which means we are investing more, adding more lines and adding more products,” he said.

The PLI scheme offers up to 20 times incentive on incremental sales of telecom equipment made in India. The government has added additional incentives for designing products in India in the second version of the PLI scheme. Marwah said that manufacturing is on a very positive note in India across the sectors but definitely in telecom.

“The only challenge right now is the availability of fabs which are semiconductors. 60-80 per cent of what we manufacture requires semiconductors. That is the area where we still need to work on. There is still some kind of infiltration of equipment in telecom from neighboring countries which need to have a little more vigilance and kind of stopping at the customs,” Marwah added.

Note: In October, Nokia announced that it had won a multi-year deal with Reliance Jio India to build one of the largest 5G networks in the world.

Department of Telecom, Deputy Director General (Policy) YGSC Kishore Babu said that the 5G adoption and applications are expected to be more diverse in India compared to other countries. “However, most of the use cases across the world remind us we may have to innovate to meet most of the requirements in the coming months and years,” Babu said.

Tech Mahindra, Chief Strategy Officer and Head of Growth, Jagdish Mitra said 5G is the biggest opportunity in technology so far, for India to bridge what we have typically referred to as Bharat and India.

“We have 62 per cent of our workforce in the agriculture sector, and 5G presents us with a huge opportunity to convert that into the most profitable segment. We can enable high yields by producing smarter networks and delivering products to the farmers,” Mitra said.

Telecom Sector Skill Council, CEO, Arvind Bali said close to 25 lakh people need to be reskilled and up-skilled in the field of telecom in the next few years because there is a shift from 4G to 5G.

“We need to have at least one lakh technicians and engineers, in the next few years, who have been trained specifically on 5G courses for the new job requirements and we at TSSC are setting up Centers of Excellence and training labs with the help of the industry. 5G is going to open up big requirements for a talented workforce and we are training the youth in new-age technologies,” Bali said. He added that TSSC is also developing all the curriculum and the digital content for training people to meet the industry requirement.

End Note: Despite all the hype and hoopla about 5G in India, none of the 5G network announcements have stated support for 5Gi which is part of the ITU-R M.2150 5G standard for RIT/SRITs. The 5Gi standard uses Low Mobility Large Cell (LMLC) to extend 5G connectivity and the range of a base station. It does so by using bands of the spectrum, which are lower than 5G’s operational bands but offers a high-range waveform. Ideally, the 5G frequency band ranges from 700MHz to 52GHz, but 5Gi can go lower than 700MHz and up to 36GHz without sacrificing the range. 5Gi was contributed to ITU-R WP 5D by TSDSI and backed by the Indian government.

LMLC technology increases the inter cell site distance to 6 km from the 3GPPs 1.7 km, which should make the deployment cost-effective. Also, the 5Gi standard reduces the mobility speed from 3 km/h to 30 km/h to make 5G network usage satisfactory to India’s scenario. In contrast, the 3GPP RIT/SRIT in the ITU M.2150 5G standard has maintained the mobility requirement between 120 km/h to 500 km/h, which is inconceivable in India.

One year ago, Vodafone Idea said it was working with a “few companies” to prepare for trials using 5Gi. “We are already working with a few companies. As and when the product is ready, we will be keen and will be doing trials and deploy accordingly” Jagbir Singh, chief technology officer (CTO) of Vi said at the time. He didn’t divulge details of the partners are. At this time, Vodafone Idea has not stated when it would deploy 5G– only that it would be 5G NSA (with a LTE anchor for everything other than the radio access network).

References:

India’s TSDSI candidate IMT 2020 RIT with Low Mobility Large Cell (LMLC) for rural coverage of 5G services

At long last: India enters 5G era as carriers spend $ billions but don’t support 5Gi

Vodafone Idea to use 5Gi (ITU M.2150-LMLC) in trials

https://www.itu.int/dms_pubrec/itu-r/rec/m/R-REC-M.2150-1-202202-I!!PDF-E.pdf (ITU-R 5G RIT/SRIT standard is M.2150)

Reliance Jio’s “Home Grown” 5G? Ericsson and Nokia in multi-year deals with Jio to build a mega 5G network

What ever happened to “Home Grown 5G” at Reliance Jio? Over two years ago, Jio Chairman Mukesh Ambani said his company had developed its own 5G solution “from scratch.”

“Jio plans to launch “a world-class 5G service in India…using 100% home grown technologies and solutions,” he said in a statement at the Reliance Industries annual shareholders meeting. “Once Jio’s 5G solution is proven at India-scale, Jio Platforms would be well-positioned to be an exporter of 5G solutions to other telecom operators globally, as a complete managed service,” he added.

–>Since then we haven’t heard anything about Jio’s indigenously built 5G network. Jio has not disclosed whose network equipment is being used for its current 5G roll-out in India which started this month.

In stark contrast, telecom equipment vendors Ericsson and Nokia have signed separate multi-year deals with Reliance Jio to build a mega 5G network. The announcements neither divulged the deal sizes or time frames. They came amid large network deployments across India for 5G services.

- Swedish telecom gear maker Ericsson announced a long-term strategic 5G contract with Reliance Jio to roll out a 5G standalone (SA) network in the country.

- Finland headquartered Nokia will supply Reliance Jio, which has more than 420 million customers, with 5G radio access network (RAN) equipment in a multi-year deal, the Finnish company said in a statement.

Announcing the partnership with Ericsson, Akash Ambani, Chairman, Reliance Jio, says: “We are delighted to partner with Ericsson for Jio’s 5G SA rollout. Jio transformed the digital landscape in India with the launch of LTE services in 2016. We are confident that Jio’s 5G network will accelerate India’s digitalization and will serve as the foundation for achieving our nation’s ‘Digital India’ vision.”

Ericsson’s 5G RAN products and solutions from Ericsson Radio System and E-band microwave mobile transport solution will be deployed in the 5G network for Jio, the equipment company said. This is the first partnership between Jio and Ericsson for radio access network deployment in the country, according to the previously referenced press release.

Ericsson recently topped the Frost Radar™: Global 5G Network Infrastructure Market ranking for second year in a row. Ericsson was also named a Leader in the 2022 Magic Quadrant for 5G Network Infrastructure for Communications Service Providers report by Gartner. The Company invests around 18 percent of global revenue in R&D and holds the leading patent portfolio in the industry, with more than 60,000 granted patents worldwide. It is also the holder of the most 5G essential patents.

“Nokia will supply equipment from its AirScale portfolio, including base stations, high-capacity 5G Massive MIMO antennas, and Remote Radio Heads to support different spectrum bands, and self-organizing network software,” the company said. Nokia has a long-standing presence in India. This new deal will mean that Nokia is now supplying India’s three largest mobile operators.

Pekka Lundmark, President and CEO at Nokia stated: “This is a significant win for Nokia in an important market and a new customer with one of the largest RAN footprints in the world. This ambitious project will introduce millions of people across India to premium 5G services, enabled by our industry-leading AirScale portfolio. We are proud that Reliance Jio has placed its trust in our technology and we look forward to a long and productive partnership with them.”

5G data speeds in India are expected to be about 10 times faster than those of 4G, with the network seen as vital for emerging technologies like self-driving cars and artificial intelligence. Reliance snapped up airwaves worth $11 billion in a $19 billion 5G spectrum auction in August and had launched 5G services in select cities. It is also working with Alphabet Inc’s Google to launch a budget 5G smartphone. As India’s telecom service providers roll out 5G services, the government is also pushing top mobile phone manufacturers, like Apple Inc, Samsung and others to prioritise rolling out software upgrades to support 5G, amid concerns that many of their models are not ready for the high-speed service. The Reliance-Nokia deal comes at a time some gover nments, including India, have either banned or discouraged the use of China’s Huawei in national networks.

“Jio is committed to continuously investing in the latest network technologies to enhance the experience of customers,” Akash Ambani, chairman of Reliance Jio, said. Meanwhile, Jio is planning to raise an additional $1.5 billion via external commercial borrowings to fund its 5G capital expenditure plans, reports said. ABP Pvt. Ltd.

Analysts said the 5G rollout in the country would be much slower than 4G or 3G as the main revenue for the service would be generated from enterprise solutions. Indian telco deals with the equipment makers are meant for areas where enterprises would demand the service. Retail consumers will be wary of paying a higher price just for speed, they said.

References:

https://www.jio.com/5g-banner-3.jpg

Reliance Jio claim: Complete 5G solution from scratch with 100% home grown technologies

At long last: India enters 5G era as carriers spend $ billions but don’t support 5Gi

After years of 5G auction delays, India became the last major Asian economy to launch a 5G network, marking a new wave of spending by indebted Indian carriers. Prime Minister Narendra Modi made the first 5G video call on Saturday to school students to demonstrate use of the service in education. “5G is the beginning of an infinite space of opportunities,” especially for the country’s youth, he said. Well, that has yet to be proven!

Though 5G mobile technology — first introduced in South Korea three years ago — has been viewed by consumers as underwhelming so far because of a dearth of matching applications, local operators led by billionaire Mukesh Ambani’s Reliance Jio Infocomm Ltd. are betting that will change. They are counting on the nation’s 600 million-plus smartphone users to switch to the new network in due course and also on industries gearing for a digital transformation.

Carriers agreed to fork out $19 billion just two months ago for airwaves at a government auction, with Reliance’s $11 billion bid topping the list. The conglomerate proposes to invest 2 trillion rupees ($25 billion) more. Billionaire Sunil Mittal’s Bharti Airtel Ltd. and Vodafone Idea Ltd. haven’t disclosed their spending plans as yet.

While Reliance raised more than $25 billion from marquee investors in 2020 to help fund digital expansion, the need to spend big on 5G could weigh on the finances of rivals. Bharti and unprofitable Idea have a combined net debt of $37 billion, and the latter staved off bankruptcy by giving 36% of its equity to the Indian government earlier this year in lieu of back fees it couldn’t pay.

At the launch event on Saturday, Ambani said Jio’s 5G network will cover the entire country by December next year, while Mittal said Bharti Airtel plans to do so by 2024. Given the scale of spending, some experts said carriers are unlikely to undercut each other on prices once again — something that was tried in 2016 when Jio entered the market by offering free calls and cheap 4G data plans, which ended up putting some rivals out of business.

“They will likely provide 5G services to those segments of the market that are willing to pay higher and try and recover as much as possible before making it available to others,” said Rajat Kathuria, a senior visiting professor at the Indian Council for Research on International Economic Relations in New Delhi.

5G’s long road to India has been dogged by several controversies. The main one was about how secure Chinese equipment is — a crucial issue for a country engaged in a border conflict with its northern neighbor. Last year, carriers decided to avoid Chinese vendors such as Huawei Technologies Co. and ZTE Corp., and opted instead to tie up with makers like Ericsson AB, Nokia Oyj and Samsung Electronics Co., potentially adding to their costs.

“India may have started a little late, but we’ll finish first by rolling out 5G services that are of higher quality and more affordable,” Ambani said at the launch event. The technology can bring affordable, superior education and skill development to ordinary Indians and deliver high-quality healthcare to rural and remote areas, he said.

Despite India’s TSDSI getting 5Gi (5G for India or Low Mobility Large Cell) included in ITU M.2150 (previously known as IMT 2020), no Indian carrier has announced support of it. That is a major disappointment for TSDSI. Please refer to the numerous references below.

Offering low latency (that does not meet ITU-R M.2410 URLLC performance requirements) and data speeds about 100 times faster than 4G (depending how close your 5G endpoint is to the cell tower or small cell), the technology may someday have the potential to enable a variety of advanced applications such as holograms, 3D avatars of people in metaverses and telemedicine, in which near-instantaneous transmission of video and data would allow surgeons to operate remotely using a robotic scalpel. So far, such applications have been too slow to evolve. For average users, 5G has mostly meant faster video games and content streaming.

To capitalize on 5G, China has been rolling out smartphone apps and industrial projects such as super high-definition live streaming, remote manufacturing, virtual reality and robotic surgery arms. The country’s three state-owned carriers have introduced more than 25,000 such applications, according to a news article posted by the State Council on its website in August. In South Korea, despite mobile operators’ efforts to come up with killer apps, average revenue per person has only climbed slightly since the 4G era.

In India’s race to roll out 5G, the only winner to emerge so far has been the government: The airwave auction was set to raise a record amount, Telecom Minister Ashwini Vaishnaw said in July.

Proceeds from the spectrum auction could provide a big financial boost to Modi’s administration, which has been seeking to tame inflation and rein in fiscal deficits as economists warn of a looming global recession.

References:

https://ieeetv.ieee.org/2020-5g-world-forum-keynote-radha-krishna-ganti

https://tsdsi.in/wp-content/uploads/2020/02/LMLC_ver1_RIT-Prof-Ganti.pdf

TSDSI’s 5G Radio Interface spec advances to final step of IMT-2020.SPECS standard

India lagging in 5G unless spectrum prices decrease & 5Gi standard debate is settled

Jio and Airtel against 5Gi standard; 2 GHz of mid-band needed for India 5G demand

India’s Success in 5G Standards; IIT Hyderabad & WiSig Networks Initiatives