Telecom in India

Reliance Jio claim: Complete 5G solution from scratch with 100% home grown technologies

Indian wireless upstart Reliance Jio has developed its own 5G solution “from scratch,” according to Jio Chairman Mukesh Ambani (India’s richest man). The company plans to launch “a world-class 5G service in India…using 100% home grown technologies and solutions,” he said in a statement at the Reliance Industries annual shareholders meeting. “Once Jio’s 5G solution is proven at India-scale, Jio Platforms would be well-positioned to be an exporter of 5G solutions to other telecom operators globally, as a complete managed service,” he added.

–>Please see references 1. and 2. below for video clips of Ambani’s speech.

The company’s equipment is ready for deployment this year, as soon as 5G spectrum is available, Ambani said (more details below). A roll-out will be relatively easy, thanks to its existing all-IP 4G network, according to Ambani.

The development supports the India government’s local production push, to develop home-grown alternatives to technology from China (Huawei, ZTE), Ericsson, Nokia, Samsung, etc. Ambani did not outline the exact components developed, but he said the company would look to export the 5G system to other countries as well.

Nor did he comment on India’s IMT 2020 Low Mobility Large Cell (LMLC) submission from TSDSI which is moving forward as a 5G Radio Interface Technology (RIT) that will be standardized by ITU-R in IMT-2020.SPECS late this year.

The regulatory environment for Jio has been incredibly benign for its entire existence, from being given a special national license to the crippling historical license fees being imposed on its competitors. As a result Jio now sees itself as the world’s first ‘super operator’ and it seems to have the full backing of the Indian state in that ambition.

…………………………………………………………………………………………………………………………………………………………………….

The Business Standard reports that Jio has applied to the Department of Telecom for trial 5G spectrum. The company is reportedly seeking 800 MHz in the mmWave bands 26 and 24 GHz and 100 MHz in the 3.5 GHz band for field trials of its new network in a few metro areas.

If Jio really does have 5G Radio and Core technology, it will be in competition with global wireless network infrastructure giants, such as Huawei, ZTE, Ericsson, Nokia, and Samsung, which dominate the global wireless telecom market.

According to India Department of Telecom (DOT) sources, Jio has said its 5G network solution is ready and it can start trials immediately after spectrum is allocated. It has also revealed that it took the company three years and a few hundred engineers to turn this dream into reality. DOT sources say that, in a communication on July 17th, Jio made a strong pitch for spectrum in the mmwave band, arguing that countries like the US, South Korea, Japan, and Canada are veering towards preference of the 28- GHZ band for 5G deployment, while others like Australia, the UK, and European countries want to be in the 26- GHZ band.

Jio’s reasoning is that, given its plans to offer its 5G products in the global market, it is essential for it to have trial runs of the technology on these crucial frequency bands. It plans to test and successfully deploy the 5G technology on its own network, after which it can be sold overseas to other wireless telcos.

Moreover, it would like to test the technology in dense urban environments in India. Once it has proved itself there, it’s likely to work well in large big cities overseas.

As a result, Jio has requested that 800 MHZ of spectrum be assigned to it in 26.5–29.5 GHZ and 24.25-27.5 GHZ in the mmWave bands. It has also asked for 100 MHZ in the 3.5- GHZ mid spectrum band.

The government’s upcoming auction process is expected to kick-start by August, but it might be limited to only 4G spectrum. The Telecom Regulatory Authority of India has currently given its recommendation for the base price of spectrum in the 3.5-GHZ band for 5G auctions and not for mmwave bands. The DOT is expected to inform the regulator soon about the pricing of the mmwave bands for auction.

The Jio announcement comes at a time when Chinese telecom gear makers Huawei and ZTE face serious challenges, with numerous countries banning the use of their 5G equipment which they allege is, or can be, used by China to spy on them. Samsung is one player that is overly dependent on Jio as it is Jio’s largest client for 4G telecom gear and had earlier applied to the government to undertake 5G trial runs together. Jio’s 5G technology is based on a ‘virtualised 5G network’, which will ensure the current hardware-dependent networks shift to software-centric platforms.

This poses a challenge to current networks, which are based on proprietary technology, where both the hardware and software have to be bought from the same vendor, who then maintains and upgrades the system, leaving operators with limited flexibility.

The new networks being developed will be built on open platforms, so that operators will have the choice of buying hardware or software separately from different vendors or even building the latter on their own on an open platform. They could also ally with information technology companies to undertake system integration between the hardware and software and run the networks.

Apart from flexibility, this will bring down network costs substantially for 5G. According to cloud-native network software provider Mavenir, the new virtualized networks would lead to a saving of 40 per cent in capital expenditure and 34 per cent in terms of lower operations cost for operators.

………………………………………………………………………………………………………………………………………………………………….

References:

https://www.pressreader.com/india/business-standard/20200720/281573768006663

https://telecoms.com/505654/jio-lobbies-for-a-head-start-on-its-5g-network/

Vestaspace Technology joins SpaceX in launching Internet Satellites

Commercial space-tech company Vestaspace Technology will launch 35+ 5G satellites this September for pilot to build 5G speed network connections and IoT functionalities for industries.

Editor’s Note:

Sounds a lot like what Elon Musk’s SpaceX plans to do with its Starlink internet satellites. The satellite constellation will consist of thousands of mass-produced small satellites in low Earth orbit (LEO), working in combination with ground transceivers. Starlink is targeting service in the Northern U.S. and Canada in 2020, rapidly expanding to near global coverage of the populated world by 2021.

Image Credit: SpaceX

…………………………………………………………………………………………………………………………………..

In a statement Tuesday, Vestaspace said it will release beta version of satellite constellations pan-India in September and fully-operational version early next year into Low-Earth-Orbit or Geosynchronous Equatorial Orbit.

“The company plans to replace traditional fiber networks with all the satellite constellations and to provide high-speed 5G network connections PAN India with its unmanned Software Data processing,” it said.

The company has tested a live-streamed video of 1080p (Full HD) with less than 34 milliseconds latency with the speed of more than 400 Mbps.

With regards to data privacy and security issues, Vestaspace has put 10 layer firewall that does immediate remediation if any false data is found.

Arun Kumar Sureban, Founder & CEO, Vestaspace Technology said, “To solve the complex system and to provide 5G internet network solutions to the Urban, Rural and unserved regions, we have positioned 8 Ground Stations and 31,000 data receptors all over India. This is made possible with the help of accurate positioning and telemetry related activities.”

The Pune, India-based startup has secured USD 10 million funding from an American investment and advisory firm Next Capital LLC, and has been working with ISRO, NASA and other leading space agencies on various strategic projects.

However, we don’t think these Internet satellites have anything to do with 5G which is defined as a terrestial wireless interface (at least that’s true for IMT 2020).

References:

India telecom revenue to slow through March 2021; 5G spectrum auction delayed yet again

Revenue and profit growth at Indian telecom operators during the financial year ending March 2021 will slow due to lower data growth and weaker economic activity amid the coronavirus pandemic, according to Fitch Ratings.

Mobile service EBITDA will increase by about 15 percent in fiscal 2021 from 25 percent in fiscal 2020, as the industry will realise the full-year benefit of industry-wide tariff hikes of around 30 percent, effective from December 2019.

India telecom operators’ Q4FY2020 EBITDA growth was driven by tariff hikes and 4G data growth, which will decelerate in FY2021, as lockdowns were only implemented from 24 March 2020, Fitch Ratings reported.

Market leader, Reliance Jio, a subsidiary of Reliance Industries Ltd, reported sequential revenue and EBITDA growth of 6% and 11%, respectively, as ARPU growth was less pronounced, at 2%, to INR 131. This was due to the significant proportion of Jio’s customers being on long-tenor plans, on which tariff hikes will be implemented only in 1QFY21. In addition, sale of incremental Jiophones led to slower growth in ARPU. Its monthly data and voice usage per user was at 11.3GB and 771 minutes, respectively. Jio continued to gain market share at the expense of India’s third-largest telco, Vodafone-Idea Limited, as it added 18 million subscribers to reach a customer base of 388 million, the industry’s highest. We expect Jio’s FY21 mobile revenue to increase by at least 20%, led by higher monthly ARPU of INR147 and subscriber additions of 30 million (FY20: 80 million).

Bharti Airtel’s Indian mobile segment’s EBITDA will improve by 15-20 percent, on lower data growth, as smartphone sales are likely to drop significantly in 1HFY21 as feature-phone users are unable to upgrade to 4G smartphones during the lockdowns.

Airtel will be adding around 15 million new subscribers in fiscal 2021 as compared with the earlier prediction of 30 million, as users are unable to port their numbers during the lockdowns.

The pandemic-led economic slowdown will mostly affect lower-revenue users – those who spend INR 50-100 a month – which could prevent further improvements in monthly average revenue per user (ARPU), Fitch Ratings said.

Bharti Airtel management, headed by India CEO Gopal Vittal, is confident that the pandemic will have limited impact on FY21 EBITDA growth, which it forecasts to be at least 25 percent as compared with 25 percent in FY20, supported by ARPU growth to INR 170-175 a month.

Management says that data growth has increased by 20-25 percent in the short-term as users work from home and upgrade to higher-ARPU plans.

Airtel will generate small positive free cash flow in FY21, as Capex / revenue is likely to decline to around 26-27 percent on lower core Capex, interest costs and the government’s two-year moratorium on the payment of existing spectrum dues, which will defer about $840 million in each of FY21 and FY22.

Airtel has almost completed the shutdown of its 3G network across India and has redirected its 900MHz and 2100MHz spectrum for 4G usage. Telecom sector Capex peaked in 2019, as both Airtel and Jio front-laded Capex to expand 4G coverage and capacity and invested in fibre networks and in-building coverage.

Revenue market share is consolidating fast at Jio and Bharti, with Vodafone Idea rapidly losing market share. Vodafone Idea lost about 131 million subscribers in the last six quarters and is struggling to service its debt due to stagnant EBITDA generation, which is insufficient to cover its interest costs. The telco’s subscriber base is shrinking due to its deteriorating network on limited capex. Vodafone Idea has paid only USD 926 million in adjusted gross revenue dues, against the department’s demand of USD 6 billion, and has not yet reported its 4QFY2020 results.

……………………………………………………………………………………………………………………………….

5G Auction to be Delayed:

Fitch Ratings believes a 5G spectrum auction looks increasingly improbable in 2020 in light of incumbent telcos’ limited financial flexibility, a high base price of USD 7 billion for pan-India 5G spectrum in 3.3GHz-3.6GHz bandwidth and a limited business case for 5G, when 4G penetration is only around 50%. Bharti and Vodafone Idea have publicly stated that they will not participate in 5G auctions at such high prices.

A report in The Economic Times of India claims that the government will go ahead with the auction of additional 4G spectrum as planned, later this year but will defer the 5G spectrum sale until 2021.

Bharti Airtel and Vodafone Idea, who were both hit with multi-billion dollar AGR dues by the country’s Supreme Court last October, have both called for the auction to be delayed, as they battle to rein in expenses.

Sources familiar with the matter told journalists at The Economic Times of India that the country’s Digital Communications Commission had met on Monday to discuss postponing the 5G auction.

“Discussions are on to hold the 5G auctions later as some of the telcos need to buy spectrum but 5G may not be the priority now,” a source told the ET.

Light Reading reports that all the Indian telecom providers (including Reliance Jio, Airtel and Vodafone Idea) have asked the government to lower the high base price for 5G spectrum. Airtel says it will not participate in the auction at the current reserve prices. The Department of Telecommunications has attached a base price of INR4.92 billion ($64.9 million) per MHz to spectrum in the 5G band.

Besides the negative effects of the COVID-19 pandemic, another possible reason for India postponing the sale of 5G spectrum is the deteriorating financial position of the telcos. That makes it unlikely the government would generate decent proceeds from the sale of 5G spectrum at this time. A recent court ruling about fees the telcos owe the government has further harmed their financial health, making it harder for them to participate in the auction.

Equally important is that the 5G ecosystem is far from developed. The lack of “use cases” [1.] for the new technology means telcos are unable to justify the high spectrum costs to investors. This was the main reason Vodafone Idea gave when it pushed for a reduction in fees.

Note 1.: The important 5G use cases of Ultra High Reliability and Ultra Low Latency will not be realized anytime in 2021 as it is only 27% complete at this time in 3GPP Release 16. You can’t implement something which hasn’t been specified yet!

………………………………………………………………………………………………………………………………………………..

India to Miss “5G Bus”:

Muntazir Abbas wrote in a May 23rd ETTelecom post:

India is set to miss the ‘5G bus‘ following the lack of preparedness, unavailability of sufficient spectrum, absence of encouraging use cases, and uncertainty around radiowaves sale for the next generation of telecom services.“The Department of Telecommunications (DoT) is yet to form relevant study groups and revise the National Frequency Allocation Plan (NFAP) 2018 to include more bands including mmWave frequencies as a part of 5G roadmap,” an industry executive aware of the developments said.

In the past, Prime Minister Narendra Modi-led government maintained that it “won’t afford to miss 5G bus” like in the case of 2G, 3G, and 4G technologies that were deployed in India way later than many countries.

The executive further said that the quantum of spectrum availability in the 3300 – 3600 Mhz range also remains uncertain, while the department has not sought views on 26 GHz from the regulator despite agreeing to its viability for the commercial launch of fifth-generation or 5G networks.

The India government-backed high-level 5G Forum headed by the Stanford University Professor Emeritus AJ Paulraj anticipated the first 5G commercial launch by 2020, while suggesting that most guidelines on regulatory matters be promulgated by March 2019 to facilitate early 5G deployment. That will clearly not happen!

India government authorities have yet to decide whether the 5G market is open to Chinese vendors Huawei and ZTE. Huawei has been banned from several countries, including Australia and the U.S,, over security concerns. Initially, Chinese vendors were not invited to participate in India’s 5G trials, although this was later changed. Now, India’s government is under immense pressure from the US to ban Huawei.

The current backlash against China over coronavirus, which originated in the Chinese city of Wuhan, makes the decision even harder for India’s government. That lack of clarity may have been the main factor in the postponement of the 5G auction, said Gagandeep Kaur, contributing editor to Light Reading

References:

https://www.lightreading.com/asia/india-postpones-5g-spectrum-sale-to-2021/d/d-id/759852?

https://www.telecomlead.com/4g-lte/india-telecom-revenue-will-face-slow-growth-fitch-ratings-95298

India’s Tumultuous Telecom Market: Government vs the Telcos

by MG Arun, India Today

Ten years after the Indian telecom was rattled by the 2G spectrum scam and the Supreme Court cancelled 122 licences issued by the UPA government in 2008, the sector is witnessing another upheaval. This time, the apex court has stepped in to ensure that telcos Bharti Airtel, Vodafone Idea and Tata Teleservices pay up over Rs 1 lakh crore in revenue share the government claims they owe in return for acquiring licences and spectrum. The three companies are widely referred to as the ‘incumbent’ players, since the other major operator, Reliance Jio, entered the market only in 2016. According to the Department of Telecommunications (DoT), which issues the licences, the three incumbents owe the government Rs 35,600 crore, Rs 53,038 crore and about Rs 14,000 crore, respectively.

On February 17, three days after the Supreme Court pulled up telcos for not abiding by its January 16 order to clear the dues, Vodafone Idea made a Rs 2,500 crore part-payment to the DoT, with the assurance that it will pay another Rs 1,000 crore by February 21. Bharti Airtel said it had paid Rs 10,000 crore to the DoT while Tata Teleservices paid Rs 2,197 crore.

While the telcos have sought relief from the hefty payments, Vodafone Idea‘s case is particularly complicated, with the court rejecting its plea that the DoT be directed not to invoke the company’s bank guarantees-reportedly about Rs 2,500 crore-to recover dues. “I hope good sense prevails over the government that if it encashes the guarantees, the banks will pay, but the company will go down,” Vodafone Idea’s counsel Mukul Rohatgi told a TV channel.

Industry observers say if Vodafone Idea shuts down, the consequences will be drastic. “It will be a terrible thing for the economy, the banking system, the telecom industry and its customers, suppliers and digital partners,” says a telecom official, requesting anonymity. “Unlike airlines, where the supply breach caused by the closure of, say, Jet Airways could be filled by other players, in telecom, capacity cannot be replaced, including the enormous physical infrastructure. In such cases, the executive should wield its powers and step in to save the operator.”

The industry expects the government to allow it an extended moratorium to make the payments, to redefine Adjusted Gross Revenue (AGR), or even waive interest and penalties, and to stick to the principal amount to be paid. The incumbents and the DoT have been waging a legal battle for around 15 years. The crisis points to ambiguities in policy, which have not only caused confusion, but also left loopholes for telcos to exploit. The government’s handling of the telecom sector has also come under question. What was a sunrise industry now sees players, except Reliance Jio, battling for survival. It all threatens to end in a duopoly that could send tariffs skyrocketing.

TROUBLED HISTORY

The telecom sector was liberalised under the National Telecom Policy, 1994, paving the way for the entry of private players. For a fixed fee, licences were issued in various categories-unified licence, which allowed a firm to offer both wireless and wireline services; licences to Internet Service Providers (ISPs); and licences to provide passive infrastructure, such as towers and fibre. In 1999, the NDA government gave licensees the option to migrate to the revenue-sharing fee model.

As per the model, telecom operators were to share a percentage of their AGR with the government as annual licence fee and spectrum usage charges. The licence fee was pegged at 8 per cent of AGR while the spectrum usage charges were fixed at 3-5 per cent. According to Clause 19.1 of the Draft Licence Agreement, gross revenue included installation charges, revenue on account of interest, dividend, value-added services and so on. Calculated on this basis, AGR excluded certain charges, such as the Interconnection Usage Charge (IUC) and roaming revenues that are passed on to other operators.

While the DoT says it is following the definition of AGR as per the licence agreement, industry sources claim the definition of AGR in the licence conditions underwent revisions regarding the applicable rates for licence fee and spectrum usage charge. While operators wanted to be charged on the basis of their core business, involving use of the spectrum allotted, the DoT said the definition of AGR includes other items, such as dividend, interest, capital gains on sales of assets and securities and gains from foreign exchange fluctuations. In 2001, the Association of Basic Telecom Operators submitted to the government that non-operational income should not be included while computing AGR. However, in 2002-2003, the DoT demanded revenue share as per the Draft Licence Agreement, following which operators approached the Telecom Disputes Settlement and Appellate Tribunal (TDSAT).

A long-drawn-out legal battle followed. Around the same time, the telcos stopped paying their revenue share on the disputed part of the AGR. Operators argued that taxes and levies in India were among the highest in the world and appealed to the government not to press for payment of AGR-based dues. The industry’s contention is that it pays the government Rs 30 for every Rs 100 earned, in the form of levies and taxes. GST is at 18 per cent, and the industry has been demanding that the licence fee be reduced to 3 per cent, and the Universal Service Obligation Fund (USOF) charge to 3 per cent from the current 5 per cent. USOF was created in 2002 to expand internet and mobile connectivity in rural areas. In August 2019, the Cellular Operators Association of India (COAI) alleged that half the funds raised by USOF between 2002-03 and 2018-19 remained unutilised.

In 2015, the TDSAT ruled that AGR includes all receipts except capital receipts and revenue from non-core sources. But on October 24, 2019, the Supreme Court set aside that order and upheld the DoT’s definition of AGR. The incumbents approached the court for a review, but the plea was rejected on January 16 this year. However, the Supreme Court agreed, on January 21, to take up a modification plea filed by the telcos, seeking to negotiate a ‘sustainable payment schedule’. This followed the Union cabinet’s decision on November 20, 2019, that telcos be given a two-year moratorium on payments.

However, on February 14 this year, the Supreme Court slammed the telcos over unpaid dues and warned of contempt proceedings if they did not pay up by March 17. “The companies have violated the order passed by this court in pith and substance,” said the court. “In spite of the dismissal of the review application, they have not deposited any amount so far.” Following the Supreme Court rap, the DoT asked the telcos to pay the AGR dues by the end of day on February 14.

As per reports, the original disputed amount of about Rs 23,000 crore snowballed to the present figure of close to Rs 1.5 lakh crore as the DoT contended that the entire dues accumulated over the past 15 years be paid with interest and penalty.

The Supreme Court was of the view that telecom players benefited immensely from the DoT’s formula of AGR calculation. In its October 24, 2019, order, the court said the “revenue-sharing package turned out to be very beneficial to the telecom service providers, which is evident from the continuing rise in the gross revenue”. Gross revenues earned by telecom service providers stood at Rs 4,855 crore in 2004, Rs 89,108 crore by 2007, and subsequently touched Rs 2,37,676 crore in 2015, said the court.

SIGNALS TURN RED

“The industry is reeling from the Supreme Court decision on AGR. It has further aggravated the already precarious financial position of operators,” says Rajan Mathews, director general of COAI. “The ball is now firmly in the government’s court to fix the vexatious AGR problem, by either eliminating it altogether or redefining it along the lines recommended by the Telecom Regulatory Authority of India and the industry, as well as reduce the licence fee and spectrum usage charge to 3 per cent and 1 per cent, respectively. We believe AGR is an anachronism in a day when operators have paid for spectrum and licences upfront.”

As of January, TRAI pegs Reliance Jio as the largest telecom player, with 369 million mobile subscribers, followed by Vodafone Idea (336 million) and Bharti Airtel (327 million). ‘The increase in Jio’s subscriber base is largely at the cost of the fall in Vodafone Idea‘s subscriber base,’ says a report by India Ratings and Research. While a Vodafone Idea spokesperson refused to comment, company sources said the board had assessed the company could pay up Rs 3,500 crore without delay, of which Rs 2,500 crore was paid on February 17. Vodafone Idea‘s assessment of its dues to the government is “significantly different” from the government’s claim, the source says. For part payments of dues, the company can dip into its cash reserves without affecting its working capital needs. Also, the Indian subsidiary can ask the parent Vodafone Plc to pitch in with Rs 8,000 crore, the source says. The proposed sale of Indus Towers, a telecom infrastructure firm jointly promoted by the Bharti Group and Vodafone Group, would also help.

In a February 17 letter to member (finance), DoT, Bharti Airtel director-legal Vidyut Gulati said that of the Rs 10,000 crore paid, Rs 9,500 crore was on behalf of Bharti Airtel and Rs 500 crore on behalf of its subsidiary, Bharti Hexacom. ‘We are in the process of completing the self-assessment exercise expeditiously and will duly make the balance payment upon completion of the same, before the next hearing in the Supreme Court,’ says the letter, which india today has seen. While a Bharti Airtel spokesperson declined comment on the AGR matter, a mail sent to Tata Teleservices went unanswered till the time of going to press.

The Supreme Court’s October 2019 directive hit the incumbent telcos hard. The year-to-date losses for Vodafone Idea, Bharti Airtel and Tata Teleservices in FY2019-20 stand at Rs 62,233.8 crore, Rs 26,946 crore and Rs 2,840 crore, respectively. Vodafone Plc has already spent over $17 billion (around Rs 1.2 lakh crore) to buy out Hutch and Essar’s stake in Vodafone Essar between 2007 and 2012, and injected several billions of dollars more to acquire spectrum and build infrastructure. Effective December 1, 2019, Reliance Jio, Vodafone Idea and Bharti Airtel announced tariff hikes, for the first time in five years. According to India Ratings and Research: ‘The average revenue per user (ARPU) reported by telcos has started showing signs of recovery in the last two-three quarters. The recent tariff hikes are likely to support the increase in ARPU over the next few quarters.’

Even if Vodafone Idea tides over the AGR crisis by, say, delayed annual payments over the long term, its weak balance sheet makes it vulnerable, as per an SBI Caps note, to incremental regulatory changes. In a three-player market, that could be a reason for TRAI to go soft on it. ‘But the moment Indian telecom shapes up as a duopoly, the regulator may start perceiving telcos differently. Price hikes, pricing power, spectrum pricing-all…may see the regulator taking a tougher stand,’ the note says. While some analysts foresee a Reliance Jio–Bharti Airtel duopoly and higher tariffs, Vodafone Idea is looking to stay in the fight. “There is hope of some relief in terms of staggered payments [of dues],” says a company official. But the options seem to be running out for the British telco that had entered India betting on its high growth potential.

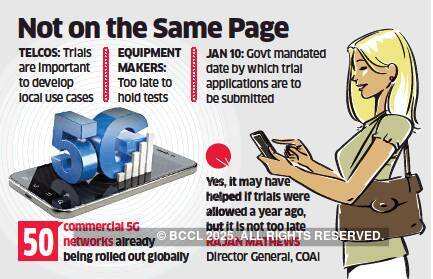

At long last: India Telecom Minister gives go ahead for 5G trials

India’s telecom minister has met with the major mobile network operators and invited them to start testing their 5G services. The government also confirmed that Chinese network infrastructure equipment vendors Huawei and ZTE would be allowed to participate in the trials.

The meeting was chaired by telecom secretary Anshu Prakash and was attended by senior representatives of Bharti Airtel, Vodafone Idea, Reliance Jio and all equipment vendors, including Huawei, reports Live Mint. Indian television channel CNBC-TV18 reported the news first, citing a senior official. The trials will be held in January, according to the official, the channel reported.

India’s department of telecom expects to allocate spectrum soon (we’ve heard that before?) for trials, which should begin in Q1-2020, ahead of plans for a spectrum auction no later than April 2020.

India Telecom Minister Ravi Shankar Prasad said earlier that 5G spectrum for trials would be available to all wireless network equipment (base station) vendors. In particular, he told reporters in India earlier this week:

“5G trials will be done with all vendors and operators. We have taken an in-principle decision to give 5G spectrum for trials.” On being asked specifically about Huawei, Prasad said that at this stage, all vendors are invited.

India Telecom Minister Ravi Shankar Prasad

………………………………………………………………………………………………………….

The Indian government believes the trials, which were originally supposed to be held in 2019, will help in the development of the country’s 5G ecosystem. The Indian telcos will be conducting 5G tests with different vendors: Bharti Airtel plans to conduct trials with Nokia, Huawei and Ericsson, while Vodafone Idea wants to partner with Ericsson and Huawei. Reliance Jio, which currently works primarily with Samsung, has applied to conduct 5G tests with the South Korean vendor.

A senior executive at one vendor said the trials should have begun a year ago and now that global testing is over, it does not make sense to start from scratch in India, especially with the auction of 5G airwaves slated for March-April.

…………………………………………………………………………………….

India’s telcos have been asking for clarity from the government regarding the participation of both Chinese vendors in 5G activities. Initially only a handful of vendors, including Cisco, Ericsson, NEC, Nokia and Samsung, received invitations to participate in the 5G trials.

The decision was welcomed by Huawei India in a statement, as well as comments from the Chinese ambassador in India on Twitter. Huawei is already active in the country, where it has deployed 4G networks for Bharti Airtel and Vodafone Idea.

The inclusion in India’s 5G trials is of particular significance for Huawei, which faces trading restrictions in several countries, including Australia, New Zealand and the US, because of security concerns. The US has been lobbying the Indian government to exclude Huawei from the 5G market but, equally, China has been lobbying for Huawei and ZTE to be given equal opportunities in India’s 5G market.

The efforts of the US authorities to restrict Huawei’s business had an impact on the vendor’s sales in 2019, though with expected full-year revenues of almost $122 billion it is still by far the largest supplier of telecoms infrastructure globally and the number two player in the smartphone market.

During the past few years, Chinese vendors have provided crucial support to India’s service providers as they attempted to manage their costs and keep tariffs under control. Chinese network equipment is cheaper than the equivalent offerings from Western rivals, enabling traditional telcos to offer services in a market with one of the lowest average revenue per user (ARPU) figures in the world.

The exclusion of Huawei and ZTE from forthcoming 5G deals would almost certainly result in an increase in capital expenditure by India’s telcos: Sunil Bharti Mittal, the chairman of Bharti Enterprises, the parent company of Airtel, spoke out in support of Huawei during a recent event organized by World Economic Forum, stating that Huawei’s equipment was superior to that of its main European rivals, Ericsson and Nokia.

“Glad to know all players got equal chance to participate in 5G trial in India. A welcome move conducive to initiatives like Digital India,” said Chinese Ambassador Sun Weidong in a social media message.

References:

India: Low mobile tariffs end; Big 3 Telcos increase rates by 40-50%

by CanIndia New Wire Service (edited for accuracy and clarity by Alan J Weissberger)

The long honeymoon for India telecom subscribers has come to an end as all the three private wireless telecom network providers — Vodafone Idea, Bharti Airtel and Jio — on Sunday announced pre-paid tariff plans with 40-50 per cent higher rates. The hike comes after three years and amid the acute financial stress the sector is going through after a Supreme Court ruling on adjusted gross revenue. The hikes, however, come with enhanced data and other benefits.

Editor’s Note:

India is currently the world’s second-largest telecommunications market (China is number 1) with a subscriber base of 1.20 billion and has registered strong growth in the past decade and half. The Indian mobile economy is growing rapidly and will contribute substantially to India’s Gross Domestic Product (GDP), according to report prepared by GSM Association (GSMA) in collaboration with the Boston Consulting Group (BCG). As of January 2019, India has experienced a 165 per cent growth in app downloads in the past two years.

…………………………………………………………………………………………………………………………………………………………………………………………………………………..

Reliance Jio, the last one to announce a revised rates on Sunday, said it would raise tariffs by up to 40 per cent. “Jio will be introducing new ‘all-in-one’ plans with unlimited voice and data. These plans will have a fair usage policy for calls to other mobile networks. The new plans will be effective from December 6,” Jio said.

“The new ‘all-in-one’ plans will be priced up to 40 per cent higher, staying true to its promise of being ‘customer-first’, Jio customers will get up to 300 per cent more benefits,” it said.

Airtel’s new rates will be effective from December 3. After December 3, the Rs 129 pack for 28 days with unlimited calling, 300 SMS, and 2GB data would cost Rs 148, it said.

A major hike is witnessed in Airtel’s Rs 998 plan with 336-day validity, unlimited calling, 3,600 SMSs and 12GB data. It would be replaced by a Rs 1,498 plan, marking 50 per cent rise, with 24GB data and 365-day validity. The users of Rs 1,699 plan would have to pay Rs 2,398, which is an increase of 41 per cent. It would continue to offer unlimited calling, 100 SMS and 1.5GB data per day. Airtel had merged Rs 169 and Rs 199 plans for 28 days to offer a Rs 248 plan with same benefits — unlimited calling, 100 SMS and 1.5GB data a day.

The Rs 249 plan, which offered unlimited calls, 100 SMS and 2GB data a day, would now cost Rs 298. The Rs 448 and 499 plans for 82 days would now cost Rs 598 and Rs 698 for 84 days.

“Airtel’s new plans represent tariff increases in the range of 50 paise a day to Rs 2.85 a day and offer generous data and calling benefits. Airtel also provides exclusive benefits as part of the Airtel Thanks platform, which enables access to premium content from Airtel Xstream (10,000 movies, exclusive shows and 400 TV channels), Wynk Music, device protection, anti-virus protection and much more,” it said.

The revised Vodafone Idea tariffs too would come into effect from December 3. It has launched ‘First Recharge Packs’ where the four first recharge packs will cost Rs 97 with Rs 45 talk time, 100MB data and voice calls charged at 1 paisa per second along with 28 days validity. Other plans include Rs 197, Rs 297 and Rs 647. They offer up to 1.5GB data a day and unlimited ‘on-net’ calling for 84 days.

Vodafone Idea announced that the ‘on-net’ voice calls would be billed at 6 paise per minute. The ‘on-net’ voice calls after the provided FUP limit will be charged 6 paise per minute, similar to Reliance Jio. It is also providing bundled ‘on-net’ minutes, whereas Jio will be charging customers for IUC ‘top-up’ vouchers.

In unlimited packs with 28-day validity are — Rs 149 plan with unlimited voice (FUP of 1,000 minutes for off-net calls), 2GB data, 300 SMS; Rs 249 plan with unlimited voice (FUP of 1,000 minutes for off-net calls), 1.5GB data, 100 SMS per day.

The company has removed the All Rounder packs and introduced two Combo Vouchers of Rs 49 and Rs 79 with 28-day validity. It has announced new prepaid plans with 2 days, 28 days, 84 days, 365 days validity, and broadly compared with existing plans of similar nature. However, new plans are costlier up to 42 per cent.

Vodafone Idea had earlier said it would increase tariff in December. The announcement has come in the backdrop of its highest quarterly loss of Rs 50,922 crore.

It’s now expected that the state-run BSNL could also hike tariffs. The government and the Telecom Regulatory Authority of India (TRAI) have made it clear that there will be no floor rate for voice or data and the telcos would have to thrash out pricing among themselves to cover up losses.

………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

The original (unedited) article was first published at:

Also see:

Mobile call, internet to become costlier in India by up to 50% from Dec 3rd

India’s Airtel, Vodafone Idea preparing for commercial NB-IoT after pilots

Danish Khan | ET Telecom (editd and corrected by Alan J Weissberger)

Bharti Airtel and Vodafone Idea Limited are now preparing to launch commercial narrow-band IoT (NB-IoT) service in India in the coming months having brought various partners on board to develop a complete device and sensor ecosystem. Both Indian telcos are in currently in various stages of pilot runs in different circles.

Airtel is now deploying around 20,000 sites in Karnataka and Chennai to conduct NB-IoT trials. “We’ll be going with a pilot in a denser way rather than just a few trial sites..in a couple of months, we will be commercially rolling out,” Ajay Chitkara, Director and CEO, Airtel Business, told ET.

Vodafone Idea Limited, on the other hand, has already conducted commercial pilots in eight cities in India, and is now hoping to win its first commercial NB-IoT deployment deal in the coming weeks.

“We’re looking at winning our first commercial deployments over the next six weeks. So commercially we’re also seeing customers now, wanting to buy that. Once we contract them will go and deploy,” Nick Gliddon, chief enterprise business officer separately told ET.

Gliddon said that all eight pilots were conducted in cities like Kochi, Jaipur, Bengaluru, and Chennai and involved smart meters. “We’ve run a long-term trial with those guys to understand how the network and services work.

Airtel’s Chitkara said that the telco’s IoT services are already growing in the country and NB-IoT technology will help it address the demand. “We have around five and a half million subscribers on our IoT side and the way growth is happening, we need to eventually get into NB-IoT.”

Chitkara added that NB-IoT will offer scale as compared to traditional IoT technologies. “130 million devices need to be connected on meter and that is the reason people say that you can’t run on the existing ecosystem.”

Vodafone is also aiming to expand its NB-IoT in India in the next 12 months to tap specific opportunities in the smart city space along with other applications.

NB-IoT is a new 3GPP spec which will likely be included in IMT 2020. It is designed to broaden the future of IoT connectivity, providing significantly improved and deeper network coverage for communication between machines while lowering power consumption by devices.

Both telcos are taking a partner-led approach building a complete ecosystem including sensors, devices and to bring the overall cost down for devices.

Chitkara said that building applications is a challenge, thereby Airtel is bringing partners on board. “…another issue is with all the sensors and other things there is a cost involved so it’s a chicken and egg story…the cost of those 2G sensors still is cheaper so we are making sure at least this whole ecosystem is build up so that we can bring from some more sites,” he added.

Vodafone Idea has already brought over 25 partners on-board and is working towards doubling this number soon to build new use cases around the new technology. These partners are mainly startups and small and medium enterprises that will bring in hardware and software capabilities to enable new NB-IoT use cases.

Rival Reliance Jio Infocomm had last year launched an NB-IoT network with a commercial network available in Mumbai. It is preparing to foray into enterprise services and may expand its IoT services accordingly.

Jio recently claimed that it is the only telco in India to have the capability and network footprint for a nationwide launch of NB-IoT services. Airtel, however, countered the claim by saying that the company’s pan-India 4G network is also ready to support the technology, along with LTE-M.

Within the enterprise business, IoT is expected to be the growth area going forward, given that the consumer retail business continues to face competitive headwinds. India’s IoT market size is expected to increase to $9 billion by 2020 from $1.3 billion in 2016, according to consultancy firm Deloitte.

UBS: 5G capex at $30 billion for India telcos; 5G spectrum auction by January 2020?

UBS analysts say that India’s top three telecom operators will have to spend a little over $30 billion on 5G base stations and fiber infrastructure. According to UBS, the need for a dense site footprint and fiber backhaul for 5G access networks will likely shift the balance of power towards larger and integrated operators with strong balance sheets.

Bharti Airtel and Vodafone Idea would need $10 billion capex each over the next five years.

“Bharti has solidly defended its market share and has narrowed the gap with Jio on 4G network reach, with improving 4G net adds. The company recently revamped its digital offering and launched converged digital proposition ‘Airtel Xstream’ offering digital content across TV, PC and mobile devices along with IoT solutions for connected homes. Further, Jio’s recently announced fixed broadband plans starting at Rs 699 are not as aggressive as we (and the market) feared and, therefore, do not pose significant pricing pressure on Bharti’s broadband average revenue per user,” UBS said in a research note to clients.

Reliance Jio’s incremental 5G capex is estimated somewhat lower at around $8 billion. That’s because Jio already has more 5G-ready fiberised towers than the incumbents, having already spent around $2 billion on tower fiberization.

Analysts were skeptical about Vodafone Idea’s ability to sustain such big-ticket capex spends given its continuing market share losses and weak financials, which they said could limit its 5G deployment ambitions.

They also said the need for a dense site footprint and fibre backhaul in 5G would shift the balance of power towards larger and integrated operators with strong balance sheets like Jio and Airtel, while those with high gearing levels are at risk given the sustained high capex needs.

“Airtel and Vodafone Idea will each need to spend $2 billion annually on 5G radio and fiber capex spread across 5 years,” UBS said in a report, implying 65% and 85% of Airtel’s and Vodafone Idea’s current annual India capex run rates respectively.

By contrast, Jio’s 5G capex, “would be lower due to its larger tower footprint and higher proportion of towers on fibre backhaul compared with Airtel and Vodafone Idea.” The brokerage firm also expects Jio to transition to 5G in a “time-efficient manner,” given its in-house data centres and investments in a content distribution network (CDN).

“Vodafone Idea’s stretched balance sheet will limit its participation in the 5G opportunity, and the company will require a significant improvement in network quality to arrest market share loss and revert to revenue growth,” UBS said.

Credit Suisse backed the view, saying, “Vodafone Idea will lose the most market share, and will need additional equity capital by FY2021, given our expectation of no price increase”.

UBS estimates that Airtel’s India mobile revenue will grow 5-6% in this financial year and the next even if interconnect usage charges – a source of revenue for incumbents – get scrapped from January 2020.

According to analysts, the India telecom sector can reduce overall estimated $30.5 billion 5G capex spends by 15-20% if Airtel, Vodafone Idea and Jio share towers and fiber resources. However, there is currently no progress on that front.

“We estimate the sector can reduce overall capex by 15-20 per cent if the three Indian telcos share towers and fiber (either commercially or driven by the regulator) – third-party tenancy poses upside risks to our estimates,” UBS said in its report.

……………………………………………………………………………………………………………

India’s Department of Telecommunications wants to hold a 5G spectrum sale by January 2020 at the latest, according to referenced sources.

Credit Suisse doesn’t expect that 5G spectrum sale to attract much interest. That’s due to a mix of “high reserve prices, telcos’ focus on monetising 4G investments, stretched balance sheets, a nascent 5G ecosystem and lack of significant 5G use cases for mass consumption.”

Rajiv Sharma, co-head of research at SBICap Securities, said that Vodafone Idea is unlikely to bid for 5G spectrum at current base prices “as the telco doesn’t have an existing pan-India 4G network that is essential for any telco planning to spend top dollars on 5G,” according to the report.

Analysts believe that Reliance Jio will probably take part in the process, as it is the only profit-making telco in the Indian market.

The Department of Telecommunications (DoT) had recently asked the Trai to lower the starting prices, which the regulator refused. “There was a chance for the Trai to reduce 5G prices. Let’s see what the DoT does now. But at current rates, Airtel won’t buy,” Airtel’s executive reportedly said.

Vodafone Idea CEO Balesh Sharma has previously said that the prices recommended by the regulator were ‘exorbitant.’ The telco said it will participate in the next auction but did not confirm if it would buy 5G spectrum.

Hemant Joshi, partner at Deloitte India, said it would be “prudent to defer the 5G auction till 2020 at least since at Trai’s recommended base prices, the industry response may be very lukewarm.” He also said that the reserve prices need to be lowered, taking into account the experiences in countries where 5G spectrum was recently auctioned.

……………………………………………………………………………………………

Analysts said there are three things that India’s Centre for Telecom Excellence (within the DoT) must do immediately to hasten the adoption of 5G:

First, lay down a clear roadmap of spectrum availability and specify frequency bands aligned with global standards (IMT 2020 from ITU-R). Given that 5G services will be supporting massive data applications, operators will need adequate spectrum.

Editor’s Note: India’s TSDSI has proposed a candidate IMT 2020 RIT based on Low Mobility Large Cell (LMLC), but it hasn’t yet been accepted by ITU-R WP 5D. TSDSI posted a revised and more comprehensive proposal on 10 September 2019, which will be evaluated at the next ITU-R WP 5D meeting in December.

………………………………………………………………………………………………….

Second, there is a need to move away from the existing mechanism of pricing spectrum on a per MHz basis. 5G services require at least 80-100 Mhz of contiguous spectrum per operator. If the Centre were to fix the floor price based on the per Mhz price realised in the last auction then no operator would be able to afford buying 5G spectrum. The pricing, therefore, will have to be worked out anew, keeping in mind the financial stress in the telecom sector and affordability of services.

Finally, the Centre must rapidly complete the national fiber optic network rollout as 5G high speed services will require huge back-haul support for which existing microwave platforms will not be sufficient.

India’s TSDSI candidate IMT 2020 RIT with Low Mobility Large Cell (LMLC) for rural coverage of 5G services

India’s telecom standards organization TSDSI has submitted its candidate IMT-2020 Radio Interface Technology (RIT) to the IMT-2020 evaluation at the ITU-R WP 5D meeting #32 being held in Buzios, Brazil from 9 July 2019 to 17 July 2019. TSDSI’s IMT 2020 submission is one of five candidate RIT proposals- see NOTE at bottom of this article for more information.

TSDSI’s RIT is described in document ITU-R WP5D-AR Contribution 770. This RIT has been developed to address the rural requirements by enabling the implementation of Low Mobility Large Cell (LMLC), particularly with emphasis on low-cost rural coverage of 5G wireless network services. TSDSI believes that this RIT will also help to meet the rural requirements of other developing countries. This author agrees!

TSDSI proposal on Low Mobility Large Cell (LMLC) configuration has been included as a mandatory test configuration under the Rural eMBB (enhanced Mobile BroadBand) test environment in IMT 2020 Technical Performance Requirements (TPR) in ITU-R with an enhanced Inter Sire Distance (ISD) of 6 km. Incorporation of LMLC in IMT2020 will help address the requirements of typical Indian rural settings and will be a key enabler for bridging the rural-urban divide with 5G rollouts.

–>The Indian administration (ITU member country) extends its support to the RIT of TSDSI and solicits the support of ITU Member States to support this proposal.

Indian wireless network operators, including Reliance Jio Infocomm Ltd, have expressed interest in LMLC.

About TSDSI:

*TSDSI is a Standards development organization similar to ETSI, SRIB, ATIS, CCSA, TTA, TTC, etc.

*TSDSI is an Organisational Partner of 3GPP and oneM2M, an Associate member of ITU-R and ITU-T and a member of GSC.

*TSDSI delegations have been actively participating and contributing in Standards development Working Groups in all these forums.

*TSDSI has formal affiliations (MoUs/Agreements) with – ETSI, 5GIA, ATSC, BIF, CCICI, GCF, IEEE-SA, TIA, TAICs, TTA, WWRF, ARIB, ATIS, CCSA, TTC

*TSDSI conducts several joint activities – projects, workshops, conferences etc. with its affiliates

*TSDSI’s operating procedures have been derived based on best practices being followed by similar Global SDOs.

*TSDSI Rules & Regulations, Working Procedures and IPR Policy are all transparent and available on our website – http://www.tsdsi.in. A brief perusal will show the similarity with the processes and policies followed by other SDOs.

*TSDSI strictly follows the Rules and Procedures. It provides an open, transparent and collaborative platform for its members to participate and contribute in the development of Standards with a special focus on India Specific Requirements and Indian Innovations. The governance model is also very inclusive, open and transparent with fresh elections being conducted for all positions every 2 years.

Submitted by: Chair TSDSI , Vice Chair TSDSI and DG TSDSI

http://www.tsdsi.in

………………………………………………………………………………………………………………………………………….

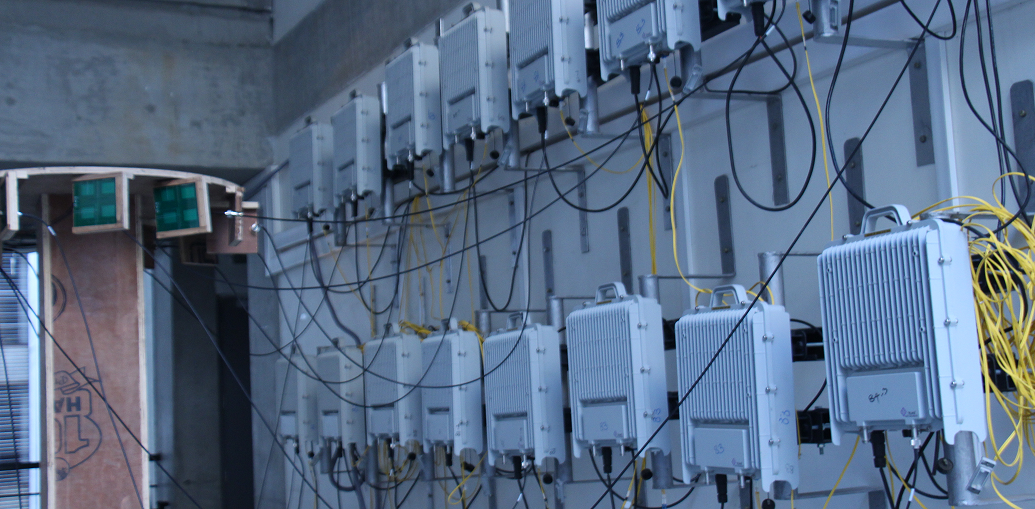

Kiran Kumar Kuchi, a professor at IIT Hyderabad is building a 5G testbed there. The system will exceed IMT 2020 5G performance requirements including Low Mobility Large Cell.

IIT Hyderabad 5G Testbed. Photo courtesy of IIT Hyderabad.

……………………………………………………………………………………………………………………………………………………………………………………………………………

TSDSI’s baseline RIT (initial description template) is documented in ITU-R WP 5D Document 5D/980: Revision 2 to Document IMT-2020/7-E, submitted on 14 February 2019. Several updates to TSDSI RIT included the updated characteristics template, initial link budget template, etc. They are in Document 5D/1138: Attachment Part 1: 5D/1138!P1; Attachment Part 2: 5D/1138!P2; Attachment Part 3: 5D/1138!P3; Attachment Part 4: 5D/1138!P4)

Here are a few key excerpts from the TSDSI baseline RIT:

Describe details of the radio interface architecture and protocol stack such as: – Logical channels – Control channels – Traffic channels Transport channels and/or physical channels.

RAN/Radio Architectures: This RIT contains NR standalone architecture. The following paragraphs provide a high-level summary of radio interface protocols and channels.

Radio Protocols: The protocol stack for the user plane includes the following: SDAP, PDCP, RLC, MAC, and PHY sublayers (terminated in UE and gNB). On the Control plane, the following protocols are defined: – RRC, PDCP, RLC, MAC and PHY sublayers (terminated in UE and gNB); – NAS protocol (terminated in UE and AMF) For details on protocol services and functions, please refer to 3GPP specifications (e.g. [38.300]).

Radio Channels (Physical, Transport and Logical Channels):

- The physical layer offers service to the MAC sublayer transport channels. The MAC sublayer offers service to the RLC sublayer logical channels.

- The RLC sublayer offers service to the PDCP sublayer RLC channels.

- The PDCP sublayer offers service to the SDAP and RRC sublayer radio bearers: data radio bearers (DRB) for user plane data and signalling radio bearers (SRB) for control plane data.

- The SDAP sublayer offers 5GC QoS flows and DRBs mapping function.

The physical channels defined in the downlink are: – the Physical Downlink Shared Channel (PDSCH), – the Physical Downlink Control Channel (PDCCH), – the Physical Broadcast Channel (PBCH).

The physical channels defined in the uplink are: – the Physical Random Access Channel (PRACH), – the Physical Uplink Shared Channel (PUSCH), – and the Physical Uplink Control Channel (PUCCH). In addition to the physical channels above, PHY layer signals are defined, which can be reference signals, primary and secondary synchronization signals.

The following transport channels, and their mapping to PHY channels, are defined:

Uplink: – Uplink Shared Channel (UL-SCH), mapped to PUSCH – Random Access Channel (RACH), mapped to PRACH

Downlink: – Downlink Shared Channel (DL-SCH), mapped to PDSCH – Broadcast channel (BCH), mapped to PBCH – Paging channel (PCH), mapped to (TBD)

Logical channels are classified into two groups: Control Channels and Traffic Channels.

Control channels: – Broadcast Control Channel (BCCH): a downlink channel for broadcasting system control information. – Paging Control Channel (PCCH): a downlink channel that transfers paging information and system information change notifications. – Common Control Channel (CCCH): channel for transmitting control information between UEs and network. – Dedicated Control Channel (DCCH): a point-to-point bi-directional channel that transmits dedicated control information between a UE and the network.

Traffic channels: Dedicated Traffic Channel (DTCH), which can exist in both UL and DL. In Downlink, the following connections between logical channels and transport channels exist: – BCCH can be mapped to BCH, or DL-SCH; – PCCH can be mapped to PCH; – CCCH, DCCH, DTCH can be mapped to DL-SCH;

In Uplink, the following connections between logical channels and transport channels exist: – CCCH, DCCH, DTCH can be mapped to UL-SCH.

Enhancements:

1. Method to improve broadcast and paging control channel efficiency over access elements.

2. Reduce the impact of congestion in the data path and control path to improve overall efficiency in the network.

3. Other aspects

– NR QoS architecture The QoS architecture in NG-RAN (connected to 5GC), can be summarized as follows: For each UE, 5GC establishes one or more PDU Sessions. For each UE, the NG-RAN establishes one or more Data Radio Bearers (DRB) per PDU Session. The NG-RAN maps packets belonging to different PDU sessions to different DRBs. Hence, the NG-RAN establishes at least one default DRB for each PDU Session. NAS level packet filters in the UE and in the 5GC associate UL and DL packets with QoS Flows. AS-level mapping rules in the UE and in the NG-RAN associate UL and DL QoS Flows with DRBs

– Carrier Aggregation (CA) In case of CA, the multi-carrier nature of the physical layer is only exposed to the MAC layer for which one HARQ entity is required per serving cell.

– Dual Connectivity (DC) In DC, the radio protocol architecture that a radio bearer uses depends on how the radio bearer is setup.

…………………………………………………………………………………………………………..

Four bearer types (information carrying channels) exist: MCG bearer, MCG split bearer, SCG bearer and SCG split bearer.

The following terminology/definitions apply:

– Master gNB: in dual connectivity, the gNB which terminates at least NG-C.

– Secondary gNB: in dual connectivity, the gNB that is providing additional radio resources for the UE but is not the Master node.

– Master Cell Group (MCG): in dual connectivity, a group of serving cells associated with the MgNB

– Secondary Cell Group (SCG): in dual connectivity, a group of serving cells associated with the SgNB

– MCG bearer: in dual connectivity, a bearer whose radio protocols are only located in the MCG.

– MCG split bearer: in dual connectivity, a bearer whose radio protocols are split at the MgNB and belong to both MCG and SCG.

– SCG bearer: in dual connectivity, a bearer whose radio protocols are only located in the SCG.

– SCG split bearer: in dual connectivity, a bearer whose radio protocols are split at the SgNB and belong to both SCG and MCG.

In case of DC, the UE is configured with two MAC entities: one MAC entity for the MCG and one MAC entity for the SCG. For a split bearer, UE is configured over which link (or both) the UE transmits UL PDCP PDUs. On the link which is not responsible for UL PDCP PDUs transmission, the RLC layer only transmits corresponding ARQ feedback for the downlink data.

What is the bit rate required for transmitting feedback information? The information will be provided in later update.

……………………………………………………………………………………………………………………

LMLC Detailed Description – Characteristics template for TSDSI RIT:

The description template provides the characteristics description of the TSDSI RIT.

For this characteristic template, it has chosen to address the characteristics that are viewed to be very crucial to assist in evaluation activities for independent evaluation groups, as well as to facilitate the understanding of the RIT.

Channel access: Describe in detail how RIT/SRIT accomplishes initial channel access, (e.g. contention or non-contention based).

Initial channel access is typically accomplished via the “random access procedure” (assuming no dedicated/scheduled resources are allocated). The random access procedure can be contention based (e.g. at initial connection from idle mode) or non-contention based (e.g. during Handover to a new cell). Random access resources and parameters are configured by the network and signaled to the UE (via broadcast or dedicated signaling). Contention based random access procedure encompasses the transmission of a random access preamble by the UE (subject to possible contention with other UEs), followed by a random access response (RAR) in DL (including allocating specific radio resources for the uplink transmission). Afterwards, the UE transmits the initial UL message (e.g. RRC connection Request) using the allocated resources, and wait for a contention resolution message in DL (to confirming access to that UE). The UE could perform multiple attempts until it is successful in accessing the channel or until a timer (supervising the procedure) elapses. Non-contention based random access procedure foresees the assignment of a dedicated random access resource/preamble to a UE (e.g. part of an HO command). This avoids the contention resolution phase, i.e. only the random access preamble and random access response messages are needed to get channel access.

From a PHY perspective, a random access preamble is transmitted (UL) in a PRACH, random access response (DL) in a PDSCH, UL transmission in a PUSCH, and contention resolution message (DL) in a PDSCH.

……………………………………………………………………………………………………………………

| Radio interface functional aspects: | ||||||||||||||||||

| Multiple access schemes

Which access scheme(s) does the proposal use? Describe in detail the multiple access schemes employed with their main parameters. – Downlink and Uplink: The multiple access is a combination of ● OFDMA: Synchronous/scheduling-based; the transmission to/from different UEs uses mutually orthogonal frequency assignments. Granularity in frequency assignment: One resource block consisting of 12 subcarriers. Multiple sub-carrier spacings are supported including 15kHz, 30kHz, 60kHz and 120kHz for data (see Item 5.2.3.2.7 and reference therein). 1. CP-OFDM is applied for downlink. DFT-spread OFDM and CP-OFDM are available for uplink. 2. Spectral confinement technique(s) (e.g. filtering, windowing, etc.) for a waveform at the transmitter is transparent to the receiver. When such confinement techniques are used, the spectral utilization ratio can be enhanced. ● TDMA: Transmission to/from different UEs with separation in time. Granularity: One slot consists of 14 OFDM symbols and the physical length of one slot ranges from 0.125ms to 1ms depending on the sub-carrier spacing (for more details on the frame structure, see Item 5.2.3.2.7 and the references therein). ● SDMA: Possibility to transmit to/from multiple users using the same time/frequency resource (SDMA a.k.a. “multi-user MIMO”) as part of the advanced-antenna capabilities (for more details on the advanced-antenna capabilities, see Item 5.2.3.2.9 and the reference therein) At least an UL transmission scheme without scheduling grant is supported for initial access. Inter-cell interference suppressed by processing gain of channel coding allowing for a frequency reuse of one (for more details on channel-coding, see Item 5.2.3.2.2.3 and the reference therein). (Note: Synchronous means that timing offset between UEs is within cyclic prefix by e.g. timing alignment.) For NB-IoT, the multiple access is a combination of OFDMA, TDMA, where OFDMA and TDMA are as follows · OFDMA: n UL: DFT-spread OFDM. Granularity in frequency domain: A single sub-carrier with either 3.75 kHz or 15 kHz sub-carrier spacing, or 3, 6, or 12 sub-carriers with a sub-carrier spacing of 15 kHz. A resource block consists of 12 sub-carriers with 15 kHz sub-carrier spacing, or 48 sub-carriers with 3.75 kHz sub-carrier spacing → 180 kHz. n DL: Granularity in frequency domain: one resource block consisting of 6 or 12 subcarriers with 15 kHz sub-carrier spacing→90 or 180 kHz · TDMA: Transmission to/from different UEs with separation in time n UL: Granularity: One resource unit of 1 ms, 2 ms, 4 ms, 8 ms, with 15 kHz sub-carrier spacing, depending on allocated number of sub-carrier(s); or 32 ms with 3.75 kHz sub-carrier spacing (for more details on the frame structure, see Item 5.2.3.2.7 and the references therein) n DL: Granularity: One resource unit (subframe) of length 1 ms. Repetition of a transmission is supported |

||||||||||||||||||

| Modulation scheme | ||||||||||||||||||

| What is the baseband modulation scheme? If both data modulation and spreading modulation are required, describe in detail.

Describe the modulation scheme employed for data and control information. What is the symbol rate after modulation? – Downlink: ● For both data and higher-layer control information: QPSK, 16QAM, 64QAM and 256QAM (see [T3.9038.211] sub-clause 7.3.1.2). ● L1/L2 control: QPSK (see [T3.9038.211] sub-clause 7.3.2.4). ● Symbol rate: 1344ksymbols/s per 1440kHz resource block (equivalently 168ksymbols/s per 180kHz resource block) – Uplink: ● For both data and higher-layer control information: π/2-BPSK with spectrum shaping, QPSK, 16QAM, 64QAM and 256QAM (see [T3.9038.211] sub-clause 6.3.1.2). ● L1/L2 control: BPSK, π/2-BPSK with spectrum shaping, QPSK (see [T3.9038.211] sub-clause 6.3.2). ● Symbol rate: 1344ksymbols/s per 1440kHz resource block (equivalently 168ksymbols/s per 180kHz resource block) The above is at least applied to eMBB. For NB-IoT, the modulation scheme is as follows. · Data and higher-layer control: π/2-BPSK (uplink only), π/4-QPSK (uplink only), QPSK · L1/L2 control: π/2-BPSK (uplink), QPSK (uplink), QPSK (downlink) Symbol rate: 168 ksymbols/s per 180 kHz resource block. For UL, less than one resource block may be allocated. |

||||||||||||||||||

| PAPR

What is the RF peak to average power ratio after baseband filtering (dB)? Describe the PAPR (peak-to-average power ratio) reduction algorithms if they are used in the proposed RIT/SRIT. The PAPR depends on the waveform and the number of component carriers. The single component carrier transmission is assumed herein when providing the PAPR. For DFT-spread OFDM, PAPR would depend on modulation scheme as well. For uplink using DFT-spread OFDM, the cubic metric (CM) can also be used as one of the methods of predicting the power de-rating from signal modulation characteristics, if needed. – Downlink: The PAPR is 8.4dB (99.9%) – Uplink: ● For CP-OFDM: The PAPR is 8.4dB (99.9%) ● For DFT-spread OFDM: The PAPR is provided in the table below.

Any PAPR-reduction algorithm is transmitter-implementation specific for uplink and downlink. For NB-IoT, – Downlink: The PAPR is 8.0dB (99.9%) on 180kHz resource. – Uplink: The PAPR is 0.23 – 5.6 dB (99.9 %) depending on sub-carriers allocated for available NB-IoT UL modulation. |

||||||||||||||||||

| Error control coding scheme and interleaving | ||||||||||||||||||

| Provide details of error control coding scheme for both downlink and uplink.

For example, – FEC or other schemes? The proponents can provide additional information on the decoding schemes. – Downlink and Uplink: ● For data: Rate 1/3 or 1/5 Low density parity check (LDPC) coding, combined with rate matching based on puncturing/repetition to achieve a desired overall code rate (For more details, see [T3.9038.212] sub-clauses 5.3.2). LDPC channel coder facilitates low-latency and high-throughput decoder implementations. ● For L1/L2 control: For DCI (Downlink Control Information)/UCI (Uplink Control Information) size larger than 11 bits, Polar coding, combined with rate matching based on puncturing/repetition to achieve a desired overall code rate (For more details, see [T3.9038.212] sub-clauses 5.3.1). Otherwise, repetition for 1-bit; simplex coding for 2-bit; reedmuller coding for 3~11-bit DCI/UCI size. The above scheme is at least applied to eMBB. Decoding mechanism is receiver-implementation specific For NB-IoT, the coding scheme is as follows: · For data: Rate 1/3 Turbo coding in UL, and rate-1/3 tail-biting convolutional coding in DL, each combined with rate matching based on puncturing/repetition to achieve a desired overall code rate; one transport block can be mapped to one or multiple resource units (for more details, see [T3.9036.212] sub-clause 6.2) · For L1/L2 control: For L1/L2 control: Rate-1/3 tail-biting convolutional coding. Special block codes for some L1/L2 control signaling (For more details, see [T3.9036.212] sub-clauses 5.1.3.1) |

||||||||||||||||||

| Describe the bit interleaving scheme for both uplink and downlink.

– Downlink: ● For data: bit interleaver is performed for LDPC coding after rate-matching (For more details, see [T3.9038.212] sub-clauses 5.4.2.2) ● For L1/L2 control: Bit interleaving is performed as part of the encoding process for Polar coding (For more details, see [T3.9038.212] sub-clauses 5.4.1.1) – Uplink: ● For data: bit interleaver is performed for LDPC coding after rate-matching (For more details, see [T3.9038.212] sub-clauses 5.4.2.2) ● For L1/L2 control: Bit interleaving is performed for Polar coding after rate-matching (For more details, see [T3.9038.212] sub-clauses 5.4.1.3) The above scheme is at least applied to eMBB. NB-IOT Uplink For Control (Format 2) : Bit interleaver is not applied For Data (Format1): Bit interleaver is performed after rate matching only for multitone transmissions (3,6,12). For single tone transmissions it is not applicable. -Downlink Bit interleaver is not applied

|

||||||||||||||||||

| Describe channel tracking capabilities (e.g. channel tracking algorithm, pilot symbol configuration, etc.) to accommodate rapidly changing delay spread profile.

To support channel tracking, different types of reference signals can be transmitted on downlink and uplink respectively. – Downlink: ● Primary and Secondary Synchronization signals (PSS and SSS) are transmitted periodically to the cell. The periodicity of these signals is network configurable. UEs can detect and maintain the cell timing based on these signals. If the gNB implements hybrid beamforming, then the PSS and SSS are transmitted separately to each analogue beam. Network can configure multiple PSS and SSS in frequency domain. ● UE-specific Demodulation RS (DM-RS) for PDCCH can be used for downlink channel estimation for coherent demodulation of PDCCH (Physical Downlink Control Channel). DM-RS for PDCCH is transmitted together with the PDCCH. ● UE-specific Demodulation RS (DM-RS) for PDSCH can be used for downlink channel estimation for coherent demodulation of PDSCH (Physical Downlink Shared Channel). DM-RS for PDSCH is transmitted together with the PDSCH. ● UE-specific Phase Tracking RS (PT-RS) can be used in addition to the DM-RS for PDSCH for correcting common phase error between PDSCH symbols not containing DM-RS. It may also be used for Doppler and time varying channel tracking. PT-RS for PDSCH is transmitted together with the PDSCH upon need. ● UE-specific Channel State Information RS (CSI-RS) can be used for estimation of channel-state information (CSI) to further prepare feedback reporting to gNB to assist in MCS selection, beamforming, MIMO rank selection and resource allocation. CSI-RS transmissions are transmitted periodically, aperiodically, and semi-persistently on a configurable rate by the gNB. CSI-RS also can be used for interference measurement and fine frequency/time tracking purposes. – Uplink: ● UE-specific Demodulation RS (DM-RS) for PUCCH can be used for uplink channel estimation for coherent demodulation of PUCCH (Physical Uplink Control Channel). DM-RS for PUCCH is transmitted together with the PUCCH. ● UE-specific Demodulation RS (DM-RS) for PUSCH can be used for uplink channel estimation for coherent demodulation of PUSCH (Physical Uplink Shared Channel). DM-RS for PUSCH is transmitted together with the PUSCH. ● UE-specific Phase Tracking RS (PT-RS) can be used in addition to the DM-RS for PUSCH for correcting common phase error between PUSCH symbols not containing DM-RS. It may also be used for Doppler and time varying channel tracking. DM-RS for PUSCH is transmitted together with the PUSCH upon need. ● UE-specific Sounding RS (SRS) can be used for estimation of uplink channel-state information to assist uplink scheduling, uplink power control, as well as assist the downlink transmission (e.g. the downlink beamforming in the scenario with UL/DL reciprocity). SRS transmissions are transmitted periodically aperiodically, and semi-persistently by the UE on a gNB configurable rate. Details of channel-tracking/estimation algorithms are receiver-implementation specific, and not part of the specification. Details of channel-tracking/estimation algorithms are receiver-implementation specific, e.g. MMSE-based channel estimation with appropriate interpolation in time and frequency domain could be used. NB-IOT NB-IoT is based on following signals transmitted in the downlink: the primary and secondary narrowband synchronization signals. The narrowband primary synchronization sequence is transmitted over 11 sub-carriers from the first subcarrier to the eleventh subcarrier in the sixth subframe of each frame, and the narrowband secondary synchronization sequence is transmitted over 12 sub-carriers in the NB-IoT carrier in the tenth subframe of every other frame. ● Demodulation RS (DM-RS) for NPUSCH format 1&2 (used for Data and control respectively) can be used for uplink channel estimation for coherent demodulation of NPUSCH F1 & F2 (Narrowband Physical Uplink Shared Channel Format 1 and 2). DM-RS for NPUSCH F1& F2 is transmitted together with the NPUSCH F1 & F2. They are not UE specific, as they do not depend on RNTI. The reference sequence generation is different for single tone and multi tone. For more details refer to [T3.9036.211] For single-tone NPUSCH with UL-SCH demodulation, uplink demodulation reference signals are transmitted in the 4- th block of the slot for 15 kHz subcarrier spacing, and in the 5-th block of the slot for 3.75 kHz subcarrier spacing. For multi-tone NPUSCH with UL-SCH demodulation, uplink demodulation reference signals are transmitted in the 4-th block of the slot. The uplink demodulation reference signals sequence length is 16 for single-tone NPUSCH with ULSCH transmission, and equals the size (number of sub-carriers) of the assigned resource for multi-tone transmission. For single-tone NPUSCH with UL-SCH transmission, multiple narrow band reference signals can be created: – Based on different base sequences; – A common Gold sequence. For multi-tone NPUSCH with UL-SCH transmission, multiple narrow band reference signals are created: – Based on different base sequences; – Different cyclic shifts of the same sequence. For NPUSCH with ACK/NAK demodulation, uplink demodulation reference signals are transmitted in the 3-rd, 4-th and 5-th block of the slot for 15 kHz subcarrier spacing, and in the 1-st, 2-nd and 3-rd block of the slot for 3.75 kHz subcarrier spacing. Multiple narrow band reference signals can be created: – Based on different base sequences; – A common Gold sequence; – Different orthogonal sequences (OCC). |

||||||||||||||||||

| Physical channel structure and multiplexing | ||||||||||||||||||

| What is the physical channel bit rate (M or Gbit/s) for supported bandwidths?

i.e., the product of the modulation symbol rate (in symbols per second), bits per modulation symbol, and the number of streams supported by the antenna system. The physical channel bit rate depends on the modulation scheme, number of spatial-multiplexing layer, number of resource blocks in the channel bandwidth and the subcarrier spacing used. The physical channel bit rate per layer can be expressed as Rlayer = Nmod x NRB x 2µ x 168 kbps where – Nmod is the number of bits per modulation symbol for the applied modulation scheme (QPSK: 2, 16QAM: 4, 64QAM: 6, 256QAM: 8) – NRB is the number of resource blocks in the aggregated frequency domain which depends on the channel bandwidth. – µ depends on the subcarrier spacing, , given by For example, a 400 MHz carrier with 264 resource blocks using 120 kHz subcarrier spacing, , and 256QAM modulation results in a physical channel bit rate of 2.8 Gbit/s per layer. NB-IOT The physical channel bit rate depends on the modulation scheme, number of tones used in the channel bandwidth in the resource block and the subcarrier spacing used. The physical channel bit rate per user can be expressed as : Uplink NPUSCH Format 1 R = Nmod x Ntone x 12 kbps for carrier spacing of 15kHz where – Nmod is the number of bits per modulation symbol for the applied modulation scheme (QPSK: 2, BPSK:1) – Ntone is the number of tones . This can be 1,3,6,12 R = Nmod x 3 kbps for carrier spacing of 3.75kHz Downlink R = Nmod x 12 x 12 kbps |

||||||||||||||||||

| Layer 1 and Layer 2 overhead estimation.

Describe how the RIT/SRIT accounts for all layer 1 (PHY) and layer 2 (MAC) overhead and provide an accurate estimate that includes static and dynamic overheads. – Downlink The downlink L1/L2 overhead includes: 1. Different types of reference signals a. Demodulation reference signals for PDSCH (DMRS-PDSCH) b. Phase-tracking reference signals for PDSCH (PTRS-PDSCH) c. Demodulation reference signals for PDCCH d. Reference signals specifically targeting estimation of channel-state information (CSI-RS) e. Tracking reference signals (TRS) 2. L1/L2 control signalling transmitted on the up to three first OFDM symbols of each slot 3. Synchronization signals and physical broadcast control channel including demodulation reference signals included in the SS/PBCH block 4. PDU headers in L2 sub-layers (MAC/RLC/PDCP) The overhead due to different type of reference signals is given in the table below. Note that demodulation reference signals for PDCCH is included in the PDCCH overhead.