Verizon

Verizon broadband – a combination of FWA and Fios (but not so much pay TV)

Verizon today announced its earnings for the third quarter of 2021, with the company posting net income of $6.6 billion, operating revenue of $32.9 billion, and $1.55 in earnings per share. Verizon now expects total wireless service revenue growth of around 4%, an increase to prior guidance of 3.5% to 4%. It’s earnings guidance was also revised upwards. Verizon adjusted earnings per share of $5.35 to $5.40 is now forecast for the current quarter – an increase from its prior guidance of $5.25 to $5.35.

“We had a strong third quarter, delivering on our strategy and growing in multiple areas,” Verizon Chairman and CEO Hans Vestberg said in the earnings release. “Our disciplined strategy execution demonstrated growth in 5G adoption, broadband subscribers and business applications. We are increasing our 2021 guidance, and we continue to expand our 4G LTE and 5G network leadership. We fully expect to have a strong finish to the year as we accelerate deployment of 5G to our customers across the country,” he added.

“Verizon reported another quarter of strong financial and operating performance,” Verizon Chief Financial Officer Matt Ellis said in the press release. “We are seeing strong demand for connectivity across our Consumer and Business segments as our Mix and Match and Business Unlimited value propositions, network quality and unique partnerships are resonating with both new and existing customers. We grew revenue in the quarter, achieved solid cash flow, completed the sale of Verizon Media and increased the dividend for a 15th consecutive year.”

The #1 wireless telco in the U.S. lost 68,000 net video subscribers from its Fios (FTTH/FTTP) service in the third quarter. “The telecom giant has been shifting its video focus away from Fios TV to partnerships with third-party streaming services as it positions itself as a key distribution platform for them. For example, Verizon has a deal with The Walt Disney Co. for the Disney bundle, which gives customers with select Verizon wireless unlimited plans access to Disney streaming services Disney+, Hulu and ESPN+,” said the Hollywood Reporter.

During the quarter, Verizon sold off its Verizon Media unit, which consisted of formerly dominant tech brands like AOL and Yahoo. The unit was acquired by Apollo Global Management, although Verizon continues to hold a 10 percent stake.

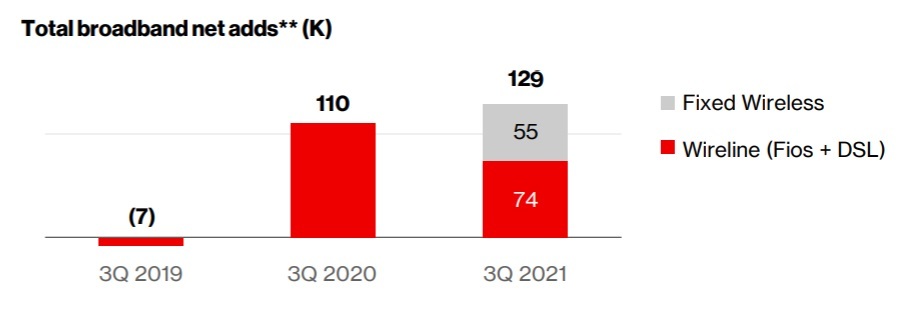

Verizon reported 129,000 broadband net additions in the third quarter, comprised of Fios, DSL and FWA subscribers, during the quarter. Of those, there were 55,000 Fixed Wireless Access (FWA) subscriber adds , which was about 42% of the 129,000 total broadband net adds generated in the quarter. Verizon FWA has a total of ~150,000 subscribers.

Source: Verizon Infographic from 3Q 2021 Earnings Report

Verizon CEO Hans Vestberg said during the earnings call, “We’re on track to meet our fixed wireless access household coverage targets with an expected 15 million homes passed by the end of the year between 4G and 5G. To date, 5G Home is in 57 markets and 4G LTE Home is in over 200 markets across all 50 states.”

Verizon first began offering 4G LTE Home in July 2020 and has really accelerated its rollout. The company has also rolled out 5G Home. Verizon executives on today’s earnings call noted that the FWA subscriber base is a mix of customers getting service from its 4G/LTE network and via Verizon’s 5G millimeter wave (mmWave) network. The company’s FWA base currently is a mix of residential and business customers, but did not break out that ratio. But they did note that there’s about a rough 50/50 split between FWA customers that are coming from Verizon’s existing base and from other service providers. CFO Matt Ellis said Verizon’s FWA customers aren’t solely focused on rural areas, as Verizon is also seeing “good traction” with the product in urban and suburban areas.

Verizon now seems to favor FWA over Fios, probably because of significantly lower installation costs for the former. Yet the company is not giving up on Fios. “In addition to fixed wireless access, we’re pleased with the great performance of Fios and continue to grow the open-for-sale volumes within our footprint.”

Indeed, Fios Internet net adds were 104,000 in the quarter. The telco is increasing its Fios footprint, adding over 400,000 open-for-sale locations this year. One analyst noted that Verizon hasn’t talked about increasing its Fios brand within its ILEC for quite some time.

Chief Financial Officer Matt Ellis said, “On the Fios expansion, we see great opportunity. We have been investing in that for a number of years; maybe haven’t spoken about it quite as much. But it continues to be a very good growth driver for the business.”

The company reported that Fios revenue of $3.2 billion in the quarter was up 4.7% year over year, driven by continued growth in customers as well as Verizon’s effort to increase the value of each customer by encouraging them to step up in speed tiers.

“We remain focused on bringing in high-quality net adds,” said Elllis. “The mix and match pricing structure for both wireless and Fios provides opportunity to migrate customers to higher value tiers and bring in customers on higher value plans. Our strategy is focused on increasing the value we receive from every connection.”

Vestberg said, “Our strategy is becoming a national broadband provider with the best access to the tech for our customers, including Fios, fixed wireless access on 5G, on 4G, mmWave and C-band.”

In a research note to clients, analyst Craig Moffett discussed Verizon’s broadband business:

Verizon’s FiOS service continues to show strength, a product of both more aggressive pricing and a lessening drag from video as the video base shrinks. Notably, Verizon is also beginning to see some contribution from fixed wireless access.

- FiOS internet subscriber gains of 104K were almost spot on with consensus. DSL losses

remained relatively steady (-30K) despite the fact that the base of legacy DSL has been

gradually depleted. Overall broadband net additions came in at 129K, which includes

55K fixed wireless connections. The company reported that it had 150K fixed wireless

broadband customers at the end of Q3. Wireline broadband net additions were strong,

at 74K, but were still weaker than expected. Notably, the company has guided to an

addition of 400K FiOS homes open for sale, the first meaningful expansion of homes

available for sale in some time (note that “open for sale” does not necessarily equate to

new build – particularly in New York, there has long been a large gap between homes

already passed and homes open for sale – but it is likely that there is at least some new

build here. - Like peers, Verizon is losing video subscribers (down 68K, a little worse than the 54K

loss we had expected, and worse than the 62K loss a year ago despite a smaller

denominator). Their decline rate of 7.2% is broadly in line with the rate of decline for the

industry overall.

With respect to Verizon’s 5G strategy and competition (e.g. T-Mobile), Craig wrote:

As we creep up to the 5G epoch, we’re on the brink of a very different industry. Despite a relatively healthy third quarter report – albeit against relatively easy year ago comps – there are reasons for disquiet. A post-COVID service revenue growth recovery has already begun to slow, and incremental revenue streams from 5G are still uncertain. Industry structure, which once appeared to be getting better – we went from four to three with the merger of Sprint and T-Mobile – is now arguably getting worse, as we now arguably go from three to five with the emergence of hybrid MVNO/MNO networks from Cable and Dish. Verizon is on the brink of a very different competitive position.

T-Mobile’s 5G network is increasingly viewed as better than Verizon’s for coverage, speed, and reliability. Verizon’s one-time bid for sustained superiority – millimeter wave “ultra-wideband” service – currently accounts for just one half of one percent of the time 5G users are connected.

Craig notes that Verizon’s initial gambit to retain network superiority in 5G was built on millimeter wave spectrum. The very limited propagation of millimeter wave spectrum, however, demands an incredibly dense wired backhaul network, at enormous cost, lest customers are simply out of range much of the time. Verizon is, anecdotally at least, well ahead of peers in network densification. Still, recent data (once again, from OpenSignal) suggests that, while 5G customers of Verizon’s 5G service are connected to mmWave spectrum much more often than are 5G customers of AT&T or T-Mobile, that is still too trivial a percentage of the time (one half of one percent). That’s hardly the basis of an advantaged network.

T-Mobile has an advantage in both spectrum propagation (coverage) and spectrum depth (speed). And Verizon still charges a premium. Retention and growth will be harder in a world where their network superiority has been ceded to a lower priced service.

In conclusion, Craig states that Verizon enjoyed years as the best network, but it will be harder to maintain that claim in the 5G era, where T-Mobile has a coverage and spectrum depth (speed) advantage. And where TMobile and the company’s Cable MVNO partners charge meaningfully lower prices than Verizon does for the same or better service.

Verizon’s Year End 2021 Priorities:

• Expand 5G leadership (?) and drive adoption; mmWave deployment and C-Band launch

• Customer differentiation and scaling premium experiences

• Transform the business; Tracfone acquisition and Verizon Media Group sale

• Accelerate and amplify 5 vectors of growth; Network-as-a-Service strategy

References:

https://www.lightreading.com/5g/verizon-has-150000-fixed-wireless-access-subs-/d/d-id/772925?

https://www.slashgear.com/verizon-5g-home-internet-expands-to-cover-more-cable-cutters-07694326/

Verizon starts private 5G mobile edge services with Microsoft Azure cloud

Verizon announced the availability of an on-premises, private edge compute service with Microsoft Azure, building on their collaboration formed last year. Verizon 5G Edge with Microsoft Azure Stack Edge is a cloud computing platform that brings compute and storage services to the edge of the network at the customer premises. This should provide enterprises with increased efficiencies, higher levels of security, and the low lag and high bandwidth needed for applications involving computer vision, augmented and virtual reality, and machine learning, Verizon said. Here are the highlights:

- Through its relationship with Microsoft, Verizon is now offering businesses an on-premises, private edge compute solution that enables the ultra-low latency needed to deploy real-time enterprise applications.

- Solution leverages Verizon 5G Edge with Microsoft Azure Stack Edge to bring compute and storage services to the edge of the network at the customer premises, providing increased efficiencies, higher levels of security, and the low lag and high bandwidth needed for applications involving computer vision, augmented and virtual reality, and machine learning.

- Ice Mobility has used Verizon 5G Edge with Microsoft Azure to help with computer vision-assisted product packing to improve on-site quality assurance. The company is now exploring additional 5G Edge applications that provide tangible, material automation enhancements to its business, such as near real-time activity-based costing.

Some of the applications possible with the on-site 5G and edge computing include in-shop information processing in near real time to help retailers manage inventory, or factory data processing and analytics to minimize downtime and gain visibility across manufacturing processes.

Logistics company Ice Mobility has used Verizon 5G Edge with Azure Stack Edge to help with computer vision-assisted product packing to improve on-site quality assurance. The company is exploring additional 5G applications that leverage initial computer vision and 5G edge investments to provide automation enhancements, such as near real-time activity-based costing. This would allow the company to assign overhead and indirect costs to specific customer accounts, pick and pack lines, and warehouse activities to enhance efficiencies and improve competitiveness.

“This announcement aligns with IDC’s view that an on-premises, private 5G edge compute deployment model will spur the growth of compelling 4th generation industrial use cases,” said Ghassan Abdo, Research VP at IDC. “This partnership is a positive development as it leverages the technology and communications leadership of both companies.”

“Our partnership with Microsoft brings 5G Edge to enterprises, dropping latency at the edge, helping critical, performance-impacting applications respond more quickly and efficiently,” said Sampath Sowmyanarayan, Chief Revenue Officer of Verizon Business. “5G is ushering in next-generation business applications, from core connectivity to real-time edge compute and new applications and solutions that take advantage of AI transforming nearly every industry.”

“Business innovation demands powerful technology solutions and central to this is the intersection between the network and edge” said Yousef Khalidi, corporate vice president Azure for Operators at Microsoft. “Through our partnership with Verizon, we are providing customers with powerful compute and storage service capabilities at the edge of customers’ networks, enabling robust application experiences with increased security.”

Verizon offers a similar service with Amazon Web Services (AWS which provides private multi-access edge computing (Private MEC) for enterprises. Private MEC integrates edge computing infrastructure with private networks deployed on or near the customer’s premises.

……………………………………………………………………………………………………………………………………..

References:

https://www.verizon.com/about/node/921923

Watch this video to learn more about how Ice Mobility is using Verizon 5G Edge. Learn more information about Verizon 5G Edge and Verizon’s 5G technology

Amazon AWS and Verizon Business Expand 5G Collaboration with Private MEC Solution

Verizon and Samsung Complete Fully Virtualized 5G Data Session on C-band Spectrum

Introduction:

Verizon and Samsung Electronics recently completed an end-to-end fully virtualized 5G data session over C-band spectrum in a live network environment. The new milestone was reached in preparation for its upcoming 5G Ultra Wideband expansion using its newly acquired C Band spectrum.

This trial used cloud-native end-to-end virtualization and Massive MIMO technology to optimize 5G performance on C-band spectrum.

“We have been driving the industry to large scale virtualization using the advanced architecture we have built into our network from the core to the far edge. This recent accomplishment paves the way for a more programmable, efficient, and scalable 5G network,” said Adam Koeppe, Senior Vice President of Technology Planning at Verizon. “Customers deserve more than mere access to 5G. They deserve 5G built with the highest, gold-standard engineering practices that have positioned Verizon as the most reliable industry leader for years.”

Virtualization Is Important for 5G Performance Optimization:

The trials, conducted over Verizon’s network (using C-band Special Temporary Authority granted to Verizon by the FCC) in Texas, Connecticut and Massachusetts, used Samsung’s fully virtualized RAN (vRAN) solution built on its own software stack and C-band 64T64R Massive MIMO radio in coordination with Verizon’s virtualized core. The trials achieved speeds commensurate with traditional hardware-based equipment

Virtualization is critical to delivering the services promised by advanced 5G networks. Key 5G use cases such as massive scale IOT solutions, more robust consumer devices and solutions, AR/VR, remote healthcare, autonomous robotics in manufacturing environments, and ubiquitous smart city solutions, will heavily rely on the programmability of virtualized networks.

Cloud native virtualized architecture leads to greater flexibility, faster delivery of services, greater scalability, and improved cost efficiency in networks, paving the way for wide-scale mobile edge computing and network slicing. This technology enables Verizon to rapidly respond to customers’ varied latency and computing needs. Virtualization will also lower the barrier to entry for new vendors in the ecosystem. New entrants will accelerate innovation, reduce operating costs, and lay the groundwork for flexible network and cloud infrastructure closer to the customer, eventually leading to single digit millisecond latency.

“We’re proud to mark another milestone following our first large-scale commercial 5G vRAN deployment for Verizon, which is currently servicing millions of users. This trial reinforces our commitment to helping operators evolve their advanced 5G networks,” said Junehee Lee, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics. “This achievement represents our dedicated efforts in leading the transition to virtualization, and helping Verizon realize greater efficiency, scalability and flexibility. vRAN is a powerful enabler for network transformation, and we aim to continue leading this journey.”

Why Massive MIMO Is Important for 5G Performance Optimization:

Massive MIMO is an evolution in antenna arrays that uses a high number of transmitters which enables more possible signal paths between a device and a cell tower. It also reduces interference through beamforming, which directs the beam from the cell site directly to where the customer is resulting in higher and more consistent speeds for customers using apps and uploading and downloading files. This trial used Samsung’s C-band 64T64R Massive MIMO radios that support digital/dynamic beamforming, SU-MIMO, MU-MIMO and dual connectivity and carrier aggregation.

“Incorporating full, cloud-native virtualization, Massive MIMO and beamforming into our network design and deployment will result in so much more than our customers merely seeing a 5G icon on their devices. This is 5G service optimized for peak performance,” said Koeppe.

Today’s milestone follows Samsung’s recent announcement on expanding its vRAN capability to support mid-band Massive MIMO radios—a first for the industry. Samsung’s C-band Massive MIMO radio is part of a complete C-band solutions portfolio.

Verizon on Track To Deliver 5G Over C-band:

This virtualization work comes on the heels of other work to speed the expansion of 5G Ultra Wideband service using C-band spectrum including:

- Successful trials integrating C-band with mmWave licensed spectrum,

- Securing new agreements with Verizon’s tower partners, which provide for process improvements including standardizing and reducing forms and minimizing legal reviews, and…

- Installation of C-band equipment.

These combined efforts, along with ongoing lab and field trials to optimize 5G technology on C-band spectrum will allow Verizon to offer expanded mobility and broadband services to millions more consumers and businesses as soon as the spectrum is cleared.

In the first quarter of 2022, Verizon expects to put its new 5G C-band spectrum into service in the initial 46 markets and to provide 5G Ultra Wideband service to 100 million people. Over 2022 and 2023, coverage is expected to increase to more than 175 million people and by 2024 and beyond, when the remaining C-band spectrum is cleared, more than 250 million people are expected to have access to Verizon’s 5G Ultra Wideband service on C-band spectrum.

About Verizon Communications Inc.

Verizon Communications Inc. was formed on June 30, 2000 and is one of the world’s leading providers of technology, communications, information and entertainment products and services. Headquartered in New York City and with a presence around the world, Verizon generated revenues of $128.3 billion in 2020. The company offers data, video and voice services and solutions on its award-winning networks and platforms, delivering on customers’ demand for mobility, reliable network connectivity, security and control.

References:

https://www.verizon.com/about/news/verizon-announces-c-band-auction-results

Verizon Exec on 4G/5G fiber backhaul, One Fiber initiative and 5G at Home

Verizon Executive VP and CTO Kyle Malady stated: Right now we have about 1/3 of our cell sites and small cells on our own fiber asset (backhaul). And I think that’s — we like the owner’s economics of that. We also like the control of the network because we can maintain quality and reliability.

Wells Fargo Question:

Let’s talk about Verizon’s One Fiber project, where you’re building in more than 60 cities. Has that continued at its pace that it was at last year? Has it slowed down at all? And at what point is most of the network core already built and you’ve really flipped to more kind of success-based fiber CapEx once you get beyond the core build?

Kyle Malady’s Answer:

We’re getting there on the core build. I’d say maybe 80% there roughly. And now it’s more connecting in a lot of markets. It’s more connecting the cell sites into it and making what we call laterals. So building the fiber laterals to cell sites or what have you and connecting back to the core. So we got two or three more years left on our fiber build here. And then primarily, it will be just success-based builds.

Verizon launched its One Fiber initiative in 2016, unifying its fiber planning and purchasing for both wireless and wireline into a single program. It initially announced a six-year, $300 million project in Boston, eventually outlining ambitions to add fiber to more than 60 markets outside of its ILEC footprint.

Speaking in May 2019 during the Wireless Infrastructure Association’s Connectivity Expo, Verizon SVP Adam Koeppe said:

We’ve made a conscious effort to really pair our wireless engineering with a fiber engineering process and what that’s allowed us to do is pursue over 60 markets around the country. We’re going to actually be building fiber into the footprint and, you know, truthfully, serving our own needs if you will from a frontal and backhaul perspective. That’s a very integrated engineering process that creates tremendous synergy on our end and allows for very rapid deployment.

Regarding Verizon’s 5G Home (fixed wireless access or FWA) expansion, Malady said:

Now that we have millimeter wave and C-Band spectrum, I feel confident that we can do this. And I feel confident we can do this in a good way, a way that is consistent with the quality people have come to rely on Verizon for. So we’re going to engineer this right. We have enough spectrum to do it. And I’m excited about the possibilities for us from a — meeting customers where they want to be. And without this millimeter wave and C-Band, we couldn’t have been able to support this kind of use case.

Besides the consumer market for 5G Home, SMB seems to be kind of a no-brainer. If we make it easy to use, if we make it easy to buy and set up and utilize, people will probably figure out ways to use that we haven’t even thought of yet. So I do think it’s something that will be used across the board. You could use it (5G Home) at Wells Fargo. You could use them in ATMs. You can use the service for a whole host of things, if you make — if it’s easier to use, more reliable, good price point. So if the value is there, I think people will use it no matter kind of — no matter what segment of the economy they are in. So — but obviously, we’re a heavy Consumer company, and that’s where we’re going to start.

Malady added he expects Verizon’s fiber experience to give it a competitive edge in the FWA arms race with rivals like T-Mobile. “Having been in the FiOS game for a long time we understand what works, what doesn’t work, how to set things up, the customer support, all the different angles. So I do believe that having experience with FiOS is absolutely going to translate over to what we do with 5G Home.”

References:

For fiber and small cells, Verizon follows an ‘integrated engineering process’ (rcrwireless.com)

Verizon: Private 5G market at $8B in 4 years

Verizon distinguishes between a private wireless network product and mobile edge compute (MEC) offerings, he noted, but likes it when both come together. That’s when “the full power of 5G” can be exploited, he said, with features like low power usage and high device density. Verizon has ambitions for both public and private MEC, in partnerships with Microsoft and AWS.

Asked about moving beyond just providing connectivity and driving new revenue streams with private wireless, he pointed to recurring services such as security, managed services, and running custom applications or IoT.

“The private network piece, very few can do it as well as us, but it’s the layers of services on top that creates a pretty compelling revenue case for us,” Sowmyanarayan said. “But more importantly use-cases for the customer.”

He acknowledged that typically with large customers there’s also a significant upfront piece to get the private network up and running. The private network is essentially a scaled down version of the macro network consisting of core, radio, and other elements at a local location. But afterwards the recurring services are attractive for both Verizon and private wireless customers who can then keep attention on their main business functions.

“They are able to look to a large partner to offload some of the complex work so they can focus on what their core is,” Sowmyanarayan noted, pointing to mines as an example.

Verizon also has a private wireless offering for international customers, which uses Nokia network equipment. The carrier recently signed its first European 5G private wireless deal with Associated British Ports (ABP) for the Port of Southampton in the U.K. Sowmyanarayan said the carrier is very excited about the ABP deal and categorized it as “a sign for things to come” for Verizon.

In the 1st Quarter of 2021, Verizon posted a loss of 170,000 monthly wireless subscribers. Analysts had predicted 82,100 new customers. The top U.S. wireless carrier continues to see partnerships like its ones with Amazon.com Inc. and Corning Inc. as the best path to bring advanced 5G services from development to actual sales.

……………………………………………………………………………………………………………………………………..

References:

https://www.fiercewireless.com/private-wireless/verizon-chases-7-8b-private-wireless-market

https://www.fiercedigitaltechevents.com/private-wireless-networks-summit

FCC permits Verizon to test 5G and carrier aggregation in CBRS spectrum band

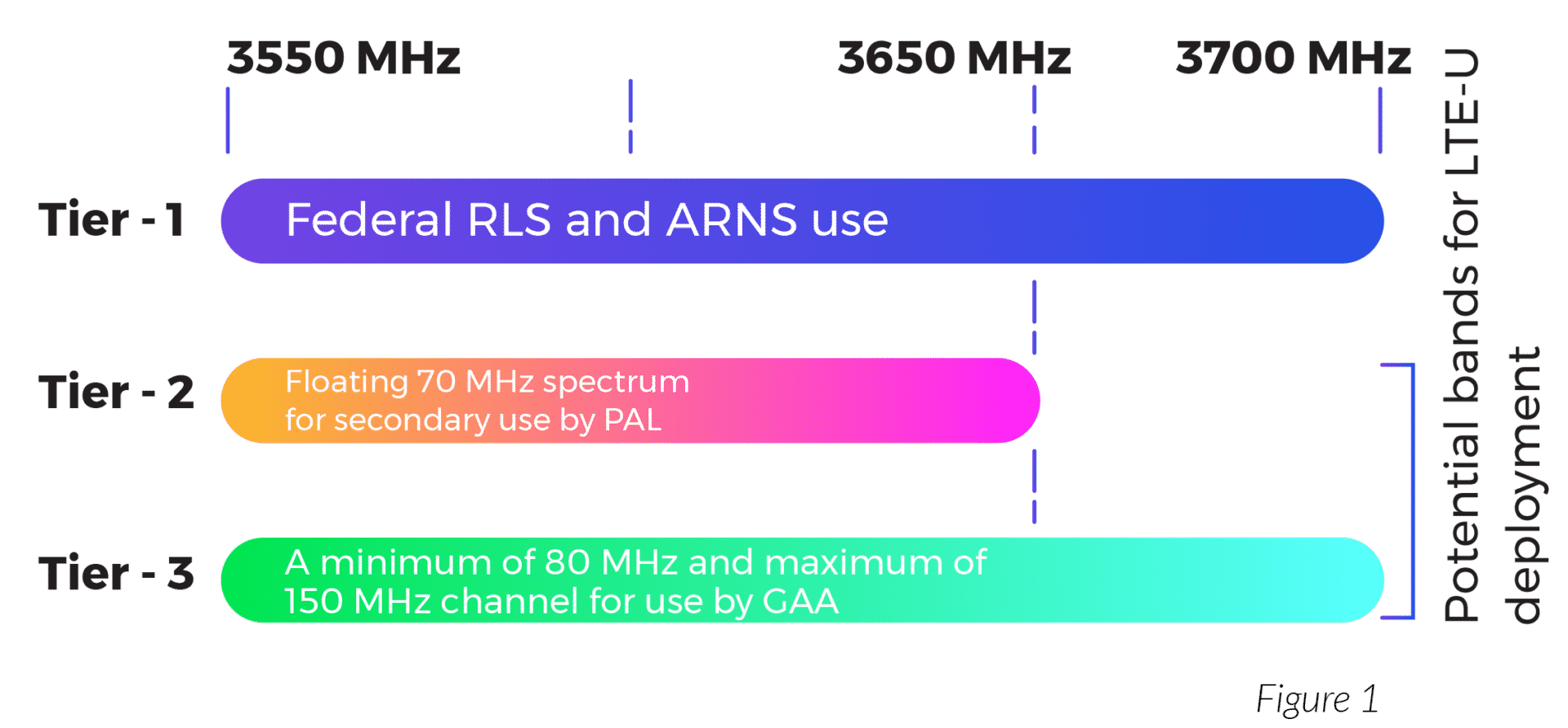

The Federal Communications Committee (FCC) has given Verizon Wireless permission to conduct a series of tests in the 3.55 to 3.7GHz CBRS spectrum band using three radio stations in Minneapolis, Minnesota. Verizon said the tests will involve 5G and carrier aggregation technology. The FCC grant reads as follows:

Verizon Wireless is working with 5G base station and mobile device equipment vendors to

conduct product testing of 3.5 GHz in outdoor locations listed below.

Station Locations:

1. Minneapolis (HENNEPIN), MN – NL 44-48-26; WL 93-22-29; MOBILE: within 0.75 km

radius of center point location, within 0.75 km, centered around NL 44-48-26;

2. Minneapolis (HENNEPIN), MN – NL 44-48-24; WL 93-22-29; MOBILE: within 0.75 km

radius of center point location, within 0.75 km, centered around NL 44-48-24;

3. Minneapolis (HENNEPIN), MN – NL 44-48-24; WL 93-22-29; MOBILE: within 0.75 km

radius of center point location, within 0.75 km, centered around NL 44-48-24.

“Verizon and partners plan to conduct the proposed 5G tests using pre-commercial equipment in prototype form,” Verizon said in its FCC application. The operator did not name the device or network equipment partners it will be working with for the tests.

PCMag reported that Verizon has only been using CBRS spectrum only for 4G – LTE. In Jackson Heights (Queens, NY), the CBRS-enhanced 4G clocked 456Mbps, while 5G DSS at the same times and similar locations hit 232Mbps. The PCMag author previously observed Verizon’s 5G Ultra Wideband at about3.2Gbps.

Therefore, the move to 5G over CBRS is significant. Verizon added that it plans to evaluate “intra-band and inter-band carrier aggregation between 3.5GHz and licensed (and/or unlicensed) bands,” including its licensed 700MHz, PCS and AWS bands. [Carrier aggregation technology can be used to bond together transmissions across different spectrum bands, thus dramatically increasing users’ connection speeds.]

Light Reading’s Mike Dano says that Verizon has been adding support for the 3.5GHz CBRS spectrum band to its network for years. And last year Verizon spent $1.9 billion to purchase CBRS spectrum licenses across the country in an FCC auction.

Verizon’s tests roughly coincide with the operator’s three-year, $10 billion program to put its C-band spectrum licenses into use. Verizon succeeded in more than doubling its existing mid-band spectrum holdings by adding an average of 161 MHz of C-Band nationwide paying $52.9 billion including incentive payments and clearing costs.

References:

https://apps.fcc.gov/oetcf/els/reports/GetApplicationInfo.cfm?id_file_num=0461-EX-ST-2021

https://apps.fcc.gov/oetcf/els/reports/STA_Print.cfm?mode=current&application_seq=106415

https://apps.fcc.gov/els/GetAtt.html?id=273078&x=.

https://www.fiercewireless.com/operators/verizon-boosts-lte-speeds-philly-via-cbrs-spectrum

https://www.verizon.com/about/news/verizon-announces-c-band-auction-results

Amazon AWS and Verizon Business Expand 5G Collaboration with Private MEC Solution

AWS and Verizon Business have expanded their 5G collaboration to provide private multi-access edge computing (Private MEC) for enterprises. Private MEC integrates edge computing infrastructure with private networks deployed on or near the customer’s premises. AWS and Verizon have integrated Verizon’s 5G Edge MEC platform with AWS Outposts [1.], a fully managed service that offers the same AWS Infrastructure, AWS services, APIs, and tools to virtually any data center, colocation space, or on-premises facility for a consistent, hybrid experience.

Note 1. Outposts is AWS’ on-premises option that involves data center equipment being installed at an enterprise facility. It uses AWS infrastructure, services, APIs, and tools to support a hybrid cloud service. Verizon is offering several form factor options of Outposts, include 1U and 2U deployments.

AWS initially launched Outposts in late 2019. “Instead of building this funky bridge between two things,” on-premises data centers and the cloud, Outposts brings native AWS services into on-premises data centers while “seamlessly connecting to AWS’s broad array of services in the cloud,” AWS CEO Andy Jassy explained at the time.

Outposts is similar to competing offers like Microsoft’s Azure Arc, Google’s Anthos, and IBM’s Cloud Satellite. AWS last month also struck a deal with Nokia to combine Outposts with the telecom vendor’s RAN and edge equipment to target the enterprise space.

………………………………………………………………………………………………………………………………………

Verizon Business customers will be able to tap into the combination to deploy a fully managed private mobile edge compute network within their on-premises environment that can handle low-latency applications like intelligent logistics, robotics, and factory automation.

MEC deployment across different enterprise networks. Source: ETSI

…………………………………………………………………………………………………………………………………….

According to Amazon, cloud migrations are often inhibited by residency or privacy constraints that prevent data from leaving the premises, strict compute latency requirements, or the need for cloud infrastructure to connect directly to onsite equipment. Similarly, many workloads involve huge volume of data, making transfers to the cloud infeasible due to limited available network bandwidth and timing constraints.

Furthermore, enterprise applications commonly depend on local wired or Wi-Fi networks to transport data locally. While wired networks can provide acceptable performance, they are expensive to upgrade, reroute, and extend. On the other hand, enterprise Wi-Fi offers simplicity and cost-effectiveness, but offers less manageability and suffers from coverage, capacity, reliability, security, and handoff issues.

The Private MEC solution deployed on AWS Outposts addresses these challenges by providing a secure, dedicated cloud computing platform and reliable on-premises wireless networking based on 5G, all using a single infrastructure deployment. The private 5G network offers better performance, control, reliability, and density than existing options. Combined with the AWS services brought by AWS Outposts, we are enabling Enterprise customers to deploy low latency, high-performance applications on their premises, leveraging both the benefits of 5G and the cloud, locally. By leveraging Private MEC enterprises can host workloads in emerging areas such as Industry 4.0; for example, Private MEC and private 5G can facilitate deeper integration between IT and operational technology (OT) systems in manufacturing facilities.

Private MEC also supports many use cases beyond the factory. Events and venues, such as sports, concerts, and theme parks can use Private MEC to provide enhanced experiences with AR/VR, live information overlays, multi-camera, multiple angle views, and personalized instant replays. Healthcare providers use Private MEC for real-time diagnostics over 5G for rapid access to radiological scans on-site and local processing of sensitive patient data. Schools and universities can benefit from Private MEC by servicing students in rural areas without adequate broadband coverage to run applications like virtual desktops. We are excited about the innovations that Private MEC solutions can unlock across industries, and continue to work with customers to power their innovation with edge computing.

……………………………………………………………………………………………………………………………………………

Amazon AWS is also working with Corning Incorporated, a leading materials science and advanced manufacturing innovator, and Verizon to deploy a Private MEC solution on AWS Outposts at the Corning factory in Hickory, North Carolina. Corning uses AWS Outposts to run computer vision software from Gestalt Robotics that provides autonomous navigation and advanced environmental sensing. Corning recently installed an AWS Outposts rack that places the power of the AWS cloud within the four walls of its optical cable plant in Hickory, North Carolina.

The AWS capabilities that Outposts delivers, combined with the ultra-low latency, high throughput of the private 5G network, provide a powerful platform upon which Corning will innovate with applications never before possible, such as real-time analysis of large volumes of high-resolution video streams from across the factory and integration of high-data-rate automation systems. In factory environments like this, Amazon EC2 instances with GPU acceleration provide the necessary computing power to run Computer Vision (CV) and AI/ML workloads efficiently, enabling real-time control of Autonomous Mobile Robots (AMRs) that roam the factory floors.

The software running on the Private MEC service can guide the AMRs safely and speedily through a factory, avoiding people and obstacles while ferrying their payloads from point to point. The Private 5G network enables reliable, low-latency transmission of rich sensor data (lidar, vibration, temperature, audio) from these AMRs and other industrial devices located throughout the factory. Importantly, this enables operators to observe a live stream of video in near real-time and intervene when necessary.

The same computer vision technology used by the AMRs for navigation and safety can also be used to detect and inventory raw material and finished goods in a factory. Mobile video streams from the AMRs can be combined with feeds from cameras installed in the factory and onsite sensor inputs and RFIDs for accurate counting and tracking. In addition, integration with Manufacturing Execution Systems (MES) running on Outposts enables real-time monitoring, automation, and optimization, as raw material is turned into the final product.

This opens up possibilities such as performing predictive maintenance and servicing of onsite machinery without the need to ship massive amounts of sensor data over network links into the cloud. Private MEC solutions like this enable factories to become even smarter and leverage the power of innovation that AWS brings to the cloud, while simplifying the deployment and management of on-premise networking with the latest 5G technologies.

References:

https://aws.amazon.com/outposts/

https://www.sdxcentral.com/articles/news/verizon-adds-aws-outposts-to-5g-edge-plan/2021/04/

https://www.etsi.org/images/files/ETSITechnologyLeaflets/MultiAccessEdgeComputing.pdf

Verizon Business wins Private 5G contract in the UK

Verizon Communications Inc. won a contract to erect and operate a private 5G network in Southampton, England (United Kingdom), for Associated British Ports Holdings, its first industrial 5G award in Europe. The #1 U.S. wireless telco beat out local telecommunications companies and is jump starts a push to sell the wireless systems to global businesses.

- Verizon teams up with Nokia to offer private 5G capabilities to enterprises in Europe and Asia-Pacific

- Private 5G will enable organizations to deliver mission critical and real-time capabilities

- Announcement marks Verizon’s continued investment in 5G and network-as-a-service strategy

A private 5G network is a self-contained network whose components all reside in a single facility, consisting of micro towers and small cells and connects to an organization’s Local Area Network (LAN) and enterprise applications. It will utilize Nokia’s Digital Automation Cloud, a private wireless network solution with automation enablers that will allow for application deployment through a web-based interface.

New York-based Verizon opened a showroom in London last year and spoke about its hopes to muscle in on 5G enterprise deals beyond the U.S. It’s a sign competition is heating up in the segment, seen as a key way to fuel growth in the otherwise stagnant telecommunications sector for local carriers like Newbury, England-based Vodafone Group Plc.

“We chose Verizon simply just due to the track record within setting up private 5G networks,” said Henrik Pedersen, chief executive officer of ABP, in a video call with Bloomberg. “Regional or local, I don’t see it like this. I see 5G as a global thing.”

Southampton is a crucial British terminal which usually handles about 900,000 cars and sees millions of cruise ship passengers per year. It’s upgrading its network as the port adapts to its new status as a freeport, one of several low-tariff business zones on the British coast that U.K. chancellor Rishi Sunak unveiled last month as part of his plans to stimulate post-Brexit trade.

Verizon’s 5G network will remove dead spots and increase bandwidth at the port, ultimately enabling new systems, such as using drones that can transmit high-definition video for maintenance checks, and sending live shipping data, Pedersen said.

“There’ll be a lot of need for data transfer in the future in the freeport zone, and especially when you start to move goods in and out of the customs zones,” said Pedersen. He said he wants the system up and running by July, and added that more of ABP’s 21 ports are likely to get 5G networks in the future.

“Today, we’ve announced the next phase of Verizon’s global 5G vision with the launch of private 5G for our international customers,” said Tami Erwin, CEO, Verizon Business. “If the past few months have taught us anything, it’s that there’s never been a more critical time for mobility, broadband and cloud products and services. Private 5G networks will be a transformative technology that will drive the new era of disruption and innovation for enterprises around the world.”

“Private wireless connectivity has become central to many industries in realizing their long-term digital transformation goals. By delivering private 5G together with Verizon, we’re paving the way to accelerate digitalization for the most demanding industries who crave reliable wireless connectivity,” said Brian R. Fitzgerald, SVP Global Solutions at Nokia.

“We’re seeing international markets moving rapidly to deploy 5G Private Networks, which appears as a major use case for the uptake of 5G, particularly in order to capitalize on 5G investments in the enterprise market. With the ingredients of an early mover go-to-market 5G-know-how, foundational enterprise networking and innovative 5G enabled services Verizon’s go-to-market recipe with Nokia will be an attractive solution to the broader market,” said Martina Kurth, associate vice president of IDC’s European Telco Research practice.

Today’s announcement follows recent MEC partnership announcements with Microsoft, Cisco, IBM and AWS. In August, Verizon recently announced its successful completion of lab trials with Corning and Samsung on its new 5G mmWave in-building solutions.

………………………………………………………………………………………………………………………………

References:

https://www.verizon.com/about/news/verizon-business-takes-private-5g-global

https://www.bnnbloomberg.ca/verizon-beats-out-european-carriers-to-run-5g-at-u-k-freeport-1.1585233

Verizon Outlines Plans for C-Band and mmWave 5G, Business Internet and MEC

C-Band auction results:

Verizon has outlined its plans to expand 5G network coverage using the spectrum it acquired in the recent C-band auction. The company pledged to cover 100 million Americans with its new C-band 5G network—which it will brand as “ultra wideband”—by next March

Verizon succeeded in more than doubling its existing mid-band spectrum holdings by adding an average of 161 MHz of C-Band nationwide for $52.9 billion including incentive payments and clearing costs.

Verizon won between 140 and 200 megahertz of C-Band spectrum in every available market. Specifically, Verizon:

- Secured a minimum 140 megahertz of total spectrum in the contiguous United States and an average of 161 megahertz nationwide; that’s bandwidth in every available market, 406 markets in all.

- Secured a consistent 60 megahertz of early clearing spectrum in the initial 46 markets – this is the swath of spectrum targeted for clearing by the end of 2021, home to more than half of the U.S. population.

- Secured up to 200 megahertz in 158 mostly rural markets covering nearly 40 million people. This will further enhance Verizon’s broadband solution portfolio for rural America.

The auction results represent a 120 percent increase in Verizon’s spectrum holdings in sub-6 gigahertz bands. The quality of this spectrum and Verizon’s depth of licensed holdings represent the premier asset in the industry. In addition, C-Band is a widely used spectrum band throughout the world and will allow for roaming opportunities and economies of scale. The spectrum bands Verizon won are contiguous, which will streamline deployment of this spectrum across the mainland United States.

At an analysts meeting on Wednesday evening, the company said the improved services will help it accelerate wireless network service revenue growth. Verizon expects growth of at least 2 percent this year, 3 percent in 2022 and 2023 and 4 percent or more in 2024. It’s committed an extra $10 billion in capex over the next three years to support the additional 5G network roll-out. Projected spending this year is in the range of $17.5-18.5 billion.

5G mmWave: The super-fast 5G mmWave network that Verizon launched two years ago has seen slow growth, even though Verizon has put up 17,000 cell sites. It’s a very short-range technology, and it’s best used in places like stadiums, concert halls, and convention centers—all the places that have been hardest hit by the pandemic.

Only 5% of Verizon’s total network usage will be on millimeter-wave by the end of 2021, although that could double if stadiums fill up again, according to Verizon CTO Kyle Malady. Only 9% of the carrier’s postpaid customer base has mmWave-capable phones.

Ultimately, he sees as much as 50% of 5G network usage moving to mmWave in dense cities. Of course, that involves people going outside to use it, because mmWave requires line of sight communications so can’t penetrate building walls or other structures.

Verizon is looking at using millimeter-wave for focused backhaul, which will let it put up more rural sites quickly without worrying about running fiber to them.

The company intends to put up another 14,000 millimeter-wave sites this year, Malady said. There’s still technical room for improvement with millimeter-wave, he added. Verizon is working with three different repeater vendors to improve range without adding entire new sites, and he has a “roadmap with Qualcomm” for better beamforming and software features to improve both range and latency.

…………………………………………………………………………………………………………………………………………

In the next 12 months, Verizon expects to have incremental 5G bandwidth via the new spectrum available to 100 million people in the initial 46 markets, delivering 5G Ultra Wideband performance on C-Band spectrum. Over 2022 and 2023, coverage is expected to increase to more than 175 million people and by 2024 and beyond, when the remaining C-Band is cleared, more than 250 million people are expected to have access to Verizon’s 5G Ultra Wideband service on C-Band spectrum.

In addition, Verizon is committing to an additional $10 billion in capital expenditures over the next three years to deploy C-Band as quickly as possible. This spend will be in addition to the current capital expenditure guidance of $17.5B-$18.5B for 2021, which is expected to be at comparable levels through 2023.

C-Band spectrum in Verizon’s Network:

More than 70% of the 5G devices in the hands of customers today are C-Band compatible. Every iPhone 12 model is C-Band compatible. The Samsung Galaxy S21 series and Google Pixel 5 are also compatible. Going forward, all new 5G handsets Verizon brings to market to postpaid customers will be C-Band compatible, with more than 20 C-Band compatible devices offered by the end of the year.

The acquisition of this C-Band spectrum will be a critical component in Verizon’s 5G broadband strategy — 5G Home and 5G Business Internet.

5G Home: By the end of this year, Verizon expects to cover nearly 15 million homes with its home broadband product, and by the end of 2023, 30 million homes, using both 4G and 5G.

To accompany the growth in fixed broadband offerings, the company introduced new 5G Home devices which will be simple for customers to install in their homes – including the Internet Gateway, and the Verizon Smart Display, which join the Verizon 5G Internet Gateway. All three devices will have a sleek design and ‘self setup’ featuring AR guidance, simple instruction videos, and in-app chat and call support.

5G Home internet, the super fast service with download speeds up to 1 Gbps, depending on location, is currently available in 18 markets, with one to two million households expected to be covered via mmWave by end of 2021 and a total of 15 million with LTE Home and the arrival of the first tranche of C-Band. Verizon has teamed up with some of the best content providers in the industry to bring customers plenty of options for all their gaming and streaming needs.

5G Business Internet: 5G Business Internet complements the full suite of Verizon Business tools and offerings, including OneTalk voice communications, BlueJeans by Verizon video-collaboration platform, advanced security and other business services.

By using a high powered fixed 5G receiver, business customers will be able to access the broadband speeds they need with the reliability from Verizon they have come to expect. 5G Business Internet is now available in three markets on mmWave with plans to bring the product to 20 more before the end of the year.

Accelerate 5G Edge:

Verizon Business is well positioned to capture significant edge compute share and is in-market today with both public and private MEC models in collaboration with leading cloud providers. With the addition of C-Band spectrum, the company expects a wider and faster path to monetization.

By the end of 2022, the total edge compute addressable market in the U.S. is estimated to reach $1 billion, and by 2025, rapid adoption of Edge Compute is estimated to create a $10 billion addressable marketplace.

Public MEC Model: Last year, the company partnered with AWS: Wavelength and immediately connected AWS’s 1 million plus developer community to the nearly 170 million end-devices across Verizon’s 4G and 5G Nationwide networks at the edge. Developers today are building use cases spanning a wide array of commercial applications – all through an easy on-ramp in the AWS portal where they can move their workloads to the edge of our network, automatically triggering a recurring revenue share for Verizon and AWS. This partnership enables Verizon Business to be a key participant in this growing opportunity with C-Band accelerating our reach and time to market.

Private MEC Model: Last year, Verizon Business announced a collaboration with Microsoft to deliver a Private MEC model for customers that want a completely dedicated edge compute infrastructure on-premise to provide unique connectivity for their employees, enable data-intensive applications and benefit from solutions like computer vision, augmented reality and machine learning – all built to increase productivity, provide enhanced security and reduce latency in ways that wi-fi cannot.

This fully integrated Verizon 5G solution includes:

- Verizon Private Edge, which combines the power of Microsoft Azure cloud and edge capabilities with 5G on the customer premise.

- Verizon Private network connectivity, which is forecast to be a $10 billion dollar global market by 2025.

- Co-developed real-time enterprise solutions like Intelligent Logistics, Predictive Maintenance, Robotics and Factory Automation, which give Verizon Business a direct line of sight to another $12 billion applications and solutions addressable opportunity by 2025 that will be commercialized through a growing partner ecosystem, including IBM, Cisco, Deloitte and SAP.

The demand for MEC services unlocks an estimated Verizon total market that is forecast to exceed $30 billion by 2025, revenue that will be shared with partners.

Verizon expects to increase service revenues by shifting people to higher-tier unlimited (text, talk, Internet) cellular plans.

…………………………………………………………………………………………………………………………………………………….

Quotes from Executives:

Hans Vestberg, Chairman and CEO of Verizon

FCC C-Band auction results

“Today is one of the most significant days in our 20-year history. This was a highly successful auction for Verizon – a once in a lifetime opportunity – and I am thrilled with what we were able to accomplish.”

Verizon’s strategy

“Our growth model is based on a clear vision: We are a multi-purpose network company with the best networks architected by the best engineers on the planet. This idea of a multi-purpose network at scale is our strategic foundation to maximize growth and put us in a position to realize the best return on investment in the fully-networked economy.”

Verizon’s competitive advantage

“Since we began building 5G, we have had a first mover advantage. We are more than a year ahead in building and selling mmWave with our 5G Ultra Wideband service and still the only company with commercial Mobile Edge Compute. Now we intend to extend our lead by accelerating our deployment of C-Band. Our new C-Band position combined with our mmWave, means we are the only carrier suited to deploy the fastest, most powerful 5G experience to the most people – or as we call it, 5G built right.”

Ronan Dunne, CEO of Verizon Consumer Group

5G adoption

“Customers are migrating to 5G in earnest. As of YE 2020, 9% of our Consumer postpaid phone base were on a 5G device. With the exciting device lineup we have in store, and the superior 5G experience that we deliver, we expect to reach 50% some 18 months ahead of GSMA forecast, and end 2023 ahead of even the more ambitious Ericsson Mobility Report forecast.”

5G devices

“Overall we have 10M 5G Ultra Wideband devices in the hands of customers on our network today. And of those, approximately 70% are already C-Band compatible. Going forward all new 5G handsets we sell to postpaid customers will be C-Band compatible.”

Step ups

“We have seen tremendous step-ups from our customers from Metered to Unlimited and Unlimited to Premium Unlimited as we discussed back in November. We continue to see this with over 20% of our postpaid accounts ending the year on a Premium Unlimited plan. We expect this number to grow to over 30% this year and approximately 50% by 2023. With C-Band included, we think step-ups to premium will only accelerate.”

5G Home acceleration

“By the end of 2021 we will have between 1 and 2 million millimeter wave 5G Homes open for sale and some 15 million in total with the arrival of the first tranche of C Band. By the end of 2023 this will have risen to more than 30 million households we can serve.”

Tami Erwin, CEO of Verizon Business

Mobile Edge Compute

“Verizon Business has a strong first-mover advantage to build a nationwide Mobile Edge Compute platform and be both a market leader and a market maker. This is not just an idea, it’s happening. Companies in every industry are finding exciting ways to bring 5G and 5G Edge to life – leveraging the full capabilities of 5G from throughput and ultra-low latency to sensor densification and rock solid reliability.”

Kyle Malady, CTO of Verizon

Auction results

“We secured a game-changing amount of C-Band spectrum to go along with our leadership in millimeter wave spectrum. We’ve been planning for many months, and are already working to make this the fastest deployment of new spectrum ever. As the leader in the wireless industry, we have consistently deployed a deep portfolio of strong spectrum holdings with best in class technology capabilities. This same focus will continue to position us for growth for years to come.”

Matt Ellis, CFO of Verizon

“Our Network as a Service strategy is our foundation when considering significant investments. We’ve leveraged that framework, investing in key strategic areas, such as spectrum, network assets, partnerships, and disciplined M&A, to position us for this next technology era.”

“Our strategy is working. Our core business is producing revenue growth today. More customers are experiencing the benefits of 5G Ultra Wideband every month on our millimeter wave spectrum and C-Band helps us accelerate the timeline and expand upon that growth.”

US Ignite Pilot Program for 5G Living Lab at Marine Corps Air Station Miramar in San Diego, CA

- The 1st project will use the Verizon 5G network through a Cooperative Research and Development Agreement (CRADA) to offload data from an automated package-delivery shuttle.

- The 2nd project will track the development of four finalist applications selected in a recent 5G pitch competition, culminating in a demonstration event for U.S. Marine Corps and Department of Defense officials.

“Military bases, like smart cities, are a crucial testing ground for new sensor-driven technologies, particularly as we upgrade the nation’s wireless networks to 5G,” said Nick Maynard, Chief Operating Officer for US Ignite. “We have an opportunity at Miramar not only to experiment with systems to improve overall safety and efficiency on base, but also to help develop a framework of best practices that will serve smart bases and smart communities across the country.”

MCAS Miramar is part of the first wave of military bases deploying 5G networks. Through a partnership with Verizon, the base is fast tracking deployment of 5G and 4G small cells to supplement 4G LTE macro cells already in place. The upgraded wireless network serves as the foundation for the 5G Living Lab at Miramar, making it possible to experiment with digitally connected infrastructure to improve operational resiliency.

“We can create a smarter, more connected military base by working collaboratively across the public and private sector, which is why our partnerships with US Ignite and Verizon are so critical,” said Lieutenant Colonel Brandon Newell, NavalX SoCal Tech Bridge Director and 5G Living Lab Lead. “Through the 5G Living Lab at Miramar, we expect to develop technologies that benefit: military operations, the private sector forging new business models around 5G services, and the public we serve.”

“Since Verizon and Miramar announced the first-ever 5G Ultra Wideband deployment on a military base last July, the NIWC Pacific team has created a true testbed for innovation,” said Andrés Irlando, Senior Vice President and President, Public Sector and Verizon Connect at Verizon. “Leaders across the Department of Defense understand the mission-critical role 5G plays in unlocking innovation for the military, and this new pilot program will accelerate the research to help bring it all to life.”

US Ignite has begun work on both of the initial pilot projects for the MCAS Miramar 5G Living Lab. Team members are designing a route map and finalizing operational details for package delivery service on base using an Olli automated shuttle. Finalists from the recent 5G pitch competition – hosted by the National Security Innovation Network (NSIN) in partnership with NavalX SoCal Tech Bridge and NIWC Pacific – are working on prototype demonstrations of their 5G applications as part of a process facilitated by US Ignite to present the new technology at multiple stages of development to military officials.

Additional pilot projects are planned for 2021, including an effort to connect solar cells on base to the local 5G network. US Ignite will also partner with the University of California San Diego for future data analysis work related to transportation and energy projects.

NIWC Pacific contracted with US Ignite to run the 5G Living Lab pilot program located at MCAS Miramar based on proven technical and project management capabilities. US Ignite has demonstrated its experience through efforts that include: leading a broad portfolio of connected communities in testing applications and services powered by advanced networks; overseeing the development and deployment of multiple city-scale wireless testbeds; and implementing new automated vehicle technology at the United States Army installation at Fort Carson, Colorado.

About US Ignite:

US Ignite is a high-tech nonprofit with a mission to accelerate the smart community movement. We work to guide communities into the connected future, create a path for private sector growth, and advance technology research that’s at the heart of smarter development. For more information, visit www.us-ignite.org.

Media Contact: Sarah Archer-Days, +1 646-596-6103, [email protected], www.us-ignite.org