Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

Dell’Oro Group estimates the RAN market is currently generating between $40 billion and $45 billion in annual revenues. The market research firm forecasts that Open RAN will account for 15% of sales in 2026. Research & Markets is more optimistic. They say the Open RAN Market will hit $32 billion in revenues by 2030 with a growth rate of 42% for the forecast period between 2022 and 2030.

As the undisputed leader of microprocessors for compute servers, it’s no surprise that most of the new Open RAN and virtual RAN (vRAN) deployments use Intel Xeon processors and FlexRAN™ software stack inside the baseband processing modules. FlexRAN™ is a vRAN reference architecture for virtualized cloud-enabled radio access networks.

The hardware for FlexRAN™ includes: Intel® Xeon® CPUs 3rd generation Intel® Xeon® Scalable processor (formerly code named Ice Lake scalable processor), Intel® Forward Error Correction Device (Intel® FEC Device), Mount Bryce (FEC accelerator), Network Interface Cards – Intel® Ethernet Controller E810 (code name Columbiaville). Intel says there are now over 100 FlexRAN™ licensees worldwide as per these charts:

Source: Intel

A short video on the FlexRAN™ reference architecture is here.

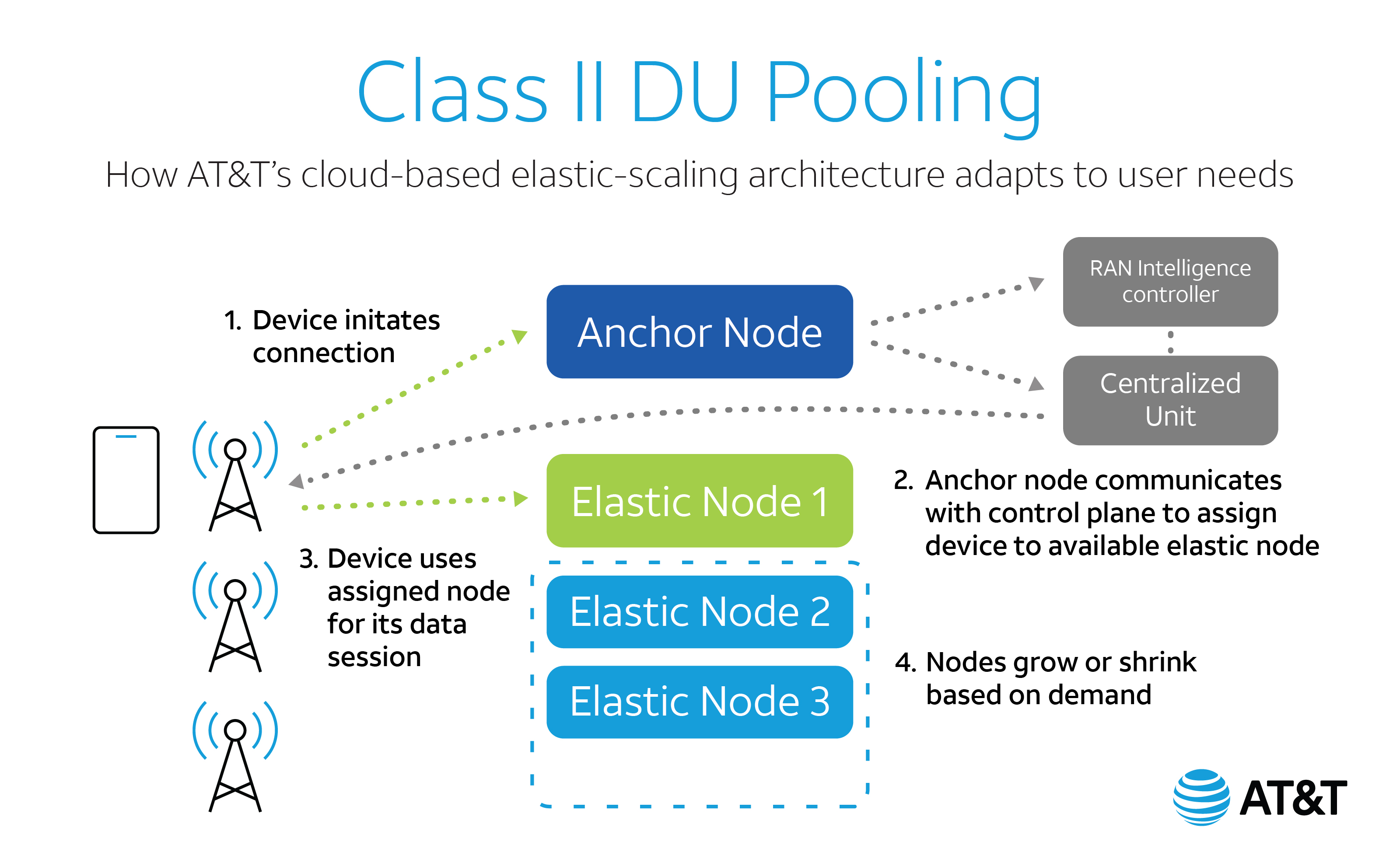

FlexRAN™ got a big boost this week from AT&T. In a February 24, 2022 blog post titled “Cloudifying 5G with an Elastic RAN,” Gordon Mansfield, AT&T VP Mobility Access & Architecture said that “AT&T and Intel had co-developed an industry-leading advanced RAN pooling technology freeing 5G radios from the limitations of dedicated base stations, while enabling more efficient, resilient, and green 5G networks. DU-pooling will eventually be usable by the entire 5G operator community to drive the telecom industry’s goals of green and efficient wireless networks forward.”

DU pooling technology was made possible by combining AT&T’s deep knowledge of Open RAN technologies as one of the co-founders of the O-RAN Alliance with Intel’s expertise in general purpose processors and software-based RAN through its FlexRAN™ software stack running on Intel 3rd generation Intel® Xeon® Scalable processors. The open standards for communications between radios and DUs that were published by O-RAN enabled its development, and the result is a technology demonstrator implemented on FlexRAN™ software.

………………………………………………………………………………………………………………………………………………………………………………..

Intel is now facing new Open RAN competition from several semiconductor companies.

Marvell has just unveiled a new accelerator card that will slot into a Dell compute server (which uses x86 processors). Based on a system called “inline” acceleration, it is designed to do baseband PHY layer processing and do it more efficiently than x86 processors. A Marvell representative claims it will boost open RAN performance and support a move “away from Intel.” Heavy Reading’s Simon Stanley (see below) was impressed. “This is a significant investment by Dell in open RAN and vRAN and a great boost for Marvell and the inline approach,” he said.

Qualcomm, which licenses RISC processors designed by UK-based ARM, has teamed up with Hewlett Packard Enterprise (HPE) on the X100 5G RAN accelerator card. Like Marvel’s offering, it also uses inline acceleration and works – by “offloading server CPUs [central processing units] from compute-intensive 5G baseband processing.”

There is also EdgeQ which is sampling a “Base Station on a Chip” which is targeted at Open RAN and private 5G markets. Three years in the making, EdgeQ has been collaborating with market-leading wireless infrastructure customers to architect a highly optimized 5G baseband, networking, compute and AI inference system-on-a-chip. By coupling a highly integrated silicon with a production-ready 5G PHY software, EdgeQ uniquely enables a frictionless operating model where customers can deploy all key functionalities and critical algorithms of the radio access network such as beamforming, channel estimation, massive MIMO and interference cancellation out of the box.

For customers looking to engineer value-adds into their 5G RAN designs, the EdgeQ PHY layer is completely programmable and extensible. Customers can leverage an extendable nFAPI interface to add their custom extensions for 5G services to target the broad variety of 5G applications spanning Industry 4.0 to campus networks and fixed wireless to telco-grade macro cells. As an industry first, the EdgeQ 5G platform holistically addresses the pain point of deploying 5G PHY and MAC software layers, but with an open framework that enables a rich ecosystem of L2/L3 software partners.

The anticipated product launches will be welcomed by network operators backing Open RAN. Several of them have held off making investments in the technology, partly out of concern about energy efficiency and performance in busy urban areas. Scott Petty, Vodafone’s chief digital officer, has complained that Open RAN vendors will not look competitive equipped with only x86 processors. “Now they need to deliver, but it will require some dedicated silicon. It won’t be Intel chips,” he told Light Reading in late 2021.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Inline vs Lookaside Acceleration:

While Marvell and Qualcomm are promoting the “inline” acceleration concept, Intel is using an alternative form of acceleration called “lookaside,” which continues to rely heavily on the x86 processor, offloading some but not all PHY layer functions. This week, Intel announced its own product refresh based on Sapphire Rapids, the codename for its next-generation server processors.

Simon Stanley, an analyst at large for Heavy Reading (owned by Informa), said there are two key innovations. The first involves making signal-processing tweaks to the Sapphire Rapids core to speed up the performance of FlexRAN™, Intel’s baseband software stack. Speaking on a video call with reporters, Dan Rodriguez, the general manager of Intel’s network platforms group, claimed a two-fold capacity gain from the changes. “In the virtual RAN and open RAN world, the control, packet and signal processing are all done on Xeon and that is what FlexRAN enables,” he said.

The other innovation is the promise of integrated acceleration in future Sapphire Rapids processors. Sachin Katti, who works as chief technology officer for Intel’s network and edge group, said this would combine the benefits of inline acceleration with the flexibility of x86. That is preferable, he insisted, to any solution “that shoves an entire PHY layer into an inflexible hardware accelerator,” a clear knock at inline rivals such as Marvell and Qualcomm. Despite Katti’s reference to inline acceleration, Stanley does not think it is Intel’s focus. “None of this rules out an inline acceleration solution, but it does not seem to be part of the core approach,” he told Light Reading. “The key strategy is to add maximum value to Xeon Scalable processors and enable external acceleration where needed to achieve performance goals.”

Both inline and lookaside involve trade-offs. Inline’s backers have promised PHY layer software alternatives, but Intel has a major head start with FlexRAN™, which it began developing in 2010. That means lookaside may be a lot more straightforward. “The processor is in control of everything that goes on,” said Stanley during a previous conversation with Light Reading. “It is essentially the same software and makes life very easy.”

Larger network operators seemed more enthusiastic about inline during a Heavy Reading survey last year. By cutting out the processor, it would reduce latency, a measure of the delay that occurs when signals are sent over the network. That could also weaken Intel, reducing power needs and allowing companies to use less costly CPUs. “If you use inline, you probably need a less powerful processor and less expensive server platform, which is not necessarily something Intel wants to promote,” Stanley said last year.

References:

https://www.intel.com/content/www/us/en/communications/virtualizing-radio-access-network.html

EdgeQ Samples World’s 1st Software-Defined 5G Base Station-on-a-Chip

Light Counting: Wireless infrastructure market grew at a slower pace than in the past 2 years

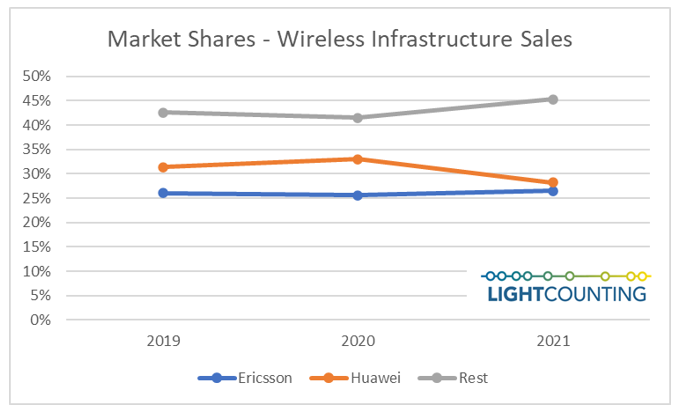

In contrast to Dell’Oro Group’s assessment of the RAN market, Light Counting says that the wireless infrastructure market grew QoQ and YoY but at a slower pace than in the past 2 years. In addition, global sales were affected by supply chain issues that created logistical nightmares and led to increase in network node average sales prices.

This environment is divided into two spheres of influence, China versus the West and its allies. Both Ericsson and Nokia gained market share at the expense of Huawei and ZTE in 4Q21:

–>Ericsson moved into the #1 position, Huawei dropped to #2, Nokia came back to #3 while ZTE slipped to #4; although Samsung gained share, it was not enough to surpass ZTE. Note that Dell’Oro still has Huawei as #1.

For the full year, Ericsson finished neck and neck with Huawei with just 1 percentage point separating the 2 vendors. “In 4Q21, the wireless infrastructure market equilibrium reached and reported last quarter was on full display: the 2 opposite spheres of influence were fully balanced. As a result, the 2 respective markets reached roughly the same size and Ericsson closed the market share gap with Huawei. 2021 was a reset year that signaled a return to normalcy with a market peak in 2022,” said Stéphane Téral, Chief Analyst at LightCounting Market Research.

|

|

After this year’s peak, our model points to a slow single-digit declining market. This bell-shaped pattern reflects the differences in regional and national agendas, including the COVID-19 impact as well as the impact of “the 2-year step function”—2 years (2019 and 2020) in a row of double-digit growth. The model considers all the 5G 3-year rollout plans we have gathered from many service providers and indicates strong activity through 2022 and 2023.

About the report:

Wireless Infrastructure quarterly report analyzes the wireless infrastructure market worldwide and covers 2G, 3G, 4G and 5G radio access network (RAN) and core network nodes. It presents historical data from 2016 to 2021, on quarterly market size and vendor market shares, and a detailed market forecast through 2027 for 2G/3G/4G/5G RAN, including open vRAN, and core networks (EPC, vEPC, and 5GC), in over 10 product categories for each region (North America, Europe, Middle East Africa, Asia Pacific, Caribbean Latin America).

The historical data accounts for the sales of more than 30 wireless infrastructure vendors, including vendors that shared confidential sales data with LightCounting. The market forecast is based on a model correlating wireless infrastructure vendor sales with 20 years of service provider network rollout pattern analysis and upgrade and expansion plans.

For more information about the market report go to LightCounting.com or email us at [email protected].

References:

|

Dell’Oro: Mobile Core Network and MEC Stagnant in 2021; Will Growth in 2022

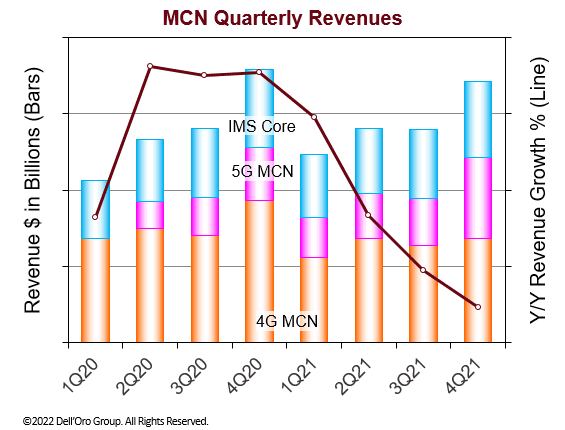

According to a recently published report from Dell’Oro Group, the total Mobile Core Network (MCN) and Multi-access Edge Computing (MEC) market 2021 revenue growth slowed to the lowest rate since 2017. The growth rate is expected to go higher in 2022 with the expansion of the 21 commercial 5G Standalone (5G SA) MBB networks that were deployed by the end of 2021, coupled with new 5G SA networks readying to launch throughout the year.

“MCN revenues for 2021 were lower than expected due to an unexpectedly poor fourth quarter performance. The revenues for 4Q 2021 were lower than in 4Q 2020. The last time that happened was in 4Q 2017,” stated Dave Bolan, Research Director at Dell’Oro Group. “The poor performance in 4Q 2021 was due to negative year-over-year revenue performance for the China region. The performance for the rest of the world was almost flat but still negative and obviously was not enough to offset the decline in China.

“The growth in 2021 came from the 5G MCN segment and was not enough to offset the decline in 4G MCN and IMS Core. Of the 21 5G SA networks commercially deployed Huawei is the packet core vendor in seven of the networks, including the three largest networks in the world located in China, and Ericsson is the packet core vendor in 10 of the networks. Not surprisingly, of the top five vendors, only Huawei and Ericsson gained overall MCN revenue market share during 2021.

“Looking at the MEC market, MEC is still a fraction of the overall MCN market, but we believe two recent announcements by Ericsson are noteworthy because, in our opinion, Ericsson will accelerate the adoption of MEC and help 5G MNOs monetize their networks by coalescing MEC implementations around the 3GPP standards. Ericsson claims to be the first to leverage recent advancements by the 3GPP standards body for edge exposure, and network slicing all the way through to a smartphone,” continued Bolan.

Additional highlights from the 4Q 2021 Mobile Core Network Report:

- Top-ranked MCN vendors based on revenue in 2021 were Huawei, Ericsson, Nokia, ZTE, and Mavenir.

- The EMEA region was the only region to grow in revenue in 2021.

- The APAC region was the largest region in revenue for 2021.

As of December 31, 2021 there were 21 known 5G SA eMBB networks commercially deployed.

|

5G SA eMBB Network Commercial Deployments |

|

|

Rain (South Africa) |

Launched in 2020 |

|

China Mobile |

|

|

China Telecom |

|

|

China Unicom |

|

|

T-Mobile (USA) AIS (Thailand) True (Thailand) |

|

|

China Mobile Hong Kong |

|

|

Vodafone (Germany) |

Launched in 2021 |

|

STC (Kuwait) |

|

|

Telefónica O2 (Germany) |

|

|

SingTel (Singapore) |

|

|

KT (Korea) |

|

|

M1 (Singapore) |

|

|

Vodafone (UK) |

|

|

Smart (Philippines) |

|

|

SoftBank (Japan) |

|

|

Rogers (Canada) |

|

|

Taiwan Mobile |

|

|

Telia (Finland) |

|

|

TPG Telecom (Australia) |

|

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

References:

https://www.delloro.com/news/mobile-core-network-stagnant-in-2021-poised-for-growth-in-2022/

https://techblog.comsoc.org/2021/12/01/delloro-5g-sa-core-network-launches-accelerate-14-deployed/

Vi and A5G Networks partner to enable Industry 4.0, Smart Cities in “Digital India” using 4G spectrum

India network operator Vodafone Idea Limited (Vi) today announced its collaboration with Nashua, NH based A5G Networks, Inc. to enable industry 4.0 and smart mobile edge computing in India.

Vi and A5G Networks have together set up a pilot private network in Mumbai utilizing existing 4G spectrum.

Vi’s association with A5G Networks is in line with its commitment to realize Digital India dreams with the latter’s differentiated and unique 4G, 5G, and Wi-Fi autonomous software for distributed Networks. A5G Networks software is fully cloud-native containerized built for hybrid and multi-cloud infrastructure.

“Vi is committed to providing superior services to digital enterprises and consumers to enhance user experiences, empowered by an autonomous network,” said Mr. Jagbir Singh, Chief Technology Officer, Vodafone Idea Ltd. “As part of our digital transformation journey on the 5G roadmap, we are happy to partner with A5G Networks to bring new services enabling industry 4.0 and smart cities in the digital era.”

“We are excited to be a part of this important journey for Digital India with Vi,” said Rajesh Mishra, Founder, and CEO of A5G Networks. “Vi is committed to delivering best-in-class services to their subscribers and driving the Digital India movement. Success depends upon a highly resilient, secure, and flexible network infrastructure.

In November 2020, Mishra told Light Reading he decided to start A5G Networks due to the growth in the Open RAN market, where Parallel Wireless has been a leading player. “When you have a lot of [Open] RANs, what happens then?” Mishra said, explaining that A5G Networks will sell software for network orchestration. “The timing was right,” he said of his departure from Parallel Wireless, citing the status of open RAN in the wider wireless market. “I’ve got to start working and building.”

Vi is partnering with technology leaders and innovators to set up digital networks enabling several low latency applications, private networks, smart cities, and connected cars.

The 5G Open Innovation Lab (“5GOILab”), a global applied innovation ecosystem for corporations, academia and government institutions, selects 15 early- to late-stage companies twice a year to join our enterprise innovation program. Companies are led by founders that have demonstrated a vision and strategy for leveraging 5G networks to achieve digital transformation in the enterprise and advance applications and solutions in artificial intelligence, augmented reality, edge computing and IoT. A5G and Santa Clara CA based EdgeQ (4G/5G base station on a chip) were selected to participate. A5G Networks for enabling distributed and disaggregated network of networks to create autonomous private and public 4G, 5G, and WiFi Networks.

The Lab does not take an equity position in its member companies, rather, companies collaborate with 5G technology experts and business advisors through CEO and CTO roundtables, private working sessions, virtual networking and social events, and opportunities to meet with the Lab’s extensive partner network of venture capital firms.

About Vodafone Idea Limited:

Vodafone Idea Limited is an Aditya Birla Group and Vodafone Group partnership. It is India’s leading telecom service provider. The Company provides pan India Voice and Data services across 2G, 3G, 4G and has a 5G ready platform. With the large spectrum portfolio to support the growing demand for data and voice, the company is committed to deliver delightful customer experiences and contribute towards creating a truly ‘Digital India’ by enabling millions of citizens to connect and build a better tomorrow. The Company is developing infrastructure to introduce newer and smarter technologies, making both retail and enterprise customers future ready with innovative offerings, conveniently accessible through an ecosystem of digital channels as well as extensive on-ground presence.

The company offers products and services to its customers in India under the TM Brand name “Vi”.

For more information, please visit: www.MyVi.in and www.vodafoneidea.com

About A5G Networks Inc:

A5G Networks Inc. is a leader and innovator in autonomous mobile network infrastructure. The company is headquartered in Nashua, NH, USA with offices in Pune MH, India. A5G Networks is pioneering secure and scalable 4G, 5G and Wi-Fi software to enable distributed network of networks. To learn more about A5G Networks, visit www.a5gnet.com

References:

ONF’s Private 5G Connected Edge Platform Aether™ Released to Open Source

Furthering its mission to seed the industry with innovative open source platforms to advance 5G and software-defined open networking, the Open Networking Foundation (ONF) today announced that its Aether Private 5G + Edge Cloud platform, and related component projects SD-Core™, SD-RAN™ and SD-Fabric™ have now all been released under the permissive Apache 2.0 open source license.

Aether is the first open source 5G Connected Edge platform for enabling enterprise digital transformation. Aether provides 5G mobile connectivity and edge cloud services for distributed enterprise networks. Aether represents a complete, open 5G solution, addressing RAN through Core, democratizing availability of a robust and complete software-defined 5G platform for developers.

In just 2 years, Aether has achieved significant milestones and demonstrated numerous industry firsts:

- Aether was selected for the $30M DARPA Pronto project for building secure 5G

- Aether was deployed in an ongoing field trial with Deutsche Telekom in Berlin

- Aether has been deployed in over 15 locations, operating 7×24 and delivering production-grade uptime

- Aether is the only private 5G solution leveraging the benefits of open RAN for private enterprise use cases

In the process of achieving these remarkable milestones, Aether has matured to the point where it is ready to be released to the community for broad consumption.

Aether is built upon a number of world-class component projects that are each in their own right best-in-class. Today, all the component projects are also being open sourced, including:

SD-Core 4G/5G dual-mode cloud native mobile core

SD-Fabric SDN P4 Programmable Networking Fabric

SD-RAN Open RAN implementation with RIC and xApps

Demonstrating Aether at MWC:

The ONF stand #1F66 at Mobile World Congress (MWC) will showcase an Aether deployment, demonstrated as a cloud managed offering optimized for enterprise private networks. In the demo, devices (UEs), such as mobile phones, cameras, sensors and IoT devices, can be aggregated into device-groups, and each device-group assigned a 5G slice and connected to specific edge applications thereby extending the slicing concept to individual applications and services. Each slice is attached to specific Industry 4.0 application(s), thereby creating distinct slices for different use cases and guaranteeing each slice secure isolation for security along with bandwidth, latency, quality of service (QoS) and resource assurances.

Two Industry 4.0 applications are demonstrated running over the Aether Private 5G using Intel technologies enabling ONF SD-RAN and SD-Core ranging from Intel Xeon Scalable processors, Intel vRAN accelerator ACC100, Intel Tofino Intelligent Fabric Processors, to software offerings such as Intel’s FlexRAN reference architecture, Intel Smart Edge Open, and the Intel Distribution of OpenVINO. The first is a security application built on Intel’s Distribution of OpenVINO toolkit, an intelligent AI/ML edge platform running on Aether 5G and leveraging Aether’s Industry 4.0 APIs to dynamically change the network slice to suit the application’s real time requirements for connectivity. The demo first creates an application slice for video surveillance, grouping together a set of streaming cameras. Next, whenever a human is detected in the field of vision for a camera, the solution automatically increases the 5G bandwidth for the impacted camera and instructs the camera to increase its resolution so a high-def recording can be made. With this approach, 5G wireless capacity is reserved for mission critical applications, and bandwidth is dynamically allocated precisely when and where needed. All of this is performed in real time without human intervention.

Anomaly detection is featured in the second Industry 4.0 application. Based on Intel’s Anomalib, an Aether application slice carries a mission critical video feed of a manufacturing / packaging line which is channeled into an anomaly detection edge-app. The edge app is trained using defect free data and uses probabilistic AI to detect anomalies like spoiled fruit (bananas). Given the time critical nature of detecting faults early, the app is built to work in a real time fashion over Aether to deliver results at line rate for typical industrial and packaging production lines.

Getting Started with Aether:

It is easy to get started using Aether Private 5G. Aether can be deployed by developers on a laptop using Aether-in-a-Box, a simple pre-packaged end-to-end development environment including RAN through mobile core. By making such a complete solution available in a footprint that can run on a laptop, developers can get started with minimal friction. Developers can then organically grow the test deployment at their own pace into a fully disaggregated production-grade deployment, including production-grade RAN radios, disaggregated UPF edge processing and cloud-native mobile core. This makes it easy to get started with Aether, while assuring developers that Aether can scale to meet the needs of even the most demanding commercial applications.

The ONF Community:

Aether has been an amazing collaboration between ONF engineering resources and an active community that includes: Aarna Networks, AirHop, AT&T, Binghamton University, China Mobile, China Unicom, Ciena, Cohere Technologies, Cornell University, Deutsche Telekom, Edgecore Networks, Facebook Connectivity, Foxconn, Google, GSLab, HCL, Intel, NTT Group, Microsoft, Princeton University, Radisys, Sercomm, Stanford University and Tech Mahindra.

About the Open Networking Foundation:

The Open Networking Foundation (ONF) is an operator-led consortium spearheading disruptive network transformation. Now the recognized leader for open source solutions for operators, the ONF first launched in 2011 as the standard bearer for Software-Defined Networking (SDN). Led by its operator partners AT&T, China Unicom, Deutsche Telekom, Google, NTT Group and Türk Telekom, the ONF is driving vast transformation across the operator space. For further information visit http://www.opennetworking.org

References:

To learn more about the project and join our growing community by reviewing the Aether documentation, by visiting the ONF booth at MWC Barcelona (#1F66), or registering here to be sent a pointer to the recorded demo to be released after MWC. Developers can also easily get started by running Aether-in-a-Box on a bare metal machine or VM.

RAN growth slowed in 4Q-2021, but full year revenues rose to ~$40B – $45B; Open RAN market highlights

- Global RAN rankings did not change with Huawei, Ericsson, Nokia, ZTE, and Samsung leading the full year 2021 market.

- Ericsson, Nokia, Huawei, and Samsung lead outside of China while Huawei and ZTE continue to dominate the Chinese RAN market.

- RAN revenue shares are changing with Ericsson and Samsung gaining share outside of China.

- Huawei and Nokia’s RAN revenue shares declined outside of China.

- Relative near-term projections have been revised upward – total RAN revenues are now projected to grow 5 percent in 2022.

Open RAN Market – Highlights

- While 5G offers superior performance over 4G, both will coexist comfortably into the 2030s as the bedrock of next-generation mobile networks. There are three perspectives that help to underline this point. Firstly, unlike voice-oriented 2G and 3G (which were primarily circuit-switched networks with varying attempts to accommodate packet-switching principles), 4G is a fully packet-switched network optimized for data services. 5G builds on this packet switching capability. Therefore, 4G and 5G networks can coexist for a long while because the transition from 4G to 5G does not imply or require a paradigm shift in the philosophy of the underlying technology. 5G is expected to dominate the OPEN RAN market with $22B TAM in 2030 with a growth rate of 52% as compared to a 4G growth rate of 31% between 2022 and 2030

- Within OPEN RAN radio unit (RU), Small cells and macrocells are likely to contribute $7.5B and $2.4B TAM by 2030 respectively. It is going to be a huge growth of 46% from the current market size of $327M for such cells in the OPEN RAN market

- The sub-6GHz frequency band is going to lead the market with a 70% share for OPEN RAN although the mmWave frequency band will have a higher CAGR of 67% as compared to 37% CAGR of Sub-6GHz. Most focus has been on the 3.5 GHz range (i.e., 3.3-3.8 GHz) to support initial 5G launches, followed by mmWave awards in the 26 GHz and 28 GHz bands. In the longer term, about 6GHz of total bandwidth is expected for each country across two to three different bands

- Enterprises are adopting network technologies such as private 5G networks and small cells at a rapid rate to meet business-critical requirements. That’s why public OPEN RAN is expected to have the majority share of round ~95% as compared to the small market for the private segment

- At present, it is relatively easy for greenfield service providers to adopt 5G open RAN interfaces and architectures and it is extremely difficult for brownfield operators who have already widely deployed 4G. One of the main challenges for brownfield operators is the lack of interoperability available when using legacy RAN interfaces with an open RAN solution. Still, Mobile network operators (MNOs) throughout the world, including many brownfield networks, are now trialling and deploying Open RAN and this trend is expected to grow with time to have a larger share of brownfield deployments

- Asia Pacific is expected to dominate the OPEN RAN market with nearly 35% share in 2030. OPEN RAN market in the Asia Pacific is expected to reach USD 11.5 billion by 2030, growing at a CAGR of 34% between 2022 and 2030. Japan is going to drive this market in the Asia Pacific although China will emerge as a leader in this region by 2030. North America and Europe are expected to have a higher growth rate of more than 45% although their share will be around 31% and 26% respectively in 2030

References:

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Frontier Communications says it’s on track with a plan to add 1 million fiber-to-the-premises (FTTP) locations in 2022. Under the plan, Frontier expects to expand its FTTP footprint to 10 million locations by 2025, up from about 4 million today. However, fiber-related revenue growth has yet to match up to recent fiber subscriber and NPS gains. Frontier reported Q4 2021 fiber revenues of $675 million, down from $684 million in the year-ago period.

“We’ve got good supply resilience. We’ve expanded the number of vendors in every category, and we’ve got good forward cost visibility as well,” Nick Jeffery, Frontier’s president and CEO, said Wednesday on the company’s 4th quarter 2021 earnings call.

But he acknowledged that Frontier, which has taken on a “fiber first” posture, was “lucky,” in that the company started to accelerate its fiber build ahead of many other telcos and cable operators.

“We’re in relatively good and insulated position because, frankly, we got there first and we signed up the terms before anyone else had a chance to do so,” Jeffery said.

Supply chain constraints didn’t slow Frontier’s fiber build in Q4 2021, as the company added a record 192,000 FTTP passings in the quarter, improving on the 185,000 new fiber passings built in Q3 2021. Last month Frontier announced that it added a record 45,000 fiber broadband subscribers in the fourth quarter of 2021, beating its prior record in Q3 2021 by more than 50%. That was also enough to overtake subscriber losses from Frontier’s legacy copper broadband business, as the company posted a Q4 net gain of 14,000 consumer broadband subs. Frontier ended 2021 with 1.33 million fiber broadband customers, up 8% year-over-year. About half of Frontier’s consumer broadband sub base is now served by fiber.

Frontier, which launched a symmetrical 2-Gig fiber service on February 22nd, is seeing solid penetration in its existing “base” FTTP markets and positive signs in newer fiber buildout areas. Penetration in Frontier’s relatively mature base-fiber footprint rose to nearly 42%, and the company expects that to eventually increase to 45%.

In its FTTP expansion effort, Frontier is seeing penetrations of 22% at the 12-month mark, expecting that to rise to 25% to 30% at 24 months. In later years, the company expects the percentage to jump to a terminal penetration of 45%.

“We’re now, I believe, gaining market share in all of our fiber markets against every single one of our competitors,” Jeffery said. “That is not a moment in time or an aberration. That’s the result of strong operational execution across many different dimensions, and I think we’ll see that carry forward into the future.”

Frontier said its fiber-related net promoter score (NPS) went positive for the first time in November 2021, while fiber churn dropped to 1.32% in Q4 2021, improved from 1.56% in the year-ago quarter.

Scott Beasley, Frontier’s CFO, said Frontier expects fiber revenues to reach positive territory as 2022 progresses, driven by the growth of its consumer fiber segment and a stabilization of the company’s business and wholesale units.

MoffetNathanson analyst Nick Del Dio had this to say in a research note to clients:

“Large scale network upgrade projects take years to complete. Achieving targeted levels of penetration once the network in a given geography has been upgraded takes years, too. By our estimates, it will be about a decade before Frontier’s potential will be fully realized.”

“Frontier’s operating metrics continue to move in the right direction. Total consumer broadband net adds were positive for the first time in many, many years; copper losses were stable, while the company gained fiber subscribers in both new and existing markets. Fiber gross adds and churn both improved in Q2. Frontier’s fiber NPS scores have improved dramatically over the past year, going from -24 in January 2021 to +9 in December 2021, a 33 point swing, with NPS scores associated with new customers better than those associated with old customers. The company expects continued strength in fiber and better churn in copper in coming periods. Consumer fiber broadband ARPU declined about $1 sequentially, which management attributed to promoting autopay adoption and giving gift cards for new customers.”

……………………………………………………………………………………………………………………………………………………………………………………………

Frontier’s plan to bring FTTP to 10 million locations by 2025 includes what the company calls Wave 1 and Wave 2 builds. Wave 3 includes another 5 million locations that might be built out using supplemental government funding and partnerships, or could be tied to potential divestments or system swaps. Frontier’s analysis of the Wave 3 section continues, and the company should have some specific guidance in the coming months, said John Stratton, Frontier’s executive chairman of the board.

Q4 2021 was the last quarter in which Frontier received subsidy revenues from the Connect America Fund (CAF) II program. Yet they hope President Biden’s infrastructure bill passes and directs revenues to telcos to help them build out their networks.

“It’s complicated,” Stratton said with respect to government stimulus funding, noting that Frontier expects to be an active participant in the new infrastructure bill. “The rules of engagement, both at the federal and state level, are still being worked… Our thought process is that this a 2023 and onward in terms of it becoming something that starts to scale.”

References:

Verizon, AWS and Bloomberg media work on 4K video streaming over 5G with MEC

Verizon, Bloomberg Media, Zixi and Amazon Web Services (AWS) are working together to test how 5G and mobile edge computing (aka Multi-access Edge Computing or MEC) can transform how global business news is produced, delivered and consumed. Using Verizon 5G Edge with AWS Wavelength, Bloomberg Media will be able to package and deliver live 4K Ultra High Definition (UHD) content without the need for satellites, allowing for fast and efficient content delivery.

Verizon 5G Edge with AWS Wavelength, a real-time cloud computing platform, brings AWS compute and storage services to the edge of Verizon’s wireless network. This, coupled with Zixi’s SDVP and ZEN Master control plane, shows that it is possible to change the way broadcast content is packaged and delivered. This combination of Zixi software minimizes the latency and simplifies the networking required to connect from hosted software services on 5G Edge with AWS Wavelength to the end user’s device while ensuring a high quality broadcast signal is maintained.

Media consumption today has its challenges for content providers. Broadcasters are looking to simplify their distribution workflows being driven by a ubiquitous content economy and consumers who want more live streamed 4K content, with quick start times and minimal buffering. To accomplish this, Bloomberg Media sends UHD video using Verizon 5G Edge with AWS Wavelength coupled with Zixi’s software to quickly process the video into multiple streams for broadcast across various platforms.

The companies also plan to test streaming Bloomberg TV+ 4K UHD content direct to consumers’ 5G-connected devices, via Verizon 5G Edge with AWS Wavelength, allowing users to access data rich content on market news and business insights on the go. This will be followed by another trial that will involve near real-time native translation of Bloomberg TV+ content for transcripts, captioning and subtitles distributed globally.

“5G and edge compute have the potential to revolutionize the media and entertainment space and reinvent how global business news is produced and consumed,” said Tami Erwin, CEO of Verizon Business. “By leveraging Verizon 5G Edge with AWS Wavelength and Bloomberg Media’s premium 4K UHD service, we’re testing how we can potentially reimagine the future of media delivery and the viewer experience.”

“Bloomberg Media is committed to continuous innovation and experimentation of technologies to better reach our global audience of business leaders with the insights, information and solutions they need,” said Roman Mackiewicz, Chief Information Officer at Bloomberg Media. “This proof of concept trial combines Verizon’s 5G and mobile edge computing capabilities with Bloomberg TV+ premium 4K UHD content to create a modern streaming news experience with the potential for true industry disruption.”

“It has been fantastic working with Verizon, Bloomberg Media and AWS to deliver pristine 4K UHD quality content over 5G while leveraging edge compute” said Gordon Brooks, Executive Chairman and CEO of Zixi. “Verizon 5G Edge with AWS Wavelength and Zixi can potentially transform the M&E industry.”

Last May, Verizon demonstrated 4K video on a camera connected to its 5G Ultra Wideband network in Verizon’s 5G Lab in Los Angeles, CA. With 5G, Verizon was able to record and stream TheHxliday’s performance in a visually lossless way, nearly eliminating the side-effects of image compression that’s visible to the naked eye.

The premise behind the 4K over 5G is that there’s a great demand for 4K streamed content over a cellular network. However, 4K resolution is only really noticeable on large screens and those are usually connected via WiFI- not cellular. 5G has been desperately searching for killer apps since it’s inception, but it remains highly debatable whether 4K streaming will provide one.

Launched in August 2020, Verizon 5G Edge with AWS Wavelength is currently available in 17 metropolitan areas in the U.S. Learn more information about Verizon 5G Edge and Verizon’s 5G technology.

References:

https://www.verizon.com/about/news/verizon-bloomberg-media-zixi-aws-5g-edge-compute

Deutsche Telekom demos end to end network slicing; plans ‘multivendor’ open RAN launch in 2023

DT and Ericsson recently demonstrated an impressive proof of concept implementation: they established connectivity with guaranteed quality of service (QoS) between Germany and Poland via 5G end-to-end network slicing. With an SD-WAN solution from Deutsche Telekom, the data connection can be flexibly controlled and managed via a customer portal. The solution ensures that different service parameters in the network can be operated across country borders. At the same time, network resources are flexibly allocated. This approach is being presented for the first time worldwide. It is particularly advantageous for global companies that operate latency-critical applications at different, international locations.

End-to-end network slicing, which requires a 5G SA core network, is a key enabler for unlocking 5G opportunities. It’s been highly touted to drive business model innovation and new use cases across various industry segments. 5G slicing will enable use cases that require specific resources and QoS levels. Globally operating enterprise are more and more seeing the need for uniform connectivity characteristics to serve their applications in different markets. Some of the latency-critical business applications that demand consistent international connectivity performance are related to broadcasting, logistics, and automotive telematics.

In this trial, the QoS connectivity was extended from Germany to Poland using a 5G slicing setup that is based on commercial grade Ericsson 5G Standalone (SA) radio and core network infrastructure and a Deutsche Telekom commercial SD-WAN solution. The home operator-controlled User Plane Function (UPF) is placed in Poland as the visited country and the entire setup is managed by an Ericsson orchestrator integrated with a Deutsche Telekom business support system via open TM Forum APIs. Combining 5G slicing and SD-WAN technology allows flexible connectivity establishment and control, while traffic breakout close to the application server in visited countries enables low latency.

…………………………………………………………………………………………………………………………………..

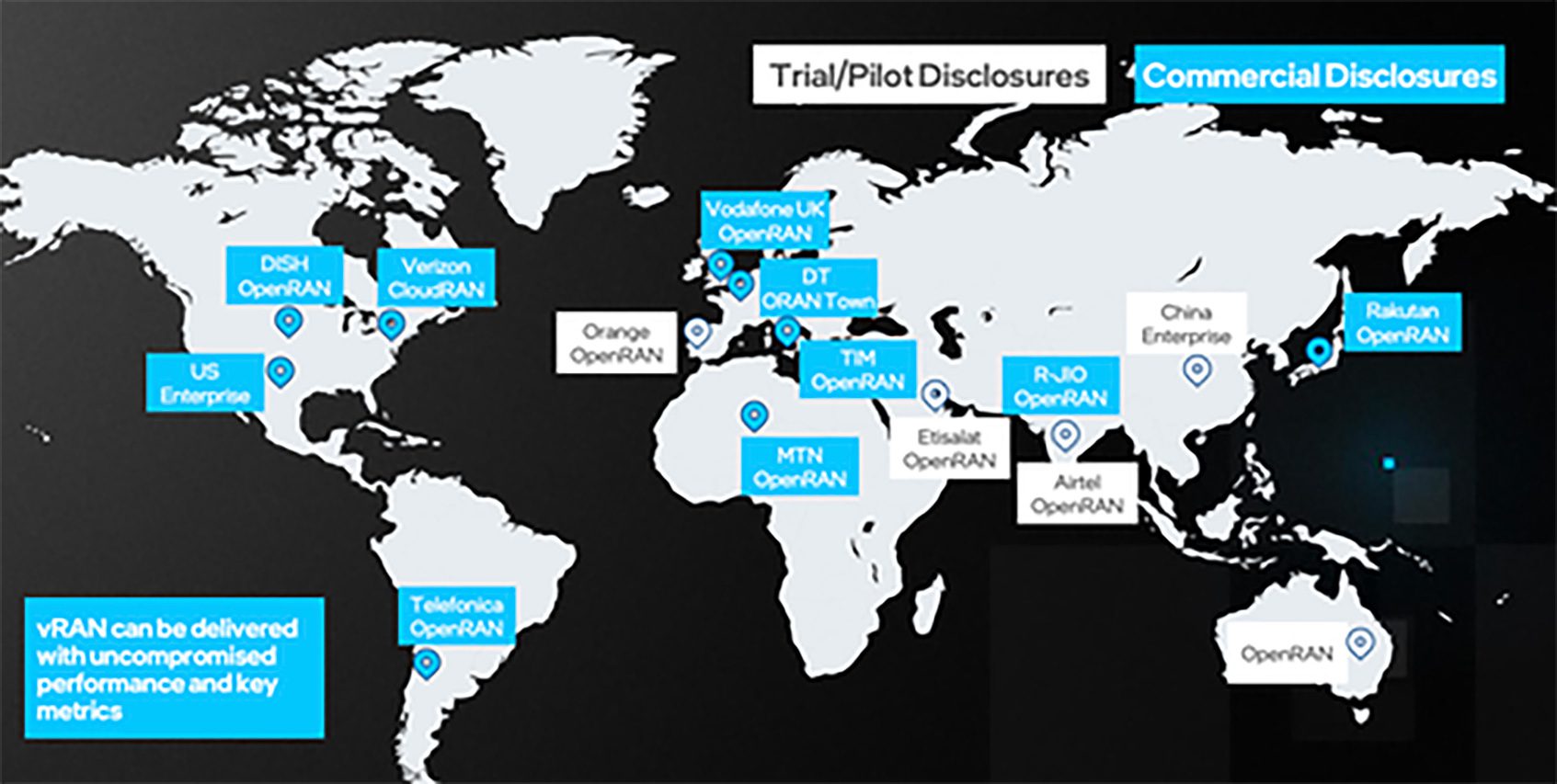

According to Light Reading, Deutsche Telekom (DT) has already issued a request for quotation (RFQ) to Open RAN vendors and is currently selecting partners for a commercial rollout next year. NEC – a Japanese vendor of radio units (among other things)- and Mavenir -a U.S. developer of baseband software-were mentioned as Open RAN Town participants (and likely DT RFQ respondents). “It is a multivendor setup,” said DT’s Claudia Nemat.

However, there are obstacles that Open RAN must overcome to be widely deployed. In particular, energy efficiency. Deutsche Telekom, along with most other big operators, is determined to reduce its carbon footprint and slash energy bills. Open RAN “is less energy efficient than today’s RAN technology,” Ms. Nemat said. The use of x86 general-purpose microprocessors in virtualized, open RAN deployments seems to be responsible for this inefficiency.

“If you have an ASIC [application-specific integrated circuit] for baseband processing, it is always cheaper than using a general-purpose microprocessor like an Intel processor,” said Alex Choi, Deutsche Telekom’s head of strategy and technology innovation, two years ago.

One option is to use ASICs and other chips as hardware accelerators for more efficient baseband processing. Companies including Marvell, Nvidia and Qualcomm all have products in development for sale as merchant silicon in open RAN deployments. Nemat, noted a breakthroughs with Intel.

“We achieved a reduction of electricity consumption of around minus 30%. For us, that is a big step forward for commercial deployment.”

Light Reading’s Iain Morris, provided this assessment:

Even so, a commercial open RAN deployment involving companies like NEC and Mavenir is hard to imagine. Any widespread rollout of their technologies would mean swapping out equipment recently supplied by Ericsson or Huawei (DT’s current 5G network equipment vendors), unless Deutsche Telekom plans to run two parallel networks. Either option would be costly.

Far likelier is that a 2023 deployment will be very limited. Other operators including the UK’s BT and France’s Orange have talked about using open RAN initially for small cells – designed to provide a coverage boost in specific locations.

A private network for a factory is one possible example. Outside Germany, of course, there may be a bigger short-term opportunity in Deutsche Telekom markets where 5G has not been as widely deployed.

In late June 2021, Deutsche Telekom switched on its ‘O-RAN Town’ deployment in Neubrandenburg, Germany. O-RAN Town is a multi-vendor open RAN network that will deliver open RAN based 4G and 5G services across up to 25 sites. The first sites are now deployed and integrated into the live network of Telekom Germany. This includes Europe’s first integration of massive MIMO (mMIMO) radio units using O-RAN open fronthaul interfaces to connect to the virtualized RAN software.

Ms. Nemat said at the time, “Open RAN is about increasing flexibility, choice and reinvigorating our industry to bring in innovation for the benefit our customers. Switching on our O-RAN Town including massive MIMO is a pivotal moment on our journey to drive the development of open RAN as a competitive solution for macro deployment at scale. This is just the start. We will expand O-RAN Town over time with a diverse set of supplier partners to further develop our operational experience of high-performance multi-vendor open RAN.”

……………………………………………………………………………………………………………………………………………………………………..

In November 2021, Deutsche Telekom announced it was taking the lead in a new Open lab to accelerate network disaggregation and Open RAN. The German Federal Ministry for Transport and Digital Infrastructure (BMVI) is financing the Lab with 17 million Euros and that’s to be matched by approximately a 17 million Euro investment from a consortium under the leadership of Deutsche Telekom (DT).

The lab will furthermore be supported by and working closely with OCP (Open Compute Project), ONF (Open Networking Foundation), ONAP (Open Network Automation Platform), the O-RAN Alliance and the TIP (Telecom Infra Project). Partners and supporters together form the user forum, which is open for participation by other interested companies, especially SMEs, working on applications as well as equipment and development. As an open lab it is built for collaboration within the wider telecommunications community. The i14y Lab Berlin will be the central location and core node of satellite locations such as Düsseldorf and Munich. Other highlights:

- Testing and integrating components of disaggregated networks in the lab to accelerate time to market of open network technology for the multi-vendor network of the future.

- The lab has already started operations at DT Innovation Campus Winterfeldtstraße

- Important foundation for building a European and German ecosystem of vendors and system integrators

A recent Research Nester report predicts a market size of $21 billion for O-RAN in 2028.

[Source: https://www.researchnester.com/reports/open-radio-access-network-market/2781].

References:

https://www.telekom.com/en/media/media-information/archive/telekom-at-mwc-barcelona-2022-647894

https://www.telekom.com/en/media/media-information/archive/global-5g-network-slicing-648218

GSA: Private Mobile Networks Summary-2022

Introduction:

The demand for private mobile networks based on 4G LTE (and increasingly 5G) technologies is being driven by the spiralling data, security, digitisation and enterprise mobility requirements of modern business and government entities. Organisations of all types are combining connected systems with big data and analytics to transform operations, increase automation and efficiency or deliver new services to their users. Wireless networking with LTE or 5G enables these transformations to take place even in the most dynamic, remote or highly secure environments, while offering the scale benefits of a technology that has already been deployed worldwide.

The arrival of LTE-Advanced systems delivered a step change in network capacity and throughput, while 5G networks have brought improved density (support for larger numbers of users or devices), even greater capacity, as well as dramatic improvements to latency that enable use of mobile technology for time-critical applications.

Private mobile networks are often part of a broader digital transformation programme in an organisation. This could include the introduction or development of cloud networking and other digital technologies such as artificial intelligence and machine learning, and data analytics. More and more applications of the private mobile network will use these capabilities combined with mobile connectivity.

In addition to companies looking to deploy their own private mobile network for the first time, there is a large group of potential customers that currently operate private networks based on technologies such as TETRA, P25, Digital Mobile Radio, GSM-R and Wi-Fi. Many of these customers are demanding critical broadband services that are simply not available from alternative technologies, so private mobile networks based on LTE and 5G could eventually replace much of this market.

The exact number of existing private mobile network deployments is hard to determine, as details are not often made public. To improve information about this market, GSA is now maintaining a database of private LTE and 5G networks worldwide.

Since the last market update, GSA has been working with Executive Members Ericsson, Huawei and Nokia on harmonising definitions of what counts as a valid private mobile network, and on harmonising sector definitions. That work has led to a restatement of some of GSA’s market statistics.

The definition of a private mobile network used in this report is a 3GPP-based 4G LTE or 5G network intended for the sole use of private entities, such as enterprises, industries and governments. The definition includes MulteFire or Future Railway Mobile Communication System. The network must use spectrum defined in 3GPP, be generally intended for business-critical or mission-critical operational needs, and where it is possible to identify commercial value, the database only includes contracts worth more than €100,000, to filter out small demonstration network deployments.

Private mobile networks are usually not offered to the general public, although GSA’s analysis does include the following: educational institutions that provide mobile broadband to student homes; private fixed wireless access networks deployed by communities for homes and businesses; city or town networks that use local licences to provide wireless services in libraries or public places (possibly offering Wi-Fi with 3GPP wireless backhaul) which are not an extension of the public network.

Non-3GPP networks such as those using Wi-Fi, TETRA, P25, WiMAX, Sigfox, LoRa and proprietary technologies are excluded from the data set. Furthermore, network implementations using solely network slices from public networks or placement of virtual networking functions on a router are also excluded. Where identifiable, extensions of the public network (such as one or two extra sites deployed at a location, as opposed to dedicated private networks), are excluded. These items may be described in the press as a type of private network.

GSA has identified 58 countries and territories with private network deployments based on LTE or 5G, or where private network spectrum licences suitable for LTE or 5G have been assigned. In addition, there are private mobile network installations in various offshore locations serving the oil and gas industries, as well as on ships.

GSA has collated information about 656 organisations known to be deploying LTE or 5G private mobile networks. Since the last update of this report in November 2021, some organisations have been removed from the database and this analysis, owing to a lack of evidence that they met the definition criteria. These examples may be added again in the future.

GSA has counted over 50 equipment vendors that have been involved in the supply of equipment for private mobile networks based on LTE or 5G. Commercial availability of pre-integrated solutions from several equipment providers increased in 2021; these solutions aim to simplify adoption of private networks, which should add market impetus. In addition, GSA has identified more than 70 telecom network operators (counting national operators within the same group as distinct entities) involved with private mobile network projects. Also, global-scale cloud providers (often referred to as “hyperscalers”) are offering private mobile network solutions, sometimes in partnership with mobile operators or network suppliers. Their ability to exploit mass-scale cloud infrastructure and their existing presence in commercial enterprises is likely to drive additional growth in the private mobile network market.

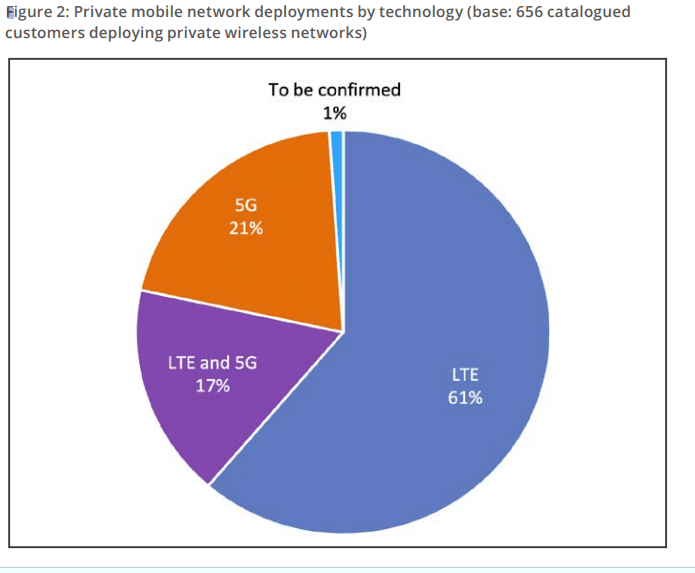

GSA has been able to categorise 656 customers deploying private mobile networks, which as Figure 1 shows, are located all around the world. Where organisations have subsidiaries in different countries or territories deploying their own networks, each subsidiary is counted separately. LTE is used in 78% of the catalogued private mobile network deployments for which GSA has data; 5G is being deployed in 38% of networks.

Dell’Oro Group forecasts a much smaller private wireless market share for 5G. They say LTE is dominating the private market in 2021 and 5G NR still on track to surpass LTE by the outer part of the forecast period, approaching 3 percent to 5 percent of the total 5G private plus public RAN market by 2026.

GSA also tracks the spectrum bands being used for deployments assigned specifically for local or private network purposes. Figure 4 shows that, including known spectrum assignments and deployments, C-band spectrum is the most widely assigned; TDD spectrum at 1.8 GHz comes second and is associated with the greatest number of identified deployments (more than 100 separate metro rail deployments in China). After that comes CBRS spectrum (also technically within the C-band but split out owing to the unusual way it has been assigned in the US).

There are more than 200 CBRS licensees, although they have not all been counted within the licence data, as it is not certain whether the spectrum will be used for public or private networks.

Telecom regulators are also showing signs of making increased allocations of dedicated spectrum available for private mobile networks — typically small tranches in specified locations. This could be acquired directly by organisations instead of by mobile operators, giving industries an alternative deployment model. Dedicated spectrum of this sort has already been allocated in France, the US, Germany and the UK, for example, and GSA expects this trend to be followed in other countries in 2022.

Note that owing to the removal of projects not meeting the new size requirement of at least €100,000, the counts are not directly comparable with those in the previous issue, although the patterns are the same.

GSA will be publishing further statistical updates covering the private mobile sector during 2022.

Acknowledgement: GSA would like to thank its Executive Members Ericsson, Huawei and Nokia for sharing general information about their network deployments to enable this dataset and report to be produced.

References:

https://gsacom.com/paper/private-mobile-networks-summary-february-2022/