FTTH Council Europe: FTTH/B reaches nearly 183 million (>50% of all homes)

Europe has passed over half of homes able to receive fiber broadband. According to the latest figures compiled by Idate for the FTTH Council Europe, 52.5% of homes will be covered by FTTH/B at the end of September 2020. That’s up from 49.9% a year earlier.

FTTH Council Europe revealed the following:

• Number of homes passed by fiber (FTTH/B) reaches nearly 183 million homes in EU39.

• Europe’s fiber footprint (number of homes passed) expanded the most in the past year in France (+4.6M homes passed), Italy (+2.8M), Germany (+2.7M) and the UK (+1.7M).

• Three countries are accounting for almost 60% of homes left to be passed with fiber in the EU27+UK region.

• FTTH/B Coverage in Europe surpasses more than half of total homes.

• 16.6% growth in the number of fiber subscribers.

• Iceland leads the European FTTH/B league table second year in a row. 70.7% of its households having fiber connections. Belarus (70.4%) and Spain (62.6%) came in second and third.

• Belgium, Israel, Malta and Cyprus enter the FTTH/B ranking for the first time.

The above figures cover 39 countries across Europe, where nearly 183 million homes have fibre access. For the EU and UK alone, penetration reached 43.8 percent in September, up from 39.4 percent a year earlier.

The report also shows fiber take-up is accelerating, with a subscriber penetration of 44.9 percent of lines in the 39 countries, compared to 43 percent in September 2019. In total there were 81.9 million FTTH/B subscribers in September 2020, up 16.6 percent from a year earlier. Annual growth was again strongest in France, with nearly 2.8 million subscribers added in the 12 months, followed by Russia with 1.7 million and Spain with 1.4 million.

The countries with the highest fiber penetration across Europe are Iceland and Belarus, with over 70 percent of households using fiber broadband. Spain and Sweden are at over 60 percent, and Norway, Lithuania and Portugal over 50 percent.

“The telecoms sector can play a critical role in Europe’s ability to meet its sustainability commitments

by reshaping how Europeans work, live and do business. As the most sustainable telecommunication

infrastructure technology, full fibre is a prerequisite to achieve the European Green Deal and make the

European Union’s economy more sustainable. Competitive investments in this technology should,

therefore, remain a high political priority and we look forward to working with the EU institutions,

national governments and NRAs towards removing barriers in a way to full-fibre Europe” said Vincent

Garnier, Director General of the FTTH Council Europe.

About the FTTH Council Europe:

The FTTH Council Europe is an industry organization with a mission to advance ubiquitous full fibre based connectivity to the whole of Europe. Our vision is that fiber connectivity will transform and

enhance the way we live, do business and interact, connecting everyone and everything,

everywhere.

Fiber is the future-proof, climate-friendly infrastructure which is a crucial prerequisite for

safeguarding Europe’s global competitiveness while playing a leading global role in sustainability.

The FTTH Council Europe consists of more than 150 member companies.

Contacts:

Eric Joyce, Chair, Market Intelligence Committee

[email protected]

Sergejs Mikaeljans. Communications and Public Affairs Officer

[email protected] Tel: +32 474 81 04 54

……………………………………………………………………………………………………………………

Separately, BT has increased its its total FTTP network build target from 20 million to 25 million premises by December 2026, with Openreach working to connect up to 4 million premises a year.

……………………………………………………………………………………………………………………..

References:

https://www.ftthcouncil.eu/documents/Fibre_Market_Panorama_2021_PR_final.pdf

https://register.gotowebinar.com/register/2424555495368131344 (webinar registration)

Verizon: Private 5G market at $8B in 4 years

Verizon distinguishes between a private wireless network product and mobile edge compute (MEC) offerings, he noted, but likes it when both come together. That’s when “the full power of 5G” can be exploited, he said, with features like low power usage and high device density. Verizon has ambitions for both public and private MEC, in partnerships with Microsoft and AWS.

Asked about moving beyond just providing connectivity and driving new revenue streams with private wireless, he pointed to recurring services such as security, managed services, and running custom applications or IoT.

“The private network piece, very few can do it as well as us, but it’s the layers of services on top that creates a pretty compelling revenue case for us,” Sowmyanarayan said. “But more importantly use-cases for the customer.”

He acknowledged that typically with large customers there’s also a significant upfront piece to get the private network up and running. The private network is essentially a scaled down version of the macro network consisting of core, radio, and other elements at a local location. But afterwards the recurring services are attractive for both Verizon and private wireless customers who can then keep attention on their main business functions.

“They are able to look to a large partner to offload some of the complex work so they can focus on what their core is,” Sowmyanarayan noted, pointing to mines as an example.

Verizon also has a private wireless offering for international customers, which uses Nokia network equipment. The carrier recently signed its first European 5G private wireless deal with Associated British Ports (ABP) for the Port of Southampton in the U.K. Sowmyanarayan said the carrier is very excited about the ABP deal and categorized it as “a sign for things to come” for Verizon.

In the 1st Quarter of 2021, Verizon posted a loss of 170,000 monthly wireless subscribers. Analysts had predicted 82,100 new customers. The top U.S. wireless carrier continues to see partnerships like its ones with Amazon.com Inc. and Corning Inc. as the best path to bring advanced 5G services from development to actual sales.

……………………………………………………………………………………………………………………………………..

References:

https://www.fiercewireless.com/private-wireless/verizon-chases-7-8b-private-wireless-market

https://www.fiercedigitaltechevents.com/private-wireless-networks-summit

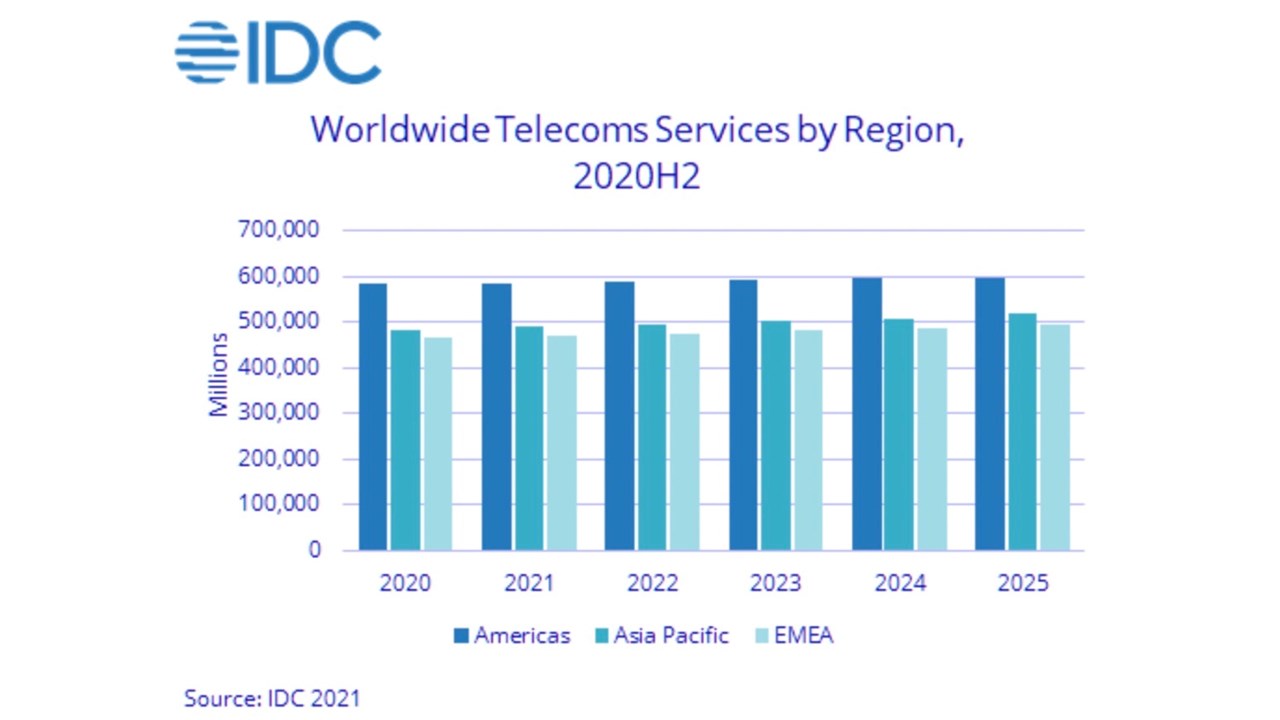

IDC: Global Telecoms Market at $1.53T in 2020; Meager Growth Forecast

According to IDC’s Worldwide Semiannual Telecom Services Tracker. the worldwide market for telecoms and pay-TV services experienced a recovery during the second half of 2020, following the turbulent first half of the year as Covid-19 encouraged much greater on-line access and video binging.

Worldwide telecommunications services and pay TV services revenues totaled $1,53-trillion in 2020, representing flat year-over-year growth. Americas was the largest region, accounting for $583 billion in services revenues, 38% of the total market. Asia-Pacific telcos generated $482 billion from services (more than 31% of the total), while those in EMEA generated services sales valued at $471 billion (almost 31% of the total).

| Global Regional Services Revenue and Year-on-Year Growth (revenues in $B) | |||

| Global Region | 2020 Revenue | 2019 Revenue | 2020/2019

Growth |

| Americas | $583 | $579 | 0.7% |

| Asia/Pacific | $482 | $482 | 0.0% |

| EMEA | $467 | $471 | -0.8% |

| WW Total | $1,532 | $1,532 | 0.0% |

| Source: IDC Worldwide Semiannual Services Tracker – 2H 2020 | |||

Although the revenue outcome in 2020 was neutral, the pandemic drastically changed the trends that have shaped the global telco market for a long time. Consumer fixed data services have suddenly become the most important type of connectivity, enabling home-bound people to work and entertain. Business fixed data services have temporarily lost momentum due to the migration of traffic to the consumer segment, but most of these connections were preserved as they were protected by long-term contracts. Fixed voice services saw a slight increase in dropout rates because some companies within the small business segments went bankrupt and more residential clients gave up their connections for cost-cutting purposes. Mobile services spending also declined slightly due to slower renewal of contract agreements, reduction of out-of-bundle spending, and a sharp decrease in roaming revenues due to travel restrictions. In the Pay TV segment, the migration from traditional Pay TV to Over the Top (OTT) services accelerated during the COVID-19 crisis, driven by increased consumption of video content and new OTT service launches.

IDC expects worldwide telecom services spending to increase by a meager 0.7% in 2021 reaching a total of $1,54-trillion. Growth during each of the next four years will take the market over the $1.6 trillion mark by 2025.

Is that tiny growth in revenues (not profits) enough to give the network operators the confidence to invest suitably in their networks (especially 5G), autonomous systems, operations and processes?

Telecom TV’s Ray Lemaistre addresses that question in a blog post:

There are two ways to look at this, using ‘5G’ as the lens (which is a valid perspective given the industry focus in terms of stated service potential and investment focus).

The first is the ‘glass half full’ view, that service providers are managing to at least grow and that without the benefits of enhanced mobile and fixed broadband services they’d be shrinking and in trouble.

The second (glass half empty) perspective is that a very small level of annual growth in a global market that underpins the strategies of pretty every other vertical sector, enables high-value enterprise and consumer services and now has 5G as a new value creator following significant levels of investment (that are ongoing) should be generating much greater returns on investment and sales growth – if IDC is right, the market is little better than ‘flat’, which isn’t much to get excited about.

So is IDC being too pessimistic? Or realistic? Or even too positive about the service revenue trends of the telcos? The world is now revolving around digital services, yet the traditional suppliers of communications services don’t appear to be the ones that will financially benefit, no matter how much time, effort and money they pump into 5G.

IDC believes that connectivity will become an even more critical asset for households and businesses after the pandemic, as some of the habits adopted during the crisis (remote working, collaboration, online media consumption) are expected to become part of everyday life. The migration toward FttP access is expected to accelerate in most of the country markets, while the business fixed data market will recover in the longer term as the economic recovery drives increased investments in the cloudification of enterprise business activities. Revenue growth in the mobile services space will be buoyed to a degree by 5G adoption, which will invite users to deploy more advanced data capabilities and uptake the content and services dependent on high-speed data connectivity.

The global telco market was put to a serious test in 2020 and it successfully passed. IDC believes that the lessons learned last year will help the industry to secure stable growth in the coming period. “The COVID-19 pandemic demonstrates the resilience and value of the telecoms industry,” said Chris Barnard, vice president, European Infrastructure and Telecoms. “New ways of working will persist beyond the pandemic, shaping future revenue opportunities, while the network-centricity of consumers will drive bandwidth requirements in that segment as well.”

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

For more information about IDC’s Worldwide Semiannual Telecom Services Tracker, please contact Kathy Nagamine at 650-350-6423 or [email protected].

……………………………………………………………………………………………………………………………………

References:

https://www.idc.com/getdoc.jsp?containerId=prUS47671521

US Cellular touts 5G millimeter wave and cell tower agreement with Dish Network

US Cellular is investing in network modernization, 5G, and spectrum assets. Laurent Therivel (LT), the company’s President & Chief Executive Officer said during their 1st Quarter 2021 earnings call that US Cellular is focusing on low band and millimeter wave spectrum for 5G. Their initial deployment is in clean, low band spectrum. “US Cellular 5G is available to some degree in 18 states today,” LT said.

The company is satisfied with their C band spectrum purchases, especially when combined with their CBRS holdings. Mid-band spectrum is available in nearly all of US Cellular’s “operating footprint.”

Millimeter wave spectrum has been deployed to offer fixed wireless access in three test markets pilot launch in those markets is expected to occur in the third quarter of this year. LT expanded on millimeter wave:

“We need to be optimistic on the performance capabilities of millimeter wave spectrum. We recently performed additional millimeter wave spectrum testing the base station and radio enhancement we achieved a line of sight propagation distance of the 7 kilometers with average speeds, approaching 1 gigabit per second this exceeds our results from last year where we achieved this the 5 kilometers of average speed with 100 megabits per second.”

Strategic partnerships were said to be an area of opportunity to better leverage the value of US Cellular assets. In April, US Cellular signed a Tower MLA (master lease agreement) with Dish Network. The company expects “this agreement to contribute to our tower revenue growth beginning in 2022.” However, any details on the deal have to remain confidential, LT said. US Cellular recently hired Austin Summerford to oversee its cell towers strategy.

US Cellular CFO Douglas Chambers highlighted the importance of the Towers MLA with Dish Network:

“The control of our towers remains very important. By owning our towers we ensure we maintain the operational flexibility to add new equipment to make other changes to our cell sites without incurring additional costs which is very important, particularly given our current technology evolution. As you can see on the slide with the assistance of our third -party marketing agreement, we have seen steady growth in tower rental revenues. As I mentioned first quarter tower rental revenues increased by 9% year-over-year. As LT noted earlier, new master lease agreement we signed with DISH Wireless and we will continue to focus on growing revenues from these strategic assets.”

In answer to a Morgan Stanley analyst question about growth drivers, LT again alluded to the towers deal with Dish (grammar corrections):

‘The best thing we did is, we said look, we’ve got assets in those towers in the form of generators, shelters and backhaul and we’re willing to share that with our partners if the economics makes sense. We’ve taken those actions. I think the DISH deal is the first example of those actions bearing fruit, and I expect to see more. So, I hope that gives you some flavor about how we’re doing from a growth perspective. I’m encouraged — I expect to see those efforts continue to bear fruit; certainly throughout the rest of this year and particularly going into next.”

“We still see significant unrecognized market value in the [US Cellular] towers,” stated financial analysts at Raymond James in a May 10th note to clients. US Cellular owned 4,270 towers at the end of the 1st quarter of 2021. Analyst Ric Prentiss wrote that Raymond James does not expect an outright sale of US Cellular towers, which is a question that has come up repeatedly in the past. Operationally, the company’s 4,300 tower portfolio produced $20.3 million in third-party revenue in the 1st quarter of 2021.

“Importantly, USM announced it has had signed a Master Lease Agreement (MLA) with Dish in April, and as Dish ramps the deployment of its greenfield nationwide 5G network in 2H21/2022, USM should see some upside. Moreover, USM under new (as of July 2020) CEO Laurent Therivel (LT) has focused on ‘sweating’ the tower assets, including more aggressive marketing, faster application cycle times, and sharing backhaul/generators/shelters at tower sites with tenants,” Prentiss stated.

US Cellular is somewhat unique in the U.S. wireless industry because it owns thousands of cell towers. Most wireless network operators like Verizon and AT&T have sold off most of their towers and now primarily rent space on towers owned by other companies like Crown Castle.

Image credit: Pixabay

…………………………………………………………………………………………………………………………………………

US Cellular reported total operating revenues of around $1 billion, up from the $963 million it reported in the same quarter a year ago. US Cellular ended the period with roughly 5 million total wireless subscribers, which was a subscriber net loss of 6,000. Smartphone connections increased by 15,000 during the quarter and by 56,000 over the course of the past 12 months. There were lower additions of Internet products such as hotspots and routers compared to the prior year when there was an increase in demand due to COVID 19.

…………………………………………………………………………………………………………………………………………..

Dish Network and Cell Towers:

To comply with Dish Network’s 2019 agreement with the U.S. Department of Justice, Dish is to cover 20% of the U.S. population by June 2022 with 5G, and 70% by June 2023. It will need to do so via thousands of cell towers across the country. Dish has already signed agreements with a wide variety of cell tower companies, including Crown Castle, American Tower, Vertical Bridge among others.

New Street Research analysts wrote in a note to clients this week:

“Between cash on hand and ongoing cash generation, the company has all the resources it needs to fund the early stages of the network buildout. The company will need to raise more capital to fully fund the build, but they will likely do that after proving out their technology platform and its commercialization, starting with its [5G] deployment in Las Vegas later this year.”

The majority of cell towers in the U.S. are owned by three cell tower companies:

- American Tower 40,586

- Crown Castle 40,567

- SBA Communications 16,401

………………………………………………………………………………………………………………………………………

References:

https://www.lightreading.com/5g/dish-teams-with-uscellular-for-5g-towers/d/d-id/769381?

https://www.fiercewireless.com/operators/uscellular-touts-tower-deal-dish

IDC forecasts $522B semiconductor market in 2021; robust growth in 5G; Samsung #1

Worldwide semiconductor revenue grew to $464 billion in 2020, an increase of 10.8% compared to 2019, according to the Semiconductor Applications Forecaster (SAF) from International Data Corporation (IDC). IDC forecasts the semiconductor market will reach $522 billion in 2021, a 12.5% year-over-year growth rate. IDC anticipates continued robust growth in consumer, computing, 5G, and automotive semiconductors.

Supply constraints will continue through 2021. While shortages initially occurred in automotive semiconductors, the impact is being felt across the board in semiconductors manufactured at older technology nodes. Much like a traffic jam and the ripple effect, a disruption on the semiconductor supply chain operating close to capacity will impact across the supply chain. The industry will continue to struggle to rebalance across different industry segments, while investment in capacity now will improve the industry’s resiliency in a few years. Looking forward to 2021, IDC sees continued strong growth in semiconductor sales worldwide as adoption of cloud technologies and demand for data and services remain unchanged. Global fiscal and monetary policy remain accommodative and will provide a tailwind for continued capital investments in long term infrastructure.

The market for semiconductors in Computing systems, such as PCs and servers, outpaced the overall semiconductor market, growing 17.3% year over year to $160 billion in 2020. “Demand for PC processors remains strong, especially in value-oriented segments,” said Shane Rau, research vice president, Computing Semiconductors. “The PC processors market looks strong through the first half and likely the whole year.” IDC forecasts Computing systems revenues will grow 7.7% to $173 billion in 2021.

Growth in Mobile Phone semiconductors was resilient in 2020. “Mobile phone shipments fell by more than ten percent in 2020, but mobile phone semiconductor revenues grew by 9.1% due to a shift to higher priced 5G semiconductors, more memory per phone, sensors, and RF support for more spectrum bands,” said Phil Solis, research director for Connectivity and Smartphone Semiconductors.

“2021 will be an especially important year for semiconductor vendors as 5G phones capture 34% of all mobile phone shipments while semiconductors for 5G phones will capture nearly two thirds of the revenue in the segment.” IDC forecasts mobile phone semiconductor revenues will grow by 23.3% in 2021 to $147 billion.

The Consumer semiconductor market segment rebounded in 2020. Robust sales of game consoles, tablets, wireless headphones and earbuds, smart watches, and OTT streaming media devices fueled segment growth by 7.7% year over year to $60 billion. “Apple, AMD, and Intel showed exceptional growth as consumers upgraded their digital spaces at home,” said Rudy Torrijos, research manager, Consumer Semiconductors. “New gaming consoles from Microsoft and Sony, continued strong sales of wearables from Apple, and the rise in smart home networks managed by Amazon Alexa and Google Assistant will accelerate growth in 2021 to 8.9% year over year.”

“Automotive sales recovered in the second half of 2020, but the supply constraints for the automotive semiconductor market for some products will last through 2021 as fires and fab shutdowns further impacted the automotive semiconductor market and it takes time for chips to move through the automotive ecosystem, specifically in the U.S. and Europe,” said Nina Turner, research manager, Automotive Semiconductors. For 2021, IDC forecasts that automotive semiconductor revenue will grow 13.6%.

“Overall, the semiconductor industry remains on track to deliver another strong year of growth as the super cycle that began at the end of 2019 strengthens this year,” said Mario Morales, program vice president, Semiconductors at IDC. “The markets remain narrowly focused on shortages across specific sectors of the supply chain, but what is more important to emphasize is how critical semiconductors are to every major system category and content growth that remains unabated.”

The IDC Worldwide Semiconductor Applications Forecaster (SAF) database serves as the basis for IDC’s semiconductor supply-side research, including our market forecasts and custom market models. This database contains revenue data collected from over 150 of the top semiconductor companies for 2015-2020 and forecasts for 2021-2025. Revenue for over twenty semiconductor device areas, five geographic regions, seven industry segments, and more than 65 end-device applications are included in the database and pivot tables.

For more information about the SAF, please contact Nina Turner at [email protected]

……………………………………………………………………………………………………………………………….

Separately, IC Insights believes that Samsung will again replace Intel as the leading semiconductor producer beginning in the second quarter of this year.

Intel was the world’s top semiconductor manufacturer from 1993 through 2016. However, after nearly a quarter of a century, the semiconductor industry saw a new number-one supplier beginning in 2017 when the memory market surged and Samsung displaced Intel. This unseating marked a milestone achievement not only for Samsung, but also for all other competing semiconductor producers who had tried for years to supplant Intel as the world’s largest supplier, according to IC Insights.

Samsung held the leading semiconductor supplier spot for six quarters before the memory market collapsed in late 2018 and Intel once again became the leading IC supplier in the fourth quarter of 2018, IC Insights indicated. The memory market plunge was so steep in late 2018 and early 2019 that Samsung went from having 17% more revenue than Intel in third-quarter 2018 to having 18% less sales than Intel just two quarters later. Intel endured its own sales slump in the first quarter of 2019, although it was nowhere near the decline exhibited by the memory producers.

With the DRAM market on the rise and the NAND flash market forecast to gain momentum in the second half of the year, it appears likely that Samsung will once again position itself at the number-one semiconductor supplier for the full year 2021, IC Insights said.

References:

https://www.digitimes.com/news/a20210505PR201.html

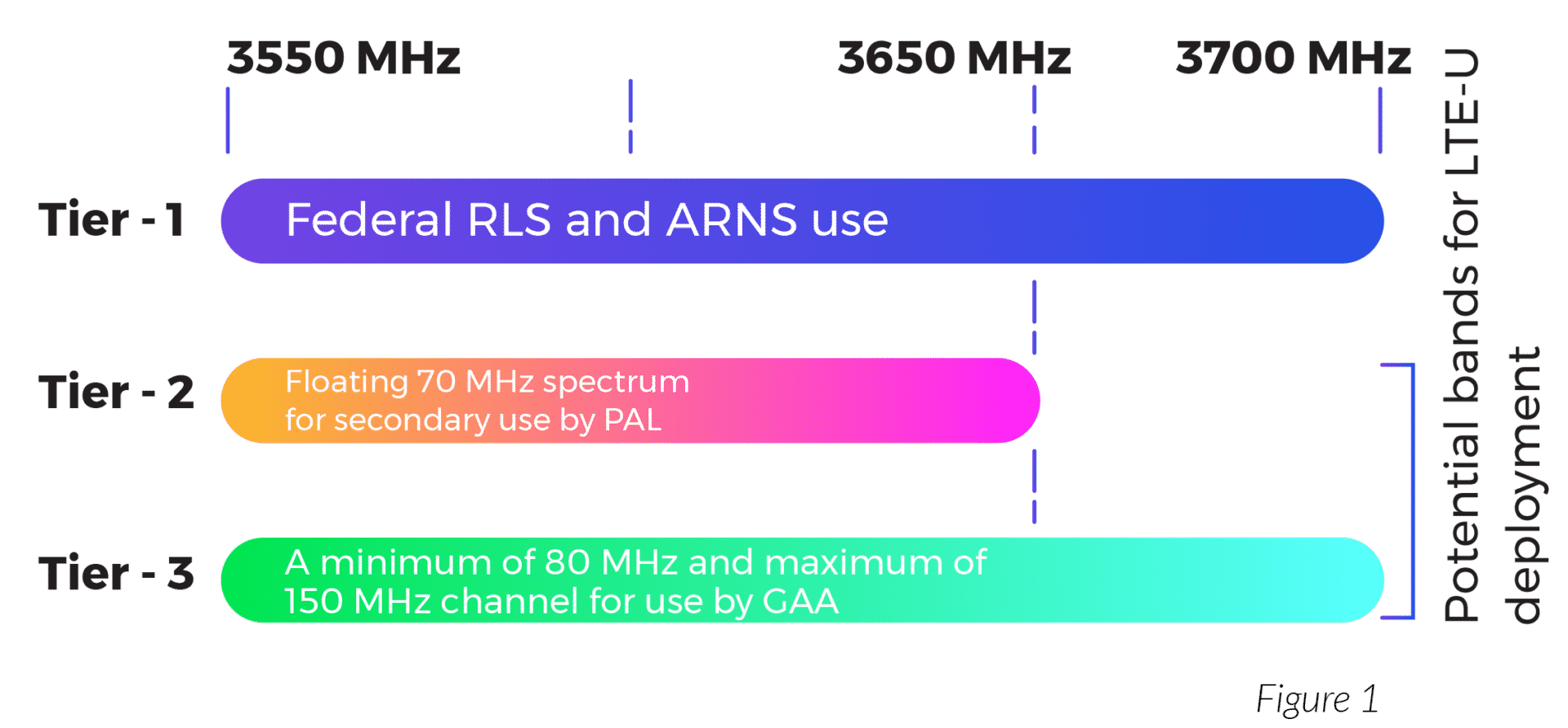

FCC permits Verizon to test 5G and carrier aggregation in CBRS spectrum band

The Federal Communications Committee (FCC) has given Verizon Wireless permission to conduct a series of tests in the 3.55 to 3.7GHz CBRS spectrum band using three radio stations in Minneapolis, Minnesota. Verizon said the tests will involve 5G and carrier aggregation technology. The FCC grant reads as follows:

Verizon Wireless is working with 5G base station and mobile device equipment vendors to

conduct product testing of 3.5 GHz in outdoor locations listed below.

Station Locations:

1. Minneapolis (HENNEPIN), MN – NL 44-48-26; WL 93-22-29; MOBILE: within 0.75 km

radius of center point location, within 0.75 km, centered around NL 44-48-26;

2. Minneapolis (HENNEPIN), MN – NL 44-48-24; WL 93-22-29; MOBILE: within 0.75 km

radius of center point location, within 0.75 km, centered around NL 44-48-24;

3. Minneapolis (HENNEPIN), MN – NL 44-48-24; WL 93-22-29; MOBILE: within 0.75 km

radius of center point location, within 0.75 km, centered around NL 44-48-24.

“Verizon and partners plan to conduct the proposed 5G tests using pre-commercial equipment in prototype form,” Verizon said in its FCC application. The operator did not name the device or network equipment partners it will be working with for the tests.

PCMag reported that Verizon has only been using CBRS spectrum only for 4G – LTE. In Jackson Heights (Queens, NY), the CBRS-enhanced 4G clocked 456Mbps, while 5G DSS at the same times and similar locations hit 232Mbps. The PCMag author previously observed Verizon’s 5G Ultra Wideband at about3.2Gbps.

Therefore, the move to 5G over CBRS is significant. Verizon added that it plans to evaluate “intra-band and inter-band carrier aggregation between 3.5GHz and licensed (and/or unlicensed) bands,” including its licensed 700MHz, PCS and AWS bands. [Carrier aggregation technology can be used to bond together transmissions across different spectrum bands, thus dramatically increasing users’ connection speeds.]

Light Reading’s Mike Dano says that Verizon has been adding support for the 3.5GHz CBRS spectrum band to its network for years. And last year Verizon spent $1.9 billion to purchase CBRS spectrum licenses across the country in an FCC auction.

Verizon’s tests roughly coincide with the operator’s three-year, $10 billion program to put its C-band spectrum licenses into use. Verizon succeeded in more than doubling its existing mid-band spectrum holdings by adding an average of 161 MHz of C-Band nationwide paying $52.9 billion including incentive payments and clearing costs.

References:

https://apps.fcc.gov/oetcf/els/reports/GetApplicationInfo.cfm?id_file_num=0461-EX-ST-2021

https://apps.fcc.gov/oetcf/els/reports/STA_Print.cfm?mode=current&application_seq=106415

https://apps.fcc.gov/els/GetAtt.html?id=273078&x=.

https://www.fiercewireless.com/operators/verizon-boosts-lte-speeds-philly-via-cbrs-spectrum

https://www.verizon.com/about/news/verizon-announces-c-band-auction-results

T-Mobile 5G hype vs Craig Moffett: “We’re not in the 5G era yet”

T-Mobile US reported total revenues of $19.8 billion and service revenues of $14.2 billion in the last quarter. T-Mobile’s gain of 1.2M post-paid net additions was solidly ahead of Wall Street consensus of 1.0M, and was similar to last year’s pro forma gain of 1.3M. The company added 773K post-paid phone subscribers, dramatically better than last year’s pro-forma gain of just 104K, and blowing away consensus of 475K.

T-Mobile’s 773,000 postpaid phone customer additions during the first quarter handily beat AT&T’s 536,000 and Verizon’s loss of 178,000 customers, according to Walter Piecyk, a financial analyst at LightShed Partners. They continue to take market share. Their annual post-paid subscriber growth rate of 3.9% marks a sharp acceleration from the 2.7% growth rate reported last quarter.

T-Mobile has already migrated 20% of Sprint’s customers, and 50% of Sprint’s traffic (a doubling from

last quarter), to the much more robust T-Mobile network. The vast majority of Sprint customers

are already enjoying service benefits from access (even with legacy handsets) to T-Mobile’s

lower frequency spectrum bands.

T-Mobile: America’s Largest, Fastest and Most Reliable 5G Network Extends its Lead

- Extended Range 5G covers 295 million people across 1.6 million square miles, 4x more than Verizon and 2x more than AT&T

- Ultra Capacity 5G covers 140 million people and on track to cover 200 million people nationwide by the end of 2021

- Majority of independent third-party network benchmarking reports show T-Mobile as the clear leader in 5G speed and availability

- Network perception catching up to reality with a nearly 120 percent increase in consumers who view T-Mobile as “The 5G Company” since Q3 2019

Image Credit: T-Mobile

……………………………………………………………………………………………………………………………………………….

On the company’s earnings call, T-Mobile US CEO Mike Sievert said that “discerning customers” are choosing T-Mobile’s new Magenta Max pricing plan, which offers few limits in the amount of 5G data that customers can consume. T-Mobile’s new Magenta Max customers consume 40% more data than its other 5G customers, and fully 70% more data than T-Mobile’s average 4G LTE customers.

“The take rate has just been amazing,” T-Mobile CFO Peter Osvaldik said of Magenta Max. “There are premium customers that are attracted to this premium network.”

“We’ve never been able to outrun the insatiable demand that customers have,” Sievert said of Internet service providers in general. “So when you provide the industry’s only true, unlimited plan, they do what they do, they use it up.”

According to Sievert, that indicates that T-Mobile’s 5G network will be a big winner. “We’re really starting to pull away from the pack. T-Mobile is positioned to maintain our 5G leadership for the duration of the 5G era.”

In a great example of braggadocio, Sievert said:

“We have again demonstrated that our unique winning formula and balanced approach enables us to grow share while delivering strong financial results. In our increasingly connected world, we recognize our role as stewards of this profitable company and industry, while continuing to use our Un-carrier DNA to bring change to wireless and broadband alike, to disrupt the status quo and ultimately benefit customers. And this quarter was no exception.”

T-Mobile said it now covers fully 140 million people with its 2.5GHz network, which it calls “ultra capacity.” By the end of this year, the company said that number will increase to 200 million people. Meantime, speeds available on that network will rise from an average of 300 Mbit/s today to up to 400 Mbit/s by the end of this year, the operator said. 5G speeds will continue to rise after that, according to T-Mobile’s network chief Neville Ray. “2022 is going to be even better,” he said.

Analyst Craig Moffett (who participated in the earnings call) put somewhat of a damper on all that 5G hype by stating: “But we’re not in the 5G era yet. We’re not even a year into the first generation of 5G iPhones. Less than 10% of Americans have 5G-enabled phones, and half of those probably only got a new phone because they needed a replacement. 5G isn’t really driving handset selection, or service provider selection, yet.”

“That T-Mobile continues to take share even in the twilight of the LTE era is reassuring. In a world of roughly comparable networks, they are competing on the basis of price alone… and they are taking share rapidly. In 5G, they will compete not only on the basis of the industry’s lowest prices, but also the industry’s best network. As we’ve said before, T-Mobile’s ‘worst to first’ story is a generational one. Networks don’t achieve advantage overnight, and they don’t lose it overnight, either. Ten and twenty-year cycles in telecom aren’t unusual.”

“T-Mobile’s brand, and its network, have been ascendant for years. But they have, up to now, achieved only parity. Their path to network superiority is potentially even longer, and, we suspect, even brighter.”

T-Mobile continues to increase market share even in the twilight of the LTE era is reassuring. In a

world of roughly comparable networks, they are competing on the basis of price alone… and they

are taking share rapidly. In 5G, they will compete not only on the basis of the industry’s lowest prices, but also the industry’s best network.

……………………………………………………………………………………………………………………………………….

References:

https://www.t-mobile.com/news/business/t-mobile-reports-strong-first-quarter-2021-results

https://www.lightreading.com/5g/does-5g-make-difference-t-mobile-says-yes/d/d-id/769256?

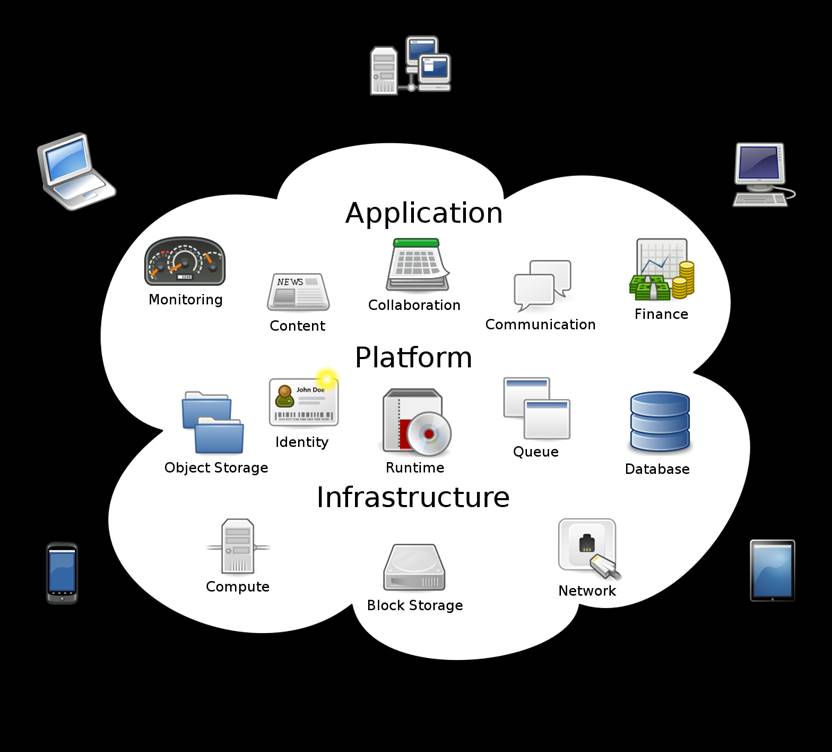

Gartner: Global public cloud spending to reach $332.3 billion in 2021; 23.1% YoY increase

According to Gartner, global public cloud spending is forecast to reach $332.3 billion in 2021, increasing by 23.1% from $270 billion in 2020. Growth in cloud spending can be attributed to increased adoption in technologies such as virtualization, edge computing and containerization.

“The events of last year allowed CIOs to overcome any reluctance of moving mission critical workloads from on-premises to the cloud,” said Sid Nag, research vice president at Gartner. “Even absent the pandemic there would still be a loss of appetite for data centers.

Table 1. Worldwide Public Cloud Services End-User Spending Forecast (Millions of U.S. Dollars)

| 2020 | 2021 | 2022 | |

| Cloud Business Process Services (BPaaS) | 46,131 | 50,165 | 53,121 |

| Cloud Application Infrastructure Services (PaaS) | 46,335 | 59,451 | 71,525 |

| Cloud Application Services (SaaS) | 102,798 | 122,633 | 145,377 |

| Cloud Management and Security Services | 14,323 | 16,029 | 18,006 |

| Cloud System Infrastructure Services (IaaS) | 59,225 | 82,023 | 106,800 |

| Desktop as a Service (DaaS) | 1,220 | 2,046 | 2,667 |

| Total Market | 270,033 | 332,349 | 397,496 |

BPaaS = business process as a service; IaaS = infrastructure as a service; PaaS = platform as a service; SaaS = software as a service Note: Totals may not add up due to rounding.

Source: Gartner (April 2021)

As organizations mobilize for a massive global effort to produce and distribute COVID-19 vaccinations, SaaS based applications that enable essential tasks such as automation and supply chain is critical. Such applications continue to demonstrate reliability in scaling vaccine management, which in turn will help CIOs further validate the ongoing shift to cloud.

“It’s important to note that the usage and adoption of cloud that served enterprises well during the ongoing crisis will not look the same in the coming years,” said Mr. Nag. “It will further evolve from serving pedestrian use cases such as infrastructure and application migration, to those that combine cloud with technologies such as artificial intelligence, the Internet of Things, 5G and more.

“In other words, cloud will serve as the glue between many other technologies that CIOs want to use more of, allowing them to leapfrog into the next century as they address more complex and emerging use cases. It will be a disruptive market, to say the least.”

Cloud Computing Fuels Revenues and Profits for Big 3 Cloud Companies:

Amazon’s market-leading AWS cloud business grew revenue 32% in the first quarter, a faster pace than analysts had expected and accelerating from 28% growth in the fourth quarter. Microsoft’s revenue has skyrocketed since it invested billions of dollars to build a massive, interconnected cloud computing platform. Revenues for its Azure cloud offering were up 50% in the quarter. Meanwhile, revenues at Google’s Cloud business grew 46% this past quarter. However, Google continues to be a distant third to Amazon and Microsoft in the cloud business.

All three cloud providers are making a big push into edge computing and 5G “cloud native” core networks. That effectively makes them leaders in those new tech markets, with the traditional network providers playing a subservient role. For example, Dish Network will build its 5G core network using the AWS cloud infrastructure and services.

These big three cloud businesses are in reality massive cloud (i.e. Internet) resident data centers with high-speed interconnections (Data Center Interconnects). There’s no reason to think growth will slow any time soon. Were they stand-alone businesses, they would be the three largest enterprise-software entities in the world. And they design their own compute servers, making them the world’s largest global computer companies too!

………………………………………………………………………………………………………………………………………………….

While cloud services boomed in the past year, Gartner suggests that spending on cloud might take a different note in 2021 and 2022 as enterprises shift away from infrastructure and application migration towards advanced applications integrating AI and IoT and 5G.

In the first quarter of 2021, research and analytics firm Canalys reported that global cloud services infrastructure spending grew to $41.8 billion to represent a 35% year-on-year increment and 5% quarter-on-quarter growth.

References:

Curmudgeon/Sperandeo: Technology Fab Five Biggest Winners from Covid-19 Pandemic

Vodafone and Google Cloud to Develop Integrated Data Platform

Vodafone and Google Cloud today announced a new, six-year strategic partnership to drive the use of reliable and secure data analytics, insights, and learnings to support the introduction of new digital products and services for Vodafone customers simultaneously worldwide.

In a significant expansion of their existing agreement, Vodafone and Google Cloud will jointly build a powerful new integrated data platform with the added capability of processing and moving huge volumes of data globally from multiple systems into the cloud.

The platform, called ‘Nucleus‘, will house a new system – ‘Dynamo‘ – which will drive data throughout Vodafone to enable it to more quickly offer its customers new, personalized products and services across multiple markets. Dynamo will allow Vodafone to tailor new connectivity services for homes and businesses through the release of smart network features, such as providing a sudden broadband speed boost.

Capable of processing around 50 terabytes of data per day, equivalent to 25,000 hours of HD film (and growing), both Nucleus and Dynamo, which are industry firsts, are being built in-house by Vodafone and Google Cloud specialist teams. Up to 1,000 employees of both companies located in Spain, the UK, and the United States are collaborating on the project.

Vodafone has already identified more than 700 use-cases to deliver new products and services quickly across Vodafone’s markets, support fact-based decision-making, reduce costs, remove duplication of data sources, and simplify and centralize operations. The speed and ease with which Vodafone’s operating companies in multiple countries can access its data analytics, intelligence, and machine-learning capabilities will also be vastly improved.

By generating more detailed insight and data-driven analysis across the organization and with its partners, Vodafone customers around the world can have a better and more enriched experience. Some of the key benefits include:

- Enhancing Vodafone’s mobile, fixed, and TV content and connectivity services through the instantaneous availability of highly personalized rewards, content, and applications. For example, a consumer might receive a sudden broadband speed boost based on personalized individual needs.

- Increasing the number of smart network services in its Google Cloud footprint from eight markets to the entire Vodafone footprint. This allows Vodafone to precisely match network roll-out to consumer demand, increase capacity at critical times, and use machine learning to predict, detect, and fix issues before customers are aware of them.

- Empowering data scientists to collaborate on key environmental and health issues in 11 countries using automated machine learning tools. Vodafone is already assisting governments and aid organisations, upon their request, with secure, anonymised, and aggregated movement data to tackle COVID-19. This partnership will further improve Vodafone’s ability to provide deeper insights, in accordance with local laws and regulations, into the spread of disease through intelligent analytics across a wider geographical area.

- Providing a complete digital replica of many of Vodafone’s internal support functions using artificial intelligence and advanced analytics. Called a digital twin, it enables analytic models on Google Cloud to improve response times to enquiries and predict future demand. The system will also support a digital twin of Vodafone’s vast digital infrastructure worldwide.

- In addition, Vodafone will re-platform its entire SAP environment to Google Cloud, including the migration of its core SAP workloads and key corporate SAP modules such as SAP Central Finance.

Johan Wibergh, Chief Technology Officer for Vodafone, said: “Vodafone is building a powerful foundation for a digital future. We have vast amounts of data which, when securely processed and made available across our footprint using the collective power of Vodafone and Google Cloud’s engineering expertise, will transform our services, to our customers and governments, and the societies where they live and serve.”

Thomas Kurian, CEO at Google Cloud, commented: “Telecommunications firms are increasingly differentiating their customer experiences through the use of data and analytics, and this has never been more important than during the current pandemic. We are thrilled to be selected as Vodafone’s global strategic cloud partner for analytics and SAP, and to co-innovate on new products that will accelerate the industry’s digital transformation.”

Revenues at Google’s Cloud business grew 46% this past quarter. However, Google continues to be a distant third to Amazon and Microsoft in the cloud business.

Technical Notes:

All data generated by Vodafone in the markets in which it operates is stored and processed in the required Google Cloud facilities as per local jurisdiction requirements and in accordance with local laws and regulations. Customer permissions and Vodafone’s own rigorous security and privacy by design processes also apply.

On the back of their collaborative work, Vodafone and Google Cloud will also explore opportunities to provide consultancy services, offered either jointly or independently, to other multi-national organizations and businesses.

The platform is being built using the latest hybrid cloud technologies from Google Cloud to facilitate the rapid standardization and movement of data in both Vodafone’s physical data centers and onto Google Cloud. Dynamo will direct all of Vodafone’s worldwide data, extracting, encrypting, and anonymizing the data from source to cloud and back again, enabling intelligent data analysis and generating efficiencies and insight.

References:

https://cloud.google.com/press-releases/2021/0503/vodafone-google-cloud (video)

Strand Consult: The 10 Parameters of Open RAN; AT&T memo to FCC

Strand Consult is attempting to determine if, when, and how Open RAN (TIP project) and O-RAN (Alliance) will replace conventional RAN on a 1:1 basis without compromising the network quality, security, energy efficiency, and other important factors. Mobile operators have little ability to raise price, so operators must compete on network quality, coverage, and other factors. Here are few things to keep in mind.

In general, mobile ARPU is falling. In many countries, operators are trying to shift the focus away from price by competing on innovation and quality. For example, US mobile operators compete on the quality and coverage of their 4G and 5G networks. Mobile operators are focused on rolling out technology quickly, maintaining customer satisfaction, and ensuring quality of experience and other key performance indicators (KPIs). Chief technology officers, network managers, and other technical staff are laser focused on these KPIs and are loath to make changes to which would negatively impact these indicators.

In general, Strand Consult observes that what public affairs officials say about OpenRAN differs significantly from what network managers say.

Strand Consult’s 10 parameters to evaluate OpenRAN:

Strand Consult’s investigation has been guided by 10 parameters or questions to determine the value of OpenRAN. Here is what we’ve learned.

- Whether OpenRAN is a technical standard. The O-RAN Alliance is a private organization that develops technical specifications for OpenRAN. It should not be confused with the OpenRAN Policy Coalition which is a public affairs organization. The O-RAN Alliance is not a standards development organization (SDO), but rather an industrial collaboration that builds solutions on top of 3GPP specifications. While industrial cooperation is important, there can be no mobile networks the 3rd Generation Partnership Project (3GPP), an umbrella term for many standards organizations which develop protocols for mobile telecommunications and define the technological inputs for cellular networks. Companies like Rakuten develop their own corporate and proprietary concepts for OpenRAN. These concepts that do not necessarily follow a particular standard (3GPP) or O-RAN Alliance specification.

- Whether OpenRAN can replace Chinese equipment. Some mobile operators have suggested that OpenRAN is the way to avoid Huawei and ZTE in mobile networks. However other Chinese companies are deeply involved with OpenRAN technical specifications, product roadmap, and strategy. One founding member of the O-RAN Alliance is China Mobile, a state-owned company and the world’s largest mobile operator with 950 million subscribers and 450,000 employees. The O-RAN Alliance has more than 40 Chinese member companies, many of which government-owned and military aligned (See Strand Consult’s research note 44 Chinese companies have joined the OpenRAN effort, a strategy to reduce Huawei’s presence in 5G). The Chinese members of 0-RAN Alliance outnumber the Europeans. China Mobile’s Chih-Lin has veto power over the organization. China Mobile leads or co lead 8 of the 9 O-RAN Alliance’s working groups either as chairman or vice-chairman.

- OpenRAN and 5G innovation. OpenRAN proponents claim it will have a revolutionary impact on 5G, however reports suggest that large scale deployment of OpenRAN won’t happen until 2025. This means that OpenRAN cannot replace existing RAN on a 1:1 basis today. The 5G networks rolled out today use the standards from 3GPP Release 15 with increased functionality forthcoming in Releases 16 and 17 within two years. There are more than 144 3GPP-5G commercial networks deployed but only one proprietary OpenRAN 5G network (Rakuten). If OpenRAN is to increase 5G innovation, it must evolve faster than 5G itself. Presently it is not on par with the 5G standards defined years ago. It is difficult to see how OpenRAN can catch up when the significant resources already supporting the 3GPP standards timeline.

- OpenRAN and 5G deployment. Today mobile operators are rolling out 5G at a faster than 4G and even fast than 3G. In practical terms, 5G networks already built in 2019 and 2020 and those to be built in 2021 and 2022 already have the standards roadmap in place. If OpenRAN can’t catch up by 2025, operators have only two choices, delay 5G until 2025 (when 6G will start to take root) or replace their 5G equipment in 4 to 5 years. OpenRAN may be too little, too late for 5G operators.

- OpenRAN and vendor diversity. OpenRAN proponents claim that it will create more competition in the network equipment market. The 5G network equipment vendor market has many vendors and segments. Omdia details more than a dozen full-service providers with additional providers in segments for antennas, basebands, remote radios, small cells, macro cells, phase shifters and so on. This idea that there are not many vendors for 5G equipment was likely created by Huawei to deter the security reviews and subsequent restrictions imposed on the military-aligned company. If anything, the restrictions on Huawei have helped to open the door to new equipment vendors which could not compete because of Huawei’s predatory pricing and anti-competitive tactics. For example, Samsung has quickly gained market share and is supply 5G rollouts in the US, Australia, and other countries.

- OpenRAN and network equipment cost. OpenRAN proponents suggest that it can lower the cost of network equipment. The cost competitiveness of OpenRAN versus RAN is not yet known. It may be that some OpenRAN providers can offer equipment more cheaply on some parameters, but the cost advantage may not be significant when considering all the costs such as supply, availability, energy consumption, security, warranty, network integration, equipment matching, new contracts and service level agreements etc. However, operators frequently reduce their number of vendors so that they can enjoy lower unit costs with volume purchasing, the company BUYIN is a great case. For an operator’s perspective, check out the comments from Neil McRae, Managing Director and Chief Architect at BT (Scroll to minute 51 minute in the video). McRae explains that when he took his job, he inherited a network portfolio with 50 vendors. He subsequently reduced it to 4 vendors and saved £1 billion in 3 years. He observed that too many vendors not only increased cost, it increased complexity. He is wary of notions of “open architectures” which require managing portfolios of 5-50 vendors. He noted that vendor reduction increased shareholder value and that he would pursue the same strategy again.

- OpenRAN and security. OpenRAN proponents suggest that OpenRAN technology and the “unbundling” of 5G hardware and software is the means reduce reliance on Huawei and hence greater security. However, it is not clear how trading one known insecure Chinese vendor for 50 unknown Chinese vendors is the path to greater security. The issue of backdoors is omnipresent on all Chinese hardware given the country’s disposition and associated intelligence and surveillance policies. Moreover, it is not clear how security is improved when network owners must vet not one, but multiple new OpenRAN vendors. The time and cost to perform this review would seem to be multiplied by the number of vendors the operators takes on.

- OpenRAN and energy efficiency. Energy efficiency is an increasingly important issue for mobile operators which expect to compete on carbon reduction strategies. Naturally if OpenRAN could offer a greener solution, that would be an advantage. However, it is reported that many OpenRAN installation use the Intel X86 processor, which is less efficient than specialized RAN chips. If anything, energy consumption could increase if signals must traverse a multitude of mix and match components instead of a single end-to-end system designed with energy efficiency in mind. To reduce energy, Apple developed tits own processer as an alternative to Intel X86.

- OpenRAN and Rakuten. The media has promoted a supposed Rakuten success story with OpenRAN success. However, Rakuten is not offering open-source tools, but rather proprietary OpenRAN solution. It offers this through a freemium model in which free service is offered for a period, and operators pay down the line. Some companies have success with freemium and loss leader models, but typically they need scale.

- OpenRAN and the indigenous movement. OpenRAN has been promoted as a way to support domestic innovation like India or Brazil or what Germany’s Economic Minister calls for European-only actors in 5G. Curiously many of these calls are coupled with operator strategies to keep Huawei equipment in place because OpenRAN will not be ready for some years. Policymakers have also pursued subsidies and other financial incentives to support local OpenRAN startups which may design the equipment in their respective country but manufacture it in China. Unfortunately, production in China and with Chinese partners could compromise security, as the Supermicro case demonstrates.

Conclusion

The many problems that OpenRAN is purported to solve is impressive. In fact, I have to go back to 3G in 2000 to find the level of hype observed today with OpenRAN. Indeed, the Huawei problem is so serious that people are desperate for a solution. However, in the enthusiasm for the OpenRAN solution, too many want to look past the inconvenient reality that China is shaping much of the Open RAN future particularly through the O-RAN Alliance.

It is important to develop secure alternatives to Huawei, but this is not a reason to oversell OpenRAN. While it may be commendable to pursue the goals proffered by OpenRAN proponents, the actual impact of OpenRAN must be measured by real world facts and experience.

The questions remain how OpenRAN will affect the CAPEX and OPEX mobile operators in the short, medium and long term and whether operators will buy OpenRAN as a serious 1:1 alternative to standard RAN in Paris, London, Berlin, Madrid, New York, Sao Paulo and Copenhagen. It seems that OpenRAN is falling short of expectations.

Separately, AT&T told the FCC it plans to begin adding open RAN-compliant equipment into its network “within the next year.”

That puts AT&T on roughly the same timeframe as Verizon. Verizon’s SVP Adam Koeppe told Light Reading earlier this year that the operator’s 5G hardware vendors – Ericsson, Samsung and Nokia – will begin supplying open RAN-compliant equipment starting later this year. And he expects that the bulk of their equipment shipments to Verizon will comply with open RAN specifications by next year. AT&T told the FCC it expects to implement similar changes into its own network.

“The challenge for an operator shifting to any open network architecture, including but not limited to O-RAN, will be maintaining network reliability, integrity and performance for customers during the transition,” the operator wrote in a filing. “For our part, AT&T serves multiple customer groups, with varied and often complex, service requirements. As we introduce O-RAN into our network, our goal will be maintaining the same high level of performance at scale. We are actively working in this direction.”

References:

https://www.lightreading.com/open-ran/atandt-to-launch-open-ran-by-next-year/d/d-id/769199?

AT&T to FCC: Promoting the Deployment of 5G Open Radio ) Access Networks – GN Docket No. 21-63

https://ecfsapi.fcc.gov/file/1042871504579/AT%26T%20Comments%20to%20FCC%20NOI%20(04.28.21).pdf