MIIT: China has 260M 5G subs; Telecom business revenue significantly increased

China telecom regulator MIIT (Ministry of Industry and Information Technology) revealed this week that China has 260 million 5G subscribers at the end of February 2021. That is a huge number and more than the rest of the world combined [1.], but still a long way short of the 361 million claimed by the three operators. in February.

- China Mobile reported 173.2 million 5G package customers compared to 15.4 million 5G customers in February 2020. China Mobile’s overall mobile subscriber base was said to be 937.16 million at the end of February, down from 940.86 million in January.

- China Telecom added a total of 6.2 million 5G subscribers in February 2021 for a total of 103.4 million.

- China Unicom had 84.5 million 5G subscribers at the end of February 2021.

Note 1. GSA says that global 5G subscriptions grew by 57% in the fourth quarter of 2020 to reach nearly 401 million globally (representing 4.19% of the entire global mobile market). By the end of 2025, 5G will account for 31% of the global market (at 3.39 billion subscriptions), although LTE will still be dominant at 53.3% of all global mobile subscriptions.

……………………………………………………………………………………………………………………………………….

China’s vice-minister of industry and information technology Liu Liehong recently said that a total of 718,000 5G base stations have been built in China, accounting for nearly 70% of the world’s total 5G cell sites.

During Mobile World Congress Shanghai 2021, government officials said that Chinese carriers have invested more than CNY260 billion ($40.2 billion) to build the world’s largest 5G network.

MIIT further stated:

The growth rate of telecom business revenue has increased significantly. From January to February, the total revenue of telecommunications services reached 237.3 billion yuan, an increase of 5.8% year-on-year, and the growth rate increased by 4.3 percentage points year-on-year. The total telecommunications business calculated at the constant price of the previous year was 249.1 billion yuan, a year-on-year increase of 25.9%.

The scale of mobile phone users is basically stable, and 5G users are developing rapidly. As of the end of February, the total number of mobile phone users of the three basic telecommunications companies reached 1.592 billion, a year-on-year increase of 0.8%. As of the end of February, the number of 5G mobile terminal connections of the three basic telecommunications companies reached 260 million, a net increase of 61.3 million from the end of the previous year, accounting for 16.3% of mobile phone users.

Light Reading’s Robert Clark wrote: “The three (China) telcos’ annual filings over the past two weeks indicate that between them they spent a hefty 173 billion yuan ($26.5 billion) on 5G and they’re not slowing down; they’ve set aside another 185 billion yuan for 2021.”

“Their pricing, with plenty of encouragement from government officials, is also aggressive, with China Mobile’s 5G entry package costing just 128 yuan ($19.56). The heavy investment and the moderate pricing in pursuit of national objectives is why their results indicate little reward for the effort so far.”

MIIT also commented on other telecom services (besides 5G):

Data and Internet business revenue accounted for 60%, supporting the steady growth of overall telecom business revenue. From January to February, the three basic telecommunications companies completed fixed data and Internet business revenues of 41.5 billion yuan, a year-on-year increase of 10.2%, accounting for 17.5% of telecommunications business revenues, accounting for a year-on-year increase of 0.8 percentage points, driving a 1.7 percentage point increase in telecommunications business revenue . The revenue from mobile data and Internet services showed a decline for the first time. The completed business revenue was 106.2 billion yuan, a year-on-year decrease of 1.2%, and its share of telecom business revenue fell to 44.7%.

Fixed and mobile voice services declined steadily, and their share of telecom business revenue continued to decline. From January to February, the three basic telecommunications companies completed fixed voice and mobile voice business revenues of 3.82 billion yuan and 18.64 billion yuan, a year-on-year decrease of 1.1% and an increase of 5.0%, respectively, accounting for 9.5% of the total revenue of telecommunications services, and a decrease of 0.1%. Percentage points. The rapid growth of income from emerging businesses has strongly promoted the growth of telecom business income. The three basic telecommunications companies are actively transforming and upgrading, promoting IPTV, Internet data centers, big data, cloud computing, artificial intelligence and other emerging businesses. From January to February, they completed a total of 36.2 billion yuan in related business income, a year-on-year increase of 28.9%. The proportion increased sharply by 2.8 percentage points year-on-year to 15.3%, driving the growth of telecom business revenue by 3.6 percentage points.

The proportion of fixed broadband access users with speeds above 100M has exceeded 90%, and the number of gigabit users has continued to increase. The total number of fixed Internet broadband access users reached 492 million, a year-on-year increase of 8.9% and a net increase of 8.67 million from the end of the previous year. Among them, there are 463 million FTTH/O users, accounting for 94% of the total number of fixed Internet broadband users. The number of fixed Internet broadband access users with an access rate of 100Mbp and above reached 450 million, accounting for 90.4% of the total number of users, an increase of 0.5% from the end of the previous year; the promotion of gigabit broadband services was accelerated, and the access rate of 1000Mbps and above was fixed. The number of Internet broadband access users reached 8.03 million, a net increase of 1.63 million over the end of the previous year.

Mobile Internet traffic increased significantly, and DOU remained at a relatively high level in February. From January to February, the cumulative mobile Internet traffic reached 30.9 billion GB, a year-on-year increase of 31.8%. Among them, the Internet traffic through mobile phones reached 29.7 billion GB, a year-on-year increase of 31.2%, accounting for 96% of the total mobile Internet traffic. In February, the average mobile Internet access traffic (DOU) per household was 10.85GB/household, which was 1.97GB/household higher than the same period last year.

The penetration rate of fixed broadband access users of 100M and above tends to be even in all regions. As of the end of February, fixed broadband access users of 100Mbps and above in the eastern, central, western and northeastern regions reached 189.68 million, 11.17 million, 116.57 million and 26.74 million, respectively, accounting for 89.3. %, 91.7%, 90.8% and 91.8%. The difference between the highest proportion of fixed broadband access users above 100M and the lowest proportion in each province was 15.3 percentage points.

China Unicom and China Telecom say nearly a quarter of their mobile customers are on 5G plans. Chna Unicom boosted ARPU 4%, while China Telecom reported 5G ARPU nearly 50% above its blended ARPU.

China Mobile reported a 1% rise in profit but, despite the huge 5G subscriber base, recorded another decline in mobile ARPU.One winner for China Mobile was broadband access, which grew 17%, while China Telecom and China Unicom both experienced large increases in their smart home services.

………………………………………………………………………………………………………………………………………

Editorial Comment:

Many experts don’t trust economic numbers released by China’s government. Questions over the accuracy of China’s economic data, including industry groups like telecom, persist due to the lack of transparency used in the collection process. Critics say the government does not state how the data is collected or the different components that form the final numbers that are released to the public.

The methodology China uses to calculate its economic and industry data is opaque, and some knowledgeable people even accuse the government of abruptly changing methods without announcement to distort figures and hide declines.

The motivation seems to be to make China’s economy and industry groups look much stronger than they really are.

Most analysts treat any official Chinese data with caution and skepticism. Yet they have few, if any ways to establish an alternative, more accurate assessment of the world’s second-largest economy.

…………………………………………………………………………………………………………………………………………..

References:

https://www.miit.gov.cn/gxsj/tjfx/txy/art/2021/art_82f101e1d078447fac75443a50348b7c.html

https://www.lightreading.com/asia/china-5g-race-taking-its-toll-on-operators/d/d-id/768369?

https://gsacom.com/paper/lte-and-5g-subscribers-march-2021-q4/

ATIS: Next G Alliance leadership and 6G Roadmap – Is it premature?

The Alliance for Telecom Industry Solutions (ATIS) has announced election results for the Next G Alliance and its Steering Group as well as the launch of work on a 6G Roadmap.

Andre Fuetsch, Executive Vice President & Chief Technology Officer, AT&T, has been named chair of the Next G Alliance executive governing body, the Full Member Group (FMG). Jan Söderström, Ericsson’s Head of Technology Office Silicon Valley, has been named FMG vice chair. Among its many roles, the FMG sets the overall strategy and direction for the Next G Alliance as well as its organizational policies. Both the chair and vice chair serve a two-year term.

Three co-chairs have also been named for the Next G Alliance Steering Group (SG). The SG is composed of technology leaders and experts who will identify key North American R&D needs, standards strategies and market readiness policies to achieve the goals established by the Next G Alliance. The SG co-chairs are: AT&T Assistant Vice President – Standards & Industry Alliances Brian Daly; Head of North American Standardization at Nokia, Devaki Chandramouli; and VMware Director, Edge & AI Ecosystems, Telco Cloud Business Unit, Benoit Pelletier.

Setting the stage for the eventual commercialization of 6G, the work of the Next G Alliance will influence and encompass the full lifecycle of research and development, manufacturing, standardization and market readiness. As an initial priority, a 6G Roadmap Working Group has been launched. The National 6G Roadmap being developed will act as a foundation for future outputs, delivering a common vision and destination point for achieving North American 6G wireless leadership. It will define what is needed in terms of research needs, technology developments, service and application enablers, policies and government actions and market priorities.

In addition to the 6G Roadmap Working Group, the Next G Alliance will simultaneously launch a “Green G” Working Group focused on achieving energy efficiency by reducing power consumption and assessing how to achieve a sustainable ecosystem with emerging technologies. The Working Group will evaluate the environmental impact of a broad range of sources including water and materials consumption as well as the use of renewable or ambient energy.

“While innovation frequently occurs in response to market needs, long-term technology leadership takes strategic foresight and critical stakeholders committed to reaching the desired future state,” said Susan M. Miller, President and CEO, ATIS. “With its leadership set and work on both sustainability and the 6G Roadmap launched, the Next G Alliance is well positioned to create a national vision for the next decade.”

Thus far, the Next G Alliance has united 45 of the leading information and communications companies in a shared commitment to advance the evolution of 5G, chart the future of 6G technology and put North America at the forefront of wireless technology leadership for the next decade and beyond. The membership spans infrastructure, semiconductors and device vendors; operators; hyper-scalers and other organizations, including those in the area of research.

If your company is interested in joining, contact ATIS Membership Director Rich Moran.

Learn more about the Next G Alliance at: https://nextgalliance.org/

About ATIS:

As a leading technology and solutions development organization, the Alliance for Telecommunications Industry Solutions (ATIS) brings together the top global ICT companies to advance the industry’s business priorities. ATIS’ 150 member companies are currently working to address 6G, 5G, robocall mitigation, IoT, Smart Cities, artificial intelligence-enabled networks, distributed ledger/blockchain technology, cybersecurity, emergency services, quality of service, billing support, operations, and much more. These priorities follow a fast-track development lifecycle – from design and innovation through standards, specifications, requirements, business use cases, software toolkits, open source solutions, and interoperability testing.

ATIS is accredited by the American National Standards Institute (ANSI). ATIS is the North American Organizational Partner for the 3rd Generation Partnership Project (3GPP), a founding Partner of the oneM2M global initiative, a member of the International Telecommunication Union (ITU), as well as a member of the Inter-American Telecommunication Commission (CITEL). For more information, visit www.atis.org. Follow ATIS on Twitter and on LinkedIn.

Editorial Comment:

We think it’s very premature to start an INDEPENDENT group to plan the future of 6G networks for North America. That’s because 5G standards and specs are not even close to be finished. The standardization work on 6G hasn’t started in earnest yet. There’s only an ITU-R draft report on “Technology Trends of terrestrial IMT systems towards 2030 and beyond,” which is scheduled to be completed in July 2022.

Regarding 5G standards and specs being incomplete, revision 6 of ITU-R M.1036 recommendation specifying Frequency Arrangements for the terrestrial component of IMT (including 5G/IMT 2020) has not yet been agreed upon yet in ITU-R WP5D. It should include all the WRC 19 recommended frequencies for 5G/IMT 2020, especially mmWave.

Another example is that 3GPP Release 16 URLLC in the RAN [Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC)] has not been completed, despite that release being frozen last July.

3GPP Release 16 5G NR-URLLC in the RAN spec status as of as of March 25, 2021:

- RP-191584 5G NR Physical Layer Enhancements for Ultra-Reliable and Low Latency Communication (URLLC) [UID=830074 and CODE=NR_L1enh_URLLC] was 37% complete. It is scheduled for completion June 12, 2022).

- RP-190726 Performance part: Physical Layer Enhancements for NR Ultra-Reliable and Low Latency Communication (URLLC) spec was 0% complete and hasn’t been updated since 2019.

- RP-200472 revised NR performance requirement enhancement [UID=840094 CODE=NR_perf_enh] was 0% complete.

URLLC Enhancement of URLLC support in the 5G Core network (UID=830098) is stated to be 90% complete.

Note also that there are no ITU-T recommendations/standards that specify implementation for IMT 2020/5G non radio aspects. All the work is being done in 3GPP and at a reference architecture level that does NOT specify detailed implementation. That applies to 3GPP specs on 5G core network, network slicing, and other highly touted 5G features.

Hence, there will surely be many implementations of 5G “cloud native” core networks, network slicing, virtualization, security, etc

We think any 6G technology aspects and specification work should be done in ITU-R WP5D for the RAN and 3GPP for the RAN and Core network.

References:

https://www.3gpp.org/DynaReport/GanttChart-Level-2.htm#bm830074

ETNO Report: €300bn still missing for networks

European telecom operators have released a new report on how the sector can contribute to digital transformation and economic recovery. The “Connectivity and Beyond: How Telcos Can Accelerate a Digital Future For All” report from industry group ETNO (European Telecoms Network Operator’s association) and consulting firm BCG comes ahead of a summit of EU leaders to discuss industrial and digital policy, among other topics. The European network operators expressed the need for significant investments to realize the economic benefits of digital infrastructure.

The report sees the potential to create 2.4 million new jobs in the next four years through investment in digital transformation. This will require the telecom operators to invest EUR 300 billion in networks, along with additional action to stimulate demand and improve digital skills.

In order to achieve the opportunity, Europe must dramatically ramp up its network investment capacity to achieve gigabit speeds across territories and ensure full digital inclusion. BCG estimates €150bn is still needed to achieve a full-5G scenario in Europe, while an additional €150bn is required to finish upgrading fixed infrastructure to gigabit speeds.

However, increased investment is also much needed on the demand side, with 83% of EU SMEs still not using advanced cloud and 60% of 9 year-olds currently educated in schools that are not digitally equipped. BCG estimates that upgrading the digital infrastructure of all European schools would require €14bn/year, which corresponds to 1.8% of the Next Generation EU fund. Similarly, digitalizing all European SMEs would require €26bn/year, or 3.5% of the Next Generation EU fund.

BCG analysis finds that 5G alone can generate an annual increase of EUR 113 billion in GDP and 2.4 million new jobs in Europe by 2025. A widespread uptake of digital solutions can also help reduce carbon emissions, by up to 15 percent, the report said. This is based on rolling out smart city services and digital transformation in the transport sector.

The report highlighted the significant investment needed to realize these gains, saying Europe will need to ramp up network spending quickly to achieve its goals. BCG estimates it will cost EUR 150 billion to bring 5G to all of Europe and another EUR 150 billion to upgrade fixed infrastructure to gigabit speeds. More can be done also to stimulate demand, such as supporting digital transformation among small businesses and bringing internet infrastructure and digital skills training to schools, the report said.

The EU members agreed last year that 20 percent of the EUR 750 billion economic recovery fund should go to digital investment. ETNO members are hoping part of this funding can go towards supporting investment in the next generation of telecom networks.

The report details a series of “urgent” policy actions to support these aims, including increasing the attractiveness of investment in roll-out, allowing for more industry collaboration and scale in the sector, stimulating demand and digital transformation across industrial sectors, prioritizing leadership in European digital services and investment in digital skills.

References:

https://etno.eu/news/all-news/704-etno-bcg.html

https://etno.eu/library/reports/96-connectivity-and-beyond.html

Altiostar and Rakuten Mobile Demonstrate Success for Open RAN Network in Japan

Rakuten Mobile and Altiostar have announced a number of performance and scalability achievements for the Rakuten Mobile 4G and 5G Open RAN deployments in Japan. That network, built on Altiostar’s cloud-native Open vRAN software, was said to achieve superior levels of automation and performance.

Rakuten Mobile launched its 4G network in April 2020. The wireless network operator ended January 2021 with more than 11,000 base stations that cover 74.9 percent of the population. Rakuten Mobile plans to expand its network coverage to 96 percent of Japan’s population coverage by summer this year. That’s about five years ahead of its own schedule! The network has achieved both high performance (number one in upload speed in market at 16.8Mbps, per OpenSignal), despite having only 1/6th of the spectrum holdings of competing operators in market.

In September 2020, five months after the initial launch, Rakuten Mobile launched a commercial-scale, cloud-native 5G network, using Altiostar’s Open vRAN service. As baseband functions are deployed as VNFs (virtual network functions), Rakuten Mobile automated various operational tasks such as new cell site integration (auto-commissioning), as well as fault detection and automated recovery from failures (self-healing). Due to the automation of its network, Rakuten Mobile reports it can provide a new 5G cell site in four minutes and a 4G site in eight minutes.

The 5G network, using advanced massive MIMO and millimeter wave (mmWave) radios, covers both sub-6 GHz and mmWave frequency bands. Altiostar worked with Qualcomm Technologies, Airspan, and Rakuten Mobile on innovation in mmWave radios based on Qualcomm 5G RAN platforms. Altiostar partnered with NEC and Rakuten Mobile to introduce to the 5G network the sub-6 GHz massive MIMO radios, which were validated as compliant with O-RAN specifications during an O-RAN Alliance Plugfest held this past September in India.

The 5G network has demonstrated impressive performance for end users, with throughput of 1.77 Gbps. This compares favorably to data from a Ookla, which detailed speed test results for Japan in Q3 2020, where the fastest 10% of users realized an average download speed of 719.42 Mbps.

Image Credit: Altiostar

“Rakuten has been a disruptor in the mobile space and our 4G and 5G Open vRAN deployments reflect this strategy,” said Tareq Amin, Representative Director, Executive Vice President and Chief Technology Officer at Rakuten Mobile. “The performance and stability of the 5G network shows that a cloud-native framework and web-scale architecture can compete with a traditional RAN approach and provide new levels of automation to the network. We will continue to drive the transformation of the mobile industry with a rich and diverse ecosystem with companies including Altiostar, Qualcomm Technologies and NEC.”

“Rakuten has been at the forefront of the Open vRAN movement since it began. The industry is closely watching its every step, and it has been able to demonstrate a high-quality experience for their customers,” said Stéphane Teral, Chief Analyst, LightCounting. “This is validated by the performance metrics of their 5G network and I am excited to see the next steps they take as the network goes national.”

“This is a significant milestone for the Rakuten Mobile and Altiostar partnership towards commercial realization of a high performing, cloud-native 5G RAN architecture,” said Ashraf Dahod, CEO of Altiostar. “The Altiostar container-based solution allows Rakuten Mobile to quickly provision new sites and turn up service for a customer in record time. By leveraging the power of an Open virtualized RAN, Rakuten can transform its network and its business to provide a robust service for the consumer that exceeds that of a traditional operator.”

Altiostar has partnered with Rakuten Mobile to design and deploy its Open vRAN. Rakuten Mobile has standardized on the Altiostar Open vRAN software for all types of deployment models from small cells to macro to massive MIMO, across 4G and 5G radio access technologies.

About Altiostar

Altiostar provides 4G and 5G open virtualized RAN (Open vRAN) software that supports open interfaces and virtualizes the radio access baseband functions to build a disaggregated multi-vendor, web-scale, cloud-based mobile network. Operators can add intelligence, quickly adapt the network for different services and automate operations to rapidly scale the network and reduce Total Cost of Ownership (TCO). Altiostar collaborates with a growing ecosystem of partners to support a diverse Open RAN supply chain.

The company was selected by Dish last June to deliver its cloud-native O-RAN compliant solution for DISH’s nationwide 5G network buildout, the first of its kind in the U.S. The Altiostar solution will provide openness, modularity, agility and scalability to DISH, enabling faster deployment of new 5G services for consumers and businesses.

The Altiostar Open vRAN solution has been deployed globally, including the world’s first cloud-native commercial-scale mobile network with Rakuten Mobile in Japan. For more information, visit www.altiostar.com

About Rakuten Mobile

Rakuten Mobile, Inc. is a Rakuten Group company responsible for mobile communications, including mobile network operator (MNO) and mobile virtual network operator (MVNO) businesses, as well as ICT and energy. Through continuous innovation and the deployment of advanced technology, Rakuten Mobile aims to redefine expectations in the mobile communications industry in order to provide appealing and convenient services that respond to diverse customer needs.

Qualcomm 5G RAN Platform is a product of Qualcomm Technologies, Inc. and/or its subsidiaries.

Qualcomm is a trademark or registered trademark of Qualcomm Incorporated.

SOURCE: Altiostar

……………………………………………………………………………………………………………………………………………

References:

References:

NTT DOCOMO selects Samsung for 5G and O-RAN network solutions

Samsung Electronics announced on Monday that it has been selected as a 5G network solutions provider for NTT DOCOMO, the leading mobile operator in Japan with 82 million customers. Samsung will support DOCOMO (now wholly owned by NTT Corp.) with its innovative 5G technology, including O-RAN-compliant solutions, to bring enriched 5G services to users, advance digital transformation for businesses, and improve society at large.

As part of its ongoing strategy to deliver an advanced network and provide customers an array of enhanced mobile services, DOCOMO leverages leading edge-technologies in its 5G network.

“As a leading mobile operator, our goal is to provide our customers the best possible services for creating innovative, fun and exciting experiences and finding solutions to social issues,” said Sadayuki Abeta, General Manager of the Radio Access Network Development Department at NTT DOCOMO. “We are excited to collaborate with Samsung for the next phase of 5G Open RAN and accelerate the expansion of our ‘Lightning Speed 5G’ coverage in the nation.”

“We are pleased to be part of DOCOMO’s 5G networks and look forward to continued collaboration in advancing 5G innovation for their customers,” said Satoshi Iwao, Vice President and Head of Network Division at Samsung Electronics Japan. “Our goal is to leverage Samsung’s technical leadership to bring the best network solutions to mobile operators around the world, so they can deliver the next generation of transformative 5G services and electrifying user experiences.”

“The agreement between NTT DOCOMO and Samsung is significant,” said Stefan Pongratz, Vice President at Dell’Oro. “NTT DOCOMO has a history of being at the forefront with new and innovative technologies and this announcement cements Samsung’s position as a major 5G RAN supplier.”

Samsung says they have pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios, and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from fully virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing connectivity to hundreds of millions of users around the world.

This is the latest in a series of recent contract awarded to Samsung. The company scored its biggest win when it received a $6.6 billion 5G contract from Verizon, replacing Nokia. It got a contract from Canada’s SaskTel earlier this month and is also in talks with European telecom operators to gain a foothold on the continent.

It is supplying 5G RAN to New Zealand’s Spark and last week announced it will be the sole 4G/5G core and RAN supplier to Sasktel. Samsung also supplies 5G RAN and core equipment to SK Telecom and KT in its home market.

NTT DoCoMo already has a broad slate of 5G vendors. Fujitsu supplies RAN equipment, NEC core and edge, Nokia baseband and Ericsson (a major supplier to rival KDDI) supplies RAN optimization. Six weeks after DoCoMo, a founding member of the O-RAN Alliance, unveiled its “5G Open RAN Ecosystem” aimed at “accelerating open RAN introduction to operators” worldwide. Members include NEC, Fujitsu, Mavenir, Intel and Qualcomm which are DoCoMo’s own team of preferred open RAN solution vendors.

………………………………………………………………………………………………………………………………………

References:

https://news.samsung.com/global/samsung-collaborates-with-ntt-docomo-on-5g

https://www.lightreading.com/asia/samsung-networks-lands-docomo-for-5g-open-ran/d/d-id/768255?

North American Cloud and Traditional Telco CapEx Drops in 4th Quarter 2020

Subhead: Exceptional 4Q Cloud & Colo Operator Spending in APAC

|

||||

|

||||

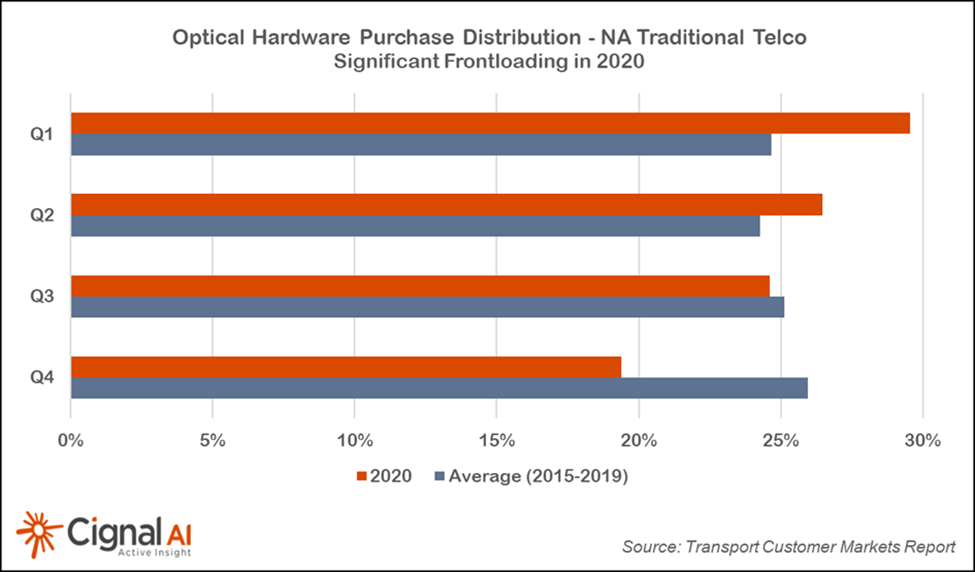

More Key Findings from the 4Q20 Transport Customer Markets Report:

Separately, Cignal AI said on March 16th that Ciena’s revenue decline this quarter was steeper than forecast, but the company is poised to grow revenues based on the success of its WaveLogic 5e fifth generation coherent technology. On March 2nd, Cignal AI said that Infinera originally expected its ICE6 technology to enter the market in the second half of 2020. The company’s current guidance now indicates a 2H21 arrival. Infinera reports a strong order pipeline, but has not specified exactly when the first ICE6 will ship for revenue. About the Transport Customer Markets Report:

About Cignal AI:

References:https://cignal.ai/opteq-hw-dashboard/https://cignal.ai/free-articles/

|

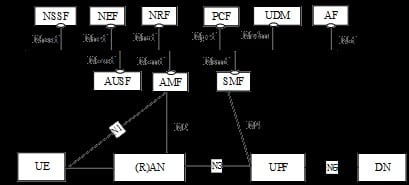

Evaluating Gaps and Solutions to build Open 5G Core/SA networks

by Saad Sheikh, Vice President and Chief Architect, SouthTel, South Africa

Since the “freezing” of the much awaited 3GPP Release-16 in July 2020, many network equipment vendors have sought to develop 5G core/5G stand alone (5G SA) network capabilities. Those includee network slicing. massive IoT. uRLLC (ultra reliable, ultra low latency communications), edge network computing, NPN (non public network) and IAB (Integrated Access and Backhaul), etc.

It is just natural that all of the big telco’s in APAC and globally have started their journey towards 5G Standalone (5G SA) core network. However, most of the commercial deployments are based on vendor E2E stack which is a good way to start the journey and offer services quickly.

Yet there’s a big caveat: With the type of services and versatility of solution specially on the industry verticals required and expected from both 3GPP Release16 and 5G SA core network it is just a matter of time when network equipment vendors cannot fulfill all the solutions and that is when a dire need to build a Telco grade Cloud platform will become a necessity.

During the last two years we have done a lot of work and progress in both better understanding of what will be the Cloud Native platforms for the real 5G era. As of now, the 5G Core container platforms from an open cloud perspective are not fully ready but we are also not too far from making it happen.

2021 is the year that we expect a production ready open 5G native cloud platform avoiding all sorts of vendor lock ins.

…………………………………………………………………………………………………………………………….

Let’s try to understand top issues enlisted based on 5G SA deployments in Core and Edge network:

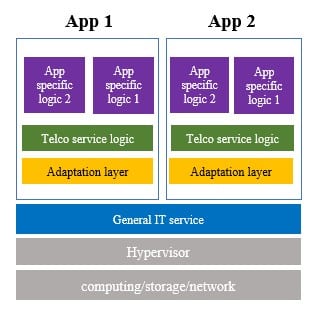

- Vendors are mostly leveraging existing NFVI to evolve to CaaS by using a middle layer shown Caas on Iaas. The biggest challenge is this interface is not open which means there are many out of box enhancements done by each vendor. This is one classic case of “When open became the new closed.”

Reference: https://cntt-n.github.io/CNTT/doc/ref_model/chapters/chapter04.html

The most enhancement done on the adaptors for container images are as follows:

- Provides container orchestration, deployment, and scheduling capabilities.

- Provides container Telco enhancement capabilities: Huge page memory, shared memory, DPDK, CPU core binding, and isolation

- Supports container network capabilities, SR-IOV+DPDK, and multiple network planes.

- Supports the IP SAN storage capability of the VM container.

- Migration path from Caas on IaaS towards BMCaaS is not smooth and it will involve complete service deployment, it is true with most operators investing heavily in last few years to productionize the NFVi no body is really considering to empty pockets again to build purely CaaS new and stand-alone platform however smooth migration must be considered.

- We are still in early phase of 5G SA core and eMBB is only use case so still we have not tested the scaling of 5G Core with NFVi based platforms.

- ETSI Specs for CISM are not as mature as expected and again there are a lot of out of the box. customizations done by each vendor VNFM to cater this.

Now let’s consider where the open platforms are lacking and how that might be fixed.

Experience #1: 5G Outgoing traffic from PoD:

The traditional Kubernetes and CaaS Platforms today handles and scales well with ingress controller however 5G PoD’s and containers outgoing traffic is not well addressed as both N-S and E-W traffic follows same path and it becomes an issue of scaling finally.

We know some vendors like Ericsson who already bring products like ECFE and LB in their architecture to address these requirements.

Experience#2: Support for non-IP protocols:

PoD is natively coming with IP and all external communication to be done by Cluster IP’s it means architecture is not designed for non-IP protocols like VLAN, L2TP, VLAN trunking

Experience#3: High performance workloads:

Today all high data throughputs are supported CNI plugin’s which natively are like SR-IOV means totally passthrough, an Operator framework to enhance real time processing is required something we have done with DPDK in the open stack world

Experience#4: Integration of 5G SBI interfaces:

The newly defined SBI interfaces became more like API compared to horizontal call flows, however today all http2/API integration is based on “Primary interfaces” .

It becomes a clear issue as secondary interfaces for inter functional module is not supported.

Experience#5: Multihoming for SCTP and SI is not supported:

For hybrid node connectivity at least towards egress and external networks still require a SCTP link and/or SIP endpoints which is not well supported

Experience#6: Secondary interfaces for CNF’s:

Secondary interfaces raise concerns for both inter-operability, monitoring and O&M, secondary interfaces is very important concept in K8S and 5G CNF’s as it is needed during

- For all Telecom protocols e.g BGP

- Support for Operator frameworks (CRD’s)

- Performance scenarios like CNI’s for SR-IOV

Today, only viable solution is by NSM i.e. a service mesh that solves both management and monitoring issues.

Experience#7: Platform Networking Issues in 5G:

Today in commercial networks for internal networking most products are using Multus+VLAN while for internal based on Multus+VxLAN it requires separate planning for both underlay and overlay and that becomes an issue for large scale 5G SA Core Network

Similarly, top requirements for service in 5G Networks are the following:

- Network separation on each logical interface e.g VRF and each physical sub interface

- Outgoing traffic from PoD

- NAT and reverse proxy

Experience#8: Service Networking Issues in 5G:

For primary networks we are relying on Calico +IPIP while for secondary network we are relying ion Multus

Experience#9: ETSI specs specially for BM CaaS:

Still I believe the ETSI specs for CNF’s are lacking compared to others like 3GPP and that is enough to make a open solution move to a closed through adaptors and plugin’s something we already experienced during SDN introduction in the cloud networks today a rigorous updates are expected on

- IFA038 which is container integration in MANO

- IFA011 which is VNFD with container support

- Sol-3 specs updated for the CIR (Container image registry) support

Experience#10: Duplication of features on NEF/NRM and Cloud platforms:

In the 5G new API ecosystem operators look at their network as a platform opening it to application developers. API exposure is fundamental to 5G as it is built into the architecture natively where applications can talk back to the network, command the network to provide better experience in applications however the NEF and similarly NRF service registry are also functions available on platforms. Today it looks a way is required to share responsibility for such integrations to avoid duplicates.

Reference Architectures for the Standard Platform:

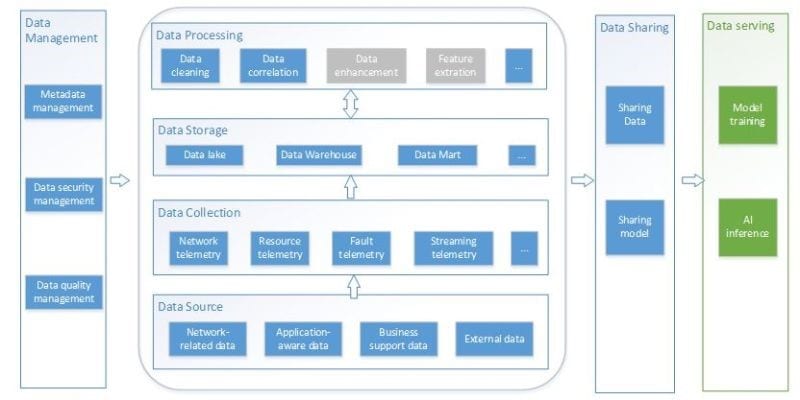

Sol#1: Solving Data Integration issues

Real AI is the next most important thing for telco’s as they evolve in their automation journey from conditional #automation to partial autonomy . However to make any fully functional use case will require first to solve #Data integration architecture as any real product to be successful with #AI in Telco will require to use Graph Databases and Process mining and both of it will based on assumption that all and valid data is there .

Sol#2: AI profiles for processing in Cloud Infra Hardware profiles

With 5G networks relying more on robust mechanisms to ingest and use data of AI , it is very important to agree on hardware profiles that are powerful enough to deliver AI use cases to deliver complete AI pipe lines all the way from flash base to tensor flow along with analytics .

Sol#3: OSS evolution that support data integration pipeline

To evolve to future ENI architecture for use of AI in Telco and ZSM architecture for the closed loop to be based on standard data integration pipeline like proposed in ENI-0017 (Data Integration mechanisms).

Sol#4: Network characteristics

A mature way to handle outgoing traffic and LB need to be included in Telco PaaS.

Sol#5: Telco PaaS

Based on experience with NFV it is clear that IaaS is not the Telco service delivery model and hence use cases like NFVPaaS has been in consideration for the early time of NFV . With CNF introduction that will require a more robust release times it is imperative and not optional to build a stable Telco PaaS that meet Telco requirements. As of today, the direction is to divide platform between general PaaS that will be part of standard cloud platform over release iterations while for specific requirements will be part of Telco PaaS.

The beauty of this architecture is no ensure the multi-vendor component selection between them. The key characteristics to be addressed are discussed below.

Paas#1: Telco PaaS Tools

The agreement on PaaS tools over the complete LCM , there is currently a survey running in the community to agree on this and this is an ongoing study.

Reference: https://wiki.anuket.io/display/HOME/Joint+Anuket+and+XGVELA+PaaS+Survey

Paas#2: Telco PaaS Lawful interception

During recent integrations for NFV and CNF we still rely on Application layer LI characteristics as defined by ETSI and with open cloud layer ensuring the necessary LI requirements are available it is important that PaaS include this part through API’s.

Paas#3: Telco PaaS Charging Characteristics

The resource consumption and reporting of real time resources is very important as with 5G and Edge we will evolve towards the Hybrid cloud.

Paas#4: Telco PaaS Topology management and service discovery

A single API end point to expose both the topology and services towards Application is the key requirement of Telco PaaS

Paas#5: Telco PaaS Security Hardening

With 5G and critical services security hardening has become more and more important, use of tools like Falco and Service mesh is important in this platform

Paas#6: Telco PaaS Tracing and Logging

Although monitoring is quite mature in Kubernetes and its Distros the tracing and logging is still need to be addressed. Today with tools like Jaeger and Kafka /EFK needs to be include in the Telco PaaS

Paas#7: Telco PaaS E2E DevOps

For IT workloads already the DevOps capability is provided by PaaS in a mature manner through both cloud and application tools but with enhancements required by Telco workloads it is important the end-to-end capability of DevOps is ensured. Today tools like Argo need to be considered and it need to be integrated with both the general PaaS and Telco PaaS

Paas#9: Packaging

Standard packages like VNFD which cover both Application and PaaS layer.

Paas#8: Standardization of API’s

API standardization in ETSI fashion is the key requirement of NFV and Telco journey and it needs to be ensured in PaaS layer as well. For Telco PaaS it should cover VES , TMForum,3GPP , ETSI MANO etc . Community has made following workings to standardize this

- TMF 641/640

- 3GPP TS28.532 /531/ 541

- IFA029 containers in NFV

- ETSI FEAT17 which is Telco DevOps

- ETSI TST10 /13 for API testing and verification

Based on these features there is an ongoing effort with in the LFN XGVELA community and I hope more and more users, partners and vendors can join to define the Future Open 5G Platform

Reference: https://github.com/XGVela/XGVela/wiki/XGVela-Meeting-Logistics

………………………………………………………………………………………………………………………………….

………………………………………………………………………………………………………………………………….

Glossary:

|

Term |

Description |

|

NFV |

Network Function Virtualization |

|

VNF |

Virtual Network Functions |

|

CNF |

Containerized Network Functions |

|

UPF |

User Plane Function |

|

AMF |

Access Management Function |

|

TDF |

Traffic Detection Function |

|

PCF |

Policy Charging Function |

|

NSSF |

Network Slice Subnet Function |

|

UDSF |

Unstructured Data Storage Function |

|

A & AI |

Active and Available Inventory |

|

CLAMO |

Control Loop Automation Management Function |

|

NFVI |

Network Function Virtualized Infrastructure |

|

SDN |

Software Defined Networks |

|

VLAN |

Virtual LAN |

|

L2TP |

Layer2 Tunneling Protocol |

|

SBI |

Service Based Interface |

|

NRF |

Network Repository Function |

|

NEF |

Network Exposure Function |

|

NAT |

Network Address translation |

|

LB |

Load Balance |

|

HA |

High Availability |

|

PaaS |

Platform as a Service |

|

ENI |

Enhanced Network Intelligence |

|

ZSM |

Zero touch Service Management |

|

EFK |

Elastic search, FLuentd and Kibana |

|

API |

Application Programming Interface |

………………………………………………………………………………………………………………………………..

About Saad Sheikh:

Saad Sheikh is an experienced telecommunications professional with more than 18 years of experience for leading and delivering technology solutions . He is currently Vice President and Chief Architect with Southtel, which is the leading System integrator in South Africa. There he is leading 5G, Cloud, Edge Networking, Open RAN, Networking and Automation units. He is helping to bring the power of innovative solutions to Africa.

Prior to this he was Chief Architect with STC (Saudi Telecom Company) where he lead the company Cloud Infrastructure Planning and Architecture Design to deliver large scale 5G , NFV , SDN and Cloud projects in Middle East. Previously, he held senior positions with both vendors and operators in Asia, Africa and APAC driving large scale projects in IT and Telecom.

India’s BSNL Selects NOVELSAT Hub System for Remote Islands Connectivity

NOVELSAT’s High Performance Hub Will Enhance Broadband Connectivity to Lakshadweep, Andaman and Nicobar Islands. The contract was awarded by System Integrator Precision Electronics Ltd (PEL) on behalf of BSNL.

State-run telecoms provider (BSNL) selected Israeli satellite transmission company Novelsat to provide high-capacity satellite-based backhaul and broadband services to Lakshadweep, Andaman, and Nicobar Islands under a Universal Service Obligation (USO) project funded by the Department of Telecommunications (DoT). The contract was awarded by System Integrator Precision Electronics Ltd (PEL) on behalf of BSNL.

Under the partnership, BSNL will use Novelsat’s Xnet Data Hub system [1.] for flexibility in its growing network. BSNL will also use Novelsat’s DynamiX technology for dynamic allocation of network resources in MCPC/Point-to-Multi-Point networks on top of Novelsat’s NS4 waveform for improved network economics, the company said.

Note 1. The Xnet Data Hub is for Point-to-Multi-Point satellite network data applications requiring high performance connectivity. Addressing multiple applications including enterprise, backhaul & trunking, government & defense, aero and maritime, NOVELSAT Xnet Data Hub delivers highly integrated and optimized and efficient hub solution.

Satellite backhaul more practical than fiber backhaul for remote islands:

Satellite has always been the advantageous solution for remote and hard to reach locations. As cost of satellite capacity continues to sharply decrease, satellite connectivity cost now rivals terrestrial solutions in a growing number of use cases, making satellite connectivity a viable and economical solution for providing connectivity to more locations and more users. Offering compressive point-to-point and point-to-multi-point solutions, NOVELSAT provides high data rate broadband connectivity for demanding telecom and enterprise applications including: backhaul, trunking, backbone networks, enterprise networks, maritime and aero connectivity.

…………………………………………………………………………………………………………………………………………

BSNL is looking to increase its network capacity to address growing demand for broadband amidst sharp rise in data consumption across users and locations. PEL along with its technology partner NOVELSAT addressed the BSNL requirement, and in turn their customer BSNL selected NOVELSAT’s Xnet Data hub system for the exceptional efficiency and flexibility it offers for growing BSNL network.

Designed to support the growing needs of hub network operators, NOVELSAT’s Xnet optimizes and maximizes both performance and usage of satellite and network resources. Utilizing NOVELSAT’s DynamiX technology for dynamic allocation of network resources in MCPC/Point-to-Multi-Point networks on top of the most bandwidth-efficient waveform, NOVELSAT NS4™, significantly improves network economics.

NOVELSAT partnered with Precision Electronics Limited, a listed company in India to offer its solution to BSNL. Precision Electronics Limited brings in network elements like networking gear, antenna & indoor/outdoor electronics, and overall systems integration beyond the core satellite hub and remote solution from NOVELSAT.

“BSNL’s network requires the highest levels of network quality and flexibility. NOVELSAT’s proven track record, combined with its leading-edge technology, allow us to rapidly expand our network and offer better services to our customers,” said Sh. Sanjay Kumar, GM (Radio) at BSNL. “NOVELSAT has been selected to meet our challenge of providing highly efficient and reliable broadband connectivity between our country’s islands and the mainland. With this solution we are supporting the goal of accelerating the economic growth and bettering the life of the islands population”.

“We are honored to play a part in the rollout of enhanced broadband connectivity to the people of Lakshadweep, Andaman, and Nicobar Islands, and we are committed to supporting BSNL during these challenging times, as it implements its network development,” said Gary Drutin, CEO of NOVELSAT. “The BSNL deployment is a great example of the benefits offered by NOVELSAT’s Xnet data hub system, delivering a high capacity, scalable solution with maximum performance and efficiency.”

Last month, U.S.-based ST Engineering iDirect inked a partnership with BSNL to provide satellite broadband to the Indian islands of Andaman & Nicobar and Lakshadweep.

About BSNL

BSNL is an Indian state-owned telecommunications company, headquartered in New Delhi, India. It was incorporated by the Department of Telecommunications (DOT), Ministry of Communications, Government of India in 2000. It provides mobile voice and internet services through its nationwide network across India. It is the largest government owned telecom company in India offering variety of services in retail and enterprise segment.

About PEL

Precision Electronics Ltd. (PEL) is a listed company that is focused to provide customized mission critical solutions to its customers. Backed by a strong Design & Engineering team and a state of art manufacturing infrastructure, PEL designed products are being used by the Indian defence/paramilitary forces, TSPs, Railways, Healthcare sector to name a few. It is strongly poised to garner substantial business in the near future.

About Novelsat

NOVELSAT is an innovator and a leading provider of next-generation content connectivity solutions over satellite. Powered by our innovative technology, our solutions are transforming network capabilities to drive new experiences and expand growth potential.

Our leadership foundations are built around our proprietary waveform and premier system architecture, combined with cutting-edge video capabilities and best-in-industry content security. Pioneering, expanding and enhancing core and end-to-end capabilities, we outperform competitive solutions and products, delivering new levels of performance, efficiency and flexibility. Our high-performance solutions are setting the industry standards in spectral efficiency, transmission performance, media processing, video delivery, and content protection, powering mission-critical and demanding applications for the broadcast, cellular, government, and mobility markets.

World’s leading service and content providers have recognized the unique value of our state-of-the-art technology, selecting our solutions for their most demanding applications, including: Video transmission for the world’s leading broadcasters and content rights holders, as well as for the world’s major sports events; Broadband connectivity for backhaul/trunking networks of leading network operators and services providers; Mission critical communications for military, defense, security and emergency organizations; and Earth observation connectivity for leading earth observation constellation.

………………………………………………………………………………………………………………………………………….

References:

BSNL Selects NOVELSAT Hub System for Remote Islands Connectivity

IBM, Samsung Electronics, and M1 Unveil Singapore’s 1st 5G Industry 4.0 Studio

IBM, Samsung Electronics and Singapore network operator M1 opened the IBM Industry 4.0 Studio, which will combine advanced 5G connectivity with artificial intelligence, hybrid cloud and edge computing functionalities to make and test innovative Industry 4.0 products for enterprises in Singapore and across the Asia Pacific region.

The Studio simulates operational use cases that demonstrate how businesses can harness the power of hybrid cloud and AI technologies and advanced 5G capabilities to transform critical operations and drive new value – from improving quality and productivity in production lines to empowering service and quality control personnel. The Studio will develop, test and benchmark real-world Industry 4.0 use cases involving autonomous guided vehicles, collaborative robots, 3-D augmented reality, and real-time AI visual and acoustic recognition and classification.

IBM worked with Samsung and M1 to deliver products that take advantage of the ultra-low latency, high reliability, and security of 5G connectivity, combining Samsung’s standalone 5G network products and mobile devices with IBM’s hybrid cloud, edge computing, and AI technologies, as well as M1’s engineering and network services expertise in the designing and integration of 5G SA products and formulation of 5G test cases to meet regulatory requirement.

Built on Red OpenShift, the Industry 4.0 use cases employ IBM’s AI products for visual and acoustic analysis and augmented reality technologies.

Supported by Singapore’s Infocomm Media Development Authority as part of Singapore’s 5G journey, the Studio is hosting the country’s first 5G Industry 4.0 trial, testing real-world applications that can be applied in the manufacturing sector, while measuring and optimising the performance of enterprise 5G for industrial use.

With full-fledged 5G standalone functionality covering at least half of Singapore by end 2022, Singapore will drive more businesses to evaluate the ways in which they can integrate 5G into their existing operations, but they need a way to trial new use cases to evaluate their adoption strategies and return on investment.

The launch is the next step in Samsung and IBM’s global strategic partnership to advance 5G and edge industry innovation through enterprise networks and through cross collaboration with global mobile operators.

“5G presents an enormous opportunity for enterprises to drive new value and transform their operations to harness the next era of industrial connectivity. This project builds on IBM’s longstanding strategic partnership with Samsung, and a shared vision with M1 and IMDA, to help businesses tap into emerging hybrid cloud and AI technologies that will define their future success. It is crucial these businesses have an opportunity to test and evaluate these technological investments, and we are committed to working shoulder to shoulder with them to ensure they make the best decisions that will truly propel their businesses forward,” said Brenda Harvey, General Manager, IBM APAC.

There are seven focus areas being explored via the Studio that could deliver transformative value for customers by applying ultra-low latency, high-bandwidth, stable and secure 5G connectivity to Industry 4.0 applications:

1. Visual Recognition solutions using IBM Maximo Visual Inspection. With 5G, this enables real-time, streaming video analytics to power use cases such as faster identification of defects on the manufacturing line or rapid sorting of parts in a warehouse environment.

2. Acoustic Insights. Applies AI to analyze audio captured by phones and tablets to uncover potential defects in server fans, for example. Combined with 5G, this enables audio streaming and more rapid analysis to enable continuous monitoring in real time.

3. Augmented reality (AR) solution, a collaboration between IBM Singapore and IBM Haifa Research Lab. For example, users can point the camera of their mobile device at equipment and view step-by-step instructions that are superimposed on the image on their screen to walk them through a procedure such as setup, testing, or repair. 5G enables rapid, dynamic access to multiple procedure models, so a technician could browse quickly from step to step without long delays to download new models. If the technician encounters a problem not covered in the procedure model, 5G enables a remote expert to provide real-time, live, peer-to-peer assistance using on-screen AR guidance.

4. Complex use cases for automated guided vehicles and collaborative robots, enabled by the low latency of 5G. For example, a robot arm uses a phone to visually scan an item; the visual is sent to the server, analysed and the result returned; the robot arm then takes action to sort or reject the item based on the Visual Inspection result. The low latency of 5G enables this process to take place in near-real-time, allowing the robot arm to immediately sort or reject parts.

5. AI models developed and deployed on edge servers, with flexibility and dynamic resource scalability via Red Hat OpenShift.

6. Container-based applications with continuous monitoring and automated management, integration, and control of multiple deployed solutions at the edge, via IBM Edge Application Manager.

7. 5G end-to-end solutions and vertical use cases for private networks. Delivering private networks that combine Samsung’s latest 5G end-to-end solutions, including the RAN and the Core, with IBM’s open hybrid cloud technologies. Additionally, exploring new vertical use cases to enable enterprises to adopt emerging technologies crucial to Industry 4.0.

Quotes:

“5G is a potential game changer for Industry 4.0. It is the critical connectivity layer that can enable smart manufacturing. I would like to congratulate IBM for the opening of its 5G-enabled Industry 4.0 studio here in Singapore. It is important for Singapore to be the place where innovative 5G solutions can be developed and deployed globally. A strong 5G ecosystem will provide more opportunities for businesses and our people. We will work with industry to forge ahead with 5G, as we architect Singapore’s digital future,” said Lew Chuen Hong, Chief Executive, IMDA.

“As a forerunner in Singapore’s 5G development, M1 is the first network operator to roll out 5G trials as early as 2018 and has developed more than 15 5G use cases, trials and partnerships – a record in the industry, in the areas of autonomous vehicles, robotics, AI and more. The endless possibilities that 5G SA network can bring to Industry 4.0 manufacturing in Singapore is set to benefit enterprises. M1’s 5G hyper-connectivity, end-to-end network slicing, ultra-low latency, as well as highly reliable and secured communications will enable businesses to work not just faster, more efficiently and securely, but smarter too. The use cases being tested and developed out of this project will help more Singapore businesses to adopt 5G, value-adding to the acceleration of Industry 4.0 and building a vibrant 5G ecosystem for Singapore,” said Manjot Singh Mann, CEO of M1.

KC Choi, Executive Vice President & Global Head of B2B Business, Mobile Communications Business, Samsung Electronics commented, “The opening of the Studio in Singapore is an important milestone in applying 5G-enabled mobile and network solutions with Industry 4.0 capabilities to help transform manufacturing. Mobile and 5G capabilities like these are empowering workers and changing the way factories and warehouses operate, bringing new efficiency and productivity to operations. Samsung is pleased to be collaborating with IBM, IMDA, and M1 in this groundbreaking project to help make 5G a reality for customers.”

References:

https://www.telecompaper.com/news/ibm-samsung-m1-open-5g-industry-40-studio-in-singapore–1376197

FCC Notice of Inquiry to discuss Open and Virtualized RANs (vs Vendor Lock-in 2.0)

The Federal Communications Commission (FCC) today adopted a Notice of Inquiry to start a formal discussion on the opportunities and potential challenges presented by open and virtualized radio access networks (RANs), and how the FCC might leverage these concepts to support network security and 5G leadership.

The FCC seeks comment on the current status of development and deployment, whether and how the FCC might foster the success of these technologies, and how to support competitiveness and new entrant access to this emerging market.

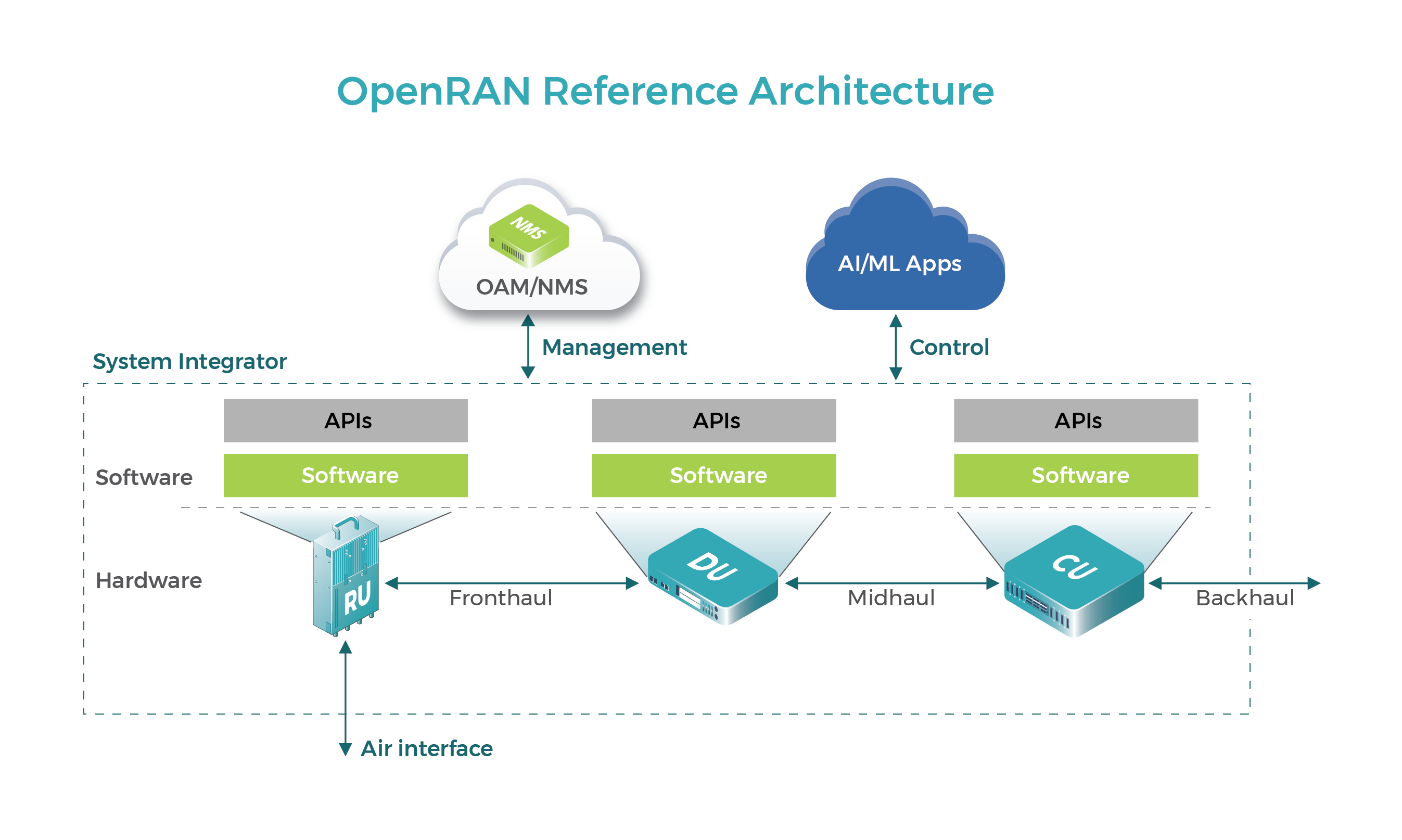

The Open Radio Access Networks (Open RAN) concept promotes the use of open interface

specifications (not standards as the FCC incorrectly stated) in the portion of the telecommunications network that connects wireless devices—like mobile phones—to the core of the network.

This can be implemented in vendor-neutral hardware and software-defined technology based on open interfaces and standards. In addition, Open RAN allows disaggregation of the radio access network, which can enable the use of interchangeable technologies that promote network security and public safety. The FCC is seeking input from academics, industry, and the public on what steps are required to deploy Open RAN networks broadly and at scale.

The Notice of Inquiry (NOI) seeks comment on the current status of Open RAN development and deployment in networks in the U.S. and abroad. It asks about the role of established large manufacturers and new entrants in setting standards for this new network architecture. It seeks input on what steps should be taken by the FCC, federal partners, industry, academia, and others to accelerate the timeline for Open RAN standards development. Further, it seeks comment on any challenges or other considerations related to the deployment, integration, and testing of systems based on Open RAN specifications. The NOI also requests comment on the costs and benefits associated with Open RAN development and deployment.

The FCC’s Technological Advisory Committee, a group of industry representatives that provides technical advice to the Commission, recently recommended that the Commission encourage the development of the Open RAN ecosystem by supporting Open RAN innovation, standardization, testing, and security and reliability. The Commission also hosted a Forum on 5G Open Radio Access Networks in September 2020.

This Notice of Inquiry seeks input on the status of Open RAN and virtualized network environments: where the technology is today and what steps are required to deploy Open RAN networks broadly and at scale. It also seeks comment on whether and, if so, how deployment of Open RAN-compliant networks could further the Commission’s policy goals and statutory obligations, advance legislative priorities, and benefit American consumers by making state-of-the-art wireless broadband available more quickly and to more people in more parts of the country.

What the Notice of Inquiry Would Do:

- Describe the relationship of recent government action to Open RAN development, including through Commission and other U.S. government action, legislative developments, and international activity.

- Seek comment on the current status of Open RAN development and deployment domestically and internationally.

- Seek comment on potential public interest benefits in promoting Open RAN development and deployment, including increased competition, network vendor diversity, affordability for consumers, network security and public safety, and other potential benefits.

- Seek comment on additional considerations regarding Open RAN development and deployment, including potential software vulnerabilities or risks posed by a virtualized operating environment. o Seek comment on barriers to Open RAN development and deployment and whether and what Commission efforts could be undertaken to promote Open RAN development and deployment.

- Seek comment on how the Commission can collaborate with and/or leverage ongoing Open RAN research and development activities in academia and other federal agencies.

- Discuss and seek comment on the costs and benefits of Open RAN deployment.

Diagram courtesy of TIP Open RAN Project

……………………………………………………………………………………………………………………….

Author Notes:

It’s important to note that there is no Open RAN work ongoing within SDOs like ITU-R, ITU-T, ETSI or IEEE. Nor is there any Open RAN activity within 3GPP. Instead, there are three consortia/forums that are working on Open RAN specifications and market awareness. They are: O-RAN Alliance, TIP Open RAN project and GSMA which will surely be the marketing arm for this technology.

In addition, there are several consortiums in the U.S., Europe, and Asia that are trying to promote Open RAN technology.

In the U.S., the Open RAN Policy Coalition “represents a group of companies formed to promote policies that will advance the adoption of open and interoperable solutions in the Radio Access Network (RAN) as a means to create innovation, spur competition and expand the supply chain for advanced wireless technologies including 5G.”

“Coalition members believe that by standardizing or “opening” the protocols and interfaces between the various subcomponents (radios, hardware and software) in the RAN, we move to an environment where networks can be deployed with a more modular design without being dependent upon a single vendor.”

The above statement is quite strange, considering that 1) There is NO ongoing standardization work on Open RAN (consortiums produce specs but NOT standards) and 2) An “open” network should not exclude vendors (e.g. Huawei, ZTE) or cause vendor lock-in.

However, it seems vendor lock-in is how Open RAN technology is being deployed today with various vendors and operators banding together to offer Open RAN technology solutions. Some examples of that include:

- Rakuten-NEC “RCS” which has been endorsed by Telefonica and supposedly sold to 15 network operators.

- Mavenir, a U.S. based software developer, has teamed up with MTI, a Taiwanese maker of radio units.

- Parallel Wireless, a Mavenir rival, has a similar partnership with China’s Comba.

- NTT DoCoMo’s open RAN ecosystem includes some prominent names in the IT and telecom sectors, such as Dell, Fujitsu, Intel, Mavenir, NEC, Nvidia, Qualcomm, Red Hat, VMware, Wind River and Xilinx.

- Telefonica, Deutsche Telekom, Orange and Vodafone pledged in a MoU to back Open RAN systems that take advantage of new open virtualized architectures, software and hardware with a view to enhancing the flexibility, efficiency and security of European networks in the 5G era.

Light Reading’s Iain Morris coined the term “Vendor Lock-in 2.0.” He says that Open RAN deployment is all about trading one form of vendor lock-in for another, as depicted in this illustration, courtesy of Light Reading:

Market research firm Omdia’s view is that “preferred partnerships” will take shape between software developers and hardware manufacturers. Its latest forecast is that open and “virtualized” radio access network products will account for roughly 9% of the total market by the end of 2024, up from just 1% in 2020.

However, rather than encouraging new RAN companies, Omdia believes the big five – Huawei, Ericsson, Nokia, ZTE and Samsung – will “probably seize the majority” of this business. The challengers, it says, simply “cannot achieve the same economies of scale as the incumbents.”

………………………………………………………………………………………………………………………………………………..

References:

https://www.fcc.gov/document/fcc-seeks-comment-open-radio-access-networks

https://docs.fcc.gov/public/attachments/DOC-370266A1.pdf

https://techblog.comsoc.org/2021/01/20/analysis-telefonica-vodafone-orange-dt-commit-to-open-ran/