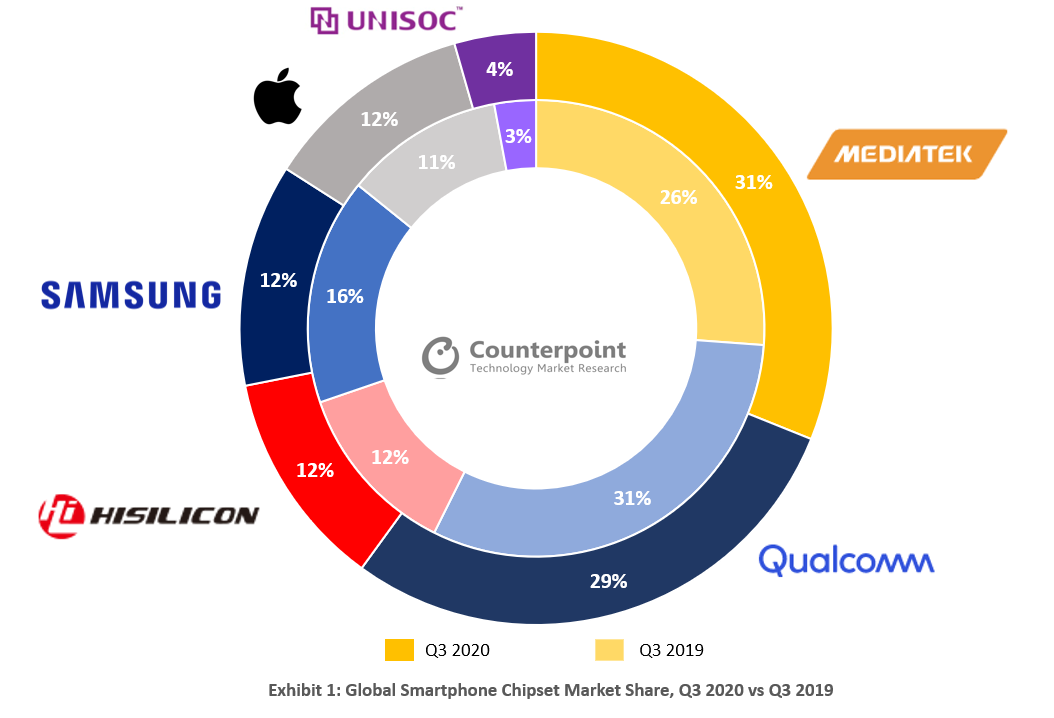

Counterpoint Research: Mediatek is world’s #1 smartphone chipset vendor

Christmas day surprise! Taiwanese fabless chipmaker Mediatek has overtaken Qualcomm and is now the #1 smartphone chipset vendor with a 31% market share in Q3 2020. Mediatek was helped by its growth in regions like India and China, and a strong performance in the $150-200 price smartphone category, according to estimates from market research firm Counterpoint Technology Market Research.

In terms of market share, MediaTek led the chipset market at the first position, followed by Qualcomm (29%), HiSilicon (12%), Samsung (12%), Apple (12%), and UNISOC (4%) respectively.

Qualcomm was the biggest 5G chipset vendor in Q3 2020. Its silicon powered 39% of the 5G phones sold worldwide. The demand for 5G smartphones doubled in Q3 2020 – 17% of all smartphones sold in Q3 2020 were 5G. This impressive growth trajectory is going to continue, more so with Apple launching its 5G line-up. One-third of all smartphones shipped in Q4 2020 are expected to be 5G enabled. There is still a chance Qualcomm will regain the top position in Q4 2020.

Source: Counterpoint Research

………………………………………………………………………………………………………………………………………………………………………………………………………

MediaTek’s Research Director Dale Gai said:

“MediaTek’s strong market share gain in Q3 2020 happened due to three reasons – strong performance in the mid-end smartphone price segment ($100-$250) and emerging markets like LATAM and MEA, the U.S. ban on Huawei and finally wins in leading OEMs like Samsung, Xiaomi and Honor. The share of MediaTek chipsets in Xiaomi smartphones has increased by more than three times since the same period last year.’

“MediaTek was also able to leverage the gap created due to the U.S. ban on Huawei. Affordable MediaTek chips fabricated by TSMC became the first option for many OEMs to quickly fill the gap left by Huawei’s absence. Huawei had also previously purchased a significant amount of chipsets ahead of the ban.”

“On the other hand, Qualcomm also posted strong share gains (from a year ago) in the high-end segment in Q3 2020, again thanks to HiSilicon’s supply issues. However, Qualcomm faced competition from MediaTek in the mid-end segment. We believe both will continue to compete intensively through aggressive pricing, and mainstream 5G SoC products into 2021.”

Counterpoint Research Analyst Ankit Malhotra said:

“Qualcomm and MediaTek have both reshuffled their portfolios, and consumer focus has played a key role here. Last year, MediaTek launched a new gaming-based G-series, while Dimensity chipsets have helped in bringing 5G to affordable categories. The world’s cheapest 5G device, the realme V3, is powered by MediaTek.”

Commenting on the outlook for chipset vendors, Malhotra added, “The immediate focus of chipset vendors will be to bring 5G to the masses, which will then unlock the potential of consumer 5G use cases like cloud gaming, which in turn will lead to higher demand for higher clocked GPUs and more powerful processors. Qualcomm and MediaTek will continue to contend for the top position.”

Source: Counterpoint Research

……………………………………………………………………………………………………………………………………………………………………………………………………..

About Counterpoint Research:

Counterpoint Technology Market Research is a global research firm specializing in Technology products in the TMT industry. It services major technology firms and financial firms with a mix of monthly reports, customized projects and detailed analysis of the mobile and technology markets. Its key analysts are experts in the industry with an average tenure of 13 years in the high-tech industry.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Separately, MediaTek 5G silicon will be used in future notebook PCs with Intel inside.

MediaTek’s T700 5G modem, which will be used to bring 5G connectivity to Intel-powered PCs, completed 5G standalone (SA) calls in real world test scenarios. Additionally, Intel has progressed on system integration, validation and developing platform optimizations for a superior user experience and is readying co-engineering support for its OEM partners. MediaTek and Intel are both committed to delivering a superior user experience.

“Our partnership with Intel is a natural extension of our growing 5G mobile business, and is an incredible market opportunity for MediaTek to move into the PC market,” said MediaTek President Joe Chen. “With Intel’s deep expertise in the PC space and our groundbreaking 5G modem technology, we will redefine the laptop experience and bring consumers the best 5G experiences.”

“A successful partnership is measured by execution, and we’re excited to see the rapid progress we are making with MediaTek on our 5G modem solution with customer sampling starting later this quarter. Building on our 4G/LTE leadership in PCs, 5G is poised to further transform the way we connect, compute and communicate. Intel is committed to enhancing those capabilities on the world’s best PCs,” said Chris Walker, Intel corporate vice president and general manager of Mobile Client Platforms.

References:

MediaTek Becomes Biggest Smartphone Chipset Vendor for First Time in Q3 2020

SK Telecom and AWS launch 5G edge cloud service and collaborate on other projects

South Korea’s #1 wireless network operator SK Telecom (SKT) has launched a 5G edge cloud service in partnership with Amazon Web Services (AWS). ‘SKT 5GX Edge’ uses AWS Wavelength at the edge of SKT’s 5G network. SKT said that SKT 5GX Edge will enable customers to develop mobile applications that require ultra-low latency.

With SKT 5GX Edge, applications are connected to ‘AWS Wavelength Zones’, which are located at the edge of SK Telecom’s 5G network, making it unnecessary for application traffic to hop through regional aggregation sites and the public internet.

SKT 5GX Edge with AWS Wavelength is expected to enable SK Telecom’s enterprise customers and developers to build innovative services in areas including machine learning, IoT, video games and streaming using the AWS services, APIs, and tools they already use.

SK Telecom and AWS started operating the first AWS Wavelength Zone in South Korea in the central city of Daejeon (140 kilometers south of Seoul) earlier this month. They plan to expand the SKT 5GX Edge infrastructure to other parts of the country, including Seoul in 2021.

SK Telecom has been cooperating with AWS since February of this year to deploy AWS Wavelength Zones on SK Telecom’s 5G network and worked with 20 enterprise customers to test the service.

SKT and AWS are actively cooperating in the area of non-face-to-face services as demand grows due to the pandemic. The two companies have been working with video conferencing solution provider Gooroomee to build an environment where two-way video conferencing and remote education services are provided without delay, and have realized a service with a latency of less than 100 milliseconds for multiple simultaneous sessions.

“With AWS Wavelength on SKT’s 5G network, customers in South Korea can develop applications that take advantage of ultra-low latencies to address use cases like machine learning inference at the edge, smart cities and smart factories, and autonomous vehicles – all while using the same familiar AWS services, API, and tools to deploy them to 5G networks worldwide,” said Matt Garman, Vice President of Sales and Marketing, AWS.

“In collaboration with AWS, SK Telecom has successfully integrated private 5G and edge cloud. By leveraging this new technology, we will lead the efforts to create and expand innovative business models in game, media services, logistics, and manufacturing industries,” said Ryu Young-sang, President of MNO at SK Telecom.

………………………………………………………………………………………………………………………………

SK Telecom and AWS also report that they have been working to improve operational stability of autonomous robots and efficiency in remote monitoring and control. Together with Woowa Brothers, the operator of food delivery app ‘Baedal Minjok,’ the two companies have completed tests of applying the 5G MEC service to outdoor food delivery robot Dilly Drive. Meanwhile, work continues with local robotics company Robotis to test run autonomous robots in the 5G cloud environment.

SK Telecom and AWS have also signed an agreement with Shinsegae I&C and Maxst to build an AR navigation and guidance system in the Coex Starfield shopping mall in Seoul. They are also working on potential use of the 5G cloud service with Deep Fine, an AR glass solution developer, and Dabeeo, a spatial recognition service provider. With the National IT Industry Promotion Agency (NIPA), SK Telecom has launched an open lab to develop realistic contents optimized for the 5G network and to support the growth of the related ecosystem.

Collaboration is also ongoing with Looxid Labs, a provider of real-time analysis for eye-gaze tracking and brain wave data, to develop services on the 5G MEC for a senior citizen center in Busan.

SK Telecom and AWS are also cooperating in the area of non-face-to-face services as demand grows due to the COVID-19 pandemic. The two companies have been working with video conferencing services provider Gooroomee to develop an environment where 2-way video conferencing and remote education services are provided without delay, and claim they have achieved a service with a latency of less than 100 milliseconds for multiple simultaneous sessions.

………………………………………………………………………………………………………………………………………………

References:

https://www.sktelecom.com/en/press/press_detail.do?page.page=1&idx=1494&page.type=all&page.keyword=

https://www.telecompaper.com/news/sk-telecom-launches-5gx-edge-cloud-service-with-aws–1366915

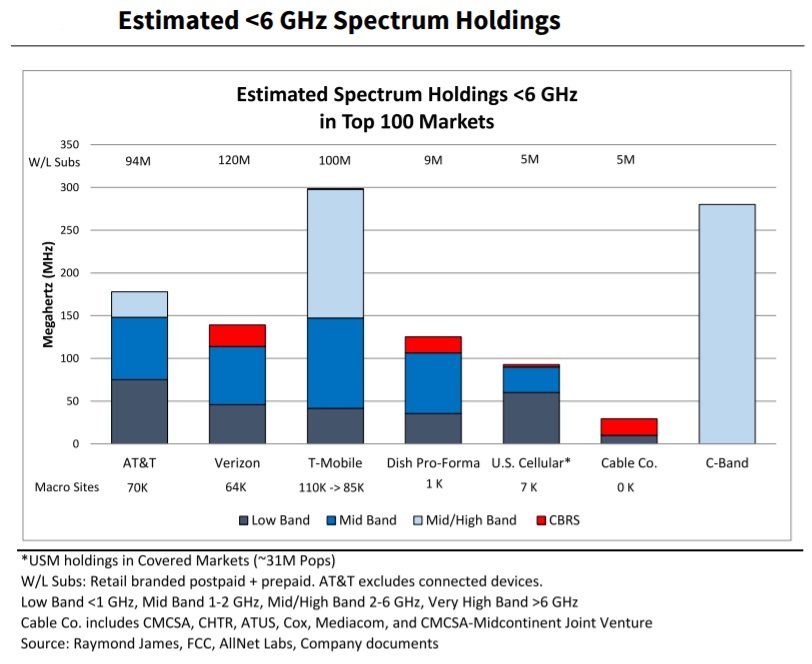

UPDATED: Mid-band Spectrum for 5G: FCC C-Band Auction at $80.9B Shattering Records

The FCC’s latest auction has raised more than $69.8 billion after three weeks of bidding, a record sum that could alter cellphone carriers’ prospects for 5G and the next decade. The C-band auction, offering 280-megahertz of spectrum, started on December 8th. Just within two weeks, it’s by far the biggest U.S. spectrum auction ever. The auction will now pause for the Christmas holidays until Jan. 4th , when total bids could move even higher.

The radio frequencies being offered range between 3.7 GHz and 4 GHz, a middle-of-the-road range considered well-suited for 5G service. New 5G smartphones can already connect to those frequencies in other countries that have licensed equivalent mid-band spectrum. The U.S. is also selling big chunks of spectrum all at once, enhancing its value.

The high offers benefit the U.S. Treasury, which will collect a windfall after the winners pay for their licenses. The victors will also need to spend at least $13 billion more to help modify equipment for a group of satellite companies that already use the frequencies. The satellite operators agreed to an FCC plan that shifts their TV transmissions to a narrower portion of the radio spectrum.

The current auction proceeds have already topped the $44.9 billion in provisional bids in a 2015 FCC sale of mid-band spectrum licenses, which U.S. cellphone carriers used at the time to enhance their 4G LTE service. Those telcos are now investing billions of dollars in 5G coverage. Some higher-end estimates for the auction had ranged from $35.2 to $51 billion.

After 45 rounds, the average nationwide price per MHz PoP price for licenses was of $0.81. That rises to $0.96 across categories when factoring in accelerated clearing payments and relocation costs to move satellite operators out of the band band, estimated at $9.7 billion and $3.3 billion respectively.

Editors Notes: The B block consists of 100 megahertz (five 20-megahertz sub-blocks) from 3.8-3.9 GHz) and the C block makes up the final 80 megahertz with four 20-megahertz sub-blocks; there are 406 available Partial Economic Areas (PEAs) across the United States. 406 available Partial Economic Areas across the United States.

…………………………………………………………………………………………………………………………….

Analysts had estimated C-band licenses would be between $0.20-$0.50 per MHz PoP (Point of Presence). The nationwide price for A block licenses per MHz Pop was $1.21 as of Wednesday, while BC prices were $1.11 per MHz PoP according to tracking by BitPath COO Sasha Javid.

Demand for most of the category A blocks (which includes the first 100-megahertz tranche of spectrum in 46 of the top 50 markets that has a clearing schedule of December 2021) has evened out. In the top 20 PEAs at the end of round 43 there were still 12 markets that had competition, mostly for BC blocks, but also a few category A, including PEAs of Miami, Phoenix, and Minneapolis-St.Paul.

PHOTO: ADREES LATIF/REUTERS

……………………………………………………………………………………………………………………………………………………

The recent bids have blown past Wall Street’s highest forecasts, suggesting that several companies are fighting over the most valuable wireless rights.

There are 57 participants in the clock phase of this auction, but each bid is cloaked in secrecy until the auction process ends. Industry analysts expect mega telcos like AT&T and Verizon Communications to obtain a large share of the licenses to match the trove of 2.5 GHz assets that rival T-Mobile US acquired from Sprint.

Wall Street analyst firms like Wells Fargo, believe Verizon will spend the most, previously estimating around $22 billion in gross proceeds to acquire 120 MHz of mid-band spectrum. AT&T could spend anywhere from $4.3 billion to $20 billion for the C-band.

All three major U.S. wireless carriers have rolled out nationwide 5G either using low-band spectrum or dynamic spectrum sharing (DSS) technology, but performance hasn’t proved better than 4G LTE. Verizon has deployed 5G with high-band millimeter wave in parts of 60 cities, and AT&T has a few mmWave markets, but mid-band is seen as the sweet spot in delivering both capacity and coverage.

Meanwhile, T-Mobile says its 2.5 GHz can deliver 300 Mbps and peak speeds up to 1 Gbps.

……………………………………………………………………………………………………………………………………………………………………………………………………..

“Mid-band spectrum will be where 5G lives,” said Walt Piecyk, a telecom analyst for research firm LightShed Partners. He added that T-Mobile’s merger with Sprint “clearly put pressure on Verizon and AT&T” to match their rival’s war chest. “When the numbers get this big, you have to assume that everybody’s getting more aggressive,” Mr. Piecyk said.

“Gross proceeds have been driven by surprisingly robust and persistent demand,” wrote Javid in an analysis Tuesday morning. “In Round 36, I suspect that a large bidder pulled back significantly in the largest markets given that all the top 10 markets experienced a drop in demand.”

Mobile service providers are also bidding against investment firms and new market entrants. Satellite provider Dish Network Corp. won many of the licenses sold in the 2015 auction. The company this month raised more cash through a $2 billion convertible-note offering to help fund more network investments. Dish is building its own 5G network after buying spectrum assets and about 8 million customers from Sprint.

Cable internet providers (MSOs) could also influence the auction’s outcome after years of experimentation with wireless services. Comcast Corp. and Charter Communications Inc. teamed up to bid in the current auction after they spent nearly $1 billion on a smaller license sale earlier this year.

…………………………………………………………………………………………………………………………………

Cellphone carriers can afford to commit to big payments given their low borrowing costs and relatively stable service revenue (AT&T is an exception due to its high debt), said Raymond James analyst Frank Louthan. “Investors see these companies as some of the most secure around,” Mr. Louthan said. “I don’t think a slight change in a debt ratio would make much of a difference. Time to market matters. We generally see prices get high when you can deploy spectrum quickly.”

The FCC won’t reveal the auction’s winners for several days after the auction ends, meaning the broader telecom industry could remain in suspense until February. Federal rules against coordinated bidding also limit what the auction participants can say about the process, restricting their ability to raise capital or discuss major deals involving spectrum.

The auction is a first step in a multiyear process. Wireless customers might not see the full band cleared for cellphone service until late 2023, though there is an early tranche slated to move by late 2021. Auction winners with no time to spare could also pay the incumbent satellite users larger fees to quicken their relocation. That would allow some companies to repurpose spectrum in base stations and related cell-tower equipment that is already transmitting data on other frequencies–just not the bands in question. The change could result in faster and more reliable 5G service.

………………………………………………………………………………………………………………………………………….

This author is astonished there has been no concern expressed regarding C-Band Auction’s Threat to Aviation. Viodi View principal Ken Pyle wrote:

The RTCA is recommending that the mobile wireless and aviation industries work with their respective regulators to take appropriate steps to mitigate the risk associated with the deployment of 5G in the C-Band. The question is what impact will this interference risk have on the rollout of 5G in the C-band?

It will be interesting to see how the potential interference risks raised by RTCA impact the rollout of 5G in the C-Band.

On December 7th, Reuters reported that House Committee on Transportation and Infrastructure Chair Peter DeFazio urged a delay in the FCC auction of C-Band spectrum over concerns it could jeopardize aviation safety. He cited a six-month review of 5G network emissions with safety-critical radio altimeter performance by the Radio Technical Commission for Aeronautics (RTCA) that found serious risks of harmful interference on all types of aircraft.

Caveat Emptor!

References:

https://www.wsj.com/articles/5g-auction-shatters-record-as-bidding-tops-66-billion-11608731335 (on-line subscription required)

https://www.fiercewireless.com/5g/c-band-nears-70b-rockets-above-prior-us-spectrum-auctions

https://www.rcrwireless.com/20201223/spectrum/fccs-auction-holiday-haul-closing-in-on-70-billion

https://viodi.com/2020/11/30/c-band-5gs-threat-to-aviation/

https://www.wsj.com/articles/everything-you-need-to-know-about-5g-11605024717

……………………………………………………………………………………………………………………………………

January 18, 2021 Update:

The Federal Communications Commission has completed the first round of the auction of the 3.7-3.98 GHz band, raising the most ever in a spectrum auction in the US. All 5,684 blocks on offer were acquired, with total bids of USD 80.9 billion, nearly twice the previous record for a FCC auction.

China tops 200M 5G subs while operators move to 5G SA

According to filings by China’s state owned telcos, China now has more than 200 million “official 5G subscribers.” China Mobile and China Telecom tallied 147.4 million and 74.9 million “5G package subscribers” respectively as of November 30, 2020. China Mobile adding nearly 19 million subs last month.

“Package subscribers” is a unique category that includes subscribers that have migrated to 5G but are still using 4G phones, which greatly overstates the actual 5G user numbers.

- China Mobile is adding 5G subs at a fast pace, with 18.6 million adds last month and 15.2 million in October.

- China Telecom added more than 7 million every month since August.

- The third telco, China Unicom, has suffered a net loss of 11.4 million subs for the year to date. It had 307.1 million mobile customers at November 30, down 1.9 million on the previous month.

Some energetic price-cutting has helped. At launch time in November 2019 the lowest package price was 128 yuan ($19.57). Now many plans are being sold at 100 yuan ($15.29) or less.

………………………………………………………………………………………………………………………………………….

Separately, the three state owned network operators are said to be close to deploying 5G standalone (SA) with a 5G core network. China Unicom and China Telecom are leading the move.

China Telecom says its 5G standalone network is commercially available in more than 300 cities, according to Sohu.

According to THEELEC, China Unicom will expand 5G network slicing technology to the whole country next year, the company said on December 7th at a press conference in Beijing. China’s third largest telco launched 5G SA network in over 300 cities this year, the company said. Last month, it added network slicing technology to its 5G network in Beijing and Guangdong Province.

Miao Shouye, the head of China Unicom’s 5G co-construction project with China Telecom, spoke at the “2020 Communication Industry Conference and the 15th Communication Technology Annual Conference” on December 17th. He said that “China has achieved full leadership in the 5G field.”

Also, that China Unicom launched the world’s first commercial network slicing service in Beijing and Guangdong in November. It will be commercially available nationwide next year, C114 reported.

Data shows that China has more than 700,000 5G base stations , accounting for 80% of the world’s total; 5G users exceed 160 million, accounting for 70% of the world’s total. The rapid development of networks and users has also driven the development of terminals. China’s 5G terminal shipments accounted for more than 60%, and 5G thousand yuan phones began to appear.

In Miao Shouye’s view, mobile internet is about to enter the 5G era. “It is estimated that by 2021, the penetration rate of 5G users in China will cross the 20% mark.”

In 2020, China Unicom has achieved good results in 5G co-construction and sharing. According to reports, as of the end of this year, the two parties have shared 5G base stations with a scale of 380,000 stations, realizing 5G coverage in cities and key counties at prefecture-level and above across the country, and completing the goal of jointly building “one network.” At the same time, co-construction and sharing also saves 5G expenses, CAPEX saves 40% and OPEX saves 35% annually. Based on such a co-built and shared network, the rate has been further improved, and the world’s highest 3.2Gbps peak experience rate of 200MHz full sharing is the first.

As the network is deployed, technology is constantly evolving. Miao Shouye pointed out that China Unicom is the first operator in the world to implement SA commercial networks . In June this year, China Unicom announced the commercialization of its 2B SA network; in September, the commercialization of 2C SA; in November, China Unicom achieved the world’s first commercial slicing in Beijing and Guangdong; it is expected that by 2021, 5G slicing will be commercialized nationwide.

In terms of security, China Unicom is actively building 5G security capabilities. The flexible combination of 5G network, MEC , and slice security capabilities provide multiple levels of protection capabilities to meet customized security requirements.

China Unicom continues to carry out technological innovation to enhance user experience. In October this year, China Unicom joined forces with Huawei to demonstrate the first 5G R17 FDD ultra-large bandwidth prototype device PoC field test. At the same time, China Unicom also cooperated with Huawei to carry out innovative experiments, and the throughput rate reached 4.7Gbps.

Miao Shouye believes that the 5G industry supply chain should work together from the terminal to the network to improve capabilities. At the terminal level, power consumption and heating issues need to be paid attention to; terminal network coordination still needs to be continuously strengthened; industry terminals/modules are lacking, shipments are small, and diversity is poor.

- At the network level, 5G standards (ITU) and specifications (3GPP) continue; 5G equipment has high energy consumption and pressure on network operating costs. Network empowerment needs to be improved, such as network slicing, 5G+TSN (Time Sensitive Networking), etc.

- At the business level, 2C killer applications still need to be explored; 5G products need to be continuously improved in practice; 2B business models need to be explored; business applications still need to be incubated.

Meanwhile, China Mobile hasn’t given a timetable for standalone deployment or services, although executives have promised they are building a “premium” SA network.

References:

https://www.lightreading.com/asia/china-5g-crosses-200m-mark-as-operators-prep-for-sa/d/d-id/766292?

Synergy Research: Hyperscale Operator Capex at New Record in Q3-2020

Hyperscale cloud operator capex topped $37 billion in Q3-2020, which easily set a new quarterly record for spending, according to Synergy Research Group (SRG). Total spending for the first three quarters of 2020 reached $99 billion, which was a 16% increase over the same period last year.

The top-four hyperscale spenders in the first three quarters of this year were Amazon, Google, Microsoft and Facebook. Those four easily exceeded the spending by the rest of the hyperscale operators. The next biggest cloud spenders were Apple, Alibaba, Tencent, IBM, JD.com, Baidu, Oracle, and NTT.

SRG’s data found that capex growth was particularly strong across Amazon, Microsoft, Tencent and Alibaba while Apple’s spend dropped off sharply and Google’s also declined.

Much of the hyperscale capex goes towards building, expanding and equipping huge data centers, which grew in number to 573 at the end of Q3. The hyperscale data is based on analysis of the capex and data center footprint of 20 of the world’s major cloud and internet service firms, including the largest operators in IaaS, PaaS, SaaS, search, social networking and e-commerce. In aggregate these twenty companies generated revenues of over $1.1 trillion in the first three quarters of the year, up 15% from 2019.

“As expected the hyperscale operators are having little difficulty weathering the pandemic storm. Their revenues and capex have both grown by strong double-digit amounts this year and this has flowed down to strong growth in spending on data centers, up 18% from 2019,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “They generate well over 80% of their revenues from cloud, digital services and online activities, all of which have seen COVID-19 related boosts. As these companies go from strength to strength they need an ever-larger footprint of data centers to support their rapidly expanding digital activities. This is good news for companies in the data center ecosystem who can ride along in the slipstream of the hyperscale operators.”

Separately, Google Cloud announced it is set to add three new ‘regions,’ which provide faster and more reliable services in targeted locations, to its global footprint. The new regions in Chile, Germany and Saudi Arabia will take the total to 27 for Google Cloud.

About Synergy Research Group:

Synergy provides quarterly market tracking and segmentation data on IT and Cloud related markets, including vendor revenues by segment and by region. Market shares and forecasts are provided via Synergy’s uniquely designed online database tool, which enables easy access to complex data sets. Synergy’s CustomView ™ takes this research capability one step further, enabling our clients to receive on-going quantitative market research that matches their internal, executive view of the market segments they compete in.

Synergy Research Group helps marketing and strategic decision makers around the world via its syndicated market research programs and custom consulting projects. For nearly two decades, Synergy has been a trusted source for quantitative research and market intelligence. Synergy is a strategic partner of TeleGeography.

To speak to an analyst or to find out how to receive a copy of a Synergy report, please contact [email protected] or 775-852-3330 extension 101.

References:

Verizon and Deloitte collaborate on 5G mobile edge computing + 6G nonsense talk

Verizon today announced a deal with Deloitte to collaborate on 5G mobile edge computing services for manufacturing and retail businesses and ultimately expand to other industry verticals. The companies plan to create transformational solutions to serve client-specific needs using Deloitte’s industry and solution engineering expertise combined with Verizon’s advanced mobile and private enterprise wireless networks, 5G Edge MEC platform, IoT, Software Defined-Wide Area Network (SD-WAN), and VNS Application Edge capabilities.

Verizon and Deloitte are collaborating on innovative solutions to transform manufacturers into “real-time enterprises” with real-time intelligence and business agility by integrating next-gen technologies including 5G, MEC, computer vision and AI with cloud and advanced networking. The companies are co-developing a smart factory solution at Verizon’s Customer Technology Center in Richardson, TX that will utilize computer vision and sensor-based detection coupled with MEC to identify and predict quality defects on the assembly line and automatically alert plant engineering and management in near real-time.

The companies will also introduce an integrated network and application edge compute environment for next generation application functionality and performance that reduces the need for manual quality inspection, avoids lost productivity, reduces production waste, and ultimately lowers the cost of raw materials and improves plant efficiency. The combination of SD-WAN and VNS Application Edge will bring together software defined controls, application awareness, and application lifecycle management to deliver on-demand network transformation and edge application deployment and management.

“By bringing together Verizon’s 5G and MEC prowess with Deloitte’s deep industry expertise and track record in system integration with large enterprises on smart factories, we plan to deliver cutting-edge solutions that will close the gap between digital business operations and legacy manufacturing environments and unlock the value of the end-to-end digital enterprise,” said Tami Erwin, CEO of Verizon Business. “This collaboration is part of Verizon’s broader strategy to align with enterprises, startups, universities and government to explore how 5G and MEC can disrupt and transform nearly every industry.”

“In our recently published Deloitte Advanced Wireless Adoption study, over 85% of US executives surveyed indicated that advanced wireless is a force multiplier that will unlock the full potential of edge computing, AI, Cloud, IoT, and data analytics. Our collaboration with Verizon combines Deloitte’s business transformation expertise with advanced wireless and MEC technology to deliver game changing solutions,” said Ajit Prabhu, US Ecosystems & Alliances Strategy Officer and 5G/Edge Computing Commercialization leader, Deloitte Consulting LLP.

The #1 U.S. wireless telco still plans to reach an additional two cities with its mobile edge computing (MEC) network, ending the year with availability in 10 cities.

Verizon is also working with Microsoft Azure on private 5G MEC, Amazon Web Services (AWS) on consumer-oriented 5G MEC, IBM on IoT, Samsung and Corning on in-building 5G radios, Apple, major sporting leagues, and other organizations — all in an effort to explore and develop new use cases for 5G.

The MEC activities follows a flurry of announcements last week when Verizon expanded its low-band 5G network to reach up to 230 million people, said its millimeter-wave 5G network is now live in parts of 61 U.S. cities, revealed an on-premises private 4G LTE service for enterprises, expanded a partnership with SAP, inked a multi-year deal with Walgreens Boot Alliance, and launched an IoT services platform.

…………………………………………………………………………………………………………………………………………….

Separately, Verizon CTO Kyle Malady said that there’s currently no clear reason to move beyond 5G. “I really don’t know what the hell 6G is,” he said. Neither does anyone else- see Opinion below.

“We just put 5G in. And I think there’s a lot of development still to come on that one.”

Verizon, AT&T, Apple, Google and a wide range of other companies have already teamed under ATIS’ “Next G Alliance” that seeks to unite US industry, government and academia around 6G efforts.

………………………………………………………………………………………………………………………………….

Opinion on “6G”:

Talk of “6G” is preposterous at this time, since we don’t even have an approved 5G RAN/ IMT 2020 RIT spec or standard that meets the 5G URLLC performance requirements in ITU M.2410. Despite numerous 3GPP Release 16 specs, we don’t have a standard for 5G core network implementation, 5G security, 5G network management, 5G network slicing, etc.

At its 34th meeting (19-26 February 2020), ITU‑R Working Party (WP) 5D decided to start study on future technology trends for the future evolution of IMT. A preliminary draft new Report ITU-R M.[IMT.FUTURE TECHNOLOGY TRENDS] will be developed and will consider related information from various external organizations and country/regional research programs.

The scope of the new report ITU-R M.[IMT.FUTURE TECHNOLOGY TRENDS] focuses on the following aspects:

“This Report provides a broad view of future technical aspects of terrestrial IMT systems considering the time frame up to 2030 and beyond. It includes information on technical and operational characteristics of terrestrial IMT systems, including the evolution of IMT through advances in technology and spectrally-efficient techniques, and their deployment.”

In a Sept 27, 2020 ITU-R WP5D contribution, China stated:

IMT technology needs to show sustainable vitality in the perspective of technical development. There are emerging services and applications, and their further development towards 2030 and beyond will impose higher requirements on the IMT system. It motivates the introduction of new IMT technical features, e.g., very high spectrum up to Terahertz, native artificial intelligence (AI), integrated sensing and communications, integrated terrestrial and non-terrestrial networks, block chain and quantum computing for multi-lateral trustworthiness architecture, etc., which were not emphasised in Report ITU-R M.2320-0 considering the time-frame for 2015-2020. IMT technology continues to develop and it is necessary for ITU to provide a broad view of future technical aspects of IMT systems considering 2030 and beyond.

And suggested topics to be covered in this new IMT.FUTURE TECHNOLOGY TRENDS Report:

-

IMT technology trends and enablers for the time up to 2030 and beyond:

-

-

Technologies for further enhanced radio interface, including advanced modulation, coding and multiple access schemes, E-MIMO (Extreme -MIMO), Co-frequency Co-time Full Duplex (CCFD) communications, multiple physical dimension transmission

-

Technologies for Tera Hertz communication and optical wireless communication

-

Technologies for native AI based communication

-

Technologies for integrated sensing and communication

-

Technologies for integrated terrestrial and non-terrestrial communications

-

Technologies for integrated access and super sidelink communications

-

Technologies for high energy efficiency and low energy consumption

-

Technologies for native security, privacy, and trust

-

Technologies for efficient spectrum utilization

-

Terminal Technologies

-

Network Technologies

-

Editor’s Note: The next meeting of ITU-R WP5D is March 1-to-12, 2021 (e-meeting)

………………………………………………………………………………………………………………………………………..

References:

https://www.verizon.com/about/news/verizon-business-deloitte-5g-mobile-edge-computing

https://www.lightreading.com/cloud-nativenfv/verizons-cto-i-dont-know-what-hell-6g-is/d/d-id/766270?

ITU-R: Future Technology Trends for the evolution of IMT towards 2030 and beyond (including 6G)

SNS Telecom & IT: Spending on Unlicensed LTE & 5G NR RAN infrastructure at $1.3 Billion by 2023

Annual spending on LTE and 5G NR RAN (Radio Access Network) infrastructure operating in unlicensed spectrum will reach $1.3 Billion by 2023, says SNS Telecom & IT in a new report. That’s despite competition from non-3GPP wireless technologies and the ongoing economic impact of the COVID-19 pandemic.

Over the past decade, the operation of 3GPP-based cellular networks in unlicensed spectrum has gone from being a perennial talking point to what is now a key element of mobile network densification strategies. Mobile operators across the globe are increasingly rolling out LTE RAN (Radio Access Network) infrastructure operating in unlicensed spectrum – primarily the globally harmonized 5 GHz band – to expand network capacity and deliver higher data rates, particularly in dense urban environments. These implementations are largely based on LAA (Licensed Assisted Access) technology which aggregates unlicensed channels with anchors in licensed spectrum to maintain seamless and reliable connectivity.

However, the practical applicability of unlicensed spectrum is not limited to the capacity enhancement of traditional mobile operator networks. Technical and regulatory initiatives such as MulteFire, CBRS (Citizens Broadband Radio Service) and sXGP (Shared Extended Global Platform) make it possible for enterprises, vertical industries, third-party neutral hosts and other new entrants to build and operate their own independent cellular networks solely in unlicensed spectrum without requiring an anchor carrier in licensed spectrum. Furthermore, in conjunction with the availability of new license-exempt frequencies such as the recently opened 6 GHz band from 5925 MHz to 7125 MHz, the introduction of 5G NR-U in 3GPP’s Release 16 specifications paves the way for 5G NR deployments in unlicensed spectrum for both licensed assisted and standalone modes of operation. Given 5G’s inherent support for reliability and time-sensitive networking, NR-U is particularly well suited to meet industrial IoT requirements for the automation and digitization of environments such as factories, warehouses, ports and mining sites.

Despite the economic slowdown due to the COVID-19 pandemic, competition from non-3GPP wireless technologies and other challenges, SNS Telecom & IT estimates that global investments in LTE and 5G NR-ready RAN infrastructure operating in unlicensed spectrum will reach nearly $500 Million by the end of 2020. The market is further expected to grow at a CAGR of approximately 40% between 2020 and 2023, eventually accounting for $1.3 Billion by 2023.

The “LTE & 5G NR in Unlicensed Spectrum: 2020 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents a detailed assessment of the market for LTE and 5G NR in unlicensed spectrum including the value chain, market drivers, barriers to uptake, enabling technologies, key trends, future roadmap, business models, use cases, application scenarios, standardization, spectrum availability/allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also provides global and regional forecasts for unlicensed LTE and 5G NR RAN infrastructure from 2020 till 2030. The forecasts cover two air interface technologies, two modes of operation, two cell type categories, seven frequency band ranges, seven use cases and five regional markets.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report.

The key findings of the report include:

-

Despite the economic slowdown due to the COVID-19 pandemic, competition from non-3GPP wireless technologies and other challenges, SNS Telecom & IT estimates that global investments in LTE and 5G NR-ready RAN infrastructure operating in unlicensed spectrum will reach nearly $500 Million by the end of 2020. The market is further expected to grow at a CAGR of approximately 40% between 2020 and 2023, eventually accounting for $1.3 Billion by 2023.

-

As part of their network densification efforts, mobile operators across the globe are increasingly employing the use of LAA technology to aggregate licensed spectrum assets with unlicensed frequencies – primarily the globally harmonized 5 GHz band – in order to deliver higher data rates and alleviate capacity constraints across the most congested parts of their networks.

-

With the possibility to leverage the 3.5 GHz CBRS band on a GAA (General Authorized Access) basis in the United States and the availability of Japan’s license-exempt 1.9 GHz sXGP band, independent cellular networks that can operate solely in unlicensed spectrum – without requiring an anchor carrier in licensed spectrum – are beginning to emerge as well. In addition, it is worth noting that a limited number of custom-built, standalone LTE networks operating in the unlicensed 2.4 GHz and 5 GHz bands are operational in certain national markets, predominantly for industrial IoT applications.

-

In the coming years, with the commercial maturity of 5G NR-U technology, we also anticipate to see 5G NR deployments in unlicensed spectrum for both licensed assisted and standalone modes of operation – using the 3.5 GHz CBRS, 5 GHz, 6 GHz and higher frequency bands up to 71 GHz.

The report will be of value to current and future potential investors into the unlicensed spectrum LTE and 5G network market, as well as LTE/5G equipment suppliers, mobile operators, MVNOs, fixed-line service providers, neutral hosts, private network operators, vertical domain specialists and other ecosystem players who wish to broaden their knowledge of the ecosystem.

For further information concerning the SNS Telecom & IT publication “LTE & 5G in Unlicensed Spectrum: 2020 – 2030 – Opportunities, Challenges, Strategies & Forecasts” please visit: https://www.snstelecom.com/unlicensed

For a sample please contact: [email protected]

https://www.snstelecom.com/Unlicensed-LTE-5G-a-1-3-Billion-opportunity

……………………………………………………………………………………………………………………………..

Editor’s Notes:

1. LTE in unlicensed spectrum (LTE-Unlicensed, LTE-U) is a proposed extension of the Long-Term Evolution (LTE) wireless standard intended to allow cellular network operators to offload some of their data traffic by accessing the unlicensed 5 GHz frequency band.

LTE-Unlicensed is a proposal, originally developed by Qualcomm, for the use of the 4G LTE radio communications technology in unlicensed spectrum, such as the 5 GHz band used by 802.11a and 802.11ac compliant Wi-Fi equipment. It would serve as an alternative to carrier-owned Wi-Fi hotspots. Currently, there are a number of variants of LTE operation in the unlicensed band, namely LTE-U, License Assisted Access (LAA), and MulteFire.

Proponents of LTE-U argue that the use of LTE in unlicensed bands produces better spectrum efficiency than WiFi, leading to higher data rates and capacity. With carrier aggregation, end users should experience better performance as service quality is ensured if unlicensed band becomes unstable due to interference.

For more info: https://www.leverege.com/blogpost/unlicensed-lte-lte-u-vs-laa-vs-lwa-vs-multefire

2. 5G NR in Unlicensed band

5G NR-U is the first global cellular standard with both license-assisted and standalone use of unlicensed spectrum.

3GPP Release 16 begins with 5G NR-U in the 5 GHz unlicensed band. With new unlicensed 6 GHz spectrum now being available in the US and coming soon to other countries, the 5G NR-U standard is gearing up to support this band next, followed by the 60 GHz millimeter wave band which is being developed as part of Release 17.

For more information: https://www.qualcomm.com/invention/5g/5g-unlicensed-shared-spectrum

……………………………………………………………………………………………………………………………………………..

Reliance Jio may deploy 5G SA while Bharti Airtel to trial both 5G NSA and SA

Reliance Jio may launch its much touted 5G services using the next generation 5G standalone (GSMA Option 2) architecture for its network, Business Standard reported.

The telco may skip the current non-standalone 5G. The NSA 5G architecture enables operators to leverage their existing investments in their 4G LTE networks and reduce capital costs. Mukesh Ambani recently said that Jio intends to roll-out 5G services in India in the second half of 2021.

Image Credit: Reliance Jio

Conversely, Sunil Mittal of Bharti Airtel said that 5G will take 2-3 years to reach mass scale in India’s market. Nonetheless, Airtel recently applied for both NSA and SA 5G trials to test its network architecture.

“Even though the majority of countries are offering 5G using NSA, SA is also being used for 5G services. Airtel feels it’s a good time to test its network using both modes,” a person familiar with the development told ETTelecom.

Airtel is planning to do Standalone 5G trials in Karnataka and Kolkata using Nokia and Ericsson 5G gear, respectively. In both circles, ZTE and Huawei currently power the Sunil Mittal-led telco’s 4G network.

Non-standalone (NSA) and standalone (SA) are two 5G tracks that communication service providers can opt for when transitioning from 4G to the next-generation mobile technology. In NSA, the existing 4G LTE network is used for everything except the 5G data plane, which is usually based on 3GPP Release 15 version of 5G NR. 5G NSA enables operators to leverage their existing investments in their 4G LTE networks and reduce capital costs, but it can’t support new 5G features such as network slicing.

Reliance Jio, Bharti Airtel, Vodafone Idea, and BSNL recently submitted a list of “preferred vendors” which includes European and American companies for 5G field trials with the telecom department (DoT).

Jio had submitted fresh applications for 5G trials with Samsung, Nokia, Ericsson, and for its own 5G technology. The largest Indian telco recently submitted an application trial of its own 5G technology in South Mumbai and Navi Mumbai areas, while it intends to do trials with Samsung in other areas like Bandra Kurla complex, Kamothe Navi Mumbai, and Solapur with Maharashtra.

Jio intends to 5G trials with Nokia in Pune and Ahmednagar, and with Ericsson in Delhi areas like Chandani chowk and Shashtri Nagar and in Dabwali in Haryana.

References:

Ambani: Reliance Jio to deploy 5G network in second half of 2021

Singtel and Ericsson 5G NR SA and dual mode 5G core network

Ericsson and Singapore communications service provider Singtel, are accelerating their 5G partnership in Singapore through the deployment of high-end 5G technology enabled by 5G New Radio (NR) Standalone (SA) and dual-mode 5G core network products and solutions, including real-time rating and policy control.

The energy-efficient, end-to-end 5G network will operate on Singtel’s 3.5GHz and 28GHz spectrum bands, spanning outdoor and indoor 5G coverage. Millimeter wave (mmWave) connectivity will also be deployed in hotspots across the city state.

Ericsson’s radio and core solutions will ensure that residents, enterprises, industry and government authorities in Singapore – renowned the world over as early technology adapters and hi-tech innovators – are among the first in the world to benefit from the highest performance that 5G can offer.

5G-enabled application use cases could include cloud gaming, immersive virtual reality/augmented reality, robot-human collaboration in real-time, autonomous transport, remote healthcare, precision smart manufacturing and smart-nation connectivity.

The 5G contract award takes the partnership between Ericsson and Singtel to new levels, as Industry 4.0 gathers pace globally. Singapore was recently named world’s most competitive economy for the second successive year in the latest IMD World Competitiveness Ranking.

Image Credit: Singtel

Mark Chong, Group Chief Technology Officer, Singtel, says: “As the leading telco in Singapore, Singtel is committed to building a secure, resilient, world-class 5G network that will serve as the backbone of Singapore’s digital economy. We are pleased to be working with Ericsson, leveraging on its industry-leading 5G capabilities and to deliver innovative applications and transformative customer experiences for our consumers and enterprise customers.”

Martin Wiktorin, Head of Ericsson Singapore, Brunei and Philippines, says: “Singtel is determined to play a leading role in keeping Singapore at the cutting edge of technology innovation and to ensure that the whole nation benefits from 5G. To do so they need the best 5G technology on the market. At Ericsson, our global leadership is evidenced by our extensive deployment experience with 75 live 5G networks worldwide. As a long-standing partner, we are equally determined to work alongside Singtel to ensure its subscribers and business customers enjoy the best experiences and opportunities that 5G has to offer.”

Earlier this month, Singtel said it was using 28 GHz mmWave spectrum, in addition to the 3.5 GHz and 2.1 GHz bands, to boost its 5G deployment in Singapore.

Singtel has switched on mmWave in several locations across the island, including Orchard Road, the Padang area and Marina Bay Sands Expo. Singtel also reports it has achieved 5G speeds of 3.2Gbps at its pop-up store dubbed Unboxed.

Singtel’s 5G network will take advantage of mmWave through a combination of the latest cellular technologies including massive MIMO, carrier aggregation and beam-forming solutions. Singtel customers with 5G plans can expect to experience mobile speeds of up to 3 Gbps speeds when mmWave-enabled handsets arrive in Singapore next year, the carrier said.

The largest telco inSingapore had initially launched its 5G non-standalone (NSA) network in September, using spectrum in the 3.5 GHz frequency as well as existing 2.1 GHz spectrum. Singtel was officially awarded a 5G license issued by Singapore’s Infocomm Media Development Authority (IMDA) in June 2020.

Singtel and Ericsson will deploy 5G SA networks beginning in January 2021 and will be required to provide coverage for at least half of Singapore by the end of 2022, scaling up to nationwide coverage by the end of 2025.

Related links:

Ericsson 5G

Ericsson 5G Core

Ericsson Radio System

Ericsson 5G New Radio (NR)deployment solutions

References:

44 Chinese companies have joined the O-RAN Alliance

by John Strand, Strand Consult (edited by Alan J Weissberger)

In 2019, the world’s mobile network operators earned just over $1 trillion and spent $30 billion on Radio Access Network (RAN) equipment, which was some 3 percent of revenue. To reduce cost, mobile operators leverage the pool of network equipment vendors, for example by developing new interfaces in network equipment to lower barriers to entry, under the industry term OpenRAN or “Open Radio Access Network.”

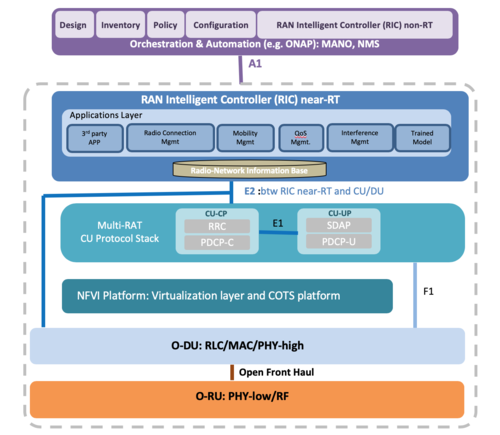

OpenRAN is not a standard, but a collection of technological features purported to allow different vendors to supply 5G networks with “standardized open interfaces” specified by the O-RAN ALLIANCE.

Source: O-RAN Alliance

……………………………………………………………………………………………………………………….

O-RAN only addresses internal RAN components. The wireless telecom industry still relies on 3GPP, the 3rd Generation Partnership Project, to build an end-to-end mobile cellular network and to connect end-user devices.

OpenRAN has become a hot topic in tech policy as an antidote to Huawei network equipment in mobile networks, but dozens of Chinese companies have joined the O-RAN ALLIANCE and are poised to drive OpenRAN standards and manufacturing

Chinese technological threats extend beyond Huawei

As the practices and relationships between Huawei and the Chinese government have been revealed, many nation state leaders have demanded the removal of Huawei equipment from communications networks. Huawei itself has not succeeded to demonstrate that it is an employee- owned company free from Chinese government control. China’s practice of civil military fusion means that all economic inputs can be commandeered for military purposes. Its de facto information policy asserts sovereignty over the internet and can thus enjoin any Chinese firm or subject to participate in surveillance and espionage. This means that restricting Huawei alone is not sufficient to secure 5G; the presence of any Chinese product in the network poses a security risk. Now that the Huawei brand name is toxic, many non-Chinese firms see an opportunity to enter the 5G network equipment market, but it is not clear whether and to what degree they will use Chinese standards, components, and manufacturing.

The O-RAN ALLIANCE was established in 2018 by Deutsche Telekom, NTT DOCOMO, Orange, AT&T, and China Mobile and has grown to 237 mobile operators and network equipment providers. The US has 82 O-RAN Alliance members; China, 44 (3 from Hong Kong); Taiwan, 20; Japan, 14; United Kingdom, 10; India, 10; and Germany, 7. Notably the 44 Chinese member companies exert significant control on the technical specifications and supply chain of OpenRAN 5G products and services. The conundrum of engagement with restricted Chinese entities does not end there. Citing security concerns, the Federal Communications Commission rejected a US operating license to China Mobile and may revoke approvals for China Telecom for its failure to demonstrate that it is not influenced the Chinese government. Other O-RAN ALLIANCE members include Inspur, Lenovo, Tsinghua, and ZTE, companies the US government restricts for security reasons given their ties to the Chinese government and/or military. The O-RAN ALLIANCE did not return a request for comment.

Some mobile operators cite OpenRAN to avoid ripping and replacing Huawei equipment

While many mobile operators are taking precautions to protect their customers by removing Huawei equipment, Vodafone, Telefonica, and Deutsche Telekom have resisted. They posit the promise of OpenRAN (with the O-RAN ALLIANCE specification) to justify a delay of rip and replace efforts, knowing that OpenRAN products will not be available for some years. Thus, these three operators can extend the life of Huawei in their 5G networks with the promise of using so called “open” equipment built with Chinese government standards. Separately the cost to rip and replace Huawei in European networks is minimal, about $7 per European mobile subscriber. The mobile operators which have switched out Huawei equipment have not experience increased cost or delay to the rollout of 5G.

Local politicians jump on the OpenRAN bandwagon thinking it has no Chinese connection

With the manufacturing base decimated in the countries they represent, many policymakers have looked to OpenRAN to get back into the network equipment game. Presumably OpenRAN would provide some high-end software jobs, though manufacturing is likely to be dominated by established Chinese entities. A US House bill would offer a whopping $750 million for OpenRAN development, though the location of manufacturing is not conditioned. Similar bills have been offered in UK, Japan, India, Germany, and Brazil. However commendable the notion of OpenRAN may be from a technical perspective, it appears that China has already outwitted Western leaders. China can afford to lose the Huawei battle if it wins the war on standardizing and building billions of “open”, “interoperable”, and “vendor neutral” devices. As long China influences the O-RAN specifications and manufacturing, it does not care whose brand is used.

Policymakers in the US and EU have today a lot of focus on communications network equipment from Chinese vendors. In 2019 and 2020 Strand Consult published many research notes and reports to help telecom companies navigate a complex world. We focused heavily on the problem of Chinese equipment in telecommunications networks. While the media has largely focused on Huawei, the discussion should be broadened to the many companies that are owned or affiliated with the Chinese government including but not limited to TikTok, Lexmark, Lenovo, TCL, and so on. Although some of our customers disagree with our views, Strand Consult’s job is to publish what is actually happening and how policy decisions may affect their business in the future.

Here are some of Strand Consult’s research.

44 Chinese companies have joined the OpenRAN effort, a strategy to reduce Huawei’s presence in 5G

https://www.o-ran.org/membership

…………………………………………………………………………………………………………………..

Open RAN first surfaced nearly three years ago at Mobile World Congress 2018. It promised a new set of interfaces that would allow service providers to mix and match vendors at the same mobile site, instead of buying all products from the same supplier. Operators hoped it would inject competition into a market dominated by Ericsson, Huawei and Nokia.

Since then, geopolitics has propelled it to the very top of the telecom agenda. Non-Chinese policymakers have latched onto open RAN as an alternative to Huawei, a Chinese vendor that governments are banning and operators are ditching because of its suspected links to an increasingly authoritarian Chinese state.

Avoiding Chinese equipment makers is one thing. Skirting Chinese technology expertise is not so easy. Already, there is concern that China, through Huawei and ZTE, has too much influence in the 3GPP, the group that develops the 5G standard. Further worsening of relations between Western democracies and China could prompt a future break-up of international standards-setting bodies, according to several experts.

Chinese influence:

These circumstances leave open RAN in an awkward situation. Anyone listening to the Open RAN Policy Coalition might think the technology was born in the USA and has never set foot in China. The O-RAN Alliance shows otherwise. Its most prominent Chinese members include ZTE, an equipment vendor that was on a US trade blacklist until it hawked up billions in fines. Also named are China Mobile and China Telecom, two state-backed operators that turned up on a Pentagon blacklist in June.

China Mobile is a busy member of the group, says a source who requested anonymity. That is hardly surprising as it was arguably the main force in the C-RAN Alliance, a Chinese group whose merger with the largely American xRAN Forum created the O-RAN Alliance in 2018. Today, the Chinese operator is a very active contributor to specifications, according to Light Reading’s source. ZTE has been similarly engaged, said sources within the company at the start of the year.

None of this will be very palatable to US politicians determined to block China’s influence. Yet any break-up of the O-RAN Alliance into C-RAN Alliance and xRAN Forum camps would be a major setback for open RAN. It would complicate development and threaten new disputes over intellectual property.

Right now, the issue of technology patents means the O-RAN Alliance faces a potential dilemma about involving Huawei. The group’s interfaces build heavily on specifications developed outside the O-RAN Alliance by Ericsson, Nokia, NEC and Huawei. The Nordic and Japanese vendors have all now joined the club, agreeing to license their patents on fair, reasonable and non-discriminatory (FRAND) terms. But Huawei has not. There is concern it could attempt to thwart open RAN by arguing its patents have been infringed.

While addressing that risk, its membership of the O-RAN Alliance would create other problems. For one thing, China’s biggest slab of tech R&D muscle would – paradoxically – have gained entry to the design room of the technology touted as a Huawei substitute. US policymakers able to live with China Mobile and China Telecom might balk at the involvement of telecom public enemy number one.

It would also make all three big telecom equipment vendors a part of the specifications group. That would increase the likelihood that Ericsson, Huawei and Nokia become the main suppliers of open RAN products, frustrating efforts to nurture competitors. There are already doubts that smaller rivals will be able to land much open RAN work. Appledore Research, an analyst firm, reckons open RAN will generate $11.1 billion in revenues in 2026. As much as $8 billion will go to the incumbents, it predicts.

Ever wary of open RAN, Huawei signaled its growing interest in the technology in July, when Victor Zhang, its vice president, was being grilled by UK politicians. “We are watching open RAN as one of the choices,” he told a parliamentary committee. “Once it has comparable performance to single RAN, we believe Huawei will be one of the best suppliers of open RAN as well.” Outside China, an open RAN ecosystem that makes space for Huawei could fast lose its appeal.

https://www.lightreading.com/open-ran/chinas-role-in-open-ran-is-looming-problem/d/d-id/766204?