ITU-R WP 5D Dec 2019 meeting #33: activity related to IMT 2020 RIT/SRIT

by ITU-R WP 5D Chair persons with Editor’s Note (and copy edits) by Alan J Weissberger, IEEE Techblog Content Manager

Main activities of WP5D WG Technology Aspects during meeting #33 (Dec 10-13 in Geneva) were:

i) Review additional materials provided by the candidate IMT-2020 RIT/SRIT proponents ETSI (TC DECT) and DECT Forum, Nufront and TSDSI, per the agreed way forward at the 32nd meeting of WP 5D regarding their respective submissions;

ii) Review of external activities in Independent Evaluation Groups (for candidate IMT 2020 RIT/SRITs) through interim evaluation reports;

iii) Continue work on revision of Recommendation ITU-R M.1457-14 (specification of terrestrial radio interfaces for IMT-2000)

iv) Start working on Report ITU-R M.[IMT-2020.OUTCOME].

v) Start working on Recommendation ITU-R M.[IMT-2020.SPECS].

During this meeting, WG Technology Aspects established three Sub-Working Groups (SWG):

– SWG Coordination (Chair: Mr. Yoshio HONDA)

– SWG Evaluation (Co-Chair: Ms. Ying PENG)

– SWG IMT Specifications (Chair: Mr. Yoshinori ISHIKAWA)

…………………………………………………………………………………………………………….

Review of updated materials of IMT-2020 submissions:

As per the agreed way forward at the 32nd WP 5D meeting regarding candidate IMT-2020 RIT/SRIT submissions of ETSI (TC DECT) and DECT Forum, Nufront and TSDSI, the respective proponents provided updated materials of their submissions on September 10th of 2019.

After review of these updated materials of submissions under the IMT-2020 Process Step 3 – Submission / reception of the RIT and SRIT proposals and acknowledgement of receipt, the meeting determined that the submissions of ETSI (TC DECT) and DECT Forum, Nufront and TSDSI are “complete” per Section 5 of Report ITU-R M.2411 (Requirements, evaluation criteria and submission templates for the development of IMT-2020).

Editor’s Note: Also see ITU-R Report M.2412: Guidelines for evaluation of radio interface technologies for IMT-2020.

……………………………………………………………………………………………………………

During the course of this review, documents for observations on the submissions were updated.

Review of interim evaluation reports:

A workshop on IMT-2020 terrestrial radio interfaces evaluation was conducted at beginning of this WP 5D meeting (Dec 10-11, 2019), where the registered independent evaluation groups presented their activities and findings. In addition, some independent evaluation groups also submitted interim evaluation reports. The meeting reviewed these contributions and recorded them.

Report ITU-R M.[IMT-2020.OUTCOME]:

The meeting created the draft detailed workplan and draft working document towards a prelimininary draft new Report ITU-R M.[IMT-2020.OUTCOME] which will collect outcomes from Step 4 to 7 in IMT-2020 development process. Those two documents were carried forward to the next meeting for further work.

Detailed schedule for development of IMT-2020.SPECS:

Detailed workplan for development of draft new Recommendation ITU-R M.[IMT-2020.SPECS] and its working document were developed in the meeting. A related liaison statement to the external organizations was also developed.

……………………………………………………………………………………………………..

Editor’s Note:

IMHO, the IMT 2020.SPECS schedule is NOT realistic, mainly because there isn’t enough time for 5D WG Technology Aspects to evaluate 3GPPs expected Release 16 submission at their June 2020 meeting. Note that China, Korea and India (TSDSI) have all based their IMT 2020 RIT submissions on 3GPP Release 15 “5G NR” data plane which must be enhanced in IMT 2020.SPECs to meet the ultra high reliability/ultra high latency performance requirements for both the data and control planes.

There are only two more WP 5D meetings in 2020 (see last section below) after the June 2020 5D meeting, yet a complete IMT 2020.SPECs must be submitted by Nov 23, 2020 to ITU-R SG 5 (5D’s parent) for approval. If not, IMT 2020 will become IMT 2021 (or later if companion IMT 2020 recommendations have not been approved). What good is it to have a 5G data plane without ultra low latency/ultra high reliability and a 4G (EPC) packet core? With no 5G network management or 5G security specified (presumably by ITU-T)?

Specifically, what if the 5G Mobile Packet Core (3GPP 5GC), enhanced 5G control plane/signaling, 5G network management, 5G security, etc (all in 3GPP Release 16) are not completed in time to be considered by ITU-R or ITU-T in 2020?

Another danger is IMT 2020.SPECS revision control with multiple RIT submissions dependent on 3GPP 5G NR. What if some proponents stick with Release 15 NR while others adopt Release 16 NR in July 2020? And how can all the different proponent IMT 2020 RITs be harmonized to ensure interoperability and roaming?

……………………………………………………………………………………………………..

Objective for the 34th WP 5D meeting – Feb 2020 in Geneva:

The key objectives of WG Technology Aspects for the 34th WP 5D meeting are as follows:

i) Review of external activities and evaluation reports of Independent Evaluation Groups.

ii) Complete evaluation reports summary (IMT-2020/ZZZ).

iii) Continue working on a new Report ITU-R M.[IMT-2020.OUTCOME].

iv) Continue the work on “Over-the-air (OTA) TRP field measurements for IMT radio equipment utilizing AAS” based on the requested response from 3GPP and expected input from other organisations and administrations.

v) Continue working on revision of Recommendation ITU-R M.1457-14.

vi) Continue working on new Recommendation ITU-R M.[IMT-2020. SPECS]

Submitted by Ying Peng, Chair, SWG Evaluation

…………………………………………………………………………………………

M.[IMT-2020.SPECS]:

Under agenda item 4 (PDN Rec. ITU-R M.[IMT-2020.SPECS]), the meeting received two input contributions from Korea, Japan and China.

Both contributions proposed the detailed work plan for developing the new Recommendation ITU-R M.[IMT-2020.SPECS] and the working document towards a preliminary draft new Recommendation.

The meeting reviewed those proposals and discussed the work plan and contents for the working document and agreed the detailed work plan and the working document towards a PDNR (preliminary draft new report).

Detailed workplan and working document towards PDNR M. [IMT‑2020.OUTCOME]

The meeting created the draft detailed work plan and draft working document towards PDNR M.[IMT-2020.OUTCOME] based on the carried forward document and input contributions to this meeting. Two TEMP Documents were created accordingly and will be carried forward to the next meeting.

………………………………………………………………………………………………………

Meeting #33 also created a liaison statement to relevant External Organizations (RIT/SRIT Proponents, potential GCS Proponent(s) of IMT-2020) to request the inputs to 34th and 35th meetings in accordance with Doc. IMT-2020/21. WG-IMT Specification seeks approval of this liaison in WG Technology Aspects Plenary and WP 5D Plenary.

Submitted by Yoshinori ISHIKAWA, Chairman, SWG IMT Specifications

…………………………………………………………………………………………..

RECOMMENDATION ITU-R M.[IMT-2020.SPECS]:

Detailed specifications of the terrestrial radio interfaces of International

Mobile Telecommunications-2020 (IMT-2020)

Scope:

This Recommendation identifies the terrestrial radio interface technologies of International Mobile Telecommunications-2020 (IMT-2020) and provides the detailed radio interface specifications.

Korea, Japan:

[These radio interface specifications detail the features and parameters of IMT-2020, which enable worldwide compatibility, international roaming, access to the services under the usage scenarios including enhanced mobile broadband (eMBB), massive machine type communications (mMTC) and ultra-reliable and low latency communications (URLLC).]

China:

[These radio interface specifications detail the features and parameters of IMT-2020. This Recommendation includes the capability to ensure worldwi.de compatibility, international roaming, access to enhanced mobile broadband (eMBB), massive machine type communications (mMTC) and ultra reliability and low latency communications (URLLC).]

……………………………………………………………………………………………………………

For more details on skeleton IMT 2020.SPECs and related work plan, please see:

China ITU-R WP5D submission: work plan and working document for IMT-2020.SPECS

…………………………………………………………………………………………

Because of their ultra critical importance we repeat the objectives of the last three WP 5D meetings in 2020:

Meeting No. 35 (Jun. 2020, [China])

1 Receive and review information, including the texts for its RIT/SRIT overview sections, List of Global Core Specifications and Certification B by GCS Proponents[1].

2 Reach its conclusion on the acceptability of the proposed materials for inclusion in the working document towards PDN Rec. ITU-R M.[IMT-2020.SPECS].

3 Finalizes the working document including specific technologies (not necessarily including the detailed transposition references) and provisionally agree for promoting the document to preliminary draft new Recommendation.

4 Provide and send liaison of the provisionally agreed preliminary draft new Recommendation ITU-R M.[IMT-2020.SPECS] to the relevant GCS Proponents and Transposing Organizations for their use in developing their inputs of the detailed references.

Meeting No. 36 (Oct. 2020, [India])

1 Update PDNR if there are modifications proposed by GCS Proponent.

2 Perform a quality and completion check of the provisionally agreed final draft new Recommendation ITU-R M.[IMT-2020.SPECS] without the hyperlinks.

3 Have follow-up communications initiated with GCS Proponents and/or Transposing Organizations, if necessary.

Meeting No. 36bis (Nov. 2020, Geneva)

1 Receive Transposition references and Certification C from each Transposing Organization.

2 Perform the final quality and completeness check (with detailed transposition references) of the preliminary draft new Recommendation and promotes it to draft new Recommendation.

3 —>Send the draft new Recommendation ITU-R M.[IMT-2020.SPECS] to Study Group 5 for consideration (at their Nov 23-24, 2020 meeting).

[1] If the GCS Proponentrnal (potential GCS Proponent) decides to use DIS style, it doesn’t need to submit List of Global Core Specifications but needs to submit full materials for describing its RIT/SRIT in the Recommendation and Form B.

………………………………………………………………………………………………….

Century Link selected by Internet2 for Advanced Optical Fiber & Professional Services

Internet2, a non-profit, member-driven advanced technology community, selected CenturyLink to provide the fiber network and related professional services for the technology community’s network infrastructure. Contractual fiber-use agreements extend through at least 2042.

The forthcoming Internet2 network will use the company’s low-loss optical fiber for the majority of its footprint. CenturyLink’s optical fiber is ITU-T G.652.D compliant and designed to be optimized for high bit rate coherent systems using advanced modulation schemes supporting 100G and above. Internet2 also chose CenturyLink to provide the professional services to migrate to the new platform, which will be equipped with a flex-grid open-line system from Ciena.

“We believe the combination of the most advanced fiber from CenturyLink with the latest coherent transmission technologies from Ciena provides enormous opportunities to enable research and academic pursuits in the United States,” said Rob Vietzke, vice president of network services for Internet2, in a prepared statement.

“Whether it is tracking the origins of Neutrinos in the Antarctic, comparing gene sequences or studying the climate, this new optical network, with its ability to span very long distances at very high bandwidths [with] improved efficiency, is essential to providing the best research infrastructure for data-intensive science on the globe.”

Map of Internet2® Network Advanced Layer 1 Service, December 2019 (Source: CenturyLink) – Image courtesy of Matthew Wilson

……………………………………………………………………………………………………….

Internet2’s core infrastructure components include the nation’s largest and fastest research and education network. The network currently connects 321 U.S. universities, 60 government agencies, 43 regional and state education networks and through them supports more than 100,000 community anchor institutions, among others.

“One of America’s leading research and education organizations (Internet2) placed its trust in CenturyLink to upgrade its network to a high-speed, high-capacity, fiber-optic network that will support today’s leading-edge research projects,” said Sonia Ramsey, CenturyLink’s vice president for the state and local government and education market. “Internet2’s selection of CenturyLink recognizes the company’s long-standing relationship with the research and education community and our commitment to meet the community’s ever-increasing advanced technology needs,” she added.

CenturyLink recently overpulled a large portion of its national fiber footprint and also realigned amplifier spacing to create more efficient resources for optimized optical networks. Internet2 will migrate its segments to the new fiber on all available segments and continue to work with CenturyLink to migrate the remaining segments as their build-out continues.

With the low-loss optical fiber and the upgraded optronics kit, Internet2 will have the ability to reach anywhere on its domestic footprint with an unregenerated wavelength of up to 200G. Many high-use spans on Internet2’s Network will also support 400G and 800G wavelengths with existing technologies and higher bitrates are expected in the coming years as new DSP technology comes into production. Internet2 has been able to achieve unregenerated spans without employing Raman amplification, a reduction in complexity and improved efficiency both at installation and for ongoing operations.

…………………………………………………………………………………………………..

About Internet2:

Internet2® is a non-profit, member-driven advanced technology community founded by the nation’s leading higher education institutions in 1996. Internet2 serves 321 U.S. universities, 60 government agencies, 43 regional and state education networks and through them supports more than 100,000 community anchor institutions, over 1,000 InCommon participants, 56 leading corporations working with our community, and 70 national research and education network partners that represent more than 100 countries.

Internet2 delivers a diverse portfolio of technology solutions that leverages, integrates, and amplifies the strengths of its members and helps support their educational, research and community service missions. Internet2’s core infrastructure components include the nation’s largest and fastest research and education network that was built to deliver advanced, customized services that are accessed and secured by the community-developed trust and identity framework.

Internet2 offices are located in Ann Arbor, Mich.; Denver, Colo.; Washington, D.C.; and West Hartford, Conn. For more information, visit www.internet2.edu or follow @Internet2 on Twitter.

About CenturyLink:

CenturyLink is a technology leader delivering hybrid networking, cloud connectivity, and security solutions to customers around the world. Through its extensive global fiber network, CenturyLink provides secure and reliable services to meet the growing digital demands of businesses and consumers. CenturyLink strives to be the trusted connection to the networked world and is focused on delivering technology that enhances the customer experience. Learn more at http://news.centurylink.com/.

Media Contact

Sara Aly, Internet2

[email protected]

References:

AT&T targets 50% coverage in its FTTH regions; U.S. Fiber Broadband Remarkable Progress

AT&T’s fiber-to-the-home (FTTH) technology could provide 50% of the connections in areas where it’s available within the next three years, the company says. 3.1 million people were subscribing to AT&T’s FTTH service as of June 2019, a 57% rate of growth from year to year.

“We have proof of how we do this historically,” Jeffrey McElfresh, CEO AT&T Communications, said at the Barclays Global Technology, Media and Telecommunications Broker Conference. “As you look at the fiber that we built out in the ground in 2016, at the three-year mark, we roughly approach about a 50% share gain in that territory. And so for 2020, with the bulk of our investments behind us in this fiber plan, our tactics are to drive penetration with the fiber that we’ve built.”

McElfresh said “the economic performance of our broadband business is very strong, setting aside subscriber losses in the lower speed DSL segment in the copper network.”

In markets where AT&T faces off against Comcast, Charter Communications and other cable broadband providers, “where we have fiber, we win and win handily,” he added. In a June 4 note to investors, MoffettNathanson analyst Craig Moffett said that AT&T had gained 1.1 million FTTH customers in the previous year, bringing its base at the time to 3.1 million subscribers, an impressive 57% annual growth rate.

“But from whom are these market share gains coming?” Moffett asked. “The short answer appears to be …. from AT&T itself.”

Indeed, rather than poaching customers from cable operators, AT&T has largely been upgrading existing DSL and U-verse users.

In any event, the No. 2 U.S. wireless operator appears to be charging forward with the strategy. It plans to bundle its new premium virtual pay TV service, AT&T TV, to drive FTTH growth.

At the Barclays conference, McElfresh said AT&T TV — which has been soft-launched in New York and a dozen other markets — will roll out nationally in February. That livestreamed service, which comes with a two-year contract, requires no truck rolls or satellite launches and requires half the capital spending of DirecTV satellite TV.

“Our growth agenda is on fiber and our entertainment group, and on the AT&T TV product that will be offered nationwide,” McElfresh said.

…………………………………………………………………

Separately, a new report notes the tremendous progres fiber broadband has made in the U.S. recently. More than 20 million U.S. homes (20.5 million) are now connected to fiber broadband service, according to new research conducted by RVA for the Fiber Broadband Association. That’s a substantial increase since last year, when a similar FBA report found 18.4 million U.S. fiber broadband homes.

Fiber broadband has been making gains against DSL and fiber-to-the-neighborhood (FTTN). According to the researchers, 2019 was the first year when more U.S. homes received broadband service via fiber than via DSL or FTTN. That milestone makes fiber broadband the second most popular choice after cable modem service.

References:

https://www.multichannel.com/news/at-t-will-grow-on-fiber-diet

AT&T and Verizon to use Integrated Access and Backhaul for 2021 5G networks

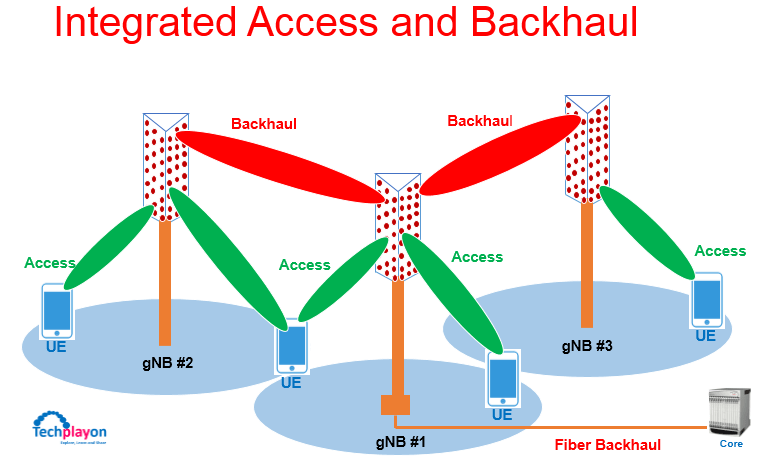

AT&T sketched out its plans to start testing Integrated Access and Backhaul (IAB) technology during 2020, saying it can prove a reliable backhaul alternative to fiber in certain cases, such as expanding millimeter-wave locations to reach more isolated areas. Verizon also confirmed, without adding any details, that it plans to use IAB, which is an architecture for the 5G cellular networks in which the same infrastructure and spectral resources will be used for both access and backhaul. IAB will be described in 3GPP Release 16 (see 3GPP section below for more details).

…………………………………………………………………………………………………………………………………………..

“Fiber is still required in close proximity to serve the capacity coming from the nodes, so if it can be extended to each of the nodes, it will be the first choice,” said Gordon Mansfield, VP of Converged Access and Device Technology at AT&T. in an statement emailed to FierceWireless.

“From there, IAB can be used to extend to hard to reach and temporary locations that are in close proximity. As far as timing, we will do some testing in 2020 but 2021 is when we expect it to be used more widely,” he said.

Verizon also told Fierce that it has plans to incorporate IAB as a tool. It doesn’t have any details to share at this time, but “it’s certainly on the roadmap,” an unknown Verizon representative said.

Earlier this year, Mike Dano of Lightreading reported:

Verizon’s Glenn Wellbrock said he expects to add “Integrated Access Backhaul” technology to the operator’s network-deployment toolkit next year, which would allow Verizon to deploy 5G more easily and cheaply into locations where it can’t get fiber.

“It’s a really powerful tool,” Glenn Wellbrock, director of architecture, design and planning for Verizon’s optical transport network, explained during a keynote presentation here Thursday at Light Reading’s 5G Transport & the Edge event.

Wellbrock said IAB will be part of the 3GPP’s “Release 16” set of 5G specifications, which is expected to be completed by July 2020. However, Wellbrock said it will likely take equipment vendors some time to implement the technology in actual, physical products. That means 2020 would be the earliest that Verizon could begin deploying the technology, he added.

Wellbrock said IAB would allow Verizon to install 5G antennas into locations where routing a fiber cable could be difficult or expensive, such as across a set of train tracks.

However, Wellbrock said that IAB will be but one tool in Verizon’s network-deployment toolbox, and that Verizon will continue to use fiber for the bulk of its backhaul needs. Indeed, he pointed out that Verizon is now deploying roughly 1,400 miles of new fiber lines per month in dozens of cities around the country.

He said Verizon could ultimately use IAB in up to 10-20% of its 5G sites, once the technology is widely available. He said that would represent an increase from Verizon’s current use of wireless backhaul technologies running in the E-band; he said less than 10% of the operator’s sites currently use wireless backhaul. He said IAB is better than current wireless backhaul technologies like those that use the E-band because it won’t require a separate antenna for the backhaul link. As indicated by the “integrated” portion of the “integrated access backhaul” moniker, IAB supports wireless connections both for regular 5G users and for backhaul links using the same antenna.

………………………………………………………………………………………………………………………………………..

According to 5G Americas, the larger bandwidths associated with 5G New Radio (NR), such as those found in mmWave spectrum, as well as the native support of massive MIMO and multi-beams, are expected to facilitate and/or optimize the design and performance of IAB.

5G Americas maintains that the primary goals of IAB are to:

- Improve capacity by supporting networks with a higher density of access points in areas with only sparse fiber availability.

- Improve coverage by extending the range of the wireless network, and by providing coverage for isolated coverage gaps. For example, if the user equipment (UE) is behind a building, an access point can provide coverage to that UE with the access point being connected wirelessly to the donor cell.

- Provide indoor coverage, such as with an IAB access point on top of a building that serves users within the building.

5G Americas also said that in practice, IAB is more relevant for mmWave because lower frequency spectrum may be seen as too valuable (and also too slow) to use for backhaul. The backhaul link, where both endpoints of the link are stationary, is especially suitable for the massive beam-forming possible at the higher frequencies.

……………………………………………………………………………………………………………

3GPP Release 16 status of work items related to IAB:

(Note: Study is 100% complete, but others are 0% or 50% complete):

| 750047 | FS_NR_IAB | … Study onNR_IAB | 100% |

| 820170 | NR_IAB-Core | … Core part: NR_IAB | 0% |

| 820270 | NR_IAB-Performance | 850002 | – | … CT aspects of NR_IAB | 0% |

| 830021 | FS_NR_IAB_Sec | … Study on Security for NR_IAB | 50% |

| 850020 | – | … Security for NR_IAB | 0% |

| 850002 | – | … CT aspects of NR_IAB | 0% |

References:

https://www.fiercewireless.com/wireless/at-t-expects-to-test-iab-2020-use-it-more-widely-2021

China to launch first private 5G satellite by end of 2019

Sources: China Daily/Asia News Network and Beijing Daily (see References blow)

China’s first private 5G low-orbit broadband satellite has passed factory tests and is expected to be launched at the end of the year, chinanews.com reported. The 5G satellite is expected to be put into orbit via Kuaizhou-1A (KZ-1A) rocket by the end of December.

It is China’s first satellite developed by a commercial aerospace company GalaxySpace and weighs approximately 200 kg. The launch will be the first Q/V band and 200-kilogram private (non-government owned) satellite.

With an orbit altitude of 1,200 meters, it will cover 300,000 square kilometers, roughly equivalent to 50 Shanghai cities. The satellite will gradually provide 5G signal services to various places through ground stations. From this starting point, China has taken the first step in its 5G “space communications” journey.

The satellite, made by Galaxy Space, will be launched via the domestically made KZ-1A carrier rocket at the end of December. Xu Ming, founder of GalaxySpace, said the launch of the satellite could mark the first step of its “space internet” project. The company wants to develop more low-cost, high-performance 5G satellites in the future, so as to fill digital gaps and connect the world with the 5G satellite network, he added.

“The coverage of 5G signals from the sky is huge, and the signals of each 5G low-orbit broadband satellite can evenly cover a range of 300,000 square kilometers. Large cities such as Beijing, Shanghai, Guangzhou, and Shenzhen can easily achieve full coverage for autonomous driving, aircraft, ships, high-speed rail And other mobile platforms to provide high-speed, stable, low-latency 5G network connection services. “Liu Chang said.

“China Telecom has proposed to promote the integration of mobile phone communications and satellites through software and hardware technologies such as mobile phone multi-mode.” Biqi, the chief expert of China Telecom and a member of Bell Labs in the United States, who is participating in the World 5G Conference, told reporters that Among the operators, China Telecom is currently the only operator with satellite spectrum related resources.

In order to make commercial use of 5G satellite signals as early as possible, Liu Chang said that Galaxy Aerospace is indeed expected to cooperate with operators.

Low-orbit broadband communications satellites could overcome challenges that ground base stations currently confront in covering areas such as deserts and the ocean, and shed light on those living in places where communication signals rarely reach, the report said.

References:

https://www.thestar.com.my/news/regional/2019/12/13/china-to-launch-first-private-5g-satellite

http://bjrb.bjd.com.cn/html/2019-11/23/content_12431015.htm

https://www.chinadaily.com.cn/a/201912/12/WS5df20a57a310cf3e3557dc80.html

ITU-R Schedule for completion of IMT-2020.SPECS; Workshop Results

Schedule for Detailed specifications of the terrestrial radio interfaces of International Mobile Telecommunications-2020 (IMT-2020) – IMT-2020.SPECS:

Meeting No. 33 (Dec. 2019, Geneva)

- Develop a detailed work plan

- Develop a working document towards PDNR M.[IMT-2020.SPECS]

Meeting No. 34 (Feb. 2020, Geneva)

- Review the work plan, if necessary

- Continue developing the working document towards PDNR M.[IMT-2020.SPECS]

- Receive and take note of “Form A”, in order to determine the structure of the Recommendation

- Provide and send liaisons to RIT/SRIT Proponents and GCS Proponents

Meeting No. 35 (Jun. 2020, [China])

- Receive and review information, including the texts for its RIT/SRIT overview sections, List of Global Core Specifications and Certification B by GCS Proponents1

- Reach its conclusion on the acceptability of the proposed materials for inclusion in the working document towards PDNR M.[IMT-2020.SPECS]

- Finalizes the working document including specific technologies (not necessarily including the detailed transposition references) and provisionally agree for promoting the document to preliminary draft new Recommendation

- Provide and send liaison of the provisionally agreed Preliminary Draft New Recommendation ITU-R M.[IMT-2020.SPECS] to the relevant GCS Proponents and Transposing Organizations for their use in developing their inputs of the detailed references

Meeting No. 36 (Oct. 2020, [India])

- Update PDNR if there are modifications proposed by GCS Proponent

- Perform a quality and completion check of the provisionally agreed final draft new Recommendation ITU-R M.[IMT-2020.SPECS] without the hyperlinks

- Have follow-up communications initiated with GCS Proponents and/or Transposing Organizations, if necessary

Meeting No. 36bis (Nov. 2020, Geneva)

- Receive Transposition references and Certification C from each Transposing Organization

- Perform the final quality and completeness check (with detailed transposition references) of the preliminary draft new Recommendation and promotes it to draft new Recommendation

- Send the draft new Recommendation ITU-R M.[IMT-2020.SPECS] to Study Group 5 for consideration

1____________________ If the GCS Proponentrnal (potential GCS Proponent) decides to use DIS style, it doesn’t need to submit List of Global Core Specifications but needs to submit full materials for describing its RIT/SRIT in the Recommendation and Form B.

…………………………………………………………………………………………………………….

Workshop on IMT-2020 terrestrial radio interfaces evaluation (10 to 11 December 2019, Geneva, Switzerland):

ITU-R Working Party (WP) 5D started the evaluation process for Independent Evaluation Groups (IEGs) as of its 31st meeting in Oct. 2018, in conjunction with the ongoing IMT-2020 development under Step 3 and Step 4 of the IMT-2020 process.

Working Party 5D has received, at its July 2019 meeting, several candidate technology submissions for IMT-2020 from six proponents, under Step 3 of the IMT-2020 developing process.

WP 5D held a workshop on IMT-2020, focusing on the evaluation of the candidate terrestrial radio interfaces at its 33rd meeting taking place December 2019 in Geneva, at which interim evaluation reports are expected. This will help the IEGs understand the details of the proposed candidate technologies, and interact amongst themselves as well as other WP 5D participants. This workshop is a continuation of the previous one on IMT-2020 held in 2017, Munich, which addressed the process, requirements, and evaluation criteria for IMT-2020 as well as views from proponents on the developments of IMT-2020 radio interfaces and activities of the IEGs.

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/Pages/ws-20191210.aspx

December 12, 2019 UPDATE:

See Comment in box below this article for disposition of TSDSI, ETSI/DECT Forum, and Nufront IMT 2020 RIT self evaluations. They have not “satisfactorily fulfilled Section 4.3 for the self-evaluation,” which means that the respective IMT 2020 RIT submissions will not be progressed at this time by WP 5D.

Cisco’s ‘Internet of the Future’ Strategy with Silicon One Architecture

Executive Summary:

- Cisco shared further details behind its ‘Internet for the Future’ technology strategy based on development investments in Silicon+Optics+Software.

- Cisco Silicon OneTM, a first-ever single, unified silicon architecture that can serve anywhere in the network and be used in any form factor.

- New Cisco 8000 Series, the first platform built with Silicon One and new IOS XR7 operating system.

- Cisco 8000 Series set to reduce cost of building and operating mass scale networks to run digital applications and services such as 5G, video and cloud.

- New flexible business model options that enable customers to consume new innovation in new ways that best fit their business needs.

- AT&T, Century Link, Comcast, Facebook, Microsoft and The Walt Disney Studios share insights on joint innovation and the needs of the next Internet

Cisco announced its “Internet of the Future” strategy at a December 11th event in San Francisco, CA. The highlight of the announcement was Cisco’s Silicon One chip, which is a unified silicon architecture that can work anywhere in the network and be used in any form factor. Silicon One, along with Cisco’s new IOS XR7 operating system, is powering Cisco’s new 800 series routers that were designed for hyperscale web operators and large service providers to power applications and services, such as 5G core network, video streaming and 400GE transport.

“Innovation requires focused investment, the right team and a culture that values imagination,” said Cisco Chairman and CEO Chuck Robbins, in a press release. “We are dedicated to transforming the industry to build a new internet for the 5G era. Our latest solutions in silicon, optics and software represent the continued innovation we’re driving that helps our customers stay ahead of the curve and create new, ground-breaking experiences for their customers and end users for decades to come.”

The next-generation of internet infrastructure combines Cisco’s new silicon architecture with its next-generation of optics. Cisco says its strategy will change the economics behind how the internet will be built to support the demands of future, digital applications and will enable customers to operate their businesses with simpler, more cost-effective networks.

Cisco’s strategy is based on development and investments in three key technology areas: silicon, optics and software.

“Pushing the boundaries of innovation to the next level — far beyond what we experience today — is critical for the future and we believe silicon, optics and software are the technology levers that will deliver this outcome,” said David Goeckeler, executive vice president and general manager of the Networking and Security Business at Cisco.

“Cisco’s technology strategy is not about the next-generation of a single product area. We have spent the past several years investing in whole categories of independent technologies that we believe will converge in the future — and ultimately will allow us to solve the hardest problems on the verge of eroding the advancement of digital innovation. This strategy is delivering the most ambitious development project the company has ever achieved.”

Silicon One will be the foundation of Cisco’s routing portfolio going forward, with expected near-term performance availability up to 25 Terabits per second (Tbps). Cisco says it is the industry’s first networking chip designed to be universally adaptable across service provider and web-scale markets. Designed for both fixed and modular platforms, it can manage the most challenging requirements in a way that’s never been done before. The first Cisco Silicon One ‘Q100’ model surpasses the 10 Tbps routing milestone for network bandwidth without sacrificing programmability, buffering, power efficiency, scale or feature flexibility.

Traditionally, multiple types of silicon with different capabilities are used across a network and even within a single device. Developing new features and testing can be lengthy and expensive. Unified and programmable silicon will allow for network operators to greatly reduce costs of operations and reduce time-to-value for new services.

The new Cisco 8000 series is the first platform built with Cisco Silicon One Q100. It is engineered to help service providers and web-scale companies reduce the costs of building and operating mass-scale networks for the 5G, AI and IOT era. Key features include:

- Optimized for 400 Gbps and beyond, starting at 10.8 Tbps in just a single rack unit

- Powered by the new, cloud-enhanced Cisco IOS XR7 networking operating system software, designed to simplify operations and lower operational costs

- Offers enhanced cybersecurity with integrated trust technology for real-time insights into the trustworthiness of your critical infrastructure

- Service providers gain more bandwidth scale and programmability to deliver Tbps in even the most power and space constrained network locations

Cisco is also supporting Microsoft-developed SONiC (Software for Open Networking in the Cloud) OCP software in its 800 series routers.

Global Customer Deployments and Trials:

Cisco is working with a group of pioneering customers on deployments and trials of the Cisco 8000 Series. STC, the leading telecom services provider in the Middle East, Northern Africa region, marks the first customer deploying the new technology. Ongoing trials include Comcast and NTT Communications among others.

Testimonials:

“We look forward to working with Cisco as it enters the high-end routing silicon space, collaborating to help meet the next generation of network demands for higher speeds and greater capacity,” said Amin Vahdat, fellow and vice president of Systems Infrastructure, Google Cloud.

“Facebook has been a strong advocate for network disaggregation and open ecosystems, launching key industry initiatives such as the Open Compute Project and the Telecom Infrastructure Project to transform the networking industry,” said Najam Ahmad, vice president, Network Engineering at Facebook. “Cisco’s new Silicon One architecture is aligned with this vision, and we believe this model offers network operators diverse and flexible options through a disaggregated approach.”

“It’s aggregation through disaggregation,” said Scott Raynovich, founder and chief analyst of Futuriom. “Cisco clearly thinks the way to compete in web scale is to deliver its own optical platform with a vertically oriented system and a new, disaggregated OS — which also means it can protect profit margins by owning its own components. The cloud so far is being built on disaggregation — so it will be interesting to see how the market receives this.”

“Cisco is changing the economics of powering the Internet, innovating across hardware, software, optics and silicon to help its customers better manage the operational costs to function on a larger scale for the next phase of the Internet,” said Ray Mota, CEO and principal analyst at ACG Research. “As we move to 2020, the timing of delivering operational efficiency will be vital.”

…………………………………………………………………………………………………………..

Optics for 400G and Beyond:

Building a new internet that can support future digital innovation will depend on continued breakthroughs in silicon and optics technologies. Cisco is unique in the industry with advanced intellectual property in both areas.

As port rates increase from 100G to 400G and beyond, optics become an increasingly larger portion of the cost to build and operate internet infrastructure. Cisco is investing organically to assure our customers that as router and switch port rates continue to increase, optics will be designed to meet the industry’s stringent reliability and quality standards.

Through the company’s qualification program, Cisco will test its optics to comply with industry standards and operate in Cisco – and non-Cisco hosts. With this program, customers can utilize Cisco optics in applications where non-Cisco hosts have been deployed and have confidence that the optics will meet the reliability and quality standards that they have come to expect from Cisco.

In addition, as silicon and silicon photonics advance, functions that were traditionally delivered in separate chassis-based solutions will soon be available in pluggable form factors. This transition has significant potential benefits for network operators in terms of operational simplicity. Cisco is investing in silicon photonics technologies to effect architectural transitions in data center networks and service provider networks that will drive down cost, reduce power and space, and simplify network operations.

……………………………………………………………………………………………..

Cisco rival Juniper Networks announced a major reboot to its MX routing platform last year, which included new silicon—which gives Juniper’s MX routers a 50% increase in efficiency—more programmability and more chassis options, but Juniper isn’t able to match the breadth of Cisco’s Internet of the Future platform.

References:

https://newsroom.cisco.com/press-release-content?type=webcontent&articleId=2039386

https://www.fiercetelecom.com/telecom/cisco-makes-a-bold-play-silicon-space-bows-new-router-series

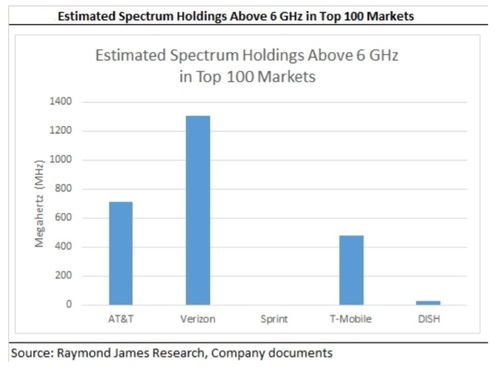

Analysis and results of FCC Auction 103 for 5G mmWave Spectrum

The Federal Communications Commission (FCC) commenced its latest 5G mmWave spectrum auction today. This morning, Auction 103 bidding began on spectrum in the upper 37 GHz, 39 GHz, and 47 GHz bands. Auction 103 is the largest auction of millimeter wave spectrum the FCC has conducted. The Commission is making 3,400 MHz of millimeter-wave spectrum available through this auction. At the end of the day there were $715,333,400 in second round bids at Auction 103, which had two rounds of bidding on Tuesday. It’s moving to three rounds on Wednesday. Real-time results from the auction are available here.

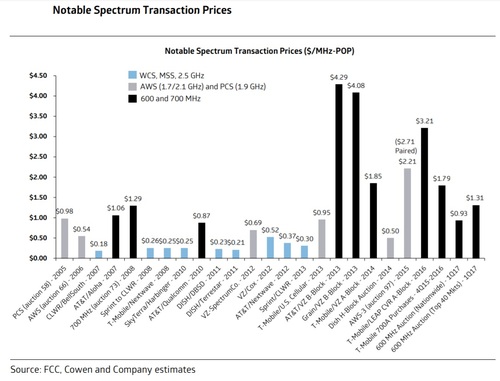

After Round 1 in Auction 103, spectrum was selling for just $0.000931 per MHz-POP compared to $0.001606 per MHz-POP at the same point in Auction 102. “With 3400 MHz of spectrum available and just 35 bidders competing, it will be a struggle for Auction 103 to reach anywhere near the disappointing $0.009112 per MHz-POP that Auction 102 reached after 91 rounds,” wrote Sasha Javid, COO at the Spectrum Consortium, in a blog post. “I think it’s safe to say they’re going to try to do this faster than the previous auctions,” he added, referring to the number of rounds per day. Javid is tracking the latest auction on his website. Javid said he suspects the FCC will stick with three rounds for a few more days but will increase the number of rounds per day much faster than in previous millimeter wave auctions. “I think it’s safe to say they’re going to try to do this faster than the previous auctions,” he said, referring to the number of rounds per day.

The full list the 35 qualified bidders for Auction 103 is here. The FCC won’t release the identities of the bidders until the auction is over. And analysts continue to believe that overall demand for mmWave spectrum is cooling as more and more mmWave spectrum becomes available, and the industry’s attention turns to other types of spectrum — specifically midband spectrum for 5G.

“There’s so much of it [millimeter wave spectrum] that’s already been brought to the marketplace that hasn’t even started to be used yet,” Brian Goemmer, president of spectrum analysis company AllNet Insights & Analytics, told FierceWireless in October.

Analysts at Wall Street brokerage firm Raymond James wrote in an October report that there’s “not much treasure expected in these waters.” They estimate that the FCC’s newest mmWave spectrum auction will raise around $3 billion in total bids — slightly above previous mmWave auctions but well below auctions for mid-band and low-band spectrum.

The FCC has already auctioned a significant amount of mmWave spectrum during its two other auctions: Auction 101, which raised $703 million in bids, and Auction 102, which raised $2 billion in bids. The first round of Auction 101 raised just $36 million in bids, while the first round of Auction 102 raised $284 million in bids.

FCC Chairman Ajit Pai issued the following statement:

Today’s spectrum auction shows that America is continuing to lead the world in 5G, the next generation of wireless connectivity. These airwaves will be critical in deploying 5G services and applications. Auctioning the 39 GHz and upper 37 GHz bands together presents a critical opportunity for 5G deployment as it represents the largest amount of contiguous spectrum available in the millimeter-wave bands.

Notably, we’re setting up the Upper 37 GHz, 39 GHz, and 47 GHz auction to be our second ever incentive auction. This one will be different from the broadcast incentive auction that Congress authorized years ago, but it’ll have the same worthy goal: clearing or repacking existing licensees to make spectrum as useful as possible, boosting competition and benefiting consumers.

Pushing more spectrum into the commercial marketplace is a key component of our 5G FAST plan to advance American leadership in the next generation of wireless connectivity. Earlier this year, we concluded our first-ever high-band 5G auctions of the 28 GHz and 24 GHz bands. Next year, we look forward to initiating two mid-band spectrum auctions—the 3.5 GHz auction on June 25, 2020, and an auction in the 3.7-4.2 GHz band in the latter part of 2020. These and other steps will help us stay ahead of the spectrum curve and allow wireless innovation to thrive on our shores.”

Light Reading’s Mike Dano notes that most of the rest of the world is moving forward with 5G in midband spectrum, not mmWave spectrum. For example, China and South Korea are both mainly using the 3.5GHz band for their respective 5G buildouts.

A recent report from the Global mobile Suppliers Association (GSA) indicates that other countries besides the U.S have a vested interest in mmWave spectrum. GSA’s report on spectrum above 6GHz found that 66 operators across 13 countries hold licences enabling operation of 5G networks using mmWave spectrum, and that 14 are known to be deploying 5G networks using mmWave spectrum. We analyzed and broke down GSA’s mmWave findings in this IEEE Techblog post.

In an earlier post, we noted that WRC 19 had approved the frequency bands of 24.25-27.5 GHz, 37-43.5 GHz, 45.5-47 GHz, 47.2-48.2 and 66-71 GHz for the deployment of 5G networks (IMT 2020).

………………………………………………………………………………………

Dec 13th Update from Light Reading:

Millimeter Wave Spectrum Auction Blasts Past $1.5B, Shows No Signs of Cooling

The FCC’s ongoing auction of millimeter-wave (mmWave) spectrum this week shot past the $1.5 billion-mark in terms of total bids placed, and the pace of action in the event hasn’t slowed down since it started on Monday. The spectrum will likely be put to use in 5G networks.

According to spectrum expert Stephen Wilkus of Spectrum Financial Partners, bidders in the FCC’s latest spectrum auction have been increasing their bids by 10% to 20% during each of the last nine rounds of bidding. He said that the event, which started Monday, has already exceeded his expectations and appears to be headed toward $3 billion in total bids.

However, analyst Tim Farrar with TMF Associates noted that the auction would have to generate between $7 billion and $8 billion in total bids to reach the same valuations as the FCC’s two prior mmWave spectrum auctions.

The FCC’s Auction 101 for 28GHz spectrum licenses raised $703 million in total bids, while its Auction 102 for 24GHz licenses raised $2 billion in bids. The FCC disclosed the results of those auctions this summer. The agency’s Auction 103, which started Monday, offers an astounding 3,400MHz of spectrum across the 37GHz, 39GHz and 47GHz bands — that’s far more overall spectrum than was available in the agency’s two prior mmWave auctions.

With more spectrum coming to market, the overall demand for the mmWave spectrum is declining. (The FCC just this week took steps to release even more spectrum for commercial uses.)

Wilkus of Spectrum Financial Partners said that the average price for spectrum licenses in the FCC’s ongoing Auction 103 clocked in at just $0.00187 per MHz/POP in round eight, which he said was five times lower than the final price of the 24GHz spectrum auction earlier this year.

At issue is the way the value of spectrum is calculated. “MHz/POP” refers to the amount of spectrum available in a license across how many people it covers. For lowband spectrum like 600MHz, those calculations often sit in the $1 range since 600MHz transmissions can travel across miles of geography, and operators generally buy licenses in the band in blocks of 10MHz. Calculations for mmWave spectrum are much different though, considering transmissions in such spectrum can’t travel more than a few thousand feet, and operators often buy such spectrum in 100MHz chunks. That’s why the FCC’s first two mmWave spectrum auctions ended at just $0.01 per MHz-POP.

“Results after the first round of bidding in the FCC’s Auction 103 appear to indicate that the federal coffers may end up lighter than expected,” wrote Spectrum Consortium COO Sasha Javid on LinkedIn after the first day of bidding in Auction 103. Javid manages some of the spectrum holdings of some TV broadcasters. “Round 1 ended with gross proceeds totaling $637,295,800. While this is more than the approximately $284 million raised after Round 1 of Auction 102 (the 24 GHz auction), it is approximately 40% less on a MHz-POP basis. After Round 1, spectrum is selling for just $0.000931 per MHz-POP, compared to $0.001606 per MHz-POP at the same point in Auction 102. With 3400 MHz of spectrum available and just 35 bidders competing, it will be a struggle for Auction 103 to reach anywhere near the disappointing $0.009112 per MHz-POP that Auction 102 reached after 91 rounds.”

……………………………………………………………………………………….

Dec 24th Update from Light Reading:

mmWave Auction Nears $6B, but Action Slows

The FCC paused its millimeter-wave (mmWave) spectrum auction for the holidays, allowing bidders to take a break from their billion-dollar gambles. Action in the auction — which is nearing $6 billion in total bids — is scheduled to resume Jan. 6.

Already the auction has surpassed some initial estimates that pegged total bids topping out at $3 billion.

However, it appears that the event is slowly cruising toward a finish. “Incremental gross bids by round had been climbing uphill, but then started going downhill fast in recent rounds,” noted the analysts at Wall Street research firm Raymond James in a note this weekend to investors.

https://www.lightreading.com/mobile/5g/mmwave-auction-nears-$6b-but-action-slows/d/d-id/756484?

…………………………………………………………………………………………………..

Jan 22, 2020 Update from RCR Wireless:

mmWave auction activity surges as FCC pushes toward conclusion

Auction total hits $7.5 billion, as bidders scoop up licenses in smaller and rural markets

A nudge from the Federal Communications Commission has prompted a surge in bidding activity in the ongoing millimeter wave spectrum auction, with bidders broadening their interest to include licenses in geographic areas which they had ignored until this point.

That hasn’t moved the bid total by much, though, with gross proceeds having crept up from around $7.4 billion last week to $7.5 billion as of the end of round 76 on Wednesday. No bidding was held on Monday due to the federal holiday.

As of Tuesday, the FCC began requiring that bidders use 100% of their eligible bidding activity, instead of the 95% that had been previously required. It’s a use-it-or-lose it scenario in which bidders who don’t use all of their bidding units risk having their eligibility for bid units decreased until it’s in line with their activity, a move which the FCC noted in an auction announcement could “possibly [curtail]or [eliminate]the bidder’s ability to place additional bids in the auction.”

In response, the number of spectrum “products” with more bidding demand than license supply has jumped, from low double-digits late last week to nearly 300 as of the end of round 76. Auction 103 is using a clock format for its first phase, in which bidders compete for the license type and location they desire, with prices automatically increasing each round, until bidders’ demand for licenses at a certain price matches the supply. At that point, the clock phase with end and an assignment phase for specific spectrum blocks will follow.

While major urban market licenses were bid up quickly and then mid-sized markets followed, licenses with low demand have been those in lightly populated, rural and remote areas, and U.S. island territories. There are 832 total spectrum products (the MN and P licenses in each of the 416 geographic Partial Economic Areas) available in the auction, and as of the close of round 76, 284 of those had greater demand than supply, 545 had demand equal to supply and just three had demand less than supply.

Last week, around 40 licenses had no demand at all, according to analysis from Sasha Javid, COO at the Spectrum Consortium and former chief data officer and legal advisor on the FCC’s Incentive Auction Task Force; that figure has since dropped to zero licenses with no demand.

There are still 35 qualified bidders competing in Auction 103.

Stephen Wilkus, CTO at Spectrum Financial Partners, has been tweeting his auction observations and opined on Tuesday that the push from the FCC “will pressure the auction to end in the next few rounds.”

Another five, 30-minute rounds of bidding are scheduled for Thursday, but the FCC has held off on scheduling rounds for Friday as of yet.

More than 14,100 licenses are up for grabs across three mmWave bands in Auction 103: the upper 37 GHz band (37.6-38.6 GHz), the 39 GHz band (38.6-40 GHz) and the 47 GHz band (47.2-48.2 GHz). The licenses are based on a Partial Economic Area geographic basis which divides the country into 416 sections.

There is more spectrum available at 39 GHz than in the other two bands, with 14 blocks of 100 megahertz available, or 5,824 individual licenses. The 47 GHz and upper 37 GHz bands each have 4,160 licenses available, or 10 blocks of 100 megahertz in each PEA. The FCC has divided the spectrum into two categories of licenses: 24 100-MHz licenses in the 37 and 39 GHz frequency blocks, the MN or M/N licenses, and ten 100-MHz licenses in the 47 GHz frequency block, the P licenses.

The FCC has authorized either fixed or mobile use in the bands, and the commission has emphasized the sheer amount of spectrum available: at 3,400 megahertz, Auction 103 puts up the largest amount of spectrum ever offered in an auction.

mmWave auction activity surges as FCC pushes toward conclusion

References:

https://docs.fcc.gov/public/attachments/DOC-361255A1.pdf

https://sashajavid.com/FCC_Auction103.php

https://www.fiercewireless.com/wireless/auction-103-concludes-second-round-715m-bids

WRC 19 Wrap-up: Additional spectrum allocations agreed for IMT-2020 (5G mobile)

Information on FCC Auction 103 is available at: https://www.fcc.gov/auction/103/factsheet

To learn more about the FCC’s 5G efforts, please visit www.fcc.gov/5G

Australia telco Optus claims ‘world first’ 5G data call over 2300 MHz spectrum

Optus, Australia’s second largest telco (Telstra is #1), says it is the first telecommunications network operator in the world to achieve a 5G data call over 2300 MHz spectrum, completing the test call in Sydney via pre-standard 5G equipment from partner Ericsson.

According to Optus its unique ownership of both 2300MHz and 3500MHz spectrum means that it will be able to build a “true dual band 5G network which will ultimately provide customers with even more capacity and more coverage on 5G than a single band 3500MHz 5G today.”

“There is strong industry interest in the use of the 2300MHz band for 5G and as the only telecommunications operator in Australia to currently have access to this band in metro capital cities, it’s great to be leading the way with testing and trialing this for future 5G deployment,” said Dennis Wong, Optus managing director networks.

“With its lower frequency the 2300MHz spectrum band will, in the future, ultimately offer our customers even greater speeds as well as providing greater coverage depth enabling even more customers to benefit from 5G services.

“We are actively pushing forward with our robust 5G deployment plan utilizing the 3500MHz spectrum band and have more than 300 5G sites now live. At this stage we are working towards deploying our 2300MHz spectrum some time during 2020 which together with our existing 3500MHz spectrum will offer our customers a world-leading 5G experience both in the home and on the go.”

Optus says it currently has more than 300 5G cell sites live across Sydney, Brisbane, Perth, Melbourne, Adelaide, Canberra and other important Australia locations in NSW, Victoria and Queensland. The company currently offers 5G Home Broadband service with a 50Mbps Satisfaction Guarantee. It plans to deliver 1,200 5G sites by March 2020.

Media enquiries:

Anna Garcia

Optus Corporate Affairs

Tel: (02) 8082 7850

[email protected]

………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.optus.com.au/for-you/5g

https://www.optus.com.au/about/media-centre/media-releases/2019/01/Optus-5G-Whiz

AWS looks to dominate 5G edge with telco partners that include Verizon, Vodafone, KDDI, SK Telecom

On Dec. 3rd at AWS re:Invent (Dec. 2-6, 2019) in Las Vegas, Amazon Web Services Inc. (AWS), announced AWS Wavelength, which provides developers the ability to build applications that serve end-users with single-digit millisecond latencies over the 5G network. AWS is partnering with Verizon on making AWS Wavelength available across the United States. Currently, AWS Wavelength is being piloted by select customers in Verizon’s 5G Edge, Verizon’s mobile edge compute (MEC) solution, in Chicago. Additionally, AWS is collaborating with other global telecommunications companies (including Vodafone, SK Telecom, and KDDI) to launch AWS Wavelength across Europe, South Korea, and Japan in 2020, with more global partners coming soon. From Amazon’s AWS Wavelength press release:

AWS Wavelength enables developers to build applications that deliver single-digit millisecond latencies to mobile devices and end-users. AWS developers can deploy their applications to Wavelength Zones, AWS infrastructure deployments that embed AWS compute and storage services within the wireless telecommunications providers’ data centers at the edge of the 5G networks, and seamlessly access the breadth of AWS services in the region. This enables developers to deliver applications that require single-digit millisecond latencies such as game and live video streaming, machine learning inference at the edge, and augmented and virtual reality (AR/VR).

AWS Wavelength brings AWS services to the edge of the 5G network, minimizing the latency to connect to an application from a mobile device. Application traffic can reach application servers running in Wavelength Zones without leaving the mobile provider’s network. This reduces the extra network hops to the Internet that can result in latencies of more than 100 milliseconds, preventing customers from taking full advantage of the bandwidth and latency advancements of 5G.

More from the press release:

Wavelength embeds AWS compute and storage services at the edge of wireless telecommunications providers’ 5G networks, enabling developers to serve use-cases that require ultra-low latency like machine learning inference at the edge, autonomous industrial equipment, smart cars and cities, Internet of Things (IoT), and Augmented and Virtual Reality. Wavelength brings the power of AWS to the edge of the 5G network, so developers can deploy the portions of an application that require ultra-low latency within the 5G network, and then seamlessly connect back to the rest of their application and full range of cloud services running in AWS. AWS customers can now use the same familiar AWS APIs, tools, and functionality they use today, to deliver-low latency applications at the edge of the 5G network, around the world […]

With infrastructure that consists of 69 Availability Zones, in 22 AWS Regions, AWS enables developers to serve end-users with low latencies worldwide. However, emerging interactive applications like game streaming, virtual reality, and real-time rendering require even lower latencies, of single-digit milliseconds to end-users and devices, connected through mobile networks. In addition, use-cases like industrial automation, smart cities, IoT, and autonomous vehicles require data processing to take place close to the source in order to conserve resources like device power and bandwidth. The 5G network is up to 20 times faster than 4G, and can be used to dramatically increase the number of supported devices and shrink network latency for mobile devices. However, even with the arrival of 5G, mobile devices still have to cross multiple network hops when connecting to an application over the Internet. Today, application traffic has to travel from a device to a cell tower to metro aggregation sites to regional aggregation sites and to the Internet before it can access resources running in AWS. These network hops can result in latencies of more than 100 milliseconds. This prevents developers from realizing the full potential of 5G to address low-latency use-cases.

Wavelength addresses these problems by bringing AWS services to the edge of the 5G network, minimizing the latency to connect to an application from a mobile device. With Wavelength, AWS developers can deploy their applications to Wavelength Zones, AWS infrastructure deployments that embed AWS compute and storage services within the network operators’ datacenters at the edge of the 5G network, so application traffic only needs to travel from the device to a cell tower to a Wavelength Zone running in a metro aggregation site. This removes a lot of the latency that would result from multiple hops between regional aggregation sites and across the Internet, which enables customers to take full advantage of 5G networks. Wavelength also delivers a consistent developer experience across multiple 5G networks around the world, and allows developers to build the next generation of ultra-low latency applications using the familiar AWS services, APIs, and tools they already use today – eliminating the need for developers to negotiate for space and equipment with multiple telecommunications providers, and stitch together application deployment and operations through different management interfaces, before they can begin to deploy their applications.

AWS Wavelength combines the power of the AWS cloud with the cutting-edge 5G networks of leading telecommunications providers like Verizon, Vodafone, KDDI, and SK Telecom to unlock a new wave of innovative applications and services around the world. By delivering these new capabilities, Wavelength enables developers to serve mobile users with single-digit millisecond latency and to optimize their applications by processing data closer to its source, enabling use-cases across a wide range of platforms – from factories to stores to cars to homes.

To deploy their application to the 5G edge, developers can simply extend their Amazon Virtual Private Cloud (VPC) to include a Wavelength Zone and then create AWS resources like Amazon Elastic Compute Cloud (EC2) instances, Amazon Elastic Block Storage (EBS) volumes, and AWS Elastic Container Service (ECS) and Amazon Elastic Kubernetes Services (EKS) containers. In addition, developers can continue to use familiar and powerful AWS services to manage, secure, and scale their applications like AWS CloudFormation, AWS Identity and Access Management (IAM), and AWS Auto Scaling. This enables developers to easily run a wide variety of latency-sensitive workloads like analytics, IoT, machine learning, game streaming, and AR/VR.”

With Wavelength, we bring 5G and cloud together to give our customers the powerful new capability to run cloud services consistently within a few milliseconds of mobile end-users,” said Matt Garman, Vice President Compute Services, AWS. “This is a game changer for developers that is going to unlock a whole new generation of applications and services. We are really excited to see our customers innovate with these unique new capabilities that they did not have access to before.

AWS Wavelength: Partner testimonials:

From the AWS press announcement, here are current Amazon’s Wavelength partners’ testimonial statements:

“Verizon is building the most powerful 5G network in the U.S. Launched in April, Verizon’s 5G Ultra Wideband network is currently live in 18 cities as well as 16 sporting and entertainment arenas across the country, and plans to expand to more than 30 U.S. cities by the end of this year. “Continuing our tradition of bringing new technology to market first we are excited to launch a mobile edge compute service — integrating our 5G Edge platform with Wavelength to allow developers to build new categories of applications and network cloud experiences,” said Kyle Malady, CTO of Verizon. “Bringing together the full capabilities of Verizon’s 5G Ultra Wideband network and AWS, we unlock the full potential of our 5G services for customers to create applications and solutions with the fastest speeds and ultra-low latency.”

Verizon and AWS will integrate AWS – Wavelength with 5G Edge so developers can begin testing applications on ultra-low latency networks. The plan is to connect 5G applications to AWS cloud services without the hops. The two companies will bring compute and storage closer to 5G users. Deployments are planned in Chicago for select customers in 2020 with additional locations added throughout the year.

“Varjo Technologies Oy is based in Helsinki and is creating the world’s best hardware and software for groundbreaking VR/AR/XR computing devices, merging the real and digital worlds seamlessly together in human-eye resolution. “Simulating things at the same acuity you see in real life is a game changer compared to standard VR approaches. Varjo’s unique human-eye resolution technology helps professionals save time, money, and effort,” said Niko Eiden, Founder and CEO, Varjo. “Not too far down the road, our technology will be fully wireless, collaborative mixed reality. And this workspace of the future needs to be rendered in the cloud – with millions of pixels of extremely high-resolution, uncompressed content with single-digit millisecond latencies delivered to our devices – whether on premises at carmakers or in remote sites, through 5G. Now, instead of having to develop expensive local computing services that would be impossible to run on a battery-operated device, we can use edge computing to scale the rendering power and the business of our industrial-grade VR/MR from thousands to hundreds of thousands of units. Having access to the power of the AWS Cloud, together with 5G’s high bandwidth, low latency, and increased connectivity, is vital to our ability to deliver professional immersive computing experiences and to grow our business.”

“Mapbox is the location data platform for mobile and web developers, providing building blocks to add location features like maps, search, and navigation into any experience and changing the way people move around cities and explore the world. Mapbox tools are used by more than 1.7 million live location developers to power daily experiences for people, technology, and business. “Everyone needs maps, so 600 million people touch Mapbox every month as they read the headlines of the New York Times, check the weather on Weather.com, and find great restaurants or concerts on Facebook,” said Eric Gundersen, CEO and Co-Founder, Mapbox. “Our map gets smarter every time someone touches it, using AI to constantly update traffic and new streets — AWS Wavelength’s ultra-low-latency compute can help us process billions of sensor data updates into better maps by identifying new roads as they’re built, routing drivers around traffic jams, and spotting road construction with the Vision SDK. AWS Wavelength can reduce our refresh timelines from minutes to seconds, delivering Mapbox users a truly living map.”

“SK Telecom, the largest mobile operator in Korea, with nearly 50 percent market share, has been leading the global mobile industry through constant innovations in technologies and services. As a 5G pioneer, SK Telecom is also one of the first telco providers to launch commercial 5G mobile-edge computing (MEC) in collaboration with AWS. “By combining the strengths of SK Telecom’s 5G network and AWS cloud, we are set to bring innovative changes to all individuals, businesses and industries. This collaboration enables exciting use cases like game streaming, headless robotics, Ultra High Definition interactive media, autonomous driving, and smart factories. For example, through the application of AWS Wavelength and SK Telecom’s advanced 5G solutions, a smart factory can enhance the response time of robots performing maintenance, security, and manufacturing tasks, allowing the factory to scale operations without increasing costs,” said Ryu Young-sang, Vice President and Head of MNO Business, SK Telecom. “SK Telecom and AWS are deploying 5G multi-access cloud services at the edge, helping third-party developers and enterprises improve quality of experience, create business models, and accelerate time to market for new revenue opportunities. With SK Telecom’s 5G network, we can jointly develop sophisticated cloud services that can create greater value for enterprises of any size in Korea.”

“Vodafone Group is one of the world’s leading telecoms and technology service providers, with extensive experience in connectivity, convergence and the Internet of Things, as well as championing mobile financial services and digital transformation in emerging markets. Vodafone Business and AWS will provide multi-access edge computing capabilities to developers, Internet of Things (IoT), devices and end users by bringing the AWS cloud closer to the devices that need it, and running AWS Wavelength in strategic locations within Vodafone’s 5G network. “With Europe’s largest 5G network across 58 cities and as a global leader in the Internet of Things (IoT) with over 90 million connections, Vodafone is pleased to be the first telco to introduce AWS Wavelength in Europe,” said Vinod Kumar, CEO of Vodafone Business. “Faster speeds and lower latencies have the potential to revolutionize how our customers do business, and they can rely on Vodafone’s existing capabilities and security layers within our own network.”

“KDDI, a leading telecommunications provider in Japan, offers services that include both mobile and fixed-line communications, and Internet services. KDDI, which plans to launch commercial 5G services in Japan by March 2020, is actively developing its 5G network to enable enhanced Mobile Broadband in both densely populated metropolitan areas and rural areas. “In preparation for our 5G service launch, KDDI has been successfully proving that 5G can be delivered with reliable service quality in Japan in metropolitan and rural locations. We have achieved successful trials, like 5G handovers for high-speed racing cars and trains, a real-time, free-viewpoint video stream at a baseball stadium, and 4K video communication at a major station,” said Makoto Takahashi, President, KDDI. “Having the power of the AWS cloud processing and storage services available at the edge of the KDDI 5G network enables us to accelerate IoT innovation for applications like high-definition VR video streaming, VPS (visual positioning service), smart factories, autonomous vehicles, and more. AWS Wavelength provides Japanese businesses and consumers immediate access to these services over the KDDI 5G network. This will also enable us to address some of Japan’s pressing societal issues, such as revitalizing economies in areas facing population decline, rebuilding infrastructure, and improving prompt reaction to natural disasters.”

Interoperability Issues:

The tight coupling of 5G networks with edge computing raises challenging interoperability questions. Currently, it appears that a U.S. end user wanting to use an application that relies on a AWS Wavelength Zone would have to be a Verizon 5G Edge customer with a Verizon 5G end point device. That’s not how we usually think about “the cloud,” which today can be accessed from a wide range of different vendor devices over a wide range of connectivity providers.

At MWC 2019, A&T announced it was working with Microsoft Azure to bring network edge computing (NEC) closer to the end point. We wrote in February 2019 that AT&T is using drones to test the network edge compute capabilities with Azure, working with Israel-based startup Vorpal in its foundry in Plano, TX. Microsoft provided new details of its Azure – AT&T 5G partnership on November 26th:

Microsoft Azure cloud services are being integrated into AT&T network edge locations (closer to customers). This means AT&T’s software-defined and virtualized 5G core – what the company calls the Network Cloud – is now capable of delivering Azure services. NEC will initially be available for a limited set of select customers in Dallas. Next year, Los Angeles and Atlanta are targeted for select customer availability.

That implies if you are an AT&T 5G customer you will, at some point in time, likely have access to Microsoft Azure cloud services via NEC. However, AT&T customers won’t be able to access NEC for any other cloud provider, i.e. AWS, Google Cloud, etc.

Hence, you only get the advantages of edge computing (with much lower latency) if you are locked in to a pair of 5G network and cloud providers that have an edge computing partnership.

And what about roaming or truly mobile, such that a 5G endpoint device (in a train, car, bus, ship, etc) moves from one Wavelength Zone or 5G network to another? Will there be any sort of hand-off between providers and will the 5G device be able to operate on more than the 5G network it subscribed to?

Once again, this issue can only be solved once the complete suite of IMT 2020 standards are finalized and implemented by 5G network operators and endpoint device makers!

References:

https://aws.amazon.com/wavelength

https://www.businesswire.com/news/home/20191203005910/en/AWS-Announces-AWS-Wavelength