Tutorial: Utilizing Containers for Cloud-Native and Elastic SBCs

by Bhupen Chauhan (edited by Alan J Weissberger)

Introduction:

A recent advancement in Session Border Controllers (SBCs) involves moving them to the cloud and utilizing elasticity. The use of Containers (defined below) intensifies this change even more. SBC solutions are essential for businesses. Service providers depend on Voice over IP (VoIP), because they provide security, interoperability, quality, and compliance in their communication infrastructure. We’ll delve further into the world of Cloud Native/Elastic SBCs using containers in this post.

What is a SBC?

A Session Border Controller (SBC) is a specialized hardware device or software program that controls how phone calls are answered, carried out, and ended as VoIP. They act as gatekeepers between internal and external networks, managing the media streams and signals necessary for establishing, carrying out, and terminating calls.

A SBC establishes and keeps track of each session’s quality of service (QoS) state, guaranteeing calls must be answered correctly, and urgent calls take precedence over all other calls. Additionally, an SBC can act as a firewall for session traffic by enforcing its QoS policies and recognizing particular inbound threats to the communication environment.

SBC’s Significance in Communications:

By providing security, guaranteeing interoperability, and enabling the effective use of network resources, SBCs strengthen communication networks. Here are several reasons to have Session Border Controller in VoIP Phone System and protect IP communications, defending against intrusions and offering essential functions, including:

- Security: An SBC’s most important responsibility is to defend the network against hostile assaults, including fraud, eavesdropping, and denial of service (DoS) attacks. They add a layer of security by concealing the network topology.

- Quality of Service (QoS): SBCs ensure that voice calls have the capacity and resources to remain high-quality by prioritizing voice traffic over other kinds of traffic.

- Interoperability: SBCs provide smooth communication between various devices, protocols, and signaling in IP networks by offering the required protocol translations.

- NAT Traversal: VoIP communication may encounter problems due to Network Address Translation (NAT). By fixing NAT traversal issues, SBCs guarantee reliable and continuous communications.

- Call Routing and Policy Enforcement: SBCs effectively route calls according to rules and specifications. They can also control bandwidth usage and implement various payment methods.

- Regulatory Compliance: Communication service providers are required in some areas to offer the ability to intercept communications legally. SBCs help VoIP service providers in fulfilling these kinds of legal obligations.

- Media services: Comprise functions like tone production, DTMF (dual-tone multi-frequency) interworking, and transcoding (changing one codec to another).

SBCs are essential to today’s communications environment, particularly regarding IP-based voice and video communications. Cloud-based and elastic SBCs will play a more significant role as communications change and more services go to the cloud. Now, we will together understand the concept of Cloud Native and Elastic SBCs.

What are Cloud Native and Elastic SBCs?

A strategy for developing and executing programs that takes advantage of the cloud computing concept is known as cloud-native. Conversely, Elastic SBCs describe a system’s capacity to adjust automatically to variations in workload by allocating and releasing resources.

Traditional SBCs and Cloud Native/Elastic SBCs are different as we now explain.

Traditional SBCs vs. Cloud Native/Elastic SBCs:

Traditional SBCs lack flexibility and are usually hardware-based. They might be expensive and difficult to expand or change. In comparison, Cloud Native/Elastic SBCs are highly adaptable. They provide cost-effectiveness and agility by effortlessly scaling up or down in response to demand.

Elasticity’s Function in Communication Services:

Elasticity guarantees continuous communication services that can adjust to heavy demands, particularly during peak hours. It implies that networks may scale resources without human intervention, ensuring service quality without taxing the infrastructure or adding needless expenses.

………………………………………………………………………………………………………………………………………

What are Containers?

Containers are small, independent, executable software packages containing all the necessary components to run a piece of software, guaranteeing that it performs consistently in various computing settings.

Function of Containers in the Modern Applications Deployment:

Containers offer an unequaled level of consistency and speed, revolutionizing how programs are delivered. They contain an application and all its dependencies, guaranteeing that it functions the same everywhere it is deployed.

Kubernetes and Docker:

Docker technology creates, transports, and operates applications inside containers. Meanwhile, Kubernetes’s container orchestration technology ensures that massive container deployments are effectively scaled and managed.

The Research and Markets predicts the global Kubernetes market is anticipated to expand significantly, rising from USD 1.8 billion in 2022 to USD 7.8 billion by 2030, with a spectacular Compound Annual Growth Rate (CAGR) of 23.4%

Use of Containers in SBCs:

SBCs benefit from unrivaled scalability, flexibility, and agility thanks to containers. They enable rapid deployments, guarantee consistency across many environments, and dramatically cut overall overheads—financially and in terms of time. Using Containers involves:

- Individual micro-services package and deploy using containers such as Docker. It guarantees scalability, isolation, and effective resource use.

- It can easily update services, rolled back, and versioned.

Architectural Considerations for Creating Cloud-Native Applications:

Scalability, Redundancy, Resilience, and Performance considerations are crucial when constructing Cloud Native/Elastic SBCs with containers. Architectures must be modular, and facilities must be made for smooth upgrades and patches that don’t interfere with running services. The following architectural factors should be taken into account while creating and deploying Cloud Native/Elastic SBCs using containers:

Disentanglement of Elements:

- Conventional SBCs frequently integrate several features into a single monolithic system.

- Micro-services design, in which every function (signaling, media processing, transcoding, security, etc.) is a separate, independent service, is the best way to create cloud-native SBCs.

Coordination:

- Containerized SBC micro-services can be managed and orchestrated by tools such as Kubernetes, which guarantees their efficient scheduling, scaling, and maintenance.

- Consider putting service mesh technologies into practice for enhanced traffic management and security.

State Administration:

- Active call sessions require careful management.

- Consider utilizing state full sets in Kubernetes or distributed databases to maintain a session state.

High Redundancy and Availability:

- Should guarantee redundancy over several zones or regions Via cloud-native design.

- Incorporate self-healing procedures and health checks to ensure uninterrupted service availability.

Converting SBCs to a containerized, cloud-native architecture has benefits for maintainability, scalability, and flexibility. However, careful architectural considerations are necessary to guarantee cost-effectiveness, security, and performance.

Containers Networking for Real-Time Communication:

The networking element of containers is essential in the area of real-time communication. It guarantees seamless switching between media streams, satisfies low-latency specifications, and ensures that Quality of Service (QoS) standards.

Elastic and Cloud Native SBC Security and Compliance:

SBCs play a crucial role in addressing security. Strong security measures are required for Cloud Native/Elastic SBCs to thwart threats, prevent unwanted access, and guarantee data privacy. They must also adhere to industry norms and laws to ensure reliable communication connections.

Prospects for the Future and the Changing Scene for Cloud Native SBCs:

SBCs will likely interact more deeply with cloud ecosystems in the future, utilizing AI and machine learning to provide more innovative and adaptive features. To support developing IoT and 5G use cases, edge computing may also play a more significant part in Cloud Native SBCs.

Conclusions:

A significant improvement in the evolution of network security and telecommunications has been realized cloud-native and elastic principles and the power of containers. This new paradigm is poised to completely reshape communication networks in the future since it provides agility, scalability, and efficiency. As we embrace containerization and the cloud, the possibilities are endless, opening the prospect of a more efficient, safe, and networked world.

References:

Session Border Controller (SBC) for Enterprises and VoIP Service Providers

Ericsson’s India 6G Research Program at its Chennai R&D Center

Today at the India Mobile Congress 2023, Ericsson announced the launch of its ‘India 6G‘ program with the establishment of an India 6G Research team at its Chennai R&D Center. Ericsson stated that the ‘India 6G’ team consists of senior research members and a team of experienced researchers in Radio, Networks, AI, and Cloud. They have been tasked with developing fundamental solutions for the future.

The India Research team, in collaboration with Ericsson research teams in Sweden and the US, will work together to develop the technology that will enable the delivery of a cyber-physical continuum. In this continuum, networks will provide critical services, immersive communications, and omnipresent IoT, all while ensuring the integrity of the delivered information.

The 6G Research team in India, in collaboration with Ericsson Global Research teams, will develop novel solutions. The teams are working on various projects, including Channel Modelling and Hybrid Beamforming, Low-energy Networks, Cloud Evolution and Sustainable Computing, Trustworthy, Explainable, and Bias-Free AI algorithms, Autonomous Agents for Intent Management Functions, Integrated Sensing and Communication Functions for the Man-Machine Continuum, and Compute Offload to Edge-Computing Cloud, among others.

“By establishing a dedicated 6G research team for in-country research, contextual to India’s need and collaborating with the world class research programs across international research labs, we look forward to incorporating the needs of India into the mainstream of telecommunication technology evolution. “stated Magnus Frodigh, Head of Research at Ericsson.

Ericsson says it is partnering with premier institutes in India for Radio, AI and Cloud Research. The company said, “AI Research is of high importance to Ericsson as the 6G networks would be autonomously driven by AI algorithms. Ericsson is also looking to partner with other premier engineering institutes in India for 6G related research.”

The Centre for Responsible AI is an interdisciplinary research centre that envisions becoming a premier research centre for both fundamental and applied research in Responsible AI with immediate impact in deploying AI systems in the Indian ecosystem. AI Research is of high importance to Ericsson as the 6G networks would be autonomously driven by AI algorithms. Ericsson is also looking to partner with other premier engineering institutes in India for 6G related research.

Ericsson in India:

Ericsson is reportedly partnering with Communication Service Providers, Bharti Airtel, and Reliance Jio to deploy 5G in the country.

According to the statement, Ericsson has been present in India since 1903, and the Ericsson Research team was established in 2010. With the establishment of 6G Research in India, Ericsson looks forward to playing a key role in advancing this technology in the country.

The company has three R&D centres in India, located in Chennai, Bengaluru, and Gurgaon.

References:

https://www.ericsson.com/en/press-releases/2/2023/10/ericsson-initiates-india-6g-program-in-india

https://telecomtalk.info/ericsson-announces-india-6g-program-at-imc2023/889172/

India unveils Bharat 6G vision document, launches 6G research and development testbed

Enable-6G: Yet another 6G R&D effort spearheaded by Telefónica de España

Nokia to open 5G and 6G research lab in Amadora, Portugal

6th Digital China Summit: China to expand its 5G network; 6G R&D via the IMT-2030 (6G) Promotion Group

China to introduce early 6G applications by 2025- way in advance of 3GPP specs & ITU-R standards

Charter Communications adds broadband subs and raises CAPEX forecast

Cableco Charter Communications added 63,000 broadband internet subscribers in the third quarter. Net adds in new markets hit 31,000 in the third quarter, accelerating from 26,000 last quarter. A note from New Street Research said the company passed fewer homes in new markets than expected, “and so the pace of penetration growth is tracking ahead of expectations.”

Charter’s third-quarter revenue of $13.6 billion grew by 0.2% year-over-year, driven by residential internet revenue growth of 3.7%, residential mobile service revenue growth of 33.8% and other revenue growth of 28.8%, mostly driven by higher mobile device sales.

Free cash flow of $1.1 billion decreased from $1.5 billion in the prior year, due to higher capital expenditures, mostly driven by Charter’s network evolution and expansion initiatives.

As of September, Charter had a total of 32.2 million residential and SMB customer relationships, excluding mobile-only relationships.

“We continue to make significant progress against the multi-year strategic initiatives we outlined last year,” said Chris Winfrey, President and CEO of Charter. “These initiatives drive continuing improvements in the quality of our products, and when combined with our customer-friendly pricing and packaging and high-quality service, will drive significant, long-term growth in shareholder value.”

…………………………………………………………………………………………………………………….

On its earnings call, CEO Winfrey said that “given the greater subsidized rural passings and construction opportunity,” Charter may even look to partially fund those new markets by “very modestly slowing our network evolution plan” — which includes upgrades to its hybrid fiber-coaxial footprint.

Winfrey said Charter expects to add approximately 300,000 new subsidized rural (NSR) passings in 2023 and to accelerate that pace in 2024. In the third quarter, 78,000 rural passings were activated. He added that Charter is ahead with its Rural Digital Opportunity Fund (RDOF) builds and “will end up with more (rural) passings than originally expected.”

However, NSR said Charter’s results in core markets were “disappointing,” with adds of 47,000 way below their estimate of 79,000. While NSR expected stabilization in pressure from fixed wireless access (FWA), Charter continues to see some impact from FWA competitors in the lower usage and price sensitive customer segments of its residential and SMB businesses.

Charter is raising its capital-expenditures (CAPEX) forecast for the year as it pours billions back into upgrading its network and its Xumo business. The company now expects to spend about $7.2 billion in CapEx, up from prior guidance of $6.5 billion to $6.8 billion. That excludes line-extension CapEx, which is still expected to be about $4 billion for the year. The $7.2 billion will be put to work upgrading and maintaining the cable company’s network. Some of it will also go toward sending Xumo stream boxes to customers. Xumo is a joint venture between Charter and Comcast that offers free ad-supported streaming TV. Charter shares fall 6%.

References:

https://corporate.charter.com/newsroom/charter-announces-third-quarter-2023-results

https://www.fiercetelecom.com/broadband/charter-adds-63k-subscribers-q3-eyes-more-rural-builds

Precision Optical Technologies (OT) in multi-year “strategic partnership” to upgrade Charter Communications optical network

Charter Communications selects Nokia AirScale to support 5G connectivity for Spectrum Mobile™ customers

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

Comcast Xfinity Communities Wi-Fi vs Charter’s Advanced Wi-Fi for Spectrum Business customers

Huawei reports 1% YoY revenue growth in 3Q-2023; smartphone sales increase in China

Huawei reported a flat third quarter, with sales of 145.7 billion Chinese yuan ($19.9 billion), up just 1% over last year and a net profit margin of 16.0%. The Shenzhen based telecom equipment and mobile phone vendor said the profit margin had been boosted by the latest tranche from the sale of the Honor handset assets three years ago. It said improved efficiencies and optimized sales and product strategies had also had a positive impact on profitability.

“The company’s performance is in line with forecast,” said Ken Hu, Huawei’s Rotating Chairman. “I’d like to thank our customers and partners for their ongoing trust and support. Moving forward, we will continue to increase our investment in R&D to make the most of our business portfolio and take the competitiveness of our products and services to new heights. As always, our goal is to create greater value for our customers, partners, and society.”

Huawei reported growth in the consumer business unit and “strong growth” in the new digital power and cloud businesses, but the company was silent on its carrier equipment unit, its largest, suggesting it has also been hit by the decline in operator spending.

Huawei smartphone summary:

Huawei was the fastest-growing smartphone maker in China in the third quarter after the company released a smartphone with a surprisingly advanced chip inside.

- In September, Huawei launched the Mate 60 Pro in China. It’s equipped with an advanced chip and 5G connectivity, technology that U.S. sanctions had been designed to stop Huawei getting its hands on.

- The success of that device helped Huawei’s smartphone sales in China grow 37% year on year, according to a report from Counterpoint Research.

- Sales of Honor, the largest smartphone maker by market share, rose just 3% year on year. Vivo, Oppo and Apple all saw double-digit declines, according to Counterpoint Research.

References:

https://www.huawei.com/en/news/2023/10/businessresults-threequarters

https://www.lightreading.com/5g/huawei-reports-no-real-growth-in-q3

https://www.lightreading.com/5g/huawei-lifts-handset-outlook-wins-1b-in-5g-orders

Google Fiber planning 20 Gig symmetrical service via Nokia’s 25G-PON system

Google Fiber is planning to rollout a symmetrical 20G b/sec service for select residential and business customers by the end of this year. It will use Nokia’s 25G-PON system for this new service.

Nokia’s 25G PON solution will allow Google Fiber to provide broadband speeds up to 10x faster than what most fiber networks can deliver today. GFiber Labs is using Nokia’s solution to deliver 20 Gig services to the University of Missouri-Kansas City (UMKC) and United Way of Utah County, with plans to expand to select residential customers by the end of the year.

Liz Hsu, Senior Director, Product & Billing at Google Fiber, said: “The age of multi-gig broadband services is here and we’re committed to ensuring all of our customers can benefit from the incredible potential it brings. We believe investments in advanced network technologies like Nokia’s 25G PON solution will help catalyze change, drive innovation and revolutionize the user experience. We’re thrilled to be working with Nokia to move our industry and customers forward.”

Geert Heyninck, General Manager of Broadband Networks at Nokia, said: “It’s an exciting time to be a Google Fiber customer as we work to help them usher in a new era of connectivity that’s capable of delivering lightning fast 20 gigabit services. With our 25G PON solution Google Fiber can reuse its existing fiber network to quickly and cost effectively deliver the next generation of gigabit services to their customers. We’re proud to continue supporting Google Fiber on its quest to build the foundation of tomorrow’s internet.”

Julie Kunstler, Chief Analyst, Broadband Access Intelligence Service at Omdia, said: “This announcement highlights the momentum we are starting to see for 25G PON. With a robust ecosystem, 25G PON can be a natural fit for those operators that want to pursue higher-revenue customers and applications. Because you can use the same underlying infrastructure as FTTH, this means more revenues without expensive new network builds or additional operational costs.”

Nick Saporito, head of product at Google Fiber, told Fierce Telecom that the company has been trialing the 20-gig service in “many markets” for almost a year. Additional residential test ers are “in the pipeline,” he said.

Asked why Google Fiber is jumping from its current top tier 8-gig offering all the way to 20-gigs, Saporito said “We definitely see a need for this. This is sort of a very early adopter product. This isn’t going to be a GA [general availability] product from Google Fiber where we just make it broadly available like we’re doing with 5-gig and 8-gig. This is going to be a bit of an invite-only opportunity for our early adopters.”

To be clear, Google Fiber’s forthcoming offering won’t be the fastest available in the country nor is the company the first to break the 10G speed barrier. EPB, a local provider in Tennessee, launched a symmetrical 25-gig service in August 2022. It, too, is using Nokia’s 25G kit.

But the move is significant as Google Fiber seems to be the largest operator to make such a play in earnest thus far. Frontier Communications previously said it is working with Nokia on 25G trials, but has yet to announce plans for a commercial service beyond its current 5-gig offering.

Stefaan Vanhastel, VP of Innovation for Fixed Networks at Nokia, told Fierce that Google Fiber was already using the company’s XGS-PON gear, which is based on its upgradable Quillion chipset. So, all the operator needs to do to get to 25G is plug in a new optical module and replace the optical network terminal on the end-user side.

He noted that 25G uses different wavelengths than GPON and XGS-PON, meaning all three technologies can coexist on the same network.

Vanhastel said globally Nokia has around eight or nine 25-gig operators, most of whom are squarely focused on enterprises services. Thus, Google Fiber’s desire to serve both residential and enterprise use cases is special. “To me that’s really exciting, because it’s going to be really interesting to see those multi-gig users how they’re using the service, what they’re doing,” he said. “You build a pipe, someone’s going to try to find a way to fill it.”

Saporito declined to name the markets where its symmetrical 20-gig service will initially be available (though Kansas City seems like a safe bet based on the trial locations). However, he said the operator does have broader plans to make the service available “in most, if not all, of our markets” eventually.

……………………………………………………………………………………………………………………..

Nokia 25G PON details:

As 25GPON will drive new and exciting applications, GFiber’s introduction of Nokia’s Lightspan and Altiplano solution increases service agility with operational efficiency. The fiber access node supports multiple fiber technologies including GPON, XGS-PON, 25GS-PON and Point-to-Point Ethernet to deliver a wide range of services with the best fit technology.

Resources and additional information:

Google Fiber and Nokia Video: https://youtu.be/zCFiHdhYSx0

25G PON | Nokia

25GS-PON MSA Group

References:

https://www.fiercetelecom.com/broadband/google-fiber-goes-big-20-gig-plan

Google Fiber is testing ways to boost home internet speeds with new hub

Verizon, T-Mobile and AT&T brag about C-band 5G coverage and FWA

Verizon says it has approximtely 222 million people covered with its mid-band C-band network, [1.] a figure the company hopes to increase to 250 million by the end of next year. “C-band is a game change for our business,” CEO Hans Vestberg said on the telco’s 3rd quarter earnings call. “Our network is winning.”

Note 1. C-band sits between the two Wi-Fi bands, which are at 2.4GHz and 5GHz. It’s slightly above and very similar to the 2.6GHz band that Clearwire and then Sprint used for 4G starting in 2007, and which T-Mobile currently uses for mid-band 5G. And it adjoins CBRS, a band from 3.55 to 3.7GHz that’s currently being deployed for 4G. ITU-R divided C-band into three chunks, referred to as band n77, band n78, and band n79.

……………………………………………………………………………………………………………………………

Verizon officials said the company is using the capacity in its mid-band 5G network to pursue opportunities like fixed wireless access (FWA) and private wireless networks. “We see demand for the product continuing to grow,” Vestberg said of Verizon’s private wireless network offerings. He added that Verizon is working to transition its private wireless customers from pilots to commercial deployments. He also said the company is growing its ecosystem of suppliers for that business.

…………………………………………………………………………………………………………………………

T-Mobile announced Tuesday it now covers 300 million people with its 2.5GHz mid-band network, reaching that goal three months earlier than the company had planned. T-Mobile’s overall 5G footprint has expanded as well, now covering more than 330 million people or 98% of the population.

“We have been leaders in the 5G era from the start, deploying the largest, fastest, most awarded and most advanced 5G network in the country faster than anyone else,” said Ulf Ewaldsson, President of Technology at T-Mobile. “While the other guys are playing catch-up, finally beginning to build out their mid-band 5G networks, we are maintaining our lead and will continue offering customers the best network – paired with the best value – for years to come.”

“T-Mobile’s turnaround story is incredible, going from network underdog a decade ago to the undeniable network leader today,” said Anshel Sag, Principal Analyst at Moor Insights and Strategy. “T-Mobile has not only built out a robust 5G network with unmatched coverage and capacity, but the Un-carrier is also leading the way in rolling out new capabilities that will unlock the true promise of 5G.”

………………………………………………………………………………………………………………………..

Last week, AT&T said it ended the third quarter covering 190 million subscribers for its mid-band 5G network, and said it remains on track to cover 200 million by the end of the year. On the telco’s 3-2023 earnings call, CEO John Stankey said, “we continue to enhance the largest wireless network in North America and expand the nation’s most reliable 5G network. It’s no surprise that when you combine our high-value customer growth and rising revenues per user, we continue to grow profits in our wireless business.”

Regarding FWA, Stankey touted the company’s Internet Air offering. “We have no issues selling Internet Air into the business segment. It’s a really attractive thing for us to do. It’s a really helpful product on a number of different fronts. It meets a particular need.

……………………………………………………………………………………………………..

References:

https://www.lightreading.com/private-networks/verizon-jumps-too-as-mobility-biz-surprises-in-q3

https://www.pcmag.com/news/what-is-c-band

https://www.fool.com/earnings/call-transcripts/2023/10/19/att-t-q3-2023-earnings-call-transcript/

https://www.att.com/internet/internet-air/

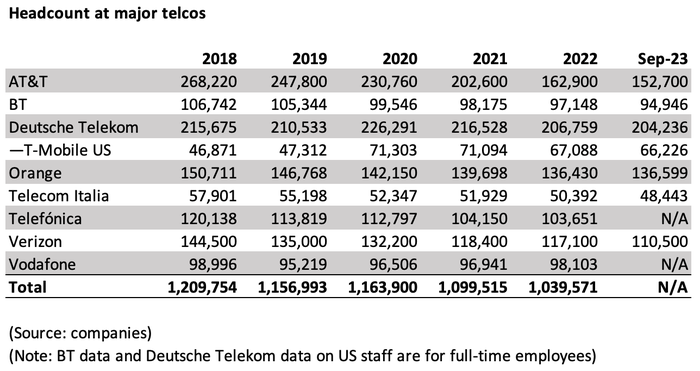

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

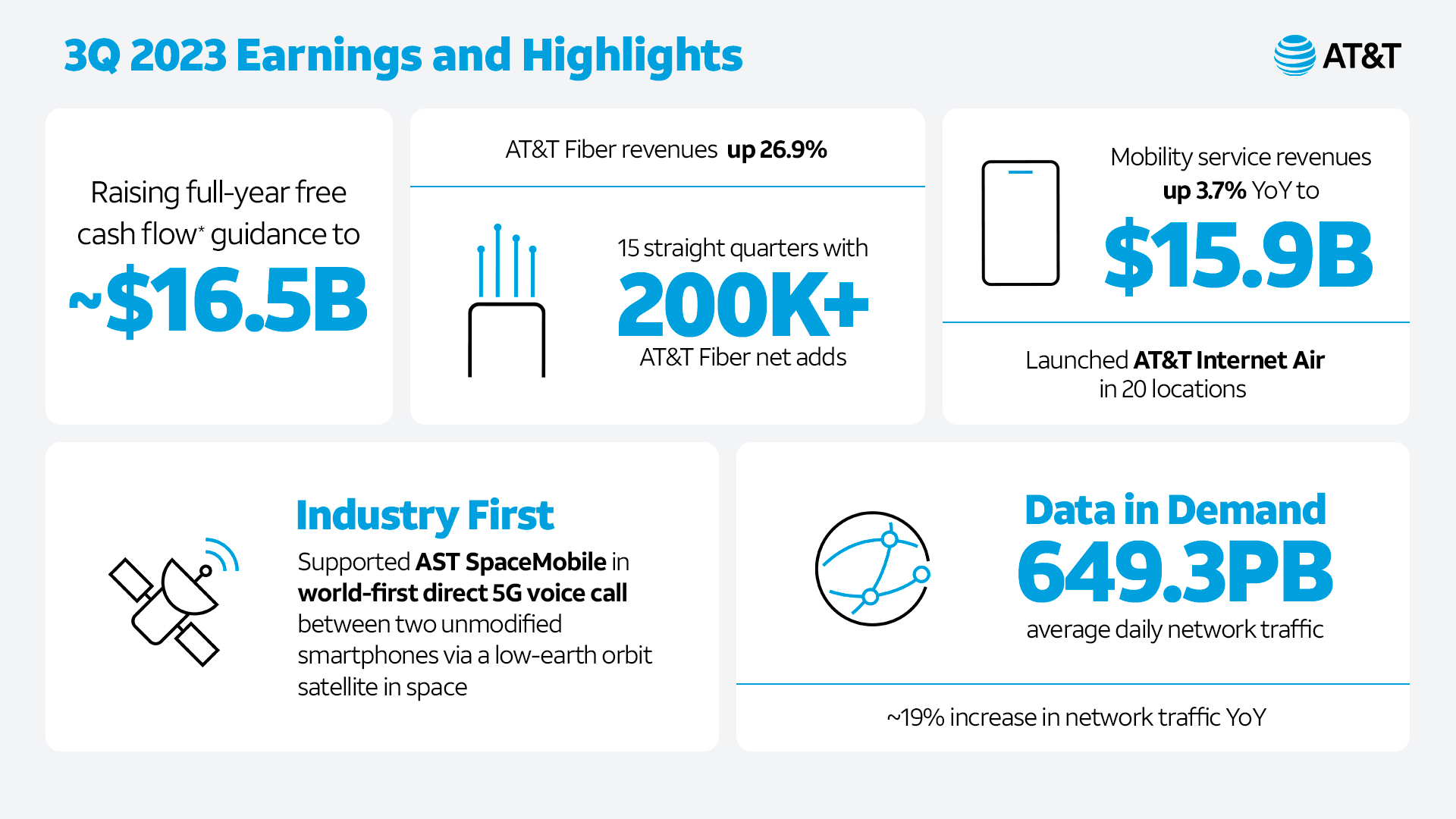

As we have repeatedly stated, the entire telecom industry is in a funk and the 2024 outlook is looks just as gloomy as this year. MTN claims that telecom is a zero growth industry (see References below) and that certainly seems to be true. Let’s start with AT&T – the largest telco in the U.S. with 229.2M wireless subscribers as of Q2-2022.

In the first nine months of 2023, AT&T has shed 10,200 employees, including nearly 4,000 in the recent third quarter alone. AT&T cut many more jobs – 39,700 in total – in 2022 when it was in the process of spinning out Warner Media to Warner Brothers Discovery (the deal closed on April 8, 2022).

AT&T’s CEO told reporters last week that the U.S. based teclo plans to reduce costs by another $2 billion over the next three years. That’s after Stankey boasted that the company has cut costs by $6 billion in the last three and in an “inflationary environment.”

AT&T is hardly a growth company and has tons of debt. In the 3rd quarter of 2023, AT&T reported revenues of $30.4 billion, up only 1% year over year. Yet Stankey had the audacity to say in a press release, “Our investments in best-in-class 5G and fiber connectivity are fueling our growth engine. We’re gaining profitable customer relationships and becoming more efficient. This is powering our strong business performance.”

Today, LightReading announced the departure of a key AT&T executive. Jason Inskeep, previously the senior assistant VP for AT&T’s 5G Center of Excellence and focusing on the operator’s work in private wireless networking and edge computing, recently left the company for a senior director position at consulting firm Slalom.

Iain Morris of LightReading wrote on October 20th, “The future AT&T is conceivably a cohort of antenna-carrying robots, some AI that writes code and Stankey with his feet up on the table, providing the only whiff of humanity.”

AT&T is not the only U.S. telco reducing its workforce. Earlier this year, T-Mobile announced that it will be laying off ~5,000 workers or around 7% of its workforce. This latest job cutting move will primarily impact employees in corporate, back-office, and technology roles, while those in retail or customer care positions will not be affected.

……………………………………………………………………………………………………………………………….

Network Equipment Vendors Layoffs and Gloomy Outlook:

Last week, Nokia said the company plans to cut at least 9,000 jobs and as many as 14,000 over the next three years. That’s mainly due to weak 5G equipment demand. Nokia CEO Pekka Lundmark told reporters that Nokia’s sales have plummeted in North America (sales were down 40%) and that India’s 5G rollout is now slowing down as expected.

Over the next three years, his latest target is to reduce annual costs by between €800 million (US$843 million) and €1.2 billion ($1.3 billion). It’s a move that will reduce Nokia’s headcount by at least 9,000 roles from its current level of roughly 86,000. And at the upper end of the range, it will see an exodus of 14,000 employees, more than 16% of the total.

Ericsson CEO Borje Ekholm cautioned of persistent macroeconomic uncertainty into 2024 which it expects will impact customers’ investment ability, as the wireless network equipment vendor reported a year-on-year net loss of SEK30.5 billion ($2.8 billion) from net income of SEK5.4 billion in Q2 2022, due to a SEK32 billion charge related to the acquisition of cloud company Vonage in 2022. In February, Reuters reported that Ericsson will lay off 8,500 employees globally as part of its plan to cut costs, a memo sent to employees.

……………………………………………………………………………………………………………………..

Semiconductor Layoffs:

Wireless network chip maker Qualcomm is slashing 1,258 jobs in California, including nearly 200 in the Bay Area, in the latest tech layoffs to hit the region. Qualcomm said in state filings that it will lay off approximately 194 workers in its Santa Clara offices and another 1,094 employees at its San Diego headquarters. The cuts are slated to begin Dec. 13th, based on a notice submitted to state officials this week. The job cuts represent roughly 2.5% of Qualcomm’s workforce and mark the second round of layoffs for the wireless semiconductor company this year.

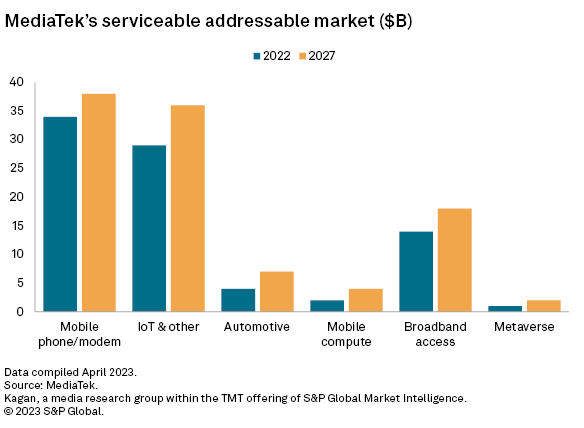

The Qualcomm layoff news comes about a month after the company announced a deal with Apple to provide 5G chips through at least 2026. Qualcomm is also the chip supplier for the newly announced Meta Quest 3. It is only 1 of 2 companies that sell 5G end point silicon on the merchant market (Taiwan based MediaTek is the other one).

It’s not a pretty picture to say the least for telecom industry employees.

References:

https://www.lightreading.com/ai-machine-learning/at-t-seems-on-a-mission-to-be-a-zero-employee-telco

https://www.lightreading.com/private-networks/at-t-s-private-wireless-chief-departs

https://about.att.com/story/2023/q3-earnings.html

Inside AT&T’s newly expanded $8 billion cost-reduction program & huge layoffs

High Tech Layoffs Explained: The End of the Free Money Party

MTN Consulting’s Network Operator Forecast Through 2027: “Telecom is essentially a zero-growth industry”

SNS Telecom & IT: Shared Spectrum 5G NR & LTE Small Cell RAN Investments to Reach $3 Billion

SNS Telecom & IT‘s latest research report indicates that annual spending on 5G NR and LTE-based small cell RAN (Radio Access Network) equipment operating in shared and unlicensed spectrum will account for nearly $3 Billion by the end of 2026.

As the 5G era advances, the cellular communications industry is undergoing a revolutionary paradigm shift, driven by technological innovations, liberal regulatory policies and disruptive business models. One important aspect of this radical transformation is the growing adoption of shared and unlicensed spectrum – frequencies that are not exclusively licensed to a single mobile operator.

Telecommunications regulatory authorities across the globe have either launched or are in the process of releasing innovative frameworks to facilitate the coordinated sharing of licensed spectrum.

Examples include (but are not limited to): the three-tiered CBRS (Citizens Broadband Radio Service) spectrum sharing scheme in the United States, Germany’s 3.7-3.8 GHz and 28 GHz licenses for 5G campus networks, United Kingdom’s shared and local access licensing model, France’s vertical spectrum and sub-letting arrangements, Netherlands’ geographically restricted mid-band spectrum assignments, Switzerland’s 3.4 – 3.5 GHz band for NPNs (Non-Public Networks), Finland’s 2.3 GHz and 26 GHz licenses for local 4G/5G networks, Sweden’s 3.7 GHz and 26 GHz permits, Norway’s regulation of local networks in the 3.8-4.2 GHz band, Poland’s spectrum assignment for local government units and enterprises, Bahrain’s private 5G network licenses, Japan’s 4.6-4.9 GHz and 28 GHz local 5G network licenses, South Korea’s e-Um 5G allocations in the 4.7 GHz and 28 GHz bands, Taiwan’s provision of 4.8-4.9 GHz spectrum for private 5G networks, Hong Kong’s LWBS (Localized Wireless Broadband System) licenses, Australia’s apparatus licensing approach, Canada’s planned NCL (Non-Competitive Local) licensing framework and Brazil’s SLP (Private Limited Service) licenses.

Another important development is the growing accessibility of independent cellular networks that operate solely in unlicensed spectrum by leveraging nationally designated license-exempt frequencies such as the GAA (General Authorized Access) tier of the 3.5 GHz CBRS band in the United States and Japan’s 1.9 GHz sXGP (Shared Extended Global Platform) band. In addition, vast swaths of globally and regionally harmonized license-exempt spectrum – most notably, the 600 MHz TVWS (TV White Space), 5 GHz, 6 GHz and 60 GHz bands – are also available worldwide, which can be used for the operation of unlicensed LTE and 5G NR-U (NR in Unlicensed Spectrum) equipment subject to domestic regulations.

Collectively, ground-breaking spectrum liberalization initiatives are catalyzing the rollout of shared and unlicensed spectrum-enabled LTE and 5G NR networks for a diverse array of use cases – ranging from mobile network densification, FWA (Fixed Wireless Access) in rural communities and MVNO (Mobile Virtual Network Operator) offload to neutral host infrastructure and private cellular networks for enterprises and vertical industries such as agriculture, education, healthcare, manufacturing, military, mining, oil and gas, public sector, retail and hospitality, sports, transportation and utilities.

SNS Telecom & IT estimates that global investments in 5G NR and LTE-based RAN infrastructure operating in shared and unlicensed spectrum will account for more than $1.4 Billion by the end of 2023. The market is expected to continue its upward trajectory beyond 2023, growing at a CAGR of approximately 27% between 2023 and 2026 to reach nearly $3 Billion in annual spending by 2026.

The “Shared & Unlicensed Spectrum LTE/5G Network Ecosystem: 2023 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents a detailed assessment of the shared and unlicensed spectrum LTE/5G network ecosystem, including the value chain, market drivers, barriers to uptake, enabling technologies, key trends, future roadmap, business models, use cases, application scenarios, standardization, spectrum availability and allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also provides global and regional forecasts for shared and unlicensed spectrum LTE/5G RAN infrastructure from 2023 to 2030. The forecasts cover two air interface technologies, two cell type categories, two spectrum licensing models, 15 frequency bands, seven use cases and five regional markets.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report.

The report will be of value to current and future potential investors into the shared and unlicensed spectrum LTE/5G network market, as well as LTE/5G equipment suppliers, system integrators, mobile operators, MVNOs, fixed-line service providers, neutral hosts, private network operators, vertical domain specialists and other ecosystem players who wish to broaden their knowledge of the ecosystem.

Key Findings:

- SNS Telecom & IT estimates that global investments in LTE and 5G NR-based RAN infrastructure operating in shared and unlicensed spectrum will account for more than $1.4 Billion by the end of 2023. The market is expected to continue its upward trajectory beyond 2023, growing at a CAGR of approximately 27% between 2023 and 2026 to reach nearly $3 Billion in annual spending by 2026.

- Breaking away from traditional practices of spectrum assignment for mobile services that predominantly focused on exclusive-use national licenses, telecommunications regulatory authorities across the globe have either launched or are in the process of releasing innovative frameworks to facilitate the coordinated sharing of licensed spectrum. Examples include but are not limited to:

- The three-tiered CBRS spectrum sharing scheme in the United States

- Germany’s 3.7-3.8 GHz and 28 GHz licenses for 5G campus networks

- United Kingdom’s shared and local access licensing model

- France’s vertical spectrum and sub-letting arrangements

- Netherlands’ geographically restricted mid-band spectrum assignments

- Switzerland’s 3.4 – 3.5 GHz band for NPNs (Non-Public Networks)

- Finland’s 2.3 GHz and 26 GHz licenses for local 4G/5G networks

- Sweden’s 3.7 GHz and 26 GHz permits, Norway’s regulation of local networks in the 3.8-4.2 GHz band

- Poland’s spectrum assignment for local government units and enterprises

- Bahrain’s private 5G network licenses

- Japan’s 4.6-4.9 GHz and 28 GHz local 5G network licenses

- South Korea’s e-Um 5G allocations in the 4.7 GHz and 28 GHz bands

- Taiwan’s provision of 4.8-4.9 GHz spectrum for private 5G networks

- Hong Kong’s LWBS (Localized Wireless Broadband System) licenses

- Australia’s apparatus licensing approach

- Canada’s planned NCL (Non-Competitive Local) licensing framework

- Brazil’s SLP (Private Limited Service) licenses

- Another important development is the growing accessibility of independent cellular networks that operate solely in unlicensed spectrum by leveraging nationally designated license-exempt frequencies such as the GAA tier of the 3.5 GHz CBRS band in the United States and Japan’s 1.9 GHz sXGP band. In addition, vast swaths of globally and regionally harmonized license-exempt spectrum – most notably, the 600 MHz TVWS, 5 GHz, 6 GHz and 60 GHz bands – are also available worldwide, which can be used for the operation of unlicensed LTE and 5G NR-U (NR in Unlicensed Spectrum) equipment subject to domestic regulations.

- Collectively, ground-breaking spectrum liberalization initiatives are catalyzing the rollout of shared and unlicensed spectrum-enabled LTE and 5G NR networks for a diverse array of use cases – ranging from mobile network densification, FWA in rural communities and MVNO offload to neutral host infrastructure and private cellular networks for enterprises and vertical industries such as agriculture, education, healthcare, manufacturing, military, mining, oil and gas, public sector, retail and hospitality, sports, transportation and utilities.

- In particular, private LTE and 5G networks operating in shared spectrum are becoming an increasingly common theme. Hundreds of local and priority access licenses – predominantly in mid-band spectrum – have been issued in the United States, Germany, United Kingdom, France, Finland, Sweden, Japan, South Korea, Taiwan and other pioneering markets to facilitate the operation of purpose-built wireless networks based on 3GPP standards.

- Airbus, ArcelorMittal, Bayer, BBC (British Broadcasting Corporation), BMW, Bosch, Dow, EDF, Ferrovial, Groupe ADP, Holmen Iggesund, Hoban Construction, Hsinchu City Fire Department, Inventec, John Deere, KEPCO (Korea Electric Power Corporation), Lufthansa, Mercedes-Benz, Mitsubishi, NAVER, NFL (National Football League), Osaka Gas, Ricoh, SDG&E (San Diego Gas & Electric), Siemens, SVT (Sveriges Television), Tesla, Toyota, Volkswagen, X Shore and the U.S. military are just a few of the many end user organizations investing in shared spectrum-enabled private cellular networks.

- In some national markets, neutral host solutions based on shared spectrum small cells are being employed as a cost-effective means of coverage enhancement inside office spaces, public venues and other indoor environments. One prominent example is social media and technology giant Meta’s in-building wireless network that uses small cells operating in the GAA tier of CBRS spectrum and MOCN (Multi-Operator Core Network) technology to provide multi-operator cellular coverage at its properties in the United States.

- Although the uptake of 5G NR equipment operating in high-band mmWave (Millimeter Wave) frequencies has been slower than initially anticipated, practical cases of 5G networks based on locally licensed 26/28 GHz spectrum are steadily piling up in multiple national markets – examples range from private 5G installations at HKIA (Hong Kong International Airport), SMC (Samsung Medical Center) and various manufacturing facilities to Japanese cable TV operator-led deployments of 28 GHz local 5G networks.

- The very first deployments of 5G NR-U technology are also beginning to emerge. For example, the SGCC (State Grid Corporation of China) has deployed a private NR-U network – operating in license-exempt Band n46 (5.8 GHz) spectrum – to support video surveillance, mobile inspection robots and other 5G-connected applications at its Lanzhou East and Mogao substations in China’s Gansu province. In the coming years, with the technology’s commercial maturity, we also anticipate seeing NR-U deployments in Band n96 (6 GHz) and Band n263 (60 GHz) for both licensed assisted and standalone modes of operation.

References:

https://www.snstelecom.com/shared-spectrum

SNS Telecom & IT: CBRS Network Infrastructure a $1.5 Billion Market Opportunity

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT: Spending on Unlicensed LTE & 5G NR RAN infrastructure at $1.3 Billion by 2023

SNS Telecom: U.S. Network Operators will reap $1B from fixed wireless by late 2019

SK Telecom and Deutsche Telekom to Jointly Develop Telco-specific Large Language Models (LLMs)

SK Telecom and Deutsche Telekom announced that they signed a Letter of Intent (LOI) to jointly develop a telco-specific Large Language Models (LLMs) that will enable global telecommunication companies (telcos) to develop generative AI models easily and quickly. The LOI signing ceremony took place at SK Seorin Building located in Seoul with the attendance of key executives from both companies including Ryu Young-sang, CEO of SKT, Chung Suk-geun, Chief AI Global Officer of SKT, Tim Höttges, CEO of Deutsche Telekom, Claudia Nemat, Board Member Technology and Innovation of Deutsche Telekome, and Jonathan Abrahamson, Chief Product and Digital Officer of Deutsche Telekom.

SK Telecom and Deutsche Telekom to Jointly Develop Telco-specific LLM

This marks the first fruition of discussions held by the Global Telco AI Alliance, which was launched by SKT, Deutsche Telekom, E&, and Singtel, in July 2023, and lays the foundation to enter the global market. SKT and Deutsche Telekom plan to collaborate with AI companies such as Anthropic (Claude 2) and Meta (Llama2) to co-develop a multilingual – i.e, German, English, Korean, etc. – large language model (LLM) tailored to the needs of telcos. They plan to unveil the first version of the telco-specific LLM in the first quarter of 2024.

The telco-specific LLM will have a higher understanding of telecommunication service-related areas and customer’s intentions than general LLMs, making it suitable for customer services like AI contact center. The goal is to support telcos across the world, including Europe, Asia, and the Middle East, to develop generative AI services such as AI agents flexibly according to their respective environment. That will enable telcos to save both time and cost for developing large platforms, and secure new business opportunities and growth engines through AI innovation that shifts the paradigm in the traditional telecommunications industry. To this end, SKT and Deutsche Telekom plan to jointly develop AI platform technologies that telcos can use to create generative AI services to reduce both development time and cost.

For instance, when a telco tries to build an AI contact center based on generative AI, it itself will be able to build one that suits their environment more quickly and flexibly. In addition, AI can be applied to other areas such as network monitoring and on-site operations to increase efficiency, resulting in cost savings in the mid- to long-term.

Through this collaboration, the two companies will proactively respond to the recent surge in AI demand from telcos, while also promoting the expansion of the global AI ecosystem through the successful introduction of generative AI optimized for specific industries or domains.

“AI shows impressive potential to significantly enhance human problem-solving capabilities. To maximize its use especially in customer service, we need to adapt existing large language models and train them with our unique data. This will elevate our generative AI tools,” says Claudia Nemat, Member of the Board of Management for Technology and Innovation at Deutsche Telekom.

“Through our partnership with Deutsche Telekom, we have secured a strong opportunity and momentum to gain global AI leadership and drive new growth,” said Ryu Young-sang, CEO of SKT. “By combining the strengths and capabilities of the two companies in AI technology, platform and infrastructure, we expect to empower enterprises in many different industries to deliver new and higher value to their customers.”

References:

Global Telco AI Alliance to progress generative AI for telcos

Cloud Service Providers struggle with Generative AI; Users face vendor lock-in; “The hype is here, the revenue is not”

Bain & Co, McKinsey & Co, AWS suggest how telcos can use and adapt Generative AI

Generative AI Unicorns Rule the Startup Roost; OpenAI in the Spotlight

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Generative AI could put telecom jobs in jeopardy; compelling AI in telecom use cases

Google Cloud infrastructure enhancements: AI accelerator, cross-cloud network and distributed cloud

Cloud infrastructure services market grows; AI will be a major driver of future cloud service provider investments

TPG, Ericsson launch AI-powered analytics, troubleshooting service for 4G/5G Mobile, FWA, and IoT subscribers

Economic Times: Qualcomm, MediaTek developing chipsets for Satcom services

Over the next few years,, consumers can expect to use their mobile phones for satellite communications, including for calls, messages and broadband data, as the broadband from-space service gains pace.

Currently, satcom through mobile devices is primarily used for coverage in emergency text messages. However, it’s expected that in a few years, both phone calls and broadband internet will be available with new mobile phones. There are now 5-6 devices available in the market globally, including the iPhone 14 and 15 models, that support satellite connectivity. Going forward, more OEMs are expected to incorporate Satcom technology.

Leading chipmakers Qualcomm and MediaTek said they have already developed chipsets supporting satellite connectivity.

“Right now, it’s catering to the niche market, but we expect that eventually it will cater to the mainstream consumers and businesses,” MediaTek India managing director Anku Jain told Economic Times. MediaTek has adhered to the 3GPP specs for designing satcom chipsets so that there is interoperability in the long run, he said. “For the technology to become mainstream, more and more OEMs (original equipment manufacturers) need to adopt it and we will see how that happens. “From MediaTek point of view, we are ready with the solution,” Jain added.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………….

“The technology is already there, and we have the chips to support direct-to-device satcom services,” Qualcomm India president Savi Soin told ET.

Asked about the opportunity in India, Soin said while the technology is available, standards are the key. “The question is who will provide the (satellite) constellation and is that constellation compliant with India,” he said. NOTE THAT THERE IS NO CURRENT WORK IN ITU-R TO STANDARDIZE SATCOM SERVICES- ALL THE WORK IS BEING DONE BY 3GPP!

In January, Qualcomm and Iridium entered into an agreement to bring satellite-based connectivity to next-generation premium Android smartphones. Garmin looks forward to collaborating with support for emergency messaging.

If the majority of satellite operators and OEM makers adopt global open standards, there would be better interoperability. But if players adopt propriety standards, it would be difficult to predict how the market would shape up, experts said.

Currently, satellite constellation providers like Starlink, Amazon Kuiper, OneWeb, etc. are pushing for their standards and it all depends on how the market evolves as satellite constellations deployment by the satellite internet providers are completed.

–>Please refer to references below.

References:

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

Juniper Research: 5G Satellite Networks are a $17B Operator Opportunity

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU