Huawei

Huawei says 5.5G is necessary with fully converged cloud native core network

Huawei maintains that a new 5.5G core network is needed to address a plethora of new use cases and new opportunities. That despite of the very limited deployment of 3GPP’s 5G SA Core network architecture specs. The company is calling on partners to promote industry consensus and commercial deployments for the era of 5.5G, an evolution of 5G technology.

Yang Chaobin, senior vice-president of Huawei, said: “The rapid growth of 5G has led to new service requirements that are becoming more diverse and complex. Such changes demand stronger 5G capabilities.”

Yang said that as 6G is still in the early stages of research, 5.5G is a necessary and natural evolution of 5G, which has become an industry consensus.

According to GSA, 35 network operators in 20 countries have launched commercial public 5G SA networks. In addition to those, GSA identified 77 other operators that are currently investing in 5G SA for public networks (including those evaluating/testing, piloting, planning, or deploying).

In 2020, containers and micro-services were introduced as key components of cloud-native network design and migration path to 5G core networks with high degree of much needed automation. At this point, intent-driven algorithms are used to automate large-scale cloud-native 5G telecom networks.

Figure 1. Huawei at MWC 2023

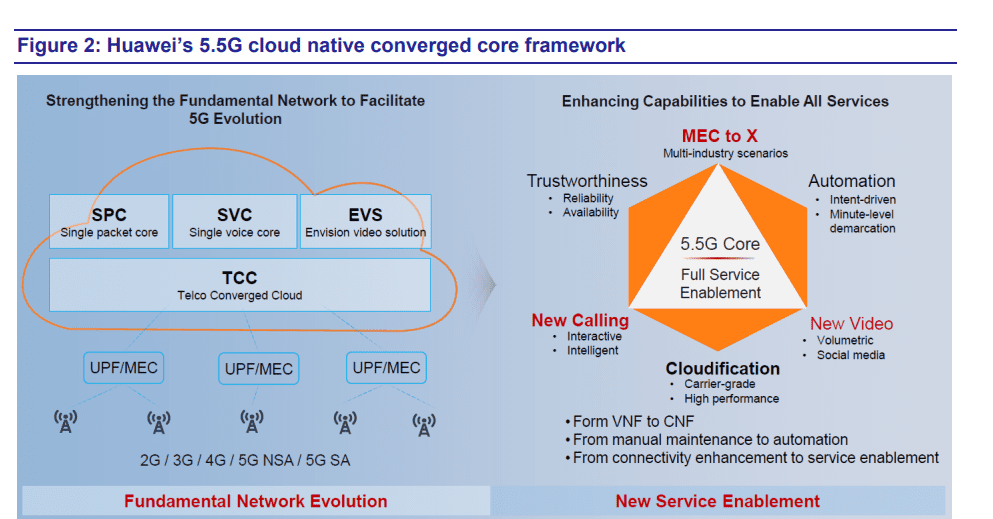

Figure 2. below illustrates Huawei’s complete 5.5G cloud-native converged core strategy that is based on strengthening the current networking building blocks that paved the way to where we are today, and continuously adding new capabilities and enhancing them to enable all services needed to address the plethora of new 5G use cases.

Source: Huawei

……………………………………………………………………………………………………………………………………………………………

Backgrounder on 5G Advanced:

3GPP initiated the 5G-Advanced project in early 2021 and started the formulation of Release 18 specs to enhance the existing mobile network capabilities. Case in point: UPF (User Plane Function) Mesh and MEC (Multi-access Edge Computing) enhancements were introduced to enable 5G to cover more industry scenarios, which in the new 5.5G core platform, is addressed through the “MEC to X” concept to accelerate the digital transformation of industries.

In addition, the Rel. 18 NG-RTC (Next Generation Real-Time Communications) feature enhances the communication capability and enriches the communication services, including calling and video, or “New Calling” and “New Video” in 5.5G core (see Figure 2. above).

……………………………………………………………………………………………………………………………………………………………

Huawei laid out five major characteristics of the 5.5G era – 10 Gbps experiences, full-scenario interconnection, integrated sensing and communication, autonomous networks and green information communications technology.

Yang called on the global telecom industry to jointly promote 5.5G development in four areas including setting clear roadmaps for industry standardization and a clear strategy for spectrum, which is fundamental to wireless networks.

Huawei and Saudi Arabian telecommunications operator Zain KSA signed a memorandum of understanding (MoU) last month for the”5.5G City” joint innovation project.

Under the MoU, both parties will work together to promote technological innovation for 5.5G evolution and expand scalable offerings to individuals, enterprises and government customers. Additionally, they will strengthen the digital infrastructure and build a global 5.5G evolution pioneer network, providing a strong engine to achieve the national digitalization goals outlined in Saudi Vision 2030.

Abdulrahman Al-Mufadda, chief technology officer of Zain KSA, said, “Our commitment to driving digital transformation has been made possible by combining innovative technology investments with pioneering digital solutions across multiple fields, including cloud computing, fintech, business support and drone technologies.”

The cooperation came as 5G is now in the fast lane after three years of commercial use. By the end of 2022, global 5G users exceeded 1 billion, gigabit broadband users reached 100 million, and more than 20,000 industry applications were put into use, according to data compiled by Huawei.

Leading operators in China, South Korea, Switzerland, Finland and Kuwait have already achieved 5G user penetration rates of more than 30 percent with more than 30 percent of their traffic coming from 5G, Huawei said.

Network intelligence and connectivity insights provider Ookla’s latest 5G City Benchmark Report showed Huawei has played an important role in 5G network construction in all of the top 10 cities among the world’s 40 most 5G-enabled cities. Performance results in these 10 cities show 5G networks constructed by Huawei offer the best experience.

Last month, Huawei also revealed a collaboration with Botswana’s Debswana Diamond Co (Pty) Ltd on the world’s first 5G smart diamond mine project.

Debswana’s Head of Information Management Molemisi Nelson Sechaba said that the Huawei-enabled smart mine solution has been deployed at Debswana’s Jwaneng open-pit diamond mine. The project started operation in December 2021.

At present, Huawei’s 4G eLTE, an advanced version of 4G technology, provides stable connectivity for the Jwaneng mine, connecting more than 260 pieces of equipment, including drilling rigs, excavators, heavy trucks and pickup trucks. This enables interconnection between the mine’s production, safety and security systems, Sechaba said.

The Jwaneng mine is the world’s first 5G-oriented smart diamond mine, which means the hardware equipment such as base stations used in the mine’s digital transformation support network has upgraded to 5G, Huawei said.

Huawei claims they’ve seamlessly migrated their existing and dedicated core network platforms (e.g., SPC, SVC, EVS in Figure 2) as well as its telco converged cloud to a fully converged cloud-native 5.5G core that features full-service enablement. In other words, the company says the transition from virtual network functions (VNF) to cloud native network functions (CNF), from manual operation to automation and from connectivity provisioning and enhancement to full-service enablement has been completed.

–>That’s all in advance of 3GPP Release 18 specs on 5G Advanced (which won’t be frozen till March 2024)?

…………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.chinadaily.com.cn/a/202303/20/WS6417b0a5a31057c47ebb55b2.html

Huawei’s blueprint to lay the foundation for 5.5G and the “intelligent world”

Virtual Network Function Orchestration (VNFO) Market Overview: VMs vs Containers

Huawei’s blueprint to lay the foundation for 5.5G and the “intelligent world”

According to Huawei, the intelligent world will be deeply integrated with the physical world. Everything, including personal entertainment, work, and industrial production, will be intelligently connected. This means that networks will have to evolve from ubiquitous Gbps to ubiquitous 10Gbps, connectivity and sensing will need to be integrated, and the ICT industry will have to shift its focus from energy consumption to energy efficiency. The evolution from 5G to 5.5G will be key to meeting these growing requirements.

At MWC 2023, Huawei unveiled its “GUIDE to the Intelligent World“ as a business blueprint to lay the foundation for 5.5G. Whatever happened to 5G Advanced and 3GPP Release 18? and ITU-R WP5D M.2150 recommendation?.

Following on from Huawei’s concept of “Striding Towards the 5.5G Era” that was proposed in July 2022, Huawei is highlighting the five major characteristics of the 5.5G era:

- 10 Gbps experiences

- Full-scenario interconnection

- Integrated sensing and communication

- L4 autonomous driving networks

- Green ICT

For Huawei, 5.5G represents a 10-fold improvement in performance over 5G in every metric. That means 10 Gbps headline connection speeds, 10 times the number of IoT connections – which translates to 100 billion in total – and reducing latency by a factor of 10. Networks also need to consume a tenth of the energy that they consume today on a per Terabyte basis, and they need to be 10x more intelligent, which means supporting level 4 autonomous driving, and making operations and maintenance (O&M) more efficient by a factor of 10.

With these capabilities in place, 5.5G networks will enable a boom in immersive interactive experiences, like VR gaming in 24K resolution, and glasses-free 3D video, predicts Huawei. It expects the installed user base of these services will grow 100-fold to 1 billion. On the enterprise side, the vendor expects the number of private cellular networks to increase from 10,000 today to 1 million by 2030.

Huawei says that leading global operators, standards organizations, and industry ecosystem partners are coming together to promote innovation and exploration for this 5.5G era, as it will create more new applications and business opportunities. This author disagrees- they are not coming together at all!

According to Ookla’s latest 5G City Benchmark Report, Huawei has played an important part in 5G network construction in all of the top 10 cities among the world’s 40 representative 5G-enabled cities. It’s important to note that 5G performance results in these 10 cities show that the 5G networks constructed by Huawei offer the best experience.

…………………………………………………………………………………………………………………………………………..

David Wang, Huawei’s Executive Director of the Board, Chairman of the ICT Infrastructure Managing Board, and President of the Enterprise BG, said, “Huawei will deepen our roots in the enterprise market and continue our pursuit of innovation. We are ready to use leading technologies and dive deep into scenarios. Together with our partners, we will enable industry digitalization, help SMEs access intelligence, and promote sustainable development, creating new value together.”

Bob Chen, Vice President of Huawei Enterprise BG, delivered a keynote speech entitled “Digital Technology Leads the Way to the Intelligent World,” which outlined how digital technologies have impacted the development of the world’s economy, cultures, societies, and environment. He stated, “Archimedes, a great Greek physicist, said, ‘Give me a place to stand and I shall move the earth.’ Digital technology is the right place for us to help industries go digital. Huawei will focus on connectivity, computing, cloud, and other digital technologies. We will continue inspiring innovation to drive industry digital transformation. Together, let’s build a fully connected, intelligent world!”

Huawei said they would continue to work with customers to build next-generation network infrastructure to better serve all industries. Here are a few of their focus areas:

- Smart campus: Huawei redefines campus networks and launches the Next-Generation enterprise flagship core switch CloudEngine S16700, first enterprise-level Wi-Fi 7 AP AirEngine 8771-X1T, along with first 50G PON OLT and optical terminal product.

- Easy branch: Huawei launches the industry’s first simplified hyper-converged branch solution.

- Single OptiX: Huawei launches the industry’s first end-to-end optical service unit (OSU) product portfolio.

- Cloud WAN: Huawei defines a brand-new cloud WAN and launches the NetEngine 8000 series routers oriented to the all-service intelligent router platform in the cloud era.

- Data Center solution: Four industry-first products and product portfolios, unleashing the power of digital innovation

Storage and computing power have become one of the core strategic resources of enterprises. Huawei focuses on data center infrastructure innovation, leads the development of new data centers, helps enterprises cope with uncertain threats, ensures ultimate service experience, processes massive and diversified computing power, and brings data centers more green, more reliability, and more efficiency.

For large enterprises,Huawei launches the industry’s first multi-layer DC ransomware protection solution powered by network-storage collaboration, the industry’s first unified DC DR product portfolio featuring storage and optical connection coordination (SOCC),and CloudEngine 16800-X, which is the industry’s first DC switch designed for diversified computing power.

For SMEs, Huawei also launches OceanStor Dorado 2000 and OceanProtect X3000, which are the industry’s first entry-level storage combination based on the active-active architecture.

Juan De Dios Navarro Caballero, councillor of Alicante province, Spain, stated, “Huawei’s SDN-based CloudFabric Solution and All-Wireless Campus Network Solution enable network automation, intelligent O&M, and ubiquitous connectivity. Through these solutions, the government offices of Alicante province are now more efficient, and offer a better user experience for public services. The province has seen faster digital transformation along with digital economy development.”

Faith Burn, CIO of Eskom, a South African electric power company, shared the company’s digital transformation methodology and practical experience. She stressed that Eskom seeks to work with partners that can help realize the company’s digital vision, saying that, “It is very important to find capable partners to realize our digital vision. Eskom would like to collaborate with OEMs like Huawei to build advanced electricity ICT infrastructure to achieve comprehensive digitalization.”

Steven Zhu, President of Partner Development and Management of Huawei Enterprise BG, mentioned that “Huawei is committed to working with partners to complement each other, motivate partners to support customers proactively, and serve customers well together.”

In the future, Huawei says they will continue to invest and innovate, working alongside global customers and partners to deeply integrate ICT, accelerate digital transformation, promote digital economy development and speed up the realization of the intelligent world within industries, in order to create new value.

References:

https://www.huawei.com/en/news/2023/2/mwc2023-5g-huawei%20-connectivity

https://www.huawei.com/en/news/2023/2/mwc2023-industry-digital-transformation

https://telecoms.com/520240/huaweis-5-5g-vision-is-what-5g-should-have-been-all-along/

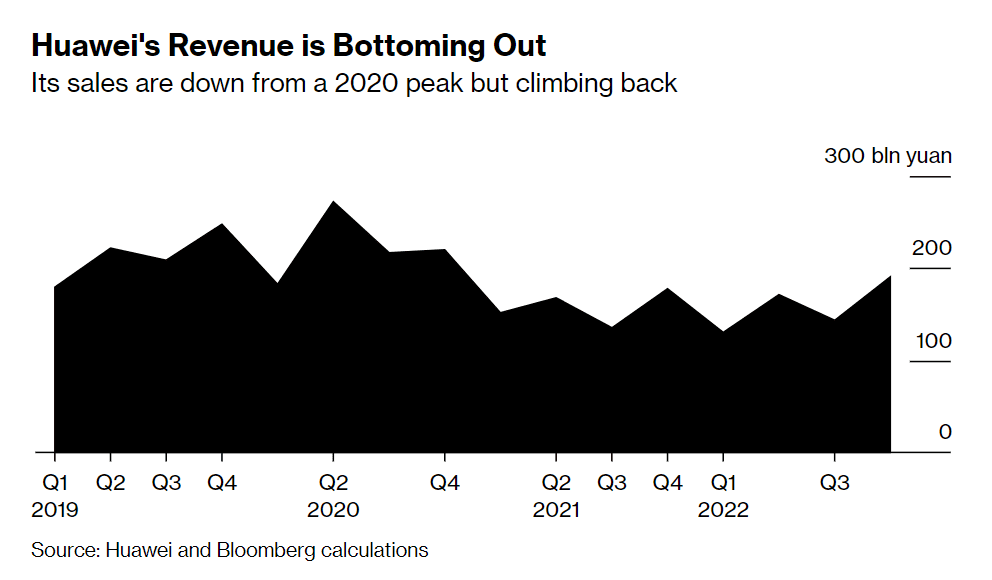

Huawei reports 3rd straight quarter of revenue growth despite U.S. sanctions

FCC bans Huawei, ZTE, China based connected camera and 2-way radio makers

On Friday, the Federal Communications Commission (FCC) banned Huawei Technologies Co. and ZTE Corp. from selling electronics in the U.S. by regulators who say they pose a security risk, continuing a years-long effort to limit the reach of Chinese telecommunications companies into U.S. telecommunications networks.

The FCC also named connected-camera makers Hangzhou Hikvision Digital Technology Co. and Dahua Technology Co., as well as two-way radio manufacturer Hytera Communications Corp.

“The FCC is committed to protecting our national security by ensuring that untrustworthy communications equipment is not authorized for use within our borders, and we are continuing that work here,” Chairwoman Jessica Rosenworcel said in a news release. “These new rules are an important part of our ongoing actions to protect the American people from national security threats involving telecommunications.”

“On March 12, 2021, we published the first-ever list of communications and services that pose an unacceptable risk to national security as required under the Secure and Trusted Communications Networks Act. This initial Covered List included equipment from the Chinese companies Huawei, ZTE, Hytera, Hikvision, and Dahua. Since then, we’ve added equipment and services from five additional entities. Last year I also proposed stricter data breach reporting rules and worked with the Department of State to improve how we coordinate national security issues related to submarine cable licenses.”

In the 4-0 vote, the FCC concluded the products pose a risk to data security. Past efforts to curb Chinese access include export controls to cut off key, sophisticated equipment and software. Recently US officials have weighed restrictions on TikTok over fears Chinese authorities could access US user data via the video sharing app.

“This is a culminating action,” said Klon Kitchen, a senior fellow at the Washington-based American Enterprise Institute, a public-policy think tank. “Things that began under Trump are now being carried out. The Biden administration is continuing to turn the screws on these companies because the threat isn’t changing.”

Hikvision said its video security products “present no security threat to the United States and there is no technical or legal justification for the Federal Communications Commission’s decision.” The company said the ruling will “make it more harmful and more expensive for US small businesses, local authorities, school districts, and individual consumers to protect themselves, their homes, businesses and property.”

Huawei declined to comment, while Dahua, Hytera and ZTE didn’t respond to emails sent outside normal business hours in China.

The looming FCC move didn’t come up in the bilateral meeting between US President Joe Biden and Chinese President Xi Jinping in Indonesia last week, a US official said, speaking on condition of anonymity. Biden did discuss technology issues more broadly with Xi and was clear that the US will continue to take action to protect its national security, the official said.

“This is the death knell for all of them for their US operations,” said Conor Healy, director of government research for the Bethlehem, Pennsylvania-based surveillance research group IPVM. “They won’t be able to introduce any new products into the US.”

Dahua and Hikvision stand to be affected most since their cameras are widely used, often by government agencies with many facilities to monitor, Healy said. Agencies including police also use handheld Hytera radios, he said.

In its order, the FCC also asked for comment on whether to revoke existing equipment authorization, Rosenworcel said in an online statement.

According to Healy, merchants could be stuck with gear that’s illegal to sell.

In 2018, Congress voted to stop federal agencies from buying gear from the five companies named by the FCC. The agency said earlier that the companies aren’t eligible to receive federal subsidies, and also has barred Chinese phone companies from doing business in the U.S.

The order released Friday was required under the Secure Equipment Act – a bill President Biden signed into law on November 2021.

The big picture: Huawei and ZTE are two of the world’s biggest suppliers of telecom equipment.

- Countries including Canada, Britain and Australia have ramped up restrictions against the use of 5G technologies from Huawei and ZTE in recent years.

- Huawei executives have previously said the company does not give data to the Chinese government and that its equipment is not compromised.

- The company’s chief security officer Andy Purdy has also argued that a ban would hurt American jobs because it spends over $11 billion a year from American suppliers.

References:

https://www.axios.com/2022/11/25/fcc-bans-huawei-zte-equipment-national-security

Huawei Connect 2022: Intelligent Cloud-Network Upgrades Announced

During HUAWEI CONNECT 2022 in Dubai, Huawei unveiled the upgraded capabilities of its Intelligent Cloud-Network Solution at the “Intelligent Cloud-Network, Unleashing Digital Productivity” summit. These capabilities, which center on three major scenarios —CloudFabric 3.0, CloudCampus 3.0, and CloudWAN 3.0— are provided to meet network development trends. Huawei also released the L3.5 Data Center Autonomous Driving Network White Paper, together with IEEE-UAE Section and pioneering customers, to contribute to the thriving data communications industry and unleash digital productivity.

The changes in enterprise business are driving the development of enterprise ICT infrastructure, and IP networks — serving as the bridge between IT and CT and covering all production and office procedures of enterprises, constitute the connectivity foundation for industry digital transformation. Networks have never been more important than they are today.

Daniel Tang, CTO of Huawei Data Communication Product Line, shed light on how to respond to future development trends and address network challenges. According to Daniel Tang, Huawei keeps innovating data communications technologies in areas such as Wi-Fi 7, 400GE, IPv6 Enhanced, multi-cloud synergy, autonomous driving network, and ubiquitous security. With these innovative technologies, Huawei has upgraded its capabilities in three scenarios: CloudFabric 3.0, CloudCampus 3.0, and CloudWAN 3.0.

Huawei CloudFabric 3.0 offers full-lifecycle intelligent capabilities for multi-cloud and multi-vendor networks based on L3.5 ADN technology. Stand-out features include unified management and control, flexible orchestration and collaboration, simulation & verification, risk prediction, and unified O&M for applications and networks. Plus, this solution facilitates easy interconnection with customers’ IT management systems to achieve end-to-end automation. Key results include easy deployment, easy O&M, and easy evolution.

By leveraging Huawei’s ADN and hyper-converged Ethernet technologies, Ankabut is building the world’s first HPC supercomputing center with Ethernet and InfiniBand co-cluster.

At the summit, Huawei, together with IEEE-UAE Section, Ankabut of UAE, and CBK of Kuwait, released the L3.5 Data Center Autonomous Driving Network White Paper.

- CloudCampus 3.0

Huawei further upgraded its CloudCampus 3.0 offerings by unveiling a host of flagship products, including the first enterprise-class Wi-Fi 7 AP AirEngine 8771-X1T, next-generation flagship core switch CloudEngine S16700, and 4-in-1 hyper-converged enterprise gateway NetEngine AR5710.

Huawei CloudCampus 3.0 helps enterprises simplify their campus networks from four aspects: access, architecture, branch, and Operations and Maintenance (O&M).

- CloudWAN 3.0

In the WAN field, Huawei continues to innovate technologies such as SRv6, FlexE slicing, and application-based IFIT measurement, and all of these technologies rely on IPv6 Enhanced. Huawei has further upgraded its CloudWAN 3.0 offerings to achieve agile connectivity, deterministic experience, and agile O&M and launched an ultra-high-density multi-service aggregation router — NetEngine 8000 F8 — to improve digital productivity with agile connectivity.

With Huawei’s help, the Gauteng province successfully deployed the first 100GE private network in South Africa — GBN.

The future digital world is full of uncertainties. As the saying goes, “If you want to go fast, go alone. If you want to go far, go together.” Mindful of this, Huawei strongly advocates partnerships and will continue to cooperate and innovate with more customers and partners in the data communication field. Vincent Liu, President of Huawei’s Global Enterprise Network Marketing & Solutions Sales Dept, highlighted that Huawei has set up many regional joint innovation labs and OpenLabs. Through these labs, Huawei is well poised to jointly innovate with customers from sectors such as public service, oil and gas, electric power, finance, education, and ISP. These concerted efforts pay off in many high-value application scenarios and achieve remarkable results. To date, Huawei has already trained and certified 188,000 data communication engineers, providing a large pool of ICT talent for digital transformation across industries.

Photo – https://mma.prnewswire.com/media/1921355/image_986294_38236382.jpg

SOURCE Huawei

SOURCE Huawei

References:

Huawei Connect 2022: It’s Cloud Native everything!

Huawei’s annual flagship event, Huawei Connect 2022 –“Unleash Digital” opened in Bangkok, Thailand today.

- Ken Hu, the Rotating Chairman of Huawei, spoke about the importance of cloud adoption for enterprises to achieve leap-forward development.

- Zhang Ping’an, CEO of Huawei Cloud, announced the launch of two new Huawei Cloud regions in Indonesia and Ireland, as well as the “Go Cloud, Go Global” program for enterprises to access expertise and experience from Huawei Cloud’s global ecosystem partners.

- By the end of this year, Zhang said that Huawei Cloud will be deployed in 29 regions and 75 availability zones, covering 170 countries and regions worldwide. At the core of its offering is Everything as a Service built on a cloud-native foundation to enable enterprises to innovate faster and accelerate digital transformation.

Zhang Ping’an, CEO of Huawei Cloud

Editor’s Note: The top four Cloud service providers in China are Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu. That’s very different from the U.S. where the leaders are Amazon AWS, Microsoft Azure, and Google Cloud.

Huawei Cloud has already set up 13 localized service centers in the Asia Pacific, with more than 1,000 certified engineers to provide tailored services. In addition, ecosystem development has been fruitful, with more than 2,500 local partners generating more than 50% of the revenue of Huawei Cloud. Huawei Cloud is also forging ahead with industry-government-academia collaboration in the Asia Pacific. Investment in the Huawei ASEAN Academy and the Seeds for the Future Program will be used to cultivate more than 1 million digital experts over the next five years.

Huawei Cloud serves 80% of the 50 biggest Internet companies in China and more than 200 major Internet companies in the Asia Pacific. In Sarawak, Malaysia, Huawei Cloud, together with its partners, has built cloud native infrastructure to support the collaboration of more than 30 government departments in five fields, and provided more than 80 digital government and smart city services to ensure more efficient and better-informed decision-making. In Indonesia, Huawei Cloud has provided a unified data foundation to help CT Corp migrate its media, retail, and finance services to the cloud, enabling precise recommendations for 200 million Internet users. The cloud native technologies of Huawei Cloud have helped Siam Commercial Bank (SCB) in Thailand quickly roll out its digital loan service. Loan approval and issuance, which used to take one month of work, is now fully automated and can be completed in just five minutes.

…………………………………………………………………………………………………………………………………………… …..

To address this pain point and unleash digital productivity for thousands of industries, Zeng Xingyun, President of Huawei Cloud, APAC, shared a three-pronged approach: to act with strategic resolve, embrace cloud-native and cultivate digital talent.

Zeng Xingyun, President of Huawei Cloud, APAC

Zeng emphasized long-term planning and a top-down approach to drive collaboration between IT and business departments to modernize blueprints and architecture based on cloud-native technologies. With 90% of enterprises in developed countries already using cloud technologies and 80% of all applications to be cloud-native by 2023, Zeng noted that cloud-native delivers efficient use of resources, agile applications, intelligent services and a secured system that helps government and enterprises stay compliant and grow sustainably.

In his speech, Zeng noted that Huawei Cloud has served more than 200 top Internet enterprises in Asia Pacific and 80% of the top 50 Internet enterprises in China. Huawei Cloud has 13 service centers in Asia Pacific, but more notably, Huawei Cloud is the first public cloud vendor to build local nodes in Thailand, with three availability zone data centers serving the local market.

He spoke about how cloud-native drives digital transformation in public and private sector, elaborating on how Huawei Cloud supports Siam Commercial Bank’s (SCB) automated processes to approve large volumes of loan requests within minutes, helping SCB attract 45,000 digital users and a credit limit worth THB 204 million within a quarter.

He also highlighted the importance of a talent ecosystem to address a digital talent shortage amounting to 47 million by 2030 in Asia Pacific. Through industry-academia cooperation such as the ASEAN Academy and the Seeds for the Future Program, more than 1 million digital talents will be cultivated in the next five years. Meanwhile, the Huawei Cloud Startup Program, aimed to help regional startups adopt cloud agilely, has already attracted more than 120 Asian enterprises since its recent launch. One such enterprise is ReverseAds, a Phuket-founded startup that has successfully secured US$24 million in funding to expand beyond Thailand.

The summit also saw the joint launch of Cloud Native Elite Club (CNEC) APAC by Huawei Cloud and Cloud Native Computing Foundation (CNCF). First established in China two years ago, CNEC gathers over 200 members working collaboratively to develop industry standards and promote cloud-native technologies in China. Likewise, the APAC branch will look to further cloud-native technologies.

Cloud-Native 2.0 for Industry Enablement:

An important driving force for service innovation, cloud-native technologies such as container, microservice, and dynamic orchestration empower enterprises to build and run scalable applications in modern, dynamic environments.

As cloud-native enters a new developmental stage, Fang Guowei, Chief Product Officer of Huawei Cloud, shared that Cloud Native 2.0 is a new phase for the intelligent upgrade of enterprises, focused on delivering Everything as a Service incorporating Infrastructure as a Service, Technology as a Service and Expertise as a Service to yield breakthroughs in digital transformation for government and enterprises.

An advocate of cloud-native innovations with open source, Huawei Cloud has contributed to the CNCF with open source projects including KubeEdge, Volcano and Karmada, hence growing the CNCF community from 1 Kubernetes project in 2015 to more than 20 categories and over 1,100 projects today.

Huawei Cloud delivers cost-effective cloud services with the innovative full-stack QingTian Architecture, featuring ultra-fast I/O engine, end-to-end security and enhanced operations and maintenance.

Adding to its offerings are more than 15 cloud-native products and services introduced to the global market for the first time. Elaborating on two core cloud-native innovations, Fang introduced the Cloud Container Engine (CCE) Turbo as a new cloud-contained engine that yields increased resource utilization, reduced access latency by up to 40%, and scale out 3,000 pods per minute to cope with traffic surges.

He also featured the Ubiquitous Cloud-Native Service (UCS), a distributed cloud-native service that allows enterprises to connect thousands of Kubernetes clusters to deliver a consistent experience through multi-cloud, cross-region applications.

Introductions were made to new services based on four pipelines: ModelArts to help AI developers effectively achieve one-stop data-tagging/model training; DataArts for an efficient and intelligent data governance pipeline; DevCloud for a secure and productive software development pipeline; and MetaStudio to provide better media experience. Other upcoming offerings include MacroVerse aPaaS such as KooMessage, KooSearch and KooGallery.

Fang also took the opportunity to release the Cloud-Native 2.0 Architecture White Paper to help enterprises embark on digital transformation.

Articulating the impact of Huawei Cloud’s innovations on industries, Hu cited AI adoption in the Pangu Drug Molecule Model to yield faster drug discovery for the First Affiliated Hospital of Xi’an Jiaotong University – successfully reducing R&D costs by 70% and development to approval time from a decade to a month for the world’s first broad-spectrum antimicrobial drug.

As one global network, Huawei Cloud has launched more than 240 cloud services, aggregating more than 38,000 partners and 3 million developers to release more than 7,400 applications in the cloud market.

With cloud-native technologies becoming a key engine to unleash digital productivity, Huawei Cloud demonstrates a commitment to harness cloud-native, Everything as a Service to spur economies.

References:

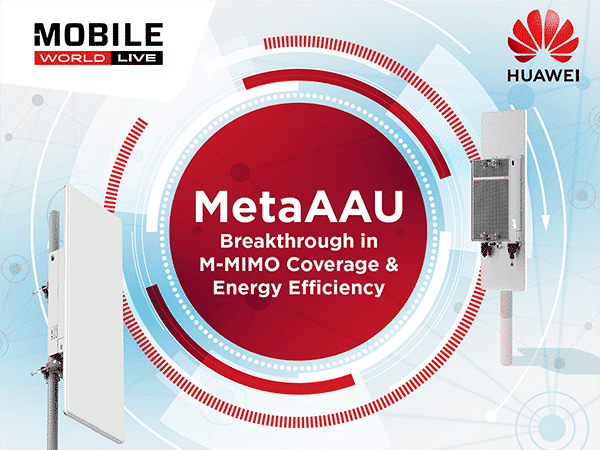

China Unicom to deploy Huawei’s 64T64R MetaAAU product-an upgrade of Huawei MetaAAU

China Unicom Beijing will commercial Huawei’s 64T64R MetaAAU product in a pilot urban residential area in Tongzhou District. China Unicom says the rollout of 64T64R MetaAAU resulted in a significant increase in user-perceived rates. Even at a building near the cell edge, the downlink user-perceived rate was able to reach 100 Mbps on every floor, China Unicom added.

64T64R MetaAAU is an upgrade of the Huawei MetaAAU series that adopts extremely large antenna array (ELAA) technology. The number of channels has grown from 32T32R to 64T64R, meaning this new green 5G base station Massive MIMO product can deliver upgrade coverage and capacity.

China Unicom Beijing and Huawei have created a commercial MetaAAU network as part of a project that has deployed MetaAAUs at over 1,000 rural network sites on the outskirts of Beijing. According to China Unicom, this new network has already seen a 38 percent increase in traffic per site by improving 5G services in rural areas.

The MetaAAUs used by this network are also designed to reduce site energy consumption by 5 percent under the same network load compared with previous-generation AAUs. MetaAAUs are the third-generation of 5G AAU developed by Huawei. They use the company’s new extreme-large antenna array (ELAA) architecture to double the scale of arrays compared with the previous-generation AAU. According to Huawei, this innovation results in extended coverage because channel beams are narrower and energy is more focused.

China Unicom Beijing has leveraged these advancements to hit its 2022 5G construction targets for small towns and rural areas which face unique challenges when it comes to inter-site distance, gigabit user experience, and green networking. China Unicom Beijing deployed these MetaAAUs at over 1,000 sites in July in towns and rural areas including the Shunyi, Huairou, and Pinggu districts of Beijing.

The company claims the MetaAAUs have delivered a 40 percent increase in coverage area, increased uplink and downlink user-perceived rates by 10 percent, and lowered network energy consumption by 5 percent over previous-generation AAUs. Since their deployment, user traffic has increased by 38 percent in their coverage areas and the operator’s user base has increased by 37 percent.

References:

https://www.telecompaper.com/news/china-unicom-deploys-1000-metaaaus-with-huawei–1430843

Huawei to expand consumer products to include smartphones, PCs and other consumer-oriented devices

Huawei Technologies said on Wednesday it will step up efforts to expand its presence in the commercial hardware market in its latest effort to pursue new growth opportunities beyond smartphones amid foreign government restrictions. Richard Yu Chengdong, a member of Huawei‘s executive board, said: “The company has rebranded its consumer business group that includes smartphones, PCs and other consumer-oriented businesses, into a device business group, to showcase its determination to tap into enterprise-oriented businesses such as PCs used in offices, desktops and large displays for industry customers.”

Huawei‘s new group will focus on providing office hardware and software solutions for key sectors including education, healthcare, manufacturing, transportation, finance and energy, Huawei said. Huawei‘s consumer business group used to contribute the most to the overall revenue of the company. But due to tough US government restrictions on Huawei‘s access to crucial technologies including semiconductors, the company’s smartphone sales plunged.

In the fourth quarter of 2021, Huawei‘s consumer business group revenue dropped nearly 50 percent to 243.4 billion yuan ($38 billion).

According to market research company Counterpoint, the company’s global smartphone market share fell below 4 percent since the first quarter of 2021, compared with its peak of 20 percent in the second quarter of 2020.

Amid such a context, Huawei has been working hard to find new growth engines to offset its declining smartphone business.

At an online product launch on Wednesday, Huawei unveiled its latest commercial tablets, smart wearables and displays equipped with its self-developed HarmonyOS. Huawei also provides a customized full-scenario payment solution called Huawei Payment for government clients and small and medium-sized enterprises.

Xiang Ligang, director-general of the Information Consumption Alliance, an industry association, said sales channels constitute the biggest difference between consumer-oriented and enterprise-oriented businesses. The former relies on retail stores, while the latter depends on close partnerships with customers from industries.

Huawei‘s advantages in product performance, quality as well as research and development can still give it an edge in enterprise-oriented business, Xiang said, adding that Huawei has accumulated experience in targeting industrial customers in its 5G base station business. Huawei is also continuing its drive for development of the OpenEuler operating system as part of its broader push to solve China’s lack of homegrown operating systems for fundamental digital technologies.

OpenEuler is designed for enterprise customers and can be used in devices such as servers and cloud computing. Last year, Huawei donated its Euler operating system to the OpenAtom Foundation, a major open source foundation in China, to become an open-source OS.

Jiang Dayong, director of the OpenEuler Community, said the OpenEuler open source community has attracted more than 8,000 developers and 330 partners such as chip makers, software companies and hardware makers. At present, the cumulative installed capacity of OpenEuler stands at more than 1.3 million in industries such as finance, transportation and telecom, which means the system is ready for faster growth. Jiang said he expects about 2 million new installations of OpenEuler in 2022.

Computer products at a Huawei store in Foshan, Guangdong province, on April 4, 2022. Photo: VCG

……………………………………………………………………………………………………………………………………………………………………….

References:

Huawei: XR industry to realize exponential growth with 5G; ‘Spatial Internet’ will be the next big thing

The world of Extended Reality or XR, which covers Virtual Reality, Augmented Reality and Mixed Reality, offers infinite potential, said Dr. Philip Song, Chief Marketing Officer, Huawei Carrier, during his keynote speech “5G + XR: Bringing Imagination into Reality,” at the 2022 Mobile World Congress (MWC) in Barcelona.

According to a survey, the XR industry will contribute US$1.5 trillion to the global GDP by 2030. In 2021, more than 10 million units of Quest 2 were shipped. These 10 million users will be the critical mass for the XR ecosystem to take off. Dr. Song added that following the mobile internet, ‘Spatial Internet’ [1.] will be the next big thing.

Note 1. While there’s no clear definition, the Spatial Web or Spatial Internet refers to a computing atmosphere that exists in a 3D space. It is a pairing of real and virtual realities, enabled via billions of connected devices, and accessed through the interface of Virtual and Augmented Reality.

…………………………………………………………………………………………………………………………………………………………………………………………………………..

Song introduced how Huawei held VR-enabled annual meetings and uses AR to assist with 5G base station delivery. Huawei and third-party data shows that the XR market will generate US$1.5 trillion in GDP by 2030, which is roughly equivalent to the current 5G market.

Comparing the XR industry’s progress to how the smartphone industry developed, Song said many vendors are now offering XR devices for under US$300, making the technology more affordable while still offering next-gen user experiences. XR development tools are being increasingly adopted. The new OPEN XR standard is now supported by almost every major hardware, platform, and engine company, making multi-platform deployment possible without multiple rounds of development.

What is more noteworthy is that a number of global XR pioneer carriers have made commercial breakthroughs in recent years. Carriers in countries like South Korea, Thailand, and China have led the deployment of VR/AR services and gained significant returns through three steps: selecting industries, setting business models, and developing capabilities. A carrier said, “If XR was launched three months later, it might take three years to catch up.”

XR Industry to Grow Rapidly:

The world is on the cusp of witnessing the fast-paced growth of the XR industry, he said. VR headset shipments are accelerating. In 2021, more than 10 million units of Oculus Quest 2, a VR headset, were shipped. Ten million users will be the critical mass for the XR ecosystem to take off. The growth of VR devices will mirror that of smartphones and mobile devices. From 1983 to 1994, it took 11 years to sell the first 10 million cellphones. However, the cellphone shipment touched 20 million in 1995, and 100 million were sold over the next three years. According to market forecast, VR headset shipment will reach 100 million units by 2025.

Also, the price of VR devices continues to drop, making them affordable for more people. Lastly, continuous innovation in XR technologies has made it possible to deliver a generational leap in user experience.

Huawei launched its next-generation, innovative AR-HUD, expanding XR applications. In terms of XR data transmission, Huawei presented innovative solutions such as 5G Massive MIMO and FTTR. The company has publicly committed to supporting a “Gigaverse” that provides ubiquitous gigabit access to support XR experiences anytime, anywhere. Huawei also launched its “Cloud-network Express” solution to help XR industry partners quickly access multiple clouds and use cloud-based development and rendering capabilities.

As he closed out his presentation, Song called on industry partners to work together in line with the “new Moore’s Law” and seize this great development opportunity for the XR industry. “I do believe that with industry-wide collaboration, 5G+XR will have a bright future. The best way to predict the future is to create it. The time to act is now,” concluded Dr. Song.

ZTE using TSMC’s 7-nm process to build custom chips for its 5G base stations

ZTE is on a roll! China’s #2 telecom firm said in its annual report that it gained market share in China last year for servers, core networks and storage solutions — the three areas where Huawei is a key player. Revenues grew at a double-digit percentage rate last year, rising inside and outside China and across all three business units – carrier (networks), enterprise (business) and consumer (gadgets).

With TSMC’s business booming, Nikkei Asia believes that ZTE is quietly building a technological edge in the base station market for fifth-generation (5G) cellular connectivity. These base stations are used by telecommunications carriers to meet consumer demands, and the publication believes that ZTE has designed its equipment to be based on the 7-nanometer (nm) process node.

The company [ZTE] has been utilizing some of TSMC’s most advanced chip production technology — the so-called 7-nm tech — to build processors for its 5G base stations. Sources said it also uses the Taiwanese chipmaker’s advanced chip packaging technology, which uses stacking technology to arrange chips with different functions into one package.

Nikkei Asia also said that Huawei’s inability to conduct business with TSMC due to American sanctions has left the field wide open for ZTE. The company is targeting double-digit growth for its server and base station segment, and it is also interested in TSMC’s leading-edge chip node, which is the company’s 5nm process.

However, while ZTE might not be sanctioned to procure the latest chip technologies from TSMC, the company still can not sell its 5G base stations to several Western companies. This has resulted in it focusing its efforts mostly on China, as the U.S. will rely on small cell 5G Open RAN platform developed by Qualcomm Incorporated on the 4nm node.

Source: Jordi Boixareu/Alamy Live News

“ZTE has turned quite aggressive in pursuing its chip capability in the past few years. Although the volume is still small, it is showing impressive progress,” said one unnamed source.

TSMC, as well as ZTE, seems to be on a very solid growth track. On the back of another robust set of quarterly financials Q4 FY21 and a strong balance sheet, the world’s #1 chip making firm announced a massive capex budget hike to increase manufacturing capacity in “advanced process technologies,” including 2nm, 3nm, 5nm and 7nm.

TSMC also sells products built on the 4nm, which is a design extension of the company’s 5nm process families. Different process technologies marketed under the 4nm branding are expected to commence production from the second half of this year to the first half of 2023.

References:

https://wccftech.com/tsmc-reveals-36-revenue-growth-as-chinas-zte-reportedly-using-7nm-for-5g/

https://www.lightreading.com/asia/zte-has-designs-on-chips-with-tsmc/d/d-id/775180?