Huawei

Global Data: Huawei #1 amongst 5 major LTE RAN vendors

Executive Summary:

GlobalData, a leading market data and analytics company, has rated Huawei’s LTE RAN portfolio to be a leader in the market. In competitive analyses of five major RAN vendors, GlobalData evaluated 4G LTE base station portfolios according to four key areas important to mobile operators: baseband unit (BBU) capacity, radio unit portfolio breadth, ease of deployment and technological evolution. GlobalData found Huawei to be a Leader in all four categories and a Leader overall among its peers.

Editor’s Note/ Disclaimer:

We don’t know whether Huawei paid Global Data (?) to evaluate 4G LTE vendor portfolios or if that was done indepedently on Global Data’s own initiative. It’s disturbing that we could not find a related report or media press release on the company’s website after doing multiple searches.

…………………………………………………………………………………………………………………………………………………………………………………………..

LTE RAN Basics: In the RAN, radio sites provide radio access and coordinate the management of resources across the radio sites. User Equipment (e.g. wireless network endpoints) are connected to Nodes (base stations or small cells) using LTE. Radio Network Controllers are wirelessly connected to the core network which for LTE is called the Evolved Packet Core (EPC). This is depicted in the illustration below:

Source: Research Gate

……………………………………………………………………………………………………………………………………………………………………………………

Huawei has introduced new advances in its LTE RAN portfolio to enhance the coverage and capacity of mobile networks. It also offers solutions to aid the coordination of 4G and 5G networks and to enable new services for operators. The Chinese IT behemoth has the highest BBU cell capacity – in terms of both LTE carriers and Narrowband IoT – of any major RAN vendor. It also offers more radio units and more Massive MIMO options than other vendors and supports a wide array of 4G spectrum bands. To make deployment easier, Huawei offers multiple novel solutions, including its Super Blade Site and Bracelet Kit offerings. And to help operators evolve their networks technologically, Huawei has been proactive in commercializing spectrum-sharing capabilities such as its CloudAIR solution, which allows various access technologies (2G/3G/4G/5G) to use the same spectrum, and its SuperBAND solution, which can improve user experience under multi-frequency networks.

This portfolio is well-suited to meet the diverse needs of the world’s mobile operators, and Huawei continues to expand its RAN portfolio to help operators prepare for the future and maximize the value of their LTE networks.

Coverage:

Adequate network coverage is an essential characteristic for ensuring quality mobile services. It becomes especially important in LTE networks as 5G is deployed in high-frequency bands whose coverage footprint areas are more limited. LTE must cover the areas that 5G does not.

To enhance the coverage of 4G/5G networks, Huawei has introduced the Blade Pro solution. The Blade Pro Ultra-Wideband Remote Radio Unit (RRU) is a pole-mountable RU that supports three low or medium Frequency-Division Duplex (FDD) bands simultaneously: it currently supports 700 MHz, 800 MHz and 900 MHz; and in late 2021, it will support 1.8 GHz, 2.1 GHz and 2.6 GHz.

By supporting three frequency bands in a single 25-kilogram unit, the Blade Pro eliminates the need for two boxes, reducing the load on poles, easing the burden on installers and making deployment faster, smoother and less expensive. Making installation easier means operators are better able to increase coverage by expanding or densifying their networks.

Capacity:

Operators face the eternal challenge of keeping up with ever-increasing user demand for data at faster speeds in the space of finite spectrum. One way to add network capacity without finding additional spectrum is to deploy greater antenna arrays, upgrading radios with two transceivers to those with four or eight, for example, or adding Massive MIMO antennas bearing 32 or 64 arrays.

Huawei’s LTE RAN portfolio now includes a radio unit with eight transceivers and receivers for enhanced capacity, useful for urban hotspot areas. The “Smart 8T8R” solution also gives operators flexibility in their migration to 5G. The FDD 8T8R RRU is hardware-ready for 5G NR, and the antenna array is software-defined, meaning its configuration can be adjusted – without changing the hardware – for example, to six sectors for LTE and three sectors for 5G. The solution also dynamically adjusts the power supply allocated to sectors according to how users are distributed. This flexibility can be helpful in allowing operators to serve specific needs on a site-by-site basis and to adapt in real time to changes in user behavior. On TDD side, meanwhile, Huawei leverages its considerable research in TDD-LTE to offer an 8T8R IMB (Intelligent Multi-Beam) solution, which is also based on a software-defined antenna and promises to deliver 1.8-2.2x capacity gains compared with more common products.

For even higher capacity needs, Huawei has introduced the “Smart Massive MIMO” solution, a dual-band 5G-ready 4G radio with 32 transceivers and receivers promising three to five times the download speeds compared with more common products. Like the Smart 8T8R solution, Smart Massive MIMO automatically adjusts the power allocated to individual beams based on user traffic patterns. This lends efficiency in two ways, since Massive MIMO beamforming is itself a more efficient use of mobile spectrum than traditional antenna arrays, and the Smart Massive MIMO solution uses its power supply more efficiently than typical Massive MIMO gear.

4G/5G Coordination:

In addition to the ways Huawei’s aforementioned gear balances and coordinates 4G and 5G networks, its portfolio also includes other solutions to further optimize the relationship between the two.

Its SuperBAND solution uses artificial intelligence (AI) to aggregate network scheduling – the coordinated allocation of radio resources to mobile signals – among multiple frequency carriers, essentially boosting network capacity beyond the divisions and fragmentation of various spectrum bands. In 4G/5G networks, SuperBAND can perform this aggregation across both 4G and 5G, maximizing spectral efficiency and, ultimately, optimizing the quality of the user experience.

Meanwhile, Huawei also offers Dynamic Spectrum Sharing (DSS) as part of its CloudAIR solution. DSS allows 4G and 5G traffic to share the same spectrum bands, increasing spectral usage efficiency; it also allows 4G and 5G traffic to dynamically switch from one band to another, regardless of radio access technology, in response to congestion on specific bands, ensuring the best use of spectrum even as user behavior changes. CloudAIR goes even further, applying a similar spectrum-sharing function to 2G and 3G traffic as well for a more comprehensive capability that is especially relevant to markets where legacy networks remain.

New Service Enablement:

Enhancing and optimizing the network are important aims, but from a commercial perspective, one of the most important imperatives operators face is the need to deliver new revenue-generating services. Huawei’s LTE RAN portfolio addresses this requirement in multiple ways.

Huawei’s Voice-over-LTE solution, VoLTE Plus, helps operators migrate voice traffic from legacy technologies like 2G and 3G to LTE, not only achieving higher quality voice service but also allowing operators to sunset their legacy networks and repurpose their VoLTE investments for the future. In addition, Huawei’s latest VoLTE solution, goes further, adding four new capabilities that help protect the quality of voice service in 4G/5G networks:

- 5G-to-LTE EPS fallback

- LTE-to-5G fast return

- New Enhanced Voice Services capabilities

- Dedicated services that allow for optimization on LTE

Beyond voice, Huawei’s LTE portfolio also supports Narrowband IoT, to capture opportunities in the Internet-of-Things space. The vendor’s roadmap also targets support for 5G NB-IoT in particular, which will allow operators with existing IoT services to migrate those services to their 4G/5G network and replace disparate or ad-hoc legacy networks with a unified network that yields multiple revenue streams from a common infrastructure investment.

Huawei’s portfolio also enables new services via fixed wireless access (FWA) products. Amid the global pandemic, the increase in telecommuting and home-based learning based on video connections has increased the demand for residential broadband networks. Where fiber isn’t available, FWA is vital in building these residential networks. Huawei’s LTE-based FWA solutions have achieved enviable momentum in the market. The vendor has also added 4G/5G customer premises equipment to its portfolio, giving these networks a future-proof migration path to continued service enablement.

Conclusion

Huawei’s LTE RAN portfolio continues to evolve in order to help operators maximize the value of their networks as they prepare for the future. New solutions in the portfolio enhance the coverage and capacity of LTE networks as well as maximize network efficiency by coordinating 4G and 5G operations. Meanwhile, Huawei offers multiple solutions aimed at enabling the delivery of additional services that can help operators grow revenue in a variety of ways, including VoLTE, the Internet of Things and FWA.

SOURCE: GlobalData

Reference:

https://www.prnewswire.com/news-releases/globaldata-lte-ran-innovation-and-competitiveness-insight-301202706.html

WSJ: Samsung (not Ericsson or Nokia) best alternative to Huawei for 5G network equipment

By Elizabeth Koh

The Trump administration’s campaign pressuring allies to avoid 5G equipment made by Huawei Technologies Co. always had a hometown hitch: The U.S. doesn’t have a domestic manufacturer to rival the Chinese company. The best alternative may be South Korea’s Samsung Electronics

Samsung makes all of its network gear domestically and in India. That distinguishes it from its European rivals, Ericsson AB and Nokia Corp. , which both have significant manufacturing operations in China. Beijing has weighed retaliating against Nokia and Ericsson for any action by European Union members against Huawei by barring them from sending their Chinese-made products abroad, according to people familiar with the matter. Were that to happen, it could slow deliveries by the European companies in an already-competitive 5G rollout. The Chinese Foreign Ministry has denied considering that option.

Samsung already has some unique ties with the U.S. beyond the home appliances filling American homes. The company long ago won Pentagon clearance for government use of Samsung devices equipped with its Knox security software, which allows users to safeguard sensitive data on their phones and for years was overseen by a former Pentagon chief information officer. Devices with Knox software are used by military personnel in the U.S., U.K. and Canada.

The South Korean firm two years ago opened a new, seven-story office in Washington just a mile from Capitol Hill. Along with Nokia and Ericsson, Samsung drew an invitation for a planned White House strategy meeting on 5G in April that has been delayed indefinitely.

Samsung is far better known as the world’s largest producer of smartphones and televisions. But the firm is making a big push to turn its sleepy networks business into a 5G winner. Its differentiator is its product range, covering all aspects of 5G, from smartphones to base stations to the underlying chips that make network connections possible.

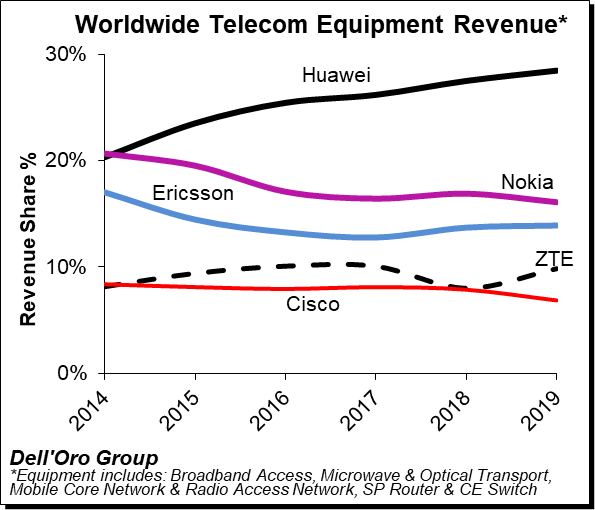

Samsung is one of four major 5G players. Huawei controls about a third of the 5G network market, trailed by Ericsson with a fourth and Nokia with about a fifth, according to market tracker Dell’Oro. Samsung has roughly 13%.

After flirting for years with major U.S. telecom carriers with limited success, Samsung is pushing hard—and succeeding—in its efforts to get a second look with Huawei off the table.

In September, Samsung announced it had signed a $6.65 billion deal with the largest U.S. wireless carrier, Verizon Communications Inc., the Korean company’s biggest such contract to date. Samsung, which is a secondary equipment vendor to AT&T Inc. and T-Mobile US Inc., is also still pursuing bigger deals with those carriers. Carriers often use multiple vendors for network infrastructure so they don’t rely on a single source of equipment.

Samsung’s 5G momentum is building just as the U.S. rollout is expected to hit another gear following Apple’s recent introduction of its first 5G phones.

PHOTO: GEORGE FREY/REUTERS

But Samsung is still, in part, relying on Ericsson and Nokia tripping up to bolster its case, says Ryan Koontz, a senior research analyst for Rosenblatt Securities, a New York-based brokerage firm.

Nokia, for example, was Verizon’s primary equipment vendor before the Samsung deal, Mr. Koontz says. But several problems—including a recent stumble with a key computer chip for 5G deployment—likely hurt Nokia’s relationship with the carrier for years, he says. Neither Nokia nor Verizon commented for this article. Ericsson, meanwhile, is just emerging from a costly yearslong restructuring, though it has recently returned to profitability.

“Samsung’s timing is perfect,” Mr. Koontz says. “The 5G programs are set up for a banner year.” Samsung’s 5G momentum is building just as the U.S. rollout is expected to hit another gear following Apple Inc.’s recent introduction of its first-ever lineup of 5G iPhones. The new iPhones are expected to boost sales of 5G-capable handsets to 20% of all U.S. phone sales in 2020, according to market tracker Counterpoint Research. That would mean substantially more subscribers to motivate the nation’s three main carriers to speed the expansion of their 5G networks. All three have some 5G coverage now, though some of the fastest service remains limited to certain cities.

Huawei, Nokia, Ericsson, ZTE, and Cisco comprised 28% (28%), 16% (17%), 14% (14%), 10% (8%), 7% (8%), respectively.

…………………………………………………………………………………………………………………………………………………………………………………………………………………

Samsung ships one out of every five smartphones shipped globally. The company has sought to leverage its wide base of users as an asset for its network business, touting its experience building 5G phones and its devices’ ability to interact smoothly with its end-to-end network offerings. Controlling the network infrastructure throughout, Samsung says, ensures faster speeds.

Samsung’s push to broaden its network business is unprecedented for the industry, because it has such a small presence for existing 4G LTE and 3G networks globally, industry analysts say. Network gear traditionally builds on the equipment laid down for previous wireless standards, meaning bigger players in the network industry have enjoyed a solid starting advantage.

Even with Huawei forcibly stripped out of the network market, operators must weigh the significant cost and effort that would be required to tear out their existing equipment for another company’s new network. In the U.K., backing away from Huawei could delay its 5G rollout for years, and operators could pay billions to replace their hardware, the British minister in charge of digital issues, Oliver Dowden, has said.

Should Samsung succeed in making its case in the U.S., the payoff in the form of a substantial revenue increase likely wouldn’t emerge until late next year, analysts say. But Samsung is unlikely to see another upstart challenger making a similar case while the U.S. lags behind in making network equipment at home.

“There’s not a lot of choices for some networking equipment,” says Stan Adams, deputy general counsel at the Washington, D.C.-based nonprofit Center for Democracy and Technology. “If there are concerns about security and foreign-made networking equipment, that’s going to be a problem until we change our manufacturing base.”

Ms. Koh is a Wall Street Journal reporter based in Seoul. She can be reached at [email protected].

Huawei Executive: “China’s 5G user experience is fake, dumb and poor”-is it a con game?

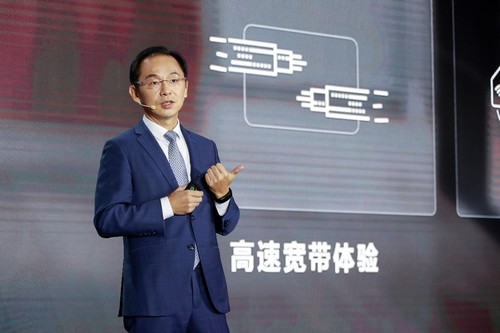

At the opening ceremony of the China International Information and Communication Exhibition on October 14th, Ding Yun, executive director of Huawei Technologies Co., Ltd said that China’s 5G user experience has three problems of “fake, dumb, and poor.” In particular, some users have a 5G LOGO on their mobile phones, but they are not connected to the 5G network, cannot make 5G calls, or frequently switch signals, according to an article by Xia Xutian on the Sina Tech website.

How could a Huawei executive say such things about its home country which supposedly has very close ties, impact and influence on the world’s top telecom equipment supplier and #1 or #2 global smartphone vendor? See Comment and Analysis below for more on this.

While China has built the world’s largest 5G network, it has a gap in experience, coverage, and commercial closed-loop operation, Ding Yun said. For comparison purposes, that the 5G downlink rate in South Korea is more than 600 megabits while the average in China is only a bit more than 270 megabits. South Korea’s 5G user penetration at the end of September reached 25%, while China’s penetration level is only about 8%.

“Objectively speaking, I am also a 5G user. We have just completed the first phase of 5G construction today. It is indeed a great improvement over the 4G experience, but our network still has many problems. I use three words to sum it up: fake, dumb, bad/poor.”

Huawei’s Ryan Ding speaking at the China International Information and Communication Exhibition about 5G in China

Photo Credit: Huawei

…………………………………………………………………………………………………………………………………………………………………………………………………………….

What’s fake? In many cases the user’s smartphone has a 5G logo but no 5G coverage. The experience is still 4G, but the display is 5G. Those users are not connected to the 5G network and can’t make 5G calls.”

What is dumb? Some places in China have 5G signal coverage, but there is no 4G anchor station, so calls cannot be made. He said the anchor point of 4G happens to be on the edge of multiple cells. The frequent handover of 4G and 5G results in a very poor user experience.

Ding Yun noted that although the number of 5G users in China has reached 150 million, the matching rate of networks, mobile phones and packages of 5G users is still very low. Many users have bought 5G packages, but their mobile phones are still 4G. There are also many users who have 5G mobile phones, but there is no 5G network coverage in their geographical area.

Ding Yun pointed out that operations and maintenance costs are also an unavoidable issue for 5G. At present, the peak rate of 5G is 25 times that of 4G, but 5G equipment (especially mmWave if and when deployed in China) will greatly increase the power consumption of 5G base stations, which poses a huge challenge to the entire power supply system (not to mention the huge electricity costs incurred by the 5G network operator).

“We have conducted a survey on the power consumption of China’s network. About 32% of the sites have insufficient power, and in some places, the battery capacity is also insufficient,” he added.

Ding Yun urged 5G network operators to:

1] build out 5G business ecosystems through innovative and differentiated applications;

2] reduce expenditure and optimize the TCO of operators from an overall perspective; and

3] look towards the future and upgrade the current operating platform as soon as possible to face potential problems such as the bill storm that 5G will bring.

In response to the 3rd objective, Huawei is using big data to connect user data, operational data, and terminal data, so that the machine, network, and applications can provide a better match.

In conclusion Ding Yun suggested the following:

- To build the most successful 5G for thousands of industries, wireless network operators must first have a deep understanding of the industries they are targeting. Different industries have different specific requirements for 5G in terms of latency, reliability/availability, throughput, security, etc. Therefore, to develop 5G industry applications, we first need to clarify the boundaries of capabilities, consolidate the ability base to serve thousands of industries, implement a replicable business model, and actively promote ecological construction, especially the development of application ecology.

- As operators expand the construction of 5G industry applications from connection to connectivity + computing, and then to SLA (network) slicing, their corresponding business models will gradually shift from a direct sales model to a value sharing model that combines active integration and integration . Ultimately, the business model of 5G industry applications will develop in the direction of multi-path, closed-loop, and multi-win as operators choose their roles.

- Unify (5G and other) standards and develop ecology. (What 5G standards is he referring to? There are none at this time). The application development of the 5G industry is not only a matter for operators, but also requires the entire industry chain to “stretch it into one strand” and integrate the telecommunications industry with other industries to form industry standards. Only in this way can the development of 5G industry applications be accelerated.

…………………………………………………………………………………………………………………………………………………………………………………………………

Comment and Analysis:

Ding Yun’s remarks are a refreshing change from the usual self congratulatory speeches given by 5G network operators and equipment suppliers (like Huawei). We are astonished he can be so honest with the Chinese government and China Communist Party having so much control over telecommunications and other industries in China.

Here are a few copy/paste (and translated from Chinese to English) Sina reader comments:

“I have not found a demand for 5G in the current application (environment)”

“Haha, so embarrassing![[Yun Bei] [Yun Bei]](http://comment.sinaimg.cn/emoji/png/2018new_kuxiao_org.png)

![[Yun Bei] [Yun Bei]](http://comment.sinaimg.cn/emoji/png/2018new_kuxiao_org.png) “

“

“China’s 5G, got up early. Experience the night episode (where there is no 5G service to conserve electricity costs for carriers)”

“In Qingdao, there is basically no real 5G SA network. When only the SA mode is selected, the 5G signal is gone, and now the operator’s 5G speed limit is 500M bps”

“The conclusion is that I continue to use my 4G”

“The worst is a three-year contract with China Mobile”

“The three major operators are too hateful and must be punished.”

“China network operators are deliberately lowering the 4G signal, forcing everyone to use 5G. Just this dirty trick, give his grandma a whistle.”

“No 5G signal coverage.”

“Fake, dumb, and bad are synonymous with China’s three major network operators.”

“What is the conclusion? For 5G, it’s better to wait first, don’t worry about changing phones ![[Hee hee] [Hee hee]](http://comment.sinaimg.cn/emoji/png/2018new_xixi_org.png) , let alone changing pricing packages. It’s not very useful and costs money.

, let alone changing pricing packages. It’s not very useful and costs money.![[Yun Bei] [Yun Bei]](http://comment.sinaimg.cn/emoji/png/2018new_kuxiao_org.png) “

“

“The basic meaning is, the operator, burn me![[doge] [doge]](http://comment.sinaimg.cn/emoji/png/2018new_doge02_org.png) “

“

……………………………………………………………………………………………………………………………………………………………………………………………

Email from a very knowledgeable, anonymous Chinese 5G expert corroborates what Ding Yun said:

- China claims they have 100 millions of 5G end point devices now. Actually, those are mostly 4G handsets whose users were coerced to subscribe to a 5G package. The 3 major state owned network operators purposely lowered 4G-LTE speeds and forced subscribers change to the 5G package which only provides the previous 4G-LTE speeds.

- China claims they have deployed 40,000 5G NR base stations. But without URLLC (ultra high reliability, ultra low latency) enhancements to 5GNR (3GPP Release 16) and mMTC (massive machine to machine communications) standards, 5G NR is not complete. (3GPP has not set a date for the conclusion and evaluation of URLLC in the RAN performance testing which is supposed to be in the “frozen” 3GPP Release 16 set of specs)

- There are no mmWave 5G base stations at all in China.

- Currently China 5G base stations consume huge amounts of energy, so the 3 major 5G network operators shut them down at night to reduce electricity bills. Note the above readers comment, “Experience the night episode.”

- Former minister of China Ministry of Finance and seated deputy minister of the Ministry of Industry and Information Technology (MIIT) recently publicly expressed concerns about China’s 5G development and investments. They said China had made bad 5G investments and that China has not yet balanced the 3G and 4G investments made by its network operators).

- What kind of joke is this?

References:

https://finance.sina.com.cn/tech/2020-10-15/doc-iiznezxr6037613.shtml

https://www.wsbtv.com/news/ap-explains-promise/KEKKYBDSVGE4W66CY24PMOYMJA/

Dell’Oro: Telecom equipment revenues to grow 5% through 2020; Huawei increases market share

Dell’Oro analysts say first half global telecom equipment [1.] revenues were up 4% YoY in 1st half of 2020, as 5G infrastructure investments offset declines due to the impact of the coronavirus pandemic. The market research firm forecasts a 5% advance for the entire year.

Rollouts of 5G wireless, especially in China, were a primary cause of the first half increases, which benefit the entire supply chain, including telecommunications semiconductors. China 5G spending surely helped Huawei increase its market share, despite U.S. sanctions.

Note 1. Dell’Oro includes the following types in the telecom equipment market: Broadband Access, Microwave & Optical Transport, Mobile Core & Radio Access Network, SP Router & Carrier Ethernet Switch

In the first half of 2020, double digit growth in mobile infrastructure offset declining investments in broadband access, microwave and optical transport and service provider routers and ethernet switches, Dell’Oro said. Statista analysts in June said 2020 telecom equipment revenues should nearly reach $50 billion.

Rankings of the biggest telecom equipment providers remained the same in the first half of 2020, with Huawei dominating at 31%, followed by Nokia and Ericsson tied at 14% each, then ZTE at 11% and Cisco at 6%, according to Dell’Oro.

Second quarter results were stronger than expected following a 4% decline in the first quarter. The biggest driver was a strong rebound in China across 5G Radio Access Network, 5G Core and other areas. Supply chain disruptions of the first quarter also stabilized in the second quarter, Dell’Oro said.

Additional key takeaways from the 2Q20 reporting period include:

- Following the 4% Y/Y decline during 1Q20, the overall telecom equipment market returned to growth in the second quarter, with particularly strong growth in mobile infrastructure and slower but positive growth for Optical Transport and SP Routers & CES, which was more than enough to offset weaker demand for Broadband Access and Microwave Transport.

- For the 1H20 period, double-digit growth in mobile infrastructure offset declining investments in Broadband Access, Microwave and Optical Transport, and SP Routers & CES.

- The results in the quarter were stronger than expected, driven by a strong rebound in China across multiple technology segments including 5G RAN, 5G Core, GPON, SP Router & CES, and Optical Transport.

- Also helping to explain the output acceleration in the quarter was the stabilization of various supply chain disruptions that impacted the results for some of the technology segments in the first quarter.

- Shifting usage patterns both in terms of location and time and surging Internet traffic due COVID-19 has resulted in some infrastructure capacity upside, albeit still not proportional to the overall traffic surge, reflecting operators ability to address traffic increases and dimension the network for additional peak hours throughout the day using a variety of tools.

- Even though the pandemic is still inflicting high human and economic losses, the Dell’Oro analyst team believes the more upbeat trends in the second quarter will extend to the second half, propelling the overall telecom equipment market to advance 5% in 2020.

Semiconductor officials are less optimistic for the rest of the year with SIA President John Neuffer recent saying “substantial market uncertainty remains for the rest of the year.” Semiconductor sales were up 5% in July, reaching $35 billion, but dropped in early August, according to reports.

According to the Semiconductor Industry Association, about 33% of all semiconductors made (the largest category) are devoted to communications, including networking equipment and radios in smartphones.

…………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.fierceelectronics.com/electronics/telecom-equipment-revenues-to-grow-5-through-2020

UPDATED: Huawei now #1 global smartphone vendor

Despite the severe U.S. restrictions on Huawei, the company has succeeded in taking the top spot in the global smartphone market, according to figures from Canalys. The market research firm estimates Huawei shipped more smartphones worldwide than any other vendor for the first time in Q2 2020, marking the first quarter in nine years that a company other than Samsung or Apple led the market.

Note, however, that global smartphone sales DECLINED in the second quarter. Huawei shipped an estimated 55.8 million devices in the quarter, down 5 percent year on year. Samsung came second with 53.7 million smartphones, down 30 percent from a year earlier.

Huawei’s resilience was due to its strong position in China, where its shipments rose 8 percent in Q2. This offset an estimated 27 percent fall in its shipments abroad. Canalys estimates over 70 percent of Huawei’s smartphone sales are now in mainland China. That helps explains why the company can be so successful in selling smartphones, despite not being able to use licensed Google Android and associated apps on its latest flagship devices (that’s because Huawei was placed on the U.S. Entity list last year).

Canalys said the situation would likely not have happened without the Covid-19 pandemic. Huawei profited from the strong recovery in the Chinese economy, while Samsung has a very small presence in China, with less than 1 percent market share, and suffered from the restrictions in key markets such as the US, India, Brazil and Europe.

“This is a remarkable result that few people would have predicted a year ago,” said Canalys Senior Analyst Ben Stanton. “If it wasn’t for COVID-19, it wouldn’t have happened. Huawei has taken full advantage of the Chinese economic recovery to reignite its smartphone business. Samsung has a very small presence in China, with less than 1% market share, and has seen its core markets, such as Brazil, India, the United States and Europe, ravaged by outbreaks and subsequent lockdowns.”

“Taking first place is very important for Huawei,” said Canalys Analyst Mo Jia. “It is desperate to showcase its brand strength to domestic consumers, component suppliers and developers. It needs to convince them to invest, and will broadcast the message of its success far and wide in the coming months. But it will be hard for Huawei to maintain its lead in the long term. Its major channel partners in key regions, such as Europe, are increasingly wary of ranging Huawei devices, taking on fewer models, and bringing in new brands to reduce risk. Strength in China alone will not be enough to sustain Huawei at the top once the global economy starts to recover.”

As a result, it will be hard for Huawei to maintain its lead in the long term. Its major channel partners in key regions such as Europe are increasingly wary of stocking Huawei devices, taking on fewer models and bringing in new brands to reduce risk, as per the above Canalys quote from analyst Mo Jia.

Separately, Gartner estimates that 10% of smartphone shipments, or about 220 million units in 2020, will have 5G capability, but they’ll work on “5G” networks with a LTE core (5G NSA).

…………………………………………………………………………………………………………………………………

Addendum:

Huawei’s just announced global licensing agreement with Qualcomm grants Huawei back rights to some of the San Diego-based company’s patents effective Jan. 1, 2020. It remains to be seen if Huawei will design smartphone components that use those patents in their next generation of 5G endpoint devices.

………………………………………………………………………………………………………………………………….

References:

https://www.canalys.com/newsroom/Canalys-huawei-samsung-worldwide-smartphone-market-q2-2020

………………………………………………………………………………………………………………………………………

Update- August 3, 2020:

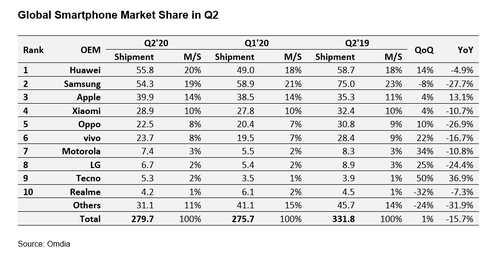

According to market research firm Omdia, overall Q2-2020 smartphone shipment volume was down a hefty 15.7%, year-on-year, to 229.7 million units.

Samsung will certainly hope there are better times ahead. Omdia figures show the South Korean behemoth lost its #1 position in Q2, dislodged by Huawei. Samsung’s Q2 shipments plummeted nearly 28%, year-on-year, to 54.3 million.

Many of Samsung’s most important markets, were significantly impacted by COVID-19, especially emerging markets, which apparently accounted for more than 70% of Samsung’s overall shipments in 2019.

For its part, Samsung is hopeful of a Q3 smartphone recovery, helped by the launch of new flagship models, including the Galaxy Note and a new foldable phone.

Huawei, helped by a resurgent domestic market in China, snagged a 20% global smartphone share during Q2 (55.8 million units), up from an 18% market share the previous quarter. Year-on-year, Huawei’s Q2 shipment units were down a comparatively modest 4.9%.

Apple was one of the few OEMs to increase Q2 shipment volumes, year-on-year (up 13.1%, to 39.9 million units). The iPhone SE, a model with mid-range pricing, coupled with the iPhone 11, helped Apple expand its unit shipments, and cement its third-spot position with a market share of 14% (up from 11% in Q2 2019).

“With the launch of the iPhone SE in April, Apple has released a long-desired product, with an attractive price,” said Jusy Hong, director of smartphone research at Omdia.

“For existing iPhone users who needed to upgrade their smartphones in the second quarter, the new SE represented an affordable option that does not require a large downpayment or high monthly repayment rates,” added Hong.

Reference:

https://www.lightreading.com/huawei-apple-buck-q2-smartphone-trends—report/d/d-id/762886?

No stopping Huawei: 1st half 2020 revenues rose 13.1%, to $64.9 billion despite U.S. led boycott; ~60% of biz from China!

Huawei Technologies Co Ltd, the #1 telecom equipment company #2 smartphone maker, reported a 13.1% rise in revenue in the first half of the year, showing slower growth as U.S. officials continue to pressure the company’s suppliers and customers. Revenue rose to 454 billion yuan ($64.90 billion) in the first half of the year. ($1 = 6.9958 Chinese yuan renminbi or RMB). That was compared to 401.3 billion yuan revenues the year before. Huawei’s growth rate was down from 23.2% in the first half 2019. Huawei said net profit margins were 9.2%, up from 8.7% in the first half 2019.

FILE PHOTO: Huawei’s new flagship store is seen ahead of tomorrow’s official opening in Shanghai, following the coronavirus disease (COVID-19) outbreak, China June 23, 2020.

REUTERS/Aly Song/File Photo: REUTERS

……………………………………………………………………………………………………………………

The results were published as Huawei fights a U.S.-led campaign to ban it from Europe’s 5G markets and choke off its supplies of components based on U.S. design expertise or manufacturing technology. Speculation has risen that UK authorities will this week move to exclude Huawei from the country’s 5G market just months after saying they would restrict it to 35% of any radio access or fiber broadband network.

The UK government previously thought such restrictions – combined with a ban on Huawei in the intelligent “core” of any network – would mitigate the risk and minimize disruption to service providers reliant on Huawei technology.

But security watch dogs are now worried the latest U.S. sanctions would heighten risks and potentially threaten Huawei’s ability to continue serving UK operators.

While other European governments and operators have similar concerns, Huawei has been able to rely on a 5G rollout in China for sales growth.

Victor Zhang, the company’s head of government affairs, told UK officials last week that Huawei will this year erect about half a million base stations for Mobile, Telecom and Unicom, China’s three national operators.

The company has referred to the scale of the Chinese deployment in refuting suggestions it may run out of components early next year. With the current 35% cap on its UK role, it needs components for only about 20,000 UK base stations, which it can easily supply through existing inventory, said a Huawei spokesperson.

A breakdown of the figures released today indicates growth in all three of Huawei’s business lines.

At the carrier division, which develops network products for communications service providers, sales were up 9%, to RMB159.6 billion ($22.8 billion), despite coronavirus-triggered lockdowns in some of Huawei’s most important markets.

While Huawei did not provide a regional breakdown of the numbers, a Chinese splurge on 5G equipment is likely to have fueled the increase given the pressure elsewhere.

Last year, the Chinese market accounted for nearly 60% of Huawei’s entire business, a figure that proves any European restrictions would have only a limited effect on the company.

Huawei’s relatively small enterprise business managed a 15% increase in sales, to RMB36.3 billion ($5.2 billion), while its device-making consumer business – which last year blamed U.S, sanctions for wiping about $10 billion off sales – said revenues were up 16%, to about RMB255.8 billion ($36.6 billion).

“Our business depends on delivering what our customers need,” said Zhang in a prepared statement about the latest numbers. “These results show that they continue to choose Huawei when they want reliability, security and value.”

Zhang said: “Our priority here is to build a better-connected UK where everyone can benefit from 5G and fiber broadband, no matter where they live.”

BT and Vodafone, the UK operators most heavily reliant on Huawei’s products, have told UK officials they need at least five years to phase out the Chinese vendor. Anything less and customers would face major disruption, including outages as equipment is replaced, said technology executives during a parliamentary committee last week.

…………………………………………………………………………………………………………..

Huawei’s rise in sales comes after more than a year of pressure from American officials on the company’s suppliers and customers. The company sells 5G networking equipment to carriers and smart phones and laptops to consumers.

American officials placed Huawei on a blacklist in May of last year, restricting sales to the company of U.S.-made goods such as semiconductors. Huawei built up inventories and also continued to design its own chips and have them manufactured by Taiwan Semiconductor Manufacturing Co Ltd and others.

“Huawei has promised to continue fulfilling its obligations to customers and suppliers, and to survive, forge ahead, and contribute to the global digital economy and technological development, no matter what future challenges the company faces,” the company said in a statement on Monday.

In May, U.S. officials announced new rules aimed at constricting Huawei’s ability to self-supply chips, an ability that is critical to its efforts to sell 5G networking gear.

The first half results showed faster growth than Huawei’s first quarter results released in April. For the first quarter, revenues rose by about 1% to 182.2 billion yuan, versus 39% growth posted a year previous. Net profit margin in the first quarter narrowed to 7.3% from about 8% a year earlier.

Huawei did not report unit shipments of phones. Research firm IDC reported Huawei was the second largest phone maker in the first quarter of 2020, with 17.8% market share, behind No. 1 Samsung Electronics Co Ltd and ahead of No.3 Apple Inc.

References:

GreyB study: Huawei undisputed leader in 5G Standard Essential Patents (SEPs)

Market research firm GreyB cooperated with Amplified, which develops software for intellectual property research, to publish a “preliminary” report named ‘Who Owns Core 5G Patents? – A Detailed Analysis of 5G Standard Essential Patents (SEP)s.’ The stated aim of the project is ‘to bring greater transparency to the landscape of 5G standard essential patents.’

The caveat is that the data used for the study in this report is from March 2019 and its taken from the ETSI website, rather than ITU-R WP5D–IMT 2020 website. Note that 3GPP members declare IPR not to 3GPP (which is not a legal entity but is a collaborative activity between several SDOs), but to their regional standard bodies for which they are participating. Many of the 3GPP members are also ETSI members, so they declare their IPR to ETSI.

For info on 3GPP IPR handling: https://www.3gpp.org/about-3gpp/legal-matters

………………………………………………………………………………………………………………………………………………..

From the report authors:

The report is the first of a series of collaborations between Amplified and GreyB that aim to bring greater transparency to the landscape of 5G standard essential patents. The data is large, opaque, and highly technical. Our focus will be on making the data involved more accessible and understandable. The issues are nuanced and complicated. We hope that this report and the following reports enable the many stakeholders involved to have more effective discussions and make better decisions.

Patents, which help protect the rights of the innovators who contribute to building the standard, may be declared as potentially essential and relevant to the standard. These are known as SEPs. Declaration does not require verification. Verifying that a patent is essential to a particular standard is a complex task

requiring significant time from experts in the field.

Importance of Standards:

Standards benefit businesses, policy makers, and society in general.

• They promote innovation in the market through rewarding R&D

• Help to commercialize the technology and bring products to market faster

• Ensure and define interoperability and interchangeability which gives manufacturers and consumers more choice

• Encourage improvement and competition in the market

• Help protect consumer safety

They balance cooperation and competition among innovative companies such that the net benefit is greater than the sum of their individual parts.

Manufacturers who implement standardized technology get an even playing field – a blueprint from which they can all build from at a predictable cost. This encourages more companies to participate in a market and innovate around the core technology.

Standards provide the ground rules for different devices, systems and processes to work together. Interoperable and interchangeable products gives consumers more choice and that encourages market pressure towards better, safer, and cheaper products.

Finally, standards provide policymakers with well-documented baselines and rules for implementation which helps them to understand the implications of new technology and take action to protect consumer, business, societal interests

……………………………………………………………………………………………………………………….

5G Patent Leaders:

The strong conclusion of the report is that Huawei is the 5G SEP leader, and not just by a little bit. As you can see in the chart below, Huawei accounts for 19% of core (used in 5G standards/3GPP specs) patents, followed by the two Korean tech giants, which are surprisingly ahead of Huawei’s main rivals in this case.

GreyB originally got in touch with Telecoms.com after reading an article there titled: 5G patent chest-beating is an unhelpful distraction. The purpose of the research is an attempt to cut through the noise created by various competing claims and get to the heart of the matter.

“5G is going to be next disruptive technology,” report co-author Muzammil Hassan of GreyB, told Telecoms.com. “And going by all the fuss around, it is important to know where each of the top contributors of 5G technology stand in terms of quality of innovation. Some may want to switch gears and file better inventions.”

One other metric GreyB was keen to flag up was ‘essentiality ratio,’ which seeks to illustrate the proportion of filed patents that make it into the core standard. Once more, in the chart below, Huawei comes top, but it should be noted that the ratio is derived from only those patents analyzed.

As a proportion of all declared patents Huawei is among the lowest at 13%, compared to the leader Nokia with 20%. Ericsson has the lowest ranks of all by this metric with 11%. The Sweden based company is also the lowest in SEPs with only 9%.

Problems and pitfalls:

Reviewing historical work done in this field we’ve identified the following pitfalls which we seek to avoid:

• Extrapolating conclusions done from a small sample size

• Using proxies from 4G and projecting those onto 5G

• Taking declared numbers at face-value

• Implicitly framing all patents as equal by focusing on patent quantity only without accounting for quality

The complex nature of patent data analysis simply makes it impossible to address these issues completely so unfortunately it may be impossible to avoid all of these in entirety. However, it is our goal to create a reliable report and therefore we believe it is critical to acknowledge and account for them transparently and to the best of our ability. Our methodology is detailed in the appendix and we invite corrections, additions, criticism, and contributions.

Patent Source and Study Methodology:

The data covered was all patents from the ETSI website 5G declaration list March 2019 version. This covers any patent or patent application declared to the ETSI 5G standard. Essentiality evaluation involves significant time and effort so there is a lag between release date of our report and data covered. We’ll issue updates as we continue to analyze the data.

• All patents declared to relevant 5G specifications and projects were selected resulting in 63,985 individual patent documents (granted patents, published patent applications, and non-public patent applications)

• ~500 Non-public patent documents, unavailable for inspection, were removed

• The remaining ~63,500 patent documents were grouped into 12,002 patent families.

• 6,402 of the 12,002 patent families with a granted patent having live legal status as of 31st December 2019 were kept, the rest were removed

• We determined our understanding of each of the 6,402 patent families by reading the claims and related embodiments from these granted patents and checked the correspondence history and documentation at the patent office to understand each patent.

• We determined essentiality for each patent family as a Core SEP or not by checking any specifications declared to be relevant by the patent holder to the SEP and compared the specific sections of these to compare overlap of the patent claims with those sections. If partial or no overlap was found, we then broadened our comparison to the wider group of all other specifications to repeat this process.

………………………………………………………………………………………………..

References:

2021: Who Owns Core 5G Patents? – A Detailed Analysis of 5G SEPs

5G Patent Wars: Are Nokia’s 3,000 “5G” Patent Declarations Legit?

Strategy Analytics: Huawei 1st among top 5 contributors to 3GPP 5G specs

U.S. Commerce Dept NO-OP rule allows U.S. companies to work with Huawei on 5G & other standards

by Karen Freifeld (Reuters) with Opinion by Alan J Weissberger (does not reflect any IEEE position)

The U.S. Department of Commerce on Tuesday posted a new rule that allows U.S. companies to work with China’s Huawei to develop standards for 5G and other cutting-edge technologies, despite restrictions on doing business with the world’s top telecommunications equipment maker.

………………………………………………………………………………………………………………………………

Personal Opinion:

This new rule accomplishes NOTHING and may even backfire according to some analysts. First and foremost, the U.S. government has no authority to dictate whether or not U.S. companies are permitted to attend and contribute to international standards committee meetings that are attended by non-U.S. companies deemed to be a threat. It is up to each individual standards body to grant or deny membership to a company. Once that company becomes a member of the committee then NO GOVERNMENT ENTITY can block other companies from working with it on various standards.

Today (June 16th), a joint ITU-R WP5D contribution from Nokia Corporation, Telefon AB – LM Ericsson, Qualcomm, Inc., Samsung Electronics contribution asks WP5D to delete China and Korea IMT 2020 RIT submissions as they are technically identical to 3GPP’s IMT 2020 RIT submission.

Did the Korea government prevent Samsung (#1 company in Korea by far) from co-authoring that contribution, even though it is NOT in the best interest of Korea to have their national 5G (IMT 2020 RIT) standard withdrawn/deleted? Of course not, because they don’t have the authority to do that!

Separately, the U.S. government is dogmatic in destroying Huawei to end that company’s dominance of global telecom equipment, especially 5G where the U.S. wants to encourage (now non-existent) 5G equipment companies. The only U.S. 5G technology company we know of is Qualcomm. The others just do software for so called “Open RAN” (which can’t really be open if two companies have to spec out the radio and radio interface to the digital baseband unit).

“The United States will not cede leadership in global innovation,” said Wilbur Ross, the U.S. Secretary of Commerce, in his statement about the decision. “The Department is committed to protecting U.S. national security and foreign policy interests by encouraging US industry to fully engage and advocate for U.S. technologies to become international standards.”

Light Reading also take a negative view of the U.S. announcement. Iain Morris wrote in a blog post today (Bold font added for emphasis):

If the US is to remain a part of the global standards community, as it inevitably decided it would this week, the only way it can become less dependent on Chinese knowhow is to make the Chinese firms less influential in the standards groups. That could mean imitating China’s strategy of trying to shape the international standard and essentially crowd out the other players.

How successful that strategy has been is up for debate. Huawei undoubtedly plays a more prominent role in the 5G standard than it ever did in 3G or 4G. Yet critics believe the company’s influence has been overstated in the media. Its vast array of patents, they say, includes relatively few that are genuinely “standard-essential,” despite the findings of several studies that tout Huawei’s significance.

Richard Windsor, an analyst with Radio Free Mobile, thinks US semiconductor giant Qualcomm has “a much stronger position in 5G” than one high-profile study gives it credit for. The 3GPP, for its part, remains tight-lipped on this entire subject. Revelations could be awkward.

Whatever transpires in the world of standards, no one should seriously expect a rapprochement between the US and Huawei after all that has already happened. Meng Wanzhou, the Chinese firm’s chief financial officer (and daughter of its founder), remains under house arrest in Canada, awaiting possible extradition to the US to face charges of fraud. Countries including the UK are still under US pressure to ban Huawei from their 5G networks. And trade sanctions have not been eased.

Quite the opposite, in fact. A recent tightening-up of Commerce Department rules will stop Huawei from buying any components made with US technology. Previous restrictions covered only US components made on US soil, inflicting limited damage on Huawei and disappointing its US antagonists. Unable to procure equipment from important suppliers like Taiwan’s TSMC, Huawei could be finished within a year as a result of the latest measures, according to some analysts. If that happens, any concern about US firms working alongside their Chinese counterparts in standards groups would be largely academic.

People walk past a Huawei shop, amid an outbreak of the coronavirus disease (COVID-19), in Beijing, China, May 18, 2020. Photo Credit: REUTERS/Thomas Peter …………………………………………………………………………………………………………………………………………………

Reuters reported on Monday that the rule had been approved and sent to the Federal Register, the official U.S. publication for rules. It was posted for public inspection on the Federal Register’s website on Tuesday and is scheduled to be formally published on Thursday.

The rule amends the Huawei “entity listing,” which restricts sales of U.S. goods and technology to the company. The United States placed Huawei on the list in May 2019, citing national security concerns.

The amendment authorizes the release of certain technology to Huawei and its affiliates if it contributes “to the revision or development of a ‘standard’ in a ‘standards organization.’”

Industry and government officials have said the entity listing backfired in standards settings. With U.S. companies uncertain what technology they could share, some U.S. engineers did not engage, and Huawei gained a stronger voice, they said.

Huawei and 114 of its foreign affiliates on the Entity List “continue to participate in many important international standards organizations in which U.S. companies also participate,” the new rule says.

“As international standards serve as the building blocks for product development and help ensure functionality, interoperability and safety of the products, it is important to U.S. technological leadership that U.S. companies be able to work in these bodies in order to ensure that U.S. standards proposals are fully considered.”

Naomi Wilson of the Information Technology Industry Council, which represents tech companies, said the rule was a “long-awaited step to clarify that U.S. companies can participate in international standards bodies – even where certain listed entities are present.”

Boston lawyer Andy Updegrove, who has represented over 150 standards organizations, said he found one catch: Not all standards consortiums may meet the requirements in the rule.

To do so, he said, some may change the way they work, but other foreign ones may not. “Overall, it’s a big improvement, but it’s not going to help U.S. companies in every case,” Updegrove said.

Huawei said in a statement it wants to continue standards discussions with counterparts, including those in the United States, and that “inclusiveness and productive dialogue will better promote” their formulation and encourage development.

References:

ADDENDUM: The Dispatcher- Sept 2020:

After the U.S. Commerce Department last year put HUAWEI on a list of companies that it considered unsuitable for U.S companies and government—and the companies and governments of all its allies—to do business with, engineers in most U.S. technology companies stopped engaging with HUAWEI to develop standards. Since the standards train was going to go down the tracks with or without the U.S. on board, and Europe’s, Japan’s and the rest of the world’s companies were continuing to occupy their seats, the absence of U.S. engineers put the U.S. at a severe disadvantage, said QUALCOMM, Intel, AMAZON and many others. 10 HUAWEI had a louder voice at the table with the U.S. sitting outside.

“Confusion stemming from the May 2019 entity list had inadvertently sidelined U.S. companies from some technical standards conversations, putting them at a strategic disadvantage,” said a representative for the Information Technology Industry Council, a Washington, DC-based trade association that represents the companies making the complaint. After a year, the Commerce Department drafted a new rule which states that if HUAWEI is sitting at any standards table (not just 5G), the U.S. needs to be there. On June 15th, the rule was approved. In confirming the rule’s passing,

U.S. Commerce Secretary Wilbur Ross said:

“The United States will not cede leadership in global innovation. The department is committed to protecting U.S. national security and foreign policy interests by encouraging U.S. industry to fully engage and advocate for U.S. technologies to become international standards.”

U.S. Government Attempts to Strangle Huawei; China-U.S. Trade War likely to Accelerate into HYPER-DRIVE mode

On Friday, the U.S. government said it would impose export restrictions designed to cut off Chinese tech giant Huawei Technologies Co. from overseas suppliers, threatening to ignite a new round of U.S.-China trade tensions. The U.S. Commerce Department said its new sanctions would “narrowly and strategically target Huawei’s acquisition of semiconductors that are the direct product of certain U.S. software and technology.”

These new restrictions stop foreign semiconductor manufacturers whose operations use U.S. hardware, software and technology from shipping products to Huawei without first getting a license from U.S. officials, essentially giving the U.S. Commerce Department a veto over the kinds of technology that Huawei can use.

The restriction further tightens the U.S. export-control system’s existing rules related to Huawei. Washington alleges that Huawei gear could be used by Beijing to spy globally, which Huawei has repeatedly denied.

A logo of Huawei retail shop is seen through a handrail inside a commercial office building in Beijing.

…………………………………………………………………………………………………………………………………………………

U.S. Commerce Secretary Wilbur Ross said Friday that Washington wants to prevent Huawei from evading sanctions imposed earlier on its use of American technology to design and produce semiconductors abroad. “There has been a very highly technical loophole through which Huawei has been able, in effect, to use U.S. technology with foreign fab producers,” Ross said in an interview on Fox Business Network. He said the changes announced Friday were tailored moves “to try to correct that loophole and make sure that the American fab foundries are competing on an equal footing with the foreign ones.”

Also on Friday, a senior administration official said there were “legal, human rights, and strategic rationales” for the actions against Huawei. Those included Huawei’s alleged theft of intellectual property and aid in developing surveillance technology and new weapon systems, the official said.

Under the new rules, the department can block the sale of semiconductors manufactured by Taiwan Semiconductor Manufacturing (TSMC) for Huawei’s HiSilicon subsidiary, which designs chips for the company, as well as chips and other software produced by manufacturing facilities in Taiwan, China and South Korea, which use American chip-making technology. The Commerce Department already had the ability to license software shipments from U.S.-based facilities.

Companies can apply for a license to continue supplying tech products to Huawei, but the administration said the presumption would be to deny those requests.

John Neuffer, the president of the Semiconductor Industry Association, which represents chip makers, said his group was concerned that the rule would “create uncertainty and disruption for the global semiconductor supply chain.” He added, however, that it appeared less damaging than broader approaches the administration had previously considered.

Huawei had no immediate comment.

China’s foreign ministry, in a statement, urged the U.S. to immediately halt “its unreasonable suppression against Huawei.”

“The U.S.’s practices not only harm the legitimate rights and interests of Chinese enterprises, but also do not accord with the interests of U.S. enterprises, and cause damage to the global industrial chain, supply chain and value chain,” it said.

………………………………………………………………………………………………………………………………………………….

On Sunday, China’s commerce ministry said it will take “all necessary measures” in response to new U.S. restrictions on Chinese tech giant Huawei’s ability to use American technology, calling the measures an abuse of state power and a violation of market principles.

An unidentified spokesperson quoted Sunday in a statement on the China ministry’s website said the regulations also threatened the security of the “global industrial and supply chain.”

“The U.S. has utilized national power and used the so-called national security concern as an excuse, and abused export controls to continue to suppress some particular companies in other countries,” China’s commerce ministry said in today’s statement.

“China urges the U.S. to immediately cease its wrong actions,” the ministry added, calling the restrictions a “serious threat to global supply chains.”

China’s retaliation could take the form of restrictions on U.S. tech firms (Qualcomm, Apple. Intel, Nvidia, AMD, Broadcom, Cisco, even Boeing) selling their products in China.

Victor Gao, vice-president of the Centre for China and Globalisation, a Beijing-based think tank, said there were many ways in which China could retaliate for the new restrictions on Huawei, including selling its huge holdings of U.S. treasury bonds or halting any future purchases, and tightening its controls on Apple products.

“For example, if Beijing declared that all Apple products made in China had to be inspected, which would delay their shipment, in three months, Apple would be dead,” he said.

……………………………………………………………………………………………………………………………………………..

China’s state-run newspaper reported on Sunday that the Chinese government was ready to retaliate against the U.S.. The source, who is described as close to China’s government, told the state-run Global Times that China was planning countermeasures, such as “imposing restrictions” against U.S. companies like Apple, Cisco, and Qualcomm. The source also suggested the possibility of China halting Boeing airplane purchases.

“China will take forceful countermeasures to protect its own legitimate rights” if the Trump administration goes ahead with the plan to block essential suppliers of semiconductors from selling those components to Huawei.

…………………………………………………………………………………………………………………………………….

Backgrounder:

U.S. government officials have repeatedly accused Huawei of stealing American trade secrets and aiding China’s espionage efforts, ramping up tensions with the rival superpower while both sides were involved in a long-simmering trade war.

As a result, Huawei has increasingly relied on domestically manufactured technology, but the latest rules will also ban foreign firms that use US technology from make semiconductors to Huawei without US permission. The new restrictions will cut off Huawei’s access to one of its major suppliers of semiconductors- Taiwanese chipmaker TSMC (world’s largest silicon foundry).

………………………………………………………………………………………………………………………………………………

May 18th UPDATE:

Huawei on Monday assailed the latest U.S. move to cut it off from semiconductor suppliers as a “pernicious” attack that will put the Chinese technology giant in “survival” mode and sow chaos in the global technology sector.

“The decision was arbitrary and pernicious and threatens to undermine the entire (technology) industry worldwide. This new rule will impact the expansion, maintenance, and continuous operations of networks worth hundreds of billions of dollars that we have rolled out in more than 170 countries,” Huawei said in a statement.

The ban also went against the US government’s claim that it is motivated by network security, the company said.

“The US is leveraging its own technological strengths to crush companies outside its own borders. This will only serve to undermine the trust international companies place in US technology and supply chains. Ultimately, this will harm US interests,” said Huawei.

https://www.globaltimes.cn/content/1188683.shtml

References:

https://www.wsj.com/articles/u-s-moves-to-cut-off-chip-supplies-to-huawei-11589545335

https://abcnews.go.com/US/wireStory/china-warns-us-measures-huawei-rules-70728162

http://www.globaltimes.cn/content/1188491.shtml

U.S. government in talks with Intel, TSMC to develop chip ‘self-sufficiency’

The coronavirus pandemic has underscored longstanding concern by U.S. officials and executives about protecting global supply chains from disruption. Administration officials say they are particularly concerned about reliance on Taiwan, the self-governing island China claims as its own, and the home of Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chip manufacturer and one of only three companies capable of making the fastest, most-cutting-edge chips (the two other foundries are Samsung and Intel).

Officials from the U.S. government are in talks with Intel and Taiwan Semiconductor Manufacturing to build chip factories in the U.S., the Wall Street Journal reported, citing sources familiar with the matter. The U.S. government believes the pandemic showed how reliant the U.S. is on Asian factories and it now wants to promote more tech self-sufficiency.

“The administration is committed to ensuring continued U.S. technological leadership,” a senior official said in a statement. “The U.S. government continues to coordinate with state, local and private-sector partners as well as our allies and partners abroad, to collaborate on research and development, manufacturing, supply-chain management, and workforce development opportunities.”

HiSilicon, owned by Huawei, is a fabless semiconductor company which doesn’t have its own manufacturing plant. It relies on foundry companies like Taiwan Semiconductor Manufacturing Co. to make its chips. The Trump administration is preparing rules that could restrict TSMC’s sales to HiSilicon. Huawei may be storing up chip inventories in anticipation of such tighter restrictions. Huawei may shift some of its orders to Chinese foundry Semiconductor Manufacturing International Corp. (SMIC), but technology there still lags behind industry leaders like TSMC and Samsung.

Ultimately SMIC’s capabilities could be hampered if the Trump administration decides to dial up the pressure in its campaign against China. The Commerce Department said last week that it would expand the list of U.S.-made products and technology shipped to China that need to be reviewed by national security experts before shipping. SMIC depends on foreign semiconductor manufacturing equipment, including some from the U.S.

………………………………………………………………………………………………………………………………………..

Intel VP of policy and tech affairs Greg Slater said Intel’s plan would be to operate a plant that could provide advanced chips securely for both the government and other customers. “We think it’s a good opportunity,” he added. “The timing is better and the demand for this is greater than it has been in the past, even from the commercial side.”

Intel Chief executive Bob Swan sent a letter to Defense Department officials on 28 April, saying the company was ready to build a commercial foundry in partnership with the Pentagon. Strengthening U.S. domestic production and ensuring technological leadership is “more important than ever, given the uncertainty created by the current geopolitical environment,” Swan wrote in the letter. “We currently think it is in the best interest of the U.S. and of Intel to explore how Intel could operate a commercial U.S. foundry to supply a broad range of microelectronics,” the letter said. The letter was then sent to Senate Armed Services Committee staffers, calling the proposal an “interesting and intriguing option” for a U.S. company to lead an “on-shore, commercial, state of the art” chip foundry.

TSMC has been in talks with people at the Commerce and Defense departments as well as with Apple, one of its largest customers, about building a chip factory in the U.S., other sources said. In a statement, TSMC said it is open to building an overseas plant and was evaluating all suitable locations, including the US. “But there is no concrete plan yet,” the company said.

Some U.S. officials are also interested in having Samsung, which already operates a chip factory in Austin, Texas, expand its contract-manufacturing operations in the U.S. to produce more advanced chips, more sources said.

A trainee at a facility of the U.S. chip maker GlobalFoundries in Germany last year. The U.S. is looking to strengthen its own production of semiconductors. PHOTO: SEBASTIAN KAHNERT/DPA/ZUMA PRESS

…………………………………………………………………………………………………………………………………..

Taiwan, China and South Korea “represent a triad of dependency for the entire US digital economy,” said a 2019 Pentagon report on national-security considerations regarding the supply chain for microelectronics. The US has dozens many semiconductor factories, but only Intel’s are capable of making the chips with transistors of 10 nanometers or smaller. The company however mostly produces for its own products. Among companies that make chips on contract for other companies, only TSMC and Samsung make those high-performing chips. Many US chip companies such as Qualcomm, Nvidia, Broadcom, Xilinkx and Advanced Micro Devices rely on TSMC for the manufacture of their most advanced products. Intel also makes chips with TSMC, according to TSMC’s 2019 annual report.

The Semiconductor Industry Association is conducting its own study on domestic chip production. The report is expected to recommend the US government set up a billion-dollar fund to push domestic chip investment, another source said. Another proposal by SEMI, an industry group representing semiconductor manufacturing equipment makers, involves giving tax credits to chip makers when they purchase and install equipment at factories in the US.

The Commerce Department is also considering a rule aimed at cutting off Huawei’s ability to manufacture chips at TSMC (see Addendum below). President Donald Trump has approved the move, but Commerce Department officials are still working through preliminary drafts, sources said.

May 16, 2020 Addendum: U.S. Moves to Cut Off Chip Supplies to Huawei

References: