Verizon

Verizon realizes operational efficiencies as massive cost cutting continues; 4G-LTE Home (Fixed Wireless Access)

Speaking at the Citi 2021 Global TMT investor conference on January 5, 2021, Verizon executive Ronan Dunne said the telco’s operational efficiency has continued to increase, largely due to cutting $10 billion in costs, which was first announced four years ago by then CEO Lowell McAdam.

Dunne said Verizon has been reaping billions of dollars every year in operational efficiencies from the core of how it builds network to the efficient way it carries traffic on that network with its One Fiber strategies. Verizon’s One Fiber project, which has been underway for five years, combined all of the telco’s fiber needs and planning into one project. It also allows Verizon to plot out its fiber uses cases and purchasing plans across all of its sectors.

“But as regards (to) the focus of operational efficiency, it’s a ruthless, consistent focus inside the business in exactly the same way as balance sheet strength has always been a watchword of Verizon. And so rest assured those will continue to be as important in ’21 and ’22 as they have been in the last few years.”

Regarding cost cutting, Dunne had this to say: “So yes, Matt (Verizon CFO Matt Ellis) has talked about our commitment to a $10 billion cost program, and we’ve made excellent progress on that. But in my time in the wireless business originally and then consumer, we’ve made significant strides. We’re talking about billions of dollars every year in operational efficiencies. From — right from the core of how we build the network, to be highly, highly efficient, how we carry traffic on the network with our One Fiber strategies to how we serve customers and deliver experiences. And across all of those vectors, we see continued opportunity.”

In addition to densification of the wireless network, backhaul and fronthaul, and enabling wireline access, having fiber deep is key for supporting radio access networks (RAN) as well as provisioning an increasing number of small cells. Verizon CTO Kyle Malady built the telco’s Intelligent Edge Network, which has allowed Verizon to lower its operational costs by benefiting “from efficiencies within the core and right through the business.”

“The particular area that I’m focused on in my part of the business is really AI at scale,” Dunne said. “That really allows us to improve our CRM (Customer Relationship Management) efficiency. So the efficiency of every dollar invested in acquisition and retention. Also the efficiency of every dollar invested in those elements that are customer service elements, and distribution elements,” he added.

Dunne opined that when you think about Verizon you recognize its network as a platform, it’s distribution as a platform and it’s billing and services platforms. He believes the opportunity to improve the efficiency of those platforms through investment in technology.

He also talked about the relationships with Microsoft and AWS for edge computing as a new platform capability that’s available both to us internally but also available to customers and partners. “So that’s the strategy. So we see the opportunity to grow highly efficiently as well as serve the existing base more efficiently and lots more to come there.”

“I’m not building a fixed wireless access network,” said Dunne, expressing a bit of frustration regarding a question of whether the company is on target to hit that 30 million homes passed goal. “I’m building a 5G mobility network with a second use case where it’s appropriate, where it covers 5G Office and 5G Home, so we just shouldn’t lose sight of that.”

Dunne says that he believes they are still on track, but the reality on the ground has Verizon constantly updating its 5G mobility strategy of where and how the service gets deployed. That reality impacts the ramp up of 5G Home, potentially slowing its deployment. The service is currently in 12 markets, with very limited footprints in those markets.

Verizon’s recently launched 4G LTE Home fixed wireless service (intended for rural subscribers) should also be included in a discussion of the company’s overall fixed wireless goals. The carrier’s 5G Home service and the goals associated with it pre-date the launch of the new 4G LTE based fixed wireless service, that Verizon initially said would target smaller markets.

Image Credit: Getty

……………………………………………………………………………………………………………………………………………………………………………………………….

“One of the other things that I think is important for people to think about is that as we build out the 5G network, we’ve also built 4G Home and we’ve seen significant response to that,” said Dunne. “My addressable market for Home, for me, has always been not limited to the specific of a 5G fixed wireless, but a broader ambition to be able to participate in the home.”

4G LTE fixed wireless access offers peak speeds of 50 Mbps for now, compared to its 5G Home service which claims average speeds of 300 Mbps. Nevertheless, Dunne sees this broader footprint of 4G and 5G fixed wireless combined with mobility, as a formidable competitor to cable broadband, and its fixed wireless homes passed goal attainment should be agnostic to the underlying wireless technology.

Can 5G fixed wireless access be an alternative to cable?

“Well, then my strong view is, yes, it can. But to be clear, we only build where there’s a mobility case to build. We’re not building a stand-alone 5G fixed wireless network. So sometimes when respectfully, people get frustrated with us and say, well, hold on a second. What about — I want to see all your discrete reporting of 5G fixed wireless or why aren’t you there or there or there? The answer, which — forgive me, but I keep repeating is because I’m not building a fixed wireless access network. I’m building a 5G mobility network with a second use case, where it’s appropriate, where it covers 5G office and 5G home. So we shouldn’t lose sight of that.

So as I build over that sort of 7-, 8-year horizon, one of the realities is that I will be updating my mobility deployment patterns all the time. So we’re not really — we’re not saying that, that sort of 7, 8 years for the 30 million homes time line is shifting. But what I am saying is we continue to optimize the mobility 5G deployment strategy. And as a result, we continue to finesse and update the practicalities of that relative to the homes past. But one of the other things that I think is important for people to think about is that as we build out the 5G network, we’ve also built 4G home, and we’ve seen significant response to that. And yes, that’s a maybe a 50 meg product rather than a 500 meg product. But for a lot of people, that’s important. And that also affords us this opportunity that as we build out 5G, as we put more nodes in place, but also as we put more carriers out there, deploy more spectrum, et cetera, we have this ability to build a home portfolio, which is carrier — basically bearer-agnostic. And I think the thing for us is that we see the opportunities to participate in tens of millions of homes across the U.S. as really attractive.

What I want to do is have toolkit that says, in my Fios footprint, if fiber is the right thing to do, great. If anywhere in the U.S. 5G ultra-wideband is available to me, I have that. And in other places, I have my 4G increasingly enhanced performance in that network, which may ultimately be a 5G nationwide solution. So my addressable market for home for me has always been not limited to the specific of a 5G fixed wireless but a broader ambition to be able to participate in the home and to bring the scale benefits of that to my customers who see Verizon as the partner of choice.”

We think we have a very strong growth opportunity, which is stimulate the base, spread through our network and distribution as

a platform, our access to the market across all of the available segments and really execute on a very strong, high performance, both network, but also a set of experiences….

References:

https://www.verizon.com/about/investors/citi-2021-global-tmt-west-virtual-conference

https://www.verizon.com/about/sites/default/files/2021-01/Citi-Conf-Transcript-01052021.pdf

https://www.fiercetelecom.com/telecom/verizon-closes-its-10-billion-cost-cutting-goal

https://www.pcmag.com/news/verizon-launches-unlimited-4g-home-internet-for-rural-users-here-are-the

Verizon and Deloitte collaborate on 5G mobile edge computing + 6G nonsense talk

Verizon today announced a deal with Deloitte to collaborate on 5G mobile edge computing services for manufacturing and retail businesses and ultimately expand to other industry verticals. The companies plan to create transformational solutions to serve client-specific needs using Deloitte’s industry and solution engineering expertise combined with Verizon’s advanced mobile and private enterprise wireless networks, 5G Edge MEC platform, IoT, Software Defined-Wide Area Network (SD-WAN), and VNS Application Edge capabilities.

Verizon and Deloitte are collaborating on innovative solutions to transform manufacturers into “real-time enterprises” with real-time intelligence and business agility by integrating next-gen technologies including 5G, MEC, computer vision and AI with cloud and advanced networking. The companies are co-developing a smart factory solution at Verizon’s Customer Technology Center in Richardson, TX that will utilize computer vision and sensor-based detection coupled with MEC to identify and predict quality defects on the assembly line and automatically alert plant engineering and management in near real-time.

The companies will also introduce an integrated network and application edge compute environment for next generation application functionality and performance that reduces the need for manual quality inspection, avoids lost productivity, reduces production waste, and ultimately lowers the cost of raw materials and improves plant efficiency. The combination of SD-WAN and VNS Application Edge will bring together software defined controls, application awareness, and application lifecycle management to deliver on-demand network transformation and edge application deployment and management.

“By bringing together Verizon’s 5G and MEC prowess with Deloitte’s deep industry expertise and track record in system integration with large enterprises on smart factories, we plan to deliver cutting-edge solutions that will close the gap between digital business operations and legacy manufacturing environments and unlock the value of the end-to-end digital enterprise,” said Tami Erwin, CEO of Verizon Business. “This collaboration is part of Verizon’s broader strategy to align with enterprises, startups, universities and government to explore how 5G and MEC can disrupt and transform nearly every industry.”

“In our recently published Deloitte Advanced Wireless Adoption study, over 85% of US executives surveyed indicated that advanced wireless is a force multiplier that will unlock the full potential of edge computing, AI, Cloud, IoT, and data analytics. Our collaboration with Verizon combines Deloitte’s business transformation expertise with advanced wireless and MEC technology to deliver game changing solutions,” said Ajit Prabhu, US Ecosystems & Alliances Strategy Officer and 5G/Edge Computing Commercialization leader, Deloitte Consulting LLP.

The #1 U.S. wireless telco still plans to reach an additional two cities with its mobile edge computing (MEC) network, ending the year with availability in 10 cities.

Verizon is also working with Microsoft Azure on private 5G MEC, Amazon Web Services (AWS) on consumer-oriented 5G MEC, IBM on IoT, Samsung and Corning on in-building 5G radios, Apple, major sporting leagues, and other organizations — all in an effort to explore and develop new use cases for 5G.

The MEC activities follows a flurry of announcements last week when Verizon expanded its low-band 5G network to reach up to 230 million people, said its millimeter-wave 5G network is now live in parts of 61 U.S. cities, revealed an on-premises private 4G LTE service for enterprises, expanded a partnership with SAP, inked a multi-year deal with Walgreens Boot Alliance, and launched an IoT services platform.

…………………………………………………………………………………………………………………………………………….

Separately, Verizon CTO Kyle Malady said that there’s currently no clear reason to move beyond 5G. “I really don’t know what the hell 6G is,” he said. Neither does anyone else- see Opinion below.

“We just put 5G in. And I think there’s a lot of development still to come on that one.”

Verizon, AT&T, Apple, Google and a wide range of other companies have already teamed under ATIS’ “Next G Alliance” that seeks to unite US industry, government and academia around 6G efforts.

………………………………………………………………………………………………………………………………….

Opinion on “6G”:

Talk of “6G” is preposterous at this time, since we don’t even have an approved 5G RAN/ IMT 2020 RIT spec or standard that meets the 5G URLLC performance requirements in ITU M.2410. Despite numerous 3GPP Release 16 specs, we don’t have a standard for 5G core network implementation, 5G security, 5G network management, 5G network slicing, etc.

At its 34th meeting (19-26 February 2020), ITU‑R Working Party (WP) 5D decided to start study on future technology trends for the future evolution of IMT. A preliminary draft new Report ITU-R M.[IMT.FUTURE TECHNOLOGY TRENDS] will be developed and will consider related information from various external organizations and country/regional research programs.

The scope of the new report ITU-R M.[IMT.FUTURE TECHNOLOGY TRENDS] focuses on the following aspects:

“This Report provides a broad view of future technical aspects of terrestrial IMT systems considering the time frame up to 2030 and beyond. It includes information on technical and operational characteristics of terrestrial IMT systems, including the evolution of IMT through advances in technology and spectrally-efficient techniques, and their deployment.”

In a Sept 27, 2020 ITU-R WP5D contribution, China stated:

IMT technology needs to show sustainable vitality in the perspective of technical development. There are emerging services and applications, and their further development towards 2030 and beyond will impose higher requirements on the IMT system. It motivates the introduction of new IMT technical features, e.g., very high spectrum up to Terahertz, native artificial intelligence (AI), integrated sensing and communications, integrated terrestrial and non-terrestrial networks, block chain and quantum computing for multi-lateral trustworthiness architecture, etc., which were not emphasised in Report ITU-R M.2320-0 considering the time-frame for 2015-2020. IMT technology continues to develop and it is necessary for ITU to provide a broad view of future technical aspects of IMT systems considering 2030 and beyond.

And suggested topics to be covered in this new IMT.FUTURE TECHNOLOGY TRENDS Report:

-

IMT technology trends and enablers for the time up to 2030 and beyond:

-

-

Technologies for further enhanced radio interface, including advanced modulation, coding and multiple access schemes, E-MIMO (Extreme -MIMO), Co-frequency Co-time Full Duplex (CCFD) communications, multiple physical dimension transmission

-

Technologies for Tera Hertz communication and optical wireless communication

-

Technologies for native AI based communication

-

Technologies for integrated sensing and communication

-

Technologies for integrated terrestrial and non-terrestrial communications

-

Technologies for integrated access and super sidelink communications

-

Technologies for high energy efficiency and low energy consumption

-

Technologies for native security, privacy, and trust

-

Technologies for efficient spectrum utilization

-

Terminal Technologies

-

Network Technologies

-

Editor’s Note: The next meeting of ITU-R WP5D is March 1-to-12, 2021 (e-meeting)

………………………………………………………………………………………………………………………………………..

References:

https://www.verizon.com/about/news/verizon-business-deloitte-5g-mobile-edge-computing

https://www.lightreading.com/cloud-nativenfv/verizons-cto-i-dont-know-what-hell-6g-is/d/d-id/766270?

ITU-R: Future Technology Trends for the evolution of IMT towards 2030 and beyond (including 6G)

U.S. Wireless Carrier’s Aggressive Promotions for iPhone 12 explained

- The launch of the iPhone 12 has sparked a battle for U.S. carriers to entice devices upgrades.

- AT&T, T-Mobile, and Verizon’s aggressive promotional pricing reflects the higher perceived lifetime value of attracting and retaining 5G wireless consumers.

The U.S. wireless carriers are betting that steep iPhone 12 promotions will more than pay off over time. Here’s why:

- U.S. wireless carriers are turning to promotions now in hopes that they will be able to secure new or retain customers throughout the 5G era. The most common time for wireless carriers to lose or gain subscribers is when customers switch smartphones, per The Wall Street Journal.

- The unusually aggressive device promotions also likely reflect the higher lifetime value of 5G customers. By 2025, 5G subscribers are expected to generate 2.5x more revenue per connection for carriers than the average cellular connection, according to Juniper Research forecasts cited by Light Reading.

- Wireless carriers are also likely attempting to meet US customers halfway, since so many people are cutting back on spending amid the economic slowdown. In Q2 2020, the average sale price of smartphones in the US sank to $503, representing a 10% year-over-year decline, according to Canalys.

Analyst colleague Craig Moffett generated this iPhone 12 Q & A in a blog post for his clients:

1. Why was Verizon featured so prominently in Apple’s iPhone launch?

Answer: Their millimeter wave broadband, sparsely available though it may be, is the only credible showcase for what 5G can do.

2. Why do Apple’s new iPhone’s sold outside of the U.S. not support millimeter wave signals?

Answer: Millimeter wave drains battery life incredibly quickly, and generates unwanted heat in the handset.

3. Why do Apple’s new phones in the U.S. default to turning off the very feature that is supposedly the reason to buy them?

Answer: To reduce heat and extend battery life.

4. What are the use cases that make 5G worth having?

Answer: We don’t know yet.

5. Why did AT&T decide to offer such a rich promotion – a free iPhone with almost any trade-in – for their existing subscribers?

Answer: Again, we don’t know.

6. Will 5G produce a high ROI for wireless carriers?

Answer: Most expect that 5G will mean higher capital intensity (capex), and therefore lower ROI.

………………………………………………………………………………………………………………………………………………

References:

Samsung Electronics wins $6.6B wireless network equipment order from Verizon; Galaxy Book Flex 5G

Samsung Electronics said on Monday it had won a $6.64 billion order to provide wireless communication solutions to Verizon in the United States, a major win for the South Korean firm in the next-generation 5G network market. Samsung’s local unit Samsung Electronics America signed the agreement with Verizon Sourcing, a subsidiary of Verizon Communications, to offer network products for the wireless carrier through the end of 2025. This includes providing, establishing and maintaining the company’s 5G mobile telecom equipment.

…………………………………………………………………………………………………………………………………………………………………………….

Sidebar: Nokia on the sidelines:

Nokia’s biggest customer is Verizon, JP Morgan research said in a July note to clients. Yet Nokia didn’t win any part of the new Verizon 5G order. That was predicted by Rosenblatt analyst Ryan Koontz, who said in July “Samsung will “leapfrog Nokia to secure one of the largest new supplier telecom contracts in many years.”

Nokia wrote in an email, “We do not comment on our customers’ vendor strategy. Nokia is proud to serve Verizon, and we are committed to continuing to help them build the best, most reliable and highest performing network. Nokia and Verizon have a longstanding strategic partnership in key technologies across their network with our end-to-end solutions portfolio.”

…………………………………………………………………………………………………………………………………………………………………………….

Samsung’s global prospects for its network business have improved following U.S. sanctions on its bigger rival Huawei , analysts said. The Trump administration last month unveiled plans to auction off spectrum previously dedicated to military purposes for commercial use starting in mid-2022, to ramp up fifth-generation network coverage in the United States. In July, the UK ordered Huawei equipment to be purged completely from its 5G network by the end of 2027, adding it needs to bring in new suppliers like Samsung Electronics and Japan’s NEC Corporation.

Verizon CEO Hans Vestberg told CNBC in July last year that Verizon does not use any Huawei equipment. Verizon had already been a Samsung customer before the order. Vestberg’s statement about no Huawei gear is not true, as Light Reading and other websites noted on Friday.

The FCC requested information about “the presence or use of Huawei or ZTE equipment and/or services in their networks, or in the networks of their affiliates or subsidiaries.”

The FCC’s goal is to determine how many US companies use equipment from Huawei or ZTE – the equipment has been deemed a threat to national security – and how much it might cost to replace that gear with equipment from “trusted” suppliers.

On Friday, the FCC published a list of companies that reported they have existing Huawei or ZTE equipment and services.

Three of the nation’s five biggest wireline phone providers (Verizon, CenturyLink and Windstream) have admitted to having equipment from Huawei or ZTE, according to Leichtman Research Group.

“Verizon’s networks do not include equipment from any untrusted vendors. In addition, the company is not seeking funds from the FCC to replace equipment,” a Verizon representative wrote in response to questions from Light Reading. “Verizon has a relatively small number of devices, called VoiceLink, which were made by Huawei and are used by some customers to make voice calls. There are no data services associated with these devices. Earlier this year, Verizon started replacing these units. That effort was temporarily halted by the pandemic and is now underway again. We expect to have all Voicelink devices fully retired by the end of the year.”

“Samsung winning the order from Verizon would help the company expand its telecom equipment business abroad, potentially giving leverage to negotiate with other countries,” Park Sung-soon, an analyst at Cape Investment and Securities told Reuters.

The order is for network equipment, a Samsung spokesman said. The company declined to comment on detailed terms the contract such as the portion of 5G-capable equipment included.

Verizon joined with Samsung long before 5G made its debut in smartphones last spring. In early 2018, the two firms teamed up for trial runs of 5G-powered home internet. Verizon officials have previously pledged not to use Huawei for its next-generation rollout. Samsung has supplied some network gear for prior generations including 4G LTE.

To Samsung, the deal represents a major 5G win. The contract, valued at 7.898 trillion South Korean won over five years, compares with the roughly 5 trillion won Samsung’s network business racked up in revenue in all of 2019.

Last year, 5G represented less than half of Samsung’s network business, of which U.S. carriers accounted for 10%, said S.K. Kim, a Seoul-based analyst with Daiwa Securities.

“With this latest long-term strategic contract, we will continue to push the boundaries of 5G innovation to enhance mobile experiences for Verizon’s customers,” Samsung said in a statement.

………………………………………………………………………………………………………………………………………………………………………………………….

Sidebar — Telecom Equipment Vendor Market Shares:

Samsung had a 3% market share of the global total telecom equipment market in 2019, behind No. 1 Huawei with 28%, Nokia’s 16%, Ericsson’s 14%, ZTE’s 10% and Cisco’s 7%, according to market research firm Dell’Oro Group.

Among 5G network sales, Samsung ranks No. 4 with about 13% of the total market, according to market research firm Dell’Oro Group. It trails the top three, which include China’s Huawei Technologies Co. and the European firms Ericsson AB and Nokia Corp.

Huawei said early this year that it had signed more than 90 5G contracts, and Ericsson last month touted its 100th 5G “commercial agreement.” Samsung hasn’t divulged how many 5G contracts it has signed. But it has high hopes, having invested more than $30 billion in the U.S. market alone.

………………………………………………………………………………………………………………………………………………………………………………………….

Separately, Samsung announced the Galaxy Book Flex 5G, an adaptable, 5G-powered addition to its premium laptop line. Galaxy Book Flex 5G is powered by the new 11th Gen Intel® Core™ processor with Intel® Iris® Xe graphics offering intelligent performance and powerful processing for impressive productivity and stunning entertainment, along with Wi-Fi 6 and 5G connectivity for an unparalleled laptop experience.

“Across the world, we’re being asked to adapt and change constantly, and it’s vital we have devices that move with us,” said Mincheol Lee, Corporate VP and Head of New Computing Biz Group at Samsung Electronics. “Thanks to our close collaboration with Intel, Galaxy Book Flex 5G provides users with a powerful performance, next-generation connectivity, effortless productivity and premium entertainment features, all in the form function of their choosing.”

……………………………………………………………………………………………………………………………………………………………………………………………..

References:

Verizon Trials Quantum Key Distribution for Encryption over Fiber Optic Links

Verizon has begun testing quantum key distribution (QKD) [1.], a new encryption method that uses photon properties to protect subscriber data. The company says they are the first U.S. carrier to do so, although AT&T is also exploring quantum computing applications in partnership with the California Institute of Technology. Verizon said it sent encrypted streaming video from a 5G Lab to two East Coast offices.

Note 1. Unlike number-based encryption methods used today, QKD creates keys based on the quantum properties of photons, making it much harder for even advanced computing systems to crack. QKD could be applied to exchange a key between the two ends of a communication. QKD provides protection against the threat posed by quantum computing to current cryptographic algorithms and provides a high level of security for the exchange of data.

An article by ITU-T SG13 chair Leo Lehmann, PhD, described new ITU-T Recommendations related to IMT 2020 and Quantum Key Distribution. ITU-T SG13 has published two new recommendations for networks to support quantum key distribution (QKD) [1] :

- Y.3800 (Y.QKDN_FR) Overview on networks supporting quantum key distribution

- Y.3801 (Y.QKDN_req) Functional requirements for quantum key distribution networks

Y.3800 describes the basic conceptual structures of QKD networks as the first of a series of emerging ITU standards on network and security aspects of quantum information technologies. SG13 standards for QKD networks – networks of QKD devices and an overlay network – will enable the integration of QKD technology into large-scale ICT networks.

Complementing these activities, ITU-T SG17 standards provide recommendations for the security of these QKD networks.

Image depicting Quantum Cryptography

……………………………………………………………………………………………………………………………………………………………………………………….

Verizon is exploring the physics of the ultra small which could help protect encrypted network connections.

“A QKD network derives cryptographic keys using the quantum properties of photons to prevent against eavesdropping,” Verizon said. It’s also using a quantum random number generator to continuously generate encryption keys.

In the trial, Verizon said it used QKD to encrypt and send a video stream between its 5G Lab and two of its offices in Virginia and Washington DC. Specifically, live video was captured outside of three Verizon locations in the D.C. area, including the Washington DC Executive Briefing Center, the 5G Lab in D.C and Verizon’s Ashburn, Virginia office.

Using a QKD network, quantum keys were created and exchanged over a fiber optic network between Verizon’s locations. Video streams were encrypted and delivered more securely allowing the recipient to see the video in real-time while instantly exposing hackers. A QKD network derives cryptographic keys using the quantum properties of photons to prevent against eavesdropping.

Though the test was conducted over its fiber network, a Verizon representative told Mobile World Live the operator is also aiming to use the technology in their mobile networks.

Verizon also demonstrated that data could be further secured with keys generated using a Quantum Random Number Generator (QRNG) that, as the name suggests, creates random numbers that can’t be predicted. With QKD, encryption keys are continuously generated and are immune to attacks because any disruption to the channel breaks the quantum state of photons, which signals that eavesdroppers are present.

“The use of quantum mechanics is a great step forward in data security,” said IDC Analyst Christina Richmond, in a statement. “Verizon’s own tests, as well other industry testing, have shown that deriving ‘secret keys’ between two entities via light photons effectively blocks perfect cloning by an eavesdropper if a key intercept is attempted.

“Current technological breakthroughs have proven that both the quantum channel and encrypted data channel can be sent over a single optical fiber. Verizon has demonstrated this streamlined approach brings greater efficiency for practical large-scale implementation allowing keys to be securely shared over wide-ranging networks.”

Verizon chief product development officer Nicola Palmer stated the test was part of an effort to “discover new ways to ensure safe networks and communications” for consumers and enterprises. “Quantum-based technology can strengthen data security today and in the future,” she said.

Verizon outlined additional work focused on 5G security, including tests of a system using AI and machine learning to detect anomalies in the network and analyse cell site performance; network accelerators to mitigate increases in latency caused by security functions; and a credential management system for connected vehicles.

References:

https://www.cnet.com/news/verizon-reveals-quantum-networking-trials/

https://www.fiercetelecom.com/telecom/verizon-tunes-up-quantum-technology-trial-to-bolster-security

Quantum Cryptography Demystified: How It Works in Plain Language

New ITU-T SG13 Recommendations related to IMT 2020 and Quantum Key Distribution

Verizon earnings beat estimates despite COVID-19 impact; wireless revenues down; 2H-2020 Priorities

Verizon’s reported today that 2nd-quarter adjusted earnings per share was $1.18, ahead of analysts’ consensus estimate of $1.15, but down from $1.23 in the same period last year. The company estimates that second-quarter 2020 EPS and adjusted EPS included approximately 14 cents of COVID-19-related net impacts, primarily driven by impacts to wireless service revenue and lower advertising and search revenue from Verizon Media.

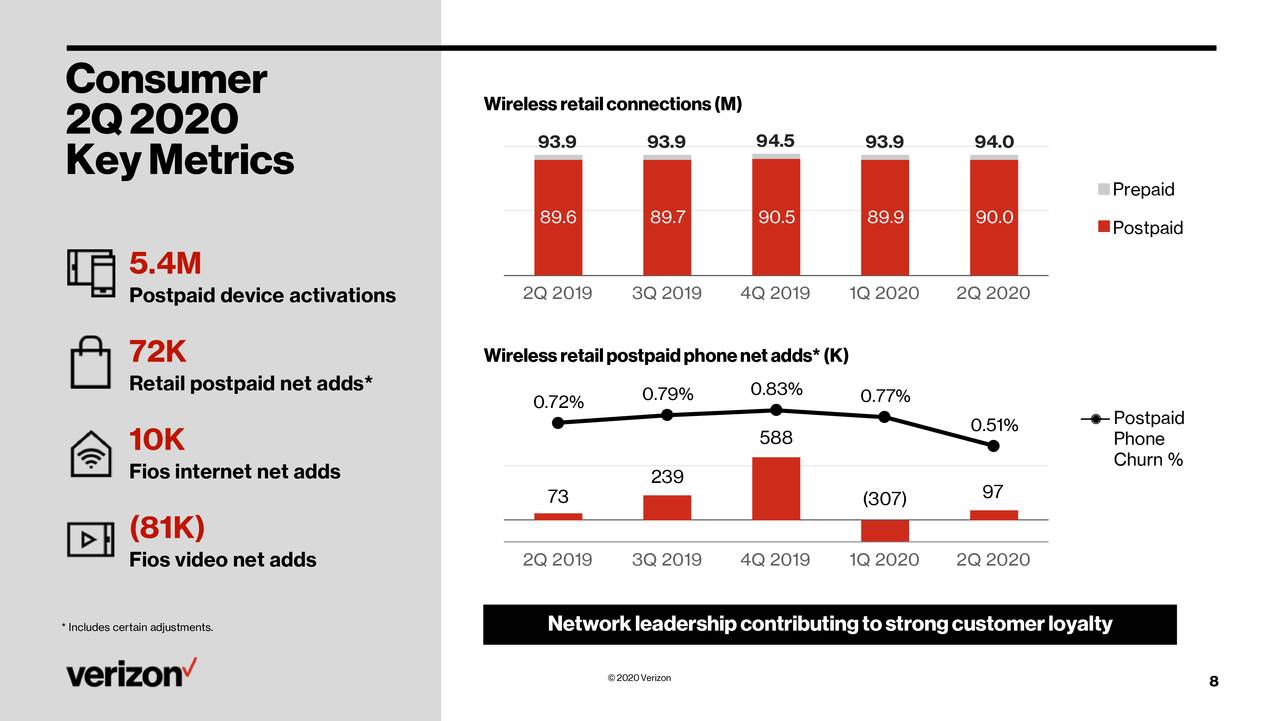

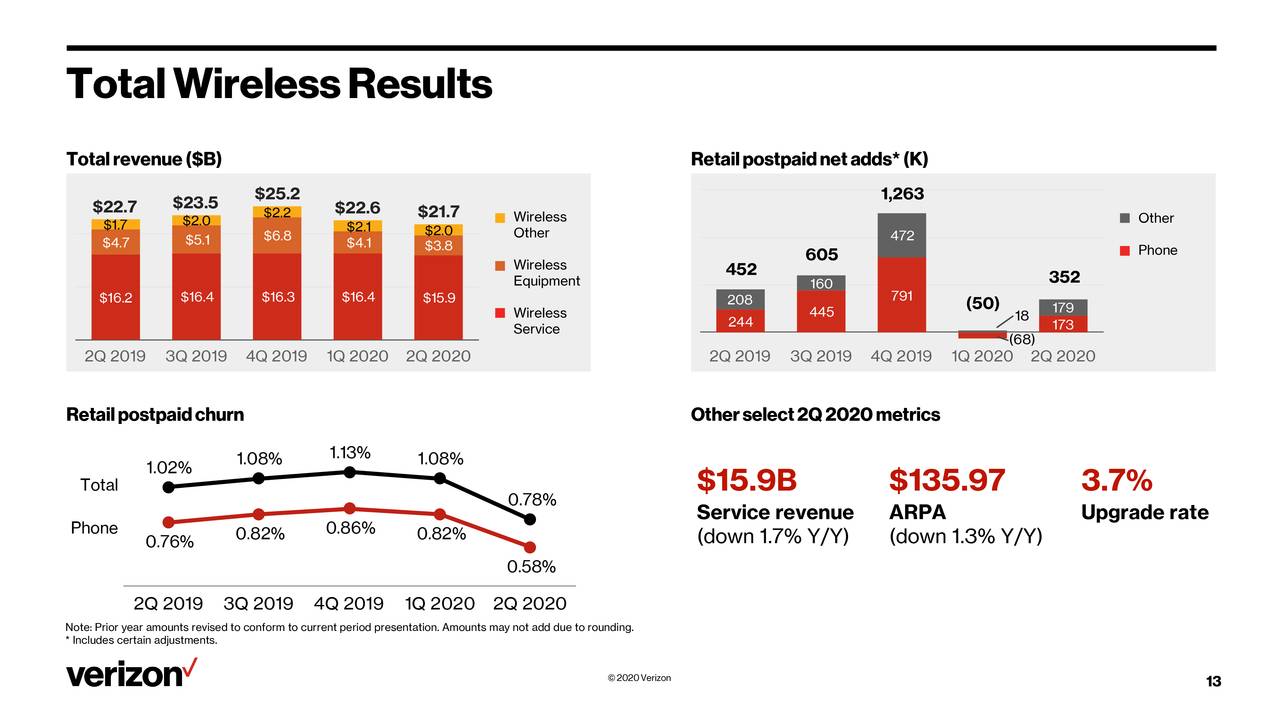

Verizon added 173,000 wireless postpaid phone subscribers for the second quarter, as the COVID-19 pandemic weighed on wireless service and equipment revenue (see CFO Matt Ellis quote below).

Total wireless service revenue was down 1.7% from the same period a year ago, to $15.9 billion, while postpaid phone churn for Q2 was 0.51%. Verizon cited a significant drop in wireless equipment revenue because of low activations as the main driver behind a 4% drop in total consumer revenues to $21.1 billion and business to $7.5 billion.

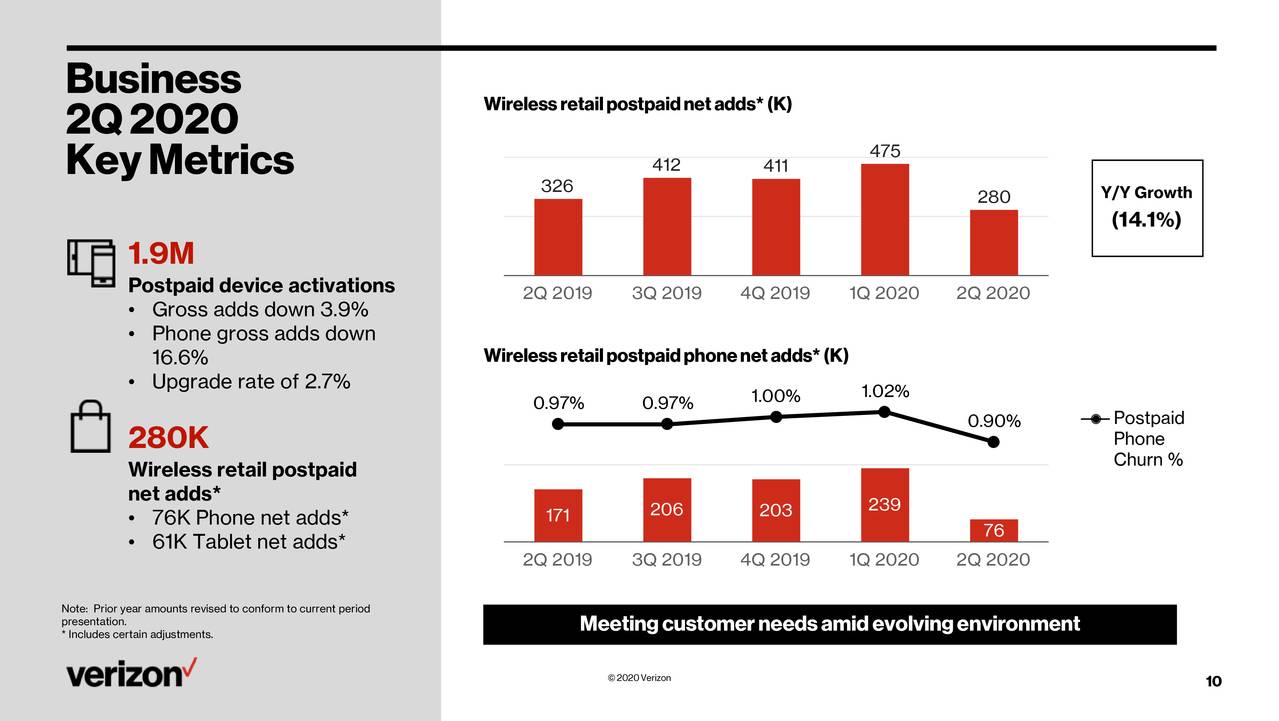

Consumer wireless service revenue declined 2.7% from the year ago period to $13.1 billion. Business wireless revenue declined 3.7% YoY to $7.5 billion (see charts below).

Like AT&T, which reported earnings yesterday, Verizon said the results include impacts from reduced roaming and usage as travel remains restricted, and waived fees. However, Verizon said it had record uptake of its premium Unlimited plans by new accounts. Wireless postpaid average service revenue per account (ARPA) declined 1.8% to $116.02.

……………………………………………………………………………………………………………………………………………………….

Verizon continues to build-out its 5G network, with $9.9 billion in capital expenditures in the first half of the year. Those investments supported capacity and traffic growth across Verizon’s networks and included additional fiber and cell sites to expand its 5G UltraWideband rollout, which primarily uses 28 GHz millimeter wave spectrum. Verizon 5G network is in parts of 35 cities, while its fixed wireless 5G Home product is currently in six markets.

“Through extraordinary circumstances, Verizon delivered a strong operational performance in the second quarter,” said Verizon CEO Hans Vestberg in a statement. “We remain focused on our strategic direction as a technology leader, quickly adapting to the new environment and providing our customers with reliable and vital connections and technology services, while working to keep our employees safe and accelerating our 5G network deployment. We have embraced, engaged in and responded to important social movements happening throughout the world, and will continue to be at the forefront of initiatives that move the world forward for everyone. We are proud of what we have done, and continue to do, for our customers, shareholders, employees, and society.”

Other Q2 metrics for Verizon:

- Total revenue of $30.4 billion, down 5.1%

- Adjusted EBITDA of $11.5 billion and adjusted EBITDA margin of 37.9%

- Earnings per share of $1.18, down 4.1%

- Verizon Media revenues were down 24.5% to $1.4 billion

Commenting on the impact of COVID-19, Verizon Chief Financial Officer Matt Ellis told Barron’s Friday morning:

“Certainly this was a very different quarter than others, not part of our plan for the year, but when you look at the results I think you see strong operational performance and very good cash flow coming from that. I think it speaks to the nature of our business model and the importance of our products in our customers’ lives.”

Guidance and 2nd Half 2020 Priorities:

Verizon expects wireless revenue in a range of -1% to flat year over year in the 3rd quarter. Capital spending is forecast to be in the range of $17.5 billion to $18.5 billion.

Stated 2nd half 2020 initiatives are:

- 5G adoption

- Network monetization

- Next-gen B2B applications

- Customer differentiation

- New revenue opportunities

“Regardless of how results match up against expectations for Verizon, these results should be seen as good compared to what AT&T reported yesterday,” wrote New Street Research analyst Jonathan Chaplin on Friday morning. This author certainly agrees, as Verizon is not encumbered by DirecTV and Warner Media as AT&T is.

In February, we made some bold statements about our deployment on 5G in 2020 all the way from the Mobile Edge Compute, 5G Home cities, 5x more small cells on 5G and some 60 cities on the 5G Ultra-Wideband as well as a nationwide coverage on 5G with DSS. I’m happy to report we’re on track on that, and in some cases even ahead of the plan. We are continuing to deploy our technology.

Our test with DSS is going very well and as well, we have launched some of the 60 markets when it comes to mobility and some additional markets on 5G Home. However, you’re going to see that in the second half of this year we have a lot of new things happening and building on the foundation of the strategy and the strategic priorities that Verizon has outlined the last couple of years.

For Verizon Business Group, 5G Mobile Edge Compute, an important piece of our growth strategy, we have said that we are going to have 10 5G Mobile Edge Compute sites this year deployed. And now we’ve also started gearing up our partners. We have announced IBM and we also talked about SAP as two very important application providers that are going to take part of our deployment and that we’re collaborating with right now. So we’re creating a lot of excitement around the 5G Mobile Edge Compute and a lot more to come in the second half. Verizon Business Group, 5G Mobile Edge Compute, an important piece of our growth strategy, we have said that we are going to have 10 5G Mobile Edge Compute sites this year deployed. And now we’ve also started gearing up our partners. We have announced IBM and we also talked about SAP as two very important application providers that are going to take part of our deployment and that we’re collaborating with right now. So we’re creating a lot of excitement around the 5G Mobile Edge Compute and a lot more to come in the second half.

We are on plan to deploy more than 5x more millimeter wave base stations this year compared to last year, so the footprint will be much broader and we will be into 60 cities and those cities will be much more covered than they were last year. And we are disclosing that – usually on a fairly frequent basis how that map is growing. As you have seen, we have launched fairly few markets the first half when it comes to the 60, so you should expect quite a lot of noise from us in the second half and we’re really excited about that. But you also need to think about our model will also include nationwide, so think about our model being a millimeter wave that is transformative. No one is even close to it in the world. Then we will have national coverage on top of that. And then in the bottom, we have the best 4G network in the world. And then I don’t think that our customer will be disappointed with that. We build things that are transformative that are so different than others. So I would be excited for the second half if I would be you. It’s crunch time for Verizon. We have been talking about this for one and a half year. I think our customers will be very excited in the second half.

One year ago, we didn’t talk about DSS. But of course, our team was working to prepare all the networks so we can actually deploy DSS in all the radio base stations we have. So we constantly are ahead of the game thinking what is needed to be preparing for the network. But right now our focus is very much about the commitments we have to our customers when it comes to 5G, but also to keeping the best network on 4G. That’s where we’ll have it and then do that fiber reach. Those are the priorities and it will continue so. Then any speculation on the future spectrum or something, that’s a little bit early to have right now. But I can tell you my team is always proactively thinking about how to do this network continue to be the best in America. There’s no debate about that. And I have a high confidence that they will continue to do so when it comes to our CapEx allocation as well.

If you think about the Mobile Edge Compute, just last week we announced partnership with IBM and with SAP. That’s going to be part of the 5G Mobile Edge Compute in order to serve our customers. So you’re going to see that how we are doing, sort of laying out early indicators on that path to revenue that we have outlined both internally as well as externally.

5G Mobile Edge Compute. I think that the use cases we see today is very much real-time decision-making. If that’s a big distribution center that’s going to have 5G-enabled distribution center to actually take real-time decisions, or if it’s a big manufacturing plant that’s going to use 5G Mobile Edge Compute by wireless connecting to all the robotics, we’re in many of those cases. And then you also see cases where sort of IoT devices with 5G will actually enable a new way of delivering a service. And finally, the whole VR and AR for large enterprises where you need a low latency on the campus or in the manufacturing or whatever it might be, those are all the early cases. Many of them right now are based on low latency. We see it’s creeping into security because the data can then be contained with the company, meaning they can actually process and have all the processing and storage at the edge, which means they can keep the data for themselves. So those two capabilities are the first one. I think in the next, we’re going to see enormous bandwidth of enterprise that need to send a lot of data to the edge in order to take decisions. But so far, latency and security, that’s how the 5G Mobile Edge Compute scenarios are working out. And we basically have two, three – or two, I would say, per industry vertical that are lead customers for us. And we work with them to do the solutions and sometimes we are the third party as we don’t have all application ourselves. That’s how we’re working it right now and I’m encouraged. And, of course, as I said before, acceleration has been seen, because all the digitalization and touchless that is needed going forward.

We feel really good about our model. As we have said before, minimum of 10 5G Home cities. We’re going to have the cities with a much better chipset. That’s on plan for this second half.

And the self-install, which I have been talking about now for one and half year, which excites me that our customers should be able to receive the gear, the CPs and be able to install themselves in a short timeframe. It’s not that I’m down to the times that I have envisioned. I wanted to be below one hour, but we have come a far way from the eight hours we started with. And compared to a fiber installation where you need to first put it on the agenda, you wait for a couple of weeks and you have to come there and install it, and it takes hours to do. This is a totally different way. It’s transformative. As I said, we are building 5G that’s transformative, not the me-too to my 4G.

I think one thing that we have learned also is that, of course, fixed wireless access, we think a lot about consumers, but there is an opportunity clearly when you see this also as a fixed wireless access opportunity for small and medium business, et cetera, that we will start working on later on.

CFO Matt Ellis:

We’re driving these (5G Home) revenues off of the same (wireless) network that you are getting 5G mobility revenues on. So this is the first time we’ve had that opportunity to drive multiple revenue streams off of the same investment. And so as we roll out the network, we’ll have the opportunity to add more market share. And so we’re very excited about that as we head into ’21 with the progress we’re making this year.

We’re certainly excited about the opportunities that come with the C-band auction. One of the great things about having got the balance sheet in position that we have is it gives us the opportunity to take advantage of items like that when they come along. And I don’t think that – as I look at the balance sheet and I look at the auction that that will provide any inhibitor [ph] to us either in terms of what we do in the auction or how we invest in the rest of the business. In terms of the free cash flow, so the second quarter as you say, a couple of items in there. We had the tax benefit from the item that we recognized in the fourth quarter last year. We also had a timing difference of about $2 billion moving just regular cash payments from second quarter to last week. But all-in-all, look, our cash flow will continue to be strong because we have – obviously we have a strong business with a recurring revenue stream that will continue into the second half of the year. Working capital provided a benefit in the first half with the lower volumes. We’ll see how that plays out in the second half of the year. And I think that will be one of the key determinants of how cash flow looks for the full year on a year-over-year basis. So we’ll see how it plays out, but I certainly expect free cash flow to continue to be strong for the business.

………………………………………………………………………………………………………………………………………………

References:

Verizon misleading 5G commercials called out by NAD after AT&T complaint

The National Advertising Division (NAD) has condemned Verizon for misleading consumers over the quality of its 5G network across the country. NAD recommended Verizon stop using the claim that it’s delivering “the most powerful 5G experience for America” in two previously aired TV commercials touting the carrier’s 5G service rollout in sports stadiums were challenged by 5G competitor AT&T.

Editor’s Note: NAD is an investigative unit of the advertising industry’s system of self-regulation and is a division of the BBB National Programs’ self-regulatory and dispute resolution programs.

……………………………………………………………………………………………………………………………………………….

“The National Advertising Division has determined that, in the context of two challenged television commercials touting Verizon’s rollout of 5G service in sports venues, the claim that ‘Verizon is building the most powerful 5G experience for America’ reasonably communicates a message about the consumer experience of using 5G mobile service that was not supported by the evidence in the record,” according to statement from NAD.

The message is apparently that Verizon was not fairly representing its network in advertisements and promotions broadcast at sporting venues.

Verizon plans to appeal the ruling to the National Advertising Review Board.

……………………………………………………………………………………………………………………………….

Verizon is building 5G networks in sporting venues across the U.S., though the NAD believes the way the advertisements have been created suggests a similar experience would be offered outside the sports venues themselves.

The express claim stated in the ads is that “Verizon is building the most powerful 5G experience for America,” a message the carrier indicated is clear to consumers, despite NAD’s finding that Verizon’s use of past and present tense conveys the message that it currently delivers the most powerful 5G experience.

“The intent of the commercial is to inform consumers about the billions of dollars Verizon is investing in its 5G buildout. Verizon strongly believes that consumers understand that this is the only message that is reasonably conveyed,” said Verizon in its advertiser’s statement.

NAD pointed to wording like “This is happening now,” for the NFL spots and said Verizon’s “unqualified superiority claim…goes beyond touting Verizon’s spectrum portfolio.” Instead, sending the message of 5G consumer experiences that include capacity to serve many people at once and using Verizon’s 5G network to post content, along with resilience, coverage and latency – which NAD said Verizon didn’t provide sufficient evidence to support its present tense “most powerful network” claim.

Based on the context, one commercial the NAD release appears to be referring to is a Verizon NFL 5G Built Right ad, which Jeffrey Moore, principal at Wave7 Research, confirmed ran heavily in September 2019 in line with the start of NFL season and stopped airing November 18.

“5G branding efforts from Verizon, AT&T, and T-Mobile shifted to pandemic-related branding, showing that Verizon, AT&T, and T-Mobile are doing what they can to keep customers connected and safe,” Moore told Fierce Wireless.

Verizon announced last September it was expanding 5G service to 13 NFL stadiums. Given current restrictions on large public gatherings in many places though, it’s unclear when ads depicting massive crowds might come back into favor.

…………………………………………………………………………………………………………..

U.S. based wireless telcos are facing a difficult challenge in delivering the desired “5G experience.” Despite the telcos preaching about the benefits of mmWave spectrum to underpin 5G networks, the telcos are performing woefully according to many critics/pundits.

T-Mobile has been blasted for the speeds which have been delivered over the 600 MHz spectrum it has been offering, while AT&T and Verizon has been failing at coverage. In a recent Rootmetrics gaming study in Los Angeles, none met the minimum requirements for latency.

Moore noted that Metro By T-Mobile’s “Rule Your Day” campaign, was halted for a period, but restarted May 6. On the postpaid side, T-Mobile’s message for a time was “We’re with you,” but has now returned to the tagline of “Are you with us?”

This “slap on the wrist” by NAD implies that the U.S. is failing to even come close to meeting its own inflated promises in the delivery of 5G service.

For an excellent analysis and comparison of exaggerated 5G claims by Verizon vs AT&T, please see this blog post by Adrian Diaconescu.

……………………………………………………………………………………………………………………………………….

References:

https://telecoms.com/504372/verizon-gets-wrist-slap-for-misleading-5g-claims/

https://www.phonearena.com/news/verizon-misleading-5g-advertisingatt-complaint_id124706

Verizon misleading 5G commercials called out by NAD after AT&T complaint

The National Advertising Division (NAD) has condemned Verizon for misleading consumers over the quality of its 5G network across the country. NAD recommended Verizon stop using the claim that it’s delivering “the most powerful 5G experience for America” in two previously aired TV commercials touting the carrier’s 5G service rollout in sports stadiums were challenged by 5G competitor AT&T.

Editor’s Note: NAD is an investigative unit of the advertising industry’s system of self-regulation and is a division of the BBB National Programs’ self-regulatory and dispute resolution programs.

……………………………………………………………………………………………………………………………………………….

“The National Advertising Division has determined that, in the context of two challenged television commercials touting Verizon’s rollout of 5G service in sports venues, the claim that ‘Verizon is building the most powerful 5G experience for America’ reasonably communicates a message about the consumer experience of using 5G mobile service that was not supported by the evidence in the record,” according to statement from NAD.

The message is apparently that Verizon was not fairly representing its network in advertisements and promotions broadcast at sporting venues.

Verizon plans to appeal the ruling to the National Advertising Review Board.

……………………………………………………………………………………………………………………………….

Verizon is building 5G networks in sporting venues across the U.S., though the NAD believes the way the advertisements have been created suggests a similar experience would be offered outside the sports venues themselves.

The express claim stated in the ads is that “Verizon is building the most powerful 5G experience for America,” a message the carrier indicated is clear to consumers, despite NAD’s finding that Verizon’s use of past and present tense conveys the message that it currently delivers the most powerful 5G experience.

“The intent of the commercial is to inform consumers about the billions of dollars Verizon is investing in its 5G buildout. Verizon strongly believes that consumers understand that this is the only message that is reasonably conveyed,” said Verizon in its advertiser’s statement.

NAD pointed to wording like “This is happening now,” for the NFL spots and said Verizon’s “unqualified superiority claim…goes beyond touting Verizon’s spectrum portfolio.” Instead, sending the message of 5G consumer experiences that include capacity to serve many people at once and using Verizon’s 5G network to post content, along with resilience, coverage and latency – which NAD said Verizon didn’t provide sufficient evidence to support its present tense “most powerful network” claim.

Based on the context, one commercial the NAD release appears to be referring to is a Verizon NFL 5G Built Right ad, which Jeffrey Moore, principal at Wave7 Research, confirmed ran heavily in September 2019 in line with the start of NFL season and stopped airing November 18.

“5G branding efforts from Verizon, AT&T, and T-Mobile shifted to pandemic-related branding, showing that Verizon, AT&T, and T-Mobile are doing what they can to keep customers connected and safe,” Moore told Fierce Wireless.

Verizon announced last September it was expanding 5G service to 13 NFL stadiums. Given current restrictions on large public gatherings in many places though, it’s unclear when ads depicting massive crowds might come back into favor.

…………………………………………………………………………………………………………..

U.S. based wireless telcos are facing a difficult challenge in delivering the desired “5G experience.” Despite the telcos preaching about the benefits of mmWave spectrum to underpin 5G networks, the telcos are performing woefully according to many critics/pundits.

T-Mobile has been blasted for the speeds which have been delivered over the 600 MHz spectrum it has been offering, while AT&T and Verizon has been failing at coverage. In a recent Rootmetrics gaming study in Los Angeles, none met the minimum requirements for latency.

Moore noted that Metro By T-Mobile’s “Rule Your Day” campaign, was halted for a period, but restarted May 6. On the postpaid side, T-Mobile’s message for a time was “We’re with you,” but has now returned to the tagline of “Are you with us?”

This “slap on the wrist” by NAD implies that the U.S. is failing to even come close to meeting its own inflated promises in the delivery of 5G service.

For an excellent analysis and comparison of exaggerated 5G claims by Verizon vs AT&T, please see this blog post by Adrian Diaconescu.

……………………………………………………………………………………………………………………………………….

References:

https://telecoms.com/504372/verizon-gets-wrist-slap-for-misleading-5g-claims/

https://www.phonearena.com/news/verizon-misleading-5g-advertisingatt-complaint_id124706

Verizon Q1 earnings beat; loses postpaid phone & Fios TV subs, adds Fios internet subs; 5G & fiber build-out on track

Verizon lost 68,000 postpaid phone connections during the first three months of the year, compared with a net loss of 44,000 such connections during the same period a year earlier. Retail store closures led to a “significant drop” in customer activity, the company said. Postpaid phone customers are considered lucrative because they typically pay bills monthly under longer-term contracts and are less likely to switch carriers. In sharp contrast, AT&T added 163,000 postpaid phone subscribers during the first quarter.

Total revenues for wireless products and services was essentially flat, seeing just a 0.5% decrease year-over-year to $22.6 billion. While wireless service revenue grew in both the consumer and business segments, Verizon said, that growth was countered by sharp reductions in equipment revenue because in-store customer engagement was limited by social distancing measures. Consolidated operating revenues for the company were down 1.6% to $31.6 billion.

……………………………………………………………………………………………………………

The largest U.S. wireless carrier by subscribers tempered its financial forecasts for the rest of the year, lowering its profit goals (see Matt Ellis’ remarks below) and withdrawing its revenue targets. In the first quarter, the company reported a slight drop in wireless subscribers as gains in business accounts were offset by a steep decline in new consumer accounts.

Verizon increased its bad-debt reserve by $228 million based on the number of customers it expected won’t be able to pay their bills. It and other carriers signed a pledge with the Federal Communications Commission not to cut off service for 60 days or charge late fees to consumers facing pandemic-related hardships.

“We were in a position of not really having any idea what the impact of the social distancing and shelter-in-place would [be],” said Matt Ellis, Verizon’s chief financial officer. Verizon hasn’t disclosed how many customers have stopped paying, but Mr. Ellis said many consumers continue to pay their wireless bill even when they can’t pay their car loans or mortgages.

Verizon’s Progress towards their 2020 Goals:

Strengthen & Grow Core Business

•Driving digital sales through enhanced experiences

•Strengthened mmWave spectrum holdings through Auction 103

Leverage Assets to Drive New Growth

•34 Ultra wideband cities live; 5G network build on plan

•BlueJeans acquisition announced in April expands portfolio

Drive Financial Discipline & Strength in Balance Sheet

•Disciplined spend with focus on operational efficiencies

•Scenario planning to navigate uncertainties

Infuse a Purpose-Driven Culture

•Continuing initiatives to drive meaningful difference to society

•Leading brand perception related to COVID-19 response

…………………………………………………………………………………………………………………………………………………………….

CEO Hans Vestberg (English grammar is not very good and not corrected here) talked up VZ’s 5G and fiber plans on today’s earnings call:

When it comes to leverage our assets and we’re growing in the future our 5G plans and our fiber plans the build out of that are on plan. We were also a little bit ahead of plan when we ended the first quarter. And can I report still today we are on plan with the 5G and fiber. Of course, our challenge is out there when it comes to COVID-19 and so on.

But our team are finding new ways and innovative ways to actually do the deployment. There are ways of dealing with approvals from the municipalities set by new ways. And we have great collaborations from many of the municipalities to do it. There might be problems going forward but I am also confident that my team are very innovative in the field and see that we continue to drive hard on this.The 5G is still very much in the middle the center of our strategy. And as you heard me saying before we’re in the middle of the execution and we’re not halting that. We’re keeping it up all the time and the team is doing great work there. And we see opportunity with 5G going forward both with building all the cities, the 5G mobile edge compute as well as making this nationwide 5G still this year.

On top of that we increased the CapEx guidance in the quarter because we felt that it was a good time for us to continue to see that we have robust networks as we went into a moment in time we don’t really know how the network would be used. At the same time of course sending a message that we think is a good return on investment on that incremental CapEx.

Editor’s Note: We find it beyond unbelievable that Verizon is such a 5G cheerleader, especially CEO Hans Vestberg, when the company is not even a member of 3GPP and doesn’t attend 3GPP (5G architecture and 5G core) or ITU-R WP5D meetings where IMT 2020 radio aspects (RIT/SRIT) are being standardized. Yet their U.S. network provider competitors are all 3GPP members and attend 3GPP as well as ITU meetings. The competitor list includes AT&T, T-Mobile, Dish, Comcast, Charter, C-Spire, and other network service providers.

Verizon CFO Matt Ellis said:

For adjusted EPS, we are revising our original guidance of 2% to 4% growth and are now guiding to a range of negative 2% to positive 2% change from the prior year. Our new estimated range is based on a scenario that assumes significant headwinds prevail throughout the second quarter.

We have limited visibility into the second half of the year, which will depend on various potential operating environments. We will continue to assess the impact of COVID on our business, including our bad debt reserve and expect to provide an update on our next earnings call based on how things develop between now and then.

You can watch Verizon’s earnings call webcast here.

…………………………………………………………………………………………………………………………………………………………….

References:

https://www.verizon.com/about/investors/quarterly-reports/1q-2020-earnings-conference-call-webcast

https://www.wsj.com/articles/verizons-wireless-business-slowed-by-coronavirus-11587730044

Verizon Q1 earnings beat; loses postpaid phone & Fios TV subs, adds Fios internet subs; 5G & fiber build-out on track

Verizon lost 68,000 postpaid phone connections during the first three months of the year, compared with a net loss of 44,000 such connections during the same period a year earlier. Retail store closures led to a “significant drop” in customer activity, the company said. Postpaid phone customers are considered lucrative because they typically pay bills monthly under longer-term contracts and are less likely to switch carriers. In sharp contrast, AT&T added 163,000 postpaid phone subscribers during the first quarter.

Total revenues for wireless products and services was essentially flat, seeing just a 0.5% decrease year-over-year to $22.6 billion. While wireless service revenue grew in both the consumer and business segments, Verizon said, that growth was countered by sharp reductions in equipment revenue because in-store customer engagement was limited by social distancing measures. Consolidated operating revenues for the company were down 1.6% to $31.6 billion.

……………………………………………………………………………………………………………

The largest U.S. wireless carrier by subscribers tempered its financial forecasts for the rest of the year, lowering its profit goals (see Matt Ellis’ remarks below) and withdrawing its revenue targets. In the first quarter, the company reported a slight drop in wireless subscribers as gains in business accounts were offset by a steep decline in new consumer accounts.

Verizon increased its bad-debt reserve by $228 million based on the number of customers it expected won’t be able to pay their bills. It and other carriers signed a pledge with the Federal Communications Commission not to cut off service for 60 days or charge late fees to consumers facing pandemic-related hardships.

“We were in a position of not really having any idea what the impact of the social distancing and shelter-in-place would [be],” said Matt Ellis, Verizon’s chief financial officer. Verizon hasn’t disclosed how many customers have stopped paying, but Mr. Ellis said many consumers continue to pay their wireless bill even when they can’t pay their car loans or mortgages.

Verizon’s Progress towards their 2020 Goals:

Strengthen & Grow Core Business

•Driving digital sales through enhanced experiences

•Strengthened mmWave spectrum holdings through Auction 103

Leverage Assets to Drive New Growth

•34 Ultra wideband cities live; 5G network build on plan

•BlueJeans acquisition announced in April expands portfolio

Drive Financial Discipline & Strength in Balance Sheet

•Disciplined spend with focus on operational efficiencies

•Scenario planning to navigate uncertainties

Infuse a Purpose-Driven Culture

•Continuing initiatives to drive meaningful difference to society

•Leading brand perception related to COVID-19 response

…………………………………………………………………………………………………………………………………………………………….

CEO Hans Vestberg (English grammar is not very good and not corrected here) talked up VZ’s 5G and fiber plans on today’s earnings call:

When it comes to leverage our assets and we’re growing in the future our 5G plans and our fiber plans the build out of that are on plan. We were also a little bit ahead of plan when we ended the first quarter. And can I report still today we are on plan with the 5G and fiber. Of course, our challenge is out there when it comes to COVID-19 and so on.

But our team are finding new ways and innovative ways to actually do the deployment. There are ways of dealing with approvals from the municipalities set by new ways. And we have great collaborations from many of the municipalities to do it. There might be problems going forward but I am also confident that my team are very innovative in the field and see that we continue to drive hard on this.The 5G is still very much in the middle the center of our strategy. And as you heard me saying before we’re in the middle of the execution and we’re not halting that. We’re keeping it up all the time and the team is doing great work there. And we see opportunity with 5G going forward both with building all the cities, the 5G mobile edge compute as well as making this nationwide 5G still this year.

On top of that we increased the CapEx guidance in the quarter because we felt that it was a good time for us to continue to see that we have robust networks as we went into a moment in time we don’t really know how the network would be used. At the same time of course sending a message that we think is a good return on investment on that incremental CapEx.

Editor’s Note: We find it beyond unbelievable that Verizon is such a 5G cheerleader, especially CEO Hans Vestberg, when the company is not even a member of 3GPP and doesn’t attend 3GPP (5G architecture and 5G core) or ITU-R WP5D meetings where IMT 2020 radio aspects (RIT/SRIT) are being standardized. Yet their U.S. network provider competitors are all 3GPP members and attend 3GPP as well as ITU meetings. The competitor list includes AT&T, T-Mobile, Dish, Comcast, Charter, C-Spire, and other network service providers.

Verizon CFO Matt Ellis said:

For adjusted EPS, we are revising our original guidance of 2% to 4% growth and are now guiding to a range of negative 2% to positive 2% change from the prior year. Our new estimated range is based on a scenario that assumes significant headwinds prevail throughout the second quarter.

We have limited visibility into the second half of the year, which will depend on various potential operating environments. We will continue to assess the impact of COVID on our business, including our bad debt reserve and expect to provide an update on our next earnings call based on how things develop between now and then.

You can watch Verizon’s earnings call webcast here.

…………………………………………………………………………………………………………………………………………………………….

References:

https://www.verizon.com/about/investors/quarterly-reports/1q-2020-earnings-conference-call-webcast

https://www.wsj.com/articles/verizons-wireless-business-slowed-by-coronavirus-11587730044