Month: February 2021

Report Linker: 5G Security Market to experience rapid growth through 2026

Report Linker forecasts that the global 5G security market will grow from USD 580 million in 2020 to USD 5,226 million by 2026, at a Compound Annual Growth Rate (CAGR) of 44.3% during the forecast period.

The 5G security market is gaining traction due to rising security concerns in the 5G networks, increasing ransomware attacks on IoT devices, rising attacks on critical infrastructure, and increasing IoT connections paved way for mMTC with enhanced security requirement. However, high cost of 5G security solutions will restrain the adoption by SMEs.

The implied negative flipside for operators and enterprises, of course, is that more money will have to be spent on tackling 5G vulnerabilities. The report pointedly notes that the high cost of 5G security solutions will limit adoption by SMEs.

Based on solution type, the DDoS protection solution segment is expected to grow with the fastest growth rate during the forecast period

The DDoS protection segment is projected to grow with the most rapid growth rate in 2020 to 2026.Enterprises use DDoS protection and mitigation solutions and services for adaptive defense against DDoS attacks.

These attacks further affect the confidentiality, integrity, and availability of resources, which may result in billion-dollar losses for enterprises.

Enterprises segment to grow at the highest CAGR during the forecast period

Enterprises are undergoing digital transformation across different industries. Businesses are in various stages of implementing new technologies to develop new solutions, improve service delivery, increase operational efficiency, reduce cost, gain competitive advantage, and meet rising customer expectations. 5G will soon make it into the list of technologies enterprise will consider, with standalone 5G solutions that will enable various new industrial applications, such as robotics, big data analytics, IIoT and AR/VR in engineering and design, as well as new ways to provide remote support and training. As a result, enterprises will need 5G security mechanism to secure the entire network, applications, and devices.

Asia Pacific (APAC) region to record the highest growth and also account for largest markety share in the 5G security market

APAC region is set to dominate 5G, edge computing, blockchain, and 5G security technology, due to its size, diversity, and the strategic lead taken by countries, including Singapore, South Korea, China, Australia, and Japan.These countries have always supported and promoted industrial and technological growth.

Also, they possess a developed technological infrastructure, which is promoting the adoption of 5G security solutions across all industry verticals. Moreover, the region has become the center of attraction for major investments and business expansion opportunities.

While Reportlinker.com praises APAC for leading in 5G security, Europe is way behind if a recent report according to a report from the European Court of Auditors (ECA).

A year-long ECA probe into how European Union (EU) member states are dealing with 5G security found that while “member states have started to develop and implement necessary security measures to mitigate risks, they seem to be progressing at a different pace.”

More worryingly, Annemie Turtelboom, the ECA member leading the audit, indicated that some EU countries were bypassing supplier security checks in order to speed up 5G rollout.

………………………………………………………………………………………..

Companies such as ZTE (China), Samsung (South Korea), and Huawei (China) are heavily investing in the upcoming 5G technology and are initiating field trials together with some of the leading mobile service carriers, such as China Telecom (China), KT (South Korea), SK Telecom (South Korea), China Mobile (China), SoftBank (Japan), and China Unicom (China).

• By Company Type: Tier 1 – 62%, Tier 2 – 23%, and Tier 3 – 15%

• By Designation: C-level – 38%, Directors – 30%, and Others – 32%

• By Region: North America – 40%, Europe – 15%, APAC – 35%, and Rest of the World (RoW)– 10%

This research study outlines the market potential, market dynamics, and major vendors operating in the 5G security market. Key and innovative vendors in the 5G security market include A10 Networks (US), Akamai (US), Allot (Israel), AT&T (US), Avast (Czech Republic), Check Point (US), Cisco (US), Clavister (Sweden), Colt Technology (UK), Ericsson (Sweden), F5 Networks (US), ForgeRock (US), Fortinet (US), G+D Mobile Security (Germany), Huawei (China), Juniper Networks (US), Mobileum (US), Nokia (Finland), Palo Alto Networks (US), Positive Technologies (UK), Radware (Israel), Riscure (The Netherlands), Spirent (US), Trend Micro (Japan), and ZTE (China).

Research coverage

The market study covers the 5G security market across different segments. It aims at estimating the market size and the growth potential of this market across different segments based on component (solutions and services), network component security, architecture, end user, deployment type, vertical, and region.

The study also includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

References:

https://www.lightreading.com/security/5g-security-market-set-to-boom-report/d/d-id/767415?

Telefonica in 800 Gbps trial and network slicing pilot test

With this initiative the intention is also to begin building services for customers to be marketed via Telefónica’s 5G network. The project will thus enable Telefónica to obtain key results that will serve to drive the ecosystem and promote the interoperability and standardisation of this technology with a view to its marketing towards the end customer. Some of the sectors that can benefit the most from Network Slicing are the State Security Corps and Forces, media and communication, cars, industry and hotels.

5G Network Coverage Increases in Saudi Arabia; STC Selects Ericsson as Managed Service Provider

Saudi Arabia’s Communications and Information Technology Commission (CITC) has announced that seven additional cities and provinces were covered by 5G services in Q4 2020, bringing the total to 51 cities and provinces in various regions of Saudi Arabia.

CITC’s quarterly ‘Meqyas’ report highlighted that Zain led in terms of 5G footprint in the Kingdom, covering 44 cities and provinces, followed by the Saudi Telecom Company (STC) with 22 and Mobily with 21 cities and provinces.

STC recorded the highest average 5G download speed of up to 342.35Mbps, followed by Zain (338.12MB) and Mobily (220.86Mbps). The Meqyas report also revealed that Zain has deployed 5G services in all regions of the Kingdom except Makkah, in which Mobily recorded the best performance during Q4 2020.

Separately, STC announced the deployment of its 5G network in 47 cities around the country. It’s part of its plan to strengthen its leadership in reliable mobile coverage and deploy the largest 5G network in the Middle East. According to STC, phase 2 of the plan will increase 5G network coverage in Saudi Arabia to over 71 cities across the country.

As part of its infrastructure enhancement, the FTTH fiber optic network is also going to be expanded. This will enable higher broadband speeds and services to home and business users. In addition, STC has also confirmed that it has been expanding its global Internet Gateway, progressively growing the capacity of the network.

Eng. Haithem Al Faraj, SVP, technology and operations, STC, said: “STC will continue to pursue an aggressive 5G expansion, together with growth in its advanced 4G network.”

STC has selected Ericsson as its managed services provider in Saudi Arabia. As part of the agreement, Ericsson will deploy Ericsson Operations Engine to strengthen STC’s network operations with the latest technology solutions to transform operations to a predictive and proactive automated operation.

Ericsson will deploy its latest Artificial Intelligence (AI) powered software suite and machine learning tools and capabilities to provide an automated end-to-end managed operations service. The Ericsson Operation Engine will support activities in Network Operation, IT Operations and Field Support and Maintenance for stc’s networks, covering technology domains from the core to access, including 5G.

The suite will further empower stc to maintain its network quality at the highest level and deliver the best user experiences via transition towards a data-driven and proactive identification of network and performance issues.

The agreement will enable STC to succeed in its operational efficiency and digitization objectives in support of the Saudi Vision 2030.

Bader Abdullah Allhieb, Operations Vice President, STCs, says: “We are committed to providing a futuristic network that enables world-class experience for our customers in Saudi Arabia and this agreement shows our commitment in this direction. We are confident that this partnership with Ericsson will strengthen STC’s operational capabilities to improve our people’s quality of life and contributing to the economic and social development of Saudi Arabia in line with Saudi Vision 2030.”

Mathias Johansson, Vice President and Head of Saudi Arabia and Egypt, Ericsson Middle East and Africa, says: “Today’s network managed services agreement demonstrates STC’s continued confidence in our end-to-end solutions and IT operations. Through Ericsson Operations Engine, we will be able to develop data-driven insights to deliver enhanced performance focused on end-user experience. We will continue to work closely with STC to ensure consumers, enterprises and society benefit from the new experiences, services, and capabilities enabled by 5G.”

STC said it will continue to pursue its market leadership in the field of new and advanced technologies to achieve a significant and comprehensive expansion of its 5G network, while also developing its advanced 4G network.

References:

https://www.commsupdate.com/articles/2021/02/12/citc-51-cities-in-saudi-arabia-covered-by-5g/

https://www.itp.net/94380-stc-to-deploy-phase-2-of-5g-in-71-saudi-arabia-cities#:~:text=STC

https://www.telecompaper.com/news/stc-deploys-5g-network-in-over-47-cities–1372282

http://www.saudiarabiapr.com/pr.asp?pr=8911773

LightCounting: AT&T relinquishes leadership in network virtualization

AT&T made a lot of noise about its six-year push to virtualize 75% of its network functions, a goal it claims it reached in September 2020. The debt plagued network operator earned praise for being so outspoken about its software defined network (SDN) effort earlier than its competitors.

However, something changed in the last few months, and signs suggest AT&T has relinquished its leadership role, according to LightCounting.

In a recent blog post, LightCounting suggests AT&T has relinquished its leadership role. First, John Donovan left AT&T in October 2019. Former CTO Chris Rice, who played a key role in AT&T’s SDN, virtualization and cloud efforts, left in August 2020. During that period, there were job losses at AT&T, but what wasn’t reported were cutbacks in research and some of the open networking projects that AT&T had initiated. And its active blog detailing its latest network transformation developments is largely about open networking developments it is involved in with other companies, rather than its own initiatives.

Could it be that AT&T set too fast a pace and the industry pack caught it up? Or is greater financial pragmatism needed to tackle its debt following its two huge media company acquisitions in recent years?

Many leading CSPs are pursuing network transformation, in addition to AT&T, but the industry has a few visionaries and AT&T until recently served this valuable role. It remains to be seen if that will continue.

“If any one operator has sort of driven the whole vision of disaggregated, that software-defined networking, virtualization, white boxes, this is something that AT&T has pushed more than any other operator, and they put it into effect as well,” Roy Rubenstein, consultant at LightCounting, told SDxCentral in a phone interview.

“Its contributions, the various open source projects they then contributed to these open source organizations has been significant,” he said, adding that AT&T was, at least until late last year, “a real trailblazer.”

Grant Lenahan, partner and principal analyst at Appledore Research, has a less complimentary view of AT&T’s stature and success on virtualization. “It’s not clear how far ahead AT&T ever were,” he wrote in response to questions.

………………………………………………………………………………………………

This author’s checks with AT&T employees (in 2019 and 2020) indicated that vendor proprietary boxes were still in AT&T Central Offices and Data Centers. They had NOT been replaced by network virtualization software running on compute servers! The big exception was AT&T’s deployment of “dis-aggregated core routers” running Israeli unicorn DriveNets network OS and Network Cloud solution software. The DriveNets software then connects into AT&T’s centralized SDN controller that optimizes the routing of traffic across the core.

“We chose DriveNets, a disruptive supplier, to provide the Network Operating System (NOS) software for this core use case,” AT&T said in a September 28, 2020 story on its website.

“We are thrilled about this opportunity to work with AT&T on the development of their next gen, software-based core network,” said Ido Susan, CEO of DriveNets. “AT&T has a rigorous certification process that challenged my engineers to their limits, and we are delighted to take the project to the next level with deployment into the production network.”

…………………………………………………………………………………………….

“There’s definitely been a change in terms of AT&T’s own vocality and in a sense the industry has lost an important evangelist of this,” Rubenstein said.

While AT&T’s 75% milestone suggests it still has another 25% to go, that math doesn’t really add up, according to Rubenstein. The operator has effectively virtualized everything it intends to operate with software in the core of its network and the remaining 25% represents network functions or services that will just be operated to the end of their life and then decommissioned, he said.

AT&T’s decision to frame its virtualization journey on a percentage basis was also an over simplification of the work involved and objectives it achieved, Lenahan explained, adding that most operators use this framework to make their results appear more flattering.

“It’s very unclear and early announcements were unlikely or unrealistic,” he added “Solid, well understood metrics would be really useful” to gain a better understanding of what exactly has been virtualized.

The biggest bottleneck on virtualization is the service life of equipment, and that’s why Appledore Research believes the virtualization journey will span roughly two decades throughout the industry, according to Lenahan. “It’s also worth pointing out that the entire idea of virtualization flies in the face of decades of [99.999% reliability] thinking and deep, precise control of all assets, and therefore is a cultural shift,” he said.

While AT&T’s 75% milestone suggests it still has another 25% to go, that math doesn’t really add up, according to Rubenstein. The operator has effectively virtualized everything it intends to operate with software in the core of its network and the remaining 25% represents network functions or services that will just be operated to the end of their life and then decommissioned, he said.

AT&T’s decision to frame its virtualization journey on a percentage basis was also an over simplification of the work involved and objectives it achieved, Lenahan explained, adding that most operators use this framework to make their results appear more flattering.

“It’s very unclear and early announcements were unlikely or unrealistic,” he added “Solid, well understood metrics would be really useful” to gain a better understanding of what exactly has been virtualized.

The biggest bottleneck on virtualization is the service life of equipment, and that’s why Appledore Research believes the virtualization journey will span roughly two decades throughout the industry, according to Lenahan. “It’s also worth pointing out that the entire idea of virtualization flies in the face of decades of [99.999% reliability] thinking and deep, precise control of all assets, and therefore is a cultural shift,” he said.

……………………………………………………………………………………

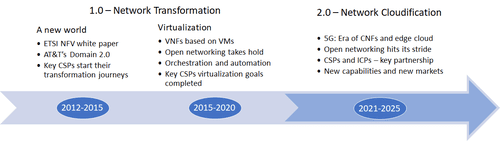

LightCounting argues that CSPs have just completed phase one of network transformation. The next phase extends the cloud to the network edge and embraces cloud-native software practices for network functions. Telcos are now moving from Network Transformation phase 1.0 to 2.0 as per this figure:

5G is the catalyst for Phase 2.0. 5G has code-based network functions and SDN built in, and it brings capabilities that will enable new services and applications, so its rollout is a natural point to introduce new technologies. The opening up of the radio access network–Open RAN–which includes 5G, embraces all the techniques associated with network transformation.

5G is the catalyst for Phase 2.0. 5G has code-based network functions and SDN built in, and it brings capabilities that will enable new services and applications, so its rollout is a natural point to introduce new technologies. The opening up of the radio access network–Open RAN–which includes 5G, embraces all the techniques associated with network transformation.

More information on the report is available at:

https://www.lightcounting.com/products/January2021_NetworkTransformation/

Resources:

https://about.att.com/story/2020/open_disaggregated_core_router.html

U.S. Government Multi-Cloud Competition; Telus selects Google Cloud

Amazon, Microsoft, and Google are competing to win a part of the U.S. federal government’s $7 billion cloud spending. The Biden administration’s IT push is going to create opportunity for the major cloud providers.

AWS still has the lead, but Microsoft is so popular one analyst called it an ‘agency’ of the Pentagon. Google is also ramping up its cloud management tool Anthos and betting on AI for defense contracts.

The federal government has been investing in cloud computing for years — starting with Obama’s Cloud First policy in 2010 all the way to Trump’s Cloud Smart strategy in 2018. But as the pandemic has accelerated the pace of technological adoption and change, the need for cloud has become even more acute, especially for federal agencies that don’t yet have it. Biden’s proposed $1.9 trillion stimulus package included $10 billion for tech initiatives — underscoring their importance to the nation’s recovery — and signaling to government contractors that more federal dollars may be going their way. (Though the latest version of the package had much of that funding cut, lawmakers are actively seeking to add it back to future bills.)

Analysts estimate the federal government spent $6.6 billion on cloud in the 2020 fiscal year, an increase from $6.1 billion the previous year, and that number will grow.

Shawn McCarthy, research director for IDC government insights, told Insider he expected the federal government’s cloud spend to increase by 7.1% from fiscal year 2020 to 2021. Marquee contracts like the Department of Defense’s $10 billion deal with Microsoft to build the Joint Enterprise Defense Infrastructure (JEDI) cloud have drawn even more attention to the federal cloud market, which analysts say is an opportunity for Amazon, Microsoft, and Google to flex their strength.

The government needs their expertise in cloud computing and, increasingly, their support for emerging technologies like artificial intelligence and 5G.

Of the major cloud providers, analysts said that Amazon Web Services is considered the leader in the overall cloud market, and the same holds true in the public sector. But Microsoft has caught up in the federal market, especially with wins like the JEDI cloud contract, meanwhile Google is taking a different tack — betting on multi-cloud management and AI. Here’s a closer look at how the three big clouds stack up in the federal sector. Amazon has a huge head start, but it can’t be complacent Andy Jassy AWS CEO Andy Jassy, who is set to become Amazon CEO, helped oversee the cloud unit’s rise.

Mike Blake/Reuters Analysts agreed that Amazon is the one to beat in the public sector cloud market, just as it is within the larger industry. “AWS had the biggest lead out of the gate,” McCarthy said, and it has “an extremely deep bench of third-party providers that are available via their dedicated government solutions marketplace.” Amazon landed its first major deal with the government in 2013, when it won a $600 million contract to build a custom cloud for the CIA. At the time, cloud computing was considered less secure than local servers — yet the Amazon deal set a precedent, showing that Silicon Valley’s cloud innovation could fit the federal government’s needs, and led AWS to become the first commercial cloud authorized to house all levels of classified government data. But in 2019, the CIA issued a new cloud contract worth billions, and jointly awarded the deal to AWS, Microsoft, Google, Oracle, and IBM — signaling a shift away from its previous single-cloud approach, and ending intelligence agencies’ reliance on a sole Silicon Valley cloud giant.

In a sign of things to come, Amazon lost the JEDI cloud contract to Microsoft the same year. Though JEDI’s future remains in flux because of Amazon’s ongoing legal protest, analysts said it proved Microsoft’s ascendance in the sector. Read more: As Pentagon warns it could abandon its $10 billion JEDI cloud with Microsoft, analysts say AWS could benefit.

“I think last year was kind of characterized by Microsoft catching up to Amazon,” said Chris Cornillie, a federal market analyst at Bloomberg Government.

Microsoft caught up to AWS, thanks to its cloud software Scott Guthrie Scott Guthrie, Microsoft’s executive vice president of cloud and AI, oversees Azure and was once described by an analyst as a “cloud visionary.” Stephen Lam/Getty Images Analysts also agreed that Microsoft isn’t catching up to Amazon anymore — they’re nearly neck-and-neck in the federal market now. McCarthy said Microsoft succeeded “thanks to the popularity of Microsoft 365 and Microsoft Azure.” Microsoft 365 includes Office 365, the company’s line of productivity software, while Azure is its cloud computing service that more directly competes with AWS. Amazon doesn’t have a direct competitor to Microsoft 365, and focuses instead on its core infrastructure cloud platform. Cornillie told Insider Microsoft had done a good job of “leveling the playing field” with its JEDI win and a number of smart investments: working with OpenAI, linking up with Oracle for data interoperability, and a partnership with AT&T to facilitate 5G.

Last year, it launched new Azure Government cloud capabilities and announced it had achieved the highest authorization for handling sensitive government data, finally matching AWS. Within the Pentagon, which has the largest IT budget of any federal agency, one analyst said Microsoft is so entrenched that it has “basically become an agency of the Department of Defense.”

Microsoft 365 was chosen as the department’s sole software suite in a $4.4 billion deal called the Defense Enterprise Office Solutions (DEOS) contract, first awarded in 2019 and recently fast-tracked because of the pandemic. “Microsoft has really benefited in a lot of ways from the COVID-19 pandemic response effort,” Cornillie said, citing that it was also picked for a separate Pentagon initiative which rapidly deployed Microsoft Teams in the department’s Commercial Virtual Remote environment.

Microsoft 365 offers the company a convenient way to sell Azure cloud, plus other services like consulting and maintenance as a bundle, he said. And although the scope of Microsoft’s entanglement in the aftermath of the SolarWinds cyberattacks is still unfolding, analysts said it likely won’t suffer much reputational damage within the federal government.

Alex Rossino, a senior principal research analyst at government contracting research firm Deltek, told Insider that as the government increasingly pushes its security burden onto vendors, big cloud players will actually benefit. “The large cloud providers especially have the deep pockets to be able to make sure they provide the best kind of upgraded security,” he said.

“So I think that’s a selling point for them when it comes to the federal government; they can actually use the SolarWinds example as a way to say, ‘Well, look, we can make sure that doesn’t happen.'” Google is banking on AI and multi-cloud Google Cloud CEO Thomas Kurian at Google Cloud Next 2019 Google Cloud CEO Thomas Kurian has been credited with shoring up its enterprise business, and could help its play for government contracts. Insider Intelligence Though Google is still catching up to Amazon and Microsoft, and only recently spun up a large-scale dedicated government cloud, they are “a known entity and should become competitive,” said McCarthy.

Analysts also said Google is leveraging its strength in AI, a field the government is very interested in, and pushing Anthos, its tool for managing multiple clouds, to break into the federal market. Some big hires are evidence of this play: Cornillie said Google Cloud CEO Thomas Kurian, who has been running the unit with strategies inspired by his former employer Oracle, would help build up its enterprise business, while Joshua Marcuse, who heads the global public sector team and was recruited from the Defense Innovation Board (the Pentagon advisory board that was led by former Google CEO Eric Schmidt) would help with its AI push. Marcuse previously led development of the Pentagon’s ethics AI principles, though that approach has since been criticized by the AI community and former Google AI researcher Meredith Whittaker for lacking accountability. Google’s renewed interest in working with the Defense Department comes after it dropped out of bidding for the JEDI contract in 2018, following employee protests over a controversial AI project called Project Maven. Google is hoping for a fresh start under Biden, and the Pentagon is too.

Cornillie said Google now views its AI prowess as helping open the door to new cloud contracts — taking a “if you want AI capabilities out of the box, it works best in our cloud” approach. However, its ambitions are limited by the fact that it doesn’t hold all security certifications required by the sector, he said.

Bringing in Todd Schroeder from Salesforce to lead global public sector digital strategy was another “smart move,” Cornillie said. Schroeder has emphasized multi-cloud, open platforms, and AI as the future for federal cloud, which play to Google’s strengths. In 2019, Google introduced its Anthos product, which lets customers build and manage their applications across Google Cloud, AWS, and Microsoft Azure.

Banking on multi-cloud as the future (a reasonable bet, as the Department of Homeland Security just issued a $3.4 billion multi-cloud contract), Google is hoping its cloud management tool will become indispensable.

A new $3.4 billion DHS cloud contract could kick off a fierce battle between cloud giants like Amazon and Microsoft, analysts say. There are signs its product is sticking: Google has already done some pilots with Customs and Border Protection to optimize workloads across Azure, AWS, and Salesforce, Cornillie said, and the agency is now competing a large cloud migration contract that has Anthos’s multi-cloud management function explicitly written in.

IBM, Oracle, and smaller players are not to be discounted are IBM and Oracle, analysts said. They’ve also been steadily making progress, but “for reasons of security certifications and for reasons of the maturity of their tech, they’re still looking for niche components or niche contracts,” Cornillie said. “They haven’t been able to land any really big fish yet.”

Both companies bid for the JEDI contract, and both lodged formal protests after being eliminated from the running. But they haven’t given up on the market: Oracle made its Cloud Marketplace available for government customers to run software in its cloud in January, while IBM acquired open-source cloud provider Red Hat for $34 billion in 2018 — a move analysts at the time were excited by, saying IBM could make inroads as a hybrid cloud provider.

Rossino said smaller cloud players could enter the U.S. federal government’s cloud market by providing cloud management services:

“If they have capabilities that allow for the automation of cloud management, that’s really important too,” he said. But still, it’s a strategy borne of necessity rather than creativity. “The Microsoft’s, Amazon’s, they’ve already locked up the infrastructure market. There’s almost excess capacity out there,” he added.

………………………………………………………………………………………………………..

Telus Selects Google Cloud in 10 year Deal:

Google Cloud on Tuesday announced a new, 10-year strategic partnership with Telus, the Canadian telecommunications company. The two companies plan on collaborating on new services and products for a handful of key industries, including healthcare, agriculture, security and connected home. Telus also plans to modernize its own IT and network with the help of the Google Cloud Platform.

It’s the latest deal to showcase Google’s efforts to cultivate more cloud business within the telecom sector. Last year, Google outlined a multi-pronged pitch to the telecommunications industry that includes industry-specific solutions like Anthos for Telecom.

Together, Google and Telus plan to develop services and products that use AI to better leverage data within specific verticals. For instance, a couple areas of focus include new collaboration solutions for healthcare providers, as well as supply chain traceability tools for the food and agriculture sector.

Meanwhile, Telus’ own wireless and wireline services will get an upgrade as part of the deal. Leveraging Anthos, Google Cloud’s managed application platform, Google will partner with Telus to deliver 5G services and Multi-Access Edge Computing (MEC). Telus also plans on using Google Cloud Contact Center AI to upgrade its customer service.

“Our strategic partnership with Google will propel our digital leadership across the communications technology, healthcare and agriculture sectors, whilst amplifying our Customers First priority, redefining how service is delivered in Canada and globally,” Telus CEO and President Darren Entwistle said in a statement.

References:

https://www.businessinsider.com/amazon-microsoft-google-public-cloud-government-2021-2 (paywall)

https://cloud.cio.gov/strategy/

https://www.zdnet.com/article/canadian-telco-telus-signs-10-year-deal-with-google-cloud/

Oracle expands cloud portfolio; Key themes for cloud in 2021

Oracle has expanded its hybrid cloud portfolio with Oracle Roving Edge Infrastructure, a new offering that brings core infrastructure services to the edge with Roving Edge Devices (REDs), namely ruggedized, portable and scalable server nodes. Using Oracle Roving Edge Infrastructure, organizations can run cloud workloads wherever they need them, even in remote locations. The new service is part of Oracle’s hybrid cloud portfolio.

The devices are effectively a mobile extension of a customer’s Oracle Cloud Infrastructure (OCI) environment. REDs can run as a single node or in clusters of five to 15 nodes. The hardware inside a RED device includes 40 CPUs, an Nvidia T4 GPU, 512 GB RAM and 61 TB of storage. The devices start at $160 per node per day.

With a RED device, a customer should be able to run cloud applications and workloads in the field, including machine learning inference, real-time data integration and replication, augmented analytics and query-intensive data warehouses.

A customer can order a RED from the Oracle Cloud console, provision it — adding VMs and object storage from the console — and have it shipped. Even in remote areas where connectivity is an issue, customers can use the RED to connect to local sensors and execute applications.

There are some clear use cases for the RED devices, such as in the oil and gas industry, where organizations may currently be relying on bespoke servers. And Oracle has already signed up the US military as an early customer.

The devices should also facilitate new use cases for cloud applications, Ross Brown, VP for Oracle Cloud Infrastructure, said to ZDNet. Customers, he said, “are coming to us with things like 5G-connected applications where processing on local makes a lot of sense. This notion of high-speed data collection and high-speed data capture in a remote metro area, across a city or whatnot, these become good use cases for” the RED.

While Oracle’s cloud infrastructure business still trails far behind Amazon Web Services, Microsoft Azure and Google, it’s picking up momentum. Oracle landed some major customers in 2020, including Zoom.

The database giant plans to catch up in the cloud in part by engineering hardware purpose-built for enterprise applications to run in the cloud — RED devices are an example of that, Brown said.

Last year, Oracle expanded its hybrid cloud portfolio with Dedicated Region Cloud@Customer — a fully-managed service brings all of Oracle’s public cloud services directly to a customer data center. Its hybrid offerings also include Oracle Exadata Cloud@Customer and Oracle VMware Cloud Solution.

The software company currently has 29 Oracle Cloud regions with plans to have 36 live by the mid-2021. They no longer talk about Sun Micro or the SPARC microprocessor that was supposed to give them a competitive edge.

……………………………………………………………………………………..

Key themes for 2021 include:

- The COVID-19 pandemic and the move to remote work and video conferencing are accelerating moves to the cloud. Enterprises increasingly are seeing the cloud as a digital transformation engine as well as a technology that improves business continuity. As work was forced to go remote due to stay-at-home orders, tasks were largely done on cloud infrastructure. Collaboration tools such as Microsoft Teams and Google Meet became cogs in the companies’ broader cloud ecosystem. Zoom not only lands subscription revenue, but also runs on cloud providers such as AWS and Oracle.

- Multicloud is both a selling point and an aspirational goal for enterprises. Companies are well aware of vendor lock-in and want to abstract their applications so they can be moved across clouds. The multicloud theme is being promoted among legacy vendors that have created platforms that can plug into multiple clouds — often with a heavy dose of VMware or Red Hat. (See: Multi-Cloud: Everything you need to know about the biggest trend in cloud computing and Multicloud deployments become go-to strategy as AWS, Microsoft Azure, Google Cloud grab wallet share),

- The game is about data acquisition. The more corporate data that resides in a cloud the more sticky the customer is to the vendor. It’s no secret that cloud computing vendors are pitching enterprises on using their platforms to house data for everything from analytics to personalized experiences.

- Artificial intelligence, analytics, IoT, and edge computing will be differentiators among the top cloud service providers — as will serverless and managed services.

- Every flavor of cloud vendor wants to be a management layer to manage your other clouds. Public cloud vendors such as Google Cloud Platform and AWS have offerings to manage various cloud services. Traditional enterprise vendors such as Dell and HPE do too. Which platform becomes that “single pane of glass” for cloud management will be positioned well.

- Sales tactics that play to fear, uncertainty, and doubt will be the norm. Right around AWS re:Invent, there appeared to be a mindshare battle in the press as the big three sniped at each other across multiple industries. Google Cloud has been hiring executives to sell into industries and has ramped its Anthos hybrid cloud effort to close its AWS and Azure sales gap. (See: What is cloud computing? Everything you need to know)

- There’s a sales war happening by industry. Cloud providers are going vertical to corner industries. Gartner’s Magic Quadrant report on public cloud providers noted that the “capability gap between hyperscale cloud providers has begun to narrow; however, fierce competition for enterprise workloads extends to secondary markets worldwide.” Indeed, the financials from AWS, Microsoft Azure, and Google Cloud have all been strong.

References:

Oracle expands hybrid cloud options with Roving Edge Devices | ZDNet

Eric Schmidt: FCC C-Band Auction Dooms U.S. 5G Future

In an opinion piece published in the Financial Times (paywall applies), former Google CEO Eric Schmidt, former CEO of Google, said that the FCC’s C band auction would threaten U.S. telcos by drastically increasing their debt loads. “It is a digital setback that America and its allies can ill-afford,” Schmidt said. Here are other excerpts from Schmidt’s FT op-ed:

FCC Auction 107 issued 280MHz in the valuable “C-Band” spectrum (3.7GHz-3.98GHz) — the ideal frequencies for 5G — to mobile telecommunications companies for network development.

But it imposed no meaningful requirement to build necessary network infrastructure. The massive sums winners paid for the spectrum will reduce their financial capacity to actually use it. Instead, it will probably result in disinvestment and downsizing.

At the same time, $81bn is merely a trifle for the U.S. government, equivalent to less than a month of US debt issuance and the money is unlikely to be spent on the 5G network the country needs. The outcomes are predictable: Americans will face higher prices and weaker digital services — yesterday’s internet tomorrow.

That is what happened when European telecoms companies paid over the odds during the 3G auctions of the early 2000s. Europe is still recovering from its lost digital decade. At stake are not just internet speeds but preserving prosperity. Today’s leading technology companies are American because U.S. companies built the core components of high-speed data infrastructure in the 4G LTE era, which meant their software was positioned to succeed. That is not the case for 5G.

Only 24 per cent of Europeans had access to a 5G network last autumn. US 5G is more marketing than a true step change in data speeds. In contrast, China will soon have a national network with speeds of 1 gigabit a second. With China’s head start, the next generation of technology giants — and the products and services they build — are not going to be European or American but Chinese.

My research team estimates that a gigabit C-band network covering 80 per cent of Americans will require 1m new cell sites and cost $70bn to build. Without it there will be no 5G, and no base on which to build 6G. America’s digital economy will become an also-ran. We need aggressive, innovative strategies to prompt rapid infrastructure buildout. It will show the world that there are viable alternatives to Chinese digital hegemony.

Here are three ways to do it:

- Congress should use the proceeds of Auction 107 for a special data infrastructure fund to provide direct aid to states that build physical 5G infrastructure.

- The money could be allocated to promote rapid and equitable buildout.

- The foregone revenue would be recouped by the documented economic boost brought by higher data speeds.

If the FCC auctions more spectrum, it should insist on getting infrastructure (built by the winning bidders). A true 5G network will require more than the C-Band auction’s 280MHz of spectrum.

Japan, China, South Korea, the UK and Canada will assign an average of 660MHz of mid-band spectrum each for 5G by 2023. Future auctions must set stringent build requirements, with penalties for underperformance.

Pursue alternatives to auctions. The defence department has proposed sharing government-controlled spectrum with commercial providers if they build infrastructure quickly.

Auction 107 has put what could be the penultimate nail in the coffin of U.S. global technology leadership. Policymakers must pursue all available means to bolster digital infrastructure rather than focusing on filling government coffers.

……………………………………………………………………………………………..

Although the identity of bidders and how much they’ve committed to spend will not be revealed until the assignment phase of Auction 107 is completed, there are signs operators shelled out much more than they anticipated.

Analysts at Credit Suisse, for example, reckon that AT&T, T-Mobile and Verizon will need to increase their aggregate debt load by a quarter, to $400 billion, to finance their expected purchases.

Ed Cholerton, who was recently promoted to Nokia’s president for North American customer experience, said, “Countries that seek to pad the treasury with these license fees hold back deployments and put themselves at disadvantage to China and others who don’t go down this path.”

Analysts at New Street Research have most recently estimated that AT&T would spend $24 billion on C-band, with Verizon estimated at $29 billion and T-Mobile at $13 billion. Meanwhile, analysts at Cowen have estimated AT&T’s C-band spend at $20 billion; Verizon’s at $35 billion; and T-Mobile at $10-15 billion.

AT&T recently filed an SEC Form 8-K, indicating that it has secured a $14.7 billion term loan credit with Bank of America, and that the purpose of the loan may include “financing acquisitions of additional spectrum.”

Schmidt Futures estimates that a gigabit C-band network, covering 80% of Americans, will require 1 million new cell sites and cost around $70 billion to build. “Without it there will be no 5G, and no base on which to build 6G,” said Schmidt. “America’s digital economy will become an also-ran.”

…………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.ft.com/content/dca96eaf-8262-42d8-a95f-d255642e9c7a

https://www.fiercewireless.com/5g/nokia-s-head-u-s-sales-worries-about-c-band-costs

Analysis: FCC’s C band auction impact on U.S. wireless telcos

Assessment of COVID-19 impact on telecom industry; C-Band Spectrum Update

Strategy Analytics: Global sales of 4G, 5G-enabled PCs rise 70% in 2020

Global sales of cellular-enabled mobile PCs grew by 70% to an annual record of over 10 million units for the first time in 2020 as home workers sought improved connectivity in response to the closure of office facilities during the Covid-19 pandemic, according to an analysis from Strategy Analytics.

North America accounted for nearly half of 3G, 4G and 5G-enabled PC shipments, while Europe and Asia-Pacific accounted for 45%. The researchers estimate that more than 26 million cellular-enabled PCs are now in use worldwide, an increase of 25 percent in twelve months.

While 4G-LTE dominated the market in 2020, accounting for 97% of cellular-enabled PC shipments, 5G notebook launches in 2021 are showing a greater diversity in price points, form factors and vendor participation, the study said. The researchers expect 5G to build its share towards 69 percent by 2025, a growth that will depend on improvements in customer education by vendors, carriers and retailers.

“What form new pricing plans take in the 5G world must be informed by a holistic view of the consumer, which devices they use where, and what they use them for,” says Chirag Upadhyay, Industry Analyst. “In the enterprise space, vendors, carriers and resellers must be able to explain how connected notebooks help save companies money in the field and help reduce security breaches compared to mobile hotspots or dongles.”

Eric Smith, Director, Connected Computing Devices, added: “We see this is a ‘when’ problem, not an ‘if’ problem. Cellular connected notebooks will become more commonplace over the next decade but the key to when that happens lies in how industry players introduce the idea to consumers. A clear view into how users choose cellular plans is crucial for vendors, carriers, and even retailers to understand how to better educate consumer segments of more cellular-embedded options.”

References:

Rakuten Communications Platform (RCP) defacto standard for 5G core and OpenRAN?

In Japanese, Rakuten stands for “optimism.” This philosophy lies at the core of the company’s brand. They may be the leader is selling 5G mobile core network specs and virtualization network software to global network operators in the absence of any ITU-T standards or 3GPP detailed implementation specs. [Please refer to References for more details, especially on the 3GPP Technical Specifications 23.501, 23.502, 23.503.]

Rakuten Communications Platform (RCP) has been sold to a total of 15 customers so far, according to the company’s mobile networking CTO Tareq Amin.

“We have already 15 global customers. A lot of people don’t know that the sales already started. And these are not small customers. Some of them are very, very massive,” he said this week during a virtual roundtable with members of the media. “I’m really delighted to see that we finally are reaching a stage where possibly in the next quarter or so we have a very large contract about the entire RCP stack.”

Regarding network performance, Amin explained that success factors are based on virtualization, standardization, optimization and automatizing. Combined, they lead to more cost efficiency, innovation, affordability and growth.

Rakuten Mobile was the first to deploy a large-scale OpenRAN commercial network and the first fully virtualized, cloud-native mobile network. And Amin refutes the perceived limitations of open radio access networks, arguing that Rakuten Mobile’s only limitation today is spectrum assets.

“With less than 20% of spectrum assets compared to our competitors, we are doing great. OpenRAN does not mean we have an average network; the truth is that we have a world-class network,” he added, explaining that once Rakuten Mobile moves from five to 20MHz, there will be a significant improvement in performance, while 5G deployment is also accelerating.

Despite launching a commercial service during a global pandemic, Rakuten Mobile already has received more than 2 million applications, with the majority of applications made online rather than in stores.

Rakuten appears to have broadened its focus a few months later when it announced it acquired operational support system (OSS) provider Innoeye for the “Rakuten Communications Platform (RCP).”

Rakuten officially took the wraps off RCP in October 2020 with an announcement that it was “bringing 5G to the word.” The business is based in Singapore and headed by Rabih Dabboussi, who previously worked at networking giant Cisco and cybersecurity company DarkMatter, according to his LinkedIn profile, before joining Rakuten in May 2020.

RCP essentially is the platform on which Rakuten is building its 4G and 5G networks in Japan. Amin explained that the offering consists of a number of different, interchangeable pieces including network orchestration, cloud management and artificial intelligence provided by a range of participating suppliers. RCP customers can pick and choose which parts of the platform they wish to use.

From Amin’s email to this author: “NEC/Rakuten 5GC is 3GPP based standardized software for network service and a de facto standard container basis infrastructure (“infrastructure agnostic”). It is a forward looking approach, but not proprietary.”

“NEC/Rakuten 5GC openness are realized by implementation of “Open Interface” defined in 3GPP specifications (TS 23.501, 502, 503 and related stage 3 specifications). 3GPP 5GC specification requires cloud native architecture as the general concept (service based architecture). It should be distributed, stateless, and scalable. However, an explicit reference model is out of scope for the 3GPP specification. Therefore NEC 5GC cloud native architecture is based on above mentioned 3GPP concept as well as ETSI NFV treats “container” and “cloud native”, which NEC is also actively investigating to apply its product.”

RCP essentially positions Rakuten against cloud giants like Amazon, Google and Microsoft, companies that are also selling cloud-based network management and operational services to network operators globally. Indeed, Microsoft last year acquired Affirmed Networks and Metaswitch Networks in pursuit of that goal.

Rakuten’s sales of RCP are directly linked to the success of the company’s ongoing 4G and 5G network buildouts in Japan. As a result, the company has been quick to address concerns over the performance of its mobile network in Japan which is both based on RCP.

“What we’ve done in 4G was enabling a world-first virtualized infrastructure. For 5G, we have a world-first containerized architecture, completely cloud-native radio access software that is (made up of) disaggregated micro services,” he explained.

“Between LTE, which is 40MHz and about 500MHz of spectrum assets, we think we have a very strong position to be able to increase capacity and demand.”

“We’re very confident about our business model and our business plan. And the idea to have zero churn in the network is also a unique value proposition that really emphasizes the critical role of the [Rakuten Mobile] ecosystem and the critical role of data for our long term viability,” said Amin.

References:

https://rakuten.today/blog/rakuten-scales-nationwide-mobile-network.html

https://www.etsi.org/deliver/etsi_ts/123500_123599/123501/16.06.00_60/ts_123501v160600p.pdf

Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS

Rakuten Mobile, Inc. and NEC to jointly develop the containerized standalone (SA) 5G core network

Another Open RAN Consortium: 5G Open RAN Ecosystem led by NTT Docomo

Japan wireless network operator NTT Docomo has partnered with 12 companies to create the ‘5G Open RAN Ecosystem.’ The companies are: Dell Technologies Japan, Fujitsu, Intel, Mavenir, NEC, NTT Data, Nvidia, Qualcomm Technologies, Red Hat, VMware, Wind River and Xilinx.

Their plan is to accelerate open radio access networks (Open RAN) and help enable global network deployment to serve diverse company and operator needs in the 5G era.

The O-RAN Alliance, which NTT Docomo has helped lead since its launch, has developed specifications and promoted products that allow operators to combine disaggregated base station equipment. Docomo has been actively developing the products for its own 4G/5G network in Japan.

Docomo will start talks with the 12 companies on accelerating open RAN introduction to operators.

Specifically, NTT DOCOMO’s target is to package best-of-breed RAN and to introduce, operate and manage them based on demands from operators considering open RAN introduction. By leveraging its years of activities in driving open network and know-how (which realized the world’s first open RAN for 5G using O-RAN), NTT DOCOMO is committed to maximize companies’ strengths in furtherance of the 5G Open RAN Ecosystem, and providing high-quality and flexible networks.

5G Open RAN Ecosystem:

Image courtesy of Viavi Solutions

………………………………………………………………………………………………….

Additionally, NTT DOCOMO will develop vRAN (virtualized RAN) with higher flexibility and scalability to further drive open RAN targeting commercialization in 2022. As COTS (Commercial Off-The-Shelf) servers can be used and dedicated equipment are not required for vRAN, it is possible to realize flexible and cost efficient networks. As of today, NTT DOCOMO will start discussion towards verification of vRAN, including performance assessments. As for the vRAN verification environment that will be constructed, opportunities for remote usage will be made available for operators themselves to freely conduct tests.

NTT DOCOMO says it will continue to cooperate with various industry partners towards accelerating wide adoption of open network, especially O-RAN and vRAN, which can cater for diversifying needs with flexibility and agility.

Comment & Analysis::

As with the two other Open RAN alliances (TIP Open RAN and O-RAN), the new 5G Open RAN Ecosystem does NOT have a formal liaison agreement with either 3GPP or ITU-R WP 5D (4G-LTE and IMT 2020 standards). Yet they are all trying to implement disaggregated network elements/equipment for 4G and 5G.

Last month legacy mobile operators Deutsche Telekom, Orange, Telefonica and Vodafone Group established a collaboration or Memorandum of Understanding (MoU) covering the rollout and development of open RAN technology, in a bid to ensure the continent keeps up with early pacesetters, namely Rakuten Mobile and NTT Docomo in Japan.

Today, Telecom Italia (TIM) said it has joined that initiative to support the development and implementation of Open RAN as the technology of choice for future mobile networks across Europe. TIM said it was committed to the development of innovative mobile network systems that used open virtualized architecture to facilitate increasingly agile, flexible, secure and functional 5G services.

However, there are no standards or 3GPPP specifications on Open RAN. Therefore, one must question if there will be different versions coming out of each consortium? Will the virtualized Open RAN architecture be implemented consistently? Will the 4G/5G endpoints be affected by different Open RAN implementations?

What is Open RAN is a good tutorial on this increasingly important subject.

References:

…………………………………………………………………………………………………

NTT DOCOMO to Establish a 5G Consortium in Thailand

NTT Docomo and an international group of several other companies have recently established a consortium to provide 5G services, first in Thailand and later in other Asia Pacific countries with the possible inclusion of additional partners. The initial members of the 5G Global Enterprise solution Consortium (5GEC) will be Activio, AGC, Advanced Wireless Network, Exeo Asia, Fujitsu, Loxley Public Company, Mobile Innovation, NEC Corp, NEC Networks & System Integration, NTT Communications, NTT Data Institute of Management Consulting, NTT Docomo, and NTT Ltd.

https://www.nttdocomo.co.jp/english/info/media_center/pr/2021/0203_00.html