Month: March 2025

Goldman Sachs: Big 3 China telecom operators are the biggest beneficiaries of China’s AI boom via DeepSeek models; China Mobile’s ‘AI+NETWORK’ strategy

According to a new research report from Goldman Sachs-China, the three major, state owned telecom operators (China Mobile, China Telecom, China Unicom) are quietly becoming the core beneficiaries of China’s AI boom. One reason is that, thanks to their deployment of China’s most extensive cloud infrastructure, they can serve other cloud companies as well as provide their own cloud services to their end user customers. They also enjoy the cost and scale advantages of owning their own data centers and bandwidth. For some IaaS companies, data center and connectivity together account for as much as 60% of total expense, according to Goldman-China.

Goldman analysts believe that telecom operators’ cloud businesses have obvious cost advantages compared to other cloud companies. Those are the following:

- The big 3 Chinese network operators have built their own Data Centers (DCs) and so do not rely on external DC service providers. They even provide DC services to other cloud companies such as Alibaba, which makes the IDC expenses of their cloud business lower.

- The bandwidth cost of operator cloud business is significantly lower than that of other cloud companies because operators use their own network infrastructure, while other cloud companies need to pay operators for bandwidth and private network fees connecting different data centers.

- For the IaaS cloud business, if external DC and bandwidth are used, data center costs (DC services and bandwidth) will account for a considerable proportion of the total cost of the cloud company. Goldman cites QingCloud Technology as an example, its data center costs (including cabinets, bandwidth, etc.) account for 50%-60% of its total costs.

Looking ahead, the telcos are strongly placed to take advantage of the DeepSeek AI boom, thanks to their early embrace of DeepSeek and the government’s push to promote AI among the state-owned enterprises that account for about 30% of operator revenue, Goldman argues. The report states, “the state-owned enterprise background makes the deployment of AI/Deepseek by government agencies and state-owned enterprises more beneficial to telecom operators.”

In the past two weeks, China’s three major operators have begun to help important customers deploy DeepSeek models. China Mobile supports PetroChina in deploying a full-stack Deepseek model; China Telecom provides the same service to Sinopec; and China Unicom cooperates with the Foshan Municipal Bureau of Industry and Information Technology. More importantly, the State-owned Assets Supervision and Administration Commission of the State Council (SASAC) launched the “AI+” action plan on February 21 to encourage Chinese state-owned enterprises to accelerate the development and commercial application of AI. According to Goldman Sachs research, government-related customers account for about 30% of telecom operators’ cloud revenue. Therefore, the deployment of AI/DeepSeek by government agencies and state-owned enterprises will clearly benefit telecom operators.

Separately, China Mobile announced at Mobile World Congress 2025 in Barcelona that it is leveraging artificial intelligence to transform telecommunications networks and drive unprecedented data growth while positioning itself at the forefront of AI-Native network innovation. China Mobile Executive Vice President Li Huidi outlined the company’s ambitious “AI+NETWORK” strategy in a keynote address titled “AI+NETWORK, Pioneering the Digital-Intelligent Future” during the Global MBB Forum Top Talk Summit on Sunday.

.jpg?width=1280&auto=webp&quality=95&format=jpg&disable=upscale)

Li Huidi, executive vice president of China Mobile, speaks at the Global MBB Forum Top Talk Summit at Mobile World Congress in Barcelona, Spain, March 2, 2025. (Photo/China Mobile)

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://wallstreetcn.com/articles/3741901 (Chinese)

https://www.telecoms.com/partner-content/china-mobile-unveils-ai-network-strategy-at-mwc

https://www.lightreading.com/ai-machine-learning/china-telcos-rush-to-embrace-deepseek

China Telecom’s 2025 priorities: cloud based AI smartphones (?), 5G new calling (GSMA), and satellite-to-phone services

Quartet launches “Open Telecom AI Platform” with multiple AI layers and domains

At Mobile World Congress 2025, Jio Platforms (JPL), AMD, Cisco, and Nokia announced the Open Telecom AI Platform, a new project designed to pioneer the use of AI across all network domains. It aims to provide a centralized intelligence layer that can integrate AI and automation into every layer of network operations.

The AI platform will be large language model (LLM) agnostic and use open APIs to optimize functionality and capabilities. By collectively harnessing agentic AI and using LLMs, domain-specific SLMs and machine learning techniques, the Telecom AI Platform is intended to enable end-to-end intelligence for network management and operations. The founding quartet of companies said that by combining shared elements, the platform provides improvements across network security and efficiency alongside a reduction in total cost of ownership. The companies each bring their specific expertise to the consortium across domains including RAN, routing, AI compute and security.

Jio Platforms will be the initial customer. The Indian telco says it will be AI-agnostic and use open APIs to optimize functionality and capabilities. It will be able to make use of agentic AI, as well as large language models (LLMs), domain-specific small language models (SLMs), and machine learning techniques.

“Think about this platform as multi-layer, multi-domain. Each of these domains, or each of these layers, will have their own agentic AI capability. By harnessing agentic AI across all telco layers, we are building a multimodal, multidomain orchestrated workflow platform that redefines efficiency, intelligence, and security for the telecom industry,” said Mathew Oommen, group CEO, Reliance Jio.

“In collaboration with AMD, Cisco, and Nokia, Jio is advancing the Open Telecom AI Platform to transform networks into self-optimising, customer-aware ecosystems. This initiative goes beyond automation – it’s about enabling AI-driven, autonomous networks that adapt in real time, enhance user experiences, and create new service and revenue opportunities across the digital ecosystem,” he added.

On top of Jio Platforms’ agentic AI workflow manager is an AI orchestrator which will work with what is deemed the best LLM. “Whichever LLM is the right LLM, this orchestrator will leverage it through an API framework,” Oomen explained. He said that Jio Platforms could have its first product set sometime this year.

Under the terms of the agreement, AMD will provide high-performance computing solutions, including EPYC CPUs, Instinct GPUs, DPUs, and adaptive computing technologies. Cisco will contribute networking, security, and AI analytics solutions, including Cisco Agile Services Networking, AI Defense, Splunk Analytics, and Data Center Networking. Nokia will bring expertise in wireless and fixed broadband, core networks, IP, and optical transport. Finally, Jio Platforms Limited (JPL) will be the platform’s lead organizer and first adopter. It will also provide global telecom operators’ initial deployment and reference model.

The Telecom AI Platform intends to share the results with other network operators (besides Jio).

“We don’t want to take a few years to create something. I will tell you a little secret, and the secret is Reliance Jio has decided to look at markets outside of India. As part of this, we will not only leverage it for Jio, we will figure out how to democratize this platform for the rest of the world. Because unlike a physical box, this is going to be a lot of virtual functions and capabilities.”

AMD represents a lower-cost alternative to Intel and Nvidia when it comes to central processing units (CPUs) and graphics processing units (GPUs), respectively. For AMD, getting into a potentially successful telco platform is a huge success. Intel, its arch-rival in CPUs, has a major lead with telecom projects (e.g. cloud RAN and OpenRAN), having invested massive amounts of money in 5G and other telecom technologies.

AMD’s participation suggests that this JPL-led group is looking for hardware that can handle AI workloads at a much lower cost then using NVIDIA GPUs.

“AMD is proud to collaborate with Jio Platforms Limited, Cisco, and Nokia to power the next generation of AI-driven telecom infrastructure,” said Lisa Su, chair and CEO, AMD. “By leveraging our broad portfolio of high-performance CPUs, GPUs, and adaptive computing solutions, service providers will be able to create more secure, efficient, and scalable networks. Together we can bring the transformational benefits of AI to both operators and users and enable innovative services that will shape the future of communications and connectivity.”

Jio will surely be keeping a close eye on the cost of rolling out this reference architecture when the time comes, and optimizing it to ensure the telco AI platform is financially viable.

“Nokia possesses trusted technology leadership in multiple domains, including RAN, core, fixed broadband, IP and optical transport. We are delighted to bring this broad expertise to the table in service of today’s important announcement,” said Pekka Lundmark, President and CEO at Nokia. “The Telecom AI Platform will help Jio to optimise and monetise their network investments through enhanced performance, security, operational efficiency, automation and greatly improved customer experience, all via the immense power of artificial intelligence. I am proud that Nokia is contributing to this work.”

Cisco chairman and CEO Chuck Robbins said: “This collaboration with Jio Platforms Limited, AMD and Nokia harnesses the expertise of industry leaders to revolutionise networks with AI.

“Cisco is proud of the role we play here with integrated solutions from across our stack including Cisco Agile Services Networking, Data Center Networking, Compute, AI Defence, and Splunk Analytics. We look forward to seeing how the Telecom AI Platform will boost efficiency, enhance security, and unlock new revenue streams for service provider customers.”

If all goes well, the Open Telecom AI Platform could offer an alternative to Nvidia’s AI infrastructure, and give telcos in lower-ARPU markets a more cost-effective means of imbuing their network operations with the power of AI.

References:

https://www.telecoms.com/ai/jio-s-new-ai-club-could-offer-a-cheaper-route-into-telco-ai

Does AI change the business case for cloud networking?

For several years now, the big cloud service providers – Amazon Web Services (AWS), Microsoft Azure, and Google Cloud – have tried to get wireless network operators to run their 5G SA core network, edge computing and various distributed applications on their cloud platforms. For example, Amazon’s AWS public cloud, Microsoft’s Azure for Operators, and Google’s Anthos for Telecom were intended to get network operators to run their core network functions into a hyperscaler cloud.

AWS had early success with Dish Network’s 5G SA core network which has all its functions running in Amazon’s cloud with fully automated network deployment and operations.

Conversely, AT&T has yet to commercially deploy its 5G SA Core network on the Microsoft Azure public cloud. Also, users on AT&T’s network have experienced difficulties accessing Microsoft 365 and Azure services. Those incidents were often traced to changes within the network’s managed environment. As a result, Microsoft has drastically reduced its early telecom ambitions.

Several pundits now say that AI will significantly strengthen the business case for cloud networking by enabling more efficient resource management, advanced predictive analytics, improved security, and automation, ultimately leading to cost savings, better performance, and faster innovation for businesses utilizing cloud infrastructure.

“AI is already a significant traffic driver, and AI traffic growth is accelerating,” wrote analyst Brian Washburn in a market research report for Omdia (owned by Informa). “As AI traffic adds to and substitutes conventional applications, conventional traffic year-over-year growth slows. Omdia forecasts that in 2026–30, global conventional (non-AI) traffic will be about 18% CAGR [compound annual growth rate].”

Omdia forecasts 2031 as “the crossover point where global AI network traffic exceeds conventional traffic.”

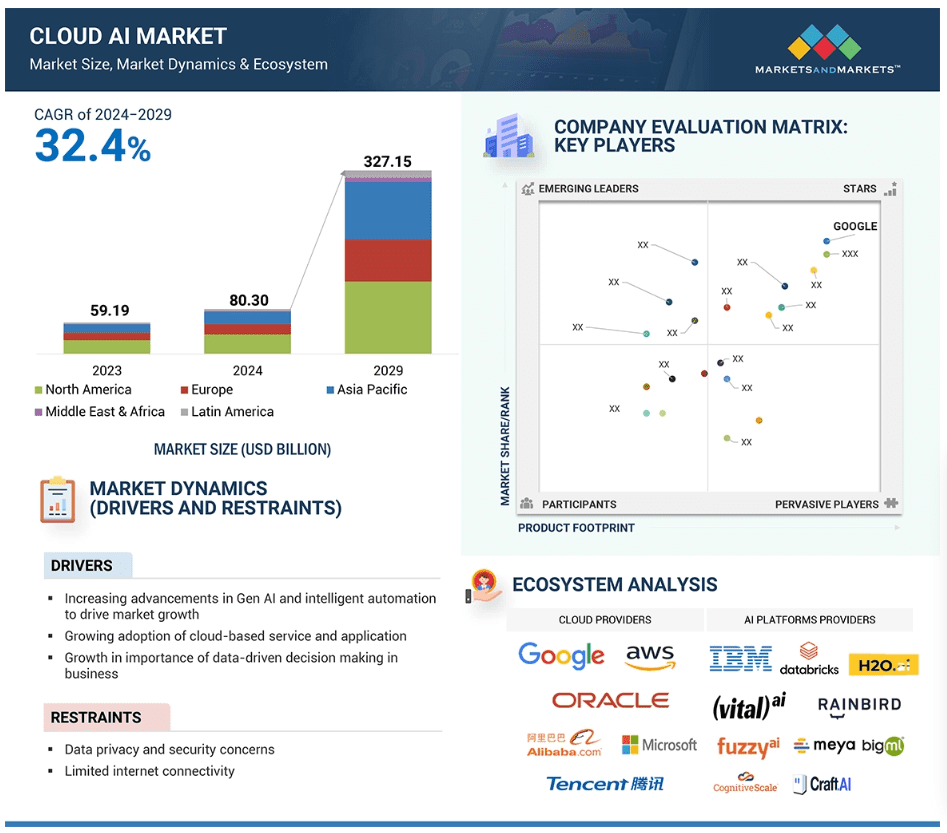

Markets & Markets forecasts the global cloud AI market (which includes cloud AI networking) will grow at a CAGR of 32.4% from 2024 to 2029.

AI is said to enhance cloud networking in these ways:

- Optimized resource allocation:

AI algorithms can analyze real-time data to dynamically adjust cloud resources like compute power and storage based on demand, minimizing unnecessary costs. - Predictive maintenance:

By analyzing network patterns, AI can identify potential issues before they occur, allowing for proactive maintenance and preventing downtime. - Enhanced security:

AI can detect and respond to cyber threats in real-time through anomaly detection and behavioral analysis, improving overall network security. - Intelligent routing:

AI can optimize network traffic flow by dynamically routing data packets to the most efficient paths, improving network performance. - Automated network management:

AI can automate routine network management tasks, freeing up IT staff to focus on more strategic initiatives.

The pitch is that AI will enable businesses to leverage the full potential of cloud networking by providing a more intelligent, adaptable, and cost-effective solution. Well, that remains to be seen. Google’s new global industry lead for telecom, Angelo Libertucci, told Light Reading:

“Now enter AI,” he continued. “With AI … I really have a power to do some amazing things, like enrich customer experiences, automate my network, feed the network data into my customer experience virtual agents. There’s a lot I can do with AI. It changes the business case that we’ve been running.”

“Before AI, the business case was maybe based on certain criteria. With AI, it changes the criteria. And it helps accelerate that move [to the cloud and to the edge],” he explained. “So, I think that work is ongoing, and with AI it’ll actually be accelerated. But we still have work to do with both the carriers and, especially, the network equipment manufacturers.”

Google Cloud last week announced several new AI-focused agreements with companies such as Amdocs, Bell Canada, Deutsche Telekom, Telus and Vodafone Italy.

As IEEE Techblog reported here last week, Deutsche Telekom is using Google Cloud’s Gemini 2.0 in Vertex AI to develop a network AI agent called RAN Guardian. That AI agent can “analyze network behavior, detect performance issues, and implement corrective actions to improve network reliability and customer experience,” according to the companies.

And, of course, there’s all the buzz over AI RAN and we plan to cover expected MWC 2025 announcements in that space next week.

https://www.lightreading.com/cloud/google-cloud-doubles-down-on-mwc

Nvidia AI-RAN survey results; AI inferencing as a reinvention of edge computing?

The case for and against AI-RAN technology using Nvidia or AMD GPUs

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search