Author: Alan Weissberger

GSA: 200 global operators offer 5G services; only 20 (Dell’Oro says 13) have deployed 5G SA core network

200 global network operators in 78 countries are offering 5G mobile and/or fixed wireless services at the end of 2021, according to the GSA. 487 operators in 145 countries are investing in 5G, including trials and spectrum license acquisitions, up from 412 operators at the end of 2020.

Notably, only 187 of the operators offering 5G services provide 5G mobile services, in 72 countries. The others are delivering 5G fixed-wireless access (even though it’s not an IMT 2020 use case). In total, 83 operators in 45 countries/territories have launched 3GPP-compliant 5G fixed-wireless access services.

Only 99 operators in 50 countries are investing already in 5G standalone (SA) core network, which includes those planning/testing and launched 5G SA networks).

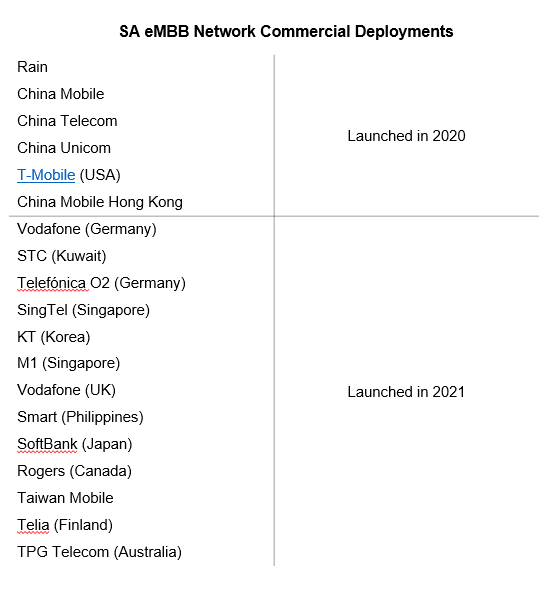

GSA has catalogued just 20 operators in 16 countries with 5G standalone deployed/launched in public networks.

13 January 2022 update from Dave Bolan of Dell’Oro Group:

We count 13 CSPs that commercially deployed 5G SA networks for enhanced Mobile Broadband (eMBB) in 2021, and they were nowhere close to the aggressiveness in breadth and depth of the buildouts that we saw by the Chinese Service Providers in 2020, or for that matter in 2021. We thought all three CSPs in Korea would have launched by now, but so far only KT has launched.

And we expected AT&T and Verizon in the U.S., and the CSPs in Switzerland to have launched 5G SA in 2021. In spite of these disappointments, the projected growth rate for 2021 is 61% Y/Y for 2021 and lowering to 18% Y/Y for 2022 due to the expected decline in growth rate by the Chinese CSPs.

The 5G device market is growing much more quickly. The GSA counted 1,257 announced devices at year-end, up nearly 125 percent from 2020. Around half (614) are 5G phones, up more than 120 percent from 278 at the end of 2020.

In total, 857 of the devices are commercially available, up more than 155% from the 335 on the market at the end of 2020. GSA has identified 614 announced 5G phones, up more than 120% from 278 at the end of 2020.

References:

https://gsacom.com/technology/5g/

GSA: 5G Market Snapshot – 5G networks, 5G devices, 5G SA status

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

IEEE 802.15. 3 Ultra Wideband (UWB) technology, consumer applications and use cases

Ultra Wideband (or UWB) is a fast, secure and low power radio technology used to determine location with precise accuracy unmatched by any other wireless technology. While similar to Bluetooth, it is more precise, reliable and effective.

UWB was standardized by IEEE 802.15 Working Group in June, 2020 as per:

IEEE 802.15.4z-2020 – IEEE Standard for Low-Rate Wireless Networks–Amendment 1: Enhanced Ultra Wideband (UWB) Physical Layers (PHYs) and Associated Ranging Techniques

This amendment enhances the UWB PHYs with additional coding options and improvements to increase the integrity and accuracy of ranging measurements. It also enhances the MAC to support control of time-of-flight ranging procedures and exchange ranging related information between the participating ranging devices.

Figure 1. Ranging time structure for beacon-enabled ranging

Figure 2. Distance commitment principle and RF integration window ………………………………………………………………………………………………………………………..

The UWB frequency range is between 3.1 and 10.6 GHz. UWB can determine the relative position of other devices in the line of sight up to 200 meters. While short range is a drawback for many applications, it’s not an issue when you have two UWB devices in close proximity of each other.

UWB’s low-power signals cause little interference with other radio transmissions and can effectively measure distance with an accuracy up to 10 cm (3.9 inches). Decawave’s UWB chip promises accuracy even up to 2 cm (0.78 inches) in indoor environments. To compare Wi-Fi and Bluetooth accuracy is only up to 1 meter (39 inches) provided there are no obstructions.

………………………………………………………………………………………………………………….

In 2002 the Federal Communications Commission (FCC) authorized the unlicensed use of UWB. As a result, UWB was used in military radars and was even briefly used as a remote heart monitoring system. However, the cost of implementation was relatively high and performance lower than expected, which limited the use of UWB in consumer products. Today, ultra-wideband chips are cheap and small enough to put them inside other devices like smartphones.

UWB applications enable a lot of new services for consumers and enterprises like accurate indoor location and positioning, providing context aware information and precise analytics in real time. One of them is digital car keys, as explained in a new whitepaper from the Car Connectivity Consortium (CCC).

UWB-compatible chips have the acuity to determine the location of an object to within a centimeter, says Daniel Knobloch, a wireless engineer at BMW and president of the Car Connectivity Consortium. That group has incorporated UWB into its standard, finalized in May of 2021, for opening and starting a car with any smartphone.

CCC’s Digital Key is a standardized technology that enables mobile devices to store, authenticate, and share digital keys for vehicles in a secure, privacy-preserving way that works everywhere. Backed by backed by Apple, Google, BMW, Volkswagen and others, Digital Key is designed to let anyone with a late-model smartphone or Apple Watch unlock and start their cars simply by walking up to them. It could make it easy for us to control any connected light, lock, speaker or other smart-home gadget simply by pointing at it with our phone or watch.

Many newer cars have keyless entry systems. This consortium’s new standard enables a vehicle to unlock when a person with a UWB smartphone walks within a certain number of feet of a car. Because access to the car is entirely through a smartphone, it can also be transferred, which could make picking up a rental car at the airport as simple as tapping on a link in a text or email to transform their phone into a “key.”

“The CCC brings together an incredibly unique group of like-minded companies, many of which are natural competitors, in order to deliver a universal digital key capability to the world’s transportation industry,” said Daniel Knobloch, president, CCC. “The strength of this digital key ecosystem rests with our member companies who are sustaining and advancing this interoperable digital key for the future of mobility. I’m confident of their commitment to our mission.”

…………………………………………………………………………………………………………….

While UWB is still in its early days for consumers, it is already embedded in smartphones and being used in selected applications. The UWB microchips and antennae that have been in every model of iPhone since the iPhone 11 (launched in 201), as well as newer smartphones from Google, Samsung, Xiaomi, Oppo and others. It’s also been in the Apple Watch since 2020’s Series 6 model.

UWB applications include iPhone owners finding their AirTags, sharing files via AirDrop, or amusing their friends with a party trick you can only do with Apple’s HomePod Mini. Owners of newer Samsung phones are using UWB when they find their Galaxy SmartTag+, that company’s answer to AirTags.

The FiRA Consortium is developing UWB specifications and certification programs ensuring interoperability among chipsets, devices, and solutions. They say, “UWB is the most effective available technology for delivering accurate ranging and positioning in challenging real-world environments, allowing devices to add real-time spatial context and enabling new user experiences.”

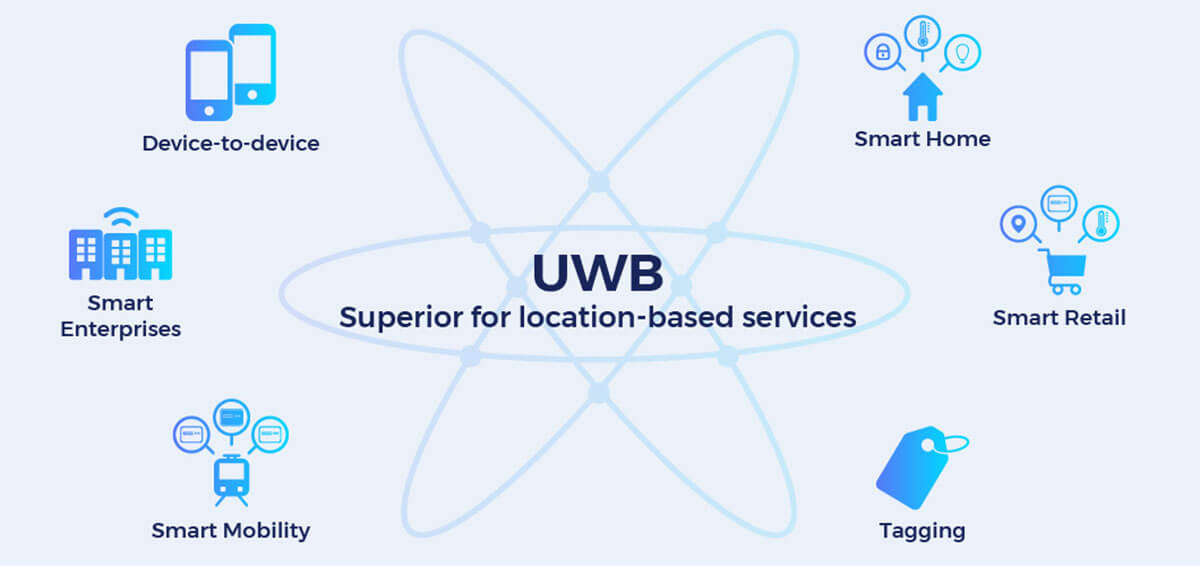

FiRA is developing additional use cases for UWB, including: SMART CITIES & MOBILITY, SMART BUILDING & INDUSTRIAL, SMART RETAIL, and SMART HOME.

………………………………………………………………………………………………………..

“UWB was developed over the past decade as a way to very precisely locate any object in three-dimensional space,” says Dr. Ardavan Tehrani, who is part of a working group at FiRa and also works for Meta Platforms, the company formerly known as Facebook, in a division called Reality Labs.

Previous attempts to track location indoors with existing wireless technologies, like Wi-Fi and Bluetooth, fell short because they were never intended for anything but transferring data, Tehrani said.

UWB, by contrast, triangulates the position of an object by measuring how long it takes radio waves to travel between devices and beacons. It’s a bit like the Global Positioning System (GPS) technology we use for things like Google Maps, except that GPS involves one-way transmissions from satellites to receivers listening on earth.

For example, UWB enables two-way communications between the chip inside a smartphone and another UWB device. These beacons can be small—the AirTag is roughly the size of four U.S. half-dollar coins, stacked—and last for years on a single battery. But the technology requires at least a few such beacons nearby for a device to locate itself inside a room.

UWB could allow paying at a store checkout without having to figure out exactly where on a payment terminal to mash one’s phone or watch, and entering a building without ever having to swipe a keycard.

A laptop equipped with UWB could recognize that its owner is sitting in front of it, by listening for the signal from her smartphone or smartwatch. It could then automatically log in to any service that person is authorized to use, possibly eliminating the need for passwords, says Dr. Tehrani.

Making smart homes easier and more intuitive to use is another emerging UWB application. Bastian Andelefski, an iOS developer in Germany, has demonstrated its potential. In a YouTube video, he showed his ability to point his iPhone at any of the smart bulb-equipped lamps in his home, and turn them on or off with a single tap, rather than opening an app and scrolling to the appropriate light, as happens today.

Making this work was expensive and complicated, says Mr. Andelefski, and his hacked-together system is hardly ready for nontechnical users. But with more and more companies rolling out affordable beacons, it’s the sort of thing that could be available to consumers sooner rather than later.

UWB has a lot of room to improve, and many more applications could arise as a result, says Dinesh Bharadia, an assistant professor at University of California, San Diego, whose lab works on wireless communications and sensing. In research announced in September, his team demonstrated that, using a new kind of beacon, the speed of UWB could be increased by about a factor of 10, while the amount of power it consumes could be decreased by the same amount.

The resulting improvements, which would require only a software update to existing smartphones that use UWB, could allow an object to be located in space every millisecond. This would allow real-time tracking of VR and AR headsets, robots and other automation, pets and livestock, boxes in a warehouse, and anything else to which an AirTag-type UWB device could be attached.

That UWB could be used for so many different applications doesn’t mean that it will be, cautions Dr. Bharadia. One application for which previous indoor-localization technologies have been touted—maps that help us navigate inside buildings, or direct us to the right item on a grocery shelf—have failed for years. There are two reasons for this, says Dr. Bharadia, neither really technological: No one has figured out how to make money from indoor mapping, and users don’t seem to really care about a technology that can be replaced by something as simple as adequate signage.

A third reason indoor localization technologies might have failed until now is privacy. Mr. Andelefski found, when using Apple’s own UWB technology, that there are many ways the iPhone’s software and hardware limit a developer’s access. Part of this he attributes to the need to maintain user privacy, and to protect data as sensitive as the precise location of their devices.

Indeed, recent reports of people using Apple AirTags to track cars before stealing them, and to stalk others, show just how sensitive this data can be.

Privacy is a “key consideration” of how the company’s UWB-based technology works, and how developers are allowed to use it, says an Apple spokesman. For example, apps can only use the phone’s UWB-powered location tech when they’re open, and after a user grants permission, so it isn’t possible for apps to track a user’s location in the background, he adds.

“UWB is enabling more accurate location data, and how it’s protected is up to Apple, Google and others,” says Mickael Viot, a member of the marketing working group at the FiRa consortium and also a director of business development at U.S. semiconductor company Qorvo.

The ability to know precisely where they are might seem minor in the pantheon of our gadgets’ superpowers, which include near-instantaneous communication with any point on the globe, sophisticated digital photography, real-time health monitoring, high-performance gaming and the like.

Today, UWB is being used as a replacement for car keys and passwords, but in the future it could well be part of making important objects in the physical world announce their position and identity to our smart glasses and other augmented-reality interfaces, says Dr. Tehrani.

Comparison of UWB with Bluetooth Low Energy:

| # | UWB | Bluetooth (BLE Beacons) |

|---|---|---|

| Battery | Low consumption | Low consumption |

| Range | up to 200 meters (656 feet) | up to 70 meters (230 feet) |

| Accuracy | 10 centimeters (3.9 inches) | up to a meter |

| Cost | Low | Low |

| Best For | Proximity Marketing, Customer Analytics, Indoor Navigation, Smart Homes, Factory Automation, Asset-Tracking, Logistics | Proximity Marketing, Customer Analytics, Loyalty, Indoor Location |

References:

https://standards.ieee.org/standard/802_15_4z-2020.html

Car Connectivity Consortium Publishes White Paper on the Future of Vehicle Access with Digital Key

https://news.samsung.com/us/introducing-the-new-galaxy-smarttag-plus/

https://www.firaconsortium.org/

Ericsson and HERE partner for custom mine mapping technology using private mobile networks and location tracking

The Ericsson and HERE partnership, announced during CES 2022, will combine private mobile networks from Ericsson with HERE’s location technology, providing real-time customizable maps of mining projects.

The mining industry is in rapid modernization phase, with smart mining operations projected to increase threefold until 20251. A key driver of this transformation is the access to private cellular networks, enabling safer, more productive, and more sustainable mining operations, through reliable and low latency connectivity. Ericsson’s high-performance 5G private networks are purpose-built for mining operations. A business can deploy an on-premise cellular network for its exclusive use. For mining this includes facilities in very remote areas and underground tunnels, both of which are not typically within public cellular range.

The combination of Ericsson connectivity and HERE location services deliver true smart mining capabilities, from mapping private terrain, to pinpointing and navigating assets in real-time. By using location data to build continuously updated private maps on the HERE location platform, mining companies can create a canvas to improve operational efficiency and safety. The living map can then be used to search or track, and deploy routing powered by HERE, as well as custom-built applications and services.

“We are partnering with HERE because of the breadth of their location services – ranging from mapping to routing, positioning and asset tracking. Combining our advanced private network solutions with HERE services will give mining firms a head start on their digitalization journey,” said Thomas Norén, Head of Dedicated Network and Vice-President at Ericsson.

“We look forward to increasing the productivity and safety of the mining industry by bringing location services to Ericsson’s customers. With our private mapping capabilities, we enable mining companies to unleash the power of their location data in many important use cases,” said Gino Ferru, General Manager EMEAR and Senior Vice-President at HERE Technologies.

In summary:

- HERE is now part of Ericsson’s industry 4.0 partner ecosystem providing location services in combination with private cellular networks for mining operations.

- HERE map making enables mining companies to build custom maps of open pit mining operations.

- Mapping of mining sites helps increase safety, efficiency and sustainability by enabling asset tracking, fleet telematics and analytics.

Photo of a Mine with Staircase

…………………………………………………………………………………………………………………………………………………………………………………………………………….

The partnership becomes part of Ericsson’s growing Industry 4.0 ecosystem, which includes HERE alongside numerous additional technology partners, such as Cisco, Cradlepoint, Dell, and HPE. The value of automation, mapping, and other Industry 4.0 applications making use of the latest connectivity technology cannot be understated. An Ericsson report on ‘Connected Mining’ in December 2020 suggested that 5G private networks could see return on investment at mining operations reach 200% within 10 years, with smart mining operations themselves expected to triple by 2025.

About HERE Technologies:

HERE, the leading location data and technology platform, moves people, businesses and cities forward by harnessing the power of location. By leveraging our open platform, we empower our customers to achieve better outcomes – from helping a city manage its infrastructure or a business optimize its assets to guiding drivers to their destination safely. To learn more about HERE, please visit https://www.here.com and https://360.here.com.

About Ericsson:

Ericsson enables communications service providers to capture the full value of connectivity. The company’s portfolio spans Networks, Digital Services, Managed Services, and Emerging Business and is designed to help our customers go digital, increase efficiency and find new revenue streams. Ericsson’s investments in innovation have delivered the benefits of telephony and mobile broadband to billions of people around the world. The Ericsson stock is listed on Nasdaq Stockholm and on Nasdaq New York. www.ericsson.com

References:

https://www.totaltele.com/512092/Ericsson-and-HERE-partner-for-custom-mine-mapping-tech

Lumen’s big fiber roll-out push from 2.5M to 12M locations passed in the next few years

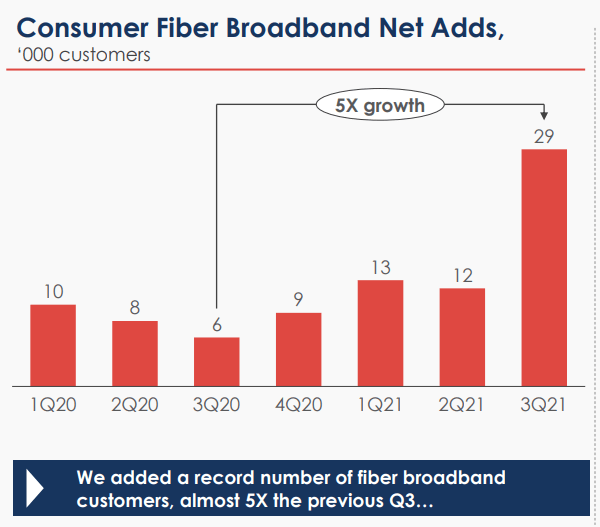

At the 2022 CitiApps Economy Virtual Conference yesterday, Lumen Technologies, Inc (formerly CenturyLink) President and CEO Jeff Storey said his company plans to increase its fiber deployments from 2.5 million locations to 12 million, which represents a five-times increase over the company’s traditional deployment rate. Storey said Lumen had been investing about 400,000 new fiber locations passed every year. “We have been very strategic and targeted and micro targeted in our approach to. We wanted to build — all digital experience of the quantum fiber platform, we’ve done that our NPS scores are really, really exceptional for quantum fiber. And so we’ve proven that we can build successfully, we proven that we can deliver successfully, and built all of the systems around the customer unnecessary to do that. So we’ll continue to invest there.”

Storey did not state how many years it would take company to reach 12M locations passed.

Separately, Lumen is expecting to close a sale of its local exchange business (formerly US West) to Apollo Funds in the second half of the year, which means it will retain mostly markets in metro areas. “We’ve rewritten the consumer playbook,” said Storey, noting that the company is now positioned as an “all-digital fiber brand.”

Like other broadband providers that have relied, in large part, on traditional copper network infrastructure, Lumen has been losing broadband customers in recent years. The company hopes that its investment in fiber will reverse that trend and has set a goal of returning to revenue growth within two to three years.

“Fiber wins. If you are competing with any other technology, fiber wins. And we’ll continue to deliver the majority of our services over fiber infrastructure and integrate those capabilities into an all digital experience. And when you do that, I think Lumen wins.” Storey said.

Lumen’s office building at 1025 Eldorado Blvd, Broomfield, CO 80021

……………………………………………………………………………………………………………………………………………………………..

Not surprisingly, considering Lumen’s emphasis on the business market for telecom services, Storey went on to note several advantages that are likely to be most appealing to business customers. In particular:

Fiber and data communications are more important than ever. But we don’t just look at it as data growth opportunity. For example, enterprises are shifting. I already said this, but more and more to hybrid environments. With hybrid employees, hybrid computing, hybrid network connect those employees, the computing, the applications that they use in the most sensible manner.

We look at combining our fiber infrastructure with capabilities like SASE, edge computing, and dynamic connections. Dynamic connections is really our network as a service capability. We create hybrid computing and networking environments that empower the enterprises to acquire, analyze and act on their data.

And looking over the Lumen platform, we enable new technologies and expanding our addressable market and we believe we’re in a great position to deliver. At the beginning of last year, we announced we’d have edge computing resources within five milliseconds, from 95% of U.S. enterprises. By the end of the year, we actually completed that somewhere in the middle of June, July, and today we’re around 97%. So we believe we have a great infrastructure tightly coupled with our fiber capabilities and we think there’s a great opportunity. Lumen and industry analysts agree, that is a major opportunity with 10s of billions of dollars in revenue potential. But it’s more than focusing on one product. It’s our ability to combine our services into holistic solutions for our enterprise customers.

Because we are a fiber-based platform… bringing our services to our customers with the connectivity of the fiber but also to cloud service providers, major data center providers,…private data centers of our customers [and] to eyeball networks,” he said, “we are in an excellent position to… help [customers] acquire their data, analyze their data [from] all of these different cloud options… and then act on their data.

In his opening remarks, Storey summed up Lumen’s strategic plan for 2022:

Our top priority is revenue growth, and we’re very focused on that, 2022 will be somewhat an investment year for Lumen, something CapEx and OpEx. CapEx is generally success-based initiatives that we have. But OpEx is a little more proactive investing in things like product development, marketing, brand, and other go-to-market initiatives that we have. We will continue to focus on investing and augmenting the Lumen platform, we believe it’s a great way to enable new technologies and expand our capabilities and our addressable market. We’ve already announced our accelerated quantum fiber bill, and plan to add more than 12 million locations over the coming years in the remaining 16 states that we operate in the states.

Lastly, we continue to invest in transforming our business for better customer experience, and operational efficiencies. We’ve done a great job of improving our customer experience, at the same time taking costs out of the business by using the technologies that we sell to our customers and then using other technologies in our business direct.

This strong increase in fiber deployment echoes what was said earlier this week at the 2022 CitiApps Economy Virtual Conference from Scott Beasley of Frontier Communications and AT&T’s CEO John Stankey. Also, from MSO Cable One’s joint venture with three private equity firms.

References:

Lumen’s Fiber Internet Offerings: https://www.lumen.com/en-us/networking/business-fiber.html

Webcast Replay: https://kvgo.com/citi-apps-economy-conference/lumen-technologies-jan-2022

CEO: Lumen Plans Fiber Deployment Rate of 5x its Historical Rate

Frontier Communications reports added 45,000 fiber broadband subscribers in 4Q-2021 – best in 5 years!

Frontier Communications added 45,000 fiber broadband subscribers in the fourth quarter, its best performance gains in five years, Frontier’s Scott Beasley said at the 2022 Citi Apps Economy Virtual Conference. The company hopes to expand by 1 million fiber locations this year as part of plan to reach 6 million by 2025.

Comment: That’s great progress for a company that filed for bankruptcy in April 2020 with a plan to cut more than $10 billion of its $17 billion debt load by handing ownership to bondholders. It was the biggest telecom filing since WorldCom in 2002, reflecting years of decline in its business of providing internet, TV and phone service in 29 states.

When combined with legacy DSL losses, Frontier added 9K net new broadband subscribers. Frontier is currently on an aggressive fiber build strategy that aims to add a total of 6 million locations by the end of 2025, resulting in 10 million locations reached in total. Beasley reports the company added 600K new fiber locations in 2021, with a goal of adding another million locations by the end of 2022. Beasley reports that the much discussed supply chain challenges facing the broadband industry have not had a significant impact at Frontier.

“We’ve managed through supply chain constraints and been able to perform very well in our fiber build and continue to ramp that up for 2022,” he said.

- This marked the first time in more than five years that the Company has posted total broadband customer growth in a quarter.

- The Company expects to continue growing the total broadband customer base as its fiber build accelerates.

Source: Frontier Communications Q3 2021 earnings presentation

Frontier has completed ‘wave 1’ of this fiber expansion. The company is now beginning ‘wave 2,’ which will take them through 2025, getting them to 6 million new locations. Build costs in wave 2 are a bit higher at $900 to $1,000 per fiber location.

Frontier envisions a ‘wave 3’ coming, but that’s outside the scope of their current committed-to fiber build. Beasley says Frontier will look to leverage government funding programs and other partnerships to help fund wave 3 fiber builds.

“There could be scenarios where we accelerate the build of some locations in wave 3 into wave 2,’ he said in discussing Frontier broadband growth. “That will likely be a destination of significant government funding as the roughly $45 billion of infrastructure bill funding that goes to broadband will be targeted at locations like wave 3.”

Asked about potential competition from fixed wireless access (FWA) and satellite broadband services, Beasley said neither presents a material threat just yet. While FWA may gain traction in some ultra-dense urban locations and satellite in extremely rural areas, Beasley asserted neither technology will be able to stand up against Frontier’s gigabit fiber offerings. The company already offers 1 Gbps and is planning the rollout of a 2 Gbps plan in the first half of this year as well as a 10 Gbps tier somewhere down the line. “It’s a technology we’re watching closely but don’t think it can compete with our core symmetrical speeds in fiber,” Beasley said of FWA.

“Against our core gigabit plus offers, 1 gig symmetrical speeds now, we’ve said we’re going to launch 2 gig in the first half of 2022, eventually we’ll move to 10 gig, the core network is 10 gig capable now, we’ve trialed 25 gig successfully in certain parts of the network,” he said. “I don’t think fixed wireless has the capacity to compete with that core infrastructure. It will be competitive in certain niches of the market…but I don’t think it can compete with our core symmetrical speeds and fiber,” he added.

References:

https://kvgo.com/citi-apps-economy-conference/frontier-jan-2022

With 45K New Fiber Subscribers, Frontier Sees First Positive Broadband Growth in 5 Years

Progress report: Moving AT&T’s 5G core network to Microsoft Azure Hybrid Cloud platform

Introduction:

A little more than six months after AT&T announced it’s 5G SA Core Network would run on Microsoft Azure cloud platform, a Microsoft blog post by Shawn Hakl, VP of 5G strategy in Azure for Operators, provides a progress report on that crucial IT industry initiative. Microsoft received requests from many operators, partners, and customers to share more details of the evolution of Microsoft’s hybrid cloud technology to support AT&T’s 5G core network workloads.

Through Azure for Operators, Microsoft has forged close ties with AT&T personnel, product services groups, and partners. At the heart of the value Microsoft delivers in each of these relationships, is the way in which we leverage the power of the cloud to improve the next generation of telco networks. Microsoft aims to harness trends toward Software Defined Networking (SDN), Cloud-Native Network Functions (CNFs), and Virtualized Network Functions (VNFs) coupled with the service-based architecture of 5G, to begin digitally transforming the network.

That evolution involves introducing both hybrid cloud infrastructure and software, building scalable elastic carrier-grade networks, and using the power of AI and machine learning to build self-optimizing networks that can heal, defend, and provision themselves. These efforts will enable operators to hyper-automate the business itself, bringing down costs and improving the overall service experience. Azure for Operators represents the set of investments Microsoft is making to bring the power of the cloud to the network.

Microsoft’s efforts are aimed at getting workloads on the network to function on a carrier-grade hybrid cloud, which includes both public and dedicated on-premises cloud infrastructure. Telecommunication services are highly distributed and will likely become more so over time. As a result, the value of creating a carrier-grade hybrid cloud model lives in its ability to meet customers where they are—at the edge of the cloud, the edge of the network, or the edge of the enterprise.

AT&T Backgrounder on use of “SDN” and network virtualization:

In 2013, AT&T adopted an aggressive position on “Software Defined Networks (SDNs)” and network virtualization, with the ultimate goal of delivering 75 percent of their network using virtualized technology by 2020. With their own definition of SDN (not related to the ONF’s strict separation of control and data planes or using OpenFlow as the southbound interface between them). AT&T says they did meet those objectives, but this author is skeptical based on checks with AT&T employees that work in their central offices.

In the 2013-2020 time frame, there was no commercial cloud option available that included the necessary features and capabilities to enable carrier-grade cloud. AT&T created a mostly proprietary (not standards based as claimed) implementation of cloud technology that was deployed in their on-premises data centers. This initial integrated cloud evolved into a Network Cloud, and today, we’ve arrived at Network Cloud 2.7—representing seven years of experience developing on-premises cloud for network workloads.

With Microsoft’s recent acquisition of this technology, development teams from AT&T’s Network Cloud organization have moved into Azure for Operators, directly integrating the intellectual property into a Microsoft offering and assuring a seamless transition.

Unique AT&T – Microsoft Partnership:

Microsoft says their collaboration with AT&T is unique in three ways:

- It’s the first time that a tier-one operator has embraced commercial hybrid cloud technology to run mobility network workloads that support their existing consumer base.

- The effort is entirely focused on the mobility core network versus go-to-market collaborations at the edge.

- It’s a multi-vendor cloud-mobile core network system: Microsoft hybrid cloud technology supports the AT&T mobile core network that spans more than 60 cloud-native network functions (CNFs) and virtual network functions (VNFs) from 15 different vendors.

Network Cloud technology originally developed by AT&T can be utilized by multiple carriers, maintaining security, without losing differentiation, and with the added benefit of having many costs such as security patching, vendor updates, and regulatory changes delivered as part of a standard commercial product.

These capabilities will be combined with Microsoft’s edge platform, our hybrid management platform, Azure Arc, and our ecosystem of partners including equipment providers, hardware vendors, and software vendors. By joining the Network Cloud with our platform and growing ecosystem, we have achieved a carrier-grade hybrid cloud solution that will be delivered as the Azure for Operators platform. The roles of the partners are as follows:

- Microsoft develops the carrier-grade hybrid cloud technology that supports the AT&T mobility core network workloads.

- AT&T continues to select and manage the network applications (VNFs and CNFs) and their configurations to deliver mobility services to AT&T customers.

In other words, Microsoft is taking the AT&T Network Cloud technology, building it into Microsoft’s standard hybrid cloud product, and then delivering a carrier-grade hybrid cloud solution to the market and AT&T itself, where it can run at AT&T on-premises or on Azure public cloud. Microsoft hybrid cloud technology supports the AT&T mobility core network workloads used to deliver 5G connectivity that supports consumer, enterprise, and the FirstNet responder community. In terms of security, it’s important to note that Microsoft does not access AT&T customer data—AT&T continues to hold access to that data, and Microsoft cannot see it.

For AT&T, this collaboration puts them in a position to deliver new services faster and more flexibly across Azure public cloud and on-premises with common tooling and services, reducing time-to-market for a cloud-native approach.

Microsoft believes the result will be better resiliency across the network, cost advantages when it comes to scaling existing services, and a more effective introduction of new services resulting in continuous improvements to the customer experience.

…………………………………………………………………………………………………………………………………………………………………………………………………………

Before joining Microsoft in 2020, Hakl was a longtime Verizon executive. He added that “Telecommunication services are highly distributed and will likely become more so over time. As a result, the value of creating a carrier-grade hybrid cloud model lives in its ability to meet customers where they are – at the edge of the cloud, the edge of the network, or the edge of the enterprise.”

James Crawshaw, a principal analyst of service provider operations and IT for research and consulting firm Omdia (owned by Informa in the UK), wrote on LinkedIn that Microsoft will have a lot of work to do to fully support AT&T’s complex core and cloud operations.

He also wrote that AT&T has a history of offloading networking systems. For example, the company in 2016 offloaded its ECOMP orchestration/automation system to the Linux Foundation open source community. However, “I don’t think that was a huge success,” Crawshaw wrote. He believes AT&T has replaced ECOMP (subsequently dubbed ONAP) elements with commercial orchestration systems in a number of areas. Here are are his exact words:

“When AT&T found that its ECOMP orchestration/automation system was getting too hard to manage they offloaded it to the Linux Foundation in the hope that the open source community would take care of it (ONAP). I don’t think that was a huge success (it was a failure, in this author’s opinion). I believe AT&T has actually replaced ECOMP/ONAP with commercial orchestration systems in a number of areas. Offloading its OpenStack-based cloud platform to Microsoft is a similar strategy. But if Microsoft struggles to turn a managed service into a repeatable product that they can sell to other operators around the world they may end up offloading it onto an IT services company whose business model is a better fit.”

Learn More:

Microsoft’s acquisition of AT&T’s Network Cloud, as well as Metaswitch Networks and Affirmed Networks, brings the anchor applications and telco know-how to build the features that are required for a carrier-grade hybrid cloud. These features, available to the entire partner ecosystem, contribute to an open, interoperable network that offers support to all operators. The message to operators from Microsoft is simple and straightforward: your partners and your customers—and the relationship is powered by our technology. For more information about the Azure for Operators strategy, refer to the e-book.

References:

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

https://www.linkedin.com/posts/jamescrawshaw_5g-telcocloud-activity-6884786261261881345-cqpb/

Complete and Comprehensive Highlights of AT&T CEO’s Remarks at Citi Conference

AT&T added 1.3 million new postpaid mobile subscribers in Q4-2021, including 880,000 cell phone customers, similar to its performance in Q4-2020.

With 3.2 million postpaid phone net adds in the full year 2021, AT&T said it delivered its best performance in over 10 years.

AT&T CFO Pascal Desroches was scheduled to discuss AT&T’s numbers at Citi’s Apps Economy Conference on January 5th. However, the company said that AT&T CEO John Stankey would replace him and participate in a Q & A discussion with a Citi moderator.

AT&T said in a statement before the event that it “continues to benefit from strong network performance and its disciplined and consistent go-to-market strategy.”

In the fixed wireline market, AT&T added 270,000 fiber optic subscribers for the quarter, taking it to a total of around 1 million net adds for the full year. This is the fourth consecutive year in which the company has added 1 million or more fiber subscribers, AT&T noted.

Fiber roll-out faced some delays earlier in the year, due to supply chain issues related to the coronavirus epidemic. Nevertheless, AT&T added 2.6 million new premises passed with fibre, slightly better than its target of 2.5 million.

The company said it also exceeded its target for HBO and HBO Max subscribers. It reached 73.8 million subscribers worldwide at year-end, compared to earlier guidance to reach the high end of its targeted range of 70-73 million subscribers.

Stankey said during his Citi keynote Q & A with Michael Rollins:

We’ve been able to run our operations better because of improved customer satisfaction. That’s extending into lower churn levels. That ultimately drives efficiency in things that we’re doing to make our business more effective and efficient moving forward, that are helping us keep that margin equation where it needs to be, so that we’re getting good, healthy, profitable growth around that. I feel really good about the progress we’ve made against our $6 billion objective over a three-year period to drive costs out. We’re halfway plus through that at this juncture. And I think there’s really good momentum and discipline and operating capability moving into the business as a result of that.

In the communications company side, we’re going to walk out of this with a capital structure and a balance sheet that I think puts us in a great position relative to our peers in the industry. I’ve articulated where we’re stepping up our investment, especially making sure that we have fiber capillaries that allow us to do really well in our wireless business and really well in our premium business networking entity. And then go back into places where we’ve been underpenetrated, like the consumer broadband market, and ultimately be share takers and grow our business as a result of that.

I do believe we’re seeing a reordering of industry structure in general where customers don’t necessarily love the notion of having to make a decision to buy one form of connectivity from one company and another form of connectivity from another. And I think most customers when they get up in the morning just think about it in the context of I need to get on the Internet, I like to just get on the Internet, I’d like to be able to do the business I need to do.

And my gut is that customer desires are ultimately going to drive how product and industry performs. And I expect that we’re going to see more consolidated offers going out to customers, where people are selling a bundle of connectivity. And it doesn’t matter where you are or where you need to use it. And as we think about how product evolves and the capabilities and features of products, that that’s going to be kind of the next several years or ultimately going to start to seed into the industry as we think about things.

And when I start talking about why I believe AT&T is well positioned with that transition, we are a company that has more fiber infrastructure than anybody else who does networking in the United States. And we know more about building these integrated networks than anybody else, and we do more — we have a more balanced portfolio at the low end of the market, in the consumer space and at the top end of the market in business networking.

I think in the business segment, we’re going to see this interesting dynamic of public and private networking start to evolve where private networking used to be in the domains of exclusively unlicensed spectrum, and what I would call fixed (wireless) LAN connectivity oftentimes and larger more complicated businesses. And I think we’re going to now start to see a little bit of that dynamic where managed wireless networks are going to become relevant in parts of businesses and how that gets done I think will be maybe another dynamic that requires companies to work — a company like ours to work with large enterprises on that approach.

And, again, I think we start from a unique place there, where we have the account management infrastructure, the consulting expertise and the capabilities to go into those businesses to support them through that evolution as they do a combination of what used to be fixed private networking that’s now fixed and wireless private networking in combination with large scale public networks. And I think that’s probably another dynamic we’ll see play out over time.

In response to Citi’s survey which found 64% thought AT&Ts biggest risk was Verizon, T-Mobile and the competitive landscape broadly; 24% cable, 12% dish, and 0% for other possible new entrants, Stankey said: “First, my reaction to kind of those results are I’m actually surprised that 0% for other new entrants is at the bottom end of the spectrum, because I frankly believe if 12% of the folks think that Dish Networks is maybe going to be the most disruptive aspect, my gut tells me that Dish coming into the market may be something that’s more paired with a combination of possibly another new entrant that wants to do something a little bit differently….I feel really good about that momentum and our ability to respond to T-Mobile and Verizon in the way we’ve done this year and continue to be very, very effective.”

Rollins asked: “Can you give us a preview of what 5G is going to look like for AT&T over the next 12 months? AT&T was in discussions with the FAA and with C-band over the last few weeks. So what should your customers and investors expect for the evolution of what 5G will look like from an experience perspective?”

Stankey replied: “When you deploy an air interface like 5G, it’s with you for a very long time. And so a couple of weeks here and a couple of weeks there at the front end of this isn’t in the context of the grand scheme of what’s going to happen and how you build networks and how you support a customer base. In my opinion, it isn’t going to be a big shift one way or the other. I think we need to keep that in perspective (this author completely agrees).

What I would tell you about our approach is no different than what I alluded to earlier. We want to make sure all of our network deployment, whether it be fiber or 5G is done in a way where we’re taking advantage of our dense and rich fiber networks, that we’re putting the bandwidth where customers need to do it and we’re evolving a product in a way that we can have a relationship with a customer that says it doesn’t matter where you go, we will handle your bandwidth needs. And we may choose to do that on 5G or we may choose to do that on fiber. At the end of the day, that should be something that’s fairly transparent to the customer. It should be done in a way that makes sense for them and a product that makes sense for them. And I think we’ll be in a good position to do that.

Our approach to 5G rollout, partly because we have such a broad and dense low band spectrum position, our networks performing incredibly well right now. You see the speed tests. And I would tell you that yes, there’s nominal differences that are showing up at a couple meg (Mbps) here, a couple meg there. This provider wins in this market, a different one wins in another. But when you look at customer feedback, customers are telling you — AT&T customers that they’re incredibly satisfied with the service.

We see sentiment on the network improving. That’s really important as a result of that. And that’s all going on within the dynamic of what’s occurring in the market right now and what other competitors are doing. When you see that momentum and that ascent on network performance and the consistency, that’s really strong and that’s partly because of one, the dense spectrum assets we already had walking into the mid-band deployment; and two, just the infrastructure of how cell sites in the network has been built.

Now as we go into this mid-band deployment, we’re going to be a bit more deliberate in our approach here, because as you know we’ve got the dynamic of certain mid-band spectrum being available now, certain mid-band spectrum that won’t be available until ’23 and we have some other mid-band spectrum that may come available somewhere in the middle of those two things. And as a result of that, as you think about how you deploy, you want to make sure that you’re using the right electronics and the right time to be on a tower once as opposed to multiple times.

And so as we move through the middle of this year, I think you’ll see us hit our stride on how we get the right kind of pervasive coverage using a collection of mid-band spectrum assets to make sure that that occurs. And I think given the near term as we kind of get in to the middle of this year and we wait for further spectrum availability into ’23, a spectrum that we’ve acquired and other auctions, we’ll be in a really nice position to take the strength of where the network is today and evolve it and ultimately be in a position to do that in the middle of this year as we start to scale that.

Rollins asked: “One of the differences so far in the 5G discussion for AT&T is on fixed wireless broadband. How are you looking at the opportunity, especially where you don’t have an incumbent wireline footprint or in the areas where it may not make sense to build fiber, how are you looking today at the opportunity to use this mid-band spectrum that you have in the wireless network and offer a wireless home broadband solution?”

Stankey replied: I believe that having some fixed high bandwidth infrastructure is going to be essential to being an effective networking company moving forward. Here’s a simple example: If you go into a typical average U.S. household and you think about the amount of video consumption that’s going on in a household today and you think about the customer trajectory of how much of that video consumption is moving from what used to be what I’ll call broadcast or multicast combinations, where it’s one stream sent out to a bunch of households or one stream watched by many people in the household to unicast where each individual in the household is watching something different at a particular time.

And I would tell you that if you believe, two things happen. One, that there’s going to be more on-demand consumption of video moving forward. And two, the resolution of that video will improve over time. And it will improve at a rate that compression technologies won’t necessarily keep you even in that consumption, so the jump to HD to 4K is an example. I would tell you that you start to look at those things and realize that wireless networks in some instances will have difficulty scaling in certain segments of the market as a result of that and there’ll be more effective ways to serve those customers.

And when I start to look at what we’re seeing as we start to do our market tests and our market pilots on multi-gig deployment on fiber and the market success we’re having and the sentiment of the customers that are taking it, I think that’s a really, really powerful combination. And I think those segments of the market are going to need to be addressed with more fixed solutions.

Now, are there single individuals living in an apartment someplace that may have a usage profile that is effectively served by fixed wireless in a metropolitan area? Sure. There are those other businesses that sit in a strip mall that are low data intensity that may have an opportunity to be served by fixed wireless, sure. Is fixed wireless going to be the best way to get a lot of bandwidth out to less densely populated rural areas? Yes, it probably will be. So is there a segment of the market where fixed wireless will apply and be effective? Sure, it will, and we’ll be in a position to have the right product to address those places.

But I don’t want to just simply say, well, that is the single solution that’s going to deal with what I would call the 70% of the business community, the 70% of the consumer population that are going to be pretty intensive users in some location, indeed, to have fixed infrastructure to support that over the long haul, given all the innovation that’s going to come. So how do I think about it out of region? Again, having a broad portfolio of business and consumer and believing that ultimately having fiber infrastructure to make both networks run well is important.

I see an opportunity for us to be very targeted and very disciplined around what we do and what used to be I hate using the term but traditional out of region markets, where good fiber deployment that supplements the strength of your wireless network and at the same time can pick up businesses and consumer, that’s probably a place where if this future that I talk about, which is a consolidated broadband product offering that occurs in the market, a customer that just wants a provider that solves their needs starts to occur, that those opportunities and companies that ultimately sustain themselves in the U.S. market for networking will need to address and ultimately effectively do. And that’s how we’re positioned to move forward right now.

Rollins asked: “On the fiber side, you announced that you hit the 2.6 million homes incrementally passed in 2021. Are those now fully open for sale in 2022? And is there another bogey that we should be thinking about for the next year in terms of the expansion of your home fiber network?”

Stankey replied: The answer is yes on the 2.6 million. And as I think I shared on the last earnings call, we wanted to do 3 million this year. We got a little bit of a supply chain dynamic that worked in the latter part of the year on how we were getting some of the elements we needed for the — the final piece of the distribution plan. It was largely how the preassembly dynamics of the fiber come in for us to be able to splice it in and ultimately serve the home. Feel pretty good about how the team and our vendor community has worked through that in the fourth quarter.

Obviously, we did 2.6, not 2.5. I think that’s indicative of the fact that we’ve got a little bit better momentum than what we had expected. And now those homes are in fact available. And the next 400,000 that we didn’t hit will come very quickly in the front end of this year in the 30, 45-day timeframe, because we are in fact starting to see that ramp in that supply component we needed. As we told you, we want 30 million fiber households by the end of ’25. I’m very confident we’ll get that done.

As I’ve told you on the last earnings call, I’d kind of like to get away from a discussion of how many new homes are added this quarter and be able to talk to you about just what are we seeing in the growth of customer acceleration? I’m really pleased with 270,000 fiber adds in the fourth quarter and be able to talk to you about just what are we seeing in the growth of customer acceleration? I’m really pleased with 270,000 fiber adds in the fourth quarter of this year, especially given we were a little bit late bringing on that new inventory. I think now that we can sell into that in ’22, that’s going to allow us to get that momentum to break through that 300,000 range on customers per quarter.

And as we continue to add in the footprint, what the investor base should look about is, is our new fiber adds, are they continuing to scale and grow irrespective of what we’re doing with the footprint. And that’s really what I hold the management team to and how we think about our commitments and our financial planning moving forward. So yes, I expect you’re going to continue to see those to grow as we move through ’22 as the footprint expands, and that will be the case all the way through ’25 as we get to 30 million fiber homes through the end of ’25.

As I’ve also shared, we’re continuing to do work to look at opportunities out of region, what we want to do to possibly find other attractive places to go and penetrate more effectively in the business community (presumably with fiber access). And as we have confidence in those things and we’re in a position to go and demonstrate that we can make that happen, we may be doing some revisions to our approach and our guidance on that moving forward.

Rollins asked: “Our final question is what application(s) can fundamentally change demand for connectivity and data consumption over the next few years?”

Stankey replied: There isn’t one, and I’d go back and say, history repeats itself. It’s like saying what application made LTE and 4G relevant in society. I’ve been around here a long time. I can remember sitting around in 2009, 2008 answering the same, well, geez, what’s going to justify this investment in LTE? Isn’t 3G good enough? And why do we need to invest this money? And it almost seems quaint right now that you’d go back and say, was it worthwhile to invest in LTE and in 4G to give people more speed and more effective and more resilient, more ubiquitous networks? And the answer was, of course. And I’d ask the question, are wireless networks as effective and as resilient as what you’re accustomed to when you sit in your living room or when you’re at your desk inside of an office building? The answer is not yet.

And so if there’s innovation that occurred on the LAN in the workplace and if there’s services and capabilities that occur in your home that you can’t quite do everywhere you are, why wouldn’t there be an opportunity to invest to take that somewhere else. And as we start to think about what I talked about earlier, public and private mixes into enterprise, when we get to low latency and what that opens up in terms of opportunity for medical diagnostics and remote health care and we think about the manufacturing dynamics and autonomous vehicles, we’re going to see a whole another decade of innovation that’s built on the back of these networks. And I’m really optimistic about that. And I have no question that we’re going to someday be sitting around saying, we need more spectrum because 6G is here and if we don’t have it, we’re not going to be able to take the next wave of innovation for ubiquitous high broadband, high speed broadband networks, no matter where we are, live, work and play.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Drew FitzGerald and Karen Langleyof the Wall Street Journal (on line subscription required to access) wrote on Wednesday afternoon:

Chief Executive Officer John Stankey in June called the period “a hard year that’s been full of anxiety.” By December, he said he hoped that within another year “our attention will be entirely on the future and not on what we needed to do to reposition or restructure the business.”

The company’s WarnerMedia unit ended 2021 with 73.8 million global HBO subscribers, ahead of its 70 million to 73 million target. AT&T in May announced plans to spin off WarnerMedia, the entertainment empire it acquired in 2018, into a new joint venture with Discovery Inc.

The transaction secured European competition authorities’ approval in December but is still under review in the U.S. and other countries. AT&T shareholders will keep a 71% stake in the new media creation, so the company’s stock price partly reflects how the market values that future media business, which will be called Warner Bros. Discovery. The telecom company that remains is expected to pay shareholders a lower annual dividend.

Executives have said the yearly payout will fall from about $15 billion to between $8 billion and $9 billion after the media spinoff closes. An AT&T spokesman pointed to executives who have said that amount will still make it one of the top-yielding companies among dividend payers.

The subscriber surge prompted some market watchers to question how long the good times can last. Jeff Moore, a wireless-industry analyst for Wave7 Research, likened such explosive growth to all 32 NFL teams winning the same Super Bowl. “It just doesn’t make sense,” he said. “You would think that someone is losing and someone else is gaining.”

AT&T‘s rivals have pointed the finger at its now year-old marketing blitz, which offered deep smartphone discounts for new and existing customers, as the start of a race to the bottom that could eventually hurt industry profitability.

AT&T‘s leaders have said their wireless customer growth is durable. They have cited smarter marketing and improving traction in the public-safety market, as well as discounts, among the factors helping their results.

Mr. Moore agreed and said Verizon is the most vulnerable to slumping customer growth this year because its retail marketing operation has lost ground to more aggressive rivals. A Verizon spokesman declined to comment. “There’s too much skepticism about AT&T,” the analyst said. “They’ve really turned around their results.”

Not all investors believe that. Jerry Braakman, chief investment officer at First American Trust, said his firm held AT&T shares in client portfolios for several years before selling them in December 2020. He said the pandemic’s reordering of the winners and losers in the film industry kept AT&T‘s WarnerMedia unit from delivering on its promise. “AT&T looked like their strategy was struggling, so we decided not to continue to ride something down,” he said. “Sometimes you have to cut your losses and move on.”

Write to Drew FitzGerald at [email protected] and Karen Langley at [email protected]

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://about.att.com/aboutus/pressrelease/2022/desroches-citi-appseconomy-conference.html

Cable One joint venture to expand fiber based internet access via FTTP

Cable One [1.] (aka Sparklight) has announced a joint venture (JV) with three private equity firms, seeking to speed its expansion of fiber based Internet access to underserved markets.

The joint venture reflects a shared commitment from Cable One and the investors to provide fast and reliable connectivity via FTTP internet to underserved markets and will allow for more rapid expansion of fiber internet to homes and businesses in small cities and big towns. Cable One owns a majority of Clearwave Fiber and the private equity investors are committed to make substantial cash investments to support the acceleration of Clearwave Fiber’s expansion.

Clearwave Fiber will be led by Executive Chairman Michael Gottdenker and CEO David Armistead, both of whom were part of Hargray’s executive leadership team from 2007 until its 2021 sale to Cable One, providing continuity of proven leadership and a continued commitment to Cable One’s shared culture, purpose, and values.

“This strategic investment will help accelerate the deployment of fiber-based broadband services to a range of markets, including underserved areas of the country,” said Michael Gottdenker, Executive Chairman of Clearwave Fiber. “Our team is motivated by our shared core values of customer service and improving lives through connectivity and is excited to bring fast and reliable Clearwave Fiber broadband to homes and businesses across the country. We are thrilled to welcome GTCR, Stephens, and TPO to the Clearwave Fiber family and look forward to our continued partnership with Cable One.”

Julie Laulis, Cable One President and CEO said:

“We look forward to supporting and sharing in Clearwave Fiber’s growth over the coming years while remaining focused on our primary business, increasing penetration rates, integrating recently acquired companies and driving higher margins and greater free cash flow. We did not take lightly our choice of partners in this transaction and are excited to be working with like-minded individuals who share our core principles.”

“Five years ago, Gig speeds were virtually unheard of in non-urban markets across the U.S. We are proud to have been able to launch Gig service and level the playing field for rural markets where access to affordable, high-speed internet is just as vital as in more urban markets. A fast and reliable internet connection means rural residents can telecommute rather than having to move to find work. It means access to medical care via telehealth services; the ability to achieve a higher education online; and the cultivation of entrepreneurship and economic growth.”

…………………………………………………………………………………………………………….

KeyBanc Capital Markets analysts indicated in a research note the deal is a positive for Cable One, noting it will allow the company to effectively offload heavy investment in fiber to the JV while maintaining majority ownership. They drew a comparison to WideOpenWest’s recently announced fiber expansion plan, writing that “in contrast to CABO, WOW will fund the expansion on-balance sheet, while CABO’s transactions move off-balance sheet, neither being wrong, in our view.”

“We believe this shows there is a lot of FTTP build opportunity within and around CABO’s footprint (likely more than one Company can handle),” Keybanc’s team conclude

……………………………………………………………………………………………………………….

About Cable One:

Cable One, Inc. (NYSE:CABO) is a leading broadband communications provider committed to connecting customers and communities to what matters most. Through Sparklight® and the associated Cable One family of brands, the Company serves more than 1.1 million residential and business customers in 24 states. Over its fiber-optic infrastructure, the Cable One family of brands provide residential customers with a wide array of connectivity and entertainment services, including Gigabit speeds, advanced WiFi and video. For businesses ranging from small and mid-market up to enterprise, wholesale and carrier, the Company offers scalable, cost-effective solutions that enable businesses of all sizes to grow, compete and succeed.

References:

https://www.fiercetelecom.com/telecom/cable-one-targets-rapid-fiber-expansion-jv-deal

Smart Meter to use AT&T IoT network for remote patient monitoring

- The SmartRPM platform supports iGlucose, iBloodPressure and iScale. A fourth product, iPulseOx, is being unveiled at CES this week in Las Vegas. End users insert the batteries — which are included — and press the start button to activate the service. The device’s IoT SIM card automatically sends data to the SmartRPM cloud, where it can be accessed by secure log-in by the healthcare provider.

- AT&T cited Smart Meter data that found that 84% of diabetes patients and 88% of hypertension patients who are at high risk for disease complications “experienced significant improvements” when using iGlocuse and iBloodPressure, respectively. Studies show remote patient monitoring can help change this.

- For example, 84% of diabetes and 88%1 of hypertension patients at highest risk for severe disease complications experienced significant improvements in their health when using the Smart Meter iGlucose and iBloodPressure as part of RPM programs.

- Smart Meter’s cellular-enabled devices simplify RPM. They are an easy out-of-the-box solution; just insert the included batteries and press the start button. The monitoring devices contain IoT SIM cards, so they automatically send the patient’s data over the AT&T IoT network to the SmartRPM cloud. The healthcare provider then accesses the data there via secure log-in.

Source: AT&T

For patients, Smart Meter’s cellular RPM devices mean easy access to improved healthcare with the peace of mind that comes from frequent assurances and support. For health care providers, the benefits include ready access to more complete patient data and the ability to act on it in near real-time, while automatic record keeping meets requirements for reimbursement.

Because of these benefits, a growing number of doctors are embracing RPM. A recent survey found 43% of clinicians believe RPM adoption will be on par with in-patient monitoring in 5 years.

“The iGlucose solution proved to be an outstanding resource for my clinical team to enable greater insights into our patients’ results between visits. More than 70% of participants required some form of intervention prior to their next in-office visit, and as a result, there was a reduction in emergency room visits and need for hospitalizations, demonstrating better overall diabetes care.” – Dr. Gail L. Nunlee-Bland, MD, Howard University Diabetes Treatment Center

“Our collaboration with Smart Meter is another example of how our IoT connectivity is advancing connected healthcare. IoT-enabled devices ultimately provide a quicker and more convenient patient service with better outcomes for both the patient and the healthcare provider.” Joe Drygas, VP of AT&T Healthcare Industry Solutions

“As an early RPM innovator, Smart Meter has done extensive work to drive the best outcomes by improving patient engagement and adherence, and our cellular alliance with AT&T has been a large part of our success.” Casey Pittock, Smart Meter CEO

Last month, AT&T said that its FirstNet first responders’ network is supporting Qure4u, which is a “patient engagement and virtual care platform” that includes a Bluetooth-enabled blood pressure cuff, the Samsung Galaxy Tab A7 Lite and enhanced security.

C Spire also is offering an RPM service. The carrier said in August 2020 that it is teaming with the Delta Regional Medical Center in Mississippi. C Spire Remote Patient Monitoring will monitor “a broad array of chronic medical conditions.”

References:

https://about.att.com/aboutus/pressrelease/2022/smart-meter.html

AT&T Taps IoT Network for Remote Patient Monitoring Partnership

Broadband accounts for 98% of households with home Internet service; 85% of all households have broadband access

Of the 87% of homes in the U.S. that are connected to the Internet via fixed access (mostly wireline), 98% have broadband access. Of those with high-speed internet, 60% find their service provider (ISP) very satisfactory, while only 7% are not satisfied. Those figures represent significant growth compared to the 83% who had broadband in 2016 and 69% in 2006.

The findings are based on a survey of 2,000 U.S. households from a new Leichtman Research Group (LRG) study, Broadband Internet in the U.S. 2021.

This is LRG’s 19th annual study on this topic.

Other related findings include:

- 63% of broadband subscribers rate the speed of their Internet connection 8-10 (with 10 being excellent), while 7% rate it 1-3 (with 1 being poor)

- 45% of broadband subscribers do not know the download speed of their service – compared to 59% in 2016

- 69% reporting Internet speeds of 100+ Mbps are very satisfied with their service, compared to 53% with speeds <50 Mbps, and 58% that don’t know their speed

- 60% of adults with an Internet service at home watch video online daily – compared to 50% in 2019, 41% in 2016, and 5% in 2006

- 87% of households use at least one laptop or desktop computer – 95% of this group get an Internet service at home

- 68% of those that do not use a laptop or desktop computer are not online at home – accounting for 67% of all that do not have an Internet service at home

Also, on-line (OTT) video viewing is a daily activity for six out of ten adults who have internet service, compared to 50% in 2019, 41% in 2016, and 5% in 2006. Another 87% of households use at least one laptop or desktop computer – 95% of this group get an ISP at home. Separately, 68% of those that do not use a laptop or desktop computer are not online at home – accounting for 67% of all that do not have an ISP at home.

“The percentage of households getting an internet service at home is now higher than in any previous year,” Bruce Leichtman, principal analyst for Leichtman Research Group, said in a statement. “Broadband subscribers generally remain satisfied with their service, with 60% reporting that they are very satisfied, compared to 57% in 2016,” he added.

Broadband Internet in the U.S. 2021 is based on a survey of 2,000 adults age 18+ from throughout the U.S. The random sample of respondents was distributed and weighted to best

reflect the demographic and geographic make-up of the U.S. The survey, conducted in November-December 2021, included a sample of 820 via telephone (including landline and

cell phone calls) used to track the presence of Internet services in the home, and an additional sample of 1,200 with an Internet service at home via an online sample. The phone sample

has a statistical margin of error of +/- 3.4%. The combined phone and online samples of those with an Internet service at home has a margin of error of +/- 2.3%. The online sample

solely used for some questions has a margin of error of +/- 2.8%.

About Leichtman Research Group:

Leichtman Research Group, Inc. (LRG) specializes in research and analysis on the broadband, media and entertainment industries. LRG combines ongoing consumer research studies with

industry tracking and analysis, to provide companies with a richer understanding of current market conditions, and the adoption and impact of new products and services. For more information

about LRG, please call (603) 397-5400 or visit www.LeichtmanResearch.com.

References: