4G

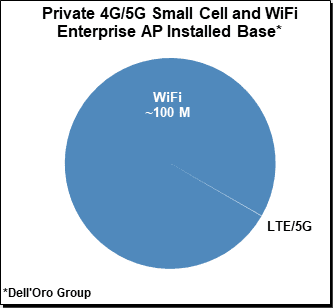

Dell’Oro: LTE still dominates private wireless market; will transition to 5G NR (with many new players)

Dell’Oro Group just published an updated Private Wireless market report with a 5-year forecast. According to the report, private wireless RAN revenues for the full-year of 2021 are slightly weaker than initially projected.

“The markdown is more driven by the challenges of converting these initial trials to commercial deployments than a sign that demand is subsiding,” said Stefan Pongratz, Vice President at Dell’Oro Group. “In fact, a string of indicators suggest private wireless activity is firming up not just in China but also in other regions,” continued Pongratz.

Additional highlights from the Private Wireless Advanced Research Report:

- Private wireless projections have been revised downward just slightly to factor in the reduced 2021 baseline.

- Total private wireless RAN revenues, including macro and small cells, are still projected to more than double between 2021 and 2026.

- The technology mix has not changed much with LTE dominating the private market in 2021 and 5G NR still on track to surpass LTE by the outer part of the forecast period, approaching 3 percent to 5 percent of the total 5G private plus public RAN market by 2026.

- Risks are broadly balanced. On the upside, the 5G enterprise puzzle has still not been solved. The successful launch of private 5G services by suppliers with strong enterprise channels could accelerate the private 5G market at a faster pace than expected. On the downside, 5G awareness is improving but it will take some time for enterprises to fully understand the value of private LTE/5G.

Comment & Analysis:

This author notes a bevy of new activity in the 5G private network space. It’s almost approaching a frenzy!

Yesterday, Cisco announced a “private 5G service that simplifies both 5G and IoT operations for enterprise digital transformation.” The company promised to show off the new product at the upcoming MWC trade show in Barcelona, Spain. Cisco to sell its 5G private network under an “as-a-service” model, such that enterprise customers who purchase it will only pay for what network resources they actually use. The company said that it would partner with unnamed vendors for all the necessary components, adding that it will run over midband spectrum. The company did not provide any further details. It should be noted that Cisco has never had ANY 2G/3G/4G/5G RAN products, as their wireless network portfolio has always been focused on WiFi (now for enterprise customers).

In late November 2021, Amazon unveiled its new AWS Private 5G service that will allow users to launch and manage their own private mobile network in days with automatic configuration, no per-device charges, and shared spectrum operation. AWS provides all the hardware, software, and SIMs needed for Private 5G, making it a one-stop solution that is the first of its kind. Dell’Oro Group’s VP Dave Bolan wrote in an email, “What is new about this (AWS Private 5G) announcement, is that we have a new Private Wireless Network vendor (AWS) with very deep pockets that could become a major force in this market segment.”

In addition, Mobile network operators like Deutsche Telekom, AT&T and Verizon offer private 5G networks, as do other cloud computing companies, mobile network equipment vendors like Ericsson and Nokia, system integrators like Deloitte, as well as startups like Betacom and Celona. So it’s a crowded market with suppliers each expecting a chunk of a very big pie.

I posed the seemingly contradictory finding of a less than forecast 2021 private wireless market vs the new private 5G players to Dell’Oro’s Pomengratz. In his email reply, Stefan wrote:

“If I had to summarize all our various projections I will just say that the things we know (public 5G MBB/FWA) are generally accelerating at a faster pace than expected while the things that we don’t know (private 5G/critical IoT etc.) are developing at a slower pace than expected.

And for this particular update, slower-than-expected comment was more related to revenues than activity. I agree with you that activity both when it comes to private trials and entering this space remains high.

At the same time, we have talked about private cellular for a long time but the reality is that we have not yet crossed the enterprise chasm. Nevertheless, we have a very large market opportunity ($10B to $20B for just the private 4G/5G RAN) that is still up for grabs, hence the high level of interest.”

References:

Private Wireless Weaker Than Expected in 2021, According to Dell’Oro Group

https://www.cisco.com/c/en/us/products/wireless/private-5g/index.html

Deloitte to co-ordinate 5G private network field trial at the largest hospital in Latin America

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

by Dario Sabella, Intel, ETSI MEC Chair, with Alan J Weissberger

Introduction (by Alan J Weissberger):

According to Research & Markets, the global Multi-access Edge Computing (MEC) market size is anticipated to reach $23.36 billion by 2028, producing a CAGR of 42.6%. Reduced Total Cost of Ownership (TCO) due to integration of MEC in network systems as compared to legacy systems and subsequent ability to generate faster Return on Investment (RoI) is further expected to encourage smaller retail chains to leverage MEC technology.

Multi-access Edge Computing Market Highlights (from Research & Markets):

- The software segment is anticipated to be the fastest-growing segment owing to emerging demand among service providers to use software that can be deployed for various applications without making changes to existing 3GPP hardware infrastructure specifications.

- The energy and utilities segment is expected to witness the fastest growth rate over the forecast period owing to increasing demand among companies to quickly access insights and analyze data generated from remote locations

- The Asia Pacific region is expected to emerge as the fastest-growing regional market due to strong support from the government to encourage advanced network infrastructure

A few important MEC applications/ use cases include:

- Streaming video and pay TV: Increasing number of users adopting the Over the Top (OTT) video delivery model is expected to promote telecom companies and mobile networks to upgrade their existing infrastructure to cache video/audio content closer to the user. Using the multi-access edge computing (MEC) architecture system brings backend functionality closer to the user network, which is expected to aid Multichannel Video Programming Distributors (MVPD) to meet their customers’ demands. Users pay subscription fees for a specified duration of time to access the content offered by the MVPD.

- Deployment of MEC technology is expected to enable retail and on line stores to improve the performance of in-store systems and reduce data processing time, thus ensuring faster resolving of customer grievances. Furthermore, adoption of this technology is expected to reduce the load on external macro sites, thus offering a seamless in-store experience for users.

- Increasing number of IoT devices and the emerging need to gain access to real-time analysis of data generated by them is expected to drive MEC market growth. Leveraging this technology in IoT can facilitate reduced pressure on cloud networks and result in lower energy consumption, which is expected to offer significant growth opportunities to the market.

- Multi-access edge computing is expected to enhance manufacturing practices and thus facilitate the advent of connected cars ecosystem. Connected cars are equipped with computing systems, wireless devices, and sensing, which have to work together in a coordinated fashion, thus facilitating the need to adopt MEC.

- 5G MEC technology can be used to exchange critical operational and safety information to enhance efficiency, safety, and enhance value-added services such as smart parking and car finder.

Previously referred to as Mobile Edge Computing, MEC raises a lot of questions. For example:

- Can MEC be used with wireline and fixed access networks?

- Is 5G Stand Alone (SA) core network with separate control, data, and management planes required for MEC to be effective?

- Finally, why should MEC (and multi-cloud) matter to infrastructure owners and application developers?

Dario Sabella, Intel, ETSI MEC Chair, answers those questions and provides more context and color in his two part article.

………………………………………………………………………………………………..

ETSI MEC Standard Explained, by Dario Sabella, Intel, ETSI MEC Chair

ETSI MEC – Foundation for Edge Computing:

MEC (Multi-access Edge Computing) “offers to application developers and content providers cloud-computing capabilities and an IT service environment at the edge of the network” [1].

The MEC ISG (Industry Specification Group) was established by ETSI to create an open standard for edge computing, allowing multiple implementations and ensuring interoperability across a diverse ecosystem of stakeholders: from mobile operators, application developers, Over the Top (OTT) players, Independent Software Vendors (ISVs), telecom equipment vendors, IT platform vendors, system integrators, and technology providers; all of these parties are interested in delivering services based on Multi-access Edge Computing concepts.

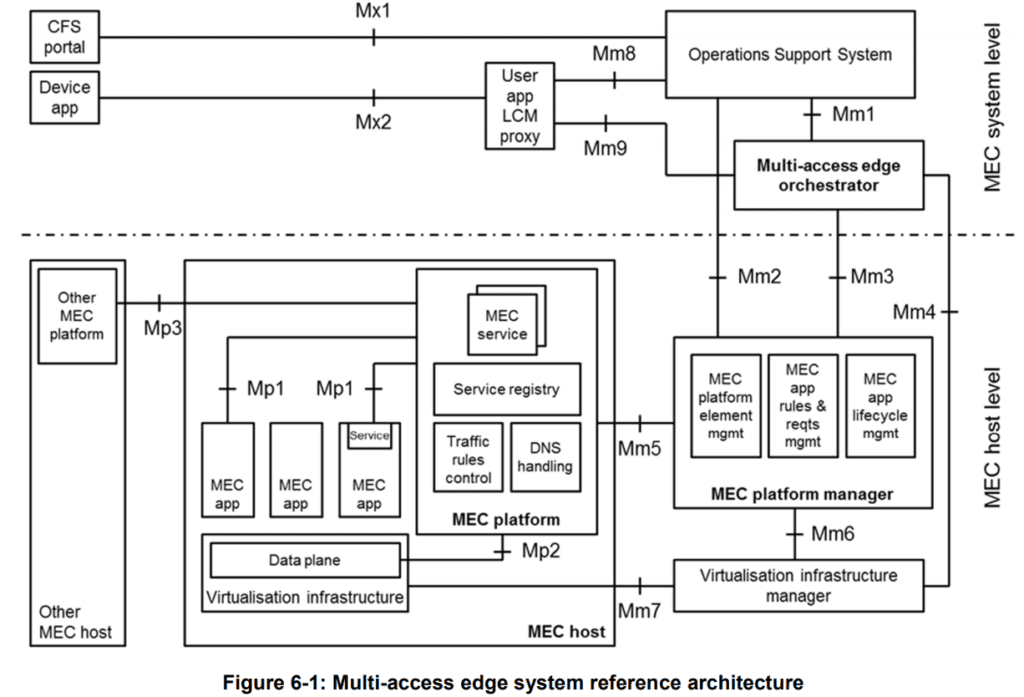

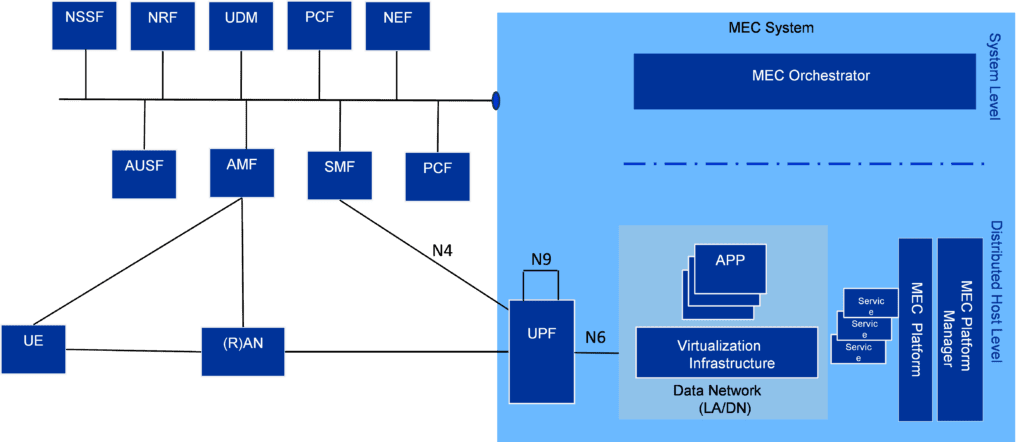

The work of the MEC initiative (see the architecture in Figure 1. above) aims to unite the telco and IT-cloud worlds, providing IT and cloud-computing capabilities at the edge: operators can open their network edge to authorized third parties, allowing them to flexibly and rapidly deploy innovative applications and services towards mobile subscribers, enterprises and vertical segments (e.g. automotive).

Author’s Note:

From a deployment point of view, a natural question is “where exactly is the edge?” In this perspective, the ETSI MEC architecture supports all possible options, ranging from customer premises, 1st wireless base station/small cell, 1st network compute point of presence, internet resident data center/compute server or edge of the core network. The MEC standard is flexible, and the actual and specific MEC deployment is really an implementation choice from the infrastructure owners.

Additionally, the MEC architecture (shown in Figure 2 and defined in the MEC 003 specification [2]) has been designed in such a way that a number of different deployment options of MEC systems are possible:

- The MEC 003 specification includes also a MEC in NFV (Network Functions Virtualization) variant, which is a MEC architecture that instantiates MEC applications and NFV virtualized network functions on the same virtualization infrastructure, and to reuse ETSI NFV MANO components to fulfil a part of the MEC management and orchestration tasks. This MEC deployment in NFV (Network Functions Virtualization) is also coherent with the progressive virtualization of networks.

- In that perspective, MEC deployment in 5G networks is a main scenario of applicability (note that the MEC standard is aligned with 3GPP specifications [3]).

- On the other hand, the nature of the ETSI MEC Standard (as emphasized by the term “Multi-access” in the MEC acronym) is access agnostic and can be applicable to any kind of deployment, from Wi-Fi to fixed networks.

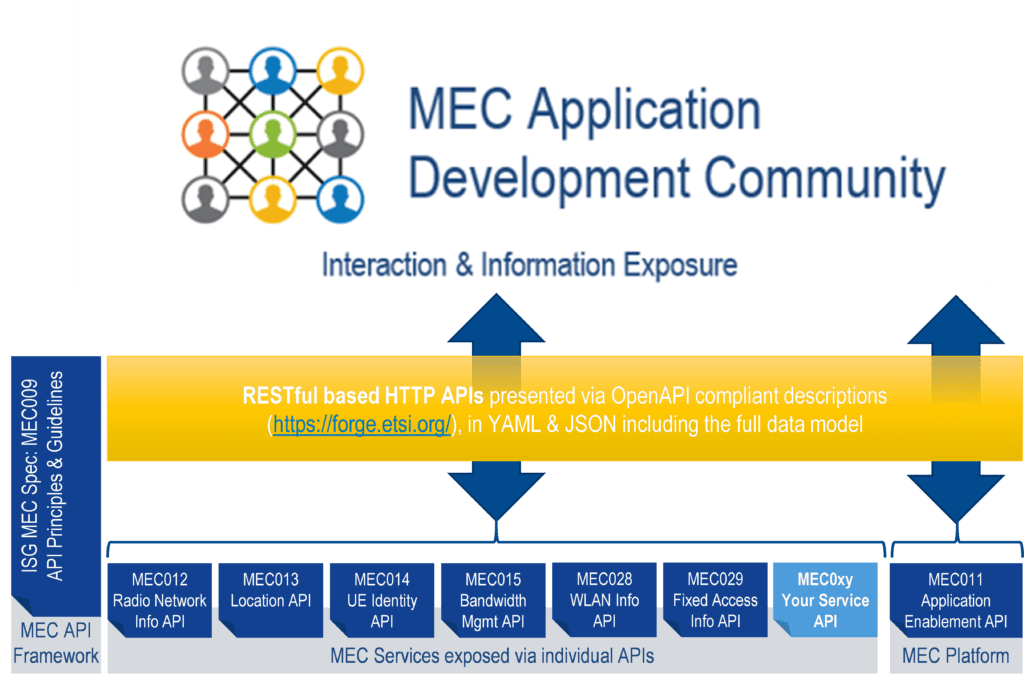

- A major effort of the MEC standardization work is dedicated to publishing relevant and industry-driven exemplary specifications of MEC service APIs, that are using RESTful principles, thus exposed to application developers in a universally recognized language.

The ETSI MEC initiative is focused on Applications at the Edge, and the specified MEC APIs (see above Figure 2.) include meaningful information exposed to application developers at the network edge, ranging from RNI (Radio Network Information) API (MEC 012), WLAN API (MEC 029), Fixed Access API (MEC 028), Location API (MEC 013), Traffic Management APIs (MEC015) and many others.

Additionally, new APIs (compliant with the basic MEC API principles [4]) can be added, without the need of being standardized in ETSI.

In this perspective, MEC truly provides a new ecosystem and value chain, by opening up the market to third parties, and allowing not only operators and cloud providers but any authorized software developers that can flexibly and rapidly deploy innovative applications and services towards mobile subscribers, enterprises and vertical segments.

MEC in 4G (and 5G NSA) Deployments:

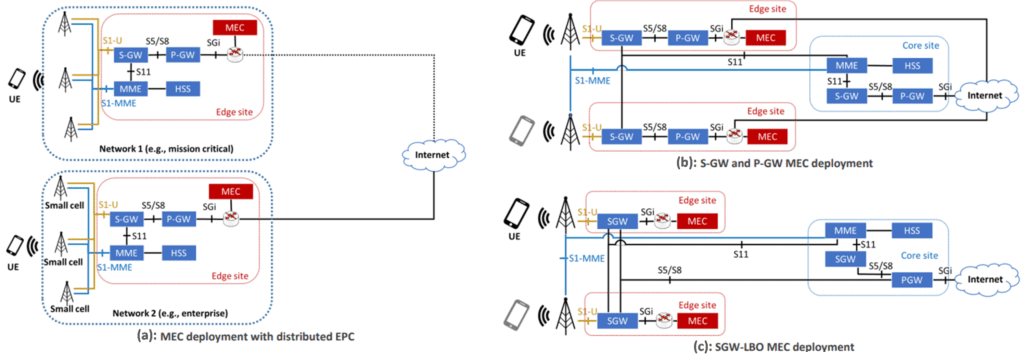

ETSI has already clarified how MEC can be deployed in 4G networks, given its access-agnostic nature [5], with many approaches:

From “bump in the wire” (where the MEC sits on the S1 interface of the 4G system architecture), to “distributed 4G-Evolved Packet Core” (EPC -where the MEC data plane sits on the SGi interface), to “distributed S/PGW” (where the control plane functions such as the MME and HSS are located at the operator’s core site) and “distributed SGW with Local Breakout” (SGW-LBO) -where the MEC system and the distributed SGW are co-located at the network’s edge.

Figure 3. MEC deployment options with distributed EPC (a), distributed S/PGW (b) and SGW-LBO (c)

Depending on the selected solution, MEC Handover is executed in different ways:

In the “bump in the wire approach,” mobility is not natively supported. Instead, in the EPC MEC, SGW + PGW MEC, and CUPS MEC, the MEC handover is supported using 3GPP specified S1 Handover with SGW relocation by maintaining the original PGW as anchor.

The same considerations apply for the SGW-LBO MEC deployment. In the latter case, the target SGW enforces the same policy towards the local MEC application.

Finally, the solutions that include an EPC gateway, such as EPC MEC, SGW+PGW MEC, SGW-LBO MEC, and CUPS MEC are compliant with LI (Lawful Interception) requirements.

This last aspect is also very relevant for MEC adoption, since public telecommunications network and service providers are legally required to make available to law enforcement authorities information from their retained data which is necessary for the authorities to be able to monitor telecommunications traffic as part of criminal investigations.

In that perspective, MEC deployment options are also chosen by infrastructure owners in the view of their compliance to Lawful Interception requirements.

Distributed SGW with Local Breakout (SGW-LBO):

A mainstream for the adoption of MEC is given by the progressive introduction of 5G networks.

Among the various 5G deployment options, local breakout at the SGWs (Figure 3c above) is a solution for MEC that originated from operators’ desire to have a greater control on the granularity of the traffic that needs to be steered. This principle was dictated by the need to have the users able to reach both the MEC applications and the operator’s core site application in a selective manner over the same APN.

The traffic steering uses the SGi – Local Break Out interface which supports traffic separation and allows the same level of security as the network operator expects from a 3GPP-compliant solution.

This solution allows the operator to specify traffic filters similar to the uplink classifiers in 5G, which are used for traffic steering. The local breakout architecture also supports MEC host mobility, extension to the edge of CDN, push applications that requires paging and ultra-low latency use cases.

The SGW selection process performed by MMEs is according to the 3GPP specifications and based on the geographical location of UEs (Tracking Areas) as provisioned in the operator’s DNS.

The SGW-LBO offers the possibility to steer traffic based on any operator-chosen combination of the policy sets, such as APN and user identifier, packet’s 5-tuple, and other IP level parameters including IP version and DSCP marking.

Integrated MEC deployment in 5G networks (3GPP Release 15 and later):

Edge computing has been identified as one of the key technologies required to support low latency together with mission critical and future IoT services. This was considered in the initial 3GPP requirements, and the 5G system was designed from the beginning to provide efficient and flexible support for edge computing to enable superior performance and quality of experience.

In that perspective, the design approach taken by 3GPP allows the mapping of MEC onto Application Functions (AF) that can use the services and information offered by other 3GPP network functions based on the configured policies.

In addition, a number of enabling functionalities were defined to provide flexible support for different deployments of MEC and to support MEC in case of user mobility events. The new 5G architecture (and MEC deployment as AF) is depicted in the Figure 4 below.

Figure 4. – MEC as an AF (Application Function) in 5G system architecture

In this deployment scenario, MEC as an AF (Application Function) can request the 5GC (5G Core network) to select a local UPF (User Plane Function) near the target RAN node. Then use the local UPF for PDU sessions of the target UE(s) and to control the traffic forwarding from the local UPF so that the UL traffic matching with the traffic filters received from MEC (AF) is diverted towards MEC hosts while other traffic is sent to the Central Cloud.

In case of UE mobility, the 5GC can re-select a new local UPF more suitable to handle application traffic identified by MEC (AF) and notify the AF about the new serving UPF.

In summary, MEC as an AF can provide the following services with a 5GC:

- Traffic filters identifying MEC applications deployed locally on MEC hosts in Edge Cloud

- Target UEs (one UE identified by its IP/MAC address, a group of UE, any UE)

- Information about forwarding the identified traffic further e.g. references to tunnels toward MEC hosts

………………………………………………………………………………………………………………………………………………………………………………………….

Part II. of this two part article will illustrate and explain concurrent access to local and central Data Networks. The enablement of MEC deployments and ecosystem development will also be presented.

Importantly, Part II will explain how MEC is evolving to the next phase of 5G– 3GPP Release 17. In particular, ETSI MEC is aligning with 3GPP SA6 which is defining an EDGEAPP architecture (ref. 3GPP TS 23.558).

Part II will also explain how MEC is evolving to multi-cloud support in alignment with GSMA OPG requirements for the MEC Federation work.

ETSI MEC Standard Explained – Part II

…………………………………………………………………………………………………………………………………………………………………………………………..

References:

1. Introduction:

https://www.accenture.com/_acnmedia/PDF-128/Accenute-MEC-for-Pervasive-Networks-PoV.pdf

PowerPoint Presentation (etsi.org)

2. Main body of this article (Part I and II):

[1] ETSI MEC website, https://www.etsi.org/technologies/multi-access-edge-computing

[2] ETSI GS MEC 003 V2.1.1 (2019-01): “Multi-access Edge Computing (MEC); Framework and Reference Architecture”, https://www.etsi.org/deliver/etsi_gs/mec/001_099/003/02.01.01_60/gs_mec003v020101p.pdf

[3] ETSI White Paper #36, “Harmonizing standards for edge computing – A synergized architecture leveraging ETSI ISG MEC and 3GPP specifications”, First Edition, July 2020, https://www.etsi.org/images/files/ETSIWhitePapers/ETSI_wp36_Harmonizing-standards-for-edge-computing.pdf

[4] ETSI GS MEC 009 V3.1.1 (2021-06), “Multi-access Edge Computing (MEC); General principles, patterns and common aspects of MEC Service APIs”, https://www.etsi.org/deliver/etsi_gs/MEC/001_099/009/03.01.01_60/gs_MEC009v030101p.pdf

[5] ETSI White Paper No. 24, “MEC Deployments in 4G and Evolution Towards 5G”, February 2018, https://www.etsi.org/images/files/ETSIWhitePapers/etsi_wp24_MEC_deployment_in_4G_5G_FINAL.pdf

[6] ETSI White Paper No. 28, “MEC in 5G network”, June 2018, https://www.etsi.org/images/files/ETSIWhitePapers/etsi_wp28_mec_in_5G_FINAL.pdf

[7] ETSI GR MEC 031 V2.1.1 (2020-10), “Multi-access Edge Computing (MEC); MEC 5G Integration”, https://www.etsi.org/deliver/etsi_gr/MEC/001_099/031/02.01.01_60/gr_MEC031v020101p.pdf

[8] ETSI GR MEC 035 V3.1.1 (2021-06), “Multi-access Edge Computing (MEC); Study on Inter-MEC systems and MEC-Cloud systems coordination”, https://www.etsi.org/deliver/etsi_gr/MEC/001_099/035/03.01.01_60/gr_mec035v030101p.pdf

[9] ETSI DGS/MEC-0040FederationAPI’ Work Item, “Multi-access Edge Computing (MEC); Federation enablement APIs”, https://portal.etsi.org/webapp/WorkProgram/Report_WorkItem.asp?WKI_ID=63022

Vodafone and Mavenir complete VoLTE call over a containerized Open RAN lab environment

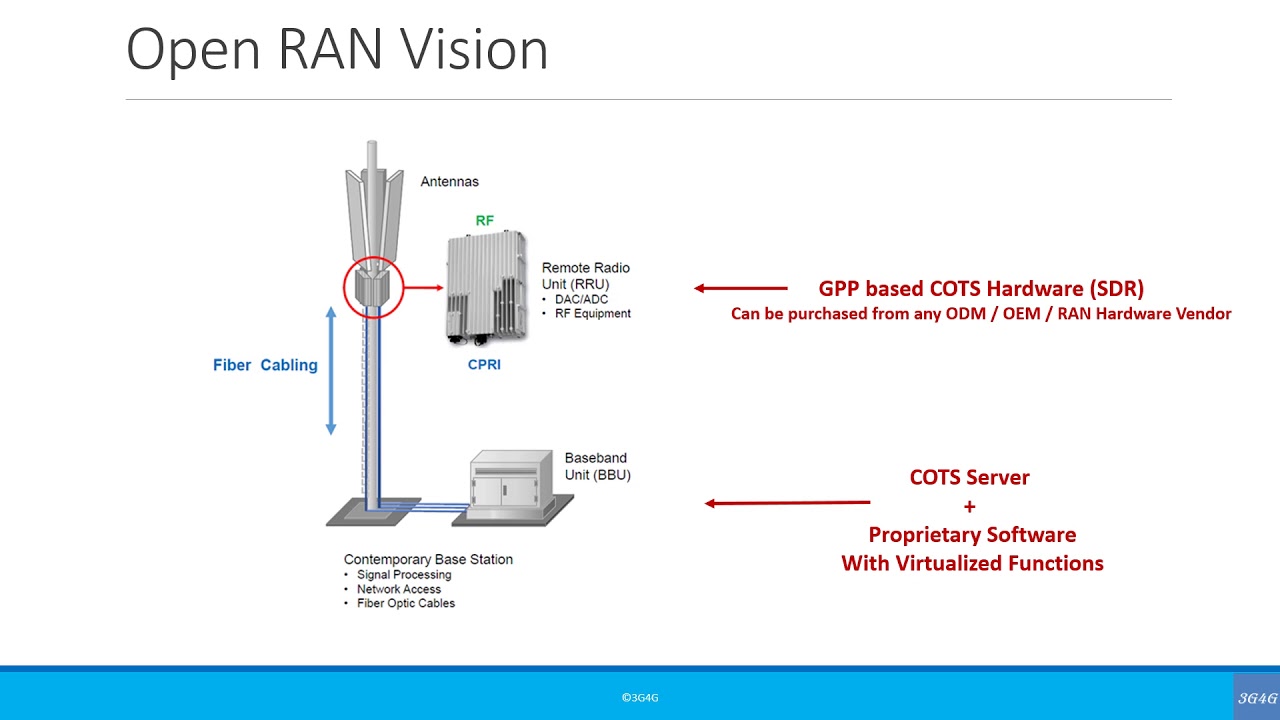

Upstart network software provider Mavenir, announced today that it completed the first data and Voice over LTE (VoLTE) call across a containerized 4G small cell Open RAN solution in a Vodafone lab environment. The completed tests are the latest steps forward to delivering an open and vendor-interoperable 4G connectivity solution for small to medium-sized office locations.

Having first started work on a containerized indoor enterprise connectivity solution in January 2021, Vodafone has completed tests for an important stage of the technology roadmap. The plug-and-play small cell equipment can ensure comprehensive mobile coverage in every corner of the office. The solution will provide 4G coverage initially, making use of radio hardware from Sercomm and software from Mavenir (Open RAN). Containerization means that software can be seamlessly transferred between equipment, platforms, and applications. Wind River provided its Containers as a Service (CaaS) software, part of Wind River Studio.

This demonstration of a containerized solution is a major milestone in the evolution of connectivity equipment away from physical infrastructure to a digital cloud-based environment. Containerization provides greater flexibility for customers, but also significant benefits in terms of speed and cost of deployment.

Open RAN technology separates software from hardware, meaning more flexibility for mobile operators and customers. This approach aims to see many companies providing the components that make up a mobile network site, where previously one vendor would have delivered the whole solution. The technology is controversial, but accepted by many as a potential disruptor for the telecommunications industry. Vodafone claims to be one of the industry leaders in supporting the development of the Open RAN vendor ecosystem.

Whereas much of the focus for Open RAN has been directed towards network infrastructure deployment on mobile sites throughout the UK, the technology can be implemented in an enterprise environment to support local connectivity requirements. As an interoperable and standardized (there are no standards for Open RAN!) technology, Open RAN solutions can be integrated with little disruption in a “plug and play” manner, interoperable with other Open RAN compliant vendors.

Andrea Dona, Chief Network Officer, Vodafone UK, said: “Open RAN is opening doors to simplified and intuitive connectivity solutions. For our wider network deployment strategy, Open RAN is enabling us to work with a wider pool of suppliers and to avoid vendor lock-in scenarios that might prevent us from taking advantage of the latest innovations. The same could be said for enterprise connectivity solutions.”

“From the moment Open RAN is deployed in an office environment, customers are no-longer locked into a single upgrade path. Working alongside Vodafone, customers can be more flexible in how connectivity solutions are adapted and upgraded as demands evolve in the future.”

Stefano Cantarelli, Executive Vice President and Chief Marketing Officer, Mavenir, said; “Cloud Native and Open Solutions are becoming the new reality of the mobile world, and these include Radio Access and its containerized implementation. Open vRAN is a very flexible architecture that can serve any type of segment and Mavenir is really pleased to work with Vodafone in the enterprise business and achieved another first together. It is an opportunity to show that automated and AI controlled systems will simplify life to business and industry.”

“Mavenir is delighted to partner with Vodafone in Open RAN and to work in the U.K. on their radio network transformation initiative, proving the extreme flexibility of Open vRAN,” Virtyt Koshi, SVP of Mavenir EMEA, said. “We are particularly proud in working in the field within the Vodafone commercial network and in the Newbury Open RAN Test and Verification lab, supporting the Vodafone effort to boost the ecosystem.”

Moving forward, Vodafone and Mavenir will focus on finalizing the packaging and automation of the solution before beginning trials with selected customers.

References:

Vodafone and Mavenir create indoor OpenRAN solution for business customers

Vodafone partners with Mavenir to leverage Open RAN for in-building enterprise 4G

Samsung and Viettel launch 5G RAN trial in Da Nang, Vietnam

Samsung has launched a commercial trial of its 5G radio access network technology with Viettel in Vietnam. The network operator will use Samsung’s advanced 5G solutions to power its commercial network and to enable users in Da Nang to “experience the full benefits of 5G services. The companies will verify the high-performance and advanced capabilities made possible by Samsung’s 4G and 5G network solutions,” Samsung said in this statement.

“Viettel has continued to prioritize building 5G infrastructure in key areas of the city,” said Tao Duc Thang, Deputy General Director from Viettel. “Viettel will join hands to make smart city development in Da Nang more synchronous and modern, to connect broadband in multi-dimensional and safe ways, ensuring best network infrastructure for digital government development, supporting for business and growth of Da Nan,” Tao added.

Viettel is Vietnam’s largest telecom operator. Its 4G infrastructure covers 97% of the Vietnamese population. The company also provided the first 5G service in Vietnam.

Currently, 11 provinces/cities of Vietnam have 5G Viettel coverage (including Hanoi, Bac Ninh, Bac Giang, Vinh Phuc, Dong Nai, Ho Chi Minh City, Ba Ria–Vung Tau, Binh Phuoc, Thua Thien–Hue and Da Nang). People in these areas can experience 5G for free with unlimited capacity, on many 5G support devices. The 5G Viettel network in the above areas has a stable data download speed of 600-700 Mbps, the highest of up to more than 1Gbps.

For the commercial trial in Da Nang, Samsung provided its latest 4G and 5G solutions, which include its baseband unit as well as 64T64R Massive MIMO radios and radios on mid-band spectrum. Samsung’s latest baseband unit offers improved performance with industry leading capacity and throughput, while supporting both 4G and 5G technologies.

Samsung says its 64T64R 5G Massive MIMO radio has the capability to power highly-congested and populated areas, delivering increased coverage and data speeds for enhanced 5G end-user experiences.

“We are excited to work with Viettel to bring immersive and reliable 5G services to consumers, and demonstrate Samsung’s technical leadership in Vietnam. This trial marks a big first step for the two companies’ collaborative efforts in Vietnam,” said Ho Chi Dung, Vice President, Network Business, Samsung VINA. “We look forward to supporting Viettel with a network that is ready to unlock the future of mobile connectivity in Vietnam, and that brings a new level of 5G experiences to the country’s increasing number of mobile users.”

Samsung has successfully delivered 5G end-to-end solutions including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from fully virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users around the world.

References:

https://news.samsung.com/global/samsung-and-viettel-to-launch-5g-commercial-trial-in-da-nang-vietnam

https://www.channelasia.tech/article/693891/viettel-kicks-off-da-nang-5g-trials-samsung/

Orange and Nokia deploy 4G LTE private network for Butachimie in Alsace, France

Orange Business Services and Nokia are deploying a redundant and secure 4G-LTE private mobile network that can be upgraded to 5G network at Butachimie’s Chalampé plant in Alsace, France. The network uses the 2.6 GHz spectrum, which French regulator Arcep has designated for mobile networks built to meet businesses’ specific needs. It also uses TDD (Time Division Duplexing) to separate wireless transmit and receive channels.

Butachimie will connect factory equipment and assets to the network, which is expected to allow technicians to geolocate assets with pinpoint accuracy. Nokia will supply a dedicated core network as well as RAN equipment, so that all network data stays onsite. The companies said both the factory equipment and the data it generates will be visible on the network at all times, enabling the manufacturer to prevent failures and ensure continuous production.

This private 4G network allows Butachimie teams to gain controlled and effective access to information system applications; they can also take advantage of new services via wirelessly connected devices (geolocation, intercom, camera, real-time sharing of videos and images, etc.). In addition, the equipment and the data collected ensure a high level of network availability of more than 99.99%, which makes it possible to forecast incipient network failures and guarantee continuous production within the plant.

Stéphane Cazabonne, project manager at Butachimie, said: “Our digital transformation and modernization plan has to meet very stringent challenges in terms of security and availability. Therefore, it is essential for us to be able to rely on reliable partners who can provide us with technological robustness, personalized support, and our business knowledge and related uses. Thanks to Orange Business Services and Nokia, we are taking a new step towards developing the Factory of the Future by offering our operators new tools to increase our performance and competitiveness in our industry. With this scalable network, we can finally benefit from the performance and benefits of the technology, such as 5G, which is already predicted.”

Butachimie’s Chalampé Plant. Photo credit: Butachimie

Butachimie’s Chalampé Plant. Photo credit: Butachimie

Orange Business Services provides advice and technical support on full network management and the use cases around it. Industry 4.0 [1.] current or future. In the design phase, Orange Business Services considered the scalability of the private mobile network, in particular by designing an architecture adapted to the principles of Mobile Edge Computing.

Note 1. Towards Factory 4.0:

Since 2010 Butachimie has been involved in the MIRe project. All the electronics on the site will be completely reviewed and modified by 2022 in order to optimize production. Digitalizing our processes and incorporating digital tools will allow us to improve both performance and competitiveness. It will also speed up process development while following the fundamental rules of safety and sustainability.

…………………………………………………………………………………………………………………………………………………

Denis de Drouâs, director of the private radio networks program at Orange Business Services, said that Butachimie chose a private network that is “totally independent from the public network.” However, other manufacturers may select different solutions.

For example, Schneider Electric is using a hybrid network model that combines private and public 4G and 5G infrastructure. The network uses Orange’s commercial 5G frequencies in the 3.4-3.5GHz bands, but Schneider’s critical data is kept on its campus and can be used for low-latency, edge-based applications.

Orange says it “slices its public network” for enterprise customers, according to de Drouâs. However, that is not the same as “network slicing” (?) which requires a 5G SA core network. Commercial frequencies are used, and the “private slice” guarantees the customer a specific quality of service.

This 4G Private Mobile Network is the backbone for all future applications currently under development as part of the Butachimie digital transformation project.

References:

Draft new ITU-R report: Applications of IMT (4G, 5G) for Specific Societal, Industrial and Enterprise Usages

Introduction and Call for Contributions:

A preliminary new ITU-R draft report M.[imt.industry] addresses the usage, technical and operational aspects and capabilities of IMT for meeting specific needs of societal, industrial and enterprise usages. ITU-R WP 5D invites the views of External Organizations (Including 3GPP TSG SA WG 6 (SA6)) involved in standardization and development of applications of IMT to provide industrial and enterprise usages and applications, required capabilities, technical and operational aspects and any other related material that would facilitate in completion of this Report.

External organizations may wish to provide information on the relevant work as indicated in Question ITU-R 262/5. External Organizations are invited to submit material preferably to the 40th meeting of WP 5D but no later than 41st meeting of WP 5D which is planned for 13-24 June 2022.

ITU-R WP 5D looks forward to collaborating with External Organizations on this matter.

Backgrounder:

ITU-R Report M.2441, published in 2018, provided an initial compilation of usage of IMT in specific applications. Further, it introduces potential new emerging applications of IMT in areas beyond traditional voice, data and entertainment type communications as envisaged in the vision for IMT-2020. PPDR, one of the specific applications of IMT is addressed in Report ITU-R M.2291.

This report has been developed in response to Question ITU-R 262/5 which calls upon ITU-R to study specific industrial and enterprise applications, their emerging usages, and their functionalities, that may be supported by IMT.

Today’s industrial automation is powered by ICT technology and this trend will increase manifold with advent of new broadband mobile technologies such as IMT-2020 (5G), leading to increased business efficiencies, improved safety, and enhanced market agility. Industry 4.0 enables industries to fuse physical with digital processes by connecting all sensors and actuators, machines and workers in the most flexible way available. Tethering them to a wired network infrastructure is expensive and, ultimately, it will limit the possible applications of Industry 4.0. Industrial grade private wireless will unleash its real potential by providing the most flexible and cost-effective way to implement a wide range of Industry 4.0 applications.

Current IT based automation solutions are well adapted for day-to-day business communications but are limited in reliability, security, predictable performance, multiuser capacity and mobility, all features which are required for operational applications that are business or mission critical. Similarly, applications in mines, port terminals or airports require large coverage area, low latency and challenging environments, which so far only two-way mission critical radios could meet. In both mining and port terminals, remotely operated, autonomous vehicles, such as trucks, cranes and straddle carriers are used requiring highly reliable mission critical mobile communications.

Take manufacturing, with thousands of factories with more than 100 employees, as an example, typical business cases revolve around controlling the production process, improving material management, improving safety, and introducing new tools. Research has shown that manufacturers can expect to see a tenfold increase in their returns on investment (ROIs) with IMT-2020, while warehouse owners can expect a staggering fourteenfold increase in ROI. Fortunately, IMT-2020 is available in configurations perfectly suited to building industrial-strength private wireless networks to support Industry 4.0. They bring the best features of wireless and cable connectivity and have proven their capabilities both in large consumer mobile networks area as well as in many industrial segments. The time is ripe for many industries to leverage private and captive IMT-2020 to increase efficiencies and automation. In simple terms –

(i) A private network is a dedicated network of the enterprise involving connections of the people, systems and processes of the enterprise.

(ii) A private network is a dedicated network by the enterprise setup internally in the enterprise by internal IT teams or outsourced.

(iii) A private network is a dedicated network for the enterprise to enable communication infrastructure for the systems and people associated with the enterprise.

The emergence of ultrafast IMT-2020 technology in higher (mmWave) frequency bands as well provides manufacturers with the much-needed reliable connectivity solutions, enabling critical communications for wireless control of machines and manufacturing robots, and this will unlock the full potential of Industry 4.0.

Apart from manufacturing, many other industries are also looking at IMT-2020 as the backbone for their equivalent of the Fourth Industrial Revolution. The opportunity to address industrial connectivity needs of a range of industries include diverse segments with diverse needs, such as those in the mining, port, energy and utilities, automotive and transport, public safety, media and entertainment, healthcare, agriculture and education industries, among others.

Some recent trial of IMT in port operations demonstrated the “5G New Radio (5G NR)” capabilities for critical communications enablers such as ultra-reliable low-latency communication (URLLC), enhanced mobile broadband (eMBB) to support traffic control, AR/VR headsets and IoT sensors mounted on mobile barges and provides countless possibilities to improve efficiency and sustainability in seaports and other complex and changing industrial environments. In response to the impact of COVID-19 pandemic some ports are increasing/accelerating their adoption of digital processes, automation and other technologies to enhance efficiency and resiliency to crises such as a global pandemic.

Similarly, in mining exploration sites, the drilling productivity could be substantially increased through automation of its drills alone. Additional savings from increased usage of equipment could also lead to lower capital expenditures for mines (CapEx) as well as a better safety and working environments for their personnel.

Even the most advanced factories of today still largely depend on inexpensive unlicensed wireless networks that have several drawbacks, such as lack of protection and potential interference in dense settings and complex fixed connections that are difficult to manage in large industrial settings. While the unlicensed spectrum is freely available, it is severely limited in quality of service (QoS) and support for mobility. In smart manufacturing, such networks cannot support the mobile requirements of automated guided vehicles (AGVs) or the even some of the faster moving arms of robots. It also does not support low power requirements of sensors and other IoT devices. Further, it cannot support the high density of sensors, devices, robots, workers and vehicles that are operating in a typical manufacturing plant.

An example of an application in health care that need critical communications that is supported by new capabilities of IMT is remote robotic surgery. A latency of 1 millisecond is critical in providing haptic feedback to a surgeon that is connected through a mobile connection to a surgical robot. A high data rate is needed to transfer high-definition image streams. As an ongoing surgery cannot be interrupted an ultra-reliable communication is needed to keep connection down-time and packet loss very low.

A new generation of private IMT networks is emerging to address critical wireless communication requirements in public safety, manufacturing industries, and critical infrastructure. These private IMT networks are physical or virtual cellular systems that have been deployed for private use by a government, company or group of companies. A number of administrations took the lead to enable locally licensed or geographically shared IMT spectrum available for enterprise use and have begun to recognize spectrum sharing and localised broadband networks in providing flexibility and meeting the needs of critical communications by vertical industries and enterprises. Some administrations have decided to partition the IMT spectrum between commercial carriers and private broadband and others enabled opportunistic use and dynamic access to IMT spectrum that is licensed to commercial carriers.

Industrial and enterprise usages and applications supported by IMT:

- IMT applications in mining sector

- IMT applications in oil and gas sector

- IMT applications in distribution and logistics

- IMT applications in construction and similar usages

- IMT applications in enterprises and retail sector

- IMT applications in healthcare

- IMT applications in utilities

- IMT applications community and education sector

- IMT applications in manufacturing

- IMT applications in airports and ports

- IMT applications in the agriculture sector

- IMT applications for in-flight passengers’ broadband communication

Required capabilities of Industrial and Enterprise usages supported by IMT:

[Editor notes: This section, when completed, will include categories of applications/usages and corresponding requirements supported by IMT]

Technical and operational aspect of industrial and enterprise usages supported by IMT:

TBD

Case studies:

TBD

Spectrum aspects:

[Editor’s note: Frequency bands, if any, can be added later from contributions]

Private IMT broadband networks need to operate in frequency bands identified for IMT in order to benefit from the economies of scale of the global IMT ecosystem. The choice of which frequency band(s) to use for local area networks is determined at the national level.

IMT frequency bands in which local area private networks have been deployed or are being planned include: TBD

Editor’s Note: ITU-R M.1036 recommendation titled, ‘Frequency arrangements for implementation of the terrestrial component of International Mobile Telecommunications (IMT) in the bands identified for IMT in the Radio Regulations,” is used for public terrestrial IMT networks.

Courtesy of WSJ: Here’s a yacht equipped with the Meridian 5G Dome Router, for 5G connectivity offshore. PHOTO: MOTORYACHT MUSASHI

Regulatory aspects:

Increased use of local (small cell) private network deployments can expand wireless capacity within existing spectrum resources.

Alternative spectrum allocation mechanisms may be needed to grant spectrum access to local area private networks to enable spectrum sharing by multiple networks operating in a portion of a frequency band or share spectrum with incumbent networks.

National Table of Frequency Allocations (NTFAs) primarily specify the radio services authorized by a national administration in frequency bands and the entities which have access to them. Frequency bands may be allocated to certain services or application on an “exclusive” or “shared” basis. The Licensed Shared Access (LSA) concept has been originally introduced as an enabler to unlock access to additional frequency bands for mobile broadband under individual licensed regime while maintaining incumbent uses. It was also developed with the aim of making a dynamic use of spectrum possible, whenever and wherever it is unused by incumbent users.[5]

LSA offers a regulatory tool to make available additional spectrum resource for use by mobile broadband when spectrum re-farming is not feasible or desirable. It is however defined as a general concept which does not specify the nature of the incumbents and LSA users. LSA licensees and incumbents operate different applications and are subject to different regulatory constraints. They would each have exclusive individual access to a portion of spectrum at a given location and time.[5]

Spectrum access mechanisms to enable spectrum sharing and deployment of local area private networks include: TBD

Dynamic spectrum access:

In the context of ITU-R Report SM.2405, dynamic spectrum access (DSA) stands for the possibility of a radio system implementing cognitive radio systems (CRS) capabilities to operate on a temporary unused/unoccupied spectrum and to adapt or cease the use of such spectrum in response to other users of the band. Cognitive Radio System (CRS) is defined as a radio system employing technology that allows the system to obtain knowledge of its operational and geographical environment, established policies and its internal state; to dynamically and autonomously adjust its operational parameters and protocols according to its obtained knowledge in order to achieve predefined objectives; and to learn from the results obtained.

In USA, the FCC established the Citizens Broadband Radio Service (CBRS) in April of 2015 and created a three-tiered access and authorization framework to accommodate shared use of the band 3550-3700 MHz between private organizations and incumbent military radar and fixed satellite stations. Access and operations are managed through the use of an automated frequency coordination system, called Spectrum Access System (SAS).

Related ITU-R documents:

[1] Question ITU-R 262/5 – Usage of the terrestrial component of IMT systems for specific applications. (Copy reproduced in Attachment 2).

[2] Recommendation ITU-R M.2083 – Framework and overall objectives of the future development of IMT for 2020 and beyond.

[3] Report ITU-R M.2440 – The use of the terrestrial component of International Mobile Telecommunications (IMT) for Narrowband and Broadband Machine-Type Communications.

[4] Report ITU-R M.2441 – Emerging usage of the terrestrial component of International Mobile Telecommunication (IMT).

[5] Report ITU-R SM.2404 – Regulatory tools to support enhanced shared use of the spectrum

[6] Report ITU-R SM.2405 – Spectrum management principles, challenges and issues related to dynamic access to frequency bands by means of radio systems employing cognitive capabilities

Revision of ITU-R Handbook on Global Trends in International Mobile Telecommunications (IMT)

ITU-R WP5D has initiated the development of a draft new edition of the Handbook on Global Trends in International Mobile Telecommunications (IMT). Fast development of mobile broadband worldwide urgently requires up-to-date general guidance on issues related to the deployment of IMT systems and the introduction/development of their IMT-2000, IMT-Advanced and IMT-2020 networks.

The Handbook on Global Trends in International Mobile Telecommunications (IMT) provides general information such as service requirements, application trends, system characteristics, as well as substantive information on spectrum, regulatory issues, guidelines for evolution and migration, and core network evolution. Since this Handbook was published in 2015, it requires urgent substantial updates to be a valid reference publication for the ITU membership.

Working Party 5D has invited contributions from the membership with the objective of completing the draft for consideration for approval by Working Party 5D at its 7-18 February 2022 meeting, with a deadline for contributions of 1600 hours UTC, 31 January 2022.

……………………………………………………………………………………………………………………………………………

Introduction:

This Handbook identifies International Mobile Telecommunications (IMT) and provides the general information such as service requirements, application trends, system characteristics, and substantive information on spectrum, regulatory issues, guideline for the evolution and migration, and core network evolution on IMT.

This Handbook also addresses a variety of issues related to the deployment of IMT systems.

Purpose and scope:

The purpose and scope of this Handbook is to provide general guidance to ITU Members, network operators and other relevant parties on issues related to the deployment of IMT systems to facilitate decisions on selection of options and strategies for introduction of their IMT‑2000, IMT‑Advanced and IMT-2020 networks.

The Handbook focuses on the technical, operational and spectrum related aspects of IMT systems, including information on the deployment and technical characteristics of IMT as well as the services and applications supported by IMT.

This Handbook updates previous information on IMT-2000 and IMT-Advanced. It also includes new information on IMT‑2020 from Recommendation ITU-R M.2150. In addition, the work from Report ITU-R M.2243 – Assessment of the global mobile broadband deployments and forecasts for International Mobile Telecommunications, is referenced regarding any future considerations that are identified. This Handbook has been and will continue to be a collaborative effort involving groups in the three ITU Sectors with ITU-R Working Party 5D assuming the lead, coordinating role and responsibility for developing text for the terrestrial aspects; with ITU-R Working Party 4B responsible for the satellite aspects, ITU-T Study Group 13 responsible for the core network aspects and ITU-D Q.25/2 responsible for the developing countries aspects.

Special attention has been given to needs of developing countries responding to the first part of Question ITU‑R 77/5 which decides that WP 5D should continue to study the urgent needs of developing countries for cost effective access to the global telecommunication networks.

This Handbook also includes summary of deliverables and on-going activities of WP 5D in order to provide an update for countries which are not able to attend 5D meetings.

References:

https://www.itu.int/pub/R-HDB-62

https://www.itu.int/en/publications/ITU-R/pages/publications.aspx?parent=R-HDB-62-2015&media=paper

Rakuten Symphony Inc. to provide 4G and 5G infrastructure and platform solutions to the global market

Japan’s Rakuten Group today announced that they have resolved to incorporate Rakuten Symphony, a business organization of the Company, and start considering a capital and business alliance (in other words, investments).

As announced on August 4, 2021 in “Rakuten launches Rakuten Symphony to accelerate adoption of cloud-native, open RAN-based mobile networks worldwide,” alongside Rakuten Communications Platform (hereafter “RCP“), Rakuten Symphony, a new business organization, was newly launched by consolidating the products and services to be implemented.

Rakuten Symphony aims to provide a future-proof, cost-effective, communication cloud platform for carriers, businesses and government agencies around the world.

Rakuten Symphony is a global business organization that develops solution businesses in Japan, the United States, Singapore, India, Europe, and the Middle East / Africa. Through this incorporation, accountability (duties) will be clarified, flexible decision-making and business execution will be possible, and products, services, and solutions for telecommunications carriers will be consolidated across the board.

“We will be ready to provide 4G and 5G infrastructure and platform solutions to the global market.”

In addition, as announced in “1&1 and Rakuten agree far-reaching partnership to build Europe’s first fully virtualized mobile network based on new Open RAN technology” also on August 4, 1&1 has agreed to comprehensively adopt RCP. This business has been steadily accumulating its achievements. In order to further accelerate the global expansion of innovative mobile network solutions, Rakuten Symphony, Inc., a newly established corporation, will consider accepting capital, etc. in addition to business partnerships with strategic partners.

The Company will establish its position as a global leader in cloud-centric and virtualized Open RAN-based mobile networks, by expanding its communication platform business overseas, as well as its track record of expanding its mobile carrier business in Japan.

Mike Dano of Light Reading wrote:

It’s no surprise that Rakuten is pulling out all the stops to make Symphony a success. The operation’s Symphony contract with flagship customer 1&1 in Germany is worth between $2.3 billion and $2.7 billion over a ten-year period, reports Nikkei Asia. By contrast, Rakuten made about $1.8 billion in revenues at its Japanese mobile business in the last year.

“This business has been steadily accumulating its achievements,” Rakuten wrote this week, pointing specifically to its 1&1 deal.

Light Reading reported in March 2020 of Rakuten’s plans to sell a networking platform internationally. The offering was initially dubbed Rakuten Mobile Platform (RMP), and then Rakuten Communications Platform (RCP), but the company in August named it Symphony and said the operation targeted an addressable market of up to $100 billion.

Symphony is essentially the portfolio of technologies Rakuten uses in its Japanese mobile network – alongside other offerings from its partners – that it is now pitching to other service providers and networking hopefuls worldwide. According to Rakuten, companies can purchase all or parts of Symphony in order to quickly and easily roll out their own open RAN 5G networks.

Thus, Symphony is now on a collision course with a wide range of other players selling similar offerings. Ericsson, Amazon, Google and Mavenir are among the many providers hoping to assemble a product portfolio stretching across core networking, radio hardware and associated software and services, and then to rope in deals with customers ranging from enterprises to government agencies.

References:

https://global.rakuten.com/corp/news/press/2021/0930_03.html

https://www.lightreading.com/the-core/rakuten-rearranges-symphony-for-investments/d/d-id/772501?

Russia’s Norilsk Nickel to deploy private 5G network without a network operator

Russian metallurgy company Norilsk Nickel is considering applying for a license to use 5G frequencies, reports Comnews.ru citing CEO Alexander Kudinov’s remarks during the GSMA Mobile 360 Eurasia conference in Russia last week. The company plans to deploy a private 5G network on its own, without cooperating with any telecommunications network operator.

Norilsk Nickel is interested in working with equipment vendors directly. The idea of deploying a private 5G network independently is based on security rather than economic issues.

“At Norilsk Nickel, work directly with the vendor is being worked out very actively. We are considering this model not for economic reasons, but from the point of view of IT security. But such a model of cooperation cannot exist at the moment. There are many incomprehensible points in the law that the government still has. In my opinion, operators have more experience. But Norilsk Nickel is interested in working directly with vendors, “emphasizes Alexander Kudinov.

Dmitry Lakontsev, head of the Skoltech-based NTI Competence Center for wireless communication or the Internet of Things, emphasizes that there is no threat to the operators’ business. Vice versa. The more companies build 5G networks, the higher the demand for equipment will be. And this, in turn, will lead to the growth of the entire industry through additional investment. “It is also worth recalling that it is the industry that gets the maximum effect from the introduction of 5G. Therefore, the creation of private mobile 5G / LTE networks by the enterprises themselves is quite logical,” he says.

According to Dmitry Lakontsev, most companies note such advantages of private networks as full control over data that does not leave the enterprise network perimeter, exact correspondence of the network to use scenarios and the radio environment of the enterprise, and quick setup, reconfiguration and expansion when needs change. In addition, private networks have such advantages as the further development of their own distributed computing resources, at the right point, at the right time, with the necessary characteristics and guaranteed reliability. Also, a private mobile network is a strategic asset of the enterprise and an essential competence.

The disadvantages of private networks are the need to create new competencies for the deployment, optimization and operation of mobile networks, the cost of building a new network and wireless infrastructure, as well as, emphasizes Dmitry Lakontsev, its maintenance and updating. Due to the lack of economies of scale, the purchase of equipment and services takes place on less favorable terms than for mobile operators and owners of a tower business (infrastructure operator). Also the disadvantage is the need to meet the requirements of regulators, which for private 5G networks are still vague and lagging behind technological progress.

At the same time, Dmitry Lakontsev notes, obtaining a license, as a rule, is one of the smallest lines in expenses. To create your own communications infrastructure, you need serious money and relevant competencies. Not all companies can afford it, so this story is unlikely to be massive. However, the demand for private networks is and is only growing, mainly from the largest enterprises. Globally, we are talking about thousands of installations, and on a Russian scale, about dozens, which is quite a lot.

Semyon Zakharov, Director of Project Implementation for Corporate Business of MegaFon PJSC, emphasizes that the operator sees a great interest in private LTE and 5G networks from the corporate market.

The participation of the telecom operator in the construction of private LTE / 5G will allow corporate clients to avoid mistakes when planning a network, taking into account the peculiarities of the territory in which the enterprise is located and the tasks that it faces. “For the same reason, it is more profitable for companies to transfer the operation of networks to operators. If an enterprise builds a network on its own, it must not only obtain frequencies, but also legalize the network itself, carry out radio control and other necessary processes. As a result, the network becomes a non-core asset, which requires significant financial and human resources. Over time, the majority of enterprises give up such non-core activities,” said Semyon Zakharov.

……………………………………………………………………………………………………………………………….

References:

https://www.comnews.ru/content/216481/2021-09-17/2021-w37/nornikel-sdelaet-5g-dlya-sebya

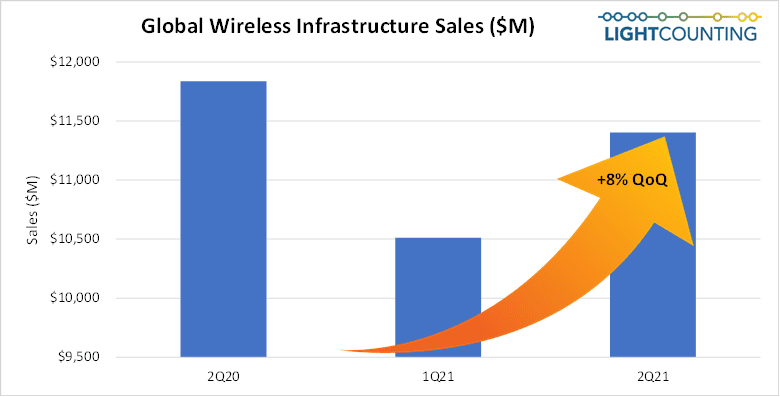

LightCounting: Wireless Infrastructure Market to Grow at 5% in 2021; 8% in 2Q-2021

LightCounting says the 2nd quarter of 2021 was robust for the wireless infrastructure market, as a second quarter typically is, but below 2Q20 that was revved up by China’s 5G catch-up after a massive COVID-19 lockdown. The 5G rollout momentum seen in North America, and Northeast Asia reported in 2H-2020 and 1Q-2021 continued in 2Q-2021 and was augmented by strong activity in Europe, and 4G expansion in India.

As a result, the global wireless infrastructure market grew sequentially, driven by RAN, open vRAN—again mostly fueled by Rakuten Mobile’s 5G network buildout, and 5G and 4G core network elements.

“2Q21 was somewhat reminiscent of the golden GSM era and I could not find anyone malcontent as sales of all 4G and 5G network nodes performed magnificently. Regarding the vendors’ market shares, the gradual rise of Ericsson and Nokia was most immediately induced by the fall of Huawei.” said Stéphane Téral, Chief Analyst at LightCounting Market Research.

LightCounting once again had to increase their North American forecast to reflect a strong start in C-band activity and Ericsson’s 5-year $8B 5G contract with Verizon and decrease their Asia Pacific’s 5G forecast due to uncertainties in China and India. As a result, the global wireless infrastructure market’s growth stayed intact at 5% over 2020.

In the long run, factoring in the strong North American 5G activity which is expected to last until 2025 our model’s market peak has moved by a year to 2023. Our service-provider 20-year wireless infrastructure footprint pattern analysis points to a 2020-2026 CAGR of 1% characterized by low single-digit growth through 2023, followed by a 1% decline in 2024, flatness in 2025, and a 4% drop in 2026. This lumpy pattern reflects the differences in regional and national agendas.

About the report:

2Q21 Wireless Infrastructure Market Size, Share, and Forecast report analyzes the wireless infrastructure market worldwide and covers 2G, 3G, 4G and 5G radio access network (RAN) and core network nodes. It presents historical data from 2016 to 2020, quarterly market size and vendor market shares, and a detailed market forecast through 2026 for 2G/3G/4G/5G RAN, including open vRAN, and core networks (EPC, vEPC, and 5GC), in over 10 product categories for each region (North America, Europe, Middle East Africa, Asia Pacific, Caribbean Latin America). The historical data accounts for the sales of more than 30 wireless infrastructure vendors, including vendors that shared confidential sales data with LightCounting. The market forecast is based on a model correlating wireless infrastructure vendor sales with 20 years of service provider network rollout pattern analysis and upgrade and expansion plans.

More information on the report is available at:

https://www.lightcounting.com/report/august-2021-wireless-infrastructure-2q21-116