4G

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

Despite being very late to deploy 5G due to tardy licensed spectrum auctions, and with no known indigenous 5G network equipment vendors, India’s Communications Minister Ashwini Vaishnaw believes the country’s indigenous 4G/5G technology stack is “now ready” and the country is poised to emerge as a major telecom technology exporter to the world in the coming three years. Speaking at the Economic Times Global Business Summit 2023, Vaishnaw, who is also the Minister for Railways, categorically said there is no program for the privatization of the national transporter.

The 5G services were launched on October 1, 2022, and within a span of 100 days have been rolled out in 200-plus cities. The sheer speed of rollout has been appreciated by industry leaders globally and is being described in many international forums as the “fastest deployment happening anywhere in the world,” he said. Vaishnaw highlighted the population-scale solutions being tested on India stack, across platforms such as payments, healthcare and identity. Each of these platforms is powerful in itself, but together become a dynamic force that can solve “any major problem in the world.”

The minister said India is set to emerge as a telecom technology exporter to the world in the next three years. “Today there are two Indian companies that are exporting to the world…telecom gear. In the coming three years, we will see India as a major telecom technology exporter in the world,” Vaishnaw said.

The minister talked of the rapid strides taken by India in developing its own 4G and 5G technology stack, a feat that caught the attention of the world. “The stack is now ready. It was initially tested for 1 million simultaneous calls, then for 5 million, and now it has been tested for 10 million simultaneous calls,” he said terming it a “phenomenal success.” At least 9-10 countries want to try it out, he added.

The minister gave a presentation outlining key initiatives under his three ministries of telecom, IT and Railways. For Railways, the focus is on transforming passenger experience, he said as he presented slides on how railways is redeveloping stations and terminals (New Delhi, Ahmedabad, Kanpur, Jaipur among others) with modern and futuristic design blueprint, and in the process creating new urban spaces while also preserving rich heritage.

The minister also gave an overview on the Vande Bharat train, the indigenous train protection system Kavach and progress on the bullet train project. To a question on the past talks around private freight rail corridors to boost logistics, the minister said “there is no program for Railway privatization.” “In a country where we have 1.35 billion people, 8 billion people moving every year on Railways, we thought that it is prudent to learn from the experience of others, and keep it within the Government set-up,” Vaishnaw said.

India’s Communications Minister Ashwini Vaishnaw (Photo Credit: PT)

To another query on dedicated freight corridor for food grains, the minister explained that when it comes to transport economics it is important not to divide assets between different applications.

“Today, the thought process has got very refined, and we are adding close to 4500 km of network every year, which amounts to 12 km of new tracks per day. So we have to increase the capacity to such a large extent that there is enough capacity for food grains, enough for coal, small parcels, and every kind of cargo,” he said. While Railways had been consistently losing market share over the last 50-60 years, it has started clawing it back.

“The lowest point was 27 per cent. I am happy to share that from the 27 per cent level, last year Railways increased to 28 per cent, this year we are doing close to 29-29.5 per cent, and in the coming 2-3 years Railways will go towards 35 per cent market share,” he added.

People will choose between transport via road, railways or air based on the distance to be travelled, and “there will be enough for everybody”. “The country will have enough for everybody, is my point. Up to 250 kilometres road is very good, 250 to 1000 kilometres railway is the ideal mode. Beyond 1000 kilometres air will be the ideal mode. So there will be enough for everybody,” the minister said.

References:

Highlights of Qualcomm 5G Fixed Wireless Access Platform Gen 3; FWA and Cisco converged mobile core network

With 5G deployed in more than 90 countries globally, network operators are increasingly considering 5G Fixed Wireless Access (FWA) to enable more homes and businesses can connect and enjoy the power of connected broadband experiences.

This week, Qualcomm unveiled its 5G Fixed Wireless Access Platform Gen 3, the world’s first fully-integrated 5G advanced-ready FWA platform. Besides benefitting from Snapdragon X75 capabilities, Qualcomm FWA Gen 3 key features include:

- Extended-range mmWave and Sub-6 GHz

- Qualcomm Tri-Band Wi-Fi 7 with expert Multi-Link operation for blazing-fast lower latency, reliable connections, and mesh capability for seamless coverage

- Quad-core central processing unit (CPU) and hardware acceleration boosts

- Self-install capabilities facilitated by Qualcomm Dynamic Antenna Steering technology

- Qualcomm RF Sensing Suite to enable indoor mmWave Customer Premises Equipment (CPE) deployments

- Support for 5G Dual-SIM Dual Active (DSDA) and Dual-SIM Dual Standby (DSDS) configurations

Qualcomm FWA Gen 3 is claimed to be the world’s first fully-integrated 5G advanced (???)-ready FWA platform, which includes support for Sub-6 GHz, mmWave, and Wi-Fi 7 connectivity, and boosted with quad-core CPU and hardware acceleration to drive a wide range of applications and value-added services.

The new platform features:

- The recently announced Snapdragon X75 5G Modem-RF, enabling breakthrough 5G performance to achieve unmatched speeds, coverage, and link robustness

- Qualcomm QTM567 mmWave Antenna Module, providing reliable and extended mmWave coverage

- Wi-Fi 7 with 10Gb ethernet, delivering multi-gigabit speeds and wire-like latency to virtually every device in the home

- Converged mmWave-sub 6 hardware architecture, reducing footprint, cost, board complexity, and power consumption

These capabilities will help OEMs accelerate time to launch, improve performance, and lower development effort for building cutting-edge FWA CPEs at scale. The Qualcomm FWA Gen 3 provides a fully-integrated solution that enables product development for multiple mobile broadband product categories and enables OEMs to offer a diverse product portfolio to their customers.

Qualcomm FWA Gen 3 includes the following features:

- Increased coverage through extended range mmWave and extended-range sub-6GHz with eight receiver antennas and support for power class 1.5 (PC 1.5)

- Enhanced self-install capabilities with Qualcomm Dynamic Antenna Steering Gen2

- Qualcomm RF Sensing Suite to help accelerate indoor mmWave CPEs deployments

- Flexible software architecture with support for multiple frameworks, including OpenWRT and RDK-B

- The Qualcomm FWA Gen 3 encapsulates the next-gen modem-RF system technologies intended to springboard 5G forward with superior 5G speeds and flexibility. This breakthrough connectivity is enabled by several capabilities including:

- Unrivalled spectrum aggregation

- Multi-Gigabit speed

- Improved uplink coverage with FDD uplink MIMO and uplink carrier aggregation (CA)

- Significant performance increase with Wi-Fi 7 advanced features:

- Tri-Band support in the 2.4GHz, 5GHz, and 6GHz spectrum bands with 320MHz and 4K QAM modulation

- Multi-Link technology enabling lower latency in heavily congested home environments

With WiFi 7 (IEEE 802.11be) and 5G connectivity, the platform offers consumers a faster and more reliable internet connection in the home. They can tap into the increased capacity and bandwidth offered by Wi-Fi and 5G to deliver multi-gigabit speeds, enabling consumers to connect all their devices and enjoy improved user experiences.

Qualcomm Resources:

Learn more about Fixed Wireless Access and its benefits here and here. Additionally, check out more on our latest Snapdragon X75 5G Modem-RF System enabling this technology here. Solutions such as this, powered by our one technology roadmap, including foundational 5G technologies, further position Qualcomm as the edge partner of choice for the cloud economy. Qualcomm makes an intelligently connected world possible.

…………………………………………………………………………………………………………………………………

FWA and a Converged Mobile Core Network:

In a blog post today, Matt Price of Cisco states that FWA is a great tool for reducing the digital divide when it comes to accessibility and affordability. The economics for providing Internet services were in need of a change and FWA offers some good ones – reducing trenching requirements, increasing serviceable area, offering self-install customer equipment (CPE), and even providing a common wireless network architecture that can serve both Fixed Wireless Access and Mobile Access services. To achieve these goals, Cisco strongly recommends 5G service providers deploy 5G SA core networks, which the vendor has implemented as a converged 4G/5G core for T-Mobile US.

Other carriers, like Verizon [1.] have deployed a 5G NSA FWA network.

Note 1. Verizon has increasingly come to view FWA as an integral part of their broadband access offering everywhere that FiOS isn’t available. At the same time, the telco has argued (with increasing confidence) that the often-assumed capacity constraints on FWA are not only addressable, but that they are not an issue. Verizon views 5G FWA as a major growth opportunity- much more so than 5G mobile services, according to Sowmyanarayan Sampath, Executive Vice President and CEO of Verizon Business. It’s also interesting that Telkom in South Africa and Safaricom in Kenya have deployed 5G NSA networks for FWA but NOT yet for 5G mobile service.

……………………………………………………………………………………………………………………………………………………………..

5G SA’s network architecture can flexibly deploy User Plane Function (UPF) nodes to anchor a FWA subscriber’s user plane traffic for peering at the nearest edge aggregation point. Unlike a typical mobile device such as a cell phone, fixed wireless devices are meant to be always-on and connected for serving end user devices. Meaning that the latency and reliability we commonly expect from traditional wireline services is expected from fixed wireless services too.

In 2022, T-Mobile US became the fastest growing U.S. Internet Service Provider—doubling their number of FWA customers in the past six months. With over 2 million FWA subscribers and counting, the scalability and flexibility of having a Converged Core has proven invaluable to T-Mobile. Being able to deploy UPF nodes for Fixed Wireless Access in remote locations while managing the Session Management Function (SMF) nodes at a central site(s) is effective for scaling the network, optimizing the usage of the transport infrastructure to deliver better end-user latency.

Scaling and extending Fixed Wireless Access with the flexible deployment of UPF nodes, optimizing the routing for user plane traffic. Source: Cisco

…………………………………………………………………………………………………………………………………………………………………

It’s estimated that around 70% of communication service providers today offer a form of Fixed Wireless Access services, most of them still using 4G LTE, which delivers a fraction of the performance of fiber. Upgrading network architectures to meet the needs of new 5G services needs a smooth plan for the transition. Cisco believes that can begin in the mobile core network. With a Converged 4G/5G Core, communication service providers can migrate from 4G to 5G without disruption while scaling to serve the needs of millions of new subscribers.

For More Information:

Learn more about the Cisco Converged Core, and how we are helping rural communities bridge the digital divide. Find out how T-Mobile and Cisco Launched the World’s Largest Cloud Native Converged Core Gateway, read the December 2022 press release.

……………………………………………………………………………………………………………………….

References:

Next-level connectivity: Unveiling our new 5G FWA Platform | Qualcomm

https://blogs.cisco.com/sp/getting-to-the-core-of-the-digital-divide-with-5g-fixed-wireless-access

https://www.verizon.com/about/blog/fixed-wireless-access

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028

Research & Markets: 5G FWA Global Market to hit $38.17B by 2026 for a CAGR of 87.1%

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile

Nokia and Kyndryl extend partnership to deliver 4G/5G private networks and MEC to manufacturing companies

Following their first partnership one year ago, Nokia and Kyndryl have extended it for three years after acquiring more than 100 customers for automating factories using 4G/5G private wireless networks as well as multi-access edge computing (MEC) technologies. Nokia is one of the few companies that have been able to get any traction in the private 4G/5G business which is expected to grow by billions of dollars every year. The size of the global private 5G network market is expected to reach $41.02 billion by 2030 from 1.38 billion in 2021, according to a study by Grand View Research.

The companies said some customers were now coming back to put private networks into more of their factories after the initial one. “We grew the business significantly last year with the number of customers and number of networks,” Chris Johnson, head of Nokia’s enterprise business, told Reuters.

According to the companies, 90% of those engagements—which span “from advisory or testing, to piloting, to full implementation”—are with manufacturing firms. In Dow Chemical’s Freeport, Texas, manufacturing facility which is leveraging a private LTE network using CBRS frequencies to cover 40 production plants over 50-square-kilometers. The private wireless network increased worker safety, enabled remote audio and video collaboration, personnel tracking, and vehicle telematics, the companies said. Dow Chemical is now planning to expand the same coverage to dozens of its factories, said Paul Savill, Kyndryl’s [1.] global practice leader. “Our pipeline has been growing fundamentally faster than it has been in the last 12 months,” he said. “We now have over 100 customers that we’re working with in the private wireless space … in around 24 different countries.”

Note 1. After getting spun off from IBM in 2021, Kyndryl has focused on building its wireless network business and has signed several agreements with cloud providers.

The current active engagements are across more than 24 countries, including markets like the U.S. where regulators have set aside spectrum assets for direct use by enterprises; this means it’s increasingly possible for buyers to access spectrum without the involvement of mobile network operators.

“As enterprises seek to accelerate and deliver on their journeys towards Industry 4.0 and digitalization, the effective integration and deployment of advanced LTE and 5G private wireless networking technologies becomes instrumental to integrate all enterprise operations in a seamless, reliable, efficient and built in a secure manner,” said Alejandro Cadenas, Associate Vice President of Telco and Mobility Research at IDC. “This expanding, powerful, relationship between Nokia and Kyndryl is a unique combination of vertical and horizontal capabilities, and offers IT, OT and business leaders access to the innovation, tools, and expert resources they need to digitally transform their operations. The partnership offers a compelling shared vision and execution that will enable customers across all industries and geographies to access the ingredients they need to deliver against the promise of digital acceleration, powered by network and edge computing.”

The expanded effort will be enhanced with Kyndryl’s achievement of Nokia Digital Automation Cloud (DAC) Advanced accreditation status, which helps ensure that enterprise customers benefit from an expanded lineup of expert resources and skilled practitioners who have extensive training and deep understanding of Nokia products and solutions. In addition, customers will gain access to Kyndryl’s accelerated network deployment capabilities and support of Nokia cellular radio expertise in selected markets.

In response to a question about how direct enterprise access to spectrum has informed market-by-market activity, Kyndryl Global Practice Leader of Network and Edge Paul Savill told RCR Wireless News in a statement, “Spectrum availability is rapidly becoming less of a barrier, with governments allocating licensed spectrum for industrial use and the emergence of unlicensed wireless networking options (such as CBRS in the US, and MulteFire).”

The companies have also developed automated industrial drones that can monitor a site with different kinds of sensors such as identifying chemicals and video recognition as part of surveillance. While drones have not yet been deployed commercially yet, customers are showing interest in rugged, industrialized non-stop automated drone surveillance, Johnson said.

References:

Hawaiian carrier Mobi to deploy a cloud-native 4G/5G core network as a fully managed service on AWS

Mobi, a leading wireless network provider in Hawaii, is now expanding into the continental United States and beyond. Mobi is one of only four full mobile virtual network operators (MVNOs) in the United States. According to Mike Dano of Light Reading, they have approximately 55,000 customers.

To support a cost-effective, scalable and innovation-friendly expansion strategy, Mobi partnered with Oslo, Norway based Working Group Two (WG2) to move its core network to the cloud. The WG2 mobile core runs cloud-natively on Amazon Web Services (AWS) and empowers Mobi to build a compelling, app-first customer experience on the largest 5G nationwide network (which is assumed to be the AWS cloud native 5G core network). Mobi plans to use its nationwide capabilities to ensure that its Hawaiian customer base won’t need to sign up for another cellular network provider if they move to the continental U.S.

A pilot solution goes live today – January 17, 2022.

By choosing a scalable and flexible cloud architecture, Mobi can offer more competitive rates and faster time-to-market with new services. The Network-as-a-Service approach reduces the time it takes to develop and deploy new features and upgrades. In contrast to legacy solutions, which include only a few network updates per year, Mobi will benefit from continuous, daily upgrades. Further, with a mobile core from WG2 that is agnostic to any generation of wireless, Mobi can future-proof its network with no end-of-life and continuous maintenance and support.

With a programmable, cloud-native core, Mobi will gain unprecedented flexibility, and will realize significantly faster time-to-market with new services. Once the WG2 mobile core is integrated with the radio network, Mobi can leverage simple APIs to determine which services to activate for every SIM or user. The network is delivered fully as-a-service and the cost is based on consumption, defined by the number and type of users/SIM cards, changing as needs and traffic fluctuate. This allows for lower barriers of entry, and a core network that can scale from single users to hundreds of millions of users.

WG2 says their core offers a full MNO core for 4G and 5G, as well as a full MVNO functionality for 2G/3G. This allows operators to build full modern 4G/5G core networks while leveraging national roaming for 2G/3G where necessary. WG2’s 4G/5G/IMS mobile core network provides Mobi with a web-based portal, through which the company can quickly and easily manage existing services and offer new ones. The WG2 core offers the full set of capabilities related to authentication and provisioning, voice, messaging, and data services.

Quotes:

Justen Burdette, CEO of Mobi:

“Our ambition is to disrupt and challenge the status quo in the wireless industry by delivering a seamless, app-first, and engaging customer experience. By working with WG2 and AWS, we not only get access to a scalable, secure, and future-proof core network, we also improve our ability to meet the demands of our customers. It’s all about making it simple to join, affordable to use, and fun to explore what our network can offer. We’re building a brand that resonates with our customers by working with a strong ecosystem of partners.”

“We’re able to do a modern, cloud-based, AWS-focused core from WG2. It’s a sight to behold.”

“You have complete API [application programming interface] control of the core. That makes it really amazing for us because we built our stack around APIs.”

Erlend Prestgard, CEO of WG2:

“Mobi is a standout example of a carrier that’s ready to unlock the benefits of a network-as-a-service, achievable with a consistent, programmable mobile core running on the cloud. This allows them to go live in new geographical markets in record time. The simplicity of the as-a-service operating model means that Mobi can focus on meeting customer expectations and spend their time dreaming about innovation, rather than managing complexity. We’re truly excited about joining Mobi on this journey.”

Fabio Cerone, Managing Director EMEA, Telco Business Unit at AWS:

“Embracing the cloud helps carriers simplify network operations, deploy networks more rapidly, scale more easily – while still retaining full control over the network and gaining additional agility and innovation capabilities. Now the core network is only one API away from the global community of developers, which can help deliver new value for Mobi’s customers.”

As an app-first company, wholly focused on user experience, Mobi embraces an open, API-enabled core network approach. Access to WG2’s global ecosystem of developers offers Mobi a selection of pre-integrated, ready-to-deploy applications for voice, messaging and data services, built by WG2’s development partners from all over the world. Following the continental U.S. rollout, Mobi also plans to leverage the same model to expand to markets including Canada, Puerto Rico and the U.S. Virgin Islands.

About Mobi:

Mobi, Inc. launched as the regional wireless provider for Hawaii in 2005 — becoming the first carrier in the United States to offer affordable, simple, unlimited mobile service at a time when activation, overage, and hidden fees were the norm. Anyone can switch to Mobi in just seconds using the Mobi app, Apple Pay, and eSIM — with smart, friendly Mobi customer care geeks ready to help at any time digitally and at Mobi stores in Hawaii. All Mobi team members are proudly represented by the Communications Workers of America (the CWA). Learn more at mobi.com, or on Facebook, Twitter, or LinkedIn.

About Working Group Two:

Working Group Two has rebuilt the mobile core for simplicity, innovation, and efficiency – leveraging the web-scale playbook and operating models. Today, Working Group Two innovation enables MVNO, MNO, and Private Network Operators a secure, scalable, and reliable telco connectivity backbone that scales across all generations of mobile technologies. Our mission is to create programmable mobile networks to allow our customers and their end users to create more valuable and useful products and services.

Media Contact:

Tor Odland

Working Group Two

+47 9909 0872

[email protected]

References:

https://www.wgtwo.com/blog/mobi-expansion-with-wg2-aws/

Rakuten Mobile in joint venture with Tokyo Electric Power Company (TEPCO) to expand 4G/5G network

Japanese wireless network operator Rakuten Mobile has established a new joint venture company in its domestic market with Tokyo Electric Power Company (TEPCO) to deploy base stations at existing power grid sites as it looks to further expand its 4G and 5G coverage in a more efficient way.

The new company, called Rakuten Mobile Infrastructure Solution, began operating in Tokyo on July 1st. The entity has an initial nominal value of ¥300m (approximately $2.2m), with Rakuten Mobile owning a 51% stake in the venture and TEPCO holding the remaining 49% stake, the operator said in a statement (available in Japanese here).

Rakuten Mobile Infrastructure Solution is set to contribute to the telco’s vision for a stable communication environment by enhancing the efficiency of maintaining base stations through effective use of public assets. The new company will also look to develop installation specifications for Rakuten Mobile’s base station equipment and manage installation-related works.

The Japanese telecom industry upstart, which already covers 96% of the Japanese population with its 4G service, noted it is using “some power assets” to further build out its network.

Through the new company, Rakuten Mobile plans to expand its 4G and 5G networks, boost the density of base station deployments and “strengthen the development of communication infrastructure with the aim of providing stable services”. As it will use the existing power assets of TEPCO for the purpose (alongside the power company’s construction capabilities and know-how), the telco believes it can “improve the cost efficiency of base station maintenance”.

This is not the first engagement for the two companies: In March 2018, Rakuten Mobile secured an agreement to make use of TEPCO’s steel towers, power distribution poles, building roofs and other infrastructure, just a few months before it began building its greenfield cellular network, and in 2019 was part of a broader mobile operator initiative with TEPCO related to power grid infrastructure sharing.

References:

June 2022 Ericsson Mobility Report: 5G subscriptions increased by 70 million in Q1-2022 to reach 620 million

Ericsson new Mobility Report [1.] states that mobile network data traffic grew 10% between the 4th quarter of 2021 and the 1st quarter of 2022. For the year-over-year comparison, growth reached 40%. “In absolute numbers, this means that it has doubled in just two years (since Q1 2020),” the company wrote in its Mobility Report, released June 20th. “Over the long term, traffic growth is driven by both the rising number of smartphone subscriptions and an increasing average data volume per subscription, fueled primarily by increased viewing of video content,” the company added.

The figures are important considering that mobile network operators are rushing to add new spectrum to their networks while upgrading their networks to support 5G, especially 5G SA Core Network. Purchasing both spectrum and 5G equipment is expensive. In the US, for example, mobile network operators are collectively spending an estimated $275 billion to improve their networks with more spectrum, cell sites and 5G.

Note 1. The Ericsson Mobility Report started in 2011, when Ericsson decided to share data and insights openly to all those interested in understanding our industry’s development. Since then, the report and featured articles have seen a continuous evolution and an expanding scope.

………………………………………………………………………………………………………………………………………………………………………………………………………….

Speaking during a webinar to discuss the report’s findings, Richard Möller, senior market analyst at Ericsson, noted that the number of 5G subscribers worldwide had been expected to reach 660 million by the end of 2021. It now seems that the figure was less than forecast: Ericsson is now saying that 5G subscriptions increased by 70 million in Q1 2022 to reach 620 million. The 40 million shortfall is due to changes in how China’s mobile operators are reporting their 5G subscriber figures. Indeed, it has become noticeable over the past year that the Chinese operators are starting to split out “5G package customers” from actual 5G network customers.

“Now we have official numbers and we’ve adjusted our estimates accordingly,” Möller said. “China is early and so large that it affects the global number.” He noted that this adjustment does not “materially affect” the five-year growth forecast. Ericsson is therefore sticking to its estimate of 4.4 billion 5G subscribers by the end of 2027, meaning that 5G will account for almost half of all mobile subscriptions by that point. 5G subscriber growth is expected to accelerate in 2022, reaching around one billion subscribers by the end of the year. The report noted that North America and North East Asia currently have the highest 5G subscription penetration, followed by the Gulf Cooperation Council countries and Western Europe. In 2027, it is projected that North America will have the highest 5G penetration at 90%. In India, where 5G deployments have yet to begin, 5G is expected to account for nearly 40% of all subscriptions by 2027.

At the same time, Möller warned that the war in Ukraine, supply chain constraints and rising inflation will affect future growth. “That’s made us take 100 million subscriptions off the current forecast. However, history has shown that mobile telephony is one of the things that people hang on to … even if the economic world turns negative,” he said.

The report’s executive editor Peter Jonsson said the current uncertainties mean that Ericsson has to be especially careful with its forecasts. However, he reiterated the point that global 5G uptake “is about two years ahead of 4G” on a comparative basis. In addition, 5G rollout “reached 25% of the world’s population about 18 months faster than 4G.”

Global mobile network data traffic and year-over-year growth:

According to Ericsson, mobile subscribers are making use of the additional network capacity and faster speeds provided by those investments. The company said that, globally, the average smartphone user is expected to consume 15GB per month in 2022. Indeed, the 5G share of mobile data traffic is growing, but not as fast as FWA (3G/4G/5G). Continued strong smartphone adoption and video consumption are driving up mobile data traffic, with 5G accounting for around 10 percent of the total in 2021.

In North America, the company estimated that average monthly mobile data usage per smartphone could reach as high as 52GB in 2027. “The data traffic generated per minute of use will increase significantly in line with the expected uptake of new XR and video-based apps,” the company wrote. “This is due to higher video resolutions, increased uplink traffic, and more data from devices off-loaded to cloud compute resources.”

Also, Fixed Wireless Access (FWA) in on the rise as per this graphic:

Over 100 million FWA connections in 2022:

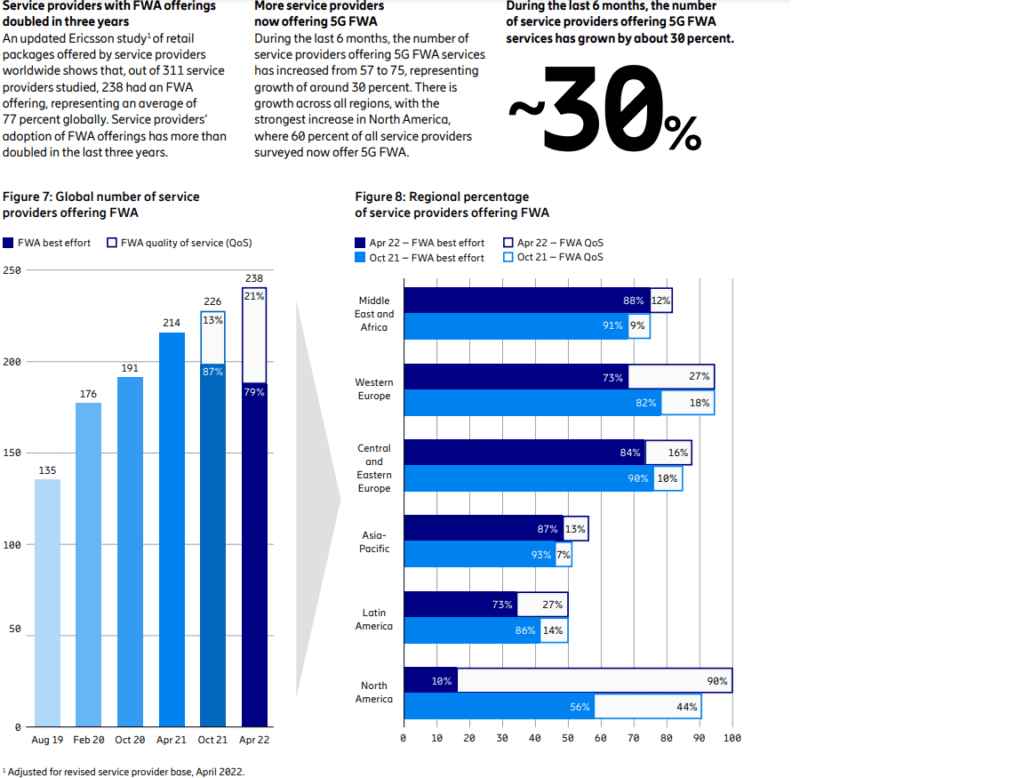

More than 75 percent of service providers surveyed in over 100 countries are offering fixed wireless access (FWA) services. Around 20 percent of these service providers apply differential pricing with speed-based tariff plans.

OpenVault, another vendor that tracks data traffic on wired networks in North America, recently reported similar findings. According to OpenVault, the average wired Internet customer consumed a total of 536.3GB in the fourth quarter of 2021, an increase of 165% over the firm’s findings from the fourth quarter of 2017, when consumption was 202.6GB.

Taken together, the companies’ findings paint a picture of a dramatic expansion in data demand on wired and wireless networks in North America and globally. Indeed, such increases have already sparked unprecedented demand in vendors’ networking equipment to keep pace with demands. Further, such demand has already withstood several price increases among many leading vendors.

The situation reflects the importance of telecom networks globally following a pandemic that pushed many to work and school remotely from home. And in response to the situation, governments globally have begun pushing network operators to construct networks in underserved areas, and to Internet users themselves who may struggle to afford such connections.

References:

https://www.ericsson.com/en/reports-and-papers/mobility-report

https://www.lightreading.com/5g/china-effect-dampens-interim-5g-subs-says-ericsson/d/d-id/778394?

https://www.ctia.org/the-wireless-industry/the-5g-economy

Will 2022 be the year for 5G Fixed Wireless Access (FWA) or a conundrum for telcos?

https://viodi.com/2020/05/05/openvault-broadband-usage-47-in-q1-2020-power-users-are-the-new-normal/

In India: What if Jio, Vi, and Airtel Skip 5G and Focus on 4G?

Telcos worldwide have already spent billions of dollars on setting up infrastructure, permissions, spectrum, and more for 4G and it is also bringing them plenty of revenues. While 5G will open up a whole new revenue stream from the enterprise sector, are the telcos really desperate for it? India has yet to hold its first 5G auction which has been repeatedly delayed.

Reliance Jio, Vodafone Idea (Vi), and Bharti Airtel are the only three PAN-India 4G operators in India right now. All the telcos have hundreds of millions of users in their subscriber base to whom they provide 4G network services. There are 2G users as well, but that’s a conversation for another day. Today, what I want to talk about is what if Jio, Vi, and Airtel don’t roll out 5G and just focus on 4G? Note that I very well know this isn’t going to happen. However, I couldn’t help but wonder, what if the telcos just went on with their usual 4G network services and didn’t care about 5G because of the steep spectrum price and the decision of the government to allow the enterprises to get airwaves directly in an administrative manner for captive private networks?

To be very honest, 5G doesn’t seem like the biggest deal-breaker for the telcos right now. From an investor perspective, the kind of expenditure that 5G would entail in 2022, factoring in spectrum price, among other things, doesn’t feel like a very solid option for Jio, Vi, or Airtel. Not to forget, Vi doesn’t even have the capacity to make large investments for 5G in the first place. Expenditure is not the issue; RoI (return on investment) is!

But one thing’s proven for the telecom operators – revenues from 4G networks. They have already spent billions of dollars on setting up infrastructure, permissions, spectrum, and more for 4G, and it is also bringing them plenty of money. While 5G will open up a whole new revenue stream from the enterprise sector, are the telcos really desperate for it? Well, I would argue not, despite fully acknowledging the fact that all the private companies just want to make more money. So, what will happen if the telcos really don’t go for 5G? Let’s take a look at the negatives first.

Negatives

The most obvious thing would be that consumers won’t get to see 5G anytime this year in any part of the nation. Second, enterprises would be very unhappy as not all of them might be looking to get the airwaves directly for setting up private 5G networks. Third, it would potentially affect the sales of 5G smartphones. Fourth, India will be left even further behind other nations in 5G network technology.

Positives

A delayed 5G rollout would mean that more users would start owning 5G smartphones over the long horizon and when telcos do launch 5G, it will be a more than ready market for them to monetise through retail consumers. Second, the industry and the government would get more time to sort through policies and the telcos would get sufficient room to set up a denser infrastructure.

Moreover, the telecom industry can upskill more people with knowledge about technologies such as 5G, AI, ML, and more which are going to be very relevant.

Again, it is unlikely that the telcos will miss out on 5G this year. But even if they do, I don’t think it is that big of an issue both from a consumer and an investor’s point of view. A seamless 4G experience is still something Indian consumers crave for! Hopefully, that is sorted along with the 5G rollout.

References:

Globe Telecom using next-generation antennas to facilitate 4G acceleration and 5G evolution

Philippine’s carrier Globe Telecom Inc. announced it is using next-generation antennas to facilitate 4G acceleration and 5G evolution. The telco said it has completed the deployment of a new series of antennas that efficiently enables the acceleration of 4G and the evolution of 5G technology. Globe said that the antennas adopts enhanced multi-array modules, ultra-high integration architecture, and full-band technology. The deployment is seen to boost the company’s 4G and 5G network and ensure energy efficiency, Globe added.

Since the antenna is smaller than the traditional design, Globe said it makes installation easier and faster even on cell sites with limited space.

The technology combines different frequency bands and accommodate different generations of cellular technologies, including 5G.

It also minimizes feed loss and improves energy efficiency, which means Globe can maximize energy efficiencies and lower electricity utilization through antenna development and power consumption innovation.

Globe said the use of the latest technology is part of its commitment to the United Nations Sustainable Development Goals, particularly UN SDG No. 9, which highlights the roles of infrastructure and innovation as crucial drivers of economic growth and development.

Globe has earmarked P89 billion for 2022 capital expenditures to roll out more 5G sites and in-building solutions, upgrade cell towers to 4G LTE, add more 4G cell sites, and lay down fiber to the homes.

The company deployed 380 new 5G sites in Metro Manila, Rizal, Cavite, Batangas, Bulacan, Davao, Cebu, Misamis Oriental, and Iloilo in the first quarter.

Globe is innovating with its vendor partners on the latest technologies available to improve customer experience through efficient 4G/5G network deployment.

References:

https://www.gizguide.com/2022/06/globe-uses-new-antennas-4g-5g.html

Summary of EU report: cybersecurity of Open RAN

The EU has published a report on the cybersecurity of Open RAN, a 4G/5G (maybe even 2G?) network architecture the European Commission says will provide an alternative way of deploying the radio access part of 5G networks over the coming years, based on open interfaces. The EU noted that while Open RAN architectures create new opportunities in the marketplace, they also raise important security challenges, especially in the short term.

“It will be important for all participants to dedicate sufficient time and attention to mitigate such challenges, so that the promises of Open RAN can be realized,” the report said.

The report found that Open RAN could bring potential security opportunities, provided certain conditions are met. Namely, through greater interoperability among RAN components from different suppliers, Open RAN could allow greater diversification of suppliers within networks in the same geographic area. This could contribute to achieving the EU 5G Toolbox recommendation that each operator should have an appropriate multi-vendor strategy to avoid or limit any major dependency on a single supplier.

Open RAN could also help increase visibility of the network thanks to the use of open interfaces and standards, reduce human errors through greater automation, and increase flexibility through the use of virtualisation and cloud-based systems.

However, the Open RAN concept still lacks maturity, which means cybersecurity remains a significant challenge. Especially in the short term, by increasing the complexity of networks, Open RAN could exacerbate certain types of security risks, providing a larger attack surface and more entry points for malicious actors, giving rise to an increased risk of misconfiguration of networks and potential impacts on other network functions due to resource sharing.

The report added that technical specifications, such as those developed by the O-RAN Alliance, are not yet sufficiently secure by design. This means that Open RAN could lead to new or increased critical dependencies, for example in the area of components and cloud.

The EU recommended the use of regulatory powers to monitor large-scale Open RAN deployment plans from mobile operators and if needed, restrict, prohibit or impose specific requirements or conditions for the supply, large-scale deployment and operation of the Open RAN network equipment.

Technical controls such as authentication and authorization could be reinforced and a risk profile assessed for Open RAN providers, external service providers related to Open RAN, cloud service/infrastructure providers and system integrators. The EU added that including Open RAN components into the future 5G cybersecurity certification scheme, currently under development, should happen at the earliest possible stage.

Following up on the coordinated work already done at EU level to strengthen the security of 5G networks with the EU Toolbox on 5G Cybersecurity, Member States have analysed the security implications of Open RAN.

Margrethe Vestager, Executive Vice-President for a Europe Fit for the Digital Age, said: “Our common priority and responsibility is to ensure the timely deployment of 5G networks in Europe, while ensuring they are secure. Open RAN architectures create new opportunities in the marketplace, but this report shows they also raise important security challenges, especially in the short term. It will be important for all participants to dedicate sufficient time and attention to mitigate such challenges, so that the promises of Open RAN can be realised.”

Thierry Breton, Commissioner for the Internal Market, added: “With 5G network rollout across the EU, and our economies’ growing reliance on digital infrastructures, it is more important than ever to ensure a high level of security of our communication networks. That is what we did with the 5G cybersecurity toolbox. And that is what – together with the Member States – we do now on Open RAN with this new report. It is not up to public authorities to choose a technology. But it is our responsibility to assess the risks associated to individual technologies. This report shows that there are a number of opportunities with Open RAN but also significant security challenges that remain unaddressed and cannot be underestimated. Under no circumstances should the potential deployment in Europe’s 5G networks of Open RAN lead to new vulnerabilities.”

Guillaume Poupard, Director General of France’s National Cyber Security Agency (ANSSI), said: “After the EU Toolbox on 5G Cybersecurity, this report is another milestone in the NIS Cooperation Group’s effort to coordinate and mitigate the security risks of our 5G networks. This in-depth security analysis of Open RAN contributes to ensuring that our common approach keeps pace with new trends and related security challenges. We will continue our work to jointly address those challenges.”

Finally, a technology-neutral regulation to foster competition should be maintained., with EU and national funding for 5G and 6G research and innovation, so that EU players can compete on a level playing field.

References:

https://ec.europa.eu/commission/presscorner/detail/en/IP_22_2881

https://digital-strategy.ec.europa.eu/en/library/cybersecurity-open-radio-access-networks

IEEE/SCU SoE Virtual Event: May 26, 2022- Critical Cybersecurity Issues for Cellular Networks (3G/4G, 5G), IoT, and Cloud Resident Data Centers

This virtual event on ZOOM will be from 10am-12pm PDT on May 26, 2022.

Session Abstract:

IEEE ComSoc and SCU School of Engineering (SoE) are thrilled to have three world class experts discuss the cybersecurity threats, mitigation methods and lessons learned from a data center attack. One speaker will also propose a new IT Security Architecture where control flips from the network core to the edge.

Each participant will provide a 15 to 20 minute talk which will be followed by a lively panel session with both pre-planned and ad hoc/ extemporaneous questions. Audience members are encouraged to submit their questions in the chat and also to send them in advance to [email protected].

Below are descriptions of each talk along with the speaker’s bio:

Cybersecurity for Cellular Networks (3G/4G, 5G NSA and SA) and the IoT

Jimmy Jones, ZARIOT

Abstract:

Everyone agrees there is an urgent need for improved security in today’s cellular networks (3G/4G, 5G) and the Internet of Things (IoT). Jimmy will discuss the legacy problems of 3G/4G, migration to 5G and issues in roaming between cellular carriers as well as the impact of networks transitioning to support IoT.

Note: It’s important to know that 5G security, as specified by 3GPP (there are no ITU recommendations on 5G security), requires a 5G Stand Alone (SA) core network, very few of which have been deployed. 5G Non Stand Alone (NSA) networks are the norm, but they depend on a 4G-LTE infrastructure, including 4G security.

Cellular network security naturally leads into IoT security, since cellular networks (e.g. NB IoT, LTE-M, 5G) are often used for IoT connectivity.

It is estimated that by 2025 we will interact with an IoT device every 18 seconds, meaning our online experiences and physical lives will become indistinguishable. With this in mind it is as critical to improve IoT security as fastening a child’s seatbelt.

The real cost of a security breach or loss of service for a critical IoT device could be disastrous for a business of any size, yet it’s a cost seldom accurately calculated or forecasted by most enterprises at any stage of IoT deployment. Gartner predicts Operational Technologies might be weaponized to cause physical harm or even kill within three years.

Jimmy will stress the importance of secure connectivity, but also explain the need to protect the full DNA of IoT (Device, Network and Applications) to truly secure the entire system.

Connectivity providers are a core component of IoT and have a responsibility to become part of the solution. A secure connectivity solution is essential, with strong cellular network standards/specifications and licensed spectrum the obvious starting point.

With cellular LPWANs (Low Power Wide Area Networks) outpacing unlicensed spectrum options (e.g. LoRa WAN, Sigfox) for the first time, Jimmy will stress the importance of secure connectivity and active collaboration across the entire IoT ecosystem. The premise is that the enterprise must know and protect its IoT DNA (Device, Network & Application) to truly be secure.

Questions from the audience:

I am open to try and answer anything you are interested in. Your questions will surely push me, so if you can let me know in advance (via email to Alan) that would be great! It’s nice to be challenged a bit and have to think about something new.

One item of interest might be new specific IoT legislation that could protect devices and data in Europe, Asia, and the US ?

End Quote:

“For IoT to realize its potential it must secure and reliable making connectivity and secure by design policies the foundation of and successful project. Success in digital transformation (especially where mission and business critical devices are concerned) requires not only optimal connectivity and maximal uptime, but also a secure channel and protection against all manner of cybersecurity threats. I’m excited to be part of the team bringing these two crucial pillars of IoT to enterprise. I hope we can demonstrate that security is an opportunity for business – not a burden.”

Biography:

Jimmy Jones is a telecoms cybersecurity expert and Head of Security at ZARIOT. His experience in telecoms spans over twenty years, during which time he has built a thorough understanding of the industry working in diverse roles but all building from early engineering positions within major operators, such as WorldCom (now Verizon), and vendors including Nortel, Genband & Positive Technologies.

In 2005 Jimmy started to focus on telecom security, eventually transitioning completely in 2017 to work for a specialist cyber security vendor. He regularly presents at global telecom and IoT events, is often quoted by the tech media, and now brings all his industry experience to deliver agile and secure digital transformation with ZARIOT.

…………………………………………………………………………………………………………………………………………………………………………………………………………………….

Title: Flip the Security Control of the Internet

Colin Constable, The @ Company

The PROBLEM:

With the explosion of Internet connected devices and services carrying user data, do current IT architectures remain secure as they scale? The simple and scary answer is absolutely no, we need to rethink the whole stack. Data breaches are not acceptable and those who experience them pay a steep price.

Transport Layer Security (TLS) encrypts data sent over the Internet to ensure that eavesdroppers and hackers are unable to see the actual data being transmitted. However, the Router needs meta data (the IP and Port) to make it work. What meta data does the Data level Router have access to?

We need to discuss how to approach the problem and selectively discard, but learn from previous IT architectures so that we can build a more solid, secure IT infrastructure for the future.

Proposition:

I will provide a glimpse of a future security focused IT architecture.

- We need to move most security control functionality to the edge of the network.

- Cloud data center storage should be positioned as an encrypted cache with encryption keys at the edge.

- No one set of keys or system admin can open all the encrypted data.

When data is shared edge to edge we need to be able to specify and authenticate the person, entity or thing that is sharing the data. No one in the middle should be able to see data in the clear.

Issues with Encryption Keys:

- IT and Data security increasingly rely on encryption; encryption relies on keys; who has them?

- Is there really any point to VPN’s Firewalls and Network segmentation if data is encrypted?

- We use keys for so many things TLS, SSH, IM, Email, but we never tend to think about the keys.

- Do you own your keys? If not someone else can see your data!

- What do we need to flip the way IT is architected?

Recommendations for Keys:

- Keys should be cut at the edge and never go anywhere else.

- You should be able to securely share keys along with the data being transmitted/received.

- There needs to be a new way to think about identity on the Internet.

The above description should stimulate many questions from attendees during the panel discussion.

Biography:

Colin Constable’s passion is networking and security. He was one of the founding members of the Jericho Forum in the 2000s. In 2007 at Credit Suisse, he published “Network Vision 2020,” which was seen by some as somewhat crazy at the time, but most of it is very relevant now. While at Juniper, Colin worked on network virtualization and modeling that blurred the boundaries between network and compute. Colin is now the CTO of The @ Company, which has invented a new Internet protocol and built a platform that they believe will change not just networking and security, but society itself for the better.

……………………………………………………………………………………………………………………….

The Anatomy of a Cloud Data Center Attack

Thomas Foerster, Nokia

Abstract:

Critical infrastructure (like a telecommunications network) is becoming more complex and reliant on networks of inter-connected devices. With the advent of 5G mobile networks, security threat vectors will expand. In particular, the exposure of new connected industries (Industry 4.0) and critical services (connected vehicular, smart cities etc.) widens the cybersecurity attack surface.

The telecommunication network is one of the targets of cyber-attacks against critical infrastructure, but it is not the only one. Transport, public sector services, energy sector and critical manufacturing industries are also vulnerable.

Cloud data centers provide the required computing resources, thus forming the backbone of a telecommunications network and becoming more important than ever. We will discuss the anatomy of a recent cybersecurity attack at a cloud data center, review what happened and the lessons learned.

Questions:

- What are possible mitigation’s against social engineering cyber- attacks?

-Multifactor authentication (MFA)

-Education, awareness and training campaigns

- How to build trust using Operational Technology (OT) in a cloud data center?

Examples:

- Access monitoring

- Audits to international standards and benchmarks

- Security monitoring

- Playbooks with mitigation and response actions

- Business continuity planning and testing

Recommendations to prevent or mitigate DC attacks:

- Privileged Access Management across DC entities

- Individual credentials for all user / device entities

- MFA: One-Time Password (OTP) via text message or phone call considered being not secure 2-Factor Authentication anymore

- Network and configuration audits considering NIST/ CIS/ GSMA NESAS

- Regular vulnerability scans and keep network entities up to date

- Tested playbooks to mitigate security emergencies

- Business continuity planning and establish tested procedures

Biography:

Thomas Foerster is a senior product manager for Cybersecurity at Nokia. He has more than 25 years experiences in the telecommunications industry, has held various management positions within engineering and loves driving innovations. Thomas has dedicated his professional work for many years in product security and cybersecurity solutions.

Thomas holds a Master of Telecommunications Engineering from Beuth University of Applied Sciences, Berlin/ Germany.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Video recording of this event: Critical Cybersecurity Issues for Cellular Networks, IoT, and Cloud-Resident Data Centers – YouTube

Previous IEEE ComSoc/SCU SoE March 22, 2022 event: OpenRAN and Private 5G – New Opportunities and Challenges

Video recording: https://www.youtube.com/watch?v=i7QUyhjxpzE