4G

Strand Consult: MWC 2022 Preview and What to Expect

by John Strand

Tomorrow the Mobile World Congress (MWC) opens physically in Barcelona and also online. Every year for the last 19 years, Strand Consult has published previews of the Mobile World Congress (MWC). After its cancellation in 2020, MWC 2021 was a shadow of its former self, though the hybrid in person/online format brought 30,000 participants. 2022 promises to bring some 50,000, one of the largest gatherings since the pandemic began.

Recall that 2019 MWC had some 110,000 participants and 2400 exhibitors. It’s come a long way from its start 36 years ago in Cannes, cozy enough that attendees to mingle at the Hotel Majestic’s bar following each day’s events.

Like the process for MWC, many people have been returning to normal after Covid. However the world has been gripped by the invasion of Ukraine by Russia, an absurd act against a sovereign, democratic nation which became independent in August 1991. Most democratic countries are united against Russia’s action. GSMA canceled the event’s Russian Pavilion and barred some Russian firms per international sanctions. Consider how Telenor stood up to dictatorship in Myanmar: by selling their assets and leaving the country. Pressure could grow for GSMA to suspend its Russian members.

Covid-19 has had a big impact on how people use mobile telecom services as well as the over-top players like Google, Facebook, Amazon, Apple etc. Historically GSMA kept a low profile on political matters. However that is increasingly difficult in a connected world when people communicate globally and have expectations of their service providers. Mobile operators and trade organizations like GSMA no longer have the luxury to focus solely on short-term profit and remain passive to aggression and autocracy.

MWC Buzzwords: 5G, OpenRAN, AI, Cloud, IoT, Green, and Diversity:

GSMA Director General Mats Granryd will open the conference, and it’s natural that this Swede would look to create consensus among 750 mobile operator members. He has a tough job to tell regulators that the industry needs better conditions while defending his members’ request for subsidies among other industries which have fared far worse than mobile telecommunications. As usual, he will focus on the latest hype and avoid the uncomfortable, which is too bad for journalists who want answers to critical questions.

Granryd will probably make the point that 5G is growing quickly: over 200 5G mobile networks based on 3GPP standards have now been launched around the world. If 4G was about the smartphone app economy, 5G is about disrupting the wireline home broadband market and opportunities for industry to integrate people and machines intelligently. There are hundreds of millions of new 5G customers. It’s an impressive accomplishment, but it’s doubtful that this can be turned into greater revenue for mobile operators’ shareholders. To date, the money has flowed to Big Tech.

Granryd will also tout the greening of the industry, though careful not to point out that the total energy footprint of the industry is growing. More traffic, devices, connections, network sites, and applications means more energy use. Not all of this is green and much is “greenwashing.”

The other hot topic is diversity, which has been moved from the last day of the conference to the first. The new Diversity4Tech replaces what was Women4Tech, an effort ended prematurely without success. Indeed, half of the world’s mobile subscribers are women, but there are still too few female executives in the mobile industry. Only 3 of GSMA’s 26 board members are women. It’s embarrassing that GSMA has not performed better on this metric. The only woman in the mobile leader line up is President & CEO of Telia Allison Kirkby who speaks on the New Tech Order. Tellingly, the session features three Chinese men: Yang Jie, Chairman, China Mobile; Ruiwen Ke, Chairman & CEO, China Telecom; and LieHong Liu, Chairman & CEO, China Unicom. Diversity, equity, and inclusion (DEI) are unlikely to be themes in the remarks of China’s state-owned operators. Moreover, they are unlikely to mention state-sponsored cyberattacks which are growing more frequent, more sophisticated, and more severe.

Oddly enough this MCW features a keynote by FC Barcelona President Joan Laporta. The program text boasts that the European football market is worth over $25 billion dollars and growing. In reality, football (soccer) is not an industry that mobile operators should emulate. Not only is FC Barcelona $1.57 billion in debt, it had to let Lionel Messi go because it couldn’t honor its financial contract. More largely, the salaries for superstars like Messi, Ronaldo and, others are breaking the cable industry. GSMA is probably thanking its lucky stars that it didn’t feature Chelsea FC owner Roman Abramovich, a Russian oligarch and Friend of Putin who invested in the UK’s Truphone in 2006.

In any event, Ukraine is a communication game changer. Look at Germany’s Chancellor Olaf Scholz now committing to pay the full freight of NATO dues, something that former Chancellor Merkel refused do to.

Regulation, the never-ending story:

MWC should be the opportunity for mobile operators take a victory lap. The mobile telecom industry salvaged society from the pandemic, allowing people to work, learn and receive health care from home. Moreover, many operators have commendable plans to be carbon neutral in the near future. Yet GSMA has failed utterly to build on mobile operators’ good citizenship to modernize regulation and kick start much-needed consolidation. Instead many authorities want to double-down on failed regulatory policies like net neutrality and are even-more entrenched against mergers. GSMA lacks a coherent strategy of policy and communication to convince competition authorities and regulators to adopt a modern framework for consolidation, investment, and innovation.

Strand Consult has studied mobile industry consolidation globally for more than 20 years and just published the definitive report on 4 to 3 mobile mergers. It describes why European operators don’t pass the acid test on consolidation and why they fail to succeed.

Strand Consult has published hundreds of research notes, reports, and articles about net neutrality around the world. Notably the leading countries for 5G; Japan, South Korea, China, and USA have no net neutrality rules, or only soft rules. It is no surprise that European countries were late to 5G. Strand Consult has documented how the Body of European Regulators (BEREC) has consistently prioritized the needs of a small cadre of so-called “civil society” advocates over Europeans as whole who want more mobile telecom innovation and investment.

More largely, the measures taken by the European Union to “tame” Big Tech have had the opposite effect. Since Margrethe Vestager became Competition Commissioner in November 2017, Big Tech companies have increased their turnover, market share and earnings.

GSMA promotes Clouds:

Where GSMA fails to communicate the value proposition of mobile operators and demand the needed regulatory update, it does a great job to promote cloud providers. Once again, mobile operators are set up to be the biggest losers while Big Tech firms Google, Apple, Amazon, and Microsoft are poised take the lion’s share of the 5G profits of connectivity, just as they did with 4G.

Few understand what AWS means for Amazon. AWS controls about a third of the global cloud market, substantially more its closest competitors Microsoft Azure and Google Cloud. In Q4 FY 2021 AWS generated net sales of $17.8 billion and operating income of $5.3 billion. Net sales grew 39.5% while operating income rose 48.5% compared to the year ago quarter. The value continues to increase as cloud services are integrated with artificial intelligence (AI) and other services.

Here are some critical questions to help you navigate the “cloudnet” sessions

- Why are clouds, which are fundamental to the running of 5G and 5G services, not subject to regulation, like mobile operators?

- Why do regulators obsess about market power of mobile operators while being oblivious to cloud providers Google, Microsoft, Amazon, and increasingly Huawei?

- What has been governments’ strategic blunder in the focus of restricting Huawei in 5G? (Hint: They forget about Huawei in the cloud. See Strand Consult’s note.

- How easy or difficult is it for customers to migrate from one cloud to another? Is data portable from Amazons AWS to Microsoft´s Azure?

3G, 4G, 5G: Where does the cash flow?

At MWC, there is always discussion about the next generation or G. However there is little discussion of the cash flow. Here are the cold, hard facts to consider.

- Many mobile operators believed in 2000 that 3G would be a gold mine for their revenues. They spent billions of euros on spectrum, but the revenue projections that ARPU will grow from to €36 to €72 per month fell far below expectation, ARPU declined.

- There are very few examples of successful partnerships that mobile operators have realized under 3G and 4G. In general, the revenue has flowed to the OTT or third-party providers, not operators.

- The value created in 4G has flowed to Google’s and Apple’s app stores which take a significant revenue cut of the apps on offer.

- Over the years, operators have attempted to launch various application programming interfaces (APIs) that third parties could integrate into their services. Some of these actions have been successful, like premium SMS. From 1998 onwards, mobile operators have been successful to offer premium SMS to pay for various digital services. Strand Consult was the first to publish research on this market and business models. Many of the world’s mobile operators followed our recommendations when it came to how to implement and operate a market with a short code where mobile customers could use to pay for services. See Strand Consult’s old report and research note about premium SMS

- Later around 2009 at MWC, GSMA launched OneAPI, about which we published a lot of research. Unfortunately, the operators did not know how to operate this market and create an ecosystem. Look at the research note ”One API is good news”. While this was a welcome development at the time, it did not develop into a revenue stream.

- Since that time, operators have been transformed into “dumb pipes”, mainly generating revenue from traffic they sell, not by adding value with better or different services. Mobile operators have little to no ability to monetize their own value-added services. In fact WhatsApp has cannibalized mobile operators’ SMS revenue. For example from 2012 to 2013, KPN´s SMS revenue declined by €100 million as customers switched to WhatsApp for messaging.

- There is only limited experience to reference for mobile operators’ 5G partnerships. The current version of 5G is 3GPP release 14 and 15 which do not have a functionality that is more advanced than 4G. Mobile operators have a dream to make money from 5G in the same way they dreamed it for 3G and 4G.

- Moreover, the EU regulatory environment with hard net neutrality rules and BEREC’s draconian over-interpretation of the rules have created an environment which discourages, if not prohibits, partnerships for mobile operators in 5G. It is not surprising that telecom investment has languished for years in EU.

- At MWC there are likely many PowerPoint presentations which describe proposed partnerships between mobile operators and other technology providers. However the business models are not in place, and many mobile operators have an unrealistic view of their ability to monetize value-added services.

- The reality is that to innovate in 5G, firms like Apple and Google, only need to add a new layer on their existing business. They are a proven partner. However mobile operators are required to do the essential retooling of networks. Mobile operators thus have a higher bar for 5G. They have to build an new ecosystem to convince a partner to join, where as Apple, Google and AWS only need, to extend their ecosystem with 5G services.

The role of mobile operators in the value chain has been decimated in the last two decades. It is not a question how mobile operators will react to 5G, but whether they have the skills at all to execute.

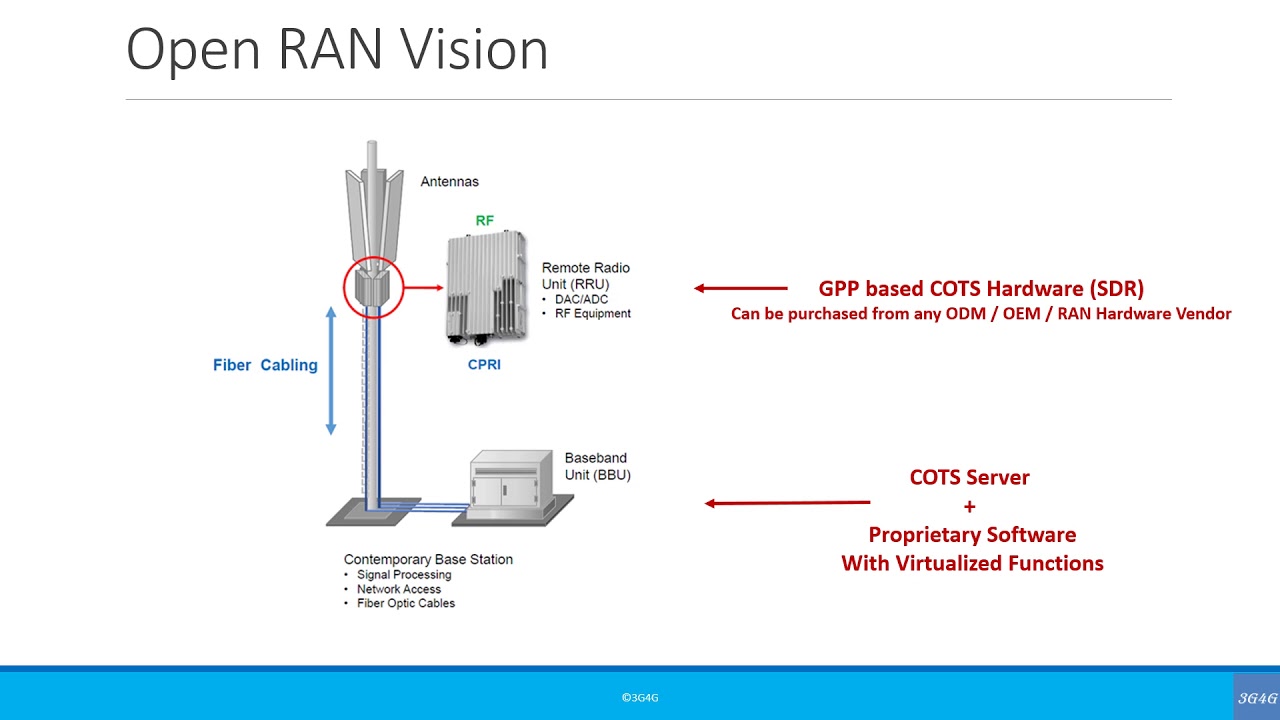

OpenRAN and Vendor Diversity – What does that mean?

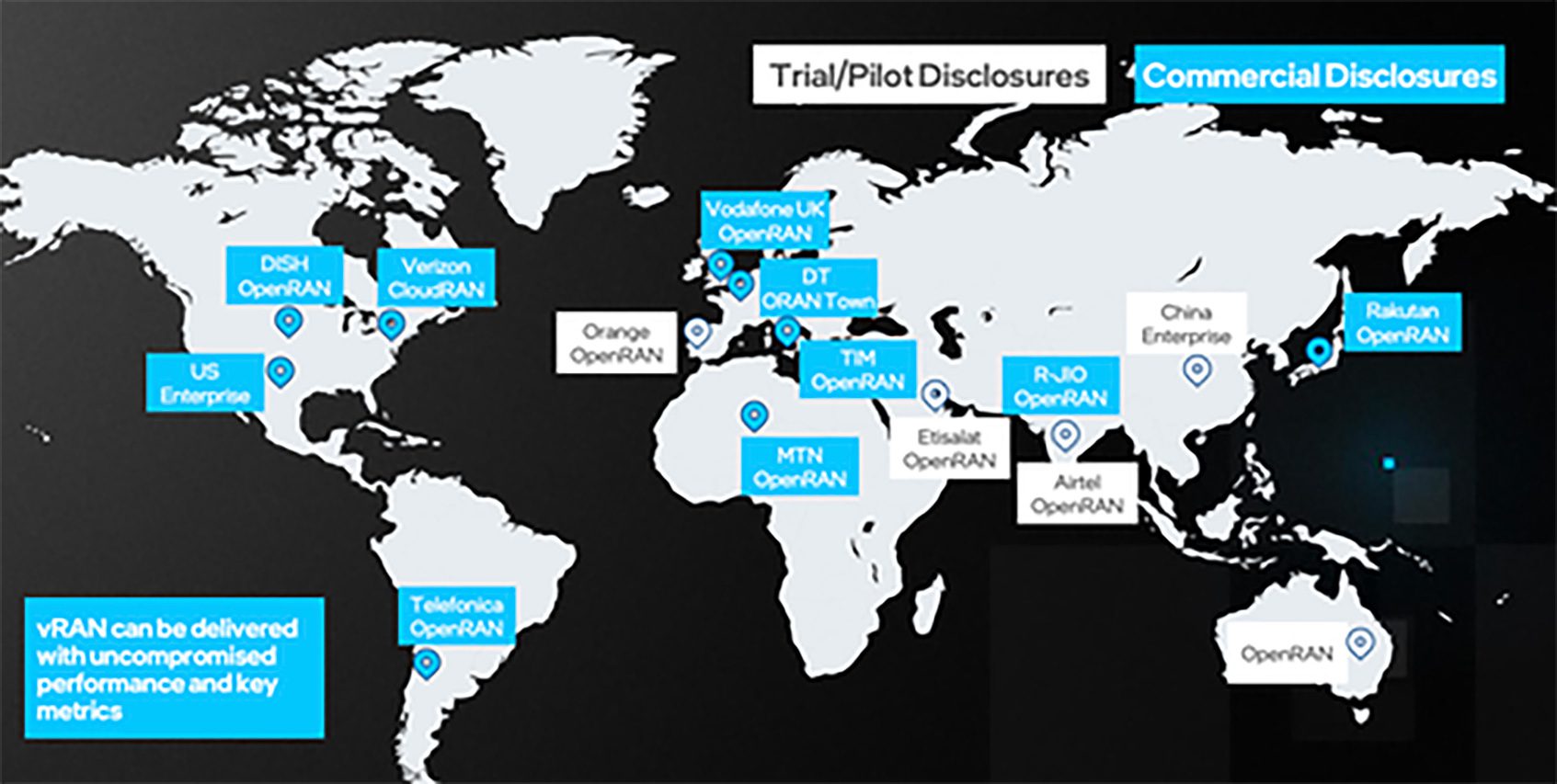

The latest MWC hype is OpenRAN and the invented term “vendor diversity”. Much of the hype is driven by OpenRAN players which claim that the market for mobile infrastructure equipment is controlled by Huawei, Ericsson, Nokia and ZTE. However, MWC features some 2000 exhibitors which supply infrastructure equipment to over 750 mobile operators. Note that the need for “vendor diversity” is not addressed with cloud providers.

Many OpenRAN pronouncements sound too good to be true, for example a technology that can reduce mobile operators infrastructure CAPEX and OPEX by 30-40 percent. Investors and other decision makers want objective information about the latest mobile industry hype. Strand Consult’s free report Debunking 25 Myths of OpenRAN examines the claims made by OpenRAN proponents. Strand Consult, having witnessed the launch of WiMax, OneAPI, and the iPhone among other hyped technologies promised to bring windfall revenues to mobile operators, provides critical questions to evaluate OpenRAN in its latest report.

The main challenge for OpenRAN is whether it can be relevant for operators which have very little room for margin of error. OpenRAN is far from being able to replace classic infrastructure on a 1:1 basis.

OpenRAN testing has been launched in a world in which mobile operators buy and build classic RAN at a high rate. There are two reference cases. One is Rakuten in Japan driven by charismatic CEO Tareq Amin. Rakukten gives away free traffic without getting paying customers into the store. It’s solution is proprietary, not open.

The US-based Dish is the second. It faces many challenges which make it hard to see how it can become a serious alternative to Verizon, AT&T and T-Mobile

The Federal Communication Commission (FCC) proceeding on OpenRAN showed few, if any examples, of US mobile operators and their trade associations (CTIA, Rural Wireless Association, and Competitive Carriers Association) testifying that OpenRAN is a serious alternative to classic RAN installations.

MWC offers an opportunity to meeting mobile operators’ Chief Technology Officers. Ask them what they think of OpenRAN why they have launched 5G using classic RAN based on 3GPP standards.

The history of OpenRAN is reminiscent of WiMax. If you have some of the PowerPoints from the early 2000s, you will see how infrastructure vendors talked about why WiMax was so amazing. These points are almost identical to what is asserted about OpenRAN.

To assess claims about vendor diversity, it’s important to look at facts and history. The infrastructure supplier market has consolidated from 20 top tier providers in the 2G market in 1989 to 12 top tier providers in 1999 to 5 top tier providers in 2019. Many of the first-generation enthusiasts did not make it out of the 1G analogue cellular world into the world of 2G digital cellular. Over time the GSM standards family (GSM, WCDMA, LTE etc.) became the de facto basis for the roadmap, the standard for global economies of scale and the industry benefits such as lower unit costs. Those equipment suppliers which focused on CDMA and analog exited the market.

There is also the practical issue of math. The notion of vendor diversity for its own sake challenges operators to reduce complexity and cost in their networks. Operators frequently reduce the number of vendors to improve security (ability to vet vendors and develop trusted relationships) and to lower cost (ability to secure volume discounts). Indeed operators want concentration in part to get better value for money.

Note how Neil McRae, Managing Director and Chief Architect at British Telecom described when he got the question; “The major operators have been telling their shareholders since 2000 that they should reduce suppliers to save money?”. He replied, I have worked with BT for 10 years. When I arrived, BT had a 21 C fixed network with 50 vendors. I reduced it to 4 vendors and saved BT £1 billion in 3 years. The key was reducing complexity, which is the killer in telecommunications. When I hear about Open architectures with 5- 50 vendors, I run for the hills. Reducing vendors was the right thing to do and we would do it again.” RAN, while important, is just one part of an operator’s infrastructure requirements.

Moreover, the consolidation of European infrastructure is the result of many European operators having opted into Huawei and opted out of European suppliers.

The active customer base of Europe’s 102 mobile operators is 673 million subscribers. Huawei’s and ZTE’s share of 4G RAN mobile networks are 44% and 4% respectively, total 48%.This means that 325 million European mobile customers access Chinese infrastructure, primarily from Huawei. Countries are divided into four categories of share of 4G RAN equipment from Chinese suppliers: 75-100%; 50-75%; 25-50%; and less than 25%.In its RAN report Strand Consult has mapped the market for 4G RAN in Europe.

More than 40% of the CAPEX that European operators have used every year for the last 10 years has been shipped to China and Chinese suppliers like Huawei and ZTE. If you look at the American operators, most of their CAPEX has gone to European suppliers Nokia and Ericsson. We thought that the EU should thank the US operators and the US government for their massive support for European manufacturers and for their fight against the use of Chinese equipment from Huawei and ZTE. The five operators Vodafone, TIM, Telefonica, Orange and Deutsche Telekom have for several years opted for Chinese manufacturers at the expense of European vendors. 62% of Vodafone´s 4G RAN in Europe are from Huawei.

The fact is that RAN Capex makes up less than 3 percent of a mobile operator’s ARPU. The global RAN market is today $29 billion and can be pitted against Verizon’s Capex which amounts to $18 billion.

The bottom line for MWC

Strand Consult has limited expectation for mobile operators’ profitability in 5G. Operators may have ambitions, but the question is whether they have the skills to build an ecosystem that can compete with Apple, Google, and AWS. However, operators can do better on the policy front to modernize regulation and promote consolidation.

Under the current frameworks, there is little to no upside for operators. Mobile operators must consolidate to cut cost and increase profitability. They will probably continue to sell off infrastructure. They continually become dumb pipes. There’s nothing wrong with being a dumb pipe; it’s a business model that works quite fine in water and energy. But don’t expect it to be innovative.

In practice, this development means that many functions from telecom regulators have become irrelevant. The primary task of the telecom regulator of the future will be to deal with spectrum.

Technology companies build services on top of US and Chinese platforms. Many of the smaller technology companies are driven by the construction of a business with the aim of being acquired by these tech companies. A good example is Facebook’s purchase of WhatsApp for $16 billion in February 2014.

There will be many interesting discussions on 5G, OpenRAN, IOT and AI, including the need for more security and transparency. In any event, MWC is always a party because of the cool people who attend giving food for thought to those who want to be stimulated intellectually. Moreover Barcelona’s bars and restaurants rarely disappoint.

Strand Consult provides both pre and post review of the Mobile World Congress. Read reviews from the past years.

Meet Strand Consult at the Mobile World Congress:

If you would like to meet with Strand Consult during the MWC, please email your contact details and the details/purpose of the meeting, and we will get back to you. Journalists are most welcome!

………………………………………………………………………………………………………………………………………………………………………

Biography:

John Strand founded Strand Consult in 1995. Since then, hundreds of companies in the telecom, media and technology industries have attended Strand Consult’s workshops, purchased reports, consulted with the company to develop strategy, launch new products, and conduct a dialogue with policymakers.

John Strand sits on the advisory board of a number of Scandinavian and International companies and is a member of the Arctic Economic Council Telecommunications Working Group. He served on the Advisory Board for the 3GSM World Congress, the event known as the Mobile World Congress in Barcelona.

References:

Strand Consult: Open RAN hype vs reality leaves many questions unanswered

O-RAN Alliance tries to allay concerns; Strand Consult disagrees!

Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

Dell’Oro Group estimates the RAN market is currently generating between $40 billion and $45 billion in annual revenues. The market research firm forecasts that Open RAN will account for 15% of sales in 2026. Research & Markets is more optimistic. They say the Open RAN Market will hit $32 billion in revenues by 2030 with a growth rate of 42% for the forecast period between 2022 and 2030.

As the undisputed leader of microprocessors for compute servers, it’s no surprise that most of the new Open RAN and virtual RAN (vRAN) deployments use Intel Xeon processors and FlexRAN™ software stack inside the baseband processing modules. FlexRAN™ is a vRAN reference architecture for virtualized cloud-enabled radio access networks.

The hardware for FlexRAN™ includes: Intel® Xeon® CPUs 3rd generation Intel® Xeon® Scalable processor (formerly code named Ice Lake scalable processor), Intel® Forward Error Correction Device (Intel® FEC Device), Mount Bryce (FEC accelerator), Network Interface Cards – Intel® Ethernet Controller E810 (code name Columbiaville). Intel says there are now over 100 FlexRAN™ licensees worldwide as per these charts:

Source: Intel

A short video on the FlexRAN™ reference architecture is here.

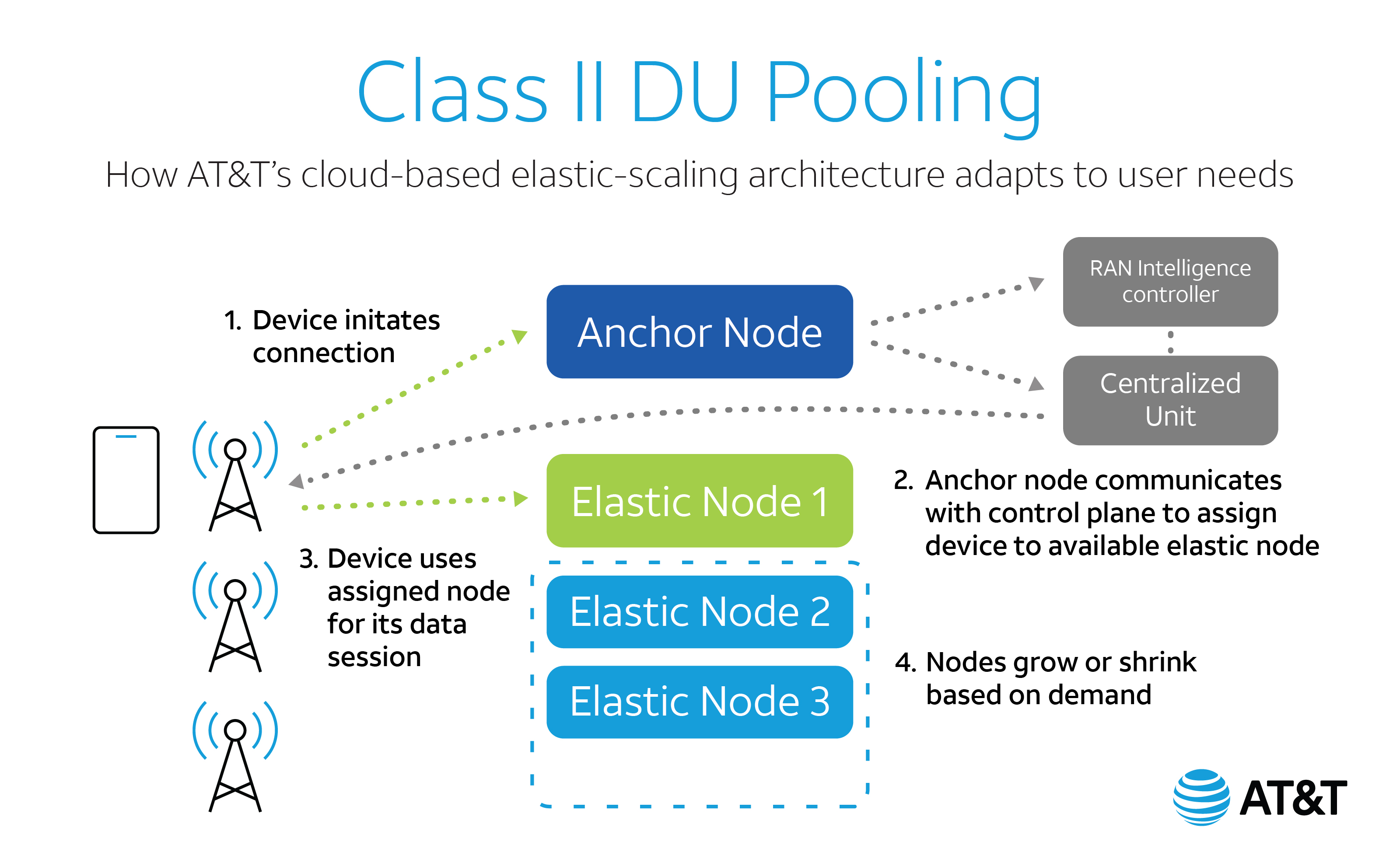

FlexRAN™ got a big boost this week from AT&T. In a February 24, 2022 blog post titled “Cloudifying 5G with an Elastic RAN,” Gordon Mansfield, AT&T VP Mobility Access & Architecture said that “AT&T and Intel had co-developed an industry-leading advanced RAN pooling technology freeing 5G radios from the limitations of dedicated base stations, while enabling more efficient, resilient, and green 5G networks. DU-pooling will eventually be usable by the entire 5G operator community to drive the telecom industry’s goals of green and efficient wireless networks forward.”

DU pooling technology was made possible by combining AT&T’s deep knowledge of Open RAN technologies as one of the co-founders of the O-RAN Alliance with Intel’s expertise in general purpose processors and software-based RAN through its FlexRAN™ software stack running on Intel 3rd generation Intel® Xeon® Scalable processors. The open standards for communications between radios and DUs that were published by O-RAN enabled its development, and the result is a technology demonstrator implemented on FlexRAN™ software.

………………………………………………………………………………………………………………………………………………………………………………..

Intel is now facing new Open RAN competition from several semiconductor companies.

Marvell has just unveiled a new accelerator card that will slot into a Dell compute server (which uses x86 processors). Based on a system called “inline” acceleration, it is designed to do baseband PHY layer processing and do it more efficiently than x86 processors. A Marvell representative claims it will boost open RAN performance and support a move “away from Intel.” Heavy Reading’s Simon Stanley (see below) was impressed. “This is a significant investment by Dell in open RAN and vRAN and a great boost for Marvell and the inline approach,” he said.

Qualcomm, which licenses RISC processors designed by UK-based ARM, has teamed up with Hewlett Packard Enterprise (HPE) on the X100 5G RAN accelerator card. Like Marvel’s offering, it also uses inline acceleration and works – by “offloading server CPUs [central processing units] from compute-intensive 5G baseband processing.”

There is also EdgeQ which is sampling a “Base Station on a Chip” which is targeted at Open RAN and private 5G markets. Three years in the making, EdgeQ has been collaborating with market-leading wireless infrastructure customers to architect a highly optimized 5G baseband, networking, compute and AI inference system-on-a-chip. By coupling a highly integrated silicon with a production-ready 5G PHY software, EdgeQ uniquely enables a frictionless operating model where customers can deploy all key functionalities and critical algorithms of the radio access network such as beamforming, channel estimation, massive MIMO and interference cancellation out of the box.

For customers looking to engineer value-adds into their 5G RAN designs, the EdgeQ PHY layer is completely programmable and extensible. Customers can leverage an extendable nFAPI interface to add their custom extensions for 5G services to target the broad variety of 5G applications spanning Industry 4.0 to campus networks and fixed wireless to telco-grade macro cells. As an industry first, the EdgeQ 5G platform holistically addresses the pain point of deploying 5G PHY and MAC software layers, but with an open framework that enables a rich ecosystem of L2/L3 software partners.

The anticipated product launches will be welcomed by network operators backing Open RAN. Several of them have held off making investments in the technology, partly out of concern about energy efficiency and performance in busy urban areas. Scott Petty, Vodafone’s chief digital officer, has complained that Open RAN vendors will not look competitive equipped with only x86 processors. “Now they need to deliver, but it will require some dedicated silicon. It won’t be Intel chips,” he told Light Reading in late 2021.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Inline vs Lookaside Acceleration:

While Marvell and Qualcomm are promoting the “inline” acceleration concept, Intel is using an alternative form of acceleration called “lookaside,” which continues to rely heavily on the x86 processor, offloading some but not all PHY layer functions. This week, Intel announced its own product refresh based on Sapphire Rapids, the codename for its next-generation server processors.

Simon Stanley, an analyst at large for Heavy Reading (owned by Informa), said there are two key innovations. The first involves making signal-processing tweaks to the Sapphire Rapids core to speed up the performance of FlexRAN™, Intel’s baseband software stack. Speaking on a video call with reporters, Dan Rodriguez, the general manager of Intel’s network platforms group, claimed a two-fold capacity gain from the changes. “In the virtual RAN and open RAN world, the control, packet and signal processing are all done on Xeon and that is what FlexRAN enables,” he said.

The other innovation is the promise of integrated acceleration in future Sapphire Rapids processors. Sachin Katti, who works as chief technology officer for Intel’s network and edge group, said this would combine the benefits of inline acceleration with the flexibility of x86. That is preferable, he insisted, to any solution “that shoves an entire PHY layer into an inflexible hardware accelerator,” a clear knock at inline rivals such as Marvell and Qualcomm. Despite Katti’s reference to inline acceleration, Stanley does not think it is Intel’s focus. “None of this rules out an inline acceleration solution, but it does not seem to be part of the core approach,” he told Light Reading. “The key strategy is to add maximum value to Xeon Scalable processors and enable external acceleration where needed to achieve performance goals.”

Both inline and lookaside involve trade-offs. Inline’s backers have promised PHY layer software alternatives, but Intel has a major head start with FlexRAN™, which it began developing in 2010. That means lookaside may be a lot more straightforward. “The processor is in control of everything that goes on,” said Stanley during a previous conversation with Light Reading. “It is essentially the same software and makes life very easy.”

Larger network operators seemed more enthusiastic about inline during a Heavy Reading survey last year. By cutting out the processor, it would reduce latency, a measure of the delay that occurs when signals are sent over the network. That could also weaken Intel, reducing power needs and allowing companies to use less costly CPUs. “If you use inline, you probably need a less powerful processor and less expensive server platform, which is not necessarily something Intel wants to promote,” Stanley said last year.

References:

https://www.intel.com/content/www/us/en/communications/virtualizing-radio-access-network.html

EdgeQ Samples World’s 1st Software-Defined 5G Base Station-on-a-Chip

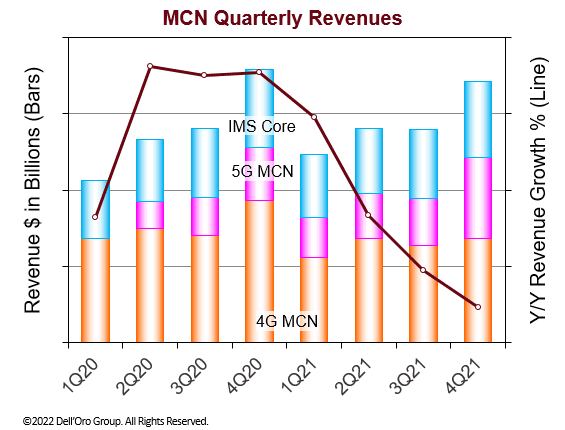

Dell’Oro: Mobile Core Network and MEC Stagnant in 2021; Will Growth in 2022

According to a recently published report from Dell’Oro Group, the total Mobile Core Network (MCN) and Multi-access Edge Computing (MEC) market 2021 revenue growth slowed to the lowest rate since 2017. The growth rate is expected to go higher in 2022 with the expansion of the 21 commercial 5G Standalone (5G SA) MBB networks that were deployed by the end of 2021, coupled with new 5G SA networks readying to launch throughout the year.

“MCN revenues for 2021 were lower than expected due to an unexpectedly poor fourth quarter performance. The revenues for 4Q 2021 were lower than in 4Q 2020. The last time that happened was in 4Q 2017,” stated Dave Bolan, Research Director at Dell’Oro Group. “The poor performance in 4Q 2021 was due to negative year-over-year revenue performance for the China region. The performance for the rest of the world was almost flat but still negative and obviously was not enough to offset the decline in China.

“The growth in 2021 came from the 5G MCN segment and was not enough to offset the decline in 4G MCN and IMS Core. Of the 21 5G SA networks commercially deployed Huawei is the packet core vendor in seven of the networks, including the three largest networks in the world located in China, and Ericsson is the packet core vendor in 10 of the networks. Not surprisingly, of the top five vendors, only Huawei and Ericsson gained overall MCN revenue market share during 2021.

“Looking at the MEC market, MEC is still a fraction of the overall MCN market, but we believe two recent announcements by Ericsson are noteworthy because, in our opinion, Ericsson will accelerate the adoption of MEC and help 5G MNOs monetize their networks by coalescing MEC implementations around the 3GPP standards. Ericsson claims to be the first to leverage recent advancements by the 3GPP standards body for edge exposure, and network slicing all the way through to a smartphone,” continued Bolan.

Additional highlights from the 4Q 2021 Mobile Core Network Report:

- Top-ranked MCN vendors based on revenue in 2021 were Huawei, Ericsson, Nokia, ZTE, and Mavenir.

- The EMEA region was the only region to grow in revenue in 2021.

- The APAC region was the largest region in revenue for 2021.

As of December 31, 2021 there were 21 known 5G SA eMBB networks commercially deployed.

|

5G SA eMBB Network Commercial Deployments |

|

|

Rain (South Africa) |

Launched in 2020 |

|

China Mobile |

|

|

China Telecom |

|

|

China Unicom |

|

|

T-Mobile (USA) AIS (Thailand) True (Thailand) |

|

|

China Mobile Hong Kong |

|

|

Vodafone (Germany) |

Launched in 2021 |

|

STC (Kuwait) |

|

|

Telefónica O2 (Germany) |

|

|

SingTel (Singapore) |

|

|

KT (Korea) |

|

|

M1 (Singapore) |

|

|

Vodafone (UK) |

|

|

Smart (Philippines) |

|

|

SoftBank (Japan) |

|

|

Rogers (Canada) |

|

|

Taiwan Mobile |

|

|

Telia (Finland) |

|

|

TPG Telecom (Australia) |

|

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

References:

https://www.delloro.com/news/mobile-core-network-stagnant-in-2021-poised-for-growth-in-2022/

https://techblog.comsoc.org/2021/12/01/delloro-5g-sa-core-network-launches-accelerate-14-deployed/

Vi and A5G Networks partner to enable Industry 4.0, Smart Cities in “Digital India” using 4G spectrum

India network operator Vodafone Idea Limited (Vi) today announced its collaboration with Nashua, NH based A5G Networks, Inc. to enable industry 4.0 and smart mobile edge computing in India.

Vi and A5G Networks have together set up a pilot private network in Mumbai utilizing existing 4G spectrum.

Vi’s association with A5G Networks is in line with its commitment to realize Digital India dreams with the latter’s differentiated and unique 4G, 5G, and Wi-Fi autonomous software for distributed Networks. A5G Networks software is fully cloud-native containerized built for hybrid and multi-cloud infrastructure.

“Vi is committed to providing superior services to digital enterprises and consumers to enhance user experiences, empowered by an autonomous network,” said Mr. Jagbir Singh, Chief Technology Officer, Vodafone Idea Ltd. “As part of our digital transformation journey on the 5G roadmap, we are happy to partner with A5G Networks to bring new services enabling industry 4.0 and smart cities in the digital era.”

“We are excited to be a part of this important journey for Digital India with Vi,” said Rajesh Mishra, Founder, and CEO of A5G Networks. “Vi is committed to delivering best-in-class services to their subscribers and driving the Digital India movement. Success depends upon a highly resilient, secure, and flexible network infrastructure.

In November 2020, Mishra told Light Reading he decided to start A5G Networks due to the growth in the Open RAN market, where Parallel Wireless has been a leading player. “When you have a lot of [Open] RANs, what happens then?” Mishra said, explaining that A5G Networks will sell software for network orchestration. “The timing was right,” he said of his departure from Parallel Wireless, citing the status of open RAN in the wider wireless market. “I’ve got to start working and building.”

Vi is partnering with technology leaders and innovators to set up digital networks enabling several low latency applications, private networks, smart cities, and connected cars.

The 5G Open Innovation Lab (“5GOILab”), a global applied innovation ecosystem for corporations, academia and government institutions, selects 15 early- to late-stage companies twice a year to join our enterprise innovation program. Companies are led by founders that have demonstrated a vision and strategy for leveraging 5G networks to achieve digital transformation in the enterprise and advance applications and solutions in artificial intelligence, augmented reality, edge computing and IoT. A5G and Santa Clara CA based EdgeQ (4G/5G base station on a chip) were selected to participate. A5G Networks for enabling distributed and disaggregated network of networks to create autonomous private and public 4G, 5G, and WiFi Networks.

The Lab does not take an equity position in its member companies, rather, companies collaborate with 5G technology experts and business advisors through CEO and CTO roundtables, private working sessions, virtual networking and social events, and opportunities to meet with the Lab’s extensive partner network of venture capital firms.

About Vodafone Idea Limited:

Vodafone Idea Limited is an Aditya Birla Group and Vodafone Group partnership. It is India’s leading telecom service provider. The Company provides pan India Voice and Data services across 2G, 3G, 4G and has a 5G ready platform. With the large spectrum portfolio to support the growing demand for data and voice, the company is committed to deliver delightful customer experiences and contribute towards creating a truly ‘Digital India’ by enabling millions of citizens to connect and build a better tomorrow. The Company is developing infrastructure to introduce newer and smarter technologies, making both retail and enterprise customers future ready with innovative offerings, conveniently accessible through an ecosystem of digital channels as well as extensive on-ground presence.

The company offers products and services to its customers in India under the TM Brand name “Vi”.

For more information, please visit: www.MyVi.in and www.vodafoneidea.com

About A5G Networks Inc:

A5G Networks Inc. is a leader and innovator in autonomous mobile network infrastructure. The company is headquartered in Nashua, NH, USA with offices in Pune MH, India. A5G Networks is pioneering secure and scalable 4G, 5G and Wi-Fi software to enable distributed network of networks. To learn more about A5G Networks, visit www.a5gnet.com

References:

GSA: Private Mobile Networks Summary-2022

Introduction:

The demand for private mobile networks based on 4G LTE (and increasingly 5G) technologies is being driven by the spiralling data, security, digitisation and enterprise mobility requirements of modern business and government entities. Organisations of all types are combining connected systems with big data and analytics to transform operations, increase automation and efficiency or deliver new services to their users. Wireless networking with LTE or 5G enables these transformations to take place even in the most dynamic, remote or highly secure environments, while offering the scale benefits of a technology that has already been deployed worldwide.

The arrival of LTE-Advanced systems delivered a step change in network capacity and throughput, while 5G networks have brought improved density (support for larger numbers of users or devices), even greater capacity, as well as dramatic improvements to latency that enable use of mobile technology for time-critical applications.

Private mobile networks are often part of a broader digital transformation programme in an organisation. This could include the introduction or development of cloud networking and other digital technologies such as artificial intelligence and machine learning, and data analytics. More and more applications of the private mobile network will use these capabilities combined with mobile connectivity.

In addition to companies looking to deploy their own private mobile network for the first time, there is a large group of potential customers that currently operate private networks based on technologies such as TETRA, P25, Digital Mobile Radio, GSM-R and Wi-Fi. Many of these customers are demanding critical broadband services that are simply not available from alternative technologies, so private mobile networks based on LTE and 5G could eventually replace much of this market.

The exact number of existing private mobile network deployments is hard to determine, as details are not often made public. To improve information about this market, GSA is now maintaining a database of private LTE and 5G networks worldwide.

Since the last market update, GSA has been working with Executive Members Ericsson, Huawei and Nokia on harmonising definitions of what counts as a valid private mobile network, and on harmonising sector definitions. That work has led to a restatement of some of GSA’s market statistics.

The definition of a private mobile network used in this report is a 3GPP-based 4G LTE or 5G network intended for the sole use of private entities, such as enterprises, industries and governments. The definition includes MulteFire or Future Railway Mobile Communication System. The network must use spectrum defined in 3GPP, be generally intended for business-critical or mission-critical operational needs, and where it is possible to identify commercial value, the database only includes contracts worth more than €100,000, to filter out small demonstration network deployments.

Private mobile networks are usually not offered to the general public, although GSA’s analysis does include the following: educational institutions that provide mobile broadband to student homes; private fixed wireless access networks deployed by communities for homes and businesses; city or town networks that use local licences to provide wireless services in libraries or public places (possibly offering Wi-Fi with 3GPP wireless backhaul) which are not an extension of the public network.

Non-3GPP networks such as those using Wi-Fi, TETRA, P25, WiMAX, Sigfox, LoRa and proprietary technologies are excluded from the data set. Furthermore, network implementations using solely network slices from public networks or placement of virtual networking functions on a router are also excluded. Where identifiable, extensions of the public network (such as one or two extra sites deployed at a location, as opposed to dedicated private networks), are excluded. These items may be described in the press as a type of private network.

GSA has identified 58 countries and territories with private network deployments based on LTE or 5G, or where private network spectrum licences suitable for LTE or 5G have been assigned. In addition, there are private mobile network installations in various offshore locations serving the oil and gas industries, as well as on ships.

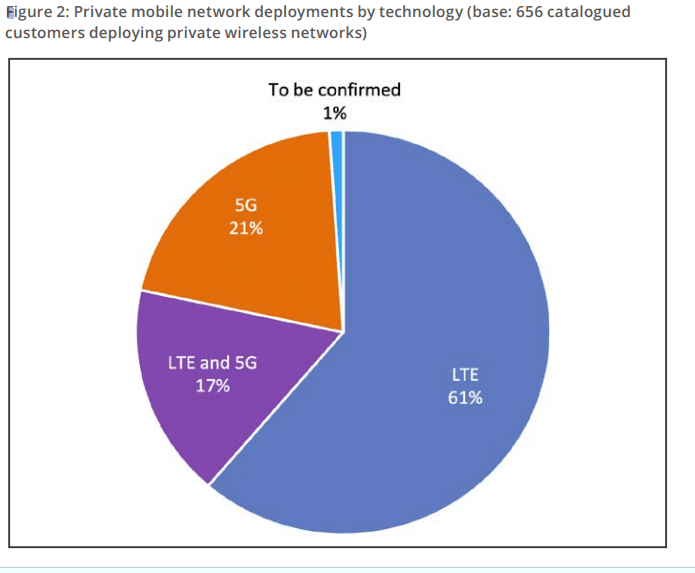

GSA has collated information about 656 organisations known to be deploying LTE or 5G private mobile networks. Since the last update of this report in November 2021, some organisations have been removed from the database and this analysis, owing to a lack of evidence that they met the definition criteria. These examples may be added again in the future.

GSA has counted over 50 equipment vendors that have been involved in the supply of equipment for private mobile networks based on LTE or 5G. Commercial availability of pre-integrated solutions from several equipment providers increased in 2021; these solutions aim to simplify adoption of private networks, which should add market impetus. In addition, GSA has identified more than 70 telecom network operators (counting national operators within the same group as distinct entities) involved with private mobile network projects. Also, global-scale cloud providers (often referred to as “hyperscalers”) are offering private mobile network solutions, sometimes in partnership with mobile operators or network suppliers. Their ability to exploit mass-scale cloud infrastructure and their existing presence in commercial enterprises is likely to drive additional growth in the private mobile network market.

GSA has been able to categorise 656 customers deploying private mobile networks, which as Figure 1 shows, are located all around the world. Where organisations have subsidiaries in different countries or territories deploying their own networks, each subsidiary is counted separately. LTE is used in 78% of the catalogued private mobile network deployments for which GSA has data; 5G is being deployed in 38% of networks.

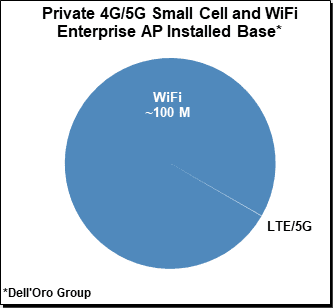

Dell’Oro Group forecasts a much smaller private wireless market share for 5G. They say LTE is dominating the private market in 2021 and 5G NR still on track to surpass LTE by the outer part of the forecast period, approaching 3 percent to 5 percent of the total 5G private plus public RAN market by 2026.

GSA also tracks the spectrum bands being used for deployments assigned specifically for local or private network purposes. Figure 4 shows that, including known spectrum assignments and deployments, C-band spectrum is the most widely assigned; TDD spectrum at 1.8 GHz comes second and is associated with the greatest number of identified deployments (more than 100 separate metro rail deployments in China). After that comes CBRS spectrum (also technically within the C-band but split out owing to the unusual way it has been assigned in the US).

There are more than 200 CBRS licensees, although they have not all been counted within the licence data, as it is not certain whether the spectrum will be used for public or private networks.

Telecom regulators are also showing signs of making increased allocations of dedicated spectrum available for private mobile networks — typically small tranches in specified locations. This could be acquired directly by organisations instead of by mobile operators, giving industries an alternative deployment model. Dedicated spectrum of this sort has already been allocated in France, the US, Germany and the UK, for example, and GSA expects this trend to be followed in other countries in 2022.

Note that owing to the removal of projects not meeting the new size requirement of at least €100,000, the counts are not directly comparable with those in the previous issue, although the patterns are the same.

GSA will be publishing further statistical updates covering the private mobile sector during 2022.

Acknowledgement: GSA would like to thank its Executive Members Ericsson, Huawei and Nokia for sharing general information about their network deployments to enable this dataset and report to be produced.

References:

https://gsacom.com/paper/private-mobile-networks-summary-february-2022/

Nokia and Mavenir to build 4G/5G public and private network for FSG in Australia

Australian rural carrier Field Solutions Holdings (FSG) has selected Nokia and Mavenir as its primary technology vendors to build Australia’s fourth mobile network.

As part of the deal, the technology partners will supply 4G and 5G radio access networks and the mobile core network. Mavenir will provide 4G/5G Converged Packet core, as well as IMS voice and messaging services.

FSG plans to deliver 4G and 5G services in rural, regional and remote areas of the country. FSG will also be delivering private 4G LTE and 5G service offerings. FSG, has secured 5G spectrum holdings to ensure that rural, regional and remote Australia is not left behind in the rollout of 5G services.

FSG CEO Andrew Roberts, said FSG’s 5G service will cover 85% of Australia’s landmass.

“FSG has run a comprehensive 6-month RFP process to select the most appropriate technology partners for the rollout of the Regional Australia Network. FSG has selected these partners to ensure we have the cost-effective, future proof and globally proven technology platform needed to deliver Australia’s 4th mobile network.”

“The demand for private 4G and 5G networks is gaining momentum, FSG will be delivering cost-effective, carrier-grade private solutions for agri-business, mining and government. We expect to be announcing several private 4G and 5G private network deployments in the coming weeks,” said FSG CEO Andrew Roberts.

“Together with our new partners, Nokia and Mavenir, FSG is primed to deliver connectivity to regions, whilst offering capability for carriers to join the solution using Active Neutral host RAN, inbound roaming or ‘old school’ passive co-location on our purpose-built infrastructure,” Roberts added.

By embracing new models, the cost to deliver these solutions can be kept to a minimum, further supporting the committee’s desire to ensure that affordability is not forgotten. FSG are in the process of delivering 19 new place-based networks across Australia. These networks, comprising over 100 sites, each of which will be 4G and 5G capable, Neutral Host and Roaming ready when delivered in FY 23/24. “The Regional Australia Network is a dedicated network supporting rural Australia. Today, we operate Australia’s largest non-NBN fixed wireless network, which delivers fixed wireless broadband across rural, regional and remote Australia. The Regional Australia Network (RAN(TM)) will see these current and all new networks being enabled to delivery 4G and 5G data and voice services, fixed wireless broadband together with NB-IoT and CatM1 services”, Roberts stated.

FSG also said that the company is in the process of delivering 19 new “place-based” networks across Australia. These networks comprise more than 100 sites, each of which will be 4G and 5G capable, neutral host and roaming-ready when delivered in fiscal year 2023/24.

Anna Perrin, Nokia’s managing director for Australia and New Zealand, said, “As a world-leading provider of mobile technology, we have championed the development of Neutral Host networks around the world and we’re excited to bring this global expertise to our partnership with FSG. Supporting the creation of new and innovative solutions and business models for rural and remote coverage across Australia.”

“Mavenir is excited to partner with FSG to deliver a cost-effective, future proof and globally proven 4G/5G Cloud-native Converged Packet Core, IMS and messaging services to enable Australia’s 4th mobile network,” said Dereck Quinlan, Mavenir regional VP.

“Mavenir continues to drive forward with advanced cloud-native solutions that our customers and the industry recognise. Our Cloud-native Converged Packet Core solution embraces a disruptive technology architecture and business model that drive network agility, deployment flexibility, and service velocity,” Quinlan added.

Over the next 18 months, FSG, in partnership with the Australian Federal Government and mobile operator Optus, will be trialing the deployment of what it says is Australia’s first “Active Neutral Host” network. The neutral-host model enables FSG to build and operate infrastructure and a single set of electronics that all mobile network operators in Australia can utilize and will be ready for PSMB services, the company says.

“The more carriers subscribe to the model, the more valuable and impactful it is for Australian Rural communities and Australia as a whole. We look forward to welcoming the other Australian Carriers to the program, to make the neutral host model a reality for rural, regional and remote Australia,” Roberts added.

References:

https://www.bloomberg.com/press-releases/2022-02-20/selects-nokia-and-mavenir-as-technology-partners

FSG selects Nokia, Mavenir to rollout Australia’s fourth mobile network

Nokia delivers private 4G fixed-wireless access (FWA) network for underserved students living in rural California

Nokia completed the first of a two-phase deployment of 4G fixed-wireless access (FWA) network with partner AggreGateway, to provide broadband internet connectivity to underserved students in the Dos Palos Oro Lomo (DPOL) school district of California.

The district comprises five campuses and serves a population of 5,000 residents. The Nokia platform will provide internet access to the homes of 2,400 students using Nokia Private 4.9G/LTE Digital Automation Cloud (NDAC) operating in the CBRS/On-Go GAA spectrum, and customer premises equipment including Nokia FastMile 4G Gateways and WiFi Beacons.

The DPOL technology team will operate its new LTE network through the centrally secure Nokia DAC Cloud monitoring application. DPOL will also provision LTE / Wi-Fi hotspots to students to be used with any standard laptop or tablet to access broadband internet.

The project’s first phase was completed in November 2021. Nokia and AggreGateway will complete the second phase in 2022.

The Federal Communications Commission (FCC) has reported nearly 17 million school children in the USA lack internet access at home, creating a nationwide ‘homework gap’ (Federal Communications Commission). This became even more pronounced during the pandemic as schools closed and distance learning became the new normal.

Image Credit: Nokia

Paoze Lee, Technology Systems Director of the Dos Palos-Oro Loma school district, said: “As we put a plan in place for distance learning during the pandemic we found we could only provide coverage for approximately 50% of DPOL students via commercial wireless network providers. Working with Nokia and AggreGateway, we are taking the next steps to level the field and ensure every student has the same access to our learning facilities.”

Octavio Navarro, President of AggreGateway, said: “Growing up in a rural small town like Dos Palos-Oro Loma, I experienced the digital divide firsthand. Being able to implement a Nokia private wireless solution for the students has been beyond rewarding. The IT staff from DPOL, AggreGateway, and Nokia worked seamlessly together to achieve this goal. We are excited, proud, and look forward to the continued success.”

Matt Young, Head of Enterprise for North America at Nokia, said: “We are pleased to help close the digital divide in the Dos Palos-Oro Loma school district. For many rural areas of the US it’s not commercially viable to build out networks, and often families on the lowest income suffer. Leveraging our DAC and FastMile FWA technologies we can enable the delivery of much needed internet connectivity to students in the area.”

The project’s first phase was completed in November 2021. Nokia and AggreGateway will complete the second phase in 2022.

About Nokia:

As a trusted partner for critical networks, we are committed to innovation and technology leadership across mobile, fixed and cloud networks. We create value with intellectual property and long-term research, led by the award-winning Nokia Bell Labs.

Adhering to the highest standards of integrity and security, we help build the capabilities needed for a more productive, sustainable and inclusive world.

About AggreGateway:

Based in San Diego, California, AggreGateway is a unique group of network and wireless engineers that are experienced in designing networks within the private, public safety, transportation, utilities, government, and educational verticals. AggreGateway provides network consulting services, wireless solutions, LAN/WAN design and implementation, network security, systems integration, and managed services. Our goal is to provide a range of robust and flexible network solutions that are customized to each individual network.

References:

Dell’Oro: LTE still dominates private wireless market; will transition to 5G NR (with many new players)

Dell’Oro Group just published an updated Private Wireless market report with a 5-year forecast. According to the report, private wireless RAN revenues for the full-year of 2021 are slightly weaker than initially projected.

“The markdown is more driven by the challenges of converting these initial trials to commercial deployments than a sign that demand is subsiding,” said Stefan Pongratz, Vice President at Dell’Oro Group. “In fact, a string of indicators suggest private wireless activity is firming up not just in China but also in other regions,” continued Pongratz.

Additional highlights from the Private Wireless Advanced Research Report:

- Private wireless projections have been revised downward just slightly to factor in the reduced 2021 baseline.

- Total private wireless RAN revenues, including macro and small cells, are still projected to more than double between 2021 and 2026.

- The technology mix has not changed much with LTE dominating the private market in 2021 and 5G NR still on track to surpass LTE by the outer part of the forecast period, approaching 3 percent to 5 percent of the total 5G private plus public RAN market by 2026.

- Risks are broadly balanced. On the upside, the 5G enterprise puzzle has still not been solved. The successful launch of private 5G services by suppliers with strong enterprise channels could accelerate the private 5G market at a faster pace than expected. On the downside, 5G awareness is improving but it will take some time for enterprises to fully understand the value of private LTE/5G.

Comment & Analysis:

This author notes a bevy of new activity in the 5G private network space. It’s almost approaching a frenzy!

Yesterday, Cisco announced a “private 5G service that simplifies both 5G and IoT operations for enterprise digital transformation.” The company promised to show off the new product at the upcoming MWC trade show in Barcelona, Spain. Cisco to sell its 5G private network under an “as-a-service” model, such that enterprise customers who purchase it will only pay for what network resources they actually use. The company said that it would partner with unnamed vendors for all the necessary components, adding that it will run over midband spectrum. The company did not provide any further details. It should be noted that Cisco has never had ANY 2G/3G/4G/5G RAN products, as their wireless network portfolio has always been focused on WiFi (now for enterprise customers).

In late November 2021, Amazon unveiled its new AWS Private 5G service that will allow users to launch and manage their own private mobile network in days with automatic configuration, no per-device charges, and shared spectrum operation. AWS provides all the hardware, software, and SIMs needed for Private 5G, making it a one-stop solution that is the first of its kind. Dell’Oro Group’s VP Dave Bolan wrote in an email, “What is new about this (AWS Private 5G) announcement, is that we have a new Private Wireless Network vendor (AWS) with very deep pockets that could become a major force in this market segment.”

In addition, Mobile network operators like Deutsche Telekom, AT&T and Verizon offer private 5G networks, as do other cloud computing companies, mobile network equipment vendors like Ericsson and Nokia, system integrators like Deloitte, as well as startups like Betacom and Celona. So it’s a crowded market with suppliers each expecting a chunk of a very big pie.

I posed the seemingly contradictory finding of a less than forecast 2021 private wireless market vs the new private 5G players to Dell’Oro’s Pomengratz. In his email reply, Stefan wrote:

“If I had to summarize all our various projections I will just say that the things we know (public 5G MBB/FWA) are generally accelerating at a faster pace than expected while the things that we don’t know (private 5G/critical IoT etc.) are developing at a slower pace than expected.

And for this particular update, slower-than-expected comment was more related to revenues than activity. I agree with you that activity both when it comes to private trials and entering this space remains high.

At the same time, we have talked about private cellular for a long time but the reality is that we have not yet crossed the enterprise chasm. Nevertheless, we have a very large market opportunity ($10B to $20B for just the private 4G/5G RAN) that is still up for grabs, hence the high level of interest.”

References:

Private Wireless Weaker Than Expected in 2021, According to Dell’Oro Group

https://www.cisco.com/c/en/us/products/wireless/private-5g/index.html

Deloitte to co-ordinate 5G private network field trial at the largest hospital in Latin America

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

by Dario Sabella, Intel, ETSI MEC Chair, with Alan J Weissberger

Introduction (by Alan J Weissberger):

According to Research & Markets, the global Multi-access Edge Computing (MEC) market size is anticipated to reach $23.36 billion by 2028, producing a CAGR of 42.6%. Reduced Total Cost of Ownership (TCO) due to integration of MEC in network systems as compared to legacy systems and subsequent ability to generate faster Return on Investment (RoI) is further expected to encourage smaller retail chains to leverage MEC technology.

Multi-access Edge Computing Market Highlights (from Research & Markets):

- The software segment is anticipated to be the fastest-growing segment owing to emerging demand among service providers to use software that can be deployed for various applications without making changes to existing 3GPP hardware infrastructure specifications.

- The energy and utilities segment is expected to witness the fastest growth rate over the forecast period owing to increasing demand among companies to quickly access insights and analyze data generated from remote locations

- The Asia Pacific region is expected to emerge as the fastest-growing regional market due to strong support from the government to encourage advanced network infrastructure

A few important MEC applications/ use cases include:

- Streaming video and pay TV: Increasing number of users adopting the Over the Top (OTT) video delivery model is expected to promote telecom companies and mobile networks to upgrade their existing infrastructure to cache video/audio content closer to the user. Using the multi-access edge computing (MEC) architecture system brings backend functionality closer to the user network, which is expected to aid Multichannel Video Programming Distributors (MVPD) to meet their customers’ demands. Users pay subscription fees for a specified duration of time to access the content offered by the MVPD.

- Deployment of MEC technology is expected to enable retail and on line stores to improve the performance of in-store systems and reduce data processing time, thus ensuring faster resolving of customer grievances. Furthermore, adoption of this technology is expected to reduce the load on external macro sites, thus offering a seamless in-store experience for users.

- Increasing number of IoT devices and the emerging need to gain access to real-time analysis of data generated by them is expected to drive MEC market growth. Leveraging this technology in IoT can facilitate reduced pressure on cloud networks and result in lower energy consumption, which is expected to offer significant growth opportunities to the market.

- Multi-access edge computing is expected to enhance manufacturing practices and thus facilitate the advent of connected cars ecosystem. Connected cars are equipped with computing systems, wireless devices, and sensing, which have to work together in a coordinated fashion, thus facilitating the need to adopt MEC.

- 5G MEC technology can be used to exchange critical operational and safety information to enhance efficiency, safety, and enhance value-added services such as smart parking and car finder.

Previously referred to as Mobile Edge Computing, MEC raises a lot of questions. For example:

- Can MEC be used with wireline and fixed access networks?

- Is 5G Stand Alone (SA) core network with separate control, data, and management planes required for MEC to be effective?

- Finally, why should MEC (and multi-cloud) matter to infrastructure owners and application developers?

Dario Sabella, Intel, ETSI MEC Chair, answers those questions and provides more context and color in his two part article.

………………………………………………………………………………………………..

ETSI MEC Standard Explained, by Dario Sabella, Intel, ETSI MEC Chair

ETSI MEC – Foundation for Edge Computing:

MEC (Multi-access Edge Computing) “offers to application developers and content providers cloud-computing capabilities and an IT service environment at the edge of the network” [1].

The MEC ISG (Industry Specification Group) was established by ETSI to create an open standard for edge computing, allowing multiple implementations and ensuring interoperability across a diverse ecosystem of stakeholders: from mobile operators, application developers, Over the Top (OTT) players, Independent Software Vendors (ISVs), telecom equipment vendors, IT platform vendors, system integrators, and technology providers; all of these parties are interested in delivering services based on Multi-access Edge Computing concepts.

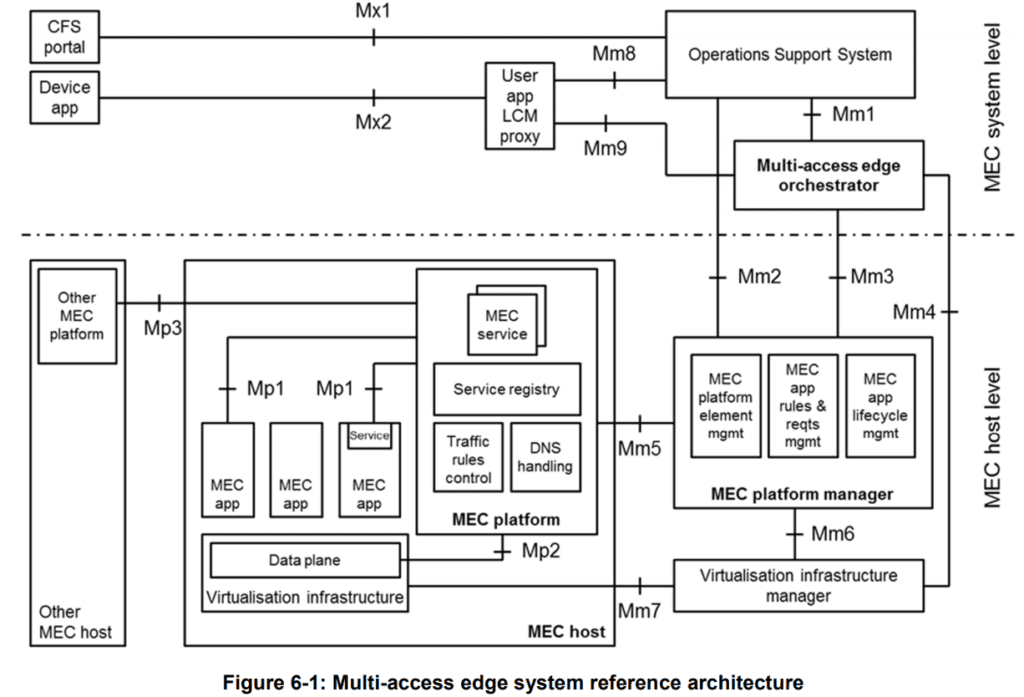

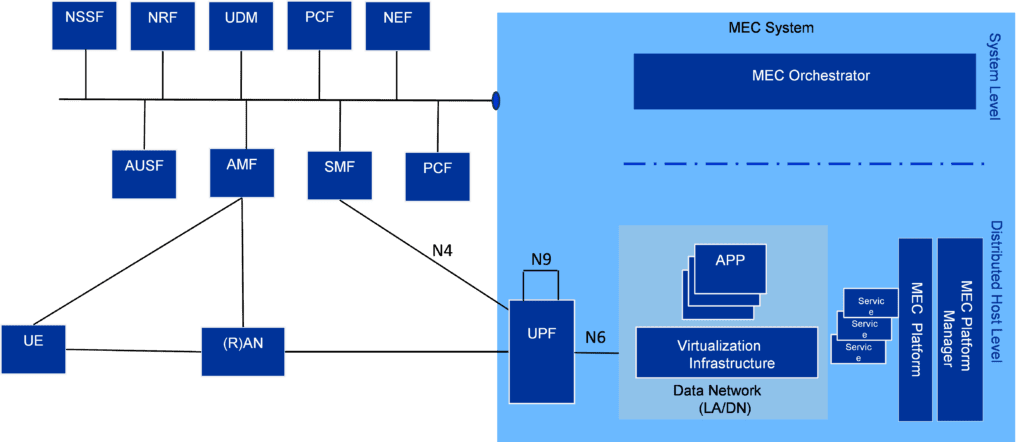

The work of the MEC initiative (see the architecture in Figure 1. above) aims to unite the telco and IT-cloud worlds, providing IT and cloud-computing capabilities at the edge: operators can open their network edge to authorized third parties, allowing them to flexibly and rapidly deploy innovative applications and services towards mobile subscribers, enterprises and vertical segments (e.g. automotive).

Author’s Note:

From a deployment point of view, a natural question is “where exactly is the edge?” In this perspective, the ETSI MEC architecture supports all possible options, ranging from customer premises, 1st wireless base station/small cell, 1st network compute point of presence, internet resident data center/compute server or edge of the core network. The MEC standard is flexible, and the actual and specific MEC deployment is really an implementation choice from the infrastructure owners.

Additionally, the MEC architecture (shown in Figure 2 and defined in the MEC 003 specification [2]) has been designed in such a way that a number of different deployment options of MEC systems are possible:

- The MEC 003 specification includes also a MEC in NFV (Network Functions Virtualization) variant, which is a MEC architecture that instantiates MEC applications and NFV virtualized network functions on the same virtualization infrastructure, and to reuse ETSI NFV MANO components to fulfil a part of the MEC management and orchestration tasks. This MEC deployment in NFV (Network Functions Virtualization) is also coherent with the progressive virtualization of networks.

- In that perspective, MEC deployment in 5G networks is a main scenario of applicability (note that the MEC standard is aligned with 3GPP specifications [3]).

- On the other hand, the nature of the ETSI MEC Standard (as emphasized by the term “Multi-access” in the MEC acronym) is access agnostic and can be applicable to any kind of deployment, from Wi-Fi to fixed networks.

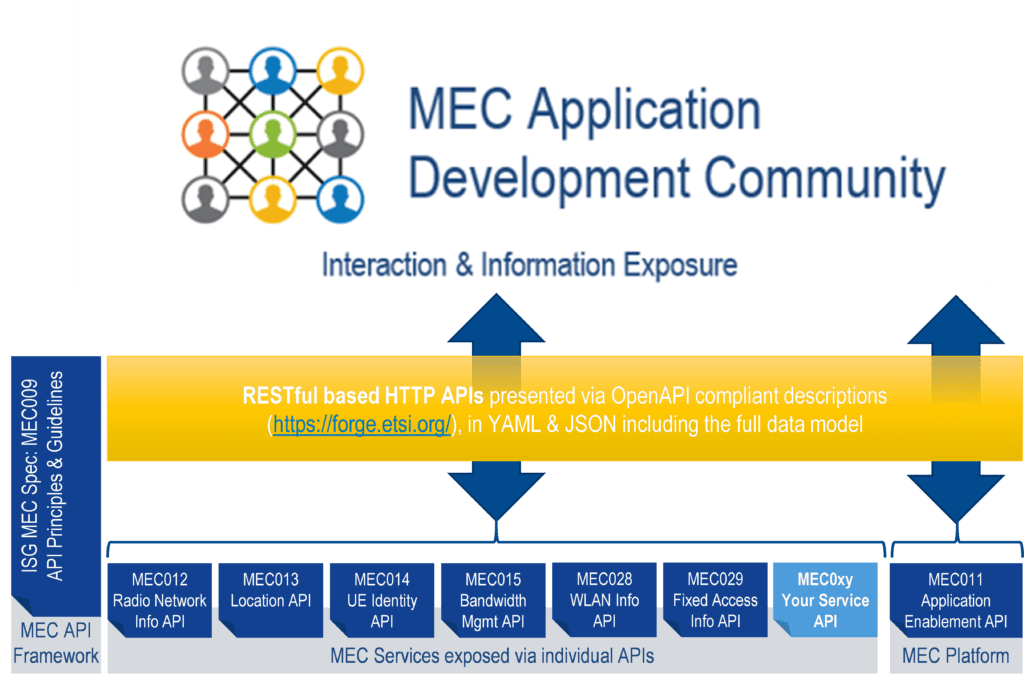

- A major effort of the MEC standardization work is dedicated to publishing relevant and industry-driven exemplary specifications of MEC service APIs, that are using RESTful principles, thus exposed to application developers in a universally recognized language.

The ETSI MEC initiative is focused on Applications at the Edge, and the specified MEC APIs (see above Figure 2.) include meaningful information exposed to application developers at the network edge, ranging from RNI (Radio Network Information) API (MEC 012), WLAN API (MEC 029), Fixed Access API (MEC 028), Location API (MEC 013), Traffic Management APIs (MEC015) and many others.

Additionally, new APIs (compliant with the basic MEC API principles [4]) can be added, without the need of being standardized in ETSI.

In this perspective, MEC truly provides a new ecosystem and value chain, by opening up the market to third parties, and allowing not only operators and cloud providers but any authorized software developers that can flexibly and rapidly deploy innovative applications and services towards mobile subscribers, enterprises and vertical segments.

MEC in 4G (and 5G NSA) Deployments:

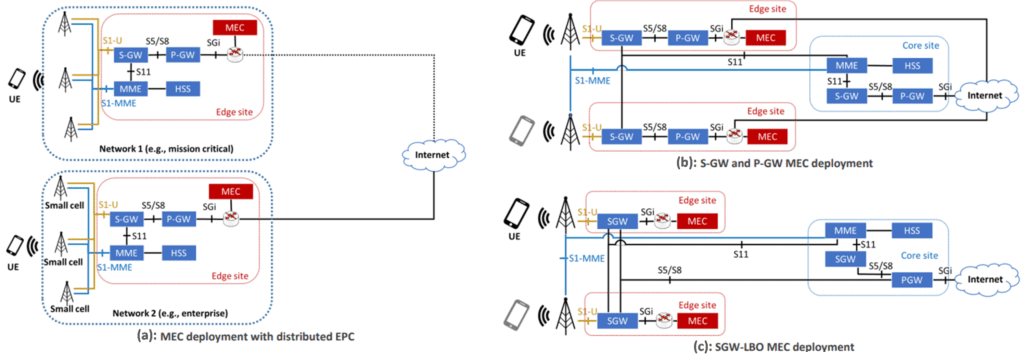

ETSI has already clarified how MEC can be deployed in 4G networks, given its access-agnostic nature [5], with many approaches:

From “bump in the wire” (where the MEC sits on the S1 interface of the 4G system architecture), to “distributed 4G-Evolved Packet Core” (EPC -where the MEC data plane sits on the SGi interface), to “distributed S/PGW” (where the control plane functions such as the MME and HSS are located at the operator’s core site) and “distributed SGW with Local Breakout” (SGW-LBO) -where the MEC system and the distributed SGW are co-located at the network’s edge.

Figure 3. MEC deployment options with distributed EPC (a), distributed S/PGW (b) and SGW-LBO (c)

Depending on the selected solution, MEC Handover is executed in different ways:

In the “bump in the wire approach,” mobility is not natively supported. Instead, in the EPC MEC, SGW + PGW MEC, and CUPS MEC, the MEC handover is supported using 3GPP specified S1 Handover with SGW relocation by maintaining the original PGW as anchor.

The same considerations apply for the SGW-LBO MEC deployment. In the latter case, the target SGW enforces the same policy towards the local MEC application.

Finally, the solutions that include an EPC gateway, such as EPC MEC, SGW+PGW MEC, SGW-LBO MEC, and CUPS MEC are compliant with LI (Lawful Interception) requirements.

This last aspect is also very relevant for MEC adoption, since public telecommunications network and service providers are legally required to make available to law enforcement authorities information from their retained data which is necessary for the authorities to be able to monitor telecommunications traffic as part of criminal investigations.

In that perspective, MEC deployment options are also chosen by infrastructure owners in the view of their compliance to Lawful Interception requirements.

Distributed SGW with Local Breakout (SGW-LBO):

A mainstream for the adoption of MEC is given by the progressive introduction of 5G networks.

Among the various 5G deployment options, local breakout at the SGWs (Figure 3c above) is a solution for MEC that originated from operators’ desire to have a greater control on the granularity of the traffic that needs to be steered. This principle was dictated by the need to have the users able to reach both the MEC applications and the operator’s core site application in a selective manner over the same APN.

The traffic steering uses the SGi – Local Break Out interface which supports traffic separation and allows the same level of security as the network operator expects from a 3GPP-compliant solution.

This solution allows the operator to specify traffic filters similar to the uplink classifiers in 5G, which are used for traffic steering. The local breakout architecture also supports MEC host mobility, extension to the edge of CDN, push applications that requires paging and ultra-low latency use cases.

The SGW selection process performed by MMEs is according to the 3GPP specifications and based on the geographical location of UEs (Tracking Areas) as provisioned in the operator’s DNS.

The SGW-LBO offers the possibility to steer traffic based on any operator-chosen combination of the policy sets, such as APN and user identifier, packet’s 5-tuple, and other IP level parameters including IP version and DSCP marking.

Integrated MEC deployment in 5G networks (3GPP Release 15 and later):

Edge computing has been identified as one of the key technologies required to support low latency together with mission critical and future IoT services. This was considered in the initial 3GPP requirements, and the 5G system was designed from the beginning to provide efficient and flexible support for edge computing to enable superior performance and quality of experience.

In that perspective, the design approach taken by 3GPP allows the mapping of MEC onto Application Functions (AF) that can use the services and information offered by other 3GPP network functions based on the configured policies.

In addition, a number of enabling functionalities were defined to provide flexible support for different deployments of MEC and to support MEC in case of user mobility events. The new 5G architecture (and MEC deployment as AF) is depicted in the Figure 4 below.

Figure 4. – MEC as an AF (Application Function) in 5G system architecture

In this deployment scenario, MEC as an AF (Application Function) can request the 5GC (5G Core network) to select a local UPF (User Plane Function) near the target RAN node. Then use the local UPF for PDU sessions of the target UE(s) and to control the traffic forwarding from the local UPF so that the UL traffic matching with the traffic filters received from MEC (AF) is diverted towards MEC hosts while other traffic is sent to the Central Cloud.

In case of UE mobility, the 5GC can re-select a new local UPF more suitable to handle application traffic identified by MEC (AF) and notify the AF about the new serving UPF.

In summary, MEC as an AF can provide the following services with a 5GC:

- Traffic filters identifying MEC applications deployed locally on MEC hosts in Edge Cloud

- Target UEs (one UE identified by its IP/MAC address, a group of UE, any UE)

- Information about forwarding the identified traffic further e.g. references to tunnels toward MEC hosts

………………………………………………………………………………………………………………………………………………………………………………………….

Part II. of this two part article will illustrate and explain concurrent access to local and central Data Networks. The enablement of MEC deployments and ecosystem development will also be presented.

Importantly, Part II will explain how MEC is evolving to the next phase of 5G– 3GPP Release 17. In particular, ETSI MEC is aligning with 3GPP SA6 which is defining an EDGEAPP architecture (ref. 3GPP TS 23.558).

Part II will also explain how MEC is evolving to multi-cloud support in alignment with GSMA OPG requirements for the MEC Federation work.

ETSI MEC Standard Explained – Part II

…………………………………………………………………………………………………………………………………………………………………………………………..

References:

1. Introduction:

https://www.accenture.com/_acnmedia/PDF-128/Accenute-MEC-for-Pervasive-Networks-PoV.pdf

PowerPoint Presentation (etsi.org)

2. Main body of this article (Part I and II):

[1] ETSI MEC website, https://www.etsi.org/technologies/multi-access-edge-computing

[2] ETSI GS MEC 003 V2.1.1 (2019-01): “Multi-access Edge Computing (MEC); Framework and Reference Architecture”, https://www.etsi.org/deliver/etsi_gs/mec/001_099/003/02.01.01_60/gs_mec003v020101p.pdf

[3] ETSI White Paper #36, “Harmonizing standards for edge computing – A synergized architecture leveraging ETSI ISG MEC and 3GPP specifications”, First Edition, July 2020, https://www.etsi.org/images/files/ETSIWhitePapers/ETSI_wp36_Harmonizing-standards-for-edge-computing.pdf

[4] ETSI GS MEC 009 V3.1.1 (2021-06), “Multi-access Edge Computing (MEC); General principles, patterns and common aspects of MEC Service APIs”, https://www.etsi.org/deliver/etsi_gs/MEC/001_099/009/03.01.01_60/gs_MEC009v030101p.pdf

[5] ETSI White Paper No. 24, “MEC Deployments in 4G and Evolution Towards 5G”, February 2018, https://www.etsi.org/images/files/ETSIWhitePapers/etsi_wp24_MEC_deployment_in_4G_5G_FINAL.pdf

[6] ETSI White Paper No. 28, “MEC in 5G network”, June 2018, https://www.etsi.org/images/files/ETSIWhitePapers/etsi_wp28_mec_in_5G_FINAL.pdf

[7] ETSI GR MEC 031 V2.1.1 (2020-10), “Multi-access Edge Computing (MEC); MEC 5G Integration”, https://www.etsi.org/deliver/etsi_gr/MEC/001_099/031/02.01.01_60/gr_MEC031v020101p.pdf

[8] ETSI GR MEC 035 V3.1.1 (2021-06), “Multi-access Edge Computing (MEC); Study on Inter-MEC systems and MEC-Cloud systems coordination”, https://www.etsi.org/deliver/etsi_gr/MEC/001_099/035/03.01.01_60/gr_mec035v030101p.pdf

[9] ETSI DGS/MEC-0040FederationAPI’ Work Item, “Multi-access Edge Computing (MEC); Federation enablement APIs”, https://portal.etsi.org/webapp/WorkProgram/Report_WorkItem.asp?WKI_ID=63022

Vodafone and Mavenir complete VoLTE call over a containerized Open RAN lab environment

Upstart network software provider Mavenir, announced today that it completed the first data and Voice over LTE (VoLTE) call across a containerized 4G small cell Open RAN solution in a Vodafone lab environment. The completed tests are the latest steps forward to delivering an open and vendor-interoperable 4G connectivity solution for small to medium-sized office locations.

Having first started work on a containerized indoor enterprise connectivity solution in January 2021, Vodafone has completed tests for an important stage of the technology roadmap. The plug-and-play small cell equipment can ensure comprehensive mobile coverage in every corner of the office. The solution will provide 4G coverage initially, making use of radio hardware from Sercomm and software from Mavenir (Open RAN). Containerization means that software can be seamlessly transferred between equipment, platforms, and applications. Wind River provided its Containers as a Service (CaaS) software, part of Wind River Studio.

This demonstration of a containerized solution is a major milestone in the evolution of connectivity equipment away from physical infrastructure to a digital cloud-based environment. Containerization provides greater flexibility for customers, but also significant benefits in terms of speed and cost of deployment.

Open RAN technology separates software from hardware, meaning more flexibility for mobile operators and customers. This approach aims to see many companies providing the components that make up a mobile network site, where previously one vendor would have delivered the whole solution. The technology is controversial, but accepted by many as a potential disruptor for the telecommunications industry. Vodafone claims to be one of the industry leaders in supporting the development of the Open RAN vendor ecosystem.

Whereas much of the focus for Open RAN has been directed towards network infrastructure deployment on mobile sites throughout the UK, the technology can be implemented in an enterprise environment to support local connectivity requirements. As an interoperable and standardized (there are no standards for Open RAN!) technology, Open RAN solutions can be integrated with little disruption in a “plug and play” manner, interoperable with other Open RAN compliant vendors.

Andrea Dona, Chief Network Officer, Vodafone UK, said: “Open RAN is opening doors to simplified and intuitive connectivity solutions. For our wider network deployment strategy, Open RAN is enabling us to work with a wider pool of suppliers and to avoid vendor lock-in scenarios that might prevent us from taking advantage of the latest innovations. The same could be said for enterprise connectivity solutions.”

“From the moment Open RAN is deployed in an office environment, customers are no-longer locked into a single upgrade path. Working alongside Vodafone, customers can be more flexible in how connectivity solutions are adapted and upgraded as demands evolve in the future.”