China 5G

Omdia: China’s 5G network co-sharing + cloud will create growth opportunities for Chinese service providers

After building the world’s largest 5G network with 2.3 million 5G base stations by the end of 2022, China is on track add over 600,000 5G base stations and reach 2.9 million by the end 2023, according to new Omdia market research (owned by Informa). A key milestone in terms of China’s co-building and co-sharing 5G networks recently took place in May 2023, through the 5G network collaboration between all the four service providers in China. Under the organization and guidance of the Ministry of Industry and Information Technology (MIIT), the four major mobile operators in China – China Mobile, China Telecom, China Unicom, and China Broadnet, jointly announced the launch of what they claimed as the world’s first 5G inter-network roaming service trial. The service enables customers to access other telecom operators’ 5G networks and continue using 5G services when outside the range of their original operators’ 5G network.

Ramona Zhao, Research Manager at Omdia said: “Omdia expects inter-network roaming to improve operators’ 5G network coverage particularly in rural areas. Driven by better 5G network coverage, 5G will overtake 4G’s leading position and become the largest technology in China’s mobile market by 2026. By the end of 2028, we anticipate 5G will account for 65.1% of the total mobile subscriptions (including IoT connections).”

An advertisement for 5G mobile service at Shanghai Pudong International Airport. Image Credit: DIGITIMES

Omdia deems China as a 5G pioneer in terms of many areas, including technology innovation, network deployment, and 5G use cases. Driven by the increasing 5G adoption, Chinese service providers’ mobile service revenue and reported mobile (non-IoT) ARPU have all achieved year-on-year (YoY) growth in 2022. China Telecom reported an increase of 3.7% in its mobile service revenue; China Unicom‘s mobile service revenue saw a YoY increase of 3.6%; while China Mobile’s mobile service revenue also increased by 2.5% YoY.

Owing to the digital transformation demand from various state-owned enterprises, cloud services are also considered a growing business for Chinese service providers.

“Omdia recommends that Chinese service providers innovate more applications through the integration of cloud and the 5G network. This will be vital to enable the digital transformation of various industries and the acquisition of new revenue streams,” concludes Zhao.

According to a previous GSMA report, dubbed “The Mobile Economy China 2023”, 5G technology will add $290 billion to the Chinese economy in 2030, with benefits spread across industries.

“Mainland China is the largest 5G market in the world, accounting for more than 60% of global 5G connections at the end of 2022. With strong takeup of 5G among consumers, the focus of operators is now increasingly shifting to 5G for enterprises. This offers opportunities to grow revenues beyond connectivity in adjacent areas such as cloud services – a segment where operators in China have recently made significant progress,” the GSMA report reads.

5G will overtake 4G in 2024 to become the dominant mobile technology in China, according to the report. “4G and 5G dominance in China means legacy networks are now being phased out. While most users have been migrated to 4G and 5G, legacy networks continue to support various IoT services. However, some estimates suggest that legacy networks could be almost entirely shut down in China by 2025,” the study reads.

Chinese vendor Huawei Technologies has secured over half of a major contract to deploy 5G mobile base stations for local carrier China Mobile, according to recent reports by Chinese media.

Huawei obtained over 50% of the total of China Mobile’s centralized procurement program in 2023.

The report also stated that Huawei will provide 5G base stations for different frequency bands. The bands ranging from 2.6 GHz to 4.9 GHz will have around 63,800 stations, divided into two projects, while the number of base stations to operate in the 700 MHz band will be 23,100, divided into three projects. ZTE was the second-biggest winner in terms of base stations, followed by Datang Mobile Communications Equipment, Ericsson and Nokia Shanghai Bell.

References:

Huawei reinvents itself via 5G-enabled digitalized services to modernize the backbone of China’s industrial sectors

In northern China sits Tianjin port’s “Smart Hub” – a fully digitalized and automated wharf where quay cranes, gantry cranes, stackers and forklifts are all controlled by a command center miles away. Powered by Huawei Technologies’ 5G telecommunications infrastructure, the smart port can move 36 20-foot equivalent units (TEU) per hour, much faster than humans.

“Digitalization is the industry trend, a direction not just for Chinese ports, but for all global ports,” Yang Jiemin, vice- president of Tianjin Port (Group), said during a recent visit by the South China Morning Post. “Our goal is to build a digital twin to Tianjin port in the next three to five years,” he added. The benefits of automation are clear. A staff of 200 operators and engineers can manage 1 million TEU in annual throughput at Tianjin port’s Terminal C, about 25 per cent of the employees needed in a typical year during its pre-digital age. The future has more in store: artificial intelligence (AI) for predicting congestion, big data analysis for parsing traffic trends and driverless trucks – all made possible by the ultra-fast exchange of data in 5G networks.

Shenzhen-based Huawei, with 195,000 employees in 2021 and one of the world’s largest research budgets, surpassing even that of Google and Microsoft, is now promoting the advantages of 5G-enabled digitalized services to modernize the backbone of China’s industrial production in coal mines, ports and even hospitals.

As U.S. sanctions tightened around Huawei’s access to critical technology, the firm’s smartphone business, which beat Apple to become the world’s second-biggest smartphone maker in 2018, came under tremendous pressure. Deprived of Google’s Android operating system and short of vital components, it sold its Honor budget smartphone business in 2020, the biggest driver behind its spectacular success. Huawei then pivoted back to its mainstay enterprise business, opening up new data-heavy products and services for customers to increase their usage and dependence on its 5G infrastructure.

The company established “legions” to spearhead the effort, a nod to the military parlance much liked by founder Ren Zhengfei, who served in the People’s Liberation Army. These cross-departmental business units were established to help clients digitally transform their products and services in mining, customs clearance and ports, energy savings at data centres, smart highways and the photovoltaic industry.

Last June, Huawei added five legions, bringing the total to 20. While it has not disclosed details about each legion, the chief executive of its airport and road legion, Li Junfeng, said the company was hopeful about the digitalization of transport.

“Airports and roads are also key infrastructure and it is difficult to expand in the overseas market. So we do not have plans for global expansion in the short term, but we will make some changes next year,” Li said in November, according to the state-owned Securities Times financial newspaper.

For Huawei, hopes are high that such industrial infrastructure can turn into a source of steady revenue – at least domestically – although the firm has declined to divulge the financial details of its showcase applications.

Huawei’s efforts to forge deeper ties with traditional industries build on its past work with the world’s private enterprises, leveraging its 5G connectivity and computing power to automate and upgrade various verticals, says Matthew Ball, chief analyst at research firm Canalys.

“Overall, this is an extension of what Huawei has done for years, even before the US sanctions, particularly its enterprise business, which had a strong vertical focus on delivering solutions across its portfolio,” Ball said.

“It’s just that its smartphone business has received more headlines.”

The jury is still out on whether Huawei can survive US sanctions, especially given Western reluctance to allow it future access to potentially sensitive data and network infrastructure contracts on national security grounds. The company has already undergone huge change since Trump added it to a trade blacklist in May 2019, barring it from doing businesses with US partners without special permits.

Huawei’s rotating chairman, Eric Xu, said in a new year’s message that the company had exited “crisis mode” and was ready to go “back to business as usual” in 2023. The bleeding has been staunched after it reported preliminary revenue of 636.9 billion yuan (HK$736.3 billion) for 2022, little changed from the previous year.

The pressure remained on Huawei even after Trump lost his re-election bid. Reports emerged last month that Joe Biden’s administration was considering cutting off Huawei from all its US suppliers, including Intel and Qualcomm, which produce the semiconductors critical to the company’s telecoms gear.

Huawei has been reporting its annual results since 2000 even if it is not subject to public disclosure regulations, a practice from bidding for tender contracts in public telecoms networks.

The share of China revenue in its overall business has increased from about half in 2018 to around two-thirds in 2021 due to a retreat from almost all overseas markets, including the Asia-Pacific, the Americas and Europe, the Middle East and Africa, according to its results.

Its consumer business, mainly smartphones and devices, has been hobbled by a lack of access to advanced chips.

At one point, Huawei briefly surpassed Apple and Samsung Electronics to become the world’s biggest handset vendor, but it is now out of the top five. By the third quarter of 2022, it finally ran out of less advanced in-house- designed semiconductors for its handsets.

Huawei’s carrier unit, once its bread-and-butter business of selling telecoms gear, has slipped as China’s telecoms operators gradually complete network upgrades. In 2021, its carrier business revenue was 40 per cent lower than in 2019 when China began 5G infrastructure installation.

That leaves enterprise as the only segment with growth, notching up a 2.1 per cent revenue increase in 2022, although its contribution was still less than one-sixth of total sales.

At the beginning of 2021, Huawei founder Ren told employees the company must make cloud computing its priority, and personally endorsed the firm’s partnership with coal mines.

The company is developing customized 5G mobile base stations for the mining industry that are resistant to dust, dampness and even shock waves from explosions. These devices are expected to support stable and fast upload of real-time data from unstaffed machinery, sensors and high-definition cameras, which would help China’s most dangerous industry cut back on the number of people working in the pits. The mining industry would be the first to use the model where scientists and experts from different corporate departments could come together to find solutions to specific industry problems, Ren said in 2021 in the Shanxi provincial capital of Taiyuan.

Enhancing end-to-end user experience, real-time processing of massive data and the operation, maintenance and management of complex networks would all become challenges for the financial industry in the future, according to a June speech by Cao Chong, the head of Huawei’s digital finance legion, the Securities Times reported.

Huawei has also made a foray into the electric-vehicle sector, with the high-profile launch of Aito cars, a brand launched jointly with Chinese electric-car maker Seres. However, competition is cutthroat in China, and Huawei ranked only sixth among the country’s electric-vehicle start-ups with a total of 76,180 units by the end of 2022. The company has also forged ties with a series of carmakers offering smart car components.

The change in Huawei’s business is visible to consumers. On the ground floor of its Shenzhen flagship store, a three-storey building with a huge glass facade, customers approached a row of Aito cars during a recent visit, asking sales representatives about vehicle specifications and available discounts. At the other end of the showroom, Huawei’s latest smartphones and tablets were on display on long wooden tables. While analysts are generally sanguine on Huawei’s new enterprise business moves, the digitalization push is not expected to result in a short-term revolution.

“The enterprise business should be able to generate rapid growth in the next five to 10 years,” said Ivan Lam, a senior analyst at Counterpoint Research. But the threat of US sanctions remains the biggest obstacle for Huawei, according to Lam, especially for products that require advanced computing power such as smartphones, servers and car components.

“Huawei has never treated existing sanctions as the last, and it has been preparing for new restrictions in various ways, such as adoption of domestic technologies. We expect Huawei to reap the benefits of these efforts in coming years and close the gap in key technologies,” ” Lam said.

……………………………………………………………………………………………………………………………………………………………………………………………….

Separately, the South China Morning Post reported that Huawei Technologies Co chief financial officer Meng Wanzhou, daughter of company founder and chief executive Ren Zhengfei, is expected to take her turn as “rotating chairwoman” in the company from April, according to local media reports, signalling that a succession plan looks to be in place at the struggling Chinese telecommunications giant.

It would mark the first time that Meng, 50, has assumed the role since she was added as one of three rotating chairmen at Huawei in March last year, alongside Eric Xu Zhijun and Ken Hu Houkun. Xu’s current acting chairman term started on October 1 last year and will conclude on March 31.

During her six-month turn as the company’s top leader, Meng, who also serves as deputy chairwoman at Huawei, will head the company’s board of directors and its executive committee.

Meng was hailed as a national hero upon her return to China in a chartered flight in September 2021, following nearly three years under house arrest in Canada where she fought extradition to the US over a bank fraud case. Under a deal reached with US prosecutors, that case and other charges against Meng were dismissed last December.

References:

China’s MIIT to prioritize 6G project, accelerate 5G and gigabit optical network deployments in 2023

China’s government has selected 6G as one of its priority projects for 2023. At a national conference on industry and information technology, the Ministry for Industry and IT (MIIT) Jin Zhuanglong, said China intends to push forward in “comprehensive” development of 6G this year. In 2023, China will introduce policies and measures to promote coordinated development of new information infrastructure construction and accelerate the construction of 5G and gigabit optical networks, Jin said. MIIT will also improve policies on telecom market development, and strengthen the protection of personal information and users’ rights and interests.

Editor’s Note: Work on 6G has not yet started in either 3GPP or ITU-R WP 5D. The latter SDO is progressing draft reports on the vision of IMT for 2030 and Beyond, but no 6G requirements will be identified.

…………………………………………………………………………………………………………………………………………………………..

More than 2.3 million 5G base stations have been put into service, and notable progress has been made in the construction of new data centers, according to the conference.

In recent years, China has intensified efforts to promote the construction of new information infrastructure, deepen the construction of 5G, gigabit optical network and industrial internet, and promote the deep integration of the digital economy and the real economy.

Image Credit: Alan Novelli/Alamy Stock Photo

At the end of last year China Telecom issued a white paper setting out its vision for 6G. Written by the China Telecom Research Institute, the paper proposes a distributed and intelligent programmable RAN (P-RAN) network architecture and what it calls a “three-layer and four-sided” framework. The white paper notes that because of the cost of building out the dense mmWave or terahertz-band networks, it will be essential to provide device-to-device connectivity.

Six months ago, heavyweight China Mobile issued its own 6G vision, calling for “three bodies, four layers and five sides.”

China’s other 6G news is a call for proposals on potential key technologies from the national coordinating body, the IMT-2030 6G Promotion Group. According to an English-language statement posted by CAICT, the main objectives are “to inspire university-academy-industry-association entities for technology innovations, gather and form a rich reserve of 6G potential key technologies, and support 6G research, standardization, and industrial R&D.”

Non-Chinese universities and research organizations are welcome to apply ahead of the deadline in November 2023. The proposed solutions should have “application and promotion value for 6G innovation and development,” and the key technical indicators should be capable of being evaluated and verified, the statement said.

References:

https://www.lightreading.com/6g/chinese-government-confirms-focus-on-6g-development/d/d-id/782727?

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

https://www.lightreading.com/6g/the-6g-mess-is-getting-out-of-hand/a/d-id/782245

Summary of ITU-R Workshop on “IMT for 2030 and beyond” (aka “6G”)

IMT towards 2030 and beyond (“6G”): Technologies for ubiquitous computing and data services

Excerpts of ITU-R preliminary draft new Report: FUTURE TECHNOLOGY TRENDS OF TERRESTRIAL IMT SYSTEMS TOWARDS 2030 AND BEYOND

Development of “IMT Vision for 2030 and beyond” from ITU-R WP 5D

China to launch world’s first 5G cruise ship via China Telecom Corp Ltd Shanghai Branch

China will debut the world’s first cruise ship covered by a 5G network later this year, due to a collaboration between CSSC Carnival Cruise Shipping Ltd’s own cruise brand Adora Cruises and China Telecom Corp Ltd Shanghai Branch. Adora Cruises [1.] has partnered with Shanghai Telecom, a major 5G network service provider in China, to bring 5G connectivity to its first China-built large cruise ship. This partnership marks a major milestone, as it is the first time a 5G network has been installed on a cruise ship in the world and sets a new standard for connectivity and convenience, according to a press release on Thursday.

Note 1. Adora Cruises is part of CSSC Carnival Cruise Shipping Limited, a joint venture between shipbuilder China State Shipbuilding Corp (CSSC) and U.S.-based leisure travel company Carnival Corporation.

“From network layout, satellite communication, to various digital applications, our goal is to deliver seamless multimedia interactions and consistent mobile connectivity for guests and crew, allowing them to stay connected with loved ones and the world while at sea,” said Chen Ranfeng, Managing Director of CSSC Carnival Cruise Shipping Limited. “By seizing a first-mover advantage in the cruise industry’s 5G market, we hope to set a new standard for digital communication in the marine travel sector.”

Adora Cruises is working towards a future where guests can enjoy an enhanced cruise experience with 5G connectivity and access to all-around multimedia and real-time interaction, the company said.

Image Courtesy of CSSC Carnival Cruise Company

“Combining 5G and satellite technology, we will focus on network communication, digital high-definition, AR/VR and other content services to further improve our guest experience and jointly promote high-quality development of the tourism economy,” said Gong Bo, general manager of Shanghai Telecom. “By seizing a first-mover advantage in the cruise industry’s 5G market, we hope to set a new standard for digital communication in the marine travel sector,” said Ranfeng.

The cruise company’s first two China-built large cruise ships are currently under construction at Shanghai Waigaoqiao Shipbuilding Corp, and will be operated under the brand name of Adora in the future.

The first 135,500-gross-ton Adora cruise ship is expected to start its journey by the end of 2023, while the second vessel is currently still being designed and constructed.

References:

http://www.ecns.cn/news/sci-tech/2023-01-13/detail-ihcircrp9799635.shtml

5G hits the open water with Adora Cruises, China Telecom partnership

China MIIT claim: 475M 5G mobile users, 1.97M 5G base stations at end of July 2022

The number of 5G mobile users in China had reached 475 million by the end of July, China’s Ministry of Industry and Information Technology (MIIT) said Friday. That was a net increase of 120 million users compared with the end of 2021, an MIIT official told a press conference. Please see Anonymous Comment in box below this article.

As of the end of July, the country had built approximately 1.97 million 5G base stations, with all prefecture-level cities, counties and 96 percent of towns equipped with 5G network coverage, according to the MIIT. China’s state owned mobile operators are expected to add a total of 600,000 base stations to boost 5G infrastructure across China during 2022, according to previous reports.

The construction of new information infrastructure including 5G networks and gigabit optical networks will continue to be promoted, and the deep integration of “double gigabit” networks with various fields will be accelerated, the MIIT said. Efforts will also be made to gradually extend the coverage of high-quality networks to rural areas, and actively expand the application of new business forms in rural areas, the ministry said.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

China Mobile, the world’s largest operator in terms subscribers, recently said it had invested a total of CNY58.7 billion ($8.7 billion) in the 5G segment in the first half of the year. “We put in use a cumulative of one million 5G base stations, including 300,000 700 MHz 5G base stations, which together served 263 million 5G network customers and more than 4,400 5G dedicated network projects,” China Mobile said. The company continues to promote the co-construction and sharing of its 5G network with China Broadcasting Network Corporation using spectrum in the 700 MHz band.

Meanwhile, China Telecom said it expected to deploy an additional 120,000 5G base stations in the second half of the year to take the total to 990,000.

Along with network partner China Unicom, China Telecom increased the number of 5G base stations by 180,000 in the first half, taking the total to 870,000. China Telecom said it aims to take 5G coverage to all cities, counties, and key villages and towns by the end of the year.

- China Mobile, the world’s largest operator in terms of subscribers, added a total of 15.81 million 5G subscribers during June with 124.14 million additional 5G subscribers in the first half of 2022. The state owned network operator said it ended last month with 510.94 million 5G subscribers.

- China Unicom said it added a total of 5.2 million 5G subscribers during June. The carrier ended the month with 184.9 million 5G subscribers.

- China Telecom added 7.18 million 5G subscribers last month to take its total 5G subscribers base to 231.6 million. During the first six months of the year, the telco had added a total of 43.85 million 5G subscribers.

………………………………………………………………………………………………………………………………………..

Update: BEIJING, Aug. 27, 2022 (Xinhua) — China’s telecommunications sector logged steady expansion in the first seven months of this year, official data showed.

The combined industrial telecom revenue rose 8.3% year on year to 944.2 billion yuan (about 137.87 billion U.S. dollars), according to China’s Ministry of Industry and Information Technology (MIIT).

Emerging businesses, such as big data, cloud computing, internet data centers and Internet of Things, expanded rapidly during the period. The emerging business revenue of China’s three telecom giants — China Telecom, China Mobile and China Unicom — surged 35.1% year on year to 184.3 billion yuan.

In breakdown, the revenue for cloud computing services soared 131.7% year on year, while that for big data and Internet of Things surged 60.3% and 25.9%, respectively.

Steady progress was also made in the construction of 5G base stations: By the end of July, the number of 5G base stations in China had reached a total of nearly 1.97 million.

https://english.news.cn/20220827/13db7111ef6545abaca284f1d49e2371/c.html

References:

https://english.news.cn/20220819/4a1afcc7427e4424bd3cf2d6929ad19c/c.html

Chinese carriers deploy over 1.97 million 5G base stations: Report

China’s telecom sector had steady growth during January-May 2022 (Updated)

China’s telecom sector had steady growth during January-May 2022 (Updated)

China’s telecommunication industry registered steady growth in the first five months of the year, with strong expansion in emerging businesses and 5G services, official data shows.

The telecom sector had 665 billion yuan (99.46 billion U.S. dollars) in total revenue during the period, up 8.5 percent year on year, according to China’s Ministry of Industry and Information Technology (MIIT).

Emerging businesses, including those in the big data, cloud computing, internet data center and Internet of Things sectors, continued to expand notably in the period.

The combined revenue of the emerging businesses of China’s three telecom giants — China Telecom, China Mobile and China Unicom — surged 34.3 percent year on year to 128.3 billion yuan, accounting for 19.3 percent of the sector’s total revenue, the ministry said.

At the end of May, China had 1.7 million 5G base stations, accounting for 16.7 percent of the country’s mobile network base stations. Some 275,000 5G base stations were built in the first five months of the year.

The data also shows that 5G mobile phone users of the three telecom giants reached 428 million at the end of May, representing 25.8 percent of China’s total mobile phone users.

–>Much more telecom data in the Addendum below.

………………………………………………………………………………………………………………………………..

Image by ADMC from Pixabay

At the end of May, China had a total of 1.7 million 5G base stations, accounting for 16.7% of the country’s mobile network base stations. According to the official data, a total of 275,000 5G base stations were built in the first five months of 2023.

China ended May 2022 with a total of 899.3 million subscribers classified as having 5G plans (even though many only had 4G endpoint devices), according to the carriers’ latest available figures. China network operators recorded a net gain of 30.18 million 5G subscribers in May.

China Mobile, the world’s largest operator in terms of subscribers, added a total of 18.21 million 5G subscribers during last month. The operator said it ended May with 495.13 million 5G subscribers, compared to 221.95 million 5G customers in May 2021.

China Mobile had added a total of 108.32 million subscribers in the 5G segment during the first five months of the year.

Rival operator China Unicom said it added a total of 4.93 million 5G subscribers during May. The carrier ended the month with 179.70 million 5G subscribers.

Meanwhile, China Telecom added 7.04 million 5G subscribers last month to take its total 5G subscribers base to 224.47 million. During the first five months of the year, the telco had added a total of 36.67 million 5G subscribers.

China expects to end this year with nearly 2 million 5G base stations, according to previous reports. Chinese carriers reportedly deployed a total of 654,000 base stations nationwide during last year.

The country’s 5G networks now covers all prefecture-level cities, more than 98% of county-level urban areas and 80% of township-level urban areas across the country..

Earlier this year, the Chinese government had unveiled plans to more than triple the number of 5G base stations over the next four years, targeting a total of 3.64 million by end-2025.

Under this plan, China aims to have 26 5G base stations for every 10,000 people by the end of 2025. In comparison, in 2020, there were five 5G base stations for every 10,000 people in China.

China is expected to reach 892 million connections in the 5G segment in 2025, according to a report recently published by the GSMA.

According to the ‘The Mobile Economy China” report, GSMA expects 5G connections in the country to represent 52% of total mobile lines in 2025, compared to 29% in 2021.

…………………………………………………………………………………………………………………………

| Indicator name | unit | end of the month

arrive |

than the end of last year

net increase (+), reduce(-) |

year-on-year

increase(%) |

| Total landline subscribers | million households | 18170 | 100 | 0.2 |

| Total mobile phone users | million households | 166249 | 1966 | 3.4 |

| Of which: 5G mobile phone users | million households | 42819 | 7334 | 109.2 |

| Of which: Mobile Internet users | million households | 143568 | 2003 | 4.3 |

| Internet broadband access users | million households | 55868 | 2289 | 10.6 |

| Of which: FTTH/O users | million households | 52976 | 2426 | 11.5 |

| Among them: users with a rate of 100M or more | million households | 52291 | 2443 | 13.4 |

| Among them: users with a rate above 1000M | million households | 5591 | 2135 | 358.6 |

| Of which: urban broadband access users | million households | 39415 | 1606 | 10.8 |

| rural broadband access users | million households | 16453 | 683 | 10.1 |

| Number of IPTV (Internet TV) users | million households | 36392 | 1540 | 10.2 |

| Number of Cellular IoT End Users | million households | 159 498 | 19 576 | 26.8 _ |

| Fixed telephone penetration | Department/100 people | 12.9 | 0.1 | – |

| Mobile phone penetration | Department/100 people | 117.9 | 1.5 | – |

http://english.news.cn/20220703/41a9776edd9d44c0ad055252c4e35818/c.html

https://www.miit.gov.cn/gxsj/tjfx/txy/art/2022/art_b8491abea6324484a19b5438b08761a4.html

China’s telecom sector revenues reach almost $100bn in Jan-May

China Broadnet launches 5G mobile service

For the first new operator in the market in 15 years, it’s going to be all uphill. Broadnet’s fate will likely be shaped by three key factors, according to Robert Clark of Light Reading:

1. How level is the playing field?

China’s telecom industry has no body of competition law. In fact, China has no telecommunications law of any kind, despite 40 years of trying. It has an anti-monopoly law, but it has never been applied to a national state-owned corporation.

By some stroke of good fortune, China Broadnet may not face any interconnection, data sharing, number porting or other issues with the incumbent operators. If it does, it will be at the mercy of the MIIT, the NRTA’s bureaucratic arch-rival and default regulator, as well as its larger competitors.

2. Strength of Broadnet’s partnership with market leader China Mobile?

The alliance with the industry giant may give Broadnet some extra backing in dealing with China Unicom and China Telecom. But that will depend on whether China Mobile sees Broadnet as a partner whose success aids its own success, or a competitor who happens to be a customer that can be easily brushed aside.

3. Whether the new 5G competitor will drive the industry into a price war?

That wouldn’t surprise anyone who has seen Rakuten overturn the staid Japanese market in the past two years (see NTT DoCoMo making gains, anticipating pain in price war).

China Telecom, ZTE jointly build spatiotemporal cognitive network for digital transformation

ZTE Corporation and the Zhejiang Branch of China Telecom have jointly built a self-adaptive spatiotemporal cognitive network based on ZTE’s Radio Composer, improving dynamic user experiences in high-capacity scenarios. Under the collaboration with intelligent user navigation, the network solution matches network resources with traffic distribution more precisely and efficiently through on-demand elastic coverage of two-layer network, adapting to user group flow in space over different time periods.

The spatiotemporal cognitive network intelligently predicts traffic distribution in the first place. According to location change of user groups in different time periods within base station coverage, the network solution, by virtue of LSTM (long short-term memory) algorithms, performs in-depth study and prediction of traffic distribution on physical grid level and analyses the traffic space distribution trend in different periods.

Based on the traffic distribution trend in both time and frequency, the spatiotemporal cognitive network implements the intelligent carrier power scaling function through power sharing, to achieve flexible coverage adjustment. Below is an example of Traffic distribution of different periods in one area over time:

When the traffic loads within coverage of the two carriers are both high, the solution balances the two carriers with the same coverage to guarantee capacity. When the traffic loads within coverage of the two carriers differentiates obviously, the solution adjusts the coverage mode. It adopts high power to cover the high-load area and decreases power in the low-load area, therefore precisely matching radio resources to ensure user experiences.

The spatiotemporal cognitive network focuses on intelligent experience collaboration and establishes AI logic grid knowledge base of base stations, in order to further balance network efficiency and user experiences.

Moving forward, the Zhejiang Branch of China Telecom and ZTE will keep innovating together to provide superb network performance and boost digital transformation.

References:

China’s state policy: shape global tech standards to increase influence and enhance global reputation

In line with China President Xi Jinping‘s goal of making the country a ‘major power with pioneering global influence’ by 2049, China has been leveraging its technological prowess and geopolitical heft to shape the global technological environment and standards to serve its commercial and strategic interests, a media report said.

China has adopted a state-directed strategy to influence international standards setting, and use them as a foreign policy tool to enhance its global standing, the Times of Israel reported, adding that, the Xi administration has employed a dual-track approach to set the international technological standards.

On the one hand, it seeks to influence both the multilateral (governmental) and the multi-stakeholder technical Standards Development Organizations (SDOs) by placing Chinese nationals in senior leadership positions (like in 3GPP and ITU-R WP5D) and larger representation of Chinese tech companies (the three China state owned network providers, Huawei, ZTE and smaller players like Nufront with its own 5G RIT spec), and other Chinese companies, with guidance from the Party-State (CCP), are creating standards utilizing the Belt and Road Initiative (BRI) and Digital Silk Road (DSR).

With respect to 5G radio interface technology (RIT) standards, three China ministries (MIIT, NDRC and MOST) jointly established the “IMT-2020(5G) Promotion Group” in February 2013. The objectives have been met:

– Promote the development of 5G technologies in China.

– Facilitate cooperation with foreign companies and organizations MIIT Ministry of Industry and Information Technology.

– Drive China’s contributions to ITU-R WP5D 5G standards (M.2150 and revisions of M.1036) and 3GPP release 15 and 16 specifications (a Chinese national heads up the critical 3GPP “URLLC in the RAN” project).

The Group helped progress the ITU-R M.2150 standard for 5G RAN/RIT/SRITs. Initially China had it’s own 5G RIT spec, but it was later merged with 3GPPs as was South Korea’s.

At the International Telecommunications Union (ITU), the involvement of Chinese commercial entities have increased after the impetus provided by ITU‘s current Secretary-General, Zhao Houlin who has served two terms as Director of ITU’s Telecommunication Standardization Bureau (STB). China is second only to the U.S. in the number of entities registered as ITU members, according to the referenced Times of Israel blog.

In 2021 alone, Chinese entities backed 145 new standards at the ITU, up from 46 in 2015 and six times more than Western entities.

The number of Chinese nationals in secretariat and leadership positions in critical multi-stakeholder SSOs such as the International Organization for Standardization (ISO) and the International Electro-technical Commission (IEC) has also surged in the past decade.

Beyond the IEC, ISO, and ITU, Chinese actors are also active in other SDOs including the 3rd Generation Partnership Project (3GPP) that develops 5G technical specifications, as well as Internet Engineering Task Force (IETF), the report said, adding that the companies such as Alibaba, Baidu, Huawei, Tencent and ZTE are advanced members of the IEEE Standards Association.

Not only do Chinese firms ‘flood’ committees with a huge volume of standards proposals and contributions, but they also typically vote as a single bloc. Beijing also has a tendency to use its debt and trade leverage to influence the votes of a number of countries in favour of its proposals. This produces a strikingly high rate of success in the number of Chinese submissions at the ITU, the Times of Israel blog noted.

Another emerging facet of China’s approach to technology standards setting is the Digital Silk Road (DSR) initiative, which is one of the primary vehicles delivering Chinese technology to BRI partner states. By signing agreements with BRI partner governments, Beijing is propagating its own technology standards in project host states, creating dependencies that lock these countries into using Chinese vendors and standards.

Beijing’s moves are aimed at setting global standards for the next-generation technologies, the report said, adding, that it wants to gain control over key technologies like the Internet of Things, Cloud Computing, Big Data, 5G and artificial intelligence.

In light of above, it is apparent that Beijing’s moves are aimed at setting global standards for the next-generation technologies. The CCP wants to gain control over key technologies like Internet of Things (IoT), Cloud Computing, Big Data, 5G and artificial intelligence.

International organizations need to be wary of these maneuvers in order to prevent Beijing from dominating global technology standards and thus gaining a monopoly over the world’s future-shaping technologies, the Times of Israel report concluded.

References:

https://blogs.timesofisrael.com/double-standards-chinas-influence-in-international-standards/

https://www.ifri.org/sites/default/files/atoms/files/seaman_china_standardization_2020.pdf

https://techblog.comsoc.org/2018/11/18/with-no-5g-standard-imt-2020-china-is-working-on-6g/

https://techblog.comsoc.org/tag/chinas-imt-2020-promotion-group/

WSJ: China Leads the Way With Private 5G Networks at Industrial Facilities

Editor’s Note on Private 5G:

Do you agree with the WSJ article below? We don’t, as we believe China’s 5G is fake news/mass propaganda!

WSJ:

China Leads the Way With Private 5G Networks at Industrial Facilities

–>Among the projects: a coal mine where 5G allows remote inspections of mines and the automation of mining activity

by Dan Strumpf

China is racing ahead in building the infrastructure of 5G networks, but it is inside factories, coal mines, shipyards and warehouses where the technology is really taking off.

The country is widely seen as being out front in the deployment of localized, high-powered 5G networks in sprawling industrial sites, which aim to use the technology to help automate labor-intensive or dangerous industrial processes, and hopefully boost productivity.

These sites include 5G coal mines with remote-operated drilling machinery, so-called smart factories that automate production and quality control, and seaports with internet-connected cameras that process and tally freight containers.

These 5G private networks are different from the consumer-oriented networks that blanket towns and cities, in that they are dedicated to specific enterprise sites with tailor-made hardware and software. Isolated from public networks, they can be adjusted to specific requirements and handle more complex jobs and processes.

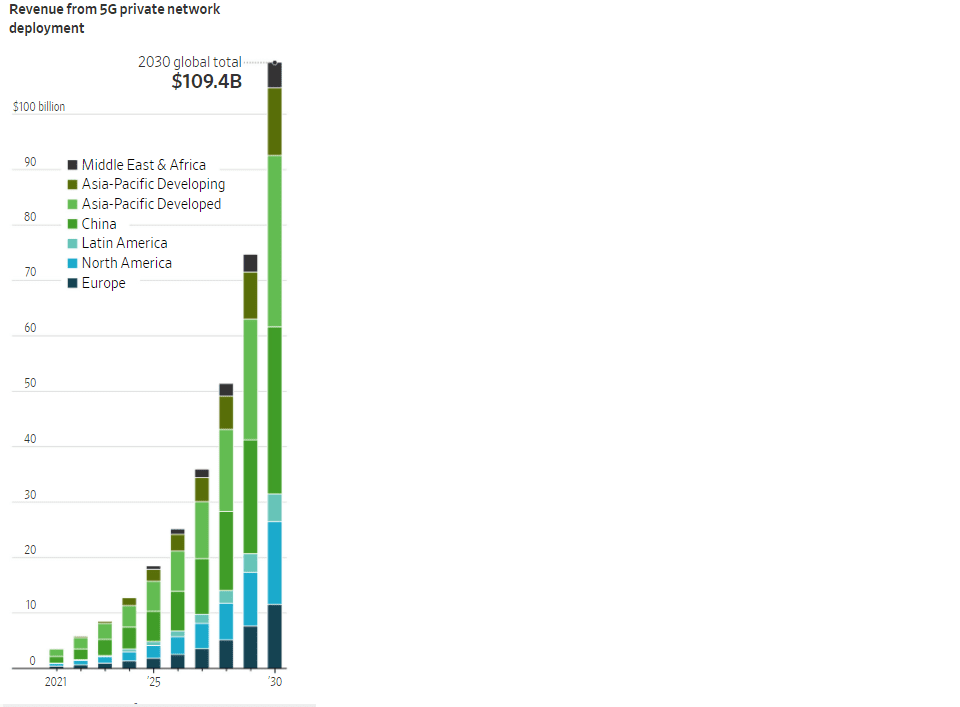

Note: 2022 to 2030 are forecasts. Source: ABI Research

Many such projects are under construction in the U.S., Europe and other parts of the world. But analysts say the construction and deployment of private networks is further along in China, where the government has set aggressive targets for building high-tech work sites powered by next-generation networks.

“China is quite ambitious in terms of developing their 5G—basically putting 5G as a national priority and targeting the digital transformation and connectivity of the economy,” says Sihan Bo Chen, head of Greater China for the telecom industry group GSMA.

Last year, companies involved in their deployment generated $1.2 billion of revenue from 5G private networks serving businesses and governments in China, accounting for about a third of the global total and more than the revenue generated in Europe and North America combined, according to ABI Research, a technology research firm. The figure is a proxy for the scale of the deployments of such networks in China, says Leo Gergs, an analyst with ABI who studies the use of 5G networks by businesses.

The research firm expects China’s lead to widen in the coming years, given aggressive government targets. This year, it expects private-network revenue generated in China to rise about 60%. By 2025, it will top $5 billion, ABI forecasts.

China leads the world in 5G deployment in general. As of the end of last year, the country had installed more than 1.4 million 5G base stations, accounting for 60% of the world’s total, according to the Ministry of Industry and Information Technology, the government agency that oversees China’s tech sector.

In April last year, Beijing set out a series of goals for the country to meet in 5G by 2023. In a plan called “Set Sail,” it aims for more than 560 million individual 5G users across the country, with the 5G subscriber rate exceeding 40% of the population. For major industries, the government wants the penetration rate for 5G to exceed 35%. It also has a goal to build more than 3,000 private 5G networks by that year.

“This shows how deeply involved the government is” in China’s 5G deployment, Mr. Gergs says.

Huawei 5G equipment at the Xinyuan Coal Mine in China’s Shanxi province. PHOTO: QILAI SHEN/BLOOMBERG NEWS

Several such projects in China are already up and running. One example: the Xinyuan Coal Mine in China’s coal-rich Shanxi province. Last year, telecom vendor Huawei Technologies Co. and state-owned operator China Mobile developed an underground 5G network to allow remote inspections of mines and the automation of mining activity, with tunneling equipment operated by remote control deep underground.

Similar technology is at work at the Xiangtan Iron & Steel plant in the southern Chinese city of Xiangtan. In 2019, Huawei and China Mobile built 5G coverage for the plant, which now runs 5G-connected cranes and video surveillance cameras to help operate and monitor the plant, according to a report on the project by GSMA. At the port city of Ningbo, the companies built a similar 5G network to help automate the tallying of freight containers and power unmanned container trucks, GSMA says.

“Private network deployments are really just starting and China is already a bit of an outlier,” Mr. Gergs says.

Mr. Strumpf is a Wall Street Journal reporter in Hong Kong. He can be reached at [email protected].

References:

WSJ: U.S. Wireless Carriers Are Winning 5G Customers for the Wrong Reason