Cloud Service Providers

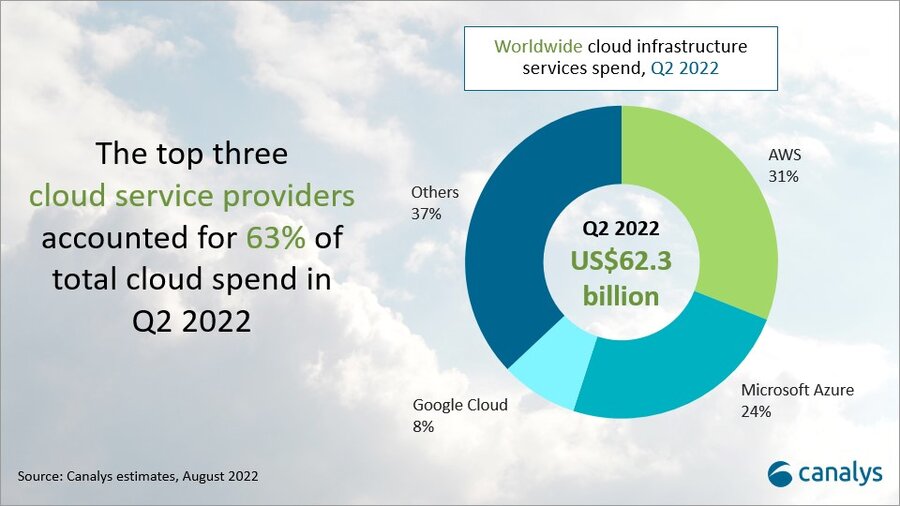

Canalys: Global cloud services spending +33% in Q2 2022 to $62.3B

According to market research firm Canalys, cloud infrastructure services continued to be in high demand in Q2 2022. Worldwide cloud spending increased 33% year on year to US$62.3 billion, driven by a range of factors, including demand for data analytics and machine learning, data center consolidation, application migration, cloud-native development and service delivery. The growing use of industry-specific cloud applications also contributed to the broader horizontal use cases seen across IT transformation. The latest Canalys data shows expenditure was over US$6 billion more than in the previous quarter and US$15 billion more than in Q2 2021.

The top three vendors in Q2 2022, Amazon Web Services (AWS), Microsoft Azure and Google Cloud, together accounted for 63% of global spending in Q2 2022 and collectively grew 42%. The key to increasing global market share is continually growing and upgrading cloud data center infrastructure, which all big three cloud service providers are working on.

- AWS accounted for 31% of total cloud infrastructure services spend in Q2 2022, making it the leading cloud service provider. It grew 33% on an annual basis.

- Microsoft Azure was the second largest cloud service provider in Q2, with a 24% market share after growing 40% annually.

- Google Cloud grew 45% in the latest quarter and accounted for an 8% market share.

In the next year, AWS plans to launch 24 new availability zones in eight regions, and Microsoft plans to launch 10 new cloud regions. Google Cloud, which accounted for 8% of Q2 cloud spend, recently announced Latin America expansion plans.

The hyperscale battle between leader AWS and challenger Microsoft Azure continues to intensify, with Azure closing the gap on its rival. Fueling this growth, Microsoft had a record number of larger multi-year deals in both the US$100 million-plus and US$1 billion-plus segments. Microsoft also said it plans to increase the efficiency of its server and network equipment by extending the depreciable useful life from four years to six.

A diverse go-to-market ecosystem, combined with a broad portfolio and wide range of software partnerships is enabling Microsoft to stay hot on the heels of AWS in the race to be #1 in cloud services.

“Cloud remains the strong growth segment in tech,” said Canalys VP Alex Smith. “While opportunities abound for providers large and small, the interesting battle remains right at the top between AWS and Microsoft. The race to invest in infrastructure to keep pace with demand will be intense and test the nerves of the companies’ CFOs as both inflation and rising interest rates create cost headwinds.”

Both AWS and Microsoft are continuing to roll out infrastructure. AWS has plans to launch 24 availability zones across eight regions, while Microsoft plans to launch 10 new regions over the next year. In both cases, the providers are increasing investment outside of the US as they look to capture global demand and ensure they can provide low-latency and high data sovereignty solutions.

“Microsoft announced it would extend the depreciable useful life of its server and network equipment from four to six years, citing efficiency improvements in how it is using technology,” said Smith. “This will improve operating income and suggests that Microsoft will sweat its assets more, which helps investment cycles as the scale of its infrastructure continues to soar. The question will be whether customers feel any negative impact in terms of user experience in the future, as some services will inevitably run on legacy equipment.”

Beyond the capacity investments, software capabilities and partnerships will be vital to meet customers’ cloud demands, especially when considering the compute needs of highly specialized services across different verticals.

“Most companies have gone beyond the initial step of moving a portion of their workloads to the cloud and are looking at migrating key services,” said Canalys Research Analyst Yi Zhang. “The top cloud vendors are accelerating their partnerships with a variety of software companies to demonstrate a differentiated value proposition. Recently, Microsoft pointed to expanded services to migrate more Oracle workloads to Azure, which in turn are connected to databases running in Oracle Cloud.”

Canalys defines cloud infrastructure services as those that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly, but includes revenue generated from the infrastructure services being consumed to host and operate them.

For more information, please contact: Alex Smith: [email protected] OR Yi Zhang: [email protected]

References:

Oracle and Microsoft Enhance Interoperability of their Cloud Platforms (facilitating multi-cloud)

At Microsoft Inspire, an online event for Microsoft partners, Oracle and Microsoft announced a deeper interoperability of their cloud platforms which will permit customers to more easily run projects across their two cloud platforms. The new service connects Oracle’s database service directly to the Azure cloud, eliminating custom work that previously would have been required.

With the general availability of Oracle Database Service for Microsoft Azure, Microsoft Azure customers can easily provision, access, and monitor enterprise-grade Oracle Database services in Oracle Cloud Infrastructure (OCI) with a familiar experience. Users can migrate or build new applications on Azure and then connect to high-performance and high-availability managed Oracle Database services such as Autonomous Database running on OCI.

Years ago, many cloud providers tried to lock customers into a single platform, but that is no longer feasible as the cloud has become more central to operations. Customers typically use multiple clouds, and cloud platform providers such as Microsoft and Oracle are adapting to that multi-cloud environment. About two-thirds of enterprise-level companies use multiple clouds (AKA multi-cloud), according to a May 2021 report by Boston Consulting Group.

Since 2019, when Oracle and Microsoft partnered to deliver the Oracle Interconnect for Microsoft Azure, hundreds of organizations have used the secure and private interconnections in 11 global regions.

Microsoft and Oracle are extending this collaboration to further simplify the multicloud experience with Oracle Database Service for Microsoft Azure. Many joint customers, including some of the world’s largest corporations such as AT&T, Marriott International, Veritas and SGS, want to choose the best services across cloud providers to optimize performance, scalability, and the ability to accelerate their business modernization efforts. The Oracle Database Service for Microsoft Azure builds upon the core capabilities of the Oracle Interconnect for Azure and enables customers to more easily integrate workloads on Microsoft Azure with Oracle Database services on OCI. Customers are not charged for using the Oracle Database Service for Microsoft Azure or for the underlying network interconnection, data egress, or data ingress between Azure and OCI. Customers will pay only for the other Azure or Oracle services they consume, such as Azure Synapse or Oracle Autonomous Database.

“Over the last couple years we have had a lot of success with Oracle Interconnect for Microsoft Azure. And we also got a lot of customer feedback. And one of the things that customers (said) was, ‘Hey, it’s great you are working together, but we really would like a more integrated experience,’” said Clay Magouyrk, executive vice president, Oracle Cloud Infrastructure.

“Microsoft and Oracle have a long history of working together to support the needs of our joint customers, and this partnership is an example of how we offer customer choice and flexibility as they digitally transform with cloud technology. Oracle’s decision to select Microsoft as its preferred partner deepens the relationship between our two companies and provides customers with the assurance of working with two industry leaders,” said Corey Sanders, corporate vice president, Microsoft Cloud for Industry and Global Expansion. “The ability to benefit from both clouds, and the flexibility, is a real win for customers,” Sanders added.

“There’s a well-known myth that you can’t run real applications across two clouds. We can now dispel that myth as we give Oracle and Microsoft customers the ability to easily test and demonstrate the value of combining Oracle databases with Azure applications. There is no need for deep skills on either of our platforms or complex configurations—anyone can use the Azure Portal to harness the power of our two clouds together,” said Clay Magouyrk, executive vice president, Oracle Cloud Infrastructure.

“Multi-cloud takes on a whole new meaning with the launch of the Oracle Database Service for Microsoft Azure. This service, designed to provide intuitive, simple access to the Exadata Database Service and Autonomous Database to Azure users in a transparent manner, responds to the critical need of Azure and Oracle customers to apply the benefits of the latest in Oracle Database technology to their Azure workloads. This combined and interactive connection of services across public clouds sets the stage for what a multi-cloud experience should be, and is a bold statement about where the future of cloud is heading. It should deliver huge benefits for customers, developers, and the cloud services landscape overall,” said Carl Olofson, research vice president, Data Management Software, IDC.

With the new Oracle Database Service for Microsoft Azure, in just a few clicks users can connect their Azure subscriptions to their OCI tenancy. The service automatically configures everything required to link the two cloud environments and federates Azure Active Directory identities, making it easy for Azure customers to use the service. It also provides a familiar dashboard for Oracle Database Services on OCI using Azure terminology and monitoring with Azure Application Insights.

“Many of our mission-critical workloads are running Oracle databases on-premises at massive scale. As we move these workloads to the cloud, Oracle Database Service for Azure enables us to modernize these Oracle databases to services such as Autonomous Database in OCI while leveraging Microsoft Azure for the application tier,” said Jeremy Legg, chief technology officer, AT&T. Watch the video.

“Multi-cloud architectures enable us to choose the best cloud provider for each workload based on capabilities, performance, and price. The OCI and Azure partnership integrates the capabilities of two major cloud providers, including the Oracle Database services in OCI and Azure’s application development capabilities,” said Naveen Manga, chief technology officer, Marriott International. Watch the video.

“Oracle Database Service for Microsoft Azure has simplified the use of a multicloud environment for data analytics. We were able to easily ingest large volumes of data hosted by Oracle Exadata Database Service on OCI to Azure Data Factory where we are using Azure Synapse for analysis,” said Jane Zhu, senior vice president and chief information officer, Corporate Operations, Veritas.

“Oracle Database Service for Microsoft Azure simplifies our multi-cloud approach. We’re going to be able to leverage the best of Oracle databases in Azure, and we are going to be able to keep our infrastructure in Azure. This is a great opportunity to have the best of the two worlds that eases our migration to the cloud and improves the skills of our people in IT,” said David Plaza, chief information officer, SGS. Watch the video.

References:

https://www.oracle.com/bd/news/announcement/oracle-database-service-for-microsoft-azure-2022-07-20/

https://www.spiceworks.com/tech/cloud/articles/multi-cloud-vs-hybrid-cloud/

IDC: Worldwide Public Cloud Services Revenues Grew 29% to $408.6 Billion in 2021 with Microsoft #1?

The worldwide public cloud services market, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service – System Infrastructure Software (SaaS – SIS), and Software as a Service – Applications, grew 29.0% year over year in 2021 with revenues totaling $408.6 billion, according to the International Data Corporation (IDC) Worldwide Semiannual Public Cloud Services Tracker.

Spending continued to consolidate in 2021 with the combined revenue of the top 5 public cloud service providers (Microsoft, Amazon Web Services, Salesforce Inc., Google, and SAP) capturing nearly 40% of the worldwide total and growing 36.6% year over year. With offerings in all four deployment categories, Microsoft captured the top position in the overall public cloud services market with 14.4% share in 2021, followed closely by Amazon Web Services with 13.7% share.

“Organizations continued their strong adoption of shared public cloud services in 2021 to align IT investments more closely with business outcomes and ensure rapid access to the innovations required to be a digital-first business,” said Rick Villars, group vice president, Worldwide Research at IDC. “For the next several years, leading cloud providers will play a critical role in helping enterprises navigate the current storms of disruption (inflation, supply chain, and geopolitical tensions), but IT teams will also focus more on bringing greater financial accountability to the variable spend models of public cloud services.”

While the overall public cloud services market grew 29.0% in 2021, revenue for foundational cloud services* that support digital-first strategies saw revenue growth of 38.5%. This highlights the increasing reliance of enterprises on a cloud innovation platform built around widely deployed compute services, data/AI services, and app framework services to drive innovation. IDC expects spending on foundational cloud services (especially IaaS and PaaS elements) to continue growing at a higher rate than the overall cloud market as enterprises leverage cloud to overcome the current disruptions and accelerate their shift toward digital business.

“The last few years have demonstrated that in challenging times, businesses increasingly rely on cloud services to modernize their operations and deliver more value to customers,” said Dave McCarthy, research vice president, Cloud and Edge Infrastructure Services. “This trend is expected to continue as public cloud providers offer more ways of extending cloud services to on-premises datacenters and edge locations. These expanded deployment options reduce many barriers to migration and will facilitate the next wave of cloud adoption.”

“In the digital-first world, enterprises that are serious about competing for the long term use the lens of business outcomes to evaluate strategic technology decisions, which fuels the fast-growing ecosystem seen in the public cloud market,” said Lara Greden, research director, Platform as a Service, IDC. “Cloud service providers showed relentless drive to enhance the productivity of developers and overall speed of application delivery, including emphasis on containers-first and serverless-first approaches.”

“SaaS applications remain the largest and most mature segment of public cloud, with 2021 revenues that have now reached $177 billion. The tailwinds of the pandemic continued to fuel expedited upgrades and replacements of older systems in 2021, though company goals haven’t changed. Companies seek applications that will help increase enterprise intelligence, improve operational efficiency, and drive better decision making. Ease of use, ease of implementation and integration, streamlined workflows, data and analytical accessibility, and time to value are the key criteria driving purchasing decisions, though verticalization has also steadily increased as a key priority,” said Eric Newmark, group vice president and general manager of IDC’s SaaS, Enterprise Software, and Worldwide Services division.

| Worldwide Public Cloud Services Revenue and Year-over-Year Growth, Calendar Year 2021 (revenues in US$ billions) | |||||

| Deployment Category | 2021 Revenue | Market Share | 2020 Revenue | Market Share | Year-over-Year Growth |

| IaaS | $91.3 | 22.4% | $67.3 | 21.3% | 35.6% |

| PaaS | $68.2 | 16.7% | $49.1 | 15.5% | 39.1% |

| SaaS – Applications | $177.8 | 43.5% | $143.9 | 45.4% | 23.5% |

| SaaS – System Infrastructure Software | $71.2 | 17.4% | $56.4 | 17.8% | 26.4% |

| Total | $408.6 | 100% | $316.7 | 100% | 29.0% |

| Source: IDC Worldwide Semiannual Public Cloud Services Tracker, 2H 2021 | |||||

While both the foundational cloud services market and the SaaS – Applications market are led by a small number of companies, there continues to be a healthy long tail of companies delivering cloud services around the globe. In the foundational cloud services market, these leading companies account for nearly three quarters of the market’s revenues with targeted use case-specific PaaS services or cross-cloud compute, data, or network governance services. The long tail is more pronounced in the SaaS– Applications market, where customers’ growing focus on specific outcomes ensures that over two thirds of the spending is captured outside the top 5.

Analysis:

We remain SUPER SKEPTICAL about IDC’s claim that Microsoft beat out cloud rival Amazon Web Services (AWS) in capturing the largest share of global public cloud services revenue last year. That conflicts with all our other resource checks!!!

IDC reported that Microsoft accumulated 14.4% of the market’s $408.6 billion in revenues last year, just a whisker ahead of the 13.7% that AWS snared. Microsoft has offerings in all four sections of the public cloud services market lumped by IDC into its report, including infrastructure as a service (IaaS), platform as a service (PaaS), system infrastructure SaaS, and application SaaS.

Salesforce, Google, and SAP rounded out the top five in IDC’s ranking, with those vendors capturing 40% of the total market. Overall market revenues increased 29% compared to the previous year.

SaaS applications brought in the most cloud services revenue with $177.8 billion, representing 23.5% growth from the year prior. IaaS accounted for $91.3 billion of revenue, followed by system infrastructure SaaS and PaaS.

Of the categories comprising IDC’s public cloud foundational services, PaaS saw the highest year-over-year growth at 39.1%, though it brought in the least 2021 revenue at $68.2 billion.

“Organizations continued their strong adoption of shared public cloud services in 2021 to align IT investments more closely with business outcomes and ensure rapid access to the innovations required to be a digital-first business,” IDC VP Rick Villars said in a statement.

In an increasingly digital world, enterprises that are truly thinking ahead use a business outcomes lens to make strategic decisions, and this is what fuels public cloud ecosystem growth, IDC PaaS Research Director Lara Greden explained.

Cloud service providers played their part in that growth this year with a “relentless drive” to improve developer productivity and speed of application delivery, “including emphasis on containers-first and serverless-first approaches,” she added.

Villars expects these cloud giants will continue to have a crucial role in helping enterprises solve persistent market challenges like supply chain disruption, inflation, and geopolitical tension.

“IT teams will also focus more on bringing greater financial accountability to the variable spend models of public cloud services,” Villars added.

……………………………………………………………………………………………………………………………………..

* Note: IDC defines Foundational Cloud Services as the Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service – System Infrastructure Software (SaaS – SIS) market segments where the top eight public cloud services providers (Amazon Web Services, Microsoft, Google, Alibaba Group, IBM, Tencent, Huawei, and Oracle) account for most of the revenue. These include the following key service portfolios:

- Compute Services: Virtualized x86 Compute, Bare Metal Compute, Block Storage, Accelerated Compute, Other Compute, and Software-Defined Compute Software.

- Data Services: Data Management Systems, Object Storage, File Storage, and Event Stream Processing Software.

- App Framework Services: Developer-centric software to develop and deploy applications in the cloud, including lifecycle management. These services include Integration Software, Deployment-Centric Application Platforms, and AI Lifecycle Software.

- Usage Multiplier Services: Services that encourage greater/more effective use of high value services by making it easier to adopt, connect, deploy, track, secure, and update those services. Includes load balancing and DNS as well as marketplaces and bundles of open-source software solutions.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS49420022

IDC’s New Public Cloud Numbers: Microsoft Azure Edged Out AWS in 2021

IDC: Microsoft Azure now tied with AWS as top global cloud services provider

Synergy Research: public cloud service and infrastructure market hit $126B in 1Q-2022

According to a new report from Synergy Research Group, public cloud service and infrastructure service provider and vendor revenues for the 1st quarter of 2022 reached $126 billion, having grown by 26% (YoY) from the 1st quarter of 2021.

As expected, Amazon Web Services (AWS), Microsoft Azure, and Google Cloud led public cloud service providers (CSPs) in revenue growth. Those three CSPs powered a robust 36% growth rate in the infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) public cloud segments, which hit $44 billion in revenues during the quarter.

In the other main service segments, managed private cloud services, enterprise SaaS and CDN (Content Delivery Networks) added another $54 billion in service revenues, having grown by an average 21% from last year. In order to support both these and other digital services, public cloud providers spent $28 billion on building, leasing and equipping their data center infrastructure, which was up 20% from Q1 of last year. Across the whole public cloud ecosystem, companies that featured the most prominently were Microsoft, Amazon, Salesforce and Google. Other major players included Adobe, Alibaba, Cisco, Dell, Digital Realty, IBM, Inspur, Oracle, SAP and VMware. In aggregate these companies accounted for 60% of all public cloud-related revenues.

Amazon, IBM, and Microsoft led in managed private cloud revenue during the quarter; Microsoft, Salesforce, and Adobe powered similar growth in enterprise software-as-a-service (SaaS) revenues; and Akamai, Amazon, and Cloudflare headed up a 14% increase in content delivery network (CDN) revenues for the quarter. Those three segments in total generated $54 billion in revenues during the first three months of the year.

While cloud markets are growing strongly in all regions of the world, the United States remains a center of gravity. In Q1 it accounted for 44% of all cloud service revenues and 51% of hyperscale data center capacity. Across all service and infrastructure markets, the vast majority of leading players are US companies, with most of the rest being Chinese (e.g. Alibaba, Tencent and Huawei). China accounted for 8% of all Q1 cloud service revenues and 15% of hyperscale data center capacity.

Editor’s Note:

In China, Alibaba Cloud remains the leader with a 37% market share, ranking first in the cloud market in 2021, Huawei Cloud and Tencent Cloud second and third respectively, and Baidu AI cloud fourth. In 2021, the four cloud providers jointly accounted for 80% of the market share.

…………………………………………………………………………………………………………………

“Public cloud-related markets are typically growing at rates ranging from 15% to 40% per year, with PaaS and IaaS leading the charge. Looking out over the next five years the growth rates will inevitably tail off as these markets become ever-more massive, but we are still forecasting annual growth rates that are generally in the 10% to 30% range,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “To enable cloud service markets to keep up with demand by doubling in size in the next 3-4 years, the major cloud providers need an ever larger footprint of hyperscale data centers and more raw computing power, which then drives the markets for data center hardware and software. For sure the competition will be tough, but up and down the cloud ecosystem there will be a bright future for companies that bring the right products to market in a timely fashion.”

About Synergy Research Group:

Synergy provides quarterly market tracking and segmentation data on IT and Cloud related markets, including vendor revenues by segment and by region. Market shares and forecasts are provided via Synergy’s uniquely designed online database SIA ™, which enables easy access to complex data sets. Synergy’s Competitive Matrix ™ and CustomView ™ take this research capability one step further, enabling our clients to receive on-going quantitative market research that matches their internal, executive view of the market segments they compete in.

Synergy Research Group helps marketing and strategic decision makers around the world via its syndicated market research programs and custom consulting projects. For nearly two decades, Synergy has been a trusted source for quantitative research and market intelligence.

References:

https://www.srgresearch.com/articles/public-cloud-ecosystem-quarterly-revenues-leap-26-to-126-billion-in-q1

Telefónica Tech to integrate Red Hat’s OpenShift platform into new enterprise cloud service in Europe and Latin America

Telecom technology integrator Telefónica Tech has signed an agreement with IBM/Red Hat to integrate Red Hat’s OpenShift platform into a new cloud service marketed at enterprises across Telefónica’s footprint in Europe and Latin America.

The integration will be marketed as the Telefónica Red Hat OpenShift Service (TROS), which will tap into the use of containers to help organizations modernize their cloud applications and drive their digital transformation. It will allow those organizations to migrate applications to hybrid cloud or multi-cloud environments using either private or public clouds from hyperscalers like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP).

OpenShift is based on the Kubernetes container orchestration project that allows for the migration of applications across different cloud and on-premises environments. A recent report from TBR Senior Analyst Catie Merrill noted that Red Hat’s OpenShift platform has four-times as many customers as it did before IBM acquired the company for $34 billion in mid-2019.

Red Hat OpenShift differentiates itself by combining multiple hardened open source technologies to provide a more complete modern application platform, enabling organizations to use it as the foundation for current and future IT strategies. Additionally, the use of Red Hat OpenShift allows for use in any type of cloud, facilitating the creation of this Multi-Cloud service for Telefónica Tech.

This new, open hybrid, multi-cloud approach will allow Telefonica Tech to strengthen and differentiate its value proposition, and provide more flexibility to its customers in their digital transformation and application modernization in the markets where Telefónica Tech is present.

The complementary nature of cloud technologies integrated in TROS will enable Telefónica Tech, Red Hat and IBM to jointly define innovative use cases and provide high value-added professional services to customers to help them make the process more efficient, cost-effective and cost-optimal.

The strategic agreement also enables Telefónica Tech to develop additional services on TROS based on Red Hat technologies and IBM Cloud Paks so that customers can accelerate their transformation to cloud-native applications, enabling a more consistent user experience both in their own cloud and on the hyperscalers.

María Jesús Almazor, CEO of Cybersecurity and Cloud at Telefónica Tech, said: “This strategic agreement allows us to strengthen our differential multicloud offer by integrating world class technologies from Red Hat and IBM and consolidate our position as a leading partner for the digital transformation of businesses. We continue to evolve our ecosystem of alliances to enhance the digital capabilities of our professionals and to include in our portfolio the most innovative proposals in the market, fundamental aspects to continue offering the best service to our customers.”

Horacio Morell, IBM General Manager for Spain, Portugal, Greece and Israel: “This alliance enables us to take a quantum leap in our business collaboration with Telefonica Tech to continue co-creating enterprise multi-cloud and cybersecurity solutions that will enable companies around the world, across all industries, to implement their technology transformation strategies with greater speed, consistency and agility, while ensuring data control, privacy and reliability and increasing decision-making efficiency through the unique capabilities of IBM’s technologies.”

Julia Bernal, Country Manager for Spain and Portugal at Red Hat, said: “Red Hat is fully committed to helping our customers and partners optimize their business with open hybrid cloud and focus on innovation rather than simply managing their IT infrastructure. Our mission is to mitigate the complexities of modern cloud-scale IT environments and with managed cloud services they can do just that. Telefónica Red Hat OpenShift Service enables customers to free resources to create and manage applications more quickly across multiple clouds, streamlining time to market and accelerating growth opportunities.”

“It is going to be the way forward and what many customers who want to evolve their business models,” said Santiago Madruga, VP for ecosystem success in EMEA at Red Hat, in an interview with SDxCentral. “When going digital, it’s not just putting workloads on the cloud but really transforming businesses.” Madruga added that the use of OpenShift also allows for the micro-segmentation of application components that will open the door for edge distributed cloud work.

References:

https://www.sdxcentral.com/articles/news/ibm-red-hat-expand-telefonicas-cloud-push/2022/06/

https://newsroom.ibm.com/2021-09-23-Telefonica-Chooses-IBM-To-Implement-Its-First-Ever-Cloud-Native-5G-Core-Network-Platform

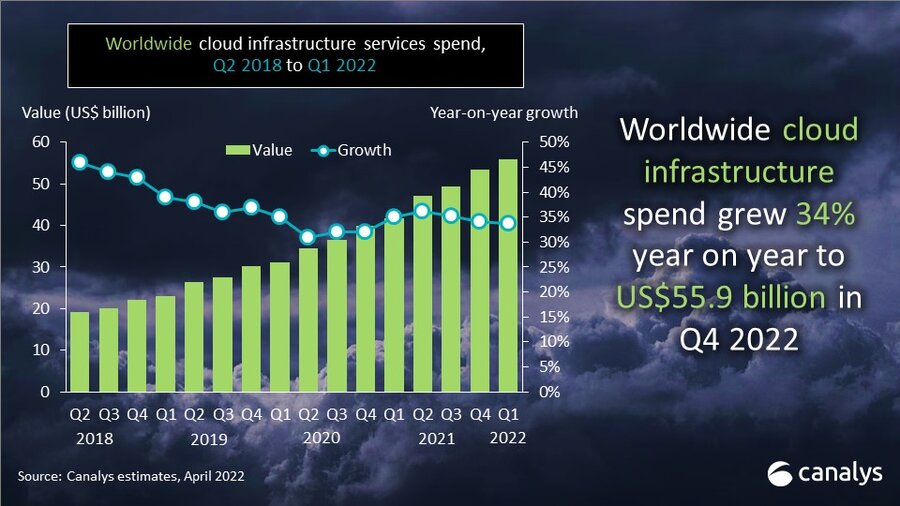

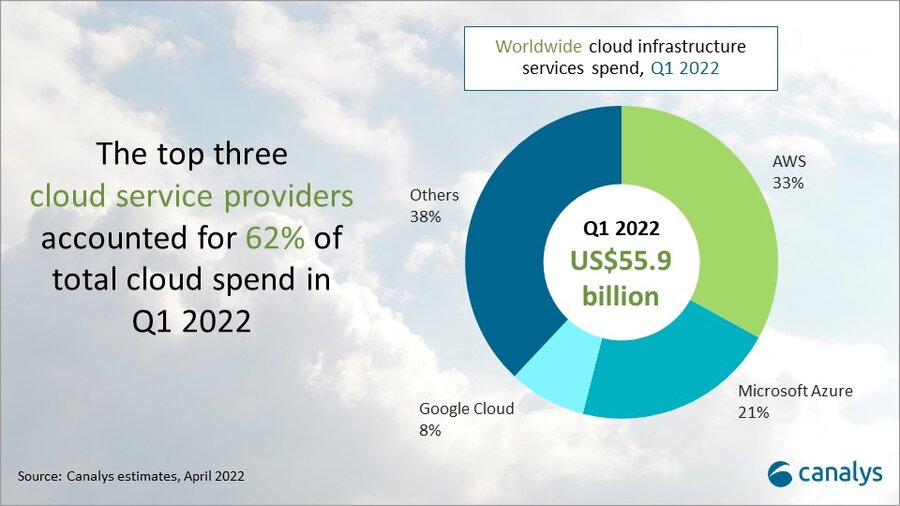

AWS, Microsoft Azure, Google Cloud account for 62% – 66% of cloud spending in 1Q-2022

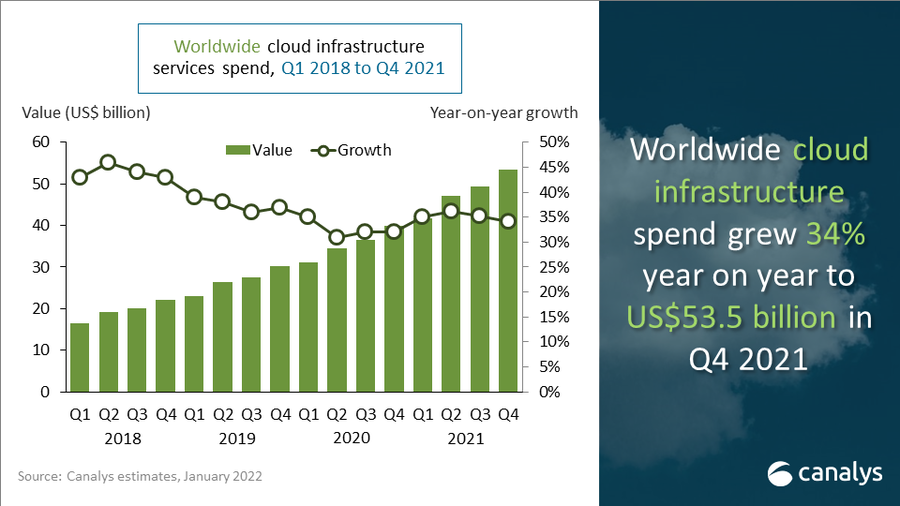

New data from Synergy Research Group shows that Q1 enterprise spending on cloud infrastructure services was approaching $53 billion. That is up 34% from the first quarter of 2021, making it the eleventh time in twelve quarters that the year-on-year growth rate has been in the 34-40% range.

To the surprise of no one, Amazon AWS continues to lead with its worldwide market share remaining at 33%. For the third consecutive quarter its annual growth came in above the growth of the overall market.

Microsoft Azure continues to gain almost two percentage points of market share per year while Google Cloud’s annual market share gain is approaching one percentage point.

In aggregate all other cloud providers have grown their revenues by over 150% since the first quarter of 2018, though their collective market share has plunged from 48% to 36% as their growth rates remain far below the market leaders.

Synergy estimates that quarterly cloud infrastructure service revenues (including IaaS, PaaS and hosted private cloud services) were $52.7 billion, with trailing twelve-month revenues reaching $191 billion. Public IaaS and PaaS services account for the bulk of the market and those grew by 37% in Q1. The dominance of the major cloud providers is even more pronounced in public cloud, where the top three control 71% of the market. Geographically, the cloud market continues to grow strongly in all regions of the world.

“While the level of competition remains high, the huge and rapidly growing cloud market continues to coalesce around Amazon, Microsoft and Google,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “Aside from the Chinese market, which remains totally dominated by local Chinese companies, other cloud providers simply cannot match the scale and geographic reach of the big three market leaders. As Amazon, Microsoft and Google continue to grow at 35-50% per year, other non-Chinese cloud providers are typically growing in the 10-20% range. That can still be an attractive proposition for those smaller providers, as long as they focus on regional or service niches where they can differentiate themselves from the big three.”

…………………………………………………………………………………………………………………..

Separately, Canalys estimates global cloud infrastructure services spending increased 34% to US$55.9 billion in Q1 2022, as organizations prioritized digitalization strategies to meet market challenges. That was over US$2 billion more than in the previous quarter and US$14 billion more than in Q1 2021.

The top three cloud service providers have benefited from increased adoption and scale, collectively growing 42% year on year and accounting for 62% of global customer spend.

Cloud-enabled business transformation has become a priority as organizations face global supply chain issues, cybersecurity threats and geopolitical instability. Organizations of all sizes and vertical markets are turning to cloud to ensure flexibility and resilience in the face of these challenges.

SMBs, in particular, have driven investment in cloud infrastructure services to support workload migration, data storage services and cloud-native application development. At the same time, infrastructure hardware shortages and the threat of further price inflation has spurred many large enterprises to invest in large-scale, multi-year cloud contracts to lock in upfront discounts with the hyperscalers.

All the major cloud providers have seen a significant increase in order backlogs as a result, which now total several hundred billion dollars worldwide. This in turn is driving the importance of cloud marketplaces as a sales channel for third-party software and security, as businesses seek to burn down these cloud commitments, further fueling infrastructure consumption.

“Cloud has continued to be a hot market and transformation strategies are emphasizing digital resiliency to face the market challenges of today and tomorrow,” said Canalys Research Analyst Blake Murray. “To be effective in resiliency planning, customers are turning to channel partners with the technical and consulting skills to help them effectively embrace hyper-scaler cloud services.”

Top cloud partners are doubling down on certification efforts and skills recruitment around hyper-scaler cloud services.

Global systems integrators, including Accenture, Atos, Deloitte, HCL Technologies, TCS, Kyndryl, Tech Mahindra and Wipro, are building practices with tens of thousands of cloud engineers and consultants. This has also included acquisitions of cloud application development and migration specialists, as well as the launch of new dedicated cloud services brands.

Smaller consultants, resellers, service providers and distributors are pursuing similar strategies as mid-market and SMB customers also demand support with cloud adoption.

“As the use cases for cloud infrastructure services expand so does the potential complexity, and we see that hybrid and multi-cloud deployments are commonplace in the market,” said Canalys Research Analyst Yi Zhang. “The hyperscalers are investing in rapid channel development and partners are responding as the opportunities grow.”

…………………………………………………………………………………………………………….

About Synergy Research Group:

Synergy provides quarterly market tracking and segmentation data on IT and Cloud related markets, including vendor revenues by segment and by region. Market shares and forecasts are provided via Synergy’s uniquely designed online database SIA ™, which enables easy access to complex data sets. Synergy’s Competitive Matrix ™ and CustomView ™ take this research capability one step further, enabling our clients to receive on-going quantitative market research that matches their internal, executive view of the market segments they compete in.

About Canalys:

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

References:

https://www.canalys.com/newsroom/global-cloud-services-Q1-2022

………………………………………………………………………………………………………………………………………..

May 6, 2022 Update from Light Counting:

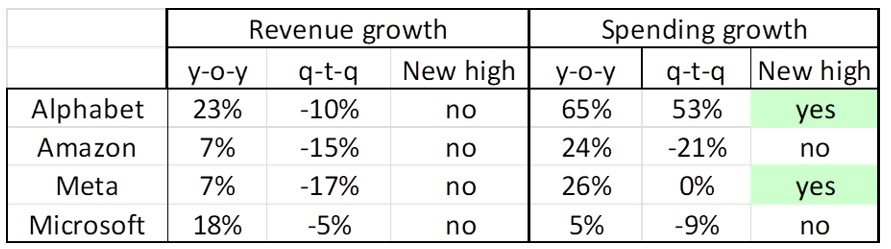

|

ICPs (Internet Cloud Providers) have grown spending by double digit rates (year-over-year) for many quarters and Q1 2022 looks like it will be no exception, as the combined spending of Alphabet, Amazon, Meta, and Microsoft increased 29% versus Q1 2021. What is surprising though is that Alphabet, not Meta, showed the fastest growth, with a 65% increase to more than $9.5 billion, a new record. And Alphabet’s big increase was not fueled by spending on infrastructure however, but by the closing of purchases of office facilities in New York, London, and Poland, which the company said added $4 billion to total spending in the quarter. We expect Alphabet’s Q2 capex will return from the stratosphere to the $5 billion range it has been running at. If Alphabet’s real estate spending is removed, Q1 capex for the group of four was up only 15% compared to Q1 2021, at the low end of the typical range for the Top 15 ICPs. While ICP spending appears on track to continue growing at double-digit rates this year, Q1 revenues were decidedly ‘off’ for the four majors that have reported, with no records set, and two of the four (Amazon and Meta) growing sales by only single-digit growth rates y-o-y. |

|

|

The Cloud services revenues of Alphabet, Amazon, and Microsoft continued to grow faster than overall company sales, increasing 44%, 37%, and 17% respectively.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Network equipment makers sales growth in Q1 2022 declined by 1% y-o-y in aggregate among the reported companies, but this figure belies the fact that individual company growth rates ranged from strong double-digits (Adtran, ADVA), middling single-digits (Ericsson Networks, Infinera, ZTE), to sales declines (Nokia Networks, Ribbon Communications).

Five Chinese optical transceiver vendors have reported Q1 results, and four of them showed strong growth: HG Tech, Innolight, Accelink, and Eoptolink. CIG was negatively impacted by shutdowns in both Shanghai and Shenzhen, which affected its ability to fulfill orders.

Among U.S.-based optical component makers, Neophotonics reported Q1 2022 revenue of $89 million, up 47% year-over-year, with 400G and above products growing 70% y-o-y to $54 million. The company is now shipping production volumes of 400ZR modules to cloud and data center customers.

Two years after the start of the COVID-19 pandemic, the effects of the COVID mitigation measures continue to disrupt manufacturing, shipping, and sales in the optical industry. Several companies warned that shortages and higher component and shipping costs would persist or even worsen as 2022 progresses. And finally, costs from Russia’s invasion of Ukraine, and subsequent withdrawals from the Russian telecoms market are starting to become known, ranging from $5 million (Infinera) to 900 million Euro (Ericsson).

|

IDC: Cloud Infrastructure Spending +13.5% YoY in 4Q-2021 to $21.1 billion; Forecast CAGR of 12.6% from 2021-2026

According to the International Data Corporation (IDC) Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment, spending on compute and storage infrastructure products for cloud infrastructure, including dedicated and shared environments, increased 13.5% year over year (YoY) in the fourth quarter of 2021 (4Q-2021) to $21.1 billion. This marked the second consecutive quarter of year-over-year growth as supply chain constraints have depleted vendor inventories over the past several quarters. As backlogs continue to grow, pent-up demand bodes well for future growth as long as the economy stays healthy, and supply catches up to demand.

For the full year 2021, cloud infrastructure spending totaled $73.9 billion, up 8.8% over 2020. IDC predicts spending on cloud infrastructure services to increase 21.7% in 2022 to $90.0 billion.

The service provider category includes cloud service providers, digital service providers, communications service providers, and managed service providers. In 4Q21, service providers as a group spent $21.2 billion on compute and storage infrastructure, up 11.6% from 4Q20. This spending accounted for 55.4% of total compute and storage infrastructure spending. For 2021, spending by service providers reached $75.1 billion on 8.5% year over year growth, accounting for 56.2% of total compute and storage infrastructure spending. IDC expects compute and storage spending by service providers to reach $89.1 billion in 2022, growing at 18.7% year over year.

At the regional level, year-over-year spending on cloud infrastructure in 4Q21 increased in most regions.

- Asia/Pacific (excluding Japan and China) (APeJC) grew the most at 59.5% year over year.

- Canada, Central and Eastern Europe, Japan, Middle East and Africa, and China (PRC) all saw double-digit growth in spending.

- The United States grew 5.6%.

- Western Europe and Latin America declined for the quarter.

For 2021, APeJC grew the most at 43.7% year over year. Canada, Central and Eastern Europe, Middle East and Africa, and China all saw double-digit growth in spending. Japan grew in the high single digits, while Western Europe grew in the low single digits. The United States grew 1.5%. Latin America declined for the year. For 2022, cloud infrastructure spending for most regions is expected to grow with the highest growth expected in the United States at 27.8%. Central and Eastern Europe is the only region expected to decline in 2022 with spending forecast to be down 21.7% year over year.

Longer term, IDC expects spending on compute and storage cloud infrastructure to have a compound annual growth rate (CAGR) of 12.6% over the 2021-2026 forecast period, reaching $133.7 billion in 2026 and accounting for 68.6% of total compute and storage infrastructure spend. Shared cloud infrastructure will account for 72.0% of the total cloud amount, growing at a 13.4% CAGR. Spending on dedicated cloud infrastructure will grow at a CAGR of 10.7%. Spending on non-cloud infrastructure will flatten out at a CAGR of 0.5%, reaching $61.2 billion in 2026. Spending by service providers on compute and storage infrastructure is expected to grow at a 11.7% CAGR, reaching $130.6 billion in 2026.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

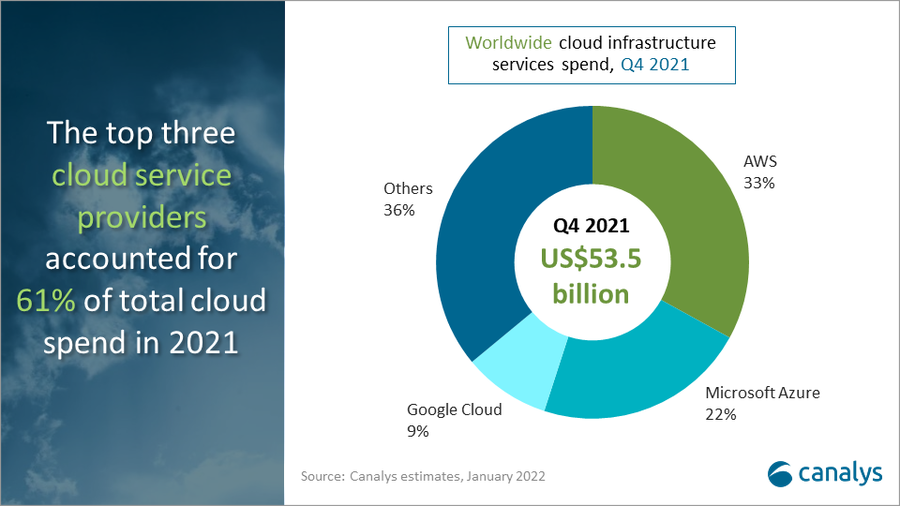

Separately, Amazon Web Services (AWS) led with 33% of spending on cloud infrastructure services in Q4 2021, according to a Feb 3, 2022 blog post from research group Canalys. Meta, previously known as Facebook, recently chose AWS as a long-term strategic cloud service provider and continues to deepen the relationship as Meta begins to move away from social media to become a broader metaverse company over the next five years. AWS also announced key customer wins across retail, healthcare and financial services and emphasized a key agreement with Nasdaq to migrate markets to AWS to become a cloud-based exchange.

Microsoft Azure was second with 22% of spending, followed by Google Cloud with 9%. The three companies accounted for 64% of total cloud investment for 2021.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

IDC’s Worldwide Quarterly Enterprise Infrastructure Tracker: Buyer and Cloud Deployment is designed to provide clients with a better understanding of what portion of the compute and storage hardware markets are being deployed in cloud environments. The Tracker breaks out each vendors’ revenue into shared and dedicated cloud environments for historical data and provides a five-year forecast. This Tracker is part of the Worldwide Quarterly Enterprise Infrastructure Tracker, which provides a holistic total addressable market view of the four key enabling infrastructure technologies for the datacenter (servers, external enterprise storage systems, and purpose-built appliances: HCI and PBBA).

Taxonomy Notes:

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service.

Shared cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The shared cloud market includes a variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters; these services in total are called public cloud services. The shared cloud market also includes digital services such as media/content distribution, sharing and search, social media, and e-commerce.

Dedicated cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In dedicated cloud that is managed by in-house staff, “vendors (cloud service providers)” are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the “service users.”

For more information about IDC’s Enterprise Infrastructure Tracker, please contact Lidice Fernandez at [email protected].

References:

https://www.idc.com/getdoc.jsp?containerId=prUS48998722

Gartner: Accelerated Move to Public Cloud to Overtake Traditional IT Spending in 2025

Strong growth for global cloud infrastructure spending by hyperscalers and enterprise customers

Gartner: Global public cloud spending to reach $332.3 billion in 2021; 23.1% YoY increase

ManTech and Google Cloud open joint facility to expedite government adoption of cloud technologies

In April, Google Cloud announced a partnership with ManTech to accelerate US government adoption of cloud technologies. The partnership will combine Google Cloud technology and security capabilities with ManTech’s federal solution delivery capability and public sector domain expertise. The two companies will launch a joint demonstration facility in Northern Virginia to showcase their combined technology capability.

Together, ManTech and Google Cloud’s full range of capabilities and technology know-how can meet government needs across multi and hybrid cloud environments, infrastructure modernization, application development, data management, artificial intelligence, analytics, and cybersecurity. This will enable the two companies to jointly assist agencies with core areas of modernization including multi-cloud and hybrid cloud adoption, hyperscale analytics, security, 5G, and edge-computing.

Google Cloud’s partnership with ManTech was said to be a critical step toward meeting the federal customer mission by expediting cloud adoption, and helping to solve the government’s unique challenges with new solutions and capabilities. As the need for cloud adoption has accelerated, and cybersecurity threats continue to destabilize our critical infrastructure, strategic private sector partnerships that support U.S. government interests have a key role to play in facilitating remote collaboration, and securing the welfare of Americans.

References:

Gartner: AWS, Azure, and Google Cloud top rankings for Cloud Infrastructure and Platform Services

Gartner’s latest Magic Quadrant report for cloud infrastructure and platform services (CIPS) ranks Amazon Web Services (AWS), Microsoft Azure, and Google Cloud as the top cloud service providers.

Beyond the top three players, Gartner placed Alibaba Cloud in the “visionaries” box, and ranked Oracle, Tencent Cloud, and IBM as “niche players,” in that order.

The scope of Gartner’s Magic Quadrant for CIPS includes infrastructure as a service (IaaS) and integrated platform as a service (PaaS) offerings. These include application PaaS (aPaaS), functions as a service (FaaS), database PaaS (dbPaaS), application developer PaaS (adPaaS) and industrialized distributed cloud offerings that are often deployed in enterprise data centers (i.e. private clouds).

Figure 1: Magic Quadrant for Cloud Infrastructure and Platform Services

……………………………………………………………………………………………..

……………………………………………………………………………………………..

1. Gartner analysts praise Amazon AWS for its broad support of IT services, including cloud native, edge compute, and processing mission-critical workloads. Also noteworthy is Amazon’s “engineering prowess” in designing CPUs and silicon. This focus on owning increasingly larger portions of the supply chain for cloud infrastructure bolsters the No. 1 cloud provider’s long-term outlook and earns it advantages against competitors, according to the Gartner report.

“AWS often sets the pace in the market for innovation, which guides the roadmaps of other CIPS providers. As the innovation leader, AWS has materially more mind share across a broad range of personas and customer types than all other providers,” the analysts wrote.

AWS, which recently achieved $59 billion in annual revenues, contributed 13% of Amazon’s total revenue and almost 54% of its profit during second-quarter 2021.

AWS’s future focus is on attempting to own increasingly larger portions of the supply chain used to deliver cloud services to customers. Its operations are geographically diversified, and its clients tend to be early-stage startups to large enterprises.

……………………………………………………………………………………

2. Microsoft Azure, which remains the #2 Cloud Services Provider, sports a 51% annual growth rate. It earned praise from Gartner for its strength “in all use cases, which include the extended cloud and edge computing,” particularly among Microsoft-centric organizations.

The No. 2 public cloud provider also enjoys broad appeal. “Microsoft has the broadest set of capabilities, covering a full range of enterprise IT needs from SaaS to PaaS and IaaS, compared to any provider in this market,” the analysts wrote.

Microsoft has the broadest sets of capabilities, covering a full range of enterprise IT needs from SaaS to PaaS and IaaS, compared to any provider in this market. From the perspective of IaaS and PaaS, Microsoft has compelling capabilities ranging from developer tooling such as Visual Studio and GitHub to public cloud services.

Enterprises often choose Azure because of the trust in Microsoft built over many years. Such strategic alignment with Microsoft gives Azure advantages across nearly every vertical market.

“Strategic alignment with Microsoft gives Azure advantages across nearly every vertical market,” Gartner said. However, Gartner criticized Microsoft for very complex licensing and contracting. Also, Microsoft sales pressures to grow overall account revenue prevent it from effectively deploying Azure to bring down a customer’s total Microsoft costs.

Microsoft Azure’s forays in operational databases and big data solutions have been markedly successful over the past year. Azure’s Cosmos DB and its joint offering with Databricks stand out in terms of customer adoption.

………………………………………………………………………………………

3. Google Cloud Platform (GCP) is strong in nearly all use cases and is slowly improving its edge compute capabilities. Google continues to invest in being a broad-based provider of IaaS and PaaS by expanding its capabilities as well as the size and reach of its go-to-market operations. Its operations are geographically diversified, and its clients tend to be startups to large enterprises.

The company is making gains in mindshare among enterprises and “lands at the top of survey results when infrastructure leaders are asked about strategic cloud provider selection in the next few years,” Gartner analysts wrote. Google is also closing “meaningful gaps with AWS and Microsoft Azure in CIPS capabilities,” and outpacing its larger competitors in some cases, according to the report.

The analysts also noted that Google Cloud “is the only CIPS provider with significant market share that currently operates at a financial loss.” The No. 3 public cloud provider reported a 54% year-over-year revenue increase and a 59% decrease in operating losses during Q2.

………………………………………………………………………………..

Separately, Dell’Oro Group Research Director Baron Fung recently said that hyperscalers make up a big portion of the overall IT market, with the 10 largest cloud-service providers, including AWS, Google, and Alibaba, accounting for up to 40% of global data center spending, and “some of these companies can have really tremendous weight on the ecosystem.”

The Dell’Oro report noted that some providers have deployed accelerated servers using internally developed artificial intelligence (AI) chips, while other cloud providers and enterprises have commonly deployed solutions based on graphics processing units (GPUs) and FPGAs.

Fung explained that this model has also spilled over into those cloud providers also building their own servers and networking equipment to better fit their needs while “moving away from the traditional model in which users are buying equipment from companies like Dell and [Hewlett Packard Enterprise]. … It’s really disrupting the vendor landscape.”

Certain applications—such as cloud gaming, autonomous driving, and industrial automation—are latency-sensitive, requiring Multi-Access Edge Compute, or MEC, nodes to be situated at the network edge, where sensors are located. Unlike cloud computing, which has been replacing enterprise data centers, edge computing creates new market opportunities for novel use cases.

…………………………………………………………………………………

References:

https://www.gartner.com/doc/reprints?id=1-26YXE86I&ct=210729&st=sb

AT&T and Google Cloud Expand 5G and Edge Collaboration

Just one week after outsourcing their 5G SA/Core network software and IP to Microsoft (Azure public cloud), AT&T and Google Cloud announced new initiatives across AT&T’s 5G and Google Cloud’s edge computing portfolio, including AT&T’s on-premises Multi-access Edge Compute (MEC) solution, as well as AT&T Network Edge capabilities through LTE, 5G, and wireline.

For over a year, AT&T and Google Cloud have been developing edge solutions for the enterprise. Now, the two companies are taking the next step to deliver transformative capabilities that help businesses drive real value and build industry-changing experiences in retail, healthcare, manufacturing, entertainment and more — with the ability to use Google Maps, Android, Pixel, augmented reality (AR) and virtual reality (VR), and other solutions across Google for more immersive customer experiences. For example:

- Enabling video analytics services to help businesses across industries with theft prevention, crowd control, and queue prediction and management.

- In retail: Streamlining and automating inventory management, connecting brick-and-mortar, and ecommerce and backend systems for near real-time visibility into operations.

- In healthcare: Scaling access to services like telehealth-based therapy, using AR and VR for remote care either from patients’ homes or at an onsite facility.

- In manufacturing: Accelerating operations with remote support and quality control checks at plant locations, and optimizing bandwidth usage by streaming video on the edge rather than on-device.

- In entertainment: Enhancing in-venue experiences for concerts and sporting events, with solutions ranging from immersive AR and VR experiences, smart parking and ticketless entry, to contactless food and souvenir payment.

The companies are also working together to evaluate how network APIs could optimize applications, using near real-time network information at the Google Cloud edge. If successful, this would allow them to optimize the user experience at the edge and drive meaningful outcomes for businesses.

AT&T Multi-access Edge Compute (MEC) with Google Cloud combines AT&T’s existing 5G and fully managed MEC offering with core Google Cloud capabilities, including Kubernetes, artificial intelligence (AI), machine learning (ML), data analytics, and a robust edge ISV ecosystem. With the solution, enterprises can build and run modern applications close to their end users, with the flexibility to manage data on-prem, in a customer’s data center, or in any cloud. All this can help customers to increase control over data, improve security, lower latency and provide higher bandwidth.

AT&T Network Edge (ANE) with Google Cloud will enable enterprises to deploy applications at Google edge points of presence (POPs), which will be connected to AT&T’s 5G and fiber networks. In this low-latency compute and storage environment, businesses can deliver faster, more seamless enterprise and customer experiences. AT&T and Google Cloud are focusing on a multi-year strategy to bring the solution to 15+ zones across major cities, starting with Chicago this year. We expect to roll out the solution next in Atlanta, Dallas, Miami, and San Francisco.

“By combining the power of AT&T 5G and Google Cloud technologies, we are helping enterprises create new customer experiences and business services that were previously impossible,” said George Nazi, Vice President, Global Telecom, Media and Entertainment Solutions, Google Cloud. “Together with AT&T, we are committed to enabling our customers to build and deliver next-generation applications, whether on-premise or on AT&T’s leading mobile network.”

“With premises-based 5G and network edge computing, we give our customers even greater control of where their data goes and how they use it – at higher speeds and with lower latency. These capabilities allow businesses to deliver unique experiences to their customers, today and into the future,” said Rasesh Patel, Chief Product and Platform Officer, AT&T Business. “We’re bringing forth a new era where the latest technological advancements, including 5G and edge computing, make it possible to transform, innovate and prepare for whatever the future holds.”

“5G, cloud services and edge compute each have a tremendous amount of promise as standalone technologies,” says Jason Leigh, research manager for 5G and Mobile Services Research at IDC. “But coupling these three as complimentary, enabling technologies both accelerates and extends the promise of digital transformation in many more business settings.”

You can learn more about AT&T’s work in on-premises edge computing here, and network-based edge computing here. To learn more about Google Cloud’s work driving transformation and 5G adoption, visit here.

AT&Ts collaboration with Google extends beyond business and reaches the hands of the consumer. Together, the two companies are combining the power of AT&Ts 5G and fiber networks with Google cloud gaming platform.

Comment: It’s quite interesting that AT&T has outsourced its 5G SA core network to Microsoft Azure, but is using Google Cloud for edge computing for its 5G and fiber optics networks. AT&T claims a cohesive cloud strategy, but the network operator’s various alliances with cloud providers are confusing, according to Kathryn Weldon, research director at GlobalData. AT&T previously announced 5G edge partnerships with IBM, Microsoft, Accenture, Hewlett Packard Enterprise, and Deloitte.

The different goals AT&T hopes to achieve with each cloud or edge vendor and how they will jointly provide specific aspects of edge computing for each remains unclear, Weldon said.

“There have been so many announcements regarding operators’ relationships with hyper-scalers for 5G edge that it would be helpful to get really specific about use cases. The immersive experience examples are a bit generic. It’s time for actual customer use cases to be cited, even if they are only in trial,” she wrote in a report. Google Cloud and AT&T said joint customers will gain near real-time access to features packed into Google’s cloud and some of its most popular services.

“While the new initiatives leverage more Google capabilities, the announcement begs the question as to what things the partners have been working on for the last year. It isn’t clear why the listed Google elements could not have been brought in before,” Weldon added.

References:

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform