Fixed Wireless Access (FWA)

Will 2022 be the year for 5G Fixed Wireless Access (FWA) or a conundrum for telcos?

Lightshed Partners says absolutely! “This is the year for 5G Wireless Home Broadband,” as it emerges as a viable competitor to cable based Internet access.

The market research firm believes that the recent deployment of large blocks of spectrum by wireless operators will enable them to offer viable home broadband service to a notable segment of the market.

T-Mobile is already adding more than 200k home broadband subs per quarter, and Verizon is about to unleash rate plans that drop as low as $25/month. Verizon is also layering additional commission opportunities for their sales group. The vast majority of cell phone upgrades in the U.S. are still done in a cellular operator’s store. That provides wireless network operators with a familiar opportunity to sell home broadband and they are incenting their salesforce to do so.

Fixed wireless access (FWA) services into homes and offices, have approximately 7 million users around the U.S. The new efforts by Verizon and T-Mobile appear poised to push the technology into the cable industry’s core domain.

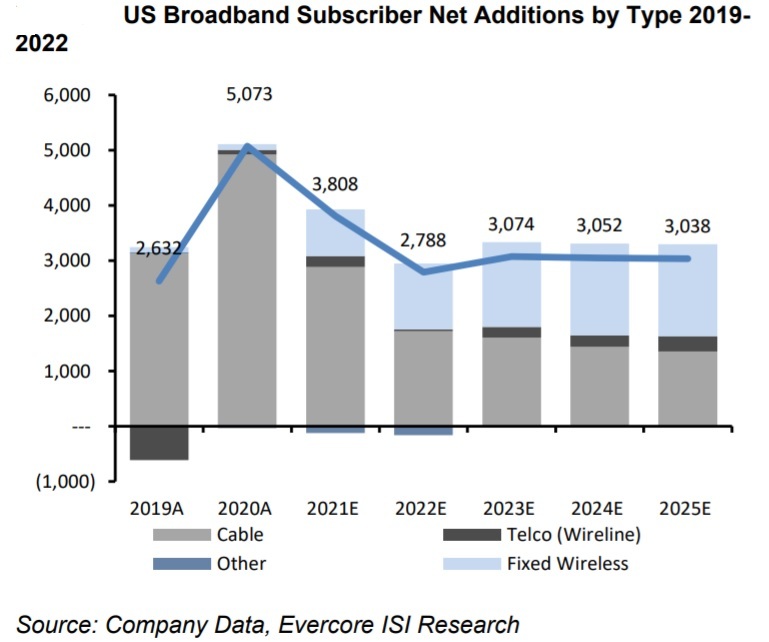

“We forecast that Verizon and T-Mobile will add 1.8 million wireless home broadband customers in 2022, more than doubling the 750,000 added in 2021,” the LightShed analysts forecast. “To put that growth in context, Comcast, Charter and Altice combined added 2.4 million broadband subscribers in 2021 and 2.7 million in 2019. Investors expect these three cable companies to add more than 2 million broadband subs in 2022, but even that reduced level of growth from recent years may prove to be too aggressive.”

5G fixed wireless access (FWA) services could serve 8.4 million rural households—nearly half the rural homes in the U.S.—with a “future-proof”, rapidly deployable, and cost-effective high-speed broadband option, according to a new Accenture study commissioned by CTIA, the wireless industry association.

Other analysts agree. “Fixed wireless probably cost Comcast and Charter, in aggregate, about 180,000 subscribers in the second half of 2021,” wrote the financial analysts at Sanford C. Bernstein & Co. in a recent note to investors.

“The great risk seems to lie in late 2022 and 2023. As Verizon, T-Mobile and AT&T deploy initial and subsequent blocks of C-band spectrum and as T-Mobile expands its 2.5GHz coverage to the last 1/3rd of US households, the availability of fixed wireless should expand,” Bernstein analysts wrote.

The financial analysts at Evercore predict that FWA services will gain a growing share of U.S. broadband new subscribe additions. Light Reading’s Mike Dano wrote the reasons are as follows:

- Verizon and T-Mobile are in the midst of deploying significant amounts of new spectrum into their networks. The addition of C-band spectrum (for Verizon) and 2.5GHz spectrum (for T-Mobile) will give them far more network capacity. And that’s important considering the average Internet household chews through almost 500 GB per month, according to OpenVault. The average smartphone user, meanwhile, consumes just 12 GB per month, according to Ericsson.

- Verizon and T-Mobile have finally shifted their FWA offerings from the test phase into the deployment phase. Although Verizon has been discussing FWA services for years, it finally started reporting actual customer numbers late last year (it ended the third quarter of 2021 with a total of 150,000 customers). Similarly, T-Mobile first outlined its FWA strategy in 2018, but officially launched its 5G FWA service in April – the company ended 2021 with 646,000 in-home Internet customers, well above its goal of 500,000. And both companies have recently cut FWA prices.

- The cable industry appears to be in the early stages of what MoffettNathanson analyst firm described as the “great deceleration.” According to the principal analyst Craig Moffett, this cable industry slowdown stems from such factors as a decrease in the rate of new household formation, increased competition from fiber providers – and FWA. He described the situation as a “concerning issue for cable investors, particularly if it appears that this is just a taste of what lies ahead.”

However, Craig is not convinced that FWA from telcos will mount a serious threat to cablecos Internet, partly because of capacity challenges operators will face as they bring subscribers onto the platform. They also wonder if it makes sense for mobile operators to get too aggressive with FWA, considering the much higher value on a per-gigabit basis they get from their respective mobile bases.

MoffettNathanson does acknowledge that both Verizon and T-Mobile have ramped up their focus on FWA even as AT&T takes a more cautious, targeted approach. Last week at an investor conference, AT&T CEO John Stankey said:

I believe that having some fixed high bandwidth infrastructure is going to be essential to being an effective networking company moving forward… Is fixed wireless going to be the best way to get a lot of bandwidth out to less densely populated rural areas? Yes, it probably will be. So is there a segment of the market where fixed wireless will apply and be effective? Sure, it will, and we’ll be in a position to have the right product to address those places.

But I don’t want to just simply say, well, that is the single solution that’s going to deal with what I would call the 70% of the business community, the 70% of the consumer population that are going to be pretty intensive users in some location, indeed, to have fixed infrastructure to support that over the long haul, given all the innovation that’s going to come……I see an opportunity for us to be very targeted and very disciplined around what we do (in FWA) and what used to be I hate using the term but traditional out of region markets, where good fiber deployment that supplements the strength of our wireless network.

Moffett wrote in a note to clients today:

There’s been a sea change in the rhetoric about fixed wireless broadband. We’re admittedly still struggling to understand it.

Until recently, Verizon and T-Mobile had, by turns, swung between aggressiveness and reticence. Investors will recall that in 2018, Verizon made bold claims about millimeter wave-based FWA. T-Mobile was rather skeptical at the time, not just about mmWave but even about FWA-over-mid-band. By 2019, Verizon had pulled in their horns, just as T-Mobile was first committing to bring FWA to rural Americans in a bid to sell their Sprint merger to regulators. At the start of last year, when all three of Verizon, AT&T, and T-Mobile held analyst days, T-Mobile upped the ante, forecasting 7-8M FWA customers by 2025. But Verizon was by then more cautious, committing only to a paltry $1B in revenue by 2024 (equating to perhaps 1.7M customers) and warning that their participation would be back end loaded. And AT&T was more cautious still, arguing that the capacity utilization implications made FWA unattractive.

Now, for the first time, Verizon and T-Mobile are pounding the table at the same time. What has changed? And what does it mean for the many plans for fiber overbuilds?

First, it’s important to consider the network capacity implications of fixed wireless. Most investors understand that the burden of serving homes with a wired broadband replacement is far greater than that of serving individual phones for mobility. But investors will also understand that network utilization isn’t uniform across all cell sites; there are cell sites with more excess capacity and there are cell sites with less.

The challenge for operators is to ensure that their FWA subscriptions fit as neatly as possible into the cell sites, or sectors of cell sites, with the most available capacity (a cell site will typically be divided into three sectors, each covering a 120 degree arc).

No operator wants to risk their high-value mobile service experience for the benefit of a few incremental low-value fixed subscriptions (as we’ll see shortly, the revenue per bit from a mobile customer is 30 to 50x higher than that for fixed).

Still, both T-Mobile and Verizon see FWA as promising. T-Mobile expects to have between 7 million to 8 million FWA subs by 2025, and views an addressable market of about 30 million homes that are suitable from a signal quality and capacity standpoint. T-Mobile has already noted that their 664K FWA customers include a mix of customers from relatively rural areas with limited or no wired broadband availability and those from suburbia who were previously cable subscribers.

Verizon, meanwhile, is committing to about $1 billion in FWA revenues by 2024, which MoffettNathanson equates to roughly 1.7 million customers (Verizon ended Q3 2021 with about 150,000 FWA subscribers).

Craig questions whether there’s enough bandwidth to go around to fulfill subscriber targets, and if getting aggressive with FWA makes business sense. He indicates that 5G telcos are getting desperate to find revenues after spending billions of dollars for licensed spectrum and 5G RAN buildouts.

With tens of billions of dollars of investment in spectrum already sunk, and with tens of billions more to come for network densification, one might imagine that carriers are desperate to find a more tangible revenue opportunity than one that depends on beating Amazon AWS at what is essentially just a next iteration of cloud services.

And when all is said and done, Craig is as puzzled as this author:

As we said at the outset… we’re struggling to understand. We’re struggling to understand why Verizon and T-Mobile suddenly see this (FWA) relatively low value use of network resources as attractive. We’re struggling to understand how, after an initial burst of growth, they will sustain that growth as sectors “fill up.” We’re struggling to understand why they have set such ambitious targets so publicly. And we’re struggling to understand why cable investors have come to expect that deployments of FWA and fiber should be treated as independent, or additive, risks. It doesn’t seem, to us, that it all adds up.

Opinion: We think an undisclosed reason for telco interest in FWA is that 5G mobile offers few, if any advantages over 4G and there is no roaming. Therefore, the 5G enhanced mobile broadband use case will continue to fail to gain market traction. 5G FWA can work well with a proprietary telco/cloud native 5G SA core network which could be shared by both 5G mobile and FWA subscribers (perhaps using the over hyped “network slicing”). So even though FWA was NOT an ITU IMT 2020 use case, it still has a lot of room to grow into a revenue generating service for wireless telcos.

References:

MoffettNathanson research note (only available to the firm’s clients)

Complete and Comprehensive Highlights of AT&T CEO’s Remarks at Citi Conference

FWA has limited deployments, many supporters, and great potential

Ericsson’s Mobility Report forecasts FWA (fixed wireless access) connections will “show strong growth of 17% annually through 2027.” That compares to anticipated wireline broadband growth over the same period of only 4%. The Ericsson report states that 57 network operators have deployed FWA commercial networks. Finnish telco DNA says FWA is its most popular broadband offering.

Ericsson says Latin America and North America are markets where FWA will play a role in closing the digital divide. Africa may also be promising because of its large rural population and the limited alternatives.

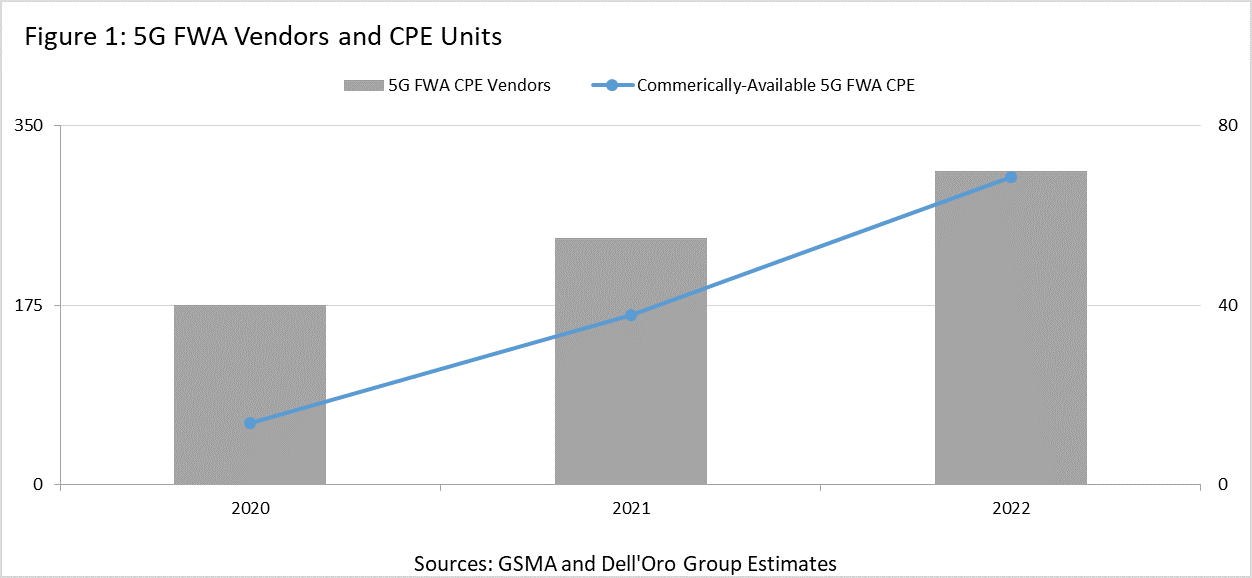

GSMA Intelligence is also enthusiastic about FWA. In a recent blog post it described FWA “as one of the most promising 5G use cases,” providing “an incremental opportunity to maximize the value of existing network assets.”

So is Dell’Oro Group’s Jeff Heynen. He wrote in an IEEE Techblog post, “We estimate that the total number of 5G FWA devices shipping to operators this year will easily exceed 3 million units and could push 4 million units. The vast majority of these units will be to support sub-6Ghz service offerings, though we also expect to see millimeter wave units, as some operators use a combination of those technologies to provide both extensive coverage and fiber-like speeds in areas where the competition from fixed broadband providers is more intense. Overall, however, we expect volumes first from sub-6GHz units this year and into next year, followed by increasing volumes of millimeter wave units beginning in the latter part of 2022 and into 2023.”

Not to be outdone, an Accenture analysis commissioned by the CTIA argues that 5G FWA can serve as many as 43% of rural households.

Light Reading’s Robert Clark writes:

Currently fixed wireless, using either 4G or some other technology, accounts for fewer than 100 million worldwide subscribers.

The challenge for 5G, as for earlier generations, is that wireless doesn’t always deliver the best performance or the strongest business case.

Philippines’ Globe Telecom is a case in point. GSMA Intelligence lauds it as a “great example” largely because it launched its 5G network two years ago with a FWA service called Air Fiber.

But two years is a long time, especially when that period includes COVID-19, and we now find that Globe has shifted away from FWA to actual fiber.

Globe’s total fixed wireless subs fell 17% sequentially in Q3 while FTTH subs grew 35%, the company said in a filing. Total home broadband revenues grew 39% thanks to “the accelerated digital habits of the Filipinos brought about by the pandemic.”

China, the global 5G champion with 450 million users, is also indifferent to the possibilities of fixed wireless. You would think this nation with a rural population of some 530 million and vast sparsely settled regions would be a prime market for FWA, but its home broadband priority is gigabit fiber.

Geography is likely the main reason for limited 5G FWA take-up worldwide. 5G is strong in countries already well-served by fiber. Those markets where operators are likely to grow FWA are still in their early stages.

Opinion:

We believe that 5G FWA has great potential. That is because no standard 5G core network is required and there is no roaming between carriers. As such, non standard/operator specific private 5G SA core networks can be deployed that can deliver a range of 5G core enabled services, e.g. network slicing, automation, security, MEC, enhanced network management.

However, URLLC in the RAN and in the core network must be standardized, performance tested, and implemented in trials. Then deployed in production networks before the various 5G FWA industrial use cases can be effectively deployed.

References:

https://www.lightreading.com/asia/5g-fixed-wireless-how-far-can-it-go/d/d-id/773784?

Dell’Oro: 5G Fixed Wireless Access (FWA) deployments to be driven by lower cost CPE

Ericsson: 660 million global 5G subscriptions at end of 2021 (?)

In its new Mobility Report, Ericsson has updated its forecast for 5G subscribers at the end of 2021, to a total of close to 660 million. The increase is due to stronger-than-expected demand in China and North America (?), driven in part by falling prices for 5G devices. Ericsson forecasts 5G to become the dominant mobile technology by 2027.

Opinion: For that to happen, this author believes many of the unfinished parts of 5G must be completely standardized and proven in the field. That list includes: URLLC in the RAN, URLLC in the core network, 5G SA core network, 5G security, reduction of very high 5G power consumption, deployment of hundreds of thousands of small cells, frequency arrangements for terrestrial (ITU-R M.1036 revision), industrial and consumer use cases, fiber optics and LEO satellite backhaul, etc.

………………………………………………………………………………………………………….

In Q3 2021, nearly twice as many 5G subscriptions were added around the world as new 4G connections, at respectively 98 million and 48 million. Ericsson expects that 5G networks will cover more than 2 billion people by the end of this year.

Ericsson’s latest forecasts put 5G on track to become the dominant mobile access technology by 2027. 5G is expected to account for around 50 percent of all mobile subscriptions worldwide in 2027, covering 75 percent of the world’s population and carrying 62 percent of the global smartphone traffic by the same date.

Not to be forgotten, Ericsson says fixed wireless access (FWA) will provide broadband access for 800 million people by 2027.

Ericsson’s latest report also looks back on the past ten years of mobile networks. According to the research, around 5.5 billion smartphone users have joined the market in the past ten years, and mobile data traffic has increased almost 300-fold in the same period.

In Q3 2021 alone, there was more mobile data traffic than the entire period up until the end of 2016.

Note that Ericsson has tended to over-estimate total mobile subscriptions but under-estimate the uptake of newer technologies, especially in their early stages. This is shown in the table below:

Fredrik Jejdling, Head of Networks at Ericsson, wrote:

“Mobile communication has had an incredible impact on society and business over the last ten years. When we look ahead to 2027, mobile networks will be more integral than ever to how we interact, live and work. Our latest Ericsson Mobility Report shows that the pace of change is accelerating, with technology playing a crucial role.”

References:

https://www.ericsson.com/en/reports-and-papers/mobility-report

Global 5G subscriptions to hit 660 million this year – Ericsson

https://www.telecompaper.com/news/ericsson-upgrades-global-5g-subscriber-forecasts–1406019

Cowen Analysts: Telcos to lead FTTH buildout; total 82M homes to be passed by 2027

According to a new report titled Fiber to the Home: Navigating the Road to Gigabit America, a multi-sector by Cowen analysts, forecasts that telco fiber-to-the-home (FTTH) lines will pass 82 million American households by 2027, nearly double the 44 million households passed today. The four biggest U.S. wireline telcos (AT&T, Verizon, Frontier and Lumen) will account for the lion’s share of those deployments, together passing more than 71 million homes with fiber.

The Cowen report also projects that cable operators (cablecos or MSOs) will pass another 5 million homes with fiber lines over the next six years, largely because of Altice USA’s current big push in the New York metro area to match Verizon’s Fios rollout. Cable operators already pass about 5 million homes with fiber.

Overall, Cowen estimates that the US now has 50 million homes passed by fiber lines, with the telcos accounting for most of them. Here are a few other highlights from the report:

- Cowen expects state/federal funding of $130B for various broadband initiatives.

- That will close the digital divide and expand the addressable market for broadband access.

- FTTH will gain market share (compared to other fixed broadband access) to take ~70% of the net positive broadband subscriber adds by 2027.

- As a result, 35M FTTH subscribers (26% market share) are expected by 2027; up from 16M (14%) today.

- FTTH subs take speeds that are 54% faster than non-FTTH broadband subs.

- The increase in FTTH subs will lead to exciting next-gen home applications (not specified) and ARPU growth.

- FTTH subs have 13% higher ARPU compared to non-FTTH subs.

Large, midsized and small telcos will all participate in this massive fiber deployment, using FTTH to reverse nearly two decades of broadband market share losses to the cable industry, the Cowen analysts say. For instance, they project the nation’s biggest telcos will add a combined 7.7 million fiber subs over the next five years.

“The next few years will be historic in terms of telco FTTH upgrades, providing consumers speeds of 1 Gbit/s, closing the digital divide, expanding the total addressable market and achieving a ‘Gigabit America’,” the analysts wrote. “After years of hemorrhaging subscribers, we expect Big Telco to stem the tide of losses to Cable…”

However, the report does not say that telcos will be gaining broadband customers from cable operators. Instead, telcos will achieve broadband subscriber gains mainly by upgrading their own remaining 15 million DSL subs to FTTH.

“The cable decade of dominance of DSL-share stealing is over,” the analysts wrote, forecasting that the telcos will overtake the cable companies in broadband sub net gains by 2024. “Cable’s days of stealing DSL subs are over, though only losing modest share (DSL taking the brunt), as the focus will be on defense.”

The Cowen analysts expect cable’s broadband market share to drop very slightly from 61% today to 58% in 2027 while the telcos’ market share creeps up from 25% now to 27% in 2027.

“It’s far from doom-and-gloom for cable operators,” the analysts note. “With cable’s effective marketing plan and speed upgrades, the vast majority of subscriber losses will be from the 15 million DSL subscribers, not cable.”

The analysts expect fixed wireless access (FWA) to play a notable tole in the US broadband market by the middle of the decade, accounting for a small but increasing fraction of high-speed data customers throughout the 2020s. “FWA will establish a solid but niche foothold,” they wrote.

Cowen now expects U.S. service providers to add a collective 17 million broadband subs by 2027, enough to reach 97% penetration of occupied homes and 90% penetration of overall homes, up from 90% and 82% today. The analysts believe that broadband could achieve utility-like penetration levels of 98% or more, like wired phone service did at its peak last century.

All this fiber optic spending will be a boon for optical network equipment vendors. Specifically, the Cowen analysts single out Calix, Adtran, Ciena, Cisco, MasTec, Nokia and Juniper as likely beneficiaries.

The analysts also see potential for further market consolidation. Some scenarios they envision are Charter buying the Suddenlink portion of Altice USA’s footprint and Charter or Altice USA merging with T-Mobile to form a third converged player in the national market.

References:

Verizon broadband – a combination of FWA and Fios (but not so much pay TV)

Verizon today announced its earnings for the third quarter of 2021, with the company posting net income of $6.6 billion, operating revenue of $32.9 billion, and $1.55 in earnings per share. Verizon now expects total wireless service revenue growth of around 4%, an increase to prior guidance of 3.5% to 4%. It’s earnings guidance was also revised upwards. Verizon adjusted earnings per share of $5.35 to $5.40 is now forecast for the current quarter – an increase from its prior guidance of $5.25 to $5.35.

“We had a strong third quarter, delivering on our strategy and growing in multiple areas,” Verizon Chairman and CEO Hans Vestberg said in the earnings release. “Our disciplined strategy execution demonstrated growth in 5G adoption, broadband subscribers and business applications. We are increasing our 2021 guidance, and we continue to expand our 4G LTE and 5G network leadership. We fully expect to have a strong finish to the year as we accelerate deployment of 5G to our customers across the country,” he added.

“Verizon reported another quarter of strong financial and operating performance,” Verizon Chief Financial Officer Matt Ellis said in the press release. “We are seeing strong demand for connectivity across our Consumer and Business segments as our Mix and Match and Business Unlimited value propositions, network quality and unique partnerships are resonating with both new and existing customers. We grew revenue in the quarter, achieved solid cash flow, completed the sale of Verizon Media and increased the dividend for a 15th consecutive year.”

The #1 wireless telco in the U.S. lost 68,000 net video subscribers from its Fios (FTTH/FTTP) service in the third quarter. “The telecom giant has been shifting its video focus away from Fios TV to partnerships with third-party streaming services as it positions itself as a key distribution platform for them. For example, Verizon has a deal with The Walt Disney Co. for the Disney bundle, which gives customers with select Verizon wireless unlimited plans access to Disney streaming services Disney+, Hulu and ESPN+,” said the Hollywood Reporter.

During the quarter, Verizon sold off its Verizon Media unit, which consisted of formerly dominant tech brands like AOL and Yahoo. The unit was acquired by Apollo Global Management, although Verizon continues to hold a 10 percent stake.

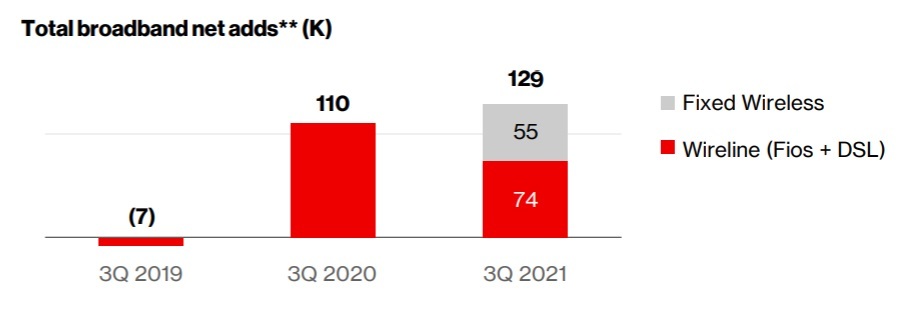

Verizon reported 129,000 broadband net additions in the third quarter, comprised of Fios, DSL and FWA subscribers, during the quarter. Of those, there were 55,000 Fixed Wireless Access (FWA) subscriber adds , which was about 42% of the 129,000 total broadband net adds generated in the quarter. Verizon FWA has a total of ~150,000 subscribers.

Source: Verizon Infographic from 3Q 2021 Earnings Report

Verizon CEO Hans Vestberg said during the earnings call, “We’re on track to meet our fixed wireless access household coverage targets with an expected 15 million homes passed by the end of the year between 4G and 5G. To date, 5G Home is in 57 markets and 4G LTE Home is in over 200 markets across all 50 states.”

Verizon first began offering 4G LTE Home in July 2020 and has really accelerated its rollout. The company has also rolled out 5G Home. Verizon executives on today’s earnings call noted that the FWA subscriber base is a mix of customers getting service from its 4G/LTE network and via Verizon’s 5G millimeter wave (mmWave) network. The company’s FWA base currently is a mix of residential and business customers, but did not break out that ratio. But they did note that there’s about a rough 50/50 split between FWA customers that are coming from Verizon’s existing base and from other service providers. CFO Matt Ellis said Verizon’s FWA customers aren’t solely focused on rural areas, as Verizon is also seeing “good traction” with the product in urban and suburban areas.

Verizon now seems to favor FWA over Fios, probably because of significantly lower installation costs for the former. Yet the company is not giving up on Fios. “In addition to fixed wireless access, we’re pleased with the great performance of Fios and continue to grow the open-for-sale volumes within our footprint.”

Indeed, Fios Internet net adds were 104,000 in the quarter. The telco is increasing its Fios footprint, adding over 400,000 open-for-sale locations this year. One analyst noted that Verizon hasn’t talked about increasing its Fios brand within its ILEC for quite some time.

Chief Financial Officer Matt Ellis said, “On the Fios expansion, we see great opportunity. We have been investing in that for a number of years; maybe haven’t spoken about it quite as much. But it continues to be a very good growth driver for the business.”

The company reported that Fios revenue of $3.2 billion in the quarter was up 4.7% year over year, driven by continued growth in customers as well as Verizon’s effort to increase the value of each customer by encouraging them to step up in speed tiers.

“We remain focused on bringing in high-quality net adds,” said Elllis. “The mix and match pricing structure for both wireless and Fios provides opportunity to migrate customers to higher value tiers and bring in customers on higher value plans. Our strategy is focused on increasing the value we receive from every connection.”

Vestberg said, “Our strategy is becoming a national broadband provider with the best access to the tech for our customers, including Fios, fixed wireless access on 5G, on 4G, mmWave and C-band.”

In a research note to clients, analyst Craig Moffett discussed Verizon’s broadband business:

Verizon’s FiOS service continues to show strength, a product of both more aggressive pricing and a lessening drag from video as the video base shrinks. Notably, Verizon is also beginning to see some contribution from fixed wireless access.

- FiOS internet subscriber gains of 104K were almost spot on with consensus. DSL losses

remained relatively steady (-30K) despite the fact that the base of legacy DSL has been

gradually depleted. Overall broadband net additions came in at 129K, which includes

55K fixed wireless connections. The company reported that it had 150K fixed wireless

broadband customers at the end of Q3. Wireline broadband net additions were strong,

at 74K, but were still weaker than expected. Notably, the company has guided to an

addition of 400K FiOS homes open for sale, the first meaningful expansion of homes

available for sale in some time (note that “open for sale” does not necessarily equate to

new build – particularly in New York, there has long been a large gap between homes

already passed and homes open for sale – but it is likely that there is at least some new

build here. - Like peers, Verizon is losing video subscribers (down 68K, a little worse than the 54K

loss we had expected, and worse than the 62K loss a year ago despite a smaller

denominator). Their decline rate of 7.2% is broadly in line with the rate of decline for the

industry overall.

With respect to Verizon’s 5G strategy and competition (e.g. T-Mobile), Craig wrote:

As we creep up to the 5G epoch, we’re on the brink of a very different industry. Despite a relatively healthy third quarter report – albeit against relatively easy year ago comps – there are reasons for disquiet. A post-COVID service revenue growth recovery has already begun to slow, and incremental revenue streams from 5G are still uncertain. Industry structure, which once appeared to be getting better – we went from four to three with the merger of Sprint and T-Mobile – is now arguably getting worse, as we now arguably go from three to five with the emergence of hybrid MVNO/MNO networks from Cable and Dish. Verizon is on the brink of a very different competitive position.

T-Mobile’s 5G network is increasingly viewed as better than Verizon’s for coverage, speed, and reliability. Verizon’s one-time bid for sustained superiority – millimeter wave “ultra-wideband” service – currently accounts for just one half of one percent of the time 5G users are connected.

Craig notes that Verizon’s initial gambit to retain network superiority in 5G was built on millimeter wave spectrum. The very limited propagation of millimeter wave spectrum, however, demands an incredibly dense wired backhaul network, at enormous cost, lest customers are simply out of range much of the time. Verizon is, anecdotally at least, well ahead of peers in network densification. Still, recent data (once again, from OpenSignal) suggests that, while 5G customers of Verizon’s 5G service are connected to mmWave spectrum much more often than are 5G customers of AT&T or T-Mobile, that is still too trivial a percentage of the time (one half of one percent). That’s hardly the basis of an advantaged network.

T-Mobile has an advantage in both spectrum propagation (coverage) and spectrum depth (speed). And Verizon still charges a premium. Retention and growth will be harder in a world where their network superiority has been ceded to a lower priced service.

In conclusion, Craig states that Verizon enjoyed years as the best network, but it will be harder to maintain that claim in the 5G era, where T-Mobile has a coverage and spectrum depth (speed) advantage. And where TMobile and the company’s Cable MVNO partners charge meaningfully lower prices than Verizon does for the same or better service.

Verizon’s Year End 2021 Priorities:

• Expand 5G leadership (?) and drive adoption; mmWave deployment and C-Band launch

• Customer differentiation and scaling premium experiences

• Transform the business; Tracfone acquisition and Verizon Media Group sale

• Accelerate and amplify 5 vectors of growth; Network-as-a-Service strategy

References:

https://www.lightreading.com/5g/verizon-has-150000-fixed-wireless-access-subs-/d/d-id/772925?

https://www.slashgear.com/verizon-5g-home-internet-expands-to-cover-more-cable-cutters-07694326/

Cambium Networks Technology Enables Pentanet to Build a Multi-Gigabit Fixed Wireless Network in Perth, Australia

Cambium Networks, a global provider of wireless networking solutions, today announced that Pentanet is building neXus, a multi-gigabit fixed wireless network across the metro area in Perth, Australia, to provide internet access for business and residential subscribers. The exceptional speeds will be achieved by extending their existing infrastructure consisting of 300 km of “dark” fiber with Cambium Networks’ 60 GHz cnWave fixed wireless platform, using Terragraph, a mesh technology developed by Facebook Connectivity. The result will be network performance that even the most demanding video gamers will appreciate.

60 GHz cnWave V5000 V5000 is featured with two sectors covering up to 280 degrees with beamforming. A single V5000 can connect up to 30 devices, which includes up to four distribution nodes. V5000 can be used for PTP, PMP and mesh configurations.

Supports 57 to 66 GHz:

• Dual-sector with 280º coverage

• Up to 7.2 Gbps (1.8 Gbps DL and 1.8 Gbps UL per sector). Channel bonding typically doubles capacity

• TDMA/TDD channel access and Network Synchronization

• 802.11ay technology with Facebook Terragraph certification

“In 2019, Perth Australia was reported as having the second slowest internet speeds of all Australian capital cities, but we know that needs to change – and fast,” said Stephen Cornish, CEO of Pentanet. “Bandwidth-heavy and latency sensitive applications like cloud-gaming are already transforming connectivity demands, and reliable gigabit speeds are the future for Perth. With Cambium Networks’ 60 GHz cnWave technology, Pentanet’s neXus is driving a leap in internet connectivity throughout the city to gigabit speeds. Using our existing fixed wireless network infrastructure, Pentanet can rapidly deploy the next-generation of wireless technology to create the neXus.”

“Our development and support teams are collaborating closely with the Pentanet team to ensure our solution can scale rapidly to be able to provide connectivity across Perth,” said Atul Bhatnagar, president and CEO of Cambium Networks. “They are pioneering a new age of communications with their business model and network architecture. We are pleased to recognize Pentanet’s disruptive leadership in the industry with our Wireless Connectivity Hero award.”

Cambium Networks’ multi-gigabit fixed wireless broadband technology and centralized management are well suited for urban applications. The solution provides multi-gigabit wireless broadband performance and reliability at a fraction of the cost of fiber. With 60 GHz cnWave, Pentanet can rapidly deploy hybrid networks to extend the fiber plant to customer premises, accelerating time to revenue at lower operating and capital costs. This video details the value that Pentanet delivers.

Cambium Networks’ 60 GHz cnWave solution elements include:

- V5000 Distribution Node – Equipped with two sectors covering up to 280 degrees with beamforming. A single V5000 can connect up to 30 devices, which includes up to four distribution nodes. The V5000 can be used for point-to-point (PTP), point-to-multipoint (PtMP) and mesh configurations.

- V3000 Client Node – Featuring a 44.5 dBi high-gain antenna with beamforming, the client nodes can support up to 3.8 Gbps with the capability for even higher rates in the future with channel bonding for both PtMP and PTP configurations.

- V1000 Client Node – Includes wide-range, 80⁰ beamforming for easy installation. Powered by 802.3af PoE, V1000 supports gigabit throughputs in a compact easy to install form factor

The latest addition to Cambium Networks’ multi-gigabit wireless fabric portfolio of solutions, 60 GHz cnWave is fully integrated into LINKPlanner and cnMaestro™ end-to-end cloud management that provides a unified view of the entire network. The solution delivers reliable and secure connectivity for residential users, schools, enterprises, and industrial operations at a low total cost of ownership.

Find out more about mmWave products including 5G Fixed wireless, Wi-Fi 6 solutions and centralized management solutions at Cambium Connections’ of Cambium Networks’ online events in September. Stephen Cornish of Pentanet will be presenting live Tuesday, 21 September – Register Here.

Cambium Networks’ full wireless fabric portfolio of solutions are available through its global network of partners.

Cambium Networks is celebrating a Decade of Excellence in 2021 with more than 10 million radios shipped worldwide since commencing operations in 2011.

About Pentanet

Pentanet is a Perth-based, growth-focused telco delivering high-speed internet to a growing number of subscribers by providing them with next-generation internet speeds. This is achieved through Pentanet’s market-leading private fixed-wireless network, the largest in Perth, as well as reselling fixed-line services such as NBN, where its wireless is not yet available.

Pentanet’s flagship fixed wireless network has benefits for both customers and investors, offering an outstanding customer experience and a fixed-wireless product that is technically superior to most of the National Broadband Network (NBN) – with attractive margins for investors. This sets Pentanet apart from most broadband providers, which only resell the NBN.

Pentanet will also be part of the rollout of the next wave of subscription-based entertainment services – cloud gaming. The Company’s Alliance Partner Agreement with NASDAQ listed NVIDIA – one of the world’s largest producers of specialised graphic chips used in gaming – allows Pentanet to be the first to bring their GeForce NOW technology to Australia in 2021.

Media Contact (Pentanet)

Alison Balch – Pentanet

+61 (04) 14 545 118

[email protected]

About Cambium Networks

Cambium Networks delivers wireless communications that work for businesses, communities, and cities worldwide. Millions of our radios are deployed to connect people, places and things with a unified wireless fabric that spans multiple standards and frequencies of fixed wireless and Wi-Fi, all managed centrally via the cloud. Our multi-gigabit wireless fabric offers a compelling value proposition over traditional fiber and alternative wireless solutions. We work with our Cambium certified ConnectedPartners to deliver purpose-built networks for service provider, enterprise, industrial, and government connectivity solutions in urban, suburban, and rural environments, with wireless that just works.

Media Contact (Cambium)

Dave Reddy – Big Valley Marketing for Cambium

+1 (650) 868-4659

[email protected]

References:

https://www.cambiumnetworks.com/products/pmp-distribution/60-ghz-cnwave-v5000/

Belgian trial of FWA using Pharrowtech’s mmWave technology

Vlaio has agreed to support a trial of fixed-wireless internet access (FWA) in the 60 GHz band using semiconductor start-up Pharrowtech’s mmWave technology. Belgian cable operator Telenet and wireless equipment supplier Unitron are also participating, with the trial services expected to start for homes and businesses in 2022.

The trial will focus on validating the performance of Pharrowtech’s mmWave technology, to help the company move towards commercialization of its products. Pharrowtech said its CMOS process technology makes mmWave services in the 60 GHz band a cost-effective, high-performance alternative to fibre roll-outs. The technology is reliable and robust enough to cope with the outdoors environment, while delivering superior performance compared to alternatives in the market, in urbran or rural areas, the company said.

The Vlaio grant will be used to support preparation and execution of the Telenet field trial of Pharrowtech’s mmWave RFIC technology using Unitron’s network elements. Beamforming and mesh control software developed by labs at the Flemish research institute Imec will also be used in the trial.

Telenet, which is controlled by the Liberty Global group, said it has multiple use cases in mind where FWA could bring benefits such as reducing installation and roll-out costs. The operator last year started exploring a cooperation on FTTH roll-out in Flanders, but has yet to commit to a technology for its next network upgrade after Docsis 3.1. In the US, operators such as Mediacom and Alaska Communications are already exploring FWA services.

Pharrowtech was founded in 2018 as a spin-off from Imec, where the founding team led CMOS IP generation and prototype development in mmWave wireless systems for more than fifteen years. In 2019, the company secured more than EUR 6 million in seed funding from imec-Xpand, Bloc Ventures and the KBC Focus Fund, and in June this year the company released its first evaluation board.

Pharrowtech CEO and Co-Founder, Wim van Thillo, said: “We are extremely pleased that VLAIO is supporting us to roll out our technology with these leading partners. This field trial perfectly represents the massive business opportunity that mmWave FWA offers. Even in areas as densely populated as Belgium, operators struggle to deploy gigabit internet services fast enough. This project will establish our technology as a key complement to fiber for fast and economical high-speed internet deployments everywhere.”

Unitron CTO, Stephen Deleu, said: “With this VLAIO project, UnitronGroup will expand its knowledge in the higher frequency ranges and discover new wireless applications for ultrafast broadband communication. UnitronGroup is the market leader in multiple high frequency technologies, and collaborating with knowledge partners helps us strengthen our position. As a key technology partner for multiple telecom operators, our role in this ambitious project is to provide the FWA customer and distribution node elements. We are excited to be part of this consortium and looking forward to the insights and outcomes of this VLAIO project.”

Telenet, Director Network & Infrastructure, Luk Bruynseels, said: “For Telenet it is paramount to keep on investing in innovative ways to deliver digital services to our customers. We have multiple use cases in scope where FWA technology brings opportunities and important benefits by reducing installation and roll-out costs. This VLAIO project is a great opportunity for Telenet to gather and share all required knowledge and expertise within the consortium to ensure we meet the expected outcome of the project.”

References:

Pharrowtech, Telenet, and Unitron secure public funding for Fixed Wireless Access field trial

Dell’Oro: 5G Fixed Wireless Access (FWA) deployments to be driven by lower cost CPE

by Jeff Heynen, Dell’Oro Group

Introduction:

The global demand for broadband service has resulted in an acceleration of interest among fixed and mobile operators alike to either expand their existing LTE or point-to-multipoint fixed wireless access (FWA) offerings or roll out early 5G FWA services to a growing base of current and potential subscribers. In both mature and emerging markets, there has been a tremendous increase in the number of RFPs for equipment and software to support large-scale 5G fixed wireless service deployments. Clearly, service providers are looking to strike while the iron is hot, securing subscribers who need broadband now, while also taking advantage of growing government subsidization of broadband service rollouts.

The vendor ecosystem supporting 5G fixed wireless has naturally increased, particularly in the area of dedicated CPE. According to the GSA (Global mobile Suppliers Association), there are currently over 130 FWA CPE devices (both indoor and outdoor) that have been announced by a growing list of vendors, which now numbers above 50. Over 50 of these dedicated CPE are now commercially available, which is up from 15 commercially-available units just one year ago. By the end of 2021, we expect that the number of commercially-available devices will exceed 100 and will double in 2022. The number of vendors producing or planning to produce 5G FWA CPE already exceeds the number of suppliers of 4G FWA CPE.

The increase in available units, which corresponds with the perceived addressable market of 5G network deployments and subscriber uptake, combined with the rapid uptake of 5G-capable smartphones will help to push the cost of both indoor and outdoor 5G FWA units down to levels that satisfy the business case requirements of operators globally. In particular, operators in emerging markets where ARPU levels are typically low, cost-reduced CPE are an absolutely critical requirement to ensuring a faster ROI.

The larger the addressable market, the more willing component suppliers will be to forward-price to capture a larger share of that growing market. The resulting price reductions in components begets wider availability of finished CPE. It becomes an iterative cycle that benefits the entire supply chain and the network operators as end purchasers.

Quick Ramp of 5G FWA Devices Expected:

At the end of 2020, we estimate that there are nearly 60M fixed wireless subscribers globally. A large percentage of these subscribers use 4G LTE networks, though there are also subscribers using 3G networks, proprietary point-to-multipoint services, as well as some using early 5G technologies, including sub-6Ghz and millimeter wave. We estimate that the 5G subscribers are around 1 million currently. However, we expect that those subscriber numbers are set to double in 2021, as operators such as T-Mobile (USA), AT&T, Verizon, Bell Canada, Saudi Telecom, Rain (South Africa), Swisscom, Deutsche Telekom, Optus, and others introduce or expand 5G FWA services this year.

With those operator commitments already in place, we estimate that the total number of 5G FWA devices shipping to operators this year will easily exceed 3 million units and could push 4 million units. The vast majority of these units will be to support sub-6Ghz service offerings, though we also expect to see millimeter wave units, as some operators use a combination of those technologies to provide both extensive coverage and fiber-like speeds in areas where the competition from fixed broadband providers is more intense. Overall, however, we expect volumes first from sub-6GHz units this year and into next year, followed by increasing volumes of millimeter wave units beginning in the latter part of 2022 and into 2023.

We also anticipate that the vast majority of 5G FWA deployments will rely on indoor gateways that combine a 5G modem with a WiFi 6 access point for signal distribution within the home. Many of these gateways will also be mesh-capable and will be paired with satellite units to blanket homes with WiFi coverage and to eliminate dead spots within the home.

There will be situations where outdoor units will be required, particularly in the case of millimeter wave deployments which require line of sight because of the high-frequency ranges being used. But even in the case of sub-6Ghz 5G FWA deployments, outdoor units will be required when homes or apartments have very thick-paned windows or are located in LEED (Leadership in Energy and Environmental Design) buildings.

With this growing clarity around deployment models and device types, we expect that the costs of 5G FWA CPE will decline throughout this year and next, providing a catalyst for much larger, global deployments of the service through 2022 and beyond. We believe that the average cost for an indoor 5G FWA CPE will decline from around $475 in 2020 to around $180 by the end of 2023 (Figure 2).

5G chipsets will see the biggest price declines, helped in large part by increasing volumes of 5G smartphones, but also by a growing ecosystem of 5G modems, gateways, tablets, cars, and other products reliant on 5G networks for WAN connectivity. Currently, 5G SoCs are roughly 4x the cost of 4G SoCs. But we have seen this played out before in the early stages of 4G network and device rollouts when the cost of chips dropped quickly as device volumes increased.

Similarly, the cost of WiFi 6 chips remains about 15-20% higher than WiFi 5 units. While WiFi 6 will be the primary technology for mature, highly competitive markets, WiFi 5 will remain an important option for very price-sensitive markets, particularly those in developing countries and in rural markets where competition comes from lower-cost services. But as enterprise and higher-end residential gateways are built with WiFi 6 technology, the cost of those chips will decline significantly over the next couple of years.

Beyond these two major components, manufacturing costs will also decline as equipment and contract manufacturers increase volumes based on initial board and hardware designs. FWA gateway designs, like higher-end residential WiFi access point designs, are well-understood at this point. However, with any new product spin, there is a learning curve for the manufacturers. Though the cost of producing the first few thousand units is high, the costs quickly decrease as the manufacturing process becomes clearly defined and as new iterations of the devices incorporate lower-cost components.

There are two critical components for the steady reduction in cost for 5G FWA CPE: Increased orders and volumes from service providers, along with the cooperation among providers of 4G CPE devices and 5G units to understand how to bring down the costs as quickly as possible. This cooperation will be necessary to stimulate interest among service providers, who can then drive the volumes necessary to improve the overall economics of delivering 5G fixed wireless services.

5G FWA Will Build on 4G Deployments:

Though the deployment of FWA services using 4G LTE networks has been moderately successful around the world, 5G will dramatically boost the addressable market of subscribers, as well as the service’s ability to reasonably compete with most fixed broadband technologies. 5G can comfortably deliver downstream speeds that compare favorably with VDSL and DOCSIS 3.0 services while easily beating previous generations of both fixed technologies. More importantly, C-band and millimeter wave technologies promise to be comparable with DOCSIS 3.1 and fiber services, thereby expanding the addressable market of subscribers even further.

Mobile operators around the world who have previously been unable to compete with fixed broadband providers, as well as fixed broadband providers looking to expand the reach of their services more quickly, are all enthusiastic about the opportunity in front of them with FWA. Their growing commitment to the service, as well as a rapidly expanding vendor ecosystem for customer devices, will help to quickly reduce the cost of those devices, thereby ensuring a faster ROI for service providers and a willingness to expand their reach even further.

ABI Research and Mobile Experts: Fixed Wireless Access CAGR >=70%

ABI Research and Mobile Experts forecast that 5G FWA connections will increase at a compound annual growth rate of 71% and “over 70%,” respectively.

Fixed Wireless Access (FWA) will be among the most valuable use cases for LTE and 5G network operators, according to two new reports that predict compound annual growth rates in excess of 70%.

- ABI Research expects global 5G fixed wireless access to exceed 58 million residential subscribers by 2026.

- Mobile Experts predicts 5G fixed wireless access to serve 66.5 million customers by 2026.

FWA is a decades-old technology (that’s how WiMAX was deployed), but its prominence and rate of growth grew substantially during the last year amid the ongoing COVID-19 pandemic, which has forced billions of people worldwide to stay home (“shelter in place”).

Image Credit: Upward Broadband

…………………………………………………………………………………..

ABI Research:

Remote working, online learning, e-commerce, and virtual healthcare drove high-speed broadband demand throughout 2020. The significant increase in the use of internet-based home entertainment such as video streaming and online gaming also pushed existing broadband users to upgrade their broadband service to a higher-tier package, while households without broadband access signed up for new subscriptions.

“Increasing adoption of internet-connected devices, smart TVs, and smart home devices, as well as consumers’ media consumption through internet applications, will continue to drive high-speed broadband adoption in the years to come. In addition, many businesses are allowing remote working for some of their employees after the pandemic, which will boost the need for home broadband services even further,” explains Khin Sandi Lynn, Industry Analyst at ABI Research.

FWA will be the fastest-growing residential broadband segment, forecast to increase at a CAGR of 71%, exceeding 58 million subscribers in 2026.

As residential broadband penetration saturates mature markets, competition among broadband operators is likely to create challenges to maintain market shares. “In addition to network upgrades, broadband operators need to invest in cutting-edge software and hardware to optimize network performance and support better user experiences. Providing advanced home networking devices, internet security, and home network self-diagnosis tools can help service providers reduce churn and improve average revenue per user,” Lynn concluded.

……………………………………………………………………………….

Mobile Experts:

Mobile Experts forecasts the number of global fixed wireless access connections will more than double to 190 million by 2026. FWA services grew almost 20% yearly to over 80 million in 2020—Mobile Experts sees that number rocketing to almost 200 million by 2026. Around 8-11% of FWA connections over the next five years will be served via proprietary technology primarily deployed by small operators.

FWA equipment sales, including IEEE 802.11 based proprietary, LTE, and 5G CPE revenue, are projected to grow from $4.0 billion this year to over $5.5 billion in 2026. Meanwhile, the proprietary equipment market, including both access point and CPE sales, is expected to stay elevated around $880–$940 million per annum over the next five years.

“Large mobile operators will leverage LTE and 5G for FWA services, and we expect the 5G mm-wave will become a key aspect of their long-term FWA plans—especially in ‘fiber-rich’ markets in the APAC region. That said, large and small operators will benefit from government funding to help build out hybrid fiber plus FWA networks for the next 5-10 years,” said Principal Analyst Kyung Mun.

This report includes 41 charts and diagrams, including a five-year forecast illustrating the growth of the market for infrastructure and customer premise equipment and fixed wireless access connections by technology. Key details such as technical breakdowns, equipment revenue, and market shares are included.

………………………………………………………………………………………..

References:

https://www.mobileexperts.org/reports/p/virtual-mobile-networks-pt3na-zrw9g

https://www.sdxcentral.com/articles/news/5g-fixed-wireless-rides-pandemic-related-shift/2021/08/

Verizon makes 5G Business Internet (FWA) available in 24 U.S. cities

Verizon Business plans to expand its 5G Business Internet fixed-wireless connectivity offering to 21 new U.S. cities this month. The service uses Verizon’s 5G Ultra Wideband technology as its connectivity backbone. Offerings include 100, 200, and 400 Mbps plans serving large companies and SMEs, with no data limits. Verizon said it will also give a 10 year price lock for new customers, no long-term contract required.

- Verizon 5G Business Internet is now available for businesses of all sizes in 24 U.S. cities.

- The fixed-wireless offering is an alternative to cable, with multiple pricing and service options and no data limits.

- Verizon offers a price lock for 10 years, no long-term contract required, and professional installation included.

- According to the Verizon 5G Business Report, business decision-makers largely agree that 5G will create new opportunities for their company (80%), their industry (79%), and their role (79%).

“As 5G Business Internet scales into new cities, businesses of all sizes can gain access to the superfast speeds, low latency and next-gen applications enabled by 5G Ultra Wideband, with no throttling or data limits,” said Tami Erwin, CEO of Verizon Business. “We’ll continue to expand the 5G Business Internet footprint and bring the competitive pricing, capability, and flexibility of our full suite of products and services to more and more businesses all over the country.”

The service launched on April 15th in parts of Anaheim, Atlanta, Cincinnati, Cleveland, Dallas, Denver, Detroit, Indianapolis, Kansas City (Missouri), Las Vegas, Miami, Minneapolis, Phoenix, Sacramento, Salt Lake City, San Diego, San Francisco, San Jose, St Louis, and St. Paul. Parts of Riverside-Corona (California) will become available on 22 April. The service previously launched in parts of Chicago, Houston and Los Angeles. Additional cities will be announced on a rolling basis.

Additional information about this offer and 5G Business Internet pricing, availability, service and more is available here. In addition, where 5G Business Internet is not yet available, Verizon offers LTE Business Internet to keep Verizon customers covered.

The launch comes at a time when business decision-makers are coming face to face with the transformational potential of 5G. According to a recent Verizon Business survey conducted in partnership with Morning Consult, seven in 10 decision-makers (69%) believe 5G will help their company overcome the negative impact of the COVID-19 pandemic, nearly half (48%) said their companies have already provided or are planning to provide a 5G-capable smartphone or device to employees within the next six months, and approximately eight in 10 agree that 5G will create new opportunities for their company (80%), their industry (79%), and their role (79%).

…………………………………………………………………………………………………………………………………..

References:

https://www.verizon.com/about/news/verizon-business-5g-business-internet-21-us-cities

https://www.rcrwireless.com/20200522/carriers/verizon-5g-virtual-lab-mmwave-amplification