Fixed Wireless Access (FWA)

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

Introduction:

According to JC Market Research, the 5G fixed wireless access (FWA) market was valued at US $296 million in 2021. In a new report ““Worldwide 5G Fixed Wireless Access (FWA) Industry Analysis,” the market research firm forecasts that global 5G FWA rеvеnuе will rеасh а vаluе оf UЅ$ 21,710 million іn 2029. That’s a remarkable CAGR of 65.6% over the forecast period.

Yesterday, we posted an article on South Africa’s Telkom deploying 5G FWA before 5G mobile and it appears that 5G FWA is a stronger use case than 5G mobile.

Glоbаl 5G Fixed Wireless Access (FWA) Industry Dуnаmісѕ:

In many of smart cities, 5G IoT will be the technology of choice for niche applications. Smart cities, with applications such as HD cameras to monitor safety, Smart energy, such as smart grid control, smart security, including the provision of emergency services and connected health, such as mobile medical monitoring is possible with the help of 5G networks. Advanced sensing for environmental monitoring can be done using this module.

The increasing adoption of connected devices such as smartphones, laptops, and smart devices in several commercial and residential applications such as distance learning, autonomous driving, multiuser gaming, videoconferencing, and live streaming, as well as in telemedicine and augmented reality, is expected to generate the demand for 5G fixed wireless access solutions to achieve extended coverage.

Global 5G Fixed Wireless Access (FWA) Industry Analysis Маrkеt Drіvеrѕ Rеgіоnаl Ѕеgmеntаtіоn аnd Аnаlуѕіѕ:

Rеgіоn-wіѕе ѕеgmеntаtіоn in the global 5G fixed wireless access (FWA) industry іnсludеѕ North Аmеrіса, Еurоре, Аѕіа Расіfіс, Ѕоuth Аmеrіса, аnd the Міddlе Еаѕt & Аfrіса. North Аmеrіса ассоuntѕ for hіghеѕt rеvеnuе ѕhаrе in the global 5G fixed wireless access (FWA) industry analysis market, аnd іѕ рrојесtеd tо rеgіѕtеr а rоbuѕt САGR оvеr thе fоrесаѕt реrіоd. While serving rural markets and developing nations is still a costly proposition, governments around the globe stand ready to provide aid. In the USA, phase two of the Connect America Fund (CAF) is supporting broadband initiatives in underserved communities. The connecting Europe Broadband fund is performing a similar role for underserved populations in EU member countries.

The report also indicated that North Аmеrіса, Еurоре, Аѕіа Расіfіс, Ѕоuth Аmеrіса аnd the Міddlе Еаѕt & Аfrіса as FWA market leaders.

JC Market Research is not the only research firm exploring the potential growth of the FWS market; ABI Research forecasts that the total number of FWA subscriptions will grow from 81 million globally in 2021 to slightly over 180 million in 2026, representing a Compound Annual Growth Rate (CAGR) of 17%. Consequently, ABI Research believes that global FWA Customer Premises Equipment (CPE) shipments will reach 47 million annually by 2026, with 5G FWA CPE making up the majority of shipments by the same year.

References:

https://jcmarketresearch.com/report-details/1538805/discount

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile

5G fixed wireless access market to reach $22 million in 2029: Report

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile

South African telecommunications operator Telkom [1.] has launched its 5G high speed Internet network using technology from China’s Huawei Technologies. The partially state-owned operator said it will initially use the network to provide fixed wireless Internet via 5G rather than focusing on mobile 5G.

“At launch Telkom will primarily focus on providing super fast 5G fixed wireless access solutions, as the demand for mobile 5G increases, we will supplement this with suitable mobile propositions,” Telkom Consumer and Business CEO Lunga Siyo explained.

Note 1. Telkom is South Africa’s third largest network operator with 17.6 million users in the third quarter of 2022, according to statistics from market research company Omdia. Vodacom remains South Africa’s largest operator with over 52 million users while MTN has about 36 million customers.

……………………………………………………………………………………………………………………………………………

Telkom joins its competitors Vodacom, MTN and Rain in the quest to provide high speed Internet in South Africa. Data-only network Rain rolled out its 5G services in 2019 and Vodacom and MTN followed with commercial launches in 2020.

Telkom said it will use its 125 5G base stations located in the provinces of Gauteng, KwaZulu-Natal, Eastern Cape and Western Cape at launch.

The telco’s managing executive Lebo Masalesa said the company is rolling out 5G nationally and in smaller towns, with the intention to build network where it is needed.

“Once there is a greater proliferation of 5G capable mobile devices on Telkom’s network, it will launch 5G services for mobile users,” he added.

“5G stands head and shoulders above 4G and LTE through faster and more reliable connection it provides, however it was critical for us to make sure that our existing 4G ecosystem remains strong whilst introducing 5G into the market,” continued Siyo.

The South African network operator invested 2.1 billion South African rand (US$116 million) for 42MHz of frequencies in the spectrum auction by the Independent Communications Authority of South Africa (ICASA), supporting its network upgrades.

“The COVID pandemic has driven significant lifestyle changes for South Africans, due to work from home or school from home, online shopping and an ‘always on’ kind of culture,” said Fortune Wang, Carrier Business Director for Huawei South Africa.

“At launch Telkom will primarily focus on providing super fast 5G fixed wireless access solutions, as the demand for mobile 5G increases, we will supplement this with suitable mobile propositions,” said Lunga Siyo, chief executive officer of Telkom Consumer and Business.

Shunned in the global north due to security concerns, which Huawei has denied, the Chinese company dominates in Africa as a supplier of equipment to many telecoms operators.

Telkom SA’s commercial 5G rollout comes on the back of Safaricom in Kenya making a similar announcement last week about a focus on retail and enterprise customers for 5G rather than mobile, as it launched its 5G Internet service following trials that started in March 2021.

Furthermore, the commercial 5G launch comes after MTN walked away from talks to acquire Telkom. The talks between the two companies stalled when the data-only network operator Rain offered its network up to Telkom SA to acquire, in a move that stood in the way of MTN’s plans to buy Telkom.

References:

https://www.euronews.com/next/2022/10/27/telkom-sa-huawei-tech-5g

Juniper Research: 5G Fixed Wireless Access to Generate $2.5 Billion in Operator Revenue by 2023

Global telco revenues from 5G Fixed Wireless Access (FWA) will rise from $515 million in 2022 to $2.5 billion next year, according to a new report from Juniper Research. FWA includes services that provide high-speed Internet connectivity through cellular‑enabled CPE (Customer Premises Equipment) for uses including broadband and IoT networks.

The research predicts that operators’ 5G FWA revenue will reach $24 billion globally by 2027. It identified the consumer market as the sector generating the highest revenue for network operators, representing 96% of global 5G FWA revenue. However, it warns that operators must provide a compelling user proposition for FWA solutions through the bundling of services such as video streaming, gaming and smart home security to enrich user experience and gain competitive advantage against incumbent high‑speed connectivity technologies, such as FTTP (Fibre‑to‑the‑Premises).

| Key Market Statistics | |

| Market size in 2022: | $515m |

| Market size in 2023: | $2.5bn |

| 2022 – 2027 Market Growth: | 480% |

Juniper Research author Elisha Sudlow-Poole remarked: “The benefits of FWA are now comparable with services using fibre-based networks. Operators have an immediate opportunity to generate revenue from broadband subscriptions directly to end users by providing last-mile solutions underpinned by their existing 5G infrastructure.”

Juniper Research notes that the increase in 5G subscribers will be driven mainly by “the accelerating migration of cellular subscriptions to 5G networks, owing to operator strategies that minimize or remove any premium over existing 4G subscription offerings,” and that 600 million additional 5G subscriptions are expected be created next year, “despite the anticipated economic downturn in 2023.”

The report predicts that the growth of 5G networks will continue, and over 80% of global operator‑billed revenue will be attributable to 5G connections by 2027. The telecommunications industry demonstrated its robustness against the impact of the COVID-19 pandemic, and the report forecasts that the growth of 5G will also be resilient against this economic downturn due to the vital importance of mobile Internet connectivity today.

Juniper Research co-author Olivia Williams noted: “Despite the growth of the Internet of Things, revenue from consumer connections will continue to be the cornerstone of 5G operator revenue increase. Over 95% of global 5G connections in 2027 will be connected personal devices such as smartphones, tablets and mobile broadband routers.”

Private 5G Networks Represent a Key Opportunity for Operators:

In addition, the report predicts that the ability of standalone 5G networks to offer ‘network slicing’ will act as the ideal platform for the growth of 5G private network revenue. 5G Standalone (SA) uses 5G core networks supporting network slicing technology, which can be used to take a ‘slice’ of public 5G infrastructure and provide it to private network users. In turn, this helps mitigate the cost of private 5G network hardware and increase its overall value proposition, all against a background of deteriorating macro-economic conditions.

The report recommends that operators use 5G FWA to facilitate the last mile-solution by treating the relationship between FWA and fibre networks as wholly collaborative to maximize network performance and return on investment.

References:

https://www.juniperresearch.com/whitepapers/how-operators-will-capitalise-on-5g-fixed-wireless

5G Service Revenue to Reach $315 Billion Globally in 2023 | TelecomTV

CCA Conference: U.S. Regional Carriers Deploying 5G, actively looking at Fixed Wireless+ CTIA on 5G

Competitive Carriers Association (CCA) conference :

Small and regional carriers are taking different approaches to 5G and fixed wireless, said Eric Boudriau, Ericsson North America head-customer unit regional carriers, at the Competitive Carriers Association (CCA) [1.] conference on September 28th in Portland, OR. “Everybody starts from a different position,” he said. Fixed wireless is “really, really accelerating” in the U.S. and internationally, he said. Other executives stressed the importance of addressing federal infrastructure rules to better fund wireless. The discussion was streamed live from Portland, Oregon.

Note 1. CCA was founded in 1992 by nine rural and regional wireless carriers as a carrier centric organization. Since its founding, CCA has grown to become the nation’s leading association for competitive wireless providers serving all areas of the United States.

Alaska’s GCI deployed 5G in its first market in the spring of 2020, in the middle of the COVID-19 pandemic, said John Myhre, vice president-wireless technology. “We’ve done very well,” he said. “We are continuing to roll out 5G as we roll through different markets.” GCI hasn’t decided what spectrum bands it will use for a fixed-wireless offering, Myhre said. “As a fixed and mobile provider, we have options,” he said. “It’s making sure that we fit the market and the requirement against the technology, not try to force it. In Alaska, everything is just really big. Any project that we do is a big project.” GCI is laying fiber to reach the Aleutian Islands, he noted, in a $58 million project requiring more than 800 miles of undersea cable to reach rural markets.

“We are actively looking at fixed (wireless),” with trials to start in the next 18 months, he said. Wisconsin-based Cellcom launched 5G in February, said CEO Brighid Riordan. The carrier is deploying some fixed wireless using 4G and citizens broadband radio service spectrum and has found the roll out challenging, she said. “We love our trees in Wisconsin, we love the lakes,” she said. “When there’s a valley, when there are trees, it provides a challenge,” she said. Small carriers need government funding to reach some markets, Riordan said. “If it were easy to provide broadband to every rural person in America, it would already be done,” she said: “There’s not necessarily a business case for these very rural customers.”

UScellular is still deploying 5G, market-by-market, said Rebecca Thompson, vice president-government affairs. The carrier started with high-band, she said. “As we get access to some more of our mid-band spectrum we’ll have a much more robust 5G product in the future,” she said. When the provider will get some of its licenses remains to be determined. “There’s some clearing and coordination … and we will still have to actually get the licenses for some of that spectrum,” she said. Mid-band “has proven to really help with geographic reach in a cost effective way” and “is really critical to deploy in rural areas,” The “good news” is fixed wireless is “mature — it’s ready, it’s reliable, it’s offering speeds that people want at home,” Thompson said. It shouldn’t be a foregone conclusion” that the NTIA’s broadband, equity, access and deployment program won’t fund fixed wireless, she added.

UScellular wants to see “less of the thumb on the scale” favoring fiber, she said. Federal funds so far are biased toward fiber and the wireless industry has to fight for more neutral rules for making awards, Boudriau said. Fixed wireless may see the most deployment “where the government isn’t involved,” Myhre said: “We have areas where we may not get funding, but we still have a need.”

References:

https://www.cca-convention.org/

https://www.ccamobile.org/about-cca#AboutUs

…………………………………………………………………………………………………………………………………………………………………………………………………..

CTIA at MWC-Las Vegas:

CTIA President Meredith Baker said Wednesday at the start of the Mobile World Congress in Las Vegas. “We’re here to talk about what 5G is,” she said: “5G is innovation. 5G is competition, and most importantly, 5G is here.”

Baker said the wireless industry needs “the right policies” from the government. “Take C band as proof,” she said. “Turning on a portion of that spectrum saw speeds increase up to 50%, and that was 100 MHz. Imagine what 150 or 200 more could do. Well, we shouldn’t have to imagine. … We need more mid-band — licensed mid-band in large contiguous blocks.” The wireless industry also needs Congress to extend the FCC’s auction authority, set to expire Friday, and designate more bands for auction, she said.

Baker also discussed the importance of fixed wireless. “For many Americans, the first 5G killer app is home broadband,” she said. “The fastest growing broadband provider is now a wireless company,” she said. U.S. wireless carriers already offer fixed service to 70 million homes, she noted.

More than 300 million AT&T customers are covered by 5G, all of the company’s major handsets support the new generation of wireless “and we’ve got business models being created,” said David Christopher, executive vice president-business development and strategic alliances. “But it is early days,” he said. Christopher spoke with Recon Analytics’ Roger Entner.

“We’re two years in,” Entner responded: “At this point in the 4G period we still thought that sending pictures was the killer app for 4G. We were wrong.” Deploying a new G “is not a 100-meter dash,” he said. “This will take years.”

“There’s a very good chance that we don’t know what the killer app for 5G is,” Christopher said. Augmented reality and the massive IoT will be important. The median speeds of 5G are already four times that of 4G two years ago, he said: “Latency is a stickier wicket. … It’s something that will certainly get better.” In some cases, better speed is “masking” the need for improved latency, he said.

Reference:

https://communicationsdaily.com/article/view?search_id=595619&id=1374622

Juniper Research: 5G Fixed Wireless Access (FWA) to Generate $2.5 Billion in Global Network Operator Revenue by 2023

According to Juniper Research, the revenue generated by telecom operators from 5G fixed wireless access (FWA) services is expected to increase by 480 percent between 2022 and 2023, from $515 million to $2.5 billion. Broadband and Internet of Things (IoT) networks are just two examples of the usage of FWA services, which offer high-speed Internet connectivity using cellular-enabled CP (Customer Premises Equipment).

According to the research company, 5G FWA revenue for telecom operators will total $24 billion globally by 2027. This increase is attributed to 5G’s advanced capabilities, such as ultra-low latency and increased data processing, which enables it to offer connectivity services that were previously impossible with 4G technology. The company predicted that, with 96% of total sales coming from the consumer market, operators would earn the most money.

A compelling user proposition for FWA solutions must be provided by telcos through the bundling of extra services like video streaming, gaming, and smart home security, according to Juniper Research. This will enhance user experience and give telcos a competitive edge over technologies like FTTP (fiber to the property).

The advantages of FWA are now on par with those of services provided by fiber-based networks. By offering last-mile solutions supported by their current 5G infrastructure, operators have an immediate chance to make income from internet subscriptions directly to end customers, according to research author Elisha Sudlow-Poole.

The Juniper Research survey also recognized private 5G networks as a significant monetization prospect, giving superior network capabilities to 4G. According to the research company, smart manufacturing, shipping ports, and airports are the most likely sectors where telcos would implement 5G FWA. In order to maximize return on investment, it also advises operators to collaborate with fiber optic networks in conjunction with 5G FWA to facilitate the last mile solution.

Juniper Research asserted operators should bundle services including video streaming, gaming and smart home security into their FWA offerings to better compete with FTTP. The company cited private networks as a key revenue opportunity for operators due to the superior network capabilities compared with 4G. Smart manufacturing, shipping and airports are also key use cases.

Juniper Research also indicated operators should use 5G FWA to provide last mile connectivity, by treating it as a collaborative effort with fibre networks to maximize performance and return on investment. Recent GSMA Intelligence research showed 83 operators across 29 countries have launched FWA.

Juniper Research author Elisha Sudlow-Poole concluded by saying:

“The benefits of FWA are now comparable with services using fiber-based networks. Operators have an immediate opportunity to generate revenue from broadband subscriptions directly to end users by providing last-mile solutions underpinned by their existing 5G infrastructure.”

……………………………………………………………………………………………………………………………………………………………………………………………

References:

5G Fixed Wireless Access Forecasts Report 2022-27: Share, Size (juniperresearch.com)

https://www.juniperresearch.com/whitepapers/how-operators-will-capitalise-on-5g-fixed-wireless

Juniper Research backs 5G FWA for growth spurt – Mobile World Live

AT&T remains a fiber first network provider with FWA in rural areas

AT&T remains a fiber-first broadband broadband network provider. The carrier’s CFO Pascal Desroches told investors that the most likely instance for AT&T to use FWA (fixed wireless access) would be in rural areas where deploying fiber could prove too costly.

“We think in certain instances FWA makes sense,” Desroches said during an interview at this week’s Bank of America Media, Communications, and Entertainment Conference, according to a transcript. “If you’re in a rural area where it does make – where the economics don’t pan out for fiber, fixed wireless will be an interesting solution.”

AT&T’s transition end game is predicated on the carrier’s belief that fiber is a better long-term solution for customers and its operations. Desroches explained that FWA extracts a “very expensive” toll on the carrier’s mobile operations.

“Long term, we don’t believe it will be good enough,” Desroches said of FWA. “And that’s why we think it is really important to start to place our bets now with fiber because by the time fiber becomes the only acceptable solution, it will be too late to start to build out because of the long lead times.”

Editor’s Note: This is what investors are missing about AT&T – it’s growing fiber footprint (#1 in the U.S.) which is probably the biggest growth area in all of telecom!!!

…………………………………………………………………………………………………………………………………………………….

“With connectivity increasing at what we estimate will be a fivefold increase between 2021 and 2025, fiber will be the solution of choice. And given the long lead times, the long payback periods, if you decide you want to do fiber 4 to 5 years from now, it’s too late. And this is why we think we are building a strategy for long-term sustainable earnings with the best possible technology.”

To support that need, AT&T recently signed a long-term deal with fiber builder Corning, which is using that deal as the basis to build a new cable manufacturing facility in Gilbert, Arizona. AT&T also formed a “Fiber Optic Training Program” with Corning targeted at training 50,000 people to design, install, and maintain fiber networks.

“This investment is a significant step forward for our country and building world-class broadband networks that will help narrow the nation’s digital divide,” AT&T CEO John Stankey noted in a statement tied to the Corning deal. “This new facility will provide additional optical cable capacity to meet the record demand the industry is seeing for fast, reliable connectivity.”

“The market demand remains really healthy. We’re continuing to see good demand for subscriber — for new subscribers coming into the service. And also, look, our churn levels are at really low levels. You look at all that together, we have a mobility business now that we expect service revenues to grow 4.5% to 5%. And we expect profitability to accelerate in the back half of the year. So all indications are green and that we are performing really well.”

“We’re going to be competitive. For years, AT&T was not competitive, and we’re going to be competitive, and we’re capitalists. At the end of the day, if there are opportunities to grow subscribers in a more efficient way, we’re going to seize those. But at the same time, we’re no longer going to be the share donor to the industry.”

“We have relationships with virtually over 90% of the Fortune 1000. And it’s a core competency that we have, and it’s one that has served us well. But it is very much in transition, and we’re — what we have to do is to grow our small, mid-business connectivity solutions.”

“There will be a very attractive market for 5G-enabled IoT solutions. There is — it will come. It is nascent today. It will come and the relationships that we have among the Fortune 1000 is critical to — is critical in serving — in helping exploit that opportunity. And again, our wireless relationships. The big part of the growth in wireless is also the ability to surgically attack our enterprise base and partner with different organizations to really drive increased subscriber adoption.”

References:

Corning to Build New Fiber Optic Plant in Phoenix, AZ for AT&T Fiber Network Expansion

AT&T continues to add customers in key focus areas- 5G and fiber

AT&T added 813K mobile postpaid subscribers & >300K net fiber subs during 2Q-2022

June 2022 Ericsson Mobility Report: 5G subscriptions increased by 70 million in Q1-2022 to reach 620 million

Ericsson new Mobility Report [1.] states that mobile network data traffic grew 10% between the 4th quarter of 2021 and the 1st quarter of 2022. For the year-over-year comparison, growth reached 40%. “In absolute numbers, this means that it has doubled in just two years (since Q1 2020),” the company wrote in its Mobility Report, released June 20th. “Over the long term, traffic growth is driven by both the rising number of smartphone subscriptions and an increasing average data volume per subscription, fueled primarily by increased viewing of video content,” the company added.

The figures are important considering that mobile network operators are rushing to add new spectrum to their networks while upgrading their networks to support 5G, especially 5G SA Core Network. Purchasing both spectrum and 5G equipment is expensive. In the US, for example, mobile network operators are collectively spending an estimated $275 billion to improve their networks with more spectrum, cell sites and 5G.

Note 1. The Ericsson Mobility Report started in 2011, when Ericsson decided to share data and insights openly to all those interested in understanding our industry’s development. Since then, the report and featured articles have seen a continuous evolution and an expanding scope.

………………………………………………………………………………………………………………………………………………………………………………………………………….

Speaking during a webinar to discuss the report’s findings, Richard Möller, senior market analyst at Ericsson, noted that the number of 5G subscribers worldwide had been expected to reach 660 million by the end of 2021. It now seems that the figure was less than forecast: Ericsson is now saying that 5G subscriptions increased by 70 million in Q1 2022 to reach 620 million. The 40 million shortfall is due to changes in how China’s mobile operators are reporting their 5G subscriber figures. Indeed, it has become noticeable over the past year that the Chinese operators are starting to split out “5G package customers” from actual 5G network customers.

“Now we have official numbers and we’ve adjusted our estimates accordingly,” Möller said. “China is early and so large that it affects the global number.” He noted that this adjustment does not “materially affect” the five-year growth forecast. Ericsson is therefore sticking to its estimate of 4.4 billion 5G subscribers by the end of 2027, meaning that 5G will account for almost half of all mobile subscriptions by that point. 5G subscriber growth is expected to accelerate in 2022, reaching around one billion subscribers by the end of the year. The report noted that North America and North East Asia currently have the highest 5G subscription penetration, followed by the Gulf Cooperation Council countries and Western Europe. In 2027, it is projected that North America will have the highest 5G penetration at 90%. In India, where 5G deployments have yet to begin, 5G is expected to account for nearly 40% of all subscriptions by 2027.

At the same time, Möller warned that the war in Ukraine, supply chain constraints and rising inflation will affect future growth. “That’s made us take 100 million subscriptions off the current forecast. However, history has shown that mobile telephony is one of the things that people hang on to … even if the economic world turns negative,” he said.

The report’s executive editor Peter Jonsson said the current uncertainties mean that Ericsson has to be especially careful with its forecasts. However, he reiterated the point that global 5G uptake “is about two years ahead of 4G” on a comparative basis. In addition, 5G rollout “reached 25% of the world’s population about 18 months faster than 4G.”

Global mobile network data traffic and year-over-year growth:

According to Ericsson, mobile subscribers are making use of the additional network capacity and faster speeds provided by those investments. The company said that, globally, the average smartphone user is expected to consume 15GB per month in 2022. Indeed, the 5G share of mobile data traffic is growing, but not as fast as FWA (3G/4G/5G). Continued strong smartphone adoption and video consumption are driving up mobile data traffic, with 5G accounting for around 10 percent of the total in 2021.

In North America, the company estimated that average monthly mobile data usage per smartphone could reach as high as 52GB in 2027. “The data traffic generated per minute of use will increase significantly in line with the expected uptake of new XR and video-based apps,” the company wrote. “This is due to higher video resolutions, increased uplink traffic, and more data from devices off-loaded to cloud compute resources.”

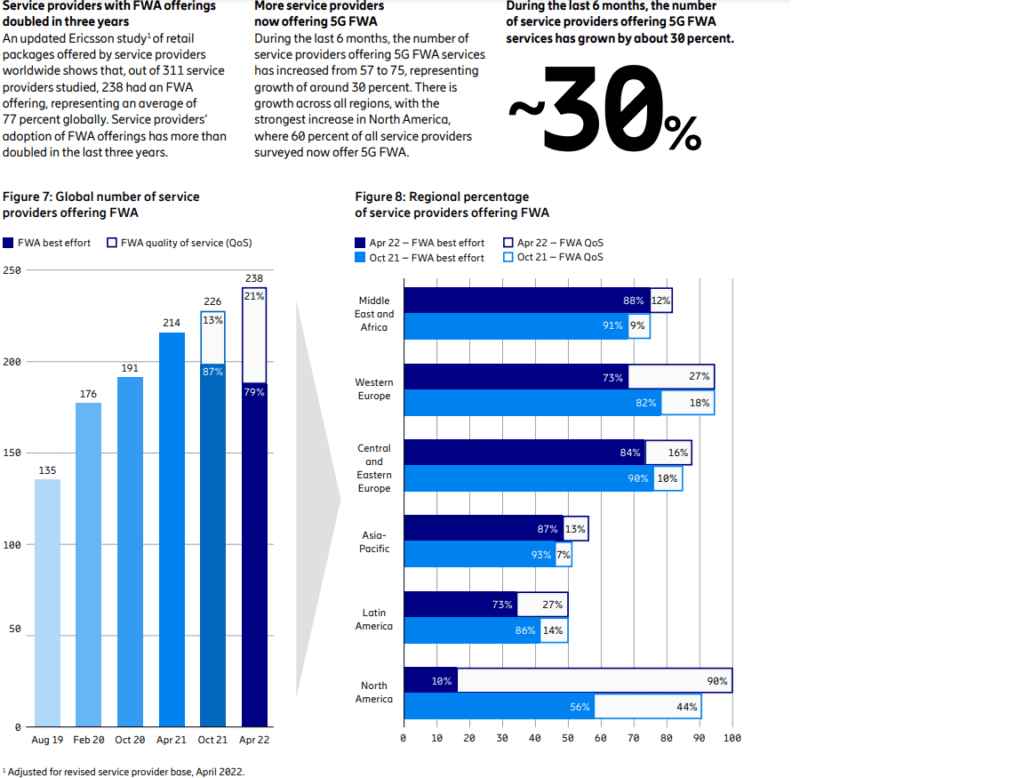

Also, Fixed Wireless Access (FWA) in on the rise as per this graphic:

Over 100 million FWA connections in 2022:

More than 75 percent of service providers surveyed in over 100 countries are offering fixed wireless access (FWA) services. Around 20 percent of these service providers apply differential pricing with speed-based tariff plans.

OpenVault, another vendor that tracks data traffic on wired networks in North America, recently reported similar findings. According to OpenVault, the average wired Internet customer consumed a total of 536.3GB in the fourth quarter of 2021, an increase of 165% over the firm’s findings from the fourth quarter of 2017, when consumption was 202.6GB.

Taken together, the companies’ findings paint a picture of a dramatic expansion in data demand on wired and wireless networks in North America and globally. Indeed, such increases have already sparked unprecedented demand in vendors’ networking equipment to keep pace with demands. Further, such demand has already withstood several price increases among many leading vendors.

The situation reflects the importance of telecom networks globally following a pandemic that pushed many to work and school remotely from home. And in response to the situation, governments globally have begun pushing network operators to construct networks in underserved areas, and to Internet users themselves who may struggle to afford such connections.

References:

https://www.ericsson.com/en/reports-and-papers/mobility-report

https://www.lightreading.com/5g/china-effect-dampens-interim-5g-subs-says-ericsson/d/d-id/778394?

https://www.ctia.org/the-wireless-industry/the-5g-economy

Will 2022 be the year for 5G Fixed Wireless Access (FWA) or a conundrum for telcos?

https://viodi.com/2020/05/05/openvault-broadband-usage-47-in-q1-2020-power-users-are-the-new-normal/

IBD – Controversy over 5G FWA: T-Mobile and Verizon are in; AT&T is out

Two of the three biggest U.S. telecom network providers, T-Mobile US and Verizon Communications, contend that selling 5G FWA (Fixed Wireless Access) broadband services to homes will prove to be a good business. However, AT&T has no plans to make a big push into that space. We wrote about this topic earlier this year, but it remains a conundrum as debate continues.

Whether these 5G FWA services will heat up broadband competition with cable TV companies — who dominate in high-speed internet services — is a controversial issue for telecom stocks. The fixed 5G wireless services also may compete with local phone companies in areas still served by copper line-based “DSL” services.

“Verizon and T-Mobile think the service can be a growth driver and will have attractive economics,” UBS analyst John Hodulik told Investor’s Business Daily (IBD). “FWA (fixed wireless access) is likely to do better where there are limited options for broadband and among subscribers used to lower speeds, so that means legacy DSL subscribers and slower speed cable. The big question is whether FWA has staying power over the next 5 to 10 years given necessary speed increases.”

AT&T has downplayed the potential of fixed 5G wireless. AT&T contends that as data usage surges over time, FWA will become increasingly uneconomic vs. fiber-optic landline alternatives.

“I think it stems from a genuinely different view of the engineering and capacity constraints,” MoffettNathanson analyst Craig Moffett told IBD. “The divergence in views about fixed wireless access between AT&T and Verizon or T-Mobile speaks to a genuine controversy in the telecom industry.” Craig added that telecom companies are scrambling to make money from huge investments in 5G radio spectrum.

Moffett said: “The renewed appetite for FWA may be a sign of a dawning realization that the gee-whizzy use cases of 5G may never materialize. That could be forcing operators to revisit every possible source of incremental revenue in a bid to earn at least some return on their huge investments in 5G spectrum.”

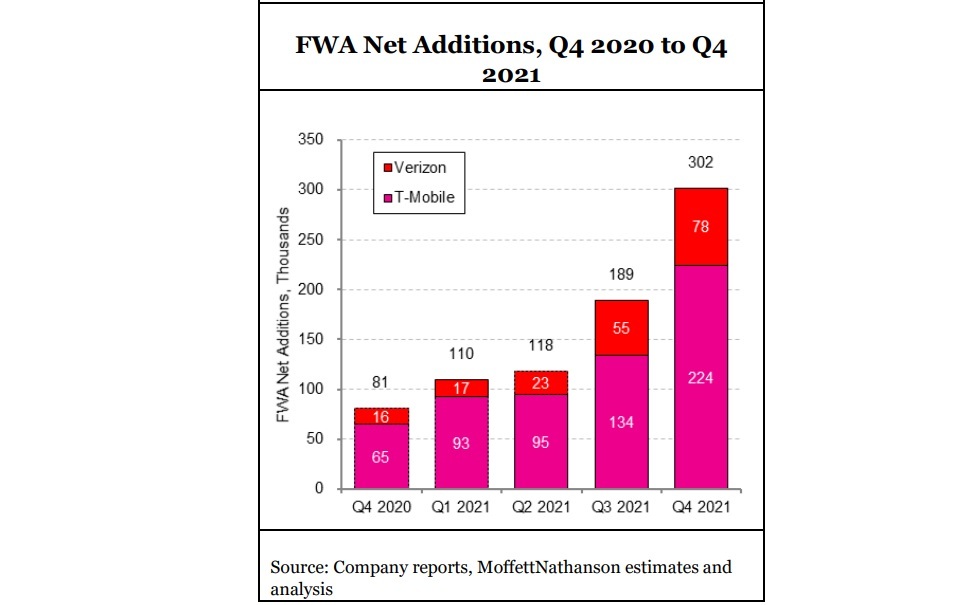

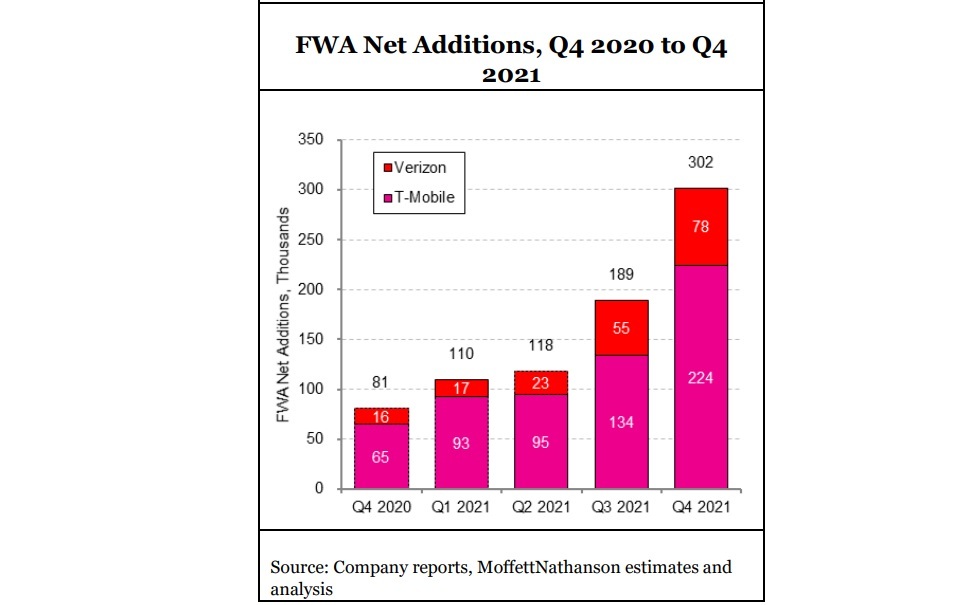

U.S. fixed wireless access (FWA market) captured ~ 38% share of broadband industry net adds in the fourth quarter of 2021. Approximately half of Verizon’s FWA customers are coming from commercial accounts, T-Mobile has indicated that about half its FWA customers are coming from former cable Internet subscribers. FWA’s strong Q4 showing left cable’s flow share at just 66%, about the same as cable’s share of installed US broadband households. “In other words, Cable likely neither gained nor lost share during the quarter, and instead merely treaded water,” Moffett noted. FWA “has gone from low-level background noise to suddenly a major force, with Verizon and T-Mobile alone capturing more than 300K FWA subscribers in the fourth quarter,” Craig noted. However, he isn’t sure that wireless network operators will allocate enough total bandwidth capacity for FWA to fully scale.

In a government auction that ended in early 2021, Verizon spent $45.45 billion on 5G “C-band” airwaves while T-Mobile invested $9.3 billion. AT&T spent $23.4 billion on the auction but it’s putting its 5G investments in areas other than FWA, like industrial 5G applications.

Meanwhile, there are cable TV firms looming with high-speed, coaxial cable. Comcast says it’s not worried about broadband competition from fixed 5G wireless services to homes.

“Time will tell, but it’s an inferior product,” Comcast Chief Executive Brian Roberts said at a recent Morgan Stanley conference. “And today, we can say we don’t feel much impact from (it). It’s lower speeds. And in the long run, I don’t know how viable the technology holds up.”

Cable companies offer hard landlines while 5G wireless services provide high-speed internet to homes mainly via indoor antennae that consumers self-install.

Eighty-seven percent of U.S. households subscribe to an internet service at home, compared with 83% in 2016, according to Leichtman Research Group. Also, cable TV firms comprise 70% of the broadband market, LRG said.

Verizon ended 2021 with 223,000 fixed wireless broadband customers, but most connected via 4G wireless networks. Meanwhile, T-Mobile had 646,000 fixed 5G broadband subscribers.

T-Mobile has told Wall Street analysts it expects to serve in a range of 7 million to 8 million fixed 5G wireless subscribers by 2025. Verizon has projected 3 million to 4 million subscribers over the same period.

T-Mobile charges $50 monthly for its home internet service. Verizon’s pricing starts at $50 or $70 monthly, depending on the data speeds provided. Verizon mobile phone customers with unlimited data plans get a discount.

T-Mobile’s 5G internet to home services provides data speeds up to 115 megabits per second, or Mbps. Verizon plans to provide speeds up to 300 Mbps.

T-Mobile uses mid-band radio spectrum to deliver fixed 5G broadband to homes. Verizon uses a mix of mid-band and high-band radio spectrum. In urban areas, Verizon may be able to deliver higher internet speeds with high-band spectrum, analysts say.

One area of debate remains whether fixed 5G broadband finds more success in suburban/urban markets or in rural areas.

“FWA is definitely a threat to cable companies,” Peter Rysavy, head of Rysavy Research, said in an email. “Particularly with (high frequency) mmWave, 5G can compete directly with cable. Mid-band spectrum is also effective but is best suited for lower density population areas. In these deployments, even T-Mobile limits the number of fixed wireless subscribers it can support in any geographical area.”

At UBS, Hodulik says that even if positioned as a low-end service, fixed 5G broadband still has a potential market of 20 million to 30 million homes.

AT&T, whose forerunner was regional Bell SBC Communications, has a sizable wireline local service area in 22 states. So it will face competition from fixed 5G broadband, just like cable TV firms. Verizon is based mainly in the northeast. T-Mobile doesn’t sell local phone services.

“AT&T has a huge wireline asset base that is only 25% upgraded to fiber,” Oppenheimer analyst Tim Horan told IBD. “So they are very exposed to competition from fixed wireless.”

At an analyst day on March 11, AT&T said it plans to upgrade 50% of its local markets, about 30 million customer locations, to high-speed fiber-optic broadband service by year-end 2025.

Meanwhile, AT&T CEO John Stankey commented on the controversy over FWA. AT&T sees FWA as playing a limited role for mobile small business and enterprise applications as well as in rural areas.

“We’re not opposed to fixed wireless, and I’m sure there’s going to be segments of the market where it’s going to be acceptable and folks are going to find it to be adequate right now,” Stankey said.

Fixed 5G broadband services to homes isn’t the only potential moneymaker for telecom network providers. Verizon, AT&T and T-Mobile aim to upgrade mobile phone users to unlimited data plans. They also plan to sell “private 5G” connections to businesses, Internet of Things (IoT) and 5G connections to industrial devices.

References:

Will 2022 be the year for 5G Fixed Wireless Access (FWA) or a conundrum for telcos?

MoffettNathanson: Robust broadband and FWA growth, but are we witnessing a fiber bubble?

MoffettNathanson: Robust broadband and FWA growth, but are we witnessing a fiber bubble?

According to a new comprehensive, market research report from MoffettNathanson (written by our colleague Craig Moffett), Q4 2021 broadband growth, at +3.3%, “remains relatively robust,” and above pre-pandemic levels of about +2.8%.

Meanwhile, the U.S. fixed wireless access (FWA market) captured ~ 38% share of broadband industry net adds in the fourth quarter of 2021. Approximately half of Verizon’s FWA customers are coming from commercial accounts, T-Mobile has indicated that about half its FWA customers are coming from former cable Internet subscribers. FWA’s strong Q4 showing left cable’s flow share at just 66%, about the same as cable’s share of installed US broadband households. “In other words, Cable likely neither gained nor lost share during the quarter, and instead merely treaded water,” Moffett noted. FWA “has gone from low-level background noise to suddenly a major force, with Verizon and T-Mobile alone capturing more than 300K FWA subscribers in the fourth quarter,” Craig noted. However, he isn’t sure that wireless network operators will allocate enough total bandwidth capacity for FWA to fully scale.

In 2020, a year that witnessed a surge in broadband subs as millions worked and schooled from home, the growth rate spiked to 5%. Here’s a snapshot of the broadband subscriber metrics per sector for Q4 2021:

Table 1:

| Sector | Q4 2021 Gain/Loss | Q4 2020 Gain/Loss | Year-on-Year Growth % | Total |

| Cable | +464,000 | +899,000 | +3.8% | 79.43 million |

| Telco | -26,000 | +21,000 | -0.4% | 33.51 million |

| FWA* | +302,000 | +81,000 | +463.9% | 869,000 |

| Satellite | -35,000 | -35,000 | -6.6% | 1.66 million |

| Total Wireline | +437,000 | +920,000 | +2.8% | 112.95 million |

| Total Broadband | +704,000 | +966,000 | +3.3% | 115.48 million |

| * Verizon and T-Mobile only (Source: MoffettNathanson) |

||||

U.S. broadband ended 2021 with a penetration of 84% among all occupied households. According to US Census Bureau data, new household formation, a vital growth driver for broadband, added just 104,000 to the occupied housing stock in Q4 2021, versus +427,000 in the year-ago period. Moffett said the “inescapable conclusion” is that growth rates will continue to slow, and that over time virtually all growth will have to stem from new household formation.

Factoring in competition and other elements impacting the broadband market, MoffettNathanson also adjusted its subscriber forecasts for several cable operators and telcos out to 2026. Here’s how those adjustments, which do not include any potential incremental growth from participation in government subsidy programs, look like for 2022:

- Comcast: Adding 948,000 subs, versus prior forecast of +1.25 million

- Charter: Adding 958,000 subs, versus prior forecast of +1.22 million

- Cable One: Adding 39,000, versus prior forecast of +48,000

- Verizon: Adding 241,000, versus prior forecast of +302,000

- AT&T: Adding 136,000, versus prior forecast of +60,000

Are we witnessing a fiber bubble?

“The market’s embrace of long-dated fiber projects rests on four critical assumptions. First, that the cost-per-home to deploy fiber will remain low. Second, that fiber’s eventual penetration rates will be high. Third, that these penetration gains can be achieved even at relatively high ARPUs. And fourth, that the capital to fund these projects remains cheap and plentiful.

None of these assumptions are clear cut. For example, there is an obvious risk that all the jostling for fiber deployment labor and equipment will push labor and construction costs higher. More pointedly, we think there is a sorely underappreciated risk that the pool of attractive deployment geographies – sufficiently dense communities, preferably with aerial infrastructure – will be exhausted long before promised buildouts have been completed.

Revenue assumptions, too, demand scrutiny. Cable operators are increasingly relying on bundled discounts of broadband-plus-wireless to protect their market share. What if the strategy works, even a little bit? And curiously, the market’s infatuation with fiber overbuilds comes at a time when cable investors are growing increasingly cautious about the impact of fixed wireless. Won’t fixed wireless dent the prospects of new overbuilds just as much (or more) as those of the incumbents.”

Moffet estimates that about 30% of the U.S. population has been overbuilt by fiber over the past 20 years, and that the number is poised to rise as high as 60% over the next five years. But the big question is whether there’s enough labor and equipment to support this magnitude of expansion. “Our skepticism about the prospects for all of the fiber plans currently on the drawing board is not born of doubt that there is enough labor to build it all so much as it is that the cost of building will be driven higher by excess demand,” Moffett explained. “There are already widespread reports of labor shortages and attendant higher labor costs,” he added.

“The outlook for broadband growth for all the companies in our coverage, particularly the cable operators, is more uncertain than at any time in memory. IMarket share trends are also more uncertain that they have been in the past. Cable continues to take share from the telcos, but fixed wireless, as a new entrant, is now taking share from all players. Share shifts between the TelCos and cable operators are suppressed by low move rates, likely due in part to supply chain disruptions in the housing market. This is likely dampening cable growth rates. In at least some markets, returns will likely be well below the cost of capital,” Moffett forecasts.

References:

U.S. Broadband: Are We Witnessing a Fiber Bubble? MoffetNathanson research note (clients and accredited journalists)

Nokia delivers private 4G fixed-wireless access (FWA) network for underserved students living in rural California

Nokia completed the first of a two-phase deployment of 4G fixed-wireless access (FWA) network with partner AggreGateway, to provide broadband internet connectivity to underserved students in the Dos Palos Oro Lomo (DPOL) school district of California.

The district comprises five campuses and serves a population of 5,000 residents. The Nokia platform will provide internet access to the homes of 2,400 students using Nokia Private 4.9G/LTE Digital Automation Cloud (NDAC) operating in the CBRS/On-Go GAA spectrum, and customer premises equipment including Nokia FastMile 4G Gateways and WiFi Beacons.

The DPOL technology team will operate its new LTE network through the centrally secure Nokia DAC Cloud monitoring application. DPOL will also provision LTE / Wi-Fi hotspots to students to be used with any standard laptop or tablet to access broadband internet.

The project’s first phase was completed in November 2021. Nokia and AggreGateway will complete the second phase in 2022.

The Federal Communications Commission (FCC) has reported nearly 17 million school children in the USA lack internet access at home, creating a nationwide ‘homework gap’ (Federal Communications Commission). This became even more pronounced during the pandemic as schools closed and distance learning became the new normal.

Image Credit: Nokia

Paoze Lee, Technology Systems Director of the Dos Palos-Oro Loma school district, said: “As we put a plan in place for distance learning during the pandemic we found we could only provide coverage for approximately 50% of DPOL students via commercial wireless network providers. Working with Nokia and AggreGateway, we are taking the next steps to level the field and ensure every student has the same access to our learning facilities.”

Octavio Navarro, President of AggreGateway, said: “Growing up in a rural small town like Dos Palos-Oro Loma, I experienced the digital divide firsthand. Being able to implement a Nokia private wireless solution for the students has been beyond rewarding. The IT staff from DPOL, AggreGateway, and Nokia worked seamlessly together to achieve this goal. We are excited, proud, and look forward to the continued success.”

Matt Young, Head of Enterprise for North America at Nokia, said: “We are pleased to help close the digital divide in the Dos Palos-Oro Loma school district. For many rural areas of the US it’s not commercially viable to build out networks, and often families on the lowest income suffer. Leveraging our DAC and FastMile FWA technologies we can enable the delivery of much needed internet connectivity to students in the area.”

The project’s first phase was completed in November 2021. Nokia and AggreGateway will complete the second phase in 2022.

About Nokia:

As a trusted partner for critical networks, we are committed to innovation and technology leadership across mobile, fixed and cloud networks. We create value with intellectual property and long-term research, led by the award-winning Nokia Bell Labs.

Adhering to the highest standards of integrity and security, we help build the capabilities needed for a more productive, sustainable and inclusive world.

About AggreGateway:

Based in San Diego, California, AggreGateway is a unique group of network and wireless engineers that are experienced in designing networks within the private, public safety, transportation, utilities, government, and educational verticals. AggreGateway provides network consulting services, wireless solutions, LAN/WAN design and implementation, network security, systems integration, and managed services. Our goal is to provide a range of robust and flexible network solutions that are customized to each individual network.

References: