global smartphone market

Counterpoint Research: Global Smartphone Market Reaches its Lowest Q3 Levels in a Decade

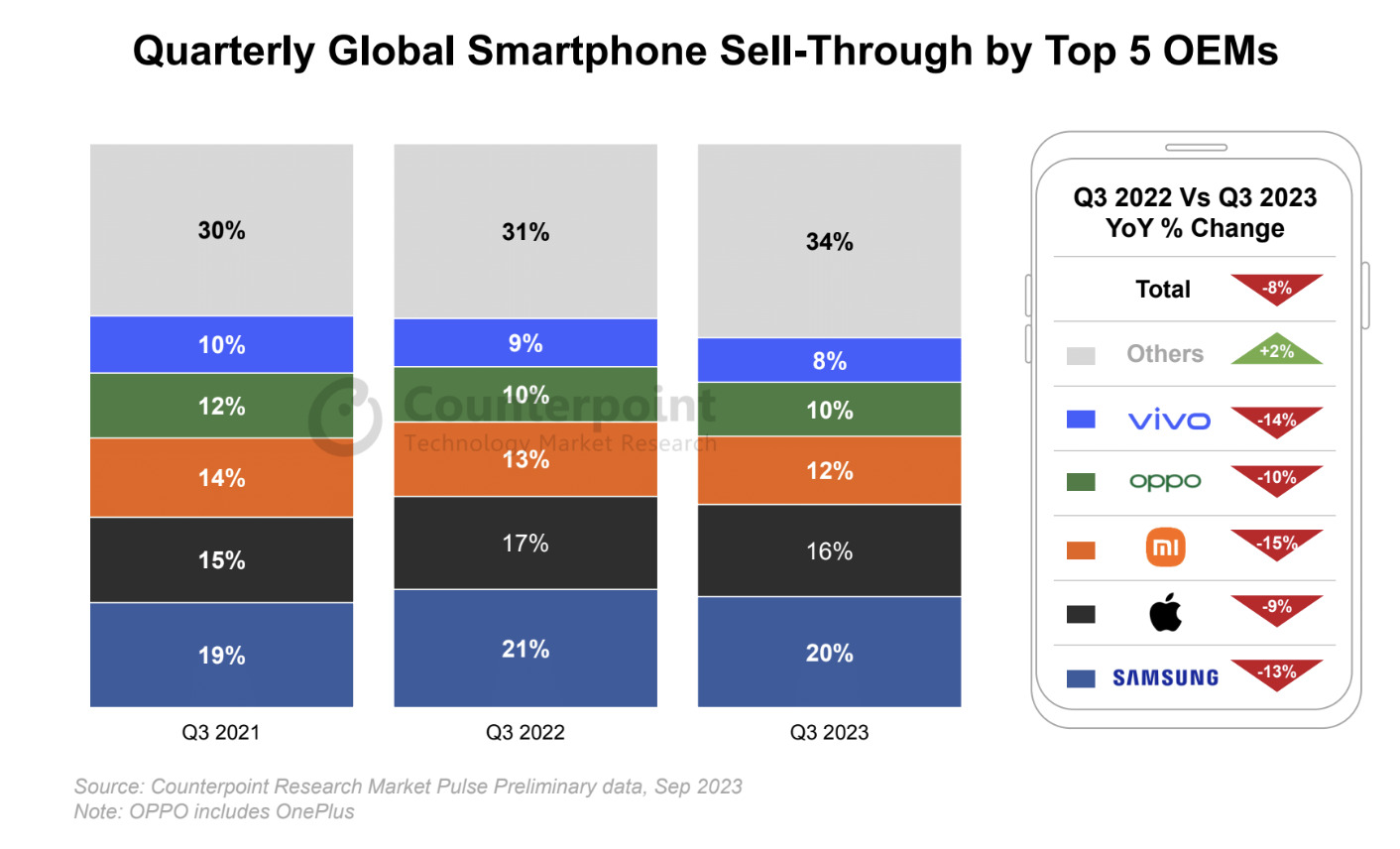

Global sales of smartphones fell 8% in the third quarter from a year earlier amid a “slower-than-expected recovery in consumer demand,” with both Apple and Samsung losing market share to competing brands during the period, according to Counterpoint Research. Highlights:

- Global smartphone sell-through declined 8% YoY but grew 2% QoQ in Q3 2023.

- Samsung led the market but declined YoY to reach its lowest quarterly level in the last decade.

- A shorter period of iPhone 15 availability in Q3 led to a shift in demand to the next quarter.

- The top five brands’ cumulative share declined in Q3 as challengers’ share grew.

- HONOR, Huawei and Transsion Group were among the only top brands to record YoY growth

The July-September sales figure represented the lowest third-quarter level in a decade, the technology market research firm said, noting that year-over-year global smartphone sales have now fallen for nine consecutive quarters.

However, Counterpoint expects that trend of declines to come to a “halt” in the fourth quarter, as sales benefit from the full impact of the recently launched iPhone 15, the festival season in India, the 11.11 Singles’ Day holiday in China, Christmas, and end-of-year promotions later in the quarter. Counterpoint noted that third-quarter sales were up from the second quarter and that a good performance in September despite the limited availability of the new iPhones provides reason for optimism.

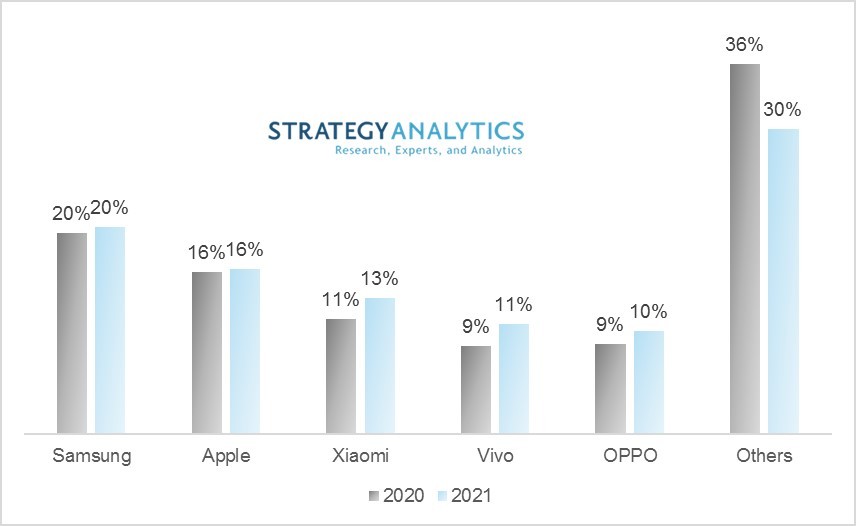

Global market leader Samsung saw its share of the global smartphone market drop to 20% in the third quarter from 21% a year earlier, as sales fell 13%. Apple’s share of the global smartphone market also fell 1 percentage point, to 16%, as its sales declined 9%.

The top five global brands — which also include Chinese smartphone makers Xiaomi, OPPO, and Vivo — made up a combined 64% of the global smartphone market in the third quarter of 2023, down from about 68% in 2022 and 2021, according to Counterpoint’s data. The Chinese companies recorded even steeper smartphone sales declines than Samsung and Apple as they “worked towards strengthening their positions in key markets like China and India while continuing to slow down expansionary efforts in overseas markets,” the report noted.

HONOR, Huawei and Transsion Group gained share and were among the only brands to record YoY growth in Q3. Huawei grew driven by the launch of the Mate 60 series in China, while HONOR’s growth was led by strong overseas performance. Transsion brands continued to expand while also benefiting from the recovery in the Middle East and Africa (MEA) market.

MEA was the only region to record YoY growth in Q3, owing to improvements in macroeconomic indicators. Most developed markets, like North America, Western Europe and South Korea, recorded steep declines. However, we expect most developed markets to grow in Q4 largely due to the delayed effect of the iPhone launch.

Following a strong September, we expect the momentum to continue till the year-end, beginning with the full impact of the iPhone 15 series along with the arrival of the festive season in India, followed by the 11.11 sales event in China and ending with the Christmas and end-of-year promotions across regions. In Q4 2023, we expect the market to halt its series of YoY declines.

However, the market is expected to decline for the full year of 2023, reaching its lowest level in the decade largely due to a shift in device replacement patterns, particularly in developed markets. Notably, the recovery of emerging markets before the global market and the growth of brands outside of the top five indicate the shifting dynamics and opportunities in the global smartphone market.

About Counterpoint Research:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

References:

Global Smartphone Market Reaches its Lowest Q3 Levels in a Decade; Apple’s Share at 16%

Omdia: Global smartphone shipments decline in 2Q23 for 8th consecutive quarter

GfK: Global telecom market (x-North America) posts 9.7% revenue drop; smartphone revenues -10.2% in 2022

IDC: Global smartphone market will remain challenged through 1st half of 2023

GfK: Global telecom market (x-North America) posts 9.7% revenue drop; smartphone revenues -10.2% in 2022

The 9.7% year-over-year drop in the global telecom market is based on GfK’s exclusive POS (point of sale) data for retailers in 67 countries worldwide, excluding North America. The industry had $360 billion (U.S. $) in revenue from January to December 2022.

The smartphone segment, including phablets, experienced a 10.2% drop year over year, but still accounted for $330 billion (US) in revenue. One of the few market drivers in 2022 was consumers with higher and middle incomes. These shoppers now account for 48% of all smartphone buyers, up 4 percentage points compared to 2021. Demand for premium devices also increased; revenue for 5G models, for example, grew by 1.2% in 2022 versus the year before. The same applies to devices with more storage; smartphones with a capacity of over 256GB recorded an increase of 19% and accounted for 41% of total market revenue in 2022.

“While we had already predicted saturation effects in 2022 after the strong telecom sales in pandemic years, the additional weakness of the Chinese market significantly impacted the results,” explains Jan Lorbach, GfK expert for the Telecom industry. “But GfK expects a stabilization of the telecom market in 2023.”

While consumers who are still buying smartphones are opting for premium devices, the total number of purchases decreased in 2022. One reason may be that people are keeping their smartphones for a longer time. Data from gfknewron Consumer shows that, from January to September 2019, only 48% of consumers used their smartphones for two years or longer; for the same period in 2022, that increased to 57% (an increase of plus 9 percentage points).

This new longevity in ownership can especially be observed in Generation Z (15 to 25 years old), where the share of Gen Z consumers keeping their smartphones for two-plus years now stands at 14 percentage points above the average. This younger generation has a clear focus on sustainability and therefore may be consciously extending the lifecycle of their devices.

Wearables Hold Steady:

One of the few telecom segments that managed to survive the difficult year 2022 in a stable manner is wearables. With $13.9 billion (US $) in revenue, the wearables market achieved almost the same level in 2022 as in the previous year (minus 1.1% compared to 2021). Although popular segments have lost ground, this has been offset by growth in other product lines.

GfK also saw significant year-over-year (2022 vs. 2021) increases and declines in revenue in specific wearables categories:

• Health and Fitness tracker: -31%

• Smartwatches: +21%

• Wrist Sport Computers: -43%

These shifts have been driven by increasing consumer demand for greater control of their health, via smart features. Accordingly, wearables with a sleep tracking feature (plus 4%) or blood oxygen sensors (plus 20%) showed strong growth. This trend also led to innovations, such as the new feature of stress level measuring (EDA). Launched in the fourth quarter of 2021, these devices already account for 16% of revenue in the wearables market and continue to grow.

AR/VR headsets: First decline ever, but potential is still high:

Further hot topics for MWC are virtual reality (VR), augmented reality (AR), and the metaverse — made possible by devices such as VR headsets. While awareness and discussions around the metaverse have risen, retail sales of VR headsets in the European market* actually declined by 15% year-over-year in 2022. This is the first decline ever, as the market has previously recorded double-digit growth for years.

“The European market seems to have accomplished initial consumer penetration of VR headsets,” says Sohjin Baek, GfK expert for global IT hardware industry. “The industry should now focus on providing more content, as well as better visual quality and security, to drive the market based on this initial penetration. Convincing consumers about the use cases will be key to drive VR/metaverse forward.”

Outlook 2023:

GfK experts forecast a stronger year 2023 for the global Telecom market overall compared to the relatively weak 2022. At a regional level, China, which is the largest single market, is expected to pick up again and significantly drive global market growth. Additionally, developments within the three main product categories will have a positive impact:

- Although replacement cycles are extending, smartphone purchases made at the height of the pandemic in 2020 and 2021 are entering the expected renewal cycle window this year.

- In wearables the next generation of Health Tracking sensors, which will expand the scope of applications, will drive the market. In addition, positive revenue growth is expected for the smartwatches segment.

- VR/AR is expected to become more tangible and grow into areas beyond gaming. This is one of the segments with the greatest potential in the coming years.

To remain competitive in the market and differentiate from competitors in terms of quality, retailers and manufacturers should continue to innovate for more powerful or faster devices that make consumers’ lives easier. “Innovation will further drive consumer’s demand,” says Jan Lorbach, GfK expert for the Telecom market. “When the holding time of smartphones is extending and budgets are tight, consumers will more than ever ask for value for money.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

About the GfK method:

Through its retail panels, GfK regularly collects POS data in more than 70 countries worldwide for the consumer electronics, photography, telecommunications, information technology, office equipment, and small and large household appliances sectors. All figures are according to GfK panel market, with global data excluding North America and presented in US dollars. Revenues are presented in US dollars Non Subsidized Prices (NSP).

gfknewron is an always-on platform that combines market, consumer and brand data supercharged with AI-powered recommendations. It enables companies to gain actionable and connected insights and act at speed to ignite sustainable growth. The platform offers three specific modules: “gfknewron Market” for market and competitor insights, “gfknewron Consumer” for an in-depth consumer understanding and “gfknewron Predict” that delivers recommendations for companies based on market data and AI-powered intelligence.

* European market data include Belgium, Denmark, Finland, France, Germany, United Kingdom, Greece, Italy, Netherlands, Norway, Portugal, Russia, Spain, Sweden

U.S. media contact: David Stanton +1 (908) 875-9844; [email protected]

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Separately, ReportLinker forecasts that the Global IoT Telecom Services Market size is expected to reach $97.9 billion by 2028, rising at a market growth of 31.8% CAGR during the forecast period. IoT protocols and 5G interconnection can broadcast information from thousands of devices to a large number of consumers without slowing communication speed or limiting capacity. The market for IoT telecom services is driven by these factors, which are anticipated to increase in the future. The growth of the IoT telecom services market is primarily driven by the increasing acceptance of technological advancement and innovation, as well as IoT-powered smart security cameras.

Based on connectivity, the IoT telecom services market is segmented into cellular technology, LPWAN, NB-IoT, and RF-based. In 2021, the LPWAN segment garnered a substantial revenue share in the IoT telecom service market. This is due to the widespread acceptance of the IoT telecom service market to strengthen LPWA Network (LPWAN) technologies, which offer a low-cost, low-power wireless option with global reach and robust security. In the telecom industry, machine-to-machine connections are crucial; for this, WiFi and GSM technologies are typically employed.

References:

https://www.gfk.com/press/telecom-global-trends-mwc

Allied Market Research: Global AI in telecom market forecast to reach $38.8 by 2031 with CAGR of 41.4% (from 2022 to 2031)

IDC: Global Telecoms Market at $1.53T in 2020; Meager Growth Forecast

IDC: Global smartphone market will remain challenged through 1st half of 2023

An updated forecast for the worldwide smartphone market from International Data Corporation (IDC) is showing a more prolonged recovery than previously expected. According to the latest Worldwide Quarterly Mobile Phone Tracker forecast, shipments of smartphones will decline 9.1% in 2022, a reduction of 2.6 percentage points from the previous forecast. As a result, IDC expects smartphone shipment volumes to total 1.24 billion units in 2022. While a recovery of 2.8% is still anticipated in 2023, IDC did reduce its 2023 smartphone forecast by roughly 70 million units, given the ongoing macroeconomic environment and its overall impact on demand.

“We believe the global smartphone market will remain challenged through the first half of 2023, with hopes that recovery will improve around the middle of next year and growth across most regions in the second half,” said Ryan Reith, group vice president with IDC’s Worldwide Mobility and Consumer Device Trackers. “Rising costs are an obvious concern for the smartphone market and adjacent consumer technology categories, but we believe most of this reduced demand will be pushed forward and will support global growth in late 2023 and beyond. A device refresh cycle continues to build in many challenged emerging markets while developed markets have offset rising costs with increased promotional activity, more attractive trade-in offers, and extended financing plans. This has supported growth in the high-end of the market despite the economic headwinds.”

5G continues to build out globally and will account for just over half of smartphones shipped worldwide in 2022, rising to 80% by 2026. In addition, market momentum continues to build around foldable phones. While this category is only about 1-2% of the global market in 2022, it still accounts for roughly 15-16 million smartphones. This number will only grow as costs decrease and more OEMs get behind the form factor transition.

“Despite the market slowdown, average selling prices (ASPs) continue to grow as consumers opt for premium devices that can last three to four years as refresh rates elongate in both developed and emerging markets,” said Anthony Scarsella, research director with IDC’s Worldwide Mobility and Consumer Device Trackers. “Smartphone ASPs are expected to grow for the third consecutive year as average selling prices will reach $413, up 6.4% from $388 in 2021. The last time the market witnessed ASPs surpass $400 was in 2011 ($425), when the market displayed over 60% shipment growth. Moreover, iOS unit share will reach 18.7% (the highest of any forecast year), which is a driving force behind the high ASP growth we currently see in 2022.”

| Worldwide Smartphone Forecast by OS, 2023 and 2026 Shipments, Year-Over-Year Growth, and 5-Year CAGR (shipments in millions) | |||||

| OS | 2023 Shipments | 2023/2022 Growth | 2026 Shipments | 2026/2025 Growth | 5-Year CAGR |

| Android | 1036.9 | 3.1% | 1145.7 | 2.5% | 0.4% |

| iOS | 233.5 | 1.3% | 247.5 | 1.9% | 1.0% |

| Total | 1270.3 | 2.8% | 1393.2 | 2.3% | 0.5% |

| Source: IDC Quarterly Mobile Phone Tracker, December 2nd, 2022 | |||||

IDC previously lowered its 2022 smartphone outlook in June, from an initial expectation of 1.6% growth in the space.

Broadly, the global sale of smartphones this year has been affected by a variety of macroeconomic trends including rising costs. For wireless network operators, that means fewer sales of smartphones and fewer opportunities to gain new customers who might switch providers amid the purchase of a new phone.

The trend could also affect 5G specifically. That’s because consumers globally may be holding onto 4G phones longer in order to avoid the purchase of a costly 5G phone.

IDC’s latest forecast follows similar warnings from other players in the space. For example, Qualcomm last month provided a revenue forecast fully $2 billion below market estimates. Qualcomm supplies core silicon to the likes of Apple, Samsung and others.

At the time, Qualcomm also reduced its projections for global 5G handset sales in 2022 to around 650 million, down from earlier forecasts of up to 750 million units

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

For more information about IDC’s Worldwide Quarterly Mobile Phone Tracker, please contact Kathy Nagamine at 650-350-6423 or [email protected].

Click here to learn about IDC’s full suite of data products and how you can leverage them to grow your business.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,300 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world’s leading tech media, data, and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn. Subscribe to the IDC Blog for industry news and insights.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS49927022

IDC: Global Smartphone Shipments +7.4% in 2021, led by Emerging Markets

Omdia and IDC: Samsung regains lead in global smartphone market

Trendforce: Global Smartphone Market to Reach 1.36 Billion Units in 2021 as Samsung regains #1 position

Counterpoint & Canalys: Global Smartphone Market Shows Signs of Recovery in Q3-2020

Canalysis & Counterpoint: Global Smartphone shipments plunge 9% YoY in 3Q-2022

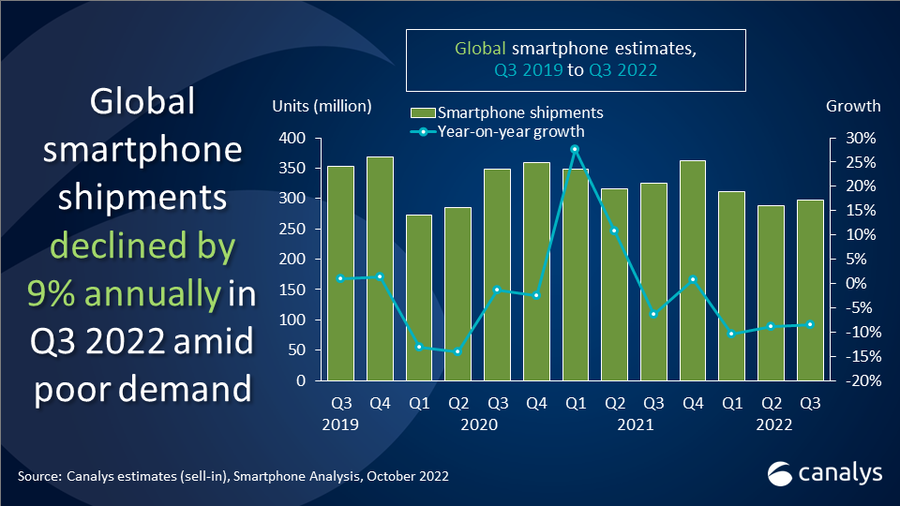

Canalys smartphone analysis indicates weak demand in 3Q-2022 caused worldwide smartphone shipments to decline by 9% year-on-year to 297.8 million units. Samsung defended its first place in the market despite an 8% decline, shipping 64.1 million units. Apple, the only leading vendor to increase year-on-year driven by robust demand, grew 8% and shipped 53.0 million units. Following two quarters of double-digit declines, Xiaomi leveraged its global scale to find opportunities helping it strengthen its position to only decline 8%, shipping 40.5 million units. OPPO and Vivo took fourth and fifth place despite having over 20% declines, shipping 28.5 million and 27.4 million units respectively in Q3 2022.

“Performance of the high-end segment was the only highlight this quarter,” said Canalys Research Analyst Runar Bjørhovde. “Apple reached its highest Q3 market share yet, driven by both the iPhone 13 and newly launched iPhone 14 series. The popularity of the iPhone 14 Pro and Pro Max, in particular, will contribute to a higher ASP and stable revenue for Apple. On the Android side, Samsung refreshed its foldable portfolio and increased its marketing initiatives significantly to generate interest and demand for its new flagships. Mid-to-low-end demand has been hit making it challenging for vendors to navigate in a competitive segment. Xiaomi managed to leverage its global scale with a refreshed product line to offset declines in its home market. OPPO and vivo are still significantly impacted by the drop in the China market but have both shown small signs of recovery.”

“Europe and Asia Pacific outperformed the rest of the world in Q3,” said Canalys Analyst Sanyam Chaurasia. “Europe avoided a significant drop helped by a spike in shipments to Russia. Here, Chinese vendors leveraged short-term opportunities to stock up the channel in a market that has been undersupplied during previous quarters. APAC had a huge variation between different markets, but sequentially improving demand in India, Indonesia and the Philippines helped the region stabilize its performance. Carrier dominated markets such as North America and Latin America presented increasingly cautious sentiments on managing inventory before heading into big holiday seasons, contrasting a much more optimistic view in Q3 last year.”

“Moving into Q4, ongoing global disruptions are hampering the performance of entire ecosystem portfolios for vendors,” said Canalys Analyst Toby Zhu. “The upstream supply chain is entering a long winter sooner than expected where OEMs’ order targets are slashed heavily. Also, slow inventory turnover and poor economic figures have affected the channel’s confidence, falling back to major brands with iconic devices to generate traffic for the most important revenue quarter. Vendors are entering Q4 with cautious strategies to handle the persisting difficulties. Managing the gloomiest Q4 outlook in over a decade will show which vendors are well-positioned for the long-term.”

|

Worldwide smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q3 2022 |

|||||||

|

Vendor |

Q3 2022 shipments (million) |

Q3 2022 |

Q3 2021 |

Q3 2021 |

Annual |

||

|

Samsung |

64.1 |

22% |

69.4 |

22% |

-8% |

||

|

Apple |

53.0 |

18% |

49.2 |

16% |

8% |

||

|

Xiaomi |

40.5 |

14% |

44.0 |

14% |

-8% |

||

|

OPPO |

28.5 |

10% |

36.7 |

12% |

-22% |

||

|

Vivo |

27.4 |

9% |

34.2 |

11% |

-20% |

||

|

Others |

84.3 |

27% |

92.1 |

25% |

-6% |

||

|

Total |

297.8 |

100% |

325.6 |

100% |

-9% |

||

|

Note: percentages may not add up to 100% due to rounding |

|||||||

Source: Canalys

…………………………………………………………………………………………………………………………………

Counterpoint: Global Smartphone Market at Lowest Q3 Level Since 2014

- The global smartphone market declined by 12% YoY even as it grew by 2% QoQ to reach 301 million units in Q3 2022.

- While quarterly growth in Apple and Samsung pushed the global smartphone market above 300 million units, a level it failed to reach last quarter, political and economic instability drove negative consumer sentiment.

- Apple was the only top-five smartphone brand to grow YoY, with shipments increasing 2% YoY, growing market share by two percentage points to 16%.

- Samsung’s shipments declined by 8% YoY but grew 5% QoQ to 64 million.

- Xiaomi, OPPO* and vivo, recovered slightly after receiving heavy beatings due to lockdowns in China in Q2, and as they captured more of the market ceded by Apple and Samsung’s exit from Russia.

Senior Analyst Harmeet Singh Walia said, “Most major vendors continued experiencing annual shipment declines in the third quarter of 2022. Russia’s escalating war in Ukraine, ongoing China-US political distrust and tensions, growing inflationary pressures across regions, a growing fear of recession, and weakening national currencies all caused a further dent in consumer sentiment, hitting already weakened demand. This is also adding to a slow but sustained lengthening of smartphone replacement cycles with smartphones becoming more durable and as technology advancement slows. This is accompanying, and to a smaller degree advancing, a fall in the shipments of mid- and lower-end smartphones, even as the premium segment weathers the economic storm better. Consequently, and thanks to an earlier launch of the latest iPhone series this year, Apple emerged as the only top-five smartphone vendor to manage annual shipment growth in the quarter.”

While Samsung grew QoQ in Q3 2022 thanks to record presales of its premium fold and flip smartphones, compared with the same quarter last year, however, its shipments fell by 8% YoY. This is primarily down to dampening consumer sentiment in several of its key markets. This also affected top Chinese brands, whose shipments remained low compared with last year as they were getting rid of excess inventory and at the same time managing a slowdown in the home market, China. However, they were able to capitalise on Apple and Samsung’s exit from the Russian market, in which their share increased substantially.

Associate Director Jan Stryjak noted, “With the full force of the latest iPhone launch being felt in Q4, we expect further quarterly improvement in the coming quarter, although central banks’ attempts to control inflation will further reduce consumer demand. The channel inventory is still higher, and the OEMs will focus on getting rid of excess inventory in Q4 as well. Hence, shipments are unlikely to reach last year’s levels, let alone pre-pandemic Q4 levels of over 400 million units. Looking further ahead into 2023, we expect sluggish demand with lengthening replacement rates, especially in the first half of the year.”

*OPPO includes OnePlus from Q3 2021

References:

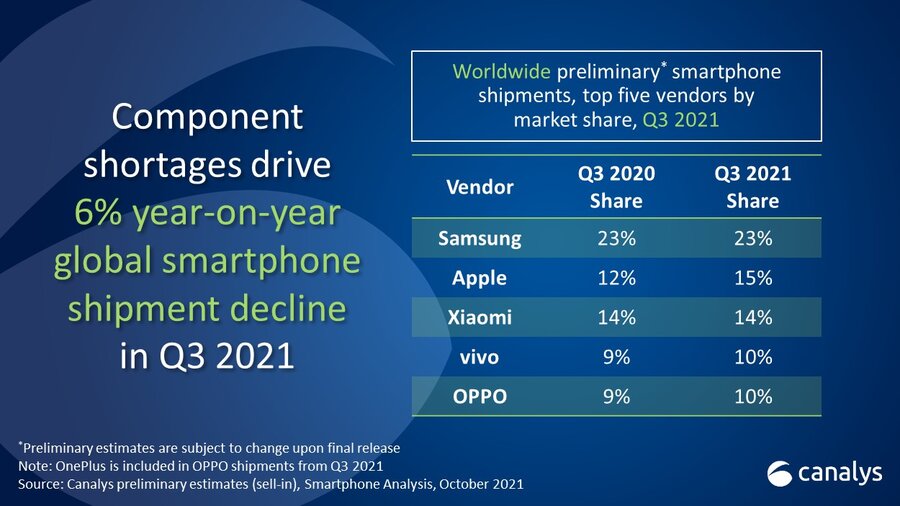

Canalys: Global Smartphone Shipments Fell 6% in 3Q-2021; Samsung Still #1

According to a new report by market tracker Canalys, global smartphone shipments fell 6 per cent in the third quarter (July-September period) this year, as vendors struggled to meet demand for devices amid component shortages. That decline comes after shipments increased by 12% in the second quarter of 2021.

- Samsung was the leading smartphone player with 23 per cent share.

- Apple regained second place in the global smartphone market with 15 per cent share in the third quarter (Q3) this year, thanks to strong early demand for iPhone 13.

- Xiaomi took 14 per cent share for the third place, while Vivo and Oppo completed the top five with 10 per cent share each.

“The chipset famine has truly arrived,” said Canalys Principal Analyst, Ben Stanton. “The smartphone industry is striving to maximize production of devices as best it can. On the supply side, chipset manufacturers are increasing prices to disincentivize over-ordering, in an attempt to close the gap between demand and supply. But despite this, shortages will not ease until well into 2022. As a result of this, as well as high costs of global freight, smartphone brands have reluctantly pushed up device retail pricing.”

“At the local level, smartphone vendors are also having to implement last-minute changes in device specification and order quantities. It is critical for them to do this and maximize volume capacity, but unfortunately it does lead to confusion and inefficiency when communicating with retail and distributor channels,” continued Stanton. “Many channels are nervous heading into important sales holidays, such as Singles’ Day in China, and Black Friday in the west. Channel inventories of smartphones are already running low, and as more customers start to anticipate these sales cycles, the impending wave of demand will be impossible to fulfill. Customers should expect smartphone discounting this year to be less aggressive. But to avoid customer disappointment, smartphone brands which are constrained on margin should look to bundle other devices, such as wearables and IoT, to create good incentives for customers.”

References:

https://www.canalys.com/newsroom/canalys-global-smartphone-market-Q3-2021

Canalys 2Q-2021 smartphone rankings show big gains for Xiaomi and OPPO

Canalys 2Q-2021 smartphone rankings show big gains for Xiaomi and OPPO

Telecom, IT and cloud market research firm Canalys, said that global smartphone shipments increased by 12% in the second quarter of 2021. Samsung still maintains its position as the world’s number one with a market share of 19%. Xiaomi’s mobile phone sales surpassed Apple’s and rose to the second place in the world for the first time, with a share of 17%. Apple ranked third with 14%. OPPO and Vivo ranked fourth and fifth in the world, with a market share of 10%.

Xiaomi’s growth rate is as high as 83%, making it the top five mobile phone brand with the fastest growth rate in market share. Lei Jun, the founder and CEO of Xiaomi, sent three consecutive Weibo messages to express his congratulations to Xiaomi, and at the same time released the “Open Letter to Xiaomi Students.” Lei Jun said that Xiaomi’s becoming the second ranked global smartphone vendor is a major milestone in the history of Xiaomi’s development.

In the third quarter of 2014, Xiaomi entered the top three in the world for the first time, and then encountered huge difficulties, and soon fell out of the top five in the world. In 2020, the launch of Xiaomi Mi 10 series will fully launch the development of Xiaomi mobile phones. In the high-end journey, in the third quarter of the same year, Xiaomi returned to the third place in the world. Only two quarters later, Xiaomi was promoted to the second place in the world.

Lei Jun also said that “the second in the world” is a major victory for Xiaomi’s strategy. In August last year, Xiaomi established its core strategy for the next ten years-mobile phone X AIoT, once again clarifying the core position of the smartphone business, progressing to promote intelligent interconnection, and the AIoT business will build a smart life around the core business of mobile phones. At the same time, it has established the “three iron laws” that will never change: technology-oriented, cost-effectiveness-oriented, and making the coolest products.

About Xiaomi:

Xiaomi is an electronics company based in Beijing, China. It was founded by Lei Jun in April 2010, and in 2014, Xiaomi was the largest smartphone company in China. Today, Xiaomi is one of the top five smartphone vendors in the world.

The “MI” in their logo stands for “Mobile Internet.” It also has other meanings, including “Mission Impossible”, because Xiaomi faced many challenges that had seemed impossible to defy in our early days.

…………………………………………………………………………………………………………………………………………

Meanwhile, Canalys said that OPPO ranked first among Android smartphone manufacturers. In addition to launching 5G phones in the full price range to meet the different needs of consumers, OPPO has been actively taking the lead in applying new technologies to its latest models.

Canalys wrote that in Middle East and Africa, OPPO has climbed to fourth place in market share with a 106% year-on-year growth. The United Arab Emirates and Saudi Arabia have been at the forefront of this rise, witnessing a 196% and a 218% year-on-year growth respectively which was attributed to OPPO’s innovative product offering and strong customer service. In addition, OPPO saw a year-on-year growth of 79% in Egypt.

Ethan Xue, President of OPPO MEA said, “We are proud to see our innovative products and customer-centric approach being well received and reflected in these promising figures. Our growth in the MENA region is phenomenal and illustrates the strong customer base we have that support us and understand our brand mission, technology for mankind, kindness for the world. At OPPO, we continue to push the boundaries and our growth only serves to motivate us even more to offer our customers the best possible products at competitive prices.”

The main proponent of the brands growth is strong product launches that closely align with the evolving demands of smartphone users. Earlier this month, OPPO launched the anticipated Reno6 series, comprising of three variations, the Reno6 Pro 5G, Reno6 5G, and the Reno6 Z 5G that have all been masterfully designed for trendsetting individuals, game enthusiasts and the young at heart. From stunning design details to powerful features, the Reno6 series is already proving to be popular in the region, with a 300% pre-order increase compared to its predecessor, solidifying the demand for the technology brand in MENA.

About OPPO:

OPPO is headquartered in Dongguan, China an has been a leading global technology brand since 2004, dedicated to providing products that seamlessly combines art and innovative technology.

OPPO says they’re on a mission to building a multiple-access smart device ecosystem for the era of intelligent connectivity. The smartphone devices have simply been a gateway for OPPO to deliver a diverse portfolio of smart and frontier technologies in hardware, software and system. In 2019, OPPO launched a $7 Billion US Dollar three-year investment plan in R&D to develop core technologies furthering design through technology.

For the last 10 years, OPPO has focused on manufacturing smartphones with camera capabilities that are second to none. OPPO launched the first mobile phone, the Smile Phone, in 2008, which marked the launch of the brand’s epic journey in exploring and pioneering extraordinary technology. Over the years, OPPO has built a tradition of being number one, which became a reality through inventing the world’s first rotating camera smartphone way back in 2013, launching the world’s then thinnest smartphone in 2014, being the first to introduce 5X Zoom ‘Periscope’ camera technology and developing the first 5G commercial smartphone in Europe.

OPPO is currently ranked as the number four smartphone brand globally. OPPO brings the aesthetics of technology of global consumers through the ColorOS system Experience, and Internet service like OPPO Cloud and OPPO+.

OPPO’s business covers 40 countries with over six research institutes and five R&D centers across the world, from San Francisco to Shenzhen. OPPO also opened an International Design Centre headquartered in London, driving cutting edge technology that will shape the future not only for smartphones but for intelligent connectivity.

References:

https://min.news/en/tech/5f2410bda155bbec25c819b98c454623.html

NEW for 3Q2021 Rankings:

Omdia and IDC: Samsung regains lead in global smartphone market

The global smartphone market climbed 28.1% year on year to reach total shipments of 351.1 million units in the first quarter of 2021, according to preliminary data from Informa owned Omdia. That gain consolidates the smartphone market’s recent recovery after it posted its first annual growth since Q3 2019 in the final quarter of 2020. However, Omdia said 2021 is set to be a year of transition with Huawei’s role continuing to change, LG exiting the market and a severe semiconductor shortage affecting sales.

Samsung took over the top spot from Apple in the first 3 months of 2021, shipping 76.1 million units, up 29.2 percent year on year, to reach 22 percent of the market. The company was able to increase shipments by 22.8 percent from Q4 2020 thanks in part to an early update to the Galaxy S line as well as the launch of its latest range of devices in the A series.

Apple followed its blockbuster Q4 2020 with another significant year on year growth of 46.5% to reach 56.4 million units shipped in the quarter, equivalent to 16% of the market, followed in third place by Xiaomi with 14% after shipping 49.5 million units, up 78.3% year on year.

Two more Chinese smartphone brands – Oppo and Vivo – continue to battle for fourth and fifth place in the global rankings and remain tied on 11 percent of the market. Vivo shipped 38.2 million units, just above the 37.8 million units Oppo shipped in Q1.

Year on year, Vivo grew shipments by 95.9 percent and Oppo by 85.3 percent, as they overtook Huawei, which slipped out of the top 5 global smartphone OEM ranking after shipping 14.7 million units, some 70 percent less than in Q1 2020, not including the 3.6 million units shipped by its sub-brand Honor, which is now an independent entity.

Top 10 Shipments per manufacturer

| Rank | OEM | 1Q21 | 4Q20 | 1Q20 | QoQ | YoY | |||

| Shipment (m) | M/S | Shipment (m) | M/S | Shipment (m) | M/S | ||||

| 1 | Samsung | 76.1 | 22% | 62.0 | 16% | 58.9 | 21% | 22.8% | 29.2% |

| 2 | Apple | 56.4 | 16% | 84.5 | 22% | 38.5 | 14% | -33.3% | 46.5% |

| 3 | Xiaomi | 49.5 | 14% | 47.2 | 12% | 27.8 | 10% | 4.9% | 78.3% |

| 4 | vivo | 38.2 | 11% | 34.5 | 9% | 19.5 | 7% | 10.7% | 95.9% |

| 5 | Oppo | 37.8 | 11% | 34.0 | 9% | 20.4 | 7% | 11.1% | 85.3% |

| 6 | Huawei | 14.7 | 4% | 33.0 | 9% | 49.0 | 18% | -55.5% | -70.0% |

| 7 | Motorola | 12.6 | 4% | 9.8 | 3% | 5.5 | 2% | 28.6% | 128.1% |

| 8 | Realme | 11.4 | 3% | 14.3 | 4% | 6.1 | 2% | -20.3% | 86.9% |

| 9 | Tecno | 8.2 | 2% | 7.7 | 2% | 3.5 | 1% | 6.5% | 133.4% |

| 10 | LG | 6.8 | 2% | 8.4 | 2% | 5.4 | 2% | -18.9% | 26.2% |

| Others | 41.3 | 12% | 46.4 | 12% | 41.1 | 15% | -11.0% | 0.6% | |

| Total | 353.0 | 100% | 381.8 | 100% | 275.7 | 100% | -7.5% | 28.1% | |

Gerrit Schneemann, principal analyst at Omdia commented: “The smartphone market continues to show resiliency in the face of multiple challenges. The global component supply shortage is looming large over the market. On the other hand, two well-known smartphone brands will disappear from the global smartphone market this year, in Huawei and LG, opening the door for other brands to reach new markets and buyers.”

……………………………………………………………………………………………………………………………………..

Separately, International Data Corporation (IDC) said that the smartphone market accelerated in the first quarter of 2021 (1Q-2021) with 25.5% year-over-year shipment growth.

According to preliminary data from the (IDC) Worldwide Quarterly Mobile Phone Tracker, smartphone vendors shipped nearly 346 million devices during the quarter. The strong growth came from all regions with the greatest gains coming from China and Asia/Pacific (excluding Japan and China). As the two largest regions globally, accounting for half of all global shipments, these regions experienced 30% and 28% year-over-year growth, respectively.

“The recovery is proceeding faster than we expected, clearly demonstrating a healthy appetite for smartphones globally. But amidst this phenomenal growth, we must remember that we are comparing against one of the worst quarters in smartphone history,1Q20, the start of the pandemic when the bulk of the supply chain was at a halt and China was in full lockdown,” said Nabila Popal, research director with IDC’s Worldwide Mobile Device Trackers. “However, the growth is still very real; when compared to two years ago (1Q19), shipments are 11% higher. The growth is coming from years of repressed refresh cycles with a boost from 5G. But above all, it is a clear illustration of how smartphones are becoming an increasingly important element of our everyday life – a trend that is expected to continue as we head into a post-pandemic world with many consumers carrying forward the new smartphone use cases which emerged from the pandemic.”

As the smartphone market is recovering, a major shift is happening in the competitive landscape. Huawei is finally out of the Top 5 for the first time in many years, after suffering heavy declines under the increased weight of U.S. sanctions. Taking advantage of this are the Chinese vendors Xiaomi, OPPO, and vivo, which all grew share over last quarter landing them in 3rd, 4th, and 5th places globally during the quarter with 14.1%, 10.8%, and 10.1% share, respectively. All three vendors are increasing their focus in international markets where Huawei had grown its share in recent years. In the low- to mid-priced segment, it is these vendors that are gaining the most from Huawei’s decline, while most of the high-end share is going to Apple and Samsung. Samsung regained the top spot in 1Q21 with impressive shipments of 75.3 million and 21.8% share. The new S21 series did well for Samsung, mainly thanks to a successful pricing strategy shaving off $200 from last year’s flagship launch. Apple, with continued success of its iPhone 12 series, lost some share from their very strong holiday quarter but still shipped an impressive 55.2 million iPhones grabbing 16.0% share.

“While Huawei continues its decline in the smartphone market, we’ve also learned that LG is exiting the market altogether,” said Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers. “Most of LG’s volume was in the Americas with North America accounting for over 50% of its volume and Latin America another 30%. Despite the vendor losing ground in recent years, they still had 9% of the North America market and 6% of Latin America. Their exit creates some immediate opportunity for other brands. With competition being more cutthroat than ever, especially at the low-end, it is safe to assume that 6-10 brands are eyeing this share opportunity.”

| Top 5 Smartphone Companies, Worldwide Shipments, Market Share, and Year-Over-Year Growth, Q1 2021 (shipments in millions of units) | |||||

| Company | 1Q21 Shipment Volumes | 1Q21 Market Share | 1Q20 Shipment Volumes | 1Q20 Market Share | Year-Over-Year Change |

| 1. Samsung | 75.3 | 21.8% | 58.4 | 21.2% | 28.8% |

| 2. Apple | 55.2 | 16.0% | 36.7 | 13.3% | 50.4% |

| 3. Xiaomi | 48.6 | 14.1% | 29.5 | 10.7% | 64.8% |

| 4. OPPO | 37.5 | 10.8% | 22.8 | 8.3% | 64.5% |

| 5. vivo | 34.9 | 10.1% | 24.8 | 9.0% | 40.7% |

| Others | 94.1 | 27.2% | 103.0 | 37.4% | -8.7% |

| Total | 345.5 | 100.0% | 275.2 | 100.0% | 25.5% |

| Source: IDC Quarterly Mobile Phone Tracker, April 28, 2021 | |||||

Notes:

- Data are preliminary and subject to change.

- Company shipments are branded device shipments and exclude OEM sales for all vendors.

- The “Company” represents the current parent company (or holding company) for all brands owned and operated as a subsidiary.

- Figures represent new shipments only and exclude refurbished units.

……………………………………………………………………………………………………………………………………………

Closing Comment:

“Globally, the top five vendors combined took a 76% market share in Q1 2021, up from 71% a year ago. Chip shortages and supply side constraints did not have a significant impact in Q1 among the top 5 brands,” said Linda Sui, senior director, Strategy Analytics. Samsung’s newly launched A series 4G and 5G phones, and the earlier launched Galaxy S21 series combined drove solid performance in the quarter. Xiaomi maintained strong momentum in both India and China, and the expansion in Europe, Latin America and Africa region also started to bear fruit.

Note: Strategy Analytics said the global smartphone shipments were 340 million units in Q1 2021, up over 24% (year-on-year) representing the highest growth since 2015. The smartphone market rebound was driven by the healthy demand of consumers with aging devices and a phenomenal 5G push from Chinese smartphone vendors.

References:

https://omdia.tech.informa.com/pr/2021-apr/global-smartphone-market-grows-28

https://www.idc.com/getdoc.jsp?containerId=prUS47646721

https://www.idc.com/tracker/showproductinfo.jsp?containerId=IDC_P8397

Trendforce: Global Smartphone Market to Reach 1.36 Billion Units in 2021 as Samsung regains #1 position

Samsung Electronics Co. is expected to remain the world’s top smartphone producer this year, according to a report by according to market researcher TrendForce. However, the company’s market share is likely to decrease as other brands will ramp up production with the recovery of mobile demand.

The top six smartphone brands ranked by production volume for 2020, in order, are Samsung, Apple, Huawei, Xiaomi, OPPO, and Vivo. The most glaring change from the previous year is Huawei’s market share.

Thanks to the Chinese government’s aggressive push for 5G commercialization in 2020, global 5G smartphone production for the year reached about 240 million units, a 19% penetration rate, with Chinese brands accounting for almost a 60% market share. While 5G will remain a major topic in the smartphone market this year, various countries will also resume their 5G infrastructure build-out, and mobile processor manufacturers will continue to release entry-level and mid-range 5G chips. As such, the penetration rate of 5G smartphones is expected to undergo a rapid increase to 37% in 2021, for a yearly production of about 500 million units.

Global smartphone production was projected to increase 9 percent on-year to 1.36 billion units in 2021. Trendforce predicted that device replacement demand and growth in emerging markets will lead to gradual recovery of the smartphone market.

…………………………………………………………………………………………………………………………………………………………………………………………………….

TrendForce indicates that smartphone brands’ recent bullish outlook towards the 2021 market and their attempt to secure more semiconductor supplies by increasing their smartphone production targets can potentially lead these brands to overbook certain components at foundries. However, smartphone brands may adjust their component inventories from 2Q21 to 3Q21 and reduce their semiconductor procurement activities if actual sales performances fall short of expectations, or if component bottlenecks remain unresolved, leading to a widening inventory gap between bottlenecked and non-bottlenecked parts. Even so, TrendForce still forecasts an above-90% capacity utilization rate for foundries in 2021.

…………………………………………………………………………………………………………………………………………………………………………………………………………

References:

http://www.trendforce.com/presscenter/news/20210105-10630.html

Counterpoint Research: Mediatek is world’s #1 smartphone chipset vendor

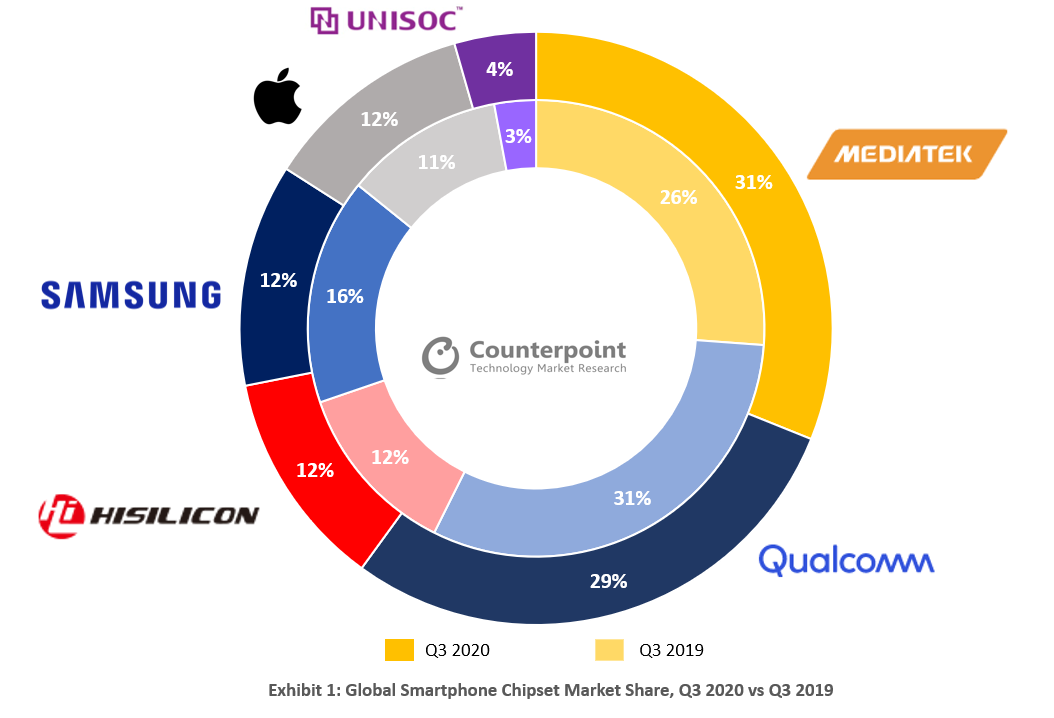

Christmas day surprise! Taiwanese fabless chipmaker Mediatek has overtaken Qualcomm and is now the #1 smartphone chipset vendor with a 31% market share in Q3 2020. Mediatek was helped by its growth in regions like India and China, and a strong performance in the $150-200 price smartphone category, according to estimates from market research firm Counterpoint Technology Market Research.

In terms of market share, MediaTek led the chipset market at the first position, followed by Qualcomm (29%), HiSilicon (12%), Samsung (12%), Apple (12%), and UNISOC (4%) respectively.

Qualcomm was the biggest 5G chipset vendor in Q3 2020. Its silicon powered 39% of the 5G phones sold worldwide. The demand for 5G smartphones doubled in Q3 2020 – 17% of all smartphones sold in Q3 2020 were 5G. This impressive growth trajectory is going to continue, more so with Apple launching its 5G line-up. One-third of all smartphones shipped in Q4 2020 are expected to be 5G enabled. There is still a chance Qualcomm will regain the top position in Q4 2020.

Source: Counterpoint Research

………………………………………………………………………………………………………………………………………………………………………………………………………

MediaTek’s Research Director Dale Gai said:

“MediaTek’s strong market share gain in Q3 2020 happened due to three reasons – strong performance in the mid-end smartphone price segment ($100-$250) and emerging markets like LATAM and MEA, the U.S. ban on Huawei and finally wins in leading OEMs like Samsung, Xiaomi and Honor. The share of MediaTek chipsets in Xiaomi smartphones has increased by more than three times since the same period last year.’

“MediaTek was also able to leverage the gap created due to the U.S. ban on Huawei. Affordable MediaTek chips fabricated by TSMC became the first option for many OEMs to quickly fill the gap left by Huawei’s absence. Huawei had also previously purchased a significant amount of chipsets ahead of the ban.”

“On the other hand, Qualcomm also posted strong share gains (from a year ago) in the high-end segment in Q3 2020, again thanks to HiSilicon’s supply issues. However, Qualcomm faced competition from MediaTek in the mid-end segment. We believe both will continue to compete intensively through aggressive pricing, and mainstream 5G SoC products into 2021.”

Counterpoint Research Analyst Ankit Malhotra said:

“Qualcomm and MediaTek have both reshuffled their portfolios, and consumer focus has played a key role here. Last year, MediaTek launched a new gaming-based G-series, while Dimensity chipsets have helped in bringing 5G to affordable categories. The world’s cheapest 5G device, the realme V3, is powered by MediaTek.”

Commenting on the outlook for chipset vendors, Malhotra added, “The immediate focus of chipset vendors will be to bring 5G to the masses, which will then unlock the potential of consumer 5G use cases like cloud gaming, which in turn will lead to higher demand for higher clocked GPUs and more powerful processors. Qualcomm and MediaTek will continue to contend for the top position.”

Source: Counterpoint Research

……………………………………………………………………………………………………………………………………………………………………………………………………..

About Counterpoint Research:

Counterpoint Technology Market Research is a global research firm specializing in Technology products in the TMT industry. It services major technology firms and financial firms with a mix of monthly reports, customized projects and detailed analysis of the mobile and technology markets. Its key analysts are experts in the industry with an average tenure of 13 years in the high-tech industry.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Separately, MediaTek 5G silicon will be used in future notebook PCs with Intel inside.

MediaTek’s T700 5G modem, which will be used to bring 5G connectivity to Intel-powered PCs, completed 5G standalone (SA) calls in real world test scenarios. Additionally, Intel has progressed on system integration, validation and developing platform optimizations for a superior user experience and is readying co-engineering support for its OEM partners. MediaTek and Intel are both committed to delivering a superior user experience.

“Our partnership with Intel is a natural extension of our growing 5G mobile business, and is an incredible market opportunity for MediaTek to move into the PC market,” said MediaTek President Joe Chen. “With Intel’s deep expertise in the PC space and our groundbreaking 5G modem technology, we will redefine the laptop experience and bring consumers the best 5G experiences.”

“A successful partnership is measured by execution, and we’re excited to see the rapid progress we are making with MediaTek on our 5G modem solution with customer sampling starting later this quarter. Building on our 4G/LTE leadership in PCs, 5G is poised to further transform the way we connect, compute and communicate. Intel is committed to enhancing those capabilities on the world’s best PCs,” said Chris Walker, Intel corporate vice president and general manager of Mobile Client Platforms.

References:

MediaTek Becomes Biggest Smartphone Chipset Vendor for First Time in Q3 2020

Counterpoint Research: Smartphone Market Decline Ends, What Might Help it Grow?

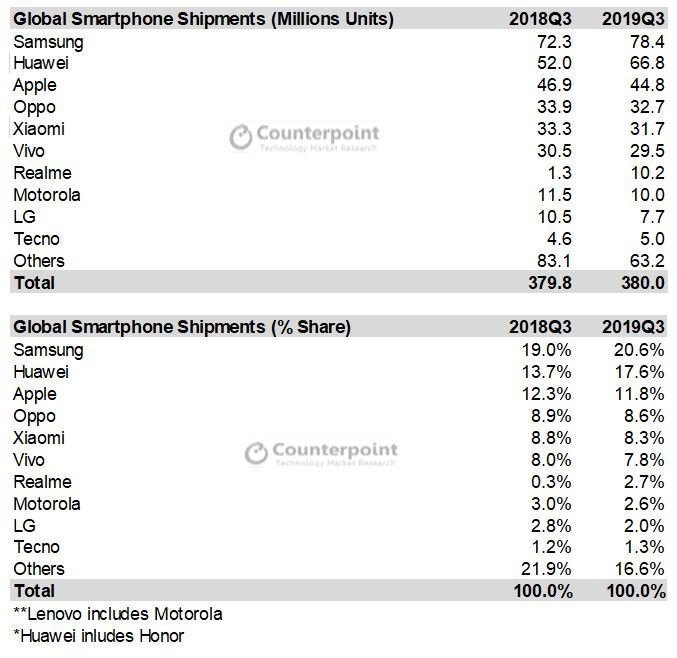

The global smartphone market showed signs of recovery ending a long period of continuous quarterly YoY declines. Shipments during 3Q 2019 were flat at 380 million units. The two markets that helped halt the slide are India, which has been growing steadily, and China, now showing a slower decline.

Both countries saw healthy channel builds, in India, OEMs prepared early for Diwali and online sales. In China, Huawei, Oppo and Vivo enjoyed healthy demand ahead of the National Day Golden Week holiday in October. The upcoming holiday season should drive smartphone demand into growth for the second half of the year.

Highlights:

- Samsung continued its growth thanks to strong sales of the Galaxy Note 10 and Galaxy A series. The improved product-mix helped it post better profits.

- Huawei grew a healthy 28.5% YoY globally. It captured a record 40% market share in China. It rebounded in Europe after the decline mid-year caused by the US trade ban. As it continues its aggressive push, there’s an increased need for careful inventory management in China and Europe in Q4 2019.

- Apple iPhone shipments were down 4% YoY. However, initial uptake for the iPhone 11 series was robust. In the US, pre-orders and the first week of sales, saw more demand for the iPhone 11 Pro Max and iPhone 11 Pro, but the standard iPhone 11 rose quickly into the best-seller’s list.

- Apple’s price corrections in China and elsewhere with iPhone 11 and iPhone XR stimulated demand during the last week of September.

- Realme was the fastest-growing brand for the second successive quarter, capturing 7th place globally. Strong performances in India and Indonesia drove its growth.

Counterpoint believes the key OEMs with the largest installed bases, especially in developed regions, will rely on 5G as a key point of differentiation and will encourage their users to upgrade. Already, 5G rollouts have been faster than 4G was in its first few months, with 15 commercially available 5G devices and many more lined-up for launch in the last few months of 2019. Nevertheless, 5G smartphones only accounted for 2% of shipments in Q3 2019 and will contribute relatively little to the overall market for the full year 2019. But, 2020 will likely be a breakout year for 5G smartphone adoption,rekindling smartphone demand.

Note: This author completely disagrees with that last conclusion. We don’t think 5G smartphone adoption will achieve any real market traction till late 2021-early 2022.

Analyst Contacts:

SOURCE Counterpoint Research

…………………………………………………………………………………….

Looking at the current scenario, Xiaomi, famous for its commitment to affordability, launched the cheapest 5G model in China at the end of September. The new flagship of Xiaomi’s number series, MI 9 Pro 5G, has a starting price of roughly US$520.

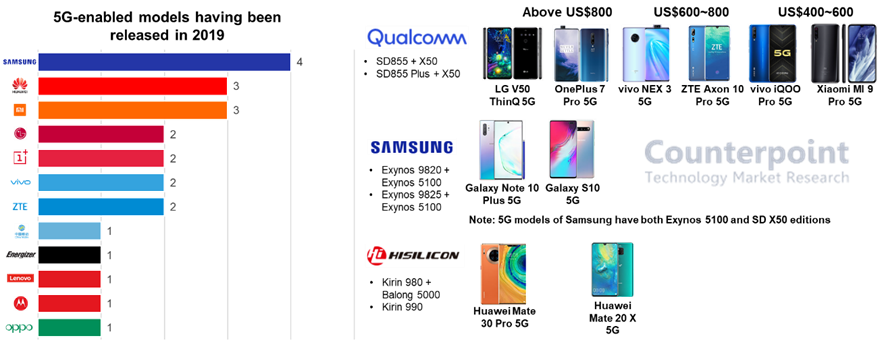

Exhibit 1: 5G enabled new models in 2019

According to the analysis of the 5G cost structure, we expect an addition of US$50 to implement the sub-6Ghz only by using a standalone 5G modem.

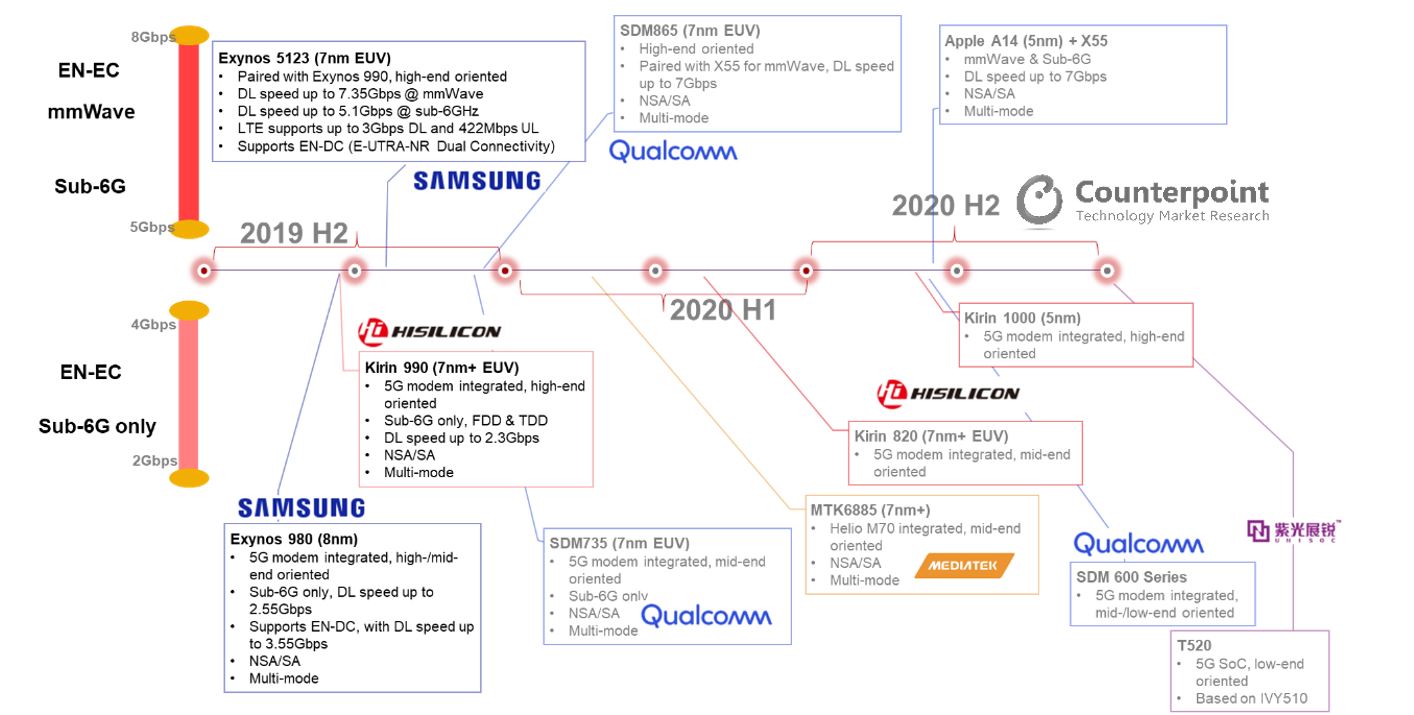

However, costs can be reduced through the integration of a modem with the SoC (System on a Chip). Huawei’s Kirin 990 and Samsung’s Exynos 980 had taken a step ahead in this direction, and Qualcomm is expected to launch its first 5G SoC in the Snapdragon 700 family by the end of 2019. Besides, both Qualcomm, MediaTek plans to mass-produce respective 5G flagship platform SDM865, MTK6885, in Q1 2020.

Exhibit 2: 5G platform timeline in 2019 & 2020

Given the fragmented frequency allocation, we expect smartphone brands targeting North America and parts of European markets will customize designs with an external 5G model for mmWave, even though, most 5G models will resort to a 5G SoC for a cheaper sub-6Ghz only solution.

Given the fragmented frequency allocation, we expect smartphone brands targeting North America and parts of European markets will customize designs with an external 5G model for mmWave, even though, most 5G models will resort to a 5G SoC for a cheaper sub-6Ghz only solution.

To sum up, we believe that 5G smartphones will be available in the mid-end price bands over the course of 2020. As a result, cheaper solutions for a next-generation offering will unlock consumer demand for upgrades of their smartphones.