Huawei

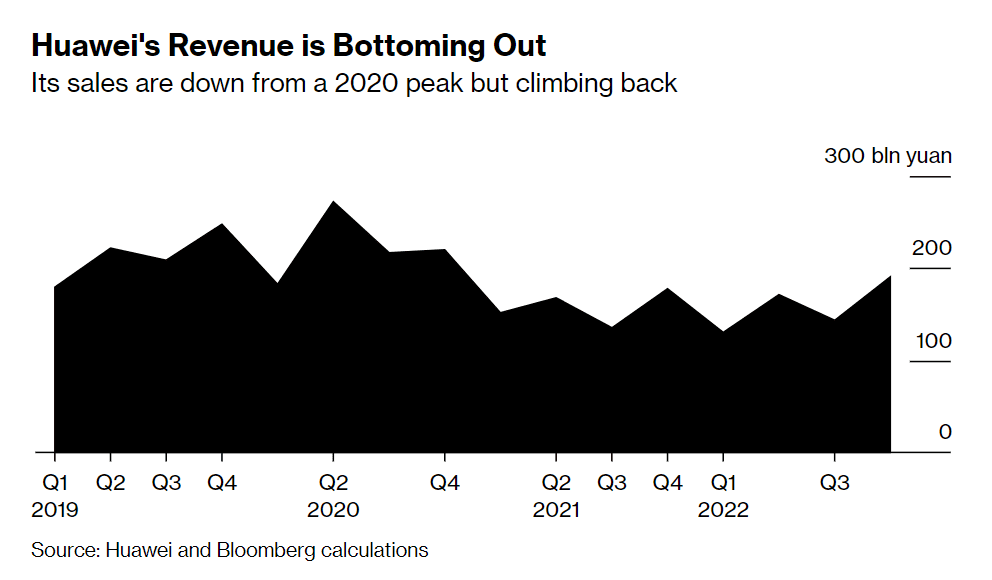

Huawei reports 3rd straight quarter of revenue growth despite U.S. sanctions

FCC bans Huawei, ZTE, China based connected camera and 2-way radio makers

On Friday, the Federal Communications Commission (FCC) banned Huawei Technologies Co. and ZTE Corp. from selling electronics in the U.S. by regulators who say they pose a security risk, continuing a years-long effort to limit the reach of Chinese telecommunications companies into U.S. telecommunications networks.

The FCC also named connected-camera makers Hangzhou Hikvision Digital Technology Co. and Dahua Technology Co., as well as two-way radio manufacturer Hytera Communications Corp.

“The FCC is committed to protecting our national security by ensuring that untrustworthy communications equipment is not authorized for use within our borders, and we are continuing that work here,” Chairwoman Jessica Rosenworcel said in a news release. “These new rules are an important part of our ongoing actions to protect the American people from national security threats involving telecommunications.”

“On March 12, 2021, we published the first-ever list of communications and services that pose an unacceptable risk to national security as required under the Secure and Trusted Communications Networks Act. This initial Covered List included equipment from the Chinese companies Huawei, ZTE, Hytera, Hikvision, and Dahua. Since then, we’ve added equipment and services from five additional entities. Last year I also proposed stricter data breach reporting rules and worked with the Department of State to improve how we coordinate national security issues related to submarine cable licenses.”

In the 4-0 vote, the FCC concluded the products pose a risk to data security. Past efforts to curb Chinese access include export controls to cut off key, sophisticated equipment and software. Recently US officials have weighed restrictions on TikTok over fears Chinese authorities could access US user data via the video sharing app.

“This is a culminating action,” said Klon Kitchen, a senior fellow at the Washington-based American Enterprise Institute, a public-policy think tank. “Things that began under Trump are now being carried out. The Biden administration is continuing to turn the screws on these companies because the threat isn’t changing.”

Hikvision said its video security products “present no security threat to the United States and there is no technical or legal justification for the Federal Communications Commission’s decision.” The company said the ruling will “make it more harmful and more expensive for US small businesses, local authorities, school districts, and individual consumers to protect themselves, their homes, businesses and property.”

Huawei declined to comment, while Dahua, Hytera and ZTE didn’t respond to emails sent outside normal business hours in China.

The looming FCC move didn’t come up in the bilateral meeting between US President Joe Biden and Chinese President Xi Jinping in Indonesia last week, a US official said, speaking on condition of anonymity. Biden did discuss technology issues more broadly with Xi and was clear that the US will continue to take action to protect its national security, the official said.

“This is the death knell for all of them for their US operations,” said Conor Healy, director of government research for the Bethlehem, Pennsylvania-based surveillance research group IPVM. “They won’t be able to introduce any new products into the US.”

Dahua and Hikvision stand to be affected most since their cameras are widely used, often by government agencies with many facilities to monitor, Healy said. Agencies including police also use handheld Hytera radios, he said.

In its order, the FCC also asked for comment on whether to revoke existing equipment authorization, Rosenworcel said in an online statement.

According to Healy, merchants could be stuck with gear that’s illegal to sell.

In 2018, Congress voted to stop federal agencies from buying gear from the five companies named by the FCC. The agency said earlier that the companies aren’t eligible to receive federal subsidies, and also has barred Chinese phone companies from doing business in the U.S.

The order released Friday was required under the Secure Equipment Act – a bill President Biden signed into law on November 2021.

The big picture: Huawei and ZTE are two of the world’s biggest suppliers of telecom equipment.

- Countries including Canada, Britain and Australia have ramped up restrictions against the use of 5G technologies from Huawei and ZTE in recent years.

- Huawei executives have previously said the company does not give data to the Chinese government and that its equipment is not compromised.

- The company’s chief security officer Andy Purdy has also argued that a ban would hurt American jobs because it spends over $11 billion a year from American suppliers.

References:

https://www.axios.com/2022/11/25/fcc-bans-huawei-zte-equipment-national-security

Huawei Connect 2022: Intelligent Cloud-Network Upgrades Announced

During HUAWEI CONNECT 2022 in Dubai, Huawei unveiled the upgraded capabilities of its Intelligent Cloud-Network Solution at the “Intelligent Cloud-Network, Unleashing Digital Productivity” summit. These capabilities, which center on three major scenarios —CloudFabric 3.0, CloudCampus 3.0, and CloudWAN 3.0— are provided to meet network development trends. Huawei also released the L3.5 Data Center Autonomous Driving Network White Paper, together with IEEE-UAE Section and pioneering customers, to contribute to the thriving data communications industry and unleash digital productivity.

The changes in enterprise business are driving the development of enterprise ICT infrastructure, and IP networks — serving as the bridge between IT and CT and covering all production and office procedures of enterprises, constitute the connectivity foundation for industry digital transformation. Networks have never been more important than they are today.

Daniel Tang, CTO of Huawei Data Communication Product Line, shed light on how to respond to future development trends and address network challenges. According to Daniel Tang, Huawei keeps innovating data communications technologies in areas such as Wi-Fi 7, 400GE, IPv6 Enhanced, multi-cloud synergy, autonomous driving network, and ubiquitous security. With these innovative technologies, Huawei has upgraded its capabilities in three scenarios: CloudFabric 3.0, CloudCampus 3.0, and CloudWAN 3.0.

Huawei CloudFabric 3.0 offers full-lifecycle intelligent capabilities for multi-cloud and multi-vendor networks based on L3.5 ADN technology. Stand-out features include unified management and control, flexible orchestration and collaboration, simulation & verification, risk prediction, and unified O&M for applications and networks. Plus, this solution facilitates easy interconnection with customers’ IT management systems to achieve end-to-end automation. Key results include easy deployment, easy O&M, and easy evolution.

By leveraging Huawei’s ADN and hyper-converged Ethernet technologies, Ankabut is building the world’s first HPC supercomputing center with Ethernet and InfiniBand co-cluster.

At the summit, Huawei, together with IEEE-UAE Section, Ankabut of UAE, and CBK of Kuwait, released the L3.5 Data Center Autonomous Driving Network White Paper.

- CloudCampus 3.0

Huawei further upgraded its CloudCampus 3.0 offerings by unveiling a host of flagship products, including the first enterprise-class Wi-Fi 7 AP AirEngine 8771-X1T, next-generation flagship core switch CloudEngine S16700, and 4-in-1 hyper-converged enterprise gateway NetEngine AR5710.

Huawei CloudCampus 3.0 helps enterprises simplify their campus networks from four aspects: access, architecture, branch, and Operations and Maintenance (O&M).

- CloudWAN 3.0

In the WAN field, Huawei continues to innovate technologies such as SRv6, FlexE slicing, and application-based IFIT measurement, and all of these technologies rely on IPv6 Enhanced. Huawei has further upgraded its CloudWAN 3.0 offerings to achieve agile connectivity, deterministic experience, and agile O&M and launched an ultra-high-density multi-service aggregation router — NetEngine 8000 F8 — to improve digital productivity with agile connectivity.

With Huawei’s help, the Gauteng province successfully deployed the first 100GE private network in South Africa — GBN.

The future digital world is full of uncertainties. As the saying goes, “If you want to go fast, go alone. If you want to go far, go together.” Mindful of this, Huawei strongly advocates partnerships and will continue to cooperate and innovate with more customers and partners in the data communication field. Vincent Liu, President of Huawei’s Global Enterprise Network Marketing & Solutions Sales Dept, highlighted that Huawei has set up many regional joint innovation labs and OpenLabs. Through these labs, Huawei is well poised to jointly innovate with customers from sectors such as public service, oil and gas, electric power, finance, education, and ISP. These concerted efforts pay off in many high-value application scenarios and achieve remarkable results. To date, Huawei has already trained and certified 188,000 data communication engineers, providing a large pool of ICT talent for digital transformation across industries.

Photo – https://mma.prnewswire.com/media/1921355/image_986294_38236382.jpg

SOURCE Huawei

SOURCE Huawei

References:

Huawei Connect 2022: It’s Cloud Native everything!

Huawei’s annual flagship event, Huawei Connect 2022 –“Unleash Digital” opened in Bangkok, Thailand today.

- Ken Hu, the Rotating Chairman of Huawei, spoke about the importance of cloud adoption for enterprises to achieve leap-forward development.

- Zhang Ping’an, CEO of Huawei Cloud, announced the launch of two new Huawei Cloud regions in Indonesia and Ireland, as well as the “Go Cloud, Go Global” program for enterprises to access expertise and experience from Huawei Cloud’s global ecosystem partners.

- By the end of this year, Zhang said that Huawei Cloud will be deployed in 29 regions and 75 availability zones, covering 170 countries and regions worldwide. At the core of its offering is Everything as a Service built on a cloud-native foundation to enable enterprises to innovate faster and accelerate digital transformation.

Zhang Ping’an, CEO of Huawei Cloud

Editor’s Note: The top four Cloud service providers in China are Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu. That’s very different from the U.S. where the leaders are Amazon AWS, Microsoft Azure, and Google Cloud.

Huawei Cloud has already set up 13 localized service centers in the Asia Pacific, with more than 1,000 certified engineers to provide tailored services. In addition, ecosystem development has been fruitful, with more than 2,500 local partners generating more than 50% of the revenue of Huawei Cloud. Huawei Cloud is also forging ahead with industry-government-academia collaboration in the Asia Pacific. Investment in the Huawei ASEAN Academy and the Seeds for the Future Program will be used to cultivate more than 1 million digital experts over the next five years.

Huawei Cloud serves 80% of the 50 biggest Internet companies in China and more than 200 major Internet companies in the Asia Pacific. In Sarawak, Malaysia, Huawei Cloud, together with its partners, has built cloud native infrastructure to support the collaboration of more than 30 government departments in five fields, and provided more than 80 digital government and smart city services to ensure more efficient and better-informed decision-making. In Indonesia, Huawei Cloud has provided a unified data foundation to help CT Corp migrate its media, retail, and finance services to the cloud, enabling precise recommendations for 200 million Internet users. The cloud native technologies of Huawei Cloud have helped Siam Commercial Bank (SCB) in Thailand quickly roll out its digital loan service. Loan approval and issuance, which used to take one month of work, is now fully automated and can be completed in just five minutes.

…………………………………………………………………………………………………………………………………………… …..

To address this pain point and unleash digital productivity for thousands of industries, Zeng Xingyun, President of Huawei Cloud, APAC, shared a three-pronged approach: to act with strategic resolve, embrace cloud-native and cultivate digital talent.

Zeng Xingyun, President of Huawei Cloud, APAC

Zeng emphasized long-term planning and a top-down approach to drive collaboration between IT and business departments to modernize blueprints and architecture based on cloud-native technologies. With 90% of enterprises in developed countries already using cloud technologies and 80% of all applications to be cloud-native by 2023, Zeng noted that cloud-native delivers efficient use of resources, agile applications, intelligent services and a secured system that helps government and enterprises stay compliant and grow sustainably.

In his speech, Zeng noted that Huawei Cloud has served more than 200 top Internet enterprises in Asia Pacific and 80% of the top 50 Internet enterprises in China. Huawei Cloud has 13 service centers in Asia Pacific, but more notably, Huawei Cloud is the first public cloud vendor to build local nodes in Thailand, with three availability zone data centers serving the local market.

He spoke about how cloud-native drives digital transformation in public and private sector, elaborating on how Huawei Cloud supports Siam Commercial Bank’s (SCB) automated processes to approve large volumes of loan requests within minutes, helping SCB attract 45,000 digital users and a credit limit worth THB 204 million within a quarter.

He also highlighted the importance of a talent ecosystem to address a digital talent shortage amounting to 47 million by 2030 in Asia Pacific. Through industry-academia cooperation such as the ASEAN Academy and the Seeds for the Future Program, more than 1 million digital talents will be cultivated in the next five years. Meanwhile, the Huawei Cloud Startup Program, aimed to help regional startups adopt cloud agilely, has already attracted more than 120 Asian enterprises since its recent launch. One such enterprise is ReverseAds, a Phuket-founded startup that has successfully secured US$24 million in funding to expand beyond Thailand.

The summit also saw the joint launch of Cloud Native Elite Club (CNEC) APAC by Huawei Cloud and Cloud Native Computing Foundation (CNCF). First established in China two years ago, CNEC gathers over 200 members working collaboratively to develop industry standards and promote cloud-native technologies in China. Likewise, the APAC branch will look to further cloud-native technologies.

Cloud-Native 2.0 for Industry Enablement:

An important driving force for service innovation, cloud-native technologies such as container, microservice, and dynamic orchestration empower enterprises to build and run scalable applications in modern, dynamic environments.

As cloud-native enters a new developmental stage, Fang Guowei, Chief Product Officer of Huawei Cloud, shared that Cloud Native 2.0 is a new phase for the intelligent upgrade of enterprises, focused on delivering Everything as a Service incorporating Infrastructure as a Service, Technology as a Service and Expertise as a Service to yield breakthroughs in digital transformation for government and enterprises.

An advocate of cloud-native innovations with open source, Huawei Cloud has contributed to the CNCF with open source projects including KubeEdge, Volcano and Karmada, hence growing the CNCF community from 1 Kubernetes project in 2015 to more than 20 categories and over 1,100 projects today.

Huawei Cloud delivers cost-effective cloud services with the innovative full-stack QingTian Architecture, featuring ultra-fast I/O engine, end-to-end security and enhanced operations and maintenance.

Adding to its offerings are more than 15 cloud-native products and services introduced to the global market for the first time. Elaborating on two core cloud-native innovations, Fang introduced the Cloud Container Engine (CCE) Turbo as a new cloud-contained engine that yields increased resource utilization, reduced access latency by up to 40%, and scale out 3,000 pods per minute to cope with traffic surges.

He also featured the Ubiquitous Cloud-Native Service (UCS), a distributed cloud-native service that allows enterprises to connect thousands of Kubernetes clusters to deliver a consistent experience through multi-cloud, cross-region applications.

Introductions were made to new services based on four pipelines: ModelArts to help AI developers effectively achieve one-stop data-tagging/model training; DataArts for an efficient and intelligent data governance pipeline; DevCloud for a secure and productive software development pipeline; and MetaStudio to provide better media experience. Other upcoming offerings include MacroVerse aPaaS such as KooMessage, KooSearch and KooGallery.

Fang also took the opportunity to release the Cloud-Native 2.0 Architecture White Paper to help enterprises embark on digital transformation.

Articulating the impact of Huawei Cloud’s innovations on industries, Hu cited AI adoption in the Pangu Drug Molecule Model to yield faster drug discovery for the First Affiliated Hospital of Xi’an Jiaotong University – successfully reducing R&D costs by 70% and development to approval time from a decade to a month for the world’s first broad-spectrum antimicrobial drug.

As one global network, Huawei Cloud has launched more than 240 cloud services, aggregating more than 38,000 partners and 3 million developers to release more than 7,400 applications in the cloud market.

With cloud-native technologies becoming a key engine to unleash digital productivity, Huawei Cloud demonstrates a commitment to harness cloud-native, Everything as a Service to spur economies.

References:

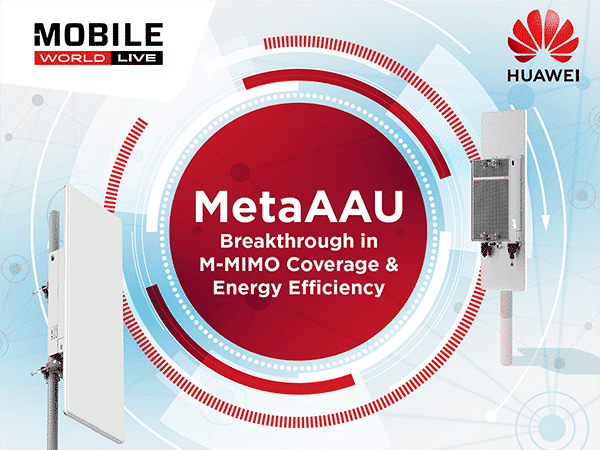

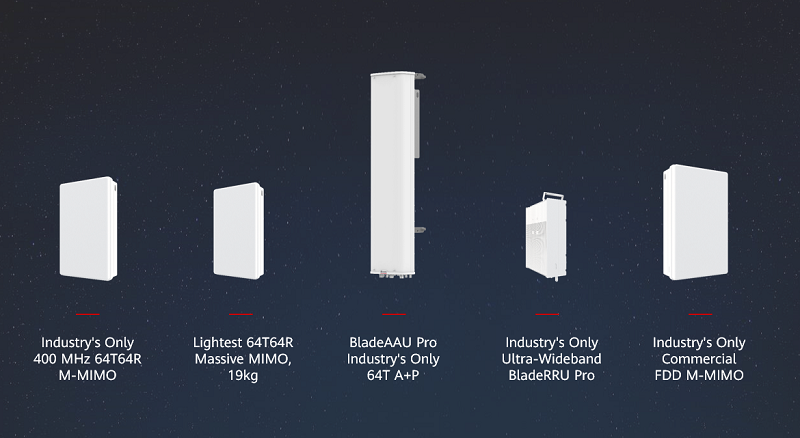

China Unicom to deploy Huawei’s 64T64R MetaAAU product-an upgrade of Huawei MetaAAU

China Unicom Beijing will commercial Huawei’s 64T64R MetaAAU product in a pilot urban residential area in Tongzhou District. China Unicom says the rollout of 64T64R MetaAAU resulted in a significant increase in user-perceived rates. Even at a building near the cell edge, the downlink user-perceived rate was able to reach 100 Mbps on every floor, China Unicom added.

64T64R MetaAAU is an upgrade of the Huawei MetaAAU series that adopts extremely large antenna array (ELAA) technology. The number of channels has grown from 32T32R to 64T64R, meaning this new green 5G base station Massive MIMO product can deliver upgrade coverage and capacity.

China Unicom Beijing and Huawei have created a commercial MetaAAU network as part of a project that has deployed MetaAAUs at over 1,000 rural network sites on the outskirts of Beijing. According to China Unicom, this new network has already seen a 38 percent increase in traffic per site by improving 5G services in rural areas.

The MetaAAUs used by this network are also designed to reduce site energy consumption by 5 percent under the same network load compared with previous-generation AAUs. MetaAAUs are the third-generation of 5G AAU developed by Huawei. They use the company’s new extreme-large antenna array (ELAA) architecture to double the scale of arrays compared with the previous-generation AAU. According to Huawei, this innovation results in extended coverage because channel beams are narrower and energy is more focused.

China Unicom Beijing has leveraged these advancements to hit its 2022 5G construction targets for small towns and rural areas which face unique challenges when it comes to inter-site distance, gigabit user experience, and green networking. China Unicom Beijing deployed these MetaAAUs at over 1,000 sites in July in towns and rural areas including the Shunyi, Huairou, and Pinggu districts of Beijing.

The company claims the MetaAAUs have delivered a 40 percent increase in coverage area, increased uplink and downlink user-perceived rates by 10 percent, and lowered network energy consumption by 5 percent over previous-generation AAUs. Since their deployment, user traffic has increased by 38 percent in their coverage areas and the operator’s user base has increased by 37 percent.

References:

https://www.telecompaper.com/news/china-unicom-deploys-1000-metaaaus-with-huawei–1430843

Huawei to expand consumer products to include smartphones, PCs and other consumer-oriented devices

Huawei Technologies said on Wednesday it will step up efforts to expand its presence in the commercial hardware market in its latest effort to pursue new growth opportunities beyond smartphones amid foreign government restrictions. Richard Yu Chengdong, a member of Huawei‘s executive board, said: “The company has rebranded its consumer business group that includes smartphones, PCs and other consumer-oriented businesses, into a device business group, to showcase its determination to tap into enterprise-oriented businesses such as PCs used in offices, desktops and large displays for industry customers.”

Huawei‘s new group will focus on providing office hardware and software solutions for key sectors including education, healthcare, manufacturing, transportation, finance and energy, Huawei said. Huawei‘s consumer business group used to contribute the most to the overall revenue of the company. But due to tough US government restrictions on Huawei‘s access to crucial technologies including semiconductors, the company’s smartphone sales plunged.

In the fourth quarter of 2021, Huawei‘s consumer business group revenue dropped nearly 50 percent to 243.4 billion yuan ($38 billion).

According to market research company Counterpoint, the company’s global smartphone market share fell below 4 percent since the first quarter of 2021, compared with its peak of 20 percent in the second quarter of 2020.

Amid such a context, Huawei has been working hard to find new growth engines to offset its declining smartphone business.

At an online product launch on Wednesday, Huawei unveiled its latest commercial tablets, smart wearables and displays equipped with its self-developed HarmonyOS. Huawei also provides a customized full-scenario payment solution called Huawei Payment for government clients and small and medium-sized enterprises.

Xiang Ligang, director-general of the Information Consumption Alliance, an industry association, said sales channels constitute the biggest difference between consumer-oriented and enterprise-oriented businesses. The former relies on retail stores, while the latter depends on close partnerships with customers from industries.

Huawei‘s advantages in product performance, quality as well as research and development can still give it an edge in enterprise-oriented business, Xiang said, adding that Huawei has accumulated experience in targeting industrial customers in its 5G base station business. Huawei is also continuing its drive for development of the OpenEuler operating system as part of its broader push to solve China’s lack of homegrown operating systems for fundamental digital technologies.

OpenEuler is designed for enterprise customers and can be used in devices such as servers and cloud computing. Last year, Huawei donated its Euler operating system to the OpenAtom Foundation, a major open source foundation in China, to become an open-source OS.

Jiang Dayong, director of the OpenEuler Community, said the OpenEuler open source community has attracted more than 8,000 developers and 330 partners such as chip makers, software companies and hardware makers. At present, the cumulative installed capacity of OpenEuler stands at more than 1.3 million in industries such as finance, transportation and telecom, which means the system is ready for faster growth. Jiang said he expects about 2 million new installations of OpenEuler in 2022.

Computer products at a Huawei store in Foshan, Guangdong province, on April 4, 2022. Photo: VCG

……………………………………………………………………………………………………………………………………………………………………….

References:

Huawei: XR industry to realize exponential growth with 5G; ‘Spatial Internet’ will be the next big thing

The world of Extended Reality or XR, which covers Virtual Reality, Augmented Reality and Mixed Reality, offers infinite potential, said Dr. Philip Song, Chief Marketing Officer, Huawei Carrier, during his keynote speech “5G + XR: Bringing Imagination into Reality,” at the 2022 Mobile World Congress (MWC) in Barcelona.

According to a survey, the XR industry will contribute US$1.5 trillion to the global GDP by 2030. In 2021, more than 10 million units of Quest 2 were shipped. These 10 million users will be the critical mass for the XR ecosystem to take off. Dr. Song added that following the mobile internet, ‘Spatial Internet’ [1.] will be the next big thing.

Note 1. While there’s no clear definition, the Spatial Web or Spatial Internet refers to a computing atmosphere that exists in a 3D space. It is a pairing of real and virtual realities, enabled via billions of connected devices, and accessed through the interface of Virtual and Augmented Reality.

…………………………………………………………………………………………………………………………………………………………………………………………………………..

Song introduced how Huawei held VR-enabled annual meetings and uses AR to assist with 5G base station delivery. Huawei and third-party data shows that the XR market will generate US$1.5 trillion in GDP by 2030, which is roughly equivalent to the current 5G market.

Comparing the XR industry’s progress to how the smartphone industry developed, Song said many vendors are now offering XR devices for under US$300, making the technology more affordable while still offering next-gen user experiences. XR development tools are being increasingly adopted. The new OPEN XR standard is now supported by almost every major hardware, platform, and engine company, making multi-platform deployment possible without multiple rounds of development.

What is more noteworthy is that a number of global XR pioneer carriers have made commercial breakthroughs in recent years. Carriers in countries like South Korea, Thailand, and China have led the deployment of VR/AR services and gained significant returns through three steps: selecting industries, setting business models, and developing capabilities. A carrier said, “If XR was launched three months later, it might take three years to catch up.”

XR Industry to Grow Rapidly:

The world is on the cusp of witnessing the fast-paced growth of the XR industry, he said. VR headset shipments are accelerating. In 2021, more than 10 million units of Oculus Quest 2, a VR headset, were shipped. Ten million users will be the critical mass for the XR ecosystem to take off. The growth of VR devices will mirror that of smartphones and mobile devices. From 1983 to 1994, it took 11 years to sell the first 10 million cellphones. However, the cellphone shipment touched 20 million in 1995, and 100 million were sold over the next three years. According to market forecast, VR headset shipment will reach 100 million units by 2025.

Also, the price of VR devices continues to drop, making them affordable for more people. Lastly, continuous innovation in XR technologies has made it possible to deliver a generational leap in user experience.

Huawei launched its next-generation, innovative AR-HUD, expanding XR applications. In terms of XR data transmission, Huawei presented innovative solutions such as 5G Massive MIMO and FTTR. The company has publicly committed to supporting a “Gigaverse” that provides ubiquitous gigabit access to support XR experiences anytime, anywhere. Huawei also launched its “Cloud-network Express” solution to help XR industry partners quickly access multiple clouds and use cloud-based development and rendering capabilities.

As he closed out his presentation, Song called on industry partners to work together in line with the “new Moore’s Law” and seize this great development opportunity for the XR industry. “I do believe that with industry-wide collaboration, 5G+XR will have a bright future. The best way to predict the future is to create it. The time to act is now,” concluded Dr. Song.

ZTE using TSMC’s 7-nm process to build custom chips for its 5G base stations

ZTE is on a roll! China’s #2 telecom firm said in its annual report that it gained market share in China last year for servers, core networks and storage solutions — the three areas where Huawei is a key player. Revenues grew at a double-digit percentage rate last year, rising inside and outside China and across all three business units – carrier (networks), enterprise (business) and consumer (gadgets).

With TSMC’s business booming, Nikkei Asia believes that ZTE is quietly building a technological edge in the base station market for fifth-generation (5G) cellular connectivity. These base stations are used by telecommunications carriers to meet consumer demands, and the publication believes that ZTE has designed its equipment to be based on the 7-nanometer (nm) process node.

The company [ZTE] has been utilizing some of TSMC’s most advanced chip production technology — the so-called 7-nm tech — to build processors for its 5G base stations. Sources said it also uses the Taiwanese chipmaker’s advanced chip packaging technology, which uses stacking technology to arrange chips with different functions into one package.

Nikkei Asia also said that Huawei’s inability to conduct business with TSMC due to American sanctions has left the field wide open for ZTE. The company is targeting double-digit growth for its server and base station segment, and it is also interested in TSMC’s leading-edge chip node, which is the company’s 5nm process.

However, while ZTE might not be sanctioned to procure the latest chip technologies from TSMC, the company still can not sell its 5G base stations to several Western companies. This has resulted in it focusing its efforts mostly on China, as the U.S. will rely on small cell 5G Open RAN platform developed by Qualcomm Incorporated on the 4nm node.

Source: Jordi Boixareu/Alamy Live News

“ZTE has turned quite aggressive in pursuing its chip capability in the past few years. Although the volume is still small, it is showing impressive progress,” said one unnamed source.

TSMC, as well as ZTE, seems to be on a very solid growth track. On the back of another robust set of quarterly financials Q4 FY21 and a strong balance sheet, the world’s #1 chip making firm announced a massive capex budget hike to increase manufacturing capacity in “advanced process technologies,” including 2nm, 3nm, 5nm and 7nm.

TSMC also sells products built on the 4nm, which is a design extension of the company’s 5nm process families. Different process technologies marketed under the 4nm branding are expected to commence production from the second half of this year to the first half of 2023.

References:

https://wccftech.com/tsmc-reveals-36-revenue-growth-as-chinas-zte-reportedly-using-7nm-for-5g/

https://www.lightreading.com/asia/zte-has-designs-on-chips-with-tsmc/d/d-id/775180?

China to accelerate 5G roll-outs while FCC faces “rip and replace” funding shortfall

China Daily reports that local governments in China are doubling down on plans to accelerate 5G rollouts in 2022. More than 20 provincial and municipal governments in China have emphasized efforts to accelerate construction of “new infrastructure” like 5G and data centers in their work plans for this year.

Shanghai plans to build more than 25,000 5G base stations this year (do you really believe that?) to push forward the in-depth coverage of the superfast wireless network. The city also has ambitions to build super large computing power platforms to meet growing demand.

Zhao Zhiguo, spokesman for the Ministry of Industry and Information Technology, China’s top industry regulator, said earlier:

“2022 is a critical year for the large-scale development of 5G applications. We will continue to improve 5G network coverage and accelerate the in-depth integration of 5G and vertical industries.”

One of the priorities is to moderately speed up the coverage of 5G in counties and rural towns in China, Zhao said.

Ten ministries, including the Cyberspace Administration of China, recently unveiled a digital rural development action plan for the period from 2022 to 2025, which called for an intensified push to promote digital infrastructure upgrades in rural areas.

Telecom operators are also moving fast. China Mobile, the nation’s largest telecom carrier, said it aims to achieve continuous 5G coverage in rural towns across the country by the end of this year.

Telecom carriers’ 5G plans seek to harness the power of more than 1.4 million 5G base stations that were deployed in China by the end of last year (but can you really trust that China government reported number?). 5G signals are already available in urban areas of all of China’s prefecture-level cities, more than 98% of county-level towns and 80 percent of rural towns, MIIT data showed.

5G Cell Tower in China. Image courtesy of China Daily

…………………………………………………………………………………………………………………………….

In the U.S., it’s a different story. The Federal Communications Commission (FCC) found a shortfall in funding for its plan to replace Chinese telecom equipment. Inadequate finance is likely to pose connectivity challenges to people in remote areas in the US, experts said.

According to a report on MobileWorld Live, a telecom industry website, the FCC said local telecom operators’ requests for funding to replace network equipment made by Chinese companies Huawei and ZTE totaled $5.6 billion, almost three times the $1.9 billion allocated by the US federal government. Network operators serving less than 10 million customers which used government subsidies to buy Huawei or ZTE equipment before 30 June 2020 were eligible to apply for funding to cover costs associated with removing, replacing and disposing of the Chinese network equipment.

In a statement released last week, FCC Chairwoman Jessica Rosenworcel said that 181 carriers submitted initial reimbursement application requests totaling approximately $5.6 billion. Carriers are required to remove and replace existing network gear from Huawei and ZTE after the vendors were deemed national security risks. Congress in late 2020 set aside around $1.9 billion to fund and carry out the effort under the Secured and Trusted Communications Act 2019.

“Last year Congress created a first-of-its kind program for the FCC to reimburse service providers for their efforts to increase the security of our nations communications networks,” Rosenworcel said. “We’ve received over 181 applications from carriers who have developed plans to remove and replace equipment in their networks that pose a national security threat,” she added.

The FCC banned U.S. telecom carriers from buying Huawei and ZTE’s equipment via federal subsidies, citing what it alleged were national security concerns. The two Chinese tech companies have repeatedly denied the accusations, which they said are groundless.

Xiang Ligang, director-general of the Information Consumption Alliance, a telecom industry association in China, said Huawei and ZTE’s products are currently used by US telecom carriers to offer network and broadband services in some of the most remote regions in the US. Xiang said that the U.S. order to replace Huawei/ZTE wireless network equipment in rural areas will result in the lack of quality telecom services.

Steve Berry, president and CEO of the Competitive Carriers Association, a trade group for about 100 wireless providers in the US, issued a statement calling on the U.S. government to ensure the FCC program is fully funded so that connectivity is maintained during the operators’ transition to new wireless telecom equipment for their cellular networks.

…………………………………………………………………………………………………………………………….

Table 1: All the companies asking for FCC “rip and replace” funding

| Company | Applicant | Wireless | Wireline | Total | Vendor |

| Viaero Wireless | NE Colorado Cellular Inc | X | $1,194,000,000 | Ericsson | |

| Union Wireless | Union Telephone Company | X | $688,000,000 | Nokia | |

| ATN International | Commnet Wireless, | X | $418,768,726 | ||

| Gogo | Gogo Business Aviation LLC | X | $332,770,202 | ||

| NTCH | PTA-FLA, Inc. | $273,971,426 | |||

| Lumen | Level 3 Communications, LLC | X | $269,999,994 | ||

| Stealth Communications | X | $199,066,226 | |||

| SI Wireless, LLC | X | $181,023,489 | |||

| United Wireless Communications, Inc. | X | $173,471,477 | |||

| Hotwire Communications, Ltd. | X | $141,299,003 | |||

| Latam Telecommunications, L.L.C. | $138,060,092 | ||||

| NEMONT TELEPHONE COOPERATIVE INC | X | $125,551,024 | |||

| NTUA Wireless, LLC | X | $124,447,019 | |||

| Windstream Communications LLC | X | $118,271,652 | |||

| Rise Broadband | Skybeam, LLC | X | $106,159,884 | ||

| Pine Telephone Company | X | $87,095,419 | |||

| Mediacom Communications Corporation | X | $86,171,976 | |||

| Flat Wireless, LLC | X | $76,284,671 | |||

| Pine Belt Cellular, Inc. | X | $74,856,191 | |||

| James Valley Cooperative Telephone Company | X | $53,000,000 | |||

| AST Telecom, LLC d/b/a Bluesky | X | $49,959,592 | |||

| Country Wireless LLC | X | $47,508,982 | |||

| Point Broadband Fiber Holding, LLC | X | $47,172,086 | |||

| Board of Trustees, Northern Michigan University | X | $45,796,636 | |||

| Hargray Communications Group, Inc. | X | $42,785,933 | |||

| NfinityLink Communications, Inc. | $37,535,905 | ||||

| Plateau Telecommunications, Incorporated | X | $30,000,000 | |||

| Texas 10, LLC | $29,088,795 | ||||

| Mark Twain Communications Company | X | $29,000,000 | |||

| Panhandle Telecommunication Systems Inc | $28,925,552 | ||||

| TelAlaska Cellular, Inc. | X | $26,567,517 | |||

| Central Louisiana Cellular, LLC | X | $26,264,528 | |||

| TRANSTELCO INC. | X | $25,573,213 | |||

| Beamspeed, L.L.C. | X | $19,596,157 | |||

| Triangle Telephone Cooperative Association, Inc. | X | $18,336,507 | Mavenir | ||

| Eastern Oregon Telecom, LLC | X | $18,122,185 | |||

| Puerto Rico Telephone Company, Inc. | X | $16,857,851 | |||

| Vitelcom Cellular, Inc. d/b/a Viya Wireless | X | $15,716,011 | |||

| Santel Communications Cooperative, Inc. | X | $14,604,337 | |||

| MHG Telco LLC | X | $14,456,482 | |||

| WorldCell Soutions, LLC | X | $12,673,559 | |||

| LIGTEL COMMUNICATIONS INC. | X | $12,000,000 | |||

| Point Broadband Fiber Holding, LLC | X | $11,344,724 | |||

| Copper Valley Wireless, LLC | X | $11,151,417 | |||

| Premier Holdings LLC | $9,759,680 | ||||

| Eltopia Communications, LLC | X | X | $7,741,951 | ||

| Metro Fibernet, LLC | X | $7,567,518 | |||

| Bestel (USA), Inc. | $6,887,500 | ||||

| PocketiNet Communications Inc. | $6,741,452 | ||||

| Carrollton Farmers Branch ISD | X | $5,943,974 | |||

| Windy City Cellular | X | $5,562,067 | |||

| Bristol Bay Cellular Partnership | X | $5,269,183 | |||

| Kings County Office of Education | $5,221,191 | ||||

| Interoute US LLC | $4,867,140 | ||||

| Pasadena ISD | $4,387,311 | ||||

| Velocity Communications, Inc. | X | $4,158,729 | |||

| Advantage Cellular Systems, Inc. | X | $3,479,000 | |||

| New Wave Net Corp | $3,365,772 | ||||

| FirstLight Fiber, Inc. | $3,306,644 | ||||

| Gigsky, Inc. | X | $3,128,678 | |||

| Triangle Communication Systems Inc | $2,779,371 | ||||

| FIF Utah LLC | X | $2,662,538 | |||

| Gallatin Wireless Internet, LLC | X | $2,399,162 | |||

| Moore Public Schools | $2,023,243 | ||||

| HUFFMAN ISD | $1,920,588 | ||||

| Crowley ISD | $1,720,496 | ||||

| Castleberry Independent School District | X | $1,672,527 | |||

| One Ring Networks, Inc. | $1,649,281 | ||||

| University of San Francisco | $1,570,437 | ||||

| Leaco Rural Telephone Cooperative, Inc. | $1,511,617 | ||||

| Zito West Holding, LLC | X | $1,453,469 | |||

| Southern Ohio Communication Services Inc | $1,312,844 | ||||

| Xtreme Enterprises LLC | X | $1,097,283 | |||

| Virginia Everywhere, LLC | X | $562,001 | |||

| South Canaan Telephone Company | $542,139 | ||||

| Palmer ISD | $520,146 | ||||

| Waxahachie ISD | X | $457,396 | |||

| Hunter Communications & Technologies LLC | $432,348 | ||||

| Utah Telecommunication Open Infrastructure Agency | $413,760 | ||||

| COMMSELL | $302,400 | ||||

| VTel Wireless, Inc. | X | $283,618 | |||

| Trinity Basin Preparatory, Inc. | $242,510 | ||||

| NTInet, inc | $198,340 | ||||

| LakeNet LLC | X | $193,277 | |||

| IdeaTek Telcom, LLC | X | $181,899 | |||

| Millennium Telcom, L.L.C., dba OneSource Communications | $165,195 | ||||

| Inland Cellular LLC | X | $117,183 | |||

| Roome Telecommunications Inc | $92,144 | ||||

| Milford Independent School District | $40,399 | ||||

| Angeles Enterprises | X | $33,368 | |||

| Crystal Broadband Networks | X | $28,704 | |||

| Natural G.C. Inc. | $27,313 | ||||

| Webformix Internet Company | X | $22,400 | |||

| Northern Cambria School District | $14,400 | ||||

| Deer Creek Independent School District | $- | ||||

| $5,609,338,024 | |||||

| This FCC data was initially compiled by vendor Mavenir and then expanded, checked and edited by Light Reading staff. | |||||

“We’ve received over 181 applications from carriers who have developed plans to remove and replace equipment in their networks that pose a national security threat. While we have more work to do to review these applications, I look forward to working with Congress to ensure that there is enough funding available for this program to advance Congress’s security goals and ensure that the US will continue to lead the way on 5G security,” FCC Chairwoman Jessica Rosenworcel said in a statement.

References:

http://www.chinadaily.com.cn/a/202202/09/WS620303dfa310cdd39bc85734.html

Mobile Experts: Ericsson #1 in RAN market; Huawei falls to #3

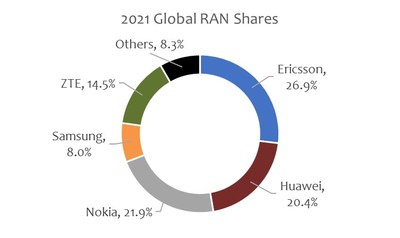

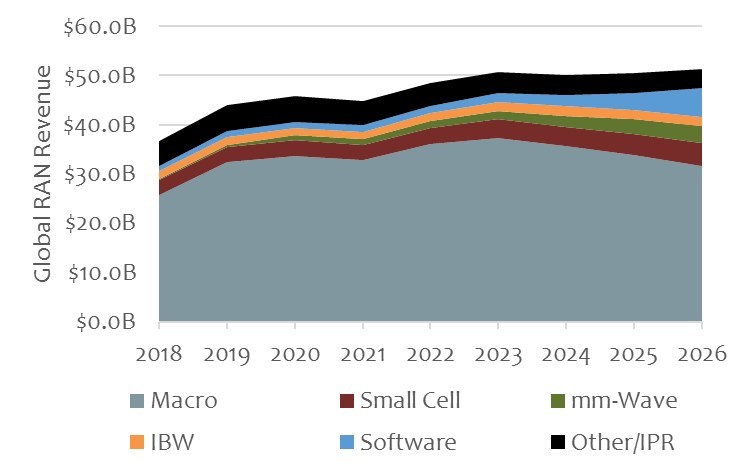

According to a new report from analyst firm Mobile Experts, Ericsson leapt into the #1 position in the RAN market for 2021. Ericsson (see Table 1. at bottom of this article), which achieved a 26.9% share of a market that grew by about 3% in value to be worth in the region of $45 billion last year.

Sanctions hit Huawei very hard as the Chinese tech giant dropped to third place in the RAN market in terms of the value of sales with a 20.4% market share. Huawei had a shortfall of roughly $4B last year due to the company’s inability to produce high-capacity TDD base stations. That was because of U.S. Government sanctions on the critical components needed. As a result, Huawei achieved much lower dollar value than their western competitors.

Nokia (21.9% market share) placed third while ZTE achieved fourth place (14.5%) ahead of Samsung (8% market share).

“Our approach to forecasting is deeply analytical, using data from more than 100 sources, rather than simply the inputs of five OEMs. Our approach works. This analyst team has been creating some of the most accurate, detailed forecasting on the market for over a decade,” commented Chief Analyst of Mobile Experts, Joe Madden. “We have developed relationships with suppliers, operators, and vendors that give us data for a three-pronged approach to triangulation on mobile infrastructure revenue.”

Mobile Experts’ models show the RAN market growing at a CAGR (Cumulative Annualized Growth Rate) of 3%, with -1% growth in macro base stations and 25%-35% growth in millimeter wave and software segments. The analyst firm, known for their unmatched accuracy, leverage over a decade of ear-to-ground experience in this market to present this detailed market forecast that presents last year’s findings concisely and completely as well as presenting what’s next for the RAN market and its players.

“Overall, the RAN market is looking up. After 30 years of boom-and-bust cycles, the market is currently reaching a peak with 5G deployment in its active mode this year. In coming years, we see new revenue coming in from private enterprises to offset the natural drop in CSP sales; specifically, the private LTE/5G market will grow by 19%, accounting for more than $4 billion in 2026. As a result, the total RAN market will remain near its 5G peak for a few years, with the possibility for growth in the longer term,” commented Chief Analyst Joe Madden.

Total Year Review for 2021 – Global RAN Revenue:

This pre-earnings report offers a comprehensive overview of the RAN market with Mobile Experts’ signature accuracy and detailed breakdowns. This quarter’s report includes revenue estimates for the top 25 vendors in the RAN market for 2021. This is the first of a series of quarterly updates, and it is available today for instant download with purchase at www.mobile-experts.net.

For more about this research and buy the report, click here.

About Mobile Experts Inc.:

Mobile Experts provides insightful market analysis for the mobile infrastructure and mobile handset markets. Our analysts are true Experts, who remain focused on topics where each analyst has 25 years of experience or more. Research topics center on technology introduction for radio frequency (RF) and communications innovation. Recent publications include: RAN Revenue, Cellular V2X, Fixed Mobile Convergence, Edge Computing, In-Building Wireless, CIoT, URLLC, Macro Base Station Transceivers, Small Cells, VRAN, and Private LTE.

……………………………………………………………………………………………..

Table 1: Ericsson’s headline figures (Swedish Krona-SEK billions)

| 2021 | 2020 | Change | |

| Net sales | 232.3 | 232.4 | 0% |

| Gross income | 100.7 | 93.7 | 7% |

| Gross margin | 43.4% | 40.3% | – |

| Research and development expenses | -42.1 | -39.7 | – |

| Selling and administrative expenses | -27.0 | -26.7 | – |

| Impairment losses on trade receivables | 0.0 | 0.1 | -134% |

| Other operating income and expenses | 0.4 | 0.7 | -45% |

| Share in earnings of JV and associated companies | -0.3 | -0.3 | – |

| EBIT | 31.8 | 27.8 | 14% |

| – of which networks | 37.3 | 30.9 | 21% |

| – of which digital services | -3.6 | -2.2 | – |

| – of which managed services | 1.5 | 1.6 | -6% |

| – of which emerging business and other | -3.4 | -2.4 | – |

| EBIT margin | 13.7% | 12.0% | – |

| Financial income and expenses, net | -2.5 | -0.6 | – |

| Income tax | -6.3 | -9.6 | 30% |

| Net income | -0.5 | -1.3 | – |

| Source: Ericsson | |||