OpenRAN

Dish Wireless with Qualcomm Technologies and Samsung test simultaneous 5G 2x uplink and 4x downlink carrier aggregation

Dish Wireless collaborated with Qualcomm Technologies and Samsung to successfully test simultaneous 5G 2x uplink and 4x downlink carrier aggregation (CA) using FDD spectrum. DISH achieved 200 Mbps uplink peak speeds with just 35 MHz of 5G spectrum. The DISH 5G network executed 1.3 Gbps downlink peak speeds with just 75 MHz of 5G spectrum, both across FDD bands n71, n70 and n66. Boost Mobile and Boost Infinite subscribers will soon benefit with even faster download and upload speeds on America’s Smart Network™.

This test was completed in both DISH labs and the field using a mobile phone form-factor test device powered by Snapdragon® X75 5G Modem RF System from Qualcomm Technologies [1.] and Samsung’s 5G vRAN solution as well as dual- and tri-band radios across the DISH 5G network.

Note 1. Qualcomm’s Snapdragon X75is currently sampling to customers with commercial devices expected to launch later this year.

“It’s been a pleasure to work closely with DISH Wireless and support their expanding cloud-native Open RAN virtualized network as 5G services are now live across several markets, clearing the path for even lower latency and faster speeds,” said Mark Louison, executive vice president and general manager, Networks Business, Samsung Electronics America. “We are committed to pushing the boundaries to advance network capabilities to meet growing consumer demands for our customers.”

“We look forward to continued collaborative efforts with industry partners such as DISH and Samsung to enable faster 5G around the world,” said Sunil Patil, vice president, Product Management, Qualcomm Technologies, Inc. “As consumers demand increases for uplink heavy applications, carrier aggregation on FDD spectrum is crucial to bring faster upload speeds to more consumers across markets and networks.”

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

DISH claims its “Open RAN cloud-native 5G network is changing the way the world communicates,” but we don’t believe that is happening and we are not proponents of OpenRAN.

“The DISH 5G Open RAN network now covers over 73% of the U.S. population 5G broadband coverage and more than 100 million Americans 5G voice service – VoNR – with more markets going live each month,” said Eben Albertyn, EVP and CTO, DISH Wireless. “By successfully delivering 5G 2x uplink and 4x downlink carrier aggregation for FDD spectrum, DISH is now poised to deliver a better customer experience across our 5G standalone network. We look forward to continuing to pave the way to fully harness the power of 5G.”

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

According to Daryl Schoolar, analyst and director at Recon Analytics, this achievement is significant for Dish because while operators have been able to do downlink CA using multiple FDD bands, uplink CA is very new. DISH’s announcement comes just a little over a month after Qualcomm and Samsung announced that they had completed the world’s first simultaneous 5G 2x uplink and 4x downlink CA for FDD spectrum. Qualcomm and Samsung noted at the time that this development was important because it gives operators with fragmented FDD spectrum assets more flexibility and makes it possible for them to deliver faster upload and download speeds. Traditionally, uplink CA has been accomplished by combining FDD+TDD or TDD+TDD configurations.

Uplink capacity is becoming more critical as more consumers use uplink-heavy applications such as social media posting and video conferencing. Indeed, the possibility of delivering peak uplink speeds of 200 Mbps is quite a sizable increase from typical uplink speeds that are measured on wireless networks today. In Ookla’s Q3 2023 report on U.S. wireless networks, it reported that T-Mobile had the fastest median upload speed in the U.S. with speeds of just 11.31 Mbps.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

About DISH Wireless:

DISH Wireless, a subsidiary of DISH Network Corporation (NASDAQ: DISH), is changing the way the world communicates with the Boost Wireless Network. In 2020, the company became a nationwide U.S. wireless carrier through the acquisition of Boost Mobile. DISH continues to innovate in wireless, building the nation’s first virtualized, O-RAN 5G broadband network, and is inclusive of the Boost Infinite, Boost Mobile and Gen Mobile wireless brands.

For company information, go to about.dish.com

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.fiercewireless.com/wireless/dishs-technical-breakthrough-means-faster-speeds-customers

https://en.wikipedia.org/wiki/5G_NR_frequency_bands

Dish says its 5G network now covers 70% of the U.S. population

Dish Network to FCC on its “game changing” OpenRAN deployment

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

Dell’Oro: OpenRAN revenue forecast revised down through 2027

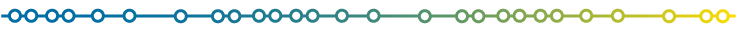

No surprise that the global Open RAN market share forecast to 2027 has been revised downward by market research firm Dell’ Oro Group. This is the first downward forecast revision since the firm started tracking Open RAN, reflecting some hesitancy about these next generation architectures.

What is complicating the analysis is the fact that Open RAN adoption has been mixed across the greenfield and the brownfield operators. With greenfield and early adopter brownfield deployments maturing, the reality the industry is now facing is that it will take some time for the other segments to match and offset the more stable trends with the early adopters.

“We can think of this revision more as a near-term calibration than a change in the long-term growth trajectory,” said Stefan Pongratz, Vice President and Analyst at the Dell’Oro Group. “This journey of “re-shaping” the RAN was never expected to be smooth and many challenges remain. Even so, our long-term position has not changed. We continue to believe that Open RAN is here to stay, and the growing support by the incumbent suppliers bolsters this thesis, “continued Pongratz.

Additional highlights from the July 2023 Open RAN Report:

- Cumulative Open RAN revenues have been revised downward by 5 percent to 10 percent through the forecast period.

- Open RAN revenues are projected to account for more than 15 percent of global RAN by 2027.

- The European operators are ahead of the rest of the world when it comes to announcing Open RAN targets, but they have been more cautious with deploying Open RAN, focusing on building out 5G using traditional RAN. The baseline forecast, which assumes more delays in Europe, is for the European Open RAN market to surpass $1 B by 2027 and eventually be one of the leading markets from an Open RAN/RAN perspective.

Light Reading previously reported that prominent greenfield network operator Open RAN deployments to date have failed to impress, leaving many Open RAN equipment and software vendors to look to brownfield operations to make an industry impact. But so far not many have achieved any significant product swaps, nor does it look like there are many progressing at a pace that would accelerate Open RAN maturity among brownfield operators.

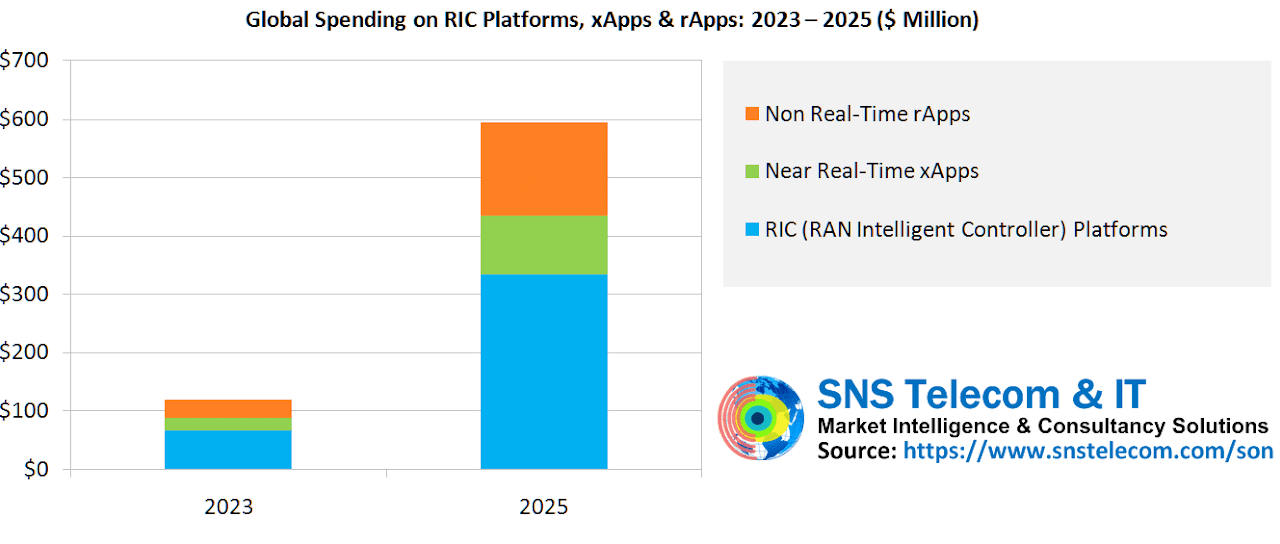

This chart below shows a timeline of Open RAN advances:

Source: 5G Americas

……………………………………………………………………………………………………………………….

Opinion: This author expects further downward revisions to come, mainly because the O-RAN Alliance, which creates the OpenRAN specifications, is not a standards body. Nor have they liaised their specs to ITU-R WP 5D which is responsible for all terrestrial IMT recommendations/standards. They do have an alliance with ATIS which has yet to contribute their specifications to either 3GPP or ITU.

………………………………………………………………………………………………………………..

The Dell’Oro Group Open RAN Advanced Research Report offers an overview of the Open RAN and Virtualized RAN potential with a 5-year forecast for various Open RAN segments including macro and small cell, regions, and baseband/radio. The report also includes projections for virtualized RAN along with a discussion about the vision, the ecosystem, the market potential, and the risks. To purchase this report, please contact us by email at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, networks, and data center markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

5-Year Open RAN Forecast Revised Downward, According to Dell’Oro Group

https://telecoms.com/522778/global-open-ran-market-share-by-2027-revised-downward/

LightCounting: Open RAN/vRAN market is pausing and regrouping

https://strandconsult.dk/category/open-ran/

NTT DOCOMO OREX brand offers a pre-integrated solution for Open RAN

NTT DOCOMO is leveraging its expertise to support the Open RAN efforts of network operators worldwide. Earlier in 2023, DOCOMO adopted the OREX (Open RAN Ecosystem Experience) brand to strengthen the support scheme for international telecom operators in delivering the Open RAN system.

“OREX provides the Open RAN solution, creating a new network experience that is truly open to the world,” explains Sadayuki Abeta, NTT DOCOMO’s Global Head of Open RAN and OREX Evangelist. “OREX is committed to making 2023 the defining year for Open RAN. Our ultimate goal is to eliminate global communication gaps through the OREX initiative.”

NTT DOCOMO is the number one mobile operator in Japan. Having launched its first-generation service in 1979, since then the company has pioneered new technologies.

Today DOCOMO has three business segments: enterprise, smart life, and telecommunications. It has 87m subscribers, with 20m subscribers enjoying its 5G Open RAN services, with a total revenue of around US$44bn.

An expert in the mobile industry for more than 25 years, Abeta’s career at NTT DOCOMO started as a researcher for 4G in 1997.

“My career at NTT DOCOMO started as a researcher for 4G in 1997,” he explains. “Then, we brought our ideas to 3GPP and I participated in 3GPP standardisation from 2005.

“With 3GPP, I served as the Vice Chair of 3GPP RAN1 and the rapporteur of LTE and LTE-A. After the completion of the LTE standard specification, I led the development of eNB and gNB commercial products and network optimization in the commercial network as the General Manager of the Radio Access Network Development department.”

In 1997 the second-generation mobile system was introduced in Japan. Instead of GSM, Japan utilised the Personal Digital Cellular (PDC) system. “During this time, data services over the mobile network were initiated, but the data rate was incredibly low, starting at only 2.4kbps,” Abeta explains. “It’s hard to imagine today, but at that time, only small text messages could be transferred over the mobile network. Eventually, the data rate increased to 28.8kbps.

“In 1999, we launched the i-mode service, marking the beginning of internet services over the mobile network.”

In 2000, 3G was introduced, with DOCOMO playing a significant role in contributing to the 3GPP standard specification work. “We led technical discussions and managed the discussions as one of the officials, serving as the Chair. We were the first operator to deploy 3G networks nationwide and provided rich content via the 3G network. However, the data rate was still limited to 64Kbps or 384kbps. Later, HSPA technology was introduced, enabling much higher throughput.

“Moving forward, we proposed LTE together with our partners and launched 4G services in 2010,” Abeta describes. “Our 4G radio access network (RAN) was fully multi-vendor interoperable. We defined interfaces that were not initially defined by 3GPP, making us the first operator to deploy a multi-vendor interoperable RAN. The rise of smartphones in conjunction with our 4G services revolutionised the user experience, and its benefits are well-known.”

While DOCOMO’s communication services continued to thrive, the company also expanded its non-communication services, evolving into the smart-life service segment.

When it comes to the rollout of 5G, DOCOMO has contributed not only to 3GPP but also to the O-RAN alliance to realise multi-vendor interoperable Open RAN solutions. “In 2018, we established the 5G Open Partner Program, aiming to create new services and address social issues by collaborating with vertical players,” Abeta adds. “Currently, this program has attracted participation from 5,300 companies and organisations.”

In this exclusive interview, Sadayuki Abeta, NTT DOCOMO’s Global Head of Open RAN Solutions and OREX Evangelist discussed its OREX brand, which offers a pre-integrated solution that simplifies integration, interoperability and lifecycle management.

“OREX provides the Open RAN solution, creating a new network experience that is truly open to the world.”

NTT DOCOMO has been featured in the July issue of Mobile Magazine

Mobile Magazine is the ‘Digital Community’ for the global Telecoms industry. Mobile Magazine covers 5G, IoT, Technology, AI, Connectivity, Mobile Operators, Wireless networks and Media – connecting the world’s largest community of Telecoms executives. Mobile Magazine focuses on telecoms news, key telecoms interviews, telecoms videos, along with an ever-expanding range of focused telecoms white papers and webinars.

References:

https://mobile-magazine.com/magazines

NTIA’s Wireless Innovation Fund to stimulate open 5G and future-gen wireless markets; OpenRAN rebuttal

The U.S. Commerce Department’s National Telecommunications and Information Administration (NTIA) has officially launched its Wireless Supply Chain Innovation Fund, which has a budget of $1.5 billion and a mandate to spend it on stimulating the development of new and exciting telco technology. It’s mission is to “open 5G and future-gen wireless markets to innovation and entrepreneurship in the U.S., as well as by our partners and allies.”

NTIA will work to catalyze the development and adoption of open, interoperable, and standards-based networks through the Innovation Fund. Authorized under the Fiscal Year 2021 National Defense Authorization Act and funded through the CHIPS and Science Act of 2022, this ten-year grant program will help drive wireless innovation, foster competition, and strengthen supply chain resilience. It will also help unlock opportunities for companies from the United States and its global allies, particularly small and medium enterprises, to compete in a market historically dominated by a few suppliers, including high-risk suppliers that raise security concerns.

On Wednesday, NTIA announced its first notice of funding opportunity (NOFO), which invites interested parties to apply for some of that money. This first tranche of grants, worth up to $140.5 million, has been earmarked for projects focused on OpenRAN R&D. By demonstrating the viability of new, open-architecture approaches to wireless networks, this initial round of funding will help to ensure that the future of 5G and next-gen wireless technology is built by the U.S. and its global allies and partners –not vendors from nations that threaten America’s national security.

“The Innovation Fund is a critical step toward securing 5G wireless networks while driving innovation at home and abroad,” said Commerce Secretary Raimondo. “Investing in the next generation of innovation will unlock opportunities for new and emerging companies to compete in the global telecom market, strengthen our telecom supply chains and provide our allies and friends with trusted choices and innovative technologies to compete in the 21st Century. We look forward to bringing the best of industry, academia, and the public together to deliver on this initiative.”

NTIA’s first NOFO aims to expand and improve testing to demonstrate the viability of new approaches to wireless like open radio access networks (OpenRAN) and remove barriers to adoption. NTIA anticipates it will award up to $140.5 million during this first tranche of grants. The first round of awards will provide for a range of R&D and testing activities in this critical field, including:

- Expanding industry-accepted testing and evaluation (T&E) activities to assess and facilitate the interoperability, performance, and/or security of open and interoperable, standards-based 5G radio access networks; and

- Developing new or improved testing methodologies to test, evaluate, and validate the interoperability, performance, and/or security of these networks, including their component parts.

Later NOFOs will build upon the foundational work of this first NOFO, creating an ecosystem for wireless innovation built by the U.S. and its global allies.

“This fund is a critical down payment on our efforts to reshape the global wireless infrastructure supply chain towards secure and trusted vendors,” said Sen. Mark Warner (VA). “I look forward to seeing how the Department – working with U.S. and allied innovators and network operators – helps encourage this market to move towards security, interoperability, and greater wireless innovation.”

“With the investments from this initiative, the US can help facilitate much-needed competition in the global wireless market and create a more resilient and secure wireless supply chain,” said Assistant Secretary of Commerce Alan Davidson.

“Today’s announcement marks critical new progress toward strengthening the security of our wireless networks,” added energy and commerce committee ranking member Frank Pallone. “This program is a win for both U.S. national security and innovation, and with it, we will help level the playing field against untrusted actors attempting to use our communications networks against us.”

This announcement comes the same week as the U.S. moved forward with its plan to name and punish any ally that permits the use of network equipment developed by Chinese vendors Huawei and ZTE. The ‘Countering Untrusted Telecommunications Abroad Act’ is reportedly due to have its second reading this week.

Separately, the NOFO announcement came a day after the UK unveiled its own strategy for driving innovation in the telecoms sector. The UK government seems to have implied that it wouldn’t necessarily oppose consolidation in the mobile market, insisting that there is no magic number of operators.

……………………………………………………………………………………………………………..

Comment and Analysis – OpenRAN Rebuttal:

This author and several of his colleagues have been negative on OpenRAN for a very long time. The main reason is that Open RAN specs (which are to ensure multi-vendor interoperability) are being developed by the O-RAN Alliance, with test scripts from the TIP OpenRAN project. Neither of those entities are Standards Development Organizations (SDOs). While O-RAN did forge an alliance with ATIS, that won’t help much as ATIS has not developed any cellular standards on its own.

The two organizations that develop all the cellular specs and standards are 3GPP and ITU-R IMT yet O-RAN Alliance does not have a liaison with either of them!

Here is the opinion of our colleague John Strand, Principal of StrandConsult on why Open RAN is popular in some countries and with selected media, but really has no serious market potential:

The U.S. State Department spends a lot of energy promoting OpenRAN as an alternative to Chinese vendors like Huawei and ZTE. It is described quite well in this article. I had a meeting with those people at the State Department in Washington on December 8th last year, and they understand that OpenRAN was not a product that operators were buying.

In Europe, operators such as Deutsche Telecom and Vodafone have bet big on Huawei. That’s described in our reports: Understanding the Market for 4G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 102 Mobile Networks – Strand Consult and The Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries – Strand Consult

Europe has also agreed that it is not smart to build vital telecom infrastructure using network equipment from China, the EU 5G tool box. For Vodafone and DT, OpenRAN is their excuse to stick with the Chinese vendors. Their story is that when OpenRAN is ready, we will replace Huawei equipped with OpenRAN vendors- when it is ready for mass market.

- The vendors who bet on OpenRAN spend a lot of money on sponsoring events with media that subsequently write a lot of positive stories, praising the technology. When I joke, I refer to TelecomTV as “OpenRAN TV.” I would guess that 95% of the OpenRAN events are sponsored events, and a lot of the articles is related to the same events.

- There are a number of politicians in countries that have 2G, 3G, 4G and 5G and they all want to dominate 6G. They have not realized that innovation is happening in global companies such as Nokia, Ericsson, Qualcomm, Samsung and Huawei/ZTE that built their own proprietary network equipment.

- The 5G and 6G standards work with 3G, 4G, 5G, and 6G happens in 3GPP and ITU-R (ATIS carries 3GPP contributions into ITU-R WP5D directed at ITU-R IMT standards (i.e. reccommendations). The next G does not come from a nation or a company, but from a group of global companies.

- For some people believe OpenRAN is the next G, but that’s total nonsense! Only ITU-R (WP 5D) is responsible for all the cellular G’s as part of International Mobile Telecommunications (IMT) recommendations and there is NO WORK IN ITU-R on OpenRAN!!!

- There are a number of companies that make their living selling market information, companies which over the last 20 years have been hit financially because there has been a consolidation of the infrastructure industry. It is in their interest that the number of suppliers is increased, it gives them access to a larger customer base. OpenRAN is a new product segment and represent around 30 – 40 potential customers with a budget.

- GSMA, along with some of their members, has marketed a narrative that there are not many suppliers in this industry and that there is a need for more supplier diversity. It’s not a true story if you look at how many vendors are exhibiting at Mobile World Congress. It is also a story that does not seem credible when these same operators are crying out for the possibility of consolidating the market. The consolidation there has been when it comes to infrastructure, it is driven by mobile operators who have changed their purchasing habits and bet on fewer suppliers.

–>To put it very simply, the less people know about the cellular communications market, the happier they are about OpenRAN.

References:

https://ntia.gov/page/public-wireless-supply-chain-innovation-fund

https://www.federalregister.gov/documents/2022/12/13/2022-26938/public-wireless-supply-chain-innovation-fund-implementation

https://telecoms.com/521184/us-dangles-1-5bn-in-front-of-open-ran-community/

LightCounting: Open RAN/vRAN market is pausing and regrouping

Paradise Mobile’s Open RAN 4G/5G core network to run on AWS cloud

Paradise Mobile, a new Mobile Network Operator (MNO) building a greenfield, cloud-native, Open RAN (oRAN) 4G/5G mobile network from the ground up in Bermuda, today announced the selection of Amazon Web Services, Inc. (AWS) as its preferred cloud provider to help build an Open RAN 4G/5G network and bring innovative services to Bermuda for the first time.

Paradise Mobile will leverage AWS for digital platform workloads, with agreements to roll out AWS edge services on island to host the wireless core and Open RAN DU and CU workloads. Paradise Mobile is also working to bring AWS services to the island, which will provide local businesses and innovators in the IoT industry the necessary tools and infrastructure to rapidly develop, test and deploy cutting edge products and services. The new environment will provide the ability for a secure, scalable, and high-performance network, optimized for businesses to develop and launch their next big thing.

Sam Tabbara, Co-Founder and CEO, Paradise Mobile, said: “We see Amazon as a strategic long-term collaborator who shares our vision and values, and has the ability to significantly accelerate our roadmap of innovative new products and services we want to launch in Bermuda. This relationship will allow us to provide our customers with the best possible experience and create a hub for IoT innovation in Bermuda and beyond.”

Tabbara said Paradise plans to run its 5G network operations – including management software from Mavenir – directly inside a Kubernetes stack running on AWS. To do so, Tabbara explained that Paradise will install an instance of AWS inside a LinkBermuda data center and will run AWS at the base of each of its roughly two dozen planned cell towers. “The opportunity for us with AWS is to accelerate that [5G] future,” Tabbara told Light Reading.

The new IoT environment will also provide businesses with access to a wide range of AWS services. These services will give businesses the ability to process and analyze vast amounts of data in real-time, enabling them to create new and innovative products and services.

Sameer Vuyyuru, head of worldwide business development at AWS, said: “Leveraging AWS helps reduce time-to-market as well as create a new path to deliver innovation to customers. Our work with Paradise Mobile will not only help Paradise Mobile rapidly build, scale, and manage its mobile network but also offer secure solutions to accelerate innovation across Bermuda.”

Paradise intends to build specific network-based applications and services that can be used by other operators. Drone operations is one of the first 5G use cases that Paradise plans to support. Tabbara said that the company is in discussions with an unnamed drone startup that may use the Paradise 5G network for testing.

AWS will play a key role in that strategy, according to Tabbara. He explained that enterprise developers are already familiar with AWS’ cloud computing platform and therefore will be able to add networking into the mix as Paradise lights up its 5G operations. “Anyone who knows how to code applications … if you are able to code within that [AWS] ecosystem, then there’s value add for us to be in that same ecosystem,” Tabbara said. The drone startup plans to do its development work inside the relatively familiar confines of Amazon’s cloud computing platform. “We’re already co-developing some of these solutions,” Tabbara said.

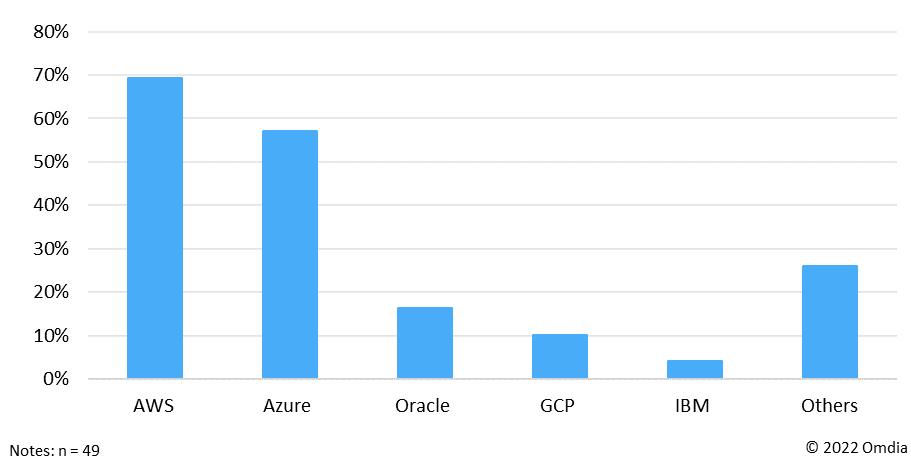

The announcement is yet another win for AWS as the hyperscaler competes against Oracle, Microsoft and Google Cloud for the telecom business. Omdia asked 49 telecom executives to list which public cloud or clouds their company is currently using to run any network functions, and respondents could select all that apply. Here was their response:

Note: Azure is Microsoft’s cloud offering, Google Cloud Platform is Google/Alphabet’s

…………………………………………………………………………………………………………………………………

Paradise Mobile is building a next generation wireless net network in Bermuda, followed by other CARICOM markets to be announced in the near future.

About Paradise Mobile:

Paradise Mobile is building a world of effortless connection with a next generation wireless network launching in multiple markets and countries, starting with Bermuda in 2023. Visit www.paradisemobile.com to learn more.

References:

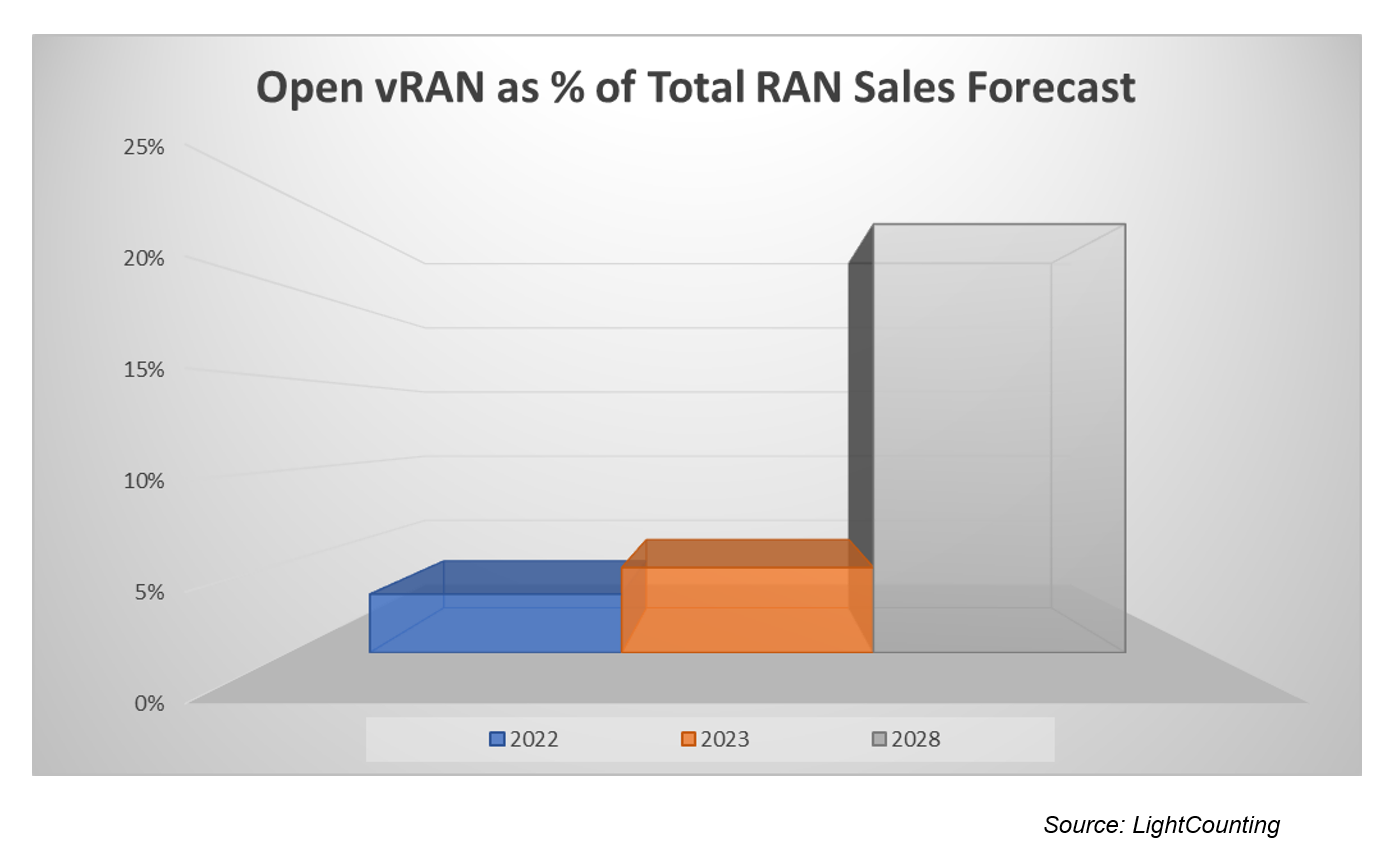

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

Global spending on Open RAN compliant RIC (RAN Intelligent Controller) platforms, xApps and rApps will reach nearly $600 Million by the end of 2025, according to a new report by SNS Telecom & IT. The market research and consulting firm estimates that global spending on RIC platforms, xApps and rApps will reach $120 Million in 2023 as initial implementations move from field trials to production-grade deployments. With commercial maturity, the submarket is further expected to quintuple to nearly $600 Million by the end of 2025.

Annual investments in the wider SON (Self-Organizing Network) [1.] market – which includes licensing of embedded D-SON features, third party C-SON functions and associated OSS platforms, in-house SON capabilities internally developed by mobile operators, and SON-related professional services across the RAN, mobile core and transport domains – are expected to grow at a CAGR of approximately 7% during the same period.

Note 1. SONs (Self-Organizing Networks) are radio access networks (RANs) that automatically plan, configure, manage, optimize, and heal themselves. SONs can offer automated functions such as self-configuration, self-optimization, self-healing, and self-protection.technology minimizes the lifecycle cost of running a mobile network by eliminating manual configuration of network elements at the time of deployment right through to dynamic optimization and troubleshooting during operation. Besides improving network performance and customer experience, SON can significantly reduce the cost of mobile operator services, improving the OpEx-to-revenue ratio and deferring avoidable CapEx. SONs strive to make complicated network administration a thing of the past by enabling the creation of a plug-and-play environment for both simple and complex network tasks.

…………………………………………………………………………………………………………………………………………………………………….

- AT&T is among the first mobile operators to invest in the development of Open RAN-aligned RIC functionality and associated applications – particularly xApps for real-time RAN control and optimization. Since 2019, the operator has been collaborating with Nokia and other partners to co-develop an RIC software platform and identify xApp use cases, in alignment with the O-RAN Alliance architecture, to enable RAN programmability for easy integration of new services, as well as AI (Artificial Intelligence) and ML (Machine Learning)-driven algorithms for automated optimization. At present, the mobile operator is trialing interference management, traffic steering and energy savings-related xApps across a 200-cell site cluster in New Jersey.

- As a precursor to rApp capabilities, rival operator Verizon has deployed Qualcomm’s RAN automation platform that uses AI/ML-driven algorithms to automate the optimization of new 5G NR cell sites and simplify the development of custom SON applications for its wireless network.

- New entrant DISH Network Corporation is trialing VMware’s RIC as the platform on top of which RAN applications will run. Through the trial, DISH will specifically evaluate VMware’s RIC on its ability to create custom solutions from a vibrant ecosystem of xApps and rApps, use RAN programmability and intelligence for network automation, and enhance security to monitor and protect RAN traffic at the point it enters the network.

Europe

- In Europe, Vodafone is actively investing in RIC applications within the framework of its wider Open RAN initiative. The mobile operator group – in collaboration with Cohere Technologies, VMware, Capgemini Engineering, Intel Corporation and TIP (Telecom Infra Project) – has successfully completed a multi-vendor PoC (Proof-of-Concept) trial, which demonstrated a two-fold increase in the capacity of a 5G NR cell site using a programmable, AI-based RIC platform supporting a mix of Open RAN components from multiple vendors. As part of the trial, Vodafone used Cohere’s Spectrum Multiplier xApp running on VMware’s distributed RIC to enable more efficient use of spectrum through a novel MU-MIMO (Multi-User MIMO) scheduler.

- In addition, Vodafone is collaborating with Juniper Networks and Parallel Wireless to carry out a multi-vendor RIC trial for tenant-aware admission control use cases using Open RAN standards-compliant interfaces. The trial is initially running in Vodafone’s test labs in Türkiye with plans to move into the mobile operator group’s test infrastructure.

- DT (Deutsche Telekom) is hosting the SD-RAN outdoor field trial in Berlin, Germany, that integrates the ONF’s (Open Networking Foundation) near real-time RIC and end-to-end 5G platform with Open RAN components from various vendors, including xApps for controlling RUs (Radio Units), DUs (Distributed Units) and CUs (Central Units). As part of a separate effort, DT has been collaborating with VMware and Intel Corporation to develop, test and validate an open-standards compliant intelligent vRAN solution, which also features an RIC element.

- Telefónica’s German business unit has connected a Nokia-supplied RIC to a mobile communications cluster – initially spanning 11 RAN nodes supporting 5G NR, LTE and 2G coverage in Berlin’s Hellersdorf district – within its live commercial network. In the initial “learning” phase of operation, the RIC will continuously analyze network data to detect unusual behavior of radio cells. In the second phase, the near-real-time RIC will take AI-driven decisions to dynamically balance the load of the radio cells, selecting optimum parameters from the network data obtained and continuously adjust them in near real-time. Since 2021, Telefónica has also been collaborating with NEC Corporation in validating and implementing cutting-edge Open RAN technologies and various use cases at its lab in Madrid, Spain, including AI-driven RIC applications for RAN optimization.

- BT Group is trialing Nokia’s Open RAN standards-compliant RIC platform across a number of sites in the city of Hull (East Riding of Yorkshire, England), United Kingdom, to optimize network performance for customers of the EE mobile network. French telecommunications giant Orange is also evaluating Open RAN standards-compliant RIC, xApps and rApps provided by various suppliers.

- In Asia, Japan’s Rakuten Mobile is embedding Juniper Networks’ RIC solution into its operating platform to support RAN automation and optimization-related applications.

- NTT DoCoMo is collaborating with NEC Corporation and NEC’s subsidiary Netcracker to jointly develop a RIC platform aimed at improving performance, enhancing customer experience, reducing power consumption and minimizing operational costs.

- Rival Japanese mobile operator KDDI has been collaborating with Samsung to trial various E2E (End-to-End) network slicing-related use cases with an RIC platform in Tokyo, Japan.

- China Mobile has also been working with multiple equipment vendors and third-party suppliers to develop and implement Open RAN standards-compliant RIC, xApps and rApps. Among other engagements, the mobile operator has collaborated with Nokia to carry out a field trial of an AI-powered RAN over its live commercial LTE and 5G NR network infrastructure. Specifically, the trial evaluated AI-based UE traffic prediction in Shanghai and an ML-enabled network anomaly detection solution across more than 10,000 4G/5G cells in Taiyuan.

The “SON (Self-Organizing Networks) in the 5G & Open RAN Era: 2022 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents a detailed assessment of the SON market, including the value chain, market drivers, barriers to uptake, enabling technologies, functional areas, use cases, key trends, future roadmap, standardization, case studies, ecosystem player profiles and strategies. The report also provides global and regional market size forecasts for both SON and conventional mobile network optimization from 2022 till 2030, including submarket projections for three network segments, six SON architecture categories, four access technologies and five regional submarkets.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report.

The report will be of value to current and future potential investors into the SON and wider mobile network optimization market, as well as SON-x/rApp specialists, OSS and RIC platform providers, wireless network infrastructure suppliers, mobile operators and other ecosystem players who wish to broaden their knowledge of the ecosystem.

For further information concerning the SNS Telecom & IT publication “SON (Self-Organizing Networks) in the 5G & Open RAN Era: 2022 – 2030 – Opportunities, Challenges, Strategies & Forecasts” please visit: https://www.snstelecom.

For a sample of the report please contact: [email protected]

About SNS Telecom & IT:

Part of the SNS Worldwide group, SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to 5G, LTE, Open RAN, private cellular networks, IoT (Internet of Things), critical communications, big data, smart cities, smart homes, consumer electronics, wearable technologies, and vertical applications.

References:

https://www.snstelecom.com/ric-xrapps

https://www.celona.io/network-architecture/self-organizing-network

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT: Spending on Unlicensed LTE & 5G NR RAN infrastructure at $1.3 Billion by 2023

SNS Telecom: U.S. Network Operators will reap $1B from fixed wireless by late 2019

Samsung in OpenRAN deal with NTT DOCOMO; unveils 28GHz Radio Unit (RU)

Samsung Electronics announced the company is supplying a variety of 5G radios to support NTT DOCOMO’s Open Radio Access Network (Open RAN) expansion. Samsung will now provide a range of Open RAN-compliant 5G radios covering all of the Time Division Duplex (TDD) spectrum bands held by the operator.

This builds upon the two companies’ 5G agreement previously-announced in March 2021, in which NTT DOCOMO selected Samsung as its 5G network solutions provider. Samsung now adds new radios — including 3.7GHz, 4.5GHz and 28GHz — to its existing 3.4GHz radio support for NTT DOCOMO.

This expanded portfolio from Samsung will enable NTT DOCOMO to leverage its broad range of spectrum across Japan to build a versatile 5G network for diversifying their services offered to consumers and businesses. The companies have also been testing the interoperability of these new radios with basebands from various vendors in NTT DOCOMO’s commercial network environment.

“We have been collaborating with Samsung since the beginning of 5G and through our Open RAN expansion, and we are excited to continue extending our scope of vision together,” said Masafumi Masuda, Vice President and General Manager of the Radio Access Network Development Department at NTT DOCOMO. “Solidifying our global leadership, we will continue to build momentum around our Open RAN innovation and to provide highly scalable and flexible networks to respond quickly to the evolving demands of our customers.”

“Japan is home to one of the world’s most densely populated areas with numerous skyscrapers and complex infrastructure. Samsung’s industry-leading 5G radios portfolio meets the demands of low-footprint, low-weight solutions, while also ensuring reliable service quality,” said Satoshi Iwao, Vice President and Head of Network Division at Samsung Electronics Japan. “As NTT DOCOMO continues to accelerate its Open RAN innovation, we look forward to working together to deliver a richer experience to consumers and generating new business opportunities.”

With this announcement, Samsung introduces its new 28GHz Radio Unit (RU) for the first time — as a new addition to its portfolio of leading mmWave solutions. This RU, which weighs less than 4.5kg (~10lbs), features a light and compact form factor with very low power consumption, enabling flexible deployments in various scenarios. Additionally, Samsung’s 3.4GHz, 3.7GHz and 4.5GHz radios are also Open RAN-compliant and designed to deliver high performance and reliability.

Last month, Samsung won a contract with NTT East to provide cloud-native 5G core and RAN equipment to the provider’s private 5G network platform. That deal followed on an agreement earlier this year for Samsung to power the operator’s private 5G network services in the east areas of Japan, and followed trials of Samsung’s 5G standalone (SA) network core in test environments.

Samsung also secured a deal with Comcast to activate the cable giant’s deep spectrum holdings and become an infrastructure-owning 5G cellular operator targeting market heavyweights Verizon, AT&T, and T-Mobile US. Comcast will use Samsung’s 5G RAN equipment for its Xfinity Mobile service, including a newly developed 5G Strand Small Cell that is designed to be mounted on Comcast’s existing aerial cable lines. This all-in-one piece of equipment is central to the deployment as it will allow Comcast to mount cellular antennas where it’s already running cable connections for wireless backhaul.

A recent Dell’Oro Group report noted the vendor has been gaining RAN market share at the expense of its China-based rivals Huawei and ZTE outside of their home country. This could accelerate as the U.S. Federal Communications Commission adopted new rules prohibiting domestic telecommunication operators from acquiring and using networking and other equipment from China-based vendors, including Huawei.

“While commercial Open RAN revenues continue to surprise on the upside, the underlying message that we have communicated now for some time now has not changed and remains mixed,” said Stefan Pongratz, Vice President with the Dell’Oro Group. “Early adopters are embracing the movement towards more openness but at the same time, there is more uncertainty when it comes to the early majority operator and the implications for the broader RAN supplier landscape now with non-multi vendor deployments driving a significant portion of the year-to-date Open RAN market,” continued Pongratz.

Additional Open RAN highlights from the Dell’Oro’s 3Q 2022 RAN report:

- Top 4 Open RAN revenue suppliers for the 1Q22-3Q22 period include Samsung, Fujitsu, NEC, and Mavenir.

- Trials are on the rise globally, however, North America and the Asia Pacific regions are still dominating the commercial revenue mix over the 1Q22-3Q22 period, accounting for more than 95 percent of the market.

- More than 80 percent of the year-to-date growth is driven by the North America region, supported by large scale non-Massive MIMO and Massive MIMO macro deployments.

- The rise of Open RAN has so far had a limited impact on the broader RAN (proprietary and Open RAN) market concentration. The data contained in the report suggest that the collective RAN share of the top 5 RAN suppliers (Huawei, Ericsson, Nokia, ZTE, and Samsung) declined by less than one percentage point between 2021 and 1Q22-3Q22.

- Short-term projections have been revised upward to reflect the higher baseline – Open RAN is now projected to account for 6 to 10 percent of the RAN market in 2023. Open RAN growth rates, however, are expected to decelerate next year, reflecting the likelihood that the sum of new brownfield deployments will be able to offset more challenging comparisons with the early adopters.

Samsung says they have pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users around the world.

………………………………………………………………………………………………………………………………………………………

NTT DOCOMO began commercial 5G services in early 2020, and included open RAN-compliant equipment provided by Fujitsu, NEC, and Nokia. The carrier more recently signed a partnership with South Korea’s SK Telecom (SKT) to develop new 5G and 6G cellular technologies and deployment plans taking advantage of open and virtualized RAN (vRAN) technology.

NTT DOCOMO is Japan’s leading mobile operator with over 85 million subscriptions, is one of the world’s foremost contributors to 3G, 4G and 5G mobile network technologies. Beyond core communications services, DOCOMO is challenging new frontiers in collaboration with a growing number of entities (“+d” partners), creating exciting and convenient value-added services that change the way people live and work. Under a medium-term plan toward 2020 and beyond, DOCOMO is pioneering a leading-edge 5G network to facilitate innovative services.

References:

https://news.samsung.com/global/samsung-electronics-expands-5g-radio-support-for-ntt-docomo

https://www.sdxcentral.com/articles/news/docomo-deepens-samsung-5g-ran-drive/2022/12/

https://www.docomo.ne.jp/english/

Summary of EU report: cybersecurity of Open RAN

The EU has published a report on the cybersecurity of Open RAN, a 4G/5G (maybe even 2G?) network architecture the European Commission says will provide an alternative way of deploying the radio access part of 5G networks over the coming years, based on open interfaces. The EU noted that while Open RAN architectures create new opportunities in the marketplace, they also raise important security challenges, especially in the short term.

“It will be important for all participants to dedicate sufficient time and attention to mitigate such challenges, so that the promises of Open RAN can be realized,” the report said.

The report found that Open RAN could bring potential security opportunities, provided certain conditions are met. Namely, through greater interoperability among RAN components from different suppliers, Open RAN could allow greater diversification of suppliers within networks in the same geographic area. This could contribute to achieving the EU 5G Toolbox recommendation that each operator should have an appropriate multi-vendor strategy to avoid or limit any major dependency on a single supplier.

Open RAN could also help increase visibility of the network thanks to the use of open interfaces and standards, reduce human errors through greater automation, and increase flexibility through the use of virtualisation and cloud-based systems.

However, the Open RAN concept still lacks maturity, which means cybersecurity remains a significant challenge. Especially in the short term, by increasing the complexity of networks, Open RAN could exacerbate certain types of security risks, providing a larger attack surface and more entry points for malicious actors, giving rise to an increased risk of misconfiguration of networks and potential impacts on other network functions due to resource sharing.

The report added that technical specifications, such as those developed by the O-RAN Alliance, are not yet sufficiently secure by design. This means that Open RAN could lead to new or increased critical dependencies, for example in the area of components and cloud.

The EU recommended the use of regulatory powers to monitor large-scale Open RAN deployment plans from mobile operators and if needed, restrict, prohibit or impose specific requirements or conditions for the supply, large-scale deployment and operation of the Open RAN network equipment.

Technical controls such as authentication and authorization could be reinforced and a risk profile assessed for Open RAN providers, external service providers related to Open RAN, cloud service/infrastructure providers and system integrators. The EU added that including Open RAN components into the future 5G cybersecurity certification scheme, currently under development, should happen at the earliest possible stage.

Following up on the coordinated work already done at EU level to strengthen the security of 5G networks with the EU Toolbox on 5G Cybersecurity, Member States have analysed the security implications of Open RAN.

Margrethe Vestager, Executive Vice-President for a Europe Fit for the Digital Age, said: “Our common priority and responsibility is to ensure the timely deployment of 5G networks in Europe, while ensuring they are secure. Open RAN architectures create new opportunities in the marketplace, but this report shows they also raise important security challenges, especially in the short term. It will be important for all participants to dedicate sufficient time and attention to mitigate such challenges, so that the promises of Open RAN can be realised.”

Thierry Breton, Commissioner for the Internal Market, added: “With 5G network rollout across the EU, and our economies’ growing reliance on digital infrastructures, it is more important than ever to ensure a high level of security of our communication networks. That is what we did with the 5G cybersecurity toolbox. And that is what – together with the Member States – we do now on Open RAN with this new report. It is not up to public authorities to choose a technology. But it is our responsibility to assess the risks associated to individual technologies. This report shows that there are a number of opportunities with Open RAN but also significant security challenges that remain unaddressed and cannot be underestimated. Under no circumstances should the potential deployment in Europe’s 5G networks of Open RAN lead to new vulnerabilities.”

Guillaume Poupard, Director General of France’s National Cyber Security Agency (ANSSI), said: “After the EU Toolbox on 5G Cybersecurity, this report is another milestone in the NIS Cooperation Group’s effort to coordinate and mitigate the security risks of our 5G networks. This in-depth security analysis of Open RAN contributes to ensuring that our common approach keeps pace with new trends and related security challenges. We will continue our work to jointly address those challenges.”

Finally, a technology-neutral regulation to foster competition should be maintained., with EU and national funding for 5G and 6G research and innovation, so that EU players can compete on a level playing field.

References:

https://ec.europa.eu/commission/presscorner/detail/en/IP_22_2881

https://digital-strategy.ec.europa.eu/en/library/cybersecurity-open-radio-access-networks

U.S. Department of Defense (DoD) and NTIA Launch 5G Challenge: RAN subsystem interoperability

The DoD, in collaboration with the National Telecommunications and Information Administration’s (NTIA) Institute for Telecommunication Sciences (ITS) [1.] have launched the 5G Challenge Preliminary Event: RAN Subsystem Interoperability. This competition aims to accelerate the development and adoption of open interfaces, interoperable components, and multi-vendor solutions toward the development of an open 5G ecosystem.

Note 1. ITS, the Nation’s Spectrum and Communications Lab, supports the Department of Defense 5G Initiative through a combination of its subject matter experts in 5G and its research, development, test, and evaluation (RDT&E) laboratory infrastructure in Boulder, Colorado, including the Advanced Communications Test Site at the Table Mountain Radio Quiet Zone.

“The Department is committed to supporting innovation efforts that accelerate the domestic development of 5G and Future G technologies. 5G is too critical a technology sector to relinquish to countries whose products and technologies are not aligned with our standards of privacy and security. We will continue our support of all necessary efforts to unleash innovation while developing secure 5G supply chains,” said Amanda Toman, Acting Principal Director, 5G-Future G.

“Increasing the resilience and security of our supply chain is at the heart of NTIA’s work to incentivize open and interoperable 5G networks and increase the diversity of suppliers in the 5G ecosystem,” said Alan Davidson, Assistant Secretary of Commerce for Communications and Information and NTIA Administrator. “NTIA and ITS are excited to collaborate with the Department of Defense on the 5G Challenge because it reinforces our joint understanding that cost-effective, secure 5G networks are key to both national and economic security.”

Today, most wireless networks are operated by mobile network operators and composed of many vendor-specific proprietary solutions. Each discrete element typically contains custom, closed-source software and hardware. This industry dynamic increases costs, slows innovation, and reduces competition, often making security issues difficult to detect and resolve. The 5G Challenge aims to foster a large, vibrant, and diverse vendor community dedicated to advancing 5G interoperability towards true plug-and-play operation, and unleashing a new era of technological innovation based on this critical technology.

This 5G Challenge Preliminary Event: RAN Subsystem Interoperability will award up to $3,000,000 to participants who submit hardware and/or software solutions for any or all of the following 5G network subsystems, which must be compliant with the 3GPP Release 15 and O-RAN Alliance specifications: Distributed Unit (DU), Central Unit (CU), and Radio Unit (RU). Interoperability is open for applications through May 5, 2022. For applications and additional information on this 2022 contest, please visit www.challenge.gov.

About NTIA:

The National Telecommunications and Information Administration (NTIA), located within the Department of Commerce, is the Executive Branch agency that is principally responsible by law for advising the U.S. President on telecommunications and information policy issues. NTIA’s programs and policymaking focus largely on expanding broadband Internet access and adoption in America, expanding the use of spectrum by all users, and ensuring that the Internet remains an engine for continued innovation and economic growth.

About USD(R&E):

The Under Secretary of Defense for Research and Engineering (USD(R&E) is the Chief Technology Officer of the Department of Defense. The USD(R&E) champions research, science, technology, engineering, and innovation to maintain the United States military’s technological advantage. Learn more at www.cto.mil, follow us on Twitter @DoDCTO, or visit us on LinkedIn at https://www.linkedin.com/company/ousdre.