Optical Network Equipment Market

Cignal AI: Network Operator Spending on Optical and Packet Transport Gear in North America

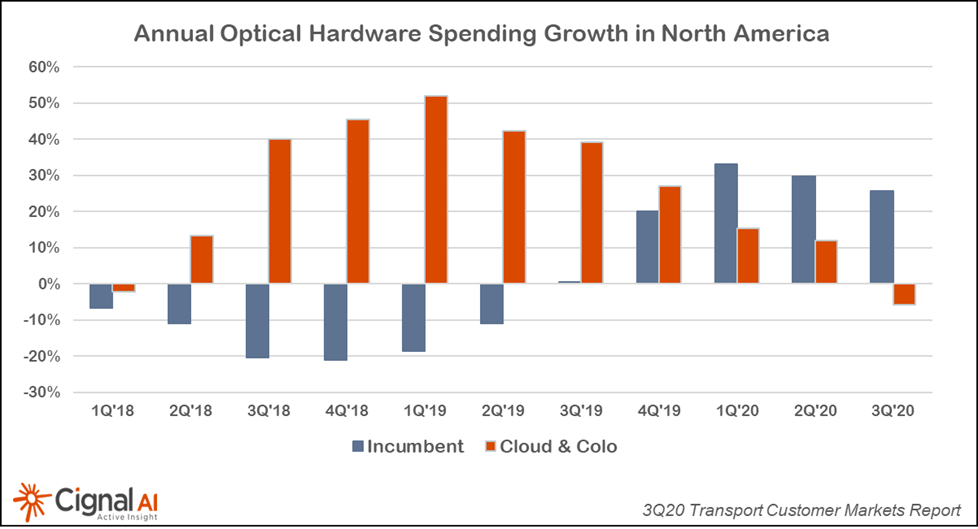

Expenditures by North American cloud and colocation operators on optical and packet transport equipment declined 20 percent year over year in the third quarter of 2020 (3Q20), while incumbent operator spending increased 2 percent, according to the 3Q20 Transport Customer Markets Report from market research firm Cignal AI. It’s quite important that incumbent operator spending grew while cloud and colocation operator spending declined during 2020.

“Equipment suppliers to cloud operators report that sales in the third quarter were depressed because service providers absorbed capacity on networks that were built during the first half of 2020,” said Scott Wilkinson, lead analyst at Cignal AI. “Both incumbent and cloud operators, especially in North America, spent significantly more of their annual budget than typical in the first half of the year.”

| More Key Findings from the 3Q20 Transport Customer Markets Report |

- After uncharacteristically strong growth in 2Q20, sales to cloud and colocation operators in Asia Pacific (APAC) rose dramatically again in the third quarter

- Despite a year-over-year decline in sales, Ciena maintained its worldwide market share leadership in sales to cloud and colocation operators in 3Q20

- The fourth quarter is expected to be challenging for sales outside APAC, with traditional telco and cloud and colocation purchases anticipated to wane worldwide

| About the Transport Customer Markets Report |

| The Cignal AI Transport Customer Markets Report tracks global optical and packet transport equipment spending by end-customer market type, including incumbent, wholesale, cloud and colocation, cable MSO and broadband, enterprise and government network operators. The report includes historical market share and market size and five-year market size forecasts. Vendors examined: Adtran, ADVA, Alaxala, Ciena, Cisco, Ekinops, Ericsson, Fiberhome, Fujitsu, Fujitsu NC, Huawei, Infinera, Juniper Networks, Mitsubishi Electric, NEC, Nokia, Padtec, RAD, Tejas Networks, Ribbon Communications, Telco Systems, Xtera and ZTE. |

| About Cignal AI |

Cignal AI provides active and insightful market research for the networking component and equipment market and its end customers. Our work blends expertise from various disciplines to create a uniquely informed perspective on the evolution of networking communications.

…………………………………………………………………………………………………………………………………………………………………………………….. Some of the Optical Transport Equipment vendors are: Ciena, Cisco, ADVA Optical networking, Aliathon Technology, ECI Telecom, Ericsson, Fujitsu, Alcatel-Lucent, Furukawa Electric / OFS Russia, Huawei Technologies, Micron Optics

|

Cignal AI: COVID-19 Continued to Pressure Optical Network Supply Chain in Q2-2020

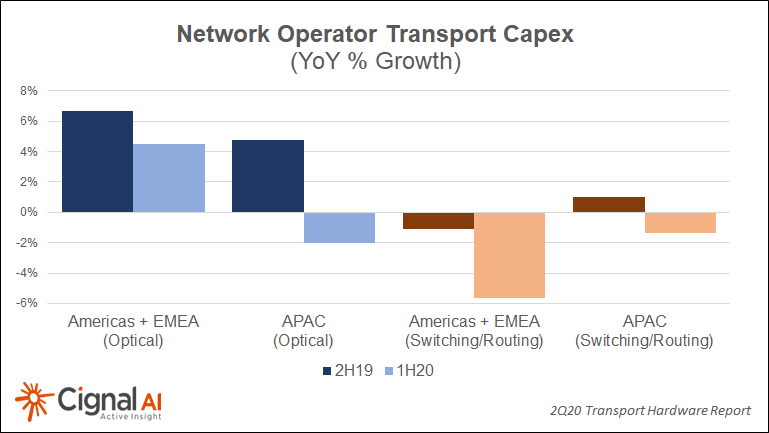

Delayed order fulfillment due to COVID supply chain impact earlier this year was expected to spur sales growth in 2Q20, but instead the results were mixed, according to the most recent Transport Hardware Report from research firm Cignal AI. Forecasted growth in Q2 from sales pushed out from Q1 did not materialize, and network operators indicated that annual CapEx would not increase (see chart below). As a result, spending on optical and switching/routing equipment will be flat to down in the second half of the year.

“COVID operational issues slowed deliveries and revenue recognition in the second quarter, although optical hardware sales increased in NA and EMEA due to high demand for inventory,” stated Cignal AI Lead Analyst Scott Wilkinson. “Growth is not expected to continue in the second half as carriers have pulled forward annual CapEx spending and networks are now able to cope with COVID-related surges.”

Some regions did shine in 2Q20. North American optical sales were up sharply YoY in both metro and long haul WDM, though the second half of the year is expected to be flat or down. Japan’s extraordinary growth in optical sales expanded to packet sales this quarter, with sales to both market segments up substantially YoY.

Additional 2Q20 Transport Hardware Report Findings:

- In addition to COVID woes, RoAPAC continues to suffer from the CapEx limitations in India, and optical sales declined -20% for the quarter while packet sales also declined.

- China has overcome its COVID related issues and returned to optical and packet spending growth this quarter, with increasing growth forecasted for Q3.

- EMEA optical spending increased YoY but was weighed down by weak Nokia sales. Nokia predicts that Q3 sales increases will offset Q2 declines.

Real-Time Market Data:

Cignal AI’s Transport Hardware Dashboardis available to clients of the Transport Hardware Report and provides up-to-date market data, including individual vendors’ results as they are released. Users can manipulate variables online and see information in a variety of useful ways, as well as download Excel files with up-to-date snapshots of market reporting.

Contact: sales@@cignal.ai

References:

https://cignal.ai/2020/08/transport-hardware-misses-expected-bounce-back-in-2q20/

Addendum:

According to Industry Research, the global Optical Transport Network (OTN) Equipment (optical transport and switching) market is projected to reach USD 20360 million by 2026, from USD 15810 million in 2020, at a CAGR of 4.3% during 2021-2026.

The Optical Transport Network (OTN) Equipment market is segmented into the following categories:

- Mobile Backhaul Solutions

- Triple Play Solutions

- Business Services Solution

- Industry and Public Sector

- Others

With respect to data rates, the Optical Transport Network (OTN) Equipment market is segmented into three categories:

- < 10G

- 10G-100G

- 100-400G

https://www.industryresearch.co/global-optical-transport-network-otn-equipment-market-16157288

Windstream Wholesale and Infinera Complete Successful Trial of LR8-Based 400GbE Client-Side Services

“Our customers’ bandwidth requirements are growing rapidly, and Windstream is increasing network capacity to meet this demand,” said Buddy Bayer, chief network officer at Windstream. “Infinera’s GX G30 Compact Modular Platform provides an ultra-efficient transport solution enabling us to offer 400GbE services to support our customers’ high-bandwidth needs. The use of LR8 clients with a single mode fiber interface and a 10-kilometer reach provides an extremely cost-effective solution by enabling us to extend these services directly to our customers’ premises.”

Windstream Wholesale is currently engaging with customers for initial deployment of the end-to-end 400G Wave service. For more information on how you can bring 400G Wave services to your company, call 1-866-375-6040.

To view the Windstream network map, visit https://www.windstreamenterprise.com/wholesale/interactive-map/.

About Windstream

Windstream Holdings, Inc., a FORTUNE 500 company, is a leading provider of advanced network communications and technology solutions. Windstream provides data networking, core transport, security, unified communications and managed services to mid-market, enterprise and wholesale customers across the U.S. The company also offers broadband, entertainment and security services for consumers and small and medium-sized businesses primarily in rural areas in 18 states. Services are delivered over multiple network platforms including a nationwide IP network, our proprietary cloud core architecture and on a local and long-haul fiber network spanning approximately 150,000 miles. Additional information is available at windstream.com or https://www.windstreamenterprise.com/wholesale/. Please visit our newsroom at news.windstream.com or follow us on Twitter at @Windstream.

About Infinera

Infinera is a global supplier of innovative networking solutions that enable carriers, cloud operators, governments, and enterprises to scale network bandwidth, accelerate service innovation, and automate network operations. The Infinera end-to-end packet optical portfolio delivers industry-leading economics and performance in long-haul, submarine, data center interconnect, and metro transport applications. To learn more about Infinera, visit www.infinera.com, follow us on Twitter @Infinera, and read our latest blog posts at www.infinera.com/blog.

Windstream Media Contact

Scott Morris, 501-748-5342

[email protected]

Infinera Media Contact

Anna Vue, (916) 595-8157

[email protected]

Source: Windstream Holdings, Inc.

Reference:

Cignal AI: Optical Network Equipment Sales +25% in 4Q2019 + 650 Group

Cignal AI:

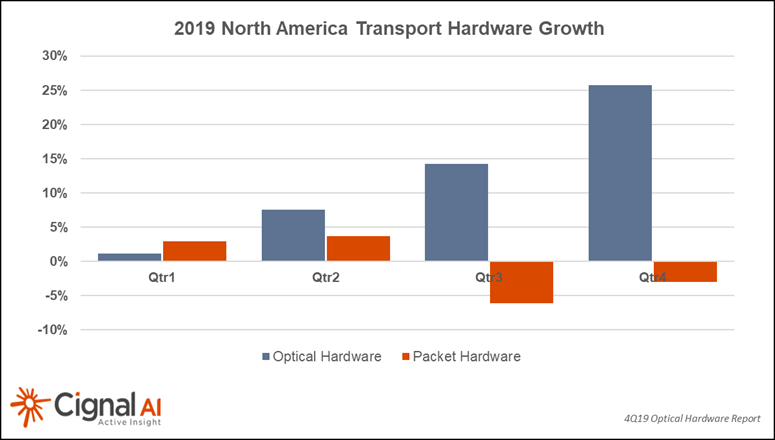

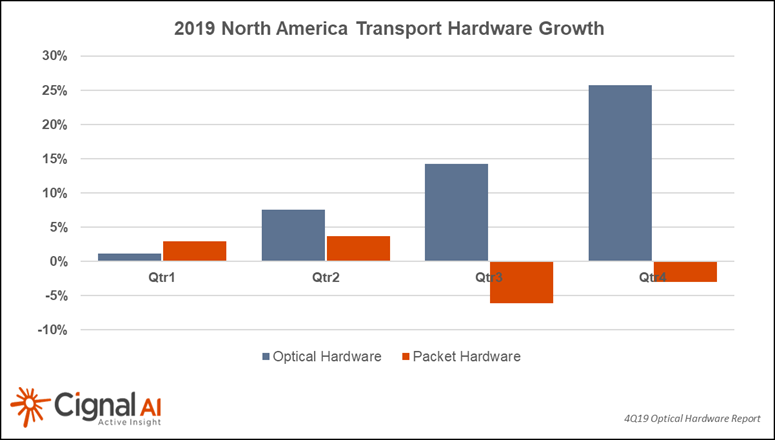

Recent optical network equipment sales in North America were quite encouraging – up more than 25% for 4Q19 and 10% for all of 2019, according to the most recent Transport Hardware Report.

“After three years of North American spending declines as operators focused capex on wireless and access, optical hardware sales in the region revived and grew at a healthy pace for 2019, while packet hardware sales remained flat,” said Scott Wilkinson, Lead Analyst at Cignal AI. “Market leaders Ciena, Infinera, and Cisco all achieved optical sales growth exceeding 25% in 2019.”

Manufacturing at Huawei in Dongguan appears to be close to resuming normal levels of operation, although installation activity underway in China is still not clear. Ciena indicated a revenue impact of $30M during an earnings call in early March. It’s unclear right now what the ultimate impact will be; time will tell. We will revisit projections in April with the hope that events will be more certain at that time.

OFC was severely impacted when almost all major exhibitors pulled out of the show as health concerns mounted. The organizers did an admirable job of salvaging the technical sessions via Zoom teleconference.

Cignal AI will deliver a wrap-up report summarizing many of the important announcements that companies intended to make during the show. Look for it in the coming weeks, and if you have important news or perspective to share – contact us!

……………………………………………………………………………………………

Separately, a newly released report by 650 Group states that the Optical Transport Network market revenues increased 5% Y/Y in 4Q19. Revenues in four of the six geographic theatres experienced year over year growth, with North America having been the most robust.

“For the full year 2019, the top five Hyperscalers experienced the most growth out of any customer segment we track and has consistently been a top-performing customer segment in recent years,” said Chris DePuy, Technology Analyst and Founder at 650 Group. “Top vendors in the market are expecting their 800 Gbps optical transport technology to contribute to revenues towards the end of this year, 2020. We expect that optical transport systems companies that ship this new technology early will be well-positioned to take on the potential substitution threat of optical modules on switches and routers in the coming years.”

The forecast section of this report has been updated to reflect changes in both demand and supply related to health fears that have emerged in 1Q20. The report also reflects quantitative Data Center Interconnect (DCI) deployment scenarios across long-haul, metro, cloud, colocation, and telecom service providers.

For more information about the report, contact:

[email protected] or www.650group.com

Cignal AI: North American Optical Sales Rebound In 2019

|

||||

|

||||

Additional 4Q19 Transport Hardware Report Findings:

Transport Hardware Superdashboard:

|

||||

About the Transport Hardware Report

About Cignal AI:

Contact Cignal AI/Purchase Report:

|

Cignal AI: Worldwide Optical Hardware Spending Increases; Huawei Remains #1 Vendor

|

||||

|

||||

|

||||

|

| About Cignal AI |

| Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications. |

| Contact Us/Purchase Report: |

| [email protected] |

CignalAI: Cloud and Colo Optical Hardware Spending Increases by 50% in North America; Century Link’s impressive fiber buildout

by Cignal AI staff

Overview:

Cloud and colocation (colo) operator spending on optical communications hardware continued to spur market growth in the first quarter of 2019, according to the most recent Optical Customer Markets Report from research firm Cignal AI. Cloud and colo spending increased over 50% in North America, offsetting declines in other regions, with Ciena continuing to lead all sales to cloud operators.

In EMEA, traditional telco (incumbent and wholesale network operators) optical spending recovered and will grow by double digits during 2019. Spending growth by these operators is slowing in APAC as total spending reaches record highs. Huawei continues to lead this market in APAC, EMEA, and CALA, while Ciena leads in North America.

“Optical spending in North America continues to shift from traditional telco providers to the cloud and colo operators,” said Scott Wilkinson, Lead Analyst for Optical Hardware at Cignal AI. “Despite traditional telco operators accounting for most spending, the rapid growth in cloud spending combined with traditional operators now adopting cloud architectures has permanently changed supplier R&D priorities.”

The Cignal AI Optical Customer Markets Report is issued quarterly and quantifies optical equipment sales to five key customer markets: Incumbent, Wholesale, Cloud and Colo, Cable/MSO, and Enterprise and Government.

The latest report is now enhanced and includes optical equipment vendor market share for all customer markets as well as updated forecasts through 2023.

Additional findings in the 1Q19 Optical Customer Markets Report include:

- Ciena Waveserver Ai market share continues to increase as cloud & colo spending grows. New compact modular platforms targeted at this market are entering the market in 2Q19 with Cisco, Infinera, and Nokia among those expecting stronger sales in the next quarter.

- North American cable/MSO spending declined in the first quarter. However, moderate growth is still expected in 2019.

- Enterprise and Government spending shows pressure from consolidation and Cloud and Colo encroachment and isn’t expected to recover in the next two years.

About the Optical Customer Markets Report:

The Cignal AI Optical Customer Markets Report tracks optical equipment spending by end customer market type. It provides forecasts based on expected spending trends by regional basis. The report includes revenue-based market size and share for all end customer markets across all regions.

Vendors examined include Adtran, ADVA, Ciena, Cisco, ECI, Ekinops, Fiberhome, Fujitsu Networks, Huawei, Infinera, Juniper Networks, Mitsubishi Electric, MRV, NEC, Nokia, Padtec, TE Conn, Tejas Networks, Xtera and ZTE.

………………………………………………………………………………………….

About Cignal AI:

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

To purchase the report contact: [email protected]

……………………………………………………………………………………………

July 25, 2019 Update-CignalAI comments on Cisco-Acacia:

Two weeks ago, Cisco announced it was acquiring Acacia, a move that could transform the company into a market leader in a new era of pluggable coherent optics and disaggregated networks. Cisco was already a growing customer for Acacia and was poised to be one of the leading consumers of Acacia’s AC1200 module that is now reaching the market. Between Cisco’s previous Luxtera acquisition for short-reach optical technology and its current addition of Acacia for long reach coherent, the company will have deep vertical integration.

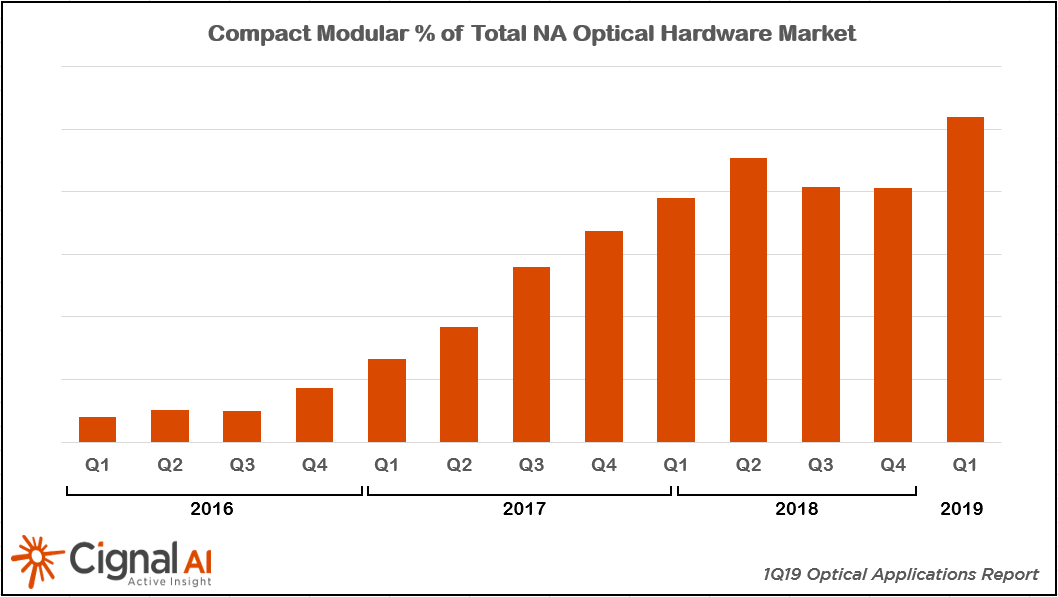

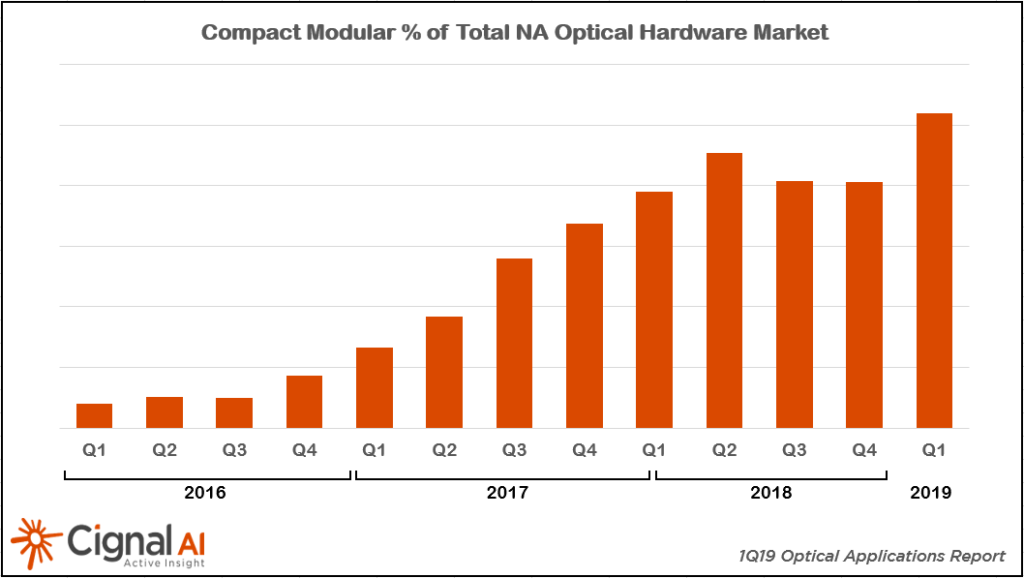

| Compact modular optical hardware is being used in more network applications than ever before, driving up sales during the first quarter of 2019 as reported in the latest Optical Applications Report. Worldwide, compact modular hardware sales are tracking to exceed $1 billion in revenue this year. |

………………………………………………………………………………………………………..

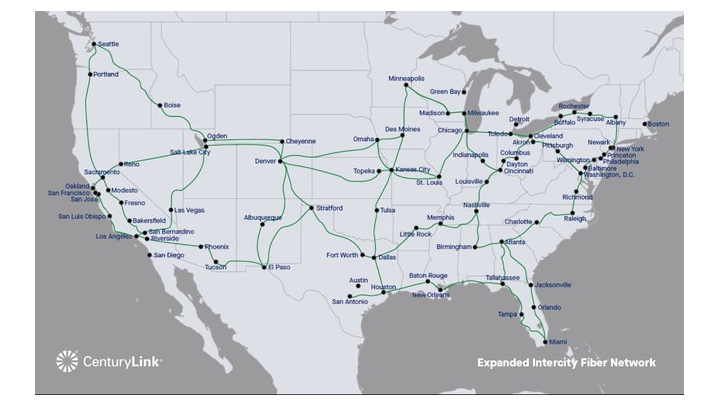

Separately, CenturyLink says it has completed the first of a two-phase build out that will see its fiber-optic networks in the U.S. and Europe grow by 4.7 million fiber miles. The new fiber infrastructure leverages ultra-low-loss fiber from Corning (NYSE: GLW) and will support businesses, government agencies, and other service providers who want access to fiber.

The first phase, completed in June, addressed CenturyLink’s U.S. requirements and connected more than 50 cities via 3.5 million new fiber miles. The European work, slated to finish in the first part of 2021, will see 1.2 million fiber miles installed. Both deployments leverage CenturyLink’s multi-conduit infrastructure, which the company says enables quick and economical fiber deploy and capacity expansion.

CenturyLink’s expanded fiber network connects more than 50 locations in the U.S. Image courtesy of Century Link

……………………………………………………………………………………………………

“Our newly built intercity fiber network, created with the latest optical technology, is another example of how our diverse fiber assets differentiate us from other network providers,” said Andrew Dugan, CenturyLink chief technology officer. “Our multi-conduit infrastructure has a significant amount of capacity for supporting the growing demand for fiber and will allow us to quickly and cost effectively deploy new fiber technology now and in the future. This uniquely positions CenturyLink to meet the needs of companies seeking highly reliable, low-latency network infrastructure designed to move massive amounts of data.”

CenturyLink was able to quickly and cost effectively complete the first phase of the project using multi-conduit infrastructure already in place. The company is currently selling routes to large enterprise companies and content providers in the U.S. and will work with customers to add additional routes as needed.

Key Facts:

- CenturyLink is creating an extensive 4.7-million fiber mile intercity fiber network across the U.S. and parts of Europe.

- The first phase, comprising 3.5 million fiber miles, was completed in June. An additional 1.2 million fiber miles will be added by early 2021.

- CenturyLink is currently selling fiber routes to large enterprise companies and content providers in the U.S.

- Multi-conduit infrastructure allows CenturyLink to quickly and economically deploy new fiber technology or add network capacity as needed.

- The investments in the first phase of the fiber upgrade are included in CenturyLink’s full year 2019 capital expenditure outlook.

- The expanded fiber network utilizes Corning’s SMF-28® ULL fiber and SMF-28® Ultra fiber, creating the largest ultra-low-loss fiber network in North America.

References:

http://news.centurylink.com/2019-07-23-CenturyLink-Expands-Fiber-Network-Across-U-S-and-Europe

Cignal AI: Modular Optical Sales Expand, Reaching Over $275M

Almost 30% of North American Optical Hardware Shipments Now in Compact Modular Format

by Cignal AI staff

Compact modular optical hardware is being used in more network applications than ever before, driving up sales during the first quarter of 2019 as reported in the latest Optical Applications Report from market research firm Cignal AI.

Compact modular optical systems were first used by cloud operators for data center interconnect applications but have since expanded well beyond into many other operators and applications. Market share leaders include the Ciena Waveserver, Infinera CX and Groove, and Cisco 1000 series.

The report illustrates significant growth throughout most regions as the compact modular customer base expands beyond cloud and webscale operators to include traditional telco customers pursuing network disaggregation. Compact modular hardware sales exceeded $275 million in Q1 and are tracking to exceed $1 billion in revenue this year. Growth was most pronounced in North America this quarter, where it accounted for almost 30% of the entire optical market and is expected to continue advancing through 2023.

“Network applications for the compact modular form factor have expanded well beyond the original data center interconnect deployments,” said Scott Wilkinson, Lead Analyst for Optical Hardware at Cignal AI. “Applications now include traditional telco networks, metro and long haul deployments, and even some early trials for subsea deployment. We expect this spending trend to increase in 2019 as new compact modular products come to market from a variety of vendors.”

Cignal AI’s 1Q19 Optical Applications Report details market share for the first quarter of 2019 and provides forecasts in three key markets: compact modular equipment, advanced packet-OTN switching hardware, and 100Gbps+ coherent WDM port shipments across multiple speeds. Hardware and coherent port shipments are forecasted through 2023. The Applications Report is issued quarterly.

Additional 1Q19 Applications Report Key Findings:

Ciena expanded its dominance in compact modular with over 50% market share in Q1. The combined Infinera/Coriant held on to second place despite declining sales.

Acacia [1] AC1200-based platforms are expected to have an impact starting next quarter. Cisco (which is acquiring Acacia) compact modular sales paused in Q1 in anticipation of the NCS1004 platform.

Note 1. Cisco and Acacia Communications entered into a definitive agreement under which Cisco has agreed to acquire Acacia for a consideration of US$2.6 billion.

……………………………………………………………………………………………..

Almost 500k physical coherent ports have shipped in the last 12 months. Currently, over 70% of coherent ports are shipped by the top five vendors in the market.

After a 2018 recovery year, long haul port shipments are starting to pick up. Metro growth is advancing at a similar pace, as next-generation coherent enables an upgrade from 100Gbps.

Packet OTN growth is slowing. New deployments are limited to China and parts of APAC as networks in other regions evolve away from the packet OTN architecture.

About the Optical Applications Report:

The Cignal AI Optical Applications Report includes market share and forecasts for revenue and port shipments for optical equipment designed to meet the needs of specific applications: 100G+ coherent, and compact modular and advanced packet-OTN switching hardware.

Vendors examined include Acacia, Adtran, ADVA, Ciena, Cisco, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Inphi, NEC, Nokia, NTT Electronics (NEL), Padtec, Tejas, Xtera and ZTE.

Deliverables include Excel files with complete data sets, PowerPoint summaries and Cignal AI’s Active Insight news reporting. Cignal AI clients with Applications report subscriptions may access this material on the Cignal AI website.

About Cignal AI:

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contact Us/Purchase Report:

| Sales: [email protected] Web: Contact us |

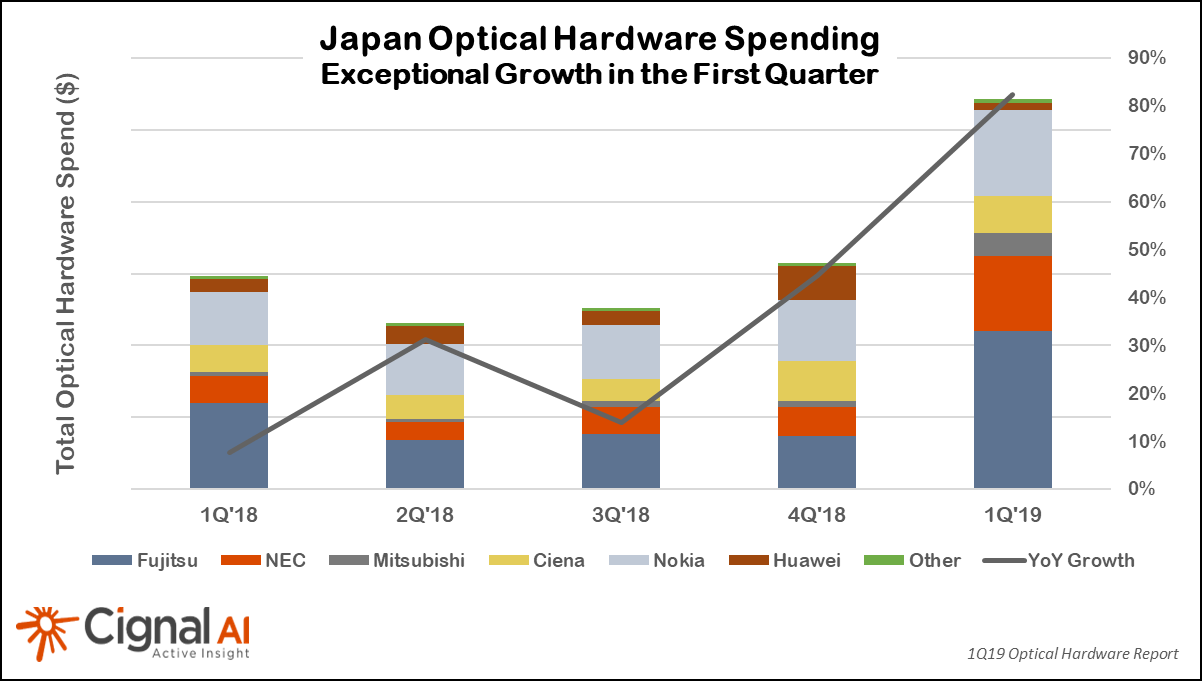

Cignal AI: Japan’s Optical Hardware Growth Soars in 1Q2019; North America Remains Weak

by Scott Wilkinson and Andrew Schmitt of Cignal AI (edited by Alan J Weissberger)

Metro Bandwidth Growth Outpaces Long Haul; North America Remains Weak

Japan continued its recent hot streak as 1Q2019 marked the fourth quarter in a row of growth with an extraordinary 82% increase, according to the most recent (1Q2019) Optical Hardware Report from research firm Cignal AI. Japan registered an extraordinary 82% year-over-year increase in optical networking hardware sales in the first quarter of 2019. Prime beneficiaries were domestic suppliers NEC, Mitsubishi and Fujitsu along with Ciena and Nokia, all of which posted significant gains during the quarter.

“The exceptional optical market growth in Japan is the story to watch for 2019,” said Scott Wilkinson, Lead Analyst for Optical Hardware at Cignal AI. “Network operators have begun significant network rebuilds and expansions, and domestic as well as non-Japanese vendors continue to grow sales in the region at remarkable rates.”

North American growth continued to disappoint as slow optical hardware spending among traditional telco operators obscured growth in sales to cloud and colo operators (e.g. multi-tenant data centers).

Additional key findings in the 1Q19 Optical Hardware Report:

- Metro Bandwidth Outpaces Long Haul – While long haul spending grew at a higher rate than metro, analysis reveals that metro bandwidth is growing more rapidly.

- Growth in China Decelerates – Growth in China moderated into the single-digits during 1Q19, as 2018’s high spending by Chinese carriers could not continue indefinitely.

- EMEA Posted Solid Gains – Both metro and long haul spending grew during the quarter, with growth led by both traditional and cloud & colo operators.

- CALA Continues Lackluster Performance –Q1 showed no improvement for the region. Relief may be coming, as vendors believe major carriers in the region will return to spending later this year.

Cignal AI’s Optical Hardware Report is issued each quarter and examines optical equipment revenue across all regions and equipment types. The analysis is based on financial results, independent research, and guidance from individual equipment companies. Forecasts are based on overall spending trends for equipment types within the regions.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Cignal AI’s interactive Optical Hardware Superdashboard is available to clients of the Optical Hardware Report and provides up-to-date market data for real-time visibility on individual vendors’ results. Users can manipulate data online and see information in a variety of useful ways.

The Cignal AI Optical Hardware Report is published quarterly and includes market share and forecasts for optical transport hardware used in optical networks worldwide. In addition to the interactive tracker, the analysis includes an Excel database as well as PDF and PowerPoint summaries. Subscribers to the Optical Hardware Report also have access to Active Insight, Cignal AI’s real-time news service on current market events.

The report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) equipment in six global regions and includes detailed port shipments by speed. Vendors in the report include Adtran, ADVA, Ciena, Cisco, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Mitsubishi Electric, NEC, Nokia, Padtec, Tejas, Xtera, and ZTE.

Full report details, as well as articles and presentations, are available on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Cignal AI: Record Spending on Cloud Operator Optical Networks Drives Growth in 2018

Cignal AI: Record Spending on Cloud Operator Optical Networks Drives Growth in 2018

|

|

|