Optical Network Equipment Market

Nokia announces Lightspan MF-14 platform as “most advanced in the world”

Nokia has unveiled what it boldly claims is the “most advanced fiber broadband platform in the world,” one it’s calling the “fiber-for-everything” world. According to the vendor, the new Lightspan MF-14 platform extends the upper reaches of its fiber broadband range, bringing “unmatched” capacity, low latency, intelligence, reliability and efficiency. The platform, which falls into “Generation 6” of such things, is already being tried out by customers looking to build 25Gbit/s-capable network in Europe, North America and the Asia-Pacific region. Lightspan MF-14 is being premiered at the Network X event in Amsterdam from 18 to 20 October.

The industry is entering a ‘fiber-for-everything’ era. Once operators have deployed fiber-to-the-home, their networks pass every other building in the street, as well as the homes, meaning they can connect businesses and other services. Fiber PON will be capable of supporting high bandwidth consumer services, industry 4.0 applications, business connectivity, 5G transport and smart city services. This creates more revenue opportunities, lowers TCO and significantly reduces overall power consumption. This new broadband era, designated Broadband 6 by the World Broadband Association (WBBA), requires a new technical solution. Nokia’s pioneering Lightspan MF-14 is the first Gen 6 optical line terminal (OLT) in the world and has already been selected by customers building 25 Gb/second capable networks in Europe, North America and Asia Pacific.

Geert Heyninck, Nokia’s VP Broadband Networks, said: “Fiber-to-the-home is becoming fiber-for-everything. This is enabled by several technology advances, most notably higher speed PON technologies to accommodate all new services, and SDN to bring more intelligence in the network. If you think about it, the massive number of connection points on fiber make it a challenge to get an instant view of everything that happens in your network, fully automate network control, and perform actions with no service interruption. Our current portfolio is doing an excellent job in supporting many of these requirements for today’s and tomorrow’s services, but we are looking ahead. The MF-14 platform will suit operators who are planning large scale 25G PON, 50G and even 100G PON within the same environment.”

In his recent report* Erik Keith, Senior Research Analyst for Broadband Infrastructure at S&P Global, says: “The PON market is at a pivotal moment in the evolution of networks, where fiber broadband means so much more than residential connectivity. There is a huge opportunity for service providers to connect everything much more efficiently by leveraging their existing fiber broadband networks. After all, the same fiber cables that were originally laid in residential areas also pass commercial buildings such as office blocks, hospitals and government properties. This approach eliminates multiple overlay networks, minimizes digging up the streets, and lowers energy use substantially. The new Lightspan MF-14 OLT can enable operators to deploy a solution that will last for decades, while providing a platform that can increase network performance exponentially compared to most networks in use today.”

Based on new, advanced hardware and disaggregated software design, MF-14 is a generation leap in fiber access solutions. It is the highest capacity platform in the industry and the only solution ready for mass delivery of 25G, 50G and 100G PON services. It’s also the industry’s first OLT with the six-nines availability and sub-millisecond latency needed for mission critical industry 4.0 and 5G transport services.

Frontier Communications, the first in the U.S. to trial 25G PON, is also the first to evaluate MF-14 in its live network. Frontier’s Scott Mispagel, SVP National Architecture and Engineering, said: “We are proud to be the first to embrace this next-generation platform. This is another way for us to provide customers with the fastest broadband available. The MF-14 platform will support our path to 100G using our existing fiber network and future-proof our network with speeds that will continue to outpace cable and other technologies for generations to come.”

Nokia Lightspan MF-14

In July this year CityFibre – the UK’s largest independent full fibre infrastructure platform – signed a 10-year equipment agreement to support its nationwide network upgrade. John Franklin, CTIO, CityFibre said: “As we accelerate our full fibre rollout to serve a third of the UK market by 2025, the demand placed on those networks will also accelerate. MF-14’s flexibility and capacity will help us to meet the needs of our partner’s and their customers for generations to come.”

* From “Nokia launches 6th generation flagship fiber platform” published by S&P Global Market Intelligence.

Resources

Lightspan MF-14, a generation leap in fiber access solutions

- 4x higher capacity than previous generation, ensures smooth evolution to massive connectivity with 25, 50, 100.

- No single point of failures, ensuring the highest availability (six nines) in the market. This is important because consumers and business depend on broadband non-stop

- Sub millisecond latency for 5G transport and new array of industry 4.0 applications

- 20% higher power efficiency than the industry average so operators can decrease overall power consumption as they connect more points on fiber network and meet sustainability targets

- Modular software architecture for more agility for upgrading software and onboarding of new functionality, with much less effort and time.

- SDN programmability and open APIs to enable control function by Nokia or 3rd party network control functions

- Fast telemetry and digital mirror in the cloud for enhanced network overview

- For more details visit the web page

Fiber for everything website

World Broadband Association (WBBA) BB6 network characteristics, published in Next-Generation Broadband Roadmap white paper, Oct 2022

- Residential speed. Up to 50Gbps *

- Enterprise speed. Up to 1.6–3.2Tbps

- Intelligence. Fully autonomous

- Reliability & latency. Deterministic reliability / <1ms latency (hard guarantee) / very low jitter

- Trustworthy & green. 10×-plus better per bit energy efficient, very fast problem detection and response (seconds)

- Connectivity. Fiber sensors, 10 times more IoT terminals

- Sensing Capability. Fiber sensing for applications, application and computing awareness, AI

*Speeds listed are speculative given the timeframe, and further work by the WBBA will explore this in more detail in future reports.

Dell’Oro: Demand for Optical Transport equipment strong and headed for double-digit growth in NA

In a new report, the Dell’Oro Group states that the demand for Optical Transport equipment remained strong in North America during 2Q 2022. In the quarter, the North American market for Optical Transport grew 10 percent year-over-year.

“At this pace, we could be headed for another year of double-digit growth in North America,” said Jimmy Yu, Vice President at Dell’Oro Group. “While we expected another year of North American optical market expansion in 2022, we thought the growth rate could slow a bit after such a strong 2021. However, considering the first-half results and higher than usual backlog held by equipment manufacturers, we think a double-digit rate of growth could occur in 2022. Our biggest concern, however, remains to be the component shortage and supply chain issues that have limited revenue growth for the past couple years,” added Yu.

Additional highlights from the 2Q 2022 Quarterly Report:

- The worldwide Optical Transport market excluding China grew 2 percent in 2Q 2022 and is projected to grow a little over 4 percent in 2022.

- The region with the lowest year-over-year growth rate in the quarter was Asia Pacific due to lower demand in China.

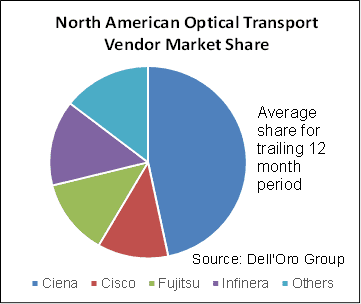

- The system manufacturers with the highest share of North America Optical Transport revenue in the quarter were Ciena, Infinera, Cisco, and Fujitsu. These four vendors held a combined market share of approximately 85 percent. Please see chart below:

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, and unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM.

To purchase this report, please contact us at [email protected].

Dell’Oro: DWDM equipment market to exceed $17 billion by 2026

Demand for optical transport DWDM equipment is forecast to exceed $17 billion by 2026, according to a new Dell’Oro Group report.

The $17 billion in revenue for dense wavelength-division multiplexing (DWDM) equipment represents the bulk of revenue for the total optical transport equipment market. Dell’Oro forecasts the total market to grow at a 3% compound annual growth rate (CAGR) to $18 billion by 2026 as a result of sales of DWDM systems delivering wavelength speeds over 200 Gbit/s.

“Although there is a ton of market turbulence, we do not see demand for DWDM equipment letting up,” said Jimmy Yu, Vice President at Dell’Oro Group. “In fact, the biggest issue is that demand seems to be growing faster than supply. Hence, even if a mild recession were to occur, we think the worst case scenario is that demand will align with supply sooner.

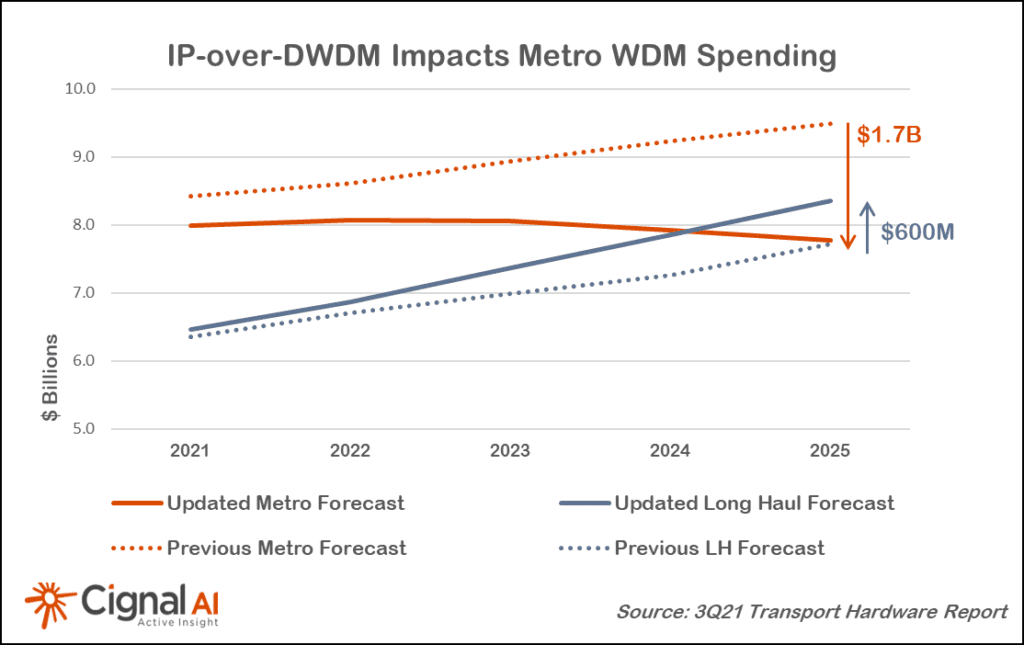

“Hence, we are projecting continuous growth for DWDM system revenues. The only difference over the next five years, compared to previous years, is that we are expecting more growth from DWDM Long Haul since IPoDWDM should lower the use of WDM Metro systems in data center interconnect,” added Yu.

Dell’Oro predicts that DWDM long-haul revenue will grow at a five-year CAGR of 5%. Over the same period, the research group forecasts that metro WDM revenue will grow at a CAGR of 3%.

Additional highlights from the Optical Transport 5-Year July 2022 Forecast Report:

- DWDM Long Haul revenue is forecasted to grow at a five-year compounded annual growth rate (CAGR) of 5 percent.

- WDM Metro revenue is forecasted to grow at a five-year CAGR of 3 percent.

- Capacity shipments each year are projected to grow at an average annual rate of 30+ percent.

- Spectral efficiency is expected to improve at an average annual rate of 9 percent.

Dell’Oro forecasts that DWDM long-haul system sales will grow faster than wavelength division multiplexing (WDM) metro system sales over this five-year period. While the DWDM market is experiencing quite a bit of “market turbulence,” demand is not expected to decrease, said Jimmy Yu, VP at Dell’Oro Group, in a statement.

Capacity shipments each year are projected to grow at an average annual rate of over 30%, according to Dell’Oro. The group also predicts that spectral efficiency will improve at an average annual rate of 9%.

Overall, the optical transport equipment market grew 2% year-over-year in Q1, largely from increased market growth in the Americas, according to another recent report by Dell’Oro. The war in Ukraine, COVID lockdowns, supply chain constraints and inflation all contributed to a decline in the optical transport equipment market in Europe, the Asia-Pacific and China.

…………………………………………………………………………………………………………………………………….

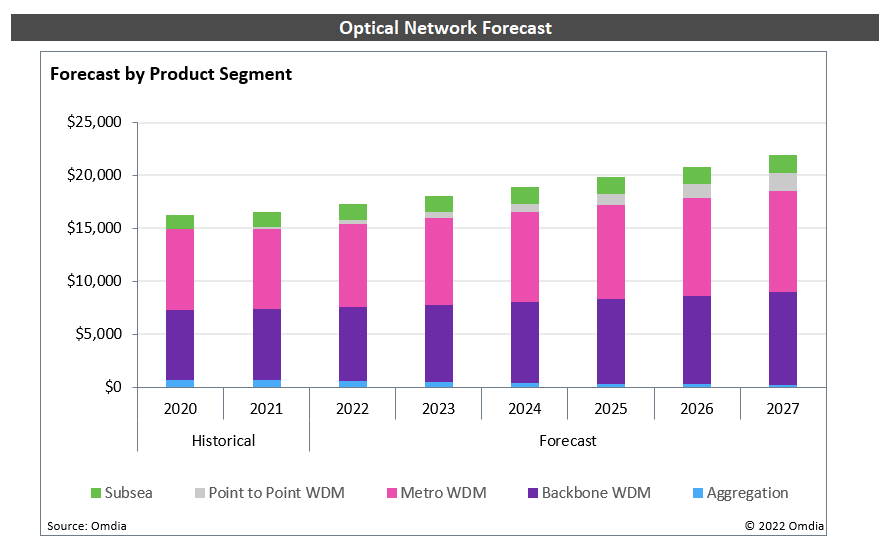

Researchers at Omdia are also bullish about growth in the optical network market, which they project will exceed $20 billion by 2027. Analysts at Omdia forecast that the metro WDM market will exceed $9 billion by 2026.

References:

Optical Transport DWDM Equipment Market to Surpass $17 Billion by 2026, According to Dell’Oro Group

Cisco’s 5G pitch: Private 5G, 5G SA Core network, optical backhaul and metro infrastructure

At MWC 2022 in Barcelona, Cisco revealed its Private 5G market strategy together with partners. It was claimed to usher in “a new wave of productivity for enterprises with mass-scale IoT adoption.” Cisco’s 5G highlights:

- Cisco Private 5G as-a-Service delivered with global partners offers enterprise customers reduced technical, financial, and operations risks with managing enterprise private 5G networks.

- Cisco has worked in close collaboration with two leading Open RAN vendors to include O-RAN technology as part of Cisco Private 5G and is currently in customer trials with Airspan and JMA.

- Multiple private 5G pilots and projects are currently underway spanning education, entertainment, government, manufacturing, and real estate sectors.

- 5G backhaul and metro infrastructure via routed optical networking (rather than optical transceivers like those sold by Ciena)

Cisco Private 5G:

The foundation of the solution is built on Cisco’s industry-leading mobile core technology and IoT portfolio – spanning IoT sensors and gateways, device management software, as well as monitoring tools and dashboards. Open Radio Access Network (ORAN) technology is a key component of the solution. Cisco is working in close collaboration with ORAN vendors, JMA and Airspan, and is currently in customer trials utilizing their technology.

Key differentiators of Cisco Private 5G for Enterprises:

- Delivered as-a-Service: Delivered together with global service providers and system integration partners, the offer reduces technical, financial, and operational risks for enterprise private 5G networks.

- Complementary to Wi-Fi: Cisco Private 5G integrates with existing enterprise systems, including existing and future Wi-Fi versions – Wi-Fi 5/6/6E, making operations simple.

- Visibility across the network and devices: Using a simple management portal, enterprise IT teams can maintain policy and identity across both Wi-Fi and 5G for simplified operations.

- Pay-as-you-use subscription model: Cisco Private 5G is financially simple to understand. With pay-as-you-use consumption models, customers can save money with no up-front infrastructure costs, and ramp up services as they need.

- Speed time to productivity: Businesses can spare IT staff from having to learn, design, and operate a complex, carrier class private network.

Key Benefits of Cisco Private 5G for Partners:

- Path to Profitability for Cisco Partners: For its channel partners, Cisco reduces the required time, energy, and capital to enable a faster path to profitability.

- Private Labeling: Partners can private label/use their own brand and avoid initial capital expenses and lengthy solution development cycles by consuming Cisco Private 5G on a subscription basis. Partners may also enhance Cisco Private 5G with their own value-added solutions.

“Cisco has an unbiased wireless strategy for the future of hybrid work. 5G must work with Wi-Fi and existing IT environments to make digital transformation easy,” said Jonathan Davidson, Executive Vice President and General Manager, Mass-Scale Infrastructure Group, Cisco. “Businesses continuing their digitization strategies using IoT, analytics, and automation will create significant competitive advantages in value, sustainability, efficiency, and agility. Working together with our global partners to enable those outcomes with Cisco Private 5G is our unique value proposition to the enterprise.”

The concept of private networks running on cellular spectrum isn’t new — about 400 private 4G LTE networks exist today — but Cisco expects “significantly more than that in the 5G world,” Davidson said. “We think that in conjunction with the additional capacity or also the need for high-value asset tracking is really important.”

During a MWC interview with Raymond James, Davidson said, “Mobile networks aren’t mobile for very long. They have to get to a wired infrastructure,” and therein lies multiple roles for Cisco to play in the telco market.

Cisco’s opportunity in the telco space includes the buildout of new backhaul and metro infrastructure to handle increased capacity and bandwidth, its IoT Control Center, private networks, and the core of mobile network infrastructure.

“We continue to be a market leader in that space,” Davidson said, referring to Cisco’s 4G LTE and 5G network core products. More than a billion wireless subscribers are connected to Cisco’s 4G LTE core, and it plays a central role on T-Mobile’s 5G standalone core, which serves more than 100 million subscribers on a converged 4G LTE and 5G core, he added.

Davidson also expects Cisco’s flattened infrastructure, or routed optical networking, to gain momentum in wireless networks. But first, a definition. For Cisco, optical refers to the technology that moves bits from point A to point B, not optical transceivers.

“Our belief is there is going to be a transition in the market towards what we call routed optical networking. And this means that takes traditional transponders and moves them from being a shelf, or a separate box, or a device, and turns them into a pluggable optic, which you then plug into a router,” he said.

That’s where Cisco’s $4.5 billion acquisition of Acacia Communications comes into play. In October 2021, we reported that Cisco’s Acacia unit is working together with Microschip to validate the interoperability of their 400G pluggable optics components – Microchip’s DIGI-G5 OTN processor and META-DX1 terabit secured-Ethernet PHY and Acacia’s 400G pluggable coherent optics.

The second phase of this type of network transformation involves the replacement of modems that exist in optical infrastructure with routers that carry pluggable transponders, Davidson added. The third phase places private line emulation onto that same infrastructure.

Supporting Comments:

“DISH Wireless is proud to partner with Cisco to bring smart connectivity to enterprise customers through dedicated private 5G networks. Together, we have the opportunity to drive real business outcomes across industries. We’re actively collaborating with Cisco on transformational projects that will benefit a variety of sectors, including government and education, and we’re working to revolutionize the way enterprises can manage their own networks. As DISH builds America’s first smart 5G network™, we’re offering solutions that are open, secure and customizable. Teaming with Cisco is a great next step, and we look forward to offering more innovative solutions for the enterprises of today and beyond.”

— Stephen Bye, Chief Commercial Officer, DISH Wireless

“Cisco is busting the myth that enterprises can’t cross Wi-Fi, private 5G and IoT streams. Enterprises are now tantalizingly closer to full visibility over their digital and physical environments. This opens up powerful new ways to innovate without compromising the robust control that enterprises require.”

— Camille Mendler, Chief Analyst Enterprise Services, Omdia

“Developing innovative, customized 5G private network solutions for the enterprise market is a major opportunity to monetize the many advantages of 5G technology. Airspan is proud to be one of the first leading Open RAN partners to participate in the Cisco Private 5G solution and offer our cutting edge 5G RAN solutions including systems and software that are optimized for numerous enterprise use cases.”

— Eric Stonestrom, Chairman and CEO, Airspan

“This partnership opens a world of new possibilities for enterprises. With simple downloaded upgrades, our all-software RAN can operate on the same physical infrastructure for 10+ years—no more hardware replacements every 36 months. And as the only system in the world that can accommodate multiple operators on the same private network, it eliminates the need to build separate networks for new licensed band operators.”

— Joe Constantine, Chief Technology & Strategy Officer, JMA

“5G marks a milestone in wireless networking. For organizations, it opens many new opportunities to evolve their business models and create a completely new type of digital infrastructure. We see strong demand in all types of sectors including manufacturing and mining facilities, the logistics and automotive industries, as well as higher education and the healthcare sector. As a leading Cisco Global Gold Partner, we are excited to help drive this evolution. Thanks to our deep expertise, international capability, and close partnership with Cisco, we can support companies in integrating Private 5G into their enterprise networks,”

— Bob Bailkoskiis, Logicalis Group CEO.

“NEC Corporation is working on multiple 5G initiatives with Cisco. We have a Global System Integrator Agreement (GSIA) partnership for accelerating the deployment of innovative 5G IP transport network solutions worldwide. Work is in progress to connect Cisco’s Mobile Core and NEC’s radio over Cisco’s 5G Showcase in Tokyo, a world leading 5G services incubation hub. Leveraging NEC’s applications, Cisco and NEC will investigate expanding the technical trials including Private 5G in manufacturing, construction, transportation, and others.”

—Yun Suhun, General Manager, NEC Corporation

Industry Projects Underway

Cisco is working together with its partners on Private 5G projects for customers across a wide range of industries including Chaplin, Clair Global, Colt Technology Services, ITOCHU Techno-Solutions Corporation, Madeira Island, Network Rail, Nutrien, Schaeffler Group, Texas A&M University, Toshiba, Virgin Media O2, Zebra Technologies and more. See news release addendum for project details and supporting comments.

Final Thoughts:

“Radio access networks themselves are between $30 billion and $40 billion a year. Depending on who you talk to, optical (networking) can be between $10 billion and $15 billion a year. And then routing is below $10 billion a year,” Davidson said. “Our belief is that the optical total addressable market will start to shift over time as routed optical networks become more prevalent, because it will move from the optical domain into the optic transceiver market,” he added.

Finally, although Cisco repeatedly insists it has no interest in becoming a RAN supplier, it remains strongly supportive of Open RAN. The RAN market “is still closed, it’s locked in, even though there are standards,” he said.

“People do not do any interoperability testing between vendors, which is fundamentally changing with open RAN” because operators are forcing vendors to make their equipment interoperate with open RAN implementations, Davidson concluded.

References:

Microchip and Cisco-Acacia Collaborate to Progress 400G Pluggable Coherent Optics

Additional Resources:

- Cisco Private 5G

- Blog: Private 5G Delivered on Your Terms, Masum Mir, Vice President and General Manager, Mobile, Cable and IoT

IPS Expands Long Haul Submarine Data Transmission Capacity with Ribbon’s 100 Gigabit Ethernet (100GbE) services

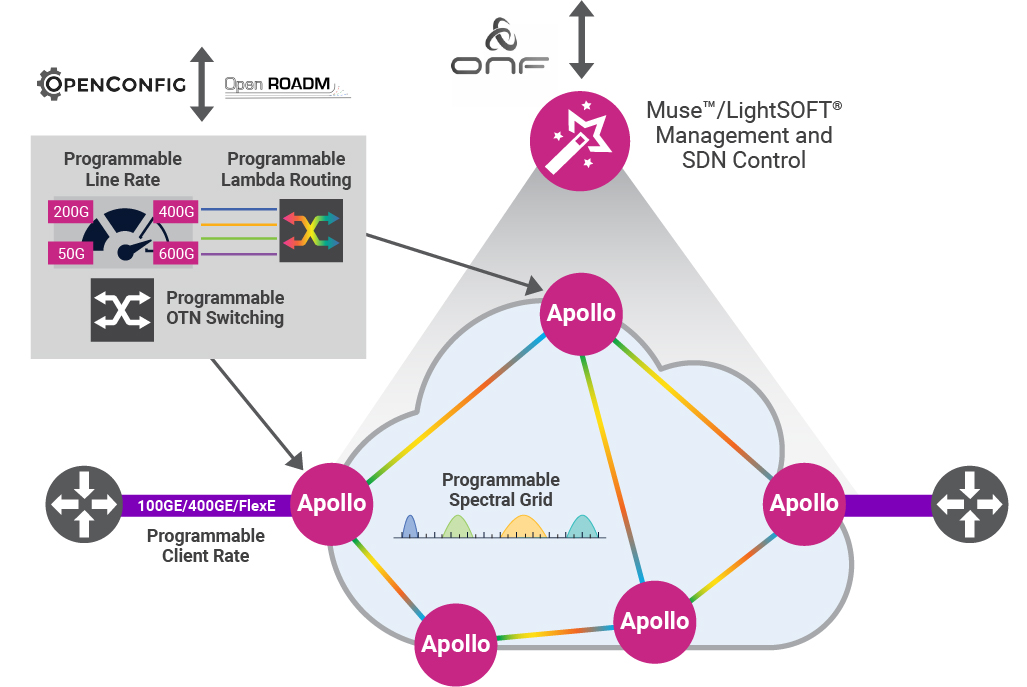

Ribbon Communications Inc, a global provider of real time communications software and IP Optical networking solutions to service providers, enterprises, and critical infrastructure sectors, today announced that Tokyo based IPS (a leading provider of international connectivity services for communications service providers), is using Ribbon’s Apollo Optical Networking solution to power 100 Gigabit Ethernet (100GbE) services delivered over both terrestrial and undersea cables from Manilla to Hong Kong and Singapore.

“Our ability to seamlessly deliver connectivity services to our customers over long distances is key to the success of our business,” said Koji Miyashita, President and CEO, IPS. “Ribbon’s Optical transport technology allowed us to maximize our available capacity and transmit world-class communications applications via our submarine services under the South China Sea.”

“Submarine applications must deliver extensive capacity and carry the highest level of communications services on each channel in order to realize cost efficiencies,” said Mickey Wilf, General Manager APAC and MEA Regions for Ribbon. “Our Apollo solution enables IPS to maximize capacity by leveraging dual wavelengths with programmable baud rate and modulation, in conjunction with flex grid technology.”

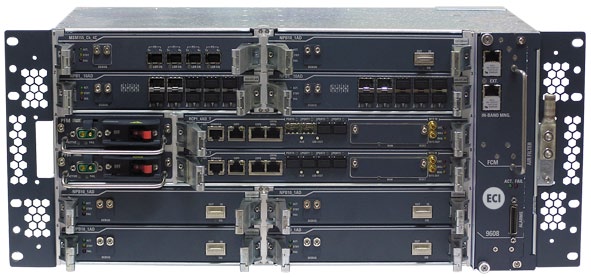

The solution deployed by IPS leverages Apollo’s high-performance programmable TM800 muxponder cards on Apollo 9600 series platforms to provide optimized long haul undersea connectivity for 100GbE services.

| 9504D | 9603 | 9608 | 9608D | 9624 | ||||

| Size | 1RU | 2RU | 5RU | 5RU | 15RU | |||

| Line Capacity | 1.6T | 2.4T | 6.4T | 6.4T | 19.2T | |||

| Photonics | CDC-F ROADMs, Fixed and Dynamic Amplifiers | |||||||

| Datasheet | Apollo 9504D | Apollo 9603 | Apollo 9608 | Apollo 9608D | Apollo 9624 | |||

| Image | Data Center |

|

|

Data Center |

|

|||

About IPS:

IPS Inc. operates as a Carriers-of Carrier in the Philippines providing network services for local and international telecom companies, contact centers and data centers. It has international telecommunication lines connecting Manila with Hong Kong, Singapore, and many other countries. IPS is listed on the Tokyo Stock Exchange.For more information visit ipsism.co.jp/en/.

About Ribbon:

Ribbon Communications (Nasdaq: RBBN) delivers communications software, IP and optical networking solutions to service providers, enterprises and critical infrastructure sectors globally. We engage deeply with our customers, helping them modernize their networks for improved competitive positioning and business outcomes in today’s smart, always-on and data-hungry world. Our innovative, end-to-end solutions portfolio delivers unparalleled scale, performance, and agility, including core to edge software-centric solutions, cloud-native offers, leading-edge security and analytics tools, along with IP and optical networking solutions for 5G. To learn more about Ribbon visit rbbn.com.

References:

https://ribboncommunications.com/products/service-provider-products/apollo-optical-systems

Cignal AI: Metro WDM forecast cut; IP-over-DWDM and Coherent Pluggables to impact market

Optical transport equipment deployment faces increasing headwinds as a broad number of network operators embrace IP-over-DWDM in Metro WDM applications, according to the most recent Transport Hardware Report from research firm Cignal AI. The impact of IP-over-DWDM on capex is expected to be moderate until 2023 when implementation of the new approach gathers momentum.

“IP-over-DWDM is a concept two decades old, but technical compromises, operational challenges, and high cost have prevented its widespread adoption. Gen60C 400ZR/ZR+ pluggable optics can solve these problems with availability well-timed to the 400 Gigabit Ethernet investment cycle,” said Kyle Hollasch, Lead Analyst for Transport Hardware at Cignal AI. “Hyperscale data center interconnect will drive early volumes, but service providers – who are responsible for 75% of optical CAPEX – should get on board in 2023 as the cost savings of IP-over-DWDM becomes impossible to ignore.”

| Cignal AI has cut forecasted spending on standalone optical transport hardware by $1.1B in 2025 as operators introduce pluggable coherent optics into routing and switching equipment to replace standalone traditional and compact modular equipment. This decline will be partially offset by greater sales of IP Routing and Switching hardware, open line systems, and long haul WDM, as well as direct sales of coherent optics to hyperscale operators. Clients can read 400ZR IPoDWDM Market Impact and Forecast for more detail. |

| Additional 3Q21 Transport Hardware Report Findings: |

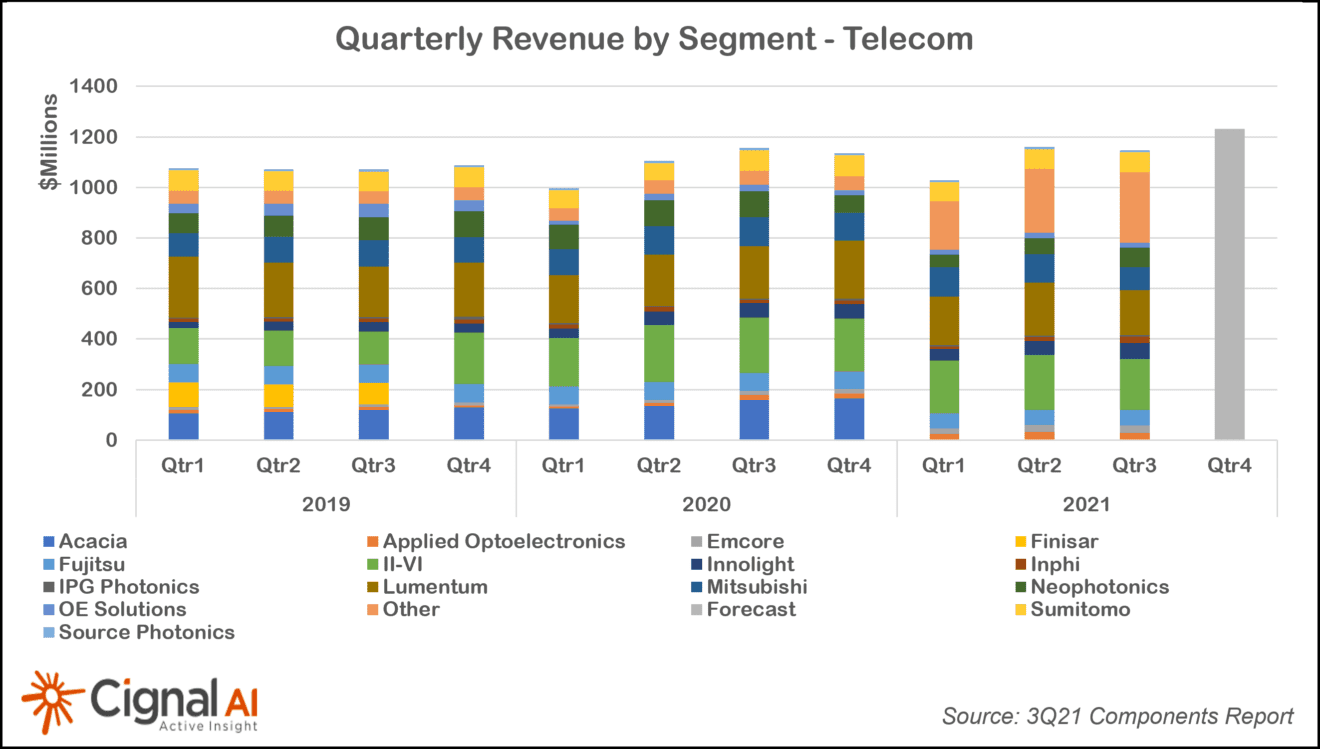

- Total transport hardware (Optical and IP Switching & Routing) revenue declined -2.5%, with sales in China declining double digits for the second consecutive quarter.

- North American optical revenue grew for the 4th consecutive quarter and registered its first quarter of YoY growth since COVID impacted 2Q20. Fujitsu and Cisco led in revenue growth.

- Sales of optical hardware in EMEA increased YoY as the region registered its 6th consecutive quarter of growth. Regional market leaders Huawei and Nokia declined while ADVA, Infinera, and ZTE grew double digits.

- North American packet transport sales grew 6%, its third straight quarter of growth. Nokia and Cisco led this growth.

- Japanese packet sales continued to grow, up nearly 10% YoY. Cisco increased its lead in the region, with YoY sales growth of 42%.

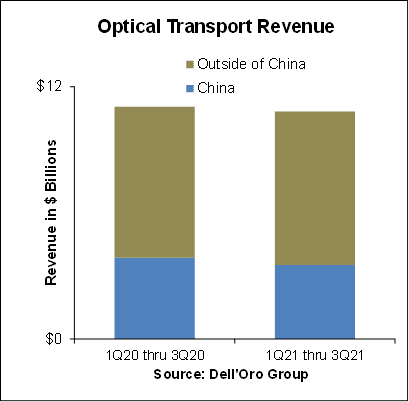

Dell’Oro: Optical Transport Market Down 2% in 1st 9 Months of 2021

According to a recently published report from Dell’Oro Group, the Optical Transport equipment market contracted 2 percent year-over-year in the first nine months of 2021 due to lower sales in China. Outside of China, however, the demand for optical equipment continued to increase, outpacing supply.

“Optical equipment revenue in China took a sharp turn for the worse in 3Q 2021,” said Jimmy Yu, Vice President at Dell’Oro Group. “As a result, optical revenue in China declined at a double-digit rate in the quarter, resulting in a 9 percent decline for the first nine months of 2021. At this rate, we are expecting a full year optical market contraction in the country. Something that has not occurred since 2012. Helping to offset some of this lower equipment revenue from China was the robust demand in North America, Europe, and Latin America.”

“We estimate that Optical Transport equipment revenue outside of China grew 6 percent year-over-year in the third quarter. However, we believe this growth rate could have been higher, closer to 10 percent, if it was not for component shortages and other supply issues plaguing the industry. So, fortunately while optical demand is hitting a rough patch in China, it seems to be accelerating in other parts of the world,” added Yu.

The optical transport market is predicted to reach $18 billion by 2025, primarily as a result of demand for WDM equipment, Dell’Oro reported in July 2021. In addition, Dell’Oro says the ZR pluggable optics market could exceed $500 million in annual sales by 2025.

In a 2Q-2021 report by market research firm Omdia, analysts noted that 5G investment, cloud service growth and demand for “infotainment-at-home” are among the drivers increasing demand in the optical networking market. “The twin dynamics of increasing optical capillarity and increasing end-point capacity continue to drive the optical core,” Omdia wrote in a note to clients.

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM. To purchase this report, please contact us at [email protected].

Jimmy Yu, Vice President, Dell-Oro Group

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

Optical Transport Market Down 2 Percent in First Nine Months of 2021, According to Dell’Oro Group

Disaggregated DWDM Equipment Market Up 36 Percent in 2Q 2021, According to Dell’Oro Group

5-Year Forecast: Optical Transport Market Reaches $18 Billion by 2025

Cowen Analysts: Telcos to lead FTTH buildout; total 82M homes to be passed by 2027

According to a new report titled Fiber to the Home: Navigating the Road to Gigabit America, a multi-sector by Cowen analysts, forecasts that telco fiber-to-the-home (FTTH) lines will pass 82 million American households by 2027, nearly double the 44 million households passed today. The four biggest U.S. wireline telcos (AT&T, Verizon, Frontier and Lumen) will account for the lion’s share of those deployments, together passing more than 71 million homes with fiber.

The Cowen report also projects that cable operators (cablecos or MSOs) will pass another 5 million homes with fiber lines over the next six years, largely because of Altice USA’s current big push in the New York metro area to match Verizon’s Fios rollout. Cable operators already pass about 5 million homes with fiber.

Overall, Cowen estimates that the US now has 50 million homes passed by fiber lines, with the telcos accounting for most of them. Here are a few other highlights from the report:

- Cowen expects state/federal funding of $130B for various broadband initiatives.

- That will close the digital divide and expand the addressable market for broadband access.

- FTTH will gain market share (compared to other fixed broadband access) to take ~70% of the net positive broadband subscriber adds by 2027.

- As a result, 35M FTTH subscribers (26% market share) are expected by 2027; up from 16M (14%) today.

- FTTH subs take speeds that are 54% faster than non-FTTH broadband subs.

- The increase in FTTH subs will lead to exciting next-gen home applications (not specified) and ARPU growth.

- FTTH subs have 13% higher ARPU compared to non-FTTH subs.

Large, midsized and small telcos will all participate in this massive fiber deployment, using FTTH to reverse nearly two decades of broadband market share losses to the cable industry, the Cowen analysts say. For instance, they project the nation’s biggest telcos will add a combined 7.7 million fiber subs over the next five years.

“The next few years will be historic in terms of telco FTTH upgrades, providing consumers speeds of 1 Gbit/s, closing the digital divide, expanding the total addressable market and achieving a ‘Gigabit America’,” the analysts wrote. “After years of hemorrhaging subscribers, we expect Big Telco to stem the tide of losses to Cable…”

However, the report does not say that telcos will be gaining broadband customers from cable operators. Instead, telcos will achieve broadband subscriber gains mainly by upgrading their own remaining 15 million DSL subs to FTTH.

“The cable decade of dominance of DSL-share stealing is over,” the analysts wrote, forecasting that the telcos will overtake the cable companies in broadband sub net gains by 2024. “Cable’s days of stealing DSL subs are over, though only losing modest share (DSL taking the brunt), as the focus will be on defense.”

The Cowen analysts expect cable’s broadband market share to drop very slightly from 61% today to 58% in 2027 while the telcos’ market share creeps up from 25% now to 27% in 2027.

“It’s far from doom-and-gloom for cable operators,” the analysts note. “With cable’s effective marketing plan and speed upgrades, the vast majority of subscriber losses will be from the 15 million DSL subscribers, not cable.”

The analysts expect fixed wireless access (FWA) to play a notable tole in the US broadband market by the middle of the decade, accounting for a small but increasing fraction of high-speed data customers throughout the 2020s. “FWA will establish a solid but niche foothold,” they wrote.

Cowen now expects U.S. service providers to add a collective 17 million broadband subs by 2027, enough to reach 97% penetration of occupied homes and 90% penetration of overall homes, up from 90% and 82% today. The analysts believe that broadband could achieve utility-like penetration levels of 98% or more, like wired phone service did at its peak last century.

All this fiber optic spending will be a boon for optical network equipment vendors. Specifically, the Cowen analysts single out Calix, Adtran, Ciena, Cisco, MasTec, Nokia and Juniper as likely beneficiaries.

The analysts also see potential for further market consolidation. Some scenarios they envision are Charter buying the Suddenlink portion of Altice USA’s footprint and Charter or Altice USA merging with T-Mobile to form a third converged player in the national market.

References:

Orange and Nokia demo 600Gb/sec transmission over a 914 km optical network; Nokia 25G PON

Nokia and Orange announced the completion of a network trial using the Nokia PSE-Vs, its fifth generation super coherent optics. With this field trial, Orange has successfully validated a planned upgrade of its long-haul backbone networks to support new high-bandwidth 400 Gb/sec services, and the ability to scale fiber capacity up to 600Gb/sec. This represents an increase in spectral efficiency by 50% compared to prior technologies on its long distance optical network.

The trial was performed in real-world conditions using Nokia PSE-Vs super coherent optics in production-ready optical transport hardware, just 16 months after the lab prototype trial done on Orange’s live network. Orange and Nokia demonstrated error-free performance at a data rate of 600Gb/sec over a 914 km network between Paris and Biarritz, under challenging live network conditions. The fiber network consisted of 13 spans of Orange’s existing network, through multiple cascaded reconfigurable optical add/drop multiplexers (ROADM), using 100GHz WDM spectrum channels.

Jean-Luc Vuillemin, Vice President of International Networks and Services at Orange, said: “With the booming market bandwidth requirement and need for scalability and flexibility, it is important that Orange continues to support an ever-greater network scale and new high-bandwidth services across our terrestrial and subsea global footprint.

Validating super coherent optics with Nokia represents an important enabler for future-proof networks which will bring spectral efficiency and operational deployment flexibility to our customer solutions. Furthermore this technology will allow for power savings by nearly 50%, which is key to our objective of developing greener networks for our customers. ”

James Watt, Head of Optical Networks Division, Nokia, said: “We are delighted to work with Orange in continued support of their network upgrade plans. With the introduction of the PSE-Vs super coherent capabilities across our entire 1830 portfolio, Nokia enables spectrally-efficient transport at 600Gb/sec over real-world long haul networks, and 400Gbps services over ultra long haul networks spanning multiple 1000’s of kilometers.”

Nokia 1830 Photonic Service Interconnect (PSE)

The Nokia PSE-V

The Nokia PSE-V is the industry’s most advanced family of digital coherent optics (DCO), powering the next generation of Nokia high-performance, high-capacity transponders, packet-optical switches, disaggregated compact modular and subsea terminal platforms. The PSE-V Super Coherent DSP (PSE-Vs) implements the industry’s only 2nd generation probabilistic constellation shaping (PCS) with continuous baud rate adjustment, and supports higher wavelength capacities over longer distances – including support for 400G over any distance – over spectrally efficient 100GHz WDM channels while further reducing network costs and power consumption per bit.

Further resources:

• Web page: Nokia 1830 Photonic Service Interconnect (PSI)

• Web page: Nokia Photonic Service Engine (PSE) Coherent DSPs

• Web page: 400G Everywhere

……………………………………………………………………………………………………………………..

Earlier this week, Nokia and Bell Canada announced the first successful test of 25G PON fiber broadband technology in North America at Bell’s Advanced Technical Lab in Montréal, Québec.

The trial validates that current GPON and XGS-PON broadband technology and future 25G PON can work seamlessly together on the same fiber hardware, which is being deployed throughout the network today. 25G PON delivers huge symmetrical bandwidth capacity that will support new use cases such as premium enterprise service and 5G transport. Nokia’s 25G PON solution utilizes the world’s first implementation of 25G PON technology and includes Lightspan and ISAM access nodes, 25G/10G optical cards and fiber modems.

For the past decade, Bell has been rolling out fiber Internet service to homes and businesses across the country, a key component in the company’s focus on connecting Canadians in urban and rural areas alike with next-generation broadband networks. With this successful trial, Bell can be confident that its network will absorb the increased capacity of future technologies and connect Canadians for generations to come.

Stephen Howe, EVP & Chief Technology Officer, Bell, said:

“As part of Bell’s purpose to advance how Canadians connect with each other and the world, we embrace next-generation technologies such as 25G PON to ensure we remain at the forefront of broadband innovation. Our successful work with Nokia to deliver the first 25G PON trial in North America will help ensure we maximize the Bell fiber advantage for our customers in the years to come.”

Jeffrey Maddox, President of Nokia Canada, said: “Nokia innovations powered the fiber networks and the connectivity lifeline that carried Canadian homes and businesses through the pandemic. 25G PON innovations will drive the next generation of advances in our connected home experience.”

Bell and Nokia have closely collaborated over the years on many industry breakthroughs, such as the first Canadian trial of 5G mobile technology in 2016. Bell continues to work with Nokia to build and expand its 5G network across Canada.

References:

STL Launches Accellus End-To-End Fiber Broadband And 5G Wireless Solution; India’s PLI scheme explained

India based telecom equipment company STL (Sterlite Technologies Limited) has launched Accellus, its flagship solution for 5G-ready, open and programmable networks. This new product line raises the position of STL as a provider of disruptive solutions for Access and Edge networks. For the past 5 years, STL has been investing in research and development to expand its capabilities in converged networks based on fiber optic broadband and Open RAN.

………………………………………………………………………………………………………………………………………………

India’s PLI Scheme

The Cellular Operators Association of India (COAI), which represents service providers and network equipment vendors, said that the production-linked incentive (PLI) scheme will boost local manufacturing, exports and also create employment opportunities. STL plans to take advantage of that initiative. Nokia (through its India subsidiary) said the guidelines were an encouraging initiative by the government towards making India a global manufacturing hub. “Nokia is committed to this vision with our Chennai factory that manufactures telecom equipment from 2G to 5G-making for India and the world.”

“India is already the second largest telecom market globally and this will go a long way in making the country a global hub for telecom innovation,” said SP Kochhar, director general, COAI.

………………………………………………………………………………………………………………………………………………..

STL’s Accellus is built on this industry-leading converged optical-radio architecture. The company expects the global adoption of this decision to accelerate at a rate of 250% on an annual basis, stimulating better TCO for customers and gross margin for shareholders. Accellus will allow four main benefits for network builders – scalable and flexible operations, faster time to market, lower TCO and greener networks.

Accellus will lead the industry’s transition from tightly integrated, proprietary products to neutral and programmable converged wireless and optical networking solutions. It offers wireless and fiber-based solutions:

1. 5G multiband radios: Exhaustive portfolio of RAN radios with single and multiband macro radios. Co-developed in partnership with Facebook Connectivity to build total availability for Open RAN-based radios

2. Internal small cells: O-RAN compliant, highly efficient internal 5G small cell solution, with level 1 edge treatment

3. Wi-Fi 6 access solutions: Outdoor Wi-Fi 6 solutions providing carrier-class public connectivity in dense environments

4. Intelligent RAN Controller (RIC): An Open RAN 5G operating system that allows the Open RAN ecosystem to use third-party applications to improve performance and save costs

5. Programmable FTTx (pFTTx): A complete solution that offers programmability and software-defined networks in large-scale FTTH, business and cellular sites (FTTx) networks

Commenting on the launch of Accellus, Philip Leidler, Partner and Consulting Director, STL Partners, said: “One of the goals of the O-RAN alliance was to expand the RAN ecosystem and encourage innovation from a wider base of technology companies worldwide. the message is the last indication that this goal has been achieved. “

Commenting on the launch of Accellus, Chris Rice, CEO of Access Solutions at STL, said: “Disaggregated 5G and FTTx networks based on open standards are becoming more common for both greenfield and brownfield deployments. These networks will require unprecedented scalability and flexibility, possible through an open and programmable architecture. STL’s Accellus will unlock business opportunities for our customers and provide a immersive digital experience worldwide.”

Optical fiber has evolved in its maturity and in its form factors to drive the infrastructure medium for the “wireline” side of the network. It continues to be the preferred medium for high-speed network delivery, Rice said.

“What network infrastructure is needed for 5G to become a reality and deliver expected Performance?”

Answer: “Upgrade the network backhaul and core IP infrastructure for the expected growth in bandwidth that 5G Applications will enable. The necessity of wireline 5G upgrades sometimes does not get the attention it deserves; this includes IP equipment (e.g. cell site routers) and the necessary fiber upgrades to the cell sites.

Perform the network planning for the new cell site builds required to get the coverage and capacity required for ubiquitous 5G at the speeds users expect. For 5G to pay off for Telcos, there have to be new capabilities and services to sell that deserve higher price points from consumers and business users.

Ensure that operational automation is available to keep operating costs reasonable, especially as the number of cell sites grows. CAPEX is typically only 20 to 25% of the Total Cost of Ownership (TCO) for a RAN, meaning that operating costs are 3X to 4X what CAPEX is. The RAN Intelligent Controller (RIC) is an example in ORAN / Open RAN that helps Telcos fulfil this need in an open way. It is essentially the operating system for Open RAN. It provides a platform for third-party applications to deliver these operational benefits and automation.”

How Is STL Helping Industry Stakeholders to Explain to Government Officials the Importance of Fiber for 5G or High-Speed Broadband?

Answer: “Network speed in the RAN air interface is essentially meaningless without the ability to ensure that the connected IP network can backhaul the required bandwidth. This fact necessitates additional fiber deployments to the existing cell sites (where it does not exist) and to new cells sites.”

In conclusion, Rice opined, “Our (STLs) newest business unit, the Access Solutions BU, focuses on fiber broadband and 5G wireless products. These products are based on open networking principles and give STL the opportunity to participate in the disruption that is occurring in the open networking markets, like ORAN and Open RAN initiatives. While Access Solutions BU is new, it has an R&D and innovation heritage of almost four years. During that time, a top talent team has been put in place, fundamental technology and innovation have been developed and matured, and now a well-defined product roadmap has been put in place as the BU launches many new products in its Accellus product line.”

References:

https://telecomtalk.info/5g-ecosystem-in-india-to-pli-scheme/468656/