RAN market

LightCounting: Wireless infrastructure market down in 2Q-23 (no surprise)

| Historical data accounts for sales of the following vendors: | |||

| Vendor | Segments | Source of Information | |

| Altran | vRAN | Estimates | |

| Amdocs | 5GC | Estimates | |

| ASOCS | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Baicell | RAN (RU) | None, supplies other RAN/vRAN vendors | |

| Benetel | Open RAN (RU) | None, supplies other RAN/vRAN vendors | |

| Cisco | EPC, vEPC, 5GC | Survey data and estimates | |

| China Information and Communication Technologies Group (CICT) | RAN | Estimates | |

| Comba Telecom | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| CommScope (acquired Phluido vRAN patents, October 2020) | vRAN (RU, DU) | Estimates | |

| Corning | vRAN | Estimates | |

| Dell | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Enea | 5GC | Estimates | |

| Ericsson | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Estimates | |

| Fairwaves | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Fujitsu | RAN | Survey data and estimates | |

| HPE | 2G/3G core, 5GC | Estimates | |

| Huawei | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

| JMA Wireless | vRAN | Estimates | |

| KMW | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Kontron | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Mavenir (acquired ip.access, September 2020) | vEPC, vRAN, 5GC | Survey data and estimates | |

| Microsoft (acquired Metaswitch and Affirmed Networks, 2020) | 5GC, vEPC and 2G/3G core | Estimates | |

| Movandi | RAN/vRAN (RU/repeater) | Estimates | |

| MTI Mobile | vRAN (RU) | None, supplies other RAN/vRAN vendors | |

| Node-H | vRAN (small cells) | Estimates | |

| Nokia | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

| NEC (including Blue Danube Systems, January 2022) | RAN, vRAN (RU), EPC, 5GC | Survey data and estimates | |

| Oracle | 5GC | Estimates | |

| Parallel Wireless | vRAN (CU, DU) | Estimates | |

| Pivotal | RAN/vRAN (RU/mmWave repeater) | Estimates | |

| Quanta Cloud Technology (QCT) | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Qucell | RAN, vRAN | Estimates | |

| Rakuten Symphony (acquired Altiostar, August 2021) | vRAN (CU, DU) | Estimates | |

| Ribbon Communications | 2G/3G core | Survey data and estimates | |

| Samsung | RAN, vRAN, vEPC, 5GC | Estimates | |

| Silicom | Open RAN (DU) | None, supplies other RAN/vRAN vendors | |

| SuperMicro Computer | vRAN (DU) | None, supplies other RAN/vRAN vendors | |

| Verana Networks | RAN/vRAN (RU/mmWave) | Estimates | |

| ZTE | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates | |

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

A new report from Dell’Oro Group says RAN sales declined at their fastest pace in nearly seven years during Q2-2023. According to preliminary findings from the market research firm, following the ‘intense ramp-up’ from 2017 through 2021. While RAN revenues stabilized in 2022 and 1Q23, market conditions worsened in the second quarter, resulting in RAN declining at the fastest pace in nearly seven years. The decline was not unexpected by Dell’Oro, yet the magnitude of the reversal was much steeper than anticipated.

………………………………………………………………………………………………………………………………..

The RAN market decline was surely expected by IEEE Techblog readers, as this publication has warned for years about the commercial failure of 5G mobile networks.

………………………………………………………………………………………………………………………………..

“It is tempting to point the finger at data traffic patterns, 5G monetization challenges, and the odds stacked against an economy struggling with persistent levels of elevated inflation,” said Stefan Pongratz, Vice President at Dell’Oro Group. “Although these are, of course, important factors, we attribute the poor performance in the quarter to the clouds forming in North America. Alongside challenging 5G comparisons, the decline was amplified by the extra inventory accumulated over the past couple of years to mitigate supply chain risks,” Pongratz added.

Additional highlights from the Q2-2023 RAN report:

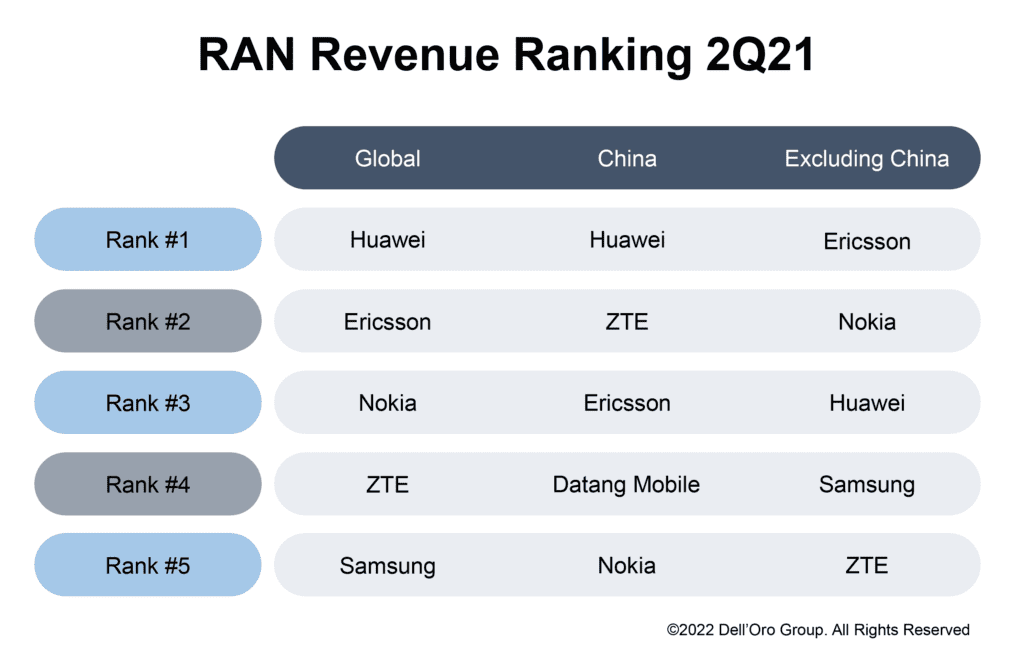

- Top 5 RAN suppliers for 1H23 include Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Nokia recorded the largest RAN revenue share gains between 2022 and 1H23.

- Huawei’s quarterly RAN share reached the highest level in three years. Huawei’s 2Q23 RAN revenue share outside of North America was as large as Ericsson and Nokia combined.

- Ericsson and Samsung’s RAN revenue shares declined between 2022 and 1H23.

- Regional projections are mostly unchanged; however, the short-term outlook has been revised upward in APAC excluding China and downward in the North American region.

- Global RAN revenues are expected to decline in 2023.

…………………………………………………………………………………………………………….

In a separate report, Dell’Oro says the Mobile Core Network (MCN) market returned to growth in 2Q 2023. The China region returned to growth and Europe, the Middle East, and Africa (EMEA) had the strongest quarterly growth rate since 3Q 2020.

“The MCN market shined on many fronts this quarter. The China region returned to growth with increased spending by two of the four Mobile Network Operators (MNOs). The EMEA region had its best quarterly growth rate since 2020, Huawei had record high revenues for the quarter, and Ericsson had its highest growth rate since 2Q20, as examples,” stated Dave Bolan, Research Director at Dell’Oro Group. “As a result, we are raising our outlook for 2023 year-over-year (Y/Y) growth rate from low single-digit percent to mid-single-digit percent.”

“As of 2Q 2023, we counted 44 Mobile Network Operators (MNOs) that have launched commercial 5G SA networks. One was added in 2Q 2023, Telefónica – Spain. The North America and EMEA regions of the 5G MCN segment Y/Y growth rates were in the triple-digit percent, signaling capacity additions to the 5G SA networks in both regions,” continued Bolan.

Editor’s Note: Despite years of promises, neither AT&T or Verizon has yet to deploy a 5G SA core network, without which no 3GPP defined 5G features/functions are possible.

…………………………………………………………………………………………………………………………

Additional highlights from the 2Q 2023 Mobile Core Network and Multi-Access Edge Computing Report include:

- The top MCN vendors worldwide for 2Q 2023 were Huawei, Ericsson, Nokia, and ZTE.

- The top 5G MCN vendors worldwide for 2Q 2023 were Huawei, Ericsson, ZTE, and Nokia.

- Five MNOs launched commercial 5G SA networks in 1H 2023.

References:

RAN Declines at the Fastest Pace in Seven Years, According to Dell’Oro Group

Mobile Core Network Market Returns to Growth in 2Q 2023, According to Dell’Oro Group

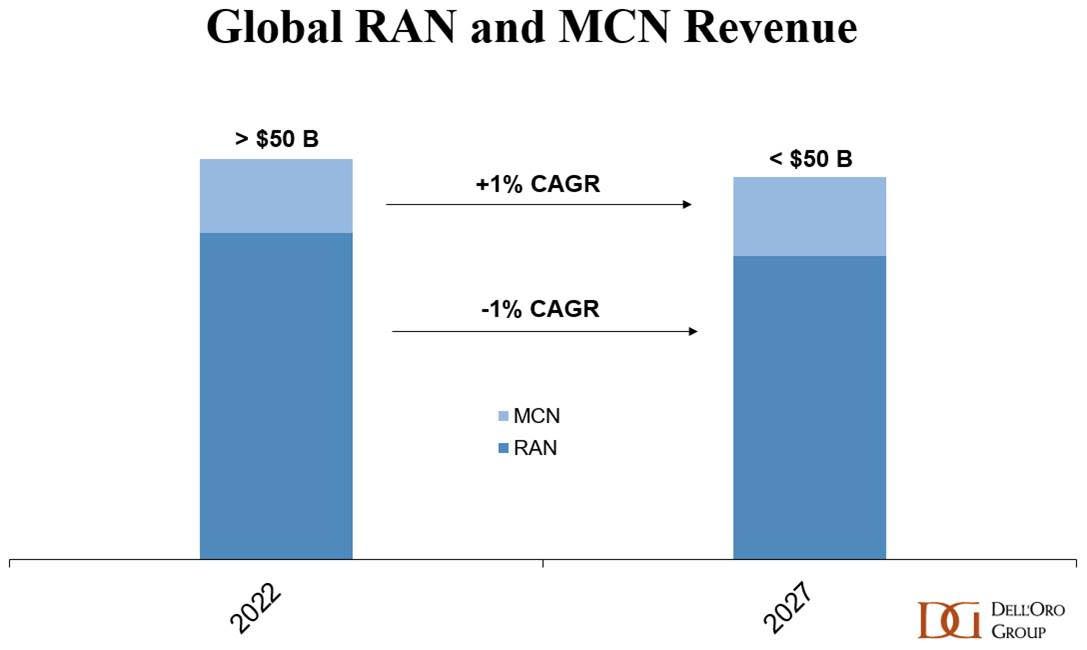

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Dell’Oro: OpenRAN revenue forecast revised down

through 2027

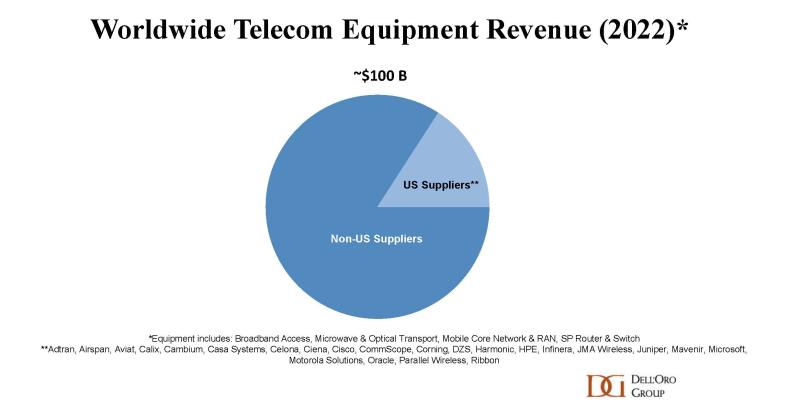

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

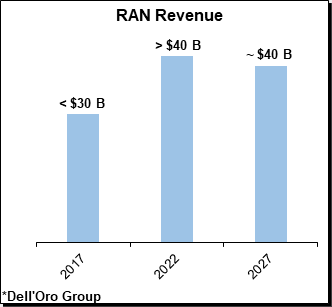

According to a newly published forecast report by Dell’Oro Group,the Radio Access Network (RAN) market is done expanding for now. Following the 40% to 50% ascent between 2017 and 2021, RAN revenues flattened out in 2022 and these trends extended to 1Q 2023.

“Even if it is early days in the broader 5G journey, the challenge now is the comparisons are becoming more challenging in the more mature 5G markets and the upside with the slower-to-adopt 5G regions is not enough to extend the growth streak,” said Stefan Pongratz, Vice President at Dell’Oro Group.

“Meanwhile, growth from new revenue streams including Fixed Wireless Access and enterprise LTE/5G is not ramping fast enough to change the trajectory. With 5G-Advanced not expected to trigger a new capex cycle, the question now is no longer whether RAN will grow. The question now is, rather, how much will the RAN market decline before 6G comes along?” Pongratz added.

Additional highlights from the Mobile RAN 5-Year July 2023 Forecast Report:

- Global RAN is projected to decline at a 1 percent CAGR over the next five years.

- The less advanced 5G regions are expected to perform better while the more developed 5G regions, such as North America and China, are projected to record steeper declines.

- LTE is still handling the majority of the mobile data traffic, but the focus when it comes to new RAN investments is clearly on 5G. Even with the more challenging comparisons, 5G is projected to grow another 20 percent to 30 percent by 2027, which will not be enough to offset steep declines in LTE.

- With mmWave comprising a low single-digit share of the RAN market and skepticism growing about the MBB business case, it is worth noting that our position has not changed. We still envision that the mmWave spectrum will play a pivotal role in the long-term capacity roadmap.

……………………………………………………………………………………………………………………….

Separately, Dell’Oro again lowered its forecasts for the Mobile Core Network market (which is now 5G SA core network), this time citing a slowdown in customer growth. It now predicts that the worldwide market for mobile core networks will expand at a CAGR of 1% over the next five years, having previously forecast a 2% CAGR as recently as January.

“We have reduced our forecast for the third consecutive time, primarily caused, this time, by an expected slowdown in subscriber growth,” said Dave Bolan, Research Director at Dell’Oro Group.

Dave said that Dell’Oro has reduced its expectations for the Multi-Access Edge Computing (MEC) market (which requires 5G SA core network). It now anticipates MEC will have a CAGR of 31%, noting that commercially-viable enterprise applications are taking much longer to come to fruition than many had hoped.

“Mobile Network Operators (MNOs) are concerned about inflation, a possible recession, and political conflicts. They are therefore being restrained in their capital expenditures, another factor weighing in on a more conservative forecast,” said Bolan. “As we continue refining our count of MNOs that have launched 5G Standalone (5G SA) eMMB networks, we note that only 4 MNOs have commercially deployed new 5G SA networks compared to six in the first half of 2022,” he added.

Additional highlights from the Mobile Core Network & Multi-Access Edge Computing 5-Year July 2023 Forecast Report:

- Year-over-year MCN revenue growth rates are projected to be flat in 2026 and turn negative in 2027.

- The North America and China regions are expected to have negative CAGRs, while Europe, Middle East, and Africa (EMEA), and Asia Pacific excluding China regions are expected to have the highest positive CAGRs.

Vodafone became one of those first-half 2023 launches, when it brought 5G Ultra to market in the UK in late June. In its latest Mobility Report, published around the same time, Ericsson noted that while around 240 telcos have launched commercial 5G services, only 35 of them have brought standalone 5G to market.

That should bode well for the mobile core market, and indeed it is faring better than the RAN space, in growth potential terms, at least.

Nonetheless, Dell’Oro predicts that year-on-year growth rates in mobile core network revenues will be flat by 2026 and turn negative the following year.

Dell’Oro Group’s Mobile RAN 5-Year Forecast Report offers a complete overview of the RAN market by region – North America, Europe, Middle East & Africa, Asia Pacific, China, and Caribbean & Latin America, with tables covering manufacturers’ revenue and unit shipments for 5GNR, 5G NR Sub 6 GHz, 5G NR mmW and LTE pico, micro, and macro base stations. The report also covers Open RAN, Virtualized RAN, small cells, and Massive MIMO. To purchase this report, please contact us by email at [email protected].

Dell’Oro Group’s Mobile Core Network & Multi-Access Edge Computing 5-Year July Forecast Report offers a complete overview of the market for Wireless Packet Core including MEC for the User Plane Function, Policy, Subscriber Data Management, and IMS Core with historical data, where applicable, to the present. The report provides a comprehensive overview of market trends by network function implementation (Non-NFV and NFV), covering revenue, licenses, average selling price, and regional forecasts for various network functions. To learn more about this report, please contact us at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, and data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

RAN Market to Decline at a 1 Percent CAGR Through 2027, According to Dell’Oro Group

Slower Subscriber Growth to Cut Mobile Core Network Market Growth, According to Dell’Oro Group

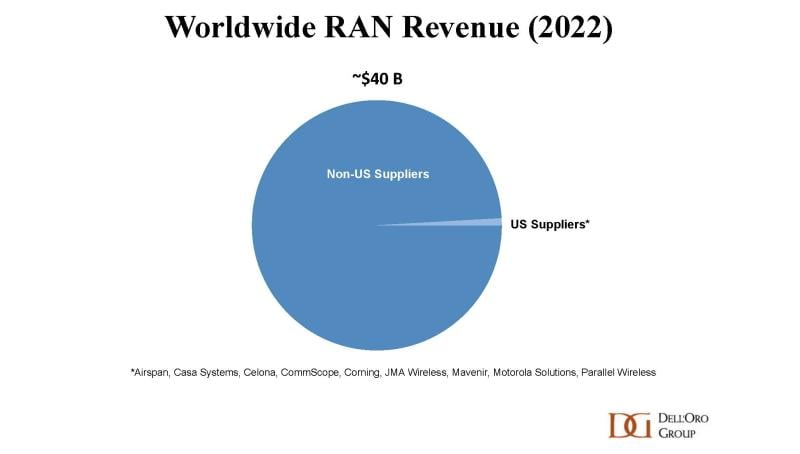

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

According to Stefan Pongratz of Dell’Oro, U.S. suppliers collectively accounted for around 16% of the global telecom equipment market in 2022, underpinned by strong presence in broadband access, optical transport and Service Provider Routers. Not surprisingly, this global view is masking the progress to some degree. If we exclude China, we estimate that the 20+ American suppliers comprise ~20% of the broader telecom equipment market.

U.S. suppliers appear to be struggling more in the RAN market. Per Dell’Oro’s 4Q22 RAN report, the American-based vendors still accounted for less than 1% of the global RAN market in 2022. Even if China is removed, the aggregate revenue share remains in the same range.

…………………………………………………………………………………………………………………………………………………………………….

Editor’s Note: The big 5 have dominated the global RAN market for over 15 years. Huawei, Ericsson, Nokia, ZTE, and Samsung together have about 95% of the global RAN market. Pongratz expects global RAN revenues to decline at a low-single-digit rate for 2023, with a surge in spending from India-based operators to fuel their 5G plans offset by dropping demand in China, Europe, and North America.

“After four years of extraordinary growth that catapulted the RAN market to record levels in 2021, the RAN market is now entering a new phase,” Pongratz wrote. “Even with 5G still increasing at a healthy pace, comparisons are more challenging and the implication for the broader RAN market is that growth is decelerating.”

…………………………………………………………………………………………………………………………………………………………………….

Dell’Oro estimates that the collective RAN revenues for the U.S. suppliers had an increased of 60% in 2022 relative to 2020, in part because of the improved entry points with Open RAN. U.S. network equipment vendors are fairly optimistic about the growth prospects:

- Mavenir is targeting 30%+ growth in 2023. While the mobile core network continues to drive the lion’s share of its revenue mix, Mavenir’s 10,000+ macro-site brownfield pipeline is expected to play a pivotal role in reaching this $1 billion group revenue target for FY23.

- Celona is working with 100+ customers and has seen a 300%+ increase in the number of connected devices across its 5G installed base. The vendor is now targeting to more than double its revenues this fiscal year.

- JMA has not shared any growth objectives for its wireless business. Even so, the vendor has announced multiple DoD wins and believes its all-American team is well positioned to support advanced private 5G networks for the U.S. government.

- Verana Networks is set to work on a trial with Verizon later this year.

- Dell is planning to enter the vRAN market over the next year, allegedly.

- Airspan’s equipment and software revenue growth slowed in 2022. Still, trial activity is on the rise and Airspan remains hopeful that its 400+ private network wins will soon have a more meaningful impact on the topline.

At the same time, it is early days in this process of re-shaping the RAN. And even if global market concentration as measured by the Herfindahl-Hirschman Index (HHI) is actually trending in the right direction, vendors with smaller footprints are still trying to figure out the best near-term and long-term approaches to improve their respective RAN positions – some think that open RAN can be an entry point for brownfield macro opportunities while others believe the likelihood of winning is greater in greenfield settings (public or private).

Open RAN might help to open the door, but this movement does not change the fact that RAN remains a scale game and double-digit RAN revenue shares are still required to maintain competitive portfolios.

Currently, this vendor asymmetry between RAN and the broader telecom equipment market then also implies that the U.S. suppliers are actually doing rather well beyond the wireless scope. In fact, if we remove the RAN from the picture, we estimate that the U.S. vendors accounted for around a fourth of the global non-RAN telecom equipment market. Better yet, if we take it one step further and also strip out China, the data shows that the American team comprised around one third of the non-RAN telco equipment market excluding China.

Dell’Oro’s assessment is that the U.S. suppliers hold a strong position in the non-RAN telecom equipment market. When it comes to RAN, however, the data shows that the American-based suppliers are moving in the right direction, especially in private wireless. But the overall progress has been slow, and it is still a long road ahead before we can establish that the U.S. suppliers are back at full speed in the broader public plus private 5G RAN business

…………………………………………………………………………………………………………………………………………………………

Stefan Pongratz is a vice president at the Dell’Oro Group. He joined Dell’Oro in 2010 after spending 10 years with the Anritsu Company. Pongratz is responsible for the firm’s Radio Access Network and Telecom Capex programs and has authored advanced research reports on the wireless market assessing the impact and the market opportunity with small cells, C-RAN, 5G, IoT and CBRS.

References:

https://www.fiercewireless.com/wireless/what-state-us-ran-and-non-ran-suppliers-pongratz

Dell’Oro: Worldwide Telecom Equipment Market Growth +3% in 2022; MTN: +2% Network Infrastructure Growth in 2022

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

Dell’Oro: 5G RAN growing; total RAN growth is slowing over next 5 years

Dell’Oro: RAN Market Disappoints in 2Q-2022

Dell’Oro: Market Forecasts Decreased for Mobile Core Network and Private Wireless RANs

Ericsson warns profit margins at RAN business set to worsen

Ericsson on Friday reported lower than expected 4th-quarter core earnings as sales of 5G equipment slowed in high-margin markets such as the United States, sending the Swedish company’s shares to their lowest since 2018.

Ericsson is the latest tech company to show the impact of customers tightening belts amid concerns about a global economic slowdown. Others have been cutting staff, including Microsoft (10,000) and Google parent Alphabet (12,000) which have announced thousands of job cuts this week while Amazon had announce 10,000 layoffs several weeks ago.

Ericsson has already announced plans to cut costs by 9 billion crowns ($880 million) by the end of 2023.

Chief Financial Officer Carl Mellander told Reuters that would involve reducing consultants, real estate and also employee headcount. “It’s different from geography to geography, some are starting now, and we’ll take it unit by unit, considering the labour laws of different countries,” Mellander said, referring to the cuts.

Mellander declined to say if the job cuts would be similar to 2017 when Ericsson laid off thousands of employees and focused on research to return the company to profitability.

Last week, the company said it would book a 2.3 billion Swedish crown ($220 million) provision for an expected fine from U.S. authorities for breach of a settlement reached in 2019.

Ericsson’s net sales rose in the fourth quarter, but margins, net income and core earnings fell. Its gross margin for the fourth quarter of 2022 fell to 41.4% from 43.2%.

Ericsson said it expected a fall in margin in its Networks business to persist through the first half of 2023, but the effect of cost savings to emerge in the second quarter.

JPMorgan analysts said given the fall in margins and higher investments, they would expect 2023 earnings to decline by a double digit percentage.

Inge Heydorn, partner and fund manager at investment firm GP Bullhound, said: “The fourth quarter shows once again that the U.S. has a big impact on Ericsson’s margins.”

With U.S. customers such as Verizon tightening their purse strings, Ericsson is hoping newer markets such as India can provide some growth. Its South East Asia, Oceania and India market was the only one to grow in the quarter, rising 21%, accounting for 13% of the company’s business.

The company’s fourth-quarter adjusted operating earnings, excluding restructuring charges, fell to 9.3 billion Swedish crowns from 12.8 billion a year earlier. That was short of the 11.22 billion expected by analysts, Refinitiv Eikon data showed. Net sales rose 21% to 86 billion crowns, beating estimates of 84.2 billion.

A settlement of a patent deal with Apple (AAPL.O) last month resulted in revenue of 6 billion crowns, but Ericsson also took 4 billion crowns in charges, including a provision for a potential fine from U.S. regulators and divestments.

However, there was some good news.

- Ericsson said it expects significant patent revenue growth over the coming 18-24 months.

- Ericsson, outside China, remains the company to beat in 5G. Its share of the market for radio access networks (RANs) appears to have increased several years in a row – from 33% in 2017 to 39% now.

- Ericsson is healthily profitable, which could not be said when CEO Ekholm took charge in 2017.

- Boosted by recent takeover activity and a major licensing deal with Apple, its headline sales for the final quarter of 2022 were up 21%, to 86 billion Swedish kronor (US$8.4 billion), compared with the same period a year before.

However, Ericsson has experienced one of its biggest profit slumps since the first half of Ekholm’s tenure. Hurt by higher costs and SEK4 billion ($390 million) worth of one-off charges – relating to US fines, write-downs and divestiture – its net income dropped by 39%, to SEK6.2 billion ($600 billion). Worse, all the various profit margins thinned, with Ericsson’s closely monitored EBIT (earnings before interest and tax) margin shrinking to just 9.1%, from 16.1% a year earlier. And the outlook is frosty.

The mini-boom in 5G spending appears to be over – temporarily, at least. Last year, the market for RAN products, where Ericsson now generates about 70% of its revenues, grew by around 5%, according to data from Dell’Oro, a market research firm that Ericsson uses. This year, RAN market sales are expected to fall by 1%. And in North America, responsible for nearly 30% of Ericsson’s overall revenues, Dell’Oro predicts they will drop by a worrying 7%.

After investing heavily in network rollouts during the last couple of years, many operators are cutting their expenditure amid signs of an economic downturn, and reducing the equipment stockpiles they built up when supplies were tight. “We expect operators to adjust inventory levels as the supply situation eases and we plan for these trends to continue during the first half of 2023,” said Ekholm on Ericsson’s earnings call today.

“The first half is really where we’ll see the sizeable inventory adjustments,” said Ekholm, answering questions asked by analysts. “Operators can sweat assets for a couple of quarters but it cannot be done much more [than that] because of the traffic growth underneath. That is the way to model it.” Ericsson’s expectation is that total mobile data traffic worldwide will grow by a factor of five between 2022 and 2028.

Given the market slowdown, turbulence of the last year and seemingly endless difficulties at smaller units, it is easy to forget that Ericsson remains a solid and successful business. But it has become more reliant on RAN sales under Ekholm – generating more than 70% of its revenues in that market last year, compared with just 47% in 2016. Ekholm clearly restored Ericsson’s reputation as a RAN provider. Amid the slowdown in that sector (zero growth forecast by Dell’Oro through 2027), his big challenge now is to prove it can thrive elsewhere.

Andrew Gardiner, analyst at Citi, said the announcements demonstrated the “significant challenges” the company faced this year. “We view Ericsson’s outlook as one of fundamentals deteriorating in the next quarter or two, as it aims to improve in the second half and beyond,” he added.

References:

https://www.reuters.com/technology/ericsson-quarterly-earnings-miss-expectations-2023-01-20/

https://www.ft.com/content/dd5cb329-f5bd-4b78-bde1-ca7510daaa7a

Dell’Oro: 5G RAN growing; total RAN growth is slowing over next 5 years

According to a newly published forecast report by Dell’Oro Group, after four years of extraordinary growth that propelled the radio access network (RAN) market to reach new record levels, the RAN market is now transitioning from the expansion phase to the next phase in this 5G journey with more challenging comparisons and slower growth.

“It is still early days in the 5G journey but at the same time, the coverage and capacity phases that have shaped the capex cycles with previous technology generations still hold,” said Stefan Pongratz Vice President and analyst with the Dell’Oro Group. “Still, even with the expected changes in capital intensities as the operators reach their initial 5G coverage targets, the plethora of 5G frequencies taken together with the upside from FWA and eventually private 5G, will curb the peak-to-trough decline relative to 2G-4G,” continued Pongratz.

Editor’s Note: In December, Ericsson said it expects the RAN market to be flat with 5G build-out still in its early days.

Additional highlights from the Mobile RAN 5-Year January 2023 Forecast Report:

- Global RAN is projected to grow at a zero percent CAGR outside of China by 2027. See chart below.

- The less advanced MBB regions are expected to grow while RAN investments in both China and North America are expected to decline at mid-single digit CAGRs over the forecast period.

- 5G RAN is expected to grow another 25 percent to 30 percent by 2027, though this will barely be enough to offset steep declines in LTE.

- mmWave projections have been revised downward over the near term and upward in the outer part of the forecast to reflect the potential upside with higher EIRP solutions.

- Small cell RAN revenue growth has been outpacing macros for some time now and these trends are expected to extend throughout the forecast period, with small cell RAN revenues growing more than 20 percent by 2027.

Dell’Oro Group’s Mobile RAN 5-Year Forecast Report offers a complete overview of the Mobile RAN industry by region – North America, Europe, Middle East & Africa, Asia Pacific, China, and Caribbean & Latin America, with tables covering manufacturers’ revenue and unit shipments for 5GNR, 5G NR Sub 6 GHz, 5G NR mmW and LTE pico, micro, and macro base stations. The report also covers Open RAN, Virtualized RAN, small cells, and Massive MIMO. To purchase this report, please contact by email at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, and data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com

References:

5G RAN is Growing but Total RAN Growth is Slowing over Next Five Years, According to Dell’Oro Group

\

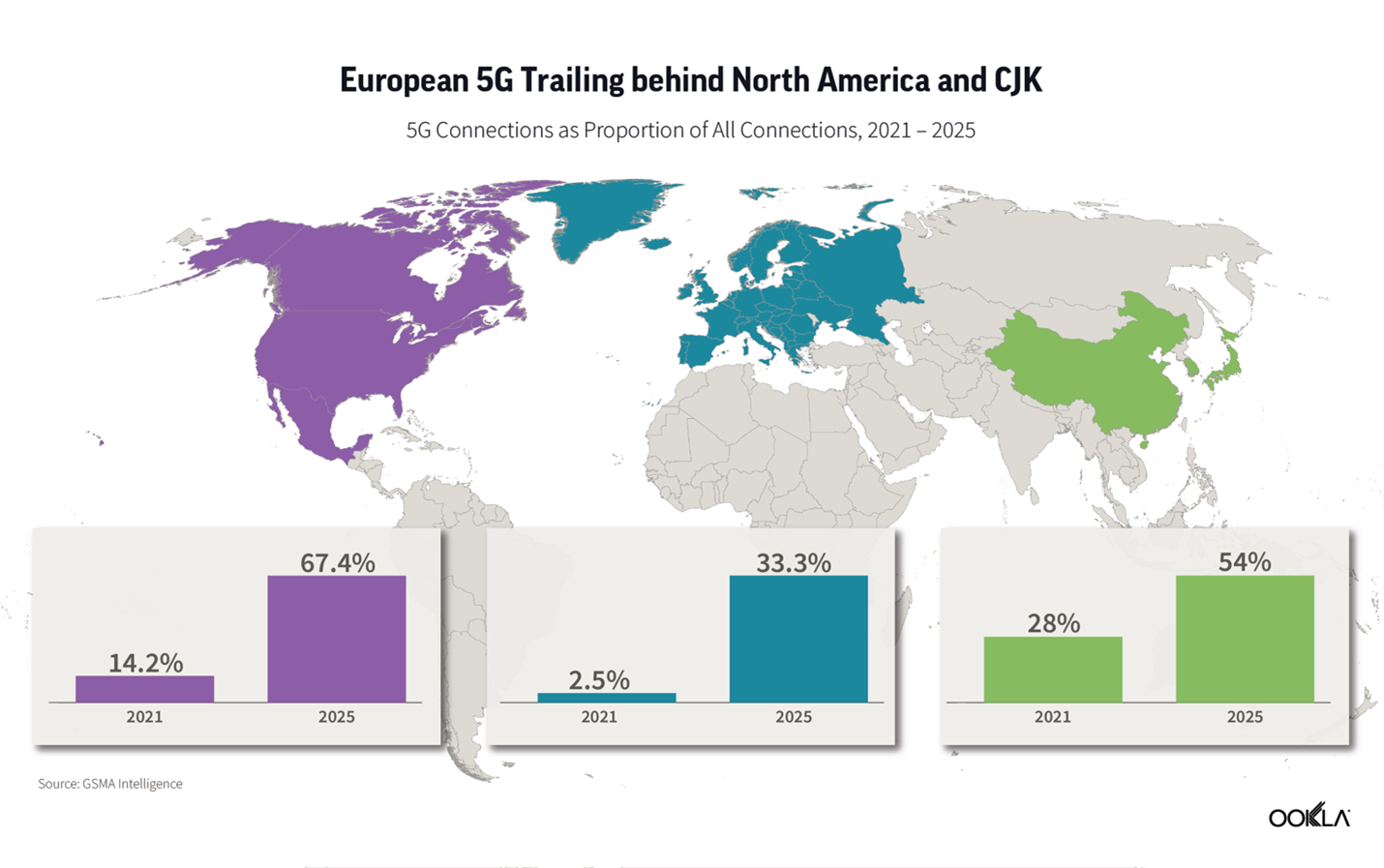

Strand Consult: Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries

With its new report “The Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries,” Strand Consult brings valuable evidence of the location, amount, and share of Chinese and non-Chinese equipment in European telecom networks. This report, the second of its kind, describes the respective amounts of 5G equipment from Huawei, ZTE, and non-Chinese vendors in European mobile networks and the share of such in equipment in the 5G Radio Access Network (RAN). Here are the highlights from the new report.

- There is little transparency about the amount, type, location, and share of 4G and 5G Chinese equipment in European networks.

- In 8 of 31 countries, more than 50% of the 5G RAN equipment comes from Chinese vendors. In 2020, it was 16 of 31 countries in which the 4G RAN equipment came from Chinese vendors.

- In one country, 100% of the 5G RAN comes from Chinese vendors. In 2020 there were 3 European countries with 100% 4G RAN equipment from Chinese vendors.

- Only 11 of 31 European countries can offer their users access to clean, non-Chinese networks.

- 41% of the mobile subscribers in Europe have access to 5G RAN from Chinese vendors. In 2020, 51% of European mobile subscribers had access to 4G RAN from Chinese vendors.

- The large European countries–Germany, Italy, Poland, Portugal, Austria, and Spain–purchase significant amounts of 5G equipment from Chinese vendors.

- Operators like Telenor and Telia in Norway, TDC in Denmark, 3 in Denmark and Sweden, T-Mobile Nederland’s, and Proximus in Belgium have switched out Chinese suppliers. None of those operators report increased networks cost or delay in 5G rollout.

- The data suggests that Germany appears not to take the security threat of China seriously. Nord Stream 2 was Germany’s debacle oil energy supplies from Russia; it appears that Germany sets up a similar scenario in the communications domain with Huawei and ZTE.

- As Germany accounts for 25% of European mobile customers, the German government’s lax approach to communications infrastructure creates a risk for Germany and all people who interconnect with German networks.

- Germany together with Italy, Poland, and Austria, comprise 50% of European mobile customers. These countries are heavily dependent on Chinese equipment, creating risk for their own nations and others which use their networks.

- In 2020, 57% of Germany’s 4G RAN came from Chinese vendors. In 2022, 59% of the 5G RAN in Germany comes from Chinese vendors.

- Huawei enjoys a higher market share in Berlin than in Beijing where it shares the market with ZTE and other vendors.

- US General Darryl A. Williams serves as the commanding general of the United States Army Europe and Africa (based in Wiesbaden, German) and commander of the Allied Land Command. He oversees more than 20,000 staff. Unwittingly when he uses a commercial mobile phone, the traffic is sent through a network built with Chinese equipment. Similarly when American military use their personal devices, they engage on a Chinese network at risk for intrusion.

Strand Consult’s report delivers detailed information about Chinese and non-Chinese network equipment in Europe at country level. The report highlights of the importance of the EU’s 5G toolbox and provides recommendations to improve its implementation. The toolbox applies to most of Europe’s 102 mobile operators across 31 countries serving some 673 million mobile customers. The report also provides valuable economic context to understand the market for RAN equipment.

The focus on 5G and 4G RAN reflects the shift of the security debate. There is consensus across most countries outside China that equipment provided by vendors owned and affiliated with the Chinese government and military poses unacceptable risk for the security and integrity of the core of the network. The discussion has evolved to whether and to what degree should such vendors be allowed to supply the RAN.

The 4G RANs studied in the 2020 report were purchased in the 12-year period of 2008-2020. Most of RANs were delivered and installed during 2009-2016 when operators upgraded their 2G and 3G networks to 4G networks. The main part of the 5G RAN was purchased, delivered, and installed after 2020.

When performing a financial analysis of the cost of restricting Huawei, one must consider that network upgrades will happen regardless of selection of vendor. There is a sunk cost to network upgrades which must be subtracted from the total cost of using a Chinese vendor.

Despite the widespread knowledge of the threat associated with using Chinese equipment, some of Europe’s largest operators have purchased and deployed Chinese 5G equipment in their networks after 2020. That decision could have major consequences for their shareholders if Europe’s policymakers conclude that it is not smart to depend on Chinese telecommunications infrastructure in the same way as it did for Russian gas.

The report is valuable for mobile operators and their shareholders, communications policymakers, security and defense analysts, network engineers, and other professionals in the field. Contact Strand Consult today to get your free copy of the report “The Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries.”

References:

https://strandconsult.dk/field/reports/

Strand Consult: Open RAN hype vs reality leaves many questions unanswered

O-RAN Alliance tries to allay concerns; Strand Consult disagrees!

Strand Consult: What NTIA won’t tell the FCC about Open RAN

Strand Consult: MWC 2022 Preview and What to Expect

Strand Consult: 5G in 2019 and 2020 telecom predictions

Ericsson expects RAN market to be flat with 5G build-out still in its early days; U.S. cellular industry growth to slow in 2023

Ericsson is planning for a flat RAN market and is structuring its cost base and operations accordingly. Underlying the flat market is a technology shift to 5G from earlier generation. 5G build-out is still in its early days with only about 20% of all base station sites outside China installed with 5G mid-band. Because 5G is still in its early days, vendors like Ericsson and Nokia are seeing lower margins. Therefore, they are relying more heavily on patent royalties to boost profits. Because 5G is still in its early days, vendors like Ericsson and Nokia are seeing lower margins. Therefore, they are relying more heavily on patent royalties to boost profits.

Given the rapid increase in network traffic levels, operators’ investment in performance and capacity is expected to remain robust. The 5G RAN market is expected to grow by over 11% per annum over the next three years, with potential further upside from areas such as Fixed Wireless Access, Enterprise connectivity, XR and Mission Critical Services (which require URLLC which meets performance requirements in ITU M.2410).

In Networks, Ericsson expects to expand its global footprint and enhance gross income through continued investments in technology for performance and cost leadership and, in addition, improve productivity and capital efficiency across the supply chain. In particular the Segment will continue investing in enhanced portfolio energy performance, enabled by Ericsson Silicon and innovating next-generation open architecture, such as Cloud RAN – key areas of strategic importance for its operator customers. Cloud RAN also offers potential in the enterprise segment.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Separately, Morgan Stanley analysts forecast that the U.S. wireless industry growth will slow in 2023.

“Carriers could move to cut pricing in order to maintain their subscriber bases,” the Morgan Stanley analysts wrote in a report to investors issued Thursday. That could reduce the operators’ ability to make money, they noted. “A continued adoption of premium plans could also support wireless service revenue growth,” they added.

Morgan Stanley analysts expect the U.S. wireless industry – including Verizon, AT&T, T-Mobile, Dish Network and cable companies like Comcast and Charter Communications – to collectively add 8.7 million new postpaid phone customers during 2023. That’s down only slightly from 8.9 million during 2022 and just below the record 10 million that providers collectively added over the course of 2021.

“We see the biggest slowdown in 2023 adds at AT&T, while Verizon could grow adds modestly yoy [year over year] off a low base, and T-Mobile can do slightly better given this year saw the impact of the Sprint network shutdown,” the Morgan Stanley analysts wrote. “We will be watching the growing deployment of eSIM technology to see if it opens the door to higher switching activity, while it should also help carriers lower costs through an easier activation process.”

References:

https://www.prnewswire.com/news-releases/ericsson-capital-markets-day-2022-301704231.html

https://telecoms.com/519003/ericsson-expects-ran-market-growth-to-be-flat-for-years/

Dell’Oro: RAN Market Disappoints in 2Q-2022

Dell’Oro Group preliminary findings suggest the Radio Access Network (RAN) market is weakening. The overall 2G-5G RAN infrastructure equipment market – including hardware and software – declined in the second quarter, recording the first year-over-year contraction in more than two years and the third consecutive quarter of RAN coming in below expectations. Although the RAN market is not immune to external risks, initial readings suggest that the RAN impact from deteriorating macro conditions, high levels of inflation, and supply chain disruptions were limited in the quarter.

“The shift in the pendulum is not a surprise, but admittedly it has swung a bit faster toward the negative than initially expected”, said Stefan Pongratz, Vice President at Dell’Oro Group. “Slower momentum is not a sign that the 5G deployment phase is over. The message we have communicated for some time now, namely that the 5G cycle will be longer than previous technology cycles, still holds. At the same time, market conditions in the quarter were impacted by APAC excluding China, Russia, and foreign exchange,” continued Pongratz.

Additional highlights from the 2Q 2022 RAN report:

- Top 5 global suppliers in the quarter include Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Top 4 suppliers outside of China in the quarter include Ericsson, Nokia, Huawei, and Samsung.

- Huawei and ZTE continued to dominate in China, together accounting for 90 to 95 percent of 1H 2022 revenues. Note that state owned Datang Mobile is ranked #4 in China’s RAN market.

- Ericsson maintained its top position in the RAN market outside of China, accounting for 39 percent of the revenues for the 1H 2022.

- Nokia’s RAN position outside of China improved between 1Q and 2Q 2022.

- Samsung’s 1H 2022 RAN share improved both in North America and globally.

- Even though RAN results disappointed in the quarter and first half revenues are tracking below expectations, RAN is still projected to record a fifth consecutive year of growth in 2022.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ and market revenue for multiple RAN segments including 5G NR Sub-6 GHz, 5G NR mmWave, LTE, macro base stations and radios, small cells, Massive MIMO, Open RAN, and vRAN. The report also tracks the RAN market by region and includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

…………………………………………………………………………………………………………………………..

Dell’Oro’s RAN vendor rankings come as no surprise.

- Ericsson in the second quarter reported a 13% increase in net sales compared with the year-earlier period.

- Nokia reported an 11% increase in net sales during the same period.

- Huawei, which has long been the world’s biggest supplier of RAN equipment, posted revenues in the first half of 2022 that were down 5.9% from last year, its lowest such results in five years.

References:

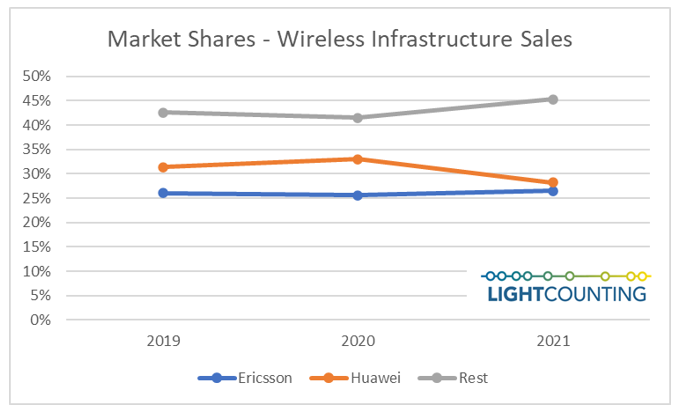

Light Counting: Wireless infrastructure market grew at a slower pace than in the past 2 years

In contrast to Dell’Oro Group’s assessment of the RAN market, Light Counting says that the wireless infrastructure market grew QoQ and YoY but at a slower pace than in the past 2 years. In addition, global sales were affected by supply chain issues that created logistical nightmares and led to increase in network node average sales prices.

This environment is divided into two spheres of influence, China versus the West and its allies. Both Ericsson and Nokia gained market share at the expense of Huawei and ZTE in 4Q21:

–>Ericsson moved into the #1 position, Huawei dropped to #2, Nokia came back to #3 while ZTE slipped to #4; although Samsung gained share, it was not enough to surpass ZTE. Note that Dell’Oro still has Huawei as #1.

For the full year, Ericsson finished neck and neck with Huawei with just 1 percentage point separating the 2 vendors. “In 4Q21, the wireless infrastructure market equilibrium reached and reported last quarter was on full display: the 2 opposite spheres of influence were fully balanced. As a result, the 2 respective markets reached roughly the same size and Ericsson closed the market share gap with Huawei. 2021 was a reset year that signaled a return to normalcy with a market peak in 2022,” said Stéphane Téral, Chief Analyst at LightCounting Market Research.

|

|

After this year’s peak, our model points to a slow single-digit declining market. This bell-shaped pattern reflects the differences in regional and national agendas, including the COVID-19 impact as well as the impact of “the 2-year step function”—2 years (2019 and 2020) in a row of double-digit growth. The model considers all the 5G 3-year rollout plans we have gathered from many service providers and indicates strong activity through 2022 and 2023.

About the report:

Wireless Infrastructure quarterly report analyzes the wireless infrastructure market worldwide and covers 2G, 3G, 4G and 5G radio access network (RAN) and core network nodes. It presents historical data from 2016 to 2021, on quarterly market size and vendor market shares, and a detailed market forecast through 2027 for 2G/3G/4G/5G RAN, including open vRAN, and core networks (EPC, vEPC, and 5GC), in over 10 product categories for each region (North America, Europe, Middle East Africa, Asia Pacific, Caribbean Latin America).

The historical data accounts for the sales of more than 30 wireless infrastructure vendors, including vendors that shared confidential sales data with LightCounting. The market forecast is based on a model correlating wireless infrastructure vendor sales with 20 years of service provider network rollout pattern analysis and upgrade and expansion plans.

For more information about the market report go to LightCounting.com or email us at [email protected].

References:

|