satellite Internet

Hellas Sat and Space Compass sign MoU for optical inter-satellite connectivity for cross-operator interoperability

Hellas Sat (Greece) and Space Compass (Japan) have executed a Memorandum of Understanding (MoU) to establish a strategic technical and commercial framework for optical inter-satellite connectivity. The collaboration focuses on integrating the forthcoming Hellas Sat 5 geostationary (GEO) satellite with Space Compass’s planned GEO optical data-relay system to enable seamless, cross-operator interoperability.

Strategic Objectives and Infrastructure Integration Inter-Satellite Interoperability:

The partners identify cross-operator optical compatibility as a critical prerequisite for deploying next-generation, high-capacity space communications.

Hellas Sat 5 (HS5) Architecture:

The HS5 satellite is expected to play an important role in advancing space-based optical communications. Currently in the design phase, HS5 will be positioned at 39° East. It is engineered to host the European Space Agency (ESA) HydRON (High Throughput Optical Network) payload. Data Relay Capabilities: The partnership aims to validate ultra-fast laser links and ground connectivity, bridging GEO and Low Earth Orbit (LEO) systems to provide near-real-time data delivery for Earth observation missions. By integrating the optical payload, HS5 will bridge geostationary and low earth orbit systems, enable seamless optical data relay.

Expanded Ecosystem Collaboration Regulatory & Research Alignment: Space Compass is concurrently working with ESA under a separate Memorandum of Intent to conduct feasibility studies on optical communication interoperability between their respective in-orbit demonstration programs.

Advanced Optical Payload:

In partnership with Thales Alenia Space, Hellas Sat 5 is designed to support capacities reaching the Terabit-per-second scale, a significant leap over current gigabit-scale radio frequency systems. This collaboration reinforces the transition toward a standardized, high-speed optical space network, essential for securing global digital infrastructure throughout the 2030s.

……………………………………………………………………………………………………………………………………………………………………..

This project is one of the initiatives of space business brand under NTT Group’s “NTT C89” and SKY Perfect JSAT.

About Space Compass:

Space Compass is a joint venture between NTT, a global Information and Communications Technology (ICT) company, and SKY Perfect JSAT Corporation, Asia’s largest satellite operator. The company was established to develop the Space Integrated Computing Network, a new multi-orbital, optical communication-based independent space infrastructure designed to address social challenges. For more information, please visit: https://space-compass.com/en/

………………………………………………………………………………………………………………………………………………………………….

- SDA’s Role: The Space Development Agency is a major driver, releasing Optical Communication Terminal (OCT) Standards (covering physical & data link layers) to ensure different systems can connect.

- Kepler Network: Demonstrated Optical ISLs between its satellites using SDA-compatible terminals, forming mesh networks for data relay.

- SpaceX Starlink: Added optical links for global coverage and resiliency, testing crosslinks with other partners like York.

- Project Kuiper: Amazon’s project also successfully tested end-to-end optical links for its constellation.

- Collaborative Efforts: Companies like Space Compass, Axelspace, NEC, and ESA are working on R&D for interoperable optical networks.

- Seamless Networks: Enables complex multi-platform, multi-orbit networks.

- Data Relay: Allows satellites to relay data for others, reducing ground station reliance.

- Standardization: Essential for different companies’ satellites to talk to each other.

References:

https://www.skyperfectjsat.space/en/news/20251211

https://space-compass.com/en/news/000080.html

Coherent Optics: Synergistic for telecom, Data Center Interconnect (DCI) and inter-satellite Networks

Important satellite network services to be discussed at WRC 23

SatCom market services, ITU-R WP 4B, 3GPP Release 18 and ABI Research Market Forecasts

Muon Space in deal with Hubble Network to deploy world’s first satellite-powered Bluetooth network

FCC: More competition for Starlink; freeing up spectrum for satellite broadband service

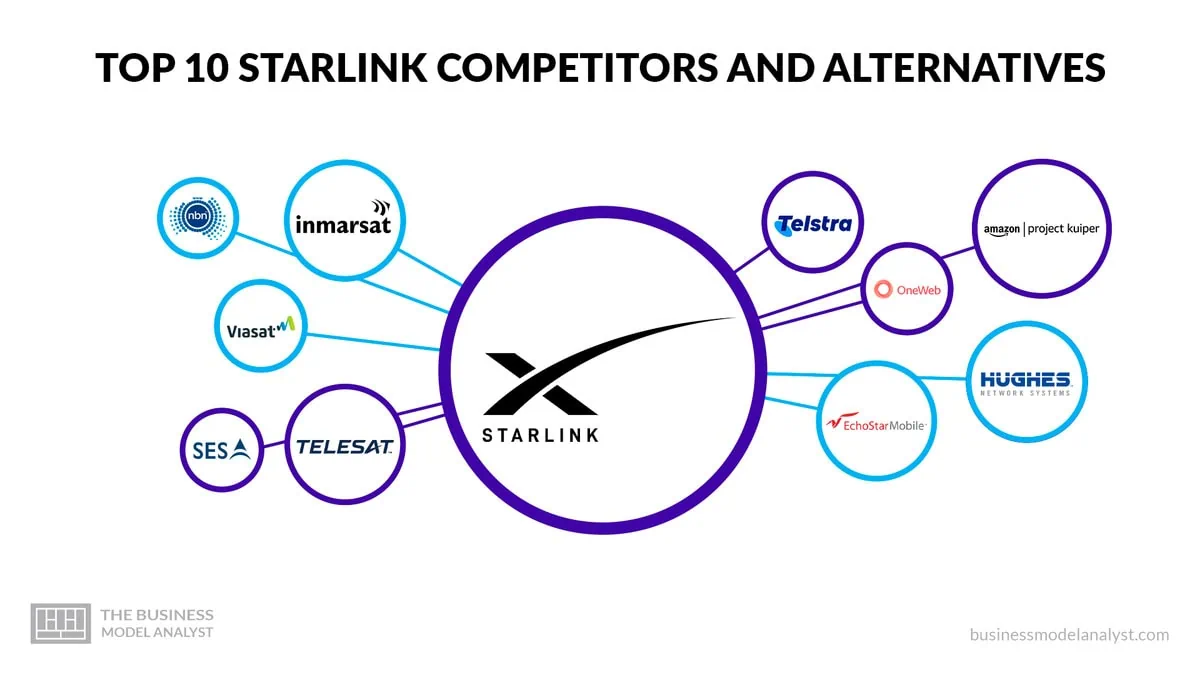

More Competition for Starlink Needed:

FCC chairwoman Jessica Rosenworcel said Wednesday that she wants to see more competition for SpaceX‘s internet satellite constellation Starlink. Starlink (owned by SpaceX, which provides launch services) controls nearly two thirds of all active satellites and has launched about 7,000 satellites since 2018. Rosenworcel said at a conference Wednesday that Starlink has “almost two-thirds of the satellites that are in space right now and has a very high portion of (satellite)) internet traffic… Our economy doesn’t benefit from monopolies. So we’ve got to invite many more space actors in, many more companies that can develop constellations and innovations in space.”

Starlink competitors include:

OneWeb is a solid alternative to Starlink’s satellite internet service by offering similar capabilities and coverage. The company plans to launch a constellation of approximately 650 satellites to provide seamless broadband connectivity to users worldwide, including remote and underserved areas. By operating in low-earth orbits (LEO), OneWeb’s satellites can offer low latency and high-speed internet access, suitable for a wide range of commercial, residential, and governmental applications. OneWeb’s satellites will be deployed in polar orbit, allowing them to cover even the Earth’s most remote regions. This global coverage makes OneWeb an attractive option for users who require internet connectivity in areas where traditional terrestrial infrastructure is limited or unavailable.

Viasat has a fleet of satellites in geostationary orbit, allowing it to provide internet services to customers in remote and rural areas. This coverage is essential for customers living in areas with limited terrestrial internet options. In addition to its satellite coverage, Viasat also offers competitive internet speeds. The company’s satellite technology allows fast and reliable internet connections, making it a viable alternative to traditional wired internet providers. This is especially beneficial for customers who require high-speed internet for activities such as streaming, online gaming, or remote work.

Telesat offers a wide range of satellite services tailored to different industries and applications. Telesat’s satellite fleet includes geostationary satellites, low-earth orbit (LEO) satellites, and high-throughput satellites (HTS), allowing it to deliver high-speed internet connectivity, broadcast services, and backhaul solutions to customers in remote and underserved areas. Telesat has extensive coverage and capacity in terms of satellite internet services. They have a strong presence in North America, South America, Europe, the Middle East, and Africa, making their services accessible to millions of users.

Telstra’s extensive network infrastructure and coverage make it a strong competitor to Starlink. The company operates a vast network of undersea cables, satellites, and terrestrial infrastructure, which enables it to provide reliable and high-speed connectivity across Australia and beyond. Telstra also has a solid customer base and brand recognition in the telecommunications industry, which gives it a competitive advantage. One of the critical business challenges that Telstra poses to Starlink is its established presence and dominance in the Australian market. Telstra has a significant market share and customer base in Australia, which gives it a strong foothold in the telecommunications industry. This makes it more difficult for Starlink to penetrate the market and attract customers away from Telstra. In addition, Telstra’s network coverage and infrastructure in remote and rural areas of Australia are competitive advantages.

Project Kuiper is backed by Amazon’s vast resources and infrastructure. Amazon’s deep pockets and logistics and cloud services expertise give Project Kuiper a decisive advantage in deploying and scaling its satellite network. By providing affordable and accessible broadband services, Project Kuiper intends to empower individuals, businesses, and communities with the opportunities and resources that come with internet access. With a constellation of low-earth orbit (LEO) satellites, Project Kuiper plans to deliver high-speed internet connectivity to areas with limited traditional terrestrial infrastructure.

Hughes Network System has a strong foothold in the market, particularly in rural areas with limited terrestrial broadband options. The company’s HughesNet service utilizes geostationary satellites to provide internet connectivity, offering up to 100 Mbps for downloads.

Inmarsat offers a range of satellite-based communication solutions that cater to its customers’ diverse needs. One key area where Inmarsat differentiates itself is its focus on mission-critical applications. The company’s satellite network is designed to provide uninterrupted and reliable connectivity, even in the most remote and challenging environments. Inmarsat’s portfolio includes services such as voice and data communications, machine-to-machine connectivity, and Internet of Things (IoT) solutions. The company’s satellite network covers most of the Earth’s surface, ensuring its customers can stay connected wherever they are.

Freeing Up Spectrum to Support Satellite Broadband Service:

At the FCC’s September 26th Open Commission Meeting, the Commission will consider a Report and Order that will provide 1300 megahertz of spectrum in the 17 GHz band for non-geostationary satellite orbit (NGSO) space stations in the fixed-satellite service (FSS) while also protecting incumbent operations. The Order provides a more cohesive global framework for FSS operators and maximizes the efficient use of the 17 GHz band spectrum. (IB Docket No. 22-273).

………………………………………………………………………………………………………………………………….

References:

https://www.fcc.gov/september-2024-open-commission-meeting

https://businessmodelanalyst.com/starlink-competitors/

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

SpaceX has majority of all satellites in orbit; Starlink achieves cash-flow breakeven

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

Amazon launches first Project Kuiper satellites in direct competition with SpaceX/Starlink

AT&T deal with AST SpaceMobile to provide wireless service from space

AT&T and satellite network provider AST SpaceMobile are teaming up to provide wireless service from space — a challenge to Elon Musk’s SpaceX, which struck a similar deal two years ago with T-Mobile US. AT&T and AST SpaceMobile formalized the partnership following an earlier testing period. They said on Wednesday that their agreement to build a space-based broadband network will run through 2030.

AT&T head of network Chris Sambar will join the AST SpaceMobile board, deepening a relationship that dates back to at least 2018. Sambar said in an interview that his team is confident in AST SpaceMobile’s technology, as demonstrated by the performance of the BlueWalker 3 test satellite. The relationship is moving from “loose partner to a strategic partner,” he said.

Wireless providers are in a race to offer connections for the world’s estimated 5 billion mobile phones when those devices are in remote areas beyond the reach of cell towers. For consumers, these services hold the promise of connectivity along rural roads and in places likes national parks. The service is typically marketed as a supplement to standard wireless coverage.

The new satellite network will work with ordinary mobile phones, offering a level of convenience that’s lacking in current call-via-satellite services, which require the assistance of bulky specialized equipment.

“Space-based direct-to-mobile technology is designed to provide customers connectivity by complementing and integrating with our existing mobile network,” said Jeff McElfresh, Chief Operating Officer, AT&T. “This agreement is the next step in our industry leadership to use emerging satellite technologies to provide services to consumers and in locations where connectivity was not previously feasible.”

“Working together with AT&T has paved the way to unlock the potential of space-based cellular broadband directly to everyday smartphones. We are thrilled to solidify our collaboration through this landmark agreement,” said Abel Avellan, AST SpaceMobile Founder, Chairman, and CEO. “We aim to bring seamless, reliable service to consumers and businesses across the continental U.S., transforming the way people connect and access information.”

AST SpaceMobile this summer will send five satellites to Cape Canaveral, Florida, for launch into low Earth orbit. AT&T’s Sambar didn’t say when service to customers might begin. “This will be a full data service, unlike anything you can get today from a low-Earth orbit constellation,” Sambar said.

T-Mobile is working with the low-Earth orbiting Starlink service from Musk’s Space Exploration Technologies Corp. The mobile carrier earlier said that its calling-via-satellite service could begin this year.

SpaceX has roughly 6,000 satellites aloft in low-Earth orbit — far more than any other company. The trajectory, with satellites circling near the Earth’s surface, allows communications signals to travel quickly between spacecraft and a terrestrial user.

SpaceX in January launched its first set of satellites capable of offering mobile phone service. The service “will allow for mobile phone connectivity anywhere on Earth,” Musk said in a post on X, the social network formerly known as Twitter, though he added that technical limitations mean “it is not meaningfully competitive with existing terrestrial cellular networks.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

About AST SpaceMobile

AST SpaceMobile, Inc. is building the first and only global cellular broadband network in space to operate directly with standard, unmodified mobile devices based on our extensive IP and patent portfolio, and designed for both commercial and government applications. Our engineers and space scientists are on a mission to eliminate the connectivity gaps faced by today’s five billion mobile subscribers and finally bring broadband to the billions who remain unconnected. For more information, follow AST SpaceMobile on YouTube, X (formerly Twitter), LinkedIn and Facebook. Watch this video for an overview of the SpaceMobile mission.

References:

https://about.att.com/story/2024/ast-spacemobile-commercial-agreement.html

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

AST SpaceMobile achieves 4G LTE download speeds >10 Mbps during test in Hawaii

AST SpaceMobile completes 1st ever LEO satellite voice call using AT&T spectrum and unmodified Samsung and Apple smartphones

AST SpaceMobile Deploys Largest-Ever LEO Satellite Communications Array

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

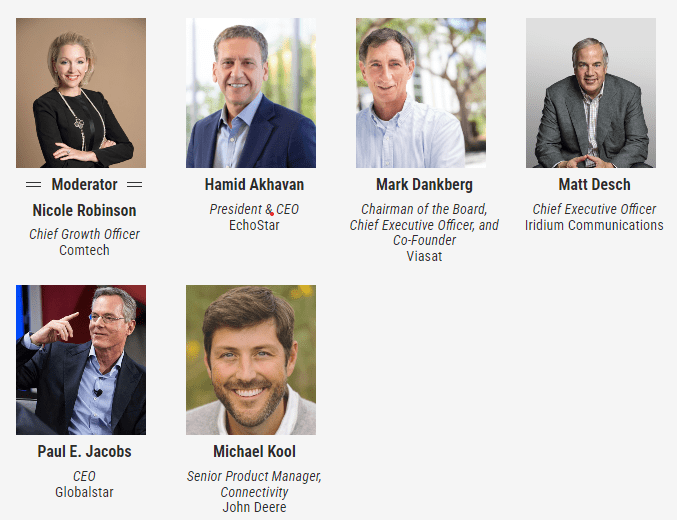

Converged terrestrial and satellite connectivity is a given, but the path is strewn with unknowns and sizable technological and business challengers, according to satellite operator CEOs. Hopefully, 3GPP Release 18 will contain the necessary specifications for it to be implemented as we explained in this IEEE Techblog post.

During Access Intelligence’s Satellite 2024 conference in Washington DC this week, Viasat CEO Mark Dankberg said satellite operators must start thinking and acting like mobile network operators, creating an ecosystem that allows seamless roaming among them. Terrestrial/non-terrestrial network (NTN) convergence requires “a complete rethinking” of space and ground segments, as well as two to three orders of magnitude improvement in data pricing, Dankberg said. Standards will help get satellite and terrestrial to fit together, but that evolution will happen slowly, taking 10 to 15 years, Iridium CEO Matt Desch said. It remains to be seen how direct-to-device services will make money, he added. Satellite-enabled SOS messaging on smartphones “is becoming free, and our satellites are not free — we need to make money on it some way,” Desch added.

The regulatory environment around satellite has changed tremendously during the past decade, with the FCC very oriented toward mobile networks’ spectrum needs and now satellite matters making up most of the agenda for the 2027 World Radiocommunication Conference, Desch said. However, there will be regulatory challenges to resolve in satellite/terrestrial convergence, he predicted. There are significant synergies in having a 5G terrestrial network and satcom assets under one roof, he said. Blurring the lines between terrestrial and non-terrestrial makes it easier for manufacturers to build affordable equipment that operates in both modes, Desch concluded.

That inevitable convergence is being driven by declining launch costs, maturing technologies and improved manufacturing, all of which make non-terrestrial network connectivity more economically competitive, said EchoStar CEO Hamid Akhavan. He said the EchoStar/Dish Network combination (see 2401020003) was driven in part by that convergence, consolidating EchoStar’s S-band spectrum holdings outside the U.S. with Dish’s S-band holdings inside the country. The deal also melds Dish’s network operator expertise with Hughes’ satellite expertise.

Wednesday Opening General Session: Are Satellite and Cellular Worlds Converging or Colliding?

To ensure space’s sustainability, missions must follow the mantra of “leave nothing behind,” sustainability advocates said. Space operators should have more universal protocols and vocabulary when exchanging space situational awareness data, as well as more uniformity in what content gets exchanged, said Space Data Association Executive Director Joe Chan. When it comes to space sustainability, clutter isn’t necessarily dangerous, and any rules fostering sustainability should avoid restricting the use of space, he said. Space lawyer Stephanie Roy of Perkins Coie said a mission authorization framework covering space operations that fall outside the regulatory domain of the FCC, FAA and NOAA is needed. Space operators and investors see sustainability rules as inevitable and want to ensure they allow flexibility and don’t mandate use of any particular technology, she added. Many speakers called for a “circular economy” in space, with more reuse of materials via refueling, reuse or life extension.

Separately, space sustainability advocates urged a mission authorization regulatory framework and universal use of design features such as docking plates enabling on-orbit serving or towing. Meanwhile, conference organizers said event attendance reached 14,000.

Also, ITU Secretary-General Doreen Bogdan-Martin urged the satellite industry to join ITU’s Partner2Connect digital coalition aimed at addressing digital divide issues, particularly in the least-developed nations and in landlocked and small island developing countries. The digital divide “is right up there” with climate change as a pressing issue for humanity, said Bogdan-Martin. She noted the coalition has received $46 billion in commitments, with a target of $100 billion by 2026.

References:

https://communicationsdaily.com/article/view?BC=bc_65fb60473d5de&search_id=836928&id=1911572

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

https://www.3gpp.org/specifications-technologies/releases/release-18

Japan telecoms are launching satellite-to-phone services

Japanese telecom carriers are rushing to launch communication services that directly connect smartphones to satellites. In recent years, global telecom carrier interest in non-terrestrial networks, such as space-based services, has grown. Such network services not only allow for expanded coverage to places that would otherwise be difficult to reach, but also are expected to be used in natural disasters. After the January 2023 Noto Peninsula Earthquake in Japan, SpaceX owned Starlink satellite internet service was used for emergency restoration of base stations and to provide internet at disaster shelters.

- Rakuten Mobile Inc. announced Friday that it will start offering a satellite-to-smartphone service that can also be used to make voice calls as early as 2026. The service is expected to provide a connection anywhere in the country, including in mountainous regions and areas offshore, where it is difficult to build base stations. It could prove useful in a natural disaster.

- KDDI Corp. also plans to launch a satellite-to-smartphone service for text messaging. Such satellite-based services do not require a dedicated receiver, and can be accessed with just a smartphone.

For the Rakuten Mobile service, the company will use satellites from AST SpaceMobile Inc., a U.S. startup that has been invested in by the Rakuten Group.

……………………………………………………………………………………………………………….

AST SpaceMobile has launched two test satellites into low-earth orbit at an altitude of about 500 kilometers. Because these satellites orbit lower than geostationary satellites, they can provide communications with less delay. The company plans to have as many as 90 satellites operating in the future.

At a press conference on Friday, Rakuten Mobile Chairman Hiroshi Mikitani said, “Our customers will be able to enjoy mobile connectivity across Japan, even offshore or on an airplane.”

KDDI, which has gotten out ahead by providing access to Starlink, a satellite-based communication network from U.S. company SpaceX, will launch its text messaging service as early as this year.

Starlink currently requires a dedicated terminal, but last month SpaceX successfully launched six satellites that allow smartphones to connect to them directly.

NTT Docomo Inc. and SoftBank Corp. are looking to commercialize high-altitude platform stations, or HAPS. These stations are large unmanned aircraft that stay in the air at an altitude of about 20 kilometers, from where they send out radio signals.

NTT Docomo is currently testing direct links between HAPS and smartphones, and expects to launch a HAPS mobile service in fiscal 2025. However, a framework for space- and air-based services is still being defined.

The frequency bands to be used for the services are expected to be discussed at an international conference, and the Internal Affairs and Communications Ministry is considering technical requirements.

References:

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

Telstra partners with Starlink for home phone service and LEO satellite broadband services

SpaceX has majority of all satellites in orbit; Starlink achieves cash-flow breakeven

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

T-Mobile US today said that SpaceX launched a Falcon 9 rocket on Tuesday with the first set of Starlink satellites that can beam phone signals from space directly to smartphones. The U.S wireless carrier will use Elon Musk-owned SpaceX’s Starlink satellites to provide mobile users with network access in parts of the United States, the companies had announced in August 2022. The direct-to-cell service at first will begin with text messaging followed by voice and data capabilities in the coming years, T-Mobile said. Satellite service will not be immediately available to T-Mobile customers; the company said that field testing would begin “soon.”

/cloudfront-us-east-2.images.arcpublishing.com/reuters/73PVHSXKT5LIHDTFDWHUSDQTL4.jpg)

SpaceX plans to “rapidly” scale up the project, according to Sara Spangelo, senior director of satellite engineering at SpaceX. “The launch of these first direct-to-cell satellites is an exciting milestone for SpaceX to demonstrate our technology,” she said.

Mike Katz, president of marketing, strategy and products at T-Mobile, said the service was designed to help ensure users remained connected “even in the most remote locations”. He said he hoped dead zones would become “a thing of the past”.

Other wireless providers across the world, including Japan’s KDDI, Australia’s Optus, New Zealand’s One NZ, Canada’s Rogers will collaborate with SpaceX to launch direct-to-cell technology.

References:

https://www.theguardian.com/science/2024/jan/03/spacex-elon-musk-phone-starlink-satellites

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

Chilean network operator Entel and SpaceX, the company that owns satellite internet provider Starlink, made a commercial agreement to provide satellite-to-mobile services. The agreement will improve broadband coverage for Entel’s LTE customers. It will allow millions of cell phones in Chile and Peru to access satellite coverage starting at the end of 2024.

The first Starlink satellites with Direct to Cell capacity will be launched, providing basic satellite connectivity by the end of 2024. Starlink is a pioneer in providing fixed broadband services through low-orbit satellite networks, which helped it to gain an advantage in the development of direct-to-cell technology.

Starlink satellites with Direct to Cell capabilities enable access to texting, calling, and browsing anywhere on land, lakes, or coastal waters. Direct to Cell will also connect IoT devices which have LTE cellular access.

“One of the great advantages of this proposal is that it will work using the same 4G VoLTE phones that exist in the market today. It does not require any special equipment or special software,” Entel network manager Luis Uribe told BNamericas. “This is an important advantage over traditional satellite solutions. It is a technology that is still evolving, it is being developed. We are going to explore [use cases] as [the technology] advances,” he added.

Although Entel’s mobile networks cover 98% of the populations of Chile and Peru, the Starlink deal will allow it to provide services in maritime territory or in areas that suffered natural disasters.

“It is a technology that has enormous potential as a result of its ability to cover areas that traditional networks cannot achieve,” Uribe said.

A so-called line of sight between device and satellite is required for direct-to-cell to work, meaning the technology might not work indoors or in dense forests. If available, terrestrial coverage will be prioritized.

While other companies are developing similar solutions, they are not as advanced as Starlink. “We see other solutions that also look interesting. To the extent that these do not involve special software or devices, they could be an option,” said Uribe.

Entel is also focused on 5G deployment, achieving a first-stage goal of connecting 270 localities from Arica in the north to Puerto Williams in the south in August.

The company is investing US$350mn in the entire deployment program. In October, Entel enabled NB-IoT at over 6,500 sites to boost connectivity for Internet of Things devices.

“From the point of view of the company’s internal processes, we are incorporating artificial intelligence and generative artificial intelligence tools,” said Uribe. The technologies are being used for automation processes and network optimization, among others.

References:

https://www.bnamericas.com/en/features/spotlight-the-entel-starlink-mobile-coverage-agreement

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

SpaceX has majority of all satellites in orbit; Starlink achieves cash-flow breakeven

Viasat launches 2nd satellite for its Arctic Satellite Broadband Mission

Viasat, a global leader in satellite communications, believes that the Arctic has rapidly growing connectivity needs to serve governments, shipping companies, commercial airlines, and scientists. The company has announced the second satellite in the upcoming Arctic Satellite Broadband Mission has completed thermal vacuum testing at Northrop Grumman’s Dulles, VA, site: a significant milestone as the project looks to connect the Arctic region with high speed broadband in the second half of 2024.

ASBM-1 during its vibration testing stage, at Northrop Grumman’s satellite manufacturing facility in Dulles, Virginia. Photo credit: Northrop Grumman

………………………………………………………………………………………………………………………………………..

The mission, led by the Space Norway subsidiary Heosat, will see two satellites deployed in a highly elliptical orbit (HEO) in the world’s first HEO mission carrying a broadband commercial service payload. The two satellites – ASBM-1 and ASBM-2 – will host Viasat’s GX-10a and GX-10b Ka-band payloads, extending Viasat’s high-speed global network across the Arctic region.

The spacecraft are designed to integrate as part of Viasat’s wider satellite fleet and extend the coverage of its Ka-band network beyond that available from geostationary satellites. The payloads will be Viasat’s first in non-geostationary orbit and will become a key element of its co-operative hybrid network. Once launched, these new payloads will increase Viasat’s fleet size to 20, with an additional eight under development.

The Arctic has rapidly growing connectivity needs to serve governments, shipping companies, commercial airlines, and scientists. In October 2023, the UK Government’s Environmental Audit Committee called for a greater political focus on the region and further research into the potential for environmental and economic impacts of changing weather patterns. Alongside GX10a and b, the spacecraft will host payloads for the Norwegian Armed Forces and the US Space Force.

Mark Dickinson, Head of Space Systems, Viasat, said “We have been talking with our customers, partners, and shareholders about how the combination with Inmarsat has given us a new scale and scope to deliver new solutions to meet our customers’ requirements. This is an example of what that means in practice. The investment we’ve made in our network is creating the flexibility, coverage, and interoperability to meaningfully connect the world wherever and whenever our customers need it – even if they happen to be standing on the North Pole.”

Space Norway Program Director, Kjell-Ove Skare, said “With both satellites through the thermal vacuum test we are really closing in on making this strategically important capability real. We have seen an unprecedented collaborative effort with Viasat, the US Space Force, our Norwegian Armed Forces and with Northrop Grumman, and are all looking forward to providing the first dedicated broadband services to users in the real Arctic.”

The ASBM-1 and ASBM-2 spacecraft will now undergo their final testing and readiness activities. Once complete, they will be transferred to Vandenberg Space Force Base, California and launched together on a SpaceX Falcon 9 rocket in mid-2024. The company will share further details on the launch schedule once confirmed.

In October 2023, the United Kingdom’s environmental audit committee called for a greater political focus on the Arctic and further research into the potential for environmental and economic impacts of changing weather patterns, Viasat’s announcement said.

Once testing is complete, Viasat’s announcement said the satellites will be transferred to Vandenberg Space Force Base in California, where they’ll be launched together on a SpaceX Falcon 9 rocket in mid-2024.

Viasat, Inc. Contacts:

Press Contact – [email protected]

Paul Froelich/Peter Lopez, Investor Relations, +1 (760) 476-2633, [email protected]

References:

Viasat reports record quarterly revenues; launch of ViaSat-3 satellites in late summer 2022

Viasat realizes major milestone for its global satellite broadband plan

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

Orange France satellite Internet based on Eutelsat Konnect VHTS satellite

Orange France has expanded its range of connectivity offerings to include satellite Internet in its technology mix, alongside fiber, ADSL, 4G and 5G Home FWA. This new Satellite offering from Orange is aimed at customers who are not eligible for fiber and those with ADSL speeds of less than 8 Mbps. It is marketed through Orange’s distribution channels and operated by Nordnet, an Orange subsidiary company that has been specializing in satellite Internet for 15 years.

This offer is part of the French government’s Cohésion Numérique des Territoires (Digital Cohesion of Regions) program, and meets the government’s objective of guaranteeing access to superfast broadband (greater than 30 Mbps) for all by 2025.

Homes without good wired broadband can benefit from a subsidy to access a better connection via wireless technology.

An offer based on the expertise of the French and European space industry:

This offer is based on the Eutelsat Konnect VHTS satellite, designed by Thalès Alenia Space in Cannes and launched by on Ariane 5 in September 2022. Weighing 6.5 tons and measuring 9 meters in height, Eutelsat Konnect VHTS is the largest European satellite ever designed. It is part of the new generation of electric propulsion satellites [3] launched from the all-electric platform built by Spacebus NEO, with the financial support of the European Space Agency and the Centre National d’Etudes Spatiales (French Space Agency).

Konnect VHTS | Broadband Satellites | Eutelsat

……………………………………………………………………………………………………………………….

For €49.99 per month (with the first month free), customers of this satellite offer can enjoy unlimited superfast broadband with a connection speed of up to 200 Mbps downstream and 15 Mbps upstream [1]. This offer requires no change of phone number and includes unlimited calls to landlines in mainland France and 50 other destinations [2] as well as calls to mobiles in mainland France and eight other destinations.

After subscribing, customers will receive a Satellite Kit, which they can install by themselves or with the help of Nordnet and its network of specialist installation partners. The Satellite Kit can be purchased for €299 or rented for €8/month. Nordnet’s installation kit option costs €299, with a one-year warranty.

Jean-François Fallacher, Executive Vice President, CEO Orange France: “The launch of Orange Satellite with Nordnet is another step towards the deployment of superfast broadband for everyone, everywhere in mainland France. At Orange, we’re proud to be able to offer all our customers a superfast broadband access solution thanks to our technology mix. Our range of connectivity offers now includes satellite, in addition to 4G and 5G Home, fiber and ADSL. This new offer responds to the needs of the French population, whatever their connectivity requirements, even in the most remote areas.”

NOTES:

[1] Offer in mainland France subject to eligibility. 12-month commitment. Maximum theoretical speeds. Details on orange.fr. €35 set-up fee & €15 equipment delivery fee

[2] List of destinations on nordnet.com

[3] The satellite’s environmental footprint is reduced thanks to its 100% electric propulsion, which is less polluting than previous propulsion systems using chemicals.

References:

https://newsroom.orange.com/orange-launches-its-satellite-offer/?lang=fr

https://www.eutelsat.com/en/satellites/2-7-east.html

Orange Business tests new 5G hybrid network service in France

AWS Integrated Private Wireless with Deutsche Telekom, KDDI, Orange, T-Mobile US, and Telefónica partners

SpaceX has majority of all satellites in orbit; Starlink achieves cash-flow breakeven

SpaceX accounts for roughly one-half of all orbital space launches around the world, and it’s growing its launch frequency. It also has a majority of all the satellites in orbit around the planet. This Thursday, majority owner & CEO Elon Musk tweeted, “Excited to announce that SpaceX Starlink has achieved breakeven cash flow! Starlink (a SpaceX subsidiary) is also now a majority of all active satellites and will have launched a majority of all satellites cumulatively from Earth by next year.”

There are some 5,000 Starlink satellites in orbit. Starlink satellites are small, lower-cost satellites built by SpaceX that deliver high-speed, space-based internet service to customers on Earth. Starlink can cost about $120 a month and there is some hardware to buy as well.

Starlink ended 2022 with roughly 1 million subscribers. The subscriber count now isn’t known, but it could be approaching 2 million users based on prior growth rates. SpaceX didn’t return a request for comment.

In 2021, Musk said SpaceX would spin off and take Starlink public once its cash flow was reasonably predictable.

A SpaceX rocket carriers Starlink satellites into orbit. PHOTO CREDIT: SPACEX

Starlink has been in the spotlight since last year as it helps provide Ukraine with satellite communications key to its war efforts against Russia.

Last month, Musk said Starlink will support communication links in Gaza with “internationally recognized aid organizations” after a telephone and internet blackout isolated people in the Gaza Strip from the world and from each other.

Musk has sought to establish the Starlink business unit as a crucial source of revenue to fund SpaceX’s more capital-intensive projects such as its next-generation Starship, a giant reusable rocket the company intends to fly to the moon for NASA within the next decade.

Starlink posted a more than six-fold surge in revenue last year to $1.4 billion, but fell short of targets set by Musk, the Wall Street Journal reported in September, citing documents.

SpaceX is valued at about $150 billion and is one of the most valuable private companies in the world.

References:

https://www.barrons.com/articles/elon-musk-spacex-starlink-86fe99ec?