satellite Internet

Important satellite network services to be discussed at WRC 23

Several agenda items for WRC‑23 include fixed, mobile, broadcasting, and radio determination satellite services. Study Group 4 ITU–R is responsible for preparing these agenda items, aiming to ensure efficient use of the radio spectrum and satellite orbit systems and networks.

Non‑geostationary satellite orbit (non‑GSO) systems are one of the top priorities on the WRC‑23 agenda.

First, coexistence must be ensured between non‑GSO and geostationary satellite orbit (GSO) systems, with protection being ensured for both kinds of satellites. This requires accurate calculations of potential interference to and from non‑GSOs, allowing possible modifications to non‑GSO systems to be considered where needed.Improved rules for non‑GSOs should also cover those on orbital tolerances. These will be treated under the conference’s agenda items for satellite services (7A), milestone reporting (7B), and aggregate interference to GSOs (7J), along with a functional description for software tools to determine non‑GSO fixed-satellite service (FSS) system or network conformity (ITU–R Recommendation S.1503).

Satellite operators expect decisions at WRC‑23 to provide maximum flexibility in the use of spectrum allocations for certain purposes.

These include: earth stations in motion (ESIM) in the FSS, under agenda items 1.15 and 1.16; inter-satellite communications in the FSS, item 1.17; and FSS in the existing broadcasting-satellite service (BSS), item 1.19.

WRC‑23 discussions on these topics will aim to allow for more efficient spectrum use than is currently the case.

Amid rapid satellite development in recent years, non‑GSO systems have been deployed on a large scale. At the same time, new high-capacity satellites have gone into geostationary orbit.

On the regulatory side, the addition of a satellite component to the International Mobile Telecommunications (IMT‑2020) ecosystem has enabled satellite usage in cellular networks, along with new satellite services and other innovations.

Member States of the International Telecommunication Union (ITU) are increasingly raising the issue of sustainability, equitable access, and the rational use of GSO and non‑GSO spectrum resources. Resolution 219 of the ITU Plenipotentiary Conference (Bucharest, 2022) reflects these concerns.

WRC‑23 needs to continue giving high priority to establishing equitable access to satellite orbits. This means recognizing the special needs of developing countries, often including geographical challenges.

The development of innovative satellite technologies has now moved significantly ahead of regulations in the use of radio-frequency spectrum and satellite orbits. As this gap continues widening, ITU must find new approaches to keep international satellite regulation timely and relevant for the industry.

Technology is advancing so rapidly that some operators have begun to introduce new satellite technologies using GSO and non‑GSO satellites without waiting for conference decisions to regulate such use. Moreover, national administrations sometimes grant authorization for such uses in the absence of internationally agreed rules.

Concerns are growing about derogations from the ITU Radio Regulations, particularly under 4.4 of Article 4 — which allows national administrations to assign frequencies exceptionally, outside the Table of Frequency Allocations and other treaty requirements, as long as such assignments do not cause harmful interference to any existing radio services.

The conference will consider how to deal with the widespread use of 4.4, for non‑coordinated satellite networks. It should also clarify whether the derogation option under 4.4 should be available for all radio systems, or only non‑commercial systems.

Overall, WRC‑23 must clarify how administrations use the provision, when they have the right to invoke it, and which specific circumstances justify exceptional use of 4.4 on a temporary basis.

The Radio Regulations, containing the rules and regulations for the use of the radio-frequency spectrum and satellite orbits, are updated approximately every four years, in line with ITU’s associated conference cycle.

Perhaps the time has come to think about reducing the number of years between World Radiocommunication Conferences and simplifying the preparatory cycle and associated documentation. One way forward could be to reassess the current Conference Preparatory Meeting (CPM) format and to consider merging the two CPM sessions into one.

Given the rapid growth, transformation and innovation phase the satellite industry is now going through, WRC‑23 should instruct the ITU Radiocommunication Sector to conduct urgent studies on the potential for reusing frequency bands allocated to mobile services for non‑GSO satellite systems.

National administrations, as well as companies and organizations taking part as ITU Sector Members, need to jointly address these new issues, strengthen the ITU–R framework, and pursue global solutions for the benefit of all.

References:

Amazon launches first Project Kuiper satellites in direct competition with SpaceX/Starlink

Juniper Research: 5G Satellite Networks are a $17B Operator Opportunity

New developments from satellite internet companies challenging SpaceX and Amazon Kuiper

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

European Union plan for LEO satellite internet system

GSMA- ESA to collaborate on on new satellite and terrestrial network technologies

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

Telstra partners with Starlink for home phone service and LEO satellite broadband services

FT: A global satellite blackout is a real threat; how to counter a cyber-attack?

Spark New Zealand partnering with Lynk Global to offer a satellite-to-mobile service

Juniper Research: 5G Satellite Networks are a $17B Operator Opportunity

New research from Juniper Research forecasts that network operators will generate $17 billion of additional revenue from 3GPP‑compliant 5G satellite networks between 2024 and 2030.

Editor’s Note: There is no serious work in ITU-R on 5G satellite networks as we’ve previously detailed. The real SatCom air interface specifications work is being done by 3GPP, under the umbrella term of NTN (Non-terrestrial Networks), in Release 17 and the forthcoming Release 18.

ITU-R WP5D is responsible for terrestrial IMT radio interfaces (IMT-2000, IMT-Advanced and IMT-2020/M.2150 as well as IMT for 2030 and Beyond), so it won’t be involved in standardizing radio interfaces satellite networks.

ITU-R Working Party 4B (WP 4B) is responsible for recommendations related to: Systems, air interfaces, performance and availability objectives for FSS, BSS and MSS, including IP-based applications and satellite news gathering.

…………………………………………………………………………………………………………………..

The market research firm urges network operators to sign partnerships with SNOs (Satellite Network Operators) which will enable operators to launch monetizable satellite-based 5G services to their subscribers. SNOs possess capabilities to launch next-generation satellite hardware into space, as well as being responsible for the operation and management of the resulting networks.

The new report, Global 5G Satellite Networks Market 2023-2030 offers the most reliable source of data for the market.

Operators Hold the Key Billing Relationship:

Juniper Research predicts the first commercial launch of a 5G satellite network will occur in 2024, with over 110 million 3GPP‑compliant 5G satellite connections in operation by 2030. To capitalise on this growth, the research urges operators to prioritise immediate partnerships with SNOs that can launch GSO (Geostationary Orbit) satellites. These satellites follow the rotation of the earth to always be located above the country that the operator serves; providing consistent connectivity.

Additionally, operators must leverage their pre-existing billing relationship with mobile subscribers and enterprises as a platform to grow 5G satellite connectivity revenue over the next seven years. The report anticipates this existing billing relationship will enable operators to rapidly drive the adoption of satellite connectivity by integrating satellite services into existing terrestrial networks.

Key Forecasts:

- Total Operator-billed 5G Satellite Revenue 2024-2030: $17bn

- Total 3GPP-compliant 5G Satellite Connections in 2030; $110mn

- Average Revenue per 5G Satellite Connection in 2030: $7.98

………………………………………………………………………………………………………………….

3GPP Releases related to SatCom:

3GPP Rel-17 is enabling the launch of satellite-based communications. Unlike traditional telecommunications ecosystems, the development of this market will be defined by the entrance of a new category of players – satellite vendors. These vendors will work with network operators to deploy NTNs (Non-terrestrial Networks) that side alongside terrestrial networks.

NTNs are a joint development between network operators and satellite vendors to drive growth of telecommunications services. In the future, NTNs will integrate directly with satellite-based networks to provide connectivity with comprehensive services.

However, the development of NTN specifications is far from complete, the 3GPP roadmap includes provisions in 3GPP Releases 18 and 19 for enhancements to satellite services. 3GPP Release 20 includes the provision of satellite-based standards for future 6G networks. It is only with these standards that satellite networks can progress past traditional use cases, such as weather monitoring, global positioning services and broadcasting, which require low-to-medium throughput rates and do not need low latency.

Additionally, satellites have not been required, as the low data rates provided by previous iterations of satellite technologies, combined with the high costs of satellite connectivity, have not been able to compete with the service provided by terrestrial networks.

These will be the most immediate benefits of satellite-based services for 5G networks:

• Increased network coverage: Satellites will provide increased coverage to areas where terrestrial networks are financially unviable. This is most notable in rural areas where there is little demand for cellular connectivity; leaving operators with no return on investment into the needed backhaul infrastructure and base stations.

• Increased support of backhaul infrastructure: Given the data-intensive nature of 5G services, satellite infrastructure will be used to carry data in a similar fashion to fibre services in terrestrial networks.

• Increase network capacity and throughput: Satellites can offload data from terrestrial networks. As the number of 5G connections increases, so will the data generated. In turn, satellites can not only provide coverage in areas where there is little support for 5G services, but they can also alleviate geographical areas that require high throughput and support for a large number of connections.

• More network resilience: Satellites will provide an additional layer of network redundancy for communication services during natural disasters or network outages. When terrestrial networks are inoperable, satellites will be used for connectivity in the absence of terrestrial network.

Preparation for 6G Networks:

However, the research predicts operators will increasingly rely on SNOs for service provision as 6G development accelerates. Research author Sam Barker commented:

“Operators must not only think of 5G satellite services when choosing an SNO partner, but also the forward plan for 6G networks, including coverage and throughput capabilities.”

About the Research Suite:

This new Juniper market research suite offers the most comprehensive assessment of the 3GPP‑compliant 5G satellite network to date; providing analysis and forecasts of over 24,000 data points across 60 markets over five years.

View the 5G Satellite Networks market research: https://www.juniperresearch.com/researchstore/operators-providers/5g-satellite-networks-research-report

Download a free sample: https://www.juniperresearch.com/whitepapers/5g-satellite-networks-the-17bn-operator

References:

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

GSMA- ESA to collaborate on on new satellite and terrestrial network technologies

Vodafone and Amazon’s Project Kuiper to extend 4G/5G in Africa and Europe

- Vodafone and Vodacom plan to use Project Kuiper’s low Earth orbit (LEO) satellite constellation to extend the reach of their 4G/5G networks.

- Companies plan to participate in beta testing of Project Kuiper service in 2024.

Vodafone and Project Kuiper, Amazon’s low Earth orbit satellite (LEO) communications initiative, today announced a strategic collaboration through which Vodafone and Vodacom plan to use Project Kuiper’s network to extend the reach of 4G/5G services to more of their customers in Europe and Africa.

Vodafone and Vodacom plan to use Project Kuiper’s high-bandwidth, low-latency satellite network to bring the benefits of 4G/5G connectivity to areas that may otherwise be challenging and prohibitively expensive to serve via traditional fibre or microwave solutions. Project Kuiper will connect geographically dispersed cellular antennas back to the companies’ core telecom networks. This means Vodafone and Vodacom will be able offer 4G/5G services in more locations without the time and expense of building out fibre-based or fixed wireless links back to the core networks.

As part of the collaboration, Amazon plans to partner with Vodafone to roll out Project Kuiper’s high-speed broadband services to unserved and underserved communities around the world. The companies are also exploring additional enterprise-specific offerings to provide businesses with comprehensive global connectivity solutions, such as backup service for unexpected events and extending connectivity to remote infrastructure.

Margherita Della Valle, Vodafone Group Chief Executive, said: “Vodafone’s work with Project Kuiper will provide mobile connectivity to many of the estimated 40% of the global population without internet access, supporting remote communities, their schools and businesses, the emergency services, and disaster relief. These connections will be complemented further through our own work on direct-to-smartphone satellite services.”

“Amazon is building Project Kuiper to provide fast, affordable broadband to tens of millions of customers in unserved and underserved communities, and our flexible network means we can connect places that have traditionally been difficult to reach,” said Dave Limp, Amazon’s senior vice president for devices and services. “Teaming with a leading international service provider like Vodafone allows us to make a bigger impact faster in closing the digital divide in Europe and Africa. Together we’ll explore how we can help our customers get the most value from expanded connectivity, particularly in areas like residential broadband, agriculture, education, healthcare, transportation, and financial services.”

“At Vodacom, our purpose is to connect for a better future, and we work every day to bring more people in Africa online,” said Shameel Joosub, CEO of Vodacom Group. “Collaborating with Project Kuiper gives us an exciting new path to scale our efforts, using Amazon’s satellite constellation to quickly reach more customers across the African continent.”

Vodafone, Vodacom and Project Kuiper will begin deploying services in Africa and Europe as Amazon’s production satellites come online. Amazon is preparing to test two prototype satellites in the coming months before starting to deploy production satellites in 2024. Amazon expects to begin beta testing Project Kuiper services with select customers by the end of 2024, and Vodafone and Vodacom plan to participate in that testing through this collaboration.

Vodafone’s Margherita Della Valle with Amazon’s David Lamp

……………………………………………………………………………………………………….

References:

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

Japan network operator KDDI announced today that it has signed an agreement with SpaceX to introduce satellite-to-cellular service in Japan. Leveraging SpaceX’s Starlink low earth orbit (LEO) satellites and KDDI’s extensive national wireless spectrum, this partnership aims to enhance cellular connectivity in areas, including remote islands and mountains that have been traditionally hard to reach using conventional 4G and 5G networks.

The partnership is slated to introduce SMS text services as the initial step, starting as early as 2024. At a later date, voice and data services will follow suit. The company also announced the service will work with almost all existing smartphones on the KDDI network.

The service is planned to be provided based on the establishment of radio-related laws and regulations in Japan.

Source: SpaceX

…………………………………………………………………………………………………………………………………

SpaceX first announced plans to provide cellular connectivity with T-Mobile in the US last year. At the time Elon Musk invited other companies to join them, and while there were no immediate takers, KDDI is now the third company to sign a deal.

Earlier this year New Zealand’s telecommunications company, One NZ (formerly known as Vodafone), announced it has signed an agreement with SpaceX to offer mobile coverage across the country, eliminating cellular dead zones.

KDDI and SpaceX also invite carries worldwide to join the ecosystem of mobile network operators bringing next generation satellite enabled connectivity to their customers.

■About KDDI:

KDDI’s au network enables our customer’s daily lives and helps them share unforgettable moments. We are proud of providing 99.9% “population coverage” to the people of Japan. Unfortunately, only a small portion of the Japanese land mass is habitable and often it is difficult to use traditional technologies to provide coverage from coast to coast. Our extensive network continues to grow in coverage as we deploy more fiber and satellite backhauled base stations. In addition to our continued efforts, we will provide “connecting the unconnected” experience, by enabling smartphones to connect to satellites.

■About Starlink by SpaceX:

Starlink delivers high-speed, low-latency internet to users all over the world. As the world’s first and largest satellite constellation using a low Earth orbit, Starlink delivers broadband internet capable of supporting streaming, online gaming, video calls and more. Starlink is engineered and operated by SpaceX. As the world’s leading provider of launch services, SpaceX is leveraging its deep experience with both spacecraft and on-orbit operations to deploy the world’s most advanced broadband internet system, as well as a Direct to Cell constellation of satellites to provide connectivity directly to unmodified LTE cell phones.

References:

https://news.kddi.com/kddi/corporate/english/newsrelease/2023/08/30/6937.html

KDDI teams up with SpaceX to bring Starlink-powered cellular service to Japan

SatCom market services, ITU-R WP 4B, 3GPP Release 18 and ABI Research Market Forecasts

Satellite Communications (SatCom) market services will include fixed broadband Internet access, satellite Internet of Things (IoT), and Non-Terrestrial Network (NTN) mobile (satellite-to-cell services). These services will experience growth due to more satellite players launching networks in Low Earth Orbit (LEO), alongside an increasing interest in terrestrial and satellite network convergence.

The market is expanding rapidly and major players are quickly recognizing its potential. While satellite networks are experiencing rapid changes due to innovations in small satellites and nanosatellites, Software-Defined Networking (SDN) applications, High Throughput Satellites (HTS), and inter-satellite links, terminals on the ground continue to see growth, with Very Small Aperture Terminals (VSAT) SatCom solutions maintaining dominance in the market.

According to Research & Markets, the SATCOM equipment market is valued at $22.6 billion in 2023 and is projected to reach $38.7 billion by 2028, at a CAGR of 11.3% from 2023 to 2028. Based on frequency, the multiband frequency is projected to register the highest during the forecast period 2023-2028.

………………………………………………………………………………………………………………………………..

ITU-R Working Party 4B (WP 4B) is responsible for recommendations related to: Systems, air interfaces, performance and availability objectives for FSS, BSS and MSS, including IP-based applications and satellite news gathering.

WP 4B has a working document which is a preliminary draft new Report ITU-R M.[SAT IOT] – Technical and operational aspects of satellite Internet of Things (IoT) applications, a work plan and working document on Work plan for development of a preliminary draft new Report ITU-R M.[DEVELOPMENT AND TECHNOLOGY TRENDS FOR THE SATELLITE COMPONENT OF INTERNATIONAL MOBILE TELECOMMUNICATIONS]. WP5D last meeting was July 2023, but the following meeting won’t be till April 29 to May 5, 2024!

Yet the real SatCom air interface specifications work is being done by 3GPP, under the umbrella term of NTN:

3GPP Release 17 introduced new network topologies that are based on High-Altitude Platforms (HAPs) and LEO and Geostationary Orbit (GEO) satellites. Crucially, these laid out the foundation for satellite IoT and NTN mobile as Release 17 extended the cellular IoT protocols, LTE-M and Narrowband (NB)-IoT for satellites. This enabled two new standards for satellite networks, IoT-NTN and New Radio-NTN (NR-NTN). SatCom with individual mobile devices will close gaps in the terrestrial cellular networks to provide global connectivity. It will target issues like unreachability and service continuity in underserved regions and improve network resilience around the world.

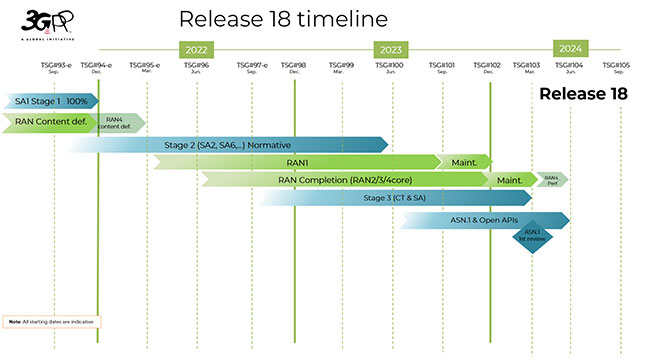

The discussion items in the upcoming 3GPP Release 18 are expected to enhance NTN Mobile and Satellite IoT as key satellite enabled services. While Release 17 established the standards for IoT-NTN and NR-NTN, Release 18 will evolve both those specifications for IoT and satellite-to-mobile broadband connectivity. For NR-NTN, there are plans to run NR-NTN on Radio Frequency (RF) spectrum above 10 Gigahertz (GHz) to serve the aerospace and maritime industry, alongside businesses and buildings (with building-mounted devices). Release 18 is also expected to include enhancements in satellite backhaul, specifically the dedication of more spectrum for Mobile Satellite Services (MSS), with approximately 80 Megahertz (MHz) of uplink in the L-band and downlink in the S-band.

At the same time, improvements targeted toward Fixed Satellite Services (FSS) will be brought about by Release 18 as well, with the consideration of more bands in the Ka frequency bands for downlink (17.7 – 20.2 GHz) and uplink (27.5 – 30 GHz). While the specifics of 3GPP Release 18 are still in development, 3GPP has already established the boundaries of Release 18 that will benefit the SatCom market. Furthermore, with the recent mergers of Eutelsat and OneWeb in 2022 and Viasat and Inmarsat in 2023, in addition to the launch of Infrastructure for Resilience, Interconnectivity and Security by Satellite (IRIS2), a project endorsed by the European Union (EU) in 2022 to enhance connectivity throughout the EU, more partnerships and agreements are expected to arise ahead of the official launch of 3GPP Release 18 in 2024.

ABI Research says that 3GPP Release 18 aims to unlock new capabilities toward the evolution of 5G-Advanced and establish new regulatory requirements, along with new bands, while optimizing satellite access performance. The market research firm forecasts the market value for worldwide SatCom to be US$94.9 billion by 2027 (MD-SATCC-102). The growth of NTN mobile, in addition to broadband, will drive the market moving forward, with special mention of NTN mobile revenue likely to shoot from 0.2% of the total revenue in 2023 to 8.8% of the overall SatCom revenue by 2027. ABI Research recognizes that greater value has been placed on the protocols, such as 3GPP Release 18 and beyond, that will develop and nurture the SatCom space.

Strategic partnerships between terrestrial and NTN operators, solution providers/Communication Service Providers (CSPs), and wireless end-user equipment vendors are currently on the rise and will be critical in expanding the ecosystem and market toward 2027. For instance, MediaTek and Qualcomm have partnered with Inmarsat and Iridium, respectively, to target the NTN mobile market.

Meanwhile, AST SpaceMobile has agreements with AT&T, Rakuten Mobile, and several other mobile network operators. Where satellite IoT is concerned, CSPs like Deutsche Telekom have established partnerships with Intelsat and Skylo, whereas Telefónica and Sateliot are working together to trial satellite IoT connectivity. While partnerships are a good indicator of SatCom’s market potential, it is important that operators consider differentiated and unique product offerings for clients.

The value proposition that SatCom players can offer their target market will be essential for this process. Some examples might include integrated end-to-end IoT solutions for maritime, offshore connectivity, or end-to-end NTN mobile solutions that marry NTN hardware and software for satellite connectivity. Nonetheless, the creation of new value added services will benefit from 3GPP Release 18, in addition to driving the overall momentum and agenda of the Satellite Communications market.

References:

https://www.itu.int/en/ITU-R/study-groups/rsg4/rwp4b/Pages/default.aspx

ABI Research’s Highlights & Developments in the SatCom NTN Market (PT-2740)

https://finance.yahoo.com/news/global-satellite-communication-satcom-equipment-214500758.html

https://www.3gpp.org/specifications-technologies/releases/release-18

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

GSMA- ESA to collaborate on on new satellite and terrestrial network technologies

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

China Mobile Partners With ZTE for World’s First 5G Non Terrestrial Network Field Trial

ITU-R M.2150-1 (5G RAN standard) will include 3GPP Release 17 enhancements; future revisions by 2025

GSMA- ESA to collaborate on on new satellite and terrestrial network technologies

The GSMA and the European Space Agency (ESA) on Wednesday announced the signing of a memorandum of intent (MoI) that covers collaboration on new satellite and terrestrial network technologies. GSMA’s Foundry innovation accelerator will work closely with the ESA’s 5G/6G Hub based at the ESA’s European Centre for Space Applications and Telecommunications in Harwell, Oxfordshire.

Non-terrestrial networking (NTN) has been incorporated into the 3GPP’s 5G specification since Release 17 (but not in the ITU-R M.2150 5G RIT/SRIT standard which covers only terrestrial networks), and work is already well underway to turn it into a commercial reality. The partnership between the GSMA and the ESA represents a more coordinated effort in that direction. What’s more, when it comes to 6G, non-terrestrial networking is expected to be baked in from the start. Again, cooperation between these two sectors will be invaluable.

The GSMA and ESA’s goal then is to create an ecosystem that can fast-track the development of new complimentary solutions for businesses and consumers. They also aim to accelerate the integration of satellite communications with 5G and, when the time comes, 6G networks.

“By collaborating more closely with the European Space Agency, and its satellite network operator ecosystem, we hope to accelerate the immense potential satellite and terrestrial telecommunications networks can create for consumers and businesses when they are more closely connected. By working together, we can help the communications industry bring innovative solutions to market, which in turn will create tremendous benefits to society by connecting even more people, wherever they are in the world,” said GSMA CTO Alex Sinclair, in a statement.

What the MoI means in practical terms is that the GSMA and ESA’s respective innovation hubs plan to start working together, sharing knowledge, ideas, and the outcomes of trials with one another.

On the telecoms side, the GSMA has the Foundry, which fosters collaboration between telcos and various industries with the aim of developing initial ideas into globally-scalable, commercial solutions. Completed projects include using 5G to enable drones to fly beyond visual line of sight (BVLOS), a 5G broadcast solution, and using 5G for automated farming solutions, among others.

Similarly, on the satellite side of the equation, the ESA has its 5G/6G Hub. Opened in February 2022, it provides a space where new 5G and satcom technologies can be developed and integrated. Developers can also use it to test and verify their 5G converged network applications and services. The ESA announced in January that it is expanding the facility to accommodate new areas of research, which it aims to identify via a consultation with industry experts.

Recent research findings by GSMAi showed that the increased adoption and integration of satellite technologies by the communications industry could lead to potential revenue gains of $35bn by 2035 (a 3% uplift on telecommunications industry revenues).

Speaking following the signing of the MOI at ECSAT in Oxfordshire, Alex Sinclair, Chief Technology Officer at the GSMA said: “By collaborating more closely with the European Space Agency, and its satellite network operator ecosystem, we hope to accelerate the immense potential satellite and terrestrial telecommunications networks can create for consumers and businesses when they are more closely connected. By working together, we can help the communications industry bring innovative solutions to market, which in turn will create tremendous benefits to society by connecting even more people, wherever they are in the world.”

Antonio Franchi, Head of Space for 5G and 6G Strategic Programme, ESA, said: “Collaboration is key to telecommunications innovation and, from our 5G/6G Hub, we are fostering industry partnerships to advance the 5G digital transformation of society and industry. We look forward to working with GSMA to explore and realise the huge potential of next-generation satellite-enabled connectivity.”

ABI Research predicts that global 5G non-terrestrial networking (NTN) service revenue will achieve a compound annual growth rate (CAGR) of 59% between 2024 and 2031, reaching $18 billion. By then, connections are expected to number 200 million.

About GSMA

The GSMA is a global organisation unifying the mobile ecosystem to discover, develop and deliver innovation foundational to positive business environments and societal change. Our vision is to unlock the full power of connectivity so that people, industry, and society thrive. Representing mobile operators and organisations across the mobile ecosystem and adjacent industries, the GSMA delivers for its members across three broad pillars: Connectivity for Good, Industry Services and Solutions, and Outreach. This activity includes advancing policy, tackling today’s biggest societal challenges, underpinning the technology and interoperability that make mobile work, and providing the world’s largest platform to convene the mobile ecosystem at the MWC and M360 series of events.

We invite you to find out more at gsma.com

For more information on GSMA Foundry, please visit: gsma.com/foundry

About the European Space Agency

The European Space Agency (ESA) provides Europe’s gateway to space.

ESA is an intergovernmental organisation, created in 1975, with the mission to shape the development of Europe’s space capability and ensure that investment in space delivers benefits to the citizens of Europe and the world.

ESA has 22 Member States: Austria, Belgium, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Luxembourg, the Netherlands, Norway, Poland, Portugal, Romania, Spain, Sweden, Switzerland and the United Kingdom. Slovenia, Latvia and Lithuania are Associate Members.

ESA has established formal cooperation with five Member States of the EU. Canada takes part in some ESA programmes under a Cooperation Agreement.

By coordinating the financial and intellectual resources of its members, ESA can undertake programmes and activities far beyond the scope of any single European country. It is working in particular with the EU on implementing the Galileo and Copernicus programmes as well as with Eumetsat for the development of meteorological missions.

References:

GSMA AND EUROPEAN SPACE AGENCY LAUNCH NEW COMMUNICATIONS INNOVATION PARTNERSHIP

https://telecoms.com/522665/gsma-esa-forge-stronger-ties-between-satellite-and-cellular-industries/

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

Telstra partners with Starlink for home phone service and LEO satellite broadband services

Telstra, Australia’s #1 telco, will partner with SpaceX’s Starlink to provide phone and broadband services to rural Australia using Low Earth Orbit (LEO) satellites. Telstra said it planned to offer the new services before year’s end according to a blog post. It also promises higher download speeds compared to copper-based ADSL internet access.

Starlink, operated by Elon Musk’s SpaceX (private company). has built a fast-growing network of more than 3,500 satellites in Low-Earth Orbit that can provide connectivity in remote areas.

“Telstra will be able to provide home phone service and Starlink broadband services to Aussies as a bundle offer, as well as local tech support and the option of professional installation,” the telco said in the same blogpost. “This agreement also provides connectivity options for our business customers, with a higher bandwidth business option available in areas without fixed and mobile connectivity. The business offer will be available to purchase from Telstra both locally and in select countries overseas.”

Using LEO satellites will bring new capabilities to commercial satellite services in Australia, including faster communications. Signal distances travelled are shorter, as LEO satellites are vastly closer to earth compared to geostationary satellites at around 35,000 km above earth. It requires less power for an earthbound device to transmit to a satellite and there’s a reduced latency (delay) in transmission time.

Telstra said in its blog post:

One of the benefits of LEO satellites are that they are much closer than geostationary satellites to Earth with multiple satellites that are a part of a “constellation”, allowing them to send and receive signals much faster. As well as offering great data throughput, the proximity of these satellites reduces latency making them a great and more consistent option for services that need low latency, like voice and video calls.

The latency, download speeds and general experience in most circumstances will be far superior to copper-based ADSL and be better suited for most modern connectivity needs. Our team has been testing out in the field Starlink’s service and how we can best offer it to customers, including evolving our own modem specifically to support Starlink connectivity and Aussie households. We’re extremely excited to show you what this looks like later in the year.

Partnerships between telcos and LEO satellite providers will allow consumers to make satellite-connected calls using their regular smartphone from almost anywhere on the planet, whether there is a local cellular network or not. In Australia, mobile calls and even video calls will be possible on regular smartphones operating in remote and rural regions of Australia.

At Mobile World Congress held in Barcelona in March 2023, Telstra told ChannelNews it was working on adding LEO satellite audio and video calls to its network. Taiwanese chip designer MediaTek demonstrated the chips that phones would use for LEO satellite communications at the same conference.

UK phone maker Bullitt Group announced it was working with Motorola to bring satellite texting to regular phones in Australia this year, with video calling via LEO satellites to come within another two years. Their texting service has already rolled out in Europe and the US.

Telstra’s move is in line with emerging partnerships between telcos and satellite providers in the US, with T-Mobile forging a deal with Starlink and AT&T with AST SpaceMobile. T-Mobile and Starlink began testing their service in March.

Optus is yet to announce any service involving LEO satellite services locally, although it has been conducting tests. In November last year, Optus demonstrated satellite direct-to-mobile calls in partnership with LEO satellite provider Lynk.

Vodafone meanwhile has launched LEO satellite trials in Turkey with local operator partner SatCo.

It is a major coup for Telstra to be first among Australia-based Telcos to announce a specific service, however longer term, LEO satellites will allow Optus and Vodafone to be more formidable competition in rural and regional Australia, as LEO satellites will give them a reach that they don’t enjoy due to their lack of ground-based cellular infrastructure compared to Telstra.

Further, the Australian telco market will be opening up to increased international competition if offshore telcos want to join in. In March, ChannelNews reported that Amazon was gearing to take on the NBN with a fast satellite-based internet service.

Nevertheless LEO satellites are a fillip for Telstra in light of the Australian Competition and Consumer Commission’s (ACCC) decision late last year to veto a deal between Telstra and TPG Telecom to consolidate their presence in rural and fringe areas of the country through an infrastructure and service swap.

The coming of LEO satellite services also will be a test for the ACCC. To what extent does its jurisdiction cover LEO-satellite-based communications, particularly when it involves telecommunication services provided by foreign companies from space?

References:

We’re working with Starlink to connect more people in remote Australia

Telstra to partner with Elon Musk’s Starlink for satellite calls and broadband

Spark New Zealand partnering with Lynk Global to offer a satellite-to-mobile service

Spark, the leading telco in New Zealand, announced it is collaborating with Lynk Global to offer a satellite-to-mobile service, aiming to enhance connectivity for its customers. Later this year, selected customers will be offered a free trial of the service.

The satellite-to-mobile service will enable periodic text messaging throughout the day during the initial trial. However, as more commercial satellites are deployed, Spark intends to expand the service in 2024 to offer more regular connectivity. The ultimate goal is to provide voice and data services to customers once they become reliably available.

Spark said while satellite coverage cannot reach 100 percent due to the requirement of a clear line of sight to the sky, it offers an additional layer of resilience, especially in light of increasingly severe and frequent weather events caused by climate change. By leveraging satellite connectivity, Spark aims to extend its network reach to areas that are currently underserved by traditional mobile coverage.

According to the Spark press release, the trial period will provide an opportunity to refine and enhance the service in alignment with the increasing number of satellites in orbit. Integration into Spark’s network and regulatory approval are also essential steps before the service can be officially launched.

Photo Credit: Spark New Zealand

The collaboration with Lynk Global and the existing partnership with Netlinkz, which aims to provide satellite broadband services, are part of Spark’s broader strategy to leverage satellite technology as part of its connectivity offering to customers. Spark says it is actively working with various partners to expand the range of services it can deliver.

In a separate announcement last week, Spark revealed its partnership agreement with Netlinkz to provide Starlink business-grade satellite broadband to customers later this year. This initiative follows ongoing trials with a select number of New Zealand businesses.

Spark Product Director, Tessa Tierney, said, “We believe satellite has an important role to play in connecting Aotearoa New Zealand. While satellite can’t provide 100% coverage – as you need a clear line of sight to the sky to get connected2 – it certainly adds an additional layer of resilience, particularly now, as we face increasingly severe and frequent weather events due to climate change. And once there are more satellites launched and the service is available more broadly, it will allow our mobile customers to start to use their phones in more areas that aren’t reached by traditional mobile coverage.”

“We know that our customers will be eager to start using satellite messaging, but the technology is still evolving, so the service and experience will improve and expand as the number of satellites in the sky increases. That’s why we’ve chosen to trial this technology with some of our customers first, to make sure we can offer a great product to our customers when we make it widely available. We also need to integrate the technology into our network and achieve regulatory approval to launch the service. But we are excited to see the possibilities this creates for New Zealanders and will be working hard to make it widely available as soon as we can.

“This partnership with Lynk, and our partnership with NetLinkz to offer a satellite business connectivity service are part of Spark’s broader strategy to use satellite as a part of our connectivity offer to customers. We are continuing to work with these and other potential partners to broaden the services Spark can offer.”

Spark’s introduction of satellite-to-mobile services and business-grade satellite broadband underscores its commitment to enhancing connectivity options for customers across the country, particularly in underserved areas. Spark said further details, including eligibility criteria and timelines, will be disclosed in the coming months.

………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.sparknz.co.nz/news/Spark-to-launch-satellite-to-mobile-service/

Spark New Zealand to Launch Satellite-To-Mobile Service With Lynk Global

LEO operator Sateliot joins GSMA; global roaming agreements to extend NB-IoT coverage

Sateliot, a company operating a low-Earth orbit (LEO) nanosatellite constellation under the 3GPP/ITU-R NB- IoT standard (which is part of 5G), has joined the GSMA as a network operator member. This membership allows Sateliot to sign standard roaming agreements with any mobile network operator (MNO) and mobile virtual network operator (MVNO) that is also a member of the GSMA. Sateliot launched the first-ever 5G standard LEO satellite, named Sateliot_0 The GroundBreaker, this past April.

According to Sateliot, The same unmodified NB-IoT cellular devices that are currently being used can now be deployed in remote areas as well, where there is a lack of terrestrial cellular infrastructure.

Sateliot’s LEO nanosatellite constellation is designed to provide coverage in areas where traditional terrestrial connectivity is limited or non-existent, such as remote locations, fields of crops, mountains, or oceans. The standard protocol will allow massive deployment of 5G IoT solutions without captivity risks or inflated prices.

Sateliot’s membership with GSMA demonstrates its commitment to democratizing access to NTN IoT, as the company is the first to sign standard roaming agreements with global MNOs and MVNOs. With this membership, Sateliot becomes the first LEO satellite operator to have standard roaming agreements with global MNOs and MVNOs.

Sateliot’s network is designed to provide coverage in areas where traditional terrestrial connectivity is limited or non-existent, such as remote locations, fields of crops, mountains or for instance oceans. The standard protocol will allow massive deployment of 5G IoT solutions without captivity risks or inflated prices.

“We are thrilled to have become a GSMA member,” said Jaume Sanpera, CEO of Sateliot. “This is a fantastic milestone we’ve accomplished, we are the first LEO satellite operators to have standard roaming agreements with global MNOS and MVNOS.”

Sateliot runs the constellation that will democratize access to NTN IoT, demonstrated first by being a major contributor to the 3GPP standard and now by joining GSMA as an operator.

The GSMA’s mission is to drive the growth and development of worldwide mobile communications and provide industry leadership and advocacy. With its membership, Sateliot is poised to become a leader in IoT connectivity, providing seamless global connectivity for 5G IoT devices and applications.“We are seeing significant developments in the area of satellite communications, and we warmly welcome Sateliot as a member of the GSMA. We look forward to having them join the GSMA’s Wholesale Agreements & Solutions Group to work collectively and gain from the benefits of our membership,” said Lara Dewar, Chief Marketing Officer, GSMA.

References:

AST SpaceMobile completes 1st ever LEO satellite voice call using AT&T spectrum and unmodified Samsung and Apple smartphones

Satellite communications firm AST SpaceMobile, with the help of AT&T, has announced the first two-way audio call using satellites with standard smartphones as the end points. The initial call was placed using AT&T’s cellular network in Midland, Texas, to mobile carrier Rakuten in Japan using AST SpaceMobile’s BlueWalker 3 satellite in Low Earth Orbit (LEO), a breakthrough that could improve global cellular connectivity in remote regions without access to cell towers.

AST SpaceMobile claims this is “the first time anyone has ever achieved a direct voice connection from space to everyday cellular devices.” The phone call was made from an unmodified Samsung Galaxy S22 in Midland, Texas, using mobile spectrum from AT&T and connected to an iPhone used by Japanese tech giant Rakuten. Engineers from AT&T, Rakuten, and UK-based telecommunications company Vodafone assisted with the testing.

The use of satellites could be a significant step toward increasing cellular access not only in the U.S., where large areas of the country struggle with service, but in developing countries too. Typically a mobile phone call requires nearby cell towers to provide service. Many areas across the United States, such as rural communities and national parks, are “dead zones” — yes, just like the eerie early 2000s Verizon commercials warned. The same technology could be a great solution to the same issues in developing countries. Instead, satellites could act as a sort of space-based network of cell towers — with AST SpaceMobile claiming it’s “building the first and only space-based cellular broadband network.”

AT&T aims to use satellites to provide global cellular broadband from 2G to 5G. “Achieving what many once considered impossible, we have reached the most significant milestone to date in our quest to deliver global cellular broadband from space,” Abel Avellan, CEO and chairman of AST SpaceMobile, said in a press release. “While we take a moment to celebrate this tremendous accomplishment, we remain focused on the path ahead and pivotal next steps that get us closer to our goal of transforming the way the world connects.”

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24612767/2022_11_BlueWalker_3_test_satellite_unfolded_3D.original.jpg)

Image Credit: Image: AST SpaceMobile

Margherita Della Valle, Vodafone Group Chief Executive, said: “Today, we have taken another major step in mobile communications. 30 years after Vodafone sent the world’s first text message, we supported AST SpaceMobile in successfully making the first ever direct-to-smartphone test call using satellite communications. This is just the start. As a lead investor in AST SpaceMobile, we will continue to break technological boundaries by connecting many more millions of people across the planet when the service becomes commercially available.”

Mickey Mikitani, Rakuten Chairman & CEO, commented: “It was a unique thrill and honor to have the Rakuten team talk with Abel in a world-first direct-to-satellite experience. Congratulations to AST SpaceMobile and all of its strategic collaborators on this groundbreaking event. As technological advancements like space connectivity become possible with pioneers like AST SpaceMobile, Rakuten will also progress even further along the road to democratizing connectivity for all.”

Chris Sambar, Head of AT&T Network, said: “AT&T’s heritage began with the birth of the telephone 147 years ago and has continued with many other firsts including: trans-continental call, overseas call, call from the moon, and partnering to deliver the only network built with and for America’s first responders. We connect people to greater possibility, and this important milestone with AST SpaceMobile is a big step and we can’t wait to see what’s next in our space-based journey.”

It’s unclear whether satellite access would come at an extra cost. In AT&T’s original AST SpaceMobile partnership annoucement, the company couldn’t say whether existing plans would include satellite coverage. While satellite offerings aren’t available for consumers yet, this successful test brings widespread access one step closer to becoming a reality.

Chairman & CEO Abel Avellan and an AST SpaceMobile engineer completing test calls in Texas

Image Credit: Image: AST SpaceMobile

Other U.S. network operators are also pursuing satellite network mobile phone calls:

Verizon teamed up with Amazon’s Project Kuiper satellite network in 2021 with the intention of connecting underserved communities and industries. Amazon is in the midst of launching its satellites into space, with its FCC license requiring at least half of the 3,236 they plan to deploy to be operational by July 2026.

T-Mobile has partnered with SpaceX, a major competitor of Project Kuiper, with plans to “start getting into testing” its satellite mobile coverage this year. There are currently over 4,000 Starlink satellites in orbit, though some have experienced issues requiring them to be removed from orbit or tested further. T-Mobile has claimed customers should have satellite access through most existing plans and, like AT&T, that existing phones should work with the satellite offerings.

See References below for more global Satellite Internet initiatives.

References: