Telecom in China

Huawei is back – net profits more than doubled in 2023!

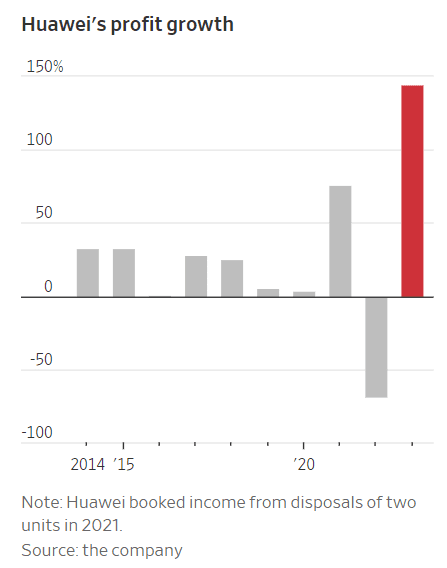

China’s Huawei Technologies said its net profit more than doubled last year, marking a stunning comeback for the company years after U.S. export controls cut it off from advanced technology.

The tech giant on Friday said profit rose to 87 billion yuan, or $12 billion, a rise of more than 140% from the same period a year ago. It is the largest jump in profit for the company since it started reporting comparable figures in 2006. Revenue rose 10% to $99 billion.

It’s Huawei’s highest revenue number, and its first year of topline growth, in four years. Operating cash flow of RMB69.8 billion ($9.7 billion), up fourfold from 2022 and also the highest in four years.

In a statement, Huawei downplayed the figures, with current rotating chairman Ken Hu describing them as “in line with forecast.”

It’s a long way from the imposition of U.S. technology transfer sanctions five years ago, when Huawei executives acknowledged the company was fighting for its survival.

Huawei said growth was driven by higher sales in its consumer electronics and cloud computing offerings.

Last September, Huawei surprised U.S. authorities by releasing a new smartphone, the Mate 60 Pro, with 5G-like capabilities, running on its homegrown chips. Five years after the U.S. restricted sales of the most powerful chips and the Android operating system to Huawei, the telecom equipment and mobile phone maker has shown strong resilience.

Huawei’s core ICT infrastructure unit, comprising the legacy carrier network business and enterprise network sales, remains the biggest source of revenue. It grew 2.3% to RMB362 billion ($50.1 billion), while the cloud business was another of the big growth drivers, gaining 22%.

The company has diversified into new business lines such as cloud computing, enterprise software and automobile systems and retooled its products.

Huawei co-built Aito, one of China’s most popular EVs. There’s also the newly formed smart auto components units business, which more than doubled revenue to RMB4.7 billion ($650 million).

“We’ve been through a lot over the past few years. But through one challenge after another, we’ve managed to grow,” said Ken Hu, Huawei’s rotating chairman.

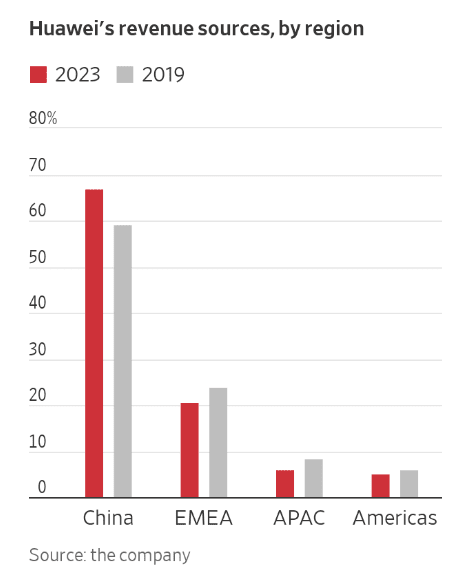

Last year nearly 70% of Huawei’s revenue came from China as its overseas presence shrunk. Five years ago, China formed about 60% of its revenue, while the rest came from Europe and emerging markets. Huawei doesn’t break out U.S. sales figures.

Revenue from its telecommunication equipment and enterprise technology business grew 2%. Sales at its consumer business group, encompassing products such as smartphones, laptops and smart wearables, rose 17%.

Huawei was the world’s largest providers of telecom equipment and among the biggest smartphone makers globally, but U.S. sanctions beginning in 2019 crushed its smartphone business and forced it to spin off its budget Honor handset brand.

U.S. authorities also blocked American carriers from buying from the Chinese company and asked allies not to use Huawei’s telecom equipment, calling the company a national security threat. Huawei said then that restricting it from doing business in the U.S. wouldn’t improve national security and would limit the country’s 5G development.

But the past few months have indicated a reversal of Huawei’s fortunes. Since the launch of the Mate 60 series, Huawei has begun to chip away at Apple’s high-end smartphone market share in China.

On Friday, Huawei said the Mate 60 Series and HarmonyOS, its own operating system for mobile phones and other smart devices, had “received wide acclaim.” The company said its consumer unit grew by “overcoming major technical barriers and diving deep into the industry’s most challenging issues.”

Huawei didn’t provide sales numbers for the phones. Ming-Chi Kuo, a supply chain analyst at TF International Securities, last September predicted that Huawei would likely deliver at least 12 million Mate 60 handsets by August.

The company said cloud computing revenue rose 22% last year. Huawei, China’s second-largest cloud computing provider, had outpaced the growth of market leader Alibaba Group and smaller rival Tencent Holdings. Last year, the company launched new cloud-based artificial-intelligence offerings for business use that are now deployed in banks and mines.

Analysts say Huawei is also set to benefit from China’s localization policy, as the company expands its offerings in areas such as semiconductors, where Beijing is seeking more self-sufficiency.

Huawei has managed to deliver AI chips that developers say match the capabilities of some of Nvidia’s top processors. Nvidia named Huawei as one of its competitors in its annual report in February.

In 2023, Huawei spent $23 billion on research and development, about 23% of its total revenue.

References:

https://www.lightreading.com/5g/huawei-profit-soars-as-it-returns-to-growth

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Kuwait stc/Huawei deploy 5G Redcap FWA in Kuwait; Huawei’s 5G core wins

Huawei pushes 5.5G (aka 5G Advanced) but there are no completed 3GPP specs or ITU-R standards!

China Unicom & Huawei deploy 2.1 GHz 8T8R 5G network for high-speed railway in China

Huawei’s comeback: 2023 revenue approaches $100B with smart devices gaining ground

Huawei reports 1% YoY revenue growth in 3Q-2023; smartphone sales increase in China

Huawei launches new network products at HNS 2023 in Mexico

Huawei and Ericsson renew global patent cross-licensing agreement

Nokia to exit TD Tech joint venture with Huawei due to U.S.-China tensions

According to a January 21,2024 article in the South China Morning Post, Nokia is set to exit its joint venture with Huawei in the telecommunications sector due to US-China tensions. Nokia has found new buyers for its majority stake in a Beijing-based joint venture with Huawei Technologies, after a proposed deal fell through last year following strong protest by the Chinese partner. The article states that Nokia will sell its majority stake in TD Tech [1.] to a group that will be jointly controlled by Huawei and a group of entities that include the government-owned Chengdu High-Tech Investment Group and Chengdu Gaoxin Jicui Technology Co, as well as venture capital firm Huagai, according to a disclosure published on Friday by the State Administration for Market Regulation (SAMR).

Huawei had a 14% share in the Chinese smartphone market in the third quarter 2023, putting it in fifth place behind its spin-off Honor and rivals Oppo, Vivo and Apple, data from market intelligence firm Counterpoint Research showed. According to Statista, Huawei had a 58% share of all 5G base stations in China as of the 3rd quarter 2023. Its closest competitor was ZTE with a market share of 31%. Nokia had only a 2% market share.

China’s telecom industry business revenue at $218B or +6.9% YoY

China’s Ministry of Industry and Information Technology (MIIT) said that in the first eleven months of 2023, the telecommunication industry’s collective business revenue soared to 1.55 trillion yuan, approximately 218 billion U.S. dollars, marking a 6.9% year-on-year increase.

Emerging sectors such as big data, cloud computing, and the Internet of Things (IoT) have shown significant growth. China’s three state owned network providers, China Telecom, China Mobile, and China Unicom have leveraged these technologies to catalyze a 20.1 percent surge in revenue from these areas, amounting to 332.6 billion yuan.

Cloud computing and big data have experienced explosive growth. Revenue from cloud computing surging by 39.7 percent and big data by 43.3 percent compared to the previous year. These figures underscore the central role of data-driven technologies in powering China’s telecom industry forward.

Broadband internet services continue to be a strong revenue stream for the three telecom giants, generating 240.4 billion yuan from January to November, which is an 8.5 percent increase year on year. This growth reflects the increasing demand for high-speed internet across China, as the country continues to embrace digital transformation in all sectors.

In conclusion, China’s telecommunication industry’s growth narrative in 2023 is not just a story of numbers but a chronicle of technological evolution and its integration into the fabric of society. With emerging sectors leading the charge, the industry’s upward trajectory seems poised to continue, as these technologies become increasingly embedded in the everyday lives of businesses and consumers alike.

……………………………………………………………………………………………………………

Separately, Mordor Intelligence forecasts the China Telecom Market size is expected to grow from USD 478.92 billion in 2023 to USD 547.43 billion by 2028, at a CAGR of 2.71% during the forecast period (2023-2028).

References:

https://english.news.cn/20231223/36996f5176e24d48a5677ddc160c99a5/c.html

China’s Telecom Sector Soars with Big Data and Cloud Computing Growth

https://www.mordorintelligence.com/industry-reports/china-telecom-market

ABI Research: Telco transformation measured via patents and 3GPP contributions; 5G accelerating in China

Every single telecom operator in the world is now attempting to transform from telco to techco, to break free from their antiquated, legacy, and stale connectivity business and evolve to sell technology platforms, a considerably more lucrative and promising business. Their success is not guaranteed, and many find it difficult – if not impossible – to unshackle themselves from their history and comfort zone.

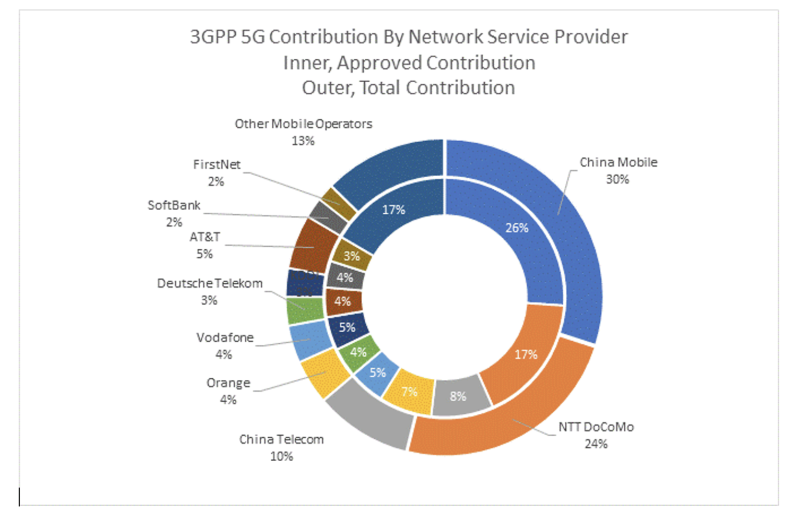

ABI Research now says it’s measuring the progress of telco transformation by quantifying the number of patents that telcos hold and also measuring their involvement in standards-setting initiatives like 3GPP (whose specs are standardized by ETSI and ITU-R).

Telecom operators from China and Japan are currently at the forefront of technology transformation, which shows in their involvement in 3GPP and patent holdings,” says Dimitris Mavrakis, Senior Research Director at ABI Research. “China Mobile, NTT Docomo, and China Telecom have invested time, effort, and capital in both domains, which now translates to significant expertise, knowledge, and recognition in the industry. Although this is not the only metric for innovation, these leading network operators are well suited to transforming their business, technology, and strategic platforms to look to the future.”

The findings of the latest ABI Research report on telecom operator innovation indicate that they consistently contribute to 3GPP work, approximately 8% of the total contribution. Of these telecom operator contributions to 3GPP, 43% originate from China, 29% from Japan, 14% from Europe, and 12% from the United States. Leading operators are China Mobile, NTT Docomo, China Telecom, Orange, Vodafone, and Deutsche Telekom. Their Standards Essential Patent (SEP) holdings are similar, with China Mobile and NTT Docomo leading the market.

Standards contributions and patent holdings are good measures of willingness to innovate and get involved in leading the market. “Telecom operators must get involved and not let other companies lead the direction of the market – especially when geopolitics and semiconductor supply constraints are affecting the market. With 5G Advanced and upcoming 6G, they have the technology to innovate, but they must now take more risks and lead the market,” Mavrakis concludes.

Fierce Wireless asked why T-Mobile didn’t rank, given the good progress that it’s made with its 5G SA network and network slicing trials. Mavrakis said, “T-Mobile US is part of Deutsche Telekom, which is represented in the chart above. They are indeed making progress toward network slicing, but our report measures 3GPP standards activities and patents, which is a different area of innovation.”

These findings are from ABI Research’s Telco versus Techco: Operators’ Role in Shaping Cellular Innovation and 3GPP Standards application analysis report. This report is part of the company’s Cellular Standards & IPR research service, which includes research, data, and ABI Insights. Based on extensive primary interviews, Application Analysis reports present in-depth analysis on key market trends and factors for a specific application, which could focus on an individual market or geography.

…………………………………………………………………………………………………………………………………

Separately, ABI Research says 5G end-user services deployment continue to accelerate in China, which is very much leaving other markets in its wake. Not only does it have 3.2 million 5G base stations up and running, but also a wide range of 5G-to-Business (5GtoB) applications.

According to China’s Ministry of Industry and Information Technology (MIIT), the country has built or upgraded more than 3.2 million 5G base stations—accounting for 30% of the overall mobile base stations nationwide—which has already exceeded the initial target of deploying 2.9 million 5G base stations by the end of 2023. A fourth mobile operator, China Broadnet, has also been issued a 5G mobile cellular license to help stimulate consumer and enterprise competition.

5G subscriber adoption has been robust. At the end of 1Q 2023, the number of 5G subscriptions in the country had increased to around 1.3 billion, which is an increase of more than 53% from approximately 850 million 5G subscribers as of March 2022. The China Telecom Research Institute reported that the average download speed for 5G is a very robust 340 Megabits per Second (Mbps).

China’s mobile operators have seen an overall increase in service revenue. China Mobile reported an 8.1% Year-over-Year (YoY) increase in telecommunication service revenue, with mobile Average Revenue per User (ARPU) up 0.4% to CNY49 (US$6.9). China Telecom also reported a 3.7% YoY increase in mobile communications service revenue with mobile ARPU up 0.4% to CNY45.2 (US$6.3), whereas China Unicom saw a 3-year consecutive growth in mobile ARPU to CNY44.3 (US$6.2).

Growth in revenue has been primed by an expansion in revenue models the telcos can offer. Revenue for China Mobile’s 5G private networks also saw an increase of 107.4% YoY growth, reaching RMB2.55 billion (US$365.5 million) by December 2022. Meanwhile, China Unicom experienced a spike in 5G industry virtual private network customers from 491 to 5,816 between June 2022 and June 2023. Across the board, the three operators have collectively reached a cumulative total of more than 49,000 5G commercial enterprise projects, with China’s MIIT reporting that the operators have built more than 6,000 5G private networks, to date.

China’s mobile cellular ecosystem is not resting on its laurels. Urged on by China’s government, the sector has been embracing 5G-Advanced, as underpinned by The 3rd Generation Partnership Project’s (3GPP) Release 18. Included in Release 18 are greater support for Artificial Intelligence (AI) integration, 10 Gigabits per Second (Gbps) for peak downlink and 1 Gbps for peak uplink experience, supporting a wider range of Internet of Things (IoT) scenarios, and integrated sensing & communication. Information gathered through sensors can enable communication to be more deterministic, which improves the accuracy of channel conditions assessment. Another example is dynamic beam alignment for vehicle communications using Millimeter Wave (mmWave). China’s mobile operators and vendors are keen to adopt 5G-Advanced due to its ability to support a 10X densification of IoT devices compared to 5G. There is also support for passive 5G IoT devices that can be queried by campus and/or indoor small cells to provide telemetry-related data. Instead of a field or warehouse worker, or even an Autonomous Guided Vehicle (AGV) with a portable Radio Frequency Identification (RFID) reader, the campus cellular network can track asset tags in real time and remotely—eliminating the need to check up and down warehouse aisles individually.

5G-Advanced (not yet standardized) deployments are materializing in China. China Mobile Hangzhou launched its Dual 10 Gigabit City project in early 2023. This project focuses on using 5G-Advanced technologies to support applications such as glasses-free Three-Dimensional (3D) experiences on different devices during the Asian Games. Such early experimental projects are not limited to only one city in China. To the northeast of Hangzhou, China Mobile Shanghai has also started its own project to build the first 5G-Advanced intelligent 10 Gigabit Everywhere City (10 GbE City). The network is built using the 2.6 Gigahertz (GHz) network initially for the main urban areas before expanding the coverage to the entirety of Shanghai.

5G deployment, integration, and usage is accelerating. The China Academy of Information and Communications Technology anticipates that US$232 billion will have been invested in 5G by 2025. An additional US$37.9 billion (RMB3.5 trillion) of investment will also take place in the upstream and downstream segments of the industrial chain. During a 2023 Science and Technology Week and Strategic Emerging Industries Co-creation and Development Conference, MIIT stated that 5G connectivity has been integrated into “60 out of 97 national economic categories, covering over 12,000 application themes.” ABI Research has not verified all the use cases reported by MIIT, but ABI Research’s ongoing research into the 5G-to-Business (5GtoB) market in Asia has validated that there are a wide range of 5GtoB trials, pilots, and commercial rollouts taking place in China.

A further ABI Insight that you may find interesting is “China Telecom Is the First Operator Worldwide to Launch a “Device-to-Device” Service on a Smartphone to Improve Coverage.”

About ABI Research:

ABI Research is a global technology intelligence firm delivering actionable research and strategic guidance to technology leaders, innovators, and decision makers around the world. Our research focuses on the transformative technologies that are dramatically reshaping industries, economies, and workforces today.

References:

https://www.fiercewireless.com/5g/abi-research-praises-china-mobile-ntt-docomo-5g-innovation

6th Digital China Summit: China to expand its 5G network; 6G R&D via the IMT-2030 (6G) Promotion Group

ABI Research: 5G Network Slicing Market Slows; T-Mobile says “it’s time to unleash Network Slicing”

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

ABI Research: Major contributors to 3GPP; How 3GPP specs become standards

ABI Research: 5G-Advanced (not yet defined by ITU-R) will include AI/ML and network energy savings

Huawei reports 1% YoY revenue growth in 3Q-2023; smartphone sales increase in China

Huawei reported a flat third quarter, with sales of 145.7 billion Chinese yuan ($19.9 billion), up just 1% over last year and a net profit margin of 16.0%. The Shenzhen based telecom equipment and mobile phone vendor said the profit margin had been boosted by the latest tranche from the sale of the Honor handset assets three years ago. It said improved efficiencies and optimized sales and product strategies had also had a positive impact on profitability.

“The company’s performance is in line with forecast,” said Ken Hu, Huawei’s Rotating Chairman. “I’d like to thank our customers and partners for their ongoing trust and support. Moving forward, we will continue to increase our investment in R&D to make the most of our business portfolio and take the competitiveness of our products and services to new heights. As always, our goal is to create greater value for our customers, partners, and society.”

Huawei reported growth in the consumer business unit and “strong growth” in the new digital power and cloud businesses, but the company was silent on its carrier equipment unit, its largest, suggesting it has also been hit by the decline in operator spending.

Huawei smartphone summary:

Huawei was the fastest-growing smartphone maker in China in the third quarter after the company released a smartphone with a surprisingly advanced chip inside.

- In September, Huawei launched the Mate 60 Pro in China. It’s equipped with an advanced chip and 5G connectivity, technology that U.S. sanctions had been designed to stop Huawei getting its hands on.

- The success of that device helped Huawei’s smartphone sales in China grow 37% year on year, according to a report from Counterpoint Research.

- Sales of Honor, the largest smartphone maker by market share, rose just 3% year on year. Vivo, Oppo and Apple all saw double-digit declines, according to Counterpoint Research.

References:

https://www.huawei.com/en/news/2023/10/businessresults-threequarters

https://www.lightreading.com/5g/huawei-reports-no-real-growth-in-q3

https://www.lightreading.com/5g/huawei-lifts-handset-outlook-wins-1b-in-5g-orders

6th Digital China Summit: China to expand its 5G network; 6G R&D via the IMT-2030 (6G) Promotion Group

China will ratchet up resources to advance the construction of its 5G network, expand the application of 5G technology in various fields, and promote the research and development of 6G, officials and experts said at the 6th Digital China Summit, which ended on Friday in Fuzhou, Fujian province.

“China has built the world’s largest 5G network with the most advanced technologies. The number of the country’s 5G base stations had exceeded 2.64 million by the end of March this year,” said Zhao Ce, deputy head of the information and telecommunications development department at the Ministry of Industry and Information Technology.

Zhao said the ministry will make more efforts to bolster the building of the 5G network in an orderly manner and accelerate its industrial applications, push forward the R&D of 6G, and strengthen international exchange and communication in 5G-related technology, standards and application. 5G wireless technology has been used in 52 of the 97 major economic categories, with large-scale application expanded to mining, ports and electricity, he said. Moreover, China has already established the IMT-2030 (6G) Promotion Group, a flagship platform in China promoting 6G and international cooperation.

As 5G technology serves as a critical foundation supporting the development of artificial intelligence, big data and cloud computing, heightened efforts should be made to explore application scenarios of 5G and empower the transformation of traditional industries, said Zhang Wang, deputy head of the informatization development bureau of the Cyberspace Administration of China.

China has recently unveiled a plan for the overall layout of the country’s digital development, vowing to make important progress in the construction of a digital China by 2025, with effective interconnectivity in digital infrastructure, a significantly improved digital economy, and major breakthroughs achieved in digital technology innovation.

Cao Ming, president of the wireless product line at Huawei Technologies, said China is taking the lead in 5G development across the globe, and 5G is expected to play a bigger role in bolstering digitalization in a wide range of sectors covering intelligent connected vehicles and intelligent transportation.

6G is the upcoming sixth-generation cellular network technology that is currently in early development. One of the goals of 6G cellular technology is not just to deliver basic content faster to smartphones, like streaming video, but to create a cellular network capable of supporting real-time augmented reality, virtual reality, and a future Internet of Things (IoT) model where small smart devices are a ubiquitous presence in and outside of our homes.

When reading anything about 6G, especially the breathless and hype-laden announcements from telecommunications companies that emphasize how 6G will usher in the metaverse, a fusion of our physical and virtual lives, and so on, you should keep the “early” part of early development in mind.

Currently, there are no established 6G specifications or standards, let alone deployed 6G networks or devices. Even the most basic aspects of 6G development, like which specific frequencies the next generation cellular technology will rely on, are still being ironed out along with technical challenges like energy and heat dissipation demands of advanced 6G devices.

That said, we do have some idea what 6G will look like. Current cellular technology operates in the Megahertz (MHz) and the lower Gigahertz (GHz) frequency ranges. The portion of the radio spectrum under consideration and testing for 6G includes frequencies in the 30-300 Ghz range—also known as millimeter waves (mmWave) or Extremely High Frequency (EHF) radio—and the Terahertz (THz) frequency up to 3000 Ghz. The use of these frequencies will allow for data transmission well beyond the bandwidth capacity of current cellular technology.

In December of 2022, Qualcomm released a 6G development plan with 2030 as a projected rollout date for 6G tech. Ericsson’s 6G messaging echoes the early 2030s timeframe too, as do various interviews with telecom executives.

5G was first introduced in 2019. Four years later, there are still millions of cellular subscribers using 4G, and 5G is yet to have a fully realized coast-to-coast rollout. GSMA’s authoritative 2023 Mobile Economy report, for instance, indicates North American adoption rate of 5G is only 39%, with more than half of cellular subscribers still using 4G. By their projections, the North American 5G adoption rate will be 91% by 2030, meaning by the time 6G potentially arrives, there will still be 4G subscribers out there.

References:

China to introduce early 6G applications by 2025- way in advance of 3GPP specs & ITU-R standards

China’s MIIT to prioritize 6G project, accelerate 5G and gigabit optical network deployments in 2023

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

China Mobile explores buyout of Hong Kong telecom firm HKBN

China Mobile Ltd is exploring a buyout of Hong Kong’s leading telecoms company HKBN Ltd, four people with knowledge of the matter said That could spark a bidding war for the firm currently valued at $1 billion.

China Mobile in recent weeks sent a request for proposal (RFP) to a small group of banks to advise on acquiring and taking-private the Hong Kong telecom provider, which offers services including broadband and Wi-Fi management, the people said.

HKBN shares jumped more than 17% after the Reuters report and closed at HK$6.57 a piece Tuesday, valuing the company at HK$8.6 billion ($1.1 billion). HKBN declined to comment. China Mobile did not respond to a request for comment.

China Mobile’s potential takeover interest in HKBN comes after infrastructure investor I Squared Asia Advisors submitted a non-binding letter of interest for the Hong Kong telecoms services provider in March.

HKBN said at that time the infrastructure investor would make an offer via its portfolio company HGC Global Communications and or one of its affiliates, should it proceed with the deal.

There could be other potential suitors for HKBN, said one of the people and a separate person with knowledge of the matter, including Hong Kong-based private equity firm PAG who declined to comment.

North Asia-focused private equity firm MBK Partners and buyout firm TPG Capital, which are among the top shareholders of HKBN, will seek to fully exit in any potential buyout of the company, separate sources have told Reuters.

…………………………………………………………………………………………………………………….

HKBN reported it had a 34 per cent share of Hong Kong’s residential broadband market and 37 per cent of the enterprise market at end-2022. In late March, HKBN’s board said it was approached about a potential take over by I Squared Asia Advisors, the same asset management company that owns Hong Kong ISP HGC Global Communications.

Others showing interest include global investment company PAG, Bloomberg wrote, noting potential buyers may team with HKBN management for a buy out.

A sale in 2022 was halted by potential buyers including KKR and PAG due to concerns over the valuation.

HKBN was sold to CVC Capital Partners in 2012 in a management buy out and was listed in 2014.

References:

China Mobile Partners With ZTE for World’s First 5G Non Terrestrial Network Field Trial

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

China plans $500 million subsea internet cable to rival US-backed project

Reuters reports that China state-owned telecom firms are developing a $500 million undersea fiber-optic internet cable network that would link Asia, the Middle East and Europe to rival a similar U.S.-backed project, four people involved in the deal told Reuters. The plan is a sign that an intensifying tech war between Beijing and Washington risks tearing the fabric of the internet.

China’s three main carriers – China Telecommunications Corporation (China Telecom), China Mobile Limited and China United Network Communications Group Co Ltd(China Unicom) – are mapping out one of the world’s most advanced and far-reaching subsea cable networks, according to the four people, who have direct knowledge of the plan.

Known as EMA (Europe-Middle East-Asia), the proposed cable would link Hong Kong to China’s island province of Hainan, before snaking its way to Singapore, Pakistan, Saudi Arabia, Egypt and France, the four people said. They asked not to be named because they were not allowed to discuss potential trade secrets.

The cable, which would cost approximately $500 million to complete, would be manufactured and laid by China’s HMN Technologies Co Ltd, a fast-growing cable firm whose predecessor company was majority-owned by Chinese telecom giant Huawei Technologies Co Ltd, the people said.

They said HMN Tech, which is majority-owned by Shanghai-listed Hengtong Optic-Electric Co Ltd, would receive subsidies from the Chinese state to build the cable.

China Mobile, China Telecom, China Unicom, HMN Tech, and Hengtong did not respond to requests for comment.

The Chinese foreign ministry said in a statement to Reuters that it “has always encouraged Chinese enterprises to carry out foreign investment and cooperation” without commenting directly on the EMA cable project.

News of the planned cable comes in the wake of a Reuters report last month that revealed how the U.S. government, concerned about Beijing eavesdropping on internet data, has successfully thwarted a number of Chinese undersea cable projects abroad over the past four years. Washington has also blocked licenses for planned private subsea cables that would have connected the United States with the Chinese territory of Hong Kong, including projects led by Google LLC, Meta Platforms, Inc and Amazon.com Inc.

Undersea cables carry more than 95% of all international internet traffic. These high-speed conduits for decades have been owned by groups of telecom and tech companies that pool their resources to build these vast networks so that data can move seamlessly around the world.

But these cables, which are vulnerable to spying and sabotage, have become weapons of influence in an escalating competition between the United States and China. The superpowers are battling to dominate the advanced technologies that could determine economic and military supremacy in the decades ahead.

The China-led EMA project is intended to directly rival another cable currently being constructed by U.S. firm SubCom LLC, called SeaMeWe-6 (Southeast Asia-Middle East-Western Europe-6), which will also connect Singapore to France, via Pakistan, Saudi Arabia, Egypt, and half a dozen other countries along the route.

The consortium on the SeaMeWe-6 cable – which originally had included China Mobile, China Telecom, China Unicom and telecom carriers from several other nations – initially picked HMN Tech to build that cable. But a successful U.S. government pressure campaign flipped the contract to SubCom last year, Reuters reported in March.

The U.S. blitz included giving millions of dollars in training grants to foreign telecom firms in return for them choosing SubCom over HMN Tech. The U.S. Commerce Department also slapped sanctions on HMN Tech in December 2021, alleging the company intended to acquire American technology to help modernize China’s People’s Liberation Army. That move undermined the project’s viability by making it impossible for owners of an HMN-built cable to sell bandwidth to U.S. tech firms, usually their biggest customers.

China Telecom and China Mobile pulled out of the project after SubCom won the contract last year and, along with China Unicom, began planning the EMA cable, the four people involved said. The three state-owned Chinese telecom firms are expected to own more than half of the new network, but they are also striking deals with foreign partners, the people said.

The Chinese carriers this year signed separate memoranda of understanding with four telecoms, the people said: France’s Orange SA, Pakistan Telecommunication Company Ltd (PTCL), Telecom Egypt and Zain Saudi Arabia, a unit of the Kuwaiti firm Mobile Telecommunications Company K.S.C.P.

The Chinese companies have also held talks with Singapore Telecommunications Limited, a state-controlled firm commonly known as Singtel, while other countries in Asia, Africa and the Middle East are being approached to join the consortium as well, the people involved said.

Orange declined to comment. Singtel, PTCL, Telecom Egypt and Zain did not respond to requests for comment.

American cable firm SubCom declined to comment on the rival cable. The Department of Justice, which oversees an interagency task force to safeguard U.S. telecommunication networks from espionage and cyberattacks, declined to comment about the EMA cable.

A State Department spokesperson said the U.S. supports a free, open and secure internet. Countries should prioritize security and privacy by “fully excluding untrustworthy vendors” from wireless networks, terrestrial and undersea cables, satellites, cloud services and data centers, the spokesperson said, without mentioning HMN Tech or China. The State Department did not respond to questions about whether it would mount a campaign to persuade foreign telecoms not to participate in the EMA cable project.

The Chinese foreign ministry said in its statement that it was opposed to the United States’ “violation of established international rules” around submarine cable cooperation.

“The U.S. should stop fabricating and spreading rumours about so-called ‘data surveillance activities’ and stop slandering and smearing Chinese companies,” the statement said.

Large undersea cable projects typically take at least three years to move from conception to delivery. The Chinese firms are hoping to finalize contracts by the end of the year and have the EMA cable online by the end of 2025, the people involved said.

The cable would give China strategic gains in its tussle with the United States, one of the people involved in the deal told Reuters.

Firstly, it would create a super-fast new connection between Hong Kong, China and much of the rest of the world, something Washington wants to avoid. Secondly, it gives China’s state-backed telecom carriers greater reach and protection in the event they are excluded from U.S.-backed cables in the future.

“It’s like each side is arming itself with bandwidth,” one telecom executive working on the deal said.

The construction of parallel U.S.- and Chinese-backed cables between Asia and Europe is unprecedented, the four people involved in the project said. It is an early sign that global internet infrastructure, including cables, data centers and mobile phone networks, could become divided over the next decade, two security analysts told Reuters.

Countries could also be forced to choose between using Chinese-approved internet equipment or U.S.-backed networks, entrenching divisions across the world and making tools that fuel the global economy, like online banking and global-positioning satellite systems, slower and less reliable, said Timothy Heath, a defense researcher at the RAND Corporation, a U.S.-based think tank.

“It seems we are headed down a road where there will be a U.S.-led internet and a Chinese-led internet ecosystem,” Heath told Reuters. “The more the U.S. and Chinese disengage from each other in the information technology domain, the more difficult it becomes to carry out global commerce and basic functions.”

Antonia Hmaidi, an analyst at the Berlin-based Mercator Institute for China Studies, said the internet works so well because no matter where data needs to travel, it can zip along multiple different routes in the time it takes to read this word.

Hmaidi said if data has to follow routes that are approved in Washington and Beijing, then it will become easier for the United States and China to manipulate and spy on that data; internet users will suffer a degradation of service; and it will become more difficult to interact or do business with people around the world.

“Then suddenly the whole fabric of the internet doesn’t work as it was intended,” Hmaidi said.

The tit-for-tat battle over internet hardware mirrors the conflict taking place over social media apps and search engines created by U.S. and Chinese firms.

The United States and its allies have banned the use of Chinese-owned short video app TikTok from government-owned devices due to national security concerns. Numerous countries have raised fears about the Chinese government gaining access to the data that TikTok collects on its users around the world.

China, meanwhile, already restricts what websites its citizens can see and blocks the apps and networks of many Western technology giants, including Google, YouTube, Facebook and Twitter.

China to introduce early 6G applications by 2025- way in advance of 3GPP specs & ITU-R standards

Liu said early 6G “application scenarios” will be introduced by 2025 in China, home to the world’s largest internet user population and biggest smartphone market, which has been conducting research and development on the technology since 2019. He said the commercial launch of 6G in China is expected to start from 2030, according to a report by local media National Business Daily.

At the same event, China’s Minister of Industry and Information Technology Jin Zhuanglong said in his speech that China was leading the pace of 6G research and development worldwide. He said the country is already ahead in rolling out 5G mobile networks and applications.

The statements made at the CDF about China’s 6G efforts have come after the Global 6G Conference, held from March 22 to 24 in Nanjing, where telecommunications industry experts reached a consensus that 6G mobile services in the country will start to roll out by early 2030.

The country’s three telecoms network operators – China Mobile, China Telecom and China Unicom – have all been reported to be involved in early 6G research and development, as they also expedited the roll-out of 5G infrastructure and services across the country.

Tensions between Beijing and Washington, however, have led to major telecoms equipment suppliers Huawei Technologies Co and ZTE Corp being handicapped by various US sanctions, including access to advanced IC’s used in smartphones and networking gear.

In spite of the disruptions caused by US pressure and the coronavirus pandemic, China has already built the world’s largest 5G mobile network, with more than 2.31 million 5G base stations deployed at the end of last year, according to MIIT data.

This year will mark the beginning of a long journey for 6G, as new studies are initiated by more countries and organisations around the world, according to a report last month by the non-profit telecoms industry body the GSMA.

The ITU-R World Radiocommunication Conference in November (WRC 23) is expected to set the spectrum foundations for 6G, the GSMA report said. Spectrum refers to the radio frequencies allocated to the mobile industry and other sectors for communications over the airwaves.

References:

China’s MIIT to prioritize 6G project, accelerate 5G and gigabit optical network deployments in 2023

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

India unveils Bharat 6G vision document, launches 6G research and development testbed

NTT DOCOMO & SK Telecom Release White Papers on Energy Efficient 5G Mobile Networks and 6G Requirements

Summary of ITU-R Workshop on “IMT for 2030 and beyond” (aka “6G”)

China’s MIIT to prioritize 6G project, accelerate 5G and gigabit optical network deployments in 2023

China’s government has selected 6G as one of its priority projects for 2023. At a national conference on industry and information technology, the Ministry for Industry and IT (MIIT) Jin Zhuanglong, said China intends to push forward in “comprehensive” development of 6G this year. In 2023, China will introduce policies and measures to promote coordinated development of new information infrastructure construction and accelerate the construction of 5G and gigabit optical networks, Jin said. MIIT will also improve policies on telecom market development, and strengthen the protection of personal information and users’ rights and interests.

Editor’s Note: Work on 6G has not yet started in either 3GPP or ITU-R WP 5D. The latter SDO is progressing draft reports on the vision of IMT for 2030 and Beyond, but no 6G requirements will be identified.

…………………………………………………………………………………………………………………………………………………………..

More than 2.3 million 5G base stations have been put into service, and notable progress has been made in the construction of new data centers, according to the conference.

In recent years, China has intensified efforts to promote the construction of new information infrastructure, deepen the construction of 5G, gigabit optical network and industrial internet, and promote the deep integration of the digital economy and the real economy.

Image Credit: Alan Novelli/Alamy Stock Photo

At the end of last year China Telecom issued a white paper setting out its vision for 6G. Written by the China Telecom Research Institute, the paper proposes a distributed and intelligent programmable RAN (P-RAN) network architecture and what it calls a “three-layer and four-sided” framework. The white paper notes that because of the cost of building out the dense mmWave or terahertz-band networks, it will be essential to provide device-to-device connectivity.

Six months ago, heavyweight China Mobile issued its own 6G vision, calling for “three bodies, four layers and five sides.”

China’s other 6G news is a call for proposals on potential key technologies from the national coordinating body, the IMT-2030 6G Promotion Group. According to an English-language statement posted by CAICT, the main objectives are “to inspire university-academy-industry-association entities for technology innovations, gather and form a rich reserve of 6G potential key technologies, and support 6G research, standardization, and industrial R&D.”

Non-Chinese universities and research organizations are welcome to apply ahead of the deadline in November 2023. The proposed solutions should have “application and promotion value for 6G innovation and development,” and the key technical indicators should be capable of being evaluated and verified, the statement said.

References:

https://www.lightreading.com/6g/chinese-government-confirms-focus-on-6g-development/d/d-id/782727?

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

https://www.lightreading.com/6g/the-6g-mess-is-getting-out-of-hand/a/d-id/782245