Telecom in China

Reuters: FCC revokes authorization of China Telecom’s U.S. unit

The U.S. Federal Communications Commission (FCC) on Tuesday voted to revoke the authorization for China Telecom’s U.S. subsidiary to operate in the United States, citing national security concerns. That despite the fact that the China telecom has a presence in the U.S.

The decision means China Telecom Americas must now discontinue U.S. services within 60 days. China Telecom, the largest Chinese telecommunications company, has had authorization to provide telecommunications services for nearly 20 years in the United States.

The FCC found that China Telecom “is subject to exploitation, influence, and control by the Chinese government and is highly likely to be forced to comply with Chinese government requests without sufficient legal procedures subject to independent judicial oversight.”

The U.S. regulator added that Chinese government ownership and control “raise significant national security and law enforcement risks by providing opportunities” for the company and the Chinese government “to access, store, disrupt, and/or misroute U.S. communications.”

“The FCC’s decision is disappointing. We plan to pursue all available options while continuing to serve our customers,” a China Telecoms America spokesperson told Reuters.

China Telecom served more than 335 million subscribers worldwide as of 2019 and claims to be the largest fixed line and broadband operator in the world, according to a Senate report, and also provides services to Chinese government facilities in the United States.

The U.S. government said in April 2020 China Telecom targets its mobile virtual network to more than 4 million Chinese Americans; 2 million Chinese tourists a year visiting the United States; 300,000 Chinese students at American colleges; and the more than 1,500 Chinese businesses in America.

In April, 2020, the FCC warned it might shut down U.S. operations of three state-controlled Chinese telecommunications companies, citing national security risks, including China Telecom Americas as well as China Unicom Americas, Pacific Networks Corp and its wholly owned subsidiary ComNet (USA) LLC after U.S. agencies raised national security concerns.

FCC Commissioner Brendan Carr, a Republican, said the FCC “must remain vigilant to the threats posed” by China. The Chinese Embassy in Washington did not respond to a request for comment.

U.S. Senators Rob Portman and Tom Carper, who issued a report in 2020 on Chinese telecom companies U.S. operations, praised the FCC decision in a joint statement that cited “substantial and serious national security and law enforcement risks.”

In March, the FCC began efforts to revoke authorization for China Unicom Americas, Pacific Networks and its wholly-owned subsidiary ComNet to provide U.S. telecommunications services.

In May 2019, the FCC voted unanimously to deny another state-owned Chinese telecommunications company, China Mobile the right to provide U.S. services.

The FCC has taken other actions against Chinese telecoms and other companies. Last year, the FCC designated Huawei Technologies Co and ZTE Corp, as national security threats to communications networks – a declaration that barred U.S. firms from tapping an $8.3 billion government fund to purchase equipment from the companies. The FCC in December adopted rules requiring carriers with ZTE or Huawei equipment to “rip and replace” that equipment.

In March, the FCC designated five Chinese companies as posing a threat to national security under a 2019 law, including Huawei, ZTE, Hytera Communications, Hangzhou Hikvision Digital Technology Co and Zhejiang Dahua Technology Co.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/BHTLI3EOA5KMRLKT4ADZMVXQEY.jpg)

ZTE wins 50% of China Mobile’s high-end router centralized procurement in 2021-2022

ZTE has secured a 50% share in section 4 of China Mobile’s high-end router/switch centralized procurement for 2021-2022. It’s number one ranking was due to its high-end routers ZXR10 M6000-18 S and ZXR10 M6000-8S Plus. This contract is the largest one in the high-end router centralized procurement of China Mobile, which contains the largest number of switch/routers in China.

ZTE will provide the routers to take the role of SR (Service Router) and PE (Provider Edge) to be used in configurations such as cloud private network, network cloud, 5G UPF (User Plane Function), IP private network and MAN (Metropolitan Area Network).

In addition, ZTE will provide necessary equipment for the future IP network of China Mobile, especially cloud private networks and 5G transport networks.

Based on ROSng, the router operating system with its independent intellectual property rights, ZTE’s high-end router ZXR10 M6000-S supports SR/EVPN/SRv6/BIER and boosts the evolution of IP networks towards simplicity and intelligence. The router employs the in-house NP (Network Processor) to enable the single-slot 1T performance, and reaches the industry-leading standards in forwarding performance, energy saving and SDN (Software Defined Network).

In June 2021, ZTE’s high-end routers ZXR10 T8000 [1.] and ZXR10 M6000-3S ranked No. 2 in the comprehensive assessment, and were respectively selected for the bid section 3 and 5 of this procurement. In addition, in China Mobile’s high-end router centralized procurement 2019-2020, ZTE’s ZXR10 M6000-S ranked No. 1 in section 2 (for 2T high-end routers) and No. 2 in section 3 (for 400G high-end routers). So far, the ZXR10 M6000-S ranked top 2 in market share of the country.

Note 1. ZXR10 T8000 is ZTE’s flagship high-end router. It has been running stably for over 10 years in 23 provinces (including autonomous regions and municipalities) in China. With excellent performance, ZTE’s ZXR10 T8000 has been working on the core backbone layer and the important part of 5G network constructions of domestic operators.

ZXR10 T8000 Cluster Router

…………………………………………………………………………………………………………………………………………………….

In China Mobile’s largest centralized procurement of data communication product in 2019, ZTE’s ZXR10 M6000-S series high-end router grabbed the largest share in Section 2 (2T high-end routers) and the second largest share in Section 3 (400G high-end routers) respectively.

ZTE has been committed to delivering the leading digital infrastructure solutions as a driver of the digital economy. With its continuous innovation, the company has built up core competitiveness in standard patents, key technologies and product solutions to accelerate 5G network constructions.

Moving forward, ZTE, in partnership with China Mobile, will further innovate its 5G network technologies, and expedite commercial deployments of 5G networks to embrace a digital future.

Media Contacts:

Margaret Ma

ZTE Corporation

Tel: +86 755 26775189

Email: [email protected]

…………………………………………………………………………………………………………………………………….

References:

…………………………………………………………………………………

China Mobile didn’t even invite Ericsson and Nokia to its latest 5G tender

Analysis and Implications: China’s 3 Major Telecom Operators to be delisted by NYSE

The New York Stock Exchange (NYSE) said it will delist China’s three large state owned telecom carriers. The move was expected after a November U.S. government order barring Americans from investing in companies it says help the Chinese military.

- China Mobile, which is among the most valuable of China’s listed state-owned enterprises, will be removed from the Big Board after more than two decades.

- China Unicom Hong Kong will also be delisted along with China Telecom.

The NYSE said it would suspend trading in securities issued by China Mobile, China Telecom and China Unicom by January 11th. The big board also said it would also halt trading in closed-end funds and in exchange-traded products listed on its NYSE Arca exchange if they hold banned China stocks.

The U.S. Defense Department (DoD) had previously listed the three companies as having significant connections to Chinese military and security forces. The delisting highlights the faltering of long-established business ties between the United States and China, which were set up over decades as China sought to internationalize and reform its state-run corporate behemoths (see China-U.S. Cold War backgrounder below).

The NYSE decision is the latest setback for these companies, which rank among the largest global telecommunications providers. The exchange’s decision is unlikely to seriously harm the Chinese telecom giants in the near term. Mounting pressure from Washington has already stymied their ability to operate in the U.S., a country that makes up a negligible amount of their international business.

China’s top three network providers still benefit from hundreds of millions of customers in their home country. That has attracted investors to their Chinese-listed shares. The cellphone carriers have spent billions of dollars on new fifth-generation wireless networks over the past two years with support from officials in Beijing, who have called 5G upgrades a national priority.

All three telecoms companies operate under Beijing’s firm control. They are ultimately owned by a government agency, the State-owned Assets Supervision and Administration Commission, and are often ordered to pursue Beijing’s goals. China’s ruling Communist Party sometimes shuffles executives among the three companies.

They are the only three companies in China that are permitted to provide broad telecommunications network services, which Beijing regards as a strategic industry that must remain under state control.

Xi Jinping, China’s top leader (President of the People’s Republic of China 中华人民共和国主席), has talked about making state companies bigger and stronger rather than more streamlined. That has led to concerns among some economists and entrepreneurs that the Chinese government is taking a greater role in private enterprise.

…………………………………………………………………………………………………………………………………………………………………………………

Impact of the Delisting:

At the same time, the imminent delisting of several major Chinese companies will get the attention of portfolio managers, after a year long push to ensure Chinese firms’ compliance with U.S. audit rules. While the final outcome of that effort is unclear, the NYSE decision underscores the fraught politics of the U.S.-China relationship as the Trump administration comes to a close.

“The delisting issue is a live one with financial clients,” said Leland Miller, chief executive of China Beige Book International, which provides data on China’s economy to international investors. “There are some jittery people out there.”

On Friday, China Unicom said it would release a statement in due course. Neither China Telecom or China Mobile responded to WSJ requests for comment.

……………………………………………………………………………………………………………………………………………………………………………….

China Telecoms Shares Greatly Underperform:

China Mobile’s U.S. stock is thinly traded compared with its Hong Kong securities, FactSet data shows. About 2.1 million American depositary receipts traded daily on average over the past three months, compared with 34 million Hong Kong shares a day. Each ADR is equivalent to five ordinary shares in Hong Kong.

U.S. shares in China Mobile, the largest of the three companies by market value, declined 29% over the past year, according to FactSet, while China Telecom dropped 30% and China Unicom fell 39%. Over the same span, the S&P 500 index returned 18% and the communications-services sector of the MSCI World Index rose 22%. All figures reflect total returns, including dividends.

Over the past decade, China Mobile shares have declined 15% including dividend payments, FactSet data show, while China Telecom has dropped 32% and China Unicom has fallen 54%. The S&P 500 has gained 267% on the same basis and the MSCI World communications sector has gained 165%.

…………………………………………………………………………………………………………………………………………………………………………………

Backgrounder: China vs U.S. Cold War:

An executive order signed by President Trump in November will block Americans from investing in a list of companies the U.S. government says supply and support China’s military, intelligence and security services. The ban starts on Jan. 11 and investors have until November to divest themselves of their holdings.

The list currently includes 35 companies—including China’s largest chip maker—as well as surveillance, aerospace, shipbuilding, construction and technology companies.

It wasn’t initially clear whether the order covered subsidiaries as well as parent companies, and U.S. government leaders clashed over how broad the blacklist should be, The Wall Street Journal reported in December.

The Chinese government has accused Washington of misusing national security as an excuse to hamper competition and has warned that Trump’s order would hurt U.S. and other investors worldwide.

Political analysts expect little change in policy under President-elect Joe Biden due to widespread frustration with China’s trade and human rights records and accusations of spying and technology theft.

U.S. officials have complained that China’s ruling Communist Party (CCP) takes advantage of access to American technology and investment to expand its military, already one of the world’s biggest and most heavily armed.

………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.wsj.com/articles/nyse-to-delist-chinas-major-telecommunications-operators-11609498750

https://www.nytimes.com/2021/01/01/business/nyse-delist-china-mobile.html

https://apnews.com/article/donald-trump-business-hong-kong-china-08e71111b26c119048c523c5ba3ebde5

……………………………………………………………………………………………………………………………………………………………………..

January 5, 2021 UPDATE:

The New York Stock Exchange reversed its decision to delist China Mobile, China Telecom, and China Unicom before it becomes effective.

NYSE said that “in light of further consultation with relevant regulatory authorities in connection with Office of Foreign Assets Control FAQ 857, available here, the New York Stock Exchange LLC (“NYSE”) announced today that NYSE Regulation no longer intends to move forward with the delisting action in relation to the three issuers enumerated below (the “Issuers”) which was announced on December 31, 2020.”

Meanwhile, the reversal is not yet final, as the NYSE maintained that it would “continue to evaluate the applicability of Executive Order 13959 to these Issuers and their continued listing status.” There is no substantiated evidence that pressure from China or intervention from the incoming Biden administration has played a role in the change of mind by NYSE.

Technically all the three Chinese state-owned telcos are listed on the Stock Exchange of Hong Kong (HKEX), and what’s traded in New York is an instrument called American depositary receipts (ADRs), which enables American investors to trade on foreign companies listed elsewhere.

On Monday, as a response to NYSE’s delisting announcement, the three telcos updated the market that ADRs represent between 3.3% and 8% of their total tradable shares. According to an earlier response by China Securities Regulatory Commission (CSRC) to NYSE’s original decision, the three operators’ ADRs only account for less than 2.2% of the equity shares of these companies, with “a total market capitalization of less than 20 billion RMB yuan” ($3.1 billion). China Mobile is the heaviest user of this instrument, accounting for 90% of the total value.

According to the Treasury Department, if NYSE’s original decision to delist were to go ahead, these companies would also need to be eliminated from other financial instruments, including derivatives, depositary receipts, exchange-traded funds, index funds, and mutual funds. The reversal of decision may have taken away the requirement for traders to make immediate changes in their products, some measures may still be needed as a precaution, and the actions may not be limited to the three telcos.

In December two index providers, FTSE Russell and S&P Dow Jones have both removed a number of Chinese companies from some of their indexes following the executive order. There are 35 companies on the Treasury Department’s list compiled for this particular executive order, including, in additions to the three operators, the usual suspects like Huawei and SMIC.

January 6, 2021 Update:

New York Stock Exchange Reverses Course Again, Will Delist 3 Chinese Telecom Firms After All!

44 Chinese companies have joined the O-RAN Alliance

by John Strand, Strand Consult (edited by Alan J Weissberger)

In 2019, the world’s mobile network operators earned just over $1 trillion and spent $30 billion on Radio Access Network (RAN) equipment, which was some 3 percent of revenue. To reduce cost, mobile operators leverage the pool of network equipment vendors, for example by developing new interfaces in network equipment to lower barriers to entry, under the industry term OpenRAN or “Open Radio Access Network.”

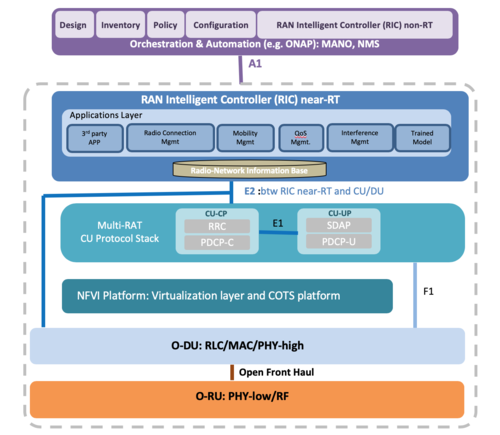

OpenRAN is not a standard, but a collection of technological features purported to allow different vendors to supply 5G networks with “standardized open interfaces” specified by the O-RAN ALLIANCE.

Source: O-RAN Alliance

……………………………………………………………………………………………………………………….

O-RAN only addresses internal RAN components. The wireless telecom industry still relies on 3GPP, the 3rd Generation Partnership Project, to build an end-to-end mobile cellular network and to connect end-user devices.

OpenRAN has become a hot topic in tech policy as an antidote to Huawei network equipment in mobile networks, but dozens of Chinese companies have joined the O-RAN ALLIANCE and are poised to drive OpenRAN standards and manufacturing

Chinese technological threats extend beyond Huawei

As the practices and relationships between Huawei and the Chinese government have been revealed, many nation state leaders have demanded the removal of Huawei equipment from communications networks. Huawei itself has not succeeded to demonstrate that it is an employee- owned company free from Chinese government control. China’s practice of civil military fusion means that all economic inputs can be commandeered for military purposes. Its de facto information policy asserts sovereignty over the internet and can thus enjoin any Chinese firm or subject to participate in surveillance and espionage. This means that restricting Huawei alone is not sufficient to secure 5G; the presence of any Chinese product in the network poses a security risk. Now that the Huawei brand name is toxic, many non-Chinese firms see an opportunity to enter the 5G network equipment market, but it is not clear whether and to what degree they will use Chinese standards, components, and manufacturing.

The O-RAN ALLIANCE was established in 2018 by Deutsche Telekom, NTT DOCOMO, Orange, AT&T, and China Mobile and has grown to 237 mobile operators and network equipment providers. The US has 82 O-RAN Alliance members; China, 44 (3 from Hong Kong); Taiwan, 20; Japan, 14; United Kingdom, 10; India, 10; and Germany, 7. Notably the 44 Chinese member companies exert significant control on the technical specifications and supply chain of OpenRAN 5G products and services. The conundrum of engagement with restricted Chinese entities does not end there. Citing security concerns, the Federal Communications Commission rejected a US operating license to China Mobile and may revoke approvals for China Telecom for its failure to demonstrate that it is not influenced the Chinese government. Other O-RAN ALLIANCE members include Inspur, Lenovo, Tsinghua, and ZTE, companies the US government restricts for security reasons given their ties to the Chinese government and/or military. The O-RAN ALLIANCE did not return a request for comment.

Some mobile operators cite OpenRAN to avoid ripping and replacing Huawei equipment

While many mobile operators are taking precautions to protect their customers by removing Huawei equipment, Vodafone, Telefonica, and Deutsche Telekom have resisted. They posit the promise of OpenRAN (with the O-RAN ALLIANCE specification) to justify a delay of rip and replace efforts, knowing that OpenRAN products will not be available for some years. Thus, these three operators can extend the life of Huawei in their 5G networks with the promise of using so called “open” equipment built with Chinese government standards. Separately the cost to rip and replace Huawei in European networks is minimal, about $7 per European mobile subscriber. The mobile operators which have switched out Huawei equipment have not experience increased cost or delay to the rollout of 5G.

Local politicians jump on the OpenRAN bandwagon thinking it has no Chinese connection

With the manufacturing base decimated in the countries they represent, many policymakers have looked to OpenRAN to get back into the network equipment game. Presumably OpenRAN would provide some high-end software jobs, though manufacturing is likely to be dominated by established Chinese entities. A US House bill would offer a whopping $750 million for OpenRAN development, though the location of manufacturing is not conditioned. Similar bills have been offered in UK, Japan, India, Germany, and Brazil. However commendable the notion of OpenRAN may be from a technical perspective, it appears that China has already outwitted Western leaders. China can afford to lose the Huawei battle if it wins the war on standardizing and building billions of “open”, “interoperable”, and “vendor neutral” devices. As long China influences the O-RAN specifications and manufacturing, it does not care whose brand is used.

Policymakers in the US and EU have today a lot of focus on communications network equipment from Chinese vendors. In 2019 and 2020 Strand Consult published many research notes and reports to help telecom companies navigate a complex world. We focused heavily on the problem of Chinese equipment in telecommunications networks. While the media has largely focused on Huawei, the discussion should be broadened to the many companies that are owned or affiliated with the Chinese government including but not limited to TikTok, Lexmark, Lenovo, TCL, and so on. Although some of our customers disagree with our views, Strand Consult’s job is to publish what is actually happening and how policy decisions may affect their business in the future.

Here are some of Strand Consult’s research.

44 Chinese companies have joined the OpenRAN effort, a strategy to reduce Huawei’s presence in 5G

https://www.o-ran.org/membership

…………………………………………………………………………………………………………………..

Open RAN first surfaced nearly three years ago at Mobile World Congress 2018. It promised a new set of interfaces that would allow service providers to mix and match vendors at the same mobile site, instead of buying all products from the same supplier. Operators hoped it would inject competition into a market dominated by Ericsson, Huawei and Nokia.

Since then, geopolitics has propelled it to the very top of the telecom agenda. Non-Chinese policymakers have latched onto open RAN as an alternative to Huawei, a Chinese vendor that governments are banning and operators are ditching because of its suspected links to an increasingly authoritarian Chinese state.

Avoiding Chinese equipment makers is one thing. Skirting Chinese technology expertise is not so easy. Already, there is concern that China, through Huawei and ZTE, has too much influence in the 3GPP, the group that develops the 5G standard. Further worsening of relations between Western democracies and China could prompt a future break-up of international standards-setting bodies, according to several experts.

Chinese influence:

These circumstances leave open RAN in an awkward situation. Anyone listening to the Open RAN Policy Coalition might think the technology was born in the USA and has never set foot in China. The O-RAN Alliance shows otherwise. Its most prominent Chinese members include ZTE, an equipment vendor that was on a US trade blacklist until it hawked up billions in fines. Also named are China Mobile and China Telecom, two state-backed operators that turned up on a Pentagon blacklist in June.

China Mobile is a busy member of the group, says a source who requested anonymity. That is hardly surprising as it was arguably the main force in the C-RAN Alliance, a Chinese group whose merger with the largely American xRAN Forum created the O-RAN Alliance in 2018. Today, the Chinese operator is a very active contributor to specifications, according to Light Reading’s source. ZTE has been similarly engaged, said sources within the company at the start of the year.

None of this will be very palatable to US politicians determined to block China’s influence. Yet any break-up of the O-RAN Alliance into C-RAN Alliance and xRAN Forum camps would be a major setback for open RAN. It would complicate development and threaten new disputes over intellectual property.

Right now, the issue of technology patents means the O-RAN Alliance faces a potential dilemma about involving Huawei. The group’s interfaces build heavily on specifications developed outside the O-RAN Alliance by Ericsson, Nokia, NEC and Huawei. The Nordic and Japanese vendors have all now joined the club, agreeing to license their patents on fair, reasonable and non-discriminatory (FRAND) terms. But Huawei has not. There is concern it could attempt to thwart open RAN by arguing its patents have been infringed.

While addressing that risk, its membership of the O-RAN Alliance would create other problems. For one thing, China’s biggest slab of tech R&D muscle would – paradoxically – have gained entry to the design room of the technology touted as a Huawei substitute. US policymakers able to live with China Mobile and China Telecom might balk at the involvement of telecom public enemy number one.

It would also make all three big telecom equipment vendors a part of the specifications group. That would increase the likelihood that Ericsson, Huawei and Nokia become the main suppliers of open RAN products, frustrating efforts to nurture competitors. There are already doubts that smaller rivals will be able to land much open RAN work. Appledore Research, an analyst firm, reckons open RAN will generate $11.1 billion in revenues in 2026. As much as $8 billion will go to the incumbents, it predicts.

Ever wary of open RAN, Huawei signaled its growing interest in the technology in July, when Victor Zhang, its vice president, was being grilled by UK politicians. “We are watching open RAN as one of the choices,” he told a parliamentary committee. “Once it has comparable performance to single RAN, we believe Huawei will be one of the best suppliers of open RAN as well.” Outside China, an open RAN ecosystem that makes space for Huawei could fast lose its appeal.

https://www.lightreading.com/open-ran/chinas-role-in-open-ran-is-looming-problem/d/d-id/766204?

China Telecom launches 5G standalone cloud native network with Tianyi Cloud

China Telecom claims it has launched what it says is the world’s largest 5G standalone (SA) network. Executives announced the start of commercial 5G SA operations during a company virtual conference last week and said their 5G SA network is currently supported by 30 devices, with 100 expected by year-end.

China Telecom’s 5G SA end-to-end capability testing with Tencent and Huawei was completed in September. Earlier in the week, China Telecom said it will offer 5G SA services to over 300 cities in China at a press event held with Qualcomm at Guangzhou, China.

Like all the other telcos on the path to 5G SA (only T-Mobile US has deployed it), China Telecom’s is said to be 5G SA is a cloud native network called the “Tianyi Cloud.” Company leaders said it’s 5G SA cloud network can guarantee “five-nines reliability,” secure network slicing and latency of below 5ms. In particular:

With the popularization of cloud computing, hybrid multi-cloud has become the new normal for cloud migration. It is just necessary to realize high-speed network interconnection and unified management between multi- clouds. The full-stack hybrid cloud launched by Tianyi Cloud realizes the same technical architecture of the underlying cloud platform and has no cloud capabilities. It extends and covers the deployment of three scenarios: edge, private cloud, and industry cloud. At the same time, it provides first-line multi-cloud capabilities, a dedicated line connects multiple mainstream public cloud service providers at the same time, and high-speed interconnection between public and private clouds can also be realized. In addition, it is worth mentioning that Tianyi Cloud’s full-stack hybrid cloud has been adapted to national production and production at the chip, hardware, and operating system levels, and has the ability to provide national production and service services.

The new generation of cloud-native database developed by Tianyi Cloud completely independently developed and technically tackled key problems. It successfully realized the de-IOE of China Telecom’s core IT system database. Telecom users and billion-level terminal equipment access. Through continuous upgrading and evolution, Tianyi Cloud’s new generation of cloud-native database has reached financial-level data security and high reliability, and has continuously broken through the limits of scale and performance, while being compatible with a complete database ecological chain, so as to meet customers’ diverse data service needs.

Also, China Telecom officially launched the “Cloud Terminal” plan at the event. Tianyi Cloud, as the base of the cloud terminal strategy, has independently created a cloud computer through computing in the cloud, data in the cloud, application in the cloud, security in the cloud, and imagination in the end mode. And cloud mobile phone products.

President and COO Li Zhengmao said the arrival of the 5G era provided the opportunity and the technical ability for the integration of cloud and the network.

In terms of 5G cloud integration, Hu Zhiqiang said:

“In the 5G era, cloud-network integration has entered a new realm. Cloud-network integration is the goal that Tianyi Cloud pursues.” On the one hand, Tianyi Cloud launched an intelligent edge video cloud to break through the bottleneck of ultra-high-definition real-time encoding technology. At the same time, it has real-time scheduling capabilities of millions of video streams. On the other hand, 5G is a cloud-based network. Tianyi Cloud provides 99.999% reliability guarantee and exclusive slice data security, achieving a comprehensive TCO reduction of more than 90%, and a delay of less than 5ms.”

A white paper presented at last week’s event describes China Telecom’s cloud-network integration as driven by open sharing, open network capabilities, multi-network access 5G and SD-WAN support. The China Telecom paper said the company was a hybrid multi-cloud strategy, integrating Alibaba Cloud, Tencent Cloud, Huawei Cloud, AWS, Azure and others into its aggregation platform.

In conclusion, Hu Zhiqiang said: “China Telecom Tianyi Cloud will continue to strengthen technological innovation, strengthen open cooperation, and accelerate the construction of a digital China and a smart society, and make greater contributions with partners.”

………………………………………………………………………………………………………………………………………………………………………………………………….

References:

http://www.c114.com.cn/news/117/a1143514.html

https://www.lightreading.com/asia/china-telecom-gets-cracking-on-5g-standalone/d/d-id/765464?

China says it has deployed 700,000 5G base stations this year; Huawei’s forecast

ZTE reports strong 1st Half 2020 financials; 5G Flexhaul; Automatic Antenna Pattern Control Trial with China Mobile

ZTE reported strong first half financial results, with operating revenues up 5.8 percent from the year before to RMB 47.20 billion and net profit increasing 26.3 percent to RMB 1.86 billion. Net profit after extraordinary items increased 47.4 percent to RMB 0.9 billion. The operating cash flow grew over 61 percent to RMB 2.04 billion while spend on research and development (R&D) advanced to RMB 6.64 billion.

In the first half of 2020, the company strengthened its cash flow and sales revenue collection management. Its net cash flow from operating activities for H1 2020 is approximately RMB2.04 billion, about 61.1% year-on-year growth. With great commitment to 5G R&D investment, the company’s R&D spending increased to RMB6.64 billion in H1 2020, covering 14.1% of operating revenue.

In light of the coronavirus pandemic and its impact, ZTE decided to push its R&D initiatives and to take advantage of the mega shift brought on by its own ongoing digital transformation. The company also focused on customer service, helping to achieve a steady growth of business.

ZTE put its in-house new-generation core chipsets for access, bearer and fixed-networks into large-scale commercial deployments, further improving the performance, integration and energy efficiency ratio of its chipsets. The company is also focusing on strengthening its algorithm processes, new materials and new technologies in general, as it helps build 5G commercial networks and works towards becoming the “ultimate” cloud company.

In terms of operator network business, ZTE, underpinned by the rapid 5G rollouts in China, achieved revenue of RMB34.97 billion, a year-on-year growth of 7.7%. (Note that ZTE and Huawei were recently banned from the UK’s 5G rollouts). In 1st half o 2020, the company continuously strengthened the landscape of global network infrastructure.

Proactively taking advantages of new infrastructure construction and new services, ZTE further explored market growth opportunities, with the revenue of ZTE’s government and enterprise business reaching RMB4.82 billion, a year-on-year growth of 2.5%. The company further explored high-value overseas markets while promoting healthy operations during the period.

In its consumer business, ZTE has continuously strengthened its 5G terminal (mostly smartphones) agreements with over 30 wireless network operators around the world, with a focus on China’s “open market.”

Moving forward, ZTE says it will continuously strengthen the research and development, operate steadily and proactively address the risks and challenges in the global markets, thereby achieving the quality growth. Meanwhile, the company will seize the opportunities of new infrastructure and network technology innovations to expand its market shares, accelerate the digital transformation, and improve the organizational efficiency, so as to become an ultimate cloud company.

The company recently announced its 5G Flexhaul solution, which adopts a minimal forwarding plane architecture and a cloud-native control plane to provide 5G fronthaul, midhaul, and traditional backhaul, flexibly meeting the differentiated needs of 5G multi-scenarios and the ultimate performance challenges of 5G services. Based on a full range of self-developed and the industry’s only “3-in-1” highly integrated 5G bearer chip, combined with the pioneering FlexE Channel technology, ZTE’s 5G Flexhaul solution not only provides ultra-large bandwidth capabilities, but also supports massive connections for different services Provide differentiated SLA guarantee and network slicing capabilities to provide customers with a flexible, scalable, and operable 5G bearer network.

……………………………………………………………………………………………………………………………………………………………………………………..

ZTE’s announced financial report comes one day after the company said that it has completed the trial of Automatic Antenna Pattern Control (AAPC) self-optimization solution in Guangzhou, China along with the Guangzhou branch of China Mobile.

By means of the seamless integration between the AI technology and the network structure optimization, this solution can greatly simplify the optimization and O&M of the 5G Massive MIMO network, thereby effectively improving the efficiency and reducing the costs.

The trial result shows that the network coverage rate has increased by nearly 12%, and the signal strength has increased about 4-to-5 dB while the signal-to-noise ratio has increased nearly 1-to-2 dB and the download rate has risen by about 10%.

The solution is based on ZTE’s intelligent AAPC optimization tool, employing the AI algorithm and the network management platform to quickly search and lock the optimal antenna parameters in complex scenarios. According to the MR (measurement report) data, the solution can accurately evaluate the quality of the network coverage.

In addition, the solution has adopted an AI model to achieve the iterative optimization, and the optimal matching between scenarios and antenna parameters, so as to create an end-to-end operational solution of self-configuration and self-evaluation.

Moving forward, ZTE and China Mobile will further explore various complex scenarios, and develop a larger-scale AI self-optimization system, expecting to accelerate the transformation and upgrade of intelligent networks.

About ZTE:

ZTE is a provider of advanced telecommunications systems, mobile devices and enterprise technology solutions to consumers, operators, companies and public sector customers. The company has been committed to providing customers with integrated end-to-end innovations to deliver excellence and value as the telecommunications and information technology sectors converge. Listed in the stock exchanges of Hong Kong and Shenzhen, ZTE sells its products and services in more than 160 countries.

References:

https://www.zte.com.cn/global/about/news/20200828e1.html

https://www.zte.com.cn/global/about/news/20200827e1.html

https://www.zte.com.cn/china/solutions/201905201708/201905201738/5G_Flexhaul

ZTE facilitates 4G and 5G co-evolution with a comprehensive set of solutions

COVID-19 has changed how we look at telecom infrastructure, cloud and AI

by John Strand, Strand Consult, Denmark; edited for clarity by Alan J Weissberger

The coronavirus (COVID-19) crisis has proven that telecom infrastructure is critically important. Telecommunications networks delivered service during the lockdown, enabling many to continue to work, learn, shop, and access healthcare.

Policymakers will likely revisit regulation for telecom networks, not only to optimize network investment, but to improve security. Indeed, policymakers will also realize that security which has focused to date on the transport layer of networks is leaving the access and applications layers vulnerable.

While the focus on Huawei is long overdue, the discussion of network security and Huawei’s role are oversimplified. It is insufficient to address only one aspect of conventional components of networks: access, core, and transport.

The bigger issues are how end-user data will be protected while stored in the network/cloud and processed by artificial intelligence (AI) agents? Also, how will connected devices on Internet of Things (IoT) networks and other applications (such as smart city solutions) can be secured?

Historically network connectivity was likened to the dumb pipe, the medium which transmits data. The “smart parts” of the network were the edge and the core, where users access networks and where information processing occurs. These actions have become more complex with third party providers of AI and cloud computing. Naturally, these models don’t fit 5G because intelligence must exist throughout the network. However, telecom regulation has been associated with these three traditional functions.

Now that networks have evolved, it’s time for telecom regulation to evolve. If the goal of security measures is to reduce the risk and vulnerability of exposure to Chinese state-owned and affiliated firms, then policymakers need holistic frameworks that address the multiple aspects of network security at its various layers: application, transport, and access.

Indeed, the singular focus on Huawei in connectivity misses the fact that Huawei sells products for the other layers, and that many other Chinese state-owned firms should be scrutinized. For example, Baidu, WeChat, Alibaba, and Huawei provide AI solutions in the Applications layer; Huawei and ZTE in transport; and Huawei smartphones and laptops by Lenovo (the world’s leading maker of laptops as well as a leader in servers).

Strand Consult has described this in the research note The debate about network security is more complex than Huawei. Look at Lenovo laptops and servers and the many other devices connected to the internet.

The EU’s 5G Toolbox is the first step towards greater security and accountability for a discrete part of 5G network transport, but it does not address all elements of 5G security nor other layers. In performing its security assessment, the United Kingdom looked beyond 5G mobile Radio Access Networks (RAN) and Core to other network layers, types and technology, notably wireline networks. Policymakers need a broader focus than 5G when assessing the security of telecommunications networks in the future. Policymakers need to look at Huawei’s movement into cloud and AI solutions in the application layer as well as the many state-owned Chinese firms in the access layer like Lenovo.

In China, Huawei is vertically integrated and delivers a suite of products and services for all the layers of a network: it transports the data; it provides access through end user devices, and it provides the applications in the form of AI and cloud solutions. While European policymakers debate issues of RAN and core, Huawei is busy selling other solutions for the rest of the network: smartphones, routers, AI, and cloud solutions. As restrictions tighten on Huawei’s network products, the company will naturally push other business lines to compensate for lost revenue. A large operator in Europe works with Huawei on a joint Chinese-German cloud platform, and the reference customer for this solution is the European Organization for Nuclear Research, CERN in Switzerland. It is not logical how Huawei which can be deemed high risk for telecommunications and military networks, but somehow neutral for nuclear research. The agreement for the project is four years old; the question is whether such a project will be acceptable for political and security standards going forward.

Vertical integration was the standard model for traditional state-owned telecommunications. The government built a telephone network (the wires and switches); it delivered a single service – telephony; and it sold the end user device, typically a classic phone. Privatizing networks was about opening up the value chain to different kinds of providers. This worked well in mobile networks; different firms specialized for different parts of the value chain. However, Huawei is driving the decentralized chain back to the state-centered concept, perhaps fitting for its practice in China where it partners with the government to deliver full-service surveillance solutions.

Policymakers, regulators, and competition authorities have long been skeptical of vertical integration in telecommunications, and it was frequently a way to control traditional telecom operators by demanding that the divest certain parts of their business or by prohibiting certain acquisitions.

COVID-19 has proven that telecommunications networks are vital infrastructure at all layers and levels. It’s not just military and public safety networks that need to be secure. Everyone needs to have secure networks if we are live in a digital society. If politicians and telecom operators don’t recognize this, network users do. Change is being driven by companies which themselves are increasingly victims of cyber-attacks. Companies are putting increased pressure on telecom operators and governments to do more to make networks secure.

John Strand of Strand Consult

…………………………………………………………………………………………………………………..

Six big issues on the future of telecom regulation:

Strand Consult believes that governments will take a broader view about network security. Here are six categories of issues for policymakers to consider.

- What is critical infrastructure, and how will it be defined in the future? Historically, critical infrastructure had to do with physical and digital network assets which are required for physical and economic security, health, and safety. Indeed, there are many vital network assets deemed “critical” including those for chemicals, communications, manufacturing, dams, defense, emergency services, energy, financials, food/agriculture, government facilities, healthcare, information technology, nuclear reactors, transportations systems, and water/wastewater. Are these networks equally prioritized? What are the security concerns and protocols for each, both on the physical and cyber fronts? Do some have greater security than others? How does this change in the COVID-19 world?

- What are the government’s responsibilities to ensure the security of communications infrastructure?What are the minimum requirements to restrict a vendor? How is this balanced with requirements for fair and open processes for bids and tenders?

- What are the relevant communications networks to secure? Is it enough to focus on 5G mobile RAN and core or should security requirements apply to wireline networks, satellite, Wi-Fi, 3G/4G and so on?

- Is it sufficient only to address the transport element of network security? How will security be ensured for the storage and processing of data, for example on the computers, laptops, and servers provided by Chinese state-owned Lenovo where China’s rules for surveillance and espionage also apply? What about apps like TikTok and Huawei’s AI and cloud solutions?

- Who should perform the security assessment? Telecom operators, military departments, intelligence agencies, private security consultants, law enforcement, or some other actor?

- How will shareholders account for increased security risk in networks? Have shareholder asked relevant questions about operators’ security practices and the associated risk?

Strand Consult believes it is dangerous for telecom operators to make the decision about Huawei themselves without involving the authorities.

There are a lot of arguments for why telecommunications companies should involve the competent and relevant authorities. Telecom operators must understand that If telecommunications companies assume responsibility as those who assess each supplier in relation to national security, they will be held responsible when things go wrong.

When you take on a responsibility, you also take on risk. Thus, shareholders are exposed to increasing risk when using high risk vendors. The historical facts show that telecommunications companies have been wrong in the past when assessing cooperation with partners which have proven to be corrupt. Some partnerships have cost shareholders billions of euros. In practice, operators are limited in their ability to judge whether partners and vendors are trustworthy.

Strand Consult’s research shows that is not only government, intelligence, and security officials who are concerned about companies like Huawei. Nor is it just telecom operators which build and run networks. It is the small, medium, and large enterprises that use networks that fear that their valuable data will be surveyed, sabotaged, or stolen by actors associated with the Chinese government and military. Consequently, it is the clients of telecom operators which push to restrict Chinese made equipment from networks. This is described in this research note, The pressure to restrict Huawei from telecom networks is driven not by governments, but the many companies which have experienced hacking, IP theft, or espionage.

What the future looks like – just ask the banks:

If you want to see the future of the telecom industry, look at what happened with banking. European banks have been required to implement Anti-Money Laundering (AML) and the Counter Terrorist Financing (CFT). About 10% of European banks employees are today working with compliance. Telecom authorities, defense officials, and other policymakers and will likely see cybersecurity is vital for Europe and that telecom infrastructure is critically important. So just as the banks have been put under a heavy regulatory regime to address corruption and financial crimes, the telecom industry will be required to implement deterrence of cyberattacks.

In practical terms, the authorities in the EU and in each nation state will likely make some demands that challenge the network paradigm that telecommunications companies operate today. The rules will likely be so rigid that they will effectively eliminate Huawei and other Chinese companies from being vendors without making explicit bans. However, it won’t be governments alone driving the charge. Corporate customers of telecom networks, companies that have experienced hacking, IP theft, or espionage, will also join the effort. This is described in this research note, The biggest taboo in European telecom industry is the cost of cybersecurity – just ask the banks.

Copyright 2020. All rights reserved

………………………………………………………………………………………………

About Strand Consult:

Strand Consult, an independent company, produces strategic reports, research notes and workshops on the mobile telecom industry.

For 25 years, Strand Consult has held strategic workshops for boards of directors and other leaders in the telecom industry. We offer strategic knowledge on global regulatory trends and the experience of operators worldwide packaged it into a workshop for professionals with responsibility for policy, public affairs, regulation, communications, strategy and related roles.

Learn more about John Strand: www.understandingmobile.com

Learn more about Strand Consult: www.strandreports.com

Strand Consult

Gammel Mønt 14

Copenhagen 1117 K

Denmark

[email protected]

U.S. Government Attempts to Strangle Huawei; China-U.S. Trade War likely to Accelerate into HYPER-DRIVE mode

On Friday, the U.S. government said it would impose export restrictions designed to cut off Chinese tech giant Huawei Technologies Co. from overseas suppliers, threatening to ignite a new round of U.S.-China trade tensions. The U.S. Commerce Department said its new sanctions would “narrowly and strategically target Huawei’s acquisition of semiconductors that are the direct product of certain U.S. software and technology.”

These new restrictions stop foreign semiconductor manufacturers whose operations use U.S. hardware, software and technology from shipping products to Huawei without first getting a license from U.S. officials, essentially giving the U.S. Commerce Department a veto over the kinds of technology that Huawei can use.

The restriction further tightens the U.S. export-control system’s existing rules related to Huawei. Washington alleges that Huawei gear could be used by Beijing to spy globally, which Huawei has repeatedly denied.

A logo of Huawei retail shop is seen through a handrail inside a commercial office building in Beijing.

…………………………………………………………………………………………………………………………………………………

U.S. Commerce Secretary Wilbur Ross said Friday that Washington wants to prevent Huawei from evading sanctions imposed earlier on its use of American technology to design and produce semiconductors abroad. “There has been a very highly technical loophole through which Huawei has been able, in effect, to use U.S. technology with foreign fab producers,” Ross said in an interview on Fox Business Network. He said the changes announced Friday were tailored moves “to try to correct that loophole and make sure that the American fab foundries are competing on an equal footing with the foreign ones.”

Also on Friday, a senior administration official said there were “legal, human rights, and strategic rationales” for the actions against Huawei. Those included Huawei’s alleged theft of intellectual property and aid in developing surveillance technology and new weapon systems, the official said.

Under the new rules, the department can block the sale of semiconductors manufactured by Taiwan Semiconductor Manufacturing (TSMC) for Huawei’s HiSilicon subsidiary, which designs chips for the company, as well as chips and other software produced by manufacturing facilities in Taiwan, China and South Korea, which use American chip-making technology. The Commerce Department already had the ability to license software shipments from U.S.-based facilities.

Companies can apply for a license to continue supplying tech products to Huawei, but the administration said the presumption would be to deny those requests.

John Neuffer, the president of the Semiconductor Industry Association, which represents chip makers, said his group was concerned that the rule would “create uncertainty and disruption for the global semiconductor supply chain.” He added, however, that it appeared less damaging than broader approaches the administration had previously considered.

Huawei had no immediate comment.

China’s foreign ministry, in a statement, urged the U.S. to immediately halt “its unreasonable suppression against Huawei.”

“The U.S.’s practices not only harm the legitimate rights and interests of Chinese enterprises, but also do not accord with the interests of U.S. enterprises, and cause damage to the global industrial chain, supply chain and value chain,” it said.

………………………………………………………………………………………………………………………………………………….

On Sunday, China’s commerce ministry said it will take “all necessary measures” in response to new U.S. restrictions on Chinese tech giant Huawei’s ability to use American technology, calling the measures an abuse of state power and a violation of market principles.

An unidentified spokesperson quoted Sunday in a statement on the China ministry’s website said the regulations also threatened the security of the “global industrial and supply chain.”

“The U.S. has utilized national power and used the so-called national security concern as an excuse, and abused export controls to continue to suppress some particular companies in other countries,” China’s commerce ministry said in today’s statement.

“China urges the U.S. to immediately cease its wrong actions,” the ministry added, calling the restrictions a “serious threat to global supply chains.”

China’s retaliation could take the form of restrictions on U.S. tech firms (Qualcomm, Apple. Intel, Nvidia, AMD, Broadcom, Cisco, even Boeing) selling their products in China.

Victor Gao, vice-president of the Centre for China and Globalisation, a Beijing-based think tank, said there were many ways in which China could retaliate for the new restrictions on Huawei, including selling its huge holdings of U.S. treasury bonds or halting any future purchases, and tightening its controls on Apple products.

“For example, if Beijing declared that all Apple products made in China had to be inspected, which would delay their shipment, in three months, Apple would be dead,” he said.

……………………………………………………………………………………………………………………………………………..

China’s state-run newspaper reported on Sunday that the Chinese government was ready to retaliate against the U.S.. The source, who is described as close to China’s government, told the state-run Global Times that China was planning countermeasures, such as “imposing restrictions” against U.S. companies like Apple, Cisco, and Qualcomm. The source also suggested the possibility of China halting Boeing airplane purchases.

“China will take forceful countermeasures to protect its own legitimate rights” if the Trump administration goes ahead with the plan to block essential suppliers of semiconductors from selling those components to Huawei.

…………………………………………………………………………………………………………………………………….

Backgrounder:

U.S. government officials have repeatedly accused Huawei of stealing American trade secrets and aiding China’s espionage efforts, ramping up tensions with the rival superpower while both sides were involved in a long-simmering trade war.

As a result, Huawei has increasingly relied on domestically manufactured technology, but the latest rules will also ban foreign firms that use US technology from make semiconductors to Huawei without US permission. The new restrictions will cut off Huawei’s access to one of its major suppliers of semiconductors- Taiwanese chipmaker TSMC (world’s largest silicon foundry).

………………………………………………………………………………………………………………………………………………

May 18th UPDATE:

Huawei on Monday assailed the latest U.S. move to cut it off from semiconductor suppliers as a “pernicious” attack that will put the Chinese technology giant in “survival” mode and sow chaos in the global technology sector.

“The decision was arbitrary and pernicious and threatens to undermine the entire (technology) industry worldwide. This new rule will impact the expansion, maintenance, and continuous operations of networks worth hundreds of billions of dollars that we have rolled out in more than 170 countries,” Huawei said in a statement.

The ban also went against the US government’s claim that it is motivated by network security, the company said.

“The US is leveraging its own technological strengths to crush companies outside its own borders. This will only serve to undermine the trust international companies place in US technology and supply chains. Ultimately, this will harm US interests,” said Huawei.

https://www.globaltimes.cn/content/1188683.shtml

References:

https://www.wsj.com/articles/u-s-moves-to-cut-off-chip-supplies-to-huawei-11589545335

https://abcnews.go.com/US/wireStory/china-warns-us-measures-huawei-rules-70728162

http://www.globaltimes.cn/content/1188491.shtml

U.S. government in talks with Intel, TSMC to develop chip ‘self-sufficiency’

The coronavirus pandemic has underscored longstanding concern by U.S. officials and executives about protecting global supply chains from disruption. Administration officials say they are particularly concerned about reliance on Taiwan, the self-governing island China claims as its own, and the home of Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chip manufacturer and one of only three companies capable of making the fastest, most-cutting-edge chips (the two other foundries are Samsung and Intel).

Officials from the U.S. government are in talks with Intel and Taiwan Semiconductor Manufacturing to build chip factories in the U.S., the Wall Street Journal reported, citing sources familiar with the matter. The U.S. government believes the pandemic showed how reliant the U.S. is on Asian factories and it now wants to promote more tech self-sufficiency.

“The administration is committed to ensuring continued U.S. technological leadership,” a senior official said in a statement. “The U.S. government continues to coordinate with state, local and private-sector partners as well as our allies and partners abroad, to collaborate on research and development, manufacturing, supply-chain management, and workforce development opportunities.”

HiSilicon, owned by Huawei, is a fabless semiconductor company which doesn’t have its own manufacturing plant. It relies on foundry companies like Taiwan Semiconductor Manufacturing Co. to make its chips. The Trump administration is preparing rules that could restrict TSMC’s sales to HiSilicon. Huawei may be storing up chip inventories in anticipation of such tighter restrictions. Huawei may shift some of its orders to Chinese foundry Semiconductor Manufacturing International Corp. (SMIC), but technology there still lags behind industry leaders like TSMC and Samsung.

Ultimately SMIC’s capabilities could be hampered if the Trump administration decides to dial up the pressure in its campaign against China. The Commerce Department said last week that it would expand the list of U.S.-made products and technology shipped to China that need to be reviewed by national security experts before shipping. SMIC depends on foreign semiconductor manufacturing equipment, including some from the U.S.

………………………………………………………………………………………………………………………………………..

Intel VP of policy and tech affairs Greg Slater said Intel’s plan would be to operate a plant that could provide advanced chips securely for both the government and other customers. “We think it’s a good opportunity,” he added. “The timing is better and the demand for this is greater than it has been in the past, even from the commercial side.”

Intel Chief executive Bob Swan sent a letter to Defense Department officials on 28 April, saying the company was ready to build a commercial foundry in partnership with the Pentagon. Strengthening U.S. domestic production and ensuring technological leadership is “more important than ever, given the uncertainty created by the current geopolitical environment,” Swan wrote in the letter. “We currently think it is in the best interest of the U.S. and of Intel to explore how Intel could operate a commercial U.S. foundry to supply a broad range of microelectronics,” the letter said. The letter was then sent to Senate Armed Services Committee staffers, calling the proposal an “interesting and intriguing option” for a U.S. company to lead an “on-shore, commercial, state of the art” chip foundry.

TSMC has been in talks with people at the Commerce and Defense departments as well as with Apple, one of its largest customers, about building a chip factory in the U.S., other sources said. In a statement, TSMC said it is open to building an overseas plant and was evaluating all suitable locations, including the US. “But there is no concrete plan yet,” the company said.

Some U.S. officials are also interested in having Samsung, which already operates a chip factory in Austin, Texas, expand its contract-manufacturing operations in the U.S. to produce more advanced chips, more sources said.

A trainee at a facility of the U.S. chip maker GlobalFoundries in Germany last year. The U.S. is looking to strengthen its own production of semiconductors. PHOTO: SEBASTIAN KAHNERT/DPA/ZUMA PRESS

…………………………………………………………………………………………………………………………………..

Taiwan, China and South Korea “represent a triad of dependency for the entire US digital economy,” said a 2019 Pentagon report on national-security considerations regarding the supply chain for microelectronics. The US has dozens many semiconductor factories, but only Intel’s are capable of making the chips with transistors of 10 nanometers or smaller. The company however mostly produces for its own products. Among companies that make chips on contract for other companies, only TSMC and Samsung make those high-performing chips. Many US chip companies such as Qualcomm, Nvidia, Broadcom, Xilinkx and Advanced Micro Devices rely on TSMC for the manufacture of their most advanced products. Intel also makes chips with TSMC, according to TSMC’s 2019 annual report.

The Semiconductor Industry Association is conducting its own study on domestic chip production. The report is expected to recommend the US government set up a billion-dollar fund to push domestic chip investment, another source said. Another proposal by SEMI, an industry group representing semiconductor manufacturing equipment makers, involves giving tax credits to chip makers when they purchase and install equipment at factories in the US.

The Commerce Department is also considering a rule aimed at cutting off Huawei’s ability to manufacture chips at TSMC (see Addendum below). President Donald Trump has approved the move, but Commerce Department officials are still working through preliminary drafts, sources said.

May 16, 2020 Addendum: U.S. Moves to Cut Off Chip Supplies to Huawei

References:

Trump and FCC crack down on China telecoms; supply chain security at risk

Excerpt of a Wired article by Justin Sherman (edited by Alan J Weissberger):

The Trump administration is clearly and publicly upping its scrutiny of Chinese-incorporated telecoms. After Washington’s crusade against Huawei, and a forthcoming Senate report that allegedly blasts U,S. regulators for failing to properly oversee Chinese telecoms and their handling of data, these recent actions aren’t exactly surprising. But even if they’re genuinely focused on real national security risks, that doesn’t change the fact that President Trump’s administration doesn’t have a broader strategy.

What the FCC sent to the four companies are called Orders to Show Cause. These orders instruct a recipient firm to demonstrate that its continued operation in the United States doesn’t pose national security risks. Specifically, the ones issued here demand evidence from the four telecoms of why the FCC shouldn’t “initiate proceedings to revoke their authorizations” to operate in the U.S., under Section 214 of the Communications Act.

“The Show Cause Orders reflect our deep concern … about these companies’ vulnerability to the exploitation, influence, and control of the Chinese Communist Party, given that they are subsidiaries of Chinese state-owned entities,” said FCC chair Ajit Pai. “We simply cannot take a risk and hope for the best when it comes to the security of our networks,” he added.

The orders to China Telecom (Americas) Corporation, China Unicom (Americas) Operations Limited, Pacific Networks Corporation, and ComNet (USA) LLC gave the companies until May 24 to respond. Included in this answer must be a “detailed description” of the firm’s “corporate governance,” network diagrams describing how its systems are used, lists and copies of interconnection agreements with other carriers, and descriptions of the extent to which the firm “is or is not otherwise subject to the exploitation, influence, and control of the Chinese government”—neither a small request nor a mere formality.

Editor’s Note: China Mobile, the largest wireless telecom carrier in China is missing from the above list!

Pacific Networks (of which ComNet is a subsidiary) is owned by the state-owned CITIC Telecom International; the government connection here is almost as direct. Linking its board room to the CCP’s Zhongnanhai headquarters is certainly a bit clearer here than with Huawei, which isn’t outright state-owned but has nonetheless been subject to many questions, especially from the White House, about its Chinese government ties. Again, Beijing’s potential access to data from Pacific Networks Corporation is a legitimate risk.

The clock is ticking for these companies to respond to the U.S. government. China Telecom asked the FCC for a 30-day extension on the original May 24 deadline. Its lawyers got a reply this past week considering extra time, conditioned on specifying by May 11 which parts of the order they want clarified. Meanwhile, the executive branch is forging ahead—per the recently issued executive order—with formalizing a committee to scrutinize foreign telecoms’ presence in the US. Recommendations to the FCC could include modifying a company’s FCC license with “mitigation” measures or even outright revoking it.

Many issues plague the recent executive order. There is broad language about which kind of FCC licenses can be reviewed; the EO’s title would suggest only those of foreign telecoms, but it appears it could be much bigger. The EO also leaves many questions of implementation up to a memorandum of understanding, which is due several weeks from now.

After the order’s publication, multiple people I spoke with had additionally drawn attention to the future head of this newly called-for, yet-to-be-created committee: the attorney general. In different times, perhaps that’d be a reasonable way to balance represented interests, from the intelligence community to the Departments of Defense and Homeland Security. But these are not normal times—and William Barr is hardly known for his impartiality or respect for the rule of law.

Zooming out even further, the U.S. government lacks clear and objective criteria to define and articulate what makes one foreign telecommunications supplier more trustworthy than another. After all, post-Snowden, it’s a bit hard for the U.S. to beat the “other countries backdoor their systems” argument, sans evidence, without raising eyebrows. The Trump administration also continues throwing digital sovereignty policies in other countries—from onerous source code inspection requirements to limited data localization provisions—into the same “protectionist” bucket. Given this reality, how will these telecom reviews be diplomatically handled?

Even the recent FCC orders don’t get especially detailed. Beyond citing that the companies are state-owned or are controlled by those that are state-owned, the documents don’t elaborate much on why these firms cannot be trusted. So, is it more about ownership, corporate governance, and legal authorities in the country of incorporation than it is about technical security issues?

Or for the administration’s China hawks, is it the mere connection to Beijing? Because as the Trump administration and the president in particular continue China-bashing, spreading xenophobic rhetoric (e.g., around coronavirus’ origins), and preferring in general a zero-sum engagement with counterparts in Beijing, it seems more likely that factor overshadows all else.

There are real national security risks that must be weighed around foreign telecommunications companies. Questions of foreign state ownership should be explored, especially as the world becomes more digitally interconnected and the technological supply chain is a growing vector for hacking and exploitation. But foregoing a broader strategy on supply chain security is not an effective, long-term option for parsing these modern digital risks. Despite the recent China focus, these questions of supply chain policy go far beyond Chinese technology firms, and the U.S. government needs a comprehensive and repeatable process for answering them.