Uncategorized

Omdia Surveys: PON will be a key part of network operator energy reduction strategies

Omdia (owned by Informa) surveys have found a “very high” number of telcos regarded PON as a key part of their energy savings programs. Omdia’s chief analyst Julie Kunstler said PON technology is fiber-asset efficient, easy to upgrade, and highly secure.

Speaking at a Light Reading webinar Thursday, Kunstler said another large cohort of network operator execs said they believed PON would play some role in their energy reduction strategies. “PON is energy efficient and this is definitely gaining attention.” Kunstler said “a very strong movement” by operators was underway toward next gen PON, in particular XGS PON. “But perhaps more importantly, PONs are also supporting other types of customers and applications.” She also noted PON technology was fiber-asset efficient, easy to upgrade, highly secure and allowed operators to choose when to upgrade. But she cautioned that in many telcos PON faced organizational obstacles because of the belief that it was for consumer services only and because of the silos between residential and business.

Anuradha Udunuwara, a senior enterprise solutions architect at Sri Lanka Telecom, said energy costs had become a bigger concern in the past 12 months following sharp hikes in power tariffs. He agreed that PON “definitely has an advantage… it is passive, so there is no energy consumption there.”

Udunuwara described PON as an “architectural option” that could support FTTX deployment. He said it was a myth about PON that it was for FTTH only. “It’s not confined to any of the variations of FTTX.” He expected that in the long run services would converge on to a single access technology.

“Oftentimes, sales and marketing teams don’t feel comfortable about PON, simply because they don’t understand it,” Kunstler said. “Many believe its point to multipoint topology is for residential only and that it’s simply best effort and there’s no technical ability to support enterprise services.”

“A lot of education is needed within some operators to explain to the sales and marketing team that PON is not just best effort and that you can actually commit to rates,” she pointed out.

“Not all enterprises need point to point. They don’t all need their own dedicated fiber, and many of them really don’t want to have to pay for dedicated fiber.”

Kunstler said selling business services over PON increased the ROI over that access infrastructure. “With 10G PON, you can easily support one gig symmetrical, two gig symmetrical five gig symmetrical and so forth, and 50 GPON, which will be here within a couple of years, can even support more bandwidth.

By using that optical distribution network for more than just residential, operators were already moving to a converged access approach. “You have more revenues over a single access network. You have a single network to upgrade. You have improved optics and you have improved energy savings.”

References:

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX

ZTE PON ONT obtains EasyMesh R3 certification from WiFi Alliance

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

Omdia: Consumer Telco Opportunity Challenged by Global Tech Giants

Market research firm Omdia (owned by Informa) says all growth areas for telcos will experience significant competition from hyperscalers – specifically the global tech giants Google, Amazon, Meta/Facebook, and Apple.

Omdia’s Quantifying the Consumer Telco Opportunity – 2023 report is an in-depth report providing analysis and insights drawn from Omdia’s related data tools as well as individual operator case studies. The market research firm says that other than core fixed-line and mobile data services, almost all of the potential growth for telcos in the consumer sector over the next few years will come from ‘non-traditional categories. Those include video streaming, digital gaming, streaming music, and smart home (whatever that means).

“Service providers must look beyond data and diversify into adjacent digital markets to enable continued growth of their telco consumer businesses,” said Omdia’s Jonathan Doran. “Many have already invested in TV and online video entertainment, but there are other fast-growing markets telcos can also explore. Adopting the right go-to-market strategy and business model for each individual service area will be critical to striking the balance between achieving market success and mitigating financial risk. In many areas, telcos will need to accept that competing head-on is unrealistic and developing partnerships with such players is not only more pragmatic but will also serve to strengthen their own products and brands” observes Doran.

“Omdia’s Digital Consumer Operator Strategy Benchmark shows that the more service providers actively invest in a given service area – including through partnerships – the bigger market impact they have, which in turn better positions them to take a bigger slice of overall market revenue”

Big tech is already there and doing a decent job of selling all these digital goodies direct to consumers without the help of operators. Every time telcos have tried to compete directly in adjacent markets is has all gone horribly wrong so, as well as picking their fights more carefully, they are advised to consider an ‘if you can’t beat em, join em’ approach.

“In many areas, telcos will need to accept that competing head-on is unrealistic and developing partnerships with such players is not only more pragmatic but will also serve to strengthen their own products and brands,” said Doran. “Omdia’s Digital Consumer Operator Strategy Benchmark shows that the more service providers actively invest in a given service area – including through partnerships – the bigger market impact they have, which in turn better positions them to take a bigger slice of overall market revenue.”

The Omdia chart below illustrates product types by growth potential (horizontal axis), relevance to the Communications Service Provider (CSP) core proposition (vertical axis) and forecasted relative 2027 market size. As you can see, most consumer digital products are pretty far from the CSP core proposition, but Omdia forecasts they will collectively amount to a $500 billion market by 2027. How much of that will find its way into the pockets of telcos as a result of partnering with Big Tech remains to be seen, but even a small fraction is better than nothing.

Amazon, Microsoft and Google are not only three of the biggest players in the digital consumer space, they also dominate the public cloud market, which network operators are constantly urged to turn to for its efficiencies and flexibility. It’s possible to imagine a time most of what we get from and operator is actually supplied, and monetized, buy one of a small number of hyperscalers. It’s not clear whether that represents a positive development for the telecoms industry.

References:

https://telecoms.com/521154/study-highlights-increasing-dependence-of-operators-on-hyperscalers/

IEEE Techblog recognized by Feedspot!

The IEEE ComSoc Techblog was voted #2 best broadband blog:

https://blog.feedspot.com/broadband_blogs/

2. The IEEE ComSoc Technology Blog

Piscataway, New Jersey, US

Piscataway, New Jersey, US

Featuring the latest in breaking telecom/networking news and analysis, the IEEE ComSoc blog is written by several expert bloggers. IEEE Communications Society is a global community of professionals with a common interest in advancing all communications and networking technologies.

Also in Telecom Blogs

techblog.comsoc.org+ Follow

…………………………………………………………………………………………………

..and #13 best telecom blog in the world:

https://blog.feedspot.com/telecom_blogs/?_src=alsoin

Many thanks to Vinny Rodriquez and Khanh Luh for making our blog so successful!

ABI Research: Major contributors to 3GPP; How 3GPP specs become standards

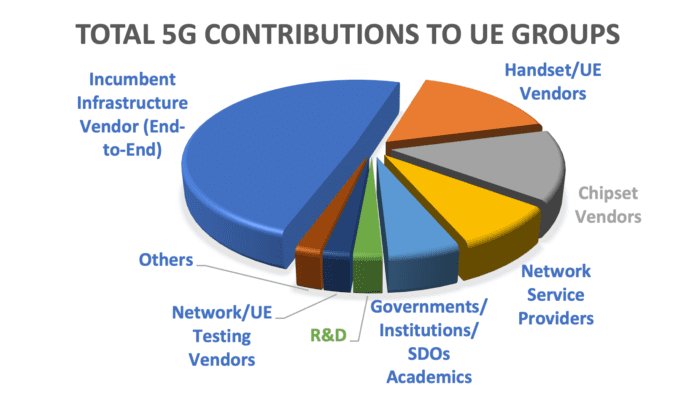

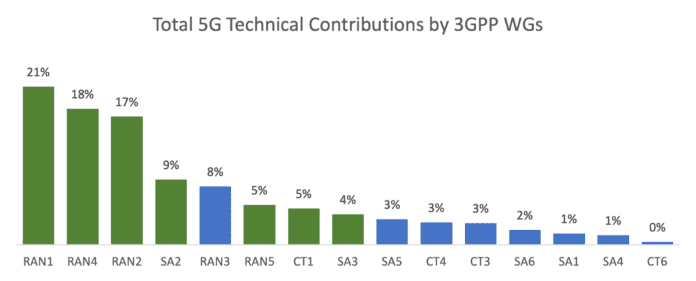

Three large network equipment vendors (Huawei, Ericsson, and Nokia) have been leading in both the number of contributions and approved contributions for 5G technologies to The 3rd Generation Partnership Project (3GPP). This is particularly the case with specifications related to User Equipment (UE) specifications and functionalities that are developed under RAN1, RAN2, RAN4, RAN5, SA2, SA3, and CT1 Working Groups (WGs).

Editor’s Note:

The 3GPP Organizational Partners (OP) are the seven Standards Developing Organizations (SDOs) – from China, Europe, India, Japan, Korea and the United States. The OPs are:

ARIB The Association of Radio Industries and Businesses, Japan

ATIS The Alliance for Telecommunications Industry Solutions, USA

CCSA China Communications Standards Association

ETSI The European Telecommunications Standards Institute

TSDSI Telecommunications Standards Development Society, India

TTA Telecommunications Technology Association, Korea

TTC Telecommunication Technology Committee, Japan

Participation in 3GPP is made possible by companies and organizations becoming Individual Members (IM) of one of the OPs.

- 3GPP specifications are not standards, they have no legal standing. They become “official” standards once one or more of the OPs transposes them, as ETSI has done many times.

- 3GPP specs become ITU-R recommendations when they are submitted to ITU-R WP5D by ATIS, discussed and agreed upon, then sent to WP5 plenary in November for final approval. That procedure was followed to create the ITU-R M.2150 recommendation which features 5G-NR.

……………………………………………………………………………………………………………………………………………………………………………………………………………….

The list of the most active companies within 5G 3GPP standards is listed in the table below:

| Top Ranked by Total Contributions | Approved Contributions | Total Contributions | Company Category |

| Huawei | 15,266 | 43,753 | Incumbent Infrastructure Vendor (End-to-End) |

| Ericsson | 11,601 | 36,375 | Incumbent Infrastructure Vendor (End-to-End) |

| Nokia | 7,553 | 23,112 | Incumbent Infrastructure Vendor (End-to-End) |

| Qualcomm | 5,523 | 18,471 | Chipset |

| Samsung | 3,548 | 16,464 | Incumbent Infrastructure Vendor (End-to-End) |

| ZTE | 3,415 | 15,291 | Incumbent Infrastructure Vendor (End-to-End) |

| Intel | 2,151 | 10,770 | Chipset |

| LGE | 1,396 | 10,139 | Handset/UE Vendor |

| CATT | 1,934 | 9,792 | Government/Institution/SDO/Academics |

| vivo | 1,205 | 8,367 | Handset/UE Vendor |

| MediaTek | 1,848 | 7,766 | Chipset |

Source: ABI Research

Key Takeaways:

- Counting contributions alone is insufficient to identify leaders in 3GPP standardization processes. However, it is a crucial step in recognizing active contributors and identifying innovation.

- More than 400 companies from the industry have participated in 3GPP standardization; however, only a handful of companies are consistently active in driving 3GPP 5G standards.

- Huawei, Ericsson, and Nokia have, so far, been leading in both the number of total and approved contributions for 5G technologies to 3GPP.

- Network infrastructure vendors are significantly more active than any other company categories, followed by handset vendors, chipset vendors, network service providers, and government research institutions.

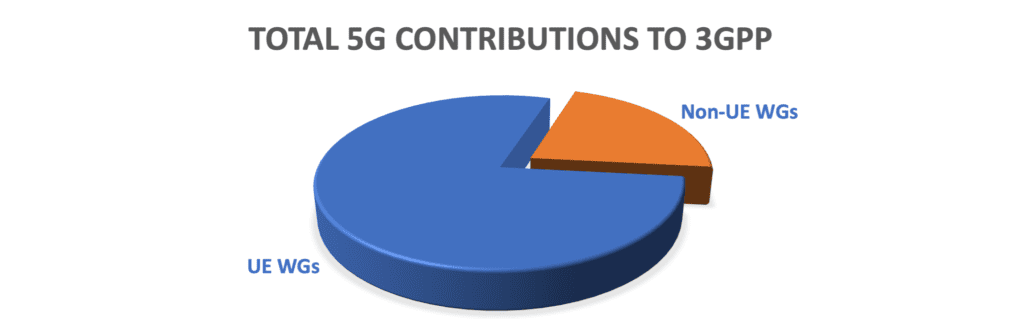

- UE-related WGs (i.e., RAN1, RAN2, RAN4, RAN5, SA2, SA3, and CT1) take 80% of total contributions. RAN1, RAN2, RAN4, and SA2 are the most important WGs, impacting the entire mobile industry and receiving massive interest.

References:

https://www.3gpp.org/about-us/partners

ITU-R M.2150-1 (5G RAN standard) will include 3GPP Release 17 enhancements; future revisions by 2025

Busting a Myth: 3GPP Roadmap to true 5G (IMT 2020) vs AT&T “standards-based 5G” in Austin, TX

Dell’Oro: Worldwide Telecom Equipment Market Growth +3% in 2022; MTN: +2% Network Infrastructure Growth in 2022

by Stefan Pongratz, VP Dell’Oro Group

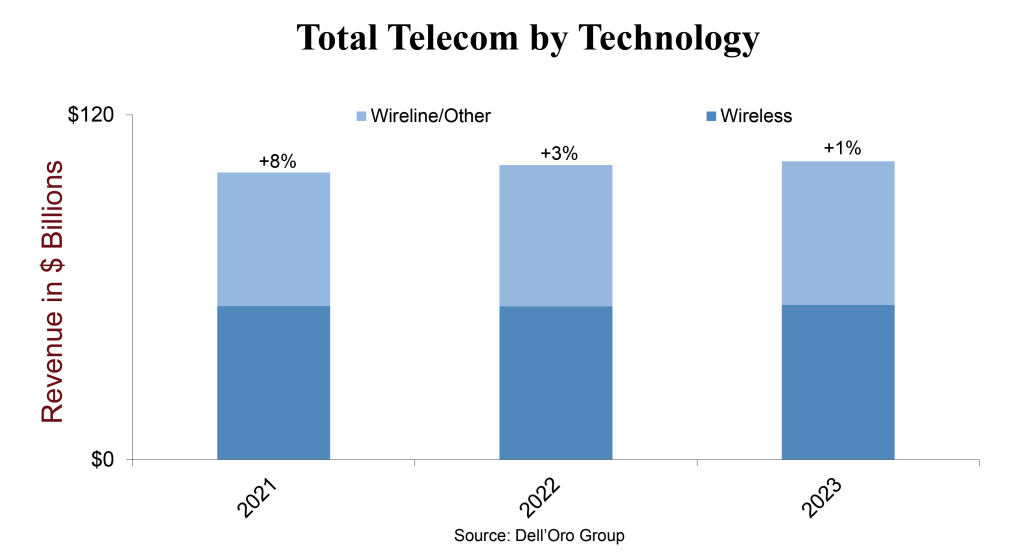

Following four consecutive years of modest telecom equipment growth across the six telecom programs tracked at the Dell’Oro Group, preliminary findings show that the aggregate telecom equipment market moderated somewhat from the 8% revenue increase in 2021 to 3% year-over-year (Y/Y) in 2022.

Looking back at the full year, the results were slightly lower than the 4% growth rate we projected a year ago going into 2022. In addition to more challenging comparisons in the advanced 5G markets and the supplier exits in Russia, the strengthening USD weighed on the broader telecom equipment market. Supply issues also impacted the market negatively during 1H22 but eased somewhat in the second half.

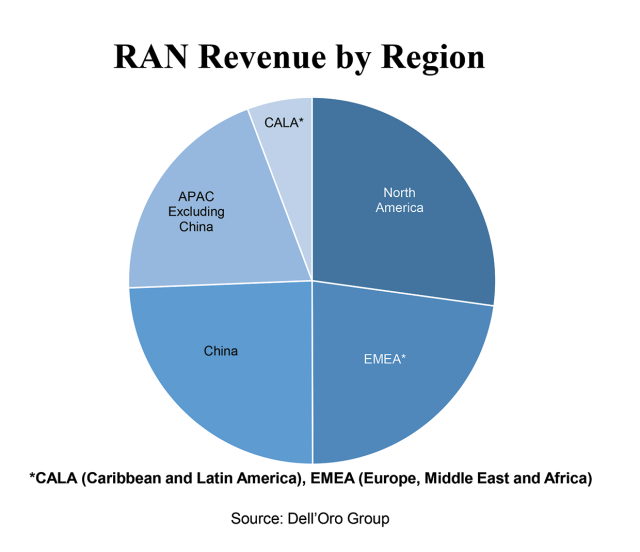

Regional developments were mixed, underpinned by strong growth in North America and CALA, which was enough to offset more challenging conditions in EMEA and the Asia Pacific. With China growing around 4%, we estimate global telecom equipment revenues excluding China increase around 3% in 2022.

From a technology perspective, there is a bit of capex shift now underway between wireless and wireline. Multiple indicators suggest Broadband Access revenues surged in 2022, however, this double-digit growth was offset by stable or low-single-digit growth across the other five segments (Microwave Transport, Mobile Core Network, Optical Transport, RAN, SP Router & Switch).

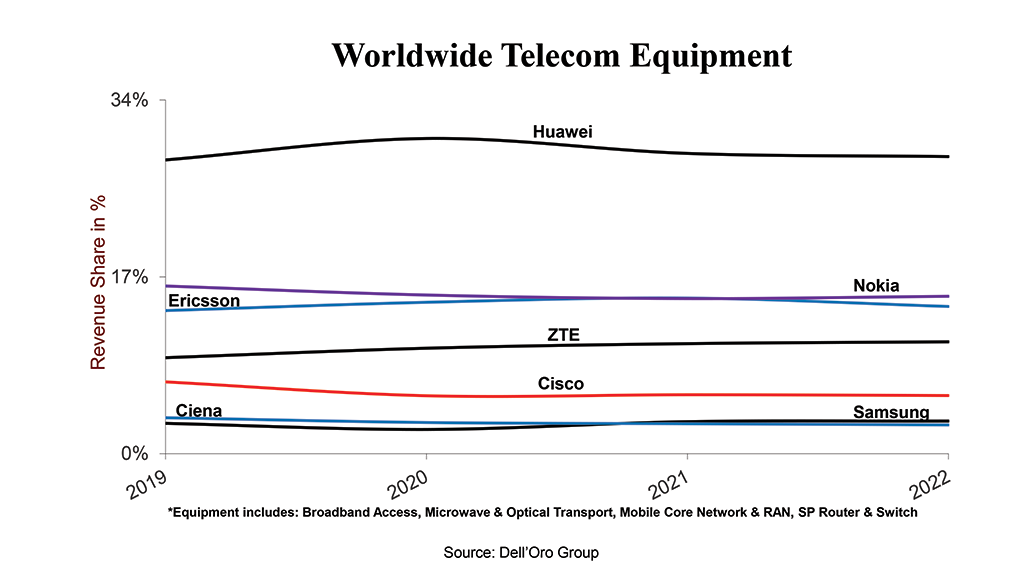

Vendor dynamics were relatively stable between 2021 and 2022, with the top 7 suppliers (Huawei, Ericsson, Nokia, ZTE, Cisco, Ciena and Samsung) driving around 80% of the overall market. Despite on-going efforts by the US government to limit Huawei’s TAM and access to the latest silicon, our assessment is that Huawei still leads the global telecom equipment market, in part because Huawei remains the #1 supplier in five out of the six telecom segments we track. At the same time, Huawei has lost some ground outside of China. Still, Nokia, Ericsson, and Huawei were the top 3 suppliers outside of China in 2022, accounting for around 20%, 18%, and 18% of the market, respectively.

Editor’s Note:

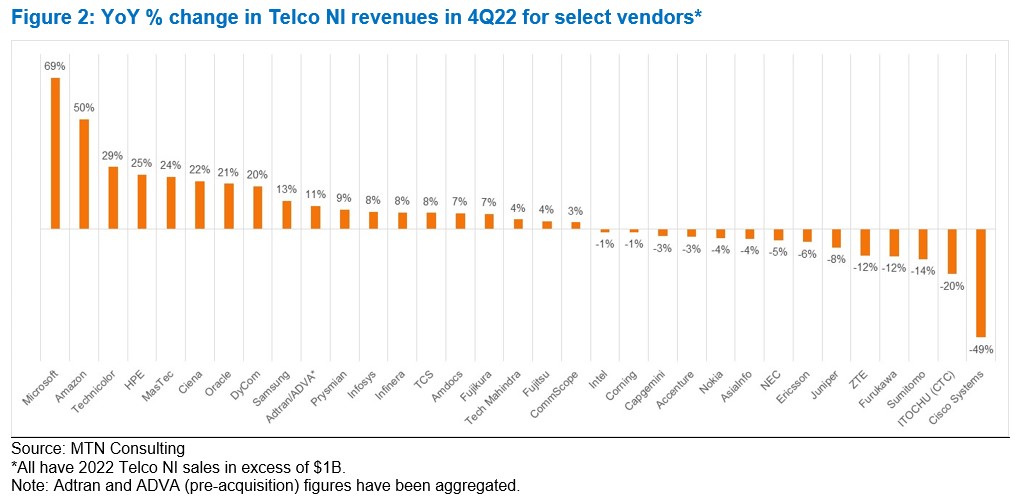

MTN Consulting recently noted that network spending was starting to flatten in the telco segment. In 3Q22, telco capex dipped 5% YoY, the first decline since 4Q20. The vendor market also weakened in 3Q22, as Telco Network Infrastructure (NI) vendor revenues grew just 2% after seven straight quarters of much stronger growth. Now we have a solid set of preliminary results for 2022’s final three months, 4Q22. For the 105 vendors available, Telco NI revenues fell by 1% YoY in 4Q22; this is the first decline for this group of Telco NI vendors since 2Q20, when COVID shut down economies. For CY2022, Telco NI grew just 2% YoY, down from +9% in 2021, when telcos splurged post-COVID, and the 5G RAN market saw a nice run-up. Among the larger reporting vendors, the best 4Q22 Telco NI growth was recorded at the three cloud providers (AWS, Azure, and GCP); engineering services companies Dycom and MasTec; NEPs Calix, Ciena, Samsung, and Technicolor (now Vantiva). New vendor Rakuten Symphony recorded the best overall growth rate in 4Q-2022, with revenues of $180M up 193% YoY. On the other side, Cisco, Ericsson, and ZTE saw the worst declines in 4Q-2022, due in part to a downswing in spending among their largest customers.

For the overall market, some of the decline seen in 4Q-2022 was inevitable, as telcos slow down their initial 5G network buildouts. Other negatives include higher interest rates, higher energy costs, weak economic growth, cloud alternatives to network builds, and 5G’s inability to deliver services revenue growth. Revenue guidance for 2023 from key vendors suggests a flat to slightly down market, as telcos absorb capacity and continue to wrestle with these challenges. Capex guidance from telcos is consistent.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Following five consecutive years of growth, the Dell’Oro Group believes there is more room left in the tank. Collectively the analyst team is forecasting the overall telecom equipment market to increase 1% in 2023 and record a sixth consecutive year of growth. Risks are broadly balanced and the analysts will continue to monitor the 5G rollouts in India, capex cuts in the US, and 5G slowdown in China (preliminary data by MIIT suggest new 5G BTS volumes will drop by a third in 2023 relative to 2022), wireless and broadband investments in Europe, forex fluctuations, and inventory optimization.

*Telecommunications Infrastructure programs covered at Dell’Oro Group, include Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch.

References:

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

UAE’s “etisalat by e&” announces first software defined quantum satellite network

Dubai’s etisalat by e& today announced the implementation of the Eutelsat quantum satellite solution, becoming the first telco in the country to expand “5G” network capabilities (NOTE: there are no standards for satellite 5G RAN- only for terrestrial RAN, e.g. ITU-R M.2150 and 3GPP Release 15-17) over a software-defined satellite network.

This deployment was a result of rigorous testing with customers for over a year to rapidly scale up the 5G mobile network deployment. etisalat by e& implemented Eutelsat’s latest technology Quantum satellite with the recently installed state-of-the-art Newtech Dialog Hub enhancing the mobile network capability.

“With the demand for ‘always-on’ connectivity as technologies like IoT, AI and blockchain make a bigger impact on consumer lives, satellite connectivity can empower communities and business in this rapidly evolving digital landscape,” said Khalid Murshed, Chief Technology and Information Officer, etisalat by e& UAE. “With the deployment of this satellite solution and technology, our customers will be able to access their data at 5G speeds even when terrestrial connectivity is unavailable, marking another important step towards the regions’ 5G adoption and bridging the digital divide,” he added.

Image Credit: e&, formerly known as Etisalat Group

………………………………………………………………………………………………………………………………………………………………………

“Eutelsat are proud to partner with etisalat by e& to deploy this 5G use case on the world’s first Software Defined satellite network,” said Ghassan Murat, Head of Connectivity Business Unit for Middle East, Africa and Asia Pacific, Eutelsat. “Our fully steerable beams are capable of meeting the most rigorous demands of Next Generation mobile and satellite networks.”

Oscar Garcia, Business Marketing and Product Innovation, etisalat by e&, said, “The need for connectivity has grown beyond traditional communications with customers wanting to access the highest speeds in the network to meet their requirements and demands for bandwidth-intensive applications such as GSM services, Remote IT, Unified communications, OTT, and media streaming among others.. The testing and implementation of this satellite solution greatly enhances the mobile network capability to address the futuristic development of new age applications while being able to build and deploy 5G use cases for various industry verticals and business.”

References:

https://eand.com/en/etisalat-uae.jsp

AST SpaceMobile Deploys Largest-Ever LEO Satellite Communications Array

European Space Agency & UK Space Agency chose EnSilica to develop satellite communications chip for terminals

FCC grants Amazon’s Kuiper license for NGSO satellite constellation for internet services

Bullitt Group & Motorola Mobility unveil satellite-to-mobile messaging service device

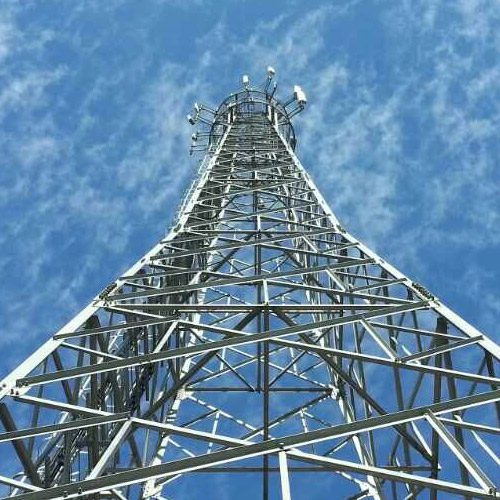

China Tower had ~2.1M telecom towers installed with 3.36M tower tenants at end of 2022

China Tower ended 2022 with 2.05 million telecom towers installed, representing a net increase of 17,000 sites from the end of 2021. The company installed approximately 745,000 5G base-stations during the year, with more than 96 percent of sites delivered through sharing existing network infrastructure. Through the end of 2022, China Tower reported that it has received cumulative orders of nearly 1.8 million new 5G cell sites. The total tower tenants rose by 102,000 in the year to 3.36 million, pushing the average number per tower from 1.62 as of the end of 2021 to 1.65 at end-2022.

China Tower primarily serves the country’s state-owned telecommunications service providers (TSP) – China Mobile, China Telecom, China Unicom, and China Broadnet. The four TSPs accounted for a total of nearly 3.4 million tower tenants, a 102,000 year-over-year increase. The TSP tenancy ratio increased from 1.60 to 1.65 over the same period last year, showing a continuous increase in the level of site colocation.

Operating revenue for 2022 reached $13.4 billion, up 6.5 percent YoY. Revenue from the TSP segment was $12.0 billion, up by 3.5 percent over the same period last year, and accounting for 90 percent of operating revenue. The TSP business comprises revenue from towers and indoor distributed antenna system (DAS) business. Towers contributed $11.3 billion, up nearly 2 percent, while DAS revenue was $845 million, a 34 percent YoY increase. Capital expenditures for new tower builds and site augmentation was $3.0 billion in 2022, up 5 percent over nearly $2.9 billion in 2021.

The company sees “5G + DAS” as its dual-growth engines, with DAS as the fastest growing segment. The DAS business focuses on providing 5G coverage under various scenarios in key sectors including education, cultural tourism, transportation, and healthcare, with an integrated approach to coordinating resources and demands.

At year-end 2022, China Tower’s DAS deployments covered buildings with a cumulative area of 7,390 million square meters, representing a 48 percent YoY increase. The company expanded DAS coverage to 10,429 kilometers in high-speed railway tunnels and to 9,611 kilometers in subways, coverage reaching a cumulative length of 20,040 kilometers, up 19 percent from a year ago.

China Tower has Commercial Pricing Agreements and Service Agreements with each of the TSPs. In a statement, the company reiterated its commitment to meeting its TSP customer network construction needs using innovative construction and service models that provide low-cost and efficient coverage.

Zhang Zhiyong, chairman of China Tower said: “Looking ahead, we will remain focused on grasping the opportunities brought by the development of 5G new infrastructure, the digital economy, and the green-oriented transition of energy. With a focus on “Digital Tower,” our Smart Tower business growth accelerated. Serving the national strategic goals.”

Tower business. China Tower advocated for the inclusion of 5G base-station sites in development planning and played an active role in setting the wireless communications specifications for buildings. Complying with these specifications, we have been included in the administrative approval process for new construction projects, further strengthening our ability to coordinate and share resources. We launched innovative low-cost construction solutions to sharpen our capability in providing integrated wireless communications coverage solutions. A higher level of resource sharing enabled us to comprehensively satisfy customer demand for 5G construction. We completed approximately 745,000 5G base-stations during the year, of which more than 96% were delivered through sharing existing resources. In addition, we focused our efforts on tackling difficult sites and continued to enhance our service quality. Alongside an improving capability in site maintenance, customer satisfaction grew. In 2022, our Tower business generated revenue of RMB77,204 million, or year-on-year growth of 1.8%. As of 31 December 2022, we managed 2.055 million tower sites, representing a net increase of 17,000 sites from the end of 2021. The number of TSP tenants reached 3.362 million, an increase of 102,000 from the end of 2021, and the TSP tenancy ratio also increased from 1.60 to 1.65 over the same period of last year, showing a continuous increase in the level of site co-location.

DAS business. China Tower focused on providing 5G coverage for key scenarios and key sectors including education, cultural tourism, transportation and healthcare, with an integrated approach to coordinating resources and demands. Playing an important role in coordinating site entry and construction, we were able to take up all DAS construction demand for key venues, scenarios and sectors, providing customers with differentiated and diversified indoor coverage solutions. In addition, we stepped up innovation to develop sharable DAS products and solutions. We enhanced our professional capabilities to optimize our advantages in providing low-cost and green and low-carbon DAS solutions, complemented by our quality services, driving accelerated growth in the DAS business. This business has increasingly become the second growth engine of our development. In 2022, our DAS business recorded revenue of RMB5,827 million, representing a year-on-year increase of 34.3%. As of 31 December 2022, we had covered buildings with a cumulative area of 7,390 million square meters, representing a year-on-year increase of 48.1%. Our high-speed railway tunnels and subway coverage reached a cumulative length of 20,040.2 kilometers, a year-on-year increase of 18.5%.

Grasping strategic opportunities to boost strong growth in Two Wings business:

By leveraging the opportunities brought forth by the growth of the “digital economy” and the “dual carbon” goals, we focused on product innovation and business optimization to fortify our competitive advantages. As a result, the Two Wings business sustained a robust growth trajectory with revenue in 2022 reaching RMB8,904 and accounting for 9.7% of our overall operating revenue, an increase of 2.6 percentage points from the same period in 2021. The business contributed 49.7% to our incremental operating revenue for the year, an increase of 9.7 percentage points year-on-year, further solidifying our multi-pillar business development structure.

Image courtesy of China Tower

…………………………………………………………………………………………………………………………………………………………………………………………

China’s wireless network operators had deployed a total of 2.29 million 5G base stations nationwide as of the end of November, according to the latest available data from China’s Ministry of Industry and Information Technology. This figure represents an increase of 862,000 compared to the end of 2021 and accounts for 21.1% of all mobile base stations in the country.

Chinese operators recorded a net gain of 16.53 million 5G subscribers in January, according to the operators’ latest available statistics. China Mobile, the world’s largest operator in terms of subscribers, added a total of 8.46 million 5G subscribers during the first month of the year. The carrier said it ended last month with 622.47 million 5G subscribers. China Mobile added a total of 227.2 million subscribers in the 5G segment during 2022.

Meanwhile, China Telecom added 5 million 5G subscribers last month to take its total 5G subscribers base to 273 million. During 2022, the telco added a total of 80.16 million 5G subscribers.

Rival operator China Unicom said it added a total of 3.07 million 5G subscribers during last month. The carrier ended January with 215.8 million 5G subscribers. China Unicom added over 42 million subscribers in the 5G segment during 2022.

…………………………………………………………………………………………………………………………………………………………………………………………

References:

China MIIT claim: 475M 5G mobile users, 1.97M 5G base stations at end of July 2022

China’s MIIT to prioritize 6G project, accelerate 5G and gigabit optical network deployments in 2023

Nokia and Kyndryl extend partnership to deliver 4G/5G private networks and MEC to manufacturing companies

Following their first partnership one year ago, Nokia and Kyndryl have extended it for three years after acquiring more than 100 customers for automating factories using 4G/5G private wireless networks as well as multi-access edge computing (MEC) technologies. Nokia is one of the few companies that have been able to get any traction in the private 4G/5G business which is expected to grow by billions of dollars every year. The size of the global private 5G network market is expected to reach $41.02 billion by 2030 from 1.38 billion in 2021, according to a study by Grand View Research.

The companies said some customers were now coming back to put private networks into more of their factories after the initial one. “We grew the business significantly last year with the number of customers and number of networks,” Chris Johnson, head of Nokia’s enterprise business, told Reuters.

According to the companies, 90% of those engagements—which span “from advisory or testing, to piloting, to full implementation”—are with manufacturing firms. In Dow Chemical’s Freeport, Texas, manufacturing facility which is leveraging a private LTE network using CBRS frequencies to cover 40 production plants over 50-square-kilometers. The private wireless network increased worker safety, enabled remote audio and video collaboration, personnel tracking, and vehicle telematics, the companies said. Dow Chemical is now planning to expand the same coverage to dozens of its factories, said Paul Savill, Kyndryl’s [1.] global practice leader. “Our pipeline has been growing fundamentally faster than it has been in the last 12 months,” he said. “We now have over 100 customers that we’re working with in the private wireless space … in around 24 different countries.”

Note 1. After getting spun off from IBM in 2021, Kyndryl has focused on building its wireless network business and has signed several agreements with cloud providers.

The current active engagements are across more than 24 countries, including markets like the U.S. where regulators have set aside spectrum assets for direct use by enterprises; this means it’s increasingly possible for buyers to access spectrum without the involvement of mobile network operators.

“As enterprises seek to accelerate and deliver on their journeys towards Industry 4.0 and digitalization, the effective integration and deployment of advanced LTE and 5G private wireless networking technologies becomes instrumental to integrate all enterprise operations in a seamless, reliable, efficient and built in a secure manner,” said Alejandro Cadenas, Associate Vice President of Telco and Mobility Research at IDC. “This expanding, powerful, relationship between Nokia and Kyndryl is a unique combination of vertical and horizontal capabilities, and offers IT, OT and business leaders access to the innovation, tools, and expert resources they need to digitally transform their operations. The partnership offers a compelling shared vision and execution that will enable customers across all industries and geographies to access the ingredients they need to deliver against the promise of digital acceleration, powered by network and edge computing.”

The expanded effort will be enhanced with Kyndryl’s achievement of Nokia Digital Automation Cloud (DAC) Advanced accreditation status, which helps ensure that enterprise customers benefit from an expanded lineup of expert resources and skilled practitioners who have extensive training and deep understanding of Nokia products and solutions. In addition, customers will gain access to Kyndryl’s accelerated network deployment capabilities and support of Nokia cellular radio expertise in selected markets.

In response to a question about how direct enterprise access to spectrum has informed market-by-market activity, Kyndryl Global Practice Leader of Network and Edge Paul Savill told RCR Wireless News in a statement, “Spectrum availability is rapidly becoming less of a barrier, with governments allocating licensed spectrum for industrial use and the emergence of unlicensed wireless networking options (such as CBRS in the US, and MulteFire).”

The companies have also developed automated industrial drones that can monitor a site with different kinds of sensors such as identifying chemicals and video recognition as part of surveillance. While drones have not yet been deployed commercially yet, customers are showing interest in rugged, industrialized non-stop automated drone surveillance, Johnson said.

References:

Nordic Semiconductor announces ICs & development kits for low power Wi-Fi 6 IoT applications

Nordic Semiconductor today announced the availability of the nRF7002™ Wi-Fi 6 companion IC and its associated nRF7002 Development Kit (DK). The IC is the first in Nordic’s Wi-Fi product family and is a low power Wi-Fi 6 companion IC providing seamless dual band (2.4 and 5 GHz) connectivity. The nRF7002 IC can be used together with Nordic’s award-winning nRF52® and nRF53® Series multiprotocol Systems-on-Chip (SoCs) and the nRF9160™ cellular IoT (LTE-M/NB-IoT) System-in-Package (SiP), but can equally be used in conjunction with non-Nordic host devices. The DK makes it easy for developers to get started on nRF7002-based IoT projects.

The nRF7002 complements Nordic’s cellular IoT and multiprotocol wireless solutions. By using the new IC, developers can leverage Wi-Fi 6’s higher throughput and ubiquitous domestic and industrial infrastructure when developing IoT applications. Design support through Nordic’s unified software development kit, nRF Connect SDK, and the nRF7002 DK make it easier and quicker to launch new products.

Wi-Fi 6 brings significant benefits to IoT applications—such as smart-home products, industrial sensors, asset trackers, and wearables—including power efficiency gains for battery powered Wi-Fi operation, and management of large IoT networks comprising hundreds of devices.

“The nRF7002 Wi-Fi 6 companion IC is a testament to Nordic Semiconductor’s leadership in low-power wireless technology,” says Svein-Egil Nielsen, CTO/EVP of R&D and Strategy at Nordic. “This highly integrated and flexible solution will empower developers to create new, innovative Wi-Fi 6-enabled products. Supported with the nRF7002 DK and the award-winning nRF Connect SDK, combined with Nordic’s best in class technical support, I believe it has never been easier to develop great Wi-Fi products.”

“The nRF7002 is designed to work alongside Nordic’s nRF52 and nRF53 Series making it a perfect fit for Matter, a smart-home standard backed by Amazon, Apple, Google, Nordic, Samsung, and hundreds of other companies,” says Finn Boetius, Product Marketing Engineer with Nordic. “The introduction of the IC and the nRF7002 DK now makes it easy for developers to get started on Matter and any other Wi-Fi based applications.” Matter uses Thread and Wi-Fi for data transport, and Bluetooth LE for commissioning.

The nRF7002 brings low power and secure Wi-Fi to the IoT. The dual-band IC complies with Station (STA), Soft Access Point (AP), and Wi-Fi Direct operation, and meets the IEEE 802.11b, a, g, n (“Wi-Fi 4”), ac (“5”), and ax (“6”) Wi-Fi standards. The product also offers excellent coexistence with Bluetooth LE, Thread, and Zigbee. The nRF7002 supports Target Wake Time (TWT) a key Wi-Fi 6 power saving feature. Interfacing with a host processor is done via Serial Peripheral Interface (SPI) or Quad SPI (QSPI). The IC offers a single spatial stream, 20 MHz channel bandwidth, 64 QAM (MCS7), OFDMA, up to 86 Mbps PHY throughput, and BSS coloring.

In addition to its suitability for general IoT applications and Matter, the nRF7002 is the ideal choice for implementing low power SSID-based Wi-Fi locationing when used together with Nordic’s nRF9160 SiP and the company’s nRF Cloud Location Services. SSID-based Wi-Fi locationing supplements GNSS- or cell-based locationing by providing accurate positioning indoors and in places with a high density of Wi-Fi access points.

nRF7002 DK supports development of low power Wi-Fi applications:

The introduction of the nRF7002 is accompanied by the launch of the nRF7002 DK, a development kit for the Wi-Fi 6 companion IC. The DK includes an nRF7002 IC and features an nRF5340 multiprotocol SoC as a host processor for the nRF7002. The nRF5340 embeds a 128 MHz Arm Cortex-M33 application processor and a 64 MHz high efficiency network processor. The DK supports the development of low-power Wi-Fi applications and enables Wi-Fi 6 features like OFDMA, Beamforming, and TWT. The DK includes: Arduino connectors; two programmable buttons; a Wi-Fi dual-band antenna and a Bluetooth LE antenna, and current measurement pins.

nRF7002 DK – Development Kit for nRF7002 Wi-Fi 6 IC:

.png?h=754&iar=0&mw=350&w=350&hash=1DF0EC6A97E1329DCCD435B7FDBF0B90)

Source Nordic Semiconductor

Together with the DK, developing nRF7002-based designs is made simpler by the support for the IC in the nRF Connect SDK, Nordic’s scalable and unified software development kit for building products based on the company’s wireless devices. With the nRF7002 IC, nRF7002 DK, and nRF Connect SDK, developers can quickly and easily add Wi-Fi connectivity to their products, allowing them to connect to the Internet and communicate with other devices over a Wi-Fi network. Example applications for the nRF7002 DK are included with nRF Connect SDK.

The nRF7002 companion IC and nRF7002 DK are available now from Nordic’s distribution partners.

……………………………………………………………………………………………………………………………………………………….

References:

https://www.nordicsemi.com/Products/nRF7002

https://www.nordicsemi.com/Products/Development-hardware/nRF7002-DK

Fortinet and Palo Alto Networks are leaders in Gartner Magic Quadrant for Network Firewalls

Gartner defines the network firewall market as the market for firewalls that use bidirectional stateful traffic inspection (for both egress and ingress) to secure networks. Network firewalls are enforced through hardware, virtual appliances and cloud-native controls. Network firewalls are used to secure networks. These can be on-premises, hybrid (on-premises and cloud), public cloud or private cloud networks. Network firewall products support different deployment use cases, such as for perimeters, midsize enterprises, data centers, clouds, cloud-native and distributed offices.

-

Cloud firewalls: These firewalls from cloud infrastructure vendors are designed for cloud-native deployment as separate virtual instances or in containers. Container firewalls can also secure connections between containers.

-

Hybrid mesh firewalls: These are platforms that help secure hybrid environments by extending modern network firewall controls to multiple enforcement points, including FWaaS and cloud firewalls, with centralized management via a single cloud-based manager.

-

Firewall as a service (FWaaS): A FWaaS is a multifunction security gateway delivered as a cloud-based service, often to protect small branch offices and mobile users.

-

Networking: This includes support for routing tables with destination network address translation (DNAT) and static network address translation (SNAT) capability.

-

Stateful inspection: This enables inspection of traffic based on stateful firewall rules.

-

Threat detection and inspection: This includes intrusion prevention system (IPS) and malware inspection capabilities.

-

Web filtering: This includes filtering of outbound traffic for HTTP and HTTPS and applications.

-

Advanced logging and reporting: All actions of firewall administrators can be logged, and reports can be customized and run based on different object types and traffic types. Threat-based and web-filtering-based granular reports can be generated.

-

Internet of Things (IoT) security: This is achieved either using a module built into threat detection controls or via a dedicated subscription integrated within network firewall offerings. Specific features may include discovery of IoT devices, risk analysis and dedicated rules to block attacks related to these devices. Also, IoT signatures as a part of IPS signature base.

-

Network sandboxing: Network sandboxing monitors network traffic for suspicious objects and automatically submits them to the sandbox environment, where they are analyzed and assigned malware probability scores and severity ratings.

-

Zero trust network access (ZTNA): Zero trust network access (ZTNA) makes possible an identity- and context-based access boundary between any user and device to applications.

-

Operational technology (OT) security: This includes integrated or dedicated features related to protecting an OT environment. Stand-alone OT security offerings are not considered here. Features may include dedicated OT-related threat intelligence, dedicated IPS signatures for OT devices, support for supervisory control and data acquisition (SCADA) applications and threat inspection.

-

Domain Name System (DNS) security: This secures traffic to DNS by offering monitoring, detection and prevention capabilities against DNS layer attacks.

-

Software-defined wide-area network (SD-WAN): This provides dynamic path selection, based on business or application policy, centralized policy and management of appliances, virtual private network (VPN), and zero-touch configuration

As network firewalls evolve into hybrid mesh firewalls with the emergence of cloud firewalls and firewall-as-a-service offerings, selecting the most suitable vendor is a challenge. Gartner assessed 17 Network Firewall vendors to help security and risk management leaders make the right choice for their organization.

…………………………………………………………………………………………………………………………………………………….

Fortinet was recognized in 2022 Gartner® Magic Quadrant™ for Network Firewalls for the 13th time. It leads for appliance-based distributed-office use cases, thanks to its offer of mature SD-WAN and firewall capabilities in a single box.

The company’s FortiGate Next-Generation Firewalls deliver seamless AI/ML-powered security and networking convergence over a single operating system (FortiOS) and across any form factor. This includes hardware appliances, virtual machines, and SASE services.

-

Integrated SD-WAN: Fortinet offers built-in advanced SD-WAN and routing capabilities in FortiGate firewall appliances. Fortinet offers a complete SD-WAN package, with features including forward error correction, packet duplication, and intelligent and dynamic app routing.

-

Hybrid ZTNA deployment: Fortinet offers flexible ZTNA deployment modes. ZTNA enforcement is part of the FortiGate operating system (FortiOS) and can be deployed on-premises or as a service as part of FortiSASE (a stand-alone offering). The vendor has also introduced an in-line CASB integrated with ZTNA capabilities.

-

Product portfolio: Fortinet has a large product portfolio. It offers products for networking, network security and security operations. The majority of its products can be managed through a single management interface and offer integration through the Fortinet Security Fabric.

-

Centralized management: Fortinet offers mature on-premises and cloud-based centralized management through FortiManager and FortiCloud, respectively. These offerings have feature parity and support centralized management of the majority of Fortinet’s devices. FortiGate customers like the ease of management and configuration of Fortinet’s firewalls.

FortiGate NGFWs offer (Source: Fortinet):

- Powerful security and networking convergence. Secure networking services like SD-WAN, ZTNA, and SSL decryption are included – no need for extra licensing.

- Best price-per-performance. Our unique ASIC architecture delivers the highest ROI plus hyperscale support and ultra-low latency.

- AI/ML-powered threat protection. Multiple AI/ML-powered security services stop advanced threats and prevent business disruptions.

……………………………………………………………………………………………………………………………………

Palo Alto Networks was among the 17 vendors that Gartner evaluated for its 2022 Magic Quadrant for Network Firewalls, which evaluates vendors’ Ability to Execute as well as their Completeness of Vision. Palo Alto Networks believes its vision of offering best-in-class security as part of an integrated network security platform, combined with its commitment to customer success, has helped the company earn a Leader position for the 11th consecutive year.

“From the industry’s first Next-Generation Firewall in 2007 to the most recently announced PAN-OS 11.0 Nova, Palo Alto Networks relentless innovation helps provide powerful protection for customers. We are honored to be recognized as a Leader in eleven consecutive Gartner Magic Quadrant for Network Firewalls reports,” said Anand Oswal, senior vice president for Products, Network Security. “We believe this recognition by Gartner is a testament to both our innovation, using ML and AI to stop the most evasive threats, and our ability to simplify network security for our customers with a consolidated platform approach.”

Palo Alto Networks believes its leader position in network firewalls is fueled by:

- Best-in-class security that prevents zero-day threats: Modern malware is now highly evasive and sandbox-aware. To address this, the recently announced PAN-OS 11.0 Nova introduced the new Advanced WildFire® cloud-delivered security service, which provides unprecedented protection against evasive malware. Advanced Threat Prevention (ATP) now helps protect against zero-day injection attacks in addition to highly evasive command-and-control communications. Additionally, Advanced URL Filtering offers industry-first prevention of zero-day web attacks with inline machine learning capabilities.

- Strength in SASE: The industry’s most complete SASE solution, Prisma® SASE simplifies secure access by connecting all users and locations with all apps from a single product. The superior security of ZTNA 2.0 protects both access and data to dramatically reduce the risk of a data breach, while a cloud-native architecture with integrated Autonomous Digital Experience Management (ADEM) provides exceptional user experiences.

- Helping customers improve their security posture: Palo Alto Networks AIOps helps customers adopt best practices with guided recommendations, reduce misconfigurations that can lead to security breaches, and predict network-impacting issues before they occur. AIOps, launched earlier this year, now processes 49 billion metrics monthly across 60,000 firewalls and proactively shares 24,000 misconfigurations and 17,000 firewall health and other issues with customers for resolution every month.

- A comprehensive product portfolio offered as a platform: Palo Alto Networks offers multiple cloud-delivered security services that work together to prevent attacks at every stage of the attack lifecycle. These security services are offered as part of a network security platform, which makes it easy for customers to consume these services while consistently protecting their data centers, branch offices and mobile workers as well as applications in multicloud and hybrid environments with best-in-class security everywhere.

Since the Gartner evaluation, Palo Alto Networks has further strengthened its NGFW capabilities with the announcement of the latest version of its industry-leading PAN-OS® software, PAN-OS 11.0 Nova. The innovations announced also included the new Advanced WildFire cloud-delivered security service, which brings unparalleled protection against evasive malware, enhancements in the Advanced Threat Prevention service and new fourth-generation ML-powered NGFWs. The company has also taken strides to enhance its customer support experience and grown its Global Customer Service organization.

To learn more about Palo Alto Networks recognition in the 2022 Gartner Magic Quadrant for Network Firewalls, please visit:

https://www.paloaltonetworks.com/blog/2022/12/gartner-leader-11-straight-times/

To read a complimentary copy of the 2022 Gartner Magic Quadrant for Network Firewalls, please visit:

https://start.paloaltonetworks.com/gartner-mq-for-firewalls.html

Register for the Palo Alto Networks PAN-OS 11.0 Nova launch event here:

https://start.paloaltonetworks.com/nova

To learn more about the Palo Alto Networks Next-Generation Firewall platform, visit:

https://www.paloaltonetworks.com/products/secure-the-network/next-generation-firewall

References:

https://www.gartner.com/reviews/market/network-firewalls

https://www.gartner.com/doc/reprints?id=1-2C62ETHZ&ct=230103&st=sb

https://www.fortinet.com/solutions/gartner-network-firewalls