Samsung Electronics wins $6.6B wireless network equipment order from Verizon; Galaxy Book Flex 5G

Samsung Electronics said on Monday it had won a $6.64 billion order to provide wireless communication solutions to Verizon in the United States, a major win for the South Korean firm in the next-generation 5G network market. Samsung’s local unit Samsung Electronics America signed the agreement with Verizon Sourcing, a subsidiary of Verizon Communications, to offer network products for the wireless carrier through the end of 2025. This includes providing, establishing and maintaining the company’s 5G mobile telecom equipment.

…………………………………………………………………………………………………………………………………………………………………………….

Sidebar: Nokia on the sidelines:

Nokia’s biggest customer is Verizon, JP Morgan research said in a July note to clients. Yet Nokia didn’t win any part of the new Verizon 5G order. That was predicted by Rosenblatt analyst Ryan Koontz, who said in July “Samsung will “leapfrog Nokia to secure one of the largest new supplier telecom contracts in many years.”

Nokia wrote in an email, “We do not comment on our customers’ vendor strategy. Nokia is proud to serve Verizon, and we are committed to continuing to help them build the best, most reliable and highest performing network. Nokia and Verizon have a longstanding strategic partnership in key technologies across their network with our end-to-end solutions portfolio.”

…………………………………………………………………………………………………………………………………………………………………………….

Samsung’s global prospects for its network business have improved following U.S. sanctions on its bigger rival Huawei , analysts said. The Trump administration last month unveiled plans to auction off spectrum previously dedicated to military purposes for commercial use starting in mid-2022, to ramp up fifth-generation network coverage in the United States. In July, the UK ordered Huawei equipment to be purged completely from its 5G network by the end of 2027, adding it needs to bring in new suppliers like Samsung Electronics and Japan’s NEC Corporation.

Verizon CEO Hans Vestberg told CNBC in July last year that Verizon does not use any Huawei equipment. Verizon had already been a Samsung customer before the order. Vestberg’s statement about no Huawei gear is not true, as Light Reading and other websites noted on Friday.

The FCC requested information about “the presence or use of Huawei or ZTE equipment and/or services in their networks, or in the networks of their affiliates or subsidiaries.”

The FCC’s goal is to determine how many US companies use equipment from Huawei or ZTE – the equipment has been deemed a threat to national security – and how much it might cost to replace that gear with equipment from “trusted” suppliers.

On Friday, the FCC published a list of companies that reported they have existing Huawei or ZTE equipment and services.

Three of the nation’s five biggest wireline phone providers (Verizon, CenturyLink and Windstream) have admitted to having equipment from Huawei or ZTE, according to Leichtman Research Group.

“Verizon’s networks do not include equipment from any untrusted vendors. In addition, the company is not seeking funds from the FCC to replace equipment,” a Verizon representative wrote in response to questions from Light Reading. “Verizon has a relatively small number of devices, called VoiceLink, which were made by Huawei and are used by some customers to make voice calls. There are no data services associated with these devices. Earlier this year, Verizon started replacing these units. That effort was temporarily halted by the pandemic and is now underway again. We expect to have all Voicelink devices fully retired by the end of the year.”

“Samsung winning the order from Verizon would help the company expand its telecom equipment business abroad, potentially giving leverage to negotiate with other countries,” Park Sung-soon, an analyst at Cape Investment and Securities told Reuters.

The order is for network equipment, a Samsung spokesman said. The company declined to comment on detailed terms the contract such as the portion of 5G-capable equipment included.

Verizon joined with Samsung long before 5G made its debut in smartphones last spring. In early 2018, the two firms teamed up for trial runs of 5G-powered home internet. Verizon officials have previously pledged not to use Huawei for its next-generation rollout. Samsung has supplied some network gear for prior generations including 4G LTE.

To Samsung, the deal represents a major 5G win. The contract, valued at 7.898 trillion South Korean won over five years, compares with the roughly 5 trillion won Samsung’s network business racked up in revenue in all of 2019.

Last year, 5G represented less than half of Samsung’s network business, of which U.S. carriers accounted for 10%, said S.K. Kim, a Seoul-based analyst with Daiwa Securities.

“With this latest long-term strategic contract, we will continue to push the boundaries of 5G innovation to enhance mobile experiences for Verizon’s customers,” Samsung said in a statement.

………………………………………………………………………………………………………………………………………………………………………………………….

Sidebar — Telecom Equipment Vendor Market Shares:

Samsung had a 3% market share of the global total telecom equipment market in 2019, behind No. 1 Huawei with 28%, Nokia’s 16%, Ericsson’s 14%, ZTE’s 10% and Cisco’s 7%, according to market research firm Dell’Oro Group.

Among 5G network sales, Samsung ranks No. 4 with about 13% of the total market, according to market research firm Dell’Oro Group. It trails the top three, which include China’s Huawei Technologies Co. and the European firms Ericsson AB and Nokia Corp.

Huawei said early this year that it had signed more than 90 5G contracts, and Ericsson last month touted its 100th 5G “commercial agreement.” Samsung hasn’t divulged how many 5G contracts it has signed. But it has high hopes, having invested more than $30 billion in the U.S. market alone.

………………………………………………………………………………………………………………………………………………………………………………………….

Separately, Samsung announced the Galaxy Book Flex 5G, an adaptable, 5G-powered addition to its premium laptop line. Galaxy Book Flex 5G is powered by the new 11th Gen Intel® Core™ processor with Intel® Iris® Xe graphics offering intelligent performance and powerful processing for impressive productivity and stunning entertainment, along with Wi-Fi 6 and 5G connectivity for an unparalleled laptop experience.

“Across the world, we’re being asked to adapt and change constantly, and it’s vital we have devices that move with us,” said Mincheol Lee, Corporate VP and Head of New Computing Biz Group at Samsung Electronics. “Thanks to our close collaboration with Intel, Galaxy Book Flex 5G provides users with a powerful performance, next-generation connectivity, effortless productivity and premium entertainment features, all in the form function of their choosing.”

……………………………………………………………………………………………………………………………………………………………………………………………..

References:

Tech Mahindra: “We can build and run an entire 4G and 5G or any enterprise network”

India based IT services provider Tech Mahindra says it has the capability to build and run an entire 4G or 5G network in India. The company’s partnership with Japanese greenfield telco Rakuten Mobile [1.] will help it get more meaningful business in India’s telecom industry, a senior executive said.

Note 1. Rakuten Mobile, together with NEC, is building a 5G Open RAN and cloud native 5G core network based on their own specifications. Open RAN and cloud native 5G core network are two different and independent initiatives.

“We can build and run an entire 4G and 5G or any enterprise network. We have done that already. We bring to the table our ability to design, to plan, to integrate and deploy and then to manage the entire suite of network capabilities, including designing various parts to it in a disaggregated world,” Manish Vyas – President, Communications, Media & Entertainment Business, and the CEO, Network Services, Tech Mahindra, told the Economics Times of India.

In August, the company announced German telecoms company Telefonica Deutschland had selected it for its network and services operations, in addition to further developing 5G, artificial intelligence, and machine learning use cases.

“We are pleased to announce this partnership with Tech Mahindra. We are supported by a globally experienced service provider to consistently drive forward the development of our network and services operations, thus leading to further enhancement of 5G, artificial intelligence and data analysis use cases,” said Mallik Rao, Chief Technology & Information Officer of Telefonica Deutschland.

“This strategic partnership strengthens our long-standing relationship with Telefonica, in which we support the company in realizing its vision of becoming the ‘Mobile Customer and Digital Champion’ by 2022,” said Vikram Nair, President, Europe, Middle East and Africa (EMEA) of Tech Mahindra.

In October 2019, the company launched a 5G enabled Factory of the Future solution. Nilesh Auti, Global Head Manufacturing Industry unit, Tech Mahindra, said:

“Factory equipment holds a great deal of meaningful data which is key to any successful Industry 4.0 project. Tech Mahindra’s solution in partnership with Cisco, will enable us to leverage this data and empower manufacturers to build factories of the future. As part of our TechMNxt charter we are focused on leveraging 5G technologies to address our customer’s evolving and dynamic needs, and enable them to RISETM.”

Tech Mahindra is also looking for strategic investments and acquisition in companies to further bolster its telecom product and services portfolio. The company says the following about their 5G capabilities and experience:

Tech Mahindra provides range of services that enable enterprises to establish private wireless network to span areas of operations & enable a plethora of IoT use cases. Our services remove inefficiencies related to slow, insufficient wireless connectivity & have a strong roadmap to support growing traffic demands for 5G establishment. From media to medicine we believe 5G is “The NXT of Everything.”

Tech Mahindra ccomplishments listed are these:

- 1M+ carrier grade cellular sites designed, delivered and managed

- Enabling 3 of the first 5 carrier 5G introductions in the world

- Strong Telco partnership/reach (80+ Global Tier 1 Telcos)

- 4 smart cities projects launched, Largest WIFI deployments in the world

- 5 connected vehicles engagements, 40+ Connected factories, 12000+ factory Assets

- 600+ Turbines and 100+ aircrafts connected; 2000+ remote healthcare patients supported

…………………………………………………………………………………………………………………………………………………………………………………….

References:

Verizon Trials Quantum Key Distribution for Encryption over Fiber Optic Links

Verizon has begun testing quantum key distribution (QKD) [1.], a new encryption method that uses photon properties to protect subscriber data. The company says they are the first U.S. carrier to do so, although AT&T is also exploring quantum computing applications in partnership with the California Institute of Technology. Verizon said it sent encrypted streaming video from a 5G Lab to two East Coast offices.

Note 1. Unlike number-based encryption methods used today, QKD creates keys based on the quantum properties of photons, making it much harder for even advanced computing systems to crack. QKD could be applied to exchange a key between the two ends of a communication. QKD provides protection against the threat posed by quantum computing to current cryptographic algorithms and provides a high level of security for the exchange of data.

An article by ITU-T SG13 chair Leo Lehmann, PhD, described new ITU-T Recommendations related to IMT 2020 and Quantum Key Distribution. ITU-T SG13 has published two new recommendations for networks to support quantum key distribution (QKD) [1] :

- Y.3800 (Y.QKDN_FR) Overview on networks supporting quantum key distribution

- Y.3801 (Y.QKDN_req) Functional requirements for quantum key distribution networks

Y.3800 describes the basic conceptual structures of QKD networks as the first of a series of emerging ITU standards on network and security aspects of quantum information technologies. SG13 standards for QKD networks – networks of QKD devices and an overlay network – will enable the integration of QKD technology into large-scale ICT networks.

Complementing these activities, ITU-T SG17 standards provide recommendations for the security of these QKD networks.

Image depicting Quantum Cryptography

……………………………………………………………………………………………………………………………………………………………………………………….

Verizon is exploring the physics of the ultra small which could help protect encrypted network connections.

“A QKD network derives cryptographic keys using the quantum properties of photons to prevent against eavesdropping,” Verizon said. It’s also using a quantum random number generator to continuously generate encryption keys.

In the trial, Verizon said it used QKD to encrypt and send a video stream between its 5G Lab and two of its offices in Virginia and Washington DC. Specifically, live video was captured outside of three Verizon locations in the D.C. area, including the Washington DC Executive Briefing Center, the 5G Lab in D.C and Verizon’s Ashburn, Virginia office.

Using a QKD network, quantum keys were created and exchanged over a fiber optic network between Verizon’s locations. Video streams were encrypted and delivered more securely allowing the recipient to see the video in real-time while instantly exposing hackers. A QKD network derives cryptographic keys using the quantum properties of photons to prevent against eavesdropping.

Though the test was conducted over its fiber network, a Verizon representative told Mobile World Live the operator is also aiming to use the technology in their mobile networks.

Verizon also demonstrated that data could be further secured with keys generated using a Quantum Random Number Generator (QRNG) that, as the name suggests, creates random numbers that can’t be predicted. With QKD, encryption keys are continuously generated and are immune to attacks because any disruption to the channel breaks the quantum state of photons, which signals that eavesdroppers are present.

“The use of quantum mechanics is a great step forward in data security,” said IDC Analyst Christina Richmond, in a statement. “Verizon’s own tests, as well other industry testing, have shown that deriving ‘secret keys’ between two entities via light photons effectively blocks perfect cloning by an eavesdropper if a key intercept is attempted.

“Current technological breakthroughs have proven that both the quantum channel and encrypted data channel can be sent over a single optical fiber. Verizon has demonstrated this streamlined approach brings greater efficiency for practical large-scale implementation allowing keys to be securely shared over wide-ranging networks.”

Verizon chief product development officer Nicola Palmer stated the test was part of an effort to “discover new ways to ensure safe networks and communications” for consumers and enterprises. “Quantum-based technology can strengthen data security today and in the future,” she said.

Verizon outlined additional work focused on 5G security, including tests of a system using AI and machine learning to detect anomalies in the network and analyse cell site performance; network accelerators to mitigate increases in latency caused by security functions; and a credential management system for connected vehicles.

References:

https://www.cnet.com/news/verizon-reveals-quantum-networking-trials/

https://www.fiercetelecom.com/telecom/verizon-tunes-up-quantum-technology-trial-to-bolster-security

Quantum Cryptography Demystified: How It Works in Plain Language

New ITU-T SG13 Recommendations related to IMT 2020 and Quantum Key Distribution

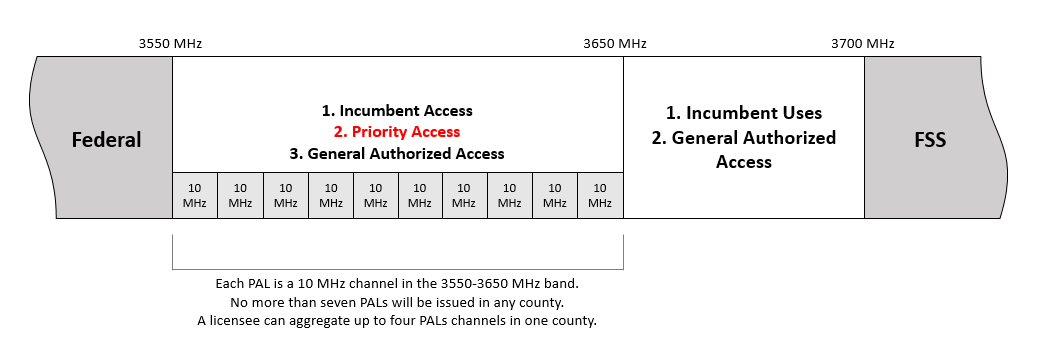

Cablecos join telcos in winning FCC auction 105 bids in 3550-3650 MHz band; Buildout

Cable companies (aka MSOs) joined Verizon and Dish Network among the top bidders in the Federal Communications Commission’s (FCC’s) latest auction of cellular spectrum licenses, according to FCC data released Wednesday. The FCC auction, which began on July 23 and wrapped up on August 25, offered 70 megahertz of Priority Access Licenses (PALs) in the 3550-3650 MHz band. In total, the FCC auction 105 generated $4,585,663,345 from 228 bidders who won a total of 20,625 licenses.

Verizon, the country’s largest cellphone carrier, topped the list with $1.89 billion in winning bids for licenses in the 3.55 gigahertz band, according to the commission.

- Dish unit Wetterhorn Wireless LLC bid about $913 million.

- Wireless units of Charter Communications Inc., Comcast Corp. and Cox Communications Inc. followed with winning bids of $464 million, $459 million and $213 million, respectively.

- Cellphone carrier T-Mobile US bid less than $6 million in the auction.

- AT&T did not bid.

The FCC said winning bidders have until September 17 to submit a down payment totaling 20 percent of their winning bid(s). Full payment is due by October 1, 2020.

The licenses were considered highly valuable (3.5GHz spectrum) but complicated by a sharing arrangement that allowed some companies to use nearby frequencies without an exclusive license. The military also uses the spectrum band, though radio engineers consider the likelihood of interference from naval radar low in most of the U.S.

Image Credit: FCC

………………………………………………………………………………………………………………………………………………………..

A frequency coordinator called a Spectrum Access System (SAS) will assign the specific channel(s) for a particular licensee on a dynamic basis. Although a Priority Access Licensee may request a particular channel or frequency range from an SAS following the auction, they are not guaranteed a particular assignment, and an SAS may dynamically reassign a PAL to a different channel as needed to accommodate a higher priority Incumbent Access user. To the extent feasible, an SAS will “assign geographically contiguous PALs held by the same Priority Access Licensee to the same channels in each geographic area” and “assign multiple channels held by the same Priority Access Licensee to contiguous frequencies within the same License Area.” An SAS may, however, temporarily reassign individual PALs to non-contiguous channels to the extent necessary to protect incumbent users from harmful interference or if necessary, to perform its required functions.

Technicians installing a cellular base station. Photo credit: GEORGE FREY/REUTERS

……………………………………………………………………………………………………………………………………………………………………………………………………

Wireless-industry analysts expected Verizon and Dish to be active participants in the most recent auction, which offered 70 megahertz of “priority access” licenses in a band considered useful for ultrafast fifth-generation, or 5G, transmissions. Rival T-Mobile’s purchase of Sprint Corp. this year gave it a treasure trove of wireless licenses that led Verizon to play catch-up in the race to supply customers with more mobile internet data. Satellite-TV operator Dish has spent the past decade amassing its own spectrum licenses for a brand-new wireless network, though the system hasn’t been built.

The entry of regional cable operators suggests that residential broadband providers are eager to offer more service over the air. Charter and Comcast have added hundreds of thousands of smartphone customers over the past year, but their mobile service runs on Verizon’s network outside the home, limiting the cable companies’ profitability. Charter also has tested fixed home broadband service over 3.5 GHz frequencies to lower the cost of stringing wires to far-flung households.

The cable companies’ wireless bets pale next to their regular investments in landline infrastructure, and the latest bids are no guarantee their strategies will shift. Cable companies have made similar wagers on wireless service before withdrawing and selling their holdings back to established cellphone carriers.

The auction results also set the stage for a more expensive auction of C-Band spectrum, another swath of frequencies useful for 5G service. The commission is expected to kick off an auction for those spectrum bands in December.

References:

https://www.fcc.gov/document/fcc-announces-winning-bidders-35-ghz-band-auction

https://docs.fcc.gov/public/attachments/DOC-366624A1.pdf

https://www.fcc.gov/auction/105/factsheet

https://www.wsj.com/articles/cable-satellite-operators-place-new-bets-on-5g-airwaves-11599063412

https://www.techspot.com/news/86623-fcc-generates-more-than-45-billion-latest-wireless.html

Ciena and TELUS demo 800Gbps fiber optic transmission over 970km link from Toronto to Quebec City; Ciena Earnings & Guidance

Ciena claims to have achieved a worldwide transmission record of 800 Gbps with TELUS, over a record-breaking 971.2km distance. Teams from both organizations worked together and turned up an 800G wavelength from Toronto to Quebec City.

TELUS is one of the early 800 Gbps technology adopters who is in the process of augmenting their network with Ciena’s WaveLogic5 Extreme (WL5e). TELUS will be standardizing WaveLogic 5 Extreme for deployment in the near future. Part of the standardization activities include testing the full capabilities of the product to plan end user service offerings.

TELUS supports 15.3 million customer connections spanning wireless, data, IP, voice, television, entertainment, video and security. The TELUS network extends 6,000 km from Victoria, British Columbia to Halifax, Nova Scotia. Designed with the future in mind, TELUS’s next generation optical network consists of a state-of-the-art, colorless, directionless, contentionless, flexible grid (CDC-F) ROADM architecture with Layer 0 Control Plane, designed to support reliable, fast turn-up and re-route of unpredictable bandwidth demands across the network. Furthermore, it is ready to support new innovations in optical technologies as they become available, including the ability to carry optical channels of any spectrum size across the fiber. This fully flexible, intelligent photonic infrastructure allows for the simple addition of WL5e wavelengths and with that, access to significant cost, footprint, and power benefits.

“TELUS prides itself on having one of the world’s fastest networks and using industry-leading technology to deliver the best experience for our customers across Canada. Our collaboration with Ciena on breaking transmission records is an exciting innovation that speaks to both teams track records of success,” said Ken Nowakowski, Director Planning and Engineering, Transport and IP Infrastructure Development and Operations at TELUS.

Testing continues at TELUS, with planned deployment of WL5e in the coming months. Does this mean 800G will be deployed across long haul links? This is not a yes or no response, but 800G will be deployed where it makes sense in the TELUS network. As has always been the case, the line rate capacity that will be deployed depends on specific link characteristics, number of channels and desired reserved margin by the operator.

Ciena 6500 shelves with WaveLogic 5 Extreme

The real news here is the resulting long-term benefits of the WL5e network upgrade for both TELUS and their end users. TELUS can continue to provide high quality, high speed connectivity to their end users – such as teleworker videoconferencing, multi-player interactive gaming, Internet access for low income families, and even live-streaming the Stanley Cup playoffs – while more efficiently using bandwidth resources and evolving to a greener network.

……………………………………………………………………………………………………………………………………………………………………………………….

Separately, Ciena announced earnings today. For the fiscal third quarter ended Aug. 1, Ciena (ticker: CIEN) reported revenue of $876.7 million, up 1.7% from a year earlier, and ahead of the Wall Street analyst consensus at $971.8 million. Non-GAAP profit was $1.06 a share, nicely above the Street consensus at 83 cents.

“Operating conditions have complicated and extended the time required to deploy and activate new equipment and services with many of our large and long-standing international customers,” the company said in a presentation prepared for its earnings call with analysts on Thursday. “Conditions have made it more challenging to ramp up and operationalize some of our newer international deals and customer wins on their original timelines.”

Ciena also said “customer uncertainty around broader economic conditions is driving more cautious spending behaviors.” It said “longer term fundamental drivers—increasing network traffic, demand for bandwidth and adoption of cloud architectures—remain strong.” Ciena CEO Gary Smith said Covid-19-related market dynamics were likely to adversely impact revenue “for a few quarters.”

Here are a few data points from the company’s earnings presentation:

- Non-telco represented 43% of total revenue

- Direct web-scale contributed 25% of total revenue

- MSO’s contributed 9% of total revenue

- Americas revenue up 9% YoY

- TTM Adjusted R&D investment was $518M

- 535 100G+ total customers, which includes 37 new wins on WaveLogic Ai and 27 new wins on WaveLogic 5e in Q3-2020

- Shipped WL 5 Extreme to almost 40 customers, and the technology is live and carrying traffic in several networks

……………………………………………………………………………………………………………………………………………………………………………………………………..

Overview of Ciena’s Technology Portfolio:

PROGRAMMABLE INFRASTRUCTURE:

Converged Packet-Optical Networking: Software-defined platforms, featuring Ciena’s award-winning WaveLogic™ Photonics and agnostic packet/OTN switching, designed to maximize scale, flexibility and openness. Optimizes network performance from the access edge, along the backbone, and across ocean floors.

Packet Networking: Purpose-built platforms hosting a common Service-Aware Operating System that are the building blocks for low-touch, high-velocity Ethernet/MPLS/IP access to metro networks.

SOFTWARE CONTROL AND AUTOMATION:

Open software that includes Blue Planet® multi-domain orchestration, inventory, and route optimization to support the broadest range of closed-loop automation use cases across multi-layer, multi-vendor networks, as well as Ciena’s Manage, Control and Plan (MCP) domain controller for bringing software-defined programmability to next-gen Ciena networks.

ANALYTICS AND INTELLIGENCE:

Blue Planet Unified Assurance and Analytics: An open suite of software products that unifies multilayer, multi-domain assurance with AI-powered analytics to provide unprecedented insights that help transform and simplify business operations for network providers.

INNOVATION AND THE ADAPTIVE NETWORK:

▪ WaveLogic™ roadmap extends beyond 400G and with multiple form factors

▪ Adaptive IP™ capabilities for Packet Networking to address fiber densification (5G & Fiber Deep)

▪ Blue Planet® Intelligent Automation Portfolio and closed-loop automation capability strengthened with recent acquisition of Centina

References:

Point Topic Analysis: 4G LTE /5G tariffs provided by mobile operators across Europe

Point Topic has compared the average monthly subscription charges and download speeds offered by mobile broadband providers across the EU-28, Norway and Switzerland. All prices are quoted in US dollars at PPP (purchasing power parity) rates to allow for easier comparison.

Overall 4G/5G tariff trends

In Q2 2020, the average monthly charge for residential 4G/5G data services varied from $73.62 (PPP) in Greece to $17.27 (PPP) in Italy.

Figure 1. Average residential 4G/5G monthly tariff in PPP$, Q2 2020

…………………………………………………………………………………………………………………………………………………………………………………………………………..

In some instances, a relatively low average monthly charge comes with high average data cap (Figure 2). For example, this quarter Switzerland, Denmark and the Netherlands stand out as being at the high end of data allowances but at the low end of monthly charges, providing the best value for money to subscribers. This is reflected in the average cost per GB of data in these countries being among the lowest in Europe (Figure 3). In Slovakia, Czech Republic, Cyprus and Greece, on the other hand users pay a high monthly price for very low data allowance.

Figure 3. Average cost per GB of 4G/5G data in PPP$, Q2 2020

One of the factors which complicates comparing mobile broadband services between countries and against fixed broadband services is the fact that some mobile operators do not report bandwidth on their tariffs. Even when they do, the difference between the theoretical maximum bandwidths and the actual ones is much higher for mobile broadband compared to fixed.

Figure 4. Average theoretical downstream speed on residential 4G/5G services, Q2 2020

Nevertheless, Figure 4 shows which countries are investing in higher speed and more advanced networks, including those using the LTE-Advanced technology as well as those which are rolling out 5G. For example, Switzerland was among countries who offered lowest average downstream speeds in Q1 2019, however, after introducing 5G services it offers the second highest average downstream speed of 760Mbps and the top 5G speed of 2Gbps. The average speed in Italy also increased significantly after the 5G launch. The country now offers the highest average downstream speed of 1Gbps having overtaken Switzerland in Q4 2019. Denmark and Austria, among others, offer relatively low bandwidth, while being among the most generous markets in terms of data allowances[1].

[1] It should be noted that Denmark is a special case. The 71Mbps refers to the maximum download speed that the Danish operators are allowed to market after agreement with the consumer ombudsman. In fact, TDC’s theoretical maximum speed in 2018 was 413Mbps.

Regional and country benchmarks

The data will vary at a country level but when comparing the markets of Central & Eastern and Western Europe at a regional level, Western Europe came out on top in terms of the average data allowance with 167GB per month, compared to 116GB in Central & Eastern Europe. At the same time, customers in Western Europe were charged a lower average monthly subscription at $32.95 PPP. In Central & Eastern Europe, the same indicator was $37.26 PPP (Figure 5). Hence, the average cost per GB in Central & Eastern Europe was significantly higher at $0.32 PPP, compared to $0.20 PPP in Western European markets. In terms of downstream speeds, both regions recorded the same average speed of 242 Mbps.

Figure 5. Regional tariff benchmarks for residential 4G/5G services, Q2 2020

Among the selected six mature markets, Sweden stands out in terms of the top average data cap and Italy in terms of the lowest average monthly charge (Figure 6).

Figure 6. Tariff benchmarks for residential 4G/5G services in six major European economies, Q2 2020

The mobile operators in Sweden offer consumers on average 145GB a month while the Netherlands follow with 123GB average allowance. For several quarters in a row the Netherlands offered the highest average monthly charge among the selected six markets but in Q3 2019 the prices dropped significantly, and the country is now the second cheapest with only Italy offering a lower average monthly subscription of $17.27 PPP. The Netherlands offers the lowest average cost per GB, currently at $0.20 PPP, compared to $3.36 PPP in Germany (Figure 7).

Figure 7. Average data and cost of 4G/5G services in selected countries, Q2 2020 (in $PPP)

To compare the prices that residential customers pay for unlimited monthly 4G/5G data in various European markets, we selected the countries which offered such tariffs in Q2 2020 (Figure 8).

Figure 8. Entry level monthly charge for unlimited data on residential 4G/5G tariffs, Q2 2020

The entry level unlimited data tariffs in the countries at the high end of the spectrum (Sweden) were 3.5 times higher than those at the low end (Switzerland). However, when customers paid $54.84 PPP for unlimited data in Sweden, they were purchasing 4G services with speeds up to 300Mbps, while in Switzerland they were charged $15.57 (PPP) for the advertised 4G speed of up to 10Mbps.

Country ranking

Comparing countries by using the average cost of mobile broadband subscriptions is a straightforward idea but the variation in entry level versus median and average costs can be significant. To help provide an easy way of comparing directly we have taken the $PPP data on entry level, median and average tariffs, produced rankings and then compared the variance (Table 1).

Table 1. Country scorecard by residential 4G/5G tariffs, Q2 2020

* Countries which now offer 5G

We have included a ‘variance’ column to indicate how different ranks for the different metrics are spread. We see that the wide spread in Austria, Slovakia and Spain for example is represented by high variance. At the other end of the scale countries like Poland, Sweden or Croatia rank rather consistently.

Why such market differences between countries?

There is no simple clear-cut explanation as many factors come into play. The length of time after the 4G/5G networks were launched, service take-up, the market shares of ‘standalone’ and of multi-play bundles, the extent of competition from fixed broadband services with comparable bandwidth, the availability and the cost of 4G/5G spectrum, the regulatory pressures to offer mobile broadband services in remote and rural areas as a priority, the demographic characteristics and life-styles of the users and the cord-cutting tendencies will all have influenced the 4G and 5G offerings available in different European markets. A further statistical modelling would provide more insight into these differences.

What Point Topic measured

This analysis is based on more than 800 tariffs from all major mobile broadband providers from the EU-28, Norway and Switzerland. In total, we provide data on 88 operators from 30 countries. We track a representative sample of tariffs offered by each operator, making sure we include the top end, the entry level and the medium level tariffs, which results in a broad range of prices and data allowances.

We use this data to report on pan-European trends in tariffs and bandwidths offered. We also report on regional trends and variations across countries. The data can be used to track changes in the tariffs offered by individual operators as well.

Technologies

We track mobile broadband tariffs provided over 4G LTE and LTE-Advanced technologies. For the sake of brevity, we are referring to both of them as ‘4G LTE’ or sometimes ‘4G’. From Q2 2019, a small number of 5G tariffs are included in our analysis. Countries which offered 5G commercially at the time of our quarterly data collection are marked with an asterisk (*).

Standalone and bundled

We record 4G / 5G tariffs which are offered as SIM only data only, some of which come with a device (a modem). From Q2 2017 onwards we do not track tariffs bundled with tablets. However, we do record multi-play service bundles (mobile broadband plus TV, fixed broadband and/or voice). From this quarter, they are not included in this analysis, only in the tariff database. We track monthly tariffs rather than daily, weekly or pay as you go, and exclude tariffs offered as part of the smartphone purchase.

Residential and business

We record both business and residential mobile broadband tariffs. The analysis in this report is based on residential tariffs.

Currency

To allow for comparison between countries with different living standards, this report refers to the tariffs in $ PPP (purchasing power parity). The data on PPP conversion rates is provided by the World Bank. The tariffs in our database are also available in local currencies, USD, EUR and GBP.

Notes on methodology

In order to represent the tariffs we collate more efficiently, we have consolidated the tariff benchmark spreadsheets into a single file. This is available to subscribers to the Mobile Broadband Tariffs service – click here to access the full file.

If there is a particular element that you cannot find, and you wish to have available please contact us on [email protected].

Coverage and methodology

A full set of mobile broadband tariff data is available for download as part of Point Topic’s Mobile Operator Tariffs Service. The data set contains the most up-to-date end of quarter tariff information including such details as monthly rental, connection speed, data allowance, equipment costs, service features and special offers.

Price comparison issues

This analysis is intended as a general indicator of the trends in 4G/5G service pricing across Europe. There are several additional variables that complicate the process of making a direct comparison of mobile broadband tariffs. They need to be taken into account when making a more in-depth analysis:

- Device charges: Some 4G/5G monthly tariffs include all charges for devices, for example, routers or dongles, whereas others come with additional one-off (upfront) costs which can be substantial. We include monthly device charges in the total monthly subscription, and it is this figure that is used in the analysis. One-off charges are more difficult to compare as they vary depending on the device and the monthly charge a user is prepared to pay.

- Bundling: Increasingly, mobile operators are entering the multi-play arena by bundling their mobile broadband services with voice services, fixed broadband and TV. At the moment, the Mobile Broadband Tariffs service provides access to a sample of multi-play bundles from Europe and beyond. Note: although 4G/5G tariffs which come with a device may be regarded as bundles, we refer to them as standalone mobile broadband services as the device such as a modem is regarded as ‘equipment’, in line with our fixed broadband tariff methodology. The analysis presented in the current report only refers to ‘standalone mobile broadband’ tariffs.

- Data allowances: Some operators offer entry-level services with very low data caps. From

Q1 2017, the minimum data allowance we include is 1GB per month. In most cases, however, these limits are generous enough for a typical user and, in some cases, even comparable to those offered by fixed broadband providers. An increasing number of tariffs are offered with ‘unlimited’ data usage. To make it possible to include these tariffs in our calculations, we assigned 600GB per month to the unlimited data tariffs. - Downstream and upstream speeds: Some operators do not report mobile broadband speeds, not least because they are so variable. Others do, and where this is the case we record the theoretical maximum speed. In reality, the actual average speed can be lower up to 10 times or more. This should be taken into account when comparing 4G LTE services with fixed broadband, for example.

References:

http://point-topic.com/free-analysis/4g-5g-tariffs-in-q2-2020/

Telefónica switches on 5G; 75% of Spain to be covered this year

Telefónica has launched commercial 5G services throughout Spain, pledging to reach 75 percent of the Spanish population by the end of the year. In a statement, the company’s executive chairman Jose Maria Alvarez-Pallete described the deployment as the most ambitious in the European Union. “The launch of 5G is a leap forward towards the hyperconnectivity that will change the future of Spain,” he said, noting that “it’s 5G for everyone, without any exceptions, in all the autonomous communities.” [That assumes low enough 5G tariffs, such that poorer working class Spaniards can afford the service]. Telefonica is accelerating “the digitalisation of small and medium companies, public administrations and citizens, ”Alvarez-Pallete added.

“Our network has always been a differential asset. People’s lives pass through it and it has demonstrated unparalleled strength when it’s been most needed”, Álvarez-Pallete continued. He pointed out that Spain already leads Europe’s digital infrastructures with the largest fiber optic network.

Editor’s Note: Telefonica’s 5G announcement follows Vodafone – Spain‘s commercial 5G network deployment in 21 cities in Spain. Initial 5G speeds of up to 1 Gbps for Vodafone subscribers in Madrid, Barcelona, Valencia, Seville, Malaga, Zaragoza, Bilbao, Vitoria, San Sebastian, La Coruna, Vigo, Gijon, Pamplona, Logrono and Santander. Speeds will rise to 2 Gbps by the end of the year, some 10 times the current 4G maximum, with latency reduced to less than 5 milliseconds in ideal conditions.

Orange and Masmovil set to launch their 5G networks in Spain this month. All four of Spain’s MNOs (Mobile Network Operators) are expected to bid for frequencies in the 700 MHz band when the government holds its delayed spectrum auction in the first quarter of 2021.

…………………………………………………………………………………………………………………………………………………………………………………………………….

Telefonica said 5G technology will give residential customers access to far faster speeds and lower latency, allowing sports fans to enjoy live 360-degree broadcasts and mobile gamers to access a “fibre-like” experience. Businesses will have access to services such as Multi-Access Edge Computing, 5G private networks, mass IoT and critical communications, as well as network virtualisation to facilitate more effective use of the network’s resources.

The Spain based network operator (also active in Latin America) clarified that it will initially launch NSA (non-standalone) 5G combined with DSS (Dynamic Spectrum Sharing) ahead of the “immediate deployment” of 5G SA (standalone) when the technology becomes fully available after standardisation. The company said it will make use of its current sites and infrastructure for the initial rollout, to be complemented by new base stations and small cells according to capacity and coverage needs.

It’s also having to rely on the 3.5 GHz band, together with mid-band (1800-2100 MHz) frequencies, for the initial coverage thanks to equipment that can operate with 4G and 5G at the same time. Telefonica also announced that it intends to shut down its 3G network in 2025, when 100 percent of its copper network will have been replaced by fiber optics.

“With 5G everything happens in a millisecond. A millisecond is what makes remote surgery, autonomous cars, the smart management of energy resources and cities and highly advanced entertainment possible. A millisecond is much more than a new response time. It’s Telefónica’s response to the new times. It’s Telefónica’s commitment to the country’s future”, concluded Álvarez-Pallete.

For residential customers, in addition to the benefits brought by 5G in terms of greater speed and lower latency, which will allow them, for example, to download a film in seconds, 5G will provide the possibility, among other features, of enjoying live sports broadcasts during which users will obtain a 360º experience and be able to view any angle of the match as if they were on the pitch itself. Gaming enthusiasts will obtain a mobility experience similar to that provided by fibre in the home, in other words, without any interruptions or latency. 5G will thus enable them to play on their mobile phones as if they were on their home computer screens or their video consoles.

5G business customers will have access to services like Multi-Access Edge Computing, which offers ultra-low latency services and greater computing capacity “on the network edge”, in addition to services such as 5G private networks, mass IoT and critical communications, as well as network virtualisation to facilitate more effective use of the network’s resources in keeping with the customers’ needs.

…………………………………………………………………………………………………………………………………………………………………………………………………………………….

Telefónica operates with the latest radio (base station) generations that allow dual 4G and 5G usage, with the aim of bringing 5G to the largest number of people from the outset. This first phase will witness the launch of the 5G network, thanks to a technology that combines the deployment of NSA (non-standalone) 5G and DSS (Dynamic Spectrum Sharing) and the subsequent immediate deployment of the SA (standalone) 5G network when the technology becomes fully available after standardisation. This initial deployment will also make use of the current sites and infrastructure and, in the mid and long terms, it will be complemented by new base stations and small cells as the capacity and coverage require.

The 3.5 GHz band frequency (the only 5G band frequency already licensed to operators) and the mid-band (1800-2100 MHz) frequencies are being used for this purpose. This is the current location of 4G, capitalising on the possibility of using NR (New Radio) equipment that can operate with both technologies (4G and 5G) at the same time.

The new deployments will take place in tandem with a gradual shut-down of the old second and third-generation networks. 100% of the copper network will have been replaced by fibre by 2025, when the 3G network will also be shut down. This will permit more effective management of investments, as it won’t be necessary to increase them to address the new deployments.

……………………………………………………………………………………………………………………………………………………………………………………………………

Extended-range 5G NR data call over mmWave completed; Ericsson & Qualcomm test 5G SA Carrier Aggregation

Qualcomm Technologies, Casa Systems and Ericsson announced that the companies successfully completed what they call the world’s first extended-range 5G NR data call over mmWave. The extended range data call was completed in Regional Victoria, Australia on 20 June, achieving a farthest-ever connection of 3.8 kilometers (km).

This so called “breakthrough” from Qualcomm Technologies, Casa Systems and Ericsson provides global network operators and ISPs with the reach and performance to offer fixed broadband wireless as a “last mile” access technology. Of course, line of sight communications (i.e. no trees, walls or other blockages permitted). With the increased range demonstrated for mmWave, that technology may be suitable for fixed wireless access (FWA) as well as for 5G mobile service in suburban or even rural areas that won’t require as many small cells or high density cell towers.

Network operators will have the potential to use their existing mobile network assets to deliver fixed wireless services and expand their service with ease to new areas, from urban to rural, while delivering 5G’s multi-gigabit speeds and ultra-low latency to a wider customer base within their coverage footprint. In addition, this milestone will proliferate the roll-out of FWA customer-premises equipment (CPE) devices to areas that are often too difficult to reach with traditional broadband, including rural and suburban areas, empowering more customers across the globe to access superior connectivity at fiber optic-like speeds.

The extended-range data call was achieved by applying extended-range software to commercial Ericsson hardware – including Air5121 and Baseband 6630 – and a 5G CPE device powered by the Qualcomm Snapdragon X55 5G Modem-RF System with the Qualcomm QTM527 mmWave antenna module.

“With the introduction of the Qualcomm QTM527 mmWave antenna module as part of the Snapdragon X55 5G Modem-RF System, we are empowering operators and OEMs to offer high-performance, extended-range multi-gigabit 5G broadband to their customers – which is both flexible and cost-effective, as they can leverage existing 5G network infrastructure,” said Gautam Sheoran, senior director, product management, Qualcomm Technologies, Inc. “With this major milestone being the first step in utilizing mmWave for an extended-range 5G data transfer, our collaboration with Casa Systems and Ericsson is paving the way to implement fixed broadband services for broad coverage in urban, suburban and rural environments.”

“As operators look to close the digital divide and expand broadband services throughout rural, suburban and urban communities, the technology in this data connection underscores the critical role mmWave will play in the global proliferation of 5G networks,” said Steve Collins, senior vice president, access devices, Casa Systems. “This collaboration with Qualcomm Technologies and Ericsson is an industry milestone that makes it possible for operators to offer multi-gigabit broadband services wirelessly as a new broadband alternative solution using mmWave spectrum, and we look forward to delivering innovative CPE devices that further empowers the global broadband delivery ecosystem.”

“Ericsson has a long history of working with extended range across generations of mobile technologies, pioneering with 3G, then 4G and now with 5G. By collaborating with leading industry partners like Qualcomm Technologies and Casa Systems, we are able to ensure that everyone can access the transformative benefits of 5G connectivity. This achievement will open up opportunities for communications service providers around the world and how they can use mmWave spectrum for long-range use cases,” said Per Narvinger, head of product area networks, Ericsson.

…………………………………………………………………………………………………………………………………………………………………………………..

5G SA Carrier Aggregation from Qualcomm & Ericsson:

Today’s announcement comes just three days after Qualcomm and Ericsson announced that they completed interoperability tests for 5G standalone (SA) carrier aggregation. Carrier aggregation allows operators to use multiple sub-6 GHz spectrum channels simultaneously to transfer data between base stations and a 5G mobile device.

The test was completed at Ericsson’s labs in Beijing, China. The connection reached 2.5 Gb/s peak speeds by aggregating 100 MHz and 60 MHz within the 2.5 GHz (n41) TDD band in a 70% downlink configuration and using 4×4 multiple-input multiple-output (MIMO) technology. In Sweden, the two companies established a successful 5G SA carrier aggregation data call by combining 20 MHz in the 600 MHz (n71) FDD band with 100 MHz of spectrum in the 2.5 GHz (n41) TDD band.

Implementation of 5G carrier aggregation delivers enhanced network capacity along with improved 5G speeds and reliability in challenging wireless conditions, allowing consumers to experience smoother video streaming and enjoy faster downloads. This key 5G capability is expected to be widely deployed by operators around the world in 2021, according to Ericsson.

…………………………………………………………………………………………………………………………………………………………………………………..

About Qualcomm

Qualcomm is the world’s leading wireless technology innovator and the driving force behind the development, launch, and expansion of 5G. When we connected the phone to the internet, the mobile revolution was born. Today, our foundational technologies enable the mobile ecosystem and are found in every 3G, 4G and 5G smartphone. We bring the benefits of mobile to new industries, including automotive, the internet of things, and computing, and are leading the way to a world where everything and everyone can communicate and interact seamlessly.

Qualcomm Incorporated includes our licensing business, QTL, and the vast majority of our patent portfolio. Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, operates, along with its subsidiaries, substantially all of our engineering, research and development functions, and substantially all of our products and services businesses, including our QCT semiconductor business.

About Casa Systems, Inc.

Casa Systems, Inc. is delivering physical, virtual and cloud-native 5G infrastructure and customer premise networking for high-speed data and multi-service communications networks. Our core and edge convergence technology enables public and private networks for both communications service providers and enterprises. Casa Systems’ products deliver higher performance, improved network flexibility and scalability, increased operational efficiency and lower total cost of ownership (TCO). Commercially deployed in more than 70 countries, Casa serves over 475 Tier 1 and regional service providers worldwide. For more information, visit http://www.casa-systems.com.

About Ericsson

Ericsson enables communications service providers to capture the full value of connectivity. The company’s portfolio spans Networks, Digital Services, Managed Services, and Emerging Business and is designed to help our customers go digital, increase efficiency and find new revenue streams. Ericsson’s investments in innovation have delivered the benefits of telephony and mobile broadband to billions of people around the world. The Ericsson stock is listed on Nasdaq Stockholm and on Nasdaq New York. www.ericsson.com

References:

https://www.ericsson.com/en/news/2020/8/5g-carrier-aggregation

ITU-T SG13 FG on “Machine Learning (ML) for Future Networks including 5G” completes mission; 10 technical specs approved

Introduction:

ITU-T Study Group 13 Focus Group on Machine Learning for Future Networks including 5G (FG ML5G) has accomplished its mission. The FG ML5G was active from January 2018 until July 2020.

During its lifetime, FG ML5G delivered ten technical specifications.. Four of those specifications have already been approved by ITU-T SG13 and published by ITU-T. Six further technical specifications are being considered by ITU-T SG13. These ten technical specifications are publicly available free of charge. Please refer to ITU-T FG ML5G webpage to download the documents. [All ITU-T Focus Group publications are available for download at ITU-T Focus Group webpage]

Deliverables processed by ITU-T SG13 and published by ITU-T are:

Y.Sup55: ITU-T Y.3170-series – Machine learning in future networks including IMT-2020: use cases

This Supplement describes use cases of machine learning in future networks including IMT-2020. For each use case description, along with the benefits of the use case, the most relevant possible requirements related to the use case are provided. Classification of the use cases into categories is also provided.

ITU-T Y.3172: Architectural framework for machine learning in future networks including IMT-2020

ITU-T Y.3172 specifies an architectural framework for machine learning (ML) in future networks including IMT-2020. A set of architectural requirements and specific architectural components needed to satisfy these requirements are presented. These components include, but are not limited to, an ML pipeline as well as ML management and orchestration functionalities. The integration of such components into future networks including IMT-2020 and guidelines for applying this architectural framework in a variety of technology-specific underlying networks are also described.

ITU-T Y.3173: Framework for evaluating intelligence levels of future networks including IMT-2020

ITU-T Y.3173 specifies a framework for evaluating the intelligence of future networks including IMT-2020 and a method for evaluating the intelligence levels of future networks including IMT-2020 is introduced. An architectural view for evaluating network intelligence levels is also described according to the architectural framework specified in Recommendation ITU-T Y.3172.

In addition, the relationship between the framework described in this Recommendation and corresponding work in other standards or industry bodies, as well as the application of the method for evaluating network intelligence levels on several representative use cases are also provided.

ITU-T Y.3174: Framework for data handling to enable machine learning in future networks including IMT-2020

ITU-T Y.3174 describes a framework for data handling to enable machine learning in future networks including International Mobile Telecommunications (IMT)-2020. The requirements for data collection and processing mechanisms in various usage scenarios for machine learning in future networks including IMT-2020 are identified along with the requirements for applying machine learning output in the machine learning underlay network. Based on this, a generic framework for data handling and examples of its realization on specific underlying networks are described.

…………………………………………………………………………………………………………………………………………………………………………………..

This document is at an advanced stage in ITU-T SG13:

Draft Recommendation ITU-T Y.3176: “ML marketplace integration in future networks including IMT-2020”

This document is a draft Recommendation under study by Q20 of SG13. This draft Recommendation provides the architecture for integration of ML marketplace in future networks including IMT-2020. The scope of this draft Recommendation includes: – Challenges and motivations for ML marketplace integration – High level requirements of ML marketplace integration – Architecture for integration of ML marketplace in networks.

The July 2020 ITU-T SG13 meeting started the approval process for this draft new Recommendation, which is largely based on the output of the FG ML5G.

…………………………………………………………………………………………………………………………………………………………………………………..

Deliverables which FG ML5G submitted to ITU-T SG13 for consideration:FG ML5G specification:

“Requirements, architecture and design for machine learning function orchestrator”

This technical specification discusses the requirements for machine learning function orchestrator (MLFO). These requirements are derived from the use cases for machine learning in future networks including IMT-2020. Based on these requirements, an architecture and design for the machine learning function orchestrator is described.

FG ML5G specification: “Serving framework for ML models in future networks including IMT-2020”

This specification describes a serving framework for ML models in future networks including IMT-2020. The specification includes requirements and architecture components for such a framework.

FG ML5G specification: “Machine Learning Sandbox for future networks including IMT-2020: requirements and architecture framework”

Use cases for integrating machine learning (ML) to future networks including IMT-2020 has been documented in Supplement 55 and an architecture framework for this integration was specified in ITU-T Y.3172. However, network stakeholders are apprehensive about using ML-driven approaches directly in live networking systems because it can lead to unexpected situations that can degrade KPIs. This is mostly due to the apparent complexity of ML mechanisms (e.g., deep learning), the incompleteness of the available training data, the uncertainty produced by exploration-exploitation approaches (e.g., reinforcement learning), etc. In the face of such impediments, the ML Sandbox emerges as a potential solution that allows mobile network operators (MNOs) for improving the degree of confidence in ML solutions before their application to the network infrastructure. This technical specification deals with the requirements, architecture, and implementation examples for ML Sandbox in future networks including IMT-2020.

FG ML5G specification: “Machine learning based end-to-end network slice management and orchestration”

This document proposes the framework and requirements of machine learning based end-to-end network slice management and orchestration in multi-domain environments.

FG ML5G specification: “Vertical-assisted Network Slicing Based on a Cognitive Framework”

This technical specification proposes a new framework that enables vertical QoE-aware network slice management empowered by machine learning technologies.

…………………………………………………………………………………………………………………………………………………………………………

Conclusions:

The activities of the FG ML5G were concluded and its mandate was accomplished. SG13 closed the FG ML5G while recognizing the FG ML5G chairman Prof. Dr. Slawomir Stanczak (Frauenhofer HHI, Germany) and his management team, active contributors and all the FG members.

|

Contact: |

Leo Lehmann |

Tel: 41 58460 5752 |

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.itu.int/en/ITU-T/focusgroups/ml5g/Pages/default.aspx

Nokia & Omdia: 5G could bring up to $3.3 trillion to Latin America by 2035- vs 13% of mobile subs in 2025?

Executive Summary:

5G services could bring up to $3.3 trillion to Latin America by 2035, according to a new study by Nokia and research firm Omdia. The study, titled ‘Why 5G in Latin America?’ notes the uncertainty around the ongoing Covid-19 pandemic – yet alongside the projected $3.3 trillion in economic and social value promised by 5G, a $9 trillion improvement in productivity is also predicted.

We question what this optimistic forecast is based on since we haven’t been able to identify any real 5G use cases with current and near future 5G deployments.

Latin American operators have been relatively silent, apart from some trials, a deployment in Uruguay, and recent soft launches using DSS in Brazil.

This caution is understandable considering the late adoption of 4G. Omdia estimates that 4G in Latin America is about 52% of lines and 3G about a third (as of year-end 2019). Even 2G remains important at 13%, and it will not disappear until well after 2024.

To ignore the potential of 5G is to miss a considerable opportunity or leave it to one’s competitors, according to Omdia. This report shows the opportunity in the mass market, as a fixed broadband substitute, and in the enterprise market. The mass-market opportunity is based on the immersive technologies powered by 5G that will take our digital experiences to the next level and beyond.

The enterprise opportunity is less familiar because it has not been as important a play in 3G and 4G as Omdia believes it will be in 5G. All Latin American enterprises must explore digital transformation to remain competitive in the rapidly evolving global economy. Latin American governments must transform themselves and, more importantly, encourage digital transformation in their economies to improve productivity and return the region to real growth in income per capita.

5G is not an option but an imperative, and this report discusses what service providers and policy makers must do to get ready. There is a brief overview in the Appendix for those who would like to understand more about 5G technology.

The pandemic can be seen as a major opportunity point for digitisation of essential sectors, such as healthcare and emergency services, manufacturing, and the supply chain. Yet a major roadblock remains; a gap between the haves and have-nots for broadband penetration and connectivity.

This is similar to the reports from the Asia Cloud Computing Association (ACCA) regarding the Asia Pacific region; countries such as China and India score poorly because of the disparity between the rich and poor regions. Brazil, another BRIC region, is therefore set to be a major beneficiary according to the report; $1.22tn of 5G economic impact and an increase in productivity of just over $3 trillion.

The report outlines recommendations for service providers, particularly with regard to upgrading 4G to make it 5G-ready. Policy makers, meanwhile, are encouraged to finish allocating 4G spectrum to enable a ‘clear spectrum policy roadmap and an infrastructure policy which both encourages and facilitates the private sector to invest in 5G.’

“Latin American countries must diversify their sources of income and jobs into higher value-added activities,” said Wally Swain, principal consultant for Omdia Latin America. “Activities including mining and manufacturing must become more productive and 5G will play an important role on this.”

It is too early to be definitive about how COVID-19 will change behaviors and the patterns of 5G adoption in Latin America. But it seems clear that increased demand for broadband can only help the 5G business case, especially in FWA for homes and businesses. Because of the pandemic, there is a clear need for digitalization of essential sectors such as healthcare, emergency services, manufacturing, and supply chain.

The need for better-quality emergency communications will encourage the deployment of network slices, a key feature of the coming versions of 5G. In the future of what is often called Industry 4.0, a large part of the new value creation will be around the ability for humans to remotely see, understand, manage, operate, fix, and generally interact with all manner of physical systems and machines, and that will be possible with 5G.

Conclusions:

It is too early to be definitive about how COVID-19 will change behaviors and the patterns of 5G adoption in Latin America. But it seems clear that increased demand for broadband can only help the 5G business case, especially in FWA for homes and businesses. Because of the pandemic, there is a clear need for digitalization of essential sectors such as healthcare, emergency services, manufacturing, and supply chain.

The need for better-quality emergency communications will encourage the deployment of network slices, a key feature of the coming versions of 5G. In the future of what is often called Industry 4.0, a large part of the new value creation will be around the ability for humans to remotely see, understand, manage, operate, fix, and generally interact with all manner of physical systems and machines, and that will be possible with 5G.

You can read the full Omdia report here (name and email address required)

………………………………………………………………………………………………………………………………………………………………………………………

According to Ebanx Labs, 5G will represent 13% of mobile connections in Latin America in 2025, according to the Ericsson Mobility Report. The survey indicates the first 5G network deployments are expected during 2020 in the region, with Argentina, Brazil, Chile, Colombia and Mexico to be the pioneer countries.

Photo Credit: Shutterstock

References:

5G could bring up to $3.3 trillion to Latin America by 2035, says Nokia and Omdia