Month: June 2019

AT&T owns >630 MHz nationwide of mmWave spectrum + HPE partnership for Edge Networking & Computing

Following the close of FCC Auction 102, AT&T won 24 GHz spectrum in 383 Partial Economic Areas (PEAs) for a nationwide average of 254 MHz. All of the licenses won were in the more valuable upper 500 MHz portion of the 24 GHz band, giving AT&T stronger nationwide coverage and additional spectrum depth and capacity in many top markets where demand is often greatest. In the top 10 markets alone, AT&T won nearly 286 MHz on average, including 300 MHz in 8 of those markets.

“We’re leading the nation in mobile 5G deployment and the large, contiguous block of spectrum we won in Auction 102 will be critical to maintaining that leadership,” said Scott Mair, president of AT&T Operations. “We’ve already been recognized for having the nation’s fastest1 and best2wireless network, and by further strengthening our spectrum position, we intend to build on our success. I’d like to congratulate and thank the FCC on the conclusion of another successful auction.”

The licenses it won cover all top 50 PEAs and 99 of the top 100 PEAs. When added to the mmWave spectrum AT&T already holds in the 39 GHz band, AT&T’s average spectrum depth in mmWave increased by two-thirds to more than 630 MHz nationwide.

AT&T will use the spectrum to bolster its mobile 5G strategy. AT&T was the first U.S. wireless carrier to introduce mobile 5G service. The company’s 5G service is currently available in parts of 19 cities – more than any other wireless carrier – with plans to reach parts of 29 cities by the end of 2019. In the first half of 2020, the company expects to have the best combination of mobile 5G, providing high speeds and low latency service over mmWave spectrum and nationwide 5G service over “sub-6” spectrum.

The company spent about $980 million to win an average of 254 MHz of 24 GHz spectrum in 383 out of about 400 total partial economic areas (PEAs) nationwide. The winnings supplement the company’s previous millimeter wave spectrum holdings in the 39 GHz band.

The key appeal of millimeter wave spectrum is that large swaths of it are available, enabling the spectrum to support the highest speeds – although service deployed in the millimeter wave band has less range than service deployed in lower-frequency bands. AT&T’s initial 5G deployments have been in the millimeter wave band, but the company eventually expects to use a combination of millimeter wave and lower frequency spectrum to support 5G.

The average 630 MHz of millimeter wave spectrum that AT&T now holds in key markets would appear to position the company well to support high speeds, as the company previously achieved speeds of 1.2 Gbps in trials using a 400 MHz channel over a distance of 150 meters.

The company also has said that it has seen speeds as high as 400 Mbps on its commercial 5G network, although it cautioned that average speeds are lower.

AT&T also noted in a press release that the licenses it won in the 24 GHz band were in the “valuable” upper 500 MHz of the 24 GHz band and that the licenses cover all top 50 PEAs and 99 of the top 100 PEAs.

Late last year, AT&T was the first U.S. carrier to launch mobile 5G service, although the company did not have a smartphone available for use with the network until last week. Customers initially used 5G-capable Wi-Fi hotspots that work with virtually any smartphone to access the network, which now covers parts of 19 cities. AT&T plans to expand to parts of 10 more cities by the end of 2019 and to launch nationwide service in the first half of 2020.

The company’s initial target for 5G service is business customers – a decision that enabled the company to plan its initial 5G millimeter wave deployments for areas in which key business customers were located. The company also has said that it hopes to command a premium for 5G service in comparison with what it charges for earlier-generation services – a strategy that U.S. wireless carriers have not used previously.

References:

https://about.att.com/story/2019/att_enhances_spectrum_position.html

………………………………………………………………………………………………………………………………..

Separately, AT&T said it will work with Hewlett Packard Enterprise (HPE) to help businesses harness powerful edge capabilities. The two companies have agreed to a go-to-market program to accelerate business adoption of edge connections and edge computing.

Edge computing marks a giant leap forward in providing faster processing and potentially enhanced security for business applications. AT&T Multi-access Edge Compute (MEC) Services enable businesses to take advantage of AT&T cellular coverage – including 5G as it becomes available – as well as new capabilities to manage cellular traffic through virtual network functions. HPE Edgeline Converged Edge Systems help create use cases where applications can reside on premises for lower latency processing.

“AT&T’s software-defined network, including our 5G network, combined with HPE’s intelligent edge infrastructure can give businesses a flexible tool to better analyze data and process low-latency, high-bandwidth applications,” said Mo Katibeh, Chief Marketing Officer, AT&T Business. “Bringing compute power closer to our network helps businesses push the boundaries of what is possible and create innovative new solutions.”

Enabling edge computing is a core tenet in AT&T’s strategy to help businesses get the most out of 5G. This is an important step in bringing these technologies to scale, so businesses can continue to transform how they will use networks in the 5G era.

“HPE believes that the enterprise of the future will need to be edge-centric, cloud-enabled and data-driven to turn all of its data into action and value,” said Jim Jackson, Chief Marketing Officer, HPE. “Our go-to-market alliance with AT&T, using HPE Edgeline Converged Edge Systems, will help deliver AT&T MEC services at scale to help our customers more quickly convert data into actionable intelligence, enabling unique digital experiences and smarter operations.”

https://about.att.com/story/2019/att_and_hpe.html

Ericsson announces 5G standalone NR software and 2 new Massive MIMO radios

Ericsson released a software update to its cellular base station hardware that the vendor says will markedly improve 5G network performance by increasing its capacity and coverage, especially indoors and in hard-to-reach areas. The upgrade will support a 3GPP Release 15 specification of Standalone 5G New Radio (NR) which, unlike NSA (Non Stand Alone), does not need 4G LTE infrastructure such as signalling, mobile packet core and network management.

Ericsson says its 5G standalone NR software makes for a new network architecture, delivering key benefits such as ultra-low latency and even better coverage (says the company).

Ericsson also announced what it calls inter-band NR carrier aggregation, which is software that extends the coverage and capacity of NR on mid bands and high bands when combined with NR on low bands. Ericsson claims the software can help improve speeds in areas with poor coverage and in indoor environments.

Ericsson says it is evolving its cloud solution with an offering optimized for edge computing to meet user demand. This will enable service providers to offer new consumer and enterprise 5G services such as augmented reality and content distribution at low cost, low latency, and high accuracy.

Fredrik Jejdling, Executive Vice President and Head of Business Area Networks, Ericsson, says: “We continue to focus our efforts on helping our customers succeed with 5G. These new solutions will allow them to follow the 5G evolution path that fits their ambitions in the simplest and most efficient way.”

The new standalone 5G NR software can be installed on existing Ericsson Radio System hardware. Coupled with Ericsson’s 5G dual-mode Cloud Core solutions, the new products are aimed at opening new business opportunities for service providers – especially having established an architecture that facilitates agility, provides advanced support for network slicing and enables the speedy creation of new services.

Most pre-standard “5G” network operators have deployed NSA (Non Stand Alone) using LTE infrastructure. Once the 5G coverage has been established, they can now also deploy standalone.

Low bands will play a key role in cost-efficiently extending the coverage provided by 5G deployments to date. Ericsson has also launched Inter-band NR Carrier Aggregation – a new software feature that extends the coverage and capacity of NR on mid- and high bands when combined with NR on low bands. This will improve speeds indoors and in areas with poor coverage.

Two new Massive MIMO radios have also been added to the Ericsson Radio System mid-band portfolio, allowing service providers to build 5G with precision: AIR 1636 for wider coverage which provides optimized performance on longer inter-site distances; and AIR 1623 for easy site build with minimal total cost of ownership.

Ericsson’s 5G hardware is now being used in networks all over the world. Image courtesy of Ericsson

Ericsson’s 5G hardware is now being used in networks all over the world. Image courtesy of Ericsson

…………………………………………………………………………………………………………………………………………………………………………

5G (with low latency as per 3GPP Release 16 and later- IMT 2020) will enable augmented reality, content distribution and gaming, and other applications that require low latency and high bandwidth to perform with accuracy. To help service providers meet these requirements and offer new consumer and enterprise services, Ericsson is evolving its cloud solution with the launch of Ericsson Edge NFVI (Network Functions Virtualization Infrastructure), optimized for the network edge.

A compact and highly efficient solution, Ericsson Edge NFVI is part of the end-to-end managed and orchestrated distributed cloud architecture, which makes it possible to distribute workloads, optimize the network and enable new services in the cloud.

Ericsson is also launching the Ericsson partner VNF Certification Service, a partner certification program for virtual network functions (VNF). The service is open to all VNF vendors and grants a certification on the Ericsson NFVI platform using Ericsson Labs. This will create an ecosystem with a shorter time-to-market for working with partners and applications.

Industry Analyst Hugh Ujhazy, Vice President, IOT & Telecommunications at International Data Corporation (IDC), Asia Pacific, says: “Ericsson’s latest 5G offerings equip service providers with an even broader 5G portfolio by adding the Standalone NR option. The series of solutions being added to the Ericsson 5G platform will allow service providers to deploy 5G sensibly and address new business opportunities with full flexibility. What you get is faster, cheaper, makes better use of existing assets and with fewer truck rolls. That’s pretty cool.”

Dana Cooperson, Research Director, Analysis Mason, says: “Improved E2E 4G/5G network architecture flexibility and new 5G use cases require distribution to the edge. To be successful in providing new services it is essential to have a cost-efficient platform for distributed workloads. Ericsson’s initiative with the Edge NFVI solution and distributed cloud architecture will contribute to service providers’ success in 5G.”

References:

https://www.ericsson.com/en/press-releases/2019/6/ericsson-launches-enhanced-5g-deployment-options

AT&T to Focus new WarnerMedia Innovation Lab on 5G Experiences

AT&T’s WarnerMedia Innovation Lab in New York City will serve as a testing ground for leveraging 5G to provide innovative storytelling through advertising, according to company executives. The 20,000 square foot lab is being built in the Chelsea neighborhood of Manhattan (this author’s home town) and is scheduled to open in early 2020. The WarnerMedia lab will also draw consumer insights and technology from AT&T’s Xandr ad sales unit.

“By working across AT&T, we’re able to combine the latest in 5G technology with immersive content experiences and cutting-edge advertising capabilities,” said David Christopher, president of AT&T Mobility and Entertainment. “The WarnerMedia Innovation Lab will be a space where developers, creators and visitors will be inspired to push the boundaries of entertainment, all powered by the company that first introduced the U.S. to the power of mobile 5G.”

“Storytelling is in our company’s DNA and part of that experience is how the content is enjoyed, including advertising. The Lab is a critical part of our testing and learning on the new experiences in advertising that we will be rolling out to market,” said Dan Reiss, head of advanced advertising and branded content at WarnerMedia Ad Sales.

“The Lab is more than a technology incubator, but also a dream factory for us to create the wonderment that fans have come to love and expect from WarnerMedia,” said Jesse Redniss, GM for WarnerMedia Innovation Lab, in a statement. He described the location as a place where WarnerMedia will “flex the best of [its] creative storytelling capabilities combined with cutting edge technology from AT&T and our partners to deliver experiences that will be talked about for a lifetime.”

“Every day, Xandr looks for new innovative ways to help marketers and create a better viewing experience for consumers,” said Kirk McDonald, CMO, Xandr. “Working with our colleagues at AT&T Communications and WarnerMedia, we are uniquely positioned to develop new advertising innovations that engage consumers and provide integral feedback for marketers and brands. The WarnerMedia Innovation Lab will accelerate the adoption of new advertising formats and provide an environment to showcase our collaborative work.”

Image Courtesy of WarnerMedia

………………………………………………………………………………………………………………………………………………………………………………………………..

AT&T stated the new lab will be “[unveiling] a new balance in the relationship between advertising, technology and content” and said that its work would include mixed reality and/or virtual reality applications, “5G uses that enhance new advertising capabilities,” and better user experiences related to advertising.

Architectural firm Design Republic will head the design of the project, with work beginning this summer with completion scheduled for early 2020.

References:

https://www.broadcastingcable.com/news/at-t-focuses-innovation-lab-on-5g-experiences

https://www.rcrwireless.com/20190617/5g/warnermedia-lab-to-be-outfitted-with-att-5g

https://www.fiercevideo.com/tech/at-t-details-new-5g-equipped-warnermedia-innovation-lab

Paul Budde: What Does ‘Peak Telecom’ Mean for 5G? Asian Telecoms Maturity Index

By Paul Budde, edited by Alan J Weissberger

Peak Telecom and 5G:

“Peak telecom” is described as the maximum point of expansion reached by the traditional telecommunications industry before the internet commoditized the industry to a utility (dumb) pipe.

I thought of this when I read the recent outcomes of the famous Ericsson Consumer Lab survey. The company used the results of the survey to counteract market criticism regarding the viability of the telco business models in the deployment of 5G.

It will come as no surprise that Ericsson, as a manufacturer of 5G gear, has given the report a positive spin. However, I remain skeptical about the short-term business models for the deployment of 5G (so does the editor). Once full deployment happens over the coming decade, I certainly can see long-term opportunities. These will revolve around content and apps as well as areas such as IoT in smart homes, cities and energy. However, the question is, will this lead to new financial opportunities for the telcos? Peak telecom questions such an outcome.

What exactly do these broader 5G opportunities mean for the telecommunications operators — the companies who have to build the infrastructure? It is here that we can see that we have reached peak telecom. For several years now, we have seen that growth in the telecom industry is rather stagnant. Profits are still being made but mostly generated by lowering costs. For example, new telecom access speeds are provided at no extra cost to the users. Basically, consumers are getting more for the same price.

There has continuously been the promise of new revenues that could be generated through a range of new telecoms development (internet, broadband, smartphones). The telcos have, however, largely failed to move into the content/app market where the new profits are occurring. Companies such as Amazon, Facebook, Google, Alibaba, Tencent and Netflix have been the primary commercial beneficiaries of these developments.

The Ericsson report mentions that mobile access in congested areas and in mega-cities is becoming a problem and that 5G will assist here. I agree, but will customers pay extra for it?

It also mentions opportunities for 5G to be an alternative to fixed broadband and for it to become a key technology in fixed wireless networks. There certainly will be niche market opportunities here, but this is a highly price-sensitive market. The economics of mass fixed infrastructure favors it over mobile infrastructure. Any gains here will basically be a substitution of a fixed service they already provide, so the overall net gain for the industry will be neglectable.

The report indicates that 20% of smartphone users are prepared to pay a premium for 5G. The current commercial 5G service in South Korea is charging a meager 10% premium. No doubt, in coming years, through competition even that premium will disappear.

The report indicates that consumers expect new innovation such as foldable phones, VR glasses, AI, 360-degree camera, robotics and so on. All true but it all depends how affordable these products and service will be and again who will develop these next “must-have” products? Here, also, the telcos will most likely be missing out.

I fully agree with the report’s assessment that we have to look at 5G over the more extended period. As mentioned, there are good reasons to believe that once full deployment exists, it will open up many new business opportunities.

However, will this promise be enough for telcos to make the substantial upfront investments that are needed? This without a clear indication if they can extract any significant new revenues from 5G? The more likely scenario is that the digital giants are going to be the ones that will reap the real profits of those innovations.

I stick to my argument that the key reason for the telcos to move into 5G is because of network efficiencies, which lead to lower costs.

–>This is absolutely critical in this peak telecom market.

To end on a more positive note for the industry, there is the first mover advantage with short term premium price opportunities for those who can tap into the early adopters’ market. There is always a group of users who simply do want to have the newest of the newest, whatever the price. The size of this market varies — depending on how “hot” the new product is seen by this market segment — and could be anywhere between 10% and 25%.

This is certainly attractive for the telcos as it allows them to recoup some of the initial investment rapidly. In relation to mobile products and services, this mainly relates to “must have” gadgets and, in particular, the smartphone. The current price (in Korea) of a 5G phone is approximately US$1,500 (AU$2,153), without any outstanding features.

The lack of attractive smartphones could be another negative for some of the early adopters. Time will tell.

Asia Telecoms Maturity Index:

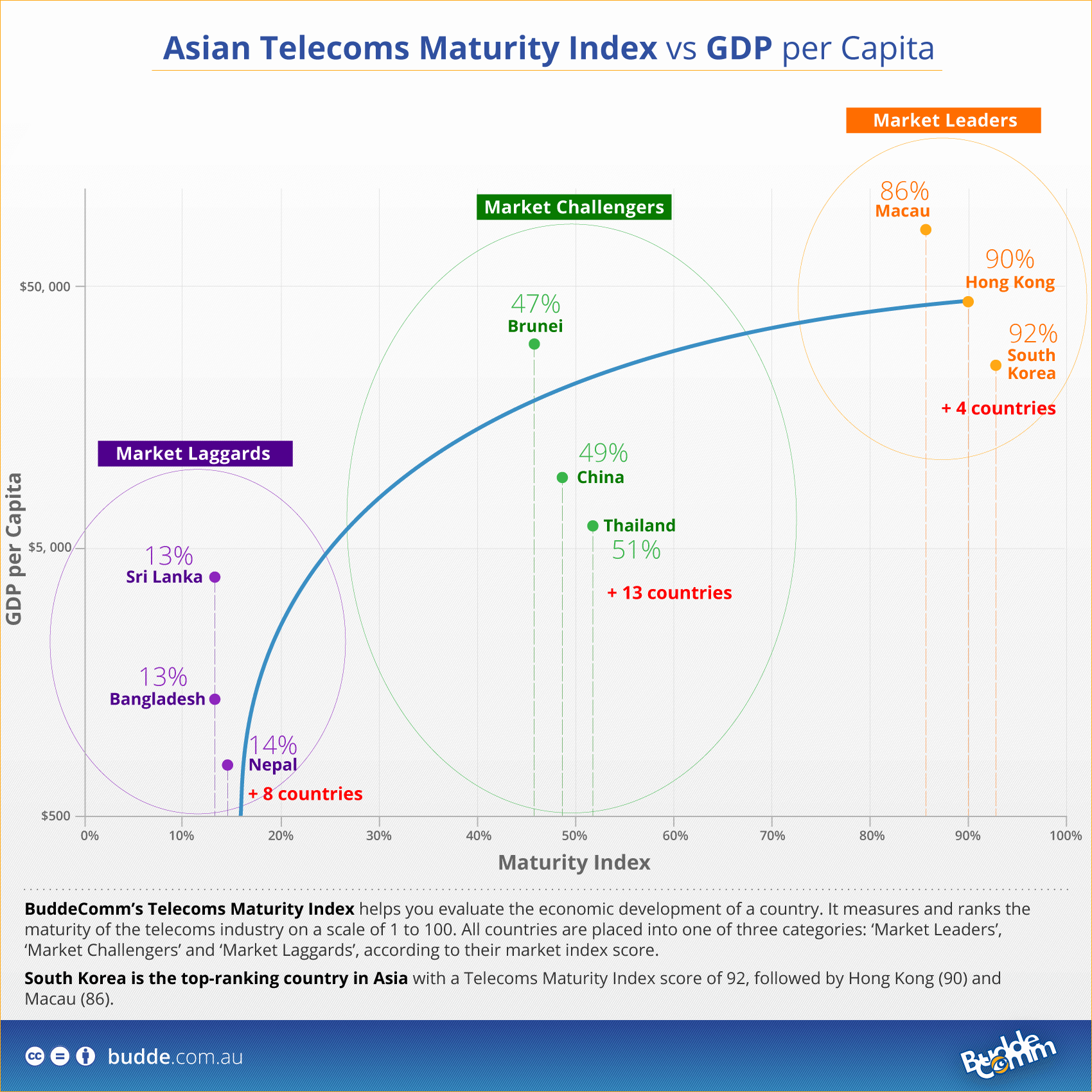

This index, created by Paul Budde, analyzes the Broadband, Mobile and Fixed Line markets of a specific country as well as a range of parameters to help you evaluate the economic development of a country.

BuddeComm’s Telecoms Maturity Index measures and ranks the maturity of a country’s telecoms industry on a scale of 1 to 100. All countries are placed into one of three categories: ‘Market Leaders’, ‘Market Challengers’ and ‘Market Laggards’, according to their Market Index score.

The Telecoms maturity index is used to fuel regional analysis, it provides a unique approach and allows a comprehensive country vs region comparison.

Asia – Mobile Network Operators and MVNOs

Asian countries in the Market Leaders category have fixed broadband penetrations in the range of 25% and 42% and mobile broadband penetrations in the range of 98% and 135%. South Korea is the top-ranking country in Asia with a Telecoms Maturity Index score of 92, followed by Hong Kong (90) and Macau (86).

Find more information on the Asian telecoms market or Contact Us.

For more information on BuddeComm’s Telecoms Maturity Index, see:

- Africa – Fixed Broadband Market – Statistics and Analyses

- Africa – Mobile Network Operators and MVNOs

- Asia – Fixed Broadband Market – Statistics and Analyses

- Asia – Mobile Infrastructure and Mobile Broadband

- Asia – Mobile Network Operators and MVNOs

- Asia – Telecom Forecasts

- Europe – Mobile Network Operators and MVNOs

- Latin America – Mobile Network Operators and MVNOs

- Middle East – Mobile Infrastructure and Mobile Broadband

- Middle East – Mobile Network Operators and MVNOs

https://www.budde.com.au/Research/Buddecomm-Telecoms-Maturity-Index

Who Stole 5G Technology? Huawei ban has huge impact on semiconductor industry

NOTE: There are no U.S. cellular equipment manufacturers. The only two in the west are Ericcson and Nokia- both based in Europe. However, U.S. based Qualcomm has been developing 5G silicon and is the only 5G (fabless) semiconductor vendor in the U.S. They will likely have an IMT 2020 compliant chip set as the company regularly attends ITU-R WP 5D meetings. The only other 5G merchant market semiconductor company we know of is Taiwan based MediaTek. Samsung and Huawei have developed 5G silicon but are using it ONLY for their own devices- not sold to merchant semiconductor market.

The only U.S. semiconductor companies that we know of that make their own chips are Intel and Micron.

…………………………………………………………………………………………………………………………………………………………………………………………….

IHS Markit says Huawei fall- out on memory market is huge:

Huawei in recent years has carved out prominent positions in the global smartphone and mobile infrastructure markets (not to mention fiber optics infrastructure and IT markets). In 2018, Huawei rose to take second place in the smartphone business, with 206.1 million shipments, according to the IHS Markit Smartphone Intelligence Service. This put it just slightly ahead of Apple, at 204.7 million.

In 2017, the company became the leader in the worldwide mobile infrastructure equipment market, surpassing Ericsson. Huawei has retained the top position and rose to account for nearly one-third of the market, with a 31 percent share of global revenue in 2018, as reported by the IHS Markit Mobile Infrastructure Intelligence Service.

Huawei’s market position has translated directly into purchasing power, with the company ranking as the world’s fourth-largest OEM semiconductor buyer in 2018. Huawei spent $15.9 billion on semiconductors in 2018, according to the IHS Markit OEM Semiconductor Spending & Design Activity Intelligence Service. Memory represents a considerable slice of that spending, with the company buying $1.7 billion worth of DRAM and $1.1 billion worth of NAND flash memory for the year.

In the memory business, the wireless communications market was the second-largest global market for DRAM in 2018, following computer platforms, with revenue of $21.3 billion. Wireless was also the second largest market for NAND flash memory after computers, with revenue of $14.6 billion in 2018. HDD and solid-state drive (SSD) products enjoy major usage in the enterprise segment where Huawei operates. The enterprise market generated 72.8 million HDD unit shipments in 2018, while SDD demand amounted to 34 million, according to the IHS Markit HDD and SDD Storage Intelligence Service. For Micron and Western Digital, the revenue lost because of the ban is not likely to be replaced easily or quickly.

IHS-Markit says No Winners:

While the ban was ostensibly designed to penalize Huawei and benefit the U.S. tech industry, the reality is the pain will be felt by companies on both sides of the Pacific, affecting key U.S. suppliers along with Huawei.

Dell’Oro: Broadband access revenue declines 2% y/y in Q1-2019

In a new report published Monday June 10th, Dell-Oro Group said that global revenue for broadband access equipment declined 2 percent Y/Y in 1Q 2019, reaching $2.9 Billion. Increased shipments of XG-PON1, XGS-PON, NG-PON2 OLT ports, and DOCSIS 3.1, CPE offset CCAP (Converged Cable Access Platform) spending declined for the second straight quarter.

“The 10 Gbps FTTH deployments continue to build momentum,” said Jeff Heynen, Research Director, Broadband Access and Home Networking. “The next-gen fiber increases nearly offset the weakness in cable CCAP spending, as cable operators push off new capacity purchases while they determine how to move forward with distributed access architectures,” Heynen added.

Following are additional highlights from the 1Q 2019 Broadband Access Quarterly Report:

- Total cable access concentrator revenue decreased 38 percent Y/Y to $275 M, driven by a strong slowdown in CCAP channel purchases in North America and EMEA.

- Total DSL port shipments decreased 21 percent Y/Y, with ADSL ports down 71 percent and VDSL ports down 20 percent.

- Total PON OLT port shipments increased 7 percent Y/Y, with XGS-PON ports up 337 percent.

- Total SOHO WLAN units increased 13 percent Y/Y, driven by the driven by 19% Y/Y growth in broadband CPE with WLAN and 125% Y/Y growth in mesh router units.

According to Dell’Oro Group’s Q1 2019 Broadband Access Quarterly Report, total cable access concentrator revenue was down 38% year over year to $275 million, driven by the slowdown in CCAP channel purchases in North America and EMEA.

Reference:

http://www.delloro.com/news/broadband-access-equipment-revenue-dipped-2-9-b-1q-2019

Dell’Oro PRESS RELEASES:

SHIPMENT OF 25 GBPS PORTS REACHED A NEW HEIGHT IN 1Q 2019 DESPITE SERVER MARKET SLOWDOWN, ACCORDING TO DELL’ORO GROUP

Rest of the Ethernet Controller and Adapter Market Remains Challenged

REDWOOD CITY, Calif. – June 11, 2019 – In a newly published report by Dell’Oro Group, the trusted source for information about the telecommunications and networking industries, shipments of 25 Gbps Ethernet controller and adapter ports reached a new height … Continued

1Q 2019 ENTERPRISE WLAN MARKET LIFTED BY STRONG SURGE IN NORTH AMERICA FOR THREE CONSECUTIVE QUARTERS, ACCORDING TO DELL’ORO GROUP

Cisco and HPE Aruba Scored Most Significant Revenue Gains

REDWOOD CITY, Calif. – June 11, 2019 – According to a recently published report by Dell’Oro Group, the trusted source for market information about the telecommunications, networks, and data center IT industries, the 1Q 2019 Enterprise Wireless LAN (WLAN) market … Continued

SERVER MARKET REVENUE GREW AT THE SLOWEST PACE IN EIGHT QUARTERS IN 1Q 2019, ACCORDING TO DELL’ORO GROUP

Cloud Capex Forecasted to Revert to Stronger Growth by Late 2019

REDWOOD CITY, Calif. – June 10, 2019 – According to a recently published report from Dell’Oro Group, the trusted source for market information about the telecommunications, networks, and data center IT industries, the worldwide Server market grew at the slowest … Continued

FCC Commissioner: Choosing the WRONG LANE (mmWave) in the race for 5G Spectrum

by Jessica Rosenworcel, Federal Communications Commission (FCC) in Wired.com – edited by Alan J Weissberger, IEEE ComSoc

Edited Summary:

Lost in the glowing 5G hype and headlines is the fact the United States is making choices that will leave rural America behind.

These choices will harm our global leadership in 5G and could create new challenges for the security of our networks.

The most important input in our new wireless world is spectrum, or the airwaves that are used to send and receive the radio signals that power wireless communications. For decades, slices of spectrum have been reserved for different uses, from television broadcasting to military radar. But today, demands on our airwaves have grown. So the Federal Communications Commission has been working to clear these airwaves of old uses and auction them so they can be re-purposed for new 5G service.

However, not all spectrum is created equal. The traditional sweet spot for wireless service has been in what we call low-band or mid-band spectrum. This is between 600 MHz and 3 GHz. For a long time, these airwaves were considered beachfront property because they send signals far. In other words, they cover wide areas but require little power to do so. This makes them especially attractive for service in rural areas, where technology that can reach more people with less infrastructure makes greater economic sense.

For 5G, however, the United States has focused on making high-band spectrum the core of its early 5G approach. These airwaves, known as “millimeter wave [1],” are way, way up there—above 24 GHz. They have never been used in cellular networks before, and for good reason—they don’t send signals very far and are easily blocked by walls. That means they are very expensive to build out. On the flip side, these airwaves offer a lot more capacity, which translates into ultra-fast speeds.

Note 1. Millimeter wave spectrum is the band of spectrum between 30 GHz and 300 GHz. Wedged between microwave and infrared waves, this spectrum can be used for high-speed wireless communications as seen with the latest IEEE 802.11ad Wi-Fi standard (operating at 60 GHz). It is being considered by standards organization, the Federal Communications Commission and researchers as the way to bring “5G” into the future by allocating more bandwidth to deliver faster, higher-quality video, and multimedia content and services.

……………………………………………………………………………………………………….

The United States is alone in this mission to make millimeter wave the core of its domestic 5G networks. The rest of the world is taking a different approach. Other nations vying for wireless leadership are not putting high-band airwaves front and center now. Instead, they are focusing on building 5G networks with mid-band spectrum, because it will support faster, cheaper, and more ubiquitous 5G deployment.

Take China, which allocated large swaths of mid-band spectrum for its carriers last year, clearing the way for deployment in a country that is also home to Huawei, the largest telecommunications equipment supplier worldwide. South Korea and Australia wrapped up an auction of key mid-band spectrum last year. At roughly the same time, Spain and Italy held their own auctions for mid-band airwaves. Austria did the same earlier this year. Switzerland, Germany, and Japan also auctioned a range of mid-band spectrum just a few months ago.

The United States, however, has made zero mid-band spectrum available at auction for the 5G economy. Moreover, it has zero mid-band auctions scheduled. This is a problem.

By ceding international leadership when it comes to developing 5G in the mid-band, we miss the benefits of scale and face higher costs and interoperability challenges. It also means less security as other nations’ technologies proliferate. Indeed, the most effective thing the United States can do in the short term to enhance the security of 5G equipment is make mid-band spectrum available, which will spur a broader market for more secure 5G equipment that will also benefit other countries that are pursuing mid-band deployments.

By auctioning only high-band spectrum, we also risk worsening the digital divide that already plagues so many rural communities in the United States. That’s because recent commercial launches of 5G service across the country are confirming what we already know—that commercializing millimeter wave will not be easy or cheap, given its propagation challenges. The network densification [2.] these airwaves require is substantial.

Note 2. Network densification will require hundreds of thousands of small cells which have to be mounted on public property in the U.S. The FCC issued a new ruling in September 2018 that set federal standards for small cell deployment regulation that aim to streamline the roll-out of 5G services across state and local governments. Similarly, state legislatures across the country have been considering bills that would create a uniform permitting and regulatory framework to support 5G network deployments. In general, a local government license will be required by the wireless telco that owns each small cell. Not all licenses will be granted as many city officials envision hordes of small cells to be a gigantic eyesore.

Reference:

https://broadbandnow.com/report/5g-small-cell-deployment-state-laws/

…………………………………………………………………………………………

In fact, recent tests of newly launched commercial 5G networks in the United States are showing that millimeter wave signals are not traveling more than 350 feet, even when there are no major obstructions. They are also not penetrating walls or windows, making indoor coverage difficult.

This means that high-band 5G service is unlikely outside of the most populated urban areas. The sheer volume of antenna facilities needed make this service viable makes it too costly to deploy in rural areas. So if we want to serve everywhere—and not create communities of 5G haves and have-nots—we are going to need a mix of airwaves that provide both coverage and capacity. That means we need mid-band spectrum. For rural America to see competitive 5G in the near future, we cannot count on high-band spectrum to get the job done.

The heat-seeking headlines about 5G are hard to resist. But the reality on the ground needs attention, too. For the United States to have secure 5G service available to everyone, everywhere, we need to stop going at it alone with millimeter wave spectrum. We need to make it a priority to auction mid-band airwaves right now. The longer we wait, the further behind the United States will fall—and the less likely our rural communities will see the benefits of next generation of (5G) wireless technology.

Original article:

https://www.wired.com/story/choosing-the-wrong-lane-in-the-race-to-5g/

THE WIRED GUIDE TO 5G

CTIA on 5G Spectrum:

https://www.ctia.org/news/5g-needs-an-all-of-the-above-spectrum-policy

Cisco announces AI/ML and Security Software to transform networks

The Network Gets Smarter, Simpler and More Secure with Artificial Intelligence and Machine Learning:

Cisco today announced software innovations designed to make managing and securing networks easier. As today’s businesses increasingly invest in digital technologies, IT teams are struggling under the amplified workload. To alleviate this burden and allow IT to focus on delivering innovation, Cisco is introducing new artificial intelligence and machine learning capabilities to allow IT teams to function at machine speed and scale through personalized network insights. As part of its broadened capabilities offering, Cisco is also unveiling innovations to more effectively manage users and applications across the entire enterprise network – from campus networks and wide-area networks, to data centers and the IoT edge.

IT teams currently face a daunting challenge. According to 451 Research, nearly two-thirds of organizations report that their IT teams are facing increased workloads; but increased IT headcount is in the cards for only about one-third of companies in the coming year. At the same time, it has never been more imperative for IT to deliver great digital experiences in this hyper-competitive landscape. Bridging the gap between the needs of a business and the resources available requires innovative network automation and analytics tools, powered by data and underpinned by artificial intelligence and machine learning.

Cisco’s new capabilities will grant IT teams:

- More Visibility: No two networks are the same. Environments are always changing. Cisco continuously collects relevant data from local networks and correlates it against the aggregate deidentified data set to create highly individualized network baselines. These baselines constantly learn and adapt as the number of devices, users and applications evolves, and as environments change.

- Greater Insights: Network complexity has grown beyond the human scale of processing. Cisco uses machine learning to correlate the immense amount of data coming from the network against the individualized network baselines to uncover the issues that will have the greatest impact on the network. This improves issue relevancy, alerting IT of the issues that matter most. It also discovers trends and patterns, so IT can pre-emptively identify issues before they become a problem.

- Guided Actions: Cisco uses machine reasoning algorithms and automated workflows to perform the logical troubleshooting steps that an engineer would execute to resolve a problem. This helps IT detect issues and vulnerabilities, analyze the root cause and execute corrective actions faster than ever.

“As the pace of change and diversity of the environment continues to rapidly evolve, Cisco is committed to continually simplifying our solutions,” said Scott Harrell, Senior Vice President and General Manager of Cisco’s Enterprise Networking Business. “Artificial intelligence and machine learning can enable businesses to efficiently discern which issues to prioritize, becoming more nimble and proactive. This will have a profound effect on network operations and the IT teams that run them. At Cisco, we’re future proofing our networks and the workforce through automation and intelligence.”

Reducing Complexity with the Multidomain Network

To help customers simplify the unprecedented complexity of modern IT, Cisco is building an architecture that spans every domain of the intent-based network — campus, branch, WAN, IoT, data center and cloud. Cisco has created solutions optimized to meet the unique needs of each of these networking domains. Today, Cisco is introducing new integrations, so users have a secure, consistent experience no matter where, when or how they connect. The new integrations allow for end-to-end:

- Network segmentation: The integration of Cisco SD-Access with Cisco SD-WAN and Cisco Application Centric Infrastructure (ACI) makes it easier for IT teams to consistently authorize, onboard and segment users and devices across campus, branch, data center and cloud networks, even when users and applications change. Because of this segmentation, IT is able to safeguard against unauthorized access to sensitive data and critical applications.

- Application experience: Cisco now automatically conveys application requirements between the data center and the WAN, allowing the network to select the best path and prioritize traffic even if applications move or change. This allows IT teams to dynamically elevate application performance across the enterprise and branch.

- Pervasive security: As an industry leader in cybersecurity, Cisco is leveraging its security innovations across all domains. By extending the ability to detect threats in encrypted traffic across public clouds, and by protecting the campus, branch and WAN against threats, Cisco says it’s providing the end-to-end security customers need.

Cisco’s Ecosystem Drives Innovation

As the network becomes increasingly programmable, Cisco’s ecosystem of partners and developers has been crucial to drive innovation. To help organizations keep up with the relentless pace of change, Cisco DevNet, the company’s developer program, has introduced community-backed efforts to make adopting networking technology easy and accessible. This includes machine learning and artificial intelligence developer resources, which include use cases and resources to get started with new applications; the Cisco DevNet Automation Exchange, which contains a curated repository of code for all levels of network automation use cases; and the Cisco DNA Center Platform, which helps networking professionals and software developers alike to build new applications and integrations.

Cisco: How AI and machine learning are going to transform your enterprise network

…………………………………………………………………………………………………………..

Availability, Licensing and Services

- Cisco AI Network Analytics will be a standard part of Cisco DNA Assurance and will be available in the next version of Cisco DNA Center, generally available summer of 2019. Cisco AI Network Analytics capabilities will be included in the Cisco DNA Advantage software licensing tier.

- The multidomain network integrations will be available with the next version of Cisco DNA Center, generally available summer of 2019. These integrations will be included in the Cisco DNA Advantage software licensing tier.

- Cisco Customer Experience for Cisco DNA solutions accelerates deployment of next-gen intent-based networking solutions while reducing risk and disruption. The Cisco Customer Experience portfolio of services delivers expert guidance, best practices and innovative tools to help customers transition with greater ease and confidence. This also allows them to innovate faster, stay competitive, extract more value and realize faster ROI.

Additional Resources

- Executive Blog: Intelligent Next Step for Intent-Based Networking (Scott Harrell)

- Executive Blog: Cisco AI Network Analytics: Making Networks Smarter and Simpler to Manage (Anand Oswald)

- Executive Blog: 3 Ways Intent-Based Networking Fulfills Business Intent with Multidomain Integration (Prashanth Shenoy)

- Cisco DNA Assurance Solution Overview

- Cisco Multidomain Integrations At-a-Glance

- Cisco AI Network Analytics wireless experience use-case video

SOURCE: Cisco Systems

………………………………………………………………………..

References:

Is a new 5G Iron Curtain emerging: Russia and China Tech Cold War vs the U.S.?

A decision by Russian telco MTS to select Huawei Technologies to develop its 5G network comes just as the U.S. ban of the Chinese telecom gear provider could leave the U.S. lagging behind other global powers, analysts say in a CNN article.

Huawei Chairman Guo Ping and MTS boss Alexei Kornya signed the agreement in the Kremlin on Wednesday, with Russian President Vladimir Putin and Chinese leader Xi Jinping watching.

“We both add momentum to strategic cooperation between the two companies in high tech, thus building a foundation for commercial 5G rollouts in Russia in the nearest future,” Kornya said in an emailed statement. Guo highlighted that Huawei’s more than 16,000 5G-related patents make it “number one worldwide.” “We hope that our joined efforts will help Russia enter the 5G era sooner,” he added.

Guo Ping -chairman of Huawei- shaking hands with Alexei Kornya- head of MTS- at the Kremlin in Moscow, Russia.

The Kremlin noted that several business deals had been signed in a ceremony attended by Russia President Vladimir V. Putin and China Premier Mr. Xi.

It’s not clear Russia will have a national 5G network, using Chinese or Western equipment, as the military has so far declined to free up the necessary radio frequencies.

“The situation there is a bit complicated,” a deputy prime minister, Maksim Akimov, said at a meeting with Mr. Putin in April. “We’d like to ask you for relevant orders,” to the military, so Russia can keep up with the new (5G) cellphone technology.

MTS’ pending 5G Huawei deal comes as Chinese authorities moved this week to license its first array of 5G wireless service providers. China approved its first batch of 5G licensing for commercial use, unveiling, in the words of state media, “a new era for the telecom industry.” Huawei will be deeply involved in that effort, adding to the more than 45 commercial 5G contracts the firm has signed in 30 countries around the world.

………………………………………………………………………………………………

The referenced CNN article stated:

The US has also been urging allies to restrict or ban the use of Huawei equipment in their 5G networks, warning that Beijing could use the sensitive data infrastructure for spying. Huawei has repeatedly denied that any of its products pose a national security risk.While some US cities have begun rolling out 5G technologies, analysts have warned the Huawei ban risks slowing down countrywide adoption, and could see it lag behind China. Now even Russia, not usually thought of as a tech leader, may be poised to pull ahead.Outside of the US, whether to buy from Huawei or not is increasingly becoming a political litmus test, one that threatens to exacerbate the bifurcation of the global internet into separate spheres, and hasten the demise of the open, truly worldwide web as we know it.Those that choose to avoid Huawei also risk falling behind as the world moves towards the next stage of internet and communications technology.

According to a report from The Financial Times, Google’s recent discussions with the US government actually argue that the Huawei ban is bad for national security. Google is reportedly asking for an exemption from the export ban.The argument, reportedly, is that Huawei is currently dependent on Google for its Android smartphone software, and that dependence is a good thing for the US. The Financial Times quotes “one person with knowledge of the conversations” as saying, “Google has been arguing that by stopping it from dealing with Huawei, the US risks creating two kinds of Android operating system: the genuine version and a hybrid one. The hybrid one is likely to have more bugs in it than the Google one, and so could put Huawei phones more at risk of being hacked, not least by China.”Banning Huawei from dealing with U.S. companies is definitely a double-edged sword. Huawei would have a tough time building smartphones or an app ecosystem without the help of U.S.-originated technology and app developers, but US hardware and software companies would lose access to the second largest smartphone maker in the world.

Facebook will no longer allow its apps to be pre-installed on Huawei phones as the Chinese tech giant faces the ongoing fallout of a blacklisting of its services in the U.S. That means that people who already own Huawei phones with apps such as Facebook, WhatsApp and Instagram will not be impacted, Facebook confirmed Friday that new phones from the tech company will not come with the applications. However, Huawei devices (smartphones and tablets) that are already in the hands of consumers will still be able to run the apps and receive regular software updates, Facebook told Reuters.

“We have a relationship of trust in the sphere of politics, security and defense,” he said. “We know that you [Xi] personally pay great attention to the development of Russian-Chinese relations.”

The new era of closer Sino-Russian relations is born out of concerns that the US-China trade war – sparked by US President Donald Trump’s “America first” foreign policy and which has cost Beijing billions of dollars in export tariffs – could escalate into a cold war between the two countries. As China and Russia get ever closer and agree to boost ties in the face of U.S. pressure, we are seeing the beginnings of a new 5G iron curtain and tech cold war.

AT&T Fiber Build-Out Ahead of Schedule; Moffett report on AT&T Fiber questions subscriber growth

AT&T Fiber Build-Outs:

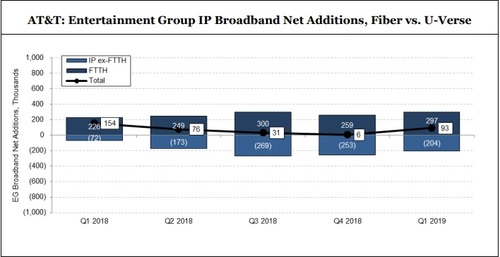

For the first quarter 2019, AT&T reported 297,000 AT&T fiber customer gains and 45,000 broadband net adds, with broadband revenue growing more than 8%.

As part of its 2015 acquisition of DirecTV, the FCC required that AT&T expand its deployment of its high-speed, fiber-optic broadband internet service to 12.5 million customer locations, as well as to E-rate eligible schools and libraries, by July 2019.

Speaking Wednesday, June 5th at the Credit Suisse 21st Annual Communications Conference (see webcast url below), AT&T Communications CEO John Donovan said that AT&T now has a large inventory of fiber-based assets and that their fiber build-out has already reached 14.5 million customer locations.

…………………………………………………………………………………………………………

Editor’s Note:

Indeed, AT&T is offering fiber based internet in the SF Bay area via a KCBS radio commercial. However, they say availability is limited.

AT&T webcast url: https://event.webcasts.com/starthere.jsp?ei=1245728&tp_key=70a2932a9e&tp_special=8

…………………………………………………………………………………………………………

AT&T will be a bit slower in future fiber build-outs. Donovan said “We’ll continue to invest in fiber but we’ll do it based on the incremental, economic case. We’re not running to any household target.”

While it used to take AT&T 36 months to get fiber into roughly 30% of a market, AT&T can now reach 50% to 55% in 24 months time, according to Donovan.

“So I really like the cadence and the momentum that we’ve got in our brand, which is AT&T Fiber,” he said. “Where we have fiber we’re doing exceedingly well. Where we have slower speeds, sub 40 megabits per second, that’s where the majority of our churn is. But right now if you look at this year, we will add a million high-speed fiber broadband subs. And roughly two thirds of those come from cable. So we’re doing extremely well.”

AT&T’s pre-standard “5G” deployments, which will be launched in 29 cities by the end of the year, also benefit from the fiber build-out as fiber is needed for high bandwidth backhaul. Note yet again that an AT&T representative chairs ITU-R WP 5D where IMT 2020 (radio aspects) is being standardized.

……………………………………………………………………………………………………………..

Moffett-Nathanson report: “U.S. Broadband: Where Are AT&T Fiber’s Subscriber Gains Coming From?“

However, LightReading says that the bulk of AT&T Fiber subscriber growth is coming from AT&T. AT&T Fiber’s subscriber base is growing rapidly. AT&T disclosed that AT&T Fiber — the expanding FTTP portion of its footprint capable of delivering speeds up to 1 Gbit/s — gained about 1.1 million subscribers over the past year, bringing the total AT&T Fiber subscriber base to about 3.1 million.

However, AT&T appears to be benefiting largely from speed upgrades from its existing high-speed Internet customers rather than by stealing share away from cable rivals, according to a new subscribers only analysis of the U.S. broadband market by MoffettNathanson titled “U.S. Broadband: Where Are AT&T Fiber’s Subscriber Gains Coming From?”

“The short answer appears to be… from AT&T itself,” wrote Craig Moffett, lead analyst with Moffett-Nathanson, surmising that the bulk of new AT&T Fiber subs are coming from the company’s own broadband subscriber base, usually in the form of upgrades or migrations of existing U-verse customers.

Moffet said AT&T’s broader “IP Broadband” category” — which includes AT&T Fiber and U-verse/fiber-to-the-neighborhood customers — has posted comparatively modest subscriber gains over the past year.

Source: Company reports, MoffettNathanson estimates and analysis

………………………………………………………………………………………………………….

“Therefore, unless AT&T’s U-verse broadband customers are suddenly fleeing for other providers in droves (unlikely), one obvious possibility is that many, or even most, of AT&T’s fiber gains are simply migrations of their existing customer base from one product to another,” Moffett explained, estimating that about 81% of AT&T Fiber net adds over Q1 2018 to Q1 2019 were migrations from U-verse.

Moffett said that migration story isn’t necessarily a surprising one. While the initial U-verse deployments in the early 2000s targeted some of the densest parts of the telco’s footprint, AT&T has predictably targeted FTTP deployments in many of the same dense areas, he added.

Also of note: AT&T Fiber’s base tier is $60 per month for a symmetrical 80 Mbit/s to 100 Mbit/s, the same as the U-verse standalone broadband product. “Even if a customer doesn’t really need faster upload speeds, if AT&T offers to upgrade a customer for no added cost why wouldn’t they switch?” Moffett asks.

And though AT&T Fiber subscribers appear to be largely coming way of upgrades or migrations of existing AT&T broadband subs, Moffett said that doesn’t mean that AT&T Fiber won’t have a bigger impact on competitors (like cable operators) eventually. “It’s just that it’s not having much impact yet,” he wrote, adding that AT&T Fiber’s expansion, expected to pass 14 million residential and small business locations by June 2019, remains a threat to cable that’s “worth watching.”

According to Moffett’s report, US MSOs added 1.04 million broadband subs in Q1, up from 962,000 in the year-ago quarter. US telcos added just 23,000 broadband subs in Q1 fueled by ongoing depletion of legacy DSL subs, but improved from a year-ago loss of 44,000 customers. The US satellite broadband sector, still a small player, added 15,000 subs in the quarter.

Combined, US broadband providers added 1.07 million subs in Q1 — a year-on-year growth rate of 2.9% — for a grand total of 107.81 million subs. Broken down by provider type, US cable led with 71.58 million, followed by the telcos (34.4 million) and satellite (1.82 million).