Month: June 2019

Verizon puts more effort in 3.5 GHz band for CBRS; 5G in China at 3.5 GHz

Verizon has reportedly shown growing interest in providing service in the 3.5 GHz band via Citizens Band Radio Service (CBRS) frequencies, even though federal regulators (FCC and NTIA- see below) have yet to allow carriers to launch commercial operations using the mid-band spectrum. The development also points to Verizon’s increased enthusiasm for unlicensed spectrum, which saves money at the risk of frequency crowding.

Verizon first signaled its interest in the 3.5GHz CBRS band during the Mobile World Congress trade show in 2017. Ed Chan — now one of Verizon’s top network executives — said CBRS could power a number of business models including both private and commercial mobile networks. And then last year Verizon issued a press release about its ongoing CBRS testing with Federated Wireless, Google, Nokia and Qualcomm.

Since then Verizon executives have routinely said the operator is interested in using the 3.5GHz for outdoor and indoor small cells. Indeed, just last month the operator embarked on new outdoor and indoor CBRS tests, according to filings with the FCC.

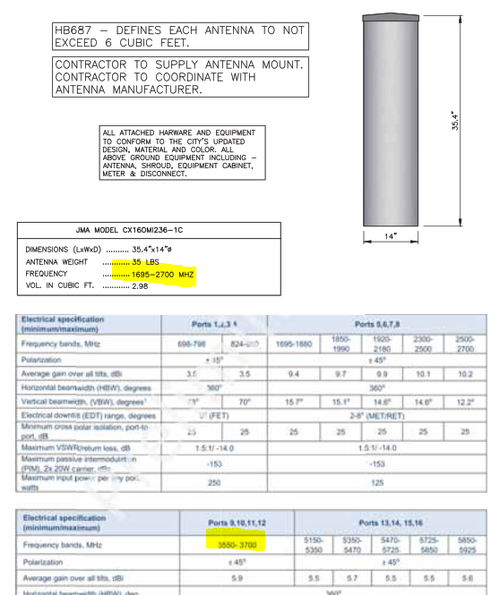

But the fact that Verizon is already deploying CBRS antennas into its network, and is already selling several CBRS-capable phones including the Pixel 3 and the Samsung Galaxy S10, shows that Verizon is keen to put the band to commercial use much more quickly than expected. According to some new Verizon cell tower applications, the largest U.S. wireless network operator is now specifically noting support for the 3.5GHz band:

Verizon and a wide range of other companies are waiting for the FCC and NTIA to give final approval for initial commercial deployments in the CBRS 3.5GHz band. Those approvals are expected in the next few weeks. After monitoring the initial deployments, the FCC is expected to sign off on broad, unlicensed commercial use of the 3.5GHz band in the third quarter. In 2020, the FCC is expected to conduct auctions of 3.5GHz licenses.

Verizon, like most wireless carriers, wants to add more spectrum to its network to keep pace with increasing user traffic. But instead of spending billions of dollars buying spectrum from someone like Dish Network, or buying it at a government auction, Verizon increasingly is using unlicensed spectrum. Such spectrum is free to use but can become crowded.

Verizon first hinted at its unlicensed aspirations in its support for the LTE-U standard roughly five years ago. That standard was designed to allow cellular operators to expand LTE transmissions from licensed spectrum bands and into the 5GHz unlicensed band. Although the similar LAA standard eventually replaced the LTE-U standard, the result is the same: Operators like Verizon can add more capacity to their networks by basically pushing LTE transmissions into unlicensed spectrum bands alongside their existing, licensed spectrum bands. AT&T and T-Mobile are also deploying LAA.

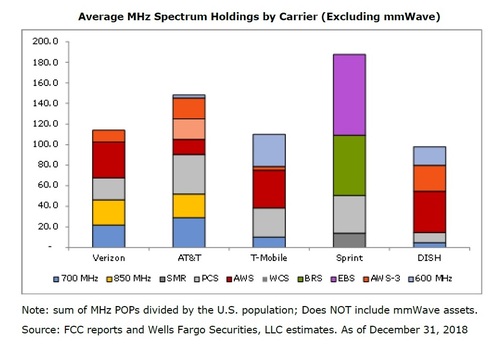

Verizon may employ the same strategy in the 3.5GHz CBRS band. And the reason Verizon is moving so fast to do so is probably to add capacity to its network quickly. As noted by the Wall Street analysts at Wells Fargo, Verizon sits well behind AT&T in terms of overall mid-band spectrum ownership:

Although Verizon owns significant amounts of so-called millimeter-wave (mmWave) spectrum, it owns just slightly more mid-band spectrum than T-Mobile does — although Verizon counts almost twice as many mobile customers.

Thus, Verizon may well be looking for ways to improve its network capacity with unlicensed spectrum like the 3.5GHz band while it waits for the FCC to release more mid-band spectrum like the C Band.

Read more at: https://www.lightreading.com/mobile/5g/verizon-slaking-mid-band-spectrum-thirst-with-35ghz-cbrs-deployments/d/d-id/751907

…………………………………………………………………………………………………………………………………………………………

Addendum — 3.5GHz band for 5G in China:

China Telecom was allowed to use the 3.4 GHz to 3.5 GHz frequency range to carry out 5G trials in mainland China. Under the agreement with the Chinese government, China Telecom will return its 2.635 GHz to 2.655 GHz spectrum over the same timeframe.

China Unicom said it has been approved to use the 3.5 GHz to 3.6 GHz frequency band for a nationwide 5G trial rollout until June 2020. The telco said that it will gradually cease to use the frequency in the 2.555 GHz to 2.575 GHz range that it had been using for 5G trials and progressively return it to the MIIT.

Reference:

https://www.rcrwireless.com/20190603/5g/5g-spectrum-allocations-china

IHS Markit: Microsoft #1 for total cloud services revenue; AWS remains leader for IaaS; Multi-clouds continue to form

Following is information and insight from the IHS Markit Cloud & Colocation Services for IT Infrastructure and Applications Market Tracker.

Highlights:

· The global off-premises cloud service market is forecast to grow at a five-year compound annual growth rate (CAGR) of 16 percent, reaching $410 billion in 2023.

· We expect cloud as a service (CaaS) and platform as a service (PaaS) to be tied for the largest 2018 to 2023 CAGR of 22 percent. Infrastructure as a service (IaaS) and software as a service (SaaS) will have the second and third largest CAGRs of 14 percent and 13 percent, respectively.

IHS Markit analysis:

Microsoft in 2018 became the market share leader for total off-premises cloud service revenue with 13.8 percent share, bumping Amazon to the #2 spot with 13.2 percent; IBM was #3 with 8.8 percent revenue share. Microsoft’s success can be attributed to its comprehensive portfolio and the growth it is experiencing from its more advanced PaaS and CaaS offerings.

Although Amazon relinquished its lead in total off-premises cloud service revenue, it remains the top IaaS provider. In this very segmented market with a small number of large, well-established providers competing for market share:

• Amazon was #1 in IaaS in 2018 with 45 percent of IaaS revenue.

• Microsoft was #1 for CaaS with 22 percent of CaaS revenue and #1 in PaaS with 27 percent of PaaS revenue.

• IBM was #1 for SaaS with 17 percent of SaaS revenue.

…………………………………………………………………………………………………………………………………

“Multi-clouds [1] remain a very popular trend in the market; many enterprises are already using various services from different providers and this is continuing as more cloud service providers (CSPs) offer services that interoperate with services from their partners and their competitors,” said Devan Adams, principal analyst, IHS Markit. Expectations of increased multi-cloud adoption were displayed in our recent Cloud Service Strategies & Leadership North American Enterprise Survey – 2018, where respondents stated that in 2018 they were using 10 different CSPs for SaaS (growing to 14 by 2020) and 10 for IT infrastructure (growing to 13 by 2020).

Note 1. Multi-cloud (also multicloud or multi cloud) is the use of multiple cloud computing and storage services in a single network architecture. This refers to the distribution of cloud assets, software, applications, and more across several cloud environments.

There have recently been numerous multi-cloud related announcements highlighting its increased availability, including:

· Microsoft: Entered into a partnership with Adobe and SAP to create the Open Data Initiative, designed to provide customers with a complete view of their data across different platforms. The initiative allows customers to use several applications and platforms from the three companies including Adobe Experience Cloud and Experience Platform, Microsoft Dynamics 365 and Azure, and SAP C/4HANA and S/4HANA.

· IBM: Launched Multicloud Manager, designed to help companies manage, move, and integrate apps across several cloud environments. Multicloud Manager is run from IBM’s Cloud Private and enables customers to extend workloads from public to private clouds.

· Cisco: Introduced CloudCenter Suite, a set of software modules created to help businesses design and deploy applications on different cloud provider infrastructures. It is a Kubernetes-based multi-cloud management tool that provides workflow automation, application lifecycle management, cost optimization, governance and policy management across cloud provider data centers.

IHS Markit Cloud & Colocation Intelligence Service:

The bi-annual IHS Markit Cloud & Colocation Services Market Tracker covers worldwide and regional market size, share, five-year forecast analysis, and trends for IaaS, CaaS, PaaS, SaaS, and colocation. This tracker is a component of the IHS Markit Cloud & Colocation Intelligence Service which also includes the Cloud & Colocation Data Center Building Tracker and Cloud and Colocation Data Center CapEx Market Tracker. Cloud service providers tracked within this service include Amazon, Alibaba, Baidu, IBM, Microsoft, Salesforce, Google, Oracle, SAP, China Telecom, Deutsche Telekom Tencent, China Unicom and others. Colocation providers tracked include Equinix, Digital Realty, China Telecom, CyrusOne, NTT, Interion, China Unicom, Coresite, QTS, Switch, 21Vianet, Internap and others.

TMR: Data Center Networking Market sees shift to user-centric & data-oriented business + CoreSite DC Tour

TMR Press Release edited by Alan J Weissberger followed by Coresite Data Center Talk & Tour for IEEE ComSocSCV and Power Electronics members

TMR Executive Summary and Forecast:

The global data center networking market is expected to emerge as highly competitive due to rising demand for networking components.

The major players operating in the global data center networking market include Hewlett Packard Enterprise, Cisco Systems, Inc., Arista Networks, Microsoft Corporation, and Juniper Networks. The key players are also indulging into business strategies such as mergers and acquisitions to improve their existing technologies. Those vendors are investing heavily in the research and development activities to sustain their lead in the market. Besides, these firms aim to improve their product portfolio in order to expand their global reach and get an edge over their competitors globally.

The global data center networking market is likely to pick up a high momentum since the firms are rapidly shifting to a more user-centric and data-oriented business. According to a recent report by Transparency Market Research (TMR), the global data center networking market is expected to project a steady CAGR of 15.5% within the forecast period from 2017 to 2025. In 2016, the global market was valued around worth US$63.05 bn, which is projected to reach around a valuation of US$228.40 bn by 2025.

On the basis of component, the global data center networking market is segmented into services, software, and hardware. Among these, the hardware segment led the market in 2016 with around 52.0% of share of data center networking market, as per the revenue. Nevertheless, projecting a greater CAGR than other segments, software segment is as well foreseen to emerge as the key segment contributing to the market growth. Geographically, North America was estimated to lead the global market in 2016. Nevertheless, Asia Pacific is likely to register the leading CAGR of 17.3% within the forecast period from 2017 to 2025.

Rising Demand for Networking Solutions to Propel Growth in Market

Increased demand for networking solutions has initiated a need for firms to change data center as a collective automated resource centers, which provide better flexibility to shift workload from any cloud so as to improve the operational efficiency.

Rising number of internet users across the globe require high-speed interface. Companies are highly dependent on the data centers in terms of efficiency to decrease the operational cost and improve the productivity.

Nevertheless, virtualization and rising demand for end-use gadgets are the major restrictions likely to hamper growth in the data center networking market in the coming years. Rising usage of mobile devices and cloud services also is hindering the steady strides in the data center networking market.

Popularity of Big Data to Add to Market Development in Future:

Rising popularity of big data and cloud services from the industry as well as consumer is anticipated to fuel the development in the global data center networking market. Advantages such as low operational costs, flexibility, better security and safety, and improved performance are likely to proliferate the market growth.

Disaster recovery and business continuity has resulted in simplification of data center networking by saving both money and time for companies. Financial advantages along with technology is likely to augur the demand in data center networking and cloud computing.

Companies are highly focused on data center solution providers to perform efficiently and effectively, with better productivity, high profit, and decreased prices. These goals require high-end networking technologies and upgraded performance server. It also needs a proper integration between simplified networking framework and server to reach the optimum level of performance.

The study presented here is based on a report by Transparency Market Research (TMR) titled “Data Center Networking Market (Component Type – Hardware, Software, and Services; Industry Vertical – Telecommunications, Government, Retail, Media and Entertainment, BFSI, Healthcare, and Education) – Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2017 – 2025.”

Get PDF Brochure at:

https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=21257

Request PDF Sample of Data Center Networking Market:

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=21257

About TMR:

Transparency Market Research is a next-generation market intelligence provider, offering fact-based solutions to business leaders, consultants, and strategy professionals.

Our reports are single-point solutions for businesses to grow, evolve, and mature. Our real-time data collection methods along with ability to track more than one million high growth niche products are aligned with your aims. The detailed and proprietary statistical models used by our analysts offer insights for making right decision in the shortest span of time. For organizations that require specific but comprehensive information we offer customized solutions through adhoc reports. These requests are delivered with the perfect combination of right sense of fact-oriented problem solving methodologies and leveraging existing data repositories.

TMR believes that unison of solutions for clients-specific problems with right methodology of research is the key to help enterprises reach right decision.”

Contact

Mr. Rohit Bhisey

Transparency Market Research

State Tower

90 State Street,

Suite 700,

Albany, NY – 12207

United States

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Email: [email protected]

Website: https://www.transparencymarketresearch.com

Research Blog: http://www.europlat.org/

Press Release:

………………………………………………………………………………………………………..

Coresite Data Center Tour:

On May 23, 2019, IEEE ComSocSCV and IEEE Power Electronics members were treated to a superb talk and tour of the Coresite Multi-Tenant Data Center (MTDC) in Santa Clara, CA.

CoreSite is a Multi-Tenant Data Center owner that competes with Equinix. CoreSite offers the following types of Network Access for their MTDC colocation customers:

•Direct Access to Tier-1 and Eyeball Networks

•Access to Broad Range of Network Services (Transit/Transport/Dark Fiber)

•Direct Access to Public Clouds (Amazon, Microsoft, Google, etc)

•Direct Access to Optical Ethernet Fabrics

………………………………………………………….

CoreSite also provides POWER distribution and backup on power failures:

•Standby Generators

•Large Scale UPS

•Resilient Design

•Power Quality

•A/B Power Delivery

•99.999% Uptime

….and PHYSICAL SECURITY:

•24/7 OnSite Security Personnel

•Dual-Authentication Access

•IP DVR for All Facility Areas

•Perimeter Security

•Equipment Check-In/Out Process

•Access-Control Policies (Badge Deactivation, etc)

……………………………………………………………………………………………………..

There are 28 network operators and cloud service providers that have brought fiber into the CoreSite Santa Clara MTDC campus. The purpose of that is to enable customers to share fiber network/cloud access at a much higher speed and lower cost than would otherwise be realized via premises-based network/cloud access.

While the names of the network and cloud service providers could not be disclosed, network providers included: Verizon, AT&T, Century Link, Zayo. In addition, AWS Direct Connect, Microsoft Azure ExpressRoute, Alibaba Cloud, Google Cloud interconnection and other unnamed cloud providers were said to have provided direct fiber to cloud connectivity for CoreSite’s Santa Clara MTDC customers.

Here’s how network connectivity is achieved within and outside the CoreSite MTDC:

The SMF or MMF from each customer’s colocation cage is physically routed (under the floor) to a fiber wiring cross-connect/patch panel maintained by Coresite. The output fibers are then routed to a private room where the network/cloud providers maintain their own fiber optic gear (fiber optic multiplexers/switches, DWDM transponders and other fiber transmission equipment) which connect to the outside plant fiber optic cable(s) for each network/cloud services provider.

The outside plant fiber fault detection and restoration are done by each network/cloud provider- either via a mesh topology fiber optic network or 1:1 or N:1 hot standby. Coresite’s responsibility ends when it delivers the fiber to the provider cages. They do, however, have network engineers that are responsible for maintenance and trouble shooting in the DC when necessary.

Instead of using private lines or private IP connections, CoreSite offers an Interconnect Gateway-SM provides their enterprise customers a dedicated, high-performance interconnection solution between their cloud and network service providers, while establishing a flexible IT architecture that allows them to adapt to market demands and rapidly evolving technologies.

CoreSite’s gateway directly integrates enterprises’ WAN architecture into CoreSite’s native cloud and carrier ecosystem using high-speed fiber and virtual interconnections. This solution includes:

-Private network connectivity to the CoreSite data center

-Dedicated cabinets and network hardware for routing, switching, and security

-Direct fiber and virtual interconnections to cloud and network providers

-Technical integration, 24/7/365 monitoring and management from a certified CoreSite Solution Partner

-Industry-leading SLA

5G Telecom Investments, Hype, Huawei & 5G replacement for cable broadband?

Wharton’s Kevin Werbach and Jeffrey Reed from Virginia Tech discuss whether 5G technology will live up to its promise.

Telecom companies and other providers will have to invest billions to make 5G a reality — not only to buy more spectrum, but also to build out the infrastructure. Because it’s yet uncertain how much revenue 5G will bring, for now the most prudent path for telecom firms is to upgrade the capacity of their 4G networks by reclaiming airwaves allocated for 2G and 3G, as well as buying more spectrum, according to a report by McKinsey. (The lower bands can be used for 5G as part of the carrier’s network management plan, even though data capacity won’t be as good.)

But there will come a time when these tactics won’t be enough. Historically, data traffic rises by 20% to 50% a year, and 5G could put the traffic increases at the higher end of that range, the McKinsey report said. That means most telecom companies will have to embark on a “significant new build out” between 2020 and 2025. Also, to handle higher traffic, carriers have to install fiber in their wired networks, where wireless connects to the internet. “It’s rather ironic that the projected performance goals of 5G wireless will depend on the availability of wireline fiber,” an executive at telecom equipment maker Ciena said.

Carriers can’t just label their service 5G, which is a lesson AT&T learned when it was sued by Sprint for putting “5GE” on its service despite not using true 5G. AT&T reportedly settled the lawsuit, explaining that “E” stands for “Evolution.” A Verizon spokesman tweeted that “5GE” stood for “5G Eventually.”

Regarding using millimeter wave spectrum for 5G:

“When you’re transmitting and receiving at very high frequencies, it is very efficient for carrying lots and lots of data,” said Gerald Faulhaber, Wharton professor emeritus of business economics and public policy and former FCC chief economist. “You can carry much, much more data than you ever could using our 4G phones.”

But a key drawback is that these signals travel only short distances. The wavelengths in this band range from 1 mm to 10 mm — the FCC’s December auction is called the millimeter wavelength auction — so these can’t reach very far and are easily degraded. “Very high frequency radio signals travel in direct, straight lines, and they attenuate very quickly,” Faulhaber said. In comparison, very low frequency 30 hertz signals can travel more than 10,000 km, or 6,200 miles. Lower frequencies also can better penetrate solid objects like buildings and walls.

Because millimeter wavelengths are short, they need more antennas to connect. “One of the things that 5G requires is a much denser network,” Werbach said. “You need many more nodes. That is partly how the capacity increases, which means either more towers or more cells in more places. You need equipment that is running on those cell sites, and then you need chips that go into people’s handsets and devices.” At least, the 5G antennas are small and can be installed easily on top of telephone poles and other locations, Faulhaber said.

Because it requires density, 5G mainly is feasible for more populated areas where many antennas can be placed close together. “The nature of the infrastructure is that it works in dense areas; it doesn’t work as well in other areas,” Faulhaber said. “Will there be 5G in [rural areas]? The answer is yes, but it won’t be over these high-frequency antennas. It will be basically where 4G is today, so you won’t get the high-capacity [service].”

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Telecom carriers have deployed limited 5G commercial service.

- In April, AT&T said mobile 5G is live in parts of 19 cities, with more cities to come. In the same month,

- Verizon said 5G service has launched in parts of Chicago and Minneapolis, where typical early adopters experience download speeds of 450 Mbps and peak speeds of 1 Gbps. That is six and 14 times faster than the median fixed broadband speed of 72 Mbps respectively, according to a December 2018 FCC report. Verizon expects to deploy limited 5G in more than 30 cities this year. Last fall, it launched a limited 5G home internet service in four cities.

- Sprint is rolling out 5G in nine markets this year. On May 31st Sprint announced the availability for its first two 5G devices, LG V50 ThinQTM 5G and HTC 5G Hub. Both devices will initially be available to customers in the first four 5G markets – Atlanta, Dallas, Houston and Kansas City.

- T-Mobile is calling out its rivals over their 5G hype. “I have the exact same 5G mmWave network equipment and software that AT&T and Verizon do, and there’s no way we would launch this for customers right now,” CTO Neville Ray wrote in a blog. The millimeter wave signal “doesn’t travel far from the cell site and doesn’t penetrate materials at all,” he said. Ray’s blog even embedded a moving image showing that millimeter waves can’t even go through a door. T-Mobile will bring 5G to market, he said, “when the technology is ready for everyday customer use.”

Telecom analyst Craig Moffett of MoffettNathanson echoed similar doubts on CNBC. “There’s zero chance that 5G is ubiquitous technology” by 2021, he said. “The promises around 5G being insanely fast are partly because the standards for 5G were set for insanely wide blocks of spectrum. But you can’t find insanely wide blocks of spectrum anywhere except in these kind of stratospherically high frequencies,” which has its own technical problems. He noted that China, which is surging ahead on 5G, doesn’t use millimeter wave but rather lower band spectrum below 6 GHz, while Europe is using a combination of the two.

Politics also influences U.S. carrier adoption of 5G. The government has security concerns about using 5G telecom equipment from China’s Huawei because of fears over spying. Huawei is the world’s largest maker of telecom equipment, including that needed for 5G. It became a colossus, and “a key reason for that is they produce very inexpensive equipment. It is much cheaper than [that of] their European competition,” Reed said. Huawei doesn’t have any U.S. competition, because infrastructure providers left the business about 20 years ago, he added.

Today, Europe and other parts of the world are customers of Huawei. Britain and Germany specifically are resisting pressure from the U.S. to stop using Huawei. Their carriers have used Huawei in their networks for years, so “for them, it is very difficult to say … ‘rip it all out and go find someone else,’” Werbach said. “They’re just not going to do it.” Added Reed: “Even though a security threat exists with Huawei, companies tend to look the other way to maximize profits, lower costs.” As for security, “that’s way down on their list,” Reed said.

Werbach explained that the U.S. can’t address these security concerns by merely saying it will not use this equipment. It has to be more proactive. “We need to invest in companies in the U.S. and bring trust around the world that, for example, the U.S. is not putting similar kinds of back doors into equipment made by U.S.-based service providers.”

Will 5G Replace Cable?

Even with 5G’s drawbacks, enthusiasm for it remains unabated. One big hope is that 5G could be a viable alternative to the wired broadband service provided by cable and telecom companies. “Could 5G … be the new single pipe into the home?” Faulhaber asked. But before one gets excited about competition bringing lower prices and better service, remember that the same companies currently providing wired broadband to the home are the ones launching 5G. “Guess who are the two dominant wireless operators that have … a big chunk of the spectrum in the service? AT&T and Verizon, who, of course, are also major wired broadband providers,” Werbach noted.

However, Werbach acknowledged that there potentially could be other players in 5G, such as T-Mobile, Sprint and Comcast. Indeed, T-Mobile and Sprint have been trying to convince regulators to let them merge because then they would have the heft to deploy 5G nationally. But The Wall Street Journal reported in April that the deal is unlikely to be approved as structured.

As for Comcast, Faulhaber pointed out that the cable giant already has installed plenty of Wi-Fi receivers, including in customers’ routers that other folks on its network can use to access the internet. “Xfinity Wi-Fi is all over the place and I would suspect we would see something like that with 5G,” he said. But Faulhaber also pointed out that Comcast has time to figure out a response to 5G since it won’t have to worry about competition from this new technology in the near future.

Comcast CFO Michael Cavanaugh put it this way at a recent conference: “The threat of 5G to our broadband business is not significant any time soon. That’s because [cable is] going to be the most economic way to deliver high-quality broadband, period.”

Any cable rival will need “high capacity, high speed and … high reliability,” he said. “Between the different ways, different levels of spectrum and approaches to 5G, it’s really hard to see how there’s a path to any one of those being a broadly addressable solution for residential [broadband] in the U.S.”

Reference:

http://gonzaloraffoinfonews.blogspot.com/2019/06/the-promise-and-pitfalls-of-5g-will-it.html

Inside Verizon’s 5G lab + Sunday NY Times: Can Holograms Give Surgeons X-Ray Vision?

Verizon showed off new technology at its Cambridge, MA lab last week, seeking to demonstrate that (pre-standard) “5G” networks are as much about reducing latency as they are about providing blazing speeds. (That’s bizarre because the low latency component of 5G won’t be specified until 3GPP Release 16 and IMT 2020).

The #1 U.S. wireless telco showed out a robot that could potentially rescue people in dangerous situations and explained how 5G will lead to advances in education, medicine and other areas. “With 5G, the robot and the operator can communicate instantly,” said Yan Gu, an assistant professor of mechanical engineering at the University of Massachusetts, Lowell.

Verizon paid for a “5G” flyer ad insert in Sunday’s NY Times: Verizon 5G Ultra Wideband Brings AR Surgery to Life. It was quite impressive, but very futuristic in this author’s opinion. “Verizon 5G Ultra Wideband is a new canvas for innovation.” said CHRISTIAN GUIRNALDA, DIRECTOR OF VERIZON’S 5G LABS.

At Columbia University, staff and students use Verizon’s 5G Labs to experiment with remote physical therapy using virtual reality. The technology allows patients and therapists to use a virtual reality headset and controller to manipulate shared objects within a virtual environment. This level of smooth interactivity and responsiveness is possible with Verizon 5G Ultra Wideband connectivity.

Dr. Choudhry, left, and Dr. Christopher Morley, wearing an AR headset, use Verizon 5G Ultra Wideband to test Medivis.

……………………………………………………………………………………………………………………………………………………………………….

Current Status of “5G” in U.S.:

In the US, Verizon and AT&T, the nation’s two biggest wireless carriers, have switched on mobile 5G networks in only a small handful of locations. Sprint just turned on its network in four cities at the end of May, right about the same time that wireless carrier EE became the UK’s first 5G provider.

Verizon customers looking to experience “5G” right now will have to head to Chicago or Minneapolis, and then find the right street corners — plus buy one of the very few 5G-capable phones out there at the moment. By the end of this year, you won’t have to look quite so hard. Verizon plans to double the coverage area in those two cities, and also drop “5G” into 30 additional cities. (In addition, the company has a “5G” home service in Houston, Indianapolis, Los Angeles and Sacramento, California.)

……………………………………………………………………………………………………………………………………………………………………..

5G use cases and applications -from remote surgery to mixed reality and autonomous cars – are expected to thrive. “They just get better with 5G,” said Christian Guirnalda, director of Verizon’s 5G Labs.

To help drive that point home, Verizon’s demo before a group of journalists showcased a small array of projects experimenting with 5G in health care, manufacturing and public safety, tapping into the company’s Ultra Wideband service. It was a showcase of winners of the company’s 5G Robotics Challenge and other partners working in the Cambridge facility.

The Cambridge lab, set in a colonial-style brick building on a leafy side street nestled next to the Harvard University campus, is one of five that the company’s currently operating. The others are in New York; Washington, DC; Los Angeles; and Palo Alto, California.

With a Verizon 5G small cell lurking overhead, software maker Proximie, based in Bedford, Massachusetts, demonstrated its cloud-based, augmented reality-capable telemedicine platform on a high-resolution screen with multiple livestreams — as many as three upload and six download streams running at about 10 to 12 megabits per second each.

A Proximie product manager moved her hand across a blank tabletop in front of a camera, and the screens showed the hand overlaid on a cutaway model of a mock patient’s midsection. It illustrated how a doctor in LA could provide AR input to a surgeon performing an operation in New York without lag or dropped signal. The system could also allow, say, radiology images to be matched up with the view of the patient.

“Once it’s rolled out, it’s gonna change the game,” said Auri Vizgaitis, Proximie’s lead software architect.

“5G lets us get more computing off the device,” said Rahul Chipalkatty, CEO of Boston-based robotics software maker Southie Autonomy.

But even with these industrial applications in mind, there’s still a spot for 5G-enabled smartphones. Pittsburgh-based robotics company RealBotics demonstrated how 5G could help get factory employees up to speed on managing robots, through a combination of smartphone speed, low latency, HD video and augmented reality via edge computing.

The advances these companies are envisioning — highly capable autonomous cars, far-flung surgeons collaborating in real time, the internet of things working in high gear — are the future that 5G’s been dangling in front of us for a while now, and probably will for some time still to come.

“It will exist at some point in the future,” said Palmer. “This lab is about how do you innovate on top of that network.”

References:

https://www.cnet.com/news/verizon-5g-lab-tunes-up-robots-and-medical-tech-heading-your-way/

https://www.nytimes.com/paidpost/verizon/can-holograms-give-surgeons-x-ray-vision.html

India’s 5G may lag due to low telecom infrastructure growth rate and insufficient fiber for backhaul

by Muntazir Abbas (edited by Alan J Weissberger) from Economic Times:

India’s 5G ambition may be thwarted as mobile infrastructure expansion is likely to remain low-paced following policy bottlenecks in the federal governance structure. Add to that India’s weak fiberization, which is mandatory for high-speed wireless network backhaul.

The country’s existing telecom infrastructure catering to a billion active subscribers may require rapid expansion, but the absence of clarity on active network sharing, distributed right-of-way norms and thin fibre penetration, may not bring 2020 a true 5G year.

The Narendra Modi-led government is eyeing to make 5G services commercially available by next year after soon-to-start field trials which would be followed by a mega spectrum sale with 275 Mhz of airwaves earmarked for the newer technology.

Plagued with high debt, the telco incumbents Vodafone Idea and Bharti Airtel, have not made much network investments over the past few years. In a constrained scenario, sharing of active and passive networks assume much significance.

The Tower and Infrastructure Providers Association (Taipa) Director General Tilak Raj Dua says, “In order to make 5G a success story in India, it is essential to invest on network densification heavily through provisioning of fiber, small cells and mobile towers.” Taipa represents telecom infrastructure companies in the country.

The India Department of Telecommunications (DoT), over the past few years, has apparently not been able to bring telecom tower companies to mainstream despite their ever-growing role in India’s digital service delivery.

The much-sought ‘infrastructure status’ accorded to the sector in 2012, has not materialised so far with firms seeking the Narendra Modi government to bring about radical reforms before the 5G make a debut.

Fiberization— A must do

Fibre-based backhaul is still in infancy in India. Industry’s assessment suggests that India’s robust 5G network would require 100 million fibre kilometres (m fkm) optic-fibre cable a year which has been growing at merely a rate of nearly 25 mfkm a year currently.

The government has recognized it as the strategic element for a high-speed data network, and has put a huge thrust and aims to increase fibre footprint to five fold or 7.5 million kilometres by 2022, from the current 1.5 million kilometers. In addition, the national policy aims to fiberise at least 60% of telecom towers by 2022, eventually accelerating migration to 5G.

“Achieving such speeds make fiber connectivity essential. India’s high population density also translates into deeper and denser fiber network,” ratings agency ICRA in its finding said, adding that the country has about 500,000 towers of which only 22% are fiberised as against 80% in China.

Earlier, telecom secretary Aruna Sundararajan said that that the department would want to benchmark how much fibre is being deployed every day to achieve 4G and 5G, and it has to become a national priority, and added that if the industry ever wants to take 5G to the villages without fibre, it would not happen, as fiberisation remains a key driver.

State-run Bharat Sanchar Nigam Limited (BSNL) that has the largest fibre base of up to 8 lakh kilometres is considering to lease out dark fibre to private players in a run up to 5G rollout that according to analysts would help operators cut Capex by leveraging state telco’s infrastructure as per need basis.

ICRA estimates the present market value of fiber assets owned by major private telecom operators stand at nearly Rs 1.25 lakh crore, with the extent of fiber rollout over the next few years would require investments of Rs 2.5 lakh crore to 3 lakh crore and sharing of fiber among multiple telcos would be the driver for a reasonable return on capital.

“5G rollout is the biggest driver for all major investment into fibre infrastructure in next five years. The next generation of technology’s performance will be dependent on the overflow of content to and from data centres,” Sandeep Aggarwal, Managing Director of Paramount Communications said, and added that the only medium capable of meeting these demands is fiber which will need to be available at every nook and corner of the country.

The government, in a recently-unveiled national policy also talked about setting up of a National Fibre Authority (NFA), but ironically there has been a dismal activity so far to take the ambitious vision forward.

The challenges, from the fibre standpoint, however, continue to remain making the 5G ride not so smooth with fibre companies together with telecom carriers seeking the Narendra Modi-led government to accelerate efforts and carve out an incentive regime.

Reliance Jio, a pure-play 4G operator that has up its ante in fibre deployment for the ambitious fibre-to-the-home (FTTH) offering dubbed as JioGigaFiber said that that to incentivise telcos, the department should draw out incentives so that operators are not challenged to deliver on fiber which is a critical element for India’s digital growth.

Earlier, Mumbai-based Jio chief Mathew Oommen said that, “service providers should use incentives for creating a deeper fiber with the redundancy of routes,” and believes that incentives should be in the form of “conducive policy to attract more investments in building fibre infrastructure” by telcos.

“5G is an interesting initiative. There is still a lag in fiber deployments in remote locations. We have learnt how to roll out fiber throughout the country, and modern technologies aligned to 5G is also one of the important factors,” R&M chairman Hans Hess told ETT.

“5G needs fiber highways and tower fiberisation is essential to be accelerated and the establishment of National Fiber Authority similar to the National Highway Authority or NHAI. These aim towards a significant portion to be invested in fibre roll out,” Sterlite Technologies Limited (STL) Group CEO Anand Agarwal told ETT.

Company’s top executive said that the national policy has accorded fibre the status of a public utility, and since fibre is essential for both wireline and wireless networks, a greater level of confidence in fibre investment was much needed.

R&M’s Hess seconded Agarwal’s views, adding that a robust fibre-based backbone would be a vital element for a network of next generation of networks.

“There would be an increase in consumption of data due to the Internet of Things (IoT) proliferation. In order to produce more data faster, a strong backbone is needed that can be built on fiber,” the Swiss company’s executive added.

“5G technology will also require a multi-fold increase in small cells deployment, with each small cell having backhaul on fibre. We are woefully inadequate in terms of optic-fibre cable density both in urban and rural areas and a special focus for its densification in a time bound manner is essential for 5G deployments,” Agarwal added.

India’s fiber coverage in kilometre per capita works out to 0.09, which is far behind 0.87 for China and more than 1.3 for the United States and Japan, according to ICRA.

The Gurugram-based firm believes that fiber density in India would have to increase at least four-fold, and that would also mean that it would evolve as a separate industry in some time, similar to the telecom tower segment in the past two decades.

Active network sharing— Do it now

The 5G, based on low latency technology, requires a dense network to seamlessly deliver Internet connectivity enabled through a telecom infrastructure such as in-building solutions, small cells, fiber and fiberised mobile towers.

In a view to ease out financially-stressed operators, the government, in the policy has envisaged active network sharing that would allow telcos to share their networks and thereby reducing their capital (Capex) as well as operational (Opex) investment. Currently, the contours of the new regime are under a discussion stage together with the department and industry, and is expected to bring much respite to 5G rollouts.

The national policy, however, talks about encouraging sharing of active infrastructure by enhancing the scope of Infrastructure Providers (IP) and promoting deployment with incentives for common sharable, passive as well as active infrastructure.

“This (active network sharing) should be done in a more structured manner. All telecom service providers should make active sharing as freely as possible that could also help them reduce Capex as well as Opex in a scenario where margins are thin,” BSNL Chairman Anupam Shrivastava said.

Shrivastava further said that it would be going to help all service providers, and added that BSNL was offering its network for sharing and the same was expected from other operators.

Sector watchdog Telecom Regulatory Authority of India (Trai), in one of its whitepaper estimates the savings on account of active infrastructure sharing to the extent of 25-35% in Opex and 33-35% in Capex.

Network sharing, according to industry analysts, can significantly bring down 5G networks rollout as well as maintenance cost. New York-based McKinsey & Company in its finding has estimated the cost reduction of up to 40% — with major savings in rollout of small cells.

In order to have a pervasive 5G and for contiguous operations, there would have to be mushrooming of small cells over a city. Infrastructure providers can play a vital role in faster deployment of small cells that comes with a huge investment and thus support telcos to save on Capex and Opex,” he added.

Telecom carriers with 5G ambitions would be able to leverage 4G unified license (UL) coverage through dual connectivity or UL-sharing and would be able to cover larger areas with the same number of sites. 5G coverage compared to 4G coverage using 1800 MHz (megahertz) spectrum band would be about 60%.

A greenfield 5G operator, according to Taipa estimates, would need to deploy about 66% more sites to compensate for penetration losses.

Right-of-way— Not so right

The industry, demanding ease in Right-of-Way (RoW) rules, has been under continuous discussions with the regulator as well as policymakers for shaping up a comprehensive ‘dig-once’ common duct policy framework that according to the industry would help in the proliferation of 5G infrastructure across the country.

The next generation technologies are shaping the world economies and the smart cities would be built on a fibre-centric network for enabling ubiquitous and seamless connectivity. Trai is expected to come out with a policy enabling ‘common duct’ that would take telecom infrastructure to a next-level of growth.

In the last two years, post industry’s continuous rigorous follow-ups, only 13 states have to some extent aligned their policies with the Centre’s RoW rules notified in November 2016, according to Taipa.

“There is an urgent need for the states to align their telecom infrastructure policies with the Indian Telegraph Right of Way Rules to facilitate deployment of mobile infrastructure and connect the unconnected,” Dua added.

Deployment of small cells is significant for a proliferation 5G in India, the network rollout would have to be facilitated through enabling policies, which, according to the group, should include mandatory provisions for small cells at government lands and premises with new business models to excite municipal corporations and state governments.

The infrastructure providers such as Bharti Infratel, ATC Corporation and GTL Infrastructure demand a uniform RoW charges and single-window clearances nationwide to facilitate the telecom infrastructure for the digital delivery of services as envisaged by the Centre.