Month: February 2020

Telstra’s 5G network expands to 32 Australian cities; CEO Andrew Penn: “mmW to supercharge 5G”

Telstra has rolled out 5G network coverage to selected areas in 32 major and regional cities. It aims to deliver 5G into 35 cities by mid-year. “More than 4 million people pass through our 5G footprint,” said Telstra CEO Andrew Penn.

……………………………………………………………………………………………………..

We’re busy rolling out 5G, and our coverage is growing day-by-day. Right now, we’re in 32 cities and regional centres across Australia – more than any other network. If you’re in an area without 5G Coverage, your device automatically swaps to 4G or 3G depending on the available signal.

This map shows where we have 5G coverage at 13 February 2020.

……………………………………………………………………………………………………………

Telstra CEO Andrew Penn said internal testing of the 5G mmWave technology had begun and work was underway to roll out trial mobile sites in selected areas ahead of an expected auction of mmWave spectrum in 2021. 26 GHz will be the first mmWave band to be used for mobile services in Australia.

“mmWave will supercharge 5G. Its higher capacity and the potential to deliver even faster speeds as well as lower latency will help power the next generation of devices and innovations,” Penn said.

Telstra customers’ early access to its mmWave 5G network will initially be in selected areas. It will be made possible through ACMA 26 GHz scientific licenses that can be used for trials ahead of the spectrum auction early next year. 26GHz is set to become one of the most prevalent spectrum bands for mmWave 5G in the world, including Europe and Asia.

Telstra and technology partners Ericsson and Qualcomm Technologies recently tested live mobile base station in a commercial network using the 26GHz band.

……………………………………………………………………………………………………..

Telstra earlier said its mobile footprint is more than 2.5 million square kilometers, at least 1 million square kilometers more than any other mobile network in Australia. Telstra has built more than 237 new mobile sites and upgraded 267 in the second half of 2019.

Average download speeds have increased from 200 megabits to 304 megabits per second now. Telstra also recorded about 1.9 gigabit in the live network. Data usage on 5G network has increased more than 28x in the first half of the year.

……………………………………………………………………………………………………..

Telstra has expanded narrowband (NB-) IoT coverage (included in the not yet completed IMT 2020 specs) to nearly 4 million square kilometers from over 3.5 million. LTE CatM1 IoT coverage is around 3 million square kilometers.

……………………………………………………………………………………………………..

References:

GSMA: New Telco Edge Cloud Platform Project has 9 Telcos Participating

GSMA announced a new initiative to develop a common telco edge cloud platform for network operators. China Unicom, Deutsche Telekom, EE, KDDI, Orange, Singtel, SK Telecom, Telefonica and TIM are participating in the project. It will make local network operator assets made available to developers and software vendors to bring their services closer to enterprise customers.

The inter-operable platform will be developed in 2020. The operators have agreed to work together to develop the edge compute architectural framework and reference platform, and the GSMA has launched an Operator Platform Project to support the initiative. Initially, the platform will be deployed across multiple markets in Europe, before expanding to other parts of the world.

Operators will offer through the platform edge compute, storage and connectivity to their customers. The GSMA said the open platform will ensure data protection and sovereignty mechanisms, while offering carrier-grade reliability, security and trustworthiness. It will leverage existing technology where possible, such as aggregation platforms like MobiledgeX, or the interconnection mechanisms developed as part of the GSMA MultiOperator MEC experience.

Telco Edge Cloud will:

- Be open and inclusive

- Provide data protection and sovereignty mechanisms

- Offer carrier-grade reliability, security, trustworthiness

- Leverage existing technology solutions; as appropriate, including, but not limited to, aggregation platform solutions such as MobiledgeX, or the interconnection mechanisms developed as part of the GSMA MultiOperator MEC experience.

“Operators are very well placed to provide capabilities such as low latency through their network assets,” said Alex Sinclair, CTO at GSMA. “It is essential for enterprises to be able to reach all of their customers from the edge of any network. Based on the GSMA Operator Platform Specification, Telco Edge Cloud will provide enterprise developers and aggregators with a consistent way to reach connected customers.”

“Edge cloud will build a unified network edge ecosystem, providing diversified and customised products and services, and multiple platform capabilities. It will also realise more extensive boundary-crossing cooperation to meet the requirements of digital transformation of various vertical industries,” said Xiongyan Tang, the Chief Scientist of China Unicom Network Technology Research Institute and the Chief Architect of China Unicom Intelligent Network Center, China Unicom.

“Edge Cloud has an exciting potential to enable and enhance many innovative experiences for our customers. I welcome this operator initiative to take ownership of the edge opportunity by joining forces to deliver our capabilities in a federated edge service,” said Claudia Nemat, Board Member Technology & Innovation at Deutsche Telekom. “Leveraging MobiledgeX as platform partner and aggregator in the federation puts operators on the best track to create scale, bring in the developer community and make a market impact.”

“Edge Cloud is a promising opportunity to enable the development of services that need low latency connection and to meet various service demands from enterprise customers. The innovation of telecommunication services will be accelerated by the enhancement of service quality and the customer experience in real-time applications such as cloud XR and cloud gaming,” said Yoshiaki Uchida, Member of the Board, Executive Vice President, Executive Director, Technology Sector at KDDI.

“To address the edge-cloud computing market, operators need to work very closely together to create an interoperable platform and to monetise their extremely valuable assets,” said Mari-Noëlle Jégo-Laveissière, Deputy Chief Executive Officer, Chief Technology and Global Innovation Officer, Orange. “We, at Orange, believe that it is a must-have to unleash new business opportunities enabled by both edge computing and 5G. That’s why we are proud to support the GSMA Telco Edge Cloud initiative.”

“We believe that a cross-border edge cloud platform which serves bandwidth needs and lower latency requirements, is what’s needed at this time as it allows organisations with multi-market operations to deploy and manage time-critical applications closer to where the data is collected. We look forward to collaborating with GSMA and the other telcos on this exciting initiative,” said Mark Chong, Group CTO of Singtel.

“Edge Cloud is a key enabler to unlock the full potential of emerging applications such as AR/VR, cloud robots, and smart factory with improved QoS, real-time intelligence, security and data privacy. In order to provide a seamless global MEC experience to our customers, it is critical that mobile operators around the world come together and join forces,” says Dr. Kang-Won Lee, Vice President and Head of Cloud Labs at SK Telecom. “SK Telecom is excited to collaborate with global partners, bringing our edge cloud experience and tech leadership to the team to realise the vision of mobile edge cloud.”

“The market needs an Edge Cloud that meets the enterprise demands to service their customers. Telecom operators are in an extremely good position to provide a trusted and open Edge Cloud, so enterprises can maximise their service offering and business opportunities being as close as needed to their customers,” said Enrique Blanco, Group CTO, Telefonica.

“Edge Cloud is a fundamental asset for the new requirements of many business segments and customers,” said Elisabetta Romano, Chief Innovation & Partnership Officer, TIM. “Edge Cloud will be a formidable enabler to transform the network from a “bit pipe” to an effective digital business platform, thanks to flexible computing capacity and low access latency to computing resources.”

Geoff Hollingworth, CMO of MobiledgeX, told RCR Wireless News that he has been very close to the company’s collaboration with the GSMA/operator initiative. He said that the goal of the program is to build an operator edge platform that presents a solution “as homogenous as possible” to the enterprise market, in the same way that the mobile industry has presented global messaging and data solutions.

“They want to fast-track that in the industry, as much as possible into the real world,” he said. Enterprises, Hollingworth went on, need easy access to high-performance, cloud-native computing close to where they need that data processed, whether it’s in a country where their products are manufactured or perhaps where they are used, or both. He said there is more than one model for providing that, such as a form of aggregated networks where local operators are paid for being part of it and running workloads locally, or via something similar to roaming agreements between operators for so-called “east-west interfaces” that allow access to local edge computing resources. He expects both to be explored in the GSMA initiative.

“It’s purely a question of agreeing to roll out in a way that actually meets the needs of the real customers,” he added. MobiledgeX, Hollingworth said, has been in conversations with operators around the world as it seeks to build its own edge computing platform footprint, and he said it has a good handle on just what enterprise customers and application developers need and brings that knowledge to the table as part of its participation in the GSMA Operator Platform Project.

Edge use cases, he went on, always begin with one thing in common: a large volume of data that is very information-rich, that needs to be interpreted in real-time, probably by artificial intelligence; and then resulting insights need to be transmitted both locally to make an immediate change, and to a larger big-data engine for longer-term processing. MobiledgeX sees that such data streams are often coming from video cameras being used as IoT sensors and requiring vast, fast image processing capabilities. Even in the case of lower-data-intensive IoT sensor capabilities, Hollingworth said, those capabilities are increasingly being built into products and solutions that enterprises are buying—but they’re not being turned up, even if the companies would like to use them, because the enterprises can’t cope with the volume of information that would result. Globally available, easily accessed edge computing resources could change that.

…………………………………………………………………………………………………………………………………………………………………………………………………………………

The GSMA Operator Platform Project:

The GSMA’s Operator Platform Project intends to develop a framework for operators to expose and monetise their network capabilities. Operators will offer through the Operator Platform edge compute, storage and connectivity to their customers leveraging:

- their existing relationships with enterprises who already have use cases requiring edge,

- their vast local footprint/real estate,

- an inimitable position for stringent security and data privacy, residency, sovereignty and

- the organisational competence from the experience of providing highly reliable (five nines) services over a distributed and capillary network environment.

Cloud capabilities will be treated as a subset of edge.

……………………………………………………………………………………………………………………………………………………………………………………………………….

About the GSMA:

The GSMA represents the interests of mobile operators worldwide, uniting nearly 750 operators with almost 300 companies in the broader mobile ecosystem, including handset and device makers, software companies, equipment providers and internet companies, as well as organisations in adjacent industry sectors. The GSMA also produces industry-leading events such as Mobile World Congress, Mobile World Congress Shanghai, Mobile World Congress Americas and the Mobile 360 Series of conferences.

For more information, please visit the GSMA corporate website at www.gsma.com. Follow the GSMA on Twitter: @GSMA.

Media Contacts:

For the GSMA

GSMA Press Office

[email protected]

………………………………………………………………………………………………………………………………………………………………………………………………………………

SKT Forms Global Alliance with 9 Telcos on 5G Mobile Edge Computing

SK Telecom Co., South Korea’s largest mobile carrier, said Sunday it has formed an international alliance with nine telecommunication firms to develop 5G mobile edge computing (MEC) technologies and services.

SK Telecom said Telecom Edge Cloud TF was established with nine other companies at a GSMA meeting in London last week. Its members include Deutsche Telekom AG of Germany, KDDI Corp. of Japan and EE Ltd. of Britain. The TF aims to have global commercialization of 5G MEC by sharing each member’s technology and service know-how.

MEC is a key technology in delivering ultra-low latency data communication in 5G networks that allows companies to offer better solutions in cloud gaming, smart factory and autonomous driving. It aims to minimize latency by providing a “shortcut” — which can be completed by installing small-scale data centers at 5G base stations — for data transmission.

SK Telecom has been one of the active players in the mobile industry to develop 5G MEC solutions. In January, the company formed Global MEC TF with five Asian telecommunication firms to develop 5G MEC technologies and services.

………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

Telecom Operators Collaborate to Build the Telco Edge Cloud Platform with GSMA Support

Nine operators join forces on global edge computing, with GSMA’s support

https://www.linkedin.com/pulse/10-things-you-should-know-telco-edge-compute-philip-laidler

https://mobiledgex.com/assets/resources/stl/what-edge-developers-want-from-telcos-now—final.pdf

ITU-R WP5D Feb 2020 Meeting Report Excerpts: Technology Aspects WG (IMT 2020 RIT/SRIT)

by Hu Wang, Chair, ITU-R WP 5D Working Group Technology Aspects (edited for clarity by Alan J Weissberger)

NOTE that all documents referenced in this meeting report are ONLY available to those that have an ITU TIES account.

Introduction and Overview:

The WP 5D Technology Aspects WG met two times during the 34th meeting of ITU-R Working Party (WP) 5D in Geneva, Switzerland. The meeting concluded on February 26, 2020.

Main activities of Technology Aspects WG during this meeting were to:

-

review evaluation reports of Independent Evaluation Groups for the candidate technologies; complete evaluation report summaries (IMT-2020/ZZZ) and complete the Step 4 of the Evaluation Process;

-

continue working on a new Report ITU-R M.[IMT-2020.OUTCOME];

-

continue working on a new Recommendation ITU-R M.[IMT-2020.SPECS];

-

continue working on the revision of Recommendation ITU-R M.1457-14 (LTE);

-

continue working on synchronization of multiple IMT TDD networks;

-

start the work on two new subjects [IMT TERRESTRIAL BROADBAND REMOTE COVERAGE] and [IMT.FUTURE TECHNOLOGY TRENDS].

During this meeting, WG Technology Aspects established five Sub-Working Groups (SWGs):

– SWG Coordination (Chair: Mr. Yoshio HONDA),

– SWG Evaluation (Acting Chair: Mr. Yoshio HONDA),

– SWG IMT Specifications (Chair: Mr. Yoshinori ISHIKAWA),

– SWG Out of band emissions (Chair: Mr. Uwe LÖWENSTEIN),

– SWG Radio Aspects (Chair: Mr. Marc GRANT)

Evaluation of IMT-2020 candidate technology submissions:

This 34th WP 5D meeting is a milestone of the IMT-2020 submission and evaluation process: Step 4 – Evaluation of candidate RITs or SRITs by independent evaluation groups.

Twelve Independent Evaluation Groups (IEGs) submitted to this meeting twenty-seven evaluation reports of all the candidate technology submissions. The meeting reviewed these evaluation reports, with participations of the IEGs, the proponents of candidate technology submissions and other participants. The Step 4 was completed with all the evaluation reports recorded.

Evaluation report summaries are captured in the respective documents (5D/TEMP/112, 113, 114, 115, 116, 117, 118, 119, 120, 121, 122, 125 and 126). The meeting also developed an overall summary – Summary of Step 4 of the IMT-2020 Process for Evaluation of IMT-2020 Candidate Technology Submissions (5D/TEMP/124), which also captures different views raised during the discussion at the meeting.

An addendum to the Circular Letter 5/LCCE/59 was developed to convey the completion of Step 4.

The meeting also made progress on the work of Document M.[IMT-2020.OUTCOME]. It was agreed to upgrade the working document to a preliminary draft new Report (5D/TEMP/111).

IMT-2020.SPECS

The work of M.[IMT‑2020.SPECS] continued at this meeting based on received contributions. The working document and the work plan were revised accordingly (5D/TEMP/41 and 40).

A draft liaison statement to potential GCS Proponents to request the inputs to 35th meeting was developed. It was noted that confirmation of the potential GCS Proponents can only be done after WP 5D takes a decision for Steps 6 & 7 on IMT-2020 RIT/SRIT at its 35th meeting.

Work items in SWG Radio Aspects

The meeting made progress on the work of Synchronization of multiple IMT-2020 TDD networks and the working document was updated (5D/TEMP/93).

A new working document is created to study terrestrial IMT for remote sparsely populated areas providing high data rate coverage – M.[IMT TERRESTRIAL BROADBAND REMOTE COVERAGE] (5D/TEMP/101).

The meeting also agreed to start work on future technology trends, and a work plan was developed (5D/TEMP/96).

Objective for the 35th WP 5D meeting:

The key objectives of WG Technology Aspects for the 35th WP 5D meeting are as follows:

i) complete the work of Step 6 and Step 7 of the IMT-2020 submission and evaluation process; finalize the document M.[IMT-2020.OUTCOME];

ii) continue work on M.[IMT‑2020.SPECS];

iii) finalize the revision of Recommendation ITU-R M.1457-14;

iv) continue work on synchronization of multiple IMT-2020 TDD networks;

v) continue work on M.[IMT TERRESTRIAL BROADBAND REMOTE COVERAGE] and M.[IMT.FUTURE TECHNOLOGY TRENDS].

TIP OpenRAN and O-RAN Alliance liaison and collaboration for Open Radio Access Networks

Overview:

The Telecom Infra Project (TIP) OpenRAN project and the O-RAN Alliance today announced a liaison agreement to ensure their alignment in developing interoperable, disaggregated and open Radio Access Network (RAN) solutions.

Since their inception, the overlapping efforts of the two consortiums led to a lot of questions about duplication of work, different specs and interface for the same functions as well as different IP licensing policies. The two groups are calling this liaison arrangement as a “new level of collaboration” for open RAN, rather than a merger. The press release stated:

With this liaison agreement O-RAN and TIP are now reaching a new level of collaboration for open RAN. The liaison allows for sharing information, referencing specifications and conducting joint testing and integration efforts.

The O-RAN Alliance was formed in February 2018 when the x-RAN Forum merged with the C-RAN Alliance. The group is focused on the development of open, intelligent, virtualized and interoperable RAN specifications. The Alliance has already created 31 specifications, with 37 demonstrations of the technology at past MWC events, global plugfests, and more than 1 000 000 lines of code released in partnership with the Linux Foundation. Operators have begun to announce network implementations.

O-RAN Alliance’s mission and focus complements TIP’s mission of deploying end-to-end disaggregated telecom infrastructure in varying environments.

TIP said it’s seen a rapid increase in demand for advanced OpenRAN trials and deployments.

- Following on the heels of its TIP Summit announcement in November 2019, Vodafone launched trials in Mozambique and the Democratic Republic of the Congo and is progressing with trials in the UK and Ireland.

- In Indonesia, Indosat Ooredoo and Smartfren will conduct the first OpenRAN field trials in the APAC region. Smartfren has also conducted and completed the first OpenRAN lab trial in the region.

- In Malaysia, Edotco, the tower arm of Axiata group, is collaborating with Celcom Axiata in conducting lab trials with the path to field trials. Following their announcement of TIP OpenRAN deployment in the UAE, Etisalat is starting trials of OpenRAN systems in other regions. In North America, Sprint completed its RFI evaluation and will begin trials of OpenRAN 5G NR technologies in its TIP Community Lab.

…………………………………………………………………………………….

Evenstar Program to feed into OpenRAN:

Vodafone, Deutsche Telekom, Mavenir, Parallel Wireless, MTI, AceAxis, Facebook Connectivity and additional partners have unveiled the Evenstar RRU (Remote Radio Units). The Evenstar program will focus on building general-purpose RAN reference designs for 4G/5G networks in the Open RAN ecosystem that are aligned with 3GPP and O-RAN specifications.

The Evenstar program will contribute to the OpenRAN ecosystem by focusing on building general-purpose RAN reference designs for 4G and 5G networks that are aligned with 3GPP and O-RAN specifications and will help accelerate the adoption of TIP OpenRAN Project Group Solutions.

By decoupling the RRU hardware, Central Unit (CU) and Distributed Unit (DU) software, mobile network operators will have the ability to select best-of-breed components and the flexibility to deploy solutions from an increasing number of technology partners, TIP said. The intention of the Evenstar program is to contribute the proposed solution into TIP’s OpenRAN Project Group to help accelerate adoption.

…………………………………………………………………………………….

Quotes:

“This new collaboration framework between O-RAN and TIP, two major initiatives in the area of open networking, will support our mission to re-shape the RAN industry towards open and intelligent mobile network infrastructure,” said Alex Jinsung Choi, COO of the O-RAN Alliance and SVP Strategy & Technology Innovation, Deutsche Telekom.

“Alignment on O-RAN interoperability efforts will help the industry to speed up the delivery of commercial open RAN solutions. The establishment of the first joint O-RAN Open Test and Integration Center (OTIC) with the TIP Community Lab in Berlin is a concrete step to facilitate this multi-community approach.”

“TIP’s OpenRAN solutions are an important element of our work to accelerate innovation across all elements of the network including Access, Transport, Core & Services. Across the TIP community, we are seeing increasing demand and have achieved meaningful progress with OpenRAN deployments around the world,” said Attilio Zani, Executive Director, Telecom Infra Project.

“With this collaboration framework in place, TIP and O-RAN will work together to develop interoperable 5G RAN solutions. One of our first outputs will be the release of the OpenRAN 5GNR NR Base Station Platform requirements document with normative references to the O-RAN specifications.”

“Our hope, longer term, is that this forms the ability to accelerate the solutions that are in the marketplace and drives greater adoption of Open RAN technologies across the world,” Zani added.

……………………………………………………………………………………..

About O-RAN Alliance:

O-RAN Alliance is a world-wide community of more than 160 mobile operators, vendors, and research & academic institutions operating in the Radio Access Network (RAN) industry. As the RAN is an essential part of any mobile network, O-RAN Alliance’s mission is to re-shape the industry towards more intelligent, open, virtualized and fully interoperable mobile networks. The new O-RAN standards will enable a more competitive and vibrant RAN supplier ecosystem with faster innovation to improve user experience. O-RAN-compliant mobile networks will at the same time improve the efficiency of RAN deployments as well as operations by the mobile operators. To achieve this, O-RAN Alliance publishes new RAN specifications, releases open software for the RAN, and supports its members in integration and testing of their implementations.

For a short video describing O-RAN’s progress, see www.o-ran.org/videos

For more information please visit www.o-ran.org

About Telecom Infra Project:

TIP is a collaborative telecom community that is evolving the infrastructure that underpins global connectivity. TIP’s mission is to accelerate the pace of innovation in next generation telecom networks, through the design, build, test and deployment of standards-based, open and disaggregated end-to-end solutions. Over the past four years, TIP has driven substantial innovation across all elements of the network including Access, Transport, Core & Services, while spanning urban through to rural market use cases. To date, it has 13 Community Labs which test, validate and integrate solutions, embarked on field trials in Africa, Latin America, Middle East and Europe. The recently launched TIP Exchange hosts 45 products from 28 member companies.

………………………………………………………………………………………………

Vodafone Moves to O-RAN:

One of those early-adopter operators of the O-RAN Alliance specs is Vodafone. In November 2019, Vodafone’s head of network strategy and architecture Santiago Tenorio announced at the Telecom Infra Project (TIP) Summit in Amsterdam that Vodafone would issue a request for quotes (RFQ) for open RAN technology for its entire European footprint.

“That’s significantly more than 100,000 sites, and all the technologies are to tender — 2G, 3G, 4G, and 5G,” said Tenorio. “We’ve invited the incumbent suppliers in Europe of course, but we’ve also invited the open RAN suppliers.” He didn’t sound too optimistic about the incumbent suppliers. Apparently, they hadn’t even responded to a Vodafone request for information about open 5G new radio equipment.

Mostafa Essa, an AI and data analytics distinguished engineer with Vodafone, told FierceWireless: “If you use a specific vendor for the RAN and ask him to carry some new features for something you are needing that is impacting your customers, they have to go back to their R&D and build up features,” said Essa. “Then we’ll test and give feedback. Right now, by using the open RAN concept, you can build up whatever you want whenever you want. It’s not connected to vendors’ roadmaps,” he added.

Vodafone has been conducting field trials in some of its markets in Europe, including Spain, Italy and in a rural area north of London. Vodafone used Parallel Wireless for its first open RAN tests, which it conducted in Turkey and Africa.

Essa continued: “We have a lot of instability, which is to be expected in trials. Right now, we are in the building phase. When you roll out this technology, sometimes you can get a lot of dropped calls and so on. But it’s the same as working with the vendors…..who are building systems with their own closed-source software.”

References:

https://www.businesswire.com/news/home/20180227005673/en/xRAN-Forum-Merges-C-RAN-Alliance-Form-ORAN

https://www.fiercewireless.com/operators/vodafone-leads-early-adopter-phase-o-ran

https://www.fiercewireless.com/wireless/tip-o-ran-alliance-reach-liaison-agreement

Huawei confirms position as #1 5G network equipment vendor with 10 key enablers for 5G

Huawei Technologies Co has secured its position as the most sought-after 5G telecom equipment supplier, despite the US government‘s intensified push to contain the Chinese technology giant on the geopolitical, legal and technological front lines. Among the 91 commercial 5G contracts Huawei has inked, the largest number by any telecom gear maker so far, more than half are from Europe, where Washington has spared no effort to dissuade its allies from using the company in their 5G systems.

Analysts said the steadily growing contracts show that Huawei has won the trust of more foreign telecom operators with its technological prowess, and Washington’s groundless security accusations have failed to convince even some of its closest allies.

Ding Yun, president of Huawei’s carrier business group, said at a launch event in London on February 20th that the company’s 91 commercial 5G contracts is an increase of nearly 30 from last year. That is ahead of the 81 announced by Swedish telecom company Ericsson last week and well ahead of Nokia, which said it had secured 67 5G commercial deals as of Feb 10th. Ding said 47 of its 5G contracts are from Europe, 27 from Asia and 17 from other regions. Huawei will invest $20 million in innovative 5G applications over the next five years, contributing to a thriving 5G ecosystem and accelerating the commercial success of 5G, officials said.

At the same event that day, Yang Chaobin, President of Huawei 5G Product Line (see photo below), unveiled Huawei’s 10 key enablers for 5G. Those are the following:

- #1 Extensive 5G Commercial Experience to Accelerate 5G Scale Deployment

- #2 Comprehensive Portfolios to Provide Consistent 5G Ultimate Experience.

- #3 Industry’s Only Ultra-Broadband Solution, Simplifying Network Deployment.

- #4 Exclusive Blade AAU, All in One for Simplified Deployment.

- #5 Industry’s First Commercial DSS Solution, Enabling Fast FDD 5G NR Deployment

- #6 Cutting-Edge Algorithm Enables Leading Network Performance

- #7 Low Energy Consumption Makes Green 5G

- #8: E2E NSA/SA Converged Solution for Future Industry Digitalization

- #9 Unique E2E SUL to Unlock UL Experience and Latency for Industry Needs

- #10 E2E Network Slicing Solution Facilitates Industry Digitalization

Yang Chaobin Unveils Huawei 5G 10 Key Enablers in London

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Mr. Yang Chaobin said, “In the process of mobile communications development, telecom operators have been using greater numbers of antenna units as a solution for insufficient sites and poles. Now they have to deal with insufficient antenna installation space. Huawei’s unique Blade AAU, which prides itself on “ultimate simplicity,” aims to reduce operators’ TCO and investment in hardware and sites.”

According to the latest GSA update, by the end of 2019, 62 telecom operators in 34 countries had officially announced the commercial release of 5G, and 41 of them are supported by Huawei, accounting for two-thirds of the total figure.

In the 5G era, continuous large-bandwidth TDD spectrum is the optimum choice for achieving an ultimate 5G experience. However, a significant number of telecom operators only get discontinuous segments of spectrum due to satellite occupation or discrete allocation. Huawei has launched the industry’s only full series of ultra-broadband solutions, which support a maximum bandwidth of 400 MHz. With just one module, all discrete spectrum within 400 MHz can be used. It saves modules and simplifies site deployment, greatly slashing site rental and hardware cost for telecom operators.

2020 will see large-scale 5G deployment worldwide. Apart from the mainstream 5G deployment on mid-band spectrums, operators can also deploy 5G networks on sub-3 GHz FDD to achieve fast 5G coverage. For new FDD spectrum, Huawei’s suggestion is direct 5G deployment on them to significantly improve the FDD spectral efficiency with NR technologies. It is proven that NR operating at an FDD frequency can deliver an impressive improvement in user experience compared to that of LTE.

For existing FDD spectrum, Huawei’s 1 ms dynamic spectrum sharing (DSS) solution can be adopted. This technology dynamically allocates spectrum resources in milliseconds based on LTE and 5G service and traffic requirements, maximizing spectral efficiency. “In November 2019, Huawei DSS was put into commercial use in Europe. Until now, our customers have 100 million legacy FDD RRUs that can be adapted efficiently to 5G using this solution,” said Yang Chaobin.

“Huawei has undergone extensive R&D, innovation, and commercial adoption in Massive MIMO. We have the most complete product portfolios and state-of-the-art algorithms to keep our Massive MIMO performance unrivalled. In terms of software algorithms, Huawei has MU-MIMO, SRS, full-channel beamforming and more to provide optimal capacity, coverage and user experiences. In 2019, Huawei helped LG U+ in South Korea, EE in the UK, and Sunrise in Switzerland to deploy 5G commercial networks.

In the third-party network performance tests conducted by RootMetrics and Connect, Huawei helped its operators rank No.1 in user experience, with an average downlink rate of 1.5 to 2 times higher than that of competitors’ networks, which further demonstrates Huawei’s superior Massive MIMO performance in actual commercial use,” according to Yang Chaobin.

“Every new generation of mobile communications technologies is developed to offer more applications and a better experience. 5G is no exception. 5G coverage must be good enough to provide excellent experience, and 5G experience must be better than any of the previous generations. Huawei’s products and solutions are committed to carrying forward this mission. 2020 will be a key year for 5G to be put into commercial use on a larger scale. “No one can whistle a symphony, it takes an orchestra to play it.” We hope to work with global partners to continuously carry out technology and application innovations, which utilize 5G as the connection platform, together with AI and Cloud technologies, to jointly build a healthy, viable, and sustainable digital ecosystem,” said Yang Chaobin.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Geo-Political Backdrop for Huawei:

The UK announced on Jan 28 that it would allow Huawei in the noncore part of its 5G network, with a cap of 35 percent market share. A day later, the EU announced its toolbox for 5G deployment, which does not ban Huawei and leaves it up to the member countries to make their final decisions.

French Minister of Economy and Finance Bruno Le Maire confirmed that the government will not exclude Huawei. The same view was expressed by Swedish and Italian officials, though those countries also said there would be security reviews for vendors.

Bai Ming, a senior research fellow at the Chinese Academy of International Trade and Economic Cooperation, said more European countries are taking an unbiased approach toward Huawei because Washington has never provided factual evidence to support its security accusations. “Challenges only make Huawei stronger,” Wang said.

“More people realized that mixing politics with normal business cooperation could only delay the global deployment of 5G,” Bai said.

But analysts also warned that tougher headwinds are still ahead for the world’s largest telecom equipment maker, given media reports that the US government is planning to further restrict US technology sales to Huawei.

Meanwhile, a federal judge in Texas on Tuesday dismissed a lawsuit filed by Huawei to challenge a 2018 congressional defense bill that stopped federal agencies from doing business with the company.

Wang Yanhui, secretary-general of the Mobile China Alliance, said a broader US ban on technology sales won’t substantially harm Huawei’s telecom business, as it has already shipped US-component-free 5G base stations around the world.

The Shenzhen-based company has also been scrambling to build its own mobile software ecosystem, the foundation for its ability to continue selling smartphones in overseas markets to mitigate the fallout from US restrictions.

References:

https://www.prnewswire.com/news-releases/huawei-unveils-10-key-enablers-for-accelerating-global-commercial-adoption-of-5g-301009039.html

Cisco’s Annual Internet Report (2018–2023) forecasts huge growth for IoT and M2M; tepid growth for Mobile

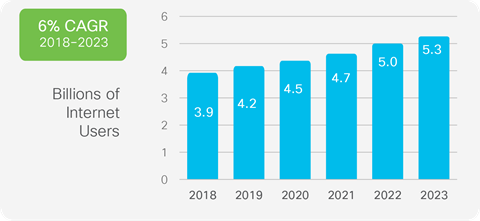

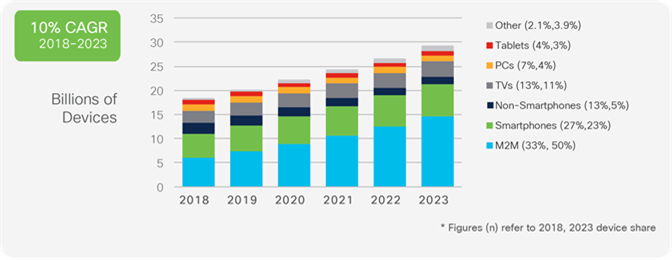

According to Cisco’s newly renamed Annual Internet Report [1.], networked devices around the globe will total 29.3 billion in 2023, outnumbering humans by more than three to one. The number of overall connected devices: 29.3 billion networked devices by 2023, compared to 18.4 billion in 2018.

The report also anticipates that the internet of things (IoT) will spread to 50% of all networked devices through machine-to-machine (M2M) technology and that the internet will reach 5.3 billion people, compared to 3.9 billion in 2018.

“There is a lot of growth that still can happen from a user perspective,” said Shruti Jain, senior analyst with Cisco. “Machine-to-machine is going to grow phenomenally,” she added.

Note 1. Cisco’s Annual Internet Report was formerly titled Visual Networking Index or VNI)

………………………………………………………………………………………………….

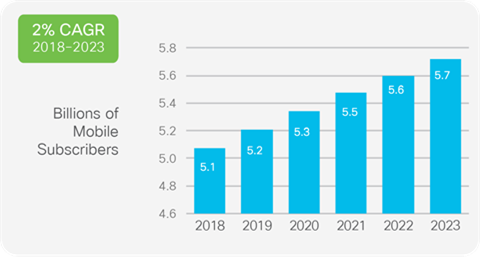

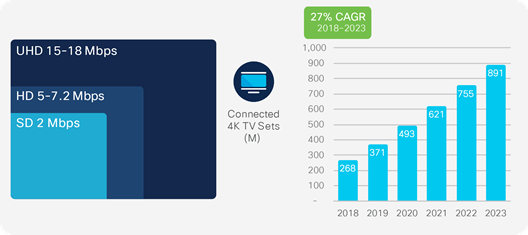

Cisco said that about 70% of the global population will have mobile-network-based connectivity by 2023, with the total number of mobile subscribers growing from 66% of the population in 2018 to 71% of the population (5.7 billion) by 2023. Of those, about 10% will be 5G connections by the end of the forecast period, with the number of global mobile devices rising from 8.8 billion in 2018 to 13.1 billion, with 1.4 billion of those being 5G-capable.

5G speeds are anticipated to be 13-times faster than the average mobile connection speed: 575 Mbps by 2023. Ms. Jain noted that as mobile network speeds approach those of wireline networks, it opens up new possibilities for mobile applications.

“Soon, those speeds are going to get very close to WiFi and [wired] broadband speeds, and be able to support a lot of new applications and experiences,” she said.

…………………………………………………………………………………………………………….

Other key findings from the 2020 Cisco AIR:

-The number of devices per person will continue to rise, from 2.4 networked devices per-capita in 2018 to 3.6 devices by 2023.

-The number of public WiFi hot spots will increase fourfold by 2023, to nearly 628 million.

-Almost 300 million mobile applications will be downloaded by 2023, with the most popular ones being social media, gaming and business applications.

-Power users’ impact is dwindling. Cisco found that globally, the top 1% of mobile data users accounted for 5% of mobile data in 2019. That has dropped significantly since 2010, when the top 1% of mobile users accounted for 52% of mobile data usage.

………………………………………………………………………………………………………

Summary: Multi-domain innovation and integration redefines the Internet

Throughout the forecast period (2018 – 2023), network operators and IT teams will be focused on interconnecting all the different domains in their diverse infrastructures – access, campus/branch, IoT/OT, wide-area, data center, co-los, cloud providers, service providers, and security. By integrating these formerly distinct and siloed domains, IT can reduce complexity, increase agility, and improve security. The future of the Internet will establish new connectivity requirements and service assurance levels for users, personal devices and IoT nodes, all applications (consumer and business), via any network access type (fixed broadband, Wi-Fi, and cellular) with dynamic security. Through our research and analysis, we anticipate innovation and growth in the following strategic areas.

Applications: Across virtually every business sector, there is an increased demand for new or enhanced applications that improve customer experiences. The Internet of Things (IoT), Artificial Intelligence (AI), Machine Learning (ML) and business analytics are changing how developers build smart applications to simplify customer transactions and deliver new business insights. Businesses and service organizations need to understand evolving demands and deliver exceptional customer experiences by leveraging technology.

Infrastructure transformation: The rapid growth of data and devices is outpacing many IT teams’ capabilities and manual approaches won’t allow them to keep up. Increased IT automation, centrally and remotely managed, is essential for businesses to keep pace in the digital world. Service providers and enterprises are exploring software-defined everything, as well as intent-driven and context-powered infrastructures that are designed to support future application needs and flexibility.

Security: Cybersecurity is a top priority for all who rely on the Internet for business and personal online activities. Protect every surface, detect fast and remediate confidently. Protecting digital assets and content encompasses an ever-expanding digital landscape. Organizations need the actionable insights and scalable solutions to secure employees’ devices, IoT connections, infrastructure and proprietary data.

Empowering employees and teams: To achieve business agility and prepare employees for the future, empowering global work forces with the right tools is a must. Automation, collaboration and mobility are essential for managing IT complexity and new customer expectations and demands. Business teams, partners and groups in all types of organizations need to collaborate seamlessly across all application mediums that are relevant to various roles and responsibilities. Employees and teams need accurate and actionable data to solve problems and create new growth strategies.

…………………………………………………………………………………………..

For more information:

Several interactive tools are available to help you create custom highlights and forecast charts by region, by country, by application, and by end-user segment (refer to the Cisco Annual Internet Report Highlights tool). Inquiries can be directed to [email protected].

……………………………………………………………………………………………………..

References:

Deutsche Telekom earnings beat, seeks to be #1 U.S. carrier

Deutsche Telekom AG (DT) said Wednesday that net profit rose 78% in 2019 as revenue climbed higher, and forecast further growth in the year ahead. Highlights of DT’s earnings report:

- Annual revenues increased 6.4 percent to EUR 80.5 billion.

- Adjusted net profit rose 8.9 percent to EUR 4.9 billion, and free cash flow was up 15.9 percent to EUR 7.0 billion.

- Adjusted EBITDA after leases improved 7.2 percent to EUR 24.7 billion, led by growth at T-Mobile US.

- CAPEX, before spectrum investments, was higher than forecast in 2019, at EUR 13.1 billion, a 7.6 percent increase over 2018. The increase was due to the accelerated 5G build-out in the US, the company said. Spending is expected down slightly to EUR 13.0 billion in 2020, with the US stable at EUR 7.8 billion.

- DT also grew to 3.3 million fiber homes passed in Europe, completed its FTTC build in Germany and expanded to 28 million premises with super-vectoring at up to 250 Mbps. The all-IP migration was completed in the consumer market in Germany and is expected finished in the B2B segment by end-2020. In the rest of Europe, 91 percent of lines were moved to IP, up 9 percent points over the year.

- DT ended the year with 9.6 million Magenta Eins subscribers taking both fixed and mobile services, up by 2 million from 2018. Mobile postpaid subscribers increased by 2.4 million in Europe to 58.0 million at year-end, and the US business grew by a total 6.4 million customers to 86.0 million.

In the fourth quarter of 2019, the company’s growth strengthened, with revenues up 5.4 percent to EUR 21.4 billion and adjusted EBITDA growing 8.2 percent to EUR 6.0 billion. Revenue growth reached 1.0 percent in Germany, 7.7 percent in the US, 3.0 percent in the rest of Europe and 0.2 percent at Systems Solutions. On an organic basis, adjusted EBITDA after leases rose 16.8 percent at Systems Solutions, 4.7 percent in the US, 3.1 percent in Europe and 2.4 percent in Germany.

“The results were strong, particularly in Europe, and reassuring on Germany,” said Citi analyst Georgios Ierodiaconou.

For 2020, the #1 German network operator forecast revenue growth and adjusted EBITDA up around 3% to EUR 25.5 billion, including EUR 13.9 billion outside of the U.S. That guidance does not take into account the impact of the U.S. merger and Deutsche Telekom will revise its outlook once it goes through.

……………………………………………………………………………

DT is aiming to become market leader in the United States, CEO Tim Hoettges said on Wednesday, now that a deal for its T-Mobile US unit to take over Sprint is within reach.

“We have the chance to become No.1 in the United States, to overtake AT&T and Verizon. That is our ambition,” Hoettges told reporters in Bonn after Deutsche Telekom reported record annual results in its 25th year as a listed company.

Ebullient, Hoettges brandished a coffee cup bearing a picture of U.S. World War Two character Rosie the Riveter and the slogan ‘We Can Do It’ in front of photographers.

“We’re going to build the best 5G network,” he added (see CNBC video reference below).

DT CEO Tim Höttges said the T-Mobile US/Sprint deal benefits Deutsche Telekom on all levels. (Deutsche Telekom)

…………………………………………………………………………………………………….

References:

https://www.marketwatch.com/story/deutsche-telekom-profit-soars-and-forecasts-growth-2020-02-19

https://www.cnbc.com/2020/02/19/deutsche-telekom-ceo-tim-hoettges-goes-on-offensive.html

Qualcomm Introduces 3rd Generation 5G Modem-RF System for 5G endpoints

Qualcomm has announced its third-generation 5G modem-to-antenna silicon system – the Snapdragon X60 5G Modem-RF System. The company said the device is the world’s first 5G modem to support spectrum aggregation across all key 5G bands and combinations, including mmWave and sub-6 GHz using FDD and TDD. This will enable speeds of up to 7.5 Gbps down and 3 Gbps up.

The modem features the new Qualcomm QTM535 mmWave antenna module and QTM535, the company’s third-generation 5G mmWave module for mobile, as well as a more compact design than the previous generation, allowing for thinner, sleeker smartphones.

Qualcomm said the modem will up performance for operators and increase 5G speeds in mobile devices. It added that the Snapdragon X60 is engineered to accelerate network transition to 5G standalone mode through support for any key spectrum band, mode or combination, along with 5G Voice-over-NR (VoNR) capabilities.

The company said the Snapdragon X60 is the world’s first to support mmWave-sub6GHz aggregation, allowing operators to maximize their spectrum resources to combine capacity and coverage. Additionally, the Snapdragon X60 contains the world’s first 5G FDD-TDD sub-6 carrier aggregation solution, in addition to supporting 5G FDD-FDD and TDD-TDD carrier aggregation, along with dynamic spectrum sharing (DSS), allowing operators a wide range of deployment options – including the ability to repurpose LTE spectrum for 5G – to effectively deliver higher average network speeds and accelerate 5G expansion. This 5G modem-to-antenna solution can deliver up to 7.5 gigabits per second (Gbps) download speeds and 3 Gbps upload speeds, and the aggregation of sub-6 GHz spectrum in standalone mode allows the doubling of peak data rates in 5G standalone mode compared to solutions with no carrier aggregation support. VoNR support in Snapdragon X60 will be an important step in the global mobile industry’s transition from non-standalone to stand-alone mode, as it will allow mobile operators to provide high-quality voice services on 5G NR.

“Qualcomm Technologies is at the heart of 5G launches globally with mobile operators and OEMs introducing 5G services and mobile devices at record pace. As 5G standalone networks are introduced in 2020, our third-generation 5G modem-RF platform brings extensive spectrum aggregation capabilities and options to fuel the rapid expansion of 5G rollouts while enhancing coverage, power efficiency and performance for mobile devices. We are excited about the fast adoption of 5G across geographies and the positive impact 5G is having on the user experience,” said Cristiano Amon, president, Qualcomm Incorporated.

Qualcomm previously said its second-generation 5G modem, the X55, was being used by over 30 device manufacturers.

For more information, visit the Snapdragon X60 Modem-RF System product page.

Or watch the Snapdragon X60 video.

Reference:

Point-Counterpoint: 5G is the future, but deployments are slowing!

Disclosure:

This author believes 5G is headed for the greatest “train wreck” in modern tech history. Over-hyped, rushed to market, incomplete standards, lack of vendor interoperability, no real business case or killer apps (not until ultra low latency and ultra high reliability are standardized and implemented), operators have no serious plan to monetize 5G and recover their build-out costs, small cell permit and placement objections/ NIMBY (Not In My Back Yard), power issues, massive fiber deployments needed in urban areas for mmWave small cell backhaul, and many other caveats.

……………………………………………………………………………………………………………

What does the future of Qualcomm look like?

Steve Mollenkopf, CEO of Qualcomm interview in Sunday’s NY Times:

It’s basically 5G. Think of it like when electricity replaced steam. Who’s going to win, who’s going to lose? The reason that you see so much international competition for the leadership of 5G is because it is so important to the fundamental way in which economy works.

The first 5G wave will be a handset wave, which is very good for us, and will continue for a long time. But there’s a second wave — with artificial intelligence, the cloud and all that data. That second wave makes me think, “Wow, we are on the cusp for something very big.”

…………………………………………………………………………………….

WSJ: 5G Rollouts Hit Slow Patch, Equipment Suppliers Say:

The rollout of new 5G wireless networks is showing signs of slowing, denting near-term sales prospects for some networking equipment makers and potentially delaying access for some consumers to the lightning-fast data speeds the technology promises.

Industry officials say there is no common cause for the slowdown seen across multiple markets, with various countries affected by different dynamics. In some cases, the equipment makers say, telecom providers want certainty that the investments made will reap returns before plowing more money into further infrastructure.

Investments required to deploy fifth-generation cellular networks are significant, in part because of how the systems operate. To blanket a city, 5G requires more base stations and local relay points than traditional communications infrastructure to connect devices to the network.

Research firm Gartner Inc. estimates companies spent more than $2 billion on 5G wireless infrastructure last year, more than triple the level in 2018. But spending growth is expected to slow somewhat this year, reaching about $4 billion.

Quinn Bolton, an analyst at Needham & Co., said delays in the build-out of 5G infrastructure in Asia and the U.S. were causing the slowdown.

South Korea was a trailblazer in 5G adoption, and operators that invested heavily in the first half of 2019 have since eased up, he said. Samsung Electronics Co., a major gear manufacturer for South Korean 5G networks, said last month its domestic 5G business would decline this year though grow elsewhere.

The 5G rollout in the U.S. is somewhat slower than expected because some cities and towns oppose the massive number of antennas needed to deliver ultrafast 5G data speeds to consumers, industry executives say. Some have banned antennas in residential areas, and a group of cities is suing the Federal Communications Commission over its requirement that cities make decisions on approval of 5G antennas within 60 or 90 days.

The protracted antitrust battle over T-Mobile US’s merger with Sprint also affected the pace of 5G spending. The two agreed to combine nearly two years ago, but it was only this week that a federal judge gave the go-ahead, siding with the companies over states that had raised antitrust concerns. The companies have yet to formally close the deal.

As the companies were awaiting the merger outcome, T-Mobile told contractors in a letter last fall that new work orders were postponed, according to people familiar with the matter. Michael Sievert, T-Mobile’s chief operating officer, earlier this month told The Wall Street Journal that engineers overshot their budget at the end of 2019 but the company would ramp up investment again early this year.

Pierre Ferragu, an analyst at New Street Research, said the T-Mobile–Sprint combination would speed 5G development in the U.S., calling it “positive for equipment vendors.”

Some makers of networking equipment that pipes data to and from new 5G antennas are still largely awaiting the anticipated spending spree. Juniper Networks Inc. Chief Financial Officer Ken Miller said this week that reaping the 5G opportunity would have to wait until 2021 or 2022.

“I think it’s going to be a little slower and a little longer spending cycle than maybe people predicted a year or two ago,” he said. Juniper makes hardware that manages internet traffic, which network operators will need more of to handle fast-moving 5G data.

For companies more directly involved in the 5G deployment, such as Cree Inc., an electronics provider in Durham, N.C., the impact has been more concrete. “We’ve seen some near-term delays in the 5G rollout,” Chief Executive Gregg Lowe said last month.

Xilinx Inc., a San Jose, Calif., chip maker, also cut its sales growth outlook and announced it was reducing its workforce by 7% because of U.S. restrictions on some trade with China and a slower 5G outlook. CEO Victor Peng said many telecom operators that spent heavily to put the initial 5G networks in place now are waiting to see if the spending generates anticipated returns before plowing more money into the infrastructure.

Overseas, Sweden’s Ericsson AB—one of the largest telecom equipment manufacturers—said it has encountered higher 5G-related costs and seen a slowdown in North America sales that it attributes partly to Sprint–T-Mobile merger delays.

Ericsson CEO Börje Ekholm said concerns around the use of Huawei Technologies Co. equipment also have affected deployments. The U.S. has been pressing allies not to use Huawei’s 5G gear because of cybersecurity concerns about the Chinese manufacturer—concerns Huawei has rejected.

References:

https://www.wsj.com/articles/superfast-5g-rollout-hits-slow-patch-some-equipment-suppliers-say-11581676202 (on line subscription required)

https://www.wsj.com/articles/5g-sends-a-confusing-signal-11581681603 (on line subscription required)

https://slate.com/technology/2019/01/5g-mobile-wireless-network-hype-consumers-fcc.html

https://www.vice.com/en_us/article/59xnw8/5g-may-never-live-up-to-the-hype

ITU-R Report: Terrestrial IMT for remote sparsely populated areas providing high data rate coverage

ITU-R WP 5D is progressing a preliminary draft new Report ITU-R M.[IMT TERRESTRIAL BROADBAND REMOTE COVERAGE] which we offer highlights of in this IEEE Techblog post. Co-authors of this draft 5D document are: Huawei Technologies Co. Ltd, Nokia Corporation, Telefon AB – LM Ericsson, Qualcomm Inc. and ZTE Corporation.

This post is an update and replacement of an earlier version, which can be read here. The scope has been broadened to include all types of IMT, not just IMT 2020 (5G).

Introduction:

On a global basis, the total number of mobile subscriptions was around 8 billion in Q3 2019, with 61 million subscriptions added during the quarter, the mobile subscription penetration is at 104 percent. There are 5.9 billion unique mobile subscribers using mobile networks, while 1.8 billion people remain unconnected. In year 2025 it is forecasted to be 2.6 billion 5G subscriptions and 8.6 billion mobile subscriptions globally at a penetration level of about 110 percent[1].

In 2025 the forecast is for 6.8 billion unique mobile subscribers using mobile networks, while 1.5 billion people remain unconnected, many of whom are below the age of nine.

The prospect of providing mobile and home broadband services for most of the 1.5 billion unconnected people, living in such underserved rural areas, is largely related to techno-economic circumstances.

This Report provides details on scenarios associated with the provisioning of enhanced mobile broadband services to remote sparsely populated and underserved areas with a discussion on enhancements of user and network equipment.

Background:

Deploying networks in remote areas is normally more expensive, and at the same time, expected revenues are lower in comparison with deployments in populated areas. A further reason for not being incentivized to deploy new IMT broadband (e.g. IMT-2020/5G) Base Stations (BS) in these areas is the expected number of new BS sites. Therefore, the total economic incentives to deploy traditional networks in sparsely populated areas are consequently narrowed.

[1] Ericsson Mobility Report, November 2019, mobile broadband includes radio access technologies HSPA (3G), LTE (4G), 5G, CDMA2000 EV-DO, TD-SCDMA and Mobile WiMAX.

……………………………………………………………………………………………………………………

The competition model, applying to densely populated areas, is normally not providing rural coverage expansion at a speed that society wish. Connectivity in underserved remote areas is important to national policy makers facing needs of consumers, to service providers for reasons of branding, and to satisfy regulatory conditions in countries.

When expanding coverage in remote areas, it may imply an undesirable local monopoly, suggesting that only one service provider would expand in to such a remote area due to a low consumer base.

Rural coverage might in the future be driven by the need for national security and public safety connectivity, intelligent traffic systems, internet of things, industry automation and end users need for home broadband services as an alternative to fiber connections. In order to fulfill the needs of rural coverage, it is a matter of urgency to identify viable solutions for mobile and home broadband services.

Related ITU-R Recommendations and Reports:

ITU-R Recommendations

M.819 “International Mobile Telecommunications-2000 (IMT-2000) for developing countries”.

ITU-R Reports

M.1155 “Adaptation of mobile radiocommunication technology to the needs of developing countries”

Solutions that support remote sparsely populated areas providing high data rate coverage:

Possible technical solutions to achieve both extended coverage as well as high capacity in remote areas could be to use dual frequency bands at the same time, one lower band for the uplink (UL) and one higher band for the downlink (DL), in aggregated configurations.

Combining spectrum bands in the mid-band range and the low-band range on an existing grid can provide extended capacity compared to a network only using the low-band range.

An alternative technical solution to provide extended coverage in a remote area using a reduced number of terrestrial BS sites, aiming to bringing cost down, requires careful selection of proper locations and technical characteristics compared to configurations of suburban networks. Realizing such extended network configuration for coverage, several considerations need to be taken into account, both at a BS site and at customer premises. Considerations of accommodating BSs on high towers in sparsely populated areas could be further studied. Such opportunities rest with traditionally high tower used for analogue or digital television with an average inter-site distance (ISD) of the order of 60 km to 80 km designed to provide blanket coverage of national terrestrial television services.

With potential enhancements of base station (BS), user equipment (UE), and customer premises home broadband configurations, it is deemed feasible to deploy a standalone network in the range 3.5 GHz providing high capacity and coverage over tens of kilometers in rural areas. This could potentially be a promising solution for bringing IMT broadband (e.g. IMT-2020/5G) to underserved regions.

Combining spectrum bands in the mid-band range 3.5 GHz and the low-band range, e.g. 600 MHz, 700 MHz or 800 MHz, on an existing grid can provide extended capacity compared to a network only using the low-band range. The reason being that the mid-band range offer access to more spectrum bandwidth, and the low-band range combined, can provide the coverage for cell edge users in a unified manner.

Generally, at a BS site, the antenna height and the radio frequency (RF) output power have a profound impact on the coverage and capacity performance. Effective performance solutions are also represented by a high level of antenna sectorization, high antenna beamforming gain, and the use of MIMO antennas, as well as the use of carrier-aggregation. Furthermore, additional spectrum bands and bandwidth, and usage of redundant signaling protocol will improve performance. As the UL performance is the limiting factor, enhancing the UE transmission performance is key to enable extended coverage. For a home broadband deployment in a “wireless fiber” configuration using an outdoor directional antenna mounted line-of-sight to the BS antenna site extend the coverage range significantly by avoiding building penetration losses.

Underserved sparsely populated areas are every so often characterized by limited internet access and basic mobile service provide by a 2G network designed for voice connectivity. Therefore, one of the key aspects providing coverage in a remote area, aiming to bringing cost down, is possible to use such existing 2G network grid by means of conventional spectrum bands in 600 MHz, 700 MHz, 800 MHz, 850 MHz or 900 MHz for UL connectivity in combination with the band 3.5 GHz for the DL system installed in a high tower used for analogue or digital terrestrial television with an average ISD of the order of 60 km to 80 km designed to provide blanket coverage of national terrestrial television services.

It is assumed that a conventional 2G or 4G antenna arrangement is used for the UL system. For the IMT-2020/5G 3.5 GHz DL system, an antenna array is assumed to have 64 dual-polarized antenna elements installed in a television towers at a height of about 250 m. The considered ISD is regarded to be representative for a conventional 2G network grid. The maximum supported coupling loss for 2G is approximately 137 – 144 dB to support acceptable control channel signaling, and here assuming a maximum of 140 dB coupling loss is needed for basic coverage. The propagation losses are similar for IMT-Advanced/4G at 600 MHz, 700 MHz, 800 MHz, 850 MHz and at 900 MHz, here searching for an ISD that results in 140 dB coupling loss at the cell-edge for 4G at 800 MHz. From experience it is estimated that at 140 dB coupling loss occurs at an ISD of about 4 km. In terms of IMT-2020/5G, a beamformed coupling loss of approximately 143 dB should be supported.

The DL and UL user throughput can be estimated in a deployment scenario using the parameters above. For DL, over 20 times capacity gain can be achieved by utilizing an additional IMT-2020/5G connectivity link in the band 3.5 GHz compared to an IMT-Advanced/4G connectivity link only in the band 800 MHz. This is in recognition of the wider bandwidth of the band 3.5 GHz together with the advanced BS antenna array deployed. For users located at the cell edge, data rates of over 100 Mbit/s can be reached in the DL direction using conventional 5G UE terminals.

Due to the limited UE transmit power of 23 dBm together with the propagation conditions in the band 3.5 GHz, a standalone network has limited possibilities to provide adequate coverage in the UL direction for users located at the cell edge.

Adding the new band 3.5 GHz for mobile and home broadband connectivity, networks can clearly deliver on the promise to increase on the coverage requirements for IMT-2020/5G services, but only adequately in the DL direction. For such a communication circumstances, a IMT-2000/2G or IMT-Advanced/4G grid is indispensable to combine to provide adequate UL coverage.

Analyzing configurations for an IMT broadband network operating only in the band 3.5 GHz:

For the circumstances in underserved remote areas the DL capacity performance can be significantly improved by using the band 3.5 GHz whilst the UL coverage is representing the bottleneck in attempts of satisfying needs for coverage. With potential upgrades of BS and consumer premises UE configurations, the feasibility of providing improved remote area coverage is considered by using only the band 3.5 GHz.

Addressing firstly the UL coverage issue for a standalone network using only the band 3.5 GHz, a potential network upgrade can include increased BS antenna height. Obviously, increased RF power only would not resolve the issues involved. In addition, improved configuration, such as usage of high gain directional UE antenna deployed at the consumer premises for home broadband systems may need to be incorporated into the network design for improved remote coverage and for the reciprocity between DL and UL performance.

This assumption for IMT-2020/5G macro sites is considering the use of television towers at a height of about 250 m, applying ISDs of the order of 60 km to 80 km which is considered to reflect realistic distances for current terrestrial television networks.

In addition, a conventional RF power of 23 dBm is considered for UE at the consumer premises using home broadband services configured for rooftop installation using a high-gain antenna of 20 dBi at about 10 m height can reach 5 Mbit/s at cell edge at reasonably low traffic loads for the UL, and 120 Mbit/s for DL.

With omni-directional UE antennas, the ISD will need to be reduced to 40 km to achieve similar performance at cell edge.

Annex 1. List of acronyms and abbreviations:

| BS | Base Station |

| DL | Downlink |

| ISD | Inter-Site Distance |

| MIMO | Multiple Input Multiple Output |

| RF | Radio Frequency |

| UE | User Equipment |

| UL | Uplink |

References:

https://www.itu.int/dms_pub/itu-d/opb/stg/D-STG-SG02.10.1-2006-PDF-E.pdf